PROSPECTUS

WESTERN CAPITAL RESOURCES, INC.

Subscription Rights to Purchase up to Shares

of Common Stock

As filed with the Securities and Exchange Commission on November 24, 2008

Registration No. 333-150914

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER

WESTERN CAPITAL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Minnesota | 47-0848102 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

11550 “I” Street, Suite 150 Omaha, Nebraska 68137 Telephone: (402) 551-8888 (Address, including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices) | |

John Quandahl Chief Executive Officer 11550 “I” Street, Suite 150 Omaha, Nebraska 68137 Telephone: (402) 551-8888 (Name, Address, Including Zip Code, and Telephone Number, | Copy to: Paul D. Chestovich, Esq. Maslon Edelman Borman & Brand, LLP 3300 Wells Fargo Center 90 South Seventh Street Minneapolis, Minnesota 55402 Telephone: (612) 672-8305 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date ofIf any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.xþ

If this Formform is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Formform is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Formform is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “Large“large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (CheckAct (check one):

| Large accelerated filero | Accelerated filero | ||

| Non-accelerated filero (Do not check if a smaller reporting company) | Smaller reporting companyþ |

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Title of each class of securities to be registered | Amount to be registered (1) | Proposed maximum offering price per share | Proposed maximum aggregate offering price | Amount of registration fee (4) | |||||||||

| Common stock, no par value | 3,192,859 shares | $ | 4.80 | (2) | $ | 15,325,723 | (2) | $ | 602.30 | ||||

| Common stock, no par value (3) | 400,000 shares | $ | 0.01 | (3) | $ | 4,000 | (3) | $ | 0.02 | ||||

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (1) |

| Rights to purchase common stock | — | — | — | — (2) |

| Common stock, no par value per share | $4,500,000 (3) | $515.70 (4) |

_____________

| (1) |

| (2) | The rights are being issued to our shareholders pro rata for no consideration. Pursuant to Rule |

| (3) |

| (4) | Registration calculated pursuant to Rule |

The registrantRegistrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the registrantRegistrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statementthe Registration Statement shall become effective on such date as the Commission, acting pursuant to suchsaid Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is prohibited.

SUBJECT TO COMPLETION, DATED NOVEMBER 24, 2008

PROSPECTUS

WESTERN CAPITAL RESOURCES, INC.

Subscription Rights to Purchase up to Shares

of Common Stock

We are distributing, at no charge, to holders of this prospectus are offering onour capital stock non-transferable subscription rights (consisting of a resale basis a total of 3,592,859basic subscription privilege and an over-subscription privilege, as described below) to purchase up to shares of our common stock. OurWe refer to this offering as the “rights offering.” In this rights offering, you will receive subscription rights for every share of capital stock owned at 5:00 p.m., Minneapolis time, on , 2012, the record date.

Each whole subscription right will entitle you to purchase one share of our common stock at a subscription price of $ per share, which we refer to as the “basic subscription privilege.” A special committee of our Board of Directors determined the per-share subscription price for the rights offering. We will not issue fractional shares of common stock in the rights offering, and holders will only be entitled to purchase a whole number of shares of common stock, rounded to the nearest whole number a holder would otherwise be entitled to purchase (with halves rounded down). If you fully exercise your basic subscription privilege and other shareholders do not fully exercise their basic subscription privileges, then you may also exercise an “over-subscription privilege” to purchase additional shares of common stock that remain unsubscribed at the expiration of this rights offering. If all subscription rights are exercised, the aggregate gross purchase price of the shares purchased in the rights offering would be approximately $4,500,000.

The subscription rights will expire and be void and worthless if they are not exercised by 5:00 p.m., Minneapolis time, on , 2012, unless we extend the rights offering period. Nevertheless, our Board of Directors reserves the right to cancel the rights offering at any time, for any reason. If the rights offering is presently listed for tradingcancelled, all subscription payments received by the subscription agent will be returned promptly without interest or deduction.

Shares of our common stock are, and we expect that the shares of common stock issued in the rights offering will be, traded on the Over-the-Counter (“OTC”) Bulletin BoardOTCBB quotation system under the symbol “WCRS.OB.“WCRS.” The last reported sales price of our common stock on the OTCBB on June 13, 2012 was $0.10. We urge you to obtain a current market price for the shares of our common stock before making any determination with respect to the exercise of your subscription rights.

You should carefully consider whether to exercise your subscription rights before the expiration of the rights offering. Any exercise of subscription rights is irrevocable. Our Board of Directors is making no recommendation regarding your exercise of the subscription rights. This is not an underwritten offering. The shares of common stock are being offered directly by this prospectus can be sold at prevailing marketus without the services of an underwriter or privately negotiated prices. We will not receive any proceeds fromselling agent.

Exercising the sale of these shares by the selling shareholders.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined ifpassed on the adequacy or accuracy of this prospectus is truthful or complete.prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

| Page | |

| ABOUT THIS PROSPECTUS | ii |

| INDUSTRY AND MARKET DATA | ii |

| QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING | 1 |

| PROSPECTUS SUMMARY | |

| RISK RELATING TO FORWARD-LOOKING STATEMENTS | 12 |

| RISK FACTORS | |

| DILUTION | 23 |

| CAPITALIZATION | 24 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF | |

| 25 | |

| MANAGEMENT | |

| EXECUTIVE COMPENSATION | |

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 65 |

| MARKET INFORMATION | 67 |

| DESCRIPTION OF SECURITIES | 67 |

| PLAN OF DISTRIBUTION | 70 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| 71 | |

| EXPERTS | 71 |

| FINANCIAL INFORMATION | F-1 |

| i |

ABOUT THIS PROSPECTUS

Unless otherwise stated or the context otherwise requires, the terms “we,” “us,” “our,” “Western Capital” and the “Company” refer to Western Capital Resources, Inc. and its subsidiaries.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional or different information. TheIf anyone provides you with additional, different, or inconsistent information, you should not rely on it. We are not making an offer to sell securities in any jurisdiction in which the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus regardless of the time of delivery of this prospectus or any exercise of any sale of our common stock.the rights. Our business, financial condition, results of operations, and prospects may have changed since that date. If there is a material change in the dateaffairs of our Company, we will amend or supplement this prospectus.

No information contained herein, nor in any prior, contemporaneous or subsequent communication should be construed by a prospective investor as legal or tax advice. Each prospective investor should consult its, his or her own legal, tax and financial advisors to ascertain the merits and risks of the transactions described herein prior to exercising your subscription rights. This written communication is not intended to be issued as a “reliance opinion” or a “marketed opinion,” as defined under Section 10.35 of Circular 230 published by the U.S. Treasury Department, so as to avoid any penalties that could be assessed under the Internal Revenue Code of 1986, as amended (the “Code”), or its applicable Treasury Regulations. Accordingly, (a) any information contained in this written communication is not intended to be used, and cannot be used or relied upon for purposes of avoiding any penalties that may be imposed on a prospective investor by the Code or applicable Treasury Regulations; (b) this written communication has been written to support the promotion or marketing of the transactions or matters addressed by this written communication; and (c) each prospective investor should seek advice based on the prospective investor’s particular circumstances from an independent tax advisor.

INDUSTRY AND MARKET DATA

The industry, market and data used throughout this prospectus have been obtained from our own research, surveys or studies conducted by third parties and industry or general publications. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. We believe that each of these studies and publications is reliable.

| ii |

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

The following are what we anticipate will be common questions about the rights offering. The answers are based on selected information from this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the rights offering. This prospectus contains more detailed descriptions of the terms and conditions of the rights offering and provides additional information about us and our business, including potential risks related to the rights offering, our common stock, and our business.

Exercising you subscription rights and investing in our common stock involves a high degree of risk. We urge you to carefully read the section entitled “Risk Factors” beginning on page 13 of this prospectus. Our sellingprospectus, and all other information included in this prospectus in its entirety before you decide whether to exercise your subscription rights.

What is a rights offering?

A rights offering is a distribution of subscription rights on a pro rata basis to all shareholders of a company. We are making offersdistributing to sellholders of our capital stock as of 5:00 p.m., Minneapolis time, on , 2012, the “record date,” at no charge, non-transferable subscription rights to purchase shares of our common stock. You will receive subscription rights (rounded to the nearest whole subscription right, with halves rounded down) for every share of our capital stock you owned as of 5:00 p.m., Minneapolis time, on the record date. The subscription rights will be evidenced by rights certificates. Each subscription right consists of a basic subscription privilege and seeking offersan over-subscription privilege.

What is the basic subscription privilege?

Each whole subscription right gives our shareholders the opportunity to buypurchase one share of our common stock for $ per share. We determined the ratio of subscription rights to distribute per our outstanding shares by dividing $4.5 million by the subscription price of $ to determine the number of shares to be issued in the rights offering and then dividing that number of shares to be offered by the number of capital shares outstanding on the record date.

What is the over-subscription privilege?

We do not expect all of our shareholders to exercise all of their basic subscription privileges. The over-subscription privilege provides shareholder that do exercise their entire basic subscription privileges the opportunity to purchase the shares that are not purchased by other shareholders who do not participate in the rights offering. If you fully exercise your basic subscription privilege and other shareholders do not fully exercise their basic subscription privileges, then you may also exercise an over-subscription privilege to purchase additional shares of common stock that remain unsubscribed at the expiration of the rights offering, subject to the availability and pro rata allocation of such shares among persons exercising this over-subscription privilege. To the extent that the number of the unsubscribed shares are not sufficient to satisfy all of the properly exercised over-subscription privilege requests, then the available shares will be prorated among those who properly exercise their over-subscription privileges based on the number of shares each shareholder subscribed for under his, her or its basic subscription privilege (i.e., pro rata in accordance with each such shareholder’s respective shareholdings. If this pro rata allocation results in any shareholder potentially receiving a greater number of common shares than the he, she or it subscribed for pursuant to the exercise of his, her or its over-subscription privilege, then such shareholder will be allocated only that number of shares for which the shareholder subscribed, and the remaining common shares will again be allocated among all other shareholders exercising the over-subscription privilege on the same pro rata basis described above. This proration process will be repeated until all common shares have been allocated or all exercises of over-subscription privileges have been fulfilled, whichever occurs earlier.

In order to properly exercise your over-subscription privilege, you must deliver the subscription payment related to your over-subscription privilege prior to the expiration of the rights offering. Because we will not know the total number of unsubscribed shares prior to the expiration of the rights offering, if you wish to maximize the number of shares you purchase pursuant to your over-subscription privilege, you will need to deliver payment in an amount equal to the aggregate subscription price for the maximum number of shares of our common stock only in jurisdictions where offers and sales are permitted. You should not consider this prospectusavailable to be an offer to sell, or a solicitation of an offer to buy,you, assuming that no shareholder other than you has purchased any shares of our common stock if the person making the offer or solicitation is not qualified to do so or if it is unlawful for you to receive the offer or solicitation.

| 1 |

How many shares may I purchase if I exercise my subscription rights?

Each subscription right entitles you to purchase one whole share of capital distribution of $278,845 in connection with the Merger. In the aggregate, WERCS received beneficial ownership of 11,125,000our common stock for $ per share. We will not issue fractional subscription rights or shares of common stock in the Merger, representing approximately 63.3%rights offering, and holders will only be entitled to purchase a whole number of shares of common stock. You may exercise any number of your subscription rights (including the over-subscription privilege), or you may choose not to exercise any subscription rights. As explained elsewhere in this prospectus, there is no limit on the number of offered shares that may be purchased pursuant to your over-subscription privilege.

If you hold your shares in street name through a broker, bank, or other nominee who uses the services of the Depository Trust Company, or “DTC,” then DTC will issue subscription rights to your nominee for every share of our common stock immediately afteryou own at the Merger. As noted directly above,close of business on the Series A Convertible Preferred Stock converts into sharesrecord date. Each subscription right can then be used to purchase one share of common stock on a one-for-one basis subjectfor $ per share pursuant to certain adjustments set forththe basic subscription privilege. For more information, see the question “What should I do if I want to participate in the applicable certificaterights offering, but my shares are held in the name of designation (which is filedmy broker, dealer, custodian bank or other nominees (commonly referred to as Exhibit 3.4 to the registration statement of which this prospectus is a part). The holders of Series A Convertible Preferred Stock also have“street name”)?” below.

Will fractional subscription rights or shares be issued in the rights offering?

No. We will not issue fractional subscription rights or subscription rights to vote their preferred stock on an as-if-converted basis together with the holders of common stock, and are entitled to cumulative dividends on the stated value of their shares at the annual rate of ten percent, calculated on the basis of a 360-day year. Accrued and unpaid dividends compound on a quarterly basis, and are payable in cash (subject to the option of the holder to receivepurchase fractional shares of common stock in lieu of cash).

Are there any limits on the number of shares I may purchase in this rights offering?

Yes. The total number of Series offered shares in this rights offering represents the maximum number of shares you may potentially purchase. In all cases, you are entitled (but not required) to purchase all shares available to you under your basic subscription privilege. Shares in excess of those available to you under your basic subscription privilege must be purchased pursuant to your over-subscription privilege. As explained elsewhere in this prospectus, other shareholders may also exercise their over-subscription privilege. If this occurs, the number of shares available for purchase by you will be reduced accordingly.

Am I required to exercise the subscription rights I receive in the rights offering?

No. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. However, if you choose not to exercise your subscription rights in full, the relative percentage of our shares of common stock that you own will decrease, and your voting and other rights will be diluted. Furthermore, if you fail to exercise your full basic subscription privilege, you will not be eligible to exercise your over-subscription privilege. For more information, see the question “How many shares of capital stock will be outstanding after the rights offering?” below.

Will our officers, directors and significant shareholders be exercising their subscription rights?

Our officers, directors and greater than 5% beneficial shareholders may participate in this offering at the same subscription price per share as all other purchasers, but none of our officers, directors or greater-than-5% beneficial shareholders are obligated to so participate. Certain executive officers and directors (who are also shareholders), and our controlling shareholder, WCR, LLC, have indicated that they will purchase shares that are subject to their subscription rights, at the same subscription price offered to our shareholders. Nevertheless, these shareholders have not executed agreements to purchase shares and there is no guarantee or commitment that they will subscribe for shares in the offering. In the case of our directors, officers and WCR, any shares purchased in the rights offering will be deemed “control securities” under federal securities rules and will likely not be eligible for public resale unless sold in accordance with the limitations of Rule 144 or the public resale of such shares are registered with the SEC.

| 2 |

Has our Board of Directors made a recommendation to our shareholders regarding the exercise of rights under the rights offering?

No. Our Board of Directors is making no recommendation regarding your exercise of the subscription rights. Shareholders who exercise their subscription rights risk loss on their investment. We cannot assure you that the market price of our common stock will be above the subscription price or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to make your decision based on your own assessment of our business and the rights offering. Please see the “Risk Factors” section of this prospectus for a discussion of some of the risks involved in investing in our common stock.

Why are we conducting a rights offering?

A Convertible Preferred Stock wouldrights offering provides eligible shareholders the opportunity to participate in a capital raise on a pro rata basis and minimizes the dilution of their ownership interest in our Company. Assuming all the shares of common stock offered are sold, we expect that the gross proceeds from the rights offering will be approximately $4.5 million. We estimate that our offering-related expenses will be approximately $100,000. We are conducting the rights offering to raise capital for the Company to be used in making acquisitions that grow or are otherwise complementary to our current business. In this regard, you should understand that our Board of Directors will have a great deal of discretion in determining what acquisition opportunities to pursue.

How was the subscription price of $ per share determined?

The subscription price was determined by a special committee of our Board of Directors. Factors considered by the committee included the strategic alternatives to our Company for raising capital, the price at which our shareholders might be willing to participate in the rights offering, historical and current trading prices of our common stock, our business prospects, the condition of the trading market for our common stock, and the condition of the securities and capital markets in general. We cannot assure you that the market price for our common stock during the rights offering will be equal to or above the subscription price or that a subscribing owner of rights will be able to sell the shares of common stock purchased in the rights offering at a price equal to or greater than the subscription price.

How soon must I act to exercise my rights?

If you received a rights certificate and elect to exercise any or all of your subscription rights, the subscription agent must receive your completed and signed rights certificate and related payment prior to the expiration of the rights offering, which is , 2012, at 5:00 p.m., Minneapolis time. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, your custodian bank, broker, dealer or other nominee may establish a deadline prior to 5:00 p.m. Minneapolis time, on , 2012, by which you must provide it with your instructions to exercise your subscription rights and pay for your shares.

Although we will make reasonable attempts to provide this prospectus to all holders of subscription rights, the rights offering and all subscription rights will expire at 5:00 p.m., Minneapolis time on , 2012 (unless extended), whether or not we have been able to locate each person entitled to receive $2.10 per preferred share, plus accrued but unpaid dividends thereon. Based solely subscription rights. Although we reserve the right to extend the expiration of the rights offering, we currently do not intend to do so.

May I transfer my subscription rights?

No. You may not sell or transfer your subscription rights to anyone.

Are we requiring a minimum aggregate subscription to complete and close the rights offering?

No. There is no minimum subscription requirement in the rights offering. Nevertheless, our Board of Directors reserves the right to cancel the rights offering for any reason or no reason, including if our board believes that there is insufficient participation by our shareholders.

Are there any conditions to completing the rights offering?

No.

| 3 |

Can the Board of Directors cancel, terminate, amend or extend the rights offering?

Yes. We have the option to extend the rights offering and the period for exercising your subscription rights, although we do not presently intend to do so. Our Board of Directors may cancel the rights offering at any time for any reason. If the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty. Our Board of Directors reserves the right to amend or modify the terms of the rights offering at any time, for any reason.

When will I receive my subscription rights certificate?

Promptly after the date of this prospectus, the subscription agent will send a subscription rights certificate to each registered holder of our common stock as of the close of business on the stated value,record date, based on our shareholder register maintained by the transfer agent for our common stock (and the shareholder register maintained by the Company for our preferred stock). If you hold your shares of common stock through a brokerage account, bank, or other nominee, you will not receive an actual subscription rights certificate. Instead, as described in this prospectus, you must instruct your broker, bank or nominee whether or not to exercise rights on your behalf. If you wish to obtain a separate subscription rights certificate, you should promptly contact your broker, bank or other nominee and request a separate subscription rights certificate. If you hold your shares of common stock through a brokerage account, bank, or other nominee, it is not necessary to have a physical subscription rights certificate in order to exercise your subscription rights.

What will happen if I choose not to exercise my subscription rights?

If you do not exercise any subscription rights, the number of our shares of common stock you own will not change. Nevertheless, due to the fact that other shareholders may purchase shares in the rights offering, your percentage ownership of our Company will be diluted after the completion of the rights offering unless you do exercise your subscription rights. For more information, see the question “How many shares of capital stock will be outstanding after the rights offering?” below.

How do I exercise my subscription rights?

If you wish to participate in the rights offering, you must take the following steps:

| · | deliver payment to the subscription agent; and |

| · | deliver your properly completed and signed rights certificate, and any other subscription documents, to the subscription agent. |

Please follow the payment and delivery instructions accompanying the rights certificate. Do not deliver documents to Western Capital. You are solely responsible for completing delivery to the subscription agent of your subscription documents, rights certificate, and related payment on or prior to the deadline for receipt of such items. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent so that they are received by the subscription agent by 5:00 p.m., Minneapolis time, on , 2012. We are not responsible for subscription materials sent directly to our offices. If you cannot deliver your rights certificate to the subscription agent prior to the expiration of the rights offering, you may follow the guaranteed delivery procedures described under the “The Rights Offering—Guaranteed Delivery Procedures” section of this prospectus.

If you send a payment that is insufficient to purchase the number of shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your subscription rights to the fullest extent possible based on the amount of the payment received, subject to the elimination of any fractional shares. Any excess subscription payments received by the subscription agent will be returned promptly, without interest or penalty, following the expiration of the rights offering.

| 4 |

What should I do if I want to participate in the rights offering but my shares are held in the name of my broker, dealer, custodian bank or other nominee (commonly referred to as “street name”)?

If you hold your shares of common stock in the name of a broker, dealer, custodian bank or other nominee, then your broker, dealer, custodian bank or other nominee is the record holder of the shares you own. Consequently, you will not receive a rights certificate. Instead, the record holder (i.e., your broker, dealer, custodian bank or other nominee) must exercise the subscription rights on your behalf for the shares of common stock you wish to purchase.

If you hold your shares of our common stock in the name of a broker, dealer, custodian bank or other nominee and you wish to purchase shares in the rights offering, please promptly contact your broker, dealer, custodian bank or other nominee as record holder of your shares. For our part, we will ask your record holder to notify you of the rights offering. Nevertheless, if your broker, dealer, custodian bank or other nominee does not contact you regarding the rights offering, you should promptly initiate contact with that intermediary if you wish to participate in the offering. Your broker, dealer, custodian bank or other nominee may establish a deadline prior to the 5:00 p.m. Minneapolis time on , 2012, which we have established as the expiration date of the rights offering.

When will I receive my new shares?

If you purchase shares in the rights offering by submitting a rights certificate and payment, we will mail you a share certificate as soon as practicable after the completion of the rights offering. One share certificate will be generated for each rights certificate processed. Until your share certificate is received, you may not be able to sell the shares of our common stock acquired in the rights offering. If your shares as of the record date were held by a custodian bank, broker, dealer or other nominee, and you participate in the rights offering, you will not receive share certificates for your new shares. Instead, your custodian bank, broker, dealer or other nominee will be credited with the shares of common stock you purchase in the rights offering as soon as practicable after the completion of the rights offering.

After I send in my payment and rights certificate, may I change or cancel my exercise of rights?

No. All exercises of subscription rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your subscription rights. You should not exercise your subscription rights unless you are certain that you wish to purchase additional shares of our common stock at a subscription price of $ per share.

How many shares of capital stock will be outstanding after the rights offering?

As of June 8, 2012, there were 5,397,780 shares of our common stock issued and outstanding, and 10,000,000 shares of Series A Convertible Preferred Stock issued in the Merger had an approximate aggregate value of $21 million. Based on a $1.20 per share price, the shares of URON common stock issued in the Merger had an approximate aggregate value of $1,350,000. The value of the common stock and Series A Convertible Preferred Stock issued to WERCS in the Merger had an aggregate value of approximately $22.35 million. Accordingly, and after considering the return of capital payment issued to WERCS in connection with the Merger, the total consideration issued to WERCS in the Merger aggregated approximately $22,628,845.

Are there risks in exercising my subscription rights?

Yes. The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional shares of common stock and retained for itself ownershipshould be considered as carefully as you would consider any other equity investment. Among other things, you should carefully consider the risks described in the section of approximately 51%this prospectus entitled “Risk Factors.”

If the rights offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription agent will hold all funds it receives in a segregated bank account until completion of the issuedrights offering. If the rights offering is not completed, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty. If you own shares in “street name,” it may take longer for you to receive payment because the subscription agent will return payments through the record holder of your shares (i.e., through your custodian bank, broker, dealer or other nominee).

| 5 |

Will the subscription rights be listed on a stock exchange or national market?

No.

How do I exercise my rights if I live outside the United States?

We will not mail this prospectus or the rights certificates to shareholders whose addresses are outside the United States or who have an army post office or foreign post office address. The subscription agent will instead hold rights certificates for the account of these shareholders. To exercise subscription rights, our foreign shareholders must notify the subscription agent and outstandingtimely follow other procedures described in the section of this prospectus entitled “The Rights Offering—Foreign Shareholders.”

What fees or charges apply if I purchase the shares of URON common stock. The spin-off dividend was effected on August 10, 2006stock?

We are not charging any fee or sales commission to issue subscription rights to you or to issue shares to you if you exercise your subscription rights. If, however, you exercise your subscription rights through your broker, dealer, custodian bank or other nominee, you are responsible for shareholderspaying any fees your nominee may charge you.

What are the material U.S. federal income tax consequences of exercising my subscription rights?

For U.S. federal income tax purposes, you should not recognize income or loss upon receipt or exercise of subscription rights. You should consult your tax advisor as to your particular tax consequences resulting from the rights offering. For a more detailed discussion, see the “Material U.S. Federal Income Tax Consequences” section of this prospectus.

To whom should I send my forms and payment?

If your shares are held in the name of a custodian bank, broker, dealer or other nominee, then you should send your subscription documents, rights certificate (if any), notices of guaranteed delivery, and related subscription payment to that record holder. If you are the record holder, then you should send your subscription documents, rights certificate, notices of Multibandguaranteed delivery, and subscription payment by hand delivery, first-class mail or courier service to:

Corporate Stock Transfer, Inc.

3200 Cherry Creek South Drive, Suite 430

Denver, Colorado 80209

Your payment of the subscription price must be made in United States Dollars for the full number of shares of our common stock asfor which you are subscribing, by (i) cashier’s check or (ii) certified check, in either case drawn upon a United States bank and payable to the subscription agent at the address set forth above.

You are solely responsible for completing delivery to the subscription agent of May 1, 2006. On August 11, 2006, Multiband sold its remaining approximate 51% interest in URON Inc.your subscription materials. The subscription materials must be received by the subscription agent on or prior to Lantern Advisors, LLC5:00 p.m., Minneapolis time, on , 2012. We urge you to allow sufficient time for $75,000 in cash.

Whom should I contact if I have other questions?

If you have any questions about the rights offering or wish to request another copy of a document, please contact Paul D. Chestovich of the Company

For a more complete description of the Company nor anyrights offering, see “The Rights Offering” beginning on page 57 of its predecessors have been in bankruptcy, receivership or any similar proceeding.

| 6 |

PROSPECTUS SUMMARY

This summary highlights material information contained elsewhere in this prospectus. This summary doesis not complete and may not contain all of the information that you should consider before deciding to invest in our common stock. Before making an investment decision, we urgewhether or not you toshould exercise your rights. You should read thisthe entire prospectus carefully, including the risks of investing in our common stock discussed undersection entitled “Risk Factors,”Factors” beginning on page 4

Our Common Stock

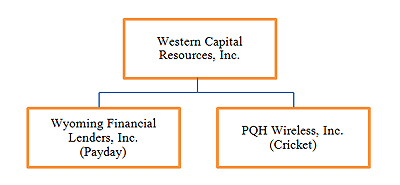

Western Capital Resources, Inc. is a Minnesota corporation that maintains two operating segments: one provides short-term consumer loans, commonly referred to as cash advance or “payday”“payday” loans, through itsand the other operates Cricket retail cellular wireless stores.

Payday operations are conducted under our wholly owned operating subsidiary Wyoming Financial Lenders.Lenders, Inc. The Federal Trade Commission describes these loans as "small, short term high rate“small, short-term high-rate loans." Because our” Our payday loans generally are offered and made in exchange for fees that, if treated as interest, are at a rate extraordinarily higher than prime and are made to individuals who do not typically qualify for prime rate loans,loans. As a consequence, our loans aremay be considered a type of subprime loan. In Wisconsin and Colorado, the Payday division provides short-term installment loans. The installment loan (assuming that the fees we charge are treated as interest). Asproduct has a rate of Decemberinterest significantly higher than traditional financial institutions. At March 31, 2007,2012, we operated 5452 payday lending stores with locations in nine states, including Colorado, Iowa, Kansas, Montana, Nebraska, North Dakota, South Dakota, Utah, Wisconsin and Wyoming. Since that date,Our provision of payday and installment loans is typically heavily regulated by the various states in which we have acquired 14 new stores, including five stores in Arizona,operate, and closed two stores. The principal amounts of over 95% of our payday loans range from $100lending and installment loan business is extremely susceptible to $500. During fiscal 2007,the adverse effects of any changes in federal or state laws and regulations that may further restrict or flatly prohibit payday lending.

Through our payday segment, we offered payday loans ranging from $20 to $1,200, with the average amount being approximately $274.

Our second segment operates retail stores selling Cricket cellular phones and Wisconsin) do not limit the amountaccessories. Cricket phones are prepaid cellular phones that function for a period of interest we may charge or the term (length) of the loans we may offer customers, and two of these states (Utah and Wisconsin) do not limit the amount we may loan to customers. In South Dakota, we offer loans from $21 to $500, charge $20 per each whole or partial increment of $100 that we loan, and offer loan terms from one to 31 days. Fiscal 2007 revenue from South Dakota amounted to 7.19% of our total 2007 revenue. In Utah, we offer loans from $20 to $1,200, charge $20 per each whole or partial increment of $100 that we loan, and offer loan terms from one to 149 days. Fiscal 2007 revenue from Utah amounted to 5.97% of our total 2007 revenue. In Wisconsin, we offer loans from $20 to $500, charge $22 per each whole or partial increment of $100 that we loan, and offer loan terms from one to 34 days. Fiscal 2007 revenue from Wisconsin amounted to 8.26% of our total 2007 revenue.

For the fiscal year ended December 31, 2007,2011, each of our major lines of business consisted of cash advance (or payday) loans, check-cashing(i.e., our payday and guaranteed phone/installment lending, and Cricket phone services. Each such servicebusinesses) generated associated fees.revenues. In fiscal 2007,2011, we generated approximately $9.105 million in cash advance fees (representing approximately 80.3% of our total revenues), approximately $1.333 million in check-cashing fees (representing approximately 11.7% of our total revenues), and approximately $0.749 million in guaranteed phone/Cricket phone fees (representing approximately 6.6% of our total revenues). Other ancillary business activities resulted in revenues of approximately $0.16 million (representing approximately 1.4% of our total revenues). We believe that the percentage of expenses we incur in the provision of services relating to our major business lines is approximately equal to the percentage of revenues generated by such services.

| · | $10.20 million in payday lending revenues representing approximately 52.3% of our total revenues, |

| · | $4.59 million in phone and accessory sales representing approximately 23.6% of our total revenues, and |

| · | $3.74 million in Cricket related sales and service fees representing approximately 19.2% of our total revenues. |

The tabletables below summarizessummarize our financial results and condition as of March 31, 2012 and 2011 (unaudited) and as of December 31, 20072011 and 2010 (audited) and September 30, 2008 (unaudited):

| 7 |

December 31, 2007 (audited) | September 30, 2008 (unaudited) | ||||||

| Revenues | $ | 11,346,524 | $ | 9,838,302 | |||

| Net loss to common shareholders | $ | (1.82 | ) | $ | (0.10 | ) | |

| Current assets | $ | 10,142,755 | $ | 8,962,676 | |||

| Current liabilities | $ | 3,122,136 | $ | 1,967,528 | |||

| Total assets | $ | 20,916,076 | $ | 20,531,017 | |||

| Total liabilities | $ | 3,667,136 | $ | 2,902,028 | |||

| Shareholder equity | $ | 17,248,940 | $ | 17,628,989 | |||

| March 31, 2012 | March 31, 2011 | |||||||

| Revenues | $ | 7,516,770 | $ | 5,083,631 | ||||

| Net income (loss) to common shareholders | $ | 264,042 | $ | (112,631 | ) | |||

| Current assets | $ | 7,851,373 | $ | 8,418,534 | ||||

| Current liabilities | $ | 7,497,621 | $ | 7,883,414 | ||||

| Total assets | $ | 21,662,004 | $ | 22,021,776 | ||||

| Total liabilities | $ | 9,306,899 | $ | 9,623,479 | ||||

| Shareholder equity | $ | 12,355,105 | $ | 12,398,297 | ||||

| December 31, 2011 | December 31, 2010 | |||||||

| Revenues | $ | 19,487,920 | $ | 17,978,447 | ||||

| Net loss to common shareholders | $ | 664,769 | $ | 751,059 | ||||

| Current assets | $ | 8,418,534 | $ | 7,958,443 | ||||

| Current liabilities | $ | 7,883,414 | $ | 6,452,628 | ||||

| Total assets | $ | 22,021,776 | $ | 20,770,882 | ||||

| Total liabilities | $ | 9,623,479 | $ | 7,707,816 | ||||

| Shareholder equity | $ | 12,398,297 | $ | 13,063,066 | ||||

The above figures include an assumed preferred stock dividend relating to our Series A Convertible Preferred Stock in the aggregate amount of $2.1 million for fiscal 2007in 2011 and the interim period presented above. 2010.

Corporate Organization

Our fiscal 2007 revenues were $11.35 million, up from $8.72 million in fiscal 2006; butprincipal offices are located at 11550 “I” Street, Suite 150, Omaha, Nebraska 68137, and our net income for fiscal 2007 was $27,404 (prior to our assumed preferred stock dividend) compared to $1.37 million for fiscal 2006. Despite our increased revenues in fiscal 2007, net income for that period declined mainly as a result of $1.49 million in expenses relating to the Merger, and stock-based compensation expense, primarily relating to incentives issued in connection with the Merger, in the amount of $.46 million.

State | Fees | APR (%) on a 14-day $100 loan (1) | APR (%) on a 28-day $100 loan (1) | APR (%) on a 14-day $274 loan (1) | APR (%) on a 28-day $274 loan (1) | |||||||||||

| Arizona | $17.50 per $100 advanced | 455.0 | % | 227.5 | % | 498.2 | % | 249.1 | % | |||||||

| Colorado | $20 on first $300 advanced; $7.75 per $100 advanced (up to $500) | 520.0 | % | 260.0 | % | 189.8 | % | 94.9 | % | |||||||

| Iowa | $15 on first $85 advanced; 11.1111% on additional amounts (up to $445) | 433.4 | % | 216.7 | % | 341.5 | % | 170.7 | % | |||||||

| Kansas | $15 per $100 advanced | 390.0 | % | 195.0 | % | 427.0 | % | 213.5 | % | |||||||

| Montana | $20.54 per $100 advanced (maximum fee of $61.62) | 534.0 | % | 267.0 | % | 584.7 | % | 292.4 | % | |||||||

| Nebraska | $17.50 per $100 advanced | 455.0 | % | 227.5 | % | 498.2 | % | 249.1 | % | |||||||

| North Dakota | $20 per $100 advanced | 520.0 | % | 260.0 | % | 569.3 | % | 284.7 | % | |||||||

| South Dakota | $20 per $100 advanced | 520.0 | % | 260.0 | % | 569.3 | % | 284.7 | % | |||||||

| Utah | $20 per $100 advanced | 520.0 | % | 260.0 | % | 569.3 | % | 284.7 | % | |||||||

| Wisconsin | $22 per $100 advanced | 572.0 | % | 286.0 | % | 626.3 | % | 313.1 | % | |||||||

| Wyoming | $20.54 per $100 advanced (maximum fee of $192.84) | 534.0 | % | 267.0 | % | 584.7 | % | 292.4 | % | |||||||

We do not obtain security for our payday loans principally because, even assuming our customers would have potential collateral to offer as security for our loans, the small size of the each particular lending transaction does not justify the time, effort and expense of identifying potential collateral for security and obtaining a security interest in such collateral. As a consequence, our loans are unsecured and our borrowers are only personally liable to repay our cash advance loans. This means that, absent court or other legal action compelling them to repay our loans, we rely principally on the willingness and ability of our customers to repay our, cash advance loans. In many cases, the costs of attempting to collect amounts exceeds the amounts which we would seek to collect, which makes it impractical to take formal legal action against a defaulted borrower.

Our fiscal year ends December 31. Neither us nor any of our management team, which has a combined 36 years of industry experience, provides us with a competitive strength. We also believe that customer servicepredecessors have been in bankruptcy, receivership or any similar proceeding. Our corporate structure, including our principal operating subsidiaries, is critical to developing loyalty. In our industry, we believe that quality customer service means (i) assisting with the loan application process and understanding the loan terms, (ii) treating customers respectfully, and (iii) processing transactions with accuracy, efficiency and speed.

| 8 |

The Rights Offering

The following summary describes the principal terms of the rights offering, but is not intended to be complete. See the information in the section entitled “The Rights Offering” in this prospectus for a more detailed description of the terms and conditions of the rights offering.

| Securities offered | We are distributing to you, at no charge, non-transferable subscription rights for each share of our capital stock | ||

| $ per share. To be effective, any payment related to the | |||

| The basic subscription privilege component of each subscription right will entitle you to purchase one share of our common stock. | |||

| Record Date | 5:00 p.m., Minneapolis time, on , 2012. |

| Expiration Date | 5:00 p.m., Minneapolis time, on , 2012, unless we extend the rights offering period in our sole discretion. |

| Use of Proceeds | We intend to use the proceeds of the rights offering primarily to provide capital for acquisitions to grow our current business or expand into new and complementary businesses, and to provide additional liquidity for working capital and general corporate purposes. |

| Transferability of Rights | The subscription rights are not transferable. |

| 9 |

| No Board Recommendation | Our Board of Directors makes no recommendation to you about whether you should exercise any subscription rights. You are urged to make an independent investment decision about whether to exercise your rights based on your own assessment of our business and the rights offering. Please see the section of this prospectus entitled “Risk Factors” for a discussion of some of the risks involved in investing in our common stock. |

| No Revocation | Any exercise of subscription rights is irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your rights. Consequently, you should not exercise your subscription rights unless you are certain that you wish to purchase additional shares of common stock |

| No Purchase Commitments | Although our officers, directors and greater-than-5% beneficial shareholders, including our controlling shareholder, WCR, LLC, may participate in this offering at the same subscription price per share as all other purchasers, none of our officers, directors or greater-than-5% beneficial shareholders are obligated to so participate. In fact, certain officers and directors (who are also shareholders), and our controlling shareholder, WCR, LLC, have indicated that they will purchase shares that are subject to their subscription rights, at the same subscription price offered to our shareholders. Nevertheless, none of these shareholders have executed any agreements to purchase shares and there is no guarantee or enforceable commitment that they will subscribe for shares in the offering. |

| Material U.S. Federal Income Tax | |

| Considerations | For U.S. federal income tax purposes, you should not recognize income or loss upon receipt or exercise of subscription rights. Nevertheless, you should consult your own tax advisor as to your particular tax consequences resulting from the rights offering. For a detailed discussion, see “Material U.S. Federal Income Tax Considerations.” |

| Extension, Cancellation and Amendment | We have the option to extend the rights offering and the period for exercising your subscription rights, although we do not presently intend to do so. Our Board of Directors may cancel the rights offering at any time for any reason. In the event that the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty. We also reserve the right to amend or modify the terms of the rights offering. |

| Procedure for Exercising Rights | To exercise your subscription rights, you must take the following steps: |

| · | If you are a registered holder of our shares of capital stock, you may deliver payment and a properly completed rights certificate to the subscription agent before 5:00 p.m., Minneapolis time, on , 2012. Payment should be made for all shares you wish to purchase upon exercise of your basic subscription privilege and your over-subscription privilege, if any. You may deliver the documents and payments by hand, mail or commercial carrier. If regular mail is used for this purpose, we recommend using registered mail, properly insured, with return-receipt requested. |

| 10 |

| · | If you are a beneficial owner of shares that are registered in the name of a broker, dealer, custodian bank or other nominee, or if you would rather an institution conduct the transaction on your behalf, you should instruct your broker, dealer, custodian bank or other nominee or to exercise your subscription rights on your behalf and deliver all documents and payments (including payment for the exercise of your over-subscription privilege, if any) before 5:00 p.m., Minneapolis time, on , 2012. |

| · | If you cannot deliver your rights certificate to the subscription agent prior to the expiration of the rights offering, you may follow the guaranteed delivery procedures described under “The Rights Offering—Guaranteed Delivery Procedures.” |

| Subscription Agent | Corporate Stock & Transfer, Inc. |

| Capital Shares Outstanding | |

| Before Rights Offering | 5,397,780 common shares, and 10 million shares of Series A Convertible Preferred Stock, as of June 13, 2012. |

| Capital Shares Outstanding | |

| After Rights Offering | Assuming no outstanding options or other convertible securities for our common shares are exercised prior to the |

| Fees and Expenses | We will pay the fees and expenses relating to the rights offering. |

| Trading Symbol | Shares of our common stock are, and we expect that the shares of common stock to be issued in the rights offering will be, traded on the over-the-counter Bulletin Board (OCTBB) under the symbol “WCRS.” |

| �� | |

| Risk Factors | Shareholders considering exercising their subscription rights should carefully consider the risk factors described in the section of this prospectus |

| Questions | Questions regarding the rights offering should be directed to Maslon Edelman Borman & Brand, LLP, Attn: Paul Chestovich at (612) 672-8305. |

| 11 |

RISK RELATING TO FORWARD-LOOKING STATEMENTS

Certain Relationships and Transactions.”

| · | changes in federal, state and local laws and regulations governing lending practices, or in the interpretation of such laws and regulations; |

| · | potential litigation and regulatory actions directed toward our industry in general; |

| · | our potential need for additional financing in the future; |

| · | our concentration of revenues in certain states where laws or regulations may change; |

| · | our historic and current reliance on debt financing, and any potential default under borrowing arrangements; |

| · | our capital structure, and any attempt by our preferred shareholders to strictly enforce the rights and privileges of their preferred stock relating to dividends and other matters; |

| · | the ultimate control of our management and our Board of Directors by our controlling shareholder, WCR, LLC; |

| · | any failure to maintain effective internal controls effective at detecting and preventing fraud; |

| · | our reliance on information management systems and exposure to cyber incidents; |

| · | unpredictability in financing markets that could affect our ability finance or grow our business; |

| · | disruptions in the availability of information systems we use to operate and manage our businesses; |

| · | competition in the markets in which we operate; |

| · | our reliance on certain key personnel in the management of our businesses; |

| · | our relative lack of product and business diversification; |

| · | general economic conditions and outlook; |

| · | any failure by us to accurately forecast loan losses; |

| · | theft, including employee theft; |

| · | employee and management turnover; |

| · | the fact that goodwill and other intangible assets represent approximately 58% of our total asset value; and |

| · | the fact that our common stock is presently thinly traded in an illiquid market. |

Some of the warrant pursuant to Lantern Advisers’ piggyback registration rights.

We base the forward-looking statements we use or include in this prospectus a total of 559,524 shareson current expectations and projections about future events and the information currently available to us. Although we believe that the assumptions for these forward-looking statements are beneficially held, directly or indirectly, by our officers, directors or employees. In particular, Mr. Mark Houlton, a directorreasonable, any of the Company, is offering 416,667 shares underassumptions could prove to be inaccurate. Consequently, no representation or warranty can be given that the estimates, opinions, or assumptions made in or referenced by this prospectus (all of which he acquired on December 31, 2007 at $1.20 per share) and Mr. David Stueve, an employee ofwill prove to be accurate. We caution you that the Company, beneficially owns the shares held by 21st Century Investment Company, which is offering 142,857 shares underforward-looking statements in this prospectus (all of which he acquired on February 26, 2008are only estimates and predictions. Actual results could differ materially from those anticipated in the National Cash & Credit acquisition, valued at $1.20 per share).

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to certain issuers, including issuers that do not have their equity traded on a recognized national exchange or the Nasdaq Capital Market. Our common stock does not trade on any recognized national exchange or the Nasdaq Capital Market. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

| 12 |

RISK FACTORS

Investing in our common stocksecurities involves a very high degree of risk and should be regarded as speculative. As a result, you should only consider purchasing common shares if you can reasonably afford to lose your entire investment.

Risks Related to the Rights Offering

The price of our common stock is volatile and may decline before or after the subscription rights expire.

The market price of our common stock is subject to fluctuations in response to numerous factors, including factors that have little or nothing to do with us or our performance, and these fluctuations could materially reduce our stock price. These factors include, among other things:

| · | governmental legislation or regulation; |

| · | business conditions in our markets and the general state of the securities markets and the market for similar stocks; |

| · | changes in capital markets that affect the perceived availability of capital to companies in our industry; |

| · | general economic and market conditions, such as recessions; |

| · | actual or anticipated variations in our operating results and cash flow; and |

| · | the number of shares of our common stock outstanding or issuable. |

In addition, the stock market historically has experienced significant price and volume fluctuations. These fluctuations are often unrelated to the operating performance of particular companies. These broad market fluctuations may cause declines in the market price of our common stock.

When the rights offering is completed, your ownership interest will be diluted if you do not exercise the basic subscription privilege component of your subscription rights.

To the extent that you do not exercise the basic subscription privilege component of your subscription rights and shares are purchased by other shareholders in the rights offering, your proportionate economic and voting interest in the Company will be reduced, and the percentage that your original shares represent of our expanded equity after the rights offering will be diluted.

The subscription price determined for the rights offering is not necessarily an indication of the fair value of our common stock.

The subscription price is $ per share. The subscription price was determined by a special committee of our Board of Directors. Factors considered by the committee included the strategic alternatives available to us for raising capital, the price at which our shareholders might be willing to participate in the rights offering, historical and current trading prices of our common stock, the business prospects of our Company, and the general condition of the securities and capital markets. We cannot assure you that the market price for our common stock during the rights offering will be equal to or above the subscription price or that a subscribing owner of rights will be able to sell the shares of common stock purchased in the rights offering at a price equal to or greater than the subscription price.

| 13 |

You may not revoke your subscription exercise and you could be committed to buying shares above the prevailing market price.

Once you exercise your subscription rights, you may not revoke the exercise of such rights. This irrevocability applies to both your basic subscription privilege and your over-subscription privilege. The public trading market price of our common stock may decline before the subscription rights expire. If you exercise subscription rights and, afterwards, the public trading market price of our common stock decreases below the subscription price, you will have committed to buying shares of our common stock at a price above the prevailing market price, in which case you will have an immediate unrealized loss. Furthermore, after your exercise of subscription rights, you may not be able to sell your shares of common stock at a price equal to or greater than the subscription price, and you may lose all or part of your investment in our common stock.

If you do not act promptly and follow the subscription instructions, you may lose your right to exercise your subscription rights or your exercise of subscription rights may be rejected.

Subscription rights holders who desire to purchase shares in the rights offering must act promptly to ensure that all required forms and payments are actually received by the subscription agent before 5:00 p.m. Minneapolis time on , 2012, the expiration date of the rights offering, unless extended. If you are a beneficial owner of shares, but not a record holder, you must act promptly to ensure that your broker, bank, or other nominee acts for you and that all required forms and payments are actually received by the subscription agent before the expiration date of the rights offering. We will not be responsible if your broker, custodian, or nominee fails to ensure that all required forms and payments are actually received by the subscription agent before the expiration date of the rights offering.

If you fail to complete and sign the required subscription forms, send an incorrect payment amount or otherwise fail to follow the subscription procedures that apply to your exercise in the rights offering, the subscription agent may, depending on the circumstances, reject your subscription or accept it only to the extent of the payment received. Importantly, neither we nor our subscription agent undertakes to contact you concerning an incomplete or incorrect subscription form or payment, nor are we under any obligation to correct such forms or payment. We have the sole discretion to determine whether a subscription exercise properly follows the subscription procedures.

The rights offering does not have a minimum amount of proceeds that must be raised for us to accept subscriptions and access proceeds. Therefore, if you exercise your subscription rights and if less than the entire offering amount is subscribed for, you may be investing in a company that continues to desire additional capital.

There is no assurance that any shareholders will exercise their subscription rights. Further, there is no minimum amount of proceeds required for us to accept subscriptions and access proceeds at the completion of the rights offering. In addition, all exercises of subscription rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your subscription rights and even if the rights offering is extended by our Board of Directors. Based on the foregoing, if you exercise any subscription rights but we do not raise the desired amount of capital in this rights offering, you may be investing in a company that continues to desire additional capital to grow its current business or expand into new and complementary businesses.

Significant issuances of our common stock, or the perception that significant issuances may occur in the future, could adversely affect the market price for our common stock.

The substantial number of subscription rights involved in the rights offering, and other actual or perceived potential future issuances of our common stock, could adversely affect the market price of our common stock. Generally, issuances of substantial amounts of common stock in the public market, and the availability of shares for future sale, including up to shares of our common stock that may be issued in the rights offering, could adversely affect the prevailing market price of our common stock and could cause the market price of our common stock to remain low for a substantial amount of time. Additional options and other equity awards may also be granted under our incentive plans.

| 14 |

We cannot foresee the impact of the rights offering and such potential securities issuances on the market for our common stock, but it is possible that the market for our shares may be adversely affected. It is also unclear whether or not the market for our common stock could absorb a large number of attempted sales in a short period of time, regardless of the price at which they might be offered. Even if a substantial number of sales do not occur within a short period of time, the mere existence of this “market overhang” could have a negative impact on the market for our common stock and our ability to raise additional equity capital.

Our officers, directors and greater-than-5% shareholders, including our controlling shareholder, WCR, LLC, may significantly increase their relative ownership and voting interest in the Company to the extent our other shareholders do not exercise their basic subscription privileges.

On June 13, 2012, the last practicable date before the filing of this prospectus:

| · | WCR, LLC beneficially owned approximately 71.5% of our common stock |

| · | John Quandahl, our Chief Executive Officer, beneficially owned approximately 3.7% of our common stock |

| · | Steve Irlbeck, our Chief Financial Officer, beneficially owned approximately 3.7% of our common stock |

| · | Richard Miller, our Chairman of the Board, beneficially owned approximately 5.9% of our common stock, and |

| · | Rich Horner, the Treasurer of our subsidiary Wyoming Financial Lenders, Inc., beneficially owned approximately 1.9% of our common stock. |

Collectively, the above-identified shareholders possess beneficial ownership of approximately 75.5% of our common stock. We have been advised that WCR intends to participate in the rights offering but WCR has not committed or entered into any agreement that would require it to do so. The cash advancesame is true for our officers and directors who are also shareholders. To the extent that other shareholders do not participate in the rights offering, our officers, directors, greater-than-5% shareholders and WCR will necessarily increase their relative percentage of ownership in the Company if they do in fact participate in the rights offering by exercising their subscription rights.

We may use the proceeds of this rights offering in ways with which you may disagree.

We intend to use the net proceeds of this offering primarily to provide capital for the growth of our business through acquisitions and to potentially add new businesses that are complementary to our current business, and to provide additional liquidity for working capital and general corporate purposes. Accordingly, we will have significant discretion in the use of the net proceeds of this offering, and it is possible that we may allocate the proceeds differently than investors in this offering desire, or that we will fail to maximize our return on these proceeds. You will be relying on the judgment of our management with regard to the use of the proceeds from the rights offering, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. For more information, see the section entitled “Use of Proceeds.”

We may cancel the rights offering at any time, and neither we nor the subscription agent will have any obligation to you except to return your exercise payments.

We may, in our sole discretion, decide not to continue with the rights offering or cancel the rights offering. If the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty.

Risks Relating to Our Business and Company

The payday loan industry is highly regulated under state laws. Changes in state laws and regulations governing lending practices, or changes in the interpretation of such laws and regulations, could negatively affect our business.

Our business is regulated under numerous state laws and regulations, which are subject to change and which may impose significant costs or limitations on the way we conduct or expand our business. As of the date of this prospectus,report, approximately 3638 states and the District of Columbia had legislation permitting or not prohibiting cash advancepayday loans. During the last few years, legislation has been adopted in some states that prohibits or severely restricts cash advancepayday loans. For example, in 2006, Oregon passed a ballot initiative that caps interest rates and origination fees on cash advance loans at 36%, among other limitations. Before that, Georgia law effectively prohibited direct payday lending in 2004.

There are nearly always bills pending in various states to alter the current laws governing cash advancepayday lending. Any of these bills, or future proposed legislation or regulations prohibiting cash advancepayday loans or making them less profitable, could be passed in any state at any time, or existing cash advance loan laws permitting payday lending could expire.Presently,

| 15 |

For example, recent legislation is pendinghas been passed in Arizona which would extend a current law permitting cash advance loans.Colorado, Wisconsin and Montana that restricts certain payday lending practices. In the absence of such legislation, current law permitting cash advance loans will “sunset” or expire at the end of 2009. While we presently do not conduct significant operations in Arizona, the failure to extend or outrightly permit cash advance lending would negatively affect us. Recently, proposedparticular:

| · | During 2010, Colorado House Bill 10-1351 was passed into law effective August 11, 2010. This law changed the single payment advance (with no minimum term) into a single or multiple payment loan with a minimum six-month term. It also limited the amount and type of fees that can be charged on these loans, effectively reducing by one-half the fees that can be charged, and when the fees may be realized. We restructured our lending in Colorado to replace payday advances with a short-term installment loan product. Our 2011 gross profit from Colorado operations was negatively affected by these developments, decreasing 22% from 2010 gross profit. |

| · | In Wisconsin, new legislation effective January 1, 2011 limited payday loans to the lesser of $1,500 or 35% of the applicant’s monthly income, permits borrowers to cancel loans within 24 hours and roll their loans over only one time. In addition, payday lenders are required to offer a 60-day, interest free, payment plan to consumers upon maturity of their payday loans. Our 2011 gross profit from Wisconsin operations was negatively affected by these developments, decreasing 41% from 2010 gross profit. |

| · | Finally, on November 2, 2010, voters in Montana passed Petition Initiative I-164. Effective January 1, 2011, Petition Initiative I-164 capped fees on payday loans at an imputed interest rate of 36%. We discontinued our operations and closed all four stores in Montana due to this law change. In 2010, approximately 3.87% of our payday division revenues were generated in Montana. |

In addition, legislation banning cash advancepayday loans was introduced in Nebraska. This billNebraska in 2008 but eventually was ultimately defeated. However,dropped. Nevertheless, since we derive approximately 36%28% of our payday revenues in Nebraska, the passage of any such legislation in Nebraska would have a substantiallyhighly material and negative effect on our business and financial condition.

Statutes authorizing cash advancepayday loans typically provide state agencies that regulate banks and financial institutions with significant regulatory powers to administer and enforce the laws relating to payday lending. Under statutory authority, state regulators have broad discretionary power and may impose new licensing requirements, interpret or enforce existing regulatory requirements in different ways or issue new administrative rules, even if not contained in state statutes, that affect the way we do business and may force us to terminate or modify our operations in those jurisdictions. They may also impose rules that are generally adverse to our industry. Finally, in many states, the attorney general has scrutinized or continues to scrutinize the cash advancepayday loan statutes and the interpretations of those statutes.

Any adverse change in present laws or regulations, or their interpretation, in one or more such states (or an aggregation of states in which we conduct a significant amount of business) would likelycould result in our curtailment or cessation of operations in such jurisdictions. Any such action wouldcould have a corresponding highly material and negative impact on our results of operations and financial condition, primarily through a material decrease in revenues, and could also negatively affect our general business prospects as well if we are unable to effectively replace such revenues in a timely and efficient manner.

Our business is subject to complex federal laws and regulations governing lending practices, and changes in such laws and regulations could negatively affect our business.

Although states provide the primary regulatory framework under which we offer cash advancepayday loans, certain federal laws also affect our business. For example, because cash advancepayday loans are viewed as extensions of credit, we must comply with the federal Truth-in-Lending Act and Regulation Z thereunder.under that Act. Additionally, we are subject to the Equal Credit Opportunity Act, the Gramm-Leach-Bliley Act and certain other federal laws.

| · | the interest rate and fees that may be charged on any loans, including payday loans, to any person in the military are limited to the equivalent of 36% per annum. |

| · | In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was passed by the U.S. Congress and signed into law. Under that Act, a new federal agency, the Consumer Financial Protection Bureau, will consolidate most federal regulation of financial services offered to consumers and replaces the Office of Thrift Supervision’s seat on the FDIC Board. Almost all credit providers, including mortgage lenders, providers of payday loans, other nonbank financial companies, and banks and credit unions with assets over $10 billion, will be subject to new regulations. While the Bureau does not appear to have authority to make rules limiting interest rates or fees charged, the scope and extent of the Bureau’s authority will nonetheless be broad, and it is expected that the Bureau will address issues such as rollovers or extensions of payday loans and compliance with federal rules and regulations. Future restrictions on the payday lending industry could have serious consequences for us. |

| 16 |