UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1 /A

Amendment No. 3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ANGLESEA ENTERPRISESSPORTS FIELD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | ||||

(State

Incorporation) | (

|

Identification Number) |

13799 Park Blvd., 1020 Cedar Ave

Suite 147, Seminole, FL 33776230

Telephone: (727) 393-7439St. Charles, Illinois 60174

978-914-7570

(Address, including zip code, and telephone number,

Including including area code,

of registrant’s principal executive offices)

CopiesPlease send copies of all communications to:

Lucosky Brookman LLP

33 Wood AvenueBRUNSON CHANDLER & JONES, PLLC

Walker Center

175 South 6th FloorMain Street

Iselin, New Jersey 08830Suite 1410

Tel No.: (732) 395-4400Salt Lake City, Utah 84111

Fax No.: (732) 395-4401801-303-5730

(Address, including zip code, and telephone, including area code)

Approximate date of commencement of proposed sale to the public:As soon as practicable From time to time after the effective date of this Registration Statement becomes effective.registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.x [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d)rule 462(c) under the Securities Act, of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ [ ]

If delivery of the prospectusthis Form is expected to be madea post-effective amendment filed pursuant to Rule 434, please462(d) under the Securities Act, check the following box.¨box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer | |||

| Non-accelerated filer | Smaller reporting company | |||

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

Title of Each Class of securities to be registered | Amount of shares of common stock to be | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (3) | ||||||||||||

| Common Stock | 7,000,000 | $ | 0.20 | $ | 1,400,000 | $ | 169.68 | |||||||||

| (1) | In accordance with Rule 416(a), this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

| (2) | Based on the lowest closing price of the Company’s common stock during the ten consecutive trading day period immediately prior to July 11, 2019, of $0.20. The shares offered hereunder may be sold by the selling stockholder from time to time in the open market, through privately negotiated transactions, via a combination of these methods at market prices prevailing at the time of sale, or at negotiated prices. |

| (3) | The fee is calculated by multiplying the aggregate offering amount by .00012120, pursuant to Section 6(b) of the Securities Act of 1933. |

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until the registrant shall file a further amendment which specifically states that this registration statement shall, thereafter, become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

CALCULATION OF REGISTRATION FEE

Title of Each Class Of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Aggregate Offering Price per share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration fee | ||||||||||||

| Common Stock, $0.00001 par value per share | 1,033,000 | $ | $0.01 | $ | 10,330 | $ | 1.18 | |||||||||

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JULY ____, 2019

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdictionstate where the offer or sale is not permitted.

PRELIMINARY PROSPECTUSSports Field Holdings, Inc.

7,000,000 Common Shares

Subject to completion, dated June 15, 2012

ANGLESEA ENTERPRISES, INC.

1,033,000 SHARES OF COMMON STOCK

This is the initial offering of common stock of Anglesea Enterprises, Inc.. The selling security holders namedstockholder identified in this prospectus are offering allmay offer an indeterminate number of shares of the Company’s common stock, which will consist of up to 7,000,000 shares of common stock to be sold by the selling stockholder, GHS Investments LLC (“GHS”), pursuant to an Equity Financing Agreement (the “Financing Agreement”) dated May 1, 2019. If issued presently, the 7,000,000 shares of common stock registered for resale by GHS would represent approximately 23.1% of the Company’s issued and outstanding shares of common stock, based on the Company’s issued and outstanding 23,318,980 shares of common stock as of July 11, 2019.

The selling stockholder may sell all or a portion of the shares being offered throughpursuant to this prospectus. prospectus at fixed prices and prevailing market prices at the time of sale, at varying prices, or at negotiated prices.

We will not receive any proceeds from the sale of the shares of our common stock covered by this prospectus.GHS. However, we will receive proceeds from our initial sale of shares to GHS pursuant to the Financing Agreement. We will sell shares of our common stock to GHS at a price equal to the lowest closing price of our common stock during the ten (10) consecutive trading day period ending on the date on which we deliver a put notice to GHS (the “Market Price”), and we will be obligated to simultaneously deliver an additional number of shares equal to an aggregate of 20% of the put notice amount based on the Market Price. For example, if we delivered a put notice to GHS for $50,000, and the Market Price were $0.20/share, we would be obligated to issue GHS $60,000 of our common stock based on the Market Price, or 300,000 shares.

GHS is an underwriter within the meaning of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933.

Our common stock is presently not tradedquoted on anythe OTC Link LLC (“OTC Link”) quotation system, operated by OTC Markets Group, Inc., and trades on the OTCQB market or securities exchange. The selling security holders have not engaged any underwriter in connection withunder the symbol “SFHI”. On July 11, 2019, the last reported sale of their shares ofprice for our common stock. Common stock being registered inwas $0.20 per share.

Prior to this registration statement may be sold by selling security holders atoffering, there has been a fixed price of $0.01 per share untilvery limited market for our securities. While our common stock is quoted on the OTCBB and thereafter at a prevailingOTC Link, there has been negligible trading volume. There is no guarantee that an active trading market prices or privately negotiated prices or in transactions that are not in the public market. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares of the selling security holders.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our common stock involveswill develop.

This offering is highly speculative and these securities involve a high degree of risk.risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors”“Risk Factors” beginning on page 52. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to read about factors you should consider before purchasing any of the shares offered by this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.contrary is a criminal offense.

The Datedate of This Prospectusthis prospectus is , 2012_________, 2019.

TABLE OF CONTENTSTable of Contents

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the Company’s securities. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision. In this Prospectus, the terms “Anglesea Enterprises,””Anglesea” “Company,” “we,” “us” and “our” refer to Anglesea Enterprises, Inc.

Overview

Anglesea Enterprises, Inc. (the “Company” or “Anglesea”) was formed on February 8, 2011, in the State of Nevada. We are a development stage company with no revenues and net losses to date. We plan to provide marketing and web-related services to small businesses including the design and development of original websites utilizing creative writing and graphics, virtual tours, audio/visual services, marketing analysis and search engine optimization. We also plan to provide economical internet-related marketing services to small businesses that are looking to expand their existing marketing efforts to reach a larger audience via their website.

Accordingly, you cannot fully evaluate our business, and therefore our future prospects, due to a lack of operating history and revenues. To date, our business development activities have consisted solely of developing our own website and preliminary discussions of our planned service offering with prospective customers strategic partners who offer such services. Potential investors should be aware of the difficulties normally encountered by development stage companies and the high rate of failure of such enterprises. In addition, there is no guarantee that we will be able to expand our business development efforts and establish revenue and profit generating operations. Failure to generate revenues and profit will cause us to suspend or cease operations. If this happens, you could lose all or part of your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such, we may have to cease operations and you could lose your investment.

The demand for web development and marketing services in the small business market continues to grow. The majority of e-commerce service providers generally focus on servicing large and medium-sized corporations. We are developing a business network to try to reduce the burden of heavy project costs in order to afford us the opportunity to offer web development services at competitive prices. We hope to accomplish this goal by strategically aligning ourselves with other service providers to create a bundle of affordable, internet and business services. To date, we have not established any strategic alliances.

Recent Developments

On June 30, 2011, we completed a Regulation D Rule 506 offering in which we sold 6,033,000 shares of the Company’s common stock to 34 investors, of which 1 was accredited and 33 were non-accredited, at a price per share of $0.01 for an aggregate offering price of $60,330.

Where You Can Find Us

Our principal executive office is located at 13799 Park Blvd., Suite 147, Seminole, FL 33776 and our telephone number is (727) 393-7439.

The Offering

| i |

We have not authorized any person to give you any supplemental information or to make any representations for us. You should not rely upon any information about our company that is not contained in this prospectus. Information contained in this prospectus may become stale. You should not assume the information contained in this prospectus or any prospectus supplement is accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus, any prospectus supplement or of any sale of the shares. Our business, financial condition, results of operations, and prospects may have changed since those dates. The selling stockholder is offering to sell and is seeking offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted.

In this prospectus, “Sports Field,” the “Company,” “we,” “us,” and “our” refer to Sports Field Holdings, Inc., a Nevada corporation.

You should carefully read all information in the prospectus, including the financial statements and their explanatory notes under the Financial Statements section of this prospectus prior to making an investment decision.

Overview

Sports Field Holdings, Inc. (the “Company” or “Sports Field”), through its wholly owned subsidiary FirstForm, Inc. (formerly SportsField Engineering, Inc., “FirstForm”), is an innovative product development company engaged in the design, engineering and construction of athletic fields, facilities and sports complexes and the sale of customized synthetic turf products and synthetic track systems.

According to Applied Market Information (AMI), over 2,000 athletic field projects were constructed in the U.S. in 2015, creating a $1.8 billion synthetic turf market. These statistics are supported by the number of square meters of synthetic turf manufactured and installed in the U.S. in 2015 based on an average size of 80,000 sqft per project. According to Acute Market Reports, the synthetic turf market was valued at $3.25 billion and is estimated to reach $8.56 billion by 2026. We believe synthetic turf fields have become the field of choice for public and private schools, municipal parks and recreation departments, non-profit and for-profit sports venue businesses, residential and commercial landscaping and golf related venues. We believe this is due to the spiraling costs associated with maintaining natural grass athletic fields and the demand for increased playing time, durability of the playing surface and the ability to play on that surface in any weather conditions.

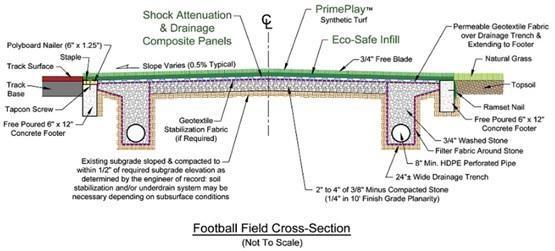

Although synthetic turf athletic fields and synthetic turf have become a viable alternative to natural grass fields, there are a number of technical and environmental issues that have arisen through the evolution of the development of turf and the systems designed around its installation. Sports Field has focused on addressing the main technical issues that still remain with synthetic turf athletic fields and synthetic turf including but not limited to environmental and safety concerns related to infill used in synthetic turf fields as well the reduction of surface heat, Gmax levels (the measure of how much force the surface absorbs and in return, how much is returned to the athlete) as well drainage issues related to the base construction of a turf installation.

In addition to increased need for available playing space, collegiate athletic facilities have become an attractive recruiting tool for many institutions. The competition for athletes and recruiting has resulted in a multitude of projects to build new or upgrade existing facilities. These facilities projects include indoor fields, bleachers, press boxes, lighting, concession stands as well as locker rooms and gymnasiums. We believe that our position in the sports facilities design, construction and turf sales industry allows us to benefit from this spending because we are able to compete for sale of the turf as well as the design and construction revenue on such projects, whereas our competitors can typically only compete for the turf components or the construction revenue, but not all three. In fact, according to an IBIS report, there were no national firms competing in these sectors that have even 5% market share.

Through our strategic operations design, we have the ability to operate throughout the U.S. and provide high quality synthetic turf systems focused on player safety and performance and construct those facilities for our clients using a single partner. Due to our ability to design, estimate, engineer, general contract and install our solutions, we can spend more of every owner dollar on product rather than margin and overhead, thereby delivering a premium product at market rates for our customers. Since inception we have completed a variety of projects from the design, engineering and build of entire football stadiums to the installation of a specialized turf track systems. Our team has also designed, engineered and installed baseball stadiums, soccer and lacrosse fields, indoor soccer facilities, softball fields and running tracks and for private sports venues, public and private high schools and public and private universities. In addition, we have designed and engineered and constructed concession stands with full kitchen facilities, restroom structures, press boxes, baseball dugouts, bleacher seating, ticket booths, locker room facilities and gymnasium expansion projects.

GHS Equity Financing Agreement and Registration Rights Agreement

Summary of the Offering

| Shares currently outstanding: | 23,318,980 | |

| The selling | ||

| Use of | ||

| OTC Markets Symbol: | SFHI | |

| Risk |

Summary of Financial Information

| 1 |

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis,” “Plan of Operation” and the Financial Statements and Notes thereto, included elsewhere in this prospectus. The statement of operations for the period from inception (February 8, 2011) through March 31, 2012 and balance sheet data as of March 31, 2012.

| For the Period from Inception (February 8, 2011) through March 31, 2012 (unaudited) | ||||

| STATEMENT OF OPERATIONS | ||||

| Revenues | $ | - | ||

| Total Operating Expenses | ||||

| Consulting Fees | 19,920 | |||

| Professional Fees | 20,900 | |||

| General and Administrative Expenses | 3,129 | |||

| Net Loss | $ | 43,949 | ||

| As of March 31, 2012 (unaudited) | ||||

| BALANCE SHEET DATA | ||||

| Cash | $ | 17,281 | ||

| Total Assets | 17,281 | |||

| Current Liabilities | ||||

| Accrued Expenses | 300 | |||

| Total Liabilities | 300 | |||

| Stockholders’ Equity | 16,981 | |||

| Total Liabilities and Stockholder’s Equity | 17,281 | |||

RISK FACTORS

The shares of our common stock being offered for resale by the selling security holders are highly speculative in nature, involveThis investment has a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock.risk. Before purchasing any of the shares of common stock,you invest you should carefully consider the following factors relating to our businessrisks and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risksuncertainties described below and the other information in this process before investing inprospectus. If any of the following risks actually occur, our common stock.

Risks Related to Our Company

OUR AUDITOR HAS EXPRESSED SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Based on ourbusiness, operating results and financial history since inception, our auditor has expressed substantial doubt as to our ability to continue as a going concern. We are a development stage company that has never generated any revenue. If we cannot obtain sufficient funding, we may have to delaycondition could be harmed and the implementationvalue of our business strategy.

WE HAVE LIMITED OPERATING HISTORY AND FACE MANY OF THE RISKS AND DIFFICULTIES FREQUENTLY ENCOUNTERED BY DEVELOPMENT STAGE COMPANY.

We are a development stage company, and to date, our development efforts have been focused primarily on the development and marketing of our business model. We have limited operating history for investors to evaluate the potential of our business development. We have not built our customer base and our brand name. In addition, we also face many of the risks and difficulties inherent in introducing new products and services. These risks include the ability to:

Our future will depend on our ability to bring our service to the market place, which requires careful planning of providing a product that meets customer standards without incurring unnecessary cost and expense. Our operation results can also be affected by our ability to introduce new services or to adjust pricing to increase our competitive advantage.

WE NEED $45,000 OF ADDITIONAL CAPITAL TO DEVELOP OUR BUSINESS. AS OF MAY 15, 2012 WE HAVE $15,300 OF CASH ON HAND LEAVING US $29,700 SHORT OF THE CAPITAL NEEDED TO EXECUTE OUR BUSINESS PLAN. WE CAN MAKE NO ASSURANCE THAT WE WILL BE ABLE TO RAISE ADDITONAL CAPITAL.

The development of our services will require the commitment of substantial resources to implement our business plan. Currently, we have no established bank-financing arrangements. Therefore, it is likely we would need to seek additional financing through subsequent future private offerings of our equity securities, or through strategic partnerships and other arrangements with corporate partners. Should we fail to raise additional capital to develop our business, potential investorsstock could go down. This means you could lose their entireall or a part of your investment.We need an $45,000 of additional capital to develop our business plan. We currently have $15,300 of cash on hand leaving us $29,700 short of the capital needed to execute our business plan. The majority shareholder has committed to cover any cash shortfalls of the Company, although there no written agreement or guarantee. If we are unable to satisfy our cash requirements we may be unable to proceed with our plan of operations.

We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us. The sale of additional equity securities will result in dilution to our stockholders. The occurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. If adequate additional financing is not available on acceptable terms, we may not be able to implement our business development plan or continue our business operations and potential investors could lose their entire investment.

WE CURRENTLY HAVE NO REVENUES.

We currently have no revenues and have sustained net losses of $43,949 for the period from inception on February 8, 2011 through March 31, 2012. We cannot give you any assurance that we will experience any positive revenues for the foreseeable future. Should we fail to raise additional capital to develop our business, potential investors could lose their entire investment.

OUR FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICE OF JAMES CHRISTIE, CHIEF EXECUTIVE OFFICER, PRESIDENT AND DIRECTOR. WITHOUT HIS CONTINUED SERVICE, WE MAY BE FORCED TO INTERRUPT OR EVENTUALLY CEASE OUR OPERATIONS.

We are presently dependent to a great extent upon the experience, abilities and continued services of James Christie, our, Chief Executive Officer, President and Director. Our failure to retain Mr. Christie or to attract additional qualified personnel could have a material adverse effect on our business, financial condition or results of operation.

MR. CHRISTIE OUR PRESIDENT AND DIRECTOR, WILL ALLOCATE HIS TIME TO OTHER BUSINESS, THEREBY CAUSING CONFLICTS OF INTERESTS IN HIS DETERMINATION AS TO HOW MUCH TIME TO DEVOTE TO OUR AFFAIRS. THIS CONFLICT OF INTEREST COULD HAVE A NEGATIVE IMPACT ON BUSINESS PLAN.

Our President and director, Mr. Christie, is not required to commit his full time to our affairs, which may result in a conflict of interest in allocating his time between our operations and other businesses. He currently devotes approximately 50% of his time to the Company. If Mr. Christie’s other business affairs require him to devote more substantial amounts of time to such affairs, it could limit his ability to devote time to our affairs and could have a negative impact on our ability to execute our business plan. Mr. Christie’s other business affairs include internet and marketing related activities and may create a conflict of interest. We cannot assure you that these conflicts will be resolved in our favor.

WE NEED TO ESTABLISH AND MAINTAIN REQUIRED DISCLOSURE CONTROLS AND PROCEDURES AND INTERNAL CONTROLS OVER FINANCIAL REPORTING AND TO MEET THE PUBLIC REPORTING AND THE FINANCIAL REQUIREMENTS FOR OUR BUSINESS, WHICH WILL BE TIME CONSUMING FOR OUR MANAGEMENT.

Our management has a legal and fiduciary duty to establish and maintain disclosure controls and control procedures in compliance with the securities laws, including the requirements mandated by the Sarbanes-Oxley Act of 2002. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. Because we have limited resources, we may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting, and other disclosure controls and procedures. We are in the process of adopting and implementing several measures to improve our internal controls. If the procedures we have adopted and implemented are insufficient, we may fail to meet our future reporting obligations, our financial statements may contain material misstatements and our operating results may be harmed. We cannot assure you that significant deficiencies or material weaknesses in our internal control over financial reporting will not be identified in the future. Any failure to maintain or implement required new or improved controls, or difficulties we encounter in their implementation, could result in significant deficiencies or material weaknesses, cause us to fail to meet our future reporting obligations or cause our financial statements to contain material misstatements. Any such failure could also adversely affect the results of the periodic management evaluations that are, or may be, required under Section 404 of the Sarbanes-Oxley Act of 2002, which will not be required until our second Annual Report on Form 10-K for the year ending September 30, 2013. Because weare a smaller reporting company, we will not be required to provide an attestation report of an independent registered accounting firm regarding the effectiveness of your internal control over financial reporting. Additionally,internal control deficiencies could also result in a restatement of our financial statements in the future or cause investors to lose confidence in our reported financial information, leading to a decline in our stock price.

WE MAY INCUR SIGNIFICANT COST TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

OUR FUTURE GROWTH WILL REQUIRE RECRUITMENT OF ADDITIONAL QUALIFIED EMPLOYEES.

In the event of our future growth in our internet and web-related services, we may have to increase the depth and experience of our management team by adding new members. Our future success will depend to a large degree upon the active participation of our key officers and employees. There is no assurance that we will be able to employ additional qualified persons on acceptable terms. Lack of qualified employees may adversely affect our business development.

OUR ARTICLESOF INCORPORATION PROVIDE FOR INDEMNIFICATION OF OFFICERS AND DIRECTORS AT OUR EXPENSE AND LIMIT THEIR LIABILITY WHICH MAY RESULT IN A MAJOR COST TO US AND HURT THE INTERESTS OF OUR SHAREHOLDERS BECAUSE CORPORATE RESOURCES MAY BE EXPENDED FOR THE BENEFIT OF OFFICERS AND/OR DIRECTORS.

Our articles of incorporation and applicable Nevada law provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s written promise to repay us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us which we will be unable to recoup.

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

YOU WILL EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND OUR PREFERRED STOCK.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 270,000,000 shares of capital stock consisting of 20,000,000 shares of preferred stock, par value $0.00001 per share and 250,000,000 shares of common stock, par value $0.00001 per share.

We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business purposes, including at a price (or exercise prices) below the price at which shares of our common stock are trading.

Risks Related to Our Industry

WE ARE HIGHLY DEPENDENT UPON TECHNOLOGY, AND OUR INABILITY TO KEEP PACE WITH TECHNOLOGICAL ADVANCES IN OUR INDUSTRY COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULT OF OPERATIONS.

Our success depends in part on our ability to develop IT solutions that keep pace with continuing changes in the IT industry, evolving industry standards and changing client preferences. There can be no assurance that we will be successful in adequately addressing these developments on a timely basis or that, if these developments are addressed, we will be successful in the marketplace. We need to continually make significant investments, with ever increasing regularity, in sophisticated and specialized communications and computer technology to meet our clients’ needs. We anticipate that it will be necessary to continue to invest in and develop new and enhanced technology in shorter intervals and on a timely basis to maintain our competitiveness. Significant capital expenditures may be required to keep our technology up-to-date. There can be no assurance that any of our information systems will be adequate to meet our future needs or that we will be able to incorporate new technology to enhance and develop our existing services. Moreover, investments in technology, including future investments in upgrades and enhancements in software, may not necessarily maintain our competitiveness. Our future success will also depend in part on our ability to anticipate and develop information technology solutions that keep pace with evolving industry standards and changing client demands. Our inability to effectively keep pace with continuing changes in the IT industry could have a material adverse effect on our business, financial condition and results of operations.

THE COMPETITIVE NATURE OF OUR INDUSTRY COULD IMPAIR OUR ABILITY TO OBTAIN CUSTOMERS AND REDUCE OUR REVENUE AND LIKELIHOOD OF PROFITABILITY.

We operate in a very competitive business environment that could adversely affect our ability to obtain and maintain customers. The web development industry is highly fragmented and competitive, with several local service providers as well as a large number of smaller independent contractors serving local and regional markets. The majority of our competitors have greater financial and other resources than we do. Many of our competitors also have a history of successful operations and an established reputation within the industry. Contracts in the web development industry are generally gained through a competitive bidding process. Some of our competitors may be prepared to accept smaller fees than we when negotiating contracts. Our inability to be competitive in obtaining and maintaining customers would reduce our revenue and our likelihood of profitability.

THE INDUSTRY IN WHICH WE OPERATE HAS RELATIVELY LOW BARRIERS TO ENTRY AND INCREASED COMPETITION COULD RESULT IN MARGIN EROSION, WHICH WOULD MAKE PROFITABILITY EVEN MORE DIFFICULT TO SUSTAIN.

Other than the technical skills required in our business, the barriers to entry in our business are relatively low. Business start-up costs do not pose a significant barrier to entry. The success of our business is dependent on our employees, customer relations and the successful performance of our services. If we face increased competition as a result of new entrants in our markets, we could experience reduced operating margins and loss of market share and brand recognition.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.Special Information Regarding Forward-Looking Statements

We are an "emerging growth company," as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404Some of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved..

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will cease to be an emerging growth company as described in the following risk factor. Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

While we currently qualify as an "emerging growth company" under the JOBS Act, we will lose that status at the latest by the end of 2017, which will increase the costs and demands placed upon management.

We will continue to be deemed an emerging growth company until the earliest of (i) the last day of the fiscal year during which we had total annual gross revenues of $1,000,000,000 (as indexed for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock under this registration statement; (iii) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which we are deemed to be a ‘large accelerated filer’ as defined by the SEC, which would generally occur upon our attaining a public float of at least $700 million. Once we lose emerging growth company status, we expect the costs and demands placed upon management to increase, as we would have to comply with additional disclosure and accounting requirements, particularly if our public float should exceed $75 million.

Risk Related to Our Stock

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS.

We have not declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend. If the Company does not pay dividends, the Company’s common stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

OUR COMMON STOCK IS CONSIDERED A PENNY STOCK, WHICH MAY BE SUBJECT TO RESTRICTIONS ON MARKETABILITY, SO YOU MAY NOT BE ABLE TO SELL YOUR SHARES.

If our common stock becomes tradable in the secondary market, we will be subject to the penny stock rules adopted by the SEC that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our shareholders to sell their securities.

Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stock and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

THERE IS NO ASSURANCE OF A PUBLIC MARKET OR THAT OUR COMMON STOCK WILL EVER TRADE ON A RECOGNIZED EXCHANGE. THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.

There is no established public trading market for our common stock. Our shares have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

BECAUSE OUR COMMON STOCK IS NOT REGISTERED UNDER THE EXCHANGE ACT, WE WILL NOT BE SUBJECT TO THE FEDERAL PROXY RULES AND OUR DIRECTORS, EXECUTIVE OFFICES AND 10% BENEFICIAL HOLDERS WILL NOT BE SUBJECT TO SECTION 16 OF THE EXCHANGE ACT. IN ADDITION, OUR REPORTING OBLIGATIONS UNDER SECTION 15(D) OF THE EXCHANGE ACT MAY BE SUSPENDED AUTOMATICALLY IF WE HAVE FEWER THAN 300 SHAREHOLDERS OF RECORD ON THE FIRST DAY OF OUR FISCAL YEAR.

Our common stock is not registered under the Exchange Act, and we do not intend to register our common stock under the Exchange Act for the foreseeable future (provided that, we will register our common stock under the Exchange Act if we have, after the last day of our fiscal year, more than 500 shareholders of record, in accordance with Section 12(g) of the Exchange Act; as of March 28, 2012, we have less than 40 shareholders of record). As long as our common stock is not registered under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing to shareholders and filing with the SEC a proxy statement and form of proxy complying with the proxy rules. In addition, so long as our common stock is not registered under the Exchange Act, our directors and executive officers and beneficial holders of 10% or more of our outstanding common stock will not be subject to Section 16 of the Exchange Act. Section 16(a) of the Exchange Act requires executive officers and directors, and persons who beneficially own more than 10% of a registered class of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of common shares and other equity securities, on Forms 3, 4, and 5 respectively. Such information about our directors, executive officers, and beneficial holders will only be available through periodic reports and any registration statements on Form S-1 we file. Furthermore, so long as our common stock is not registered under the Exchange Act, our obligation to file reports under Section 15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year (other than a fiscal year in which a registration statement under the Securities Act has gone effective), we have fewer than 300 shareholders of record. This suspension is automatic and does not require any filing with the SEC. In such an event, we may cease providing periodic reports and current or periodic information, including operational and financial information, may not be available with respect to our results of operations.

ALTHOUGH WE EXPECT TO APPLY FOR QUOTATION ON THE OTC BULLETIN BOARD (OTCBB), WE MAY NOT BE APPROVED, AND EVEN IF APPROVED, WE MAY NOT BE APPROVED FOR TRADING ON THE OTCBB; THEREFORE SHAREHOLDERS MAY NOT HAVE A MARKET TO SELL THEIR SHARES, EITHER IN THE NEAR TERM OR IN THE LONG TERM, OR BOTH.

We are not registered on any market or public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following this registration statement on Form S-1 being declared effective and apply to have the shares quoted on the Over-the-Counter Bulletin Board ("OTCBB"). The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter securities. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market makersprospectus are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 to 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. If our application is rejected, our stock may then be traded on the "Pink Sheets," and the market for resale of our shares would decrease dramatically, if not be eliminated. As of the date of this filing, there have been no discussions or understandings between the Company and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information included or incorporated by reference in this Prospectus may contain“forward-looking statements.” These forward-looking statements. This information maystatements involve certain known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from theany future results, performance or achievements expressed or implied by anythese forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use ofThese factors include, among others, the factors set forth herein under “Risk Factors.” The words “may,” “should,“believe,” “expect,” “anticipate,” “estimate,“intend,” “believe,“plan,” “intend” or “project” or the negative of these words or other variationsand similar expressions identify forward-looking statements. We caution you not to place undue reliance on these words or comparable terminology. Theforward-looking statements. We undertake no obligation to update and revise any forward-looking statements containedor to publicly announce the result of any revisions to any of the forward-looking statements in this report are based on current expectationsdocument to reflect any future or developments.

RISKS RELATED TO OUR COMPANY

WE ARE NOT YET PROFITABLE AND MAY NEVER BE PROFITABLE.

Since inception through December 31, 2018, Sports Field has raised $10,900,611 in capital. During this same period, we have recorded net accumulated losses totaling $19,566,530. As of December 31, 2018, we had a working capital deficit of $(7,756,792) Our net losses for the two most recent fiscal years ended December 31, 2018 and beliefs concerning future developments2017 have been $(3,743,434) and ($1,865,516), respectively. Our ability to achieve profitability depends upon many factors, including the potential effects on the partiesability to develop and the transaction.commercialize products. There can be no assurance that future developments actually affecting uswe will ever achieve profitable operations.

WE HAVE SUBSTANTIAL DOUBT RELATED TO THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN.

Our historical operating results indicate substantial doubt exists related to the Company’s ability to continue as a going concern. As reflected in the accompanying consolidated financial statements, as of December 31, 2018, the Company had a working capital deficit of $(7,756,792). As of December 31, 2018, the Company has cash of $247 and net loss and net cash used in operating activities of $(3,743,434) and $(510,086), respectively, for the year ended December 31, 2018, and an accumulated deficit totaling $(19,566,530). Substantially all of our accumulated deficit has resulted from losses incurred on construction projects, costs incurred in connection with our research and development and general and administrative costs associated with our operations. These factors raise substantial doubt about the Company’s ability to continue as a going concernthrough July 31, 2020.

We expect that for the next 12 months, our operating cash burn will be those anticipated. Theseapproximately $2 million, excluding repayments of existing debts at December 31, 2018, in the aggregate amount of approximately $1.8 million. Our cash requirements relate primarily to working capital needed to operate and grow our business, including funding operating expenses and continued development and expansion of our products/services. Our ability to achieve profitability and meet future liquidity needs and capital requirements will depend upon numerous factors, including the timing and size of awarded contracts; operating expenses; working capital needs; expanding our sales team and business development opportunities; developing a marketing program; warranty and other post-implementation services; and hiring and training construction and administrative staff; as well as the extent to which our brand and construction services gain market acceptance and our ongoing and any new research and development programs; and changes in our strategy or our planned activities.

We have experienced and continue to experience negative cash flows from operations and we expect to continue to incur net losses in the foreseeable future.

The Company will require additional funding to finance the growth of its current and expected future operations as well as to achieve its strategic objectives. The Company believes its current available cash along with anticipated revenues may be insufficient to meet its cash needs for the near future. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. If we are not able to obtain financing when needed, we may be unable to carry out our business plan. As a result, we may have to significantly limit our operations and our business, financial condition and results of operations would be materially harmed.

To date, we have funded our operational short-fall primarily through private offerings of common stock, convertible notes and promissory notes, billings in excess of costs, our line of credit and factoring of receivables. The Company believes it has potential financing sources in order to raise the capital necessary to fund operations through June 30, 2020.

| 2 |

WE HAVE A LIMITED OPERATING HISTORY.

We have been in existence for approximately five years. Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) develop and commercialize our products; (ii) achieve market acceptance of our products; or (iii) respond to competition. Additionally, even if we do implement our business plan, we may not be successful. No assurances can be given as to exactly when, if at all, we will be able to recognize profits high enough to sustain our business. We face all the risks inherent in a new business, including the expenses, difficulties, complications, and delays frequently encountered in connection with conducting operations, including capital requirements. Given our limited operating history, we may be unable to effectively implement our business plan which could materially harm our business or cause us to cease operations.

WE MAY SUFFER LOSSES IF OUR REPUTATION IS HARMED.

Our ability to attract and retain customers and employees may be adversely affected to the extent our reputation is damaged. If we fail, or appear to fail, to deal with various issues that may cause actualgive rise to reputational risk, we could harm our business prospects. These issues include, but are not limited to, appropriately dealing with potential conflicts of interest, legal and regulatory requirements, ethical issues, money-laundering, privacy, record-keeping, sales and trading practices, and the proper identification of the legal, reputational, credit, liquidity, and market risks inherent in our business. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines, and penalties.

WE DEPEND ON OUR CHIEF EXECUTIVE OFFICER AND THE LOSS OF HIS SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

We place substantial reliance upon the efforts and abilities of Jeromy Olson, our Chief Executive Officer. Though no individual is indispensable, the loss of the services of Mr. Olson could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the life of Mr. Olson.

Our success depends on attracting and retaining qualified personnel and subcontractors in a competitive environment.

The success of our business is dependent on our ability to attract, develop and retain qualified personnel advisors and subcontractors. Changes in general or local economic conditions and the resulting impact on the labor market may make it difficult to attract or retain qualified individuals in the geographic areas where we perform our work. If we are unable to provide competitive compensation packages, high-quality training programs and attractive work environments or to establish and maintain successful partnerships, our ability to profitably execute our work could be adversely impacted.

Accounting for our revenues and costs involves significant estimates.

Accounting for our contract-related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial position and results of operations.

WE COMPLETED A DEBT FINANCING WHICH IS secured by the grant of a security interest in all of our assets and upon a default the lender may foreclose on all of our assets.

In July 2016, we entered into the Loan Agreement with Genlink, pursuant to which Genlink made available to the Company a Revolving Loan. Pursuant to the Loan Agreement, the Company issued the Genlink Note up to an aggregate principal amount of One Million Dollars ($1,000,000), of which the Company has borrowed $1,000,000 to date, which was payable on December 20, 2017. Additionally, pursuant to the Loan Agreement, the Company and Genlink entered into the Security Agreement, pursuant to which the Company granted Genlink a senior security interest in substantially all of the Company’s assets as security for repayment of the Revolving Loan. In the event of the Company’s failure to make payments or to otherwise comply with the terms of the Revolving Loan under the Security Agreement or the Genlink Note, Genlink can declare a default and seek to foreclose on the Company’s assets. If the Company is unable to repay or refinance such indebtedness it may be forced to cease operations and the holders of the Company’s securities may lose their entire investment. In December 2017, this Loan Agreement was extended through January 25, 2019, and converted to a term loan bearing interest at 15% with monthly payments of $20,833 in principal plus interest with a balloon payment of $729,167 due on the maturity date. The Company incurred $10,000 in debt issuance costs as part of the modification which are recorded as debt discount and amortized over the agreement. In November 2018, this Loan Agreement was amended in order to increase the principal amount to $1,125,000, with the maturity extended through November 25, 2020, with interest at 15% requiring monthly payments of $26,650 in principal (scheduled to start in March 2019) plus interest with a balloon payment of $592,000 due on the maturity date. As additional security for the term loan, the Company placed 970,000 shares of common stock into reserve. The Company has not yet begun making payments.

Our contract backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings.

We cannot guarantee that the revenues projected in our contract backlog will be realized or, if realized, will be profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects.

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR SECURITIES.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result of our small size, any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital.

We currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely gather, analyze and report information relative to the financial statements. As a result, our management has concluded that as of December 31, 2018, we have material weaknesses in our internal control procedures and our internal control over financial reporting was ineffective.

Because of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation of duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting in a situation where limitations on segregation of duties exist. In order to remedy this situation, we would need to hire additional staff.

PENDING AND THREATENED CLAIMS.

Claims have been brought or threatened against the Company, and additional legal claims may arise from time to time. The Company may not be successful in the defense or prosecution of our current or future legal proceedings, which could result in settlement or damages that could significantly impact the Company’s business, financial conditions, results of operations and reputation. Please see the further discussion in “Legal Proceedings” section below.

PENDING AND THREATENED CLAIMS RELATING TO DEFAULT UNDER THE COMPANY’S OUTSTANDING NOTES.

As described in the notes to the Company’s consolidated financial statements, the Company was not compliant with the repayment terms of some of its notes. The Company is currently conducting good faith negotiations with the relevant note holders to further extend the maturity dates, however, there can be no assurance that any such extensions will be granted. At this time, no further action has been taken by the respective note holders in connection with the Company’s noncompliance with the repayment terms of the notes. It is possible that the Company’s results of operations, cash flows or financial position could be materially adversely affected by any unfavorable outcome or settlement of this matter. Additionally, resolution of this matter, through litigation or otherwise, may require significant expenditures of time and other resources. To the extent that litigation is pursued as a means of resolving this matter, litigation is inherently uncertain, and the Company could experience significant adverse results, including but not limited to adverse publicity surrounding the litigation and significant reputational harm.

RISKS RELATING TO OUR INDUSTRY

THE INSTALLATION OF SYNTHETIC TURF IS A HIGHLY COMPETITIVE INDUSTRY.

The installation of synthetic turf is a highly competitive and highly fragmented industry. Competing companies may be able to beat our bids for the more desirable projects. As a result, we may be forced to lower bids on projects to compete effectively, which would then lower the fees we can generate. We may compete for the management and installation of synthetic turf with many entities, including nationally recognized companies. Many competitors may have substantially greater financial resources than we do. In addition, certain competitors may be willing to accept lower fees for their services.

THE SUCCESS OF OUR BUSINESS IS SIGNIFICANTLY RELATED TO GENERAL ECONOMIC CONDITIONS AND, ACCORDINGLY, OUR BUSINESS COULD BE HARMED BY THE ECONOMIC SLOWDOWN AND DOWNTURN IN FINANCING OF PUBLIC WORKS CONTRACTS.

Our business is closely tied to general economic conditions. As a result, our economic performance and the ability to implement our business strategies may be affected by changes in national and local economic conditions. During an economic downturn funding for public contracts tends to decrease significantly thereby limiting the growth and opportunities available for new and established businesses in the synthetic turf industry. An economic downturn may limit the number of projects that we are able to bid on and limit the opportunities we have to penetrate the synthetic turf industry, stunting the Company’s growth prospects and having a material adverse effect on our business.

THE COMPANY’S BUSINESS MAY BE SUBJECT TO THE EFFECTS OF ADVERSE PUBLICITY AND NEGATIVE PUBLIC PERCEPTION RELATED TO SYNTHETIC TURF PRODUCTS.

Negative public perception regarding our industry resulting from, among other things, concerns raised by advocacy groups or the public in general about synthetic turf fields and the potential impact on human health related to certain chemical compounds found in the infill of such fields may negatively impact the sales of synthetic turf products. Despite not using any toxic or known harmful materials in our products, there can be no assurance that the Company will not be subject to adverse publicity or negative public perception surrounding the impact on human health of synthetic turf and related products in the future or that such negative public perception would not have an adverse or material negative impact on its financial position, results of operations or cash flows.

IF WE ARE UNABLE TO OBTAIN RAW MATERIALS IN A TIMELY MANNER OR IF THE PRICE OF RAW MATERIALS INCREASES SIGNIFICANTLY, PRODUCTION TIME AND PRODUCT COSTS COULD INCREASE, WHICH MAY ADVERSELY AFFECT OUR BUSINESS.

Synthetic turf made to our specifications can be purchased from a variety of manufacturers, there are several sources of all of our infill products and two manufacturers from which we can purchase expanded polypropylene shock and drainage pads. We do not anticipate any supply issues due to the fact that the raw materials to develop these products are readily available and currently not scarce. We do not have any exclusive supplier contracts for our products. We buy our pad, infill components and turf from manufacturers at the best price we can negotiate based on volume discounts but if the prices of the raw materials necessary to make these products, including the yarn, backing and infill in our products, rise significantly, we may be unable to pass on the increased cost to our customers. Our results of operations could be adversely affected if we are unable to obtain adequate supplies of raw materials in a timely manner or at reasonable cost. In addition, from time to time, we may need to reject raw materials that do not meet our specifications, resulting in potential delays or declines in output. Furthermore, problems with our raw materials may give rise to compatibility or performance issues in our products, which could lead to an increase in customer returns or product warranty claims. Errors or defects may arise from raw materials supplied by third parties that are beyond our detection or control, which could lead to additional customer returns or product warranty claims that may adversely affect our business and results of operations.

Failure to maintain safe work sites could result in significant losses.

Construction and maintenance sites are potentially dangerous workplaces and often put our employees and others in close proximity with mechanized equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials. On many sites, we are responsible for safety and, accordingly, must implement safety procedures. If we fail to implement these procedures or if the procedures we implement are ineffective, we may suffer the loss of or injury to our employees, as well as expose ourselves to possible litigation. Our failure to maintain adequate safety standards could result in reduced profitability or the loss of projects or clients, and could have a material adverse impact on our financial position, results of operations, cash flows and liquidity.

An inability to obtain bonding could have a negative impact on our operations and results.

We may be required to provide surety bonds securing our performance for some of our public and private sector contracts. Our inability to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

Design-build contracts subject us to the risk of design errors and omissions.

Design-build is increasingly being used as a method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We may subcontract design responsibility to outside architects and engineers. In the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case, we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity.

some of our contracts have penalties for late completion.

In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a certain date. If we subsequently fail to complete the project as scheduled, we may be held responsible for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages. To the extent these events occur, the total cost of the project could exceed our original estimate and we could experience reduced profits or a loss on that project.

Strikes or work stoppages could have a negative impact on our operations and results.

Some of our projects require union labor and although we have not experienced strikes or work stoppages in the past, such labor actions could have a significant impact on our operations and results if they occur in the future.

Failure of our subcontractors to perform as anticipated could have a negative impact on our results.

We subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher-risk subcontractors. In this case we may be responsible for the failures on the part of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In addition, the total costs of a project could exceed our original estimates and we could experience reduced profits or a loss for that project, which could have an adverse impact on our financial position, results of operations, cash flows and liquidity.

WE MUST ANTICIPATE AND RESPOND TO RAPID TECHNOLOGICAL CHANGE.

The market for our products and services is characterized by technological developments and evolving industry standards. These factors will require us to continually improve the performance and features of our products and services and to introduce new products and services, particularly in response to offerings from our competitors, as quickly as possible. As a result, we might be required to expend substantial funds for and commit significant resources to the conduct of continuing product development. We may not be successful in developing and marketing new products and services that respond to competitive and technological developments, customer requirements, or new design and production techniques. Any significant delays in product development or introduction could have a material adverse effect on our operations.

FAILURE TO PROTECT OUR INTELLECTUAL PROPERTY OR TECHNOLOGY OR OBTAIN RIGHTS TO USE OTHERS’ INTELLECTUAL PROPERTY OR TECHNOLOGY COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS.

We take steps to protect our intellectual property rights such as filing for patent protection where we deem appropriate. However, there is no guarantee that any technology we seek to protect will, in fact, be granted patent protection or any other form of intellectual property protection. Consequently, if we are unable to secure exclusive rights in such technology, our competitors may be free to use such technology as well. We may at times also be subject to the risks of claims and litigation alleging infringement of the intellectual property rights of others. There is no guarantee that we will be able to resolve such claims or litigations favorably, and may, as a result, be exposed to adverse decisions in such litigations which may require us to pay damages, cease using certain technologies or products, or license certain technology, which licenses may not be available to us on commercially reasonable terms or at all. Moreover, intellectual property litigation, regardless of the ultimate outcomes, is time-consuming and expensive and can result in the distraction of management personnel and expenditure of consider resources in defending against any such infringement claims.

WE RELY UPON THIRD-PARTY MANUFACTURERS AND SUPPLIERS, WHICH PUTS US AT RISK FOR THIRD-PARTY BUSINESS INTERRUPTIONS.

We rely on third-party manufactures and suppliers for the individual products that we use to create our system which we then sell to owners. We have dozens of tufting companies to choose from in manufacturing our specific design for turf and bid them out often. We also have multiple suppliers for all of our infill contents as well as several shock pad suppliers of which we have used two to three of each historically. The success for our business depends in part on our ability to retain such third-party manufacturers and suppliers to provide subparts for our products and materials for the services we provide. If manufacturers and suppliers fail to perform, our ability to market products and to generate revenue would be adversely affected. Our failure to deliver products and services in a timely manner could lead to customer dissatisfaction and damage to our reputation, cause customers to cancel contracts and to stop doing business with us.

LOWER THAN EXPECTED DEMAND FOR OUR PRODUCTS AND SERVICES WILL IMPAIR OUR BUSINESS AND COULD MATERIALLY ADVERSELY AFFECT OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION.