As filed with the Securities and Exchange Commission on November 17, 2014April 26, 2018

RegistrationFile No. 333-199160333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO FORM

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SINO-GLOBAL SHIPPING AMERICA, LTD.

(Exact Namename of Registrantregistrant as Specifiedspecified in Charter)its charter)

| Virginia | | 4731 | | 11-3588546 |

(State or Other Jurisdictionother jurisdiction of Incorporationincorporation or Organization)organization)

| | (Primary Standard Industrial Classification Classification Code Number) | | (IRSI.R.S. Employer Identification No.) |

1044 Northern Boulevard, Suite 305

Roslyn, New York 11576-1514

(718) 888-1814

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)place of business)

Lei Cao,

Chief Executive Officer

Sino-Global Shipping America, Ltd.

1044 Northern Boulevard, Suite 305

Roslyn, New York 11576-1514

(718) 888-1814

(Name, address, including zip code, and telephone number, including area code, of registrant’s agent for service)

Copies to:

Elizabeth F. Chen, Esq. Michael T. Campoli, Esq. Pryor Cashman LLP 7 Times Square New York, New York 10036 (212) 421-4100 (phone) Lawrence G. Nusbaum, Esq.

Bryan Dixon, Esq.

Gusrae Kaplan Nusbaum PLLC

120 Wall Street, 25th Floor

New York, New York 10005

Tel: (212) 269-1400

Fax: (212) 809-5449

| | Darrick M. Mix, Esq.

David A. Sussman, Esq.

Duane Morris LLP

30 South 17th Street

Philadelphia, PA 19103-4196

Tel: (215) 979-1000

Fax: (215) 405-2906

|

Approximate date of commencement of proposed sale to the public:public. As soon as practicable after the effective date of this Registration Statement becomes effective.registration statement.

If any of the securitiesSecurities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box:¨ ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statementRegistration Statement number of the earlier effective registration statementRegistration Statement for the same offering:¨ ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statementRegistration Statement number of the earlier effective registration statementRegistration Statement for the same offering. ¨offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statementRegistration Statement number of the earlier effective registration statementRegistration Statement for the same offering. ¨offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smallsmaller reporting company:company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer¨ | ☐ | Accelerated filer¨ | ☐ |

Non-accelerated filer¨ | ☐ (Do not check if a smaller reporting company) | Smaller reporting companyx | ☒ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 7(a)(2)(B) of the Securities Act: ☐

Calculation of Registration Fee

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be

registered | | Amount to

be registered | | | Proposed

maximum

offering price

per share | | | Proposed

maximum

aggregate offering

price(1)(2) | | | Amount of

registration Fee (3) (4) | |

| | | | | | | | | | | | | | | | | |

| Common stock, without par value per share | | | | | | | | | | $ | 8,400,000 | | | $ | 976 | |

| Title Of Each Class Of Securities To Be Registered | | Amount

to be

Registered(1) | | Proposed

Maximum

Offering Price

Per Share(3) | | | Proposed

Maximum

Aggregate

Offering Price(3) | | | Amount Of Registration Fee | |

| Common Stock, without par value per share | | 4,000,000

Shares (2) | | $ | 1.16 | | | $ | 4,640,000 | | | $ | 578 | |

| (1) | Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this registration statement also covers such additional shares as may hereafter be offered or issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or similar transactions. |

| (2) | Consists of 4,000,000 shares of common stock issuable upon exercise of warrants that were issued to the Selling Shareholders named herein. |

| (3) | Estimated solely for the purpose of calculating the registration fee underin accordance with Rule 457(o) under the Securities Act. |

| (2) | Includes the offering price of shares of common stock that may be sold if the over-allotment option granted by us to the underwriter is exercised. |

| (3) | Calculated pursuant to Rule 457(a)457(c) under the Securities Act of 1933, as amended, based on an estimatethe average of the proposed maximum aggregate offering price.high and low prices per share of the registrant’s common stock on the Nasdaq Capital Market on April 24, 2018. |

The Registrantregistrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the Registrantregistrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall hereafterthereafter become effective in accordance with Sectionsection 8(a) of the Securities Act of 1933 or until the registration statementRegistration Statement shall become effective on such date as the Commission,commission, acting pursuant to Sectionsection 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securitiesThe selling shareholders may not be soldsell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdictionstate where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED NOVEMBER __, 2014Subject to Completion, dated April 26, 2018

SINO-GLOBAL SHIPPING AMERICA, LTD.

__________4,000,000 Shares of Common Stock Issuable upon Exercise of Warrants

This prospectus relates to the resale of up to 4,000,000 shares of the common stock of Sino-Global Shipping America, Ltd., a Virginia corporation (the “Company”), that may be sold from time to time by the selling shareholders named in this prospectus (the “Selling Shareholders”).

The shares of common stock offered under this prospectus consist of 2,000,000 shares of common stock issuable upon the exercise of certain series “A” warrants (the “Series A Warrants”), and 2,000,000 shares of common stock issuable upon the exercise of certain series “B” warrants (the “Series B Warrants”, and together with the Series A Warrants, the “Warrants”), that we issued to the Selling Shareholders, each of whom is an accredited investor, on March 14, 2018, in a private placement pursuant to a Securities Purchase Agreement dated as of March 12, 2018, by and among the Company and the purchasers named therein. The issuance of the Warrants was made in reliance on the exemptions from registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) promulgated thereunder.

We are offering [__________]shareswill not receive any proceeds from the sale of our common stock, at a public offering price of $[____] per share.

For a more detailed descriptionany of the shares of common stock seeoffered hereby by the section entitled “DescriptionSelling Shareholders. To the extent that any of Securities”the Warrants are exercised for cash, if at all, we will receive the exercise price for those Warrants.

The Selling Shareholders or their pledgees, assignees or successors-in-interest may offer and sell or otherwise dispose of the shares of common stock described in this prospectus from time to time through underwriters, broker-dealers or agents, in public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sales of shares. We will bear all other costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution” beginning on page 49.43 of this prospectus for more information about how the Selling Shareholders may sell or dispose of their shares of common stock.

Our common stock is listed on the NASDAQNasdaq Capital Market under the symbol “SINO”. On November 10, 2014,April 24, 2018, the last reported closingsale price offor our common stock as reported on the Nasdaq Capital Market was $2.06$1.13 per share.

We have agreed to issue at the election of the underwriter, up to [________] additional shares of our common stock, at the public offering price of $[____], to cover over-allotments. INVESTING IN OUR COMMON STOCK INVOLVES SUBSTANTIAL RISKS. SEE THE SECTION TITLED “RISK FACTORS” BEGINNING ON PAGE 4 OF THIS PROSPECTUS TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE BUYING SHARES OF OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Investing in our common stock involves a high degree of risk. You should purchase shares of our common stock only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 5.

| | Per

Common

Share | | | Total | |

Public Offering Price | | $ | | | | $ | | |

Underwriting discount(1) | | $ | | | | $ | | |

Proceeds, before expenses, to us | | $ | | | | $ | | |

(1) In addition, we have agreed to pay or reimburse the underwriter for certain expenses. See “Underwriting” in this prospectus for additional disclosure regarding underwriting discounts and estimated offering expenses.

The underwriter expects to deliver the shares of common stock to the purchasers on or about [____________], 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

National Securities Corporation

The date of this prospectus is _________, 2014._______, 2018

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the Selling Shareholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. You should rely only on the information contained in this prospectus. Neither we nor the underwriter hasprospectus or any related prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, additional to or different from that contained in this prospectus. Neither we nor the underwriter take any responsibility for any other information others may give you. We and the underwriter are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.you should not rely on it. The information contained in this prospectus is accurate only as ofon the date of this prospectus, regardlessprospectus. Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under the timefederal securities laws, we undertake no obligation to publicly update or revise such information, whether as a result of delivery of this prospectusnew information, future events or any saleother reason.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of our common stock.

Neither westock covered hereby, nor the underwriter has done anything that would permit this offering or possession or distribution ofdoes this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction where action for that purposeto any person to whom it is required, other thanunlawful to make such offer or solicitation in the United States.such jurisdiction. Persons outside the United States who come into possession of this prospectus mustin jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions relatingas to the offering of the sales of common stock and the distribution of this prospectus outsideapplicable to those jurisdictions.

Some of the United States.industry data contained in this prospectus is derived from data from various third-party sources. We have not independently verified any of this information and cannot assure you of its accuracy or completeness. Such data is subject to change based on various factors, including those discussed under the “Risk Factors” section beginning on page 4 of this prospectus.

PROSPECTUS SUMMARY

The followingThis summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary does not contain all of the information that you shouldconsider before investing in our common stock. Before making an investmentdecision youwith respect to our securities. You should read thethis entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”especially any risk factors contained herein and our financial statements and therelated notes to the financialstatements included elsewherecontained in this prospectus.

Inprospectus before making an investment decision with respect to our securities. Please see the section titled, “Where You Can Find More Information,” beginning on page 46 of this prospectus, unlessprospectus. Unless the context indicates otherwise, indicated,references to “SINO,” the terms (i) “Sino-Global Shipping America, Ltd.”, “Sino-Global,“Company,” “SINO”, the “Company”, “we”,“we,” “us”, and “our” or similar terms refer and relate to Sino-Global Shipping America, Ltd., a Virginia corporation and its consolidated subsidiaries, (ii) “Trans Pacific” refers and relates collectively to (a) Trans Pacific Shipping Ltd., our wholly-owned subsidiary located in China, and (b) Trans Pacific Logistics Shanghai Ltd., 90% of whose equity is owned by Trans Pacific Shipping Ltd., and (iii) “Sino-China” refers and relates to Sino-Global Shipping Agency Ltd., our variable interest entity (“VIE”), in China. References to “China” or the “PRC” mean the People’s Republic of China.subsidiaries.

Our Company

Overview

We areSino-Global Shipping America, Ltd., a Virginia corporation, was founded in the United States (“US”) in 2001. Sino is a non-asset based global shipping agency,and freight logistics integrated solution provider. Sino provides tailored solutions and ship managementvalue added services company.to its customers to drive effectiveness and control in related aspects throughout the entire shipping and freight logistics chain. Our current service offerings consist of inland transportation management services, freight logistics services, container trucking services and bulk cargo container services. We suspended our shipping agency and ship management services from the beginning of the fiscal year 2016, primarily due to changes in market conditions. We also suspended our shipping and chartering services inland transportation management servicesprimarily as a result of the termination of vessel acquisition in December 2015.

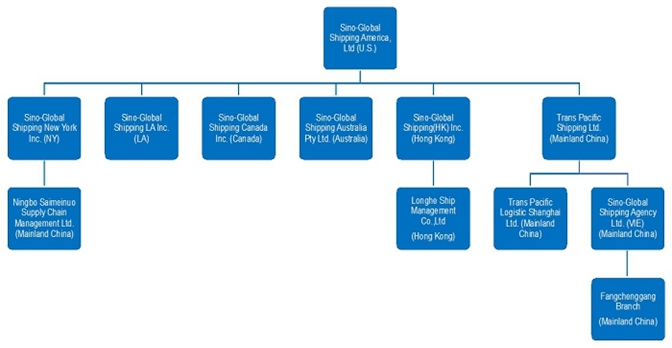

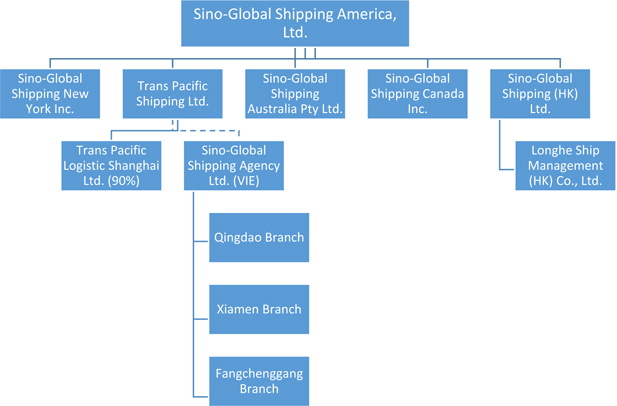

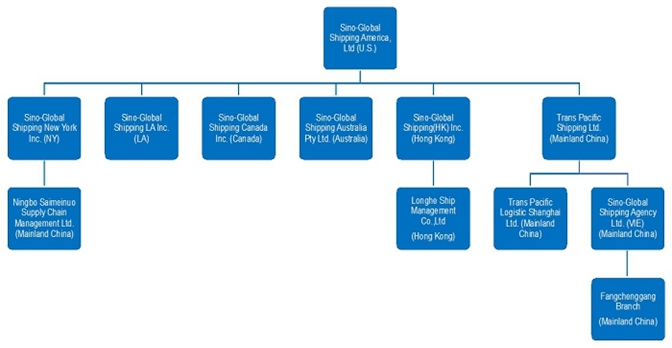

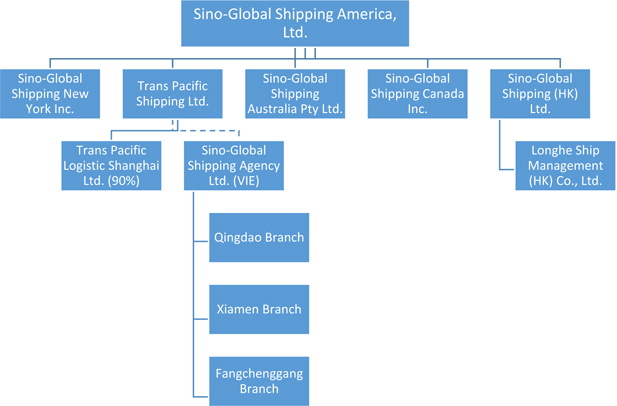

The Company conducts its business primarily through its wholly-owned subsidiaries in the U.S. (New York and ship management services. Substantially allCalifornia), China (including Hong Kong), Australia and Canada. Currently, a significant portion of our business is generated from our clients located in the People’s Republic of China (the “PRC”). In the third quarter of fiscal year 2017, the Company established ACH Trucking Center Corp. in New York as a joint venture with Jetta Global Logistics Inc. The Company owns 51% of ACH Trucking Center Corp. Although the establishment of ACH Center brought benefit for the Company and Jetta Global, it could not satisfy long term development for both the Company and Jetta Global. The Company signed a termination agreement with Jetta Global to terminate the joint venture agreement on December 4, 2017. The organizational structure of the Company is set forth in the chart below.

The Company’s subsidiary in China, Trans Pacific Shipping Limited (“Trans Pacific Beijing”), a wholly owned foreign enterprise, invested in one 90%-owned subsidiary, Trans Pacific Logistics Shanghai Limited (“Trans Pacific Shanghai”, and our operations are primarily conductedtogether with Trans Pacific Beijing, “Trans Pacific”). As PRC laws and regulations restrict foreign ownership of local shipping agency service businesses, the Company provided its shipping agency services in the PRC through Sino-Global Shipping Agency Ltd. (“Sino-China” or “VIE”), a Chinese legal entity, which holds the licenses and Hong Kong.

Since our inception in 2001 and through our fiscal year ended June 30, 2013, our sole business was providingpermits necessary to operate local shipping agency services. While we wereservices in the PRC. Trans Pacific Beijing and Sino-China do not have a parent-subsidiary relationship. Trans Pacific Beijing has contractual arrangements with Sino-China and its shareholders that enable the Company to substantially control Sino-China. Through Sino-China, the Company was able to consistently generate net revenues from such business, we were not able to achieve profitability as our costs and expenses continued to be higher than our net revenues.

Restructuring

Commencingprovide local shipping agency services in all commercial ports in the latter partPRC. In light of fiscal year 2013 and continuing through our fiscal year ended June 30, 2014, we took various actionsthe Company’s decision not to restructure our business withpursue the goal of achieving profitability. These actions included lowering our operating costs and expenses, reducing our dependency on ourlocal shipping agency business, the Company has suspended its shipping agency services through its VIE and hiring a new executive vice president and other consultantshas not undertaken any business through or with Sino-China since June 2014. Nevertheless, the Company continues to assist usmaintain its contractual relationship with the VIE because Sino-China is one of the committee members of the China Association of Shipping Agencies & Non-Vessel-Operating Common Carriers (“CASA”). CASA was approved to form by China Ministry of Communications. Sino-China is also our only entity that is qualified to conduct the shipping agency business in implementing our business restructuring efforts.

China. We keep the VIE to prepare ourselves if the market turns around.

Also, during the first and second quarters of fiscal year 2014, we expanded our service platform by adding two new services: shipping and chartering services and inland transportation management services. These two new services were added to service certain business needs of Tianjin Zhi Yuan Investment Group Co., Ltd. (the “Zhiyuan Investment Group”). The Zhiyuan Investment Group is controlled by Mr. Zhong Zhang (“Mr. Zhang”), who in April 2013, as approved by our Board of Directors and shareholders, purchased from us 1,800,000 shares of our common stock for approximately $3 million, resulting in Mr. Zhang becoming our largest shareholder.

Fiscal Year 2014 and 1st Quarter 2015 Profitability

As a result of our restructuring and the addition of our two new service lines, fiscal year 2014 represented our first year of profitability since our initial public offering, as we reported net income attributable to Sino-Global of $1,586,353 as compared to net loss attributable to Sino-Global of $1,799,755 for fiscal year 2013; and for the three months ended September 30, 2014, we reported net income attributable to Sino-Global of $332,459 as compared to net income attributable to Sino-Global of $275,394 for the three months ended September 30, 2013.

Complementary Acquisition in Fiscal Year 2015

As part of our strategy to expand our service platform, in September 2014, as approved by our Board of Directors, we acquired Longhe Ship Management (Hong Kong) Co., Limited (“LSM”), a ship management company based in Hong Kong from Mr. Deming Wang (“Mr. Wang”), who in June 2014, as approved by our Board of Directors, purchased from us 200,000 shares of our common stock for $444,000, resulting in Mr. Wang, as of the date of this prospectus, owning approximately 3.2% of our outstanding common stock. We believe that the acquisition of LSM will complement our existing service platform. Between September 8, 2014, the completion date of our acquisition of LSM, and September 30, 2014, LSM generated net revenues of $47,587 and net income of $23,178. The acquisition of LSM will result in the issuance of between 20,000 and 200,000 shares of our common stock to Mr. Wang, depending on whether LSM reaches certain net income targets for the period July 4, 2014 through December 31, 2014.

Our Strategy

Our strategy is to:

| · | Develop and implement a business model that drives sustainable earnings and profitability; |

| · | Diversify our service lines organically and/or through acquisitions;

|

| · | Continue to streamline our operations and improve our operating efficiency through effective planning, budgeting and cost control; |

| · | Continue to reduce our dependency on our shipping agency services business; |

| · | Add additional clients to reduce our dependency on a few key customers; and |

| · | Continue to monetize our relationship with strategic partners.

|

Currently, the Company’s inland transportation management services are operated by its subsidiaries in the PRC (including Hong Kong) and the U.S. Our Management Teamfreight logistics services are operated by our subsidiaries in the PRC, New York and California (Los Angeles). Our container trucking services are mainly operated by our subsidiaries and joint venture company in the PRC, New York and California (Los Angeles).

We believe we have a strongThe following table breaks down the revenues for our business segments for the fiscal years ended June 30, 2017 and experienced management team including our chief executive officer and chairman Mr. Lei Cao, our acting chief financial officer Mr. Anthony S. Chan, and our chief operating officer Mr. Zhikang Huang, who, together as a team, have many years of experience and a significant network of business contacts in the shipping industry in China and substantial experience in SEC reporting and compliance, business reorganization, mergers and acquisitions, accounting, risk management and operating both public and private companies.2016:

Risks Associated with Our Business

| | | Fiscal Year 2017 | | | Fiscal Year 2016 | |

| Key Services | | Revenues | | | % | | | GM | | | Revenues | | | % | | | GM | |

| Inland Transportation Management Services | | $ | 5,758,600 | | | | 50.3 | % | | | 89.2 | % | | $ | 4,340,522 | | | | 59.4 | % | | | 68.9 | % |

| Freight Logistics Services | | $ | 4,815,450 | | | | 42.1 | % | | | 22.9 | % | | $ | -- | | | | -- | % | | | -- | % |

| Container Trucking Services | | $ | 871,563 | | | | 7.6 | % | | | 25.4 | % | | $ | -- | | | | -- | % | | | -- | % |

| Shipping Agency and Ship Management Services | | $ | -- | | | | -- | % | | | -- | % | | $ | 2,507,800 | | | | 34.3 | % | | | 13.3 | % |

| Shipping and Chartering Services | | $ | -- | | | | -- | % | | | -- | % | | $ | 462,218 | | | | 6.3 | % | | | 54.0 | % |

| | | $ | 11,445,613 | | | | 100.0 | % | | | 56.5 | % | | $ | 7,310,540 | | | | 100.0 | % | | | 48.9 | % |

We are aware that moving forward, we are subject to various risks and uncertainties including:

| · | Our reliance on a limited number of customers;

|

| · | Our ability to continue to generate net revenues and operating profits from our two new service lines that we added during fiscal year 2014; |

| · | Our continued ability to keep our operating expenses at manageable levels; and

|

| · | Certain other risks and uncertainties set forth elsewhere in this prospectus under the section titled “Risk Factors”.

|

Certain CompanyCorporate Information

We are a Virginia corporation and ourOur principal executive offices are located at 1044 Northern Boulevard, Suite 305, Roslyn, New York 11576-1514. Our telephone number at this address is (718) 888-1814. Our shares of common stock is listedare traded on the NASDAQ Capital Market under the symbol “SINO”.“SINO.”

Our internetInternet website, www.sino-global.com, provides a variety of information about our company.Company. We do not incorporate by reference into this prospectus the information on, or accessible through, our website, and you should not consider it as part of this prospectus. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with the United States Securities and Exchange Commission (the “SEC”) are available, as soon as practicable after filing, at the investors’ page on our corporate website, or by a direct link to itsour filings on the SEC’s website.free website (www.sec.gov).

THE OFFERING

Issuer:Common Stock offered by the Selling Shareholders: | | Sino-Global Shipping America, Ltd.4,000,000 shares of common stock issuable upon exercise of the Warrants. |

| | | |

Common stock offered by us (assuming no exercise of the underwriter’s over allotment option): outstanding prior to this offering: | | 3,398,05812,533,035 shares

as of March 29, 2018 |

| | | |

Common stock to be outstanding after this offering (assuming no exercise of the underwriter’s option to purchase additional shares):

| | 9,598,899 shares

|

Underwriter’s option to purchase additional shares:

| | 509,708 shares

|

| Use of proceeds: | | We estimate thatThe Selling Shareholders will receive the net proceeds received by us from this offering will be approximately $6 Million, or approximately $6.96 Million if the underwriters exercise their option to purchase additionalsale of the shares in full based upon an assumed public offering price of $2.06 per share, which is the reported closing price of a share of our common stock on the NASDAQ Capital Market on November 10, 2014, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.offered hereby. We intend to use the netwill not receive any proceeds from this offering for general corporate and working capital purposes. Wethe sale of the shares of common stock. However, we may also usereceive proceeds in the aggregate amount of up to $7.0 million if all or a portion of such net proceeds for acquisitions of strategic and/or complementary businesses and/or assets, all as more fully described inthe Warrants covered by this prospectus under the headingare exercised for cash. See “Use of Proceeds.”

Proceeds” on page 7 of this prospectus. |

| | | |

Risk factors:Factors: | | Investing inThe purchase of our securities involves a high degree of risk. See the information contained in the section of this prospectus titled “Risk Factors” beginning on page 5,4 and other information included in this prospectus for a discussion of factors that you should carefully consider carefully before deciding to invest in our common stock

securities. |

| | | |

Market for the shares of common stock: | | Our common stock is listed on the NASDAQ Capital Market under the symbolSymbol: | | “SINO”. |

Unless expressly otherwise indicated herein, this prospectus assumes a per share public offering priceThe number of $2.06, the last reported closing price of a shareshares of our common stock outstanding, as set forth in the table above, is based on the NASDAQ Capital Market on November 10, 2014,12,533,035 shares outstanding as of March 29, 2018, and an offeringexcludes, as of $7,000,000 gross proceeds (assuming no exercise of the underwriter’s over-allotment option), and an offering of $8,050,000 gross proceeds (assuming the underwriter’s over-allotment option is fully exercised), this and all calculations based upon an assumed offering per share and the gross proceeds from the offering are based upon the above $2.06 per share offering price and a $7,000,000 offering and an $8,050,000 offering (assuming the underwriter’s over-allotment option is fully exercised).

such date:

3 | ● | 139,032 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $9.30 per share; |

| ● | 141,000 shares of common stock issuable upon the exercise of outstanding options with a weighted average exercise price of $3.81 per share, granted under our 2008 Incentive Plan and our 2014 Incentive Plan; |

| ● | 8,698,903 shares of common stock that are available for future option grants under our 2008 Incentive Plan and our 2014 Incentive Plan; and |

| ● | 4,000,000 shares of common stock issuable upon exercise of the Warrants. |

Table of Contents

SELECTED SUMMARY CONDENSED CONSOLIDATED FINANCIAL DATARISK FACTORS

The selected condensed summaryInvesting in our securities has a high degree of financial data set forth belowrisk. Before making an investment in our securities, you should be readcarefully consider the following risks, as well as the other information contained in conjunction withthis prospectus, including our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

We derived the following statement of operations data for the fiscal years ended June 30, 2014Operations.” The risks and 2013 and the balance sheet data as of June 30, 2014 from our audited financial statements included elsewhere in this prospectus. We derived the following statement of operations data for the three month period ended September 30, 2014 and 2013 and the balance sheet data as of September 30, 2014 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. Our statement of operations data for the three months ended September 30, 2014uncertainties described below are not necessarily indicative of the results to be expected for the full year.

Statement of Operations Data:

| | | Unaudited | | | Audited | |

| | | Three Months Ended September 30, | | | Year Ended June 30, | |

| | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

| | | | | | | | | | | | | |

| Net revenues | | $ | 2,605,925 | | | $ | 3,317,661 | | | $ | 11,644,392 | | | $ | 17,331,759 | |

| Cost of revenues | | | 1,409,153 | | | | 2,387,803 | | | | 7,613,459 | | | | 15,402,743 | |

| Gross profit | | | 1,196,772 | | | | 929,858 | | | | 4,030,933 | | | | 1,929,016 | |

| Operating income (loss) | | | 200,628 | | | | (17,394) | | | | 300,130 | | | | (2,203,540) | |

| Net income (loss) | | | 165,501 | | | | 28,973 | | | | 434,486 | | | | (2,576,896) | |

| Net loss attributable to non-controlling interest | | | (166,958) | | | | (246,421) | | | | (1,151,867) | | | | (777,141) | |

| Net income (loss) attributable to Sino-Global | | | 332,459 | | | | 275,394 | | | | 1,586,353 | | | | (1,799,755) | |

| Comprehensive income (loss) | | | 232,035 | | | | 3,336 | | | | 435,979 | | | | (2,592,830) | |

| Comprehensive income (loss) attributable to Sino-Global | | | 367,259 | | | | 263,510 | | | | 1,556,180 | | | | (1,761,673) | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) per common share: | | | | | | | | | | | | | | | | |

| Basic | | | 0.06 | | | | 0.06 | | | | 0.34 | | | | (0.38) | |

| Diluted | | | 0.06 | | | | 0.06 | | | | 0.34 | | | | (0.38) | |

Balance Sheet Data:

| | | September 30,

2014

(Unaudited) | | | June 30,

2014

(Audited) | |

| Cash and cash equivalents | | $ | 3,533,187 | | | $ | 902,531 | |

| Total assets | | | 7,591,374 | | | | 5,713,954 | |

| Total liabilities | | | 1,152,860 | | | | 1,230,795 | |

| Total equity | | | 6,438,514 | | | | 4,483,159 | |

RISK FACTORS

An investment in our common stock by you involves significant risks. You should carefully consider the followingonly ones we face. Additional risks and all other information set forth inuncertainties of which we are unaware or that we believe are not material at this prospectus before deciding to invest in our common stock. If any of the events or developments described below occurs,time could also materially adversely affect our business, financial condition andor results of operations may suffer.operations. In thatany case, the market pricevalue of our common stock maysecurities could decline and you could lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial maySee also impair our business operations.

Our business operations are primarily conductedthe information contained under the heading “Cautionary Statement Regarding Forward-Looking Statements” elsewhere in the PRC. Because China’s economy and its laws, regulations and policies are different from those typically found in the United States and are continually changing, we face certain risks, which are summarized below.

Risks Related to Our Business

Despite generating net income attributable to Sino-Global in our fiscal year 2014 and the three months ended September 30, 2014, we have a history of operating losses and may need to raise additional funds to continue our operations and to execute our business plan. We may not be able to obtain additional debt or equity funding under commercially reasonable terms or issue additional securities.

We reported net income attributable to Sino-Global of $1,586,353 for fiscal year 2014 and of $332,459 for the three months ended September 30, 2014, as compared to net loss attributable to Sino-Global of $1,799,755 for fiscal year 2013 and net income attributable to Sino-Global of $275,394 for the three months ended September 30, 2013. As of September 30, 2014, we had an accumulated deficit of $2,937,801 and cash and cash equivalents of $3,553,187 as compared to an accumulated deficit and cash and cash equivalents of $3,270,260 and $902,531 as of June 30, 2014, respectively. If we are not able to generate sufficient income and cash flows from operations to fund our operations and strategic growth plans, we may be required to seek additional funding through the issuance of equity or debt securities. Additional funding may not be available on terms favorable to us, or at all. If we raise additional funds by issuing equity securities, our shareholders may experience dilution. Debt financing, if available, may involve restrictive covenants or security interests in our assets. If we are unable to raise adequate funds or generate them from operations, we may have to delay, reduce the scope of, or eliminate some or all of our growth plans and/or liquidate some or all of our assets.

We have historically relied on a limited number of customers for a substantial portion of our business and no longer provide shipping agency services to our former largest customer.

In fiscal year 2014, we commenced providing shipping and chartering services and inland transportation management services to a single customer, the Zhiyuan Investment Group, an entity controlled by Mr. Zhang, our largest shareholder. During fiscal year 2014, $4,120,409 (or 35.4%), of our net revenues and $2,517,008 (or 62.4%), of our gross profits came from providing shipping and chartering services and inland transportation management services to the Zhiyuan Investment Group. For the three months ended September 30, 2014, we have not provided shipping and chartering services to the Zhiyuan Investment Group. The nature of our business is driven by the needs of our clients, and we cannot predict when, or if ever, we will receive another order for shipping and chartering services from the Zhiyuan Investment Group. For the three months ended September 30, 2014, $361,394 (or 13.9%) of our net revenues and $313,769 (or 26.2%) of our gross profits came from providing inland transportation management services to the Zhiyuan Investment Group. If we do not provide shipping and chartering services to the Zhiyuan Investment Group in the future, our business and results of operations would be materially adversely affected. Further, we cannot guarantee that we would be able to replace this customer with one or more new customers of similar size. Prior to fiscal year 2014, we relied heavily on Beijing Shourong Forwarding Service, Co., Ltd. (“Shourong”), an affiliate of Capital Steel, a steel company in China, for a substantial percentage of our shipping agency business. As part of the restructuring of our business, we exited our non-performing service arrangements including our shipping agency service with Shourong, who in fiscal year 2013, accounted for approximately 63% of our total net revenues. We did not provide any shipping agency services to Shourong in fiscal year 2014 or during the three months ended September 30, 2014 and cannot determine the extent of services, if any, we will deliver to Shourong in the future.prospectus.

We have recently entered shipping and chartering services and inland transportation management services businesses and cannot guarantee thatSince we will be able to compete effectively in these business areas.

Prior to fiscal year 2014, our sole line of business was providing shipping agency services. We expanded our services to include shipping and chartering services in the quarter ended September 30, 2013 and inland transportation management services in the quarter ended December 31, 2013. As we are a new entrant into these two business lines, we do not have a significant market presence. Further, we currently only provide shipping and chartering services and inland transportation services to one customer, the Zhiyuan Investment Group, who is controlled by Mr. Zhang, our largest shareholder. We may not have been able to enter into these business lines without our relationship with Mr. Zhang, and we cannot guarantee that we will be successful in securing and providing shipping and chartering services and inland transportation management services contracts for other customers on acceptable terms, if at all.

The fees that we received from the Zhiyuan Investment Group for our shipping and chartering services and inland transportation management services may not be indicative of the fees that we may receive for the same services provided to unaffiliated customers and may be materially lower, which would have an adverse effect on our results of operations.

Our shipping and chartering services and inland transportation management services to date have been provided primarily to a single customer, the Zhiyuan Investment Group. Therefore, we cannot provide any assurances that the fees we have received for these services from this customer are indicative of the fees that we may receive if we are able to obtain non-affiliated customers for these services. The fees that we may receive from non-affiliated customers may be less than what we have received from our affiliated customer, and could possibly be so low as to make these lines of business unprofitable, which would have a material adverse effect on our results of operations and could require us to terminate such service lines.

We have entered into a number of business arrangements that are significant to us with two of our shareholders including Mr. Zhang, our largest shareholder, and through Mr. Zhang, the Zhiyuan Investment Group, who is controlled by Mr. Zhang. The failure to maintain our business relationship with either or both of such shareholders would have a material adverse effect on our business and results of operations.

In April 2013, as approved by our Board of Directors and shareholders, Mr. Zhang purchased 1,800,000 shares of our common stock for approximately $3 million, which as of the date of this prospectus represents approximately 29% of our issued and outstanding common stock, resulting in Mr. Zhang becoming our largest shareholder. As a result of Mr. Zhang’s desire to find business opportunities that would mutually benefit us and the Zhiyuan Investment Group, a company controlled by Mr. Zhang, which owns a number of businesses in China, in June 2013, we signed a 5-year Global Logistic Service Agreement with two parties, one of which was the Zhiyuan Investment Group and the other was TEWOO Chemical & Light Industry Zhiyuan Trade Co., Ltd. (“Tewoo”). Thereafter, during the quarter ended September 30, 2013, we executed a shipping and chartering services agreement with the Zhiyuan Investment Group, pursuant to which we assisted the Zhiyuan Investment Group in the transportation of approximately 51,000 tons of chromite ore from South Africa to China; and in September 2013, we executed an inland transportation management service contract with the Zhiyuan Investment Group pursuant to which we agreed to provide certain advisory services and assist the Zhiyuan Investment Group in attempting to control its potential commodities loss during the transportation process. On a one time basis, we executed a one year short-term loan agreement with the Zhiyuan Investment Group, effective January 1, 2014, to facilitate the working capital needs of the Zhiyuan Investment Group. As of June 30, 2014, the net amount due to us from the Zhiyuan Investment Group was $2,920,950 consisting of funds borrowed from us pursuant to the short-term loan agreement and trade receivables due us from the Zhiyuan Investment Group. In September 2014, we collected approximately $2.7 million from the Zhiyuan Investment Group, representing full repayment of all funds borrowed by the Zhiyuan Investment Group from us pursuant to the short-term loan agreement and the payment to us of approximately $1.6 million of outstanding trade receivables. During the three months ended September 30, 2014, we continued to provide inland transportation management services to the Zhiyuan Investment Group. The net amount due to us from the Zhiyuan Investment Group at September 30, 2014 was $627,951. In October 2014, we collected approximately $384,000 from the Zhiyuan Investment Group which reduced the outstanding trade receivables due to us from the Zhiyuan Investment Group.

In May 2014, we signed a strategic agreement with Qingdao Zhenghe Shipping Group Limited (“Zhenghe”), to jointly explore mutually beneficial business development opportunities. Zhenghe is a PRC company to which Mr. Wang is the majority shareholder. To demonstrate the commitment by Zhenghe to its business relationship with us, in June 2014, as approved by our Board of Directors, Mr. Wang, through a company owned by him, purchased 200,000 shares of our common stock for $444,000, resulting in Mr. Wang owning as of the date of this prospectus, approximately 3.2% of our outstanding common stock. Subsequently, and as part of our strategy to expand our service platform, in September 2014, as approved by our Board of Directors, we acquired LSM, a ship management company based in Hong Kong from Mr. Wang. While to date the net revenues generated from such business have been immaterial, we believe that ship management is a good complement to our existing service platform. The acquisition of LSM will result in the issuance of between 20,000 and 200,000 shares of our common stock to Mr. Wang, depending on whether LSM reaches certain net income targets for the period July 4, 2014 through December 31, 2014. LSM outsources its ship management services to Qingdao Longhe Ship Management Services Co., Ltd., a company controlled by Mr. Wang.

As a result of our business relationship with Mr. Zhang and Mr. Wang, since April 2013, we have received approximately $3.5 million from the sale of 2,000,000 shares of our common stock to such two persons and added shipping and chartering, inland transportation management and ship management services to our service platform, which shipping and chartering services and inland transportation management services generated 35.4% and 62.4% of our net revenues and gross profit in fiscal year 2014, respectively and 13.9% and 26.2% of our net revenues and gross profit for the three months ended September 30, 2014, respectively.

Based upon the above, the failure by us to maintain our existing business relationship with Mr. Zhang and/or Mr. Wang would have a material adverse effect on our business and results of operations.

The shipping agency business is very competitive in nature and many of our competitors have greater financial, marketing and other resources than we have.

Our competitors in the shipping agency business include three major shipping agencies, China Ocean Shipping Agency Co., Ltd. (“Penavico”), China Shipping (Group) Company (“China Shipping”) and China Marine Shipping Agency Co., Ltd. (“Sinoagent”). These competitors have significantly greater financial, marketing and other resources and name recognition than we have. In addition, we also face competition from a large number of smaller, local shipping agents. Our competitors may introduce new business models, and if these new business models are more attractive to customers than the business models we currently use, our customers may switch to our competitors’ services, and we may lose market share. We believe that competition in China’s shipping agency industry may become more intense as more shipping agencies, including Chinese/foreign joint ventures, are qualified to conduct business. We cannot assure you that we will be able to compete successfully against any new or existing competitors, or against any new business models our competitors may implement. In addition, the increased competition we anticipate in the shipping agent industry may also reduce the number of vessels for which we are able to provide shipping agency services, or cause us to reduce agency fees in order to attract or retain customers. All of these competitive factors could have a material adverse effect on our business and results of operations.

Our three largest shipping agency competitors, Penavico, China Shipping and Sinoagent, are partly owned by the Chinese government which places us at a significant competitive disadvantage.

The Chinese government’s ownership interests in Penavico, China Shipping and Sinoagent, place us at a significant competitive disadvantage. When the Chinese government founded Penavico, it closed the shipping agency industry to a number of foreign shipping agents that had been providing services in China. These restrictions have since been removed, but there can be no assurance that the Chinese government will not reinstate these restrictions or impose other restrictions, or nationalize the shipping agency industry in the future. Further, we believe that state ownership provides Penavico, China Shipping and Sinoagent, with advantages and leverage over local government officials and local companies that we, as a non-state owned company, do not have. Also, due to their relationship with the Chinese government, these competitors may have access to funding that is not available to us. This access may allow them to grow their businesses at a rate we are not able to match. If the Chinese government were to take actions to limit competition or provide these competitors with preferential access to business and funding, which results in our losing business, it would have a material adverse effect on our operations and financial condition.

We believe that our competitors in the shipping and chartering services and inland transportation management services business, have greater name recognition, significantly more experience, financial, marketing and other resources than we have and we expect to face intense competition in these business segments.

We have recently launched the shipping and chartering services and inland transportation management services business and so we expect that our competitors in these segments will have greater experience and name recognition than we do, which is a competitive disadvantage to us. Further, we expect that these competitors will be larger than us and have greater financial and marketing resources than we have, which also puts us at a significant competitive disadvantage. Since larger competitors may be able to offer the same services we offer at lower rates than what we would need to charge to operate profitably, this would have a material adverse effect on our business and results of operation.

The barriers to enter into the business segments in which we operate are low and we may face competition from new entrants into these business segments.

The number of competitors offering the same services that we do may increase in the future since the barriers to entry are low. Increases in competition could lead to revenue reductions, reduced profit margins, or a loss of market share, any one of which could have a material adverse effect on our business and results of operations.

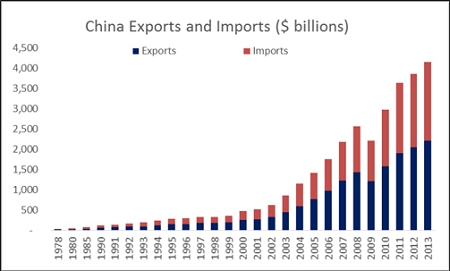

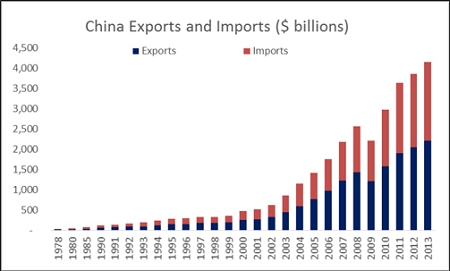

Our customers are engaged in the shipping industry, and, consequently, our financial performance is dependent upon the economic conditions of that industry.

We derive our revenues from providing services to customers in the business of shipping materials to China and our success is dependent upon our customer’s shipping needs. Our customers’ shipping needs are intrinsically linked to economic conditions in the shipping industry in general and trade with China in particular. The shipping industry, in turn, is subject to intense competitive pressures and is affected by overall economic conditions. Accordingly, demand for our services could be harmed by instability or downturns in the shipping industry, reductions in trade between China and other countries or a combination of both which could materially lower demand or cause our customers to forego the shipping agency services we provide by attempting to provide such services in-house. If any of the foregoing occurs, it would have a material adverse effect on our business and our results of operations.

We may be required to assume liabilities for our clients in the future.

An increasing number of companies that require shipping agency services have pressured shipping agents to guarantee their clients’ liabilities. Some companies have required shipping agents, as a condition of doing business, to pay for tariffs, port charges, and other fees, or to pay these fees with the promise of reimbursement at a later date. Other companies have sought to include shipping agents as parties in voyage charter agreements, leading to potential liability for shipping agents in the event of a breach by another party. We expect that these pressures on shipping agents to accept more liability will increase as competition among shipping agencies intensifies. While we do not currently pay these liabilities and have no present intention to begin doing so in the future, the assumption of any of these or other liabilities could have a material adverse effect on our business and results of operations.

We are heavily dependent upon the services of experienced personnel who possess skills that are valuable in our industry, and we may have to actively compete for their services.

We are a small company with limited resources, and we compete in large part on the basis of the quality of services we are able to provide our clients. As a result, we are heavily dependent upon our ability to attract, retain and motivate skilled personnel to serve our clients. Many of our personnel possess skills that would be valuable to other companies engaged in one or more of our business lines. Consequently, we expect that we will have to actively compete with other Chinese shipping agencies to retain these employees. Some of our competitors may be able to pay our employees more than we are able to pay to retain them. Our ability to profitably operate is substantially dependent upon our ability to locate, hire, train and retain our personnel. Although we have not experienced difficulty locating, hiring, training or retaining our employees to date, there can be no assurance that we will be able to retain our current personnel, or that we will be able to attract and assimilate other qualified personnel in the future. If we are unable to effectively obtain and maintain skilled personnel, the quality of the shipping services that we provide could be materially impaired, which would have a material adverse effect on our business and results of operations.

We are substantially dependent upon our key personnel.

Our performance is substantially dependent on the performance of our executive officers and key employees. In particular, the services of:

·Mr. Lei Cao, Chief Executive Officer;

·Mr. Anthony S. Chan, Acting Chief Financial Officer; and

· Mr. Zhikang Huang, Chief Operating Officer

would be difficult for us to replace. While we have employment contracts with each of our executive officers, such contracts may be terminated in certain circumstances by the executive officers. Moreover, we do not have any “key person” life insurance policies on any of our employees. The loss of the services of any of our executive officers or other key employees could substantially impair our ability to effectively execute our business and expand our service platform, which would have a material adverse effect on our business and results of operations.

We need to maintain our relationships with local agents.

Our shipping agency business is dependent upon our relationships with local agents operating in the ports where our customers ship their products. As a general agent, substantially all of our shipping agency revenues have been derived from services delivered by the local agents and we believe local agent relationships will remain critical to our success in the future. We have a number of local agents that account for a significant portion of our business, the loss of one or more of which could materially and negatively impact our ability to retain and service our customers. We cannot be certain that we will be able to maintain and expand our existing local agent relationships or enter into new local agent relationships, or that new or renewed local agent relationships will be available on commercially reasonable terms. If we are unable to maintain and expand our existing local agent relationships, renew existing local agent relationships, or enter into new local agent relationships, we may lose customers, customer introductions and co-marketing benefits, and our business and results of operations may suffer significantly.

We are dependent on third party carriers and inland transportation companies to transport our client’s cargo.

We rely on commercial ocean freight carriers and inland transportation companies, for the movement of our client’s cargo. Consequently, our ability to provide services for our clients could be adversely impacted by: shortages in available cargo capacity; changes by carriers and transportation companies in policies and practices such as scheduling, pricing, payment terms and frequency of service or increases in the cost of fuel, taxes and labor; and other factors not within our control. Reductions in ocean freight capacity could negatively impact our yields. Material interruptions in service or stoppages in transportation, whether caused by strike, work stoppage, lock-out, slowdown or otherwise, could adversely impact our business, results of operations and financial condition.

Our profitability depends on our ability to effectively manage our cost structure as we grow the business.

As we continue to attempt to increase our revenues through the expansion of our service offerings, we must maintain an appropriate cost structure to maintain and increase our profitability. While we intend to increase our revenues by increasing the number and quality of the shipping services we provide by strategic acquisitions, and by maintaining and expanding our gross profit margins by reducing costs, our profitability will be driven in large part by our ability to manage our agent commissions, personnel and general and administrative costs as a function of our net revenues. There can be no assurances that we will be able to effectively control our costs and failure to do so would result in lack of profitability, which would have a material adverse effect our business and results of operations.

Comparisons of our operating results from period to period are not necessarily meaningful and should not be relied upon as an indicator of future performance.

Our operating results have fluctuated in the past and likely will continue to fluctuate in the future because of a variety of factors, many of which are beyond our control. In fiscal year 2014, a substantial portion of our revenues was derived from the Zhiyuan Investment Group whose business needs we believe are tied closely to economic trends and consumer demand that can be difficult to predict. There can be no assurance that our historic operating performance will continue in future periods as we cannot assume or provide any assurance that the Zhiyuan Investment Group will continue to utilize our services, or have the same level of demand for our services that it had in fiscal year 2014. Because our quarterly revenues and operating results vary significantly, comparisons of our period-to-period results are not necessarily meaningful and should not be relied upon as an indicator of future performance.

We have not paid any dividends and we do not foresee paying dividends in the future.

We have never declared or paid any cash dividends on our common stock. We do not anticipate paying any cash dividends on our common stock in the foreseeable future, if ever. Any future determination to pay cash dividends will be at the discretion of our Board of Directors and will depend upon our financial condition, operating results, capital requirements, Virginia and PRC laws, and other factors that our Board of Directors deems relevant.

Foreign Operational Risks

We do not have business liability, disruption, or director and officer liability insurance.

We do not have any business liability or disruption insurance coverage for our operations in China, or any director and officer liability insurance coverage for our directors and officers in the United States or China. Any business interruption, litigation or natural disaster and/or any claim against any of our directors or officers resulting from any of their actions in such capacities, may result in our business incurring substantial costs and the diversion of resources.

Trans Pacific’s contractual arrangements with Sino-China may result in adverse tax consequences to us.

As a result of our corporate structure and contractual arrangements between Trans Pacific and Sino-China, any revenues generated by Sino-China’s operations in China and/or any revenues derived from Trans Pacific‘s contractual arrangements with Sino-China are subject to PRC tax. Moreover, we could face material and adverse tax consequences if the PRC tax authorities determine that Trans Pacific’s contractual arrangements with Sino-China were not made on an arm’s length basis and adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. A transfer pricing adjustment could result in a reduction, for PRC tax purposes, of adjustments recorded by Sino-China, which could adversely affect us by increasing Sino-China’s tax liability without reducing Trans Pacific’s tax liability, which could further result in late payment fees and other penalties to Sino-China for underpaid taxes.

Trans Pacific’s contractual arrangements with Sino-China may not be as effective in providing control over Sino-China as direct ownership of Sino-China.

Until fiscal year 2014, we conducted a significant portion of our shipping agency business through contractual arrangements with Sino-China that provided us, through our ownership of Trans Pacific, with effective control over Sino-China. Although each contract under Trans Pacific’s contractual arrangements with Sino-China is valid, binding and enforceable under current PRC laws and regulations, there are substantial uncertainties regarding the interpretation and application of PRC laws and regulations governing the enforcement and performance of such contractual control over Sino-China. If the PRC government determines that these contractual arrangements as a whole do not comply with applicable regulations, our business could be substantially adversely affected. In addition, these contractual arrangements may not be as effective in providing us with control over Sino-China as direct ownership of Sino-China would. Furthermore, Sino-China may breach the contractual arrangements. For example, Sino-China may decide not to pay consulting or marketing fees to Trans Pacific, and consequently to our company, in accordance with the existing contractual arrangements. In event of any such breach, we would have to rely on legal remedies under PRC law. These remedies may not always be effective, particularly in light of uncertainties in the PRC legal system. In light of rising operating costs and expenses associated with doing business in China, consecutive years of operating losses reported by Sino-China, concerns raised by the US regulators over the last few years about VIE’s and our belief that the investing public may have a negative perception of publicly traded companies with VIE structures, we decided to reorganize our shipping agency business in fiscal year 2013. As a result of our reorganization efforts, we reduced our overhead, changed our service mix, stopped providing agency services to Shourong, one of our largest customers, and shifted our agency business operation from Sino-China to our wholly-owned subsidiaries in China and Hong Kong.

Uncertainties with respect to the PRC legal system could adversely affect us.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our contractual arrangements with Sino-China and its shareholders.

We conduct a substantial portion of our business through Trans Pacific and Sino-Global Shipping (HK) Ltd. Sino-Global Shipping (HK) Ltd., Trans Pacific and our company are generally subject to laws and regulations applicable to foreign investment in China and, in particular, laws applicable to wholly foreign-owned enterprises. Trans Pacific, Sino-Global Shipping (HK) Ltd. and our company are considered foreign persons or foreign invested enterprises under PRC law. As a result, Trans Pacific, Sino-Global Shipping (HK) Ltd. and our company are subject to PRC law limitations on foreign ownership of Chinese companies. These laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

In addition, we depend on Sino-China to honor its agreements with Trans Pacific. Almost all of these agreements are governed by PRC law. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

The PRC government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new PRC laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future PRC laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

The shareholders of Sino-China have potential conflicts of interest with us, which may adversely affect our business.

Neither we nor Trans Pacific owns any portion of the equity interests of Sino-China. Instead, we and Trans Pacific rely on contractual obligations to enforce our interest in receiving payments from Sino-China. Conflicts of interest may arise between Sino-China’s shareholders and our company if, for example, their interests in receiving dividends from Sino-China were to conflict with our interest requiring Sino-China to make contractually-obligated payments to Trans Pacific. As a result, we have required Sino-China and each of its shareholders to execute irrevocable powers of attorney to appoint the individual designated by us to be his attorney-in-fact to vote on their behalf on all matters requiring shareholder approval by Sino-China and to require Sino-China’s compliance with the terms of its contractual obligations. We cannot assure you, however, that when conflicts of interest arise, Sino-China’s shareholders will act completely in our interests or that conflicts of interests will be resolved in our favor. In addition, Sino-China’s shareholders could violate their agreements with us by diverting business opportunities from us to others. If we cannot resolve any conflicts of interest between us and Sino-China’s shareholders, we would have to rely on legal proceedings, which could result in the disruption of our business. In addition, these contractual relationships are governed by PRC law, which may result in uncertainty as to application and enforcement.

We rely on dividends paid by our subsidiary for our cash needs.

We rely on dividends paid by Trans Pacific for our cash needs, including the funds necessary to pay dividends and other cash distributions, if any, to our shareholders, to service any debt we may incur and to pay our operating expenses. The payment of dividends by entities organized in China is subject to limitations. Regulations in the PRC currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. Our subsidiary in China is also required to set aside a portion of their after-tax profits according to PRC accounting standards and regulations to reserve fund and other funds required by PRC law. The PRC government also imposes controls on the conversion of Renminbi (“RMB”) into foreign currencies and the remittance of currencies out of China. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency. Pursuant to the PRC enterprise income tax law and its implementation rules that were effective on January 1, 2008, dividends payable by a foreign investment entity to its foreign investors are subject to a withholding tax of up to 10%. Meanwhile, the United States and China are signatories to the 1984 People’s Republic of China-United States Income Tax Agreement, which would allow our company to claim a deemed-paid credit, which is an indirect tax credit, on any taxes paid to China by Trans Pacific. To the extent we were not eligible to receive or were unable to use the credit, this tax could have an adverse effect on our company.

Governmental control of currency conversion may affect the value of your investment.

In the course of providing services for international shipments, we occasionally require currencies from other countries to conduct our business. While we believe that we have complied with applicable currency control laws and regulations in all material aspects, we cannot guarantee you that our efforts will be free from challenge or that, if challenged, we will be successful in our defense of our current practices. Under our current corporate structure, our income is paid in different currencies, depending on our agreements with individual customers. We then pay in local currencies the expenses associated with operating a company in several countries. Shortages in the availability of foreign currency may restrict our ability to pay such expenses unless and until we convert currencies that we have into those that we require.

One of the currencies we often convert among is the RMB. The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends, if any, in foreign currencies to our shareholders.

Fluctuation in the value of the RMB may have a material adverse effect on your investment.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an appreciation of the RMB against the U.S. dollar. While the international reaction to the RMB revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar. We rely largely on payments from Trans Pacific and Sino-China. While we charge our fees in U.S. dollars, Sino-China and Trans Pacific nevertheless operate within China and will rely heavily on RMB in their operations. Any significant revaluation of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payable on, our common stock in U.S. dollars. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditures more costly to us, to the extent that we need to convert U.S. dollars into RMB for such purposes.

Changes in China’s political and economic policies could harm our business.

China’s economy has historically been a planned economy subject to governmental plans and quotas and has, in certain aspects, been transitioning to a more market-oriented economy. Although we believe that the economic reform and the macroeconomic measures adopted by the Chinese government have had a positive effect on the economic development of China, we cannot predict the future direction of these economic reforms or the effects these measures may have on our business, financial position or results of operations. In addition, the Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD. These differences include:

·economic structure;

·level of government involvement in the economy;

·level of development;

·level of capital reinvestment;

·control of foreign exchange;

·methods of allocating resources; and

·balance of payments position.

As a result of these differences, our business may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

Since 1979, the Chinese government has promulgated many new laws and regulations covering general economic matters. Despite this activity to develop a legal system, China’s system of laws is not yet complete. Even where adequate law exists in China, enforcement of existing laws or contracts based on existing law may be uncertain or sporadic, and it may be difficult to obtain swift and equitable enforcement or to obtain enforcement of a judgment by a court of another jurisdiction. The relative inexperience of China’s judiciary, in many cases, creates additional uncertainty as to the outcome of any litigation. In addition, interpretation of statutes and regulations may be subject to government policies reflecting domestic political changes. Our activities in China will also be subject to administration review and approval by various national and local agencies of China’s government. Because of the changes occurring in China’s legal and regulatory structure, we may not be able to secure the requisite governmental approval for our activities. Although we have obtained all required governmental approval to operate our business as currently conducted, to the extent we are unable to obtain or maintain required governmental approvals, the Chinese government may, in its sole discretion, prohibit us from conducting our business.”

The Chinese government could change its policies toward private enterprise or even nationalize or expropriate private enterprises, which could result in the total loss of our investment in that country.

Our business is subject to significant political and economic uncertainties and may be adversely affected by political, economic and social developments in China. Over the past several years, the Chinese government has pursued economic reform policies including the encouragement of private economic activity and greater economic decentralization. The Chinese government may not continue to pursue these policies or may significantly alter them to our detriment from time to time with little, if any, prior notice.

Changes in policies, laws and regulations or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on dividend payments to shareholders, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business. Nationalization or expropriation could even result in the total loss of our investment in China and in the total loss of your investment in us.

As most of our officers, directors and assets are outside the United States, it will be extremely difficult to acquire jurisdiction and enforce liabilities against us and our officers, directors and assets based in China.

Most of our directors and officers reside outside the United States. In addition, the majority of our assets are located outside the United States. As a result, it may be difficult or impossible to effect service of process within the United States upon most, if not all, of our directors or officers and our subsidiaries, or enforce against any of them court judgments obtained in United States courts, including judgments relating to United States federal securities laws. Furthermore, because the majority of our assets are located in China and PRC does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts, it would also be extremely difficult to access those assets to satisfy an award entered against us in United States court.

Our international operations require us to comply with a number of U.S. regulations.