Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 29,April 4, 2016

Registration No. 333-208565

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 13

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BATS GLOBAL MARKETS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| DELAWARE (State or Other Jurisdiction of Incorporation or Organization) | 6200 (Primary Standard Industrial Classification Code Number) | 46-3583191 (I.R.S. Employer Identification Number) |

8050 Marshall Drive, Suite 120

Lenexa, Kansas 66214

(913) 815-7000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Eric Swanson, Esq.

Executive Vice President, General

Counsel and SecretaryBATSBats Global Markets, Inc.

8050 Marshall Drive, Suite 120

Lenexa, Kansas 66214

(913) 815-7000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

| Copies to: | ||

Deanna L. Kirkpatrick, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 | Gregory A. Fernicola, Esq. Phyllis G. Korff, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 | |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

| Title of Each Class of Securities to Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | Amount To Be Registered(1) | Proposed Maximum Aggregate Offering Price Per Share | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee(3) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.01 per share | $100,000,000 | $10,070 | 12,880,000 | $19.00 | $244,720,000 | $24,644 | ||||||

|

|

| ||||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion)

Issued January 29,April 4, 2016

11,200,000 Shares

BATSBats Global Markets, Inc.

COMMON STOCK

BATSThe selling stockholders of Bats Global Markets, Inc. is offering shares of common stock, and the selling stockholders identified in this prospectus are offering 11,200,000 shares of common stock. We will not receive any proceeds from the sale of common stock by the selling stockholders in this offering. This is the initial public offering of our shares, and no public market exists for our shares. We anticipate that the initial public offering price will be between $$17.00 and $$19.00 per share.

Upon completion of this offering, our principal investors will collectively own approximately %82.1% of the total voting power of our capital stock. See "Principal and Selling Stockholders."

We intendhave applied to list the common stock on BATSBats BZX Exchange, Inc. (BZX) under the symbol "BATS."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 17.19.

PRICE $ A SHARE

| | Per Share | Total | ||

|---|---|---|---|---|

Price to public | $ | $ | ||

Underwriting discounts and commissions(1) | $ | $ | ||

Proceeds to | ||||

| $ | $ | ||

| ||||

WeCertain of our selling stockholders named herein have granted the underwriters the option to purchase an additional 1,680,000 shares of common stock. The underwriters may exercise this option at any time within 30 days from the date of this prospectus.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2016.

| Morgan Stanley | Citigroup |

BofA Merrill Lynch Credit Suisse Goldman, Sachs & Co. J.P. Morgan

Jefferies Barclays Deutsche Bank Securities Nomura Rosenblatt Securities Sandler O'Neill + Partners, L.P.

, 2016

| | Page | |||

|---|---|---|---|---|

Prospectus Summary | 1 | |||

The Offering | ||||

Summary Historical and Pro Forma Financial and Operating Data | ||||

Risk Factors | ||||

Special Note Regarding Forward-Looking Statements | ||||

Recent Acquisitions | ||||

Unaudited Selected Pro Forma Financial Data | ||||

Use of Proceeds | ||||

Dividend Policy | ||||

Capitalization | ||||

Dilution | ||||

Selected Financial and Operating Data | ||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | ||||

Business | ||||

Regulation | ||||

Management | ||||

Executive Compensation | ||||

Certain Relationships and Related Transactions | ||||

Principal and Selling Stockholders | ||||

Description of Capital Stock | ||||

Material U.S. Federal Tax Considerations for Non-U.S. Holders | ||||

Shares Eligible for Future Sale | ||||

Underwriters (Conflicts of Interest) | ||||

Validity of Common Stock | ||||

Experts | ||||

Where You Can Find More Information | ||||

| ||||

Index to Consolidated Financial Statements | F-1 | |||

We, the selling stockholders and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

i

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the "Risk Factors" section and the financial statements and the notes to those statements included in this prospectus.

In this prospectus, unless the context otherwise requires, "BATS,"Bats," the "company," "we," "us" and "our" refer to BATSBats Global Markets, Inc. (or prior to the acquisition of Direct Edge Holdings LLC, or Direct Edge, in January 2014, BATSBats Global Markets Holdings, Inc.) and its consolidated subsidiaries: BZX, BYX, EDGX and EDGA (each, a national securities exchange), BATSBats Trading, Inc. (a U.S. broker-dealer), BATSBats Trading Limited (a U.K. operator of our multilateral trading facility and our Regulated Market, under its Recognised Investment Exchange status, and known as "BATS Chi-X"Bats Europe"), Chi-X Europe Limited (a stand-alone U.K. broker-dealer) and BATSBats Hotspot (operator of our institutional spot foreign currency, or FX, market). We have defined certain industry-related and other terms in a glossary appended to this prospectus. Please see the glossary for our definition of "market share" and other terms.

Our Company

We are a leading global operator of securities exchanges and other electronic markets enabled by world-class technology. We provide trade execution, market data, trade reporting, connectivity and risk management solutions to brokers, market makers, asset managers and other market participants, ultimately benefiting retail and institutional investors across multiple asset classes. Our principal objective is to improve markets by maximizing efficiency and mitigating trade execution risk for market participants. Our asset class focus currently comprises listed cash equity securities in the United States and Europe, listed equity options in the United States and institutional spot FX globally, as well as exchange-traded products, or ETPs, including exchange-traded funds, or ETFs, in the United States and Europe. Trade execution comprised 44.7%44.6% of our revenues less cost of revenues, and market data and connectivity, or non-transaction revenues, comprised 55.3%55.4% of our revenues less cost of revenues for the nine monthsyear ended September 30,December 31, 2015.

We are the second largest exchange operator in U.S. listed cash equity securities trading by market share, the largest exchange operator of ETFs and other ETPs by market share, and the largest European exchange operator as measured by notional value traded.traded as of December 31, 2015. In addition, for each of the six consecutive months ended December 31, 2015, excluding the Chinese exchanges, we were the largest equities market operator globally as measured by notional value traded. Moreover, during 2015 we operated the fastest growing market in the United States for exchange traded options as measured by market share.

We improve markets by maximizing efficiency and mitigating trade execution risk, in part by offering low-cost, innovativemarket-leading pricing and low-latency trade execution enabled by resilient and robust proprietary technology. For example, during the three monthsyear ended September 30,December 31, 2015, our net capture, including auctions, in the U.S. equities market was approximately 40%42% of the rate reported by NASDAQ Group's U.S. equities operations and Intercontinental Exchange's New York Stock Exchange, or NYSE, operations, while our net capture, including auctions, in the European listed equity securities market was approximately 54%94% of the rate reported by the London Stock Exchange's European equities operations. During the third quarter ofyear ended December 31, 2015, our net capture in the U.S. listed equity options market was 6%8% to 20%19% of the rate reported by the Chicago Board Options Exchange, or CBOE, NYSE Arca, NYSE MKT, NASDAQ Options Market and NASDAQ PHLX. We offer the same low-cost, market-leading pricing for our market data products. During the year ended December 31, 2015, our pricing for market data for the U.S. equities market was a combined $12,500 per month for data from BZX, BYX, EDGX and EDGA. This is approximately 8% of the prices reported by NYSE and NASDAQ operations to receive data for all of their respective markets during the same period.

Our market data pricing in Europe was €59.50 per month for pan-European data during the year ended December 31, 2015. This is approximately 11% of the cost of receiving data from the other exchanges across Europe during the same period. Participants can also purchase our FX market data for $5,000 per month. This is approximately 8% of the price currently charged by EBS Market.

We develop, own and operate the BATSBats trading platforms, which deploy our proprietary technology designed to offer some of the fastest and most reliable trading systems available. Our diverse exchange platforms are designed to facilitate price discovery by encouraging the quoting of competitive displayed, or lit, prices, but also offer opportunities to post undisplayed, or dark, trading

interest on our U.S. and European order books. The core offerings and products driving our volume and leading market positions include:

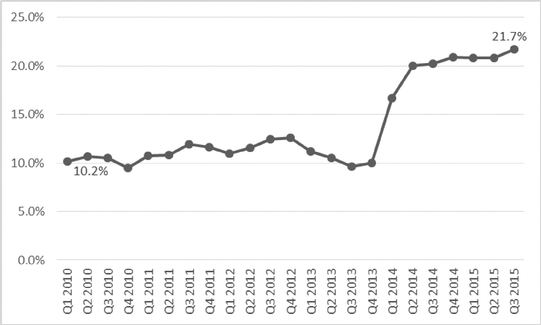

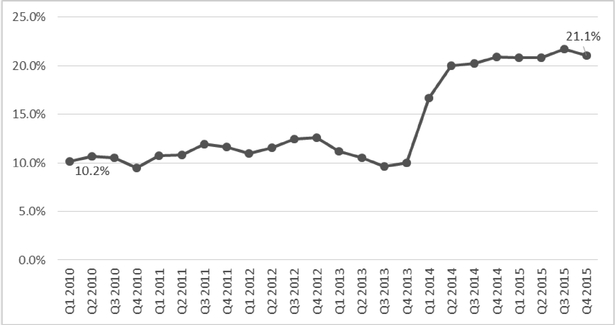

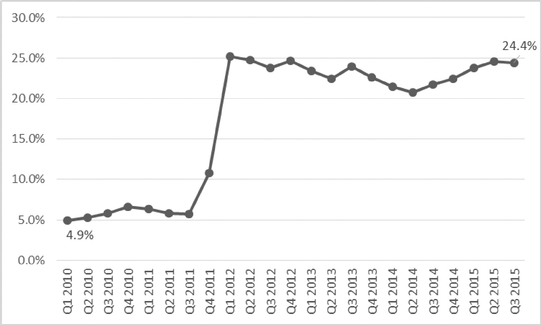

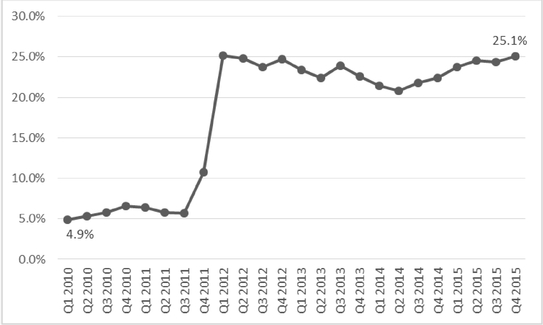

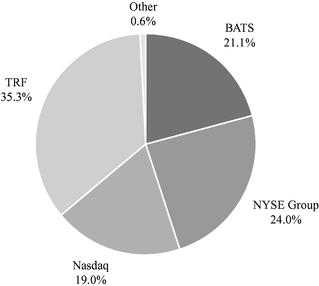

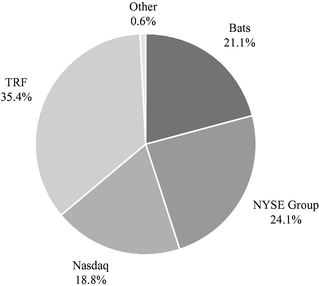

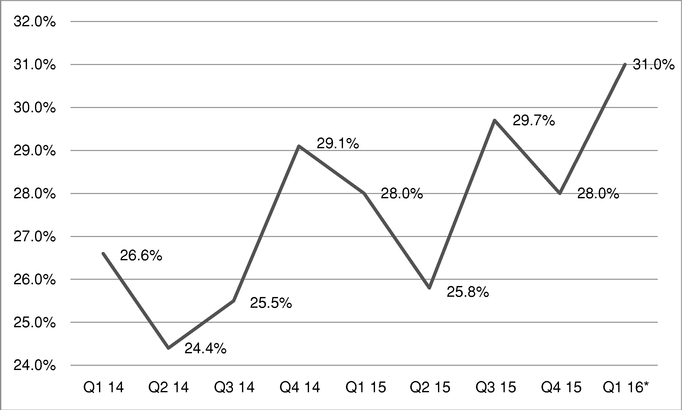

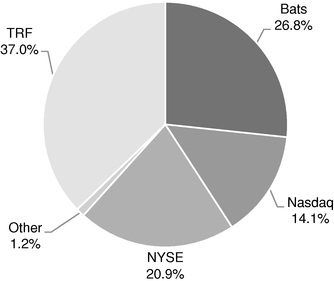

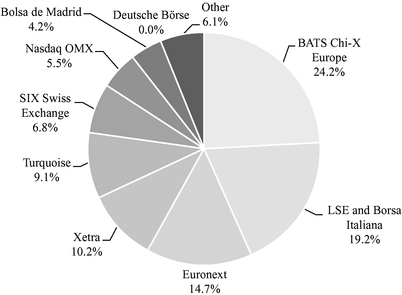

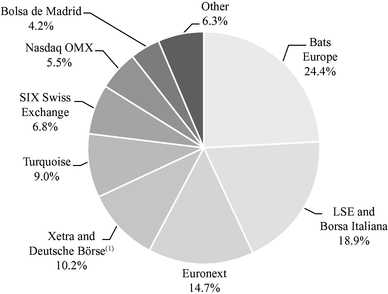

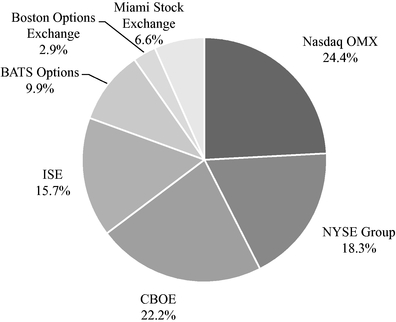

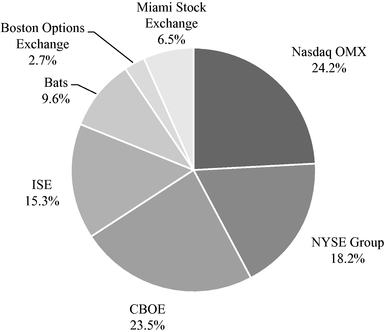

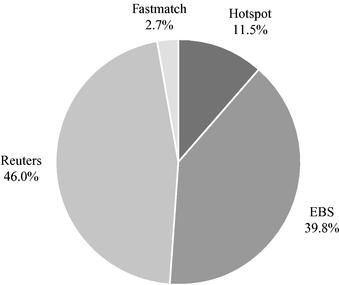

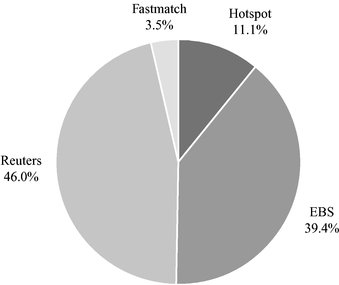

For the nine monthsyear ended September 30,December 31, 2015, we had a 21.1% share of the overall U.S. equity market, a 22.4% share of the trading of ETPs and a 9.9%9.6% share of the U.S. equity options market. In Europe, for the nine monthsyear ended September 30,December 31, 2015, we had a 24.2%24.4% share of European trading in the securities available for trading on BATS Chi-XBats Europe. In addition, we had $27.8$25.8 billion average daily notional value, or ADNV, in our Global FX segment from the BATSBats Hotspot Acquisition on March 13, 2015 to September 30,December 31, 2015. Globally, for the nine monthsyear ended September 30,December 31, 2015, we had an 11.5%11.1% share of the publicly reported institutional spot FX market.

For the two months ended February 29, 2016, we had a 21.4% share of the overall U.S. equity market, a 24.5% share of the trading of ETPs and a 10.2% share of the U.S. equity options market. For ETPs, during the two months ended December 31, 2015, we had 19 new listings, or 27.9% of all newly listed ETPs in the United States. During the two months ended February 29, 2016, we had 13 new listings, or 50.0% of all newly listed ETPs in the United States. We also had 69 total listings as of February 29, 2016, or 3.7% of all listings in the United States. In Europe, for the two months ended February 29, 2016, we had a 24.3% share of European trading in the securities available for trading on Bats Europe. In addition, for the two months ended February 29, 2016, we had $31.7 billion ADNV in our Global FX segment and 12.0% of the publicly reported institutional spot FX market.

Our revenue consists primarily of transaction fees, regulatory fees, market data fees and port fees. On a consolidated basis, our revenues less cost of revenues were $285.8$384.4 million for the nine monthsyear ended September 30,December 31, 2015, which represents a 27.7%25.0% increase from the $223.8$307.5 million generated for the nine monthsyear ended September 30,December 31, 2014. Non-transaction revenues were 55.3%55.4% of revenues less cost of revenues for the nine months ended September 30, 2015. On a consolidated basis, we generated $307.5 million in revenues less cost of revenues for the year ended December 31, 2014.2015. Adjusting for growth through acquisitions, our organic compound annual growth rate of revenues less cost of revenue for the last four years was 12.8%12.4%. For the nine months year

ended September 30,December 31, 2015, our Normalized EBITDA margin was 60.4%61.2%, an increase from 54.1%compared to 54.7% for the nine monthsyear ended September 30,December 31, 2014. We use the non-GAAP measure of Normalized EBITDA margin to measure our performance. Normalized EBITDA margin is a non-GAAP measure that is reconciled to net income in the section titled "—Summary Historical and Pro Forma Financial and Operating Data."

Our History

We were formed in 2005 as an alternative to the NYSE and the NASDAQ Stock Market, or NASDAQ, in response to increased consolidation among U.S. listed cash equity market centers. Since our founding, we have achieved the following milestones:

Industry Developments

Significant regulatory and technological developments have transformed the markets in which we operate and have been the primary drivers of our growth and development:

for trading listed cash equity securities. MiFID was designed to increase competition in pan-European trading and authorized the creation of MTFs. In particular, to create competition among markets, MiFID abolished the "concentration rule," which required firms to route orders only to national stock exchanges, and extended the concept of "passporting," which allowed firms authorized to carry on business in one European Economic Area, or EEA, member state to carry on business in other EEA member states.

costs and greater liquidity. We believe these trends will persist, generating significant growth opportunities for our product offerings.

Our Competitive Strengths

As a result of these industry developments, newer trading centers like ours are better able to compete against competing exchanges based on technology, price and customer experience. We believe that the following competitive strengths position us well to capitalize on these industry dynamics:

trading in the securities available for trading on BATS Chi-XBats Europe for the nine monthsyear ended September 30,December 31, 2015. In addition, we have a substantial presence in the FX markets with our recent BATSBats Hotspot Acquisition, with an 11.5%a 11.1% market share of the publicly reported institutional spot FX market for the nine monthsyear ended September 30,December 31, 2015. The combination of our attractive market positions, the quality of our markets and the expertise of our teams have enabled us to grow our market share across our markets over the last four years.

execution of transformational acquisitions. We do so by leveraging our vast industry expertise and through a continuous dialogue with regulators and key market participants. For example:

relationships with our principal investors and their affiliates, we benefit from access to the strategic insights and industry expertise of some of the most active market participants. For example, we offer several products that enable our customers to monitor their order handling on our markets in real-time, such as our user dashboard and latency reports, both of which are web-based tools designed to provide customers with real-time information about their connectivity to our platform and the speed at which their orders are processed and executed within our markets. We also operate one of the few market centers in Europe that offers routing services to other venues that publicly display quotes, or lit venues, which we believe provides an added incentive to use our market. Additionally, EDGX has typically been the preferred exchange destination for retail limit orders as we provide a service model for the retail trading community's unique needs, competitive rates and a general advocacy and support for retail investors.

Our Growth Strategies

We believe that we are well positioned to leverage our competitive strengths to enhance our market position, develop new products and services and continue expanding into new asset classes and geographies. We continually analyze new opportunities and, in particular, intend to pursue the following growth strategies:

functionality on the platform to specifically target more marketable flow from retail customers, more auction flow and growing complex order flow from institutional investors. In addition, we are continuing to explore the development of index and other higher-margin proprietary options products to trade on our exchanges.

Recent Developments

In March 2016, we agreed to acquire ETF.com, a leading provider of ETF data, news and analysis, which had approximately $3.0 million in annual revenue for 2015. The transaction closed on April 1, 2016.

In March 2016, together with T3Index, a research-driven financial indexing firm, we launched the Bats-T3P SPY Volatility Index, or SPYIX, an index measuring expected 30-day volatility in the most actively traded security worldwide, the SPDR S&P 500 ETF, or SPY. The SPYIX is calculated using prices from highly-active, electronically-traded multiple-listed SPY options, which we believe to be an improvement over the slower, manually-traded, floor-based S&P 500 index options used to calculate other volatility benchmarks. SPYIX also includes important features designed to enhance critical stability during periods of low liquidity in the market, namely its proprietary "price-dragging" technique which helps reduce erratic movements in the index.

In February 2016, we unveiled an updated corporate brand, including a new logo and naming conventions, all developed in-house by Bats associates. We expect the project will cost approximately $350,000 to fully implement. It is anticipated that the rebrand will be completed on or around April 30, 2016.

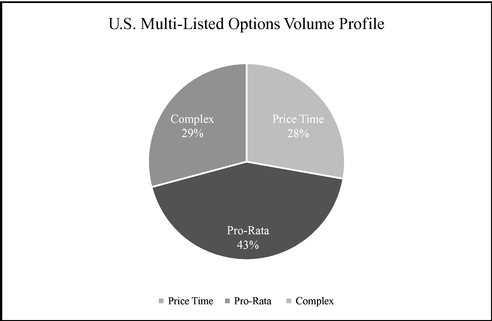

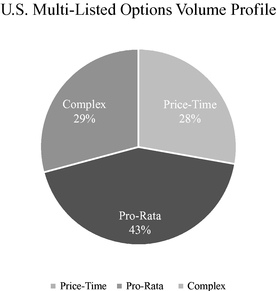

In November 2015, we launched our second options exchange, EDGX Options, with a customer priority, "pro rata" market model as a complement to our existing BZX Options exchange featuring a

price/time-priority price-time-priority model. See "Management's Discussion and Analysis of Financial Condition and Results of Operation—Our Model" for further information on our pricing models.

In October 2015, we launched in the United States "The BATSBats ETF Marketplace," a market specifically structured and designed for ETF issuers and their investors, introducing the BATSBats ETP Issuer Incentive Program and the BATSBats Lead Market Maker, or LMM, Program. The BATSBats ETP Issuer Incentive Program is an innovative program that rewards issuers as their ETP listings grow on BZX. Traditionally, ETP issuers have paid an annual exchange fee to the listing venue that increases as the product becomes more successful. The BATSBats ETP Issuer Incentive Program rewards ETP issuers for their product's success with a rebate based on the product's consolidated average daily volume, or CADV. The BATSBats LMM Program is a rewards-based program that incentivizes market makers for their participation in BZX-listed ETPs. First, LMMs receive larger incentives for providing liquidity and reduced costs for removing liquidity in their assigned ETPs. Second, LMMs receive additional economic incentives for making markets in additional ETP products listed on BATS.Bats. The BATSBats LMM Program is supplemented by BATS'Bats' Competitive Liquidity Provider, or CLP, program, which is also a rewards-based program designed to incent market makers to make tighter quote spreads with increased liquidity for BZX-listed ETPs.

Reclassification and Stock Split

In conjunction withImmediately prior to the completion of this offering, we intend to reclassify each share of our existing capital stock designated as Class A non-voting common stock as one share of common stock. We also intend to reclassify each share of our existing capital stock designated as Class B non-voting common stock as one share of non-voting common stock. In addition, immediately following the stock reclassification described above and prior to the completion of this offering, we intend to declare a -for-1-for-2.91 stock split of all outstanding common stock and non-voting common stock. See "Description of Capital Stock."

Risk Factors

Investing in our common stock involves substantial risk. Please read "Risk Factors" beginning on page 1719 for a discussion of certain factors you should consider in evaluating an investment in our common stock. Some of these risks include:

extent that they vote similarly, will be able, by virtue of their ability to elect our board of

directors, to control our policies and operations and may have interests that differ from those of other stockholders; and

Principal Investors

Immediately prior to this offering, thirteen affiliates of our customers, as well as International Securities Exchange Holdings, Inc. (owned by Deutsche Börse), or ISE, and BGM Holding, L.P., and its affiliates, collectively owned 77,904,035 shares of our common stock and 12,152,158 shares of non-voting common stock, representing approximately %93.3% of the total voting power of our capital stock. We refer to these investors as our "principal investors." Upon completion of this offering, our principal investors will collectively own approximately 72,000,805 shares of our common stock and 7,980,017 shares of non-voting common stock, representing approximately %82.1% of the total voting power of our capital stock. See "Principal and Selling Stockholders." These principal investors are affiliates of Bank of America Merrill Lynch, Citadel, Citigroup, Credit Suisse, Deutsche Bank Securities, Goldman Sachs, Instinet, J.P. Morgan, KCG, Lime, Morgan Stanley, Tradebot Ventures and WEDBUSH.

Conflicts of Interest

Merrill Lynch, Pierce, Fenner & Smith Incorporated, Citigroup, Goldman, Sachs & Co., Jefferies LLC and Nomura Securities International, Inc., underwriters of this offering, or their affiliates (as defined in FINRA Rule 5121), will each receive more than 5% of net offering proceeds and will have a "conflict of interest" pursuant to the Financial Industry Regulatory Authority, or FINRA, Rule 5121(f)(5)(C)(ii). Accordingly, this offering will be made in compliance with the applicable provisions of FINRA Rule 5121. As such, any underwriter that has a conflict of interest pursuant to FINRA Rule 5121 will not confirm sales to accounts in which it exercises discretionary authority without the prior written consent of the customer. Pursuant to FINRA Rule 5121, a "qualified independent underwriter" (as defined in FINRA Rule 5121) must participate in the preparation of the prospectus and perform its usual standard of due diligence with respect to the prospectus. Sandler O'Neill & Partners, L.P. has agreed to act as qualified independent underwriter for the offering and to perform a due diligence investigation and review and participate in the preparation of the prospectus. See "Underwriters (Conflicts of Interest)."

Corporate Information

BATS Global Markets Holdings, Inc. was incorporated in Delaware in August 2013. In connection with the Direct Edge Acquisition, BATS Global Markets Holdings, Inc. changed its name to BATS Global Markets, Inc. and became a single new holding company. Concurrently, Direct Edge and BATS Global Markets, Inc. (which was renamed BATS Global Markets Holdings, Inc.) each became intermediate holding companies held by the new BATS Global Markets, Inc. Direct Edge was dissolved on December 31, 2015. In February 2016, BATS Global Markets, Inc. changed its name to Bats Global Markets, Inc., and BATS Global Markets Holdings, Inc. changed its name to Bats Global Markets Holdings, Inc.

We are headquartered in the Kansas City area with additional offices in New York, London, Chicago and Singapore. Our principal executive offices are located at 8050 Marshall Drive, Suite 120, Lenexa, Kansas 66214, and our telephone number is (913) 815-7000. Our website is www.bats.com. Information contained on or accessible from our website is not incorporated by reference into this prospectus.

Common stock | ||

|

| |

| 11,200,000 shares | |

|

| |

Capital stock |

| |

Common stock | 87,699,410 shares | |

Non-voting common stock(1) | 7,980,017 shares | |

Total | 95,679,427 shares | |

Option to purchase additional common stock |

| |

Voting rights: |

| |

Common stock | One vote per share | |

Non-voting common stock | Only as required by applicable law | |

Use of proceeds | We | |

| ||

|

Dividend policy | The board of directors is expected to adopt a policy with respect to the payment of dividends on our capital stock following this offering. We currently expect that we will pay quarterly cash dividends following the offering, with the annual amount initially determined based on a payout ratio of earnings within a | |

BZX symbol | BATS |

Conflicts of interest | Merrill Lynch, Pierce, Fenner & Smith Incorporated, Citigroup, Goldman, Sachs & Co., Jefferies LLC and Nomura Securities International, Inc., underwriters of this offering, or their affiliates (as defined in FINRA Rule 5121), will each receive more than 5% of net offering proceeds and will have a "conflict of interest" pursuant to FINRA Rule 5121(f)(5)(C)(ii). Accordingly, this offering will be made in compliance with the applicable provisions of FINRA Rule 5121. As such, any underwriter that has a conflict of interest pursuant to FINRA Rule 5121 will not confirm sales to accounts in which it exercises discretionary authority without the prior written consent of the customer. Pursuant to FINRA Rule 5121, a "qualified independent underwriter" (as defined in FINRA Rule 5121) must participate in the preparation of the prospectus and perform its usual standard of due diligence with respect to the prospectus. Sandler O'Neill & Partners, L.P. has agreed to act as qualified independent underwriter for the offering and to perform a due diligence investigation and review and participate in the preparation of the prospectus. See "Underwriters (Conflicts of Interest)." |

Unless the context requires otherwise, all references to the number of shares of our common stock and non-voting common stock to be outstanding after this offering are based on the number of shares outstanding as of December 31, 2015 and give effect to our reclassification and stock split to be consummated in conjunction withimmediately prior to the completion of this offering, as described under "—Reclassification and Stock Split," and 275,586887,778 shares of unvested restricted stock as of September 30,December 31, 2015, but exclude:

Unless otherwise indicated, all information in this prospectus assumes that the underwriters do not exercise their option to purchase up to 1,680,000 additional shares of common stock from us.certain of the selling stockholders named herein.

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL AND OPERATING DATA

The following summary historical and pro forma financial and operating data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," the unaudited pro forma financial statements and the accompanying notes, and the consolidated financial statements and the accompanying notes, in each case included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the nine monthsyears ended September 30,December 31, 2015, and 2014 and 2013 and the statementstatements of financial condition data as of September 30,December 31, 2015 and 2014 from our unauditedaudited consolidated financial statements and related notes included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the years ended December 31, 2014, 2013 and 2012 and the statement of financial condition data as of December 31, 2014 and 2013 from our audited consolidated financial statements and related notes which are not included elsewhere in this prospectus.

We have derived the summary unaudited pro forma consolidated statements of operations data for the nine months ended September 30, 2015 and for the year ended December 31, 20142015 from the unaudited consolidated pro forma condensed combined financial statements and related notes included in this prospectus. The unaudited pro forma condensed combined statement of operations is intended to provide information about how the Direct Edge and BATSBats Hotspot acquisitionsAcquisition might have affected our historical statement of operations if theyit had been consummated as of January 1, 2014.2015. The following unaudited pro forma condensed combined statement of operations is provided for informational purposes only and does not necessarily reflect the results of operations that would have actually resulted had the Direct Edge Acquisition and BATSBats Hotspot Acquisition occurred as of January 1, 2014,2015, nor should it be taken as necessarily indicative of our future results of operations.

| | Nine Months Ended September 30, | Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma 2015(2) | 2015 | 2014 | Pro Forma 2014(2) | 2014 | 2013 | 2012 | Pro Forma 2015(1) | 2015 | 2014 | 2013 | ||||||||||||||||||||||||

| | (in millions, except per share data) | (in millions, except share and per share data) | |||||||||||||||||||||||||||||||||

Consolidated Statements of Operations Data: | |||||||||||||||||||||||||||||||||||

Revenues: | |||||||||||||||||||||||||||||||||||

Transaction fees | $ | 979.1 | $ | 970.1 | $ | 707.7 | $ | 1,095.3 | $ | 1,009.9 | $ | 612.8 | $ | 645.3 | $ | 1,299.2 | $ | 1,290.2 | $ | 1,009.9 | $ | 612.8 | |||||||||||||

Regulatory transaction fees | 207.0 | 207.0 | 186.5 | 282.0 | 272.0 | 127.4 | 148.1 | 275.7 | 275.7 | 272.0 | 127.4 | ||||||||||||||||||||||||

Market data fees | 99.4 | 99.4 | 81.2 | 114.3 | 110.3 | 59.4 | 60.3 | 131.0 | 131.0 | 110.3 | 59.4 | ||||||||||||||||||||||||

Port fees and other | 58.8 | 58.7 | 49.0 | 68.7 | 66.0 | 41.9 | 31.0 | 81.9 | 81.8 | 66.0 | 41.9 | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | 1,344.3 | 1,335.2 | 1,024.4 | 1,560.3 | 1,458.2 | 841.5 | 884.7 | 1,787.8 | 1,778.7 | 1,458.2 | 841.5 | ||||||||||||||||||||||||

Cost of revenues: | |||||||||||||||||||||||||||||||||||

Liquidity payments | 805.7 | 805.7 | 578.5 | 858.4 | 831.4 | 474.7 | 508.2 | 1,070.7 | 1,070.7 | 831.4 | 474.7 | ||||||||||||||||||||||||

Section 31 fees | 207.0 | 207.0 | 186.5 | 282.0 | 272.0 | 127.4 | 148.1 | 275.7 | 275.7 | 272.0 | 127.4 | ||||||||||||||||||||||||

Routing, clearing and other fees | 36.7 | 36.7 | 35.6 | 55.4 | 47.3 | 42.6 | 51.5 | ||||||||||||||||||||||||||||

Routing and clearing | 47.9 | 47.9 | 47.3 | 42.6 | |||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total cost of revenues | 1,049.4 | 1,049.4 | 800.6 | 1,195.8 | 1,150.7 | 644.7 | 707.8 | 1,394.3 | 1,394.3 | 1,150.7 | 644.7 | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues less cost of revenues | 294.9 | 285.8 | 223.8 | 364.5 | 307.5 | 196.8 | 176.9 | 393.5 | 384.4 | 307.5 | 196.8 | ||||||||||||||||||||||||

Operating expenses: | |||||||||||||||||||||||||||||||||||

Compensation and benefits | 61.8 | 58.4 | 66.2 | 102.4 | 87.0 | 41.5 | 48.4 | 83.5 | 79.7 | 87.0 | 41.5 | ||||||||||||||||||||||||

Other operating expenses | 101.3 | 92.4 | 73.3 | 135.4 | 100.9 | 53.7 | 69.2 | 123.0 | 122.4 | 100.9 | 53.7 | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | 163.1 | 150.8 | 139.5 | 237.8 | 187.9 | 95.2 | 117.6 | 206.5 | 202.1 | 187.9 | 95.2 | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma 2015(2) | 2015 | 2014 | Pro Forma 2014(2) | 2014 | 2013 | 2012 | Pro Forma 2015(1) | 2015 | 2014 | 2013 | ||||||||||||||||||||||||

| | (in millions, except per share data) | (in millions, except share and per share data) | |||||||||||||||||||||||||||||||||

Operating income | 131.8 | 135.0 | 84.3 | 126.7 | 119.6 | 101.6 | 59.3 | 187.0 | 182.3 | 119.6 | 101.6 | ||||||||||||||||||||||||

Interest and investment expense and other | (34.6 | ) | (31.6 | ) | (32.7 | ) | (46.8 | ) | (39.3 | ) | (26.0 | ) | (1.2 | ) | |||||||||||||||||||||

Interest expense and other | (46.4 | ) | (43.6 | ) | (39.3 | ) | (26.0 | ) | |||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income tax provision | 97.2 | 103.4 | 51.6 | 79.9 | 80.3 | 75.6 | 58.1 | 140.6 | 138.7 | 80.3 | 75.6 | ||||||||||||||||||||||||

Income tax provision | 40.2 | 42.9 | 20.7 | 30.9 | 31.1 | 28.8 | 26.5 | 57.3 | 56.5 | 31.1 | 28.8 | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | $ | 57.0 | $ | 60.5 | $ | 30.9 | $ | 49.0 | $ | 49.2 | $ | 46.8 | $ | 31.6 | $ | 83.3 | $ | 82.2 | $ | 49.2 | $ | 46.8 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings per share: | |||||||||||||||||||||||||||||||||||

Earnings per share(3): | |||||||||||||||||||||||||||||||||||

Basic | $ | 1.75 | $ | 1.86 | $ | 0.98 | $ | 1.51 | $ | 1.56 | $ | 2.07 | $ | 1.40 | $ | 2.53 | $ | 1.56 | $ | 2.07 | |||||||||||||||

Diluted | $ | 1.74 | $ | 1.85 | $ | 0.98 | $ | 1.50 | $ | 1.55 | $ | 2.06 | $ | 1.39 | $ | 2.51 | $ | 1.55 | $ | 2.06 | |||||||||||||||

Pro forma earnings per share(3): | |||||||||||||||||||||||||||||||||||

Pro forma earnings per share(4): | |||||||||||||||||||||||||||||||||||

Basic | * | * | * | * | * | $ | 2.56 | * | * | * | |||||||||||||||||||||||||

Diluted | * | * | * | * | * | $ | 2.55 | * | * | * | |||||||||||||||||||||||||

Weighted average shares outstanding: | |||||||||||||||||||||||||||||||||||

Pro forma as adjusted earnings per share(5): | |||||||||||||||||||||||||||||||||||

Basic | $ | 0.88 | * | * | * | ||||||||||||||||||||||||||||||

Diluted | $ | 0.88 | * | * | * | ||||||||||||||||||||||||||||||

Weighted average shares outstanding(3): | |||||||||||||||||||||||||||||||||||

Basic | 32.5 | 31.6 | 22.6 | ||||||||||||||||||||||||||||||||

Diluted | 32.7 | 31.8 | 22.7 | ||||||||||||||||||||||||||||||||

Pro forma weighted average common shares outstanding(4): | |||||||||||||||||||||||||||||||||||

Basic | 32.5 | * | * | * | |||||||||||||||||||||||||||||||

Diluted | 32.7 | * | * | * | |||||||||||||||||||||||||||||||

Pro forma as adjusted weighted average common shares outstanding(5): | |||||||||||||||||||||||||||||||||||

Basic | 32.5 | 32.5 | 31.4 | 32.5 | 31.6 | 22.6 | 22.5 | 94.6 | * | * | * | ||||||||||||||||||||||||

Diluted | 32.7 | 32.7 | 31.5 | 32.6 | 31.8 | 22.7 | 22.7 | 95.2 | * | * | * | ||||||||||||||||||||||||

Distributions per share | $ | 0.31 | $ | 7.67 | $ | 7.82 | $ | — | $ | 17.62 | $ | — | $ | — | $ | 7.82 | $ | — | |||||||||||||||||

| | | As of December 31, | As of December 31, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | As of September 30, 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| | 2014 | 2013 | �� | (in millions) | ||||||||||||||||

| | (in millions) | |||||||||||||||||||

Consolidated Statement of Financial Condition Data: | ||||||||||||||||||||

Consolidated Statements of Financial Condition Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 77.9 | $ | 122.2 | $ | 87.2 | $ | 75.1 | $ | 122.2 | $ | 87.2 | ||||||||

Financial investments | 0.5 | 68.4 | 25.2 | 47.7 | 68.4 | 25.2 | ||||||||||||||

Goodwill and intangible assets, net | 993.7 | 598.2 | 247.0 | 980.3 | 598.2 | 247.0 | ||||||||||||||

Total assets | 1,288.8 | 1,006.6 | 456.9 | 1,316.9 | 1,006.6 | 456.9 | ||||||||||||||

Total liabilities | 924.8 | 702.4 | 316.9 | 937.0 | 702.4 | 316.9 | ||||||||||||||

Long-term debt | 737.2 | 474.4 | 246.0 | 687.5 | 474.4 | 246.0 | ||||||||||||||

Stockholders' equity | 364.0 | 304.2 | 140.0 | 379.9 | 304.2 | 140.0 | ||||||||||||||

Selected Operating Data

The following table presents selected operating data for our four segments: U.S. Equities, European Equities, U.S. Options and Global FX for the periods presented. The information set forth below is not necessarily indicative of our future operations and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations."

| | Nine Months Ended September 30, | Year Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2015 | 2014 | 2014 | 2013 | 2012 | 2015 | 2014 | 2013 | ||||||||||||||||||

| | (in millions except for trading days, percentages and as noted below) | (in millions except for trading days, earnings per share, percentages and as noted below) | ||||||||||||||||||||||||

U.S. Equities: | ||||||||||||||||||||||||||

Market average daily volume (ADV) | 6,864.8 | 6,214.0 | 6,414.2 | 6,187.0 | 6437.2 | |||||||||||||||||||||

Average daily volume (ADV) (in billions of shares): | ||||||||||||||||||||||||||

Matched shares | 1.5 | 1.2 | 0.6 | |||||||||||||||||||||||

Routed shares | 0.1 | 0.1 | 0.1 | |||||||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

Total touched shares | 1.6 | 1.3 | 0.7 | |||||||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

| | | | | | | | | |||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

Market ADV | 6.9 | 6.4 | 6.2 | |||||||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

| | | | | | | | | |||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

Number of trading days | 188 | 188 | 252 | 252 | 250 | 252 | 252 | 252 | ||||||||||||||||||

Net capture per one hundred touched shares(1) | $ | 0.021 | $ | 0.022 | $ | 0.022 | $ | 0.024 | $ | 0.023 | $ | 0.021 | $ | 0.022 | $ | 0.024 | ||||||||||

Market share(2) | 21.1 | % | 18.9 | % | 19.4 | % | 10.4 | % | 11.9 | % | 21.1 | % | 19.4 | % | 10.4 | % | ||||||||||

European Equities: | ||||||||||||||||||||||||||

Average daily notional value (ADNV) | € | 52,394.2 | € | 38,124.1 | € | 39,659.3 | € | 32,613.6 | € | 30,857.6 | ||||||||||||||||

Average daily notional value (ADNV) (in billions): | ||||||||||||||||||||||||||

Matched and touched | € | 12.4 | € | 8.6 | € | 7.5 | ||||||||||||||||||||

Market ADNV | € | 50.8 | € | 39.7 | € | 32.6 | ||||||||||||||||||||

Number of trading days | 192 | 192 | 256 | 256 | 257 | 257 | 256 | 256 | ||||||||||||||||||

Net capture per matched notional value (in basis points)(1) | 0.132 | 0.164 | 0.162 | 0.167 | 0.113 | 0.133 | 0.162 | 0.167 | ||||||||||||||||||

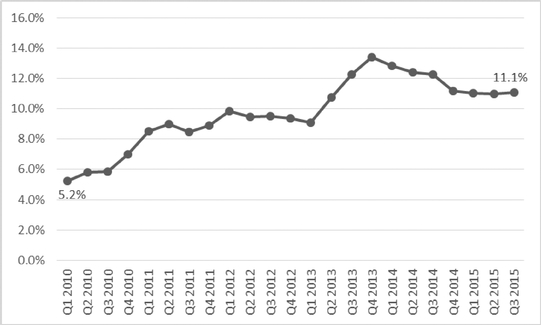

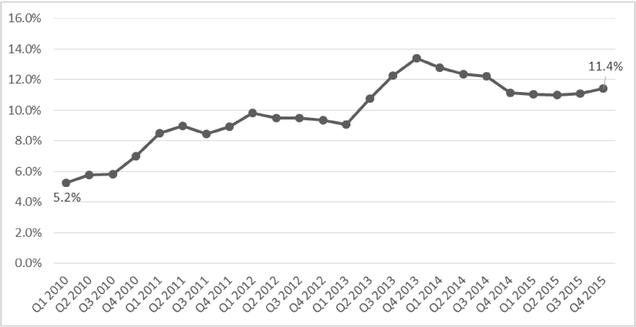

Market share(2) | 24.2 | % | 21.3 | % | 21.6 | % | 23.1 | % | 24.6 | % | 24.4 | % | 21.6 | % | 23.1 | % | ||||||||||

U.S. Options: | ||||||||||||||||||||||||||

Market average daily value (in thousands of contracts) | 16,271.1 | 16,281.5 | 16,586.3 | 15,934.2 | 15,651.6 | |||||||||||||||||||||

ADV (in millions of contracts): | ||||||||||||||||||||||||||

Matched contracts | 1.5 | 0.8 | 0.6 | |||||||||||||||||||||||

Routed contracts | 0.1 | — | — | |||||||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

Total touched contracts | 1.6 | 0.8 | 0.6 | |||||||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

| | | | | | | | | |||||||||||||||||||

| | | | | | | | | | | | ||||||||||||||||

Market ADV | 16.1 | 16.6 | 15.9 | |||||||||||||||||||||||

Number of trading days | 188 | 188 | 252 | 252 | 250 | 252 | 252 | 252 | ||||||||||||||||||

Net capture per touched contract(1) | $ | 0.024 | $ | 0.049 | $ | 0.046 | $ | 0.058 | $ | 0.063 | $ | 0.030 | $ | 0.046 | $ | 0.058 | ||||||||||

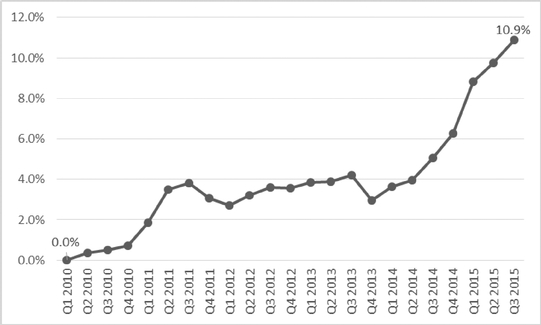

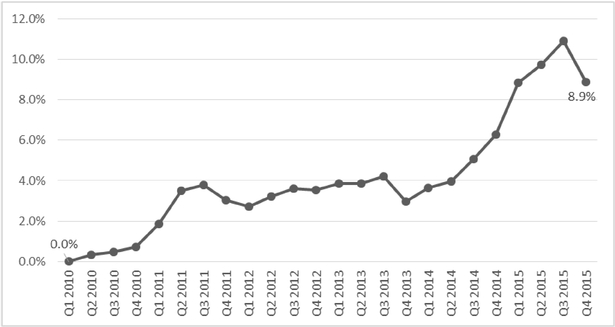

Market share(2) | 9.9 | % | 4.2 | % | 4.8 | % | 3.7 | % | 3.3 | % | 9.6 | % | 4.8 | % | 3.7 | % | ||||||||||

Global FX: | ||||||||||||||||||||||||||

ADNV (in billions) | $ | 27.8 | * | * | * | * | $ | 25.8 | * | * | ||||||||||||||||

Number of trading days | 194 | * | * | * | * | 209 | * | * | ||||||||||||||||||

Net capture per one million dollars traded(1) | $ | 3.01 | * | * | * | * | $ | 2.95 | * | * | ||||||||||||||||

Other Data: | ||||||||||||||||||||||||||

EBITDA(3) | $ | 166.1 | $ | 92.8 | $ | 136.0 | $ | 116.6 | $ | 75.7 | $ | 226.1 | $ | 136.0 | $ | 116.6 | ||||||||||

EBITDA margin(4) | 58.1 | % | 41.5 | % | 44.2 | % | 59.2 | % | 42.8 | % | 58.8 | % | 44.2 | % | 59.2 | % | ||||||||||

Normalized EBITDA(3) | $ | 172.5 | $ | 121.0 | $ | 168.1 | $ | 124.1 | $ | 101.3 | $ | 235.3 | $ | 168.1 | $ | 124.1 | ||||||||||

Normalized EBITDA margin(5) | 60.4 | % | 54.1 | % | 54.7 | % | 63.1 | % | 57.3 | % | 61.2 | % | 54.7 | % | 63.1 | % | ||||||||||

Pro Forma EBITDA(3) | $ | 173.1 | $ | 119.0 | $ | 183.0 | * | * | $ | 233.1 | * | * | ||||||||||||||

Pro Forma EBITDA margin(6) | 58.7 | % | 44.6 | % | 50.2 | % | * | * | 59.2 | % | * | * | ||||||||||||||

Adjusted earnings(7) | $ | 103.6 | $ | 75.2 | $ | 55.1 | ||||||||||||||||||||

Adjusted earnings margin(8) | 27.0 | % | 24.5 | % | 28.0 | % | ||||||||||||||||||||

Diluted Adjusted earnings per share(9) | $ | 3.17 | $ | 2.37 | $ | 2.42 | ||||||||||||||||||||

Non-transaction revenue as a percentage of revenues less cost of revenues | 55.3 | % | 58.2 | % | 57.3 | % | 51.5 | % | 51.6 | % | 55.4 | % | 57.3 | % | 51.5 | % | ||||||||||

Capital expenditures | $ | 12.3 | $ | 17.6 | $ | 25.2 | $ | 3.6 | $ | 6.9 | $ | 13.9 | $ | 25.2 | $ | 3.6 | ||||||||||

regulatory assessment charged to a member in 2013. Pro Forma EBITDA is defined as EBITDA before costs related to the Direct Edge Acquisition and the BATSBats Hotspot Acquisition, had such acquisitionsacquisition been completed on January 1, 2014.2015. EBITDA, Normalized EBITDA and Pro Forma EBITDA do not represent, and should not be considered as, alternatives to net income or cash flows from operations, each as determined in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. We have presented EBITDA, Normalized EBITDA and Pro Forma EBITDA because we consider them important supplemental measures of our performance and believe that they are frequently used by analysts, investors and other interested parties in the evaluation of companies. In addition, we use Normalized EBITDA as a measure of operating performance for preparation of our forecasts, evaluating our leverage ratio for the debt to earnings covenant included in our outstanding credit facility and calculating employee and executive bonuses. Other companies may calculate EBITDA, Normalized EBITDA and Pro Forma EBITDA differently than we do. EBITDA, Normalized EBITDA and Pro Forma EBITDA have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under U.S. GAAP.

The following is a reconciliation of net income to EBITDA, Normalized EBITDA and Pro Forma EBITDA:

| | Nine Months Ended September 30, | Year Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2015 | 2014 | 2014 | 2013 | 2012 | 2015 | 2014 | 2013 | ||||||||||||||||||

| | (in millions) | (in millions) | ||||||||||||||||||||||||

Net income | $ | 60.5 | $ | 30.9 | $ | 49.2 | $ | 46.8 | $ | 31.6 | $ | 82.2 | $ | 49.2 | $ | 46.8 | ||||||||||

Interest | 34.2 | 20.3 | 27.3 | 25.8 | 0.6 | 46.6 | 27.3 | 25.8 | ||||||||||||||||||

Income tax provision | 42.9 | 20.7 | 31.1 | 28.8 | 26.5 | 56.5 | 31.1 | 28.8 | ||||||||||||||||||

Depreciation and amortization | 28.5 | 20.9 | 28.4 | 15.2 | 17.0 | 40.8 | 28.4 | 15.2 | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | 166.1 | 92.8 | 136.0 | 116.6 | 75.7 | 226.1 | 136.0 | 116.6 | ||||||||||||||||||

Acquisition-related costs | 6.4 | 14.6 | 18.5 | 5.2 | 19.3 | 8.2 | 18.5 | 5.2 | ||||||||||||||||||

IPO costs | 0.5 | — | — | 0.6 | 6.3 | 1.5 | — | 0.6 | ||||||||||||||||||

Loss on extinguishment of debt | — | 13.6 | 13.6 | — | — | — | 13.6 | — | ||||||||||||||||||

Other one-time items | (0.5 | ) | — | — | 1.7 | — | ||||||||||||||||||||

Impairment of intangible assets | — | — | 3.5 | |||||||||||||||||||||||

Debt restructuring | 0.5 | — | — | |||||||||||||||||||||||

Gain on extinguishment of revolving credit facility | (1.0 | ) | — | — | ||||||||||||||||||||||

Regulatory assessment | — | — | (1.8 | ) | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Normalized EBITDA | $ | 172.5 | $ | 121.0 | $ | 168.1 | $ | 124.1 | $ | 101.3 | $ | 235.3 | $ | 168.1 | $ | 124.1 | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | Year Ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2015 | 2014 | 2014 | Year Ended December 31, 2015 | ||||||||||

| | (in millions) | (in millions) | ||||||||||||

Pro forma net income | $ | 57.0 | $ | 23.0 | $ | 49.0 | $ | 83.3 | ||||||

Pro forma interest | 36.2 | 35.6 | 48.4 | 48.4 | ||||||||||

Pro forma income tax provision | 40.2 | 15.4 | 30.9 | 57.3 | ||||||||||

Pro forma depreciation and amortization | 39.3 | 36.5 | 44.7 | 44.1 | ||||||||||

Acquisition costs | 0.4 | (7) | 8.5 | (8) | 10.0 | (9) | ||||||||

| | | | | | | | | | | | | | | |

Pro Forma EBITDA | $ | 173.1 | $ | 119.0 | $ | 183.0 | $ | 233.1 | ||||||

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The following is a reconciliation of net income to the Direct Edge Acquisition.Adjusted earnings:

| | Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2015 | 2014 | 2013 | |||||||

| | (in millions) | |||||||||

Net income | $ | 82.2 | $ | 49.2 | $ | 46.8 | ||||

Amortization | 26.9 | 10.3 | 5.9 | |||||||

Tax effect of amortization | (11.0 | ) | (4.0 | ) | (2.2 | ) | ||||

Acquisition-related costs | 8.2 | 18.5 | 5.2 | |||||||

IPO costs | 1.5 | — | 0.6 | |||||||

Loss on extinguishment of debt | — | 13.6 | — | |||||||

Impairment of intangible assets | — | — | 3.5 | |||||||

Debt restructuring | 0.5 | — | — | |||||||

Gain on extinguishment of revolving credit facility | (1.0 | ) | — | — | ||||||

Regulatory assessment | — | — | (1.8 | ) | ||||||

Tax effect of other items | (3.7 | ) | (12.4 | ) | (2.9 | ) | ||||

| | | | | | | | | | | |

Adjusted earnings | $ | 103.6 | $ | 75.2 | $ | 55.1 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

You should carefully consider the following risks and all of the information set forth in this prospectus before investing in our common stock.

Risks Relating to Our Business

We face intense competition and compete with a broad range of market participants globally, including our principal investors. Further consolidation and alliances among our securities trading competitors could impair our competitive position.

The market for trade execution services is intensely competitive in the asset classes and geographies in which we operate. Increased competition may result in a decline in our share of trading activity and a decline in our revenues from transaction fees and market data fees, thereby adversely affecting our operating results.

In the United States, the competition among securities exchanges and other securities execution venues has become more intense with regulatory changes. The U.S. listed cash equity securities marketplace has evolved dramatically in the years following the SEC's adoption of Regulation NMS. We compete in the U.S. listed cash equity securities market against NYSE and NASDAQ, other regional exchanges and several ATSs. Market participants now have multiple venues for the execution of orders, including national securities exchanges as well as numerous off-exchange venues, including ATSs operating "dark pools" that do not publicly display quotations, "lit" ATSs that publicly display quotations operating as ECNs and broker-dealers who internalize orders off-exchange. For example, dark pool venues compete with us by offering low cost executions and differ from "lit" ATSs in the degree of transparency with respect to quotes and trades they offer and in restrictions on who may access these systems. Unlike "lit" venues that publicly display orders, dark pools do not display orders publicly or privately. In addition, while dark pools are required to publicly report trade executions, unlike lit venues that are national securities exchanges, such as BZX, BYX, EDGX and EDGA, those public reports do not immediately identify the dark pool responsible for the trade execution. Hence, dark pools are less transparent than lit venues. Moreover, dark pools with trading volume below certain levels have discretion to offer access on discriminatory terms, effectively blocking access to certain types of market participants. These features of dark pools, which are not available to national securities exchanges, such as BZX, BYX, EDGX and EDGA, can appeal to trading participants who seek to minimize the public disclosure of their trading interest or limit the types of other trading participants that can access their orders. In addition, various broker-dealers internalize their order flow or route their orders to third-party ATSs. Based on publicly available data regarding reported trades, for the nine monthsyear ended September 30,December 31, 2015, off-exchange trading accounted for approximately 35.3%35.4% of consolidated U.S. listed equity volume, and for the year ended December 31, 2014, off-exchange trading accounted for approximately 36.2% of consolidated U.S. equity volume. If off-exchange trading expands further, it will adversely affect our market share in the United States. In addition, newer market entrants with different models may seek status as national securities exchanges, further competing with our exchange business. For example, on August 21, 2015, a subsidiary of an ATS operator, IEX Group, Inc. filed an application with the SEC to register as a national securities exchange.

The market for execution services within listed cash equity securities in Europe has become significantly more competitive since MiFID came into effect in 2007. MiFID will be superseded and enhanced by MiFID II and MiFIR, which isare expected to be implemented at the beginning of 2017.2018. MiFID created a structure for pan-European competition versus other exchange monopolies throughout the E.U. countries. As a result, new MTFs emerged that have captured significant market share from existing national exchanges. Our major competitors in Europe include the London Stock Exchange Group, or

Exchange Group, or LSE, which also includes an MTF, Turquoise, Euronext, Deutsche Börse, NASDAQ, SIX Swiss Exchange and Bolsas y Mercados Españoles, or BME.

The market for the trading of U.S. listed equity options is also intensely competitive, with thirteen authorizedfourteen U.S. options exchanges as of September 30, 2015, andthe date of this prospectus (not including a fourteenth currentlysecond U.S. options exchange of Miami International Holdings, Inc., planned for launch in the third quarter of 2016, pending approval,SEC approval) competing for market share. Our primary competitors in the U.S. options market are CBOE, NYSE, NASDAQ, ISE and Boston Options Exchange Group, LLC, or BOX. As a result of our size and limited product offerings, certain of our competitors have advantages in terms of greater market share and name recognition in the market for trading U.S. listed equity options. These advantages enable our competitors to provide products and services we do not offer, including proprietary products. For instance, some products offered uniquely by CBOE (for example, products based on the VIX volatility index) are not traded on our platform. On March 9, 2016, NASDAQ announced that it had agreed to acquire ISE, which operates three options exchanges. Additionally, a rule change recently adopted by the Options Clearing Corporation, or the OCC, concerning a proposed capital plan that, ifand affirmed on review by the SEC in February 2016, concerns a capital plan that could effectively allow itsthe OCC's shareholder exchanges, which include CBOE, ISE, NASDAQ and NYSE, to monetize for their benefit the OCC's monopoly over options clearing. We believe that the proposed capital plan has the potential to result in a wealth transfer from options investors to the OCC's shareholder exchanges, stifling future competition in the options market and increasing the costs of trading listed options.

The spot FX market remains severely fragmented, with transparent automated marketplaces such as BATSBats Hotspot challenging ICAP plc (Electronic Booking System)(EBS BrokerTec), or ICAP, and Thomson Reuters (Reuters Matching, FXall). While the spot FX market recently has been experiencing a shift from competing interbank platforms to ECNs, the electronification of spot FX may encounter resistance from clients that still prefer to utilize the phone, Reuters Conversational Dealing, Instant Bloomberg Chat, Bloomberg terminals and key banking relationships for price discovery and trading. Furthermore, electronification of FX appears to be experiencing more resistance outside the United States. The electronic FX market is also intensely competitive, with multiple venues such as EBS, Reuters Matching, FXall, FX Connect, CME Group, Currenex, 360T, Bloomberg, FastMatch, Gain GTX and others competing for market share. Additionally, exchange operators are actively expanding into the global FX market. For example Deutsche Börse has recently completed its acquisition of 360T and NASDAQ has announced its plans to launch an FX trading market. Moreover, the current market may experience consolidation, such as the recent acquisition of Molten Markets by ICAP.

We compete in the spot FX market based on our ability to execute our customers' trades at competitive prices, to retain our existing customers and to attract new customers. Certain of our competitors have larger customer bases, more established name recognition, and a greater market share in certain markets, such as Europe. These advantages may enable them, among other things, to:

In recent years, the securities trading industry has witnessed increased consolidation among market participants, such as the November 2013 acquisition of NYSE by Intercontinental Exchange and our own acquisition of Direct Edge in January 2014. More recently, in March 2016, the London Stock

Exchange and Deutsche Börse executed a merger agreement aimed at creating the largest exchange operator in Europe. Additional consolidations and alliances among market participants may create larger internal liquidity pools that may attract trading volume and liquidity away from BZX, BYX, EDGX, EDGA and BATS Chi-XBats Europe's exchanges and, therefore, lead to

decreased revenues. In addition, consolidations or alliances among our current competitors may achieve cost reductions or other increases in efficiency, which may allow our competitors to offer lower prices or better customer service than we do. These post-merger competitors may be able to achieve efficiencies that allow them to offer lower transaction fees or other financial incentives, which may hinder our ability to stay competitive in the listed cash equity securities market and to further penetrate the options market. In addition, these mergers may result in stronger competitors for us than the premerger entities as stand-alone businesses in other markets that we may decide to enter, such as futures and other derivative products.

In addition, BATSBats is dependent upon certain third parties for its ETP listings business, some of which are direct competitors of BATS.Bats. For example, BATSBats does not currently offer intraday net asset values, or INAVs, calculation services for ETP issuers, which the SEC requires ETP issuers to calculate and distribute for their funds. NYSE Arca, owned by Intercontinental Exchange, is the primary provider of INAVs for equity ETP issuers. In December 2015, Intercontinental Exchange completed its acquisition of financial market data provider Interactive Data Corp., or IDC. IDC provides data and calculation services for ETP issuers to generate INAVs for fixed-income funds. As a result of Intercontinental Exchange's acquisition of IDC, Intercontinental Exchange would increase its competitive advantage in the INAV calculation space, which could result in ETP issuers listing on BZX not to be able to obtain comparable commercial terms from IDC for IDC's provision of INAV calculation services for BZX-listed ETPs.

Further, we may face competition from our principal investors. Our principal investors or their affiliates may already have or may acquire an ownership interest in competing businesses (including national securities exchanges, dark pools, MTFs, ATSs or ECNs). These businesses may compete with us, either in relation to existing product and service offerings or any diversification of our product and service offerings into new asset classes and/or new geographic locations. For example, certain of our principal investors have a material interest in another MTF, Turquoise, and are planning to launch a new trading venue, "Plato." Furthermore, many of our principal investors operate off-exchange market-making desks, internalization platforms, dark pools, "lit" ATSs and ECNs and smart order routers, each of which potentially competes with us.

If we are unable to compete successfully in this environment, our business, financial condition and operating results may be adversely affected. Also, if our share of total trading volumes decreases relative to our competitors, we may be less attractive to market participants as a source of liquidity, and we may lose additional trading volume and associated transaction fees, market data fees and connectivity fees as a result.

Our market data fees and net transaction fees may be reduced due to declines in our market share, trading volumes or regulatory changes, and our lack of revenue diversification may adversely affect our operating results and place us at a competitive disadvantage.

We derived 34.8%34.1% and 44.7%44.6% of our revenues less cost of revenues from market data fees and net transaction fees, respectively, for the nine monthsyear ended September 30,December 31, 2015. We derived 35.9% and 42.7% of our revenues less cost of revenues from market data fees and net transaction fees, respectively, for the year ended December 31, 2014. Approximately 84.5%84.0% and 83.5%83.8% of our market data fees for the nine months ended September 30, 2015 and for the yearyears ended December 31, 2015 and 2014, respectively, represent our share of tape fees from the U.S. tape plans based on a formula, required by Regulation NMS, which takes into account both trading and quoting activity. For purposes of calculating this percentage, we have not attributed any incremental costs associated with providing trading and quoting information to the U.S. tape plans. Transaction fees represent fees that we earn for trade execution on BZX (including our U.S. listed equity options

market), BYX, EDGX (including our U.S. listed equity options market), EDGA and BATS Chi-XBats Europe, whether a trade is executed internally on BZX, BYX, EDGX, EDGA or BATS Chi-XBats Europe or routed to another market center.

Net transaction fees represent transaction fees less the liquidity payments and routing and clearing costs that we incurred to earn those transaction fees.

The occurrence of any event that reduces the amount of market data fees or transaction fees that we receive, whether as a result of fee reductions, fewer members subscribing to the U.S. tape plans, declines in market share or trading volumes (or notional volume in the case of BATS Chi-XBats Europe) or regulatory changes, will have a direct negative impact on our operating results and future profitability. For example, if our market share of U.S. listed cash equities and U.S. listed equity options trading, or our European cash equities trading, were to decline, our share of market data fees could also decline. In addition, if the amount of trading volume on BZX, BYX, EDGX or EDGA or notional value traded on BATS Chi-XBats Europe decreases, we will lose transaction fees. Moreover, market data fees could decline as a result of a reduction in the numbers of market data users, for example because of consolidation among market data subscribers or due to a decline in professional subscriptions as a result of staff reductions in the financial services industry or otherwise. For a discussion of the factors that may impact trading volumes, see "—Current economic conditions could adversely affect our business and financial condition." Regulatory changes could also impact the manner in which we set our transaction fees, the fees we receive from market data, or our cost in providing such services. See "—We operate in a highly regulated industry. Regulatory changes and changes in market structure could have a material adverse effect on our business and those of many of our clients."

In addition, our dependence upon revenues derived primarily from our transaction-based businesses may place us at a competitive disadvantage. Some of our competitors derive a more significant portion of their revenues from more than one source as a result of more diversified product and service offerings and in more numerous geographies. For example, NYSE, LSE, Euronext and NASDAQ may realize substantial revenue from listing fees and index licensing fees, and some of our FX competitors may realize substantial revenue from market data and port fees. In addition, many of our competitors also offer technology outsourcing. As a result, lower transaction fees or market data fees may impact our operating results and future profitability more significantly than our competitors', providing them with a competitive advantage in pricing their products and services or withstanding a reduction in trading volume.

Our industry is characterized by intense price competition.

The securities trading industry and FX market are characterized by intense price competition. We may be required to adjust pricing to respond to actions by new or existing competitors, which could adversely impact operating results. We also compete with respect to the pricing of market data and with respect to value-added market data such as historical market data. If we are unable to compete successfully with respect to the pricing of our services and products, our business, financial condition and operating results may be adversely affected. Furthermore, to attract market share, we may offer "inverted" pricing specials or no-transaction fee trading from time to time. For example, our BATSBats Hotspot Platform has at times offered trading of spot gold and silver pairs without any transaction fee, or waived taker fees for certain currency pairs, and previously offered free trading for all transactions on BATSBats Hotspot's London-based matching engine through 2015. In addition, BZX recently began offering to pay an incentive fee to exchange-traded investment funds that list their shares on BZX. These forms of promotions may adversely affect our profitability.

Our revenues are positively correlated with overall market volume, which can be impacted by a number of factors, including market prolonged diminished volatility.

A significant percentage of our revenue is tied directly to the volume of securities traded on our markets. Trading volume on our markets can be influenced by a number of factors, including market

volatility. The U.S. listed cash equity market trading volume was flat from 2012 through 2014 and increased 7.8% in 2015 from 2014 trading volumes. In addition, other events may affect overall market

volume on a sustained basis, including rule-making under Dodd-Frank. For example, the provision commonly known as the Volcker Rule restricts banking entities from engaging in certain kinds of proprietary trading, including with respect to listed equity securities and listed equity options. Still in its early stages of adoption, the Volcker Rule could have an adverse impact on U.S. equity market volumes and BATS'Bats' U.S. equity exchanges. For example, if banking entities reduce their trading activity and that activity is not replaced by other market participants, we may face a decline in our trading volumes, which could lower our revenues and may adversely affect our operating results.

Revenue from our FX business is influenced by the general level of trading activity in the FX market. Our FX revenue and operating results may vary significantly from period to period due primarily to movements and trends in the world's currency markets and to fluctuations in trading levels. We have generally experienced greater trading volume and higher revenue in periods of volatile currency markets. Significant swings in the market volatility can also result in increased customer trading losses, higher turnover and reduced trading volume. In the event we experience lower levels of currency volatility, our revenue and profitability may be negatively affected.

Like other financial services firms, our FX business and profitability are directly affected by factors that are beyond our control, such as economic and political conditions, government or central bank actions like the unexpected actions of the Swiss National Bank on January 15, 2015, broad trends in business and finance, changes in the volume of foreign currency transactions, changes in supply and demand for currencies, movements in currency exchange rates, changes in the financial strength of market participants, legislative and regulatory changes, changes in how such transactions are processed and disruptions due to terrorism, war or extreme weather events. Any one or more of these factors, or other factors, may adversely affect our FX business and results of operations and cash flows. A weakness in equity markets could result in reduced trading activity in the FX market and therefore could have a material adverse effect on our FX business, financial condition and results of operations and cash flows.

System limitations, failures or security breaches could harm our business.

Our business depends on the integrity and performance of our computer and communications systems. If our systems cannot expand to cope with increased demand or otherwise fail to perform, we could experience unanticipated disruptions in service, slower response times and delays in the introduction of new products and services. These consequences could result in trading outages, lower trading volumes, financial losses, decreased customer service and satisfaction and regulatory sanctions. Our markets have experienced occasional systems failures and delays in the past and could experience future systems failures and delays.

For example, on March 23, 2012, we experienced a serious technical failure on BZX, forcing us to cancel our planned IPO. The failure resulted from a software bug that appeared during the BATSBats IPO auction. In addition to forcing us to cancel our IPO, the technological failure played a role in the halting of another issuer's stock for five minutes. These technical failures damaged our reputation and resulted in increased regulatory scrutiny of the event by the SEC and other governmental authorities. We have since investigated that incident and adopted various policy and procedure enhancements, including implementation of an independent software quality assurance department, but there can be no guarantee that we will not suffer a similar technological failure in the future that damages our reputation and results in increased regulatory scrutiny by the SEC and other governmental authorities.

Our systems and operations also are vulnerable to damage or interruption from human error, natural disasters, power loss, cyber attacks, sabotage or terrorism, computer viruses, unauthorized access, intentional acts of vandalism and similar events. Persons who circumvent security measures

could wrongfully access and use our information or our customers' information or cause interruptions or malfunctions in our operations. Although we currently maintain and expect to maintain security

measures designed to protect the integrity of our systems, multiple computer facilities designed to provide redundancy and back-up to reduce the risk of system disruptions and facilities expected to maintain service during a system disruption, such security measures, systems and facilities may prove inadequate. Any breach in security or system failure that allows unauthorized access, causes an interruption in service or decreases the responsiveness of our systems could impair our reputation, damage our brand name and negatively impact our business, financial condition and operating results.

We operate in a highly regulated industry. Regulatory changes and changes in market structure could have a material adverse effect on our business and those of many of our clients.

Our securities markets and their participants are highly regulated and are subject to extensive regulation in the United States and Europe. In recent years, the securities trading industry and, in particular, the securities markets have also been subject to significant regulatory changes. Moreover, in the past several years, the securities markets have been the subject of increasing governmental and public scrutiny in response to the global economic crisis. For example, on July 21, 2010, Dodd-Frank was enacted, introducing significant changes to financial industry regulation. Dodd-Frank may also affect the structure, size, depth and liquidity of the financial markets generally and will require that certain standardized derivative products, likely including currency derivative products, be traded on a Swap Execution Facility, or SEF, or designated contract market, or DCM. Similarly, in Europe, the European Commission, or E.C., has proposed a draft delegated regulation in the context of the MiFID II reforms which would introduce a harmonized definition of currency derivative products across the European Union. If the proposed regulation is adopted in its current draft form, it would likely mean that a number of currency products which may have been treated as spot transactions (and outside the scope of the MiFID and certain other derivative rules) would thereafter be treated as derivative products (and consequently within the scope of the MiFID and certain other derivative rules). This may adversely impact the overall level of activity conducted in such products, although, to the extent that any such products are declared by the European Securities Markets Authority, or ESMA, to be subject to an obligation to trade on certain trading venues, this could lead to a greater proportion of the remaining activity taking place on trading venues.

In addition, Congress, regulators and some media have been increasingly scrutinizing electronic trading and the structure of equity markets in recent years. The SEC continues to consider various potential market structure changes, which could result in reduced trading volumes, or which could negatively affect our business. For example, in June 2014, the Chair of the SEC announced that the SEC was conducting a comprehensive review of market structure. As part of that review, in January 2015, the SEC appointed a special market structure advisory committee of industry participants to review possible regulatory changes. In response to the SEC's efforts, many market participants, including BATS,Bats, have publicly announced recommendations for regulatory changes. Reforms recommended by various market participants have included: (i) the elimination of maker-taker pricing or a drastic reduction in access fees charged by exchanges, (ii) increased transparency around order handling practices, (iii) implementation of a so-called trade-at prohibition, which would restrict execution of a trade by a market center that was not displaying the best available quotation, such as off-exchange trading in listed equities, (iv) limitations on high frequency trading and restrictions on, and enhanced oversight of, broker-dealers' automated trading algorithms, (v) limitations on the distribution of direct, or proprietary, market data feeds by exchanges, (vi) changes to the governance models of the consolidated market data national market system plans, or SIPs, including potentially providing for increased representation by non-SROs, as well as increasing the SIPs' technological capacity, (vii) elimination of Self Regulatory Organization, or SRO, status for securities exchanges and (ix) limitations on or elimination of Rule 611 of Regulation NMS, which currently requires all market participants to execute trades at prices no worse than the best bid or offer displayed by an exchange or

other automated trading center. To the extent the SEC decides to adopt some or all of these recommendations, our business could be negatively impacted. For example, elimination of maker-taker