Use these links to rapidly review the document

TABLE OF CONTENTS

[ALTERNATE PAGE FOR CANADIAN PROSPECTUS] TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on September 1,4, 2015

Registration No. 333-206218

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No 1.No. 2

to

Form S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

CPI Card Group Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 7374 (Primary Standard Industrial Classification Code Number) | 26-0344657 (IRS Employer Identification No.) |

CPI Card Group Inc.

10368 West Centennial Road

Littleton, CO 80127

(303) 973-9311

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Steven Montross

President and Chief Executive Officer

CPI Card Group Inc.

10368 West Centennial Road

Littleton, CO 80127

(303) 973-9311

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Please send copies of all communications to: | ||

Steven J. Gavin, Esq. Andrew J. McDonough, Esq. Arlene K. Lim, Esq. Winston & Strawn LLP 35 West Wacker Drive Chicago, Illinois 60601 (312) 558-5600 | Christopher J. Cummings, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 77 King Street West, Suite 3100 Toronto, Ontario, Canada M5K 1J3 (416) 504-0522 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||

|---|---|---|---|---|

| Common Stock, $0.001 par value per share | $100,000,000 | $11,620(3) | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

This registration statement contains two forms of prospectus: one to be used in connection with the offering of the securities described herein in the United States, which we refer to as the "U.S. Prospectus," and one to be used in connection with the offering of such securities in Canada, which we refer to as the "Canadian Prospectus." The U.S. Prospectus and the Canadian Prospectus are identical except for the cover page, the table of contents and the back page, and except that the Canadian Prospectus includes pages 164166 through 168,169, a "Certificate of the Company" and a "Certificate of the Canadian Underwriters." The form of the U.S. Prospectus is included herein and is followed by the alternate and additional pages to be used in the Canadian Prospectus. Each of the alternate pages for the Canadian Prospectus included herein is labeled "Alternate Page for Canadian Prospectus." Each of the additional pages for the Canadian Prospectus included herein is labeled "Additional Page for Canadian Prospectus."

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED SEPTEMBER |

Shares

CPI Card Group Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are selling shares of our common stock, and the selling stockholders named in this prospectus are selling shares of our common stock. We currently expect the initial public offering price to be between $ and $ per share of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

Prior to this offering, there has been no public market for our common stock. We have applied to list our common stock on the NASDAQ Global Select Market under the symbol "PMTS."

We are an "emerging growth company" as that term is used in the Jumpstart our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See "Prospectus Summary—JOBS Act."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 18.17.

| | Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Initial Public Offering Price | $ | $ | |||||

Underwriting Discount(1) | $ | $ | |||||

Proceeds to Us (before expenses) | $ | $ | |||||

Proceeds to the Selling Stockholders (before expenses) | $ | $ | |||||

| | | | | | | | |

The selling stockholders have granted the underwriters an option to purchase up to additional shares of our common stock within 30 days of the closing date of this offering to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2015 through the book-entry facilities of The Depository Trust Company.

| BMO Capital Markets | Goldman, Sachs & Co. | CIBC |

| Baird | William Blair | Raymond James | Scotiabank | GMP Securities |

Prospectus dated , 2015

[ALTERNATE PAGE FOR CANADIAN PROSPECTUS]

A copy of this amended and restated preliminary prospectus has been filed with the securities regulatory authority in each of the provinces and territories of Canada, but has not yet become final for the purpose of the sale of securities. Information contained in this amended and restated preliminary prospectus may not be complete and may have to be amended. The securities may not be sold until a receipt for the prospectus is obtained from the securities regulatory authorities.

This prospectus has been filed under procedures in each of the provinces and territories of Canada that permit certain information about these securities to be determined after the prospectus has become final and that permit the omission of that information from this prospectus. The procedures require the delivery to purchasers of a supplemented PREP prospectus containing the omitted information within a specified period of time after agreeing to purchase any of these securities.

All of the information contained in the supplemented PREP prospectus that is not contained in the base PREP prospectus will be incorporated by reference into this base PREP prospectus as of the date of the supplemented PREP prospectus.

No securities regulatory authority has expressed an opinion about any information contained herein and it is an offence to claim otherwise. This preliminary prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell those securities.

We have filed a registration statement on Form S-1 with the United States Securities and Exchange Commission under the United States Securities Act of 1933, as amended, with respect to these securities.

Second Amended and Restated Preliminary Base

PREP Prospectus dated September 1,4, 2015,

amending and restating the Amended and Restated Preliminary

Base PREP Prospectus dated August 12,September 1, 2015

Initial Public Offering | September |

US$

Common Stock

This preliminary base PREP prospectus (the "Prospectus") qualifies the distribution (the "Offering") of an aggregate of shares of common stock (the "Common Shares") of CPI Card Group Inc. (the "Company" or "CPI"). We expect the public offering price to be between US$ and US$ per Common Share (the "Offering Price").

The Common Shares are being offered for sale concurrently in Canada under this Prospectus and in the United States under a registration statement on Form S-1 filed with the United States Securities and Exchange Commission. The Common Shares are being offered in Canada by BMO Nesbitt Burns Inc., Goldman Sachs Canada Inc., CIBC World Markets Inc., Raymond James Ltd., Scotia Capital Inc. and GMP Securities L.P. (the "Canadian Underwriters") and in the United States by BMO Capital Markets Corp., Goldman, Sachs & Co., CIBC World Markets Corp. and��, Robert W. Baird & Co. Incorporated, William Blair & Company, L.L.C., Raymond James & Associates, Inc., Scotia Capital (USA) Inc. and Griffiths McBurney Corp. (the "US Underwriters," and together with the Canadian Underwriters, the "Underwriters"). Common Shares are being offered by the Company and Common Shares are being offered by selling stockholders named in this Prospectus. See "Principal and Selling Stockholders."

Affiliates of each of BMO Nesbitt Burns Inc., BMO Capital Markets Corp., Goldman Sachs Canada Inc., Goldman, Sachs & Co., CIBC World Markets Inc. and, CIBC World Markets Corp., Scotia Capital Inc. and Scotia Capital (USA) Inc. are lenders to the Company under its credit facility. Another affiliate of CIBC World Markets Inc. and CIBC World Markets Corp. is a limited partner of Tricor Pacific Capital Partners (Fund IV), Limited Partnership, one of the selling stockholders named in this Prospectus. Consequently, the Company may be considered a "connected issuer" to each of BMO Nesbitt Burns Inc., BMO Capital Markets Corp., Goldman Sachs Canada Inc., Goldman, Sachs & Co., CIBC World Markets Inc. and, CIBC World Markets Corp., Scotia Capital Inc. and Scotia Capital (USA) Inc., and such selling stockholder may be considered a "connected issuer" to CIBC World Markets Inc. and CIBC World Markets Corp., in each case within the meaning of National Instrument 33-105—Underwriting Conflicts of the Canadian Securities Administrators. See "Underwriting—Conflicts of Interest".

Price: US$ per Common Share | ||||

| | Price to the Public(1) | Underwriters' Commission(2)(3) | Net Proceeds to CPI(2)(4) | Net Proceeds to Selling Stockholders(3)(5) | ||||

|---|---|---|---|---|---|---|---|---|

Per Common Share | US$ | US$ | US$ | US$ | ||||

Total | US$ | US$ | US$ | US$ |

Notes:

The Canadian Underwriters, as principals, conditionally offer the Common Shares qualified under this Prospectus, subject to prior sale, if, as and when issued by CPI and accepted by the Canadian Underwriters in accordance with the conditions contained in the underwriting agreement referred to under "Underwriting" and subject to the approval of certain legal matters on behalf of CPI by Blake, Cassels & Graydon LLP, as to matters of Canadian law, and by Winston & Strawn LLP, as to matters of U.S. law, and on behalf of the Underwriters by Stikeman Elliott LLP, as to matters of Canadian law, and Paul, Weiss, Rifkind, Wharton & Garrison LLP, as to matters of U.S. law.

Underwriters' position | Maximum size or number of securities available | Exercise period or acquisition date | Exercise price or average acquisition price | |||

|---|---|---|---|---|---|---|

Over-Allotment Option | Option to acquire up to Common Shares | Exercisable for a period of 30 days after the closing date of this Offering | US$ |

In connection with this Offering, the Underwriters may, subject to applicable laws, overallot or effect transactions that stabilize, maintain or otherwise affect the market price of the Common Shares at levels other than those which otherwise might prevail on the open market. Such transactions, if commenced, may be discontinued at any time.The Underwriters may offer the Common Shares at a lower price than stated above. See "Underwriting."

There is currently no market through which the Common Shares may be sold and purchasers may not be able to resell the Common Shares purchased under this Prospectus. This may affect the pricing of the Common Shares in the secondary market, the transparency and availability of trading prices, the liquidity of the securities and the extent of issuer regulation. See "Risk Factors".

Subscriptions for the Common Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. The Common Shares to be issued or sold in this Offering will be issued in registered form to CDS Clearing and Depositary Services Inc. ("CDS") or the Depositary Trust Company ("DTC"), and deposited with CDS or DTC on the closing date of this Offering which is expected to occur on or about , 2015 or such later date as the Company and the Underwriters may agree, but in any event not later than , 2015 (the "Closing Date"). A purchaser of the Common Shares in Canada will receive only a customer confirmation from a registered dealer that is a participant in CDS through which the Common Shares are purchased, unless such purchaser requests from the Company the issuance of a certificate evidencing such Common Shares.

Any "template version" of any "marketing materials" (as such terms are defined under Canadian securities laws) that are utilized by the Canadian Underwriters in connection with the Offering are not part of this prospectus to the extent that the contents of the template version of the marketing materials have been modified or superseded by a statement contained in this prospectus. Any template version of any marketing materials that has been, or will be, filed under the Company's profile on www.sedar.com before the termination of the distribution under the Offering (including any amendments to, or an amended version of, any template version of any marketing materials) is deemed to be incorporated into this prospectus.

The Company, the Company's auditor, Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership, and each of Bradley Seaman, Nicholas Peters, Steven Montross and David Brush (collectively, the "Non-Canadian Directors and Signatories"), are incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada. The Company, the Company's auditor, Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership and the Non-Canadian Directors and Signatories have appointed the following agent for service of process:

Name of Person or Company | Name and Address of Agent | |

|---|---|---|

CPI Card Group Inc. | 595 Burrard Street, P.O. Box 49314 Suite 2600, Three Bentall Centre Vancouver, BC, V7X 1L3 Canada | |

| Blakes Vancouver Services Inc. | |

|

| |

Non-Canadian Directors and Signatories |

|

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a

foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

INVESTMENT IN THE COMMON SHARES INVOLVES SIGNIFICANT RISKS. INVESTORS SHOULD CAREFULLY CONSIDER THE RISKS REFERRED TO UNDER THE HEADING "RISK FACTORS" STARTING ON PAGE 1817 IN THIS PROSPECTUS.

We are responsible for the information contained in this prospectus and in any free-writing prospectus we have authorized. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with different information, and neither we, the selling stockholders nor the underwriters take responsibility for any other information others may give you. Neither we, the selling stockholders nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

| | Page | |||

|---|---|---|---|---|

Prospectus Summary | 1 | |||

Risk Factors | ||||

Forward-Looking Statements | ||||

Industry and Market Data | ||||

Use of Non-GAAP Financial Information | ||||

Trademarks | ||||

Glossary of Industry Terms | ||||

Use of Proceeds | ||||

Dividend Policy | ||||

Capitalization | ||||

Dilution | ||||

Selected Consolidated Financial Data | ||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | ||||

Industry | ||||

Business | ||||

Management | ||||

Executive Compensation | ||||

Structure and Formation of Our Company | 130 | |||

Certain Relationships and Related Party Transactions | 131 | |||

Principal and Selling Stockholders | 135 | |||

Description of Certain Indebtedness | ||||

Description of Capital Stock | ||||

Shares Eligible for Future Sale | ||||

Underwriting | ||||

Material U.S. Federal Income Tax Considerations to Non-U.S. Holders | ||||

Certain Canadian Federal Income Tax Considerations for Holders of Our Common Stock | ||||

Notice to Investors Regarding U.S. GAAP | ||||

Legal Matters | ||||

Experts | ||||

Change in Independent Accountant | ||||

Where You Can Find More Information | ||||

Index to Consolidated Financial Statements | F-1 | |||

Unaudited Pro Forma Condensed Combined Financial Information | P-1 | |||

i

[ALTERNATE PAGE FOR CANADIAN PROSPECTUS]

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

Prospectus Summary | 1 | |||

Risk Factors | ||||

Forward-Looking Statements | ||||

Industry and Market Data | ||||

Use of Non-GAAP Financial Information | ||||

Trademarks | ||||

Glossary of Industry Terms | ||||

Use of Proceeds | ||||

Dividend Policy | ||||

Capitalization | ||||

Dilution | ||||

Selected Consolidated Financial Data | ||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | ||||

Industry | ||||

Business | ||||

Management | ||||

Executive Compensation | ||||

Structure and Formation of Our Company | 130 | |||

Certain Relationships and Related Party Transactions | 131 | |||

Principal and Selling Stockholders | 135 | |||

Description of Certain Indebtedness | ||||

Description of Capital Stock | ||||

Shares Eligible for Future Sale | ||||

Underwriting | ||||

Material U.S. Federal Income Tax Considerations to Non-U.S. Holders | ||||

Certain Canadian Federal Income Tax Considerations for Holders of Our Common Stock | ||||

Notice to Investors Regarding U.S. GAAP | ||||

Legal Matters | ||||

Experts | ||||

Change in Independent Accountant | ||||

Where You Can Find More Information | ||||

Prior Sales | ||||

Audit Committee | ||||

ii

| | Page | |||

|---|---|---|---|---|

Material Contracts | ||||

Purchaser's Statutory Rights of Recission | ||||

Exemptions | ||||

Index to Consolidated Financial Statements | F-1 | |||

Unaudited Pro Forma Condensed Combined Financial Information | P-1 | |||

Certificate of the Company | C-1 | |||

Certificate of the Canadian Underwriters | C-2 | |||

iii

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the sections entitled "Risk Factors," "Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in any forward-looking statements as a result of certain factors such as those set forth in the sections entitled "Risk Factors" and "Forward-Looking Statements." Unless the context otherwise requires, references to the "Company," "CPI," "us," "we" or "our" refer to CPI Card Group Inc. and its subsidiaries. References to "pro forma net sales" or "pro forma Adjusted EBITDA" mean after giving effect to our acquisition of EFT Source, Inc. as if such acquisition had occurred on January 1, 2014. References to "LTM" or the "LTM Period" refer to the twelve months ended June 30, 2015. LTM financial data is derived by adding financial data for the year ended December 31, 2014 to financial data for the six months ended June 30, 2015 and subtracting financial data for the six months ended June 30, 2014. See "Summary Consolidated Historical Financial Data." Refer to "Glossary of Industry Terms" on page 45 of this prospectus for the definitions of industry and other terms not otherwise defined herein. This prospectus contains information from a report we commissioned from First Annapolis Consulting, Inc. ("First Annapolis"), a leading advisory firm to the payments industry, in May 2015. See "Industry and Market Data."

Our Business

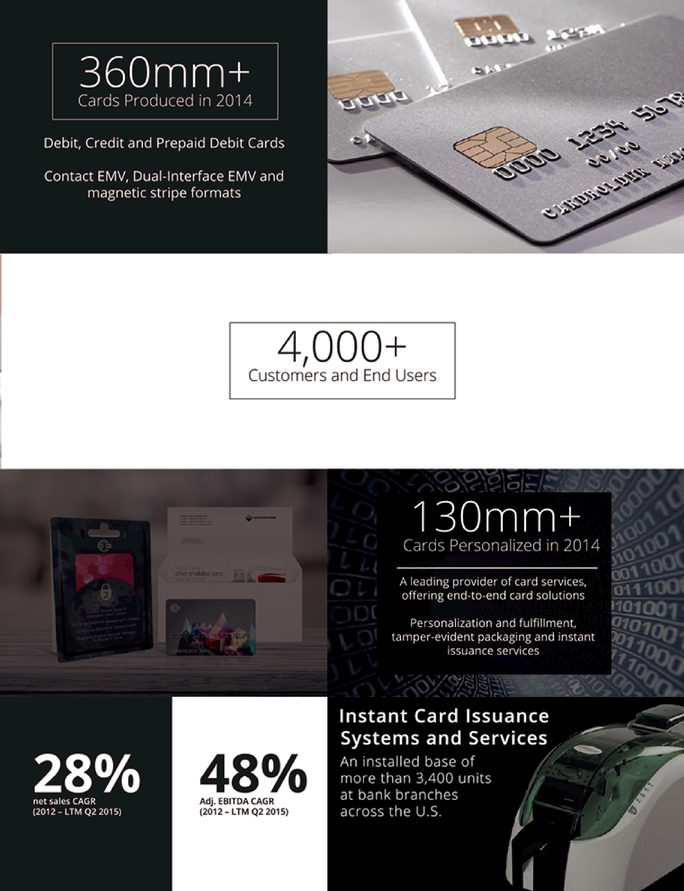

We are a leading provider of comprehensive Financial Payment Card solutions in North America. We define Financial Payment Cards as credit, debit and Prepaid Debit Cards issued on the networks of the Payment Card Brands (Visa, MasterCard, American Express and Discover) and Interac (in Canada). In 2014, we produced over 360 million Financial Payment Cards, provided integrated card services to over 3,200 card-issuing banks and Prepaid Debit Card issuers and personalized more than 130 million Financial Payment Cards. We have established a leading position in the Financial Payment Card market through more than 20 years of experience and are focused primarily on this growing subsector of the financial technology market. Our customers are primarily leading national and regional banks, independent community banks, credit unions, managers of prepaid debit programs, Group Service Providers and card processors. We serve a diverse set of over 4,000 direct and indirect customers, including many of the largest North American issuers of debit and credit cards such as JPMorgan Chase, Bank of America, American Express and Wells Fargo, the largest global managers of Prepaid Debit Card programs, including InComm, Green Dot, Blackhawk Network and American Express, as well as thousands of independent community banks, credit unions, Group Service Providers and card processors.

We serve our customers through a network of nine production and card services facilities, including seven high-security facilities in North America that are each certified by one or more of the Payment Card Brands and Interac (in Canada) and, where required by our customers, the Payment Card Industry Security Standards Council. We have the largest such network of high-security production facilities in North America, allowing us to optimize our solutions offerings to serve the needs of our diverse and long-term customer base.

We estimate that we produce approximately 35% of all Financial Payment Cards in the United States, which we believe gives us the #1 market position by unit volume. We believe we have:

We have grown our business significantly over the past decade, both organically and through acquisitions. Over that time period, we have completed six acquisitions, significantly increasing our geographic and market coverage, solutions offerings and capacity. On March 9, 2010, we purchased certain assets of Premier Card Solutions, a leading provider of Financial Payment Cards, data personalization services and tamper-evident security packaging for Prepaid Debit Cards that utilize the payment networks of the Payment Card Brands. The Premier Card Solutions transaction significantly enhanced our offering to Prepaid Debit Card customers. On September 2, 2014, we acquired EFT Source, Inc. ("EFT Source"), a recognized leader in the financial technology industry that was named to American Banker and BAI's FinTech Forward 100 in both 2013 and 2014. The acquisition of EFT Source significantly enhanced our card services offering, added Card@Once® to our instant issuance card offering and expanded our end-to-end Financial Payment Card solutions.

In addition to our seven North American facilities, we have two facilities in the United Kingdom that produce retail cards, such as gift and loyalty cards that are not issued on the networks of the Payment Card Brands, and provide personalization services. For further information on our business, see "Business."

For the LTM Period, we generated net sales of $338.1 million, net income from continuing operations of $30.5 million and Adjusted EBITDA of $81.5 million, representing net income from continuing operations and Adjusted EBITDA margins of 9.0% and 24.1%, respectively. For the year ended December 31, 2014, we generated $261.0 million of net sales, which represented an increase of 32.9% as compared to the prior year, $16.0 million of net income from continuing operations, which represented an increase of 42.6% as compared to the prior year, and $54.2 million of Adjusted EBITDA, which represented an increase of 41.3% as compared to the prior year, and net income from continuing operations and Adjusted EBITDA margins of 6.1% and 20.8%, respectively. Our 2014 and LTM results include four and ten months of results from EFT Source, respectively. Adjusted EBITDA and Adjusted EBITDA margin are financial measures not presented in accordance with generally accepted accounting principles ("GAAP"). For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income from continuing operations, the most comparable GAAP measure, see "Summary Consolidated Historical Financial Data."

EMV Conversion in the United States

As a leading provider of integrated Financial Payment Card solutions in North America, we are well-positioned to capitalize on the U.S. market conversion to EMV. The EMV standard for Financial Payment Cards, which is named after Europay, MasterCard and Visa, is a technologically advanced high security protocol that features a Financial Payment Card with an embedded microprocessor, commonly known as a "chip card." Depending on the features required by the issuer, EMV cards may sell for 5 to 10 times the average selling price of the magnetic stripe cards they are replacing. We estimate based on our experience that the industry-wide average selling prices per card, exclusive of services, are approximately as follows: magnetic stripe—$0.20 per card; Contact EMV—$1.00 per card; and Dual-Interface EMV—$2.00 per card. Comparing our costs to selling prices, we achieve similar gross margin percentages across these three card types. Actual per card pricing and margins will vary significantly depending on issuer size, order size, card features, finishes and EMV chip features selected by the issuer. According to First Annapolis, on a dollar basis, the U.S. Financial Payment Card market (excluding services) more than doubled from $180 million in 2013 to $371 million in 2014, and the conversion of U.S. Financial Payment Cards to the EMV standard is expected to further increase this

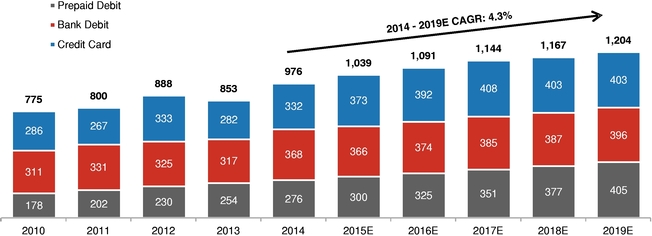

market size by more than three-fold to $1.2 billion by 2019. A number of factors have precipitated the ongoing conversion of Financial Payment Cards in the United States to the EMV standard:

EMV cards issued in the United States to date primarily have been Contact EMV cards. Globally, Dual-Interface EMV cards, which also enable contactless payment, are gaining popularity among card issuers, primarily because of the speed and convenience they offer to cardholders. For example, in Canada, we believe that the majority of all credit cards currently being issued are Dual-Interface EMV cards. Dual-Interface EMV cards are more complex to produce than Contact EMV cards and typically sell at a significantly higher price point. We believe that as the U.S. market migrates to the EMV standard, Dual-Interface EMV cards issued in the United States will gain share relative to Contact EMV cards, further expanding the dollar value of our market opportunity.

Our Market

Consumer payments in the United States and globally have shifted over the last several decades from paper-based media such as cash and checks to card-based media such as credit, debit and Prepaid Debit Cards, and electronic methods such as pre-authorized payments through ACH. The Nilson Report estimates that card-based payments have increased from 38.3% of U.S. transactions in 2005 to

56.5% in 2013, and electronic payments have increased from 4.3% to 7.2% over the same period. By 2018, card-based payments are projected to comprise 69.2% of U.S. transactions, with cash and checks accounting for 21.4% and electronic payments representing the remaining 9.4%. We believe that this long-term trend of card-based and electronic payments replacing cash and checks will continue.

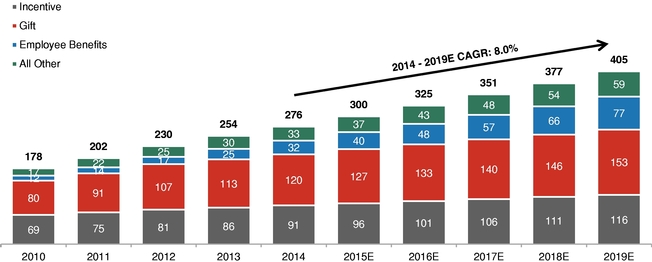

According to First Annapolis, 976 million Financial Payment Cards were produced for the U.S. market in 2014 and this number is estimated to grow to 1.2 billion cards by 2019, representing a compound annual growth rate ("CAGR") of 4.3%. The primary driver of growth is an increasing adoption of Prepaid Debit Cards, along with steady growth in debit and credit cards. On a dollar basis, the U.S. Financial Payment Card market (excluding services) was $371 million in 2014 (up from $180 million in 2013) and is anticipated to grow to $1.2 billion by 2019, driven by the EMV conversion and unit volume growth. This market can be divided as follows:

According to First Annapolis, the demand for bank debit and general purpose credit cards has been predictable and recurring in nature, with 88% of cards issued in 2014 directly replacing existing cards. This includes the regular renewal of cards (53% of 2014 issuances, which are generally renewed every three to five years due to fixed expiration dates), cards lost, stolen or replaced due to fraudulent usage (19% of 2014 issuances) and portfolio churn (16% of 2014 issuances, when cardholders move from one card program to another). The remaining demand is the issuance of cards in conjunction with net new account growth (12% of 2014 issuances). The issuance of Prepaid Debit Cards has represented a similarly predictable and recurring source of demand, as a majority of Prepaid Debit Cards have an average estimated card life of less than twelve months.

In addition, according to First Annapolis, outsourced card data personalization services for Financial Payment Cards represented a $417 million market in the United States in 2014 and is

estimated to grow to $604 million by 2019, representing a 7.7% CAGR. The process of personalization involves assigning unique identification numbers and encrypting authentication data (such as a cardholder's account number, name and other data) onto cards, embossing and encoding personal information onto the cards and distributing personal identification numbers ("PINs") and fully packaged cards to individual cardholders. We believe the value of the market for personalization services will grow over the next several years due to the growth of overall cards in circulation and the U.S. EMV conversion, which is expected to increase revenues for service providers as personalizing EMV cards incorporates higher value added services than the process for non-EMV cards.

Our Products and Services

Our leading market position is supported by our comprehensive end-to-end Financial Payment Card solutions offering which meets the stringent security requirements of the Payment Card Brands and our customers. This comprehensive offering of end-to-end solutions drives deep customer integration and long-term trusted relationships with our customers, many of which we have served for decades.

within the bank branch to individual cardholders upon demand. Our instant issuance system generates both system sales and recurring revenue from software as a service, card personalization and sales of cards and consumables. As of June 30, 2015, we had over 3,400 instant issuance systems installed in bank and credit union branches across the United States. In addition, we provide instant issuance of debit cards to large financial institutions whereby we provide fully-personalized temporary debit cards which are issued to card holders upon opening a new account, and we manage the fulfillment and replenishment of these fully personalized cards directly to thousands of individual bank branches.

Our Competitive Strengths

We serve a diverse set of over 4,000 direct and indirect customers, including many of the largest North American issuers of debit and credit cards such as JPMorgan Chase, Bank of America, American Express and Wells Fargo, as well as the largest global managers of Prepaid Debit Card programs, including InComm, Green Dot, Blackhawk Network and American Express. We have long-standing relationships with our customers, many of whom we have served for decades and provide a differentiated level of service. We also maintain important relationships with the Payment Card Brands to ensure our facilities and processes consistently meet their standards.

of the Payment Card Brands. We are integral to many of our customers' card programs, pairing card production with an end-to-end offering of card data personalization and card services that are deeply integrated within our customers operations. We provide card data personalization services for more than 3,200 financial institutions and managers of Prepaid Debit Card programs that require extensive technology integration, such as secure data links to transfer highly sensitive cardholder information. Similarly, our installed base of more than 3,400 instant issuance systems at bank and credit union branches across the United States require comparable levels of customer integration, as our Card@Once® instant issuance system utilizes only our secure technology to instantly personalize cards. Certain customers have also integrated our proprietary software into their customer-facing websites to offer card design and customization to their cardholders. We believe that our comprehensive solution allows our customers to choose a single trusted partner to address their card program needs in a cost-effective manner instead of managing multiple suppliers across a complex value chain. We believe our customers choose and retain us for these critical functions, which typically require integrations that are costly and difficult to unwind, due to our reputation as a trusted partner, our high levels of service and proven execution.

Our Growth Strategy

The key components of our strategy include:

strong track record in card services, including providing card data personalization services for more than 3,200 financial institutions and managers of Prepaid Debit Card programs and personalizing more than 130 million Financial Payment Cards in 2014, we believe we have established a reputation as a trusted partner and advisor to our customers with the ability to securely manage significant amounts of sensitive and confidential customer data throughout our network. Due to the high costs of failure, such as a data breach, we expect that customers will continue to choose trusted vendors such as CPI that can provide high levels of security, service and certainty to manage these critical functions.

Risks Associated with our Business

As part of your evaluation of our company, you should take into consideration the risks described under "Risk Factors," including the following risks that we face in implementing or executing on our growth strategies and maintaining our profitability:

See "Risk Factors" beginning on page 1817 of this prospectus.

Recent Developments

New Credit Facility

On August 17, 2015, we entered into a first lien credit agreement (the "New Credit Agreement") with a syndicate of lenders providing for a $40 million revolving credit facility (the "New Revolving Credit Facility") with a five year maturity and a $435 million first lien term loan facility (the "New Term Loan Facility" and, together with the New Revolving Credit Facility, the "New Credit Facility") with a seven year maturity. Interest rates under the New Credit Facility are based, at our election, on either a Eurodollar rate plus a margin of 4.50% or a base rate plus a margin of 3.50%. See "Description of Certain Indebtedness." Upon the closing of the New Credit Facility, we drew down the full amount of the New Term Loan Facility and used the net proceeds therefrom to repay

$142.1 million of existing indebtedness, effect the Partial Preferred Redemption as described below, and pay related transaction fees and expenses.

Preferred Stock Redemption

On August 17, 2015, we redeemed 62,140 shares of our outstanding preferred stock on a pro rata basis (the "Partial Preferred Redemption") using borrowings under the New Term Loan Facility, for which we are liable. In connection with the Partial Preferred Redemption, we paid an aggregate of $276.3 million in return of capital and accrued dividends to holders of our preferred stock, net of the repayment of certain employee loans. We expect to redeem the remaining 2,576 shares of outstanding preferred stock using approximately $11.5 million of the proceeds from this offering. We also expect to use $ million of the proceeds from this offering to repay borrowings under the New Term Loan Facility incurred in connection with the Partial Preferred Redemption. See "Use of Proceeds."

Principal Equityholder

Tricor Pacific Capital Partners (Fund IV), Limited Partnership and Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership (collectively, the "Tricor Funds"), both investment funds managed by an affiliate of Tricor Pacific Capital, Inc. ("Tricor"), currently collectively own approximately 90.9% of our outstanding preferred stock and 82.6% of our fully diluted common stock. Following this offering, all of our preferred stock will be redeemed, and the Tricor Funds will collectively own approximately % of our fully diluted common stock. Tricor is a private equity firm with offices in Lake Forest, Illinois and Vancouver, British Columbia that has managed over $1.2 billion of investor capital to date. Since its founding in 1996, Tricor's investment funds have invested in the United States and Canada across a broad spectrum of industries, including the specialty manufacturing, business services and value-added distribution sectors.

JOBS Act

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier to occur of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we become a large accelerated filer, which means that we have been public for at least 12 months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last day of our then most recently completed second fiscal quarter and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 as the "JOBS Act," and references to "emerging growth company" have the meaning given to such term in the JOBS Act.

An emerging growth company may take advantage of specified exemptions from various requirements that are otherwise generally applicable to public companies in the United States. These provisions include:

We have availed ourselves in this prospectus of the reduced reporting requirements described above with respect to selected financial data. As a result, the information that we are providing to you may be less comprehensive than what you might receive from other public companies.

In addition, the JOBS Act provides that an emerging growth company may delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate Information

CPI Card Group Inc. is a Delaware corporation. We were initially formed as CPI Holdings I, Inc. in June 2007 and changed our name to CPI Card Group Inc. in August 2015. Our principal executive offices are located at 10368 West Centennial Road, Littleton, CO 80127, and our telephone number is (303) 973-9311. Our website is www.cpicardgroup.com. Information contained on our website is not incorporated by reference into this prospectus, and such information should not be considered to be part of this prospectus.

Common stock offered by us | shares | |

Common stock offered by the selling stockholders | shares | |

Common stock to be outstanding after this offering | shares | |

Underwriters' option to purchase additional shares | The selling stockholders have granted the underwriters an option to purchase up to additional shares of common stock within 30 days of the closing date of this offering. See "Underwriting." | |

Use of proceeds | We estimate that our net proceeds from the sale of the common stock that we are offering will be approximately $ , assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of common stock by the selling stockholders. | |

We intend to use the net proceeds from this offering to redeem the remaining outstanding shares of our preferred stock, to terminate our phantom stock plan and to satisfy all liabilities due thereunder and to repay outstanding indebtedness under our New Credit Facility incurred in connection with the Partial Preferred Redemption. See "Use of Proceeds." | ||

Exchange Listing | It is a condition to the completion of this offering that our common stock be listed on the NASDAQ Global Select Market and the Toronto Stock Exchange. We have applied to list our common stock on the NASDAQ Global Select Market under the symbol "PMTS." | |

Risk Factors | You should read the "Risk Factors" section of this prospectus for a discussion of facts to consider carefully before deciding to invest in shares of our common stock. |

Unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock:

SUMMARY CONSOLIDATED HISTORICAL FINANCIAL DATA

The following tables set forth our summary consolidated historical financial data. You should read the information set forth below in conjunction with "Use of Proceeds," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated historical financial statements and notes thereto of CPI included elsewhere in this prospectus. The historical statements of income data for the years ended December 31, 2014, 2013 and 2012 and the balance sheet data as of December 31, 2014 and 2013 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The historical statements of income data for the six months ended June 30, 2015 and 2014 and the balance sheet data as of June 30, 2015 are derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. Results of interim periods are not necessarily indicative of the results expected for a full year or for future periods. The historical statement of income data for the twelve months ended June 30, 2015 are derived by adding data from our audited statement of income for the year ended December 31, 2014 to data from our unaudited statement of income for the six months ended June 30, 2015 and subtracting data from our unaudited statement of income for the six months ended June 30, 2014. Results for the twelve months ended June 30, 2015 include ten months of results from EFT Source, which we acquired in September 2014. See "Index to Consolidated Financial Statements."

| | Six Months Ended June 30, | | | | | Six Months Ended June 30, | | | | | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Twelve Months Ended June 30, 2015 | Year Ended December 31, | Twelve Months Ended June 30, 2015 | Year Ended December 31, | ||||||||||||||||||||||||||||||||||

Statement of Income Data: | 2015 | 2014 | 2014 | 2013 | 2012 | 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||||||||||||||

| | (unaudited) | (unaudited) | | | | (unaudited) | (unaudited) | | | | ||||||||||||||||||||||||||||

| | (in thousands except share and per share data) | (in thousands except share and per share data) | ||||||||||||||||||||||||||||||||||||

Net sales | ||||||||||||||||||||||||||||||||||||||

Products | $ | 112,771 | $ | 58,905 | $ | 213,086 | $ | 159,220 | $ | 101,360 | $ | 98,969 | $ | 112,771 | $ | 58,905 | $ | 213,086 | $ | 159,220 | $ | 101,360 | $ | 98,969 | ||||||||||||||

Services | 60,075 | 36,862 | 124,999 | 101,786 | 95,010 | 84,817 | 60,075 | 36,862 | 124,999 | 101,786 | 95,010 | 84,817 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total net sales | 172,846 | 95,767 | 338,085 | 261,006 | 196,370 | 183,786 | 172,846 | 95,767 | 338,085 | 261,006 | 196,370 | 183,786 | ||||||||||||||||||||||||||

Cost of sales | 111,503 | 69,969 | 220,813 | 179,279 | 136,874 | 130,897 | 111,503 | 69,969 | 220,813 | 179,279 | 136,874 | 130,897 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | 61,343 | 25,798 | 117,272 | 81,727 | 59,496 | 52,889 | 61,343 | 25,798 | 117,272 | 81,727 | 59,496 | 52,889 | ||||||||||||||||||||||||||

Operating expenses | 29,959 | 16,262 | 60,952 | 47,255 | 33,347 | 32,985 | 29,959 | 16,262 | 60,952 | 47,255 | 33,347 | 32,985 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income from operations | 31,384 | 9,536 | 56,320 | 34,472 | 26,149 | 19,904 | 31,384 | 9,536 | 56,320 | 34,472 | 26,149 | 19,904 | ||||||||||||||||||||||||||

Other income (expense) | ||||||||||||||||||||||||||||||||||||||

Interest, net | (3,505 | ) | (3,444 | ) | (7,569 | ) | (7,508 | ) | (7,838 | ) | (5,765 | ) | (3,505 | ) | (3,444 | ) | (7,569 | ) | (7,508 | ) | (7,838 | ) | (5,765 | ) | ||||||||||||||

Foreign currency gain (loss) | 149 | (211 | ) | 236 | (124 | ) | (142 | ) | (279 | ) | 149 | (211 | ) | 236 | (124 | ) | (142 | ) | (279 | ) | ||||||||||||||||||

Loss on debt modification and early extinguishment | — | — | (476 | ) | (476 | ) | — | — | — | — | (476 | ) | (476 | ) | — | — | ||||||||||||||||||||||

Gain on purchase of ID Data | — | — | — | — | — | 604 | — | — | — | — | — | 604 | ||||||||||||||||||||||||||

Other income (expense) | 61 | 19 | (59 | ) | (101 | ) | 18 | 171 | 61 | 19 | (59 | ) | (101 | ) | 18 | 171 | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | 28,089 | 5,900 | 48,452 | 26,263 | 18,187 | 14,635 | 28,089 | 5,900 | 48,452 | 26,263 | 18,187 | 14,635 | ||||||||||||||||||||||||||

Provision for income taxes | (9,974 | ) | (2,334 | ) | (17,931 | ) | (10,291 | ) | (6,988 | ) | (5,909 | ) | (9,974 | ) | (2,334 | ) | (17,931 | ) | (10,291 | ) | (6,988 | ) | (5,909 | ) | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income from continuing operations | 18,115 | 3,566 | 30,521 | 15,972 | 11,199 | 8,726 | 18,115 | 3,566 | 30,521 | 15,972 | 11,199 | 8,726 | ||||||||||||||||||||||||||

Loss from discontinued operations, net of taxes(1) | (606 | ) | (2,763 | ) | (513 | ) | (2,670 | ) | (2,612 | ) | (3,796 | ) | (606 | ) | (2,763 | ) | (513 | ) | (2,670 | ) | (2,612 | ) | (3,796 | ) | ||||||||||||||

Gain on sale of discontinued operation, net of taxes(1) | 887 | — | 887 | — | — | — | 887 | — | 887 | — | — | — | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | $ | 18,396 | $ | 803 | $ | 30,895 | $ | 13,302 | $ | 8,587 | $ | 4,930 | $ | 18,396 | $ | 803 | $ | 30,895 | $ | 13,302 | $ | 8,587 | $ | 4,930 | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share:(2) | ||||||||||||||||||||||||||||||||||||||

Basic and Diluted—Continuing Operations | $ | (3.86 | ) | $ | (9.32 | ) | $ | (9.77 | ) | $ | (15.22 | ) | $ | (12.89 | ) | $ | (14.73 | ) | $ | (0.18 | ) | $ | (0.42 | ) | $ | (0.45 | ) | $ | (0.69 | ) | $ | (0.59 | ) | $ | (0.67 | ) | ||

Basic and Diluted—Discontinued Operations | 0.15 | (1.48 | ) | 0.20 | (1.43 | ) | (1.40 | ) | (2.02 | ) | 0.01 | (0.07 | ) | 0.01 | (0.07 | ) | (0.06 | ) | (0.09 | ) | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | $ | (3.71 | ) | $ | (10.80 | ) | $ | (9.57 | ) | $ | (16.65 | ) | $ | (14.29 | ) | $ | (16.75 | ) | $ | (0.17 | ) | $ | (0.49 | ) | $ | (0.44 | ) | $ | (0.76 | ) | $ | (0.65 | ) | $ | (0.76 | ) | ||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares outstanding: | ||||||||||||||||||||||||||||||||||||||

Basic and Diluted | 1,877,857 | 1,868,816 | 1,877,176 | 1,872,693 | 1,866,925 | 1,875,674 | 41,312,854 | 41,113,952 | 41,297,872 | 41,199,246 | 41,072,350 | 41,264,828 | ||||||||||||||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||||||||||||||

Depreciation and amortization | $ | 8,040 | $ | 5,614 | $ | 15,678 | $ | 13,252 | $ | 11,595 | $ | 10,514 | $ | 8,040 | $ | 5,614 | $ | 15,678 | $ | 13,252 | $ | 11,595 | $ | 10,514 | ||||||||||||||

Capital expenditures | 10,390 | 6,578 | 19,380 | 15,568 | 10,628 | 9,113 | 10,390 | 6,578 | 19,380 | 15,568 | 10,628 | 9,113 | ||||||||||||||||||||||||||

EBITDA(3) | 39,634 | 14,958 | 71,699 | 47,023 | 37,620 | 30,914 | 39,634 | 14,958 | 71,699 | 47,023 | 37,620 | 30,914 | ||||||||||||||||||||||||||

Adjusted EBITDA(3) | 41,897 | 14,577 | 81,538 | 54,219 | 38,372 | 30,589 | 41,897 | 14,577 | 81,538 | 54,219 | 38,372 | 30,589 | ||||||||||||||||||||||||||

| | | | As Further Adjusted(5) | | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | As Adjusted(4) | | | ||||||||||||

| | | As of December 31, | ||||||||||||||

| | As of June 30, 2015 | As of June 30, 2015 | As of June 30, 2015 | |||||||||||||

Consolidated Balance Sheet Data: | 2014 | 2013 | ||||||||||||||

| | (unaudited) | (unaudited) | (unaudited) | | | |||||||||||

| | (in thousands) | |||||||||||||||

Cash and cash equivalents | $ | 13,007 | $ | 8,583 | $ | $ | 12,941 | $ | 9,702 | |||||||

Total current assets | 107,808 | 103,384 | 88,719 | 65,958 | ||||||||||||

Net property, equipment and leasehold improvements | 48,431 | 48,431 | 44,772 | 36,650 | ||||||||||||

Total assets | 287,784 | 300,568 | 266,624 | 171,867 | ||||||||||||

Total debt | 167,420 | 444,000 | 179,424 | 122,306 | ||||||||||||

Total stockholders' deficit | (3,690 | ) | (224,762 | ) | (21,694 | ) | (36,896 | ) | ||||||||

| | Six Months Ended June 30, | Twelve Months Ended June 30, 2015 | | | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Year Ended December 31, | ||||||||||||||||||

Other Data: | 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||

| | (in thousands) | ||||||||||||||||||

Financial Payment Card Shipments | |||||||||||||||||||

EMV | 75,164 | 13,921 | 125,088 | 63,845 | 6,769 | 5,015 | |||||||||||||

Non-EMV | 111,240 | 157,018 | 251,607 | 297,385 | 297,862 | 323,817 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total | 186,404 | 170,939 | 376,695 | 361,230 | 304,631 | 328,832 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation.

| | Six Months Ended June 30, | | | | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Twelve Months Ended June 30, 2015 | Year Ended December 31, | |||||||||||||||||

| | 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||

| | (in thousands) | ||||||||||||||||||

Net income from continuing operations | $ | 18,115 | $ | 3,566 | $ | 30,521 | $ | 15,972 | $ | 11,199 | $ | 8,726 | |||||||

Depreciation and amortization | 8,040 | 5,614 | 15,678 | 13,252 | 11,595 | 10,514 | |||||||||||||

Interest, net | 3,505 | 3,444 | 7,569 | 7,508 | 7,838 | 5,765 | |||||||||||||

Provision for income taxes | 9,974 | 2,334 | 17,931 | 10,291 | 6,988 | 5,909 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

EBITDA | $ | 39,634 | $ | 14,958 | $ | 71,699 | $ | 47,023 | $ | 37,620 | $ | 30,914 | |||||||

Foreign currency (gain) loss | (149 | ) | 211 | (236 | ) | 124 | 142 | 279 | |||||||||||

Loss on debt modification and early extinguishment(a) | — | — | 476 | 476 | — | — | |||||||||||||

Gain on purchase of ID Data(b) | — | — | — | — | — | (604 | ) | ||||||||||||

Non-cash compensation expense(c) | 1,503 | (591 | ) | 6,628 | 4,534 | 610 | — | ||||||||||||

EFT Source performance bonuses(d) | 500 | — | 500 | — | — | — | |||||||||||||

Investment banking and related fees(e) | 409 | — | 2,471 | 2,062 | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | $ | 41,897 | $ | 14,577 | $ | 81,538 | $ | 54,219 | $ | 38,372 | $ | 30,589 | |||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

An investment in our common stock involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below together with the other information included in this prospectus before purchasing our common stock in this offering. If any of the possibilities described as risks below actually occurs, our operating results and financial condition would likely suffer and the trading price of our common stock could fall, causing you to lose some or all of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our common stock.

Risks Related to Our Business

Material breaches in the security of our systems may have a significant effect on our business.

The reliability and security of our information technology (IT) infrastructure and our ability to protect sensitive and confidential information for our customers, which include many financial institutions, is critical to our business. Our handling of sensitive cardholder data, including cardholder names, account numbers and similar information, makes us a potential target of cyber attacks and threats to our secure IT systems. We may face attempts by others to penetrate our computer systems and networks to misappropriate this information or interrupt our business. Any system or network disruption could result in a loss of our intellectual property, the release of sensitive cardholder information, customer or employee personal data, or the loss of production capabilities at one or more of our production facilities. The protective measures we have in place may not prevent system or network disruptions and may be insufficient to prevent or limit the damage from any future security breaches.

In addition, our encryption systems are at risk of being breached or decoded. Smart cards are equipped with keys that encrypt and decode messages in order to secure transactions and maintain the confidentiality of data. The security afforded by this technology depends on the integrity of the encryption keys and the complexity of the algorithms used to encrypt and decode information. Any significant advances in technology that enable the breach of cryptographic systems, malicious software infiltration or allow for the exploitation of weaknesses in such systems, could result in a decline in the security we are able to provide through this technology. Any material breach of our secured systems could harm our competitive position, result in a loss of customer trust and confidence, and cause us to incur significant costs to remedy the damages caused by system or network disruptions, whether caused by cyber attacks, security breaches or otherwise, which could ultimately have an adverse effect on our business, financial condition and results of operations. In addition, as these threats continue to evolve, we may be required to invest significant additional resources to modify and enhance our information security and controls or to investigate and remediate any security vulnerabilities.

New and developing technology solutions and products could make our existing technology solutions and products obsolete or irrelevant, and if we are unable to introduce new products and services in a timely manner, our business could be adversely affected.

The markets for our products and services are subject to technological changes, frequent introductions of new products and services and evolving industry standards. In particular, the rise in the adoption in wireless payment systems or mobile payments may make physical cards less attractive as a method of payment. Although to date we have not seen any reduction in card-based payments resulting from the emergence of mobile payment applications, mobile payments offer consumers an alternative method to make purchases without the need to carry a physical card and could, if widely adopted, reduce the number of Financial Payment Cards issued to consumers. In addition, other new and developing technology solutions and products could make our existing technology solutions and products obsolete or irrelevant.

Our ability to enhance our current products and services and to develop and introduce innovative products and services that address the increasingly sophisticated needs of our customers will significantly affect our future success. We may not be successful in developing, marketing or selling new products and services that meet these changing demands. In addition, we may experience difficulties that could delay or prevent the successful development, introduction or marketing of these services, or our new services and enhancements may not adequately meet the demands of the marketplace or achieve market acceptance. We continually engage in significant efforts to innovate and upgrade our products and services. If we are unsuccessful in completing or gaining market acceptance of new products, services and technologies, it would likely have a material adverse effect on our ability to retain existing customers or attract new ones.

Our ability to develop and deliver new products and services successfully will depend on various factors, including our ability to:

Opportunities to bundle or package products and service offerings and the ability to cross-sell products and services are critical to remaining competitive in our industry. As a result, part of our business strategy is to develop new products and services that may be used in conjunction with or in addition to our existing offerings. If we are unable to identify adequate opportunities to cross-sell our products and services, our financial condition could be negatively impacted. Furthermore, if we are unable to develop and introduce new and innovative products in a cost-effective and timely manner, our product and service offerings could be rendered obsolete, which could have an adverse effect on our business, financial condition and results of operations.

The adoption of EMV technology and dual-interface capability in the United States may not be as rapid or widespread as we anticipate, which could adversely affect our growth.

We have made significant investments in our North American EMV production capabilities. In particular, in 2014, we opened a 50,000 square foot technology center in Colorado dedicated to EMV production and personalization and enhanced our EMV capabilities across our network. Our ability to grow depends significantly on whether U.S. card issuing banks incorporate EMV technology as part of their new technological standards and, following the initial conversion to EMV, whether such banks issue Dual-Interface EMV cards. Banks may be delayed in transitioning to the issuance of EMV cards or Dual-Interface EMV cards due to increased costs and other factors. If these entities do not continue to deploy EMV and Dual-Interface EMV technology or deploy such technology less quickly and/or completely than we expect, the consequence could have an adverse effect on our business, financial condition and results of operations.

Our business could suffer from production problems.

We produce our products using processes that are highly complex, require advanced and costly equipment and must continually be modified to improve yields and performance. Difficulties in the production process can reduce yields or interrupt production and, as a result of such problems, we may on occasion not be able to deliver products or do so in a timely or cost-effective manner. As the complexity of both our products and our technological processes has become more advanced,

production tolerances have been reduced and requirements for precision have become more demanding. We may suffer disruptions in our production, either due to production difficulties, such as machinery or technology failures, or as a result of external factors beyond our control, such as interruption of our electrical service or a natural disaster. Any such event could have an adverse effect on our business, financial condition and results of operations.

We may experience software defects, which could harm our business and reputation and expose us to potential liability.

Our services are based on sophisticated software and computing systems, and the software underlying our services may contain undetected errors or defects when first introduced or when new versions are released. In addition, we may experience difficulties in installing or integrating our technology on systems used by our clients. Defects in our software, errors or delays in the processing of electronic transactions or other difficulties could result in the interruption of business operations, delays in market acceptance, additional development and remediation costs, diversion of technical and other resources, loss of clients, negative publicity or exposure to liability claims. Although we attempt to limit our potential liability through disclaimers and limitation of liability provisions in our license and client agreements, we cannot be certain that these measures will successfully limit our liability.

Our failure to operate our business in accordance with the standards of the PCI Security Standards Council or other industry standards applicable to our customers, such as Payment Card Brand certification standards, could have a material adverse effect on our business.

Many of our customers issue their cards on the networks of the Payment Card Brands that are subject to the standards of the PCI Security Standards Council or other standards and criteria relating to service providers' and manufacturers' facilities, products and physical and logical security which we must satisfy in order to be eligible to supply products and services to these customers. Most of our contractual arrangements with our customers may be terminated if we fail to comply with these standards and criteria.

We make significant investments to our network of seven North American and one European high-security facilities in order to meet these standards and criteria, including investments required to satisfy changes adopted from time to time in their respective standards and criteria. Further investments may be costly, and if we are unable to continue to meet these standards and criteria, we may become ineligible to provide products and services that have constituted in the past an important part of our revenues and profitability. For the year ended December 31, 2014, the vast majority of the products we produced and services we provided were subject to certification with one or more of the Payment Card Brands. If we were to lose our certification from one or more of the Payment Card Brands, Interac (in Canada) or PCI certification for one or more of our facilities, we may lose the ability to produce cards for or provide services to banks issuing credit or debit cards on the networks of the Payment Card Brands. If we are not able to produce cards for or provide services to any or all of the issuers issuing debit or credit cards on such networks, we could lose a substantial number of our customers and our financial condition and results of operations would be adversely affected.

The continued adoption of EMV technology may cause our customers to extend their expiration cycles, which could reduce the volume of cards they purchase from us.

We estimate that, on average, bank debit cards and general purpose credit cards have historically been renewed every three years due to fixed expiration dates, and this regular renewal cycle is a significant driver of demand for Financial Payment Cards. As card issuers continue to adopt EMV technology, First Annapolis estimates that certain issuers of bank debit cards and general purpose credit cards will extend the length of time that each card may be active prior to expiration from three years to four or five years in order to reduce the costs associated with issuing more expensive EMV cards. As a result of this longer reissuance cycle, we may experience a decreased demand for bank

debit cards and general purpose credit cards. If the reissuance cycle is significantly extended beyond historical averages, demand from our customers for our products may decrease significantly and our business, financial condition and results of operations could be materially and adversely affected.

Demand for credit cards may be adversely impacted by U.S. and global market and economic conditions.

For the foreseeable future, we expect to continue to derive most of our revenue from products and services we provide to the financial services industry. Given this concentration, we are exposed to the economic conditions affecting the financial services industry in North America and Europe. In particular, prolonged economic downturns typically have resulted in significant reductions in the demand for general purpose credit cards due to tightening credit conditions. A prolonged poor economic environment could result in significant decreases in demand by current and potential customers for our products and services, which could have a material adverse effect on our business, results of operations and financial condition.

Failure to identify, attract and retain new customers or a failure to maintain our relationships with our major customers could adversely affect our business.

Our business is dependent upon our ability to identify, attract and retain new customers and to maintain our relationships with our existing customers. A decline in the business of our large customers or a failure to retain such customers may adversely affect our business, financial condition and results of operations.

A substantial portion of our net sales is derived from several large customers. Our top five customers as of December 31, 2014 accounted for approximately 33.9% of our pro forma net sales (37.8% of our reported net sales) for the year ended December 31, 2014, and our top customer accounted for approximately 10.1% of our pro forma net sales (11.3% of our reported net sales) for the same period. Our continued business relationship with these customers, and the renewal of key contracts by major customers, may be impacted by several factors beyond our control, including more attractive product offerings from our competitors, pricing pressures or the financial health of these customers. Many of our key customers operate in competitive businesses, and their demand and market positions may vary considerably. These customers depend on favorable macroeconomic conditions and are impacted by the availability of affordable credit and capital, the level and volatility of interest rates, inflation, employment levels and consumer confidence, among other factors.

With most of our key customers, we enter into long-term master agreements that govern the general terms and conditions of our commercial relationships. We then enter into purchase order or other short-term agreements that define the prices and the quantities of products to be delivered. Usually, our contractual arrangements include neither exclusivity clauses nor commitments from our customers to order any given quantities of products on a medium-term or longer basis.

Therefore, we may not be able to maintain our market share with our key customers, which in turn could affect the revenue streams upon which we currently rely. Furthermore, there is no guarantee that we will be able to renew or win significant contracts in a given year. If we were to lose important programs for our products with any of our key customers, or if any key customer were to reduce or change its contract, seek alternate suppliers, increase its product returns or become unable or otherwise fail to meet its payment obligations, our business, financial condition and results of operations could be materially adversely affected.

Our outstanding indebtedness may impact our business and may restrict our growth and results of operations.

As of August 17, 2015, we had $444.0 million of total indebtedness outstanding, including $435.0 million outstanding under our New Term Loan Facility. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" and "Description of Certain Indebtedness."

We may incur additional indebtedness in the future to help fund the growth of our business, subject to market and other conditions. Our substantial indebtedness and interest expense could have important consequences to us, including:

The limitations described above could have a material adverse effect on our business, financial condition, results of operations, prospects, and ability to satisfy our obligations under our indebtedness.

We may be required to defend against alleged infringement of the intellectual property rights of others and/or may be unable to adequately protect or enforce our own intellectual property rights.

Companies in our industry aggressively protect and pursue their intellectual property rights. Our products may contain technology provided to us by other parties such as suppliers or customers. We may have little or no ability to determine in advance whether such technology infringes the intellectual property rights of a third party. From time to time, we receive notices that claim we have infringed upon, misappropriated or misused other parties' proprietary rights. Additionally, we receive notices that challenge the validity of our patents. Intellectual property litigation can be expensive, time consuming and distracting to management. An adverse determination in any of these types of disputes could prevent us from producing or offering some of our products and services or could prevent us from enforcing our intellectual property rights. Furthermore, settlements can involve royalty or other payments that could reduce our profit margins and adversely affect our financial results. Our suppliers, customers and licensors may not be required to indemnify us in the event that a claim of infringement is asserted against us, or they may be required to indemnify us only up to a maximum amount, above which we would be responsible for any further costs or damages. Any of these claims or litigation may materially and adversely affect our business, financial condition and results of operations.

We may also be required to indemnify some customers and strategic partners under our agreements if a third party alleges or if a court finds that our products or activities have infringed upon, misappropriated or misused another party's proprietary rights. Indemnification provisions may, in some circumstances, extend our liability beyond the products we provide and may include consequential damages and/or lost profits. Even if claims or litigation against us are not valid or successfully asserted,

these claims could result in significant costs and the diversion of the attention of management and other key employees to defend.

Furthermore, our success and future revenue growth will depend, in part, on our ability to protect our intellectual property. We depend significantly on patents and other intellectual property rights to protect our products, proprietary designs and technological processes against misappropriation by others. We may in the future have difficulty obtaining patents and other intellectual property protection, and the patents and intellectual property rights that we receive may be insufficient to provide us with meaningful protection or commercial advantage. Effective patent, trademark, service mark, copyright and trade secret protection may not be available in every country in which our services are made available. It is possible that competitors or other unauthorized third parties may obtain, copy, use or disclose our technologies and processes, or confidential employee, customer or supplier data. Any of our existing or future patents may be challenged, invalidated or circumvented. We engage in litigation to enforce or defend our intellectual property rights, protect our trade secrets and determine the validity and scope of the proprietary rights of others, including our customers. We also enter into confidentiality agreements with our consultants and strategic partners and control access to and distribution of our technologies, documentation and other proprietary information; however, such agreements may not be enforceable or provide us with an adequate remedy. Despite these efforts, internal or external parties may attempt to copy, disclose, obtain or use our products, services or technology without our authorization. If we cannot adequately protect our technology, our competitors may be able to offer certain products and/or services similar to ours.