Use these links to rapidly review the documentTABLE OF CONTENTSTable of Contents

INDEX TO FINANCIAL STATEMENTS

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on August 1,9, 2013

Registration No. 333-189838

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 23 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OCI RESOURCES LP

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 1400 (Primary Standard Industrial Classification Code Number) | 46-2613366 (I.R.S. Employer Identification Number) |

Five Concourse Parkway

Suite 2500

Atlanta, Georgia 30328

(770) 375-2300

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Kirk Milling

Five Concourse Parkway

Suite 2500

Atlanta, Georgia 30328

(770) 375-2300

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

| Copies to: | ||

David Cho Thomas Friedmann Dechert LLP 1900 K Street, NW Washington, DC 20006 (202) 261-3300 | Joshua Davidson Hillary H. Holmes Baker Botts L.L.P. 910 Louisiana Street Houston, Texas 77002 (713) 229-1234 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||

|---|---|---|---|---|

Common units representing limited partner interests | $115,000,000 | $15,686 | ||

| ||||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section��Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where such offer or sale is not permitted.

Subject to Completion, dated August 1,9, 2013

PRELIMINARY PROSPECTUS

OCI Resources LP

Common Units

Representing Limited Partner Interests

This is the initial public offering of our common units representing limited partner interests. We are offering common units. Prior to this offering, there has been no public market for our common units. We currently expect the initial public offering price to be between $ and $ per common unit. Our common units have been approved for listing on the New York Stock Exchange, subject to official notice of issuance, under the symbol "OCIR."

Investing in our common units involves risks. Please read "Risk Factors" beginning on page 24.

These risks include the following:

We qualify as an "emerging growth company" under the Securities Act of 1933, as amended, or the Securities Act, and as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify and are eligible for reduced reporting and compliance requirements in the future. Please read "Summary—Emerging Growth Company Status" and "Risk Factors."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Common Unit | Total | ||

|---|---|---|---|---|

Public Offering Price | $ | $ | ||

Underwriting Discount(1) | $ | $ | ||

Proceeds to OCI Resources LP (before expenses) | $ | $ | ||

To the extent that the underwriters sell more than common units in this offering, the underwriters have an option to purchase up to an additional common units from OCI Resources LP at the initial public offering price less underwriting discounts.

The underwriters expect to deliver the common units to purchasers on or about , 2013 through the book-entry facilities of The Depository Trust Company.

| Citigroup | Goldman, Sachs & Co. | |||

| Barclays | Credit Suisse |

Prospectus dated , 2013

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS | vi | |

TRONA RESERVE INFORMATION | vii | |

SUMMARY | 1 | |

OCI Resources LP | 1 | |

Risk Factors | 6 | |

Formation Transactions and Partnership Structure | 7 | |

Organizational Structure | 9 | |

Our Management | 10 | |

Our Relationship with OCI Company | 10 | |

Summary of Conflicts of Interest and Contractual Duties | 11 | |

Principal Executive Offices | 11 | |

Emerging Growth Company Status | 11 | |

The Offering | 13 | |

Summary Historical and Pro Forma Financial and Operating Data | 18 | |

RISK FACTORS | 24 | |

Risks Inherent in Our Business and Industry | 24 | |

Risks Inherent in an Investments in Us | 43 | |

Tax Risks to Common Unitholders | 55 | |

USE OF PROCEEDS | 60 | |

CAPITALIZATION | 61 | |

DILUTION | 62 | |

CASH DISTRIBUTION POLICY AND RESTRICTIONS ON DISTRIBUTIONS | 64 | |

General | 64 | |

Our Minimum Quarterly Distribution | 66 | |

Unaudited Pro Forma Cash Available for Distribution for the Year Ended December 31, 2012 and the Twelve Months Ended | 68 | |

Estimated Cash Available for Distribution for the Twelve Months Ending | 70 | |

Assumptions and Considerations | 73 | |

HOW WE MAKE DISTRIBUTIONS TO OUR PARTNERS | 76 | |

General | 76 | |

Operating Surplus and Capital Surplus | 76 | |

Capital Expenditures | 79 | |

Subordination Period | 80 | |

Distributions from Operating Surplus During the Subordination Period | 81 | |

Distributions from Operating Surplus After the Subordination Period | 82 | |

General Partner Interest and Incentive Distribution Rights | 82 | |

Percentage Allocations of Distributions from Operating Surplus | 83 | |

General Partner's Right to Reset Incentive Distribution Levels | 83 | |

Distributions from Capital Surplus | 86 | |

Adjustment to the Minimum Quarterly Distribution and Target Distribution Levels | 87 | |

Distributions of Cash Upon Liquidation | 87 | |

SELECTED HISTORICAL AND PRO FORMA FINANCIAL AND OPERATING DATA | 90 | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 96 | |

Overview | 96 | |

Factors Affecting Our Results of Operations | 96 | |

How We Evaluate Our Business | 97 | |

Results of Operations | 100 | |

Liquidity and Capital Resources | 108 |

i

Capital Requirements | 108 | |

Capital Expenditures | 108 | |

Cash Flows | 109 | |

Debt | 111 | |

Contractual Obligations | 114 | |

Impact of Inflation | 115 | |

Critical Accounting Policies | 115 | |

Recently Issued Accounting Standards | 115 | |

Off-Balance Sheet Arrangements | 115 | |

Seasonality | 115 | |

Quantitative and Qualitative Disclosure about Market Risk | 115 | |

INDUSTRY | 117 | |

Introduction | 117 | |

Soda Ash Production Methods | 117 | |

Wyoming's Green River Basin | 119 | |

End-Market Uses for Soda Ash | 120 | |

Global Market and Supply and Demand | 121 | |

Soda Ash Pricing | 125 | |

BUSINESS | 126 | |

Overview | 126 | |

Our Competitive Strengths | 127 | |

Our Business Strategies | 129 | |

Our Relationship with OCI Company | 130 | |

Our Operations | 131 | |

Our Production Processes | 133 | |

Customers | 135 | |

Leases and Licenses | 136 | |

Properties and Assets | 137 | |

Trona Reserves | 138 | |

Competition | 140 | |

Insurance | 140 | |

Environmental Matters | 140 | |

Mining and Workplace Safety | 142 | |

Employees/Labor Relations | 143 | |

Legal Proceedings | 143 | |

MANAGEMENT | 144 | |

Management of OCI Resources | 144 | |

Directors and Executive Officers of Our General Partner | 145 | |

Committees of the Board of Directors | 146 | |

OCI Wyoming Partnership Agreement | 147 | |

EXECUTIVE COMPENSATION AND OTHER INFORMATION | 149 | |

Compensation Discussion and Analysis | 149 | |

Compensation of Directors | 154 | |

Reimbursement of Expenses of Our General Partner | 154 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 155 | |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 156 | |

Distributions and Payments to Our General Partner and Its Affiliates | 156 | |

Agreements Governing the Transactions | 158 | |

Omnibus Agreement | 158 | |

Transactions with Affiliates | 160 | |

Procedures for Review, Approval and Ratification of Transactions with Related Persons | 161 |

ii

CONFLICTS OF INTEREST AND CONTRACTUAL DUTIES | 162 | |

Conflicts of Interest | 162 | |

Duties of the General Partner | 168 | |

DESCRIPTION OF THE COMMON UNITS | 171 | |

The Units | 171 | |

Transfer Agent and Registrar | 171 | |

Transfer of Common Units | 171 | |

THE PARTNERSHIP AGREEMENT | 173 | |

Organization and Duration | 173 | |

Purpose | 173 | |

Cash Distributions | 173 | |

Capital Contributions | 173 | |

Voting Rights | 174 | |

Applicable Law; Forum, Venue and Jurisdiction | 175 | |

Limited Liability | 175 | |

Issuance of Additional Interests | 176 | |

Amendment of the Partnership Agreement | 177 | |

Merger, Consolidation, Conversion, Sale or Other Disposition of Assets | 179 | |

Dissolution | 180 | |

Liquidation and Distribution of Proceeds | 180 | |

Withdrawal or Removal of Our General Partner | 180 | |

Transfer of General Partner Interest | 182 | |

Transfer of Ownership Interests in the General Partner | 182 | |

Transfer of Incentive Distribution Rights | 182 | |

Transfer of Limited Partner Interests | 182 | |

Change of Management Provisions | 183 | |

Limited Call Right | 183 | |

Redemption of Ineligible Holders | 183 | |

Meetings; Voting | 184 | |

Status as Limited Partner | 185 | |

Indemnification | 185 | |

Reimbursement of Expenses | 185 | |

Books and Reports | 185 | |

Right to Inspect Our Books and Records | 186 | |

Registration Rights | 186 | |

UNITS ELIGIBLE FOR FUTURE SALE | 187 | |

Rule 144 | 187 | |

Our Partnership Agreement and Registration Rights | 187 | |

Lock-Up Agreements | 188 | |

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 189 | |

Taxation of the Partnership | 190 | |

Tax Consequences of Unit Ownership | 191 | |

Tax Treatment of Operations | 196 | |

Disposition of Units | 198 | |

Uniformity of Units | 200 | |

Tax-Exempt Organizations and Other Investors | 201 | |

Administrative Matters | 202 | |

State, Local and Other Tax Considerations | 204 | |

INVESTMENT IN OCI RESOURCES LP BY EMPLOYEE BENEFIT PLANS AND IRAS | 205 | |

UNDERWRITING | 206 | |

Option to Purchase Additional Common Units | 206 |

iii

No Sales of Similar Securities | 206 | |

Listing | 207 | |

Commissions and Discounts | 207 | |

Price Stabilization, Short Positions and Penalty Bids. | 208 | |

Electronic Distribution | 209 | |

Underwriter Relationships | 209 | |

Selling Legends | 210 | |

VALIDITY OF OUR COMMON UNITS | 213 | |

EXPERTS | 213 | |

WHERE YOU CAN FIND MORE INFORMATION | 213 | |

INDEX TO FINANCIAL STATEMENTS | F-1 | |

OCI Resources LP Unaudited Pro Forma Financial Statements | F-2 | |

OCI Wyoming Holding Co. and Subsidiary (Predecessor) Audited Financial Statements | F-9 | |

OCI Wyoming Holding Co. and Subsidiary (Predecessor) Unaudited Financial Statements | F-27 | |

OCI Resources LP Audited Financial Statements | ||

APPENDIX A—GLOSSARY OF INDUSTRY TERMS | A-1 | |

APPENDIX B—FORM OF AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP OF OCI RESOURCES LP | B-1 |

iv

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by or on behalf of us or any other information to which we have referred you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell or solicitation of an offer to buy our common units in any jurisdiction or under any circumstances in which the offer or solicitation is unlawful. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

The data included in this prospectus regarding the trona ore and soda ash industry, including descriptions of trends in the market and our position and the position of our competitors within the industry, is based on a variety of sources, including independent industry publications, government publications and other published independent sources, information obtained from customers, distributors, suppliers and trade and business organizations and publicly available information, as well as our good faith estimates, which have been derived from management's knowledge and experience in the industry in which we operate. Although we have not independently verified the accuracy or completeness of the third-party information included in this prospectus, based on management's knowledge and experience, we believe that such third-party sources are reliable and that the third-party information included in this prospectus or in our estimates is accurate and complete. In addition, we have provided amounts in this prospectus in metric tons converted to short tons at a ratio of 1 metric ton to 1.10231131 short tons. Unless otherwise specifically defined, references to "tons" shall refer to short tons.

We include a glossary of some of the industry terms used in this prospectus as Appendix A.

v

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this prospectus, including in the sections entitled "Summary," "Risk Factors," "Cash Distribution Policy and Restrictions on Distributions," "How We Make Distributions to Our Partners," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Industry" and "Business." We have based such forward-looking statements on management's beliefs and assumptions and on information currently available to us. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words "believe," "expect," "plan," "intend," "anticipate," "estimate," "predict," "forecast," "potential," "continue," "may," "will," "should" or the negative of these terms or similar expressions. In particular, statements in this prospectus concerning future distributions, if any, are subject to the approval of the board of directors of our general partner and will be based upon circumstances then existing.

When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

vi

Forward-looking statements involve risks, uncertainties and assumptions. You should not put undue reliance on any forward-looking statements. After the date of this prospectus, we do not have any intention or obligation to update any forward-looking statement, whether as a result of new information or future events except as required by applicable law.

The risk factors discussed in "Risk Factors" could cause our results to differ materially from those expressed in forward-looking statements. There may also be other risks that we are unable to predict at this time. All forward-looking statements included in this prospectus are expressly qualified in their entirety by these cautionary statements. The "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 do not apply to statements made in connection with this offering.

Reserves are broadly defined as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. In accordance with the guidance of the Securities and Exchange Commission, or the SEC, our trona reserves are categorized as "proven (measured) reserves" and "probable (indicated) reserves," which are defined as follows:

In determining whether our reserves meet these standards, our estimates are based on certain important assumptions. Please see "Business—Trona Reserves."

The information appearing in this prospectus concerning estimates of our proven and probable reserves is based on a reserve report funded by us and prepared by Hollberg Professional Group, PC, or Hollberg Professional Group, an independent mining and geological consulting firm.

vii

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the historical and pro forma financial statements and the notes to those financial statements, before investing in our common units. The information presented in this prospectus assumes (1) an initial public offering price of $ per common unit (the mid-point of the price range set forth on the cover page of this prospectus) and (2) unless otherwise indicated, that the underwriters' option to purchase additional common units is not exercised and that the common units otherwise issuable upon the exercise of such option are instead issued to the owners of our general partner. You should read "Risk Factors" for information about important risks that you should consider before buying our common units.

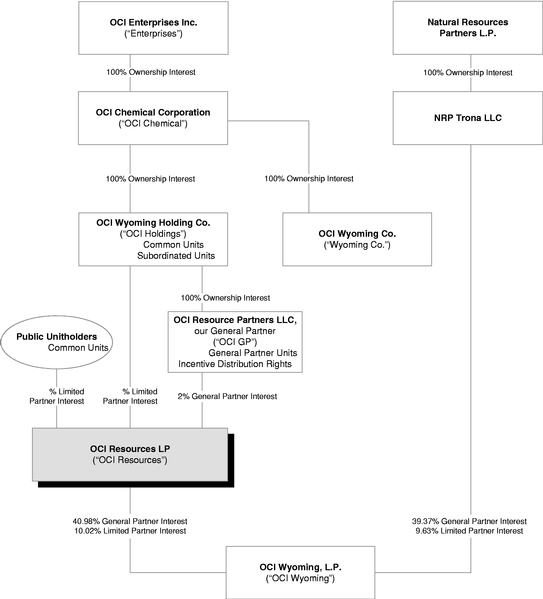

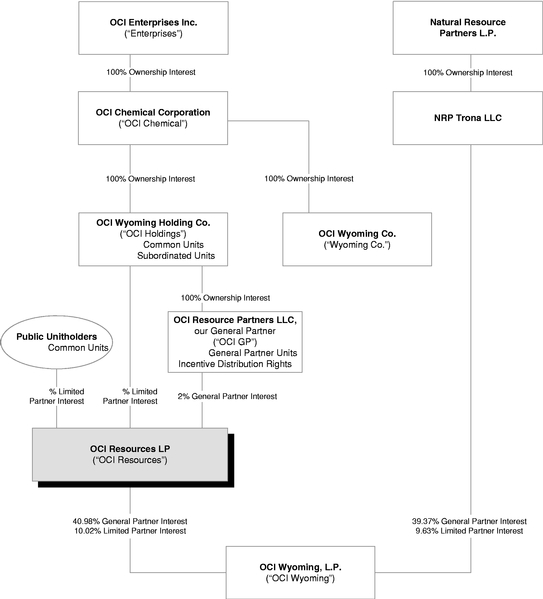

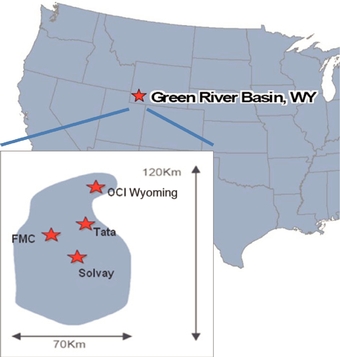

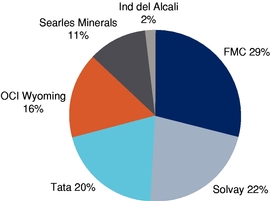

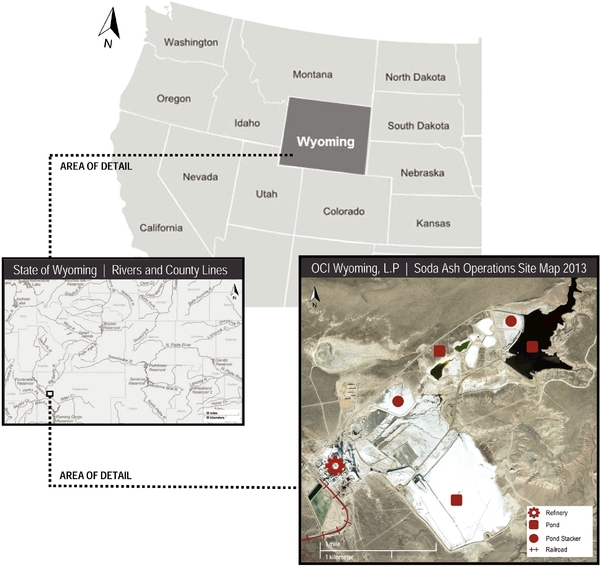

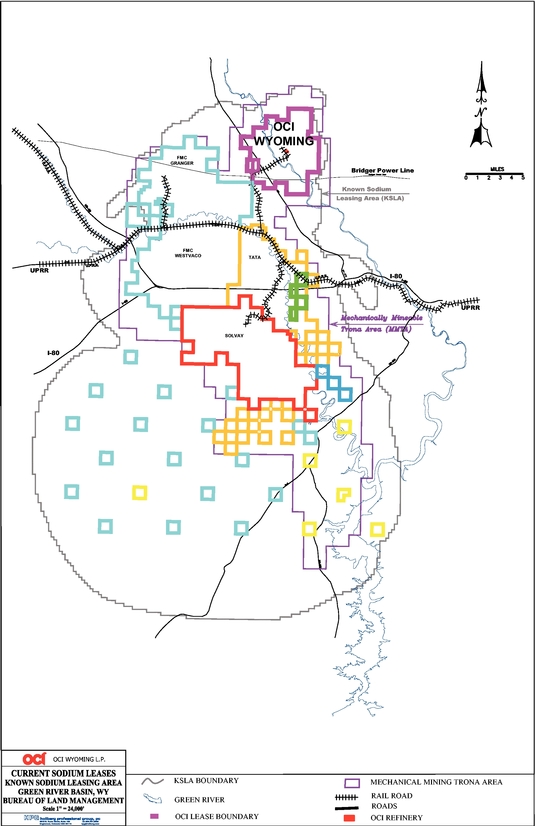

OCI Resources LP, or OCI Resources, has been recently formed by OCI Wyoming Holding Co., or OCI Holdings, to hold, at the closing of this offering, a controlling 40.98% general partner interest and 10.02% limited partner interest in OCI Wyoming, L.P., or, including any of its subsidiaries, OCI Wyoming. OCI Wyoming owns and operates a trona ore mining and soda ash production facility in the Green River Basin of Wyoming. This general partner interest in OCI Wyoming was previously held by OCI Holdings. OCI Chemical Corporation, or OCI Chemical, owns 100% of the capital stock of OCI Holdings. OCI Chemical is a wholly owned subsidiary of OCI Enterprises Inc., or Enterprises. Enterprises is a majority owned subsidiary of OCI Company Ltd., or OCI Company. NRP Trona LLC, or NRP, an unaffiliated third party, owns a 39.37% general partner interest and 9.63% limited partner interest in OCI Wyoming. We refer to our general partner interest in OCI Wyoming as the "controlling interest" and to NRP's general partner interest as the "noncontrolling interest." Prior to this offering, the 10.02% limited partner interest in OCI Wyoming was held by OCI Wyoming Co., or Wyoming Co., an entity owned by OCI Holdings. References to our general partner refer to OCI Resource Partners LLC, or OCI GP, a wholly owned subsidiary of OCI Holdings. Please read "Summary—Formation Transactions and Partnership Structure."

Unless the context otherwise requires, references in this prospectus to "the Company," "we," "our," "us," or like terms, when used in a historical context with respect to operations or assets, refer to OCI Wyoming. When used in a historical context with respect to financial results, such terms refer to OCI Holdings, or our "Predecessor," and, unless otherwised noted, financial information for our Predecessor is presented before the noncontrolling interest. When used in the present tense or prospectively, such terms refer to OCI Resources and its subsidiaries, and, unless otherwise noted, financial information for OCI Resources is presented before the noncontrolling interest. When we present financial information on a pro forma basis, such financial information assumes and gives effect to the consummation of this offering and the other transactions described under "Summary—Formation Transactions and Partnership Structure."

OCI Resources does not have any employees, and we are managed by our general partner, the executive officers of which are employees of Enterprises. In this prospectus, we refer to Enterprises as "our sponsor." Unless the context otherwise requires, references in this prospectus to "our officers" and "our directors" refer to the officers and directors of our general partner.

We are a Delaware limited partnership formed by OCI Holdings to operate the trona ore mining and soda ash production business of OCI Wyoming. We own a controlling 40.98% general partner interest and 10.02% limited partner interest in OCI Wyoming, which is one of the largest and lowest cost producers of soda ash in the world, serving a global market from our facility in the Green River Basin of Wyoming. Our facility has been in operation for more than 50 years.

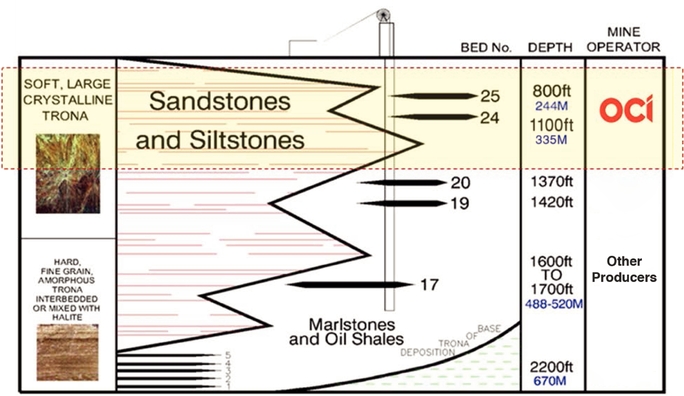

As of March 31, 2013, OCI Wyoming had proven and probable reserves of approximately 267.1 million short tons of trona, which is equivalent to 145.5 million short tons of soda ash. During the year ended December 31, 2012, OCI Wyoming mined approximately 3.87 million short tons of trona and produced approximately 2.45 million short tons of soda ash. During the threesix months ended June 30,

March 31, 2013, OCI Wyoming mined approximately 1.01.95 million short tons of trona and produced approximately 0.631.20 million short tons of soda ash. Based on a projected mining rate of 4.0 million short tons of trona per year, OCI Wyoming has enough proven and probable trona reserves to continue mining trona for approximately 67 years.

The following table sets forth certain operating data regarding our business.

| | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2011 | 2012 | 2012 | 2013 | 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||||||||

| | (millions of short tons, except percentages and ratio data) | (millions of short tons, except percentages and ratio data) | ||||||||||||||||||||||||||||||

Trona ore mined | 3.60 | 3.68 | 3.87 | 0.9 | 1.0 | 3.60 | 3.68 | 3.87 | 1.87 | 1.95 | ||||||||||||||||||||||

Operating rate(1) | 97.6 | % | 98.6 | % | 98.6 | % | 97.7 | % | 95.4 | % | 97.6 | % | 98.6 | % | 98.6 | % | 96.2 | % | 95.2 | % | ||||||||||||

Ore to ash ratio(2) | 1.64:1.0 | 1.63:1.0 | 1.59:1.0 | 1.61:1.0 | 1.63:1.0 | 1.64:1.0 | 1.63:1.0 | 1.59:1.0 | 1.61:1.0 | 1.63:1.0 | ||||||||||||||||||||||

Soda ash volume sold | 2.23 | 2.31 | 2.45 | 0.59 | 0.63 | 2.23 | 2.31 | 2.45 | 1.19 | 1.23 | ||||||||||||||||||||||

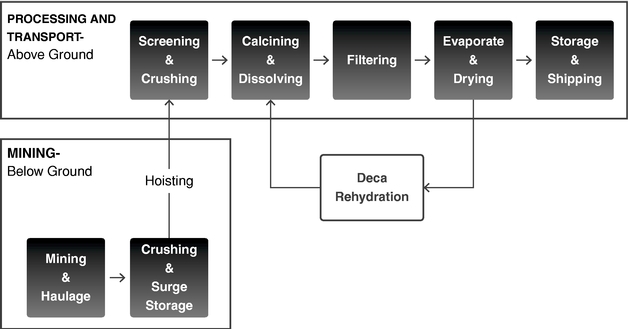

Our facility is situated on approximately 880 acres, and our mining operations consist of approximately 23,500 acres of leased and licensed subsurface mining area. We use six large continuous mining machines and ten underground shuttle cars in our mining operations. Our processing assets consist of material sizing units, conveyors, calciners, dissolver circuits, thickener tanks, drum filters, evaporators and rotary dryers. Our facility also includes seven storage silos with total capacity of 65,000 short tons in which we store soda ash before shipment by bulk rail or truck to distributors and end customers. We lease a fleet of more than 1,700 covered hopper cars that serve as dedicated rail transport for approximately 98% of our soda ash.

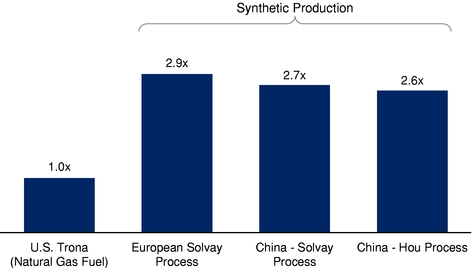

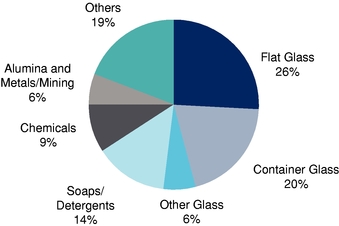

Trona, a naturally occurring soft mineral, is also known as sodium sesquicarbonate and consists primarily of sodium carbonate, or soda ash, sodium bicarbonate and water. We process trona ore into soda ash, which is an essential raw material in flat glass, container glass, detergents, chemicals, paper and other consumer and industrial products. The vast majority of the world's trona reserves are located in the Green River Basin. According to IHS Global Inc., or IHS, approximately one quarter of global soda ash is produced by processing trona, with the remainder being produced synthetically through chemical processes. We believe processing soda ash from trona is the cheapest manner in which to produce soda ash. The costs associated with procuring the materials needed for synthetic production are greater than the costs associated with mining trona for trona-based production. In addition, we believe trona-based production consumes less energy and produces fewer undesirable byproducts than synthetic production.

For the year ended December 31, 2012, before the noncontrolling interest, pro forma total net sales, net income and Adjusted EBITDA were approximately $462.6 million, $114.1 million and $142.5 million, respectively. For the year ended December 31, 2012, after the noncontrolling interest, pro forma net income and Adjusted EBITDA were approximately $58.0$57.7 million and $72.7 million, respectively. For the threesix months ended March 31,June 30, 2013, before the noncontrolling interest, pro forma total net sales, net income and Adjusted EBITDA were approximately $108.2$219.0 million, $17.2$34.7 million and $24.4$49.0 million, respectively. For the threesix months ended March 31,June 30, 2013, after the noncontrolling interest, pro forma net income and Adjusted EBITDA were approximately $8.2$17.4 million and $12.4$25.0 million, respectively. See "OCI Resources LP Unaudited Pro Forma Financial Statements" for details of pro

details of pro forma adjustments made to prepare our pro forma financial statements before the noncontrolling interest. See "Selected Historical and Pro Forma Financial and Operating Data—Non-GAAP Financial Measures" for the definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income and cash flow from operations.

We believe that the following competitive strengths will allow us to execute our business strategies successfully and to achieve our objective of generating and growing cash available for distribution to our unitholders:

Cost Advantages of Producing Soda Ash from Trona. We believe that as a producer of soda ash from trona, we have a significant competitive advantage compared to synthetic producers of soda ash. The manufacturing and processing costs for producing soda ash from trona are more cost competitive than other manufacturing techniques, partly because the costs associated with procuring the materials needed for synthetic production are greater than the costs associated with mining trona for trona-based production. In addition, we believe trona-based production consumes less energy and produces fewer undesirable byproducts than synthetic production. Based on our estimates and industry sources, we believe the average cost of production per short ton of soda ash (before freight and logistics costs) from trona is approximately one-third to one-half the cost per short ton of soda ash from synthetic production. We believe that our competitive cost structure, together with our current logistics arrangements, allows us to be competitive globally.

Substantial Reserve Life from Significant Reserves. As of March 31, 2013, we had approximately 128.8 million short tons of proven trona reserves and 138.3 million short tons of probable trona reserves as estimated by Hollberg Professional Group. Based on a mining rate of 4.0 million short tons of trona per year, we have enough proven and probable trona reserves to continue mining trona for approximately 67 years.

Certain Operational Advantages Compared to Other Trona-Based Producers. We believe we have certain operational advantages over other soda ash producers in the Green River Basin due to the operational characteristics of our facilities as described below. These advantages are manifested in our high productivity and efficiency rates.

Strong Safety Record. We have an outstanding track record for safety, and we have among the lowest instances of workplace injury in the U.S. mining industry. Our tradition of excellence in safety has been recognized by the Wyoming State Mine Inspector, which has awarded us its Safety Excellence Award for five consecutive years from 2008 to 2012. We also received three consecutive safety awards from the U.S. Industrial Minerals Association of North America and the Mine Safety and Health Administration from 2009 to 2011. In addition, the safety performance of our facilities, as measured by the number of citations, recordable injuries and lost work day injuries and accident incident rate,

exceeds that of our peers in the Green River Basin over the last five years, according to the Mine Safety and Health Administration.

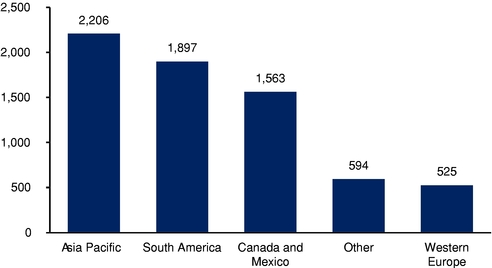

Stable Customer Relationships. We have an extensive base of over 75 customers in industries such as flat glass, container glass, detergents, chemicals, paper and other consumer and industrial products. We have long-term relationships with many of our customers due to our competitive pricing, reliable shipping and high quality soda ash. For the year ended December 31, 2012, approximately 70% of our domestic net sales were made to customers with whom we have done business for over ten years. We have a strong, long-standing relationship with our primary export customer, ANSAC. ANSAC is a cooperative that serves as the primary international distribution channel for us and two other U.S. manufacturers of trona-based soda ash. ANSAC is one of the largest purchasers and exporters of soda ash in the world, and, as a result, ANSAC is able to leverage its economies of scale in the markets it serves. We believe that our customer relationships, including our relationship with ANSAC, lead to more stable cash flows and allow us to plan production activity more accurately.

Experienced Management and Workforce. Our facility has been in continuous operation for over 50 years. We are able to build on the collective knowledge gained from our experience during this period to continually improve our operations and introduce innovative processes. In addition, many members of OCI Wyoming's senior management team have more than 20 years of relevant industry experience. Our executives lead a highly productive workforce with an average tenure of more than 18 years. We believe our institutional knowledge, coupled with the relative seniority of our workforce, engenders a strong sense of teamwork and collegiality, which has led to one of the safest and most efficient operations in the industry today.

Our primary business objective is to generate stable cash flows, allowing us to make quarterly cash distributions to our common and subordinated unitholders and, over time, to increase those quarterly cash distributions. To achieve our objective, we intend to execute the following key business strategies:

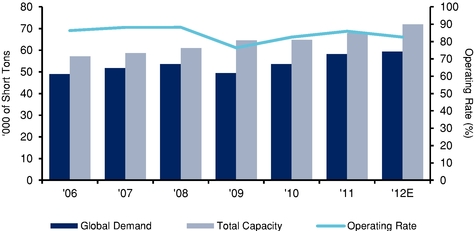

Capitalize on the Growing Demand for Soda Ash. We believe that as one of the leading low-cost producers of trona-based soda ash, we are well-positioned to capitalize on the worldwide growth of soda ash. While consumption of soda ash within the United States is expected to remain relatively stable in the near future, overall worldwide demand for soda ash is projected by IHS to grow from an estimated 59.4 million short tons in 2012 to approximately 82.3 million short tons by 2022, which represents a compounded annual growth rate of 3.3%. We believe that as global demand increases, we will be well positioned to maintain our market share in the principal markets in which we operate by increasing our production through refinements in our production process and without significant additional strategic capital expenditures.

Increase Operational Efficiencies. We intend to continue focusing on increasing the efficiency of our operations. More than $400 million in maintenance, efficiency and expansion related capital expenditures have been invested in OCI Wyoming since 1996. We have continued to improve our processing techniques, which have enabled us to reduce our ore to ash ratio by 11% over the past three years. We have identified opportunities to increase our annual production capacity by further streamlining our refining process and implementing certain process efficiencies. We anticipate that we will spend approximately $22 million on these projects, which we expect will be completed by early 2015.

Maintain Financial Flexibility. We intend to pursue a disciplined financial policy and seek to maintain a conservative capital structure that we believe will provide enhanced stability to our existing cash flows and allow us to consider attractive growth projects and strategic acquisitions in all market environments. Upon the consummation of this offering, we expect OCI Wyoming's liquidity to consist of cash on hand and borrowing availability under a $190 million senior unsecured revolving credit

facility, which we refer to as the OCI Wyoming Credit Facility. As of March 31,June 30, 2013, after giving effect to OCI Wyoming's entry into the OCI Wyoming Credit Facility and borrowings by OCI Wyoming thereunder prior to the date of this prospectus, which borrowings were used, together with $0.3 million in cash, to refinance $31.0$30.0 million of OCI Wyoming's existing debt, fund an $11.5 million special distribution to Wyoming Co. and a $91.5 million aggregate special distribution to NRP and us and pay approximately $1.3 million of debt issuance costs, OCI Wyoming's borrowing availability would have been $35.0 million under the OCI Wyoming Credit Facility. In addition, OCI Resources has $10 million of borrowing availability under its secured revolving credit facility, which we refer to as the Revolving Credit Facility. Please read "Management's Discussion and Analysis of Financial Condition and Results of Operations—Debt."

Expand Operations Strategically. In addition to capacity expansions and process improvements at our current facility, we plan to grow our business through various methods as they become available to us, including: (1) organic growth of our existing business by expanding our customer relationships and by making strategic capital expenditures; (2) acquisition of other businesses involved in mining and processing minerals and manufacturing chemicals; (3) acquisition of other soda ash facilities if and when they become available; and (4) acquisition of shipping, logistical or other ancillary businesses to improve our efficiencies and grow our cash flows. However, none of these opportunities may become available to us, and we may choose not to pursue any opportunities that are presented to us.

Based on preliminary data, we estimate that our production, average pricing and sales for the quarter ended June 30, 2013 will be as follows:

We expect that our cost of sales and expenses, including our selling and marketing expenses and other general and administrative expenses, will be relatively consistent compared with those for the three months ended March 31, 2013 and consistent with the forecast for the twelve months ending June 30, 2014.

Because our financial statements for the quarter ended June 30, 2013 are not yet available, the estimates included above are preliminary, unaudited, not reviewed by our accountants, subject to completion, reflect our current best estimates and may be revised as a result of management's further review of our results. During the course of the preparation of our consolidated financial statements and related notes, we may identify items that would require us to make material adjustments to the preliminary financial and operational information presented above.

An investment in our common units involves risks associated with our business, regulatory and legal matters, our limited partnership structure and the tax characteristics of our common units. The following list of risk factors is not exhaustive. You should carefully consider the risks described in "Risk Factors" beginning on page 24 of this prospectus and the other information in this prospectus before deciding whether to invest in our common units.

Risks Inherent in Our Business

Risks Inherent in an Investment in Us

Tax Risks to Common Unitholders

Formation Transactions and Partnership Structure

We are a Delaware limited partnership recently formed in April 2013 by OCI Holdings to own an interest in OCI Wyoming. Prior to this offering the following restructuring transactions were completed:

was reduced to a 40.98% general partner interest and NRP's 48.51% general partner interest was reduced to a 39.37% general partner interest.

As a result of these transactions, (1) we own a 40.98% general partner interest in OCI Wyoming, (2) Wyoming Co., which is now wholly owned by OCI Chemical, owns a 10.02% limited partner interest in OCI Wyoming and (3) NRP owns a 39.37% general partner interest and 9.63% limited partner interest in OCI Wyoming. See "Summary Historical and Pro Forma Financial and Operating Data."

Also prior to this offering, we and OCI Wyoming entered into the following credit facilities:

At or prior to the completion of this offering, the following transactions, which we refer to as the formation transactions, will occur:

The number of common units we will issue to OCI Holdings includes common units that will be issued at the expiration of the underwriters' option to purchase additional common units, assuming that the underwriters do not exercise their option. Any exercise of the underwriters' option to purchase additional units would reduce the number of common units shown as issued to OCI Holdings by the number of units purchased by the underwriters in connection with such exercise. If and to the extent the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters pursuant to any exercise will be sold to the public, and any remaining common units not purchased by the underwriters pursuant to any exercise of the option will be issued to OCI Holdings at the expiration of the option period. All of the net cash proceeds from any exercise of the underwriters' option to purchase additional common units will be distributed to OCI Chemical.

After the completion of this offering, OCI Wyoming may be converted into a Delaware limited liability company. If this conversion occurs, our controlling 40.98% general partner interest and 10.02% limited partner interest in OCI Wyoming would be converted into a 51% controlling limited liability company interest in such limited liability company.

The following is a diagram of our organizational structure after giving effect to this offering and the related transactions.

Public common units | % | |||

OCI Holdings: | ||||

Common units(1) | % | |||

Subordinated units | % | |||

General partner units(2) | 2.0 | % | ||

Total | 100.0 | % | ||

We are managed and operated by the board of directors and executive officers of our general partner. As the owner of our general partner, OCI Holdings will have the right to appoint all members of the board of directors of our general partner, including at least three directors meeting the independence standards established by the New York Stock Exchange, or NYSE. At least one of our independent directors will be appointed prior to the date our common units are listed for trading on the NYSE. Our unitholders will not be entitled to elect our general partner or its directors or otherwise directly participate in our management or operations. For more information about the executive officers and directors of our general partner, please read "Management."

Our Relationship with OCI Company

OCI Company, the parent company of Enterprises, is a diversified, global company with its common shares listed on the Korea Exchange and its global depositary receipts listed on the Singapore Exchange Securities Trading Limited. OCI Company, its subsidiaries and its affiliates have a product portfolio consisting of inorganic chemicals, petrochemicals and coal chemicals, fine chemicals, specialty gases and renewable energy. OCI Company and its subsidiaries have produced soda ash since the late 1960s. OCI Chemical acquired its interest in OCI Wyoming in 1996.

Upon the closing of this offering, we intend to enter into an omnibus agreement with Enterprises and our general partner under which we will agree upon certain aspects of our relationship with them, including the provision by Enterprises and certain of its affiliates to us of specified administrative services and employees, our agreement to reimburse Enterprises for the cost of such services and employees, certain indemnification and reimbursement obligations, the use by us of "OCI" as part of our partnership name, and as a trademark and service mark, or as part of a component thereof,trademark or service mark, for our products and services and other matters. Neither our general partner nor Enterprises will receive any management fee or other compensation in connection with our general partner's management of our business. However, prior to making any distribution on our common units, we will reimburse our general partner and its affiliates, including Enterprises, for all expenses they incur and payments they make on our behalf under the omnibus agreement and our partnership agreement. Our partnership agreement provides that our general partner will determine in good faith the expenses that are allocable to us. Additionally, OCI Chemical or its affiliates act, and following this offering will continue to act under the omnibus agreement, as our marketing and sales agent for all of our sales. Please read "Certain Relationships and Related Party Transactions—Omnibus Agreement."

Our general partner will own general partner units representing a 2.0% general partner interest in us. These general partner units will entitle it to receive 2.0% of all the distributions we make. Our general partner will also own initially all of our incentive distribution rights, which will entitle it to increasing percentages, up to a maximum of 48.0%, of the cash we distribute in excess of $ per unit per quarter after the closing of our initial public offering. In addition, OCI Holdings will own common units and subordinated units. Please read "Certain Relationships and Related Party Transactions."

While our relationship with OCI Company and its affiliates may provide significant benefits, it is also a source of potential conflicts. For example, OCI Company and its affiliates are not restricted from competing with us. In addition, certain of the executive officers and a majority of the directors of our general partner also serve as officers and/or directors of OCI Holdings or its affiliates, and these officers and directors face conflicts of interest, including conflicts of interest regarding the allocation of their time between us and OCI Company and its affiliates. Please read "Conflicts of Interest and Contractual Duties."

Summary of Conflicts of Interest and Contractual Duties

Our general partner has a contractual duty to manage us in a manner it believes is in our best interest. However, the officers and directors of our general partner also have fiduciary duties to manage our general partner in a manner beneficial to OCI Company, the beneficial owner of our general partner, and OCI Company's affiliates. As a result, conflicts of interest may arise in the future between us or our unitholders, on the one hand, and OCI Company, its affiliates and our general partner, on the other hand.

Delaware law provides that Delaware limited partnerships may, in their partnership agreements, expand, restrict or eliminate the fiduciary duties owed by the general partner to limited partners and the partnership. Our partnership agreement contains various provisions replacing the fiduciary duties that would otherwise be owed by our general partner under applicable law with contractual standards governing the duties of the general partner and the methods of resolving conflicts of interest. The effect of these provisions is to restrict the remedies available to our common unitholders for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty. Our partnership agreement also provides that affiliates of our general partner, including OCI Company and its other subsidiaries and affiliates, are permitted to compete with us. We may enter into additional agreements with Enterprises and its affiliates in the future relating to the purchase of additional assets, the provision of certain services to us and other matters. In the performance of their obligations under these agreements, Enterprises and its affiliates are not held to a fiduciary duty standard of care to us, our general partner or our limited partners, but rather to the standard of care specified in these agreements. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and each common unitholder is treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties under applicable state law. For a more detailed description of the conflicts of interest and duties of our general partner, please read "Conflicts of Interest and Contractual Duties." For a description of other relationships with our affiliates, please read "Certain Relationships and Related Party Transactions."

Our principal executive offices are located at Five Concourse Parkway, Suite 2500, Atlanta, Georgia 30328, and our telephone number is (707) 375-2300. Our website address will be www.ociresources.com. We intend to activate the website immediately following this offering. We intend to make our periodic reports and other information filed with or furnished to the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

Emerging Growth Company Status

We qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For as long as we are an emerging growth company, unlike other public companies, we will not be required to:

We intend to take advantage of all of these exemptions, although we have elected to present three years of audited financial statements and related Management's Discussion and Analysis of Financial Condition and Results of Operations and five years of selected financial data in this prospectus.

We will cease to be an emerging growth company when any of the following conditions apply:

In addition, an emerging growth company can delay its adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to "opt out" of such extended transition period, and as a result, we will comply with any new or revised accounting standards on the relevant dates on which non-emerging growth companies must adopt such standards. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Common units offered to the public | common units. | |

| common units if the underwriters exercise their option to purchase additional common units in full. | ||

Units outstanding after this offering | common units and subordinated units, representing a % and % limited partner interest in us, respectively. If the underwriters do not exercise their option to purchase additional common units, we will issue all of the additional common units to OCI Holdings at the expiration of the option for no additional consideration. If the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters will be sold to the public, and any remaining common units not purchased by the underwriters pursuant to any such exercise will be issued to OCI Holdings at the expiration of the option period. Accordingly, the exercise of the underwriters' option will not affect the total number of common units outstanding or the amount of cash needed to pay the minimum quarterly distribution on all units. | |

| Our general partner will own general partner units, representing a 2.0% general partner interest in us. | ||

Use of proceeds | We expect to receive estimated net proceeds of approximately $ million from this offering (assuming an initial offering price of $ per common unit, the mid-point of the price range set forth on the cover page of this prospectus), after deducting the estimated underwriting discount, the structuring fee and estimated offering expenses. We intend to use the net proceeds from this offering to make (i) a cash payment of approximately $ to Wyoming Co. in exchange for the contribution of its 10.02% limited partner interest in OCI Wyoming to us and (ii) a distribution of approximately $ to OCI Chemical. | |

| If the underwriters exercise their option to purchase additional common units in full, the additional net proceeds to us would be approximately $ million. We intend to distribute the net proceeds from any exercise of such option to OCI Chemical. Please see "Use of Proceeds." | ||

Cash distributions | We intend to pay the minimum quarterly distribution of $ per unit ($ per unit on an annualized basis) to the extent we have sufficient cash from operations after we establish adequate cash reserves and pay our fees and expenses, including payments to our general partner and its affiliates. We refer to this cash as "available cash," and we define its meaning in our partnership agreement, a copy of which is included in this prospectus as Appendix B. Our ability to distribute cash is also subject to certain restrictions and other factors described in more detail under the caption "Cash Distribution Policy and Restrictions on Distributions." | |

| We intend to pay a prorated distribution covering the period from the completion of this offering through , 2013, based on the number of days in that period. |

| Our partnership agreement generally provides that we will make any distribution of available cash each quarter in the following manner: | ||

• first, 98.0% to the holders of common units and 2.0% to our general partner, until each common unit has received the minimum quarterly distribution of $ plus any arrearages from prior quarters; | ||

• second, 98.0% to the holders of subordinated units and 2.0% to our general partner, until each subordinated unit has received the minimum quarterly distribution of $ ; and | ||

• third, 98.0% to all unitholders, pro rata, and 2.0% to our general partner, until each unit has received a distribution of $ . | ||

| If cash distributions to our unitholders exceed $ per unit in any quarter, our general partner will receive, in addition to distributions on its 2.0% general partner interest, increasing percentages, up to 48.0%, of the cash we distribute in excess of that amount. We refer to the additional increasing distributions to our general partner in this prospectus as "incentive distributions" because they are intended to incentivize our general partner to increase distributions to our unitholders. Please see "How We Make Distributions to Our Partners—General Partner Interest and Incentive Distribution Rights." | ||

| Prior to making distributions, we will reimburse Enterprises, our general partner and certain of their affiliates for provision of certain general and administrative services and any additional services we may request from them, pursuant to the omnibus agreement and our partnership agreement. Please read "Certain Relationships and Related Party Transactions—Omnibus Agreement" and "The Partnership Agreement—Reimbursement of Expenses." | ||

| Pro forma cash available for distribution for the year ended December 31, 2012 and the twelve months ended |

| We believe, based on our financial forecast and related assumptions included in "Cash Distribution Policy and Restrictions on Distributions," that we will generate sufficient cash from operations to pay the minimum quarterly distribution of $ per unit on all of our common units and subordinated units and the corresponding distributions on our general partner's 2.0% interest for the twelve months ending | ||

Subordinated units | OCI Holdings will initially own all of our subordinated units. The principal difference between our common units and subordinated units is that in any quarter during the subordination period, holders of the subordinated units are not entitled to receive any distribution of available cash until the common units have received the minimum quarterly distribution plus any arrearages in the payment of the minimum quarterly distribution from prior quarters. If we do not pay distributions on our subordinated units, our subordinated units will not accrue arrearages for those unpaid distributions. | |

Conversion of subordinated units | The subordination period will end on the first business day after we have earned and paid at least $ (the minimum quarterly distribution on an annualized basis) on each outstanding common, subordinated and general partner unit, for each of three consecutive, non-overlapping four-quarter periods ending on or after September 30, 2016, provided that there are no arrearages on our common units at that time. In addition, the subordination period will end upon the removal of our general partner other than for cause if the units held by our general partner and its affiliates are not voted in favor of such removal. | |

| When the subordination period ends, all subordinated units will convert into common units on a one-for-one basis, and all common units thereafter will no longer be entitled to arrearages. Please read "How We Make Distributions to Our Partners—Subordination Period." |

General partner's right to reset the target distribution levels | Our general partner, as the initial holder of our incentive distribution rights, has the right, at any time when there are no subordinated units outstanding and it has received incentive distributions at the highest level to which it is entitled (48.0%) for the prior four consecutive fiscal quarters, and the amount of the total distribution of available cash for each quarter did not exceed adjusted operating surplus for such quarter, to reset the initial target distribution levels at higher levels based on our cash distributions at the time it exercises this reset election. If our general partner transfers all or a portion of our incentive distribution rights in the future, then the holder or holders of a majority of our incentive distribution rights would be entitled to exercise this reset right. | |

| The following assumes that our general partner holds all of the incentive distribution rights at the time that a reset election is made. Following a reset election, the minimum quarterly distribution will be adjusted to equal the reset minimum quarterly distribution, and the target distribution levels will be reset to correspondingly higher levels based on the same percentage increases above the reset minimum quarterly distribution as the current target distribution levels. | ||

| If our general partner elects to reset the target distribution levels, the general partner will be entitled to receive a number of common units and to maintain its general partner interest. The number of common units that will be issued to our general partner in such event will equal that number of common units that would have entitled the holder of such common units to an average aggregate quarterly cash distribution in the two quarters prior to reset equal to the average of the distributions to our general partner on its incentive distribution rights in such prior two quarters. Please see "How We Make Distributions to Our Partners—General Partner's Right to Reset Incentive Distribution Levels." | ||

Issuance of additional units | Our partnership agreement authorizes us to issue an unlimited number of additional units, including units senior to the common units, without the approval of our unitholders. Please read "Units Eligible for Future Sale" and "The Partnership Agreement—Issuance of Additional Interests." | |

Limited voting rights | Our general partner will manage and operate us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights with respect to matters affecting our business. For example, our unitholders will have no right to appoint our general partner or its directors on an annual or other continuing basis. In addition, our general partner may not be removed except by a vote of the holders of at least 662/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. |

| Upon consummation of this offering, OCI Holdings will own an aggregate of % of our outstanding common units (or % of our outstanding common units if the underwriters exercise their option to purchase additional common units in full) and all of our subordinated units, representing % of the outstanding common and subordinated units in the aggregate. This will give OCI Holdings the ability to prevent the removal of our general partner. Please read "The Partnership Agreement—Voting Rights." | ||

Limited call right | If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner will have the right, but not the obligation, to purchase all of the remaining common units at a price equal to the greater of: | |

• the average of the daily closing price of the common units over the 20 trading days preceding the date three days before notice of exercise of the call right is first mailed; and | ||

• the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. Please see "The Partnership Agreement—Limited Call Right." | ||

Estimated ratio of taxable income to distributions | We estimate that if you own the common units you purchase in this offering through the record date for distributions for the period ending December 31, 2016, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be less than | |

Material U.S. federal income tax consequences | For a discussion of the material U.S. federal income tax consequences that may be relevant to prospective unitholders, you should read "Material U.S. Federal Income Tax Consequences." | |

Exchange listing | Our common units have been approved for listing on the NYSE, subject to official notice of issuance, under the symbol "OCIR." |

Summary Historical and Pro Forma Financial and Operating Data

The following table sets forth certain summary consolidated historical financial and operating data of our Predecessor, as of the date and for the periods indicated, and summary pro forma financial data of OCI Resources, as of the date and for the periods indicated. At the closing of this offering we will own a controlling 40.98% general partner interest and 10.02% limited partner interest in OCI Wyoming, the entity that owns and operates a trona ore mining and soda ash production business and related assets in the Green River Basin of Wyoming. As a result, NRP's 39.37% general partner interest and 9.63% limited partner interest in OCI Wyoming are reflected as a noncontrolling interest.

The summary consolidated financial data as of and for the threesix months ended March 31,June 30, 2013 and for the threesix months ended March 31,June 30, 2012 presented in the following table are derived from the unaudited historical condensed financial statements of our Predecessor included elsewhere in this prospectus. The summary consolidated historical financial data as of December 31, 2011 and 2012 and for the years ended December 31, 2010, 2011 and 2012 presented in the following table are derived from the audited historical financial statements of our Predecessor included elsewhere in this prospectus. The summary historical consolidated balance sheet data as of December 31, 2010 is derived from the audited historical consolidated balance sheet of our Predecessor that is not included in this prospectus. The following table should be read together with, and is qualified in its entirety by reference to, the historical audited consolidated financial statements of our Predecessor included elsewhere in this prospectus. The following table should also be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations."

The summary pro forma consolidated financial data presented in the following table for the year ended December 31, 2012 and as of and for the threesix months ended March 31,June 30, 2013 are derived from the unaudited pro forma consolidated financial data included elsewhere in this prospectus. The following table should be read together with, and is qualified in its entirety by reference to, the unaudited pro forma financial data included elsewhere in this prospectus. The following table should also be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations." The unaudited pro forma consolidated financial statements have been prepared as if the formation transactions and the completion of this offering had taken place on March 31,June 30, 2013, in the case of the pro forma balance sheet, and as of January 1, 2012, in the case of the pro forma Statement of Operations for the year ended December 31, 2012 and the threesix months ended March 31,June 30, 2013, respectively.

Our unaudited pro forma consolidated financial statements give effect to the following transactions:

The following unaudited pro forma consolidated financial statements do not necessarily reflect what our financial position and results of operations would have been if we had operated as a publicly traded partnership during the periods shown.

| | Historical | Pro Forma | Historical* | Pro Forma* | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Predecessor | OCI Resources | Predecessor | OCI Resources | ||||||||||||||||||||||||||||||||||||||||

| | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | Six Months Ended June 30, | Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||

| | 2010 | 2011 | 2012 | 2012 | 2013 | 2012 | 2013 | 2010 | 2011 | 2012 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||||||||||||||||

| | (Dollars in millions, except per unit and operating data) | (Dollars in millions, except per unit and operating data) | ||||||||||||||||||||||||||||||||||||||||||

Income Statement Data: | ||||||||||||||||||||||||||||||||||||||||||||

Total net sales | $ | 363.1 | $ | 421.9 | $ | 462.6 | $ | 117.4 | $ | 108.2 | $ | 462.6 | $ | 108.2 | $ | 363.1 | $ | 421.9 | $ | 462.6 | $ | 235.3 | $ | 219.0 | $ | 462.6 | $ | 219.0 | ||||||||||||||||

Cost of products sold | 182.5 | 201.5 | 220.6 | 51.6 | 57.2 | 221.4 | 57.4 | 182.5 | 201.5 | 220.6 | 108.9 | 114.6 | 221.4 | 115.2 | ||||||||||||||||||||||||||||||

Freight costs | 109.2 | 105.7 | 110.2 | 27.7 | 29.8 | 110.2 | 29.8 | 109.2 | 105.7 | 110.2 | 55.2 | 60.3 | 110.2 | 60.3 | ||||||||||||||||||||||||||||||

Total cost of sales | 291.7 | 307.1 | 330.7 | 79.3 | 87.0 | 331.5 | 87.2 | 291.7 | 307.1 | 330.7 | 164.1 | 175.0 | 331.5 | 175.5 | ||||||||||||||||||||||||||||||

Gross profit | 71.4 | 114.7 | 131.8 | 38.1 | 21.3 | 131.0 | 21.0 | 71.4 | 114.7 | 131.8 | 71.1 | 44.0 | 131.0 | 43.5 | ||||||||||||||||||||||||||||||

Selling and marketing expenses | 3.7 | 4.1 | 6.6 | 1.0 | 1.2 | 6.6 | 1.2 | 3.7 | 4.1 | 6.6 | 2.2 | 2.8 | 6.6 | 2.8 | ||||||||||||||||||||||||||||||

General and administrative expenses(1) | 5.2 | 6.7 | 5.2 | 1.7 | 1.9 | 5.2 | 1.9 | 5.2 | 6.7 | 5.2 | 3.4 | 3.8 | 5.2 | 3.8 | ||||||||||||||||||||||||||||||

Operating income | 62.6 | 103.9 | 120.1 | 35.4 | 18.2 | 119.3 | 17.9 | 62.6 | 103.9 | 120.1 | 65.6 | 37.4 | 119.3 | 36.9 | ||||||||||||||||||||||||||||||

Other (expense) income | ||||||||||||||||||||||||||||||||||||||||||||

Interest income | 0.1 | 0.2 | 0.2 | — | — | 0.2 | — | 0.1 | 0.2 | 0.2 | 0.1 | — | 0.2 | — | ||||||||||||||||||||||||||||||

Interest expense | (2.8 | ) | (1.5 | ) | (1.5 | ) | (0.3 | ) | (0.4 | ) | (4.8 | ) | (1.2 | ) | (2.8 | ) | (1.5 | ) | (1.5 | ) | (0.7 | ) | (0.7 | ) | (4.8 | ) | (2.4 | ) | ||||||||||||||||

Other—net | (1.8 | ) | (0.0 | ) | (0.5 | ) | (0.7 | ) | 0.5 | (0.5 | ) | 0.5 | (1.8 | ) | (0.0 | ) | (0.5 | ) | (0.2 | ) | 0.2 | (0.5 | ) | 0.2 | ||||||||||||||||||||

Total other expense | (4.5 | ) | (1.4 | ) | (1.9 | ) | (1.0 | ) | 0.1 | (5.2 | ) | (0.7 | ) | (4.5 | ) | (1.4 | ) | (1.9 | ) | (0.8 | ) | (0.5 | ) | (5.2 | ) | (2.2 | ) | |||||||||||||||||

Income before provision for income taxes | 58.1 | 102.5 | 118.2 | 34.4 | 18.3 | 114.1 | 17.2 | 58.1 | 102.5 | 118.2 | 64.8 | 36.9 | 114.1 | 34.7 | ||||||||||||||||||||||||||||||

Provision for income taxes(2) | 6.5 | 14.6 | 16.4 | 4.1 | 3.1 | — | — | 6.5 | 14.6 | 16.4 | 9.1 | 4.9 | — | — | ||||||||||||||||||||||||||||||

Net income | 51.6 | 88.0 | 101.8 | 30.3 | 15.2 | 114.1 | 17.2 | 51.6 | 88.0 | 101.8 | 55.7 | 32.0 | 114.1 | 34.7 | ||||||||||||||||||||||||||||||

Net income attributable to noncontrolling interest | 36.1 | 58.2 | 65.9 | 18.9 | 10.9 | 56.4 | 8.6 | 36.1 | 58.2 | 65.9 | 35.8 | 22.0 | 56.4 | 17.3 | ||||||||||||||||||||||||||||||

Net income attributable to Predecessor/OCI Resources | $ | 15.5 | $ | 29.8 | $ | 35.8 | $ | 11.4 | $ | 4.3 | $ | 57.7 | $ | 8.7 | $ | 15.5 | $ | 29.8 | $ | 35.8 | $ | 19.9 | $ | 10.0 | $ | 57.7 | $ | 17.4 | ||||||||||||||||

Net income per limited partner unit: | ||||||||||||||||||||||||||||||||||||||||||||

Common units | ||||||||||||||||||||||||||||||||||||||||||||

Subordinated units | ||||||||||||||||||||||||||||||||||||||||||||

Net cash provided by (used in) | ||||||||||||||||||||||||||||||||||||||||||||

Operating activities | $ | 83.0 | $ | 90.1 | $ | 101.9 | $ | 18.6 | $ | 23.4 | $ | 83.0 | $ | 90.1 | $ | 101.9 | $ | 49.6 | $ | 45.8 | ||||||||||||||||||||||||

Investing activities | $ | (7.3 | ) | $ | (25.8 | ) | $ | (27.4 | ) | $ | (3.9 | ) | $ | (2.1 | ) | $ | (7.3 | ) | $ | (25.8 | ) | $ | (27.4 | ) | $ | (11.0 | ) | $ | (3.8 | ) | ||||||||||||||

Financing activities | $ | (76.6 | ) | $ | (48.3 | ) | $ | (78.5 | ) | $ | (4.6 | ) | $ | (4.6 | ) | $ | (76.6 | ) | $ | (48.3 | ) | $ | (78.5 | ) | $ | (29.3 | ) | $ | (61.3 | ) | ||||||||||||||

Balance Sheet Data at period end): | ||||||||||||||||||||||||||||||||||||||||||||

Total assets | $ | 305.0 | $ | 352.3 | $ | 385.7 | $ | 394.7 | $ | 435.3 | $ | 305.0 | $ | 352.3 | $ | 385.7 | $ | 354.8 | $ | 396.5 | ||||||||||||||||||||||||

Property, plant and equipment, net | $ | 193.9 | $ | 201.0 | $ | 204.5 | $ | 200.9 | $ | 240.6 | $ | 193.9 | $ | 201.0 | $ | 204.5 | $ | 197.0 | $ | 236.6 | ||||||||||||||||||||||||

Long term debt | $ | 56.0 | $ | 52.0 | $ | 48.0 | $ | 47.0 | $ | 155.0 | $ | 56.0 | $ | 52.0 | $ | 48.0 | $ | 46.0 | $ | 155.0 | ||||||||||||||||||||||||

Total liabilities | $ | 143.0 | $ | 147.2 | $ | 153.3 | $ | 150.6 | $ | 218.7 | $ | 143.0 | $ | 147.2 | $ | 153.3 | $ | 149.5 | $ | 218.8 | ||||||||||||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA(3) | $ | 84.0 | $ | 126.1 | $ | 142.5 | $ | 40.5 | $ | 24.4 | $ | 142.5 | $ | 24.4 | $ | 84.0 | $ | 126.1 | $ | 142.5 | $ | 76.8 | $ | 49.0 | $ | 142.5 | $ | 49.0 | ||||||||||||||||

Adjusted EBITDA attributable to Predecessor/OCI Resources(3) | $ | 35.5 | $ | 56.4 | $ | 64.6 | $ | 18.6 | $ | 10.5 | $ | 72.7 | $ | 12.4 | $ | 35.5 | $ | 56.4 | $ | 64.6 | $ | 35.1 | $ | 21.0 | $ | 72.7 | $ | 25.0 | ||||||||||||||||

Operating and Other Data: | ||||||||||||||||||||||||||||||||||||||||||||

Trona ore mined (short tons in millions) | 3.60 | 3.68 | 3.87 | 0.9 | 1.0 | 3.87 | 1.0 | 3.60 | 3.68 | 3.87 | 1.87 | 1.95 | 3.87 | 1.95 | ||||||||||||||||||||||||||||||

Operating rate(4) | 97.6% | 98.6% | 98.6% | 97.7% | 95.4% | 98.6% | 95.4% | 97.6% | 98.6% | 98.6% | 96.2% | 95.2% | 98.6% | 95.2% | ||||||||||||||||||||||||||||||

Ore to ash ratio(5) | 1.64:1.0 | 1.63:1.0 | 1.59:1.0 | 1.61:1.0 | 1.63:1.0 | 1.59:1.0 | 1.63:1.0 | 1.64:1.0 | 1.63:1.0 | 1.59:1.0 | 1.61:1.0 | 1.63:1.0 | 1.59:1.0 | 1.63:1.0 | ||||||||||||||||||||||||||||||

Soda ash volumes sold (short tons in millions) | 2.23 | 2.31 | 2.45 | 0.59 | 0.63 | 2.45 | 0.63 | 2.23 | 2.31 | 2.45 | 1.19 | 1.23 | 2.45 | 1.23 | ||||||||||||||||||||||||||||||

Domestic | 0.97 | 0.90 | 0.83 | 0.21 | 0.21 | 0.83 | 0.21 | 0.97 | 0.90 | 0.83 | 0.41 | 0.41 | 0.83 | 0.41 | ||||||||||||||||||||||||||||||

International | 1.26 | 1.41 | 1.62 | 0.38 | 0.42 | 1.62 | 0.42 | 1.26 | 1.41 | 1.62 | 0.78 | 0.82 | 1.62 | 0.82 | ||||||||||||||||||||||||||||||

Sales | ||||||||||||||||||||||||||||||||||||||||||||

Domestic | $ | 205.3 | $ | 203.3 | $ | 199.4 | $ | 49.9 | $ | 50.9 | $ | 199.4 | $ | 50.9 | $ | 205.3 | $ | 203.3 | $ | 199.4 | $ | 99.7 | $ | 100.0 | $ | 199.4 | $ | 100.0 | ||||||||||||||||

International | 157.8 | 218.6 | 263.2 | 67.5 | 57.4 | 263.2 | 57.4 | 157.8 | 218.6 | 263.2 | 135.5 | 118.9 | 263.2 | 118.9 | ||||||||||||||||||||||||||||||

Maintenance capital expenditures(6)(7) | 5.8 | 9.4 | 19.5 | 2.6 | 2.1 | 19.5 | 2.1 | 5.8 | 9.4 | 19.5 | 8.0 | 3.5 | 19.5 | 3.5 | ||||||||||||||||||||||||||||||

Expansion capital expenditures(7)(8) | 1.5 | 16.4 | 7.9 | 1.3 | — | 7.9 | — | 1.5 | 16.4 | 7.9 | 2.8 | 0.3 | 7.9 | 0.3 | ||||||||||||||||||||||||||||||

Non-GAAP Financial Measures

We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax, depreciation and amortization, unrealized derivative gains and losses and certain other expenses that are non-cash charges or that we consider not to be indicative of ongoing operations. Adjusted EBITDA is a non-GAAP supplemental financial liquidity and performance measure that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess:

We believe that the presentation of Adjusted EBITDA in this prospectus provides useful information to investors in assessing our financial condition and results of operations. The GAAP measures most directly comparable to Adjusted EBITDA are net income and cash flow from operations. Our non-GAAP financial measure of Adjusted EBITDA should not be considered as an alternative to net income or cash flow from operations. Adjusted EBITDA has important limitations as an analytical tool because it excludes some but not all items that affect net income and cash flows from operations. You should not consider Adjusted EBITDA in isolation or as a substitute for analysis of our results as reported under GAAP. Because Adjusted EBITDA may be defined differently by other companies, including those in our industry, our definition of Adjusted EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

The following table presents a reconciliation of Adjusted EBITDA to net income and to cash flow from operations, the most directly comparable GAAP financial measures, on a historical basis and pro forma basis, as applicable, for each of the periods indicated.

| | | | | | | Pro Forma | | | | | | Pro Forma* | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Historical | Historical* | ||||||||||||||||||||||||||||||||||||||||||

| | OCI Resources | OCI Resources | ||||||||||||||||||||||||||||||||||||||||||

| | Predecessor | Predecessor | ||||||||||||||||||||||||||||||||||||||||||

| | | Three Months Ended March 31, | | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||

| | | | | Three Months Ended March 31, | Year Ended December 31, | | | | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||

| | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||

| | Three Months Ended March 31, | Year Ended December 31, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||

| | 2010 | 2011 | 2012 | 2013 | 2012 | 2013 | 2010 | 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||||||||||||||||||

| | (Dollars in millions, except per unit and operating data) | (Dollars in millions, except per unit and operating data) | ||||||||||||||||||||||||||||||||||||||||||

Reconciliation of Adjusted EBITDA to net income: | ||||||||||||||||||||||||||||||||||||||||||||

Net income | $ | 51.6 | $ | 88.0 | $ | 101.8 | $ | 30.3 | $ | 15.2 | $ | 114.1 | $ | 17.2 | $ | 51.6 | $ | 88.0 | $ | 101.8 | $ | 55.7 | $ | 32.0 | $ | 114.1 | $ | 34.7 | ||||||||||||||||

Add: | ||||||||||||||||||||||||||||||||||||||||||||

Depreciation and amortization | 23.2 | 22.2 | 22.9 | 5.8 | 5.8 | 23.7 | 6.0 | 23.2 | 22.2 | 22.9 | 11.4 | 11.4 | 23.7 | 11.9 | ||||||||||||||||||||||||||||||

Interest expense (net) | 2.7 | 1.3 | 1.3 | 0.3 | 0.3 | 4.7 | 1.2 | 2.7 | 1.3 | 1.3 | 0.6 | 0.7 | 4.6 | 2.4 | ||||||||||||||||||||||||||||||

Provision for income taxes | 6.5 | 14.6 | 16.4 | 4.1 | 3.1 | — | — | 6.5 | 14.6 | 16.4 | 9.1 | 4.9 | — | — | ||||||||||||||||||||||||||||||

Adjusted EBITDA | $ | 84.0 | $ | 126.1 | $ | 142.5 | $ | 40.5 | $ | 24.4 | $ | 142.5 | $ | 24.4 | $ | 84.0 | $ | 126.1 | $ | 142.5 | $ | 76.8 | $ | 49.0 | $ | 142.5 | $ | 49.0 | ||||||||||||||||

Less: | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA attributable to noncontrolling interest(2) | 48.5 | 69.7 | 77.9 | 21.9 | 13.9 | 69.8 | 12.0 | 48.5 | 69.7 | 77.9 | 41.7 | 28.0 | 69.8 | 24.0 | ||||||||||||||||||||||||||||||

Adjusted EBITDA attributable to Predecessor/OCI Resources(2) | $ | 35.5 | $ | 56.4 | $ | 64.6 | $ | 18.6 | $ | 10.5 | $ | 72.7 | $ | 12.4 | $ | 35.5 | $ | 56.4 | $ | 64.6 | $ | 35.1 | $ | 21.0 | $ | 72.7 | $ | 25.0 | ||||||||||||||||

Reconciliation of Adjusted EBITDA to cash flow from operations: | ||||||||||||||||||||||||||||||||||||||||||||

Net cash provided by operating activities: | $ | 83.0 | $ | 90.1 | $ | 101.9 | $ | 18.6 | $ | 23.4 | $ | 83.0 | $ | 90.1 | $ | 101.9 | $ | 49.6 | $ | 45.8 | ||||||||||||||||||||||||

Add/(Less): | ||||||||||||||||||||||||||||||||||||||||||||

Deferred income taxes | 0.5 | (2.6 | ) | 0.2 | 0.1 | 0.2 | 0.5 | (2.6 | ) | 0.2 | 0.3 | 0.4 | ||||||||||||||||||||||||||||||||

Increase (decrease) in: | ||||||||||||||||||||||||||||||||||||||||||||

Accounts receivable | 3.0 | 29.6 | 9.5 | (0.3 | ) | 2.2 | 3.0 | 29.6 | 9.5 | 0.6 | 0.8 | |||||||||||||||||||||||||||||||||