Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JANUARY 18,JULY 9, 2018

Registration No. 333-222540333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cactus, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 3533 (Primary Standard Industrial Classification Code Number) | 35-2586106 (IRS Employer Identification No.) |

Cobalt Center

920 Memorial City Way, Suite 300

Houston, TX 77024

(713) 626-8800

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Scott Bender

President and Chief Executive OfficerCobalt Center

920 Memorial City Way, Suite 300

Houston, TX 77024

(713) 626-8800

(Address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||||

Adorys Velazquez John P. Johnston Baker Botts L.L.P. 30 Rockefeller Plaza New York, NY 10112 (212) 408-2500 | Shelley Barber Vinson & Elkins L.L.P. 666 Fifth Avenue, 26th Floor New York, NY 10103 (212) 237-0000 | |||

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company' in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |||||

| Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Aggregate Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||||

|---|---|---|---|---|---|---|---|---|

Class A common stock, par value $0.01 per share | 11,500,000 | $33.06 | $380,190,000 | $47,334 | ||||

| ||||||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 18,JULY 9, 2018

PRELIMINARY PROSPECTUS

10,000,000 Shares

Cactus, Inc.

Class A Common Stock

$ per share

This is the initial public offering of our Class A common stock. We are selling 10,000,000 shares of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price of theOur Class A common stock is expected to be between $ and $ per share. We have been authorized to listlisted on the New York Stock Exchange under the symbol "WHD." The last reported sales price of our Class A common stock on the New York Stock Exchange under the symbol "WHD."on July 6, 2018 was $34.08 per share.

�� To the extent that the underwriters sell more than 10,000,000 shares of Class A common stock, the underwriters have the option, exercisable within 30 days from the date of this prospectus, to purchase up to an additional 1,500,000 shares of Class A common stock from us at the public offering price less the underwriting discount and commissions.

We are an "emerging growth company," as that term is defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

Investing in our Class A common stock involves a high degree of risk. See "Risk Factors" on page 20.21.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share | Total | ||

|---|---|---|---|---|

| $ | $ | ||

Underwriting discount and commissions(1) | $ | $ | ||

Proceeds, before expenses, to us(1) | $ | $ |

The underwriters expect to deliver the shares of our Class A common stock to investors against payment on or about , 2018.

| Citigroup | Credit Suisse | |||

, 2018

PROSPECTUS SUMMARY | 1 | |||

RISK FACTORS | ||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | ||||

USE OF PROCEEDS | ||||

MARKET PRICE OF OUR CLASS A COMMON STOCK | 46 | |||

DIVIDEND POLICY | ||||

CAPITALIZATION | ||||

| 48 | |||

SELECTED HISTORICAL | ||||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||||

BUSINESS | ||||

MANAGEMENT | ||||

EXECUTIVE COMPENSATION | ||||

| ||||

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | ||||

PRINCIPAL | ||||

DESCRIPTION OF CAPITAL STOCK | ||||

SHARES ELIGIBLE FOR FUTURE SALE | ||||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS | ||||

CERTAIN ERISA CONSIDERATIONS | 128 | |||

UNDERWRITING | ||||

LEGAL MATTERS | ||||

EXPERTS | ||||

WHERE YOU CAN FIND MORE INFORMATION | ||||

INDEX TO FINANCIAL STATEMENTS | F-1 | |||

GLOSSARY | G-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf or to the information which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of Class A common stock and seeking offers to buy shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of any sale of the Class A common stock. Our business, financial condition, results of operations, financial condition and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements."

Through and including , 2018 (the 25th day after the date of this prospectus), all dealers effecting transactions in our shares, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent

i

sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the

i

section entitled "Risk Factors." These and other factors could cause results to differ materially from those expressed in these publications.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties' trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Certain Terms Used in this Prospectus

Any reference in this prospectus to:

ii

This summary highlights selected information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the information under the headings "Risk Factors," "Cautionary Note Regarding Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical and pro forma financial statements and the notes related to those financial statements appearing elsewhere in this prospectus. TheExcept as otherwise indicated, all information presentedcontained in this prospectus assumes (i) an initial public offering price of $ per share of Class A common stock (the midpoint of the price range set forth on the cover of this prospectus) and (ii) unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of Class A common stock.stock and excludes Class A common stock reserved for issuance under our long-term incentive plan (our "LTIP").

Cactus Inc., the issuer in this offering, is a holding company formed to own an interest in, and act as the sole managing member of, Cactus LLC. Following this offering, Cactus Inc. will beis responsible for all operational, management and administrative decisions relating to Cactus LLC's business and will consolidateconsolidates the financial results of Cactus LLC and its subsidiaries. Cactus LLC is our predecessor for financial reporting purposes. Accordingly,References to "Cactus," the "Company," "us," "we," "our," "ours" or like terms refer to (i) Cactus Wellhead, LLC ("Cactus LLC") and its consolidated subsidiaries prior to the completion of our historical financial statements are thoseinitial public offering on February 12, 2018 (our "IPO") and (ii) Cactus, Inc. ("Cactus Inc.") and its consolidated subsidiaries (including Cactus LLC) following the completion of Cactus LLC.our IPO, unless we state otherwise or the context otherwise requires.

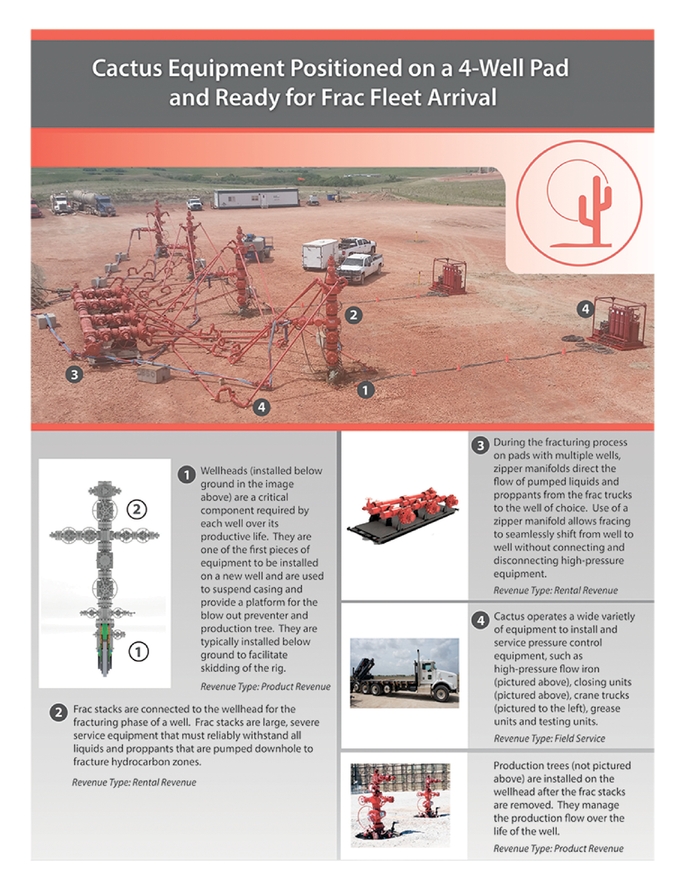

We design, manufacture, sell and rent a range of highly-engineered wellheadshighly engineered wellhead and pressure control equipment. Our products are sold and rented principally for onshore unconventional oil and gas wells and are utilized during the drilling, completion (including fracturing) and production phases of our customers' wells. In addition, we provide field services for all of our products and rental items to assist with the installation, maintenance and handling of the wellhead and pressure control equipment.

Our principal products include our Cactus SafeDrill™ wellhead systems as well as frac stacks, zipper manifolds and production trees that we design and manufacture. Every oil and gas well requires a wellhead, which is installed at the onset of the drilling process and which remains with the well through its entire productive life. The Cactus SafeDrill™ wellhead systems employ technology traditionally associated with deepwater applications, which allows technicians to land and secure casing strings more safely from the rig floor, withoutreducing the need to descend into the well cellar. We believe we are a market leader in the onshore application of such technology, with thousands of our products sold and installed across the United States since 2011.

During the completion phase of a well, we rent frac stacks, zipper manifolds and other high-pressure equipment that are used for well control and for managing the transmission of frac fluids and proppants during the hydraulic fracturing process. These severe service applications require robust and reliable equipment. For the subsequent production phase of a well, we sell production trees that regulate hydrocarbon production, which are installed on the wellhead after the frac treestack has been removed. In addition, we provide mission-critical field services for all of our products and rental items, including 24-hour service crews to assist with the installation, maintenance and safe handling of the wellhead and pressure control equipment. Finally, we provide repair services for all of the equipment that we sell or rent.

Our primaryinnovative wellhead products and pressure control equipment are developed internally. OurWe believe our close relationship with our customers provides us with insight into the specific issues encountered in the drilling and completion processes, allowing us to provide them with highly tailored product and service solutions. We have achieved significant market share, as measured by the percentage of total active U.S. onshore rigs that we follow (which we define as the number of active U.S. onshore drilling rigs to which we are the primary provider of wellhead products and corresponding services during drilling), and brand name recognition with respect to our engineered products, which

we believe is due to our focus on safety, reliability, cost effectiveness and time saving features. We optimize our products for pad drilling (i.e., the process of drilling multiple wellbores from a single surface location) to reduce rig time and provide operators with significant efficiencies that translate to cost savings at the wellsite.

Our manufacturing and production facilities are located in Bossier City, Louisiana and Suzhou, China. While both facilities can produce our full range of products, our Bossier City facility has technologically advanced machining capabilities and is designed to support time-sensitive and rapid turnaround orders, while our facility in China is optimized for longer lead time orders and outsources its machining requirements. Both our United States and China facilities are licensed to the latest American Petroleum Institute ("API") 6A specification for both wellheads and valves and API Q1 and ISO9001:2015 quality management systems.

We operate 1415 service centers in the United States, which are strategically located in the key oil and gas producing regions, including the Permian, SCOOP/STACK, Marcellus, Utica, Eagle Ford, Bakken and other active oil and gas regions in the United States. We also have one service center in Eastern Australia. These service centers support our field services and provide equipment assembly and repair services.

The following table presents information regarding our consolidated revenues, net income (loss) and Adjusted EBITDA for the periods indicated.

| | Nine Months Ended September 30, | Three Months Ended September 30, | Three Months Ended June 30, | Years Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2017 | 2016 | 2017 | 2017 | 2016 | 2015 | 2018 | 2017 | 2017 | 2016 | 2015 | ||||||||||||||||||||||||

| | ($ in millions) | ($ in millions) | |||||||||||||||||||||||||||||||||

Total revenues | $ | 236.4 | $ | 105.5 | $ | 96.0 | $ | 81.9 | $ | 155.0 | $ | 221.4 | $ | 115.1 | $ | 58.5 | $ | 341.2 | $ | 155.0 | $ | 221.4 | |||||||||||||

Revenue contribution: | |||||||||||||||||||||||||||||||||||

Product revenue | 55.8 | % | 49.1 | % | 55.9 | % | 55.2 | % | 50.1 | % | 50.1 | % | 51.2 | % | 56.5 | % | 55.4 | % | 50.1 | % | 50.1 | % | |||||||||||||

Rental revenue | 22.4 | % | 29.6 | % | 22.1 | % | 23.0 | % | 28.6 | % | 29.6 | % | 25.3 | % | 22.2 | % | 22.7 | % | 28.6 | % | 29.6 | % | |||||||||||||

Field service and other revenue | 21.8 | % | 21.3 | % | 22.0 | % | 21.8 | % | 21.3 | % | 20.3 | % | 23.5 | % | 21.3 | % | 21.9 | % | 21.3 | % | 20.3 | % | |||||||||||||

Net income (loss) | $ | 43.7 | $ | (9.5 | ) | $ | 22.3 | $ | 16.6 | $ | (8.2 | ) | $ | 21.2 | $ | 26.4 | $ | 4.9 | $ | 66.5 | $ | (8.2 | ) | $ | 21.2 | ||||||||||

Adjusted EBITDA(1) | $ | 77.1 | $ | 20.4 | $ | 34.1 | $ | 27.7 | $ | 31.9 | $ | 62.8 | $ | 42.7 | $ | 15.3 | $ | 112.1 | $ | 32.2 | $ | 63.1 | |||||||||||||

Adjusted EBITDA as a % of total revenues(1) | 32.6 | % | 19.3 | % | 35.5 | % | 33.8 | % | 20.6 | % | 28.4 | % | 37.1 | % | 26.2 | % | 32.9 | % | 20.8 | % | 28.5 | % | |||||||||||||

We believe these results have been due to our focus on providing industry-leading technology and service.

The table below sets forth the number of active U.S. onshore rigs that we followed, the total number of active U.S. onshore rigs as reported by Baker Hughes and the percentage of the total number of active U.S. onshore rigs that we followed, as of the dates presented. We believe that comparing the total number of active U.S. onshore rigs to which we are providing our products and services at a given time to the total number of active U.S. onshore rigs on or about such time provides

us with a reasonable approximation of our market share with respect to our wellhead products sold and the corresponding services we provide.

As of Mid-Month | Number of Active U.S. Onshore Rigs We Followed(1) | Total Number of Active U.S. Onshore Rigs(2) | Our Percentage of the Total Number of Active U.S. Onshore Rigs(3) | Number of Active U.S. Onshore Rigs We Followed(1) | Total Number of Active U.S. Onshore Rigs(2) | Our Percentage of the Total Number of Active U.S. Onshore Rigs(3) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

December 2011 | 15 | 1,931 | 0.8 | % | 15 | 1,931 | 0.8 | % | ||||||||||||

June 2012 | 47 | 1,899 | 2.5 | % | 47 | 1,899 | 2.5 | % | ||||||||||||

December 2012 | 75 | 1,729 | 4.3 | % | 75 | 1,729 | 4.3 | % | ||||||||||||

June 2013 | 100 | 1,694 | 5.9 | % | 100 | 1,694 | 5.9 | % | ||||||||||||

December 2013 | 119 | 1,703 | 7.0 | % | 119 | 1,703 | 7.0 | % | ||||||||||||

June 2014 | 158 | 1,780 | 8.9 | % | 158 | 1,780 | 8.9 | % | ||||||||||||

December 2014 | 179 | 1,820 | 9.8 | % | 179 | 1,820 | 9.8 | % | ||||||||||||

June 2015 | 119 | 825 | 14.4 | % | 119 | 825 | 14.4 | % | ||||||||||||

December 2015 | 99 | 684 | 14.5 | % | 99 | 684 | 14.5 | % | ||||||||||||

June 2016 | 68 | 388 | 17.5 | % | 68 | 388 | 17.5 | % | ||||||||||||

December 2016 | 129 | 601 | 21.5 | % | 129 | 601 | 21.5 | % | ||||||||||||

June 2017 | 220 | 902 | 24.4 | % | 220 | 902 | 24.4 | % | ||||||||||||

December 2017 | 245 | 909 | 27.0 | % | 245 | 909 | 27.0 | % | ||||||||||||

January 2018 | 249 | 919 | 27.1 | % | ||||||||||||||||

June 2018 | 275 | 1,035 | 26.6 | % | ||||||||||||||||

We have been expanding our market share since we began operating, including during the industry downturn that began in mid-2014. However, our financial results were burdened with significant interest expense associated with our term loan facility of $14.9$2.5 million and $15.0$4.8 million for the ninethree months ended September 30,March 31, 2018 and 2017, and 2016, respectively, and $20.0 million, $19.9 million and $21.3 million for the 2017, 2016 and 2015 fiscal years, respectively,respectively. We used a substantial portion of which we will not have upon completion of this offering. On a pro forma basis, after giving effect to this offering, the use of the net proceeds from this offering as described under "Use of Proceeds" andour IPO, which we completed in February 2018, to repay the reorganization transactions described under "Corporate Reorganization,"term loan facility, so we wouldno longer have had net income of approximately $ million for the nine months ended September 30, 2017 and $ million for the year ended December 31, 2016.interest expense associated with a term loan facility.

Over the past decade, exploration and production ("E&P") companies have increasingly focused on exploiting the vast hydrocarbon reserves contained in North America's unconventional oil and natural gas reservoirs. E&P companies utilize drilling and completioncompletions equipment and techniques, including hydraulic fracturing, that optimize cost and maximize overall production of a given well. Since the trough in the second quarter of 2016, the total number of active U.S. onshore rigs has increased by 146%176% as of January 12,June 22, 2018. Most industry experts are predicting a further, though less significant, increase in drilling and completions activity. In December 2017,June 2018, Spears & Associates reported that the average number of U.S. wells drilled per year per horizontal rig had increased from 12 in 2011 to 2219 in 2017, and the total U.S. onshore drilling rig count is expected to average 856 in 2017, 9911,036 in 2018, and 1,0511,147 in 2019 and 1,214 in 2020, a material increase relative to the 2016 average reported by Baker Hughes of 490483 rigs. Similarly, according to Spears & Associates, the total number of U.S. onshore wells drilled is

expected to increase from 15,503 in 2016 to 24,22522,051 in 2017 28,006to 24,679 in 2018, 27,062 in 2019 and 29,48928,590 in 2019.2020. Furthermore, according to Spears & Associates spending on onshore drilling and completions in the U.S. in 20172018 is expected to increase 96% from 2016, 20%26% from 2017, 18% from 2018 to 20182019 and 9% from 20182019 to 2019.2020. In addition,

the U.S. Energy Information Administration (the "EIA") projects that the average WTI spot price will increase through 2040 from growing demand and the development of more costly oil resources.

Our highly engineered wellheadswellhead and pressure control equipment areis designed for horizontal wells and supportsupports greater pad drilling efficiency while enhancing safety. We believe that demand for our products and services will continue to increase over the medium and long-term as a result of numerous favorable industry trends, including:

Our primary business objective is to create value for our shareholdersstockholders by serving as the preferred provider of wellhead and pressure control equipment to our customers through a comprehensive suite of products and services. We believe that the following strengths differentiate us from our peers and position us well to capitalize on increased opportunities across our footprint:

restrictions and the increasing number of contractor personnel are leading our customers to seek vendors that can provide comprehensive and complementary product support and services. We believe that our suite of complementary products and services can provide a distinct competitive advantage relative to our peers, reducing well pad congestion, logistical complexities and safety oversight.

City, Louisiana with technologically advanced machining capabilities to satisfy our customers' unplanned demand and a lower cost, longer lead-time production facility in Suzhou, China that outsources its machining requirements. We believe that we are one of only five API 6A licensed manufacturers of both wellheads and gate valves with meaningful capacity in the United States. Unlike the more traditional manufacturers, our Bossier City plant uses almost exclusively 5-axis machining centers, which maximize throughput by reducing machine set-up and queue times. In addition, we have a wholly-owned production facility in China, where we address a significant portion of our forecasted product needs. Our operation in China has access to significant capacity to fill, at a lower cost, large orders of high-quality components that are less time sensitive. Importantly, we have the ability to expand or contract our lower cost production capacity in China with minimal impact on capital expenditures, as our machining requirements at this facility are outsourced. We believe this diversity and flexibility of supply will continue to allow us to cost effectively better ensure availability of products.

regions, enabling us to service a majority of the U.S. onshore unconventional market. We believe we are well-positioned to capitalize on the expected growth of the U.S. oil and gas market and will benefit from the projected increase in well count. As of December 2017,June 2018, Spears & Associates expected total U.S. onshore wells drilled to increase by approximately 56% from 2016 to 2017, 16%12% from 2017 to 2018, and 5%10% from 2018 to 2019.2019 and 6% from 2019 to 2020. Furthermore, the industry trend towards pad drilling and increased completioncompletions intensity is expected to drive greater demand for the premium equipment and services we provide.

We intend to achieve our primary business objective by successful execution of the following strategies:

manufacture of high-quality products, which reduce costs, increase operating efficiencies and improve the safety of our customers' wellsite operations.

rental fleet with this new technology. We will continue to invest in engineering innovations designed to improve our rental fleet utilization by reducing the duration and expense of the repair cycle.

Preliminary Estimate of Selected Second Quarter 2018 Financial Results

Although our results of operations as of and for the three months ended June 30, 2018 are not yet final, based on the information and data currently available, we estimate, on a preliminary basis, that our total revenue will be within a range of $136.0 million to $139.0 million for the three months ended June 30, 2018, as compared to $81.9 million for the three months ended June 30, 2017. Based on currently available information and data, we also estimate that our net income will be within a range of $40.6 million to $42.4 million for the three months ended June 30, 2018, as compared to net income of $16.6 million for the three months ended June 30, 2017. In addition, we estimate that Adjusted EBITDA will be within a range of $54.0 million to $56.0 million for the three months ended June 30, 2018, as compared to $27.7 million for the same period in 2017. We estimate that our net capital expenditures (which equals net cash flows from investing activities) for the three months ended June 30, 2018 will be within the range of $13.0 million to $16.0 million. We estimate our cash and cash equivalents as of June 30, 2018 will be $27.9 million. The improved results as compared to the same period in 2017 are primarily attributable to higher revenue generated as a result of the increase in U.S. land activity associated with increased E&P drilling, completions and production.

EBITDA and Adjusted EBITDA Description and Reconciliation

EBITDA and Adjusted EBITDA are not measures of net income as determined by GAAP. EBITDA and Adjusted EBITDA are supplemental non-GAAP financial measures that are used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. We define EBITDA as net income excluding net interest expense, income tax and depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding (gain) loss on debt extinguishment and stock-based compensation expense.

Management believes EBITDA and Adjusted EBITDA are useful because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure, or other items that impact comparability of financial results from period to period. EBITDA and Adjusted EBITDA should not be considered as alternatives to, or more meaningful than, net income or any other measure as determined in accordance with GAAP. Our computations of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. We present EBITDA and Adjusted EBITDA because we believe they provide useful information regarding the factors and trends affecting our business.

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to the GAAP financial measure of net income for the three months ended June 30, 2018 (estimated) and 2017 (actual) (unaudited and in thousands).

| | Three Months Ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | June 30, 2018 (High) | June 30, 2018 (Low) | June 30, 2017 (Actual) | |||||||

Net income | $ | 42,400 | $ | 40,600 | $ | 16,578 | ||||

Interest expense, net | 255 | 235 | 5,186 | |||||||

Income tax expense | 4,707 | 4,575 | 309 | |||||||

Depreciation and amortization | 7,375 | 7,327 | 5,589 | |||||||

| | | | | | | | | | | |

EBITDA | 54,737 | 52,737 | 27,662 | |||||||

Stock-based compensation | 1,263 | 1,263 | — | |||||||

| | | | | | | | | | | |

Adjusted EBITDA | $ | 56,000 | $ | 54,000 | $ | 27,662 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The preliminary financial information included in this registration statement has been prepared by, and is the responsibility of, Cactus Inc.'s management. PricewaterhouseCoopers LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. The preliminary financial results presented above are not a comprehensive statement of our financial results for the three months ended June 30, 2018. The preliminary financial results presented above are subject to the completion of our financial closing procedures, which have not yet been completed. Our actual results for the three months ended June 30, 2018 are not available and may differ materially from these estimates. Therefore, you should not place undue reliance upon these preliminary financial results. For instance, during the course of the preparation of the respective financial statements and related notes, additional items that would require material adjustments to be made to the preliminary estimated financial results presented above may be identified. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control. Accordingly, the revenue, net income, EBITDA and Adjusted EBITDA for any particular period may not be indicative of future results. See "Cautionary Note Regarding Forward-Looking Statements."

We began operating in August 2011, following the formation of Cactus LLC by Scott Bender and Joel Bender, who have owned or operated wellhead manufacturing businesses since the late 1970s, and Cadent, as its equity sponsor. We acquired our primary manufacturing facility in Bossier City, Louisiana from one of our ExistingPre-IPO Owners in September 2011 and established our other production facility, located in Suzhou, China, in December 2013. Since we began operating, we have grown to 1314 U.S. service centers located in Texas, Louisiana, Colorado, Wyoming, New Mexico, Oklahoma, Pennsylvania and North Dakota. In July 2014, we formed Cactus Wellhead Australia Pty, Ltd and established a service center to develop the market for our products in Eastern Australia.

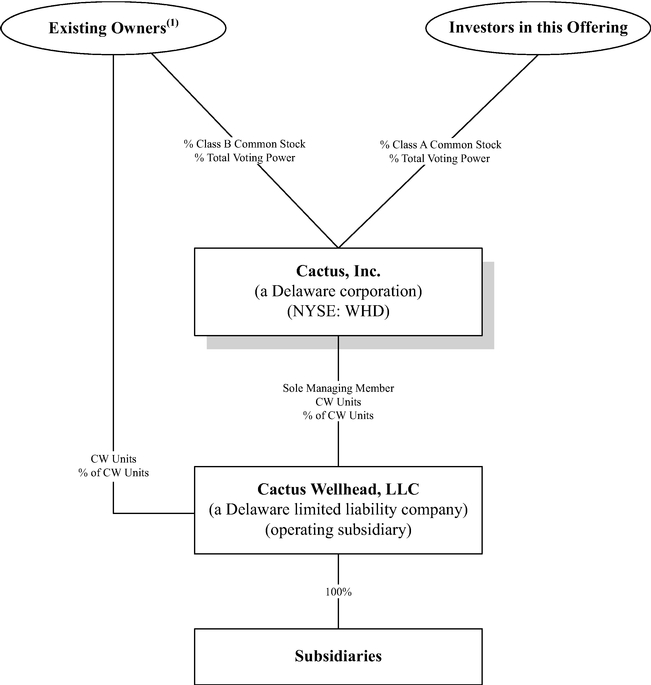

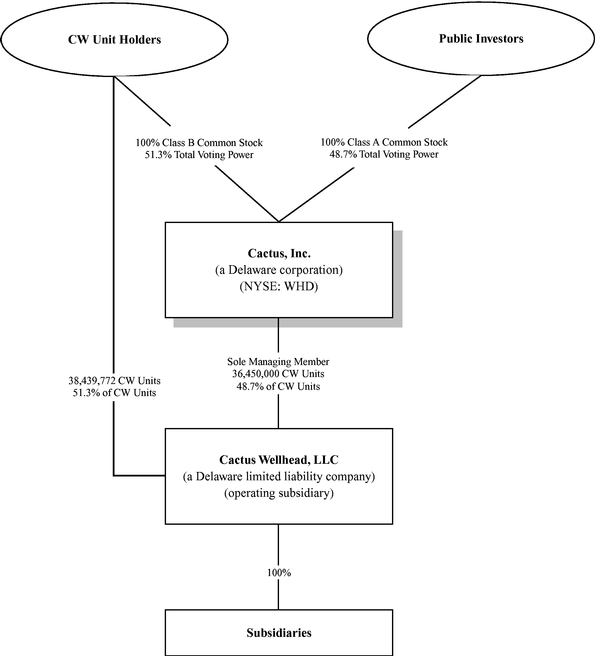

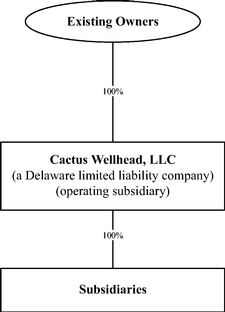

Our Initial Public Offering and Corporate ReorganizationStructure

Cactus Inc. was incorporated as a Delaware corporation on February 17, 2017. Following this2017 for the purpose of completing an initial public offering and related transactions. On February 12, 2018, following the reorganization transactions described below,completion of our IPO, Cactus Inc. will bebecame a holding company whose only material asset willassets consist of a membership interest in Cactus LLC, the operating subsidiary through which we operate our business. Cactus LLC was formed as a Delaware limited liability company on July 11, 2011 by Cactus WH Enterprises, an entity formed and controlled by Scott Bender and Joel Bender, and Cadent, as its equity sponsor.

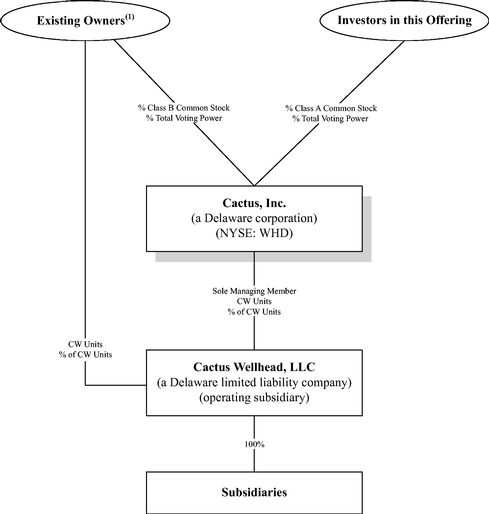

After the consummation of the transactions described in this prospectus, Cactus Inc. will beis the sole managing member of Cactus LLC and will beis responsible for all operational, management and administrative decisions relating to Cactus LLC's business and will consolidateconsolidates the financial results of Cactus LLC and its subsidiaries. The Limited Liability Company Operating Agreement of Cactus LLC will be amended and restated as the First Amended and Restated Limited Liability Company

Operating Agreement of Cactus LLC (the "Cactus Wellhead LLC Agreement") to, among other things, admit Cactus Inc. as the sole managing member of Cactus LLC.

In connection with this offering,our IPO, we completed a series of reorganization transactions (the "Reorganization Transactions"), including the following:

("CW Units");

(c) Cactus Inc. will contributecontributed the net proceeds of this offeringour IPO to Cactus LLC in exchange for 23,000,000 CW Units;

(d)

(e) and to redeem 8,667,841 CW Units from the owners thereof;

(f)

In this offering, whichprospectus, we collectively refer to in this prospectusthe owners of CW Units (along with their permitted transferees) as the "CW Unit Holders." CW Unit Holders" also own one share of Cactus Inc.'sour Class B common stock for each CW Unit such CW Unit Holder holds following the redemption described in (d) above. See "Corporate Reorganization—Offering."

Following completion of this offering, including any exercise of the underwriters' option to purchase additional shares of our Class A common stock, the total number of CW Units held by Cactus Inc. will equal the total number of shares of our Class A common stock outstanding.Holders own.

Each share of Class B common stock has no economic rights but entitles its holder to one vote on all matters to be voted on by shareholdersstockholders generally. Holders of Class A common stock and Class B

common stock will vote together as a single class on all matters presented to our shareholdersstockholders for their vote or approval, except as otherwise required by applicable law or by our amended and restated certificate of incorporation. We do not intend to list our Class B common stock on any stock exchange.

After giving effect to these transactionsUnder the First Amended and the offering contemplated by this prospectus, Cactus Inc. will own an approximate % interest inRestated Limited Liability Company Operating Agreement of Cactus LLC (or % if the underwriters' option to purchase additional shares is exercised in full) and the CW Unit Holders will own an approximate % interest in Cactus LLC (or % if the underwriters' option to purchase additional shares is exercised in full). Please see "Principal Shareholders."

Following this offering, under the Cactus(the "Cactus Wellhead LLC Agreement,Agreement"), each CW Unit Holder, will, subject to certain limitations, havehas the right (the "Redemption Right") to cause Cactus LLC to acquire all or at least a minimum portion of its CW Units for, at Cactus LLC's election, (x) shares of our Class A common stock at a redemption ratio of one share of Class A common stock for each CW Unit redeemed, subject to conversion rate adjustments for stock splits, stock dividends and reclassificationreclassifications and other similar transactions, or (y) an equivalent amount of cash. Alternatively, upon the exercise of the Redemption Right, Cactus Inc. (instead of Cactus LLC) will have the right (the "Call Right") to acquire each tendered CW Unit directly from the exchanging CW Unit Holder for, at its election,

(x) one share of Class A common stock, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications and other similar transactions, or (y) an equivalent amount of cash. In connection with any redemption of CW Units pursuant to the Redemption Right or our Call Right, the corresponding number of shares of Class B common stock will be cancelled.canceled. See "Certain Relationships and Related Party Transactions—Cactus Wellhead LLC Agreement."

The ExistingPre-IPO Owners will have the right, under certain circumstances, to cause us to register the offer and resale of their shares of Class A common stock. See "Certain Relationships and Related Party Transactions—Registration Rights Agreement."

Tax Receivable Agreement

Cactus Inc. will enter We entered into a Tax Receivable Agreement (the "Tax Receivable Agreement") with certain direct and indirect owners of Cactus LLC (each such person, a "TRA Holder") in connection with this offering.our IPO. This agreement generally provides for the payment by Cactus Inc. to each TRA Holder of 85% of the net cash savings, if any, in U.S. federal, state and local income tax or franchise tax that Cactus Inc. actually realizes or is deemed to realize in certain circumstances in periods after this offeringour IPO as a result of (i) certain increases in tax basis that occur as a result of Cactus Inc.'s acquisition (or deemed acquisition for U.S. federal income tax purposes) of all or a portion of such TRA Holder's CW Units in connection with this offeringthe Reorganization Transactions or pursuant to the exercise of the Redemption Right or the Call Right, (ii) certain increases in tax basis resulting from the repayment, in connection with this offering,our IPO, of borrowings then outstanding under Cactus LLC's term loan facility and (iii) imputed interest deemed to be paid by Cactus Inc. as a result of, and additional tax basis arising from, any payments Cactus Inc. makes under the Tax Receivable Agreement. Cactus Inc. will retain the benefit of the remaining 15% of these cash savings. There are circumstances under which the Tax Receivable Agreement may be terminated and payments thereunder are accelerated, as discussed in more detail below.

The payment obligations under the Tax Receivable Agreement are Cactus Inc.'s obligations and not obligations of Cactus LLC, and we expect that the payments we will be required to make under the Tax Receivable Agreement will be substantial. Estimating the amount and timing of payments that may become due under the Tax Receivable Agreement is by its nature imprecise. For purposes of the Tax Receivable Agreement, net cash savings in tax generally will be calculated by comparing Cactus Inc.'s actual tax liability (determined by using the actual applicable U.S. federal income tax rate and an assumed combined state and local income tax rate) to the amount it would have been required to pay had it not been able to utilize any of the tax benefits subject to the Tax Receivable Agreement. The amounts payable, as well as the timing of any payments under the Tax Receivable Agreement, are dependent upon significant future events and assumptions, including the timing of the redemption of CW Units, the price of our Class A common stock at the time of each redemption, the extent to which such redemptions are taxable transactions, the amount of the redeeming unit holder's tax basis in its CW Units at the time of the relevant redemption, the depreciation and amortization periods that apply to the increase in tax basis, the amount and timing of taxable income we generate in the future and the

U.S. federal income tax rate then applicable, and the portion of Cactus Inc.'s payments under the Tax Receivable Agreement that constitute imputed interest or give rise to depreciable or amortizable tax basis. Assuming no material changes in the relevant tax law, we expect that if the Tax Receivable Agreement were terminated immediately after this offering (assuming $ per share as the initial offering price to the public), the estimated termination payments, based on the assumptions discussed above, would be approximately $ million (calculated using a discount rate equal to one-year LIBOR plus basis points, applied against an undiscounted liability of $ million).

The term of the Tax Receivable Agreement will commence upon the completion of this offering and will continue until all tax benefits that are subject to the Tax Receivable Agreement have been utilized or expired, unless we exercise our right to terminate the Tax Receivable Agreement. In the event that the Tax Receivable Agreement is not terminated, the payments under the Tax Receivable

Agreement are anticipated to commence in 2019 and to continue for 16 years after the date of the last redemption of CW Units. Accordingly, it is expected that payments will continue to be made under the Tax Receivable Agreement for more than 20 to 25 years. If we elect to terminate the Tax Receivable Agreement early (or it is terminated early due to certain mergers, asset sales, other forms of business combinations or other changes of control), our obligations under the Tax Receivable Agreement would accelerate and we would be required to make an immediate payment equal to the present value of the anticipated future payments to be made by us under the Tax Receivable Agreement (determined by applying a discount rate of one-yearone year LIBOR plus 150 basis points) and such payment is expected to be substantial. The calculation of anticipated future payments will be based upon certain assumptions and deemed events set forth in the Tax Receivable Agreement, including the assumptions that (i) we have sufficient taxable income to fully utilize the tax benefits covered by the Tax Receivable Agreement and (ii) any CW Units (other than those held by Cactus Inc.) outstanding on the termination date are deemed to be redeemed on the termination date. Any early termination payment may be made significantly in advance of the actual realization, if any, of the future tax benefits to which the termination payment relates.

The Tax Receivable Agreement provides that in the event that we breach any of our material obligations under the Tax Receivable Agreement, whether as a result of (i) our failure to make any payment when due (including in cases where we elect to terminate the Tax Receivable Agreement early, the Tax Receivable Agreement is terminated early due to certain mergers, asset sales, or other forms of business combinations or changes of control or we have available cash but fail to make payments when due under circumstances where we do not have the right to elect to defer the payment)payment, as described below), (ii) our failure to honor any other material obligation under it or (iii) by operation of law as a result of the rejection of the Tax Receivable Agreement in a case commenced under the U.S. Bankruptcy Code or otherwise, then the TRA Holders may elect to treat such breach as an early termination, which would cause all our payment and other obligations under the Tax Receivable Agreement to be accelerated and become due and payable applying the same assumptions described above. We estimate that if the Tax Receivable Agreement had been terminated as of March 31, 2018, the termination payments would have been approximately $304.6 million (calculated using a discount rate equal to one-year LIBOR plus 150 basis points, applied against an undiscounted liability of $430.1 million). Assuming no material changes in the relevant tax law, we expect that if the Tax Receivable Agreement were terminated immediately after this offering, the estimated termination payments, based on the assumptions discussed above, would be approximately $ million (calculated using a discount rate equal to one-year LIBOR plus 150 basis points, applied against an undiscounted liability of $ million).

As a result of either an early termination or a change of control, we could be required to make payments under the Tax Receivable Agreement that exceed our actual cash tax savings under the Tax Receivable Agreement. In these situations, our obligations under the Tax Receivable Agreement could have a substantial negative impact on our liquidity and could have the effect of delaying, deferring or preventing certain mergers, asset sales, or other forms of business combinations or changes of control.

For additional information regarding the Tax Receivable Agreement, see "Risk Factors—Risks Related to this Offering and ourOur Class A Common Stock" and "Certain Relationships and Related Party Transactions—Tax Receivable Agreement."

Ownership Structure

In connection with the completion of our IPO, Cactus Inc. became the sole managing member of Cactus LLC and is responsible for all operational, management and administrative decisions relating to Cactus LLC's business and consolidates the financial results of Cactus LLC and its subsidiaries. The Limited Liability Company Operating Agreement of Cactus LLC was amended and restated in January 2018 as the Cactus Wellhead LLC Agreement to, among other things, admit Cactus Inc. as the sole managing member of Cactus LLC.

The following diagram indicates our simplified ownership structure immediately following this offering and the transactions related thereto (assuming that the underwriters' option to purchase additional shares is not exercised).

The information above does not include shares of Class A common stock that will be issued to certain employees, officers and directors of Cactus Inc. in connection with this offering or shares of Class A common stock reserved for issuance, in each case, pursuant to our equity incentive plan.

Our Principal ShareholdersStockholders

Upon completion of this offering, the ExistingPre-IPO Owners will initially own 38,297,768 CW Units and 38,297,768 shares of Class B common stock, representing approximately %51.1% of the voting power of Cactus Inc. For more information on our reorganization and the ownership of our common stock by our principal shareholders,stockholders, see "Corporate Reorganization""—Our Initial Public Offering and Corporate Structure" and "Principal Shareholders.Stockholders."

Investing in our Class A common stock involves risks associated with our business, our industry, environmental, health, safety and other regulations and other material factors. You should read carefully the section of this prospectus entitled "Risk Factors" beginning on page 2021 of this prospectus for an explanation of these risks and "Cautionary Note Regarding Forward-Looking Statements" beginning on page 4243 of this prospectus before investing in our Class A common stock.

Emerging Growth Company Status

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). For as long as we are an emerging growth company, unlike public companies that are not emerging growth companies under the JOBS Act, we will not be required to:

We will cease to be an emerging growth company upon the earliest of the:of:

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act"), for complying with new or revised accounting standards, but we intend to irrevocably opt out of the extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates in which adoption of such standards is required for other public companies.

For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see "Risk Factors—Risks Related to this Offering and Our Class A Common Stock—For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies" on page 4142 of this prospectus.

Our principal executive offices are currently located at Cobalt Center, 920 Memorial City Way, Suite 300, Houston, TX 77024, and our telephone number at that address is (713) 626-8800. Our website address iswww.cactuswellhead.com. After this offering, our website address will move towww.cactuswhd.comwww.CactusWHD.com. Information contained on these websitesour website does not constitute part of this prospectus.

Class A common stock offered by us | 10,000,000 shares | |

Option to purchase additional shares | We have granted the underwriters a 30-day option to purchase up to an aggregate of 1,500,000 additional shares of our Class A common stock. | |

Class A common stock to be outstanding immediately after completion of this offering | 36,450,000 shares | |

Class B common stock to be outstanding immediately after completion of this offering | 38,439,772 shares | |

Voting Power of Class A common stock after giving effect to this offering |

| |

Voting Power of Class B common stock after giving effect to this offering |

|

Voting rights | Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by |

Use of proceeds | We expect to receive approximately $ million of net proceeds from the sale of the Class A common stock offered by us, | |

We intend to contribute the net proceeds of this offering to Cactus LLC in exchange for CW Units. | ||

We intend to cause Cactus LLC to use | ||

We intend to contribute the net proceeds from any exercise of the underwriters' option to purchase additional shares of Class A common stock to Cactus LLC in exchange for additional CW Units, and to cause Cactus LLC to use any such amounts to |

|

| |

Redemption rights of CW Unit | Under the Cactus Wellhead LLC Agreement, each CW Unit Holder, | |

conversion rate adjustments for stock splits, stock dividends and reclassifications and other similar transactions, or (y) an equivalent amount of cash. In connection with any redemption of CW Units pursuant to the Redemption Right or our Call Right, the corresponding number of shares of Class B common stock will be | ||

Tax Receivable Agreement | In connection with | |

Dividend policy | We | |

Listing and trading symbol |

| |

Risk factors | You should carefully read and consider the information beginning on page |

The information above does not include shares of Class A common stock that will be issued to certain employees, officers and directors of Cactus Inc. in connection with this offering or shares of Class A common stock reserved for issuance, in each case, pursuant to our long-term incentive plan, which we plan to adopt in connection with this offering (our "LTIP").

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL DATA

Cactus Inc. was incorporated in February 2017 and doesdid not have any historical financial or operating results. The following table shows summary historicalresults prior to the completion of our IPO on February 12, 2018. Following our IPO, Cactus Inc. is the sole managing member of Cactus LLC. As a result, Cactus Inc. consolidates the financial results of Cactus LLC and pro formaits subsidiaries and reports non-controlling interest related to the portion of CW Units not owned by Cactus Inc. For periods prior to the completion of our IPO, the accompanying consolidated financial data, forstatements include the periodshistorical financial position and asresults of the dates indicated,operations of Cactus LLC, our accounting predecessor.

The summary historical consolidated financial data of our predecessor as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 were derived from the audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2015 are derived from audited consolidated financial statements of our predecessornot included elsewhere in this prospectus. The summary historical unaudited condensed consolidated financial data as of September 30, 2017March 31, 2018 and for the nine months ended September 30, 2017 and 2016 were derived from the unaudited condensed consolidated financial statements of our predecessor included elsewhere in this prospectus. The summary historical unaudited condensed consolidated financial data under "—Non-GAAP Financial Measures" for each of the three months ended September 30, 2017March 31, 2018 and June 30, 2017 were derived from the unaudited condensed consolidated financial statements of our predecessor not included elsewhere in this prospectus. The summary historical unaudited condensed consolidated financial data has been prepared on a consistent basis with theour audited historical consolidated financial statements of our predecessor.statements. In the opinion of management, such summary historical unaudited condensed consolidated financial data reflects all adjustments (consisting of normal recurring adjustments) considered necessary to fairly state our financial position for the periods presented. The results of operations for the interim periods are not necessarily indicative of the results that may be expected for the full year.

The summary unaudited pro forma condensed consolidated financial data have been derived from our unaudited pro forma condensed consolidated financial statements included elsewhere in this prospectus. The summary unaudited pro forma condensed consolidated statements of income data for the nine months ended September 30, 2017 and year ended December 31, 2016 has been prepared to give pro forma effect to (i) the reorganization transactions described under "Corporate Reorganization" and (ii) this offering and the application of the net proceeds from this offering as described under "Use of Proceeds," as if they had been completed as of January 1, 2016. The summary unaudited pro forma condensed consolidated balance sheet data as of September 30, 2017 has been prepared to give pro forma effect to these transactions and the issuance to certain of our employees, officers and directors of shares of Class A common stock in connection with this offering pursuant to our LTIP as if they had been completed on September 30, 2017. The summary unaudited pro forma condensed consolidated financial data are presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the reorganization transactions and this offering been consummated on the dates indicated, and do not purport to be indicative of statements of financial position or results of operations as of any future date or for any future period.

Our historical results are not necessarily indicative of future operating results. You should read the following table in conjunction with "Use of Proceeds," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Corporate Reorganization""—Our Initial Public Offering and Corporate Structure" and the historical consolidated financial statements and accompanying notes included elsewhere in this prospectus.

historical consolidated financial statements of our predecessor and accompanying notes included elsewhere in this prospectus.

| | Cactus, Inc. Pro Forma | Predecessor Historical | |||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Nine Months Ended September 30, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| | Nine Months Ended September 30, 2017 | | |||||||||||||||||||||||||||||||||

| | Year Ended December 31, 2016 | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| | 2017 | 2016 | 2016 | 2015 | 2018 | 2017 | 2017 | 2016 | 2015 | ||||||||||||||||||||||||||

| | (unaudited) (in thousands, except per share data) | (unaudited) | | | (unaudited) | | | | |||||||||||||||||||||||||||

| | (in thousands, except share and per share data) | (in thousands, except per share data) | |||||||||||||||||||||||||||||||||

Consolidated Statements of Income Data: | |||||||||||||||||||||||||||||||||||

Total revenue | $ | $ | $ | 236,407 | $ | 105,501 | $ | 155,048 | $ | 221,395 | |||||||||||||||||||||||||

Total revenues | $ | 115,110 | $ | 58,503 | $ | 341,191 | $ | 155,048 | $ | 221,395 | |||||||||||||||||||||||||

Total costs and expenses | 176,281 | 101,048 | 144,433 | 179,190 | 79,893 | 48,509 | 252,328 | 144,433 | 179,190 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income from operations | 60,126 | 4,453 | 10,615 | 42,205 | 35,217 | 9,994 | 88,863 | 10,615 | 42,205 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other income (expense): | |||||||||||||||||||||||||||||||||||

Interest income | 4 | 2 | 2 | 11 | |||||||||||||||||||||||||||||||

Interest expense | (15,455 | ) | (15,271 | ) | (20,235 | ) | (21,848 | ) | |||||||||||||||||||||||||||

Other income | — | 2,251 | 2,251 | 1,640 | |||||||||||||||||||||||||||||||

Interest expense, net | (2,852 | ) | (4,986 | ) | (20,767 | ) | (20,233 | ) | (21,837 | ) | |||||||||||||||||||||||||

Other income (expense), net | (4,305 | ) | — | — | 2,251 | 1,640 | |||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other expense, net | (15,451 | ) | (13,081 | ) | (17,982 | ) | (20,197 | ) | |||||||||||||||||||||||||||

Income (loss) before income taxes | 44,675 | (8,565 | ) | (7,367 | ) | 22,008 | 28,060 | 5,008 | 68,096 | (7,367 | ) | 22,008 | |||||||||||||||||||||||

Income tax expense(1) | 942 | 957 | 809 | 784 | 1,652 | 154 | 1,549 | 809 | 784 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | $ | $ | $ | 43,733 | $ | (9,522 | ) | $ | (8,176 | ) | $ | 21,224 | $ | 26,408 | $ | 4,854 | $ | 66,547 | $ | (8,176 | ) | $ | 21,224 | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

Earnings (loss) per common share (Class A unit for predecessor): | |||||||||||||||||||||||||||||||||||

Basic and diluted | $ | $ | $ | 826.96 | $ | (260.88 | ) | $ | (224.00 | ) | $ | 306.88 | |||||||||||||||||||||||

Less: Pre-IPO net income attributable to Cactus LLC | 13,648 | 4,854 | |||||||||||||||||||||||||||||||||

Less: net income attributable to non-controlling interest | 9,007 | — | |||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | ||||||||||||||||||||||

Net income attributable to Cactus Inc. | $ | 3,753 | $ | — | |||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | ||||||||||||||||||||||

| | | | | | | | | | | | | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | ||||||||||||||||||||||

Earnings (loss) per Class A common share (Class A unit for predecessor): | |||||||||||||||||||||||||||||||||||

Basic | $ | 0.14 | $ | 1,258.36 | $ | (224.00 | ) | $ | 306.88 | ||||||||||||||||||||||||||

Diluted | 0.14 | 1,258.36 | (224.00 | ) | 306.88 | ||||||||||||||||||||||||||||||

Weighted average shares outstanding (Class A units for predecessor): | |||||||||||||||||||||||||||||||||||

Basic and diluted | 36,500 | 36,500 | 36,500 | 36,500 | |||||||||||||||||||||||||||||||

Basic | 26,450 | 36.5 | 36.5 | 36.5 | |||||||||||||||||||||||||||||||

Diluted | 26,648 | 36.5 | 36.5 | 36.5 | |||||||||||||||||||||||||||||||

Consolidated Balance Sheets Data (at period end): | |||||||||||||||||||||||||||||||||||

Cash and cash equivalents | $ | $ | 3,224 | $ | 8,688 | $ | 12,526 | $ | 7,860 | $ | 7,574 | $ | 8,688 | $ | 12,526 | ||||||||||||||||||||

Total assets | 245,635 | 165,328 | 177,559 | 358,335 | 266,456 | 165,328 | 177,559 | ||||||||||||||||||||||||||||

Long-term debt, net | 241,641 | 242,254 | 250,555 | — | 241,437 | 242,254 | 250,555 | ||||||||||||||||||||||||||||

Shareholders'/Members' equity (deficit)(2) | (59,132 | ) | (103,321 | ) | (93,167 | ) | |||||||||||||||||||||||||||||

Stockholders'/Members' equity (deficit)(2) | 87,484 | (36,217 | ) | (103,321 | ) | (93,167 | ) | ||||||||||||||||||||||||||||

Consolidated Statements of Cash Flows Data: | |||||||||||||||||||||||||||||||||||

Net cash provided by (used in): | |||||||||||||||||||||||||||||||||||

Operating activities | $ | 19,510 | $ | 28,932 | $ | 23,975 | $ | 45,927 | $ | 38,565 | $ | 5,932 | $ | 34,707 | $ | 23,975 | $ | 45,927 | |||||||||||||||||

Investing activities | �� | (21,427 | ) | (12,512 | ) | (17,358 | ) | (23,422 | ) | (15,687 | ) | (8,501 | ) | (30,678 | ) | (17,358 | ) | (23,422 | ) | ||||||||||||||||

Financing activities | (3,609 | ) | (9,315 | ) | (10,171 | ) | (22,776 | ) | (22,640 | ) | (961 | ) | (5,313 | ) | (10,171 | ) | (22,776 | ) | |||||||||||||||||

Other Financial Data (unaudited): | |||||||||||||||||||||||||||||||||||

EBITDA(3) | $ | $ | $ | 77,102 | $ | 22,646 | $ | 34,107 | $ | 64,425 | $ | 37,533 | $ | 15,307 | $ | 112,134 | $ | 34,107 | $ | 64,425 | |||||||||||||||

Adjusted EBITDA(3) | $ | $ | $ | 77,102 | $ | 20,395 | $ | 31,856 | $ | 62,785 | $ | 42,672 | $ | 15,307 | $ | 112,134 | $ | 32,217 | $ | 63,144 | |||||||||||||||

Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are not measures of net income as determined by GAAP. EBITDA and Adjusted EBITDA are supplemental non-GAAP financial measures that are used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. We define EBITDA as net income before interest income,excluding net interest expense, income tax and depreciation and amortization. We define Adjusted EBITDA as EBITDA minus gainexcluding (gain) loss on debt extinguishment.extinguishment and stock-based compensation expense.

Management believes EBITDA and Adjusted EBITDA are useful because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure, or other items that impact comparability of financial results from period to period. EBITDA and Adjusted EBITDA should not be considered as alternatives to, or more meaningful than, net income or any other measure as determined in accordance with GAAP. Our computations of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. We present EBITDA and Adjusted EBITDA because we believe they provide useful information regarding the factors and trends affecting our business.

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to the GAAP financial measure of net income (loss) for each of the periods indicated (unaudited and in thousands).

| | Cactus, Inc. Pro Forma | Predecessor Historical | |||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Nine Months Ended September 30, | Year Ended December 31, | Nine Months Ended September 30, | Three Months Ended September 30, | Three Months Ended June 30, | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||

| | 2017 | 2016 | 2017 | 2016 | 2017 | 2017 | 2016 | 2015 | 2018 | 2017 | 2017 | 2016 | 2015 | ||||||||||||||||||||||||||||

Net income (loss) | $ | $ | $ | 43,733 | $ | (9,522 | ) | $ | 22,301 | $ | 16,578 | $ | (8,176 | ) | $ | 21,224 | $ | 26,408 | $ | 4,854 | $ | 66,547 | $ | (8,176 | ) | $ | 21,224 | ||||||||||||||

Interest income | (4 | ) | (2 | ) | (2 | ) | (1 | ) | (2 | ) | (11 | ) | |||||||||||||||||||||||||||||

Interest expense | 15,455 | 15,271 | 5,281 | 5,187 | 20,235 | 21,848 | |||||||||||||||||||||||||||||||||||

Interest expense, net | 2,852 | 4,986 | 20,767 | 20,233 | 21,837 | ||||||||||||||||||||||||||||||||||||

Income tax expense | 942 | 957 | 479 | 309 | 809 | 784 | 1,652 | 154 | 1,549 | 809 | 784 | ||||||||||||||||||||||||||||||

Depreciation and amortization | 16,976 | 15,942 | 6,074 | 5,589 | 21,241 | 20,580 | 6,621 | 5,313 | 23,271 | 21,241 | 20,580 | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | 77,102 | 22,646 | 34,133 | 27,662 | 34,107 | 64,425 | 37,533 | 15,307 | 112,134 | 34,107 | 64,425 | ||||||||||||||||||||||||||||||

Gain on debt extinguishment | — | — | (2,251 | ) | — | — | (2,251 | ) | (1,640 | ) | |||||||||||||||||||||||||||||||

(Gain) loss on debt extinguishment | 4,305 | — | — | (2,251 | ) | (1,640 | ) | ||||||||||||||||||||||||||||||||||

Stock-based compensation | 834 | — | — | 361 | 359 | ||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | $ | $ | $ | 77,102 | $ | 20,395 | $ | 34,133 | $ | 27,662 | $ | 31,856 | $ | 62,785 | $ | 42,672 | $ | 15,307 | $ | 112,134 | $ | 32,217 | $ | 63,144 | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RISK FACTORS

Investing in our Class A common stock involves risks. You should carefully consider the information in this prospectus, including the matters addressed under "Cautionary Note Regarding Forward-Looking Statements," and the following risks before making an investment decision. Our business, financial condition, prospects and results of operations, financial condition and prospects could be materially and adversely affected by any of these risks. Additional risks or uncertainties not currently known to us, or that we deem immaterial, may also have an effect on our business, financial condition, prospects or results of operations. The trading price of our Class A common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to the Oilfield Services Industry and Our Business

Demand for our products and services depends on oil and gas industry activity and expenditure levels, which are directly affected by trends in the demand for and price of crude oil and natural gas.

Demand for our products and services depends primarily upon the general level of activity in the oil and gas industry, including the number of drilling rigs in operation, the number of oil and gas wells being drilled, the depth and drilling conditions of these wells, the volume of production, the number of well completions and the level of well remediation activity, and the corresponding capital spending by oil and natural gas companies. Oil and gas activity is in turn heavily influenced by, among other factors, oil and gas prices worldwide, which have historically been volatile.

Declines, as well as anticipated declines, in oil and gas prices could negatively affect the level of these activities and capital spending, which could adversely affect demand for our products and services and, in certain instances, result in the cancellation, modification or rescheduling of existing and expected orders and the ability of our customers to pay us for our products and services. These factors could have an adverse effect on our revenue and profitability.

Factors affecting the prices of oil and natural gas include, but are not limited to, the following:

The oil and gas industry has historically experienced periodic downturns, which have been characterized by diminished demand for oilfield services and downward pressure on the prices we charge. The last downturn in the oil and gas industry that began in mid-2014 has resulted in a reduction in demand for oilfield services and has adversely affected and could further adversely affect, our financial condition, results of operations and cash flows. Any future downturn or expected downturn could again adversely affect our results of operations, financial condition and cash flows.

The cyclicality of the oil and natural gas industry may cause our operating results to fluctuate.

We derive our revenues from companies in the oil and natural gas exploration and productionE&P industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. We have experienced and may in the future experience significant fluctuations in operating results as a result of the reactions of our customers to changes in oil and natural gas prices. For example, prolonged low commodity prices during 2015 and 2016, combined with adverse changes in the capital and credit markets, caused many exploration and productionE&P companies to reduce their capital budgets and drilling activity. This resulted in a significant decline in demand for oilfield services and adversely impacted the prices we could charge, particularly for rentals of frac equipment.

If oil prices or natural gas prices remain low or decline, further, the demand for our products and services could be adversely affected.

The demand for our products and services is primarily determined by current and anticipated oil and natural gas prices and the level of drilling activity and related general production spending in the areas in which we have operations. Volatility or weakness in oil prices or natural gas prices (or the perception that oil prices or natural gas prices will decrease) affects the spending patterns of our customers and may result in the drilling of fewer new wells or lower production spending on existing wells. When this occurs, E&P companies move to significantly cut costs, both by decreasing drilling and completions activity and by demanding price concessions from their service providers. This in turn, could resultresults in lower demand for our products and services and may cause lower rates and lower utilization of our equipment. If oil prices decline or natural gas prices continue to remain low or decline further, or if there is a reduction in drilling activities, the demand for our products and services and our results of operations could be materially and adversely affected.

Historical prices for crude oil and natural gas have been extremely volatile and are expected to continue to be volatile. For example, since 1999, WTI oil prices have ranged from as low as approximately $10 per barrel to over $100 per barrel. The WTI spot price for oil was $63.82 per barrel on January 16, 2018. The Henry Hub spot market price for natural gas was $2.89 per British Thermal Units ("mmBtu") on January 8, 2018 and $5.46 per mmBtu on January 16, 2018, compared to lows in early 2016 of $26.19 per barrel of oil and $1.49 per mmBtu. In recent years, oil and natural gas prices and, therefore, the level of exploration, development and production activity, have experienced a sustained decline from the highs in the latter half of 2014 as a result of an increasing global supply of oil and a decision by OPEC to sustain its production levels in spite of the decline in oil prices and slowing economic growth in the Eurozone and China. Since November 2014, prices for U.S. oil have weakened in response to continued high levels of production by OPEC, a buildup in inventories and lower global demand. Despite any agreements by OPEC and non-OPEC members to reduce their oil production quotas, the global supply excess may persist.

As a result of the significant decline in the price of oil, beginning in late 2014, E&P companies moved to significantly cut costs, both by decreasing drilling and completion activity and by demanding price concessions from their service providers. Horizontal drilling activity, which is a principal factor influencing demand for completion services, has declined in recent years. As reported by Baker Hughes, the horizontal rig count in the U.S. declined by 77% from December 2014, to a historical low of 311 in May 2016. In turn, service providers were forced to lower their operating costs and capital expenditures, while continuing to operate their businesses in an extremely competitive environment. If these conditions persist, they will adversely impact our operations. A prolonged low level of activity in

the oil and natural gas industry will adversely affect the demand for our products and services and our financial condition, prospects and results of operations.

Additionally, the commercial development of economically viable alternative energy sources (such as wind, solar, geothermal, tidal, fuel cells and biofuels) could reduce demand for our products and services and create downward pressure on the revenue we are able to derive from such products and services, as they are dependent on oil and natural gas prices.

Anticipated growth in U.S. drilling and completioncompletions activity, and our ability to benefit from such anticipated growth, could be adversely affected by any significant constraints in pressure pumpingequipment, labor or takeaway capacity in the industry.industry in the regions we operate.

Growth in U.S. drilling and completioncompletions activity may be impacted by, among other things, pressure pumping capacity, pipeline capacity, and pricing, which,material and labor shortages. The significant growth in turn, is impacted by, among other things,drilling and completions activity that has occurred over the last year, particularly in the Permian Basin, has led to concerns over availability of fracturingthe equipment, demand for fracturing equipmentmaterials and fracturing intensity per active rig. During the industry downturn that began in mid-2014, longer lateralslabor required to drill and higher intensity fracturing resulted in greater wear and tear to the industry's fracturing equipment, which has caused and will continue to cause attrition in the supply of fracturing equipment and shortages in the availability of pressure pumping services. In addition, rising fracturing intensity per rig and an overall increase in completion activity has increased the demand for fracturing equipment. During the completion phase ofcomplete a well, we rent frac stacks, zipper manifolds and other high-pressure equipment used during the hydraulic fracturing process. For the subsequent production phase of a well, we sell production trees, which are installed on the wellhead after the frac tree has been removed. Any significant additional constraints in the availability of pressure pumping services, fracturing equipment ortogether with the ability to move the produced oil and natural gas to market. Should significant constraints develop that materially impact the economics of fracturing service providers to deliver fracturing servicesoil and gas producers, growth in U.S. drilling and completions activity could be adversely affected. This would have an adverse impact on the demand for the products we sell and rent, which could have a material adverse effect on our business, results of operations, financial condition orand cash flows.

We design, manufacture, sell, rent and install equipment that is used in oil and gas exploration and productionE&P activities, which may subject us to liability, including claims for personal injury, property damage and environmental contamination should such equipment fail to perform to specifications.