Synergy CHC Corp.

(NameExact name of small business issuerregistrant as specified in its charter)

| Nevada | 99-0379440 | |||

(State or other incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer | ||

Identification No.) |

865 Spring Street

Westbrook, Maine 04092

(615) 939-9004

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices and principal place of business)

23 Dassan Island DriveJack Ross

Chief Executive Officer

c/o Synergy CHC Corp.

865 Spring Street

Westbrook, Maine 04092

(615) 939-9004

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

W. David Mannheim E. Peter Strand Michael K. Bradshaw, Jr. Nelson Mullins Riley & Scarborough LLP 4140 Parklake Avenue, Suite 200 Raleigh, NC 27612 (919) 329-3800 | C. Brophy Christensen, Jr., Esq. Jeeho M. Lee, Esq. O’Melveny & Myers LLP Two Embarcadero Center, 28th Floor San Francisco, CA 94111 (415) 984-8793 |

Approximate date of commencement of proposed sale to timethe public: As soon as practicable after the effective date of this Registration Statement becomes effective.

If any of the securities being registered on this formForm are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated” “accelerated filer,"” “smaller reporting company,” and "smaller reporting company"“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||

| Common stock, par value $0.00001 per share | $ | 69,000,000 | $ | 6,396.3 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of any additional shares of common stock that the underwriters have the right to purchase to cover over-allotments. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

| Amount To Be | Offering Price | Aggregate | Registration Fee | |||||||||||||

| Securities to be Registered | Registered | Per Share | Offering Price | [1] | ||||||||||||

| Common Stock: | 1,000,000 | 0.04 | $ | 40,000 | $ | 1.57 | ||||||||||

The information in this offering. No exchange or over the counter market exists for our common stock. Our offering price per share was arbitrarily determined in order for us to raise $40,000.

| Offering Price | Expenses | Proceeds to Us | ||||||||||

| Per Share – Gross Proceeds | $ | 0.04 | $ | 0.005 | $ | 0.035 | ||||||

| Total – Gross Proceeds | $ | 40,000 | $ | 13,002 | $ | 26,998 | ||||||

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED OCTOBER 22, 2021 |

Shares

Common Stock

Synergy CHC Corp.

Synergy CHC Corp. is a non-contingent Offeringoffering shares of our common stock, par value $0.00001 per share. We currently estimate that the initial public offering price of our common stock will be between $ and there is no minimum number$ .

Prior to September 28, 2021, shares of Shares required to be sold.our common stock were quoted on the OTC Markets Group, Inc. Pink tier under the symbol “SNYR.” As a result of amendments to Exchange Act Rule 15c2-11, because we do not presently make current information publicly available, our common stock was shifted to the OTC Expert Market on September 28, 2021, which means that there are no longer publicly-available quotations of our common stock. We have applied to list our common stock on the Nasdaq Capital Market under the symbol “SNYR.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | The underwriters will receive compensation in addition to the discounts and commissions. See “Underwriting” beginning on page 56 for a description of compensation payable to the underwriters. |

We have granted a 30-day option to the representative of the underwriters to purchase up to additional shares of common stock solely to cover over-allotments, if any.

The underwriters are offering the shares for sale on a firm commitment basis. The underwriters expect to deliver the shares to purchasers on or about , 2021.

B. Riley Securities

The date of this prospectus is , 2021

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may provide to you in connection with this offering. Neither we nor any of the underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or in any such free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We can provide no assurance as to the reliability of any other information that others may give you. Neither we nor any of the underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of such free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

Trademarks

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

Market and Industry Data

Unless otherwise indicated, information contained in this prospectus concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions we made upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

| i |

This summary highlights information contained in greater detail elsewhere in this prospectus and does not contain all of the information that you should consider before deciding to invest in our common stock. You should read the entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included in this prospectus, before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.” Unless otherwise indicated in this prospectus, “Synergy CHC,” “we,” “us” and “our” refer to Synergy CHC Corp. and, where appropriate, its subsidiaries.

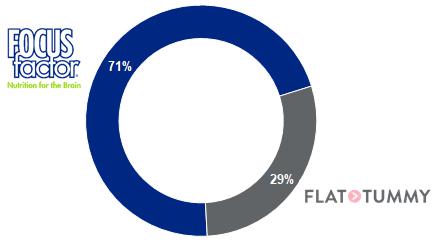

Our Company

We are a provider of consumer health care, beauty, and lifestyle products. Our current brand portfolio consists of two marquee brands, FOCUSfactor, a patented brain health supplement that has been clinically shown to improve memory, concentration and focus, and Flat Tummy, a lifestyle brand that provides a suite of nutritional products to help women achieve their weight management goals, and a developing brand, Hand MD, consisting of a full range of preventative, restorative, and anti-aging skin care products designed for the hands. During the year ended December 31, 2020, FOCUSfactor represented 62% of our net revenue, Flat Tummy was 17%, and Hand MD was 17%. During the six months ended June 30, 2021, FOCUSfactor represented 71% of our net revenue, Flat Tummy was 29%, and Hand MD was 0.2%. Our products are sold through some of the nation’s leading club, mass drug, and other retailers such as Costco, Amazon.com, Walmart, Walgreens, CVS, The Vitamin Shoppe, Target.com, H-E-B, and SuperValu.

We built our brand portfolio through strategic acquisitions. We acquired the FOCUSfactor brand in January 2015 for cash consideration of $6.0 million, including earnout. Our Hand MD brand was acquired for $1.5 million of our stock in August 2015. In November 2015, we acquired our second marquee brand – Flat Tummy – for AUD 10.0 million (or approximately $7.0 million), using a mix of cash and stock. Our capital structure following the acquisition of our key brands in 2015 was highly levered, and our focus was on paying our debt as we did not have the resources to grow our business.We have grown our FOCUSfactor brand from 2 SKUs at acquisition to 16 SKUs, and our Flat Tummy Brand from 1 SKU to 18 SKUs.

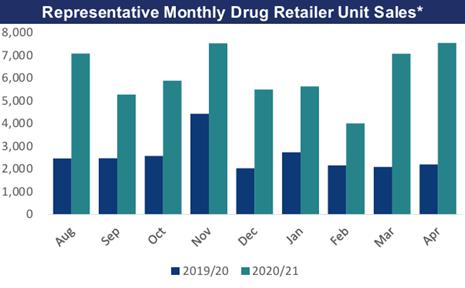

With the outbreak of the COVID-19 pandemic in North America during the first three months of 2020, we extended our Hand MD brand to produce and market a range of hand sanitizers. We deployed the cash flow from hand sanitizer sales for a television advertising strategy to drive growth in our flagship FOCUSfactor brand products. Our FOCUSfactor advertising campaigns have aired on major news and entertainment networks such as Fox News, CNN, MSNBC, TLC, and TNT, targeting adults 45 years of age and older. As a result, net revenue for the year ended December 31, 2020 was $40.2 million, an increase of $10.9 million, or 37.0%, over net revenue for the year ended December 31, 2019. Net revenue for the six months ended June 30, 2021 was $24.8 million, an increase of $6.9 million, or 38.3% over net revenue for the six months ended June 30, 2020. In particular, FOCUSfactor net revenue continued to benefit from our advertising strategy, increasing to $17.5 million for the six months ended June 30, 2021, a 124% increase over the same period in 2020.

Following the completion of this offering, we intend to use the proceeds from sales will be expended byto repay in full our outstanding debt, to accelerate the Company without escrow, minimums orgrowth of our current brands through advertising and otherwise, and to drive our acquisition strategy as we have a pipeline of potential near-term acquisition targets that we are eager to pursue. Given the success of our FOCUSfactor advertising campaigns – in which we have achieved approximately a $4 increase in gross revenue for each incremental $1 of advertising spend – we believe that we can meaningfully expand our FOCUSfactor campaigns. In addition, we have tailored strategies for our Flat Tummy and Hand MD brands to maximize our return on investment and leverage our experience with both traditional and digital marketing. Our asset-light business model, in which we partner with third-party manufacturers to produce our brand offerings, allows us to scale quickly and profitably while satisfying growing demand.

For the six months ended June 30, 2021, our net revenues, net income and Adjusted EBITDA were $24.8 million, $2.6 million and $3.5 million, respectively, representing an increase of 38.3%, 139.7%, and 13.4% over the same period in the prior fiscal year. During the year ended December 31, 2020, our net revenues, net income (loss) and Adjusted EBITDA were $40.2 million, $1.4 million and $4.7 million, respectively, as compared to $29.4 million, $(9.2) million and $4.2 million for the prior year.

Our Brands

Our flagship brand, FOCUSfactor, is a brain health nutritional supplement with over 15 years of heritage and a patented formula comprised of a proprietary blend of key brain supporting ingredients along with vitamins, minerals, and other conditions.

Our second marquee brand, Flat Tummy, consists of a range of lifestyle products and accessories including tea, shakes, lollipops, supplements, apparel, and exercise accessories. We also provide a Flat Tummy mobile app, which as of June 30, 2021 had 1.3 million unique downloads and is intended as a tool to promote the Flat Tummy lifestyle centered around general wellness and health. Our Flat Tummy brand consists of 18 SKUs and is sold direct to consumer through the Flat Tummy website and application, as well as through retailers such prospective investor.as Amazon.com and CVS.

Our Business

We were incorporated on December 29, 2010also own five additional, non-core brands. While we may elect to promote these brands and commercialize their products in the Statefuture, we have prioritized our key FOCUSfactor, Flat Tummy, and Hand MD brands, and management is focused on the growth of Nevada. Wethese core products.

Our net revenues by brand for the six months ended June 30, 2021 are an exploration stage corporation. An exploration stage corporationbelow:

Net Revenue by Brand for the Six Months Ended June 30, 2021(1)

| (1) | Hand MD represented 0.2% of our net revenue for the six months ended June 30, 2021. |

In the United States, the U.S. Food and Drug Administration (the “FDA”) has regulatory oversight over our FOCUSfactor, Flat Tummy and Hand MD products. However, no formal FDA approval or registration is one engagedrequired because our products are classified as dietary supplements (all FOCUSfactor products and some Flat Tummy products), foods (some Flat Tummy products) or cosmetics (all Hand MD products except hand sanitizer, which must follow the OTC monograph). Hand MD hand sanitizer, provided it follows the conditions, uses, doses, labeling and testing in the search for mineral deposits or reservesOTC monograph, is generally recognized as safe and effective and can be marketed without FDA approval.

In Canada, Health Canada (“HC”) has oversight over our FOCUSfactor, Flat Tummy and Hand MD products. Our FOCUSfactor and Flat Tummy products are considered natural health products by HC so they each have a natural product number that was assigned by HC upon its review and approval. Hand MD products are considered cosmetics by HC, so notification filings are required which are not in eithersubject to review and approval, with the development or production stage. We intend to conduct exploration activities on the Shipman Diamond Projectexception of hand sanitizer, which is located 50 kilometers northeast of Prince Albert, Saskatchewan, Canadaconsidered a natural health product and 2 kilometers north ofhas been assigned a natural product number by HC. This natural product number represents the village of Shipman. Oro Capital Corporation has acquired a 100% interestproduct license that enables us to distribute hand sanitizer in Canada.

In the United Kingdom, both FOCUSfactor and Flat Tummy are considered food supplements that are regulated by the Food Standards Agency. There is no requirement for licensing or registering food supplement products in the Project. United Kingdom, and products must comply with relevant food law. Hand MD products are not currently sold in the United Kingdom.

In Australia, FOCUSfactor products are “Listed Medicines” that are regulated by the Therapeutic Goods Administration (“TGA”) and require an AUST L (Australia Listed Medicine) number. Flat Tummy products are classified as either Listed Medicines or meal replacements. Listed Medicines are regulated by the TGA while meal replacements are regulated under the Australia New Zealand Food Standards Code. Hand MD products are not currently sold in Australia.

Our Competitive Strengths

We intend to explore for diamond-bearing kimberlite on the property

Well-Positioned in Growing Categories Driven by Favorable Consumer Trends

An increased focus on health, beauty and wellness by consumers has served as a tailwind for our brands. The nutritional supplement market has experienced significant growth across a range of which we paid $6,250 for office rent, $6,250 for consulting fees,areas including immune health, brain health, heart health, sleep/stress, and $12,380 for legaloverall nutrition and accounting fees. We expect to incur additional expenses of approximately $10,000wellness as a result of becomingan aging population, increased obesity, pandemic concerns and a public company. Thesedesire for more natural solutions and treatments over prescription medication. Additionally, there is an increased expenses will bedemand on hand cleansing and hand sanitizing products due to the COVID-19 pandemic, which is also driving demand for hand moisturizing products to soothe dried, chapped hands due to frequent hand washing and sanitizing. We believe that we are well positioned to benefit from these favorable trends. Our FOCUSfactor, Flat Tummy and Hand MD brands have seen strong growth with net revenues up 38% year-over-year in the six months ended June 30, 2021. We believe our focus on lifestyle products has also benefited from the growth and prevalence of social media.

Clinically Shown Results Backed by Independent Study for FOCUSfactor

We believe FOCUSfactor is the only product in its category with both a patent and a clinical study to support the product claims for improved memory, concentration, and focus. FOCUSfactor has been tested in a single-center, randomized, double-blind, placebo-controlled, parallel group study to evaluate its effect on memory, concentration, and focus in healthy adults.

In this study, FOCUSfactor was tested on its entire 52-ingredient formulation rather than testing one or two ingredients within a formulation. FOCUSfactor was shown to provide a 44% increase in recall memory after six weeks of use versus placebo. This differentiates FOCUSfactor from other brain-health supplements and is a prime reason why FOCUSfactor has been placed in premier retailers.See “Business — FOCUSfactor Clinical Study” for additional information.

Experienced Management Team with Proven Track Record of Value Creation

Our executive team has a combined 90 years of experience in consumer marketing and distribution and has been instrumental in acquiring and building our core brands. Management has exercised strong financial discipline in its acquisition strategy, with a focus on acquiring brands at attractive valuations. For example, we acquired FOCUSfactor for approximately 3x trailing EBITDA. For the six months ended June 30, 2021, the year ended December 31, 2020 and the year ended December 31, 2019, FOCUSfactor generated net revenue of $17.5 million, $24.9 million and $18.9 million, respectively. Management’s philosophy is to acquire promising brands that fit within our health, beauty and lifestyle offerings, and apply our proven marketing and distribution strategies to develop brands to their full potential. We believe we are adept at identifying promising opportunities that build out and complement our core brand portfolio.

Premier Retail Partners

Our premier retail partners include Costco, Walmart, Amazon.com, Walgreens, and CVS. We sell products to these partners under their standard arrangements, which do not include a term or duration as sales under each vendor agreement are generally made on a purchase order basis, and do not include any termination provisions. Our partners provide a platform to expand the breadth of our current offerings through product line extensions and new product innovation. We continue to introduce new SKUs to our current retail partners, such as the addition of FOCUSfactor Gummies to our membership club channel. Additionally, the international footprint of certain of our various retail partners facilitates our geographic expansion plans.

Scalable and Flexible Asset-Light Model to Support Growth

Our focus is on brand management, marketing, product development and distribution, and we utilize contract manufacturing partners in order to produce our various brand offerings. The use of third-party manufacturing partners allows us to scale quickly, as we ensure that our partners have sufficient capacity to meet our demand needs. We also maintain multiple relationships with different contract manufactures, ensuring diversification of our manufacturing base and reducing the likelihood of supply bottlenecks or deficits that could potentially slow our growth.

Our Growth Strategy

We intend to drive growth and increased profitability in our business through these key elements of our strategy:

Broaden Media Advertising Strategy

We have experienced a significant acceleration in sales growth for the FOCUSfactor brand as a result of increased audit, legalour television advertising. We launched a national advertising campaign in August 2020, which has aired on major news and Edgar fees.

Acquire Brands which Complement Our Existing Portfolio

We will continue to evaluate acquisition opportunities that we believe fit well within our brand portfolio and create value for our stockholders, such as further retail expansion in nutraceuticals and market expansion in health and beauty. In spite of historical capital constraints, our opportunistic approach to acquisitions has resulted in a successful track record of identifying promising targets that align with our overall brand strategy in the health, beauty and lifestyle segments. With the proceeds from this offering, we expect to accelerate our acquisition strategy, focusing on acquisition targets that management believes have the greatest synergistic potential, enabling us to significantly grow our product offerings and reach.

Partner with Additional Leading Retailers to Expand the Reach of Our Products

We have established distribution relationships with premier retail partners, including Costco, Walmart, Amazon.com, Walgreens, CVS, The Vitamin Shoppe, Target.com, H-E-B and SuperValu. Based on the success of our products with these leading retail partners, we believe that we are well positioned to add new retailers that will enhance our distribution footprint. We believe we have expansion opportunities with food retailers, including those focused on health foods. We intend to introduce seven new SKUs across three potential retailers, which would potentially result in the addition of approximately 50,000 retail doors.

Diversify Our Geographic Presence through Entry into New Markets

We seek to accelerate our sales growth by expanding and further diversifying our geographic footprint. In the year ended December 31, 2020, markets outside of North America represented 0.5% of our total net revenues. Our goal is to increase our net revenues generated from new markets. As we target new international markets, our strategy is to develop highly competitive and differentiated products that are produced in-country for ease of entry, with support from our regulatory group and an in-country regulatory consultant to help expedite the approval process. We currently plan to enter the United Kingdom and Australia markets in 2022, initially with FOCUSfactor, followed by Flat Tummy and Hand MD. We then plan to expand our brands into Asian markets and Mexico in late 2022 and 2023.

| 3 |

Use Innovative Strategies to Boost Consumer Engagement

We have made investments in promoting apps for Flat Tummy and view this as a key aspect of growing our customer base and maintaining high levels of engagement. We have also focused on developing our social media presence, in particular through Instagram, in order to foster and grow our relationship with customers. Our brands appeal to both specific consumer needs as well as lifestyle choices and we seek to deepen our understanding of our customers and boost recognition of our brands through increased engagement.

Continue to Develop and Expand Our Current Brands

Our plan is to further develop and expand our brands by reaching a broader set of customers through advertising and product expansion. More specifically, we look to develop new products for our brands to satisfy the various customer segment opportunities (i.e. baby boomers, millennials, etc.) and satisfy various consumer needs as they relate to new and improved formulations, expanded and improved product benefits, alternative delivery formats and sizes. As we increase the product line-up behind our brands, we leverage our current retail distribution network by expanding our presence as well as adding incremental distribution with new retail partners. With a broader brand presence, we believe our advertising becomes even more efficient at driving sales velocity.

This is evidenced by our expanded FOCUSfactor product line, including gummies that are marketed to both adults and children and liquid energy and focus shots for a younger adult audience. Beginning in 2022, we plan to introduce additional FOCUSfactor products, including a “maximum strength” formula, an “ultimate” formula, ready-to-drink beverages and a nootropic line. The Flat Tummy brand has strategically added complementary products such as new shake options and supplements to appeal to a broader consumer group. In the fourth quarter of 2021, we plan to introduce a Flat Tummy superfruits gummy and an ashwagandha/calming gummy. Beginning in 2022, we plan to introduce additional Flat Tummy products, including three new protein shakes, a protein ready-to-drink beverage, hydration powder and preworkout powder. Additionally, we plan to employ this strategy of expanding our brands into international markets that include the United Kingdom, Australia and Asia, among others.

Marketing and Sales

Our targeted, consumer-driven marketing strategy has been key to building our brands and driving revenue growth. We manage dedicated marketing strategies for each of our brands in order to build deep connections with our customers.

FOCUSfactor. Our marketing strategy for FOCUSfactor is primarily focused on television advertising campaigns with leading national networks that appeal to the demographics of our wellness focused customer base. Our television advertising campaigns, launched in 2020, have coincided with strong sales results for the brand, with FOCUSfactor net revenue increasing 124% in the six months ended June 30, 2021 compared with the same period in 2020. In the year ended December 31, 2020, FOCUSfactor net revenue increased 38.1% year-over-year, to $24.9 million. As our flagship brand, FOCUSfactor accounted for 71% of our net revenue in the six months ended June 30, 2021, compared with 44% in the six months ended June 30, 2020, 62% in the year ended December 31, 2020 and 64% in the year ended December 31, 2019.

Flat Tummy. We employ a primarily online and social media driven strategy for our Flat Tummy brand. The brand is focused primarily on women. We employ campaigns to reach our core target segments through a mix of traditional online advertising as well as influencer-based marketing. In the six months ended June 30, 2021, Flat Tummy accounted for 29% of our net revenue, compared with 25% in the six months ended June 30, 2020, 17% in the year ended December 31, 2020 and 34% in the year ended December 31, 2019.

Hand MD. We mainly rely on social media and online advertising for our Hand MD brand. In the six months ended June 30, 2021, Hand MD accounted for 0.2% of our net revenue, compared with 28% in the six months ended June 30, 2020, 17% in the year ended December 31, 2020 and 1% for the year ended December 31, 2019.

Competition

The U.S. nutritional supplements retail industry is a large and highly fragmented industry with few barriers to entry. We compete against other specialty retailers, mass merchants, multi-level marketing organizations, mail-order and direct-to-consumer companies, and e-commerce companies. This market is highly sensitive to the introduction of new products, which may rapidly capture a significant share of the property,market. Certain of our competitors may have significantly greater financial, technical and marketing resources than we willdo, and may be able to adapt to changes in consumer preferences more quickly, devote greater resources to the marketing and sale of their products, or generate greater brand recognition. In addition, our competitors may be more effective and efficient in introducing new products.

Recent Developments

Certain Preliminary Estimated Financial Data

The following presents preliminary estimates of certain of our consolidated financial data for the three months ended September 30, 2021. Our consolidated financial statements as of and for the three months ended September 30, 2021 are not yet available and are subject to completion of our financial closing procedures. The following information reflects our preliminary estimates based on currently available information and is subject to change. We have to find alternative sources, likeprovided ranges, rather than specific amounts, for the preliminary estimated results for net income, EBITDA (a non-GAAP financial measure) and Adjusted EBITDA (a non-GAAP financial measure) described below primarily because we are still in the process of finalizing our financial and operating results as of and for the three months ended September 30, 2021 and, as a second public offering, a private placementresult, our final reported results may vary from the preliminary estimates. The preliminary estimated financial data set forth below have been prepared by, and are the responsibility of, securities, or loans from our officers or others. At the present time, wemanagement. Our auditors have not made any arrangements to raise additional cash, other than through this offering. If we need additional cash and can't raise it we will either have to suspend operations until we do raise the cash,audited, reviewed, compiled or cease operations entirely. Other than as described in this paragraph, we have no other financing plans.

As of January 31, 2013 (unaudited) | As of July 31, 2012 (audited) | |||||||

| Balance Sheet | ||||||||

| Total Assets | $ | - | 4,000 | |||||

| Total Liabilities | $ | 19,205 | 18,000 | |||||

| Stockholders’ Deficit | $ | (19,205 | ) | (14,000 | ) | |||

Three Months Ended September 30, 2021 | ||||||||

| (Unaudited; in thousands of dollars) | Low (Estimated) | High (Estimated) | ||||||

| $ | $ | |||||||

| EBITDA* | $ | $ | ||||||

| Adjusted EBITDA* | $ | $ | ||||||

| * | A non-GAAP financial measure. See reconciliation to net income below. |

The below table reconciles expected net income to expected EBITDA and expected Adjusted EBITDA for the three months ended September 30, 2021.

Three Months Ended September 30, 2021 | ||||||||

| (Unaudited; in thousands of dollars) | Low (Estimated) | High (Estimated) | ||||||

| $ | | |||||||

| $ | | |||||||

| Interest expense | ||||||||

| Taxes | ||||||||

| Depreciation and amortization | ||||||||

| EBITDA | $ | $ | ||||||

| Impairment of intangible assets | ||||||||

| Stock-based compensation | ||||||||

| Non-recurring expenses | ||||||||

| Bad debts | ||||||||

| Obsolete inventory | ||||||||

| Loss on foreign currency translation and transaction | ||||||||

| Adjusted EBITDA | $ | $ | ||||||

| (1) | ||

| (2) | ||

| (3) | ||

| (4) |

Summary Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the section titled “Risk Factors” following this prospectus summary. These risks include, but are not limited to, the following:

| ● | We operate in a highly competitive industry and our failure to compete effectively could materially and adversely affect our sales and growth prospects; | |

| ● | Our failure to appropriately respond to changing consumer preferences and demand for new products or product enhancements could significantly harm our relationship with customers and our product sales, as well as our financial condition and operating results; | |

| ● | Our sales growth is dependent upon maintaining our relationships with a small number of existing large customers, and the loss of any one such customer could materially adversely affect our business and financial performance; |

| ● | If our outside suppliers and manufacturers fail to supply products in sufficient quantities and in a timely fashion, our business could suffer; | |

| ● | The COVID-19 pandemic and associated responses could materially adversely affect our business, operating results, financial condition and prospects; | |

| ● | Adverse or negative publicity could cause our business to suffer; | |

| ● | We continue to explore new strategic initiatives, but we may not be able to successfully execute on, or realize the expected benefits from, the implementation of our strategic initiatives, and our pursuit of new strategic initiatives may pose significant costs and risks; | |

| ● | The nutritional supplement industry increasingly relies on intellectual property rights and although we seek to ensure that we do not infringe the intellectual property rights of others, there can be no assurance that third parties will not assert intellectual property infringement claims against us; | |

| ● | We plan to expand into additional international markets, which will expose us to significant operational risks; | |

| ● | We may experience product recalls, withdrawals or seizures, which could materially and adversely affect our business, financial condition and results of operations; | |

| ● | We and our suppliers are subject to numerous laws and regulations that apply to the manufacturing and sale of nutritional supplements, and compliance with these laws and regulations, as they currently exist or as modified in the future, may increase our costs, limit or eliminate our ability to sell certain products, subject us or our suppliers to the risk of enforcement action or litigation, or otherwise adversely affect our business, results of operations and financial condition; and | |

| ● | The other factors described in “Risk Factors.” |

Our Corporate Information

We were organized as a corporation under the laws of the State of Nevada on December 29, 2010 under the name “Oro Capital Corporation.” In April 2014, Synergy Strips Corp., a Delaware corporation, became our wholly-owned subsidiary, and we changed our name from “Oro Capital Corporation” to “Synergy Strips Corp.” In August 2015, we changed our name to “Synergy CHC Corp.” In January 2019, our other U.S. subsidiaries, Neuragen Corp., Sneaky Vaunt Corp., The Queen Pegasus Corp. and Breakthrough Products Inc., merged with and into the Company. In July 2021, we acquired Hand MD Corp. as a wholly-owned subsidiary.

We were a public reporting company until July 17, 2020, the date on which we filed a Form 15 to voluntarily suspend our duty to file reports under Sections 13 and 15(d) of the Exchange Act. As a result of this offering, we will become subject again to the information and reporting requirements of the Exchange Act and we will file periodic reports, proxy statements and other information with the SEC.

The address of our principal executive offices is currently 865 Spring Street, Westbrook, Maine 04092 and our phone number is (615) 939-9004. Our website is www.synergychc.com. The information contained in, or that can be accessed through, our website is not incorporated by reference in, and is not part of, this prospectus.

1-for-Reverse Stock Split

Prior to the effective date of the registration statement of which this prospectus is a part, we will effect a 1-for- reverse stock split with respect to our common stock. Unless we indicate otherwise or the context otherwise requires, all information in this prospectus gives effect to this reverse stock split.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies so long as the market value of our voting and non-voting common stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

| We have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock | ||

| Use of proceeds | We We intend to | |

| Risk | You should read the | |

| Proposed Nasdaq Capital Market symbol | SNYR | |

| Insider Participation | Certain of our officers, directors and stockholders, including , and certain of their respective affiliates, have indicated an interest in participating in this offering at the public offering price. We anticipate that such persons will purchase in the aggregate approximately shares of common stock offered hereby. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell fewer shares to them than they indicated an interest in purchasing or sell no shares to them, and they could determine to purchase fewer shares than they indicated an interest in purchasing or purchase no shares in this offering. |

As of October 8, 2021, 89,889,074 shares of our common stock were outstanding. Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| ● | assumes no exercise by the underwriters of their over-allotment option; | |

| ● | excludes 3,466,667 shares of common stock issuable upon the exercise of outstanding options at a weighted exercise price of $0.54 per share; | |

| ● | gives effect to a 1-for- reverse stock split with respect to our common stock, which will occur prior to the effective date of the registration statement of which this prospectus | |

| ● | excludes 12,058,333 shares |

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our summary historical consolidated financial data as of, and for the periods ended on, the dates indicated.

The summary consolidated statements of operations data for the years ended December 31, 2020 and 2019 are derived from our audited consolidated financial statements and notes that are included elsewhere in this prospectus.

The summary condensed consolidated statements of operations data for the six months ended June 30, 2021 and 2020 and the summary consolidated balance sheet data as of June 30, 2021 are derived from our unaudited interim condensed consolidated financial statements and notes that are included elsewhere in this prospectus. We have prepared the unaudited condensed consolidated financial statements in accordance with generally accepted accounting principles (GAAP) and on the same basis as the audited consolidated financial statements. Our historical results are not necessarily indicative of our results in any future period and results from our interim period may not necessarily be indicative of the results of the entire year.

| For the six months ended | For the six months ended | For the year ended | For the year ended | |||||||||||||

| June 30, 2021 | June 30, 2020 | December 31, 2020 | December 31, 2019 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Statement of operations data: | ||||||||||||||||

| Revenue | $ | 24,761,974 | $ | 17,906,767 | $ | 40,226,865 | $ | 29,357,546 | ||||||||

| Cost of sales (including related party purchases of $0, $0, $0 and $4,847,626, respectively) | 6,794,344 | 6,593,446 | 14,578,865 | 9,137,602 | ||||||||||||

| Gross profit | 17,967,630 | 11,313,321 | 25,648,000 | 20,219,944 | ||||||||||||

| Total operating expenses | 14,505,045 | 8,736,985 | 22,609,745 | 28,176,054 | ||||||||||||

| Income (loss) from operations | 3,462,585 | 2,576,336 | 3,038,255 | (7,956,110 | ) | |||||||||||

| Total other expenses | 717,619 | 1,345,990 | 1,627,123 | 1,119,800 | ||||||||||||

| Net income (loss) before income taxes | 2,744,966 | 1,230,346 | 1,411,132 | (9,075,910 | ) | |||||||||||

| Income tax expense | (104,537 | ) | (128,996 | ) | - | (131,537 | ) | |||||||||

| Net income (loss) after tax | $ | 2,640,429 | $ | 1,101,350 | $ | 1,411,132 | $ | (9,207,447 | ) | |||||||

| Net income (loss) per share – basic and diluted | $ | 0.03 | $ | 0.01 | $ | 0.02 | $ | (0.10 | ) | |||||||

| Weighted average common shares outstanding, basic and diluted | 89,889,044 | 89,889,044 | 89,889,044 | 89,883,194 | ||||||||||||

| Adjusted EBITDA | $ | 3,507,083 | $ | 3,093,940 | $ | 4,680,161 | $ | 4,205,741 | ||||||||

Non-GAAP Financial Measures

We currently focus on Adjusted EBITDA to evaluate our business relationships and our resulting operating performance and financial position. Adjusted EBITDA is defined as EBITDA (net income plus interest expense, income tax expense, depreciation and amortization), further adjusted to exclude certain non-cash expenses and other adjustments as set forth below. We present Adjusted EBITDA because we consider it an important measure of our performance and a meaningful financial metric in assessing our operating performance from period to period by excluding certain items that we believe are not representative of our core business, such as certain non-cash items and other adjustments. We believe that Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported results in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), provides useful information to investors.

Six Months Ended June 30, 2021 | Six Months Ended June 30, 2020 | Year Ended December 31, 2020 | Year Ended December 31, 2019 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Net income (loss) | $ | 2,640,429 | $ | 1,101,350 | $ | 1,411,132 | $ | (9,207,447 | ) | |||||||

| Interest income | (24 | ) | (79 | ) | (104 | ) | (414 | ) | ||||||||

| Interest expense | 627,883 | 497,992 | 1,186,034 | 981,105 | ||||||||||||

| Taxes | 104,537 | 128,996 | – | 131,537 | ||||||||||||

| Depreciation and amortization | – | 95,686 | 148,697 | 1,342,689 | ||||||||||||

| EBITDA | $ | 3,372,825 | $ | 1,823,945 | $ | 2,745,759 | $ | (6,752,530 | ) | |||||||

| Impairment of intangible assets | – | – | 47,002 | 9,715,137 | ||||||||||||

| Stock-based compensation | – | 77,358 | 128,929 | 201,155 | ||||||||||||

| Non-recurring expenses | 393,965 | (1) | 1,014,846 | (2) | 1,263,427 | (3) | 493,924 | (4) | ||||||||

| Bad debts | – | – | 74,068 | 283,972 | ||||||||||||

| Obsolete inventory | – | – | 527,737 | 257,111 | ||||||||||||

| Loss on foreign currency translation and transaction | (259,707 | ) | 177,791 | (106,761 | ) | 6,972 | ||||||||||

| Adjusted EBITDA | $ | 3,507,083 | $ | 3,093,940 | $ | 4,680,161 | $ | 4,205,741 | ||||||||

| (1) | Consists of acquisition expenses with customers for shelf placement of $393,965. | |

| (2) | Consists of loan fees of $1,000,000 and acquisition expenses with customers for shelf placement of $14,846. | |

| (3) | Consists of loan fees of $1,000,000 and related financing costs of $61,000, leasehold renovations of $174,215 and acquisition expenses with customers for shelf placement of $28,212. | |

| (4) | Consists of acquisition expenses with customers for shelf placement of $261,801, customer return of $215,189 and inventory write off of $16,934. |

EBITDA and Adjusted EBITDA are considered non-GAAP financial measures. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA further adjusted to exclude the impact of higher-than-normal revenue change order activity and certain expenses and transactions that we believe are not representative of our core operating results; stock-based compensation; non-recurring expenses for acquisitions, such as one-time expenses with customers for shelf placement, and other fees and costs; and loss on foreign currency translation and transaction. Our definitions of EBITDA and Adjusted EBITDA might not be comparable to similarly titled measures reported by other companies.

June 30, 2021 | December 31, 2020 | December 31, 2019 | ||||||||||

| (Unaudited) | ||||||||||||

| Balance sheet data: | ||||||||||||

| Current assets | $ | 15,921,408 | $ | 12,587,089 | $ | 5,047,095 | ||||||

| Total assets | 15,921,408 | 12,587,089 | 5,190,629 | |||||||||

| Current liabilities | 15,717,469 | 14,739,196 | 10,147,064 | |||||||||

| Total liabilities | 17,258,150 | 16,271,192 | 10,393,980 | |||||||||

| Total stockholders’ deficit | (1,336,742 | ) | (3,684,103 | ) | (5,203,351 | ) | ||||||

| Total liabilities and stockholders’ deficit | $ | 15,921,408 | $ | 12,587,089 | $ | 5,190,629 | ||||||

| 7 |

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks and all shares.

Risks Related to investOur Business, Strategy and Industry

We operate in a highly competitive industry and our common stock.failure to compete effectively could materially and adversely affect our sales and growth prospects.

The U.S. nutritional supplements retail industry is a large and highly fragmented industry with few barriers to entry. We discuss allcompete against other specialty retailers, mass merchants, multi-level marketing organizations, mail-order and direct-to-consumer companies, and e-commerce companies. This market is highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. As certain products become more mainstream, with broader distribution, we experience increased competition for those products. Increased competition from companies that distribute through retail, e-commerce or wholesale channels could have a material risks in the risk factors.

| market share. Our |

Our business is subject to changing consumer trends and preferences, including rapid and frequent changes in a default under the September 2011 agreement. While the agreement does not specify remediesdemand for default, Mr. Bain would have all of the remedies allowable under Canadian lawproducts, new product introductions and investorsenhancements. Our failure to accurately predict these trends could expect to lose their entire investment.

| accurately anticipate consumer needs; | ||

| ● | innovate and | |

| ● | successfully commercialize new products or product enhancements in | |

| ● | price our products competitively; | |

| ● | manufacture and | |

| ● | differentiate our |

If we do not introduce new products or make enhancements to meet the changing needs of our customers in a timely manner, some of our products could be rendered obsolete, which could negatively impact our revenues, financial condition, and operating results.

We have only one officer and director. he lacks formal training in financial accounting and management; however, hedepend on a small number of large retailers for a significant portion of our sales. Our sales growth is responsible fordependent upon maintaining our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. When the disclosure and accounting controls referred to above are implemented, he will be responsible for the administration of them. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the Securities and Exchange Commission, which ultimately could cause you to lose your investment.

Certain retailers make up a significant percentage of our products’ retail volume. For the year ended December 31, 2020, our top two customers, Costco and Walmart, accounted for 47% of our net revenue. We sell products to each of Costco and Walmart under their standard vendor agreements. These vendor agreements do not include a term or duration as sales under each vendor agreement are generally made on a purchase order basis, and do not include any termination provisions. The loss of sales of any of our products in a major retailer, or the Securities Actreduction of 1934, we may have to hire additional experienced personnel to assist us withpurchasing levels or the preparation thereof. The hiringcancellation of additional experienced personnel will result in additional expenses whichany business from a major retailer, could have a material adverse effect on our business results of operations and financial condition.

| 8 |

If our outside suppliers and manufacturers fail to supply products in sufficient quantities and in a timely fashion, our business could suffer.

Contract manufacturers produce all of our directorsproducts. Our contract manufacturers acquire all of the raw materials for manufacturing our products from third-party suppliers. We also depend on outside suppliers for the packaging materials for our products. In the event we were to lose any significant suppliers or contract manufacturers and thereby influencehave trouble in finding or directtransitioning to alternative suppliers or manufacturers, it could result in product shortages or product back orders, which could harm our policies. Although investorsbusiness. There can be no assurance that suppliers will be able to provide our contract manufacturers the raw materials in this offering will have paidthe quantities and at the appropriate level of quality that we request or at a significantly higher price for their shares, they will have littlethat we are willing to pay. We are also subject to delays caused by any interruption in the production of these materials including weather, disease, crop conditions, climate change, transportation interruptions and natural disasters or other catastrophic events. Our profit margins and timely product delivery are dependent upon the ability of our suppliers and contract manufacturers to supply us with products in a timely and cost-efficient manner. Our ability to enter new markets and sustain satisfactory levels of sales in each market depends on the ability of our suppliers and contract manufacturers to provide required levels of ingredients and products and to comply with all applicable regulations. The failure of our outside suppliers or manufacturers to supply ingredients or produce our products could materially adversely affect the decisionsour business operations. We believe we have dependable suppliers for all of management.

A downturn in the United States and elsewhere have been experiencing extreme volatility and disruption for more than 12 months, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. In 2009, this volatility and disruption has reached unprecedented levels. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding mineral prices, the costs of operations, the cost of capital and commodity markets. While the ultimate outcome and impact of the current economic conditions cannot be predicted, a lower level of economic activity might result in a decline in energy consumption, which may adversely affect the price and market for diamonds, liquidity and future growth. Instability in the financial markets,economy, including as a result of recession or otherwise, also mayCOVID-19, could affect the costconsumer purchases of capital and our ability to raise capital.

We offer a buyerbroad selection of health and negotiate your own sale. Further, resaleswellness products. A downturn in the United States may require compliance with some state securities laws. There is no assurance that such compliance can be obtained or maintained. The Company does not presently plan to file with any state securities regulators.

Adverse or negative publicity could cause our business to suffer.

Our business depends, in part, on the public’s perception of our integrity and the safety and quality of our products. Any adverse publicity could negatively affect the public’s perception about our industry, our products, or our reputation and could result in a significant decline in our operations. Specifically, we are susceptible to adverse or negative publicity regarding:

| ● | the nutritional supplements industry; | |

| ● | skeptical consumers; | |

| ● | competitors; | |

| ● | the safety and quality of our products and/or our ingredients; | |

| ● | any recalls or adverse health consequences of our competitors’ products; | |

| ● | regulatory investigations of our products or our competitors’ products; and | |

| ● | scandals or regulatory investigations regarding the business practices or products of our competitors. |

We continue to explore new strategic initiatives, but we may not be able to successfully execute on, or realize the expected benefits from, the implementation of our strategic initiatives, and our pursuit of new strategic initiatives may pose significant costs and risks.

Our strategic initiatives are focused on, among other things, new product acquisition, new customer acquisition, improving the customer experience through the roll-out of initiatives including increasing customer engagement and personalization, improving the omni-channel experience (including in stores as well as through the internet and mobile devices), providing a relevant and inspiring product assortment and improving customer loyalty and retention. We also continually evaluate acquisition opportunities that we believe fit well within our brand portfolio and create value for our stockholders. Our future operating results are dependent, in part, on our management’s success in implementing these and other strategic initiatives, and as a result could divert management’s attention from our existing business as management focuses on developing these initiatives and related operations. Also, our short-term operating results could be unfavorably impacted by the opportunity and financial costs associated with the implementation of our strategic plans or the completion of any acquisitions, and we might not realize the benefits from such strategies. In addition, we may not be successful in achieving the intended objectives of the strategic initiatives (including acquisitions) in a timely manner or at all. We may choose to fund any acquisitions by way of (i) debt, which would subject us to additional covenant obligations and liquidity constraints, (ii) cash, which could divert working capital away from our existing business, or (iii) equity, which would result in dilution for existing stockholders, or any combination of the foregoing. There can also be no guarantee that we will be able to obtain debt on favorable terms, or at all.

As has been the case with our historical acquisition transactions, future business combinations could involve the acquisition of significant tangible and intangible assets, which could require us to record ongoing amortization expense with respect to identified intangible assets acquired. In addition, we may need to record write-downs from future impairments of identified tangible and intangible assets and goodwill. These and other similar accounting charges would reduce any future earnings or increase any losses. In future acquisitions, we could also incur debt to pay for acquisitions or issue additional equity securities as consideration, either of which could cause our stockholders to suffer significant dilution. Additionally, our ability to utilize net operating loss carryforwards, if any, acquired in any acquisitions may be significantly limited or unusable by us under “Risk Factors”Section 382 or other sections of the Internal Revenue Code (as has been the case with our net operating loss carryforwards attributable to the acquisition of Breakthrough Products, Inc.).

The nutritional supplement industry increasingly relies on intellectual property rights and matters described in this Prospectus generally. In lightalthough we seek to ensure that we do not infringe the intellectual property rights of these risks and uncertainties,others, there can be no assurance that the forward-looking statements containedthird parties will not assert intellectual property infringement claims against us, which claims may result in this Prospectus will in fact occur.

Recently it has become more and more common for suppliers and competitors to apply for patents or develop proprietary technologies and processes. We seek to ensure that we will be able to keep up with industry techniques and standards, that there will be no material adverse competitive or technological change in conditions in our business, that demand for our products will significantly increase, that our sole officer will remain employed as such, that our forecasts accurately anticipate market demand, and that there will be no material adverse change in our operations or business or in governmental regulations affecting us or our manufacturers and/or suppliers. The foregoing assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, alldo not infringe the intellectual property rights of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and thereforeothers, but there can be no assurance that the results contemplated in forward-looking statementsthird parties will be realized. In addition, as disclosed elsewherenot assert intellectual property infringement claims against us. These developments could prevent us from offering or supplying competitive products or ingredients in the “Risk Factors” sectionmarketplace. They could also result in litigation or threatened litigation against us related to alleged or actual infringement of this prospectus, therethird-party rights. If an infringement claim is asserted or litigation is pursued, we may be required to obtain a license of rights, pay royalties on a retrospective or prospective basis or terminate our manufacturing and marketing of our products that are a numberalleged to have infringed. Litigation with respect to such matters could result in substantial costs and diversion of other risks inherent in our business and operations which could cause our operating results to vary markedly and adversely from prior results or the results contemplated by the forward-looking statements. Growth in absolute and relative amounts of cost of goods sold and selling, general and administrative expenses or the occurrence of extraordinary events could cause actual results to vary materially from the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investmentmanagement and other expenditures, which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking information included in this prospectus, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

We have numerous United States and foreign trademarks and service marks. There can be no assurance that the protection afforded by these trademarks and service marks will provide us with a competitive advantage or that we will be able to assert our intellectual property rights in infringement actions. We may be required to defend our intellectual property against such infringement, which could result in substantial costs and diversion of management and other resources. In addition, results of such litigation are difficult to predict and if we are not successful in defending our intellectual property rights, this could have a material adverse effect on our business, financial condition and results of operations.

If we are not able to adequately prevent disclosure of proprietary knowledge, the value of our products could be materially diminished.

Trade secrets are difficult to protect. We rely on trade secrets to protect our proprietary knowledge, especially where we do not believe patent protection is appropriate or obtainable, or where such patents would be difficult to enforce. We rely in part on confidentiality agreements to protect our trade secrets and other proprietary knowledge. We cannot guarantee that we have entered into such agreements with each party that may have had access to our proprietary knowledge, or that such agreements, even if in place, will not be circumvented. These agreements may not effectively prevent disclosure of proprietary knowledge and may not provide an adequate remedy in the event of unauthorized disclosure of such information. In addition, others may independently discover our trade secrets and proprietary knowledge, in which case we may have no right to prevent them from using such trade secrets or proprietary knowledge to compete with us. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could materially adversely affect our business, financial condition and results of operations.

International expansion will subject our business to additional economic and operational risks that could increase our costs and make it difficult to operate profitably.

One of our key growth strategies is to pursue international expansion. Expansion of our international operations may require significant expenditure of financial and management resources and result in increased administrative and compliance costs. As a result of such expansion, we will be increasingly subject to the risks inherent in conducting business internationally, including:

| ● | foreign currency fluctuations, which could result in reduced revenues and increased operating expenses; | |

| ● | longer or less predictable payment and sales cycles; | |

| ● | difficulty in collecting accounts receivable; | |

| ● | applicable foreign tax structures, including tax rates that may be higher than tax rates in the United States or taxes that may be duplicative of those imposed in the United States; | |

| ● | tariffs and trade barriers; | |

| ● | general economic and political conditions in each country; | |

| ● | inadequate intellectual property protection in foreign countries; | |

| ● | uncertainty regarding liability for information retrieved and replicated in foreign countries; | |

| ● | the difficulties and increased expenses of complying with a variety of foreign laws, regulations and trade standards; and | |

| ● | unexpected changes in regulatory requirements. |

As a result of these risks, we may be required to incur higher than expected costs to implement or we may not be able to achieve the expected benefits of our international strategy. If we are unsuccessful in this international expansion, we would be required to reevaluate our growth strategy, and we may have incurred substantial expenses and devoted significant management time and resources in pursuing international growth.

We may experience product recalls, withdrawals or seizures, which could materially and adversely affect our business, financial condition and results of operations.

We may be subject to product recalls, withdrawals or seizures if any of the products we sell are believed to cause injury or illness or if we are alleged to have violated governmental regulations in the manufacturing, labeling, promotion, sale or distribution of those products. A significant recall, withdrawal or seizure of any of the products we manufacture or sell may require significant management attention, would likely result in substantial and unexpected costs and may materially and adversely affect our business, financial condition or results of operations. Furthermore, a recall, withdrawal or seizure of any of our products may adversely affect consumer confidence in our brands and thus decrease consumer demand for our products. As is common in the nutritional supplements industry, we rely on our contract manufacturers and suppliers to ensure that the products they manufacture and sell to us comply with all applicable regulatory and legislative requirements. In general, we seek representations and warranties, indemnification and/or insurance from our contract manufacturers and suppliers. However, even with adequate insurance and indemnification, any claims of non-compliance could significantly damage our reputation and consumer confidence in our products. In addition, the failure of those products to comply with applicable regulatory and legislative requirements could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operations.

Increases in the price or shortages of supply of key raw materials could materially and adversely affect our business, financial condition and results of operations.

Our products are composed of certain key raw materials. If the prices of these raw materials were to increase significantly, it could result in a significant increase to us in the prices charged to us. Raw material prices may increase in the future and we may not be able to pass on those increases to customers who purchase our products. A significant increase in the price of raw materials that cannot be passed on to customers could have a material adverse effect on our business, financial condition and results of operations.

We are subject to credit risk.

We are exposed to credit risk primarily on our accounts receivable. We provide credit to our customers in the ordinary course of our business and perform ongoing credit evaluations. While we believe that our exposure to concentrations of credit risk with respect to accounts receivable is mitigated by our large retail partner base, and we make allowances for doubtful accounts, we nevertheless run the risk of our customers not being able to meet their payment obligations, particularly in a future economic downturn. For instance, in 2019, payments from one of our customers were delayed, and in 2020, one of our customers entered Chapter 11 bankruptcy. If a material number of our customers were not able to meet their payment obligations, our results of operations could be harmed.

Natural disasters and unusually adverse weather conditions could cause permanent or temporary damage to our distribution centers, impair our ability to purchase, receive or replenish inventory or cause customer traffic to decline, all of which could result in lost sales and otherwise materially and adversely affect our results of operations.

The occurrence of one or more natural disasters, such as hurricanes, fires, floods, earthquakes, tornadoes, high winds and other severe weather, could materially and adversely affect our operations and results of operations. To the extent these events result in the suspension of shipping by our distributors, closure of our corporate headquarters, or a significant number of the stores in which our products are sold, or to the extent they adversely affect one or more of our key suppliers, our operations and results of operations could be materially and adversely affected through an inability to make deliveries to stores and through lost sales. In addition, these events could result in increases in fuel (or other energy) prices or a fuel shortage, the temporary lack of an adequate work force in a market, the temporary or long-term disruption in the supply of products from suppliers, delay in the delivery of goods to our distribution centers or stores, the temporary reduction in the availability of products in our stores and disruption to our information systems, as noted above. These events also could have indirect consequences, such as increases in the cost of insurance, if they were to result in significant loss of property or other insurable damage.

Our e-commerce business is dependent on certain third parties. Changes in business practices or terms by such third parties could have a material adverse effect on our results of operations.

Our e-commerce business has several third-party relationships that contribute to our ability to generate revenue from a variety of online sources. These relationships may be dependent upon third-party tools, such as search engines, established business terms negotiated by us, or utilization of third-party marketplaces. If the economics of these relationships or the use of the third-party tools used to drive revenue change materially, this could affect our decision to maintain these relationships, and could result in lost sales and otherwise materially and adversely affect our financial performance.

If we do not successfully develop and maintain a relevant omni-channel experience for our customers, our business and results of operations could be materially and adversely affected.

Omni-channel retailing is rapidly evolving, and we must keep pace with changing customer expectations and new developments by our competitors. Our customers are increasingly using computers, tablets, mobile phones, and other devices to shop online. As part of our omni-channel strategy, we have made and will continue to make technology investments to expand our online distribution. If we are unable to make, improve, or develop relevant customer-facing technology in a timely manner, our ability to compete and our business and results of operations could be materially and adversely affected. In addition, if our e-commerce businesses or our other customer-facing technology systems do not function as designed, we may experience a loss of customer confidence, lost sales, or data security breaches, any of which could materially and adversely affect our business and results of operations.

Our principal stockholders have the ability to significantly influence or control matters requiring a stockholder vote and other stockholders may not have the ability to influence corporate transactions.

Currently, our principal stockholders beneficially own approximately 77% of our outstanding common stock, and following this offering, assuming the number of shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same, will beneficially own approximately % of our outstanding common stock. As a result, they have the ability to determine the outcome on all matters requiring approval of our stockholders, including the election of directors and approval of significant corporate transactions.

We are highly dependent on our management team, and the loss of our senior executive officers or other key employees could harm our ability to implement our strategies, impair our relationships with customers and adversely affect our business, results of operations and growth prospects.

Our success depends, in large degree, on the skills of our management team and our ability to retain, recruit and motivate key officers and employees. Our active senior executive leadership team, including Jack Ross, Brendan Horning and Alfred Baumeler, have significant experience, and their knowledge and relationships would be difficult to replace. Leadership changes will occur from time to time, and we cannot predict whether significant resignations will occur or whether we will be able to recruit additional qualified personnel. Competition for senior executives and skilled personnel in our industry is intense, which means the cost of hiring, paying incentives and retaining skilled personnel may continue to increase.

We need to continue to attract and retain key personnel and to recruit qualified individuals to succeed existing key personnel to ensure the continued growth and successful operation of our business. In addition, we must attract and retain qualified personnel to continue to grow our business, and competition for such personnel can be intense. Our ability to effectively compete for senior executives and other qualified personnel by offering competitive compensation and benefit arrangements may be restricted by cash flow and other operational restraints. The loss of the services of any senior executive or other key personnel, or the inability to recruit and retain qualified personnel in the future, could have a material adverse effect on our business, financial condition or results of operations. In addition, to attract and retain personnel with appropriate skills and knowledge to support our business, we may offer a variety of benefits, which could reduce our earnings or have a material adverse effect on our business, financial condition or results of operations.

System security risks, data protection breaches, cyber-attacks and systems integration issues could disrupt our internal operations.

Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of third parties, create system disruptions or cause shutdowns. Computer programmers and hackers also may be able to develop and deploy viruses, worms, and other malicious software programs that attack or otherwise exploit any security vulnerabilities of the products that we may sell in the future. Such disruptions could adversely impact our ability to fulfill orders and interrupt other processes. Delayed sales, lower profits, or lost customers resulting from these disruptions could adversely affect our financial results, stock price and reputation.

Legal and Regulatory Risks

Our products are subject to government regulation, both in the United States and abroad, which could increase our costs significantly and limit or prevent the sale of our products.