Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on April 3,May 11, 2015

Registration No. 333-202124

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 13

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ARCADIA BIOSCIENCES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 2870 (Primary Standard Industrial Classification Code Number) | 81-0571538 (I.R.S. Employer Identification Number) |

202 Cousteau Place, Suite 105

Davis, CA 95618

(530) 756-7077

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Eric J. Rey

President & Chief Executive Officer

202 Cousteau Place, Suite 105

Davis, CA 95618

(530) 756-7077

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent of Service)

| Copies to: | ||||

Karen A. Dempsey, Esq. Christopher J. Austin, Esq. Michael J. Hopp, Esq. Orrick, Herrington & Sutcliffe LLP The Orrick Building 405 Howard Street San Francisco, CA 94105 | Wendy S. Neal, Esq. Vice President & Chief Legal Officer 4222 East Thomas Road, Suite 245 Phoenix, AZ 85018 | Andrew S. Williamson, Esq. Charles S. Kim, Esq. David G. Peinsipp, Esq. Cooley LLP 101 California Street, 5th Floor San Francisco, California 94111 | ||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory note

As a result of filing a certificate of amendment to our first amended and restated certificate of incorporation with the Secretary of State of the State of Delaware on May 8, 2015, to effect the 1-for-4 reverse stock split, the Registrant is filing this Amendment No. 3 ("Amendment No. 3") to its Registration Statement on Form S-1 (File No. 333-202124) (the "Registration Statement") to reflect that the reverse stock split was effected on May 8, 2015, to file the unlegended audit opinion of Deloitte & Touche LLP, to file certain exhibits as indicated in Part II of Amendment No. 3 and to respond to additional comments from the Staff of the Securities and Exchange Commission received on May 8, 2015.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 3,MAY 11, 2015

Preliminary Prospectus

7,150,000 Shares

Common Stock

This is the initial public offering of shares of common stock of Arcadia Biosciences, Inc. Prior to this offering, there has been no public market for our common stock. The initial public offering price of our common stock is expected to be between $$13.00 and $$15.00 per share.

We have applied to list ourOur common stock has been approved for listing on The NASDAQ Global Select Market under the symbol "RKDA."

The underwriters have an option to purchase a maximum of 1,072,500 additional shares of common stock from us.

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 12.

| | Price to Public | Underwriting Discounts and Commissions(1) | Proceeds to Arcadia | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | |||||||

| Total | $ | $ | $ | |||||||

Entities affiliated with certain of our existing stockholders have indicated an interest in purchasing up to an aggregate of approximately $10.0 million in shares of our common stock in this offering at the initial public offering price. However, because these indications of interest are not binding agreements or commitments to purchase, the underwriters could elect to sell more, fewer or no shares to any of these entities and any of these entities could elect to purchase more, fewer or no shares in this offering. The underwriters will receive the same underwriting discount on any sales to such entities as they will from other shares sold in this offering.

Delivery of the shares of common stock will be made on or about , 2015.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Credit Suisse | J.P. Morgan | Piper Jaffray |

The date of this prospectus is , 2015

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

PROSPECTUS SUMMARY | 1 | |||

RISK FACTORS | 12 | |||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 37 | |||

USE OF PROCEEDS | 38 | |||

DIVIDEND POLICY | 38 | |||

CAPITALIZATION | 39 | |||

DILUTION | 41 | |||

SELECTED CONSOLIDATED FINANCIAL DATA | 43 | |||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 45 | |||

INDUSTRY OVERVIEW | ||||

BUSINESS | ||||

MANAGEMENT | ||||

EXECUTIVE COMPENSATION | ||||

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | ||||

PRINCIPAL STOCKHOLDERS | ||||

DESCRIPTION OF CAPITAL STOCK | ||||

SHARES ELIGIBLE FOR FUTURE SALE | ||||

MATERIAL U.S. FEDERAL TAX CONSEQUENCES TO NON-U.S. HOLDERS | ||||

UNDERWRITING | ||||

LEGAL MATTERS | ||||

EXPERTS | ||||

ADDITIONAL INFORMATION | ||||

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 | |||

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Through and including , 2015 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

This prospectus includes statistical, market and industry data and forecasts that we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications. We obtained certain trait value data used in the "Prospectus Summary" and "Industry Overview" sections of this prospectus from a third-party report we commissioned Phillips McDougall to prepare. Phillips McDougall has filed a consent to be named in this prospectus. Certain estimates and forecasts involve uncertainties and risks and are subject to change based on various factors, including those discussed under the headings "Special Note Regarding Forward-Looking Statements" and "Risk Factors" in this prospectus.

i

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who obtain this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

"Arcadia Biosciences," "Sonova" and "Sonova GLA Safflower Oil and design" are our registered trademarks in the United States and, in some cases, in certain other countries. Other trademarks and service marks that we own include: "Sonova 400" and "Sonova ULTRA." This prospectus also contains trademarks, service marks, and trade names of other companies. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM, or SM symbols, but such references do not constitute a waiver of any rights that might be associated with the respective trademarks, service marks, or trade names.

ii

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding whether to purchase shares of our common stock.

Overview

We are a leading agricultural biotechnology trait company with an extensive and diversified portfolio of late-stage yield and product quality traits addressing multiple crops that supply the global food and feed markets. We have achieved this leadership position based on our development collaborations with global agricultural leaders, recognition by third parties, and our track record of success in trait development since our founding in 2002. Our traits are focused on high-value enhancements that increase crop yields by enabling plants to more efficiently manage environmental and nutrient stresses, and that enhance the quality and value of agricultural products. Our traits increase value not only for farmers, but also for users of agricultural products. Our target market is the $39.4 billion global seed market. Our goal is to increase the value of this market significantly by increasing yields, and to capture a portion of the increased value. There currently are more than 50 products in development incorporating our traits and there are 13 that have demonstrated efficacy in field trials, one that is in the process of completing the regulatory process, and one that is currently on the market.

Our crop yield traits are being utilized by our commercial partners to develop higher yielding seeds for the most widely grown global crops, including wheat, rice, soybean, corn, and sugarcane, as well as for other crops such as cotton, canola, turf, and trees. Our business model positions us at the nexus of basic research and commercial product development, as we apply our strong product development and regulatory capabilities to collaborate with, and leverage the skills and investments of, upstream basic research institutions and downstream commercial partners. We believe our approach significantly reduces risk and capital requirements, while simplifying and expediting the product development process. We also believe that our collaboration strategy leverages our internal capabilities, enabling us to capture much higher value than would otherwise be the case, and enabling commercial partners to develop and commercialize products more cost-effectively.

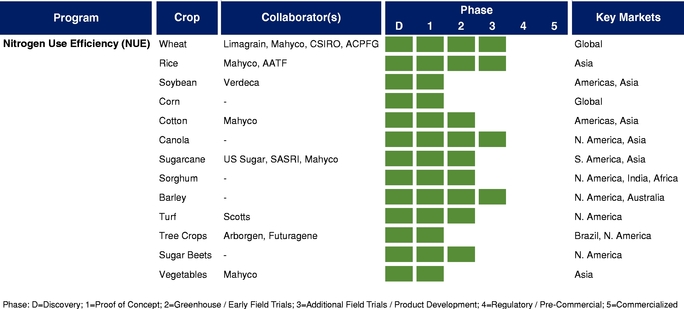

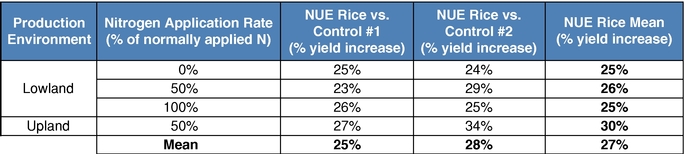

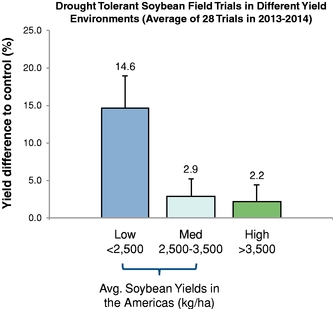

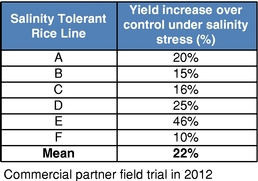

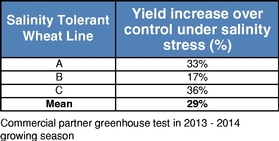

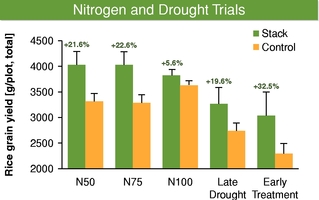

Our business model focuses on creating value by leveraging collaborator investments and capabilities upstream in basic research, and downstream in product development and commercialization. We bridge the gap between basic research and commercial development, reducing risk and adding value as a result. We reduce risk and avoid most of the costs associated with basic research by acquiring trait technologies that have already completed initial feasibility screening, thus achieving proof of concept, through basic research carried out elsewhere. We further develop these technologies by optimizing function and validating performance through intensive field trial testing in multiple crops. We then form collaborations with major seed and consumer product companies who develop and commercialize products incorporating our traits. In select instances, we may also work with our commercial partners to make any regulatory filings required to support commercial launch of the trait in order to increase our share of the value created by the trait. Field trial data to date in multiple major commodity crops has shown yield improvements attributable to our Nitrogen Use Efficiency, or NUE, trait of greater than 10%. For example, rice plants with our NUE trait, tested in independent field trials over three years from 2012 to 2014 in multiple environments, had an average yield improvement of 27% compared to controls.

By licensing later stage de-risked technologies to our commercial partners, we expect to achieve significantly greater value than generally earned for access to early stage traits. Our license agreements

typically include upfront and annual license fees, as well as multiple milestone payments for key product development stages such as demonstration of greenhouse efficacy, demonstration of field efficacy, regulatory submission, regulatory approval, and commercial launch. Following commercialization of a product utilizing one or more of our traits, we share in the value of the traits realized by our commercial partners. We believe that this broad and balanced approach diversifies and reduces risk, allowing us to address multiple end markets through strong established channels.

We have formed strategic partnerships and developed strong relationships with global agricultural leaders for development and commercialization of our traits in major crops and consumer products. Our collaborators include subsidiaries or affiliates of Limagrain (Vilmorin & Cie), Mahyco (Maharashtra Hybrid Seeds Company Limited), Dow AgroSciences, DuPont Pioneer (E.I. du Pont de Nemours and Company), SES Vanderhave, Genective (a joint venture between Limagrain and KWS SAAT), Scotts, U.S. Sugar, Abbott, Ardent Mills, Bioceres, and others. Additionally, in order to increase our participation in the value of two major crops, wheat and soybean, we have formed two joint ventures. Limagrain Cereal Seeds LLC is our joint venture with Limagrain for the development and commercialization of wheat products for North America. Limagrain is the world's fourth-largest seed company. Verdeca LLC is our joint venture with a wholly owned subsidiary of Bioceres for the development and deregulation of soybean traits globally. Bioceres is an agricultural investment and development company owned by approximately 230 shareholders, including some of South America's largest soybean growers. In April 2015, we entered into a collaboration agreement with Dow AgroSciences and Bioceres under which our Verdeca joint venture will collaborate with Dow AgroSciences on the development and deregulation of soybean traits on a global basis.

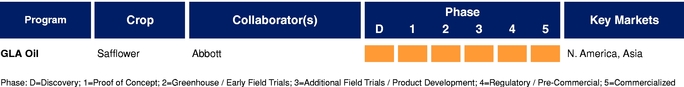

The strength of our internal capabilities and collaboration strategy enables us to quickly identify and develop valuable traits and bring them to market, as we have demonstrated through commercializing Sonova 400 GLA safflower oil in less than six years from technology acquisition to commercial launch. Sonova 400 GLA safflower oil is a key ingredient in multiple branded nutritional supplements marketed through GNC stores and other major U.S. retailers.

Our headquarters and primary research and development facilities are located in Davis, California. We have additional facilities in Seattle, Washington; American Falls, Idaho; and Phoenix, Arizona. As of March 31, 2015, we had 76 full-time employees.

Industry Background

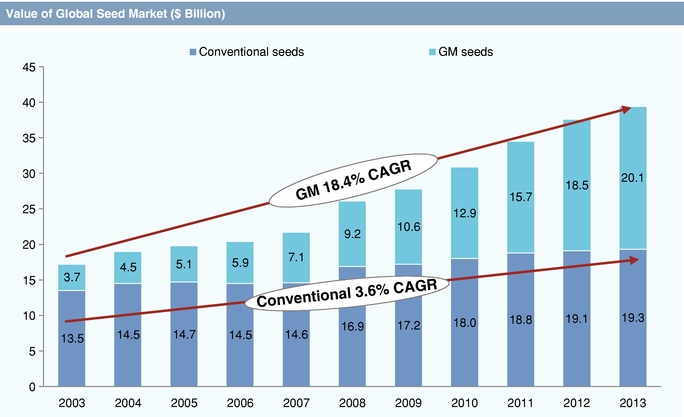

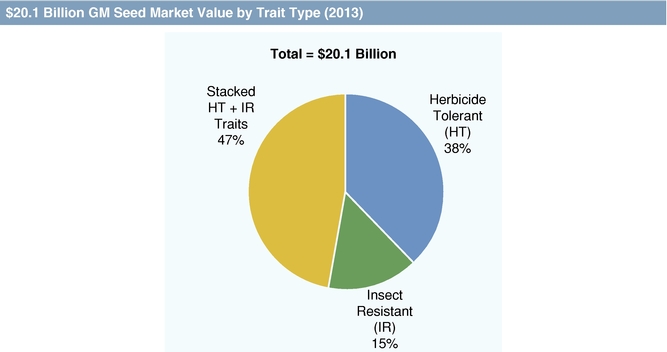

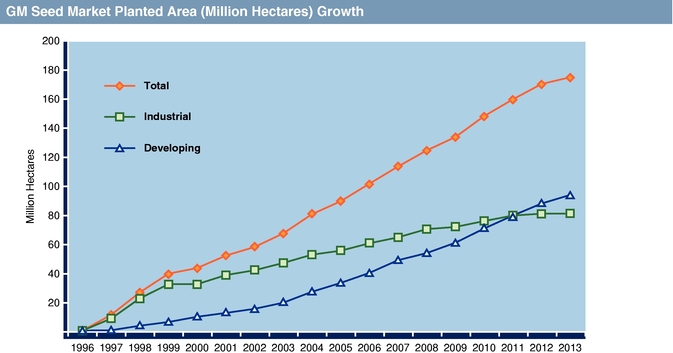

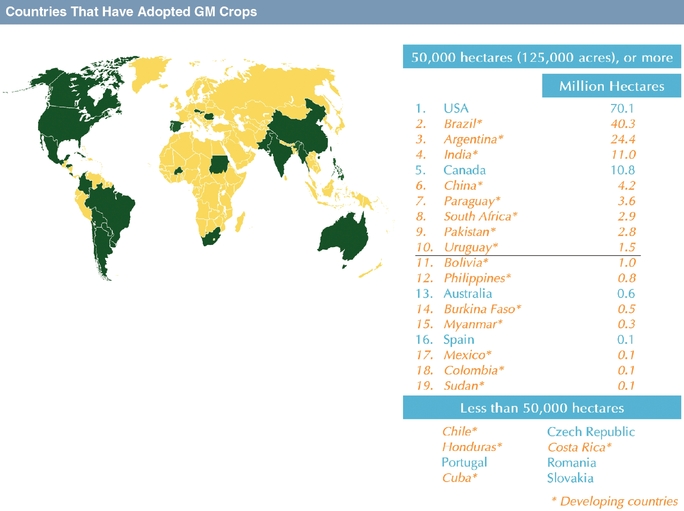

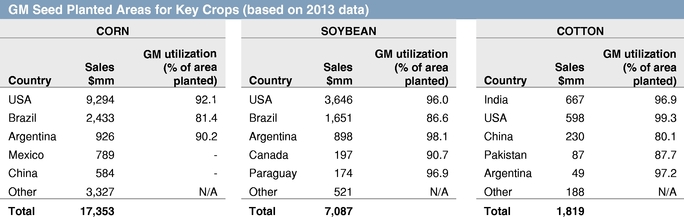

In recent decades, agricultural biotechnology has been a major driving force for improving farm economics by introducing genetically modified, or GM, seeds, with traits that reduce the cost of managing crop biotic stresses such as weeds, insects, and microbial pests. The first agricultural biotechnology traits, herbicide tolerance and insect resistance, were developed primarily by companies with deep expertise and a long heritage in crop protection chemistry and pest management. Seeds with these traits have achieved rapid growth and strong commercial success, reaching market share in excess of 90% in key crops and countries as of 2013.

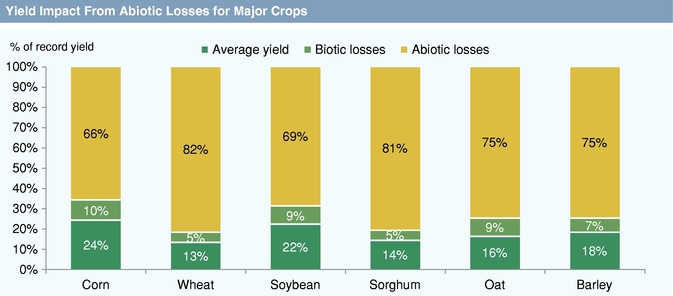

Next generation seed trait research is focused on the development of new technologies that address unmet needs such as abiotic stress tolerance and agricultural product quality. Abiotic plant stresses, or those caused by non-living factors such as heat, drought, flooding, salinity, and nutrient availability, can have a significantly greater negative impact on crop yield than biotic stresses. Successfully increasing crop yields by addressing these stresses potentially creates much greater value than created by the first wave of biotic stress management traits. Commercially available solutions to manage abiotic stresses are currently limited, but have been the focus of substantial innovation efforts. Agricultural product quality traits increase the value of crops to crop processors, food and feed manufacturers, and consumers by altering the performance of the harvested crop in end market products.

Innovative traits can provide significant additional value for farmers. Planting seed is a relatively low cost input for farmers, representing less than 10% of average total costs in 2013 according to the

U.S. Department of Agriculture, or USDA. GM seeds can provide farmers with increased profitability at a relatively low increase in operating costs by means of increased yields, reduced costs of inputs such as chemicals, or enhanced product quality. The historic success of increasing farm profits through the use of GM seeds has fueled the development of the agricultural biotechnology industry, and farmers have historically shared a portion of their economic benefit with the GM seed provider in the form of seed premiums.

The following table, based on a Phillips McDougall analysis that we commissioned, sets forth an estimated range of incremental value increase that may be attributed to the addition of a novel, newly developed trait in the most widely grown global crops and key growing regions. Incremental value increase refers to the total revenue potential for seed providers generated from the premium charged on biotechnology seeds due to the added value of the improved trait. This estimated incremental value increase, or trait commercial value, was calculated by multiplying the estimated number of acres per country that could be planted with a particular biotechnology trait by the estimated premiums that will be charged to growers by seed providers. The values displayed are in constant 2013 U.S. Dollar terms.

| | | Estimated Trait Commercial Value ($ Million)(1) | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | Key Growing Regions(2) | ||||||||

| | Crop | From | To | |||||||

Trait | | |||||||||

Nitrogen Use Efficiency | Corn | 1,285 | 2,205 | NAFTA, LATAM, China | ||||||

| Soybeans | 747 | 1,269 | NAFTA, LATAM | |||||||

| Cotton | 189 | 312 | NAFTA, LATAM, India+ | |||||||

| Canola | 142 | 227 | NAFTA, LATAM, India, China | |||||||

| Rice | 535 | 910 | India+, China, Asia | |||||||

| Wheat | 573 | 1,136 | NAFTA, Europe, India+, China, Australia | |||||||

| Sugarcane | 42 | 70 | NAFTA, LATAM, India, China | |||||||

| Total | 3,513 | 6,129 | ||||||||

Water Use Efficiency | Corn | 557 | 976 | NAFTA, LATAM, China | ||||||

| Soybeans | 373 | 642 | NAFTA, LATAM | |||||||

| Cotton | 97 | 176 | NAFTA, LATAM, India+ | |||||||

| Canola | 75 | 114 | NAFTA, LATAM, India, China | |||||||

| Rice | 269 | 535 | India+, China, Asia | |||||||

| Wheat | 487 | 569 | NAFTA, Europe, India+, China, Australia | |||||||

| Sugarcane | 25 | 53 | NAFTA, LATAM, India, China | |||||||

| Total | 1,883 | 3,065 | ||||||||

Salinity Tolerance | Soybeans | 373 | 523 | NAFTA, LATAM | ||||||

| Cotton | 97 | 176 | NAFTA, LATAM, India+ | |||||||

| Canola | 75 | 114 | NAFTA, LATAM, India, China | |||||||

| Rice | 269 | 535 | India+, China, Asia | |||||||

| Wheat | 429 | 569 | NAFTA, Europe, India+, China, Australia | |||||||

| Total | 1,243 | 1,917 | NAFTA, LATAM, India, China | |||||||

Heat Tolerance | Corn | 557 | 976 | NAFTA, LATAM, China | ||||||

| Soybeans | 373 | 523 | NAFTA, LATAM | |||||||

| Cotton | 97 | 176 | NAFTA, LATAM, India+ | |||||||

| Canola | 75 | 114 | NAFTA, LATAM, India, China | |||||||

| Rice | 269 | 535 | India+, China, Asia | |||||||

| Wheat | 429 | 569 | NAFTA, Europe, India+, China, Australia | |||||||

| Sugarcane | 21 | 41 | NAFTA, LATAM, India, China | |||||||

| Total | 1,821 | 2,934 | ||||||||

Herbicide Tolerance | Wheat | 417 | 571 | NAFTA, Europe, India+, China, Australia | ||||||

All Traits | All Crops | 8,878 | 14,616 | |||||||

The development of GM seed traits is currently concentrated in a limited number of large seed companies, including Monsanto, DuPont Pioneer, Syngenta, Limagrain, Dow AgroSciences, KWS SAAT, and Bayer CropScience. According to Phillips McDougall, the leading 11 seed and trait companies as a group invested $4.1 billion in seed and trait research and development in 2013.

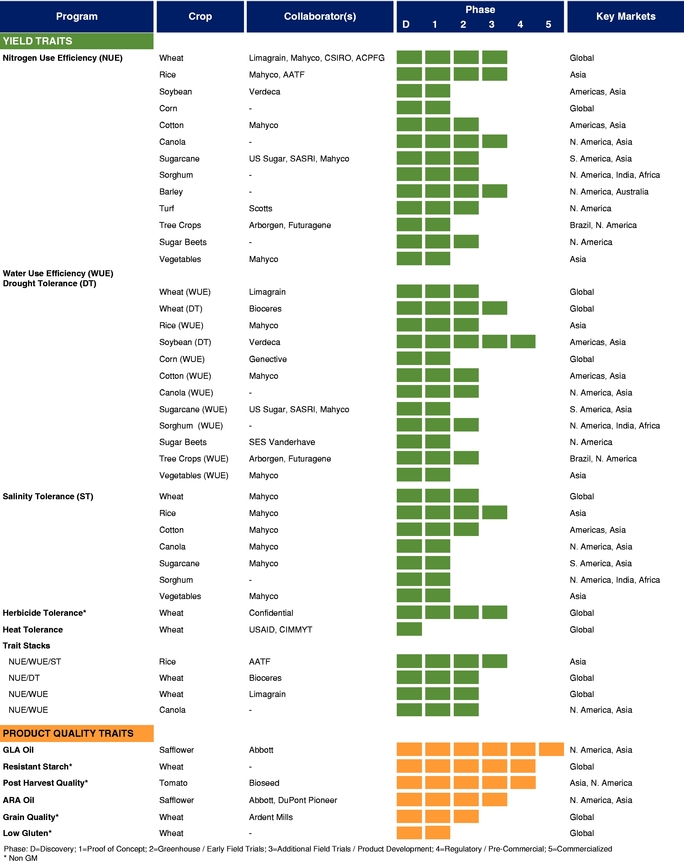

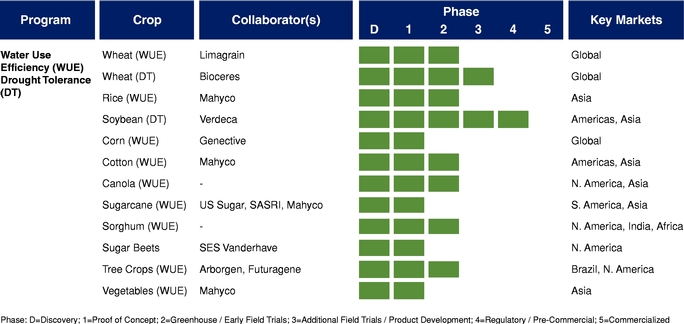

Our Products and Pipeline

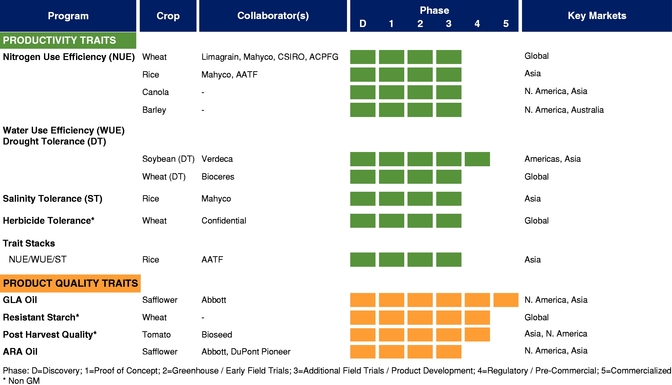

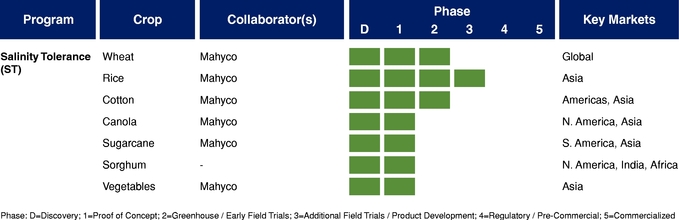

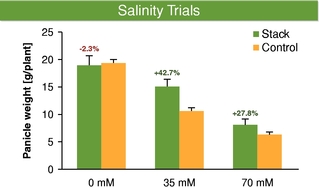

There currently are more than 50 products in development incorporating our traits and there are 13 that have demonstrated efficacy in field trials, one that is in the process of completing the regulatory process, and one that is on the market. We use both GM and non-GM technologies to develop our traits, which enables us to select the approach most suited for the particular trait, crop and market. Our agricultural yield traits are designed to substantially increase crop yields and farmer income. They do so either by improving efficiency in the use of key inputs, such as fertilizer and water, or by increasing tolerance to environmental stresses, such as drought, heat and salinity. Our existing portfolio of agricultural yield traits includes Nitrogen Use Efficiency, or NUE, Water Use Efficiency, or WUE, Drought Tolerance, Salinity Tolerance, Heat Tolerance, and Herbicide Tolerance. Field trial results have demonstrated significant yield improvements resulting from our agricultural yield traits in multiple crops and geographies.

Our agricultural product quality traits are designed to increase the value of harvested products by improving specific compositional qualities of oilseeds and grains. These traits include Enhanced Nutrition Grains and High Value Nutritional Oils, including Sonova 400 GLA safflower oil and Sonova Ultra GLA safflower oil, which we refer to as our Sonova products.

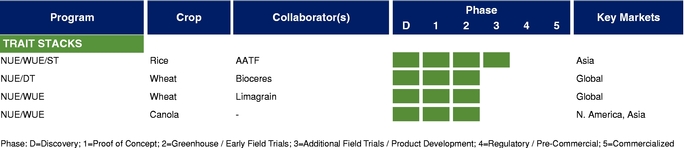

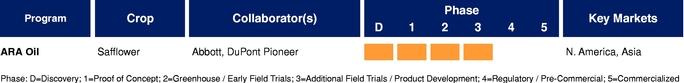

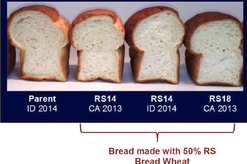

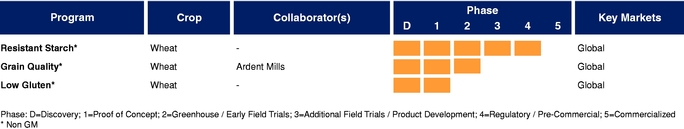

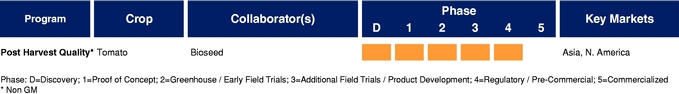

The table below summarizes our current commercial product and our pipeline of products that are in advanced stages of development or on the market, which corresponds to Phase 3 or higher in our product development cycle. The product development cycle is discussed in greater detail in "Industry Overview—Innovation and Commercialization Process in Biotech Seed Traits." The table also identifies the crops, collaborators, and markets that we and our collaborators are addressing with these products.

Our Strengths

We believe we are strategically positioned to capitalize on the need to increase crop yields and quality of agricultural products globally. Our competitive strengths include:

Our Growth Strategy

We believe that there are significant opportunities to grow our business globally by executing the following elements of our strategy:

traits, such as NUE, WUE, and Drought Tolerance, that are in advanced stages of development with our commercial partners and joint ventures.

Risks Associated with Our Business

Our business is subject to numerous risks, as more fully described in the section entitled "Risk Factors" immediately following this prospectus summary. You should read these risk factors before you invest in our common stock. For example, you should be aware of the following before investing in our common stock:

Corporate Information

We were incorporated in 2002 in Arizona and reincorporated in Delaware in March 2015. Our headquarters and primary research and development facilities are located at 202 Cousteau Place, Davis, CA 95618, and our telephone number is (530) 756-7077. Our corporate website address is www.arcadiabio.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock. We have included our website address only as an inactive textural reference and do not intend it to be an active link to our website.

Unless the context otherwise requires, the terms "Arcadia Biosciences," "Arcadia," the "company," "we," "us," and "our" in this prospectus refer to Arcadia Biosciences, Inc. and its consolidated subsidiaries.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenues during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These provisions include:

We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenues; the date we qualify as a "large accelerated filer," with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our initial public offering. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We are choosing to irrevocably "opt out" of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards, but we intend to take advantage of the other exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

The following information assumes that the underwriters do not exercise their option to purchase additional shares in the offering. See "Underwriting."

Common stock offered by us | 7,150,000 shares | |

Common stock to be outstanding after the offering | 38,036,754 shares | |

Option to purchase additional shares of common stock from us | The underwriters have an option to purchase a maximum of 1,072,500 additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. | |

Use of proceeds | We intend to use the net proceeds from this offering for general corporate purposes, including working capital, capital expenditures, further development and commercialization of our products, and sales and marketing activities. We may also use a portion of the net proceeds to expand our business through investments in other complementary strategic joint ventures, products, and technologies, although we have no agreements or commitments to do so as of the date of this prospectus. | |

Listing |

| |

Risk factors | Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under "Risk Factors" and all other information in this prospectus before investing in our common stock. |

The number of shares of our common stock to be outstanding after this offering is based on 30,886,754 shares of our common stock outstanding as of December 31, 2014, and excludes:

Except as otherwise indicated, all information in this prospectus assumes:

Entities affiliated with certain of our existing stockholders have indicated an interest in purchasing up to an aggregate of approximately $10.0 million in shares of our common stock in this offering at the initial public offering price. However, because these indications of interest are not binding agreements or commitments to purchase, the underwriters could elect to sell more, fewer or no shares to any of these entities and any of these entities could elect to purchase more, fewer or no shares in this offering.

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data and should be read together with our consolidated financial statements, the notes to our consolidated financial statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained elsewhere in this prospectus. We derived the summary consolidated statements of operations data for the years ended December 31, 2013 and 2014 from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated balance sheet data as of December 31, 2014 is derived from our audited consolidated financial statements included elsewhere in this prospectus.

| | Year Ended December 31, | Year Ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2013 | 2014 | 2013 | 2014 | ||||||||||

| | (in thousands, except share and per share amounts) | (in thousands, except share and per share amounts) | ||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||

Revenues: | ||||||||||||||

Product | $ | 1,102 | $ | 355 | $ | 1,102 | $ | 355 | ||||||

License | 1,625 | 2,325 | 1,625 | 2,325 | ||||||||||

Contract research and government grants | 3,751 | 4,302 | 3,751 | 4,302 | ||||||||||

| | ||||||||||||||

Total revenues | 6,478 | 6,982 | 6,478 | 6,982 | ||||||||||

Operating expenses: | ||||||||||||||

Cost of product revenues(1) | 673 | 1,997 | 673 | 1,997 | ||||||||||

Research and development(1) | 8,404 | 10,012 | 8,404 | 10,012 | ||||||||||

Selling, general, and administrative(1) | 7,967 | 10,126 | 7,967 | 10,126 | ||||||||||

| | ||||||||||||||

Total operating expenses | 17,044 | 22,135 | 17,044 | 22,135 | ||||||||||

| | ||||||||||||||

Loss from operations | (10,566 | ) | (15,153 | ) | (10,566 | ) | (15,153 | ) | ||||||

Interest expense | (626 | ) | (1,394 | ) | (626 | ) | (1,394 | ) | ||||||

Other income (expense), net | 5 | (597 | ) | 5 | (597 | ) | ||||||||

| | ||||||||||||||

Loss before income taxes and equity in loss of unconsolidated entity | (11,187 | ) | (17,144 | ) | (11,187 | ) | (17,144 | ) | ||||||

Income tax provision | (167 | ) | (263 | ) | (167 | ) | (263 | ) | ||||||

Equity in loss of unconsolidated entity | (1,841 | ) | (932 | ) | (1,841 | ) | (932 | ) | ||||||

| | ||||||||||||||

Net loss | (13,195 | ) | $ | (18,339 | ) | (13,195 | ) | $ | (18,339 | ) | ||||

Accretion of redeemable convertible preferred stock to redemption value | — | (3,738 | ) | — | (3,738 | ) | ||||||||

| | ||||||||||||||

Net loss attributable to common stockholders | $ | (13,195 | ) | $ | (22,077 | ) | $ | (13,195 | ) | $ | (22,077 | ) | ||

| | | |||||||||||||

Net loss per share attributable to common stockholders, basic and diluted(2) | $ | (1.61 | ) | $ | (2.68 | ) | $ | (6.43 | ) | $ | (10.71 | ) | ||

| | | |||||||||||||

Weighted-average number of shares used in per share calculations, basic and diluted(2) | 8,213,544 | 8,245,129 | 2,053,384 | 2,061,278 | ||||||||||

| | | |||||||||||||

Pro forma net loss per share attributable to common stockholders, basic and diluted(2) | $ | $ | (0.62 | ) | ||||||||||

| | | |||||||||||||

Weighted-average number of shares used in pro forma per share calculations, basic and diluted(2) | 29,595,148 | |||||||||||||

| | | |||||||||||||

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2013 | 2014 | |||||

| | (in thousands) | ||||||

Research and development | $ | 414 | $ | 249 | |||

Selling, general, and administrative | 864 | 727 | |||||

| | | | | | | | |

Total stock-based compensation | $ | 1,278 | $ | 976 | |||

| | | | | | | | |

| | | | | | | | |

| | As of December 31, 2014 | As of December 31, 2014 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) | Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) | ||||||||||||||

| | (in thousands) | (in thousands) | ||||||||||||||||||

Consolidated Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 16,571 | $ | 16,571 | $ | 16,571 | $ | 16,571 | $ | 115,299 | ||||||||||

Working capital | 7,426 | 7,426 | 7,426 | 7,426 | 107,209 | |||||||||||||||

Total assets | 24,889 | 24,889 | 24,889 | 24,889 | 123,617 | |||||||||||||||

Total indebtedness | 14,475 | 14,475 | 14,475 | 14,475 | 24,460 | |||||||||||||||

Redeemable convertible preferred stock | 34,098 | — | 34,098 | — | — | |||||||||||||||

Convertible preferred stock | 48,783 | — | 48,783 | — | — | |||||||||||||||

Common stock | — | 51 | 58 | |||||||||||||||||

Additional paid-in capital | 29,204 | 112,085 | 29,204 | 112,034 | 200,770 | |||||||||||||||

Accumulated deficit | (113,970 | ) | (113,970 | ) | (113,970 | ) | (113,970 | ) | (113,970 | ) | ||||||||||

Total stockholders' (deficit) equity | (84,766 | ) | (1,885 | ) | (84,766 | ) | (1,885 | ) | 86,858 | |||||||||||

Investing in our common stock involves a substantial risk of loss. You should carefully consider the risks and uncertainties described below and the other information in this prospectus before deciding whether to purchase shares of our common stock. If any of the following risks actually occur, our business, financial condition, or operating results could be materially adversely affected. This could cause the trading price of our common stock to decline, and you may lose part or all of your investment. See the section entitled "Special Note Regarding Forward-Looking Statements" elsewhere in this prospectus.

Risks Related to ourOur Business and ourOur Industry

We or our collaborators may not be successful in developing commercial products that incorporate our traits.

Our future growth depends on our ability to identify genes that will improve selected crop traits and license these genes to our collaborators to develop and commercialize seeds that contain the genes. Our long-term growth strategy is based on our expectation that revenues related to the sale of seeds containing our traits will comprise a significant portion of our future revenues. Pursuant to our collaboration agreements, we are entitled to share in the revenues from the sale of products that integrate our trait. We expect that it will take several years before the first seeds integrating our agricultural yield traits complete the development process and become commercially available for sale, resulting in revenues for us. However, the development process could take longer than we anticipate or could ultimately fail to succeed in commercialization for any of the following reasons:

If products containing our traits are never commercialized, or are commercialized on a slower timeline than we anticipate, our ability to generate revenues and become profitable, as well as our long-term growth strategy, would be materially and adversely affected.

Even if we or our collaborators are successful in developing commercial products that incorporate our traits, such products may not achieve commercial success.

Our long-term growth strategy is dependent upon our or our collaborators' ability to incorporate our traits into a wide range of crops with global scope. Even if we or our collaborators are able to develop commercial products that incorporate our traits, any such products may not achieve commercial success as quickly as we project, or at all, for one or more of the following reasons, among others:

Our financial condition and results of operations could be materially and adversely affected if any of the above were to occur.

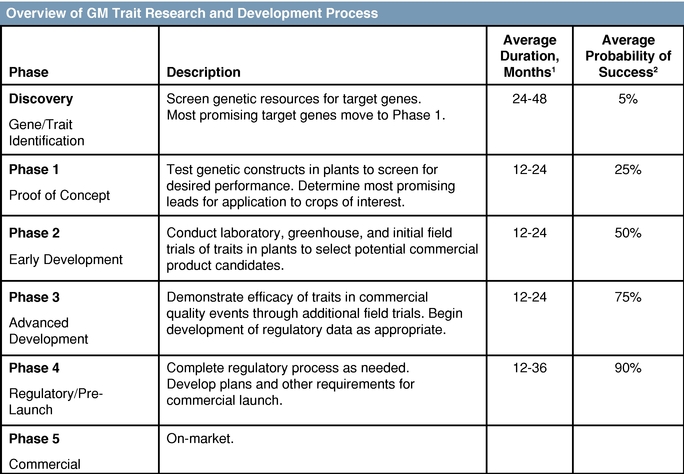

Our product development cycle is lengthy and uncertain, and we may never earn revenues from the sale of products containing our traits.

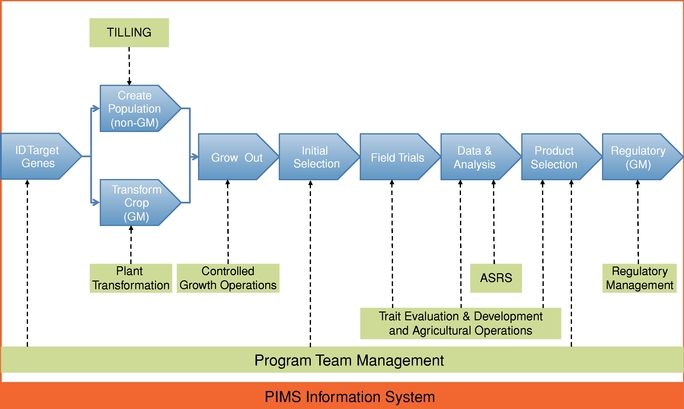

Research and development in the seed, agricultural biotechnology, and larger agriculture industries is expensive and prolonged and entails considerable uncertainty. We and our collaborators may spend many years and dedicate significant financial and other resources, including the proceeds of this offering, developing traits that will never be commercialized. The process of discovering, developing, and commercializing a seed trait through either genetic modification or advanced breeding involves multiple phases, and it may require from six to thirteen years or more from discovery to commercialization. The length of the process may vary depending on one or more of the complexity of the trait, the particular crop, and the intended geographical market involved. This long product development cycle is in large part attributable to the nature-driven breeding period for a commercial product, as well as a lengthy regulatory process.

There are currently over 50 products in development incorporating our traits, each of which consists of the application of a specific seed trait to a specific crop. Although our Sonova products are on the market currently, we expect that it will take several years before the first products containing our agricultural yield traits complete the development process and become commercially available. However, we have little to no certainty as to which, if any, of these products will eventually reach commercialization in this timeframe or at all. Because of the long product development cycle and the complexities and uncertainties associated with agricultural biotechnology research, there is significant uncertainty as to whether we will ever generate revenues from the sale of products containing one of our traits and, even if such products reach commercialization, any resulting revenues may come at a later time than we currently anticipate.

We have a history of significant losses, which we expect to continue, and we may never achieve or maintain profitability.

We have incurred significant net losses since our formation in 2002 and expect to continue to incur net losses for the foreseeable future. We incurred net losses of $13.2 million and $18.3 million for the years ended December 31, 2013 and 2014, respectively. As of December 31, 2014, we had an

accumulated deficit of $114.0 million. We expect to continue to incur losses until we begin generating revenues from the sale of traits we are currently developing, which we expect will not occur for several years, if at all. Because we have incurred and will continue to incur significant costs and expenses for these efforts before we obtain any incremental revenues from the sale of seeds incorporating our traits, our losses in future periods could be even more significant. In addition, we may find our development efforts are more expensive than we anticipate or that they do not generate revenues in the time period we anticipate, which would further increase our losses. If we are unable to adequately control the costs associated with operating our business, including costs of development and commercialization of our traits, our business, financial condition, operating results, and prospects will suffer.

In addition, our ability to generate meaningful revenues and achieve and maintain profitability depends on our ability, alone or with strategic collaborators, to successfully complete the development of and complete the regulatory process to commercialize our traits. Most of our revenues since inception have consisted of upfront and milestone payments associated with our contract research and license agreements. Additional revenues from these agreements are largely dependent on successful development of our traits by us or our collaborators. To date, we have not generated any significant revenues from product sales other than from our Sonova products, and we do not otherwise anticipate generating revenues from product sales other than from sales of our Sonova products for the next several years. If products containing our traits fail to achieve market acceptance or generate significant revenues, we may never become profitable.

If ongoing or future field trials by us or our collaborators are unsuccessful, we may be unable to complete the regulatory process for, or commercialize, our products in development on a timely basis.

The successful completion of field trials in United States and foreign locations is critical to the success of product development and marketing efforts for products containing our traits. If our ongoing or future field trials, or those of our collaborators, are unsuccessful or produce inconsistent results or unanticipated adverse effects on crops or on non-target organisms, or if we or our collaborators are unable to collect reliable data, regulatory review of products in development containing our traits could be delayed or commercialization of products in development containing our traits may not be possible. In addition, more than one growing season may be required to collect sufficient data to develop or market a product containing our traits, and it may be necessary to collect data from different geographies to prove performance for customer adoption. Even in cases where field trials are successful, we cannot be certain that additional field trials conducted on a greater number of acres, or in different crops or geographies, will be successful. Generally, our collaborators conduct these field trials or we pay third parties, such as farmers, consultants, contractors, and universities, to conduct field trials on our behalf. Poor trial execution or data collection, failure to follow required agronomic practices, regulatory requirements, or mishandling of products in development by our collaborators or these third parties could impair the success of these field trials.

Many factors that may adversely affect the success of our field trials are beyond our control, including weather and climatic variations, such as drought or floods, severe heat or frost, hail, tornadoes and hurricanes, pests and diseases, or acts of protest or vandalism. For example, if there was prolonged or permanent disruption to the electricity, climate control, or water supply operating systems in our greenhouses or laboratories, the crops in which we or our collaborators are testing our traits and the samples we or our collaborators store in freezers, both of which are essential to our research and development activities, could be severely damaged or destroyed, adversely affecting these activities and thereby our business and results of operations. Unfavorable weather conditions can also reduce both acreage planted and incidence, or timing of, certain crop diseases or pest infestations, each of which may halt or delay our field trials. We have also experienced crop failures in the past for then-unknown reasons, causing delays in our achievement of milestones and delivery of results and necessitating that we repeat the impacted field trials. Any field test failure we may experience may not be covered by

insurance and, therefore, could result in increased cost for the field trials and development of our traits, which may negatively impact our business and results of operations. Additionally, we are subject to U.S. Department of Agriculture, or USDA, regulations, which may require us to abandon a field trial or to purchase and destroy neighboring crops that are planted after our field trials have commenced. For example, while conducting early field trials for GLA safflower oil, we were forced to purchase and destroy an adjacent safflower crop when the placement of bee hives by a third party altered the required isolation distance between our crop and the neighboring crop, requiring us to either purchase and destroy the adjacent crop or abandon our field trial. In order to prevent the significant delays that would result from terminating our field trial, we decided to purchase and destroy the neighboring crop at a cost of approximately $30,000. Similar factors outside of our control can create substantial volatility relating to our business and results of operations.

Competition in traits and seeds is intense and requires continuous technological development, and, if we are unable to compete effectively, our financial results will suffer.

We face significant competition in the markets in which we operate. The markets for traits and agricultural-biotechnology products are intensely competitive and rapidly changing. In most segments of the seed and agricultural biotechnology market, the number of products available to consumers is steadily increasing as new products are introduced. At the same time, the expiration of patents covering existing products reduces the barriers to entry for competitors. We may be unable to compete successfully against our current and future competitors, which may result in price reductions, reduced margins and the inability to achieve market acceptance for products containing our traits. In addition, several of our competitors have substantially greater financial, marketing, sales, distribution, research and development, and technical resources than us, and some of our collaborators have more experience in research and development, regulatory matters, manufacturing, and marketing. We anticipate increased competition in the future as new companies enter the market and new technologies become available. Our technologies may be rendered obsolete or uneconomical by technological advances or entirely different approaches developed by one or more of our competitors, which will prevent or limit our ability to generate revenues from the commercialization of our traits being developed.

We derive a significant portion of our current revenues from government agencies, which may not continue in the future and which may expose us to government audits and potential penalties.

We historically have derived a significant portion of our revenues from grants from U.S. government agencies. Such grants accounted for 44% and 50% of our total revenue in the years ended December 31, 2013 and 2014, respectively. For example, revenues from the U.S. Agency for International Development accounted for 26% and 36% of our total revenues in the years ended December 31, 2013 and 2014, respectively. Our ability to obtain grants is subject to the availability of funds under applicable government programs and approval of our applications to participate in such programs. The application process for these grants is highly competitive. We may not be successful in obtaining any additional grants. Once we successfully obtain a grant, the awarding U.S. government agency has the right to discontinue funding on such a grant at any time. The recent political focus on reducing spending at the U.S. federal and state levels may reduce the scope and amount of funds dedicated to seed and agricultural biotechnology innovations, if such funds continue to be available at all. To the extent that we are unsuccessful in obtaining any additional government grants in the future or if funding is discontinued on an existing grant, we would lose a significant source of our current revenues.

To the extent that we do not comply with the specific requirements of a grant, our expenses incurred may not be reimbursed and any of our existing grants or new grants that we may obtain in the future may be terminated or modified. In addition, our activities funded by our government grants may be subject to audits by U.S. government agencies. As part of an audit, these agencies may review our

performance, cost structures and compliance with applicable laws, regulations and standards, and the terms and conditions of the grant. An audit could result in a material adjustment to our results of operations and financial condition. Moreover, if an audit uncovers improper or illegal activities, we may also be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, or fines, and we may be suspended or prohibited from doing business with the government. In addition, serious reputational harm or significant adverse financial effects could occur if allegations of impropriety are made against us, even if we are ultimately found to have done no wrong.

A significant portion of our revenues to date are from a limited number of strategic collaborations, and the termination of these collaborations would have a material adverse effect on our results of operations.

We derive a substantial amount of our revenues from a limited number of strategic collaborations, under which we generate revenues through licensing arrangements such as research and development payments, up-front payments, milestone payments, and, once a product is commercialized, a portion of the commercial value of the trait. In particular, revenues from Mahyco accounted for 23% and 29% of our total revenues in the years ended December 31, 2013 and 2014, respectively. A small number of commercial partners are expected to continue to account for a substantial amount of our revenues for the next several years. Our agreements with Mahyco are terminable by Mahyco at will upon 90 days' notice. The termination or non-renewal of our arrangements with Mahyco or our other commercial partners would have a material adverse effect on our business, financial condition, results of operations, and prospects.

We expect to derive a substantial portion of our future revenues from commercial products sold outside the United States, which subjects us to additional business risks.

A significant number of our research and collaboration agreements include products under development for markets outside the United States. Our collaborators' operations in these regions are subject to a variety of risks, including different regulatory requirements, uncertainty of contract and intellectual property rights, unstable political and regulatory environments, economic and fiscal instability, tariffs and other import and trade restrictions, restrictions on the ability to repatriate funds, business cultures accepting of various levels of corruption, and the impact of anti-corruption laws. These risks could result in additional cost, loss of materials, and delays in our commercialization timeline in international markets and have a negative effect on our operating results.

Revenues generated outside the United States could also be subject to increased difficulty in collecting delinquent or unpaid accounts receivables, adverse tax consequences, currency and exchange rate fluctuations, relatively high inflation, exchange control regulations, and governmental pricing directives. Acts of terror or war may impair our ability to operate in particular countries or regions and may impede the flow of goods and services between countries. Customers in these and other markets may be unable to purchase our products if their economies deteriorate, or it could become more expensive for them to purchase imported products in their local currency or sell their commodities at prevailing international prices, and we may be unable to collect receivables from such customers. If any of these risks materialize, our results of operations and profitability could be harmed.

We or our collaborators may fail to perform our respective obligations under contract research and collaboration agreements.

We are obligated under certain contract research agreements to perform research activities over a particular period of time. If we fail to perform our obligations under these agreements, in some cases our collaborators may terminate our agreements with them and in other cases our collaborators' obligations may be reduced and, as a result, our anticipated revenues may decrease. In addition, any of our collaborators may fail to perform their obligations under the diligence timelines in our

collaboration agreements, which may delay development and commercialization of products containing our traits and materially and adversely affect our future results of operations.

Furthermore, the various payments we receive from our collaborators are a significant source of our current revenues and are expected to be the largest source of our revenues in the future. If our collaborators do not make these payments, either due to financial hardship, disagreement under the relevant collaboration agreement, or for any other reason, our results of operations and business could be materially and adversely affected. If disagreements with a collaborator arise, any dispute with such collaborator may negatively affect our relationship with one or more of our other collaborators and may hinder our ability to enter into future collaboration agreements, each of which could negatively impact our business and results of operations.

Most of our collaborators have significant resources and development capabilities and may develop their own products that compete with or negatively impact the advancement or sale of products containing our traits.

Most of our collaborators are significantly larger than us and may have substantially greater resources and development capabilities. As a result, we are subject to competition from many of our collaborators, who could develop or pursue competing products and traits that may ultimately prove more commercially viable than our traits. In addition, former collaborators, by virtue of having had access to our proprietary technology, may utilize this insight for their own development efforts, despite the fact that our collaboration agreements prohibit such use. The development or launch of a competing product by a collaborator may adversely affect the advancement and commercialization of any traits we develop and any associated research and development and milestone payments and value-sharing payments we receive from the sale of products containing our traits.

We rely on third parties to conduct, monitor, support, and oversee field trials and, in some cases, to maintain regulatory files for those products in development, and any performance issues by third parties, or our inability to engage third parties on acceptable terms, may impact our or our collaborators' ability to complete the regulatory process for or commercialize such products.

We rely on third parties, including farmers, to conduct, monitor, support, and oversee field trials. As a result, we have less control over the timing and cost of these trials than if we conducted these trials with our own personnel. If we are unable to maintain or enter into agreements with these third parties on acceptable terms, or if any such engagement is terminated prematurely, we may be unable to conduct and complete our trials in the manner we anticipate. In addition, there is no guarantee that these third parties will devote adequate time and resources to our studies or perform as required by our contract or in accordance with regulatory requirements, including maintenance of field trial information regarding our products in development. If these third parties fail to meet expected deadlines, fail to transfer to us any regulatory information in a timely manner, fail to adhere to protocols, or fail to act in accordance with regulatory requirements or our agreements with them, or if they otherwise perform in a substandard manner or in a way that compromises the quality or accuracy of their activities or the data they obtain, then field trials of our products in development may be extended or delayed with additional costs incurred, or our data may be rejected by the USDA, the U.S. Food and Drug Administration, or FDA, the U.S. Environmental Protection Agency, or EPA, or other regulatory agencies. Ultimately, we are responsible for ensuring that each of our field trials is conducted in accordance with the applicable protocol, legal, regulatory and scientific standards, and our reliance on third parties does not relieve us of our responsibilities.

If our relationship with any of these third parties is terminated, we may be unable to enter into arrangements with alternative parties on commercially reasonable terms, or at all. Switching or adding farmers or other suppliers can involve substantial cost and require extensive management time and focus. In addition, there is a natural transition period when a new farmer or other third party commences work. As a result, delays may occur, which can materially impact our ability to meet our

desired development timelines. If we are required to seek alternative supply arrangements, the resulting delays and potential inability to find a suitable replacement could materially and adversely impact our business.

Our prospects for successful development and commercialization of our products are dependent upon the research, development, commercialization, and marketing efforts of our collaborators.

We primarily rely on third parties for research, development, commercialization, and marketing of our products and products in development. Other than as provided for in our collaboration agreements, we have no control over the resources, time and effort that our collaborators may devote to the development of products incorporating our traits, and have limited access to information regarding or resulting from such programs. We are dependent on our third party collaborators to fund and conduct the research and development of product candidates, to complete the regulatory process, and for the successful marketing and commercialization of one or more of such products or products in development. Such success will be subject to significant uncertainty.

Our ability to recognize revenues from successful collaborations may be impaired by multiple factors including:

If our collaborators do not perform in the manner we expect or fulfill their responsibilities in a timely manner, or at all, the development, regulatory, and commercialization process could be delayed, terminated, or otherwise unsuccessful. Conflicts between us and our collaborators may arise. In the event of termination of one or more of our collaboration agreements, it may become necessary for us to assume the responsibility for any terminated products or products in development at our own expense or seek new collaborators. In that event, we likely would be required to limit the size and scope of one or more of our independent programs or increase our expenditures and seek additional funding, which may not be available on acceptable terms or at all, and our business may be materially and adversely affected.

Our joint venture agreements could present a number of challenges that may have a material adverse effect on our business, financial condition, and results of operations.

We currently participate in two joint ventures, Limagrain Cereal Seeds LLC, which focuses on the development and commercialization of improved wheat seeds, and Verdeca LLC, which focuses on the development and deregulation of soybean traits, and we may enter into additional joint ventures in the future. Our joint venture arrangements may present financial, managerial, and operational challenges, including potential disputes, liabilities, or contingencies and may involve risks not otherwise present when operating independently, including:

The risks described above or the failure to continue any joint venture or joint development arrangement or to resolve disagreements with our current or future joint venture partners could materially and adversely affect our ability to transact the business that is the subject of such joint venture, which would in turn negatively affect our financial condition and results of operations.

We and our collaborators may disagree over our right to receive payments under our collaboration agreements, potentially resulting in costly litigation and loss of reputation.

Our ability to receive payments under our collaboration agreements depends on our ability to clearly delineate our rights under those agreements. We typically license our intellectual property to our collaborators, who then develop and commercialize seeds with improved traits. However, a collaborator may use our intellectual property without our permission, dispute our ownership of certain intellectual property rights, or argue that our intellectual property does not cover, or add value to, their marketed product. If a dispute arises, it may result in costly patent office procedures and litigation, and our collaborator may refuse to pay us while the dispute is ongoing. Furthermore, regardless of any resort to

legal action, a dispute with a collaborator over intellectual property rights may damage our relationship with that collaborator and may also harm our reputation in the industry.

Even if we are entitled to payments from our collaborators, we may not actually receive these payments, or we may experience difficulties in collecting the payments to which we believe we are entitled. After our collaborators launch commercial products containing our licensed traits, we will need to rely on the good faith of our collaborators to report to us the sales they earn from these products and to accurately calculate the payments we are entitled to, a process that will involve complicated and difficult calculations. Although we seek to address these concerns in our collaboration agreements by reserving our right to audit financial records, such provisions may not be effective.

Our business is subject to various government regulations and if we or our collaborators are unable to timely complete the regulatory process for our products in development, our or our collaborators' ability to market our traits could be delayed, prevented or limited.

Our business is generally subject to two types of regulations: regulations that apply to how we and our collaborators operate and regulations that apply to products containing our traits. We apply for and maintain the regulatory permits necessary for our operations, particularly those covering our field trials, while we or our collaborators apply for and maintain regulatory approvals necessary for the commercialization of products containing our seed traits. The large-scale field trials that our collaborators conduct during advanced stages of product development are subject to regulations similar to those to which we are subject. Pursuant to our collaboration agreements, our collaborators also apply for the requisite regulatory approvals prior to commercialization of products containing our traits. In most of our key target markets, regulatory approvals must be received prior to the importation of genetically modified products. These regulatory processes may be complex; for example, the U.S. federal government's regulation of biotechnology is divided among the EPA, which regulates activity related to the use of plant pesticides and herbicides, the USDA, which regulates the import, field testing, and interstate movement of specific technologies that may be used in the creation of genetically modified plants, and the FDA, which regulates foods derived from new plant varieties. In addition to regulation by the U.S. government, products containing our biotech traits may be subject to regulation in each country in which such products are tested or sold. International regulations may vary from country to country and from those of the United States. The difference in regulations under U.S. law and the laws of foreign countries may be significant and, in order to comply with the laws of foreign countries, we may have to implement global changes to our products or business practices. Such changes may result in additional expense to us and either reduce or delay product development or sales. Additionally, we or our collaborators may be required to obtain certifications or approvals by foreign governments to test and sell the products in foreign countries.

The regulatory process is expensive and time-consuming, and the time required to complete the process is difficult to predict and depends upon numerous factors, including the substantial discretion of the regulatory authorities. Other than our Sonova products, neither we nor our collaborators have completed the regulatory process for any of our products in development. Our traits could require a significantly longer time to complete the regulatory process than expected, or may never gain approval, even if we and our collaborators expend substantial time and resources seeking such approval. A delay or denial of regulatory approval could delay or prevent our ability to generate revenues and to achieve profitability. For example, we are currently awaiting completion of the regulatory process for one of our Sonova products to be used in pet food, which has taken longer than expected. Changes in regulatory review policies during the development period of any of our traits, changes in, or the enactment of, additional regulations or statutes, or changes in regulatory review practices for a submitted product application may cause a delay in obtaining approval or result in the rejection of an application for regulatory approval. Regulatory approval, if obtained, may be made subject to limitations on the indicated uses for which we or our collaborators may market a product. These limitations could

adversely affect our potential revenues. Failure to comply with applicable regulatory requirements may, among other things, result in fines, suspensions of regulatory approvals, product recalls, product seizures, operating restrictions, and criminal prosecution. We have on certain occasions notified the USDA of instances of noncompliance with regulations. Although these occasions did not result in any enforcement actions, we may have occasions of noncompliance in the future that result in USDA or other governmental agency enforcement action.

Consumer resistance to genetically modified organisms may negatively affect our public image and reduce sales of seeds containing our traits.

We are active in the field of agricultural biotechnology research and development in seeds and crop protection, including GM seeds. Foods made from such seeds are not accepted by many consumers due to concerns over such products' effects on food safety and the environment. The high public profile of biotechnology in food production and lack of consumer acceptance of products to which we have devoted substantial resources could negatively affect our public image and results of operations. The current resistance from consumer groups, particularly in Europe, to GM crops not only limits our access to such markets but also has the potential to spread to and influence the acceptance of products developed through biotechnology in other regions of the world. For example, in the United States, organizations have advocated for the labeling of food products containing GM ingredients, three states (Connecticut, Maine, and Vermont) have passed GM labeling legislation, and more than 20 states introduced legislation or ballot initiatives in 2014 that would require GM labeling. These labeling-related initiatives have heightened consumer awareness of GM crops generally and may make consumers less likely to purchase food products containing GM ingredients, which could have a negative impact on the commercial success of products that incorporate our traits and materially and adversely affect our financial condition and results of operations.

Governmental restrictions on the production of GM crops may negatively affect our business and results of operations.

The production of certain GM crops is effectively prohibited in certain countries, including throughout the European Union, which limits our commercial opportunities and may influence regulators in other countries to limit or ban production of GM crops. Our GM crops are grown principally in North America, South America, and Australia, where there are fewer restrictions on the production of GM crops. If these or other countries where our GM crops are grown enact laws or regulations that ban the production of such crops or make regulations more stringent, we could experience a longer product development cycle for our products, encounter difficulty obtaining intellectual property protection, and may even have to abandon projects related to certain crops or geographies, any of which would negatively affect our business and results of operations. Furthermore, any changes in such laws and regulations or consumer acceptance of our GM crops could negatively impact our collaborators, who in turn might terminate or reduce the scope of their collaborations with us or seek to alter the financial terms of our agreements with them.

Changes in laws and regulations to which we are subject, or to which we may become subject in the future, may materially increase our costs of operation, decrease our operating revenues, and disrupt our business.

Laws and regulatory standards and procedures that impact our business are continuously changing. Responding to these changes and meeting existing and new requirements may be costly and burdensome. Changes in laws and regulations could:

Any of these events could have a material adverse effect on our business, results of operations, and financial condition. Legislators and regulators have increased their focus on plant biotechnology in recent years, with particular attention paid to GM crops.

Our future growth relies on the ability of our collaborators to commercialize and market our products in development, and any restrictions on such activities could materially and adversely impact our business and results of operations. Any changes in regulations in countries where GM crops are grown or imported could result in our collaborators being unable or unwilling to develop, commercialize, or sell products that incorporate our traits. Any changes to these existing laws and regulations may also materially increase our costs of operation, decrease our operating revenues, and disrupt our business. See "Business—Regulatory Matters."

The unintended presence of our traits in other products or plants may negatively affect us.

Trace amounts of our traits may unintentionally be found outside our containment area in the products of third parties, which may result in negative publicity and claims of liability brought by such third parties against us. Furthermore, in the event of an unintended dissemination of our genetically engineered materials to the environment or the presence of unintended but unavoidable trace amounts, sometimes called "adventitious presence," of our traits in conventional seed, or in the grain or products produced from conventional or organic crops, we could be subject to claims by multiple parties, including environmental advocacy groups, as well as governmental actions such as mandated crop destruction, product recalls, or additional stewardship practices and environmental cleanup or monitoring.

Loss of or damage to our germplasm collection would significantly slow our product development efforts.

We have developed and maintain a comprehensive collection of germplasm through strategic collaborations with leading institutions, which we utilize in our non-GM programs. Germplasm comprises collections of genetic resources covering the diversity of a crop, the attributes of which are inherited from generation to generation. Germplasm is a key strategic asset since it forms the basis of seed development programs. To the extent that we lose access to such germplasm because of the termination or breach of our collaboration agreements, our product development capabilities would be severely limited. In addition, loss of or damage to these germplasm collections would significantly impair our research and development activities. Although we restrict access to our germplasm at our research facilities to protect this valuable resource, we cannot guarantee that our efforts to protect our germplasm collection will be successful. The destruction or theft of a significant portion of our germplasm collection would adversely affect our business and results of operations.

We depend on our key personnel and, if we are not able to attract and retain qualified scientific and business personnel, we may not be able to grow our business or develop and commercialize our products.

We depend heavily on the skills, expertise and legacy knowledge of principal members of our management, including Eric J. Rey, our President and Chief Executive Officer, and Vic C. Knauf, our Chief Scientific Officer, the loss of whose services might significantly delay or prevent the achievement of our scientific or business objectives.

Additionally, the vast majority of our workforce is involved in research, development, and regulatory activities. Our business is therefore dependent on our ability to recruit and maintain a highly skilled and educated workforce with expertise in a range of disciplines, including molecular biology, biochemistry, plant genetics, agronomics, mathematics, agribusiness, and other subjects relevant to our operations. All of our current employees are at-will employees, and the failure to retain or hire skilled and highly educated personnel could limit our growth and hinder our research and development efforts.

Many of our employees have become or will soon become vested in a substantial number of stock options. Our employees may be more likely to leave us if the shares they own or the shares underlying their vested options have significantly appreciated in value relative to the original purchase prices of the shares or the exercise prices of the options. Further, our employees' ability to exercise those options and sell their stock in a public market after the closing of this offering may result in a higher than normal turnover rate.

Our development activities are currently conducted at a limited number of locations, which makes us susceptible to damage or business disruptions caused by natural disasters.

Our headquarters, certain research and development operations and our seed storage warehouse are located in Davis, California. We also conduct certain research and development operations and store certain biomaterials in Seattle, Washington. The safflower grain used in the production of our Sonova products is grown in several locations throughout Idaho and is stored in a single facility in Idaho. Our production of our Sonova products takes place at a single facility in Northern California, and the inventory is stored in a single cold storage facility in Northern California. We take precautions to safeguard our facilities, including insurance, health and safety protocols, and off-site storage of critical research results and computer data. However, a natural disaster, such as a fire, flood, or earthquake, could cause substantial delays in our operations, damage or destroy our equipment, inventory, or development projects, and cause us to incur additional expenses. The insurance we maintain against natural disasters may not be adequate to cover our losses in any particular case.

Interruptions in the production or transportation of raw materials used in our Sonova products could adversely affect our operations and profitability.