As filed with the Securities and Exchange Commission on September 22,October 14, 2008

Registration No. 333-144335

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 45

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Amendment No. 12

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KKR & CO. L.P.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 6282 (Primary Standard Industrial Classification Code Number) | 26-0426107 (I.R.S. Employer Identification No.) | ||

9 West 57th Street, Suite 4200 New York, NY 10019 Telephone: (212) 750-8300 (Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices) | ||||

David J. Sorkin, Esq. General Counsel KKR & Co. L.P. 9 West 57th Street, Suite 4200 New York, NY 10019 Telephone: (212) 750-8300 (Name, address, including zip code, and telephone number, including area code, of agent for service) | ||||

Copy to: | ||

| Joseph H. Kaufman, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 Telephone: (212) 455-2000 Facsimile: (212) 455-2502 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title Of Each Class Of Securities To Be Registered | Amount to be Registered | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | |||

|---|---|---|---|---|---|---|

| Common Units | (1) | (2) | (3) | |||

| Contingent Value Interests(4) | (1) | — | — | |||

| Common Units Issuable upon Settlement of the Contingent Value Interests(4) | (1) | — | — | |||

| Total | (1) | (2) | (3) | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, SEPTEMBER 22,OCTOBER 14, 2008

PRELIMINARY PROSPECTUS

Common Units Representing Limited Partner Interests

Contingent Value Interests

We have entered into a purchase and sale agreement with KKR Private Equity Investors, L.P., or KPE, pursuant to which we have agreed to acquire all of the assets of KPE and assume all of the liabilities of KPE and its general partner in exchange for our common units representing limited partner interests in our partnership and contingent value interests representing possible additional consideration, which we refer to as the KPE Purchase. As promptly as practicable after the KPE Purchase, KPE will distribute our common units and contingent value interests to its unitholders, which we refer to as the KPE Distribution. We refer to the KPE Purchase and the KPE Distribution collectively as the KPE Transaction. The KPE Transaction will build on our foundation as a leading global alternative asset manager and we believe will more fully align our economic and strategic interests with those of KPE's unitholders and other stakeholders.

Upon completion of the KPE Transaction, KPE unitholders would receive our common units representing 21% of our fully diluted equity (prior to taking into account the issuance of any common units under our employee equity incentive plan) as well as contingent value interests, or CVIs, providing consideration of up to an additional 6% of our fully diluted equity as of the completion of the KPE Transaction, depending on the trading price of our common units three years after completion of the KPE Transaction. KPE unitholders will receive one of our common units and one CVI for each KPE unit they hold. Each CVI will be settled at maturity for an amount of consideration (payable, at the option of our principals, in cash or our common units) equal to the amount, if any, by which a strike price (based upon the net asset value of KPE as of June 30, 2008) exceeds the greater of (a) the market value of our common units (based on a volume-weighted average over a specified period) and (b) a floor price, provided that such consideration will not exceed the product of the market value of our common units and a unit cap. Prior to the KPE Transaction, there has been no public market for our common units. We intend to list our common units on the New York Stock Exchange under the symbol "KKR." The KPE Transaction will be consummated subsequent to the completion of the Reorganization Transactions described in this prospectus and prior to the listing of the common units on the NYSE. We refer to the Reorganization Transactions, the KPE Transaction and other related transactions contemplated by the purchase and sale agreement as the Transactions.

KPE will undertake a consent solicitation pursuant to which its unitholders will be asked to consent to the KPE Transaction. The consent of unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by us or our affiliates) and the completion of the Reorganization Transactions are conditions to completing the KPE Transaction. KPE units are currently admitted to listing and trading on Euronext Amsterdam by NYSE Euronext, the regulated market of Euronext Amsterdam N.V., or Euronext Amsterdam, under the symbol "KPE." If the unitholder consent described above is obtained and the other conditions precedent in the purchase and sale agreement are satisfied or waived, we will hold a closing of the KPE Purchase as soon as reasonably practicable thereafter. KPE units are expected to cease to trade on Euronext Amsterdam following the completion of the KPE Distribution. Upon completion of the KPE Transaction, KPE will be dissolved and delisted from Euronext Amsterdam.

In reviewing this prospectus, you should carefully consider the matters described under the caption "Risk Factors" beginning on page 2826 of this prospectus. These risks include but are not limited to the following:

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The date of this prospectus is , 2008.

| | Page | ||

|---|---|---|---|

| Summary | 1 | ||

| Risk Factors | |||

| Risks Related to | |||

| Risks Related to the Assets We Manage | |||

| Risks Related to Our Organizational Structure and the Transactions | 47 | ||

| Risks Related to U.S. Taxation | 55 | ||

| Risks Related to Our Common Units and the Contingent Value Interests | 59 | ||

| Distribution Policy | 63 | ||

| Capitalization | 65 | ||

| The KPE Transaction | 66 | ||

| Organizational Structure | |||

| Unaudited Pro Forma Financial Information | |||

| KPE's Selected Historical Financial and Other Data | |||

| KPE Management's Discussion and Analysis of Financial Condition and Results of Operations | |||

| Private Equity Valuations and Related Data | |||

| Industry | |||

| Business | |||

| Management | |||

| Security Ownership | |||

| Certain Relationships and Related Party Transactions | |||

| Conflicts of Interest and Fiduciary Responsibilities | |||

| Comparative Rights of Our Unitholders and KPE Unitholders | |||

| Description of Our Common Units | |||

| Description of Our Contingent Value Interests | |||

| Description of Our Limited Partnership Agreement | |||

| Common Units Eligible for Future Sale | |||

| Material U.S. Federal Tax Considerations | |||

| Plan of Distribution | |||

| Legal Matters | |||

| Experts | |||

| Where You Can Find More Information | |||

Index to Financial Statements | F-1 | ||

Appendix A—Form of Amended and Restated Limited Partnership Agreement of KKR & Co. L.P. | A-1 | ||

Appendix B—Opinion of Citigroup Global Markets Limited | B-1 | ||

Appendix C—Opinion of Lazard | C-1 | ||

i

You should rely only on the information contained in this prospectus, any free writing prospectus or consent solicitation materials we may authorize to be delivered to you or any subsequent filings we may make pursuant to Rule 425 of the Securities Act of 1933, or the Securities Act. We have not authorized anyone to provide you with additional or different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common units.

This prospectus incorporates important information about the company that is not included in or delivered with the prospectus. We will provide without charge to each person to whom a copy of this prospectus has been delivered, upon the written or oral request of such person, a copy of any and all of the documents that have been incorporated by reference into this prospectus. Requests for copies of any such document should be directed to KKR & Co. L.P. at: 9 West 57th Street, Suite 4200, New York, NY 10019, Attention: Investor Relations; telephone: (212) 750-8300. In order to obtain timely delivery, you must request the information no later than .

We have prepared this prospectus using a number of conventions, which you should consider when reading the information contained herein. Prior to the completion of the KPE Transaction, we will complete a series of transactions, which we refer to as the Reorganization Transactions, pursuant to which ourKKR's business will be reorganized into a holding company structure. The Reorganization Transactions will be completed only after unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by KKR or its affiliates) consent to the KPE Transaction. KPE will undertake the consent solicitation after the registration statement, of which this prospectus forms a part, is declared effective. We refer to the KPE Transaction, the Reorganization Transactions and other related transactions described herein as the Transactions.

Unless the context suggests otherwise, references in this prospectus to "KKR," "we," "us," "our" and "our partnership" refer:

KKR & Co. L.P. will have no operations and nominal assets consisting of cash and cash equivalents at the time the registration statement, of which this prospectus forms a part, is declared effective. As a result, at the time of effectiveness, KKR & Co. L.P. may be considered a shell company as defined under Exchange Act rules until the Reorganization Transactions have been completed. The KKR Group will bebecome our predecessor for accounting purposes and its combined financial statements will become our historical financial statements only upon completion of the Reorganization Transactions, which will take place subsequent to the time the registration statement, of which this prospectus forms a part, is declared effective and only after unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by KKR or its combined financial statements will be our historical financial statements followingaffiliates) consent to the Transactions.KPE Transaction. We will not acquire all of the interests in the KKR Group in connection with the Reorganization Transactions and, accordingly, the combined financial statements of the KKR Group may not be indicative of the results of operations and financial condition that we will have following the completion of the Transactions. In addition, we will not be allocated any of the capital contributions made by the general partners of our funds prior to the completion of the Transactions or any returns generated on those contributions. See "Organizational Structure," "Unaudited Pro Forma Financial Information" and "Our"KKR Management's Discussion and Analysis of Financial Condition and Results of Operations."

ii

References in this prospectus to "KPE" are to KKR Private Equity Investors, L.P., a Guernsey limited partnership. Unless otherwise specifically stated, references herein to units of KPE include any such units that may be represented by restricted depositary units. References in this prospectus to the "Acquired KPE Partnership" are to KKR PEI Investments, L.P., a Guernsey limited partnership whose limited partner interests are held by KPE.

References in this prospectus to "KFN" are to KKR Financial Holdings LLC, a publicly traded specialty finance company that is one of our fixed income funds and whose limited liability company interests are listed on the NYSE under the symbol "KFN." References in this prospectus to "KFI" are to

ii

Kohlberg Kravis Roberts & Co. (Fixed Income) LLC, formerly known as KKR Financial LLC, which has become one of our wholly-owned subsidiaries, and its subsidiaries.

References in this prospectus to our (i) "principals" are to our senior investment and other professionals who hold interests in our Group Partnerships and (ii) "senior principals" are to those identified as senior principals in "Business—Employees." References in this prospectus to our "traditional private equity funds" are to our private equity funds other than KPE.

In this prospectus, we also periodically refer to our "assets under management" or "AUM" which represent the assets as to which we are entitled to receive a fee or carried interest. We calculate the amount of AUM as of any date as the sum of:

You should bear in mind that our calculation of AUM may differ from the calculations of other asset managers and, as a result, our measurements of our AUM may not be comparable to similar measures presented by other asset managers. Our definition of AUM is not based on any definition of AUM that is set forth in the agreements governing the investment funds that we manage. See "Private Equity Valuations and Related Data" for more information.

Unless otherwise indicated, references in this prospectus to our fully diluted common units outstanding, or to our common units outstanding on a fully diluted basis, reflect both actual common units outstanding as well as common units in to which Group Partnership units not held by us are exchangeable pursuant to the terms of the exchange agreement to be entered into in connection with the Transactions, but do not reflect common units that may be issuable pursuant to awards that may be granted under our 2008 Equity Incentive Plan.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as "outlook," "believe," "expect," "potential," "continue," "may," "should," "seek," "approximately," "predict," "intend," "will," "plan," "estimate," "anticipate" or the negative version of these words or other comparable words. Forward-looking statements are subject to

iii

various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described under "Risk Factors," "Our"KKR's Management's Discussion and Analysis of Financial Condition and Results of Operations" and "KPE Management's Discussion and Analysis of Financial Condition and Results of Operations." These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this prospectus. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

iii

This prospectus includes market and industry data and forecasts that we have derived from independent reports, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Independent reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. Our internal data and estimates are based upon information obtained from investors in our funds, trade and business organizations and other contacts in the markets in which we operate and our understanding of industry conditions. Although we believe that such information is reliable, we have not had this information verified by any independent sources.

iv

This summary highlights information contained elsewhere in this prospectus and does not contain all the information you should consider in connection with your receipt of our common units and contingent value interests. KKR & Co. L.P. will have no operations and nominal assets consisting of cash and cash equivalents at the time the registration statement, of which this prospectus forms a part, is declared effective. As a result, at the time of effectiveness, KKR & Co. L.P. may be considered a shell company as defined under Exchange Act rules until the conditions precedent to the KPE Transaction, including obtaining the consent of unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by KKR or its affiliates) and the completion of the Reorganization Transactions, have been satisfied or waived. You should read this entire prospectus carefully, including the section entitled "Risk Factors" and the historical financial statements and related notes included elsewhere herein.

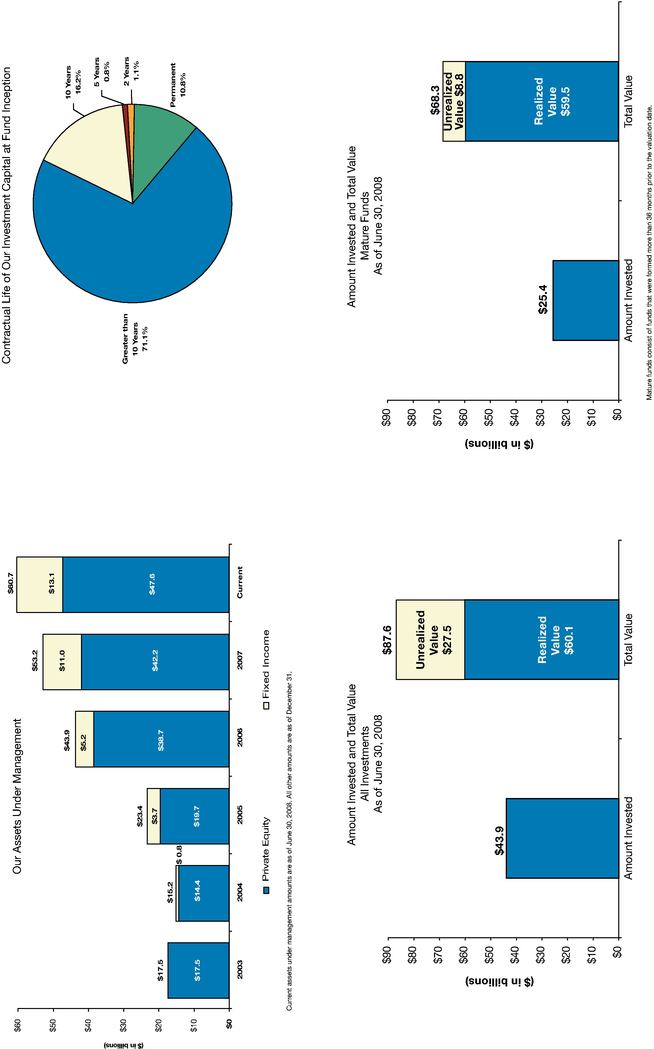

Led by Henry Kravis and George Roberts, KKR is a global alternative asset manager with $60.7 billion in AUM and a 32-year history of leadership, innovation and investment excellence. When our founders started our firm in 1976, they established the principles that guide our business approach today, including a patient and disciplined investment process; the alignment of our interests with those of our investors, portfolio companies and other stakeholders; and a focus on attracting world-class talent.

We have consistently been a leader in the private equity industry. Our achievements include completing the first leveraged buyout in excess of $1 billion, several of the largest leveraged buyouts completed worldwide to date, the first buyout of a public company by tender offer and more than 165 private equity investments with a total transaction value in excess of $423 billion. We have experienced significant growth and expect to continue to expand our platform to include complementary businesses that leverage our business model, our brand and the intellectual capital of our people. Today, with over 500 employees and more than 120 world-class investment professionals across the globe, we believe we have a preeminent global platform for sourcing and making investments in multiple asset classes and throughout a company's capital structure.

Through our offices in New York, Menlo Park, San Francisco, Houston, London, Paris, Hong Kong, Beijing, Tokyo and Sydney, we provide asset management services to a broad range of investors, including public and private pension plans, university endowments, other institutional investors and public market investors. We have grown our AUM significantly, from $15.1 billion as of December 31, 2004 to $60.7 billion as of June 30, 2008, representing a compounded annual growth rate of 48.8%. Our growth has been driven by the success of our investments, our expansion into new lines of business, value that we have created through our operationally focused investment approach, innovation in the products that we offer investors and an increased focus on capital raising and distribution activities. Our relationships with investors have provided us with a stable source of capital for investments, and we anticipate that they will continue to do so.

The KPE Transaction. On July 27, 2008, we entered into a purchase and sale agreement with KPE pursuant to which we have agreed to acquire all of the assets of KPE and assume all of the liabilities of KPE and its general partner in exchange for our common units and contingent value interests, which we refer to as CVIs. The assets that we will acquire from KPE are expected to provide us with a significant source of capital to further grow and expand our business, increase our participation in our existing portfolio of businesses and further align our interests with those of our investors and other stakeholders.

Common Units. The common units received by KPE unitholders in connection with the KPE Transaction will represent 21% of our fully diluted outstanding common units upon completion of the Transactions, prior to taking into account any adjustments relating to the CVIs.

CVIs. In the aggregate, the CVIs will entitle KPE unitholders to receive additional common units representing up to 6% of our fully diluted common units as of the completion of the Transactions (or the cash equivalent thereof), in the event that three years after the issue date the trading price of our common

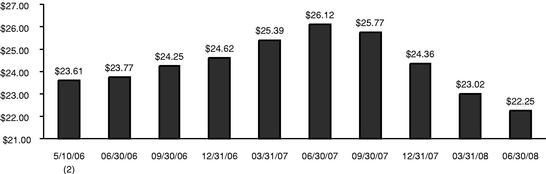

units over an averaging period plus the cumulative amount of distributions made on our common units is below a strike price based upon the NAV of KPE as of June 30, 2008 ($22.25 per unit).

KPE. KPE is a permanent capital vehicle that has historically focused primarily on making private equity investments in our portfolio companies and funds, but has the flexibility to make other types of investments, including in fixed income and public equity. KPE's units were issued at an initial offering price of $25.00 per unit on April 21, 2006 and the closing price of the KPE units, which trade on Euronext Amsterdam, on September 19,October 13, 2008 was $10.25$5.95 per unit.

The Transactions. KPE will undertake a consent solicitation pursuant to which its unitholders will be asked to consent to the KPE Transaction. The consent of unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by us or our affiliates) and the completion of the Reorganization Transactions are conditions to completing the Transactions. If the unitholder consent described above is obtained and the other conditions precedent in the purchase and sale agreement are satisfied or waived, we will undertake the following steps, which are described in greater detail under "The KPE Transaction" and "Organizational Structure":

Why We Are Undertaking the KPE Transaction

Our decision to undertake the KPE Transaction is based on our conclusion that the transaction will benefit KPE unitholders and other stakeholders over the long term. We view the KPE Transaction as part of our continued commitment to KPE and its unitholders, who supported us in KPE's initial offering and

have remained committed to us. We believe that the KPE Transaction offers a superior opportunity to KPE unitholders. In particular:

Unlocks Value and Enhances Liquidity

Through a listing on the NYSE, KPE unitholders will have access to a broader investor base and a significantly more liquid trading market for their securities. In addition to obtaining greater liquidity, as our unitholders, KPE investors will receive regular distributions of substantially all of the cash earnings generated by our asset management business annually. See "Distribution Policy."

Ownership of a Global Alternative Asset Manager with Significant Growth Potential and Diversity

The KPE Transaction provides KPE unitholders with a new opportunity to participate in all the economics of our business, as opposed to only our private equity investments, and will allow our principals and KPE unitholders to share together in attractive growth opportunities. We believe that the KPE Transaction will bolster our position as one of the world's leading alternative asset managers and further enhance our business diversity, scale, capital and growth prospects, all to the benefit of KPE unitholders.

Further Aligns Our Economic and Strategic Interests

The KPE Transaction will more fully align the interests of our principals and KPE unitholders, as we all will own the same equity and share in the same income streams. KPE unitholders will gain broad exposure to all of our activities and will no longer bear the expense of fees and carry on their investments, which are currently paid out of KPE's assets.

Significant Valuation Protection

KPE unitholders are being provided with significant valuation protection through the opportunity to obtain additional consideration in the event that the trading price of our common units over an averaging period plus the cumulative amount of distributions on our common units is below a strike price tied to the NAV of KPE as of June 30, 2008 ($22.25 per unit). This additional consideration may result in the issuance to KPE unitholders of up to an additional 6% of our fully diluted common units as of the completion of the Transactions or the cash equivalent thereof. The 6% cap is subject to adjustment to account for dividends, distributions and certain other transactions, and we will not be obligated to deliver, in consideration for the CVIs, common units exceeding 6% of our fully diluted common units as of the completion of the Transactions. In addition, any consideration to be paid to holders of the CVIs will not be delivered prior to the date that is three years after the completion of the KPE Purchase, except in limited circumstances.

Our decision to go public through the Transactions is based on our belief that such a change will benefit our firm, our investors and other stakeholders by enhancing our ability to do what we do best—grow and improve companies around the world and produce superior returns for our investors—from a larger platform and a deeper capital base. Through the Transactions and the integration of KPE, we believe we are taking the right steps to build for our future. Specifically, an NYSE listing accomplishes the following:

Enhances Our Ability to Build New Businesses

We believe there are significant opportunities for us to build new businesses by leveraging the intellectual capital of our firm and increasing the utilization of our people. While our industry teams conduct in-depth research and have developed specific views on trends and companies in their industries, a

large number of opportunities that we consider do not result in actual transactions. Historically, when we have been

unable to complete a transaction, much of the work that we had completed remained unused. With our integrated efforts in fixed income and public market investments, we have in recent years been able to leverage, where appropriate, the work and contacts of our industry teams and deploy more capital behind our ideas. We believe that gaining access to additional capital will better enable us to invest more heavily behind our activities and the ideas that we develop in the normal course of our business.

Enhances Our Ability to Continue to Attract and Incentivize World-Class People

We place a strong emphasis on our culture and our values, and we intend to continue to operate our firm in the same manner we have throughout our 32-year history. We have attracted and incentivized world-class people by allowing them to participate in our investments and by sharing economics throughout our firm. Becoming a public company will expand the range of financial incentives that we can offer our people by providing us with a publicly traded security that represents an interest in the value and performance of our firm as a whole.

In connection with the Transactions, everyone at our firm will become an owner and will have a stake in our future. More importantly, because our founders and other principals do not want our people to be advantaged or disadvantaged as a result of their title or tenure at our firm at the time of the Transactions, we have structured the equity ownership of our firm in a manner that will allow us to provide additional equity participation to our people without dilution to our public unitholders.

Creates a Currency to Finance Acquisitions

AcquisitionsBecoming a public entity will provide another meansus with a currency that we may use to enter or expand intoacquire companies with complementary lines of business and leverage our strong global brand.business. By combining our capabilities and brand with those of acquired companies, we believe that we will be well positioned to create significant value for our investors and other stakeholders. Becoming a public entity will provide us with a currency that we may use to pursue attractive opportunities as they arise.

Over our 32-year history, we have developed a unique business approach that centers around three key principles: adhere to a patient and disciplined investment process; align our interests with those of our investors and other stakeholders; and attract world-class talent for our firm and portfolio companies. We apply these principles to all aspects of our business, and we believe that they have been critical to both our success and our ability to create value for our constituencies. The Transactions are designed to enhance these fundamentals.

Patient and Disciplined Investment Process

We are a patient investor that seeks to create and realize value over the long-term. We believe that the best way to generate value for stakeholders is to build onlong-term through our strong industry and operational expertise and improve assets over time.expertise. Across our businesses, our investment professionals are organized into industry teams and work closely with operational consultants from KKR Capstone and our senior advisors to identify businesses that we can grow and improve. These teams conduct their own primary research, develop a list of industry themes and trends, identify companies and assets in need of operational improvement and seek out businesses and assets that will benefit from our involvement. Our industry teams possess a detailed understanding of the economic drivers, opportunities for value creation and strategies for improving companies across the industries in which we invest.

When we make a controlling investment, we partner with world-class management teams to execute on our investment thesis and rigorously track performance through regular reporting and detailed operational and financial metrics. We have developed a global network of experienced managers and operating executives who assist our portfolio companies in making operational improvements and achieving growth. We augment these resources with operational guidance from KKR Capstone, our senior advisors and our investment teams, and with "100-Day Plans" that focus our efforts and drive our strategy. We emphasize efficient capital management, top-line growth, R&D spending, geographical expansion, cost optimization and investment for the long-term. As we enter new lines of business, such as infrastructure, we will apply the same approach.

Alignment of Interests

Since our inception, one of our fundamental philosophies has been to align the interests of our firm and our people with the interests of our investors, portfolio companies and other stakeholders. We do this by putting our own capital behind our ideas. Since we were founded, our people have invested or committed to invest approximately $1.9 billion of their personal capital in our portfolio companies and transactions, and we and our people have been compensated substantially based on the returns generated. Through the Transactions, we will achieve an even greater alignment of interests as a result of the approximately $7.0 billion that we and our people will have invested in or committed to our portfolio companies and transactions.transactions approximately $7.0 billion, resulting in an even greater alignment of interests. In addition, our principals will not receive any proceeds from the Transactions and their interests in our business will be subject to significant vesting and transfer restrictions, further ensuring long-term alignment of interests.

World-Class Talent

We have built our firm with the intellectual capital of our people, and we are guided daily by the diversity, depth and breadth of their collective knowledge and experience. Led by Henry Kravis and George Roberts, our people have demonstrated an ability to address the challenges of cyclical markets; design and implement investment strategies and operational improvement plans; and create innovative investment products and structures. Through our people, we have access to a global network of business relationships with leading executives from major companies, financial institutions and investment and advisory institutions. We believe our people and the breadth of their experience position us to thrive in an increasingly global and constantly changing economy.

Track Record of Superior Returns for Investors

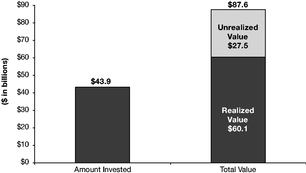

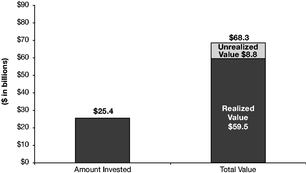

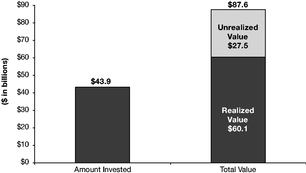

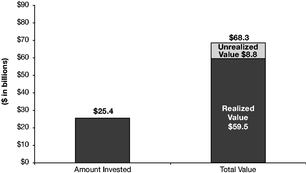

We believe that our business approach is among the reasons that we have been able to generate strong and stable returns for our investors. In our private equity business, for example, our traditional private equity funds generated a cumulative gross IRR of 26.2% from our inception in 1976 through June 30, 2008, compared to the 8.8% gross IRR achieved by the S&P 500 Index over the same period, despite the cyclical and sometimes economically challenging environments in which we have operated. We have nearly doubled the value of capital that we have invested in private equity, turning $43.9 billion of invested capital into $87.6 billion of value. Excluding our less mature funds, we have nearly tripled the value of capital invested, turning $25.4 billion of capital into $68.3 billion of value as reflected in the chart below. Mature funds consist of funds that were formed more than 36 months prior to the valuation date and do not include the European Fund II, the 2006 Fund, the Asian Fund and the European Fund III. We therefore have not calculated gross IRRs, net IRRs and multiples of invested capital with respect to those funds as of

June 30, 2008. For a description of the amounts committed and invested and the fair value of the investments with respect to those funds, see "Business—Private Equity—Private Equity Experience."

| | | |

|---|---|---|

| Amount Invested and Total Value All Investments As of June 30, 2008 | Amount Invested and Total Value Mature Funds As of June 30, 2008 | |

|  |

Recent economic and financial market conditions have not been favorablesignificantly deteriorated as compared to prior periods. WeaknessGlobal financial markets have recently experienced considerable declines in the valuations of equity and debt securities, an acute contraction in the availability of credit and the failure of a number of leading financial institutions. As a result, certain government bodies and central banks worldwide,

including the U.S. housing marketTreasury Department and global financial markets, coupled with a large backlogthe U.S. Federal Reserve, have undertaken unprecedented intervention programs, the effects of unsyndicated debt financing relatedwhich remain uncertain. The U.S. economy has experienced and continues to leveraged acquisitions, hasexperience significant declines in employment, household wealth, and lending. These events have led to a significantly diminished availability of credit and an increase in the cost of financing for our businesses, which has materially hindered the initiation of new, large-sized transactions for our private equity segment and, together with declines in valuations of equity and debt securities, has adversely impacted our recent operating results. For the six months ended June 30, 2008, we reported a net loss of $1.1 million, compared to a net income of $667.4 million for the six months ended June 30, 2007.

As a global alternative asset manager, we earn ongoing management, advisory and incentive fees for providing investment management, advisory and other services to our funds, managed accounts and portfolio companies, and we generate transaction-specific advisory income from our capital markets transactions. We earn additional investment income from investing our own capital alongside fund investors and from the carried interest we receive from private equity funds and carry-yielding co-investment vehicles. Our carried interest allocates to us a share of the investment gains that are generated on third-party capital that we invest and typically equals 20% of the net realized returns generated on private equity investments. Following the completion of the Transactions, our net income will include additional returns on assets acquired from KPE.

Private Equity Segment

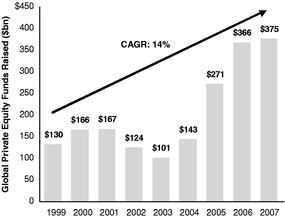

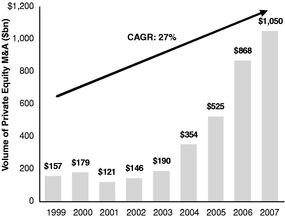

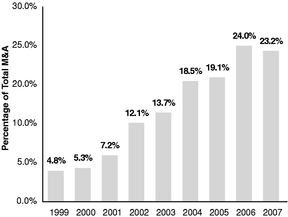

Through our private equity segment, we sponsor and manage a number of funds and co-investment vehicles that make primarily control-oriented investments in connection with leveraged buyouts and other similarly-yielding investment opportunities. We are a world leader in private equity, having raised 14 traditional private equity funds with approximately $59.9 billion of capital commitments. We have also developed innovative private equity products, such as KPE, various co-investment structures and a principal protected private equity product, that allow a broader base of investors to participate in our deals and increase the amount of capital that we may commit to transactions.

Our private equity activities focus on the largest end of the leveraged buyout market, which we believe allows us to invest in industry-leading franchises with global operations, attract world-class management teams, deploy large amounts of capital in individual transactions and optimize the income that we earn on a per transaction basis. We source these investments through our global relationships based upon the in-depth industry analysis conducted by our industry teams. When we make private equity investments, we partner with highly motivated management teams who put their own capital at risk and we design and implement strategic and operational changes that create value in the businesses we acquire. Our approach leverages our capital base, sourcing advantage, industry knowledge, operating expertise, global investment platform and unique access to KKR Capstone and our senior advisors, which we believe sets us apart from others.

We manage three traditional private equity funds that are currently in their investment period as well as a number of other funds that are fully invested. Our three active funds are geographically differentiated and consisted of the 2006 Fund (a $17.6 billion fund with $5.7 billion of uninvested capital commitments), the European Fund III (a $6.9 billion fund with $6.7 billion of uninvested capital commitments) and the Asian Fund (a $4.0 billion fund with $3.4 billion of uninvested capital commitments) as of June 30, 2008. Our other private equity products, such as co-investment structures, allow us to commit additional capital to our transactions and capture additional income streams. As of June 30, 2008, our private equity segment had $47.6 billion of AUM.

Our current private equity portfolio, which is held among a number of private equity funds and co-investment vehicles, consists of 51 companies with more than $205 billion of annual revenues and 855,000 employees worldwide. These companies are headquartered in more than 14 countries and operate in 14 general industries which take advantage of our broad and deep industry and operating expertise. TheyMany of these companies are leading franchises with global operations, strong management teams, attractive capital structures, defensible market positions and appealing growth prospects, which we believe will provide benefits through a broad range of business conditions.

We believe many of our portfolio companies have a defensive outlook and are comparatively well positioned for the current economic cycle. Examples of these companies include Energy Future Holdings (the largest producer of energy in Texas and an operator in both competitive and regulated utility markets); First Data Corporation (a leading provider of electronic commerce and payment solutions for merchants, financial institutions and card issuers with operations in 38 countries); HCA (the largest investor-owned health care services provider in the United States); Alliance Boots (an international pharmacy-led health and beauty group operating in more than 15 countries); and Dollar General (a distributor of low-price, everyday items with more than 8,000 stores in 35 states). In addition, we believe that challenging economic conditions may provide opportunities for us to provide capital and operational expertise to businesses affected by such conditions.

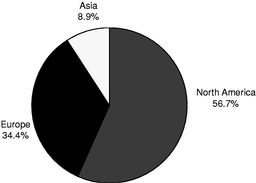

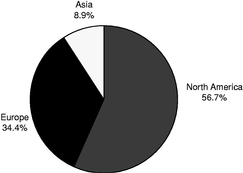

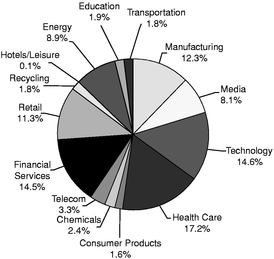

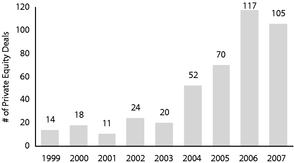

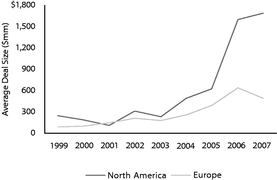

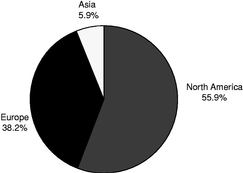

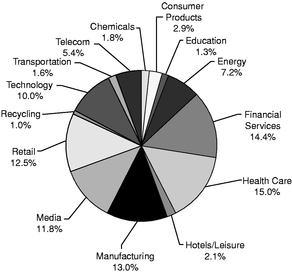

The following charts present information concerning the composition of our private equity portfolio by geography and industry as of June 30, 2008 based on fair value.

| Fair Value by Geography (1996 Fund and Subsequent Funds as of June 30, 2008) | Fair Value by Industry (1996 Fund and Subsequent Funds as of June 30, 2008) | |

|   |

We will not acquire interests in the general partners of the 1996 Fund or prior funds in connection with the Transactions. If the 1996 Fund is not included in the "Fair Value by Geography" chart above, the fair value of investments is 56.7% in North America, 34.1% in Europe and 9.2% in Asia. If the 1996 Fund is not included in the "Fair Value by Industry" chart above, only the fair value of investments in the Chemicals industry changed by at least 1.0% (-1.2%).

Fixed Income Segment

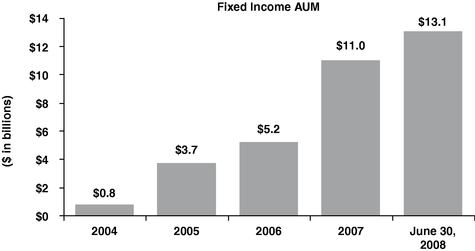

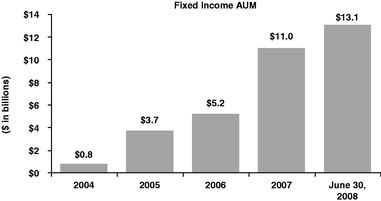

We believe the experience of our people, our global platform and our ability to effectively adapt our investment strategies to different market conditions allow us to capitalize on investment opportunities throughout a company's capital structure. Commencing in 2004, we began to actively pursue debt investments as a separate asset class and, through KFI, we now sponsor and manage a group of fixed income funds, structured finance vehicles and managed accounts that focus on corporate debt investments. As of June 30, 2008, our fixed income segment had $13.1 billion of AUM, including $10.0 billion of AUM managed through our structured finance vehicles, $2.0 billion of AUM at KKR Financial Holdings, an NYSE listed specialty finance company which we refer to as KFN, and $1.1 billion of AUM at the KKR Strategic Capital Funds, which consist of three side-by-side entities, and $10.0 billionentities. Recent credit market disruptions have negatively impacted the trading price of AUM managed through our structured finance vehicles.

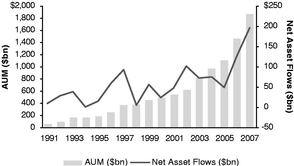

The following chart presentsKFN units, with the growth in the AUM of our fixed income segment from the commencement of operations through June 30, 2008. We believe there is a significant opportunityclosing price on October 13, 2008 equal to leverage our strengths to drive additional strong growth in this business.$3.87 per unit.

Our fixed income funds, structured finance vehicles and managed account platform are managed through KFI, which previously allocated a portion of its annual net income to non-controlling interest holders. On May 30, 2008, we acquired all of the outstanding non-controlling interests in KFI in order to further integrate our operations, enhance existing collaboration among all of our investment professionals and accelerate the growth of our business. As a result of this transaction, which we refer to as the KFI Transaction, we presently own 100% of the equity in KFI and are entitled to all of the net income and related cash flows generated through our fixed income segment.

Principal Segment

Upon completion of the Transactions, the assets, liabilities, income, expenses and cash flows of KPE and its general partner will become ours. We intend to manage these assets separately from our private equity and fixed income segments and account for them in a newly created reportable business segment referred to as our principal segment. As of June 30, 2008, KPE had an NAV of $4.6 billion, representing its interests in the Acquired KPE Partnership. We intend to use the assets that we acquire from KPE as a

source of capital to further grow and expand our business, increase our participation in our existing portfolio of businesses and further align our interests with our investors and other stakeholders.

Capital Markets Activities

Within each of our private equity and fixed income segments, we carry out capital markets activities that support our asset management business, increase our investable capital, improve our margins and allow us to capture additional income streams. These activities capitalize on our natural sourcing opportunities and include raising additional capital for our funds, providing capital markets advice, structuring new investment products and placing, arranging or underwriting equity and debt transactions for our portfolio companies and public vehicles. We believe that these activities are particularly attractive in the current economic environment as they facilitate the raising of capital from non-traditional sources andwill allow us to take greater control over both the capital formation process and the manner in which we exit investments.

We have hired a number of experienced professionals with long-standing investor relationships and industry experience to help us build our capital markets business. We have also obtained broker-dealer licenses in the United States and the United Kingdom, which allow us to engage in a broad range of capital markets and distribution activities, and a more limited license in Japan that allows us to raise capital for our funds. Today, our capital markets activities are focused on our funds, our portfolio companies and our private equity and fixed income segments. Following the completion of the Transactions, we intend to use our capital markets professionals as an additional resource in managing some of the assets acquired from KPE. Over time, we may expand our business and grow our capabilities in a manner that further complements our business.

KKR Capstone and Our Senior Advisors

Given the substantial emphasis we place on operational achievement, we have a team of over 30 operational consultants from KKR Capstone who work exclusively with our investment professionals and portfolio companies, and we are advised by a group of senior advisors that includes active or former leaders of a number ofFortune 500companies and public agencies, including Wells Fargo, HSBC Holdings, Eastman Kodak Company, Honeywell International and Accenture. KKR Capstone consultants and our senior advisors provide us with significant operational and strategic insights, serve as directors or executives of our portfolio companies, help us evaluate individual investment opportunities and assist our portfolio companies in addressing issues relating to top-line growth, cost optimization, efficient capital allocation and other challenges and opportunities that they face. They are an integral part of the way we approach our investments and our business.

Our Strategic Growth Initiatives

We are currently pursuing opportunities to develop additional lines of business and create new investment structures that will allow us to apply our business approach to a broader range of asset classes in a manner that benefits our firm, our investors and other stakeholders. Having organically grown our fixed income business from 2 executives and approximately $800 million of AUM in 2004 to more than 70 people and over $13.1 billion of AUM as of June 30, 2008, we have experience in identifying and branching out into new lines of business that naturally flow from our core competency. We believe that our expansion into new areas represents a natural next step in the evolution of our firm and will allow us to grow our AUM, generate additional income and capitalize on the global platform, infrastructure, industry knowledge, operational experience and intellectual capital of our firm.

Infrastructure

We recognize the important role that infrastructure plays in the growth of both developed and developing economies, and we believe that the global infrastructure market provides an opportunity for our unique combination of private investment, operational improvement and public affairs skills.

Accordingly, in May 2008, we announced plans to begin a new initiative to invest in infrastructure assets on a global basis. We believe that this initiative is an extension of our private equity business, building on the significant expertise we have established by managing investments in large, complex and regulated businesses and our record of driving operational improvements in a wide range of industries. We are currently building an investment team to focus specifically on global infrastructure opportunities. We have

hired a highly experienced professional and engaged a new senior advisor for this effort, and we expect to identify other highly experienced professionals and operating executives who, along with our existing professionals and senior advisors, will support this initiative. The team, which will have a presence in the United States, Europe and Asia, will collaborate with our other industry teams worldwide.

Mezzanine

Mezzanine financing represents a hybrid of debt and equity financing. Mezzanine financing has become an increasingly attractive form of investment in recent years, and interest in mezzanine products has grown considerably given the favorable position of mezzanine in the capital structure and the historically attractive risk-reward characteristics of mezzanine investments. Given the debt- and equity-like characteristics of mezzanine financing, the returns that it generates and its presence in the leveraged loan market, we believe that expanding into mezzanine products will allow us to take advantage of synergies with our existing fixed income and private equity businesses.

Other Opportunities

We believe that other asset classes, including public equity and real estate, and additional investment structures and products will present additional growth opportunities for us over the longer-term. We also intend to develop additional investment products and structures that allow us to access a broader base of investors and manage their assets in a manner that is tailored to their investment needs and objectives. Examples of our new product initiatives include the launching of a managed account platform fortailored to specific fixed income investors and the development of our principal protected private equity product, which provides investors who seek downside protection or have regulatory capital constraints with access to our private equity investments.

Over our 32-year history, we have developed a business approach that centers around three key principles: adhere to a patient and disciplined investment process; align our interests with those of our investors and other stakeholders; and attract world-class talent for our firm and portfolio companies. OtherThe following aspects of our firm help further differentiate us as an alternative asset manager and provide us with additional competitive advantages for growing our business and creating value. These include:

Firm Culture and Values

When our founders started our firm in 1976, leveraged buyouts were a novel form of corporate finance. With no financial services firm to model ourselves on and with little interest in copying an existing formula, we sought to build a firm based on principles and values that would provide a proper institutional foundation for years to come. We believe that our success to date has been largely attributable to the unique culture within our firm and the values that we live by: honesty; respect for our colleagues and others with whom we deal; teamwork; excellence, innovation and creativity; shared accountability for our successes and shortcomings; the fortitude to say no; and sharing of financial results and credit throughout our firm. Our values and our "one firm" culture will not change as a result of the Transactions.

Sourcing Advantage

We believe that we have a competitive advantage in sourcing new investment opportunities as a result of our internal deal generation strategies, our industry expertise and our global network. We maintain relationships with leading executives from major companies, commercial and investment banks and other investment and advisory institutions, including by our own estimate chief executives and directors of two-thirds of the companies in the S&P 500 and the Global S&P 100. Our industry teams work across our offices to develop a list of industry themes and trends, identify companies that will benefit from those trends and determine which of those companies would make an attractive investment. Through our industry focus and global network, we often are able to obtain exclusive or limited access to investments that we identify. Our reputation as a patient and long-term investor also makes us an attractive source of

capital for public companies, and through our relationships with major financial institutions, we are frequently one of the first parties considered for a potential transaction.

Sizeable Long-Term Capital Base

As of June 30, 2008, we had $60.7 billion of AUM, making us one of the largest independent alternative asset managers in the world. Our traditional private equity funds receive capital commitments from investors that may be called during an investment period that typically lasts for six years and remain invested for up to approximately 10 years. Our fixed income funds, structured finance vehicles and managed account platform include capital that is either not subject to optional redemption, has a maturity of at least 10 years or is otherwise subject to withdrawal only after a lock-up period ranging from 2 to 5 years. As of June 30, 2008, approximately 98.1%, or $59.7 billion, of our AUM had a contractual life at inception of at least 10 years, providing us with a stable source of long-term capital for our business.

Global Scale and Infrastructure

With offices in 10 major cities located on four continents, we are truly a global firm. Our global and diversified operations are supported by our sizeable capital base and extensive local market knowledge, which allow us to raise and deploy capital across a number of geographical markets and make investments in a broad range of companies, industry sectors and asset classes globally. As of June 30, 2008, approximately 43% of our investment professionals were based outside the United States and approximately 45% of the unrealized value of our private equity portfolio consisted of investments made outside the United States. Our executives come from more than 25 countries and speak over 18 different languages. Although our operations span multiple continents and business lines, we have maintained a common culture and are focused on sharing knowledge, resources and best practices throughout our offices. We believe that operating as an integrated global firm enhances the growth and stability of our business and helps optimize the decisions we make across asset classes and geographies.

Creativity and Innovation

We pioneered the development of the leveraged buyout and have worked throughout our history on creating new and innovative structures for both raising capital and making investments. Our history of innovation includes establishing permanent capital vehicles for our fixed income and private equity segments, creating a new principal protected product for private equity investments and developing new capital markets and distribution capabilities in the United States, Europe and Asia. An example of our achievements at portfolio companies include using an innovative power hedging program in connection with our acquisition of Texas Genco that allowed the company to lock in significant future cash flows.

Leading Brand Name

We believe the "KKR" name is associated with: the successful execution of many of the largest and most complex private equity transactions worldwide; a focus on operational value creation; a strong investor base; creativity and innovation; a global network of leading business relationships; a reputation for integrity and fair dealing; and superior investment performance. We intend to leverage the strength of our brand as we seek to grow our business.

Benefits to Multiple Stakeholders

By building world-class enterprises that thrive long after we exit our investment, our business approach benefits multiple stakeholders. Our patient and long-term focus allows our companies to become stronger and more competitive, creates employment opportunities, promotes R&D investment and allows businesses to build for the long-term. These changes improve the products and services that our companies are able to offer, benefits the communities that they serve and the workers that they employ and grows economic value in its broadest sense.

Our business approach also benefits another important group of stakeholders: the pension plans, university endowments, foundations and others who are our investment partners. The public pension plans that have invested in one of our recent private equity funds have nearly 9 million members. We take great pride in the fact that our investments have generated strong and stable returns for our investors across all economic cycles and, in doing so, have helped secure the retirements of teachers, firefighters, police officers, state and municipal employees and many others. These returns have helped reduce the size of annual pension contributions by both employees and employers and improved the funding ratio of pension plans.

Our long-term outlook also enables us to consider the perspectives of, and offer many benefits to, additional stakeholders. For example, our recent acquisition of Energy Future Holdings (previously known as TXU) included a substantial commitment to strengthen the company's environmental policies, make significant investments in alternative energy and institute corporate policies tied to climate stewardship. These efforts, among others, helped earn the endorsement of that acquisition by the Environmental Defense Fund, the Natural Resources Defense Council and labor organizations, including the AFL-CIO, International Brotherhood of Electrical Workers Seventh District and Lonestar Lodge of the International Brotherhood of Boilermakers.

Our experience with Energy Future Holdings has led to a partnership with the Environmental Defense Fund on a first-of-its kind "Green Portfolio Project" that seeks to find cost-effective ways to measure and improve the efficiency and environmental performance of our U.S. portfolio companies, similar to the way we drive operational and financial improvement. Our hope is that the knowledge and tools developed in this process will be replicated and implemented across our portfolio and serve as an example for other businesses worldwide.

On July 27, 2008, we entered into a purchase and sale agreement with KPE, pursuant to which we have agreed to acquire all of the assets of KPE and assume all of the liabilities of KPE and its general partner in exchange for newly issued common units and CVIs to be issued by us. As promptly as practicable after the KPE Purchase, KPE will distribute our common units and CVIs to its unitholders.

The KPE Transaction does not involve the payment of any cash consideration or involve an offering of any newly issued securities directly to the public for cash, and our principals are not selling any equity interests in the transaction. The purchase and sale agreement was unanimously approved by the board of

directors of KPE's general partner, acting upon the unanimous recommendation of directors of KPE's general partner who are independent of us under NYSE Rules.

Under the purchase and sale agreement, KPE unitholders will receive one of our common units and one CVI for each KPE unit they hold. Upon completion of the KPE Transaction, KPE unitholders will hold in the aggregate approximately 204,902,226 of our common units, which will represent 21% of our outstanding limited partner interests upon the completion of the Transactions on a fully diluted basis, prior to taking into account any adjustment relating to the CVIs. Through their interests in KKR Holdings L.P., which we refer to as KKR Holdings, our principals initially will retain exchangeable equity in certain of our subsidiaries which, if exchanged upon the completion of the Transactions, would represent 79% of our outstanding common units on a fully diluted basis, prior to taking into account any adjustment relating to the CVIs.

The CVIs consist of contingent value interests in our partnership. If three years after the issue date the trading price of our common units over an averaging period plus the cumulative amount of distributions that we make on our common units is below a strike price tied to KPE's NAV as of June 30, 2008 ($22.25 per unit) holders of CVIs will be entitled to receive, in the aggregate, up to (i) an additional 6% of the number of our common units outstanding on a fully diluted basis as of the completion of the Transactions, or (ii) cash having a value equivalent thereto. The CVIs would be issued pursuant to a capital contribution adjustment mechanism described below. Through KKR Holdings, our principals will have the ability to determine whether the CVIs are settled with equity or cash. The actual amount of consideration delivered, if any, will depend on the trading price and the amount of distributions that we make on our common units and is subject to adjustment.

Although under no legal, regulatory or Euronext Amsterdam requirement to do so, as a condition to the completion of the KPE Transaction, KPE will undertake a consent solicitation pursuant to which KPE

unitholders will be asked to consent to the KPE Transaction. The consent of unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by us or our affiliates) will be required. If the unitholder consent described above is obtained, the Reorganization Transactions have been completed and the other conditions precedent are satisfied or waived, we will hold a closing of the KPE Purchase as soon as reasonably practicable thereafter and KPE will distribute all of the common units and CVIs received from us in the transaction to its unitholders as promptly as practicable after the KPE Purchase. Following such actions, KPE will be dissolved and delisted from Euronext Amsterdam. See "The KPE Transaction," "Organizational Structure" and "Description of Our Contingent Value Interests."

Our Common Units Are Intended for Holders with a Long-Term Focus

We have consistently approached our business and investments with a long-term view. We intend to maintain this focusour long-term approach to investing after we become a public company and as we pursue our strategic growth initiatives, even though this may lead to increased volatility in our results from period to period. We believe that by continuing to adhere to the business approach that we have developed over our 32-year history rather than focusing on short-term financial results, we will be best positioned to continue to grow and prosper. We do not intend to allow short-term perspectives to unduly influence our business approach, our operational, strategic or investment decisions, our duties or commitments to investors or our focus on creating value over the long-term. Because of the nature of our businesses and our long-term focus, our common units should be held only by those who expect to remain unitholders for an extended period of time.

Risks Related to Our Common Units and CVIs

Holding our common units involves substantial risks and uncertainties. Some of the more significant challenges and risks related to our common units include:

Our CVIs involve certain additional risks and uncertainties separate from those affecting our common units, including the following:

In addition, members of the U.S. Congress have introduced legislation that would, if enacted, preclude us from qualifying for treatment as a partnership for U.S. federal income tax purposes under the publicly traded partnership rules. Separately, members of the U.S. Congress have introduced legislation that would, if enacted, treat income received for performing investment management services as ordinary income received for the performance of services, which would also preclude us from qualifying for treatment as a partnership for U.S. federal income tax purposes. If any of these pieces of legislation or any similar legislation or regulation were to be enacted and apply to us, we would incur a material increase in our tax liability, which could result in a reduction in the value of our common units. Please see "Risk Factors" for a discussion of these and additional factors related to our common units and CVIs.

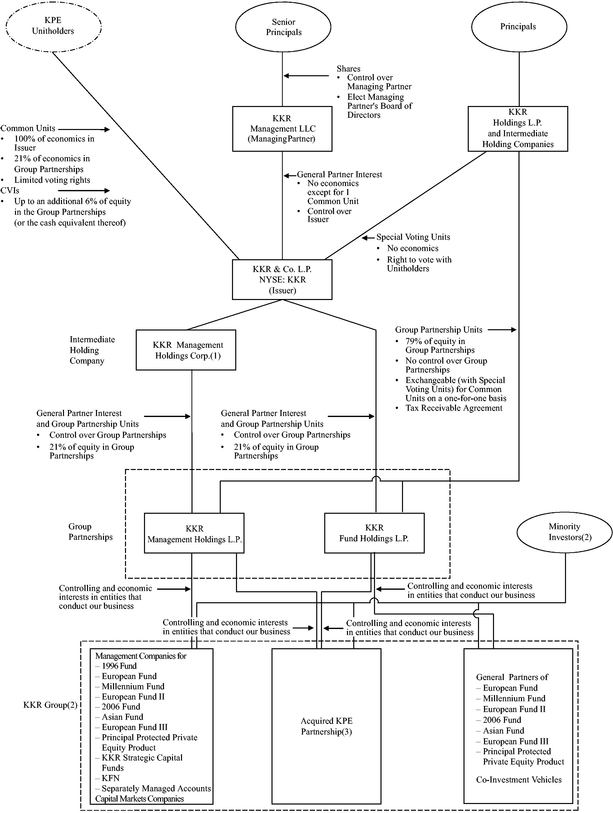

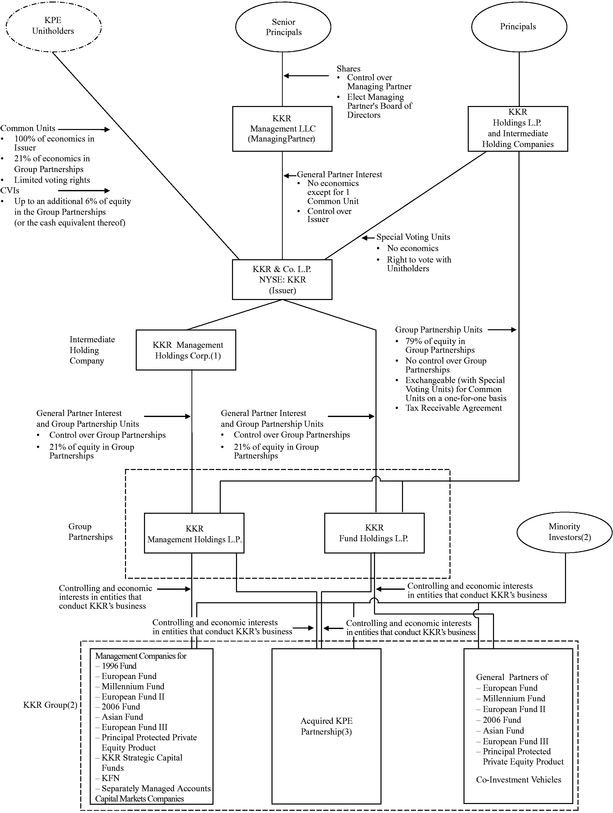

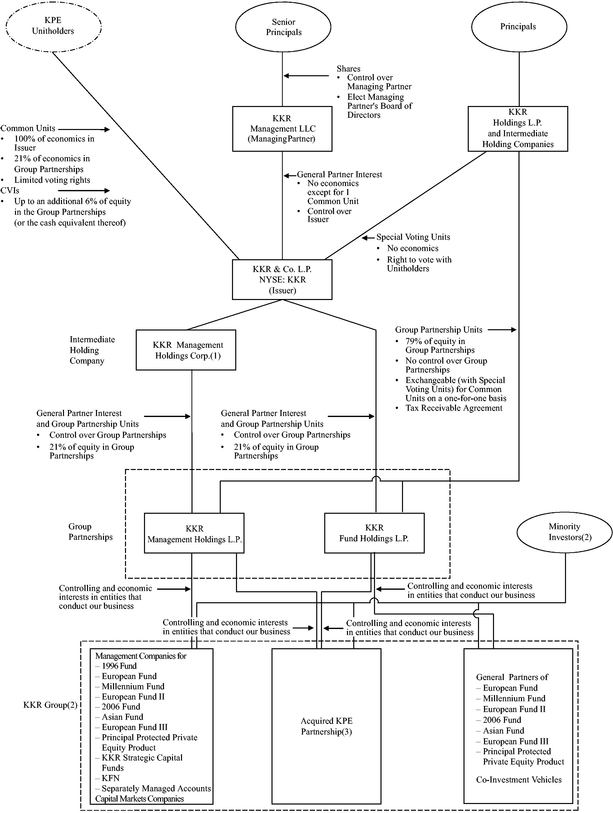

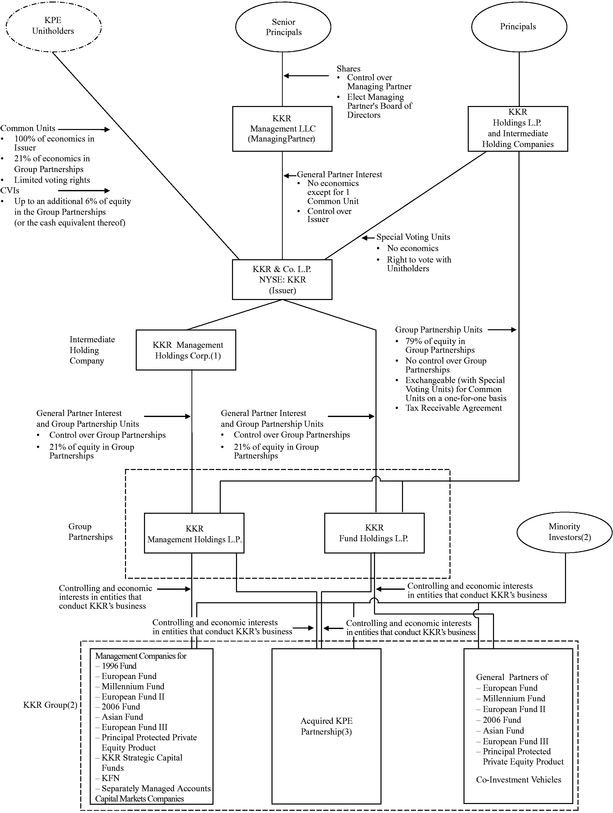

The following diagram illustrates the ownership and organizational structure that we will have upon the completion of the Transactions.

We areKKR & Co. L.P. is a Delaware limited partnership.partnership and will have no operations and nominal assets consisting of cash and cash equivalents at the time the registration statement, of which this prospectus forms a part, is declared effective. As a result, at the time of effectiveness, KKR & Co. L.P. may be considered a shell company as defined under Exchange Act rules until the conditions precedent to the KPE Transaction, including obtaining the consent of unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by KKR or its affiliates) and the completion of the Reorganization Transactions, have been satisfied or waived. As is commonly the case with limited partnerships, our partnership agreement provides for the management of our business and affairs by a general partner rather than a board of directors. Our general partner, which we refer to as our Managing Partner, is controlled by our senior principals and will have a board of directors that is co-chaired by our founders. Following the Transactions, the board will consist of a majority of independent directors and will have an audit committee and a conflicts committee consisting entirely of independent directors. Our founders will serve as Co-Chairmen of the board and Co-Chief Executive Officers of our business and have a majority of the general voting power of our Managing Partner's shareholders.members.

Prior to the completion of the KPE Transaction, we will complete a series of transactions, which we refer to as the Reorganization Transactions, pursuant to which ourKKR's business will be reorganized under two new partnerships, which we refer to as the Group Partnerships. The reorganization will involve a

contribution of equity interests in ourKKR's business that are held by our principals to the Group Partnerships in exchange for newly issued partner interests in the Group Partnerships. No cash will be received in connection with such exchanges. Following the completion of the Reorganization Transactions, the entities included in the financial statements of the KKR Group, other than the 1996 Fund and its general partners, will be reorganized under the Group Partnerships, and we will serve as the ultimate general partner and parent company of those entities. The KKR Group will bebecome our predecessor for accounting purposes only upon completion of the Reorganization Transactions which will take place subsequentand only after unitholders representing at least a majority of the outstanding KPE units (excluding KPE units whose consent rights are controlled by KKR or its affiliates) consent to the timeKPE Transaction. KPE will undertake the consent solicitation after the registration statement, of which this prospectus forms a part, is declared effective. Our principals will hold their equity in the Group Partnerships through KKR Holdings, as described under "Organizational Structure."

In connection with the KPE Transaction, we will acquire all of the assets of KPE, including all of the partner interests in the Acquired KPE Partnership held by KPE, and assume all of the liabilities of KPE and its general partner, in exchange for common units and CVIs that will be issued by us. Upon completion of the KPE Purchase, we will directly or indirectly contribute all of the assets acquired from KPE and its general partner, including all of the interests in the Acquired KPE Partnership held by KPE, to the Group Partnerships in exchange for newly issued partner interests in the Group Partnerships. Interests in one of the Group Partnerships will be held through an intermediate holding company that is taxable as a corporation for U.S. federal income tax purposes.

Each Group Partnership will have an identical number of partner interests and, when held together, one partner interest in each of the Group Partnerships will represent a Group Partnership unit. Upon the completion of the Transactions, we will initially hold 21% of the outstanding Group Partnership units and our principals, through KKR Holdings, will initially hold 79% of the outstanding Group Partnership units. These interests will allow us and KKR Holdings to share ratably in the assets, liabilities, profits, losses and distributions of the Group Partnerships based on our respective percentage interests in the Group Partnerships. The governing agreements of our Group Partnerships include a capital contribution adjustment mechanism reflecting the terms of our CVIs. Under the adjustment mechanism, we will receive additional Group Partnership units, or cash contributed by KKR Holdings, to the extent any consideration is due in respect of the CVIs.

Components of OurKKR's Business Owned by the Group Partnerships

Upon completion of the Transactions, ourKKR's business will be conducted through the Group Partnerships and we will serve as the ultimate general partner and parent company of those entities. Except for non-controlling interests in our funds that are held by fund investors, interests in the general partners of the 1996 Fund and the Retained Interests described below, the Group Partnerships will own:

In connection with the Transactions, certain minority investors will retain the following interests in ourKKR's business and such interests will not be acquired by the Group Partnerships:

funds with respect to private equity investments made during such former principals' tenure with our firm;

The interests described in the immediately preceding bullets (other than interests in the general partners of the 1996 Fund) are referred to as the Retained Interests. Following the completion of the Transactions, the Retained Interests will be reflected in our financial statements as non-controlling interests in consolidated entities. Except for the Retained Interest in our capital markets business, these interests generally are expected to run-off over time, thereby increasing the interests of the Group Partnerships in the entities that comprise ourKKR's business.

You should note that the interests that the Group Partnerships will own as described above do not represent all of the interests in the KKR Group that are reflected in the predecessorits combined financial statements included elsewhere in this prospectus or interests in all of the entities that we have sponsored over time. In particular, in addition to the Retained Interests, the Group Partnerships will not acquire any interests in the general partners of the 1987 Fund, the 1993 Fund or the 1996 Fund, because those general partners are not expected to receive meaningful proceeds from further realizations. In addition, as described elsewhere in this prospectus, we are required to consolidate in our financial statements the funds over which we exercise substantive controlling rights and operational discretion, despite the fact that the substantial majority of the economic interests in those entities are held by third party fund investors. Except for interests in the Acquired KPE Partnership that will be acquired from KPE in the KPE Transaction, we will not acquire any of the economic interests in our funds that are held by fund investors. See "Organizational Structure" and "The KPE Transaction."

Upon completion of the Transactions, our principals will hold interests in ourKKR's business through KKR Holdings, which will own all of the outstanding Group Partnership units that are not held by us. These individuals will receive financial benefits from our business in the form of distributions and payments received from KKR Holdings and through their direct and indirect participation in the value of Group Partnership units held by KKR Holdings, and KKR Holdings will bear the economic costs of any executive bonuses paid to them. Our principals' interests in Group Partnership units that are held by KKR

Holdings will be subject to transfer restrictions that lapse over 8 to 10 year periods and, except for certain interests that will vest upon completion of the Transactions, will vest over 6 to 8 year periods.

Our founders and other principals do not want our people to be advantaged or disadvantaged as a result of their title or tenure at our firm when we complete the Transactions. Our principals intend to allocate approximately 20% of the Group Partnership units that are initially held by KKR Holdings in a manner that will allow us to continue to provide our people and others we may hire with additional equity participation in our firm in future periods. See "Organizational Structure—KKR Holdings."

We intend to make quarterly cash distributions to our unitholders in amounts that in the aggregate are expected to constitute substantially all of the cash earnings of our asset management business each year in excess of amounts determined by our Managing Partner to be necessary or appropriate to provide for the conduct of our business, to make appropriate investments in our business and our funds, to comply with applicable law, any of our debt instruments or other agreements or to provide for future distributions to our unitholders for any one or more of the ensuing four quarters. We expect that our first quarterly distribution will be paid in respect of the period from the completion of the Transactions through .

Our distribution policy reflects our belief that distributing substantially all of the cash earnings of our asset management business will provide transparency for our unitholders and impose on us an investment discipline with respect to the businesses and strategies that we pursue. The actual amount and timing of distributions on our common units will be subject to the discretion of our Managing Partner's board of directors, and we cannot assure you that we will in fact make distributions as intended, or at all. See "Distribution Policy."

Distributions and Benefits to Existing Owners