As filed with the Securities and Exchange Commission on September 14,October 4, 2011

Registration No. 333-171300

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 34

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

NewLink Genetics Corporation

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 541700 (Primary Standard Industrial Classification Code Number) | 42-1491350 (I.R.S. Employer Identification Number) |

2503 South Loop Drive

Ames, IA 50010

(515) 296-5555

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

CHARLES J. LINK, JR.

Chief Executive Officer

NewLink Genetics Corporation

2503 South Loop Drive

Ames, IA 50010

(515) 296-5555

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

James C.T. Linfield Brent D. Fassett CooleyLLP 380 Interlocken Crescent Broomfield, CO 80021 (720) 566-4000 | Geoffrey E. Liebmann Cahill Gordon & ReindelLLP Eighty Pine Street New York, NY 10005 (212) 701-3000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 under the Securities Exchange Act of 1934. (Check one):

| Large Accelerated Filero | Accelerated Filero | Non-accelerated Filerý | Smaller Reporting Companyo |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||

|---|---|---|---|---|

Common Stock, $0.01 par value per share | $86,250,000 | $6,150.00(3) | ||

| ||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 14,OCTOBER 4, 2011

PROSPECTUS

Shares

Common Stock

$ per share

We are offering shares of our common stock. This is our initial public offering, and no public market currently exists for our common stock. We expect the initial public offering price to be between $ and $ per common share. We have applied to list our common stock on The NASDAQ Global Market under the symbol "NLNK."

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | PER SHARE | TOTAL | ||||

|---|---|---|---|---|---|---|

Public offering price | $ | $ | ||||

Underwriting discounts and commissions | $ | $ | ||||

Proceeds, before expenses, to NewLink Genetics Corporation | $ | $ | ||||

Delivery of the shares of common stock is expected to be made on or about , 2011. We have granted the underwriters an option for a period of 30 days to purchase, on the same terms and conditions set forth above, up to an additional shares of our common stock to cover overalottments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before expenses, will be $ .

Joint Book-Running Managers | ||

Stifel Nicolaus Weisel | Canaccord Genuity | |

Baird | ||

The date of this prospectus is , 2011.

PROSPECTUS SUMMARY | 1 | |

RISK FACTORS | 10 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 42 | |

USE OF PROCEEDS | 44 | |

DIVIDEND POLICY | 44 | |

CAPITALIZATION | 45 | |

DILUTION | 48 | |

SELECTED FINANCIAL DATA | 51 | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 53 | |

BUSINESS | 79 | |

MANAGEMENT | ||

EXECUTIVE AND DIRECTOR COMPENSATION | ||

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | ||

PRINCIPAL STOCKHOLDERS | ||

DESCRIPTION OF CAPITAL STOCK | ||

SHARES ELIGIBLE FOR FUTURE SALE | ||

CERTAIN U.S. FEDERAL INCOME AND ESTATE TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR COMMON STOCK | ||

UNDERWRITING | ||

LEGAL MATTERS | ||

EXPERTS | ||

WHERE YOU CAN FIND ADDITIONAL INFORMATION | ||

INDEX TO FINANCIAL STATEMENTS | F-1 |

You should rely only on the information contained in this prospectus and any related free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither this prospectus nor any related free writing prospectus is an offer to sell, nor are they seeking an offer to buy, these securities in any jurisdiction where the offer or solicitation is not permitted. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus, and information may have changed since those dates.

For investors outside the United States: Neither we nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

i

The items in the following summary are described in more detail later in this prospectus. This summary does not contain all of the information you should consider. Before investing in our common stock, you should read the entire prospectus carefully, including the "Risk Factors" beginning on page 10, the "Business" section beginning on page 79, which more fully describes our product candidates and the status of our clinical trials and the financial statements and related notes beginning on page F-1. Unless the context indicates otherwise, as used in this prospectus, the terms "NewLink," "the Company," "we," "us" and "our" refer to NewLink Genetics Corporation.

We are a biopharmaceutical company focused on discovering, developing and commercializing novel immunotherapeutic products to improve cancer treatment options for patients and physicians. Our portfolio includes biologic and small-molecule immunotherapy product candidates intended to treat a wide range of oncology indications. Our product candidates are designed with an objective to harness multiple components of the innate immune system to combat cancer, either as a monotherapy or in combination with current treatment regimens, without incremental toxicity. Our product candidates use allogeneic (non-patient specific) cells from previously established cell lines rather than cells derived from the patient. We believe our approach enables a simpler, more consistent and scalable manufacturing process than therapies based on patient specific tissues or cells. Our lead product candidate, HyperAcute Pancreas cancer immunotherapy, or HyperAcute Pancreas, is being studied in a Phase 3 clinical trial in surgically-resected pancreatic cancer patients. This trial is an open-label, randomized, controlled, multi-center Phase 3 clinical trial, evaluating approximately 700 Stage I and Stage II surgically-resected pancreatic cancer patients, according to the American Joint Committee on Cancer classification system, or AJCC system, who have no detectable disease by a CT scan. The clinical trial is being performed under a Special Protocol Assessment, or SPA, with the U.S. Food and Drug Administration, or FDA. We initiated this trial in May 2010 based on encouraging interim data from a 70-patient Phase 2 clinical trial in surgically-resected pancreatic cancer patients and have enrolled 161 patients at 52 clinical sites in the United States as of September 1, 2011. We plan to complete the first and second interim analysisanalyses of data from our Phase 3 clinical trial in late 2012 and 2013, respectively, and to complete enrollment in 2013. We have also received Fast Track and Orphan Drug designations from the FDA for HyperAcute Pancreas for the adjuvant treatment of surgically-resected pancreatic cancer.

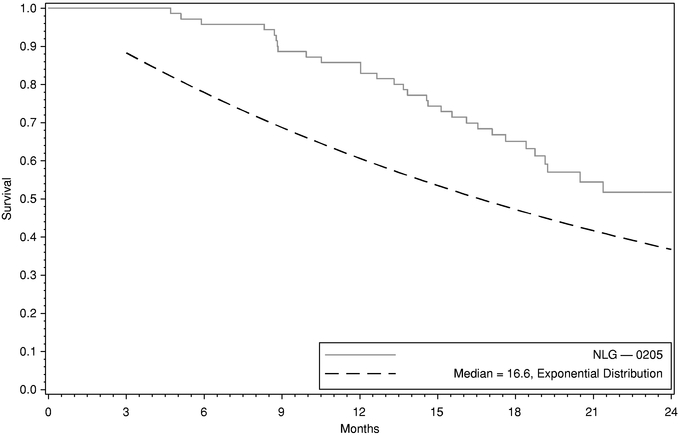

We completed enrollment of our 70-patient Phase 2 clinical trial for HyperAcute Pancreas in surgically-resected pancreatic cancer in February 2010. In this open label, non-randomized trial, HyperAcute Pancreas was given in doses of either 100 million cells or 300 million cells approximately twice monthly for six months in combination with the standard-of-care treatment regimen, which consisted of gemcitabine chemotherapy plus 5-FU based chemoradiotherapy. The interim data from this clinical trial indicate that HyperAcute Pancreas may improve disease-free and overall survival when given to patients in combination with standard-of-care following complete resection of detectable disease. As of May 10, 2011, all patients had reached at least 12 months of follow-up with a median follow-up period of approximately 21 months. The study met its primary objective with an established median disease free survival of 14.2 months. The most recent analyses of the secondary endpoint of overall survival showed one-year overall survival to be 86%. In addition, as of May 10, 2011, interim efficacy data for the 26 patients receiving high dose HyperAcute Pancreas immunotherapy demonstrated a median disease-free survival of 15.3 months and a one-year overall survival rate of 96%. HyperAcute Pancreas has also demonstrated a favorable safety profile to date.

The American Cancer Society has estimated that approximately 43,000 new cases of pancreatic cancer will be diagnosed in the United States in 2010. Pancreatic cancer has generally been recognized as an aggressive form of cancer that often remains undiagnosed in its earlier stages. As a result, the National Cancer Institute estimates a 96% mortality rate is associated with this disease, and the American Cancer

Society estimates one-year and five-year survival rates of 24% and 5%, respectively. HyperAcute Pancreas initially targets patients with localized tumors that can be removed surgically, or resected. According to eMedicine, a healthcare reference website run by WebMD containing peer-reviewed articles on diseases and medical topics, approximately 20% of patients in the United States are eligible for resection at initial diagnosis. These earlier stage, resected patients have significantly better prognoses than patients with later-stage disease since they tend to have better nutritional and immune status and significantly lower amounts of micro-metastatic and residual disease. A study published in theJournal of the American Medical Association showed that resection followed by chemotherapy or chemoradiotherapy, known as adjuvant therapy, extends median survival to approximately 18 months. We believe the addition of HyperAcute Pancreas to adjuvant standard-of-care has the potential to improve median disease-free survival and overall survival in resected pancreatic cancer patients.

In addition to HyperAcute Pancreas, we and our collaborators have completed patient enrollment for a Phase 1/2 clinical trial evaluating our HyperAcute Lung cancer immunotherapy product candidate, or HyperAcute Lung, for non-small cell lung cancer, or NSCLC, and a Phase 2 clinical trial for our HyperAcute Melanoma cancer immunotherapy product candidate, or HyperAcute Melanoma. In the Phase 1/2 single arm, open label HyperAcute Lung clinical trial, we administered our product candidate as a monotherapy in 54 patients with refractory, recurrent or metastatic nonresectable NSCLC. In the Phase 2 portion, the 28 patients evaluated for clinical response received injections of 300 million cells every two weeks for up to eight doses. We performed an interim analysis of the 28 patients on December 9, 2010, which showed median overall survival of 11.3 months and a one-year survival rate of 46%. Based on our analysis of data from comparable precedent clinical trials of similar patients, we would have expected a median overall survival of approximately eight months. In an interim analysis of 45 patients, HyperAcute Lung demonstrated a favorable safety profile and no dose limiting toxicities. We are conducting this Phase 1/2 study at the National Cancer Institute, or NCI. We anticipate initiating a Phase 2B/3 clinical trial in advanced NSCLC patients in the first half of 2012.2012 and completing the first interim analysis in 2013.

HyperAcute Melanoma is being studied in an investigator-initiated, fully-enrolled 25-patient Phase 2 clinical trial for the treatment of advanced melanoma in combination with an eight-week course of PEG-Intron, a man-made immune modulator. The treatment consists of 12 weekly injections of HyperAcute Melanoma with PEG-Intron being co-administered in weeks five through 12. As of September 8, 2011, interim analysis shows encouraging results, with all of the patients developing low levels of autoimmune antibodies and four out of 25 of the patients developing vitiligo, an autoimmune condition in which the patient's immune system attacks melanoctyes in the skin. In previous melanoma immunotherapy studies, vitiligo has been correlated with favorable response to therapy. HyperAcute Melanoma has demonstrated good tolerability and a favorable safety profile to date. We anticipate announcing the results from this trial in the second half of 2011. We anticipate initiating a Phase 2B clinical trial in melanoma in 2012.

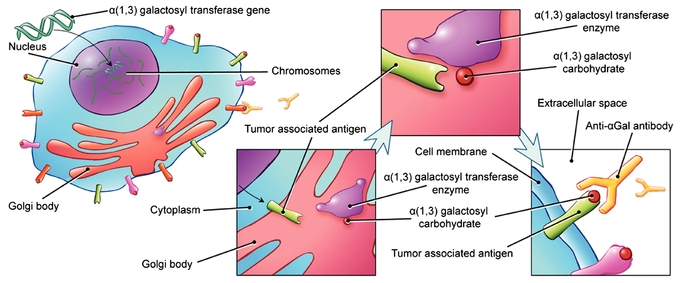

Our HyperAcute Pancreas, Lung and Melanoma product candidates are based on our HyperAcute immunotherapy technology, which is designed to stimulate the human immune system by exploiting a natural barrier present in humans that protects against infection being transmitted from other mammals. This barrier is related to the enzyme, alpha (1,3) galactosyl transferase, ora-GT, which is expressed in the cells of lower mammals but not present in human or other Old World primate cells. The presence of this enzyme results in the expression of a non-human form of carbohydrate called alpha (1,3) galactosyl carbohydrates, ora-Gal, on the surface of affected cells. Introducinga-Gal expressing cells to the human or primate immune system activates an immune response from antibodies againsta-Gal. Antibodies directed against thea-Gal epitope are potentially the most abundant natural antibody in humans and represent approximately 1% of circulating human antibodies.

Our HyperAcute immunotherapy product candidates are composed of irradiated, live, allogeneic human cancer cells modified to express the gene that makesa-Gal epitopes. This exposure toa-Gal stimulates the human immune system to attack and destroy the immunotherapy cells on whicha-Gal is

present by activating complement, an important component of the immune system that is capable of cell

destruction. After destruction, we believe the resulting cellular fragments bound by anti-a-Gal antibodies are processed by the immune system to elicit an enhanced multi-faceted immune response to tumor-associated antigens common to both the immunotherapy and the patient's tumor cells.

In addition to our HyperAcute product candidates, we are developing d-1-methyltryptophan, or D-1MT, a small-molecule, orally bioavailable product candidate from our proprietary indoleamine-(2,3)-dioxygenase, or IDO, pathway inhibitor technology. In preclinical models, IDO pathway inhibitors have shown anti-tumor effects in combination with radiotherapy, chemotherapy, targeted therapy or immunotherapy. Through our collaboration with the NCI, we are studying D-1MT in various chemotherapy and immunotherapy combinations in two Phase 1B/2 safety and efficacy clinical trials. The first clinical trial has primary endpoints that assess the safety and efficacy of D-1MT in combination with an Ad-p53 autologous dendritic cell vaccine for solid malignancies with p53 mutations, such as lung, breast and colon cancers. The second clinical trial has primary endpoints that assess safety and efficacy of D-1MT in combination with Taxotere® for patients with advanced stage solid tumors for which Taxotere is the standard-of-care, such as metastatic breast, prostate, ovarian and lung cancers. We anticipate announcing preliminary data from these trials by the end of 2011.

We believe the following are the key attributes of our company:

Our strategy is to discover, develop and commercialize immunotherapeutic products for the treatment of cancer where the needs of patients are unmet by current therapies. The critical components of our business strategy include:

We are a development stage biopharmaceutical company, and our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy

our common stock. In particular, you should consider the following risks, which are discussed more fully in "Risk Factors" beginning on page 10:

2009, respectively. As of June 30, 2011, we had an accumulated deficit of $71.7 million. We expect to continue to incur increasing net losses for the foreseeable future, and we may never achieve or maintain profitability.

We were incorporated as NewLink Genetics Corporation in Delaware on June 4, 1999. Our principal executive offices are located at 2503 South Loop Drive, Ames, IA 50010, and our telephone number is (515) 296-5555. Our website address iswww.linkp.com. The information contained in or that can be accessed through our website is not part of this prospectus.

HyperAcute® and NewLink Genetics® are registered trademarks of ours. Other trademarks and tradenames set forth herein are property of their respective owners. Registered trademarks and tradenames will be accompanied by the "®" designation only on their first reference.

| Common stock offered | shares (or shares if the underwriters' overallotment option is exercised in full). | |

Common stock to be outstanding after this offering | shares (or shares if the underwriters' overallotment option is exercised in full). | |

Use of proceeds | We intend to use the net proceeds from this offering to fund clinical trials and other research and development activities for HyperAcute Pancreas, our other HyperAcute immunotherapy product candidates and our IDO pathway inhibitor product candidate and for working capital and other general corporate purposes. | |

Risk factors | You should read the "Risk Factors" section of this prospectus beginning on page 10 for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

Proposed NASDAQ Global Market symbol | NLNK |

The number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding as of June 30, 2011, after giving effect to the conversion of all our outstanding shares of preferred stock into shares of common stock upon the completion of this offering, and excludes:

described in the "Executive Compensation—Employee Benefit Plans—2009 Equity Incentive Plan" of this prospectus, of which 887,500 shares of common stock are issuable upon the exercise of options that have been approved by the Company's Board of Directors through July 29, 2011 and will be granted effective concurrently with the completion of this offering or as of December 31, 2011, if later; and

Unless otherwise noted, the information in this prospectus assumes:

The number of shares of common stock, as reflected above, that we assume will be issued upon conversion of our preferred stock is based on an assumed initial public offering price equal to $ , which is the midpoint of the range listed on the cover page of this prospectus. If our initial public offering price is less than $5.00 per share, after deducting underwriting discounts and commissions, shares of the Series C and Series D preferred stock will be converted into more than one share of common stock, and if our initial public offering price is less than $4.25 per share, after deducting underwriting discounts and commissions, shares of the Series BB preferred stock will be converted into more than one share of common stock, in each case due to the application of antidilution adjustments with respect to the conversion prices of the preferred stock under our Restated Certificate of Incorporation. The number of shares of common stock that will be issued upon conversion of the Series E preferred Stock depends upon the initial public offering price, regardless of the specific offering price. A $1.00 increase in the assumed initial public offering price would decrease the aggregate number of shares of common stock issuable upon conversion of the Series C, D and E preferred stock from the amount set forth above by shares; a $1.00 decrease in the assumed initial public offering price would increase the aggregate number of shares of common stock issuable upon conversion of the Series BB, C, D and E preferred stock from the amount set forth above by shares.

The following tables summarize certain of our financial data. The summary statement of operations data for the years ended December 31, 2008, 2009 and 2010 are derived from our audited financial statements included elsewhere in this prospectus. The summary statement of operations data for the six months ended June 30, 2010 and 2011 and the balance sheet data as of June 30, 2011 have been derived from our unaudited interim financial statements, which are included elsewhere in this prospectus. The unaudited interim financial statements have been prepared on the same basis as the audited financial statements and, in the opinion of management, reflect all adjustments, consisting primarily of normal recurring adjustments, necessary to fairly present our financial position as of June 30, 2011, and the results of operations for the six months ended June 30, 2010 and 2011. Our historical results of operations and financial condition are not necessarily indicative of the results or financial condition that may be expected in the future. The summary financial data set forth below should be read together with our financial statements and related notes, "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus.

| | Years Ended December 31, | Six Months Ended June 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||

| | (in thousands, except per share data) | (unaudited) | (unaudited) | ||||||||||||||

Statement of operations data: | |||||||||||||||||

Grant revenue | $ | 633 | $ | 934 | $ | 2,079 | $ | 730 | $ | 1,141 | |||||||

Operating expenses: | |||||||||||||||||

Research and development(1) | 5,790 | 7,578 | 12,666 | 5,696 | 6,975 | ||||||||||||

General and administrative(1) | 3,938 | 3,705 | 6,074 | 2,284 | 2,452 | ||||||||||||

Total operating expenses | 9,728 | 11,283 | 18,740 | 7,980 | 9,427 | ||||||||||||

Loss from operations | (9,095 | ) | (10,349 | ) | (16,661 | ) | (7,250 | ) | (8,286 | ) | |||||||

Other income and expense: | |||||||||||||||||

Miscellaneous income | 42 | 19 | 71 | 8 | 1 | ||||||||||||

Interest income | 213 | 132 | 75 | 23 | 8 | ||||||||||||

Interest expense | (2 | ) | (9 | ) | (47 | ) | (19 | ) | (15 | ) | |||||||

Other income, net | 253 | 142 | 99 | 12 | (6 | ) | |||||||||||

Net loss | (8,842 | ) | (10,207 | ) | (16,562 | ) | (7,238 | ) | (8,292 | ) | |||||||

Less net loss attributable to noncontrolling interest(2) | — | 233 | 349 | 151 | 1 | ||||||||||||

Net loss attributable to NewLink | $ | (8,842 | ) | $ | (9,974 | ) | $ | (16,213 | ) | $ | (7,087 | ) | $ | (8,291 | ) | ||

Net loss per share-basic and diluted | $ | (1.35 | ) | $ | (1.50 | ) | $ | (2.30 | ) | $ | (1.06 | ) | $ | (1.08 | ) | ||

Weighted average shares outstanding—basic and diluted | 6,542 | 6,636 | 7,040 | 6,710 | 7,647 | ||||||||||||

Pro forma as adjusted net loss per share—basic and diluted (unaudited)(3) | $ | $ | |||||||||||||||

Weighted average pro forma as adjusted shares outstanding (unaudited)(3) | |||||||||||||||||

| | As of June 30, 2011 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Actual | (unaudited) Pro Forma | Pro Forma As Adjusted | |||||||

| | (in thousands) | |||||||||

Balance sheet data: | ||||||||||

Cash, cash equivalents, and certificates of deposit | $ | 9,800 | $ | 9,800 | ||||||

Working capital | 3,255 | 3,255 | ||||||||

Total assets | 17,315 | 17,315 | ||||||||

Notes payable and obligations under capital leases | 7,260 | 7,260 | ||||||||

Convertible preferred stock | 76,302 | — | ||||||||

Deficit accumulated during the development stage | (71,680 | ) | (71,680 | ) | ||||||

Total (deficit) equity | $ | (67,845 | ) | $ | 7,427 | |||||

The summary pro forma and pro forma as adjusted balance sheet data above gives effect to the following transactions as if they had occurred as of June 30, 2011:

A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the price range listed on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and certificates of deposit, additional paid-in capital, total stockholders' equity (deficit) and total capitalization by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The number of shares of common stock, as reflected above, that we assume will be issued upon conversion of our preferred stock is based on an assumed initial public offering price equal to $ , which is the midpoint of the range listed on the cover page of this prospectus. If our initial public offering price is less than $5.00 per share, after deducting underwriting discounts and commissions, shares of the Series C and Series D preferred stock will be converted into more than one share of common stock, and if our initial public offering price is less than $4.25 per share, after deducting underwriting discounts and commissions, shares of the Series BB preferred stock will be converted into more than one share of

common stock, in each case due to the application of antidilution adjustments with respect to the conversion prices of the preferred stock under our Restated Certificate of Incorporation. The number of shares of common stock that will be issued upon conversion of the Series E preferred Stock depends upon the initial public offering price, regardless of the specific offering price. A $1.00 increase in the assumed initial public offering price would decrease the aggregate number of shares of common stock issuable upon conversion of the Series C, D and E preferred stock from the amount set forth above by shares; a $1.00 decrease in the assumed initial public offering price would increase the aggregate number of shares of common stock issuable upon conversion of the Series BB, C, D and E preferred stock from the amount set forth above by shares.

The table above does not include:

Investing in our common stock involves a high degree of risk. In evaluating our business, investors should carefully consider the following risk factors. These risk factors contain, in addition to historical information, forward-looking statements that involve risks and uncertainties. Our actual results could differ significantly from the results discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below. The order in which the following risks are presented is not intended to reflect the magnitude of the risks described. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Business Risks

Risks Relating to Clinical Development and Commercialization of Our Product Candidates

Our near term prospects are highly dependent on HyperAcute Pancreas. If we fail to complete, or demonstrate safety and efficacy in, clinical trials, fail to obtain regulatory approval or fail to successfully commercialize HyperAcute Pancreas, our business would be harmed and the value of our securities would likely decline.

We must be evaluated in light of the uncertainties and complexities affecting a development stage biopharmaceutical company. We have not completed clinical development for any of our products. Our most advanced product candidate is HyperAcute Pancreas. The United States Food and Drug Administration, or FDA, must approve HyperAcute Pancreas before it can be marketed or sold. Our ability to obtain FDA approval of HyperAcute Pancreas depends on, among other things, completion of our Phase 3 clinical trial, whether our Phase 3 clinical trial of HyperAcute Pancreas demonstrates statistically significant achievement of the clinical trial endpoints with no significant safety issues and whether the FDA agrees that the data from our Phase 3 clinical trial of HyperAcute Pancreas is sufficient to support approval. The final results of our Phase 3 clinical trials of HyperAcute Pancreas may not meet the FDA's requirements to approve the product for marketing, and the FDA may otherwise determine that our manufacturing processes, facilities or raw materials are insufficient to warrant approval. We may need to conduct more clinical trials than we currently anticipate. Furthermore, even if we do receive FDA approval, we may not be successful in commercializing HyperAcute Pancreas. If any of these events occur, our business could be materially harmed and the value of our common stock would likely decline.

If our product candidates do not meet safety and efficacy endpoints in clinical trials, they will not receive regulatory approval, and we will be unable to market them. We have not tested any of our product candidates in controlled clinical trials.

The clinical development and regulatory approval process is expensive and time-consuming. The timing of any future product approval cannot be accurately predicted. If we fail to obtain regulatory approval for our current or future product candidates, we will be unable to market and sell them and therefore we may never be profitable.

As part of the regulatory process, we must conduct clinical trials for each product candidate to demonstrate safety and efficacy to the satisfaction of the FDA and other regulatory authorities abroad. The number and design of clinical trials that will be required varies depending on the product candidate, the condition being evaluated, the trial results and regulations applicable to any particular product candidate.

Prior clinical trial program designs and results are not necessarily predictive of future clinical trial designs or results. Initial results may not be confirmed upon full analysis of the detailed results of a trial. Product candidates in later stage clinical trials may fail to show the desired safety and efficacy despite having progressed through initial clinical trials with acceptable endpoints.

In particular, there have been no control groups in our clinical trials conducted to date. While comparisons to results from other reported clinical trials can assist in predicting the potential efficacy of our HyperAcute Pancreas product candidate, there are many factors that affect the outcome for patients in clinical trials, some of which are not apparent in published reports, and results from two different trials cannot always be reliably compared. As a result, we are studying HyperAcute Pancreas in combination with the current standard-of-care in direct comparison to the current standard-of-care alone in the same trial and will need to show a statistically significant benefit when added to the current standard-of-care in order for HyperAcute Pancreas to be approved as a marketable drug. Patients in our Phase 3 study who do not receive HyperAcute Pancreas may not have results similar to patients studied in the other studies we have used for comparison to our Phase 2 studies. If the patients in our Phase 3 study who receive standard-of-care without HyperAcute Pancreas have results which are better than the results predicted by the other large studies, we may not demonstrate a sufficient benefit from the HyperAcute Pancreas to allow the FDA to approve it for marketing.

Our HyperAcute product candidates are based on a novel technology, which may raise development issues we may not be able to resolve, regulatory issues that could delay or prevent approval or personnel issues that may keep us from being able to develop our product candidates.

Our HyperAcute product candidates are based on our novel HyperAcute immunotherapy technology. In the course of developing this technology and these product candidates, we have encountered difficulties in the development process. There can be no assurance that additional development problems will not arise in the future which we may not be able to resolve or which may cause significant delays in development.

Regulatory approval of novel product candidates such as ours can be more expensive and take longer than for other, more well-known or extensively studied pharmaceutical or biopharmaceutical products, due to our and regulatory agencies' lack of experience with them. This may lengthen the regulatory review process, require us to conduct additional studies or clinical trials, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization of these product candidates or lead to significant post-approval limitations or restrictions. For example, the two cell lines that comprise HyperAcute Pancreas are novel and complex therapeutics that we have endeavored to better characterize so that their identity, strength, quality, purity and potency may be compared among batches created from different manufacturing methods. We currently lack the manufacturing capacity necessary for larger-scale production. If we make any changes to our current manufacturing methods or cannot design assays that satisfy FDA's expectations regarding the equivalency of such therapeutics in the laboratory, the FDA may require us to undertake additional clinical trials.

The novel nature of our product candidates also means that fewer people are trained in or experienced with product candidates of this type, which may make it difficult to find, hire and retain capable personnel for research, development and manufacturing positions.

Our Special Protocol Assessment, or SPA, with the FDA relating to our HyperAcute Pancreas Phase 3 clinical trial does not guarantee any particular outcome from regulatory review of the trial or the product candidate, including any regulatory approval.

The protocol for our HyperAcute Pancreas Phase 3 clinical trial was reviewed by the FDA under its SPA process, which allows for FDA evaluation of a clinical trial protocol intended to form the primary basis of an efficacy claim in support of a New Drug Application, or NDA, and provides an agreement that the study design, including trial size, clinical endpoints and/or data analyses are acceptable to the FDA. However, the SPA agreement is not a guarantee of approval, the FDA retains the right to require additional Phase 3 testing and we cannot be certain that the design of, or data collected from, the HyperAcute Pancreas Phase 3 clinical trial will be adequate to demonstrate the safety and efficacy of HyperAcute Pancreas for the treatment of patients with pancreatic cancer, or otherwise be sufficient to support FDA or any foreign regulatory approval. In addition, the survival rates, duration of response and

safety profile required to support FDA approval are not specified in the HyperAcute Pancreas Phase 3 clinical trial protocol and will be subject to FDA review. Although the SPA agreement calls for review of interim data at certain times prior to completion, there is no assurance that any such review, even if such interim data is positive, will result in early approval. Further, the SPA agreement is not binding on the FDA if public health concerns unrecognized at the time the SPA agreement was entered into become evident, other new scientific concerns regarding product safety or efficacy arise, or if we fail to comply with the agreed upon trial protocols. In addition, the SPA agreement may be changed by us or the FDA on written agreement of both parties, and the FDA retains significant latitude and discretion in interpreting the terms of the SPA agreement and the data and results from the HyperAcute Pancreas Phase 3 clinical trial. As a result, we do not know how the FDA will interpret the parties' respective commitments under the SPA agreement, how it will interpret the data and results from the HyperAcute Pancreas Phase 3 clinical trial, or whether HyperAcute Pancreas will receive any regulatory approvals as a result of the SPA agreement or the HyperAcute Pancreas Phase 3 clinical trial. Therefore, significant uncertainty remains regarding the clinical development and regulatory approval process for HyperAcute Pancreas for the treatment of patients with pancreatic cancer.

We may expend our limited resources to pursue a particular product candidate or indication and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success.

Because we have limited financial and managerial resources, we must focus on research programs and product candidates for the specific indications that we believe are the most scientifically and commercially promising. As a result, we have in the past determined to let certain of our development projects remain idle including by allowing Investigational New Drug applications, or INDs, to lapse into inactive status, and we may in the future decide to forego or delay pursuit of opportunities with other product candidates or other indications that later prove to have greater scientific or commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable scientific or commercial products or profitable market opportunities. In addition, we may spend valuable time and managerial and financial resources on research programs and product candidates for specific indications that ultimately do not yield any scientifically or commercially viable products. If we do not accurately evaluate the scientific and commercial potential or target market for a particular product candidate, we may relinquish valuable rights to that product candidate through collaboration, licensing or other royalty arrangements in situations where it would have been more advantageous for us to retain sole rights to development and commercialization.

We may face delays in completing our clinical trials, and we may not be able to complete them at all.

We have not completed all the clinical trials necessary to support an application with the FDA for approval to market any of our product candidates. Our current and future clinical trials may be delayed or terminated as a result of many factors, including:

In addition, we rely on academic institutions, physician practices and clinical research organizations to conduct, supervise or monitor some or all aspects of clinical trials involving our product candidates. We have less control over the timing and other aspects of these clinical trials than if we conducted the monitoring and supervision entirely on our own. Third parties may not perform their responsibilities for our clinical trials on our anticipated schedule or consistent with a clinical trial protocol or applicable regulations. We also may rely on clinical research organizations to perform our data management and analysis. They may not provide these services as required or in a timely or compliant manner.

Moreover, our development costs will increase if we are required to complete additional or larger clinical trials for the HyperAcute product candidates, D-1MT or other product candidates prior to FDA approval. If the delays or costs are significant, our financial results and ability to commercialize the HyperAcute product candidates, D-1MT or other future product candidates will be adversely affected.

If we encounter difficulties enrolling patients in our clinical trials, our clinical trials could be delayed or otherwise adversely affected.

Clinical trials for our product candidates require us to identify and enroll a large number of patients with the disease under investigation. We may not be able to enroll a sufficient number of patients, or those with required or desired characteristics to achieve diversity in a study, to complete our clinical trials in a timely manner. Patient enrollment is affected by factors including:

In particular, the inclusion of critically ill patients in our clinical trials may result in deaths or other adverse medical events for reasons that may not be related to the product candidate we are testing or, in those trials where our product candidate is being tested in combination with one or more other therapies, for reasons that may be attributable to such other therapies, but which can nevertheless negatively affect clinical trial results. In addition, we have experienced difficulties enrolling patients in certain of our smaller clinical trials due to lack of referrals and may experience similar difficulties in the future.

If we have difficulty enrolling a sufficient number or diversity of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing or planned clinical trials, either of which would have an adverse effect on our business.

Regulatory authorities may not approve our product candidates even if they meet safety and efficacy endpoints in clinical trials.

We have discussions with and obtain guidance from regulatory authorities regarding certain aspects of our clinical development activities. These discussions are not binding commitments on the part of regulatory authorities. Under certain circumstances, regulatory authorities may revise or retract previous

guidance during the course of our clinical activities or after the completion of our clinical trials. A regulatory authority may also disqualify a clinical trial in whole or in part from consideration in support of approval of a potential product for commercial sale or otherwise deny approval of that product. Prior to regulatory approval, a regulatory authority may elect to obtain advice from outside experts regarding scientific issues and/or marketing applications under a regulatory authority review. In the United States, these outside experts are convened through the FDA's Advisory Committee process, which would report to the FDA and make recommendations that may differ from the views of the FDA; should an Advisory Committee be convened, it would be expected to lengthen the time for obtaining regulatory approval, if such approval is obtained at all.

The FDA and other foreign regulatory agencies can delay, limit or deny marketing approval for many reasons, including:

Any delay in, or failure to receive or maintain, approval for any of our product candidates could prevent us from ever generating meaningful revenues or achieving profitability.

Our product candidates may not be approved even if they achieve their endpoints in clinical trials. Regulatory agencies, including the FDA, or their advisors may disagree with our trial design and our interpretations of data from preclinical studies and clinical trials. Regulatory agencies may change requirements for approval even after a clinical trial design has been approved. Regulatory agencies also may approve a product candidate for fewer or more limited indications than requested or may grant approval subject to the performance of post-marketing studies. In addition, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of our product candidates.

We may be required to suspend, repeat or terminate our clinical trials if they are not conducted in accordance with regulatory requirements, the results are negative or inconclusive or the trials are not well designed.

Clinical trials must be conducted in accordance with the FDA's current Good Clinical Practices, or cGCP, or other applicable foreign government guidelines and are subject to oversight by the FDA, other foreign governmental agencies and Institutional Review Boards at the medical institutions where the clinical trials are conducted. In addition, clinical trials must be conducted with product candidates produced under current Good Manufacturing Practices, or cGMP, and may require large numbers of test subjects. Clinical trials may be suspended by the FDA, other foreign governmental agencies, or us for various reasons, including:

In addition, changes in regulatory requirements and guidance may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial

protocols to Institutional Review Boards for reexamination, which may impact the costs, timing or successful completion of a clinical trial. Due to these and other factors, our HyperAcute product candidates, D-1MT and other product candidates could take a significantly longer time to gain regulatory approval for any additional indications than we expect or we may never gain approval for additional indications, which could reduce our revenue by delaying or terminating the commercialization of our HyperAcute product candidates, D-1MT and other product candidates for additional indications.

Our product candidates are being and will be studied in clinical trials co-sponsored by the National Cancer Institute, or NCI, and in investigator-initiated clinical trials, which means we have little control over the conduct of such trials.

Our D-1MT product candidate is being studied in a two Phase 1B/2 clinical trials co-sponsored by the National Cancer Institute. We are also currently providing clinical supply of our HyperAcute Melanoma product candidate in support of a Phase 2 investigator-initiated clinical trial. We expect to continue to supply and otherwise support similar trials in the future. However, because we are not the sponsors of these trials, we do not control the protocols, administration or conduct of these trials and, as a result, are subject to risks associated with the way these types of trials are conducted, in particular should any problems arise. These risks include difficulties or delays in communicating with investigators or administrators, procedural delays and other timing issues and difficulties or differences in interpreting data.

If we cannot demonstrate the safety of our product candidates in preclinical and/or other non-clinical studies, we will not be able to initiate or continue clinical trials or obtain approval for our product candidates.

In order to move a product candidate not yet being tested in humans into a clinical trial, we must first demonstrate in preclinical testing that the product candidate is safe. Furthermore, in order to obtain approval, we must also demonstrate safety in various preclinical and non-clinical tests. We may not have conducted or may not conduct in the future the types of preclinical and other non-clinical testing ultimately required by regulatory authorities, or future preclinical tests may indicate that our product candidates are not safe for use in humans. Preclinical testing is expensive, can take many years and have an uncertain outcome. In addition, success in initial preclinical testing does not ensure that later preclinical testing will be successful. We may experience numerous unforeseen events during, or as a result of, the preclinical testing process, which could delay or prevent our ability to develop or commercialize our product candidates, including:

Any such events would increase our costs and could delay or prevent our ability to commercialize our product candidates, which could adversely impact our business, financial condition and results of operations.

Even if approved, the HyperAcute product candidates, D-1MT or any other product we may commercialize and market may be later withdrawn from the market or subject to promotional limitations.

We may not be able to obtain the labeling claims necessary or desirable for the promotion of our products. We may also be required to undertake post-marketing clinical trials. If the results of such post-marketing studies are not satisfactory, the FDA or a comparable agency in a foreign country may withdraw marketing authorization or may condition continued marketing on commitments from us that may be expensive and/or time consuming to fulfill. In addition, if we or others identify adverse side effects after any of our products are on the market, or if manufacturing problems occur, regulatory approval may be withdrawn and reformulation of our products, additional clinical trials, changes in labeling of our products and additional marketing applications may be required. Any reformulation or labeling changes may limit the marketability of our products.

We will need to develop or acquire additional capabilities in order to commercialize any product candidates that obtain FDA approval, and we may encounter unexpected costs or difficulties in doing so.

We will need to acquire additional capabilities and effectively manage our operations and facilities to successfully pursue and complete future research, development and commercialization efforts. Currently, we have no experience in preparing applications for marketing approval, commercial-scale manufacturing, managing of large-scale information technology systems or managing a large-scale distribution system. We will need to add personnel and expand our capabilities, which may strain our existing managerial, operational, regulatory compliance, financial and other resources. To do this effectively, we must:

We plan to increase our manufacturing capacity and seek FDA approval for our production process simultaneously with seeking approval for sale of our HyperAcute Pancreas product candidate. Should we not receive timely approval of our production process, our ability to produce the immunotherapy products following regulatory approval for sale could be delayed, which would further delay the period of time when we would be able to generate revenues from the sale of such products, if we are even able to generate revenues at all.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our product candidates, we may be unable to generate significant product revenue.

We do not have a sales organization and have no experience in the sales and distribution of pharmaceutical products. There are risks involved with establishing our own sales capabilities and increasing our marketing capabilities, as well as entering into arrangements with third parties to perform these services. Developing an internal sales force is expensive and time consuming and could delay any product launch. On the other hand, if we enter into arrangements with third parties to perform sales, marketing and distribution services, our product revenues or the profitability of these product revenues to us are likely to be lower than if we market and sell any products that we develop ourselves.

We may establish our own specialty sales force and/or engage other biopharmaceutical or other healthcare companies with established sales, marketing and distribution capabilities to sell, market and distribute any future products. We may not be able to establish a specialty sales force or establish sales,

marketing or distribution relationships on acceptable terms. Factors that may inhibit our efforts to commercialize any future products without strategic partners or licensees include:

Because the establishment of sales, marketing and distribution capabilities depends on the progress towards commercialization of our product candidates, and because of the numerous risks and uncertainties involved with establishing those capabilities, we are unable to predict when, if ever, we will establish our own sales, marketing and distribution capabilities. If we are not able to partner with third parties and are unsuccessful in recruiting sales, marketing and distribution personnel or in building the necessary infrastructure, we will have difficulty commercializing our product candidates, which would adversely affect our business and financial condition.

Failure to attract and retain key personnel could impede our ability to develop our products and to obtain new collaborations or other sources of funding.

Because of the specialized scientific nature of our business, our success is highly dependent upon our ability to attract and retain qualified scientific and technical personnel, consultants and advisors. We are highly dependent on the principal members of our scientific and management staff, particularly Dr. Charles J. Link, Jr. The loss of his services might significantly delay or prevent the achievement of our research, development, and business objectives. We do not maintain key-man life insurance with respect to any of our employees, nor do we intend to secure such insurance.

We will need to recruit a significant number of additional personnel in order to achieve our operating goals. In order to pursue our product development and marketing and sales plans, we will need to hire additional qualified scientific personnel to perform research and development, as well as personnel with expertise in clinical testing, government regulation, manufacturing, marketing and sales. We also rely on consultants and advisors to assist in formulating our research and development strategy and adhering to complex regulatory requirements. We face competition for qualified individuals from numerous pharmaceutical and biotechnology companies, universities and other research institutions. There can be no assurance that we will be able to attract and retain such individuals on acceptable terms, if at all. If the personnel that have contingently agreed to join us do not join us it will be difficult or impossible for us to execute our business plan in a timely manner. Additionally, our facilities are located in Iowa, which may make attracting and retaining qualified scientific and technical personnel from outside of Iowa difficult. We have two forgivable loans totaling $6.4 million that are contingent on us creating jobs in Iowa. If we leave Iowa or fail to create the required number of jobs in Iowa, we may be required to pay back some or all of those loans. The failure to attract and retain qualified personnel, consultants and advisors could have a material adverse effect on our business, financial condition and results of operations.

Risks Relating to Manufacturing Activities

We have never manufactured our product candidates at commercial scale, and there can be no assurance that such products can be manufactured in compliance with regulations at a cost or in quantities necessary to make them commercially viable.

We have no experience in commercial-scale manufacturing, the management of large-scale information technology systems or the management of a large-scale distribution system. We may develop our manufacturing capacity in part by expanding our current facilities. This activity would require

substantial additional funds and we would need to hire and train significant numbers of qualified employees to staff these facilities. We may not be able to develop commercial-scale manufacturing facilities that are sufficient to produce materials for additional later-stage clinical trials or commercial use.

If we are unable to manufacture or contract for a sufficient supply of our product candidates on acceptable terms, or if we encounter delays or difficulties in the scale-up of our manufacturing processes or our relationships with other manufacturers, our preclinical and human clinical testing schedule would be delayed. This in turn would delay the submission of product candidates for regulatory approval and thereby delay the market introduction and subsequent sales of any products that receive regulatory approval, which would have a material adverse effect on our business, financial condition and results of operations. Furthermore, we or our contract manufacturers must supply all necessary documentation in support of our Biologics License Application, or BLA, or New Drug Application, or NDA, on a timely basis and must adhere to Good Laboratory Practice, or GLP and cGMP regulations enforced by the FDA through its facilities inspection program. If these facilities cannot pass a pre-approval plant inspection, the FDA approval of the products will not be granted.

We and our contract manufacturers are subject to significant regulation with respect to manufacturing of our products.

All entities involved in the preparation of a therapeutic drug for clinical trials or commercial sale, including our existing contract manufacturer for D-1MT and the components used in the HyperAcute product candidates, are subject to extensive regulation. Components of a finished therapeutic product approved for commercial sale or used in late-stage clinical trials must be manufactured in accordance with cGMP. These regulations govern manufacturing processes and procedures (including record keeping) and the implementation and operation of quality systems to control and assure the quality of investigational products and products approved for sale. Our facilities and quality systems and the facilities and quality systems of some or all of our third party contractors must pass a pre-approval inspection for compliance with the applicable regulations as a condition of regulatory approval of the HyperAcute product candidates, D-1MT or any of our other potential products. In addition, the regulatory authorities may, at any time, audit or inspect a manufacturing facility involved with the preparation of the HyperAcute product candidates, D-1MT or our other potential products or the associated quality systems for compliance with the regulations applicable to the activities being conducted. The regulatory authorities also may, at any time following approval of a product for sale, audit our manufacturing facilities or those of our third party contractors. If any such inspection or audit identifies a failure to comply with applicable regulations or if a violation of our product specifications or applicable regulations occurs independent of such an inspection or audit, we or the relevant regulatory authority may require remedial measures that may be costly and/or time consuming for us or a third party to implement and that may include the temporary or permanent suspension of a clinical trial or commercial sales or the temporary or permanent closure of a facility. Any such remedial measures imposed upon us or third parties with whom we contract could materially harm our business.

We currently rely on relationships with third-party contract manufacturers, which limits our ability to control the availability of, and manufacturing costs for, our product candidates in the near-term.

We will rely upon contract manufacturers for D-1MT, and for components of the HyperAcute product candidates, for commercial sale if any are approved for sale. Problems with any of our facilities or processes, or our contract manufacturers' facilities or processes, could prevent or delay the production of adequate supplies of antigen, components or finished HyperAcute product candidates or D-1MT. This could delay or reduce commercial sales and materially harm our business. We do not currently have experience with the manufacture of products at commercial scale, and may incur substantial costs to develop the capability to manufacture products at commercial scale. Any prolonged delay or interruption in the operations of our facilities or our contract manufacturers' facilities could result in cancellation of

shipments, loss of components in the process of being manufactured or a shortfall in availability of a product. A number of factors could cause interruptions, including the inability of a supplier to provide raw materials, equipment malfunctions or failures, damage to a facility due to natural disasters, changes in regulatory requirements or standards that require modifications to our manufacturing processes, action by the regulatory authorities or by us that results in the halting or slowdown of production of components or finished product due to regulatory issues, a contract manufacturer going out of business or failing to produce product as contractually required or other similar factors. Because manufacturing processes are highly complex and are subject to a lengthy regulatory approval process, alternative qualified production capacity and sufficiently trained or qualified personnel may not be available on a timely or cost-effective basis or at all. Difficulties or delays in our contract manufacturers' production of drug substances could delay our clinical trials, increase our costs, damage our reputation and cause us to lose revenue and market share if we are unable to timely meet market demand for any products that are approved for sale.

Further, if our contract manufacturers are not in compliance with regulatory requirements at any stage, including post-marketing approval, we may be fined, forced to remove a product from the market and/or experience other adverse consequences, including delays, which could materially harm our business.

We use hazardous materials in our business and must comply with environmental laws and regulations, which can be expensive.

Our research and development involves the controlled use of hazardous materials, chemicals, various active microorganisms and volatile organic compounds, and we may incur significant costs as a result of the need to comply with numerous laws and regulations. We are subject to laws and regulations enforced by the FDA, the Drug Enforcement Agency, foreign health authorities and other regulatory requirements, including the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Food, Drug and Cosmetic Act, the Resource Conservation and Recovery Act, and other current and potential federal, state, local and foreign laws and regulations governing the use, manufacture, storage, handling and disposal of our products, materials used to develop and manufacture our product candidates, and resulting waste products. Although we believe that our safety procedures for handling and disposing of such materials, and for killing any unused microorganisms before disposing of them, comply with the standards prescribed by state and federal regulations, the risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of such an accident, we could be held liable for any damages that result and any such liability could exceed our resources.

We replicate all biological cells for our products internally and utilize a single manufacturing site to manufacture our clinical product candidates. Any disruption in the operations of our manufacturing facility would have a significant negative impact on our ability to manufacture products for clinical testing and would result in increased costs and losses.

We have thus far elected to replicate all biological cells for our products internally using a complex process. The disruption of our operations could result in manufacturing delays due to the inability to purchase the cell lines from outside sources. We have only one manufacturing facility in which we can manufacture clinical products. In the event of a physical catastrophe at our manufacturing or laboratory facilities, we could experience costly delays in reestablishing manufacturing capacity, due to a lack of redundancy in manufacturing capability.

Our current manufacturing facility contains highly specialized equipment and utilizes complicated production processes developed over a number of years, which would be difficult, time-consuming and costly to duplicate. Any prolonged disruption in the operations of our manufacturing facility would have a significant negative impact on our ability to manufacture products for clinical testing on our own and would cause us to seek additional third-party manufacturing contracts, thereby increasing our development costs. We may suffer losses as a result of business interruptions that exceed the coverage available under our insurance policies or any losses may be excluded under our insurance policies. Certain events, such as

natural disasters, fire, political disturbances, sabotage or business accidents, which could impact our current or future facilities, could have a significant negative impact on our operations by disrupting our product development efforts until such time as we are able to repair our facility or put in place third-party contract manufacturers to assume this manufacturing role.

We recently transferred our manufacturing operation to a new facility. We have experienced bacterial and mycoplasm contaminations in lots produced at the previous facility and we destroyed the contaminated lots and certain overlapping lots. We may have contaminated lots at our new facility and we will destroy any contaminated lots that we detect.

Our facilities are located in areas where floods and tornados are known to occur, and the occurrence of a flood, tornado or other catastrophic disaster could damage our facilities and equipment, which could cause us to curtail or cease operations.

Our facilities are located in Ames, Iowa, which is susceptible to floods and tornados, and our facilities are therefore vulnerable to damage or disruption from floods and tornados. We are also vulnerable to damage from other types of disasters, such as power loss, fire and similar events. If any disaster were to occur, our ability to operate our business could be seriously impaired. We currently carry business personal property insurance in the amount of $6.25 million in the aggregate, but this policy does not cover disasters such as floods and earthquakes. We may not have adequate insurance to cover our losses resulting from disasters or other similar significant business interruptions, and we do not plan to purchase additional insurance to cover such losses due to the cost of obtaining such coverage. Any significant losses that are not recoverable under our insurance policies could seriously impair our business and financial condition.

Risks Relating to Regulation of Our Industry

The industry within which we operate and our business are subject to extensive regulation, which is costly, time consuming and may subject us to unanticipated delays.

The research, design, testing, manufacturing, labeling, marketing, distribution and advertising of biologic and pharmaceutical products such as our product candidates are subject to extensive regulation by governmental regulatory authorities in the United States and other countries. The drug development and approval process is generally lengthy, expensive and subject to unanticipated delays. Data obtained from preclinical and clinical testing are subject to varying interpretations that could delay, limit or prevent regulatory approval. In addition, delays or rejections may be encountered based upon changes in regulatory policy for product approval during the period of development and regulatory review of each submitted application for approval. To obtain approval for a product candidate, we must demonstrate to the satisfaction of the regulatory authorities that the product candidate is safe, pure, potent and effective, which typically takes several years or more depending upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. There can be no assurance that we will not encounter problems in clinical trials that would cause us or the regulatory authorities to delay or suspend clinical trials. Any such delay or suspension could have a material adverse effect on our business, financial condition and results of operations.

There can be no assurance that clinical studies for any of our product candidates currently under development will be completed successfully or within any specified time period, if at all. Further, there can also be no assurance that such testing will show any product to be safe, pure, potent or effective. There can be no assurance that we will not encounter problems in clinical trials that will cause us to delay or suspend clinical trials.

Regardless of how much time and resources we devote to development of a product candidate, there can be no assurance that regulatory approval will be obtained for that product candidate. To date, the FDA has approved only one active cellular cancer immunotherapy product, even though several have been, and currently are in, clinical development. Further, even if such regulatory approval is obtained, we, our

products and any contract manufacturers or commercial collaborators of ours will be subject to continual regulatory review in both the United States and other countries. Later discovery of previously unknown problems with regard to a product, distributor or manufacturer may result in restrictions, including withdrawal of the product from the market and/or disqualification or decertification of the distributor or manufacturer.

We cannot predict when, if ever, we might submit for regulatory review our product candidates currently under development. Once we submit our potential products for review, there can be no assurance that regulatory approvals for any pharmaceutical products developed by us will be granted on a timely basis, if at all.

The FDA and comparable agencies in foreign countries impose substantial requirements on the introduction of new biologic and pharmaceutical products through lengthy and detailed preclinical and clinical testing procedures, sampling activities and other costly and time-consuming compliance procedures. Clinical trials are vigorously regulated and must meet requirements for FDA review and oversight and requirements under GCP guidelines. A new drug may not be marketed in the United States until the FDA has approved it. There can be no assurance that we will not encounter delays or rejections or that the FDA will not make policy changes during the period of product development and FDA regulatory review of each submitted BLA and NDA. A delay in obtaining or failure to obtain such approvals would have a material adverse effect on our business, financial condition and results of operations. Even if regulatory approval were obtained, it would be limited as to the indicated uses for which the product may be promoted or marketed. A marketed product, its manufacturer and the facilities in which it is manufactured are subject to continual review and periodic inspections. If marketing approval is granted, we would be required to comply with FDA requirements for manufacturing, labeling, advertising, record keeping and reporting of adverse experiences and other information. In addition, we would be required to comply with federal and state anti-kickback and other health care fraud and abuse laws that pertain to the marketing of pharmaceuticals. Failure to comply with regulatory requirements and other factors could subject us to regulatory or judicial enforcement actions, including product recalls or seizures, injunctions, withdrawal of the product from the market, civil penalties, criminal prosecution, refusals to approve new products and withdrawals of existing approvals, as well as enhanced product liability exposure, any of which could have a material adverse effect on our business, financial condition and results of operations. Sales of our products outside the United States will be subject to foreign regulatory requirements governing clinical trials, marketing approval, manufacturing and pricing. Non-compliance with these requirements could result in enforcement actions or penalties or could delay introduction of our products in certain countries.

The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement outside the United States vary greatly from country to country. The time required to obtain approvals outside the United States may differ from that required to obtain FDA approval. We may not obtain foreign regulatory approvals on a timely basis, or at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other countries or by the FDA and foreign regulatory authorities could require additional testing. Failure to comply with these regulatory requirements or obtain required approvals could impair our ability to develop foreign markets for our products and may have a material adverse effect on our results of operations and financial condition.

We are also subject to laws generally applicable to businesses, including but not limited to, federal, state and local regulations relating to wage and hour matters, employee classification, mandatory healthcare benefits, unlawful workplace discrimination and whistle-blowing. Any actual or alleged failure to comply with any regulation applicable to our business or any whistle-blowing claim, even if without merit, could result in costly litigation, regulatory action or otherwise harm our business, results of operations, financial condition, cash flow and future prospects.

The availability and amount of reimbursement for our product candidates, if approved, and the manner in which government and private payors may reimburse for our potential product, are uncertain.

In both United States and foreign markets, sales of our proposed products will depend in part on the availability of reimbursement from third-party payors such as government health administration authorities, private health insurers and other organizations. Our future levels of revenues and profitability may be affected by the continuing efforts of governmental and third party payors to contain or reduce the costs of health care. We cannot predict the effect that private sector or governmental health care reforms may have on our business, and there can be no assurance that any such reforms will not have a material adverse effect on our business, financial condition and results of operations.

In addition, in both the United States and elsewhere, sales of prescription drugs are dependent in part on the availability of reimbursement to the consumer from third-party payors, such as government and private insurance plans. Third-party payors are increasingly challenging the price and cost-effectiveness of medical products and services. Significant uncertainty exists as to the reimbursement status of newly approved health care products. There can be no assurance that our proposed products will be considered cost-effective or that adequate third-party reimbursement will be available to enable us to maintain price levels sufficient to realize an appropriate return on our investment in product development. Legislation and regulations affecting the pricing of pharmaceuticals may change before any of our proposed products are approved for marketing. Adoption of such legislation could further limit reimbursement for medical products and services. As a result, we may elect not to market future products in certain markets.

Moreover, while we are in clinical trials, we will not be reimbursed for any of our materials used during the clinical trials.