As filed with the Securities and Exchange Commission on September 18, 2008

June 28, 2022

Registration No. 333-150468

================================================================================

333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

EASY ENERGY, INC.

(Exact

Raphael Pharmaceutical Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 2833 | 26-0204284 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification |

4 Lui Paster

Tel Aviv-Jaffa, Israel 6803605

Telephone: (972) 52-775-5072

(Address, including zip code, and telephone number, including area code, of registrant'sregistrant’s principal executive offices)

EASTBIZ.COM INC.

5348 Vegas Drive

Las Vegas, NV 89108

Tel: (702) 442-1166

(Name,

Shlomo Pilo

Chief Executive Officer

4 Lui Paster

Tel Aviv-Jaffa, Israel 6803605

Telephone: (972) 52-775-5072

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy

Copies to:

Edwin L. Miller Jr., Esq.

Zysman, Aharoni, Gayer & Co.

Sullivan & Worcester LLP

One Post Office Square

Boston, Massachusetts 02110

Telephone: (617) 338-2800

Fax: (617) 338-2880

Oded Har-Even, Esq. Sullivan & Worcester LLP |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement becomes effective.

registration statement.

If any of the securities being registered on this formForm are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer,” “smaller reporting company” and "smaller

reporting company"“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer [ ] Accelerated Filer [ ]

Non-accelerated Filer [ ]

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, [X]

(Doindicate by check market if the registrant has elected not check ifto use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a Smaller reporting company)

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES

AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE

A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE

SECURITIES ACT, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON

SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID

SECTION 8(A)further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), MAY DETERMINE.

================================================================================

SUBJECT TO COMPLETION, DATED ____________, 2008

THE INFORMATION CONTAINED IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED.

THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION

STATEMENT FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION IS

EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS

NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR

SALE IS NOT PERMITTED.

EASY ENERGY, INC.

PROSPECTUS

20,638,273 SHARES OF COMMON STOCK

may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 28, 2022 |

Raphael Pharmaceutical Inc.

Resale of 1,667,393 Shares of Common Stock

This prospectus relates to the resale by the selling security holders named in this prospectus or their permitted transferees (the “Selling Securityholders”) of up to the public by certain selling

shareholders of Easy Energy, Inc. of:

* Up to 750,0001,667,393 shares of our common stock, par value $0.01 per share (“Common Stock”) issued in aone or more private placement on

March 27, 2008.

* Up to 882,353placements.

The shares of our common stock issued in a private placement on

March 10, 2008.

* Up to 3,000,000 shares of our common stock whichCommon Stock that may be issued upon the

exercise of warrants issued in connection with the private placement on

March 10, 2008.

* Up to 300,000 shares of our common stock issued in a private placement on

March 3, 2008.

* Up to 1,000,000 shares of our common stock which may be issued upon the

exercise of warrants issued in connection with the private placement on

March 3, 2008.

* Up to 3,676,480 shares of our common stock issued in a private placement on

February 28, 2008.

* Up to 11,029,440 shares of our common stock which may be issued upon the

exercise of warrants issued in connection with the private placement on

February 28, 2008.

The warrants issued on March 10, 2008 entitle the holder to purchase one

additional share of our common stock at an exercise price of $0.27 for a period

of five years from the closing date.

The warrants issued on March 3, 2008 entitle the holder to purchase one

additional share of our common stock at an exercise price of $0.15 for a period

of five years from the closing date.

The warrants issued on February 28, 2008 entitle the holder the purchase one

share of our common stock at an exercise price of $0.27 for a period of five

years.

The shares were acquiredsold by the selling stockholders directly from our company

in private transactions that were exempt from the registration requirements of

the Securities Act of 1933. The selling stockholders may offerSelling Securityholders are collectively referred to sell the

shares of common stock being offered in this prospectus at fixed prices, at

prevailing market prices atas the time of sale, at varying prices or at negotiated

prices. Our common stock is quoted on the OTC Bulletin Board under the symbol

"ESYE.OB". On September 12, 2008 the closing bid price for one share of our

common stock on the OTC Bulletin Board was $0.16.

We will not receive any proceeds from the resale of shares of common stock by

the selling stockholders, although we may receive proceeds of up to $3,937,949

if all of the warrants are exercised. We will pay for all costs associated with

this registration statement and prospectus.

The selling shareholders may be deemed to be "underwriters," as such term is

defined in the Securities Act.

OUR BUSINESS IS SUBJECT TO MANY RISKS, AND AN INVESTMENT IN OUR COMMON STOCK

WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD INVEST IN OUR COMMON STOCK

ONLY IF YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. YOU SHOULD CAREFULLY

CONSIDER THE VARIOUS RISK FACTORS DESCRIBED BEGINNING ON PAGE 3 BEFORE INVESTING

IN OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS

PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENCE.

EASY ENERGY, INC.

PROSPECTUS

20,638,273 SHARES OF COMMON STOCK

TABLE OF CONTENTS

Page Number

-----------

PROSPECTUS SUMMARY 1

RISK FACTORS 3

FORWARD-LOOKING STATEMENTS 9

USE OF PROCEEDS 9

DETERMINATION OF OFFERING PRICE 9

DILUTION 9

SELLING SHAREHOLDERS 9

PLAN OF DISTRIBUTION 12

INTEREST OF NAMED EXPERTS AND COUNSEL 13

DESCRIPTION OF BUSINESS 13

DESCRIPTION OF PROPERTY 16

DESCRIPTION OF SECURITIES 16

LEGAL PROCEEDINGS 17

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS 17

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION 18

APPLICATION OF CRITICAL ACCOUNTING POLICIES 21

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE 22

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS 22

EXECUTIVE COMPENSATION 24

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT 25

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS 27

DISCLOSURE OF SEC POSITION OF INDEMNIFICATION FOR SECURITIES

ACT LIABILITIES 27

EXPERTS 28

WHERE YOU CAN FIND MORE INFORMATION 28

FINANCIAL STATEMENTS 29

As used in this prospectus, the terms "we", "us", "our" and "Easy Energy" mean

Easy Energy, Inc., unless otherwise indicated.

All dollar amounts refer to U.S. dollars unless otherwise indicated.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus.

Because this is a summary, it may not contain all of the information that you

should consider before receiving a distribution of our common stock. You should

read this entire prospectus carefully. We are a development stage company that

has only recently begun operations. We have not generated any revenues from our

intended business activities, and we do not expect to generate revenues in the

near future. We may never generate revenues. We have minimal assets and have

incurred losses since inception.

CORPORATE BACKGROUND

Easy Energy, Inc. was incorporated under the laws of the State of Nevada on May

17, 2007. We have not generated any revenue to date and are a development stage

company. We currently have no employees other than our President and Secretary

who are also our only board members. We plan to develop a novel, man-powered

charger solution for the problems related to the ongoing power requirements of

small hand-carried battery-powered personal electronic devices. On August 20,

2007 we filed a patent application (Application No.: 11/841,046) with the United

States Patent and Trademark Office. Prior to our incorporation, Mr. Guy Ofir,

our President and Director developed a prototype of the patent. On January 29,

2008, we announced on the completion of the fully working prototype of the

man-powered charger solution for battery powered small hand-carried devices.

The Company's principal business plan is to manufacture and market the product

and/or seek third party entities interested in licensing the rights to

manufacture and market the man-powered charger. Our target market will be

consumers of disposable and rechargeable batteries, those who heavily depend on

their portable devices, especially cell phone users, and those who are looking

for "green" energy sources.

Our principal executive office is located at Suite 105 - 5348 Vegas Dr., Las

Vegas, NV 89108. Our telephone number is (702) 442-1166. We also have an office

in Israel at 26 Ga'aton Blvd., Nahariya 22401 Israel, Tel. No. +972-4-988 8314 .

We do not have any subsidiaries. The address of our resident agent is

Eastbiz.com Inc, 5348 Vegas Dr, Las Vegas, Nevada, U.S.A., 89108.

Due to the uncertainty of our ability to meet our current operating and capital

expenses, in their report on our audited financial statements for the period

ended March 31, 2008 our independent auditors included an explanatory paragraph

regarding concerns about our ability to continue as a going concern. Our

financial statements contain additional note disclosures describing the

circumstances that lead to this disclosure by our independent auditors.

NUMBER OF SHARES BEING OFFERED

This prospectus covers the resale by the selling stockholders named in this

prospectus of up to 20,638,273 shares of our common stock. The offered shares

were acquired by the selling stockholders in several private placement

transactions. All of these transactions were exempt from the registration

requirements of the Securities Act of 1933. The selling stockholders may offer

to sell the shares of common stock being offered in this prospectus at fixed

prices, at prevailing market prices at the time of sale, at varying prices or at

negotiated prices. Our common stock is presently traded on the OTC Bulletin

Board under the symbol "ESYE.OB". Please see the Plan of Distribution section at

page 11 of this prospectus for a detailed explanation of how the common shares

may be sold.

NUMBER OF SHARES ISSUED AND OUTSTANDING

There were 93,186,070 shares of our common stock issued and outstanding as at

September 12, 2008.

1

USE OF PROCEEDS“Offered Securities.” We will not receive any of the proceeds from the sale by the Selling Securityholders of the sharesOffered Securities. See “Use of Proceeds” beginning on page 29 of this prospectus. We will bear all costs, expenses and fees in connection with the registration of the Offered Securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of the Offered Securities, except as otherwise expressly set forth under “Plan of Distribution” beginning on page 62 of this prospectus.

This prospectus describes the general manner in which the Offered Securities may be offered and sold. If necessary, the specific manner in which the Offered Securities may be offered and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may add, update or change information contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement before you invest in any of our common stock being offeredsecurities.

The Selling Securityholders may offer, sell or distribute Offered Securities publicly or through private transactions. If the Selling Securityholders use underwriters, dealers or agents to sell Offered Securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net proceeds the Selling Securityholders expect to receive from that sale will also be set forth in a prospectus supplement.

No public market currently exists for saleour Common Stock. We have applied to have our Common Stock quoted on OTC Pink Market, and upon approval of such application, we intend to have our Common Stock quoted on the OTCQB operated by OTC Markets Group, Inc. We cannot assure you that our Common Stock will ever be quoted on the OTC Pink Market or OTCQB. Until such time that our Common Stock is quoted on the OTC Pink Market, OTCQB or another existing market, if ever, the Common Stock to be sold by the Selling Securityholders from time to time will be at a fixed price of $2.70 per share and thereafter at prevailing market prices or privately negotiated prices. Consequently, if you purchase Common Stock in this offering you may not be able to sell your Common Stock in any organized marketplace and you may be limited to selling stockholders, althoughyour Common Stock privately. Accordingly, an investment in our Common Stock is an illiquid investment.

See “Risk Factors” beginning on page 6of this prospectus for a discussion of information that should be considered in connection with the ownership of our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of the prospectus is , 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or a supplement to this prospectus. We have not authorized anyone to provide you with different information. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or any supplement to this prospectus is accurate as of any date other than the date on the front cover of those documents.

i

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our Common Stock, you should read the entire prospectus carefully, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

On May 14, 2021, Raphael Pharmaceutical Ltd., an Israeli company, and Easy Energy, Inc., a Nevada corporation, completed a share exchange agreement, or the share exchange, pursuant to which the shareholders of Raphael Pharmaceutical Ltd. became the holders of 90% of the issued and outstanding share capital of Easy Energy, Inc., while Easy Energy, Inc.’s shareholders hold, following the share exchange, 10% of Easy Energy, Inc. On May 19, 2021, as agreed by the parties to the share exchange, Easy Energy, Inc. changed its name to Raphael Pharmaceutical Inc. Unless otherwise mentioned or unless the context requires otherwise, when used in this prospectus, the terms “Raphael,” “Company,” “we,” “us,” and “our” refer to Raphael Pharmaceutical Inc. and its subsidiary, Raphael Pharmaceutical Ltd., or Raphael Israel. References to Easy Energy are to Easy Energy, Inc. Unless otherwise mentioned or unless the context requires otherwise, the information provided in this prospectus relates to Raphael Israel.

Our Company

History

The Company was incorporated in the State of Nevada in May 2007 and was formerly known as Easy Energy, Inc. On May 14, 2021, Easy Energy and Raphael Israel completed the Share Exchange, as a result of which, Raphael Israel’s shareholders own 90% of our Company and Easy Energy’s shareholders hold the remaining 10%. Raphael Israel was incorporated in 2019 in the State of Israel and has focused to date on developing its lead product candidate for the treatment of rheumatoid arthritis, or RA. Easy Energy did not have any ongoing business or operations before the Share Exchange and following the Share Exchange we adopted Raphael Israel’s business plan.

Overview

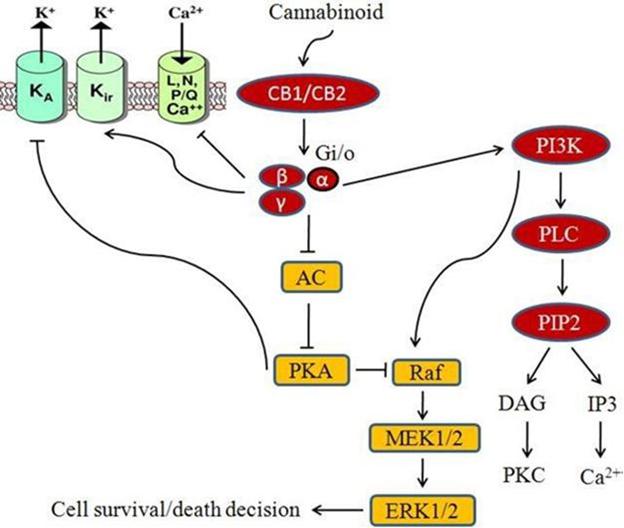

We are a pharmaceutical drug research and development company focused on the discovery and clinical development of life-improving drug therapies based on cannabinoids, including cannabidiol, or CBD, oil. Unless indicated otherwise, we plan on using oil derived from CBD strains with low levels of Tetrahydrocannabinol, or THC. All references to the use of CBD in our product candidates refer to CBD strains with less than 0.3% of THC.

We are currently in the pre-clinical development stage for our lead product candidate, our RA product candidate for the treatment of RA. In addition, we are aiming to develop a pharmaceutical drug product for the treatment of hyperinflammatory syndrome inflammation related to COVID-19, or our COVID-19 product candidate, which may be based on data or studies related to our RA product candidate. We successfully completed a preclinical study for the RA product candidate at Rambam Hospital as well as a mice model trial.

On February 9, 2022, we filed an application for a clinical trial with the Medical Cannabis Unit of the Ministry of Health of Israel, or MOH. On February 16, 2022 we submitted an application with the Helsinki Committee at Rambam Hospital for a clinical trial in COVID-19 patients. We plan to submit such applications for our RA product during 2022.

Our goal is to become a leader in development of CBD oil-based pharmaceutical drug products for the treatment of indications in which we believe there is a high unmet medical need in a range of disorders, including those related to inflammation in the body, including RA and COVID-19.

In order to achieve our goal, we have and will continue to build an experienced team of senior executives and scientists, with experience in all facets of pharmaceutical research and development, drug formulation, clinical trial execution and regulatory submissions. We intend to leverage the knowledge of our team in order to complete the clinical trials needed to receive approvals of our product candidates from applicable regulatory authorities.

Initially, we intend to obtain approvals for our product candidates from the U.S. Food and Drug Administration, or FDA, and the Medical Cannabis Unit of the Israeli Ministry of Health, or MOH. Upon obtaining FDA approvals, or in the event that we are not successful in obtaining such approvals, we intend to apply for European Medicines Agency, or EMA, and other countries’ governmental regulatory agencies approvals for our product candidates. If we are successful in obtaining FDA approvals for our product candidates, we intend to enter into royalty agreements with good manufacturing practice, or GMP, approved medical manufactures and distributors, having them using our medical formulas for the purpose of growing, cultivating, manufacturing, and distributing Raphael Pharmaceutical medical indications in their designated territories.

Our discovery platform currently focuses the use of CBD oil, one of the cannabinoids in cannabis plants, as the active pharmaceutical ingredient, or API, for our RA product candidate and COVID-19 product candidate. Research results published in 2018 (“Translational Investigation of the Therapeutic Potential of Cannabidiol (CBD): Toward a New Age”) has shown that there may be benefits to treading medical conditions, or their effects, with cannabinoids, and more specifically, with CBD, which may help reduce chronic pain by impacting endocannabinoid receptor activity, reducing inflammation and interacting with neurotransmitters. This research has also shown that CBD may have neuroprotective properties, and could have the ability to (i) reduce anxiety and depression, (ii) alleviate cancer-related symptoms, (iii) reduce acne and (iv) benefit heart health.

Over the last few years, pharmaceutical drug products that include parts of the cannabis plant have begun to receive regulatory approvals for use in patients suffering from certain disorders. In light of the past regulatory approvals for other pharmaceutical drug products and, more specifically, the potential beneficial effects of CBD and other parts of the cannabis plant, we believe that a drug discovery platform based on CBD may offer new and differentiated treatment options for patients.

After two successful years of pre-clinical research and studies at the laboratories of Rambam Hospital, in January 2021, we commenced a pre-clinical trial in mice for our RA product candidate that we expect will take four to five months. Following the completion of this pre-clinical trial, we intend on submitting an Investigational New Drug, or IND, application to the FDA and MOH. See “– Research and Clinical Development Strategy – Clinical Development Plan” for additional information on the ongoing pre-clinical trial and our planned clinical trial for our RA product candidate. In addition, with respect to our COVID-19 product candidate, our clinical research partners have been focused on the effect of cannabinoids and cannabis extracts on immune cells which induce acute inflammation. This study will begin in the pre-clinical level in immune cell models and, subject to positive results that exhibit downregulation of pro-inflammatory cytokines by cannabis extract, the study was completed successfully. Following the completion of the pre-clinical study, a mice model was conducted to analyze for acute inflammation, which resembles the immunopathology of COVID-19. The mice model was successfully completed and we have registered for a clinical trial in patients with the MOH.

As a pharmaceutical research and clinical development company we do not own or operate, and currently do not intend on creating an in-house team to manufacture and commercialize our pharmaceutical drug products, if any, that receive regulatory approval allowing for commercialization. We currently rely, and expect to continue to rely, on third parties for the manufacturing of our product candidates for preclinical and clinical testing, as well as for commercial manufacturing of any pharmaceutical drug products for which we may receive proceedsregulatory approval. Subject to the receipt of such regulatory approvals, we intend on cooperating with manufacturers and other third parties to manufacture and commercialize approved pharmaceutical drug products.

Product Pipeline

We have begun development for our RA and COVID-19 product candidates, which are in the pre-clinical stage.

Assuming that we successfully complete the clinical development of our RA and COVID-19 product candidates, we intend to then turn our attention to the clinical development of cannabinoid-based drug products for the treatment of certain oncology indications. Unlike our RA and COVID-19 product candidate, the use of our cannabinoid based drug products for the treatment of certain oncology indications will require specific dosing and potentially, a different regulatory pathway than our existing product candidates.

We intend to apply for FDA approval, subject to the completion of the applicable clinical trials, for our RA product candidate as well as our COVID-19 product candidate using the FDA’s regulatory pathway for drug products.

Research and Clinical Development Strategy

Research and clinical development of our pharmaceutical drug product candidates is our core business. We are currently focused on developing innovative cannabinoid-based medical indications that we aim to push through Phase 2A and Phase 2B approval from the MOH, FDA and EMA.

The research efforts that have been conducted to date by the team at Rambam Med-Tech Ltd., or Rambam MT, are aimed at revealing the mechanism which structures the activity of cannabinoids in human cells and organs, while applying a variety of disease models. We are using our PCR method to identify different receptors to cannabinoids and which we believe will allow us to identify which cannabinoids receptors are participating in the downregulation of inflammation. We believe that this strategy will allow us to identify the cannabinoids components of a chosen strain in order to accurately administer cannabinoids targeted to the treatment of patients.

Competition and Competitive Position

We face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions and governmental agencies and public and private research institutions. Any product candidates for which we complete clinical development successfully and for which we receive marketing approval may compete with existing therapies and new therapies that may become available in the future. However, we believe, specifically with respect to our competitors not using cannabis in their pharmaceutical drug products that our use of, and experience with, cannabinoids provides us with a potential competitive advance. Our research has shown that the use of cannabinoids for the treatment of RA is justified based on its positive effect on pain, fatigue, sleep problems and its potential safety profile. Growing evidence on the anti-inflammatory effect of cannabinoids provide more strong ground for their use in the treatment of RA. We believe that our RA product candidate, if approved for commercialization by regulators, will be available to patients at a lower price than that of other available treatments.

Cultivation of our API

In October 2020, we entered into an agreement with Way of Life Cannabis Ltd., or Wolc, pursuant to which Raphael Israel is scheduled to be provided with up to $3,937,949 if all15 liters of warrantsCBD oil, from a strain of cannabis of our selection, during a term of 18 months, to be provided in two to three deliveries of between one to seven liters of CBD oil. We believe that our current agreement with Wolc will provide us with sufficient amounts of CBD oil in order to complete our clinical development and for initial sales of our pharmaceutical drug products.

Manufacturing

We do not own or operate, and currently have no plans to establish, any manufacturing facilities for final manufacture. We currently rely, and expect to continue to rely, on third parties for the manufacture of our product candidates for preclinical and clinical testing, as well as for commercial manufacturing of any pharmaceutical drug products for which we receive regulatory approval.

Commercialization Plan

Subject to the receipt of regulatory approval to commercialize our pharmaceutical product candidates, our goal is to distribute our approved formulas to good manufacturing practice, or GMP, approved medical cannabis manufacturers and global medical cannabis distributors. Depending on the expertise of the distributors, we expect the licensing agreements to provide us with royalty-based payments for the sale of each of our approved pharmaceutical drug products.

Summary Risk Factors

The risk factors described below are exercised. We will

incur all costsa summary of the principal risk factors associated with this registration statement and prospectus.

SUMMARY FINANCIAL DATA

Thean investment in us. These are not the only risks we face. You should carefully consider these summary financial data presented below is derived from and should be readrisk factors, together with the risk factors set forth in

conjunction with our audited financial statements from May 17, 2007 (date of

inception) to June 30, 2008, including the notes to those financial statements

which are included elsewhere in this prospectus along with the section entitled "Plan of Operation"“Risk Factors” beginning on page 216.

| ● | We have a limited operating history and we have incurred significant operating losses since our inception, and anticipate that we will incur continued losses for the foreseeable future. |

| ● | We have not generated revenue from any product candidate and may never be profitable. |

| ● | We expect that we will need to raise substantial additional funding before we can expect to complete the development of our RA product candidate or any other product candidate. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product candidate development efforts or other operations. |

| ● | The lack of an existing trading market could adversely impact our ability to raise working capital and adversely impact our ability to continue operations. |

| ● | We are heavily dependent on the success of our product candidates, which are in various stages of pre-clinical development. We cannot give any assurance that any of our product candidates will proceed to clinical development or that they will receive regulatory approval, which is necessary before they can be commercialized. |

| ● | The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable. If we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed. |

| ● | Clinical drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies may not be predictive of future study results. |

| ● | We hold no patents on our products, and our business employs proprietary technology (know-how) and information may be difficult to protect and/or infringe on the intellectual property rights of third parties. |

| ● | We manage our business through a small number of employees and key consultants. |

| ● | We will need to expand our organization and we may experience difficulties in recruiting needed additional employees and consultants, which could disrupt our operations. |

| ● | We rely on third parties to conduct our preclinical and, in the future, clinical studies and perform other tasks for us. If these third parties do not successfully carry out their contractual duties, meet expected deadlines or comply with regulatory requirements, we may not be able to obtain regulatory approval for or commercialize our product candidates and our business could be substantially harmed. |

| ● | We will rely on third parties to grow and provide us with our active pharmaceutical ingredient, or API, and formulations. Our business could be harmed if those third parties fail to provide us with sufficient quantities of our needed supplies, or fail to do so at acceptable quality levels or prices. |

| ● | We rely on third parties to supply and manufacture our product candidates, and we expect to continue to rely on third parties to manufacture our products, if approved. The development of such product candidates and the commercialization of any products, if approved, could be stopped, delayed, or made less profitable if any such third party fails to provide with sufficient quantities of product candidates or products, or fails to do so at acceptable quality levels or prices, or fails to maintain or achieve satisfactory regulatory compliance. |

| ● | We and our collaborators and contract manufacturers are subject to significant regulation with respect to manufacturing our product candidates. The manufacturing facilities on which we rely may not continue to meet regulatory requirements and have limited capacity. |

| ● | Our executive officer, directors and certain stockholders who are beneficial owners of 5% or more of our outstanding Common Stock possess the majority of our voting power, and through this ownership, have the ability to control our Company and our corporate actions. |

| ● | Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws. |

| ● | Because we previously had our registration with the SEC revoked and because our business operations resulted from public by means of a “reverse merger,” we may not be able to attract the attention of major brokerage firms. |

| ● | As a former shell company, resales of shares of our restricted Common Stock in reliance on Rule 144 of the Securities Act are subject to the requirements of Rule 144(i). |

| ● | Our headquarters and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel. |

Corporate Information

The mailing address of our principal executive office is 4 Lui Paster, Tel Aviv-Jaffa, Israel 6803605 and the telephone number is Telephone: (972) 52-775-5072. The website address is www.raphaelpharmaceutical.com. The information found on the website is not part of, and is not incorporated into, this prospectus.

As at

BALANCE SHEET INFORMATION June 30, 2008

------------------------- --------------

Cash $ 595,446

Total Assets $ 970,446

Liabilities $ 300

From May 17, 2007

(date of inception) to

STATEMENT OF OPERATIONS INFORMATION June 30, 2008

----------------------------------- --------------

Working Capital $ 970,146

Expenses $ 1,480,045

Total Number of Issued Shares of Common Stock 93,186,070

Net Gain (Loss) $ (1,474,354)

2

THE OFFERING

| Common Stock offered by the Selling Securityholders | We are registering 1,667,393 shares of Common Stock to be offered from time to time by the Selling Securityholders, issued in private placements which had multiple closings between April 2021 and May 2022. | |

| Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the Common Stock, registered under this prospectus for resale. For additional information concerning the offering, see “Plan of Distribution” beginning on page 62. | |

| Risk factors | Before investing in our securities, you should carefully read and consider the information set forth in “Risk Factors” beginning on page 6 of this prospectus. | |

| Use of proceeds | We will not receive any of the proceeds from the sale of Offered Securities by the Selling Securityholders. | |

| Trading market and symbol | Our Common Stock is not listed for quotation on any exchange or market system and there is no established public trading market for our Common Stock. We have applied to have our Common Stock quoted on OTC Pink Market, and upon approval of such application, we intend to apply to list the Common Stock on OTCQB under the symbol “RAPH”. We cannot assure you that our Common Stock will ever be quoted on the OTC Pink Market or OTCQB. Consequently, if you purchase Common Stock in this offering you may not be able to sell your Common Stock in any organized marketplace and you may be limited to selling your Common Stock privately. Accordingly, an investment in our Common Stock is an illiquid investment. |

RISK FACTORS

An investment in our common stock involvessecurities carries a numbersignificant degree of very significant risks.risk. You should carefully consider the following risks, and uncertainties in addition

toas well as the other information contained in this prospectus, including our historical financial statements and related notes included elsewhere in evaluatingthis prospectus, before you decide to purchase our companysecurities. Any one of these risks and itsuncertainties has the potential to cause material adverse effects on our business, before purchasing sharesprospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our company's common stock. Our business,

operating results and financial condition couldCommon Stock. Refer to “Cautionary Statement Regarding Forward-Looking Statements.”

We may not be seriously harmed due tosuccessful in preventing the material adverse effects that any of the following risks.risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or parta significant portion of your investment due to any of these risks.

RISKS RELATED TO OUR BUSINESS

OUR SUCCESS IS HEAVILY DEPENDENT ON PROTECTING OUR INTELLECTUAL PROPERTY RIGHTS.

risks and uncertainties.

Risks Related to Our Financial Condition and Capital Requirements

We relyhave a limited operating history and we have incurred significant operating losses since our inception, and anticipate that we will incur continued losses for the foreseeable future.

We are an emerging pharmaceutical research and clinical development company with a limited operating history in our industry. Before the Share Exchange, we did not have any operations dating back to 2011. To date, we have focused almost exclusively on developing our RA product candidate. Raphael Israel has funded its operations to date primarily through proceeds from investors and from its own resources. Other than the funding that Easy Energy received, and which was lent to (invested in Raphael Israel after the closing of the Share Exchange), Easy Energy has had no sources of funding since ceasing its operations in 2011. We have only a combination of patent, copyright, trademark,limited operating history in our current industry upon which you can evaluate our business and trade secret

protections to protect our proprietary technology. Our success will, in part,

depend on ourprospects. In addition, we have limited experience and have not yet demonstrated an ability to obtain trademarkssuccessfully overcome many of the risks and patents. We have recently

submitted provisional patent applications, but we cannot ensure that any patents

will issue from those applications. We cannot assure you thatuncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the patents issued

to us will not be challenged, invalidated, or circumvented, or that the rights

granted under those registrations will provide competitive advantages to us.

We also rely on trade secrets and new technologies to maintain our competitive

position. Althoughpharmaceutical industry. To date, we have entered into confidentiality agreementsnot generated revenue from the sale of our product candidates (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information). We incurred losses in each year since its inception and, while operational, we have never been profitable and have incurred losses since inception. We expect to continue to incur losses until, and if, a product candidate that we are developing, such as our RA product candidate, receives approval from regulators for commercialization. Our net loss attributable to holders of our ordinary shares for the years ended December 31, 2021 and the three months period ended March 31, 2022 was approximately $1.62 million and $185,000, respectively. As of June 28, 2022, we had an accumulated deficit of approximately $3.0 million. Substantially all of our operating losses resulted from costs incurred in connection with our employeesdevelopment program and consultants, we cannot be certain that others will not gain accessfrom general and administrative costs associated with our operations.

We expect our research and development expenses to these trade secrets. Others may independently develop substantially

equivalent proprietary informationincrease in connection with our planned preclinical and techniques or otherwise gain access to

our trade secrets.

IF WE ARE UNABLE TO ADEQUATELY PROTECT OUR INTELECTUAL PROPERTY, THIRD PARTIES

MAY BE ABLE TO USE OUR TECHNOLOGY, WHICH COULD ADVSERSLY AFFECT OUR ABILITY TO

COMPETE IN THE MARKET.

Our commercial success will depend in part on our ability to obtain and maintain

patent protection on our products, and successfully defend these patents and

technologies against third-party challenges. In particular, On August 20, 2007,

we filed a provisional patent application (Application No.: 11/841,046) with the

United States Patent and Trademark Office, which is still pending. In doing so,

we have secured a filing date in the United States Trademark and Patent Office.

In order to extend the potential patent protection beyond the US, we are

required to file an international patent application via the Patent Cooperation

Treaty ("PCT") no later than August 19, 2008. On June 30, 2008, we have filed

the international patent application via the PCT. This international filing will

enable us to file a national patent application in any PCT country until

February 19, 2009 and still claim the benefit of the priority date of August 20,

2007. After February 29, 2009, we will be required to file a separate patent

application in each PCT country, in which we would like to have a patent

protection. There is no certainty that such applications will be approved.clinical trials. In addition, even if we obtain marketing approval for any current or future product candidate, we will likely incur significant business development expenses as we seek to commercialize such applications are approved, they may not be sufficiently

broad to prevent others from practicing our technologies or from developing

competing products.products, as well as continued research and development expenses. Furthermore, others may independently develop similar or

alternative technologies or design around our patented technologies. Patents we

use may be challenged or invalidated or may fail to provide us with any

competitive advantage. Moreover, in certain parts of the world, such as in

China, western companies are adversely affected by poor enforcement of

intellectual property rights.

WE MAY BE EXPOSED TO LIABILITY FOR INFRINGING INTELLECTUAL PROPERTY RIGHTS OF

OTHER COMPANIES.

Our success will, in part, depend on our ability to operate without infringing

on the proprietary rights of others. Although we have conducted searches and are

not aware of any patents and trademarks which our products or their use might

infringe, we cannot be certain that infringement has not or will not occur. We

could incur substantial costs, in addition to the great amount of time lost, in

defending any patent or trademark infringement suits or in asserting any patent

or trademark rights, in a suit with another.

WE HAVE LIMITED OPERATING HISTORY AND HAVE SUSTAINED LOSSES SINCE INCEPTION,

WHICH WE EXPECT TO CONTINUE INTO THE FUTURE.

3

We were incorporated on May 17, 2007, and have very limited operations to date.

We have not realized any revenues to date. Our product is under development and

is not ready for commercial sale. We have no operating history at all upon which

an evaluation of our future success or failure can be made. Our net loss from

inception to June 30, 2008 is $1,474,354 Based upon our proposed plans, we expect to incur additional costs associated with operating as a reporting company, which we estimate will be at least tens of thousands of dollars annually. As a result, we expect to continue to incur significant and increasing operating losses in future periods. This will happen because

there are substantial costsfor the foreseeable future. Because of the numerous risks and expensesuncertainties associated with the development,

testing and marketing of our product. Based on arrangements made with potential

distributors and the development stage of our product, we believe that we are at

least 6-8 months away from generating our first revenues. We may be wrong and

may fail to generate revenues in the future. If we cannot attract a significant

number of users, we will not be able to generate any significant revenues or

income. Failure to generate revenues will cause us to go out of business because

we will not have the money to pay our ongoing expenses.

In particular, additional capital may be required in the event that:

- the actual expenditures required to be made are at or above the higher

range of our estimated expenditures;

- we incur unexpected costs in completing the development of our product

or encounter any unexpected technical or other difficulties;

- we incur delays and additional expenses as a result of technology

failure;

-developing pharmaceutical products, we are unable to create a substantial market for our product; or

- we incur any significant unanticipated expenses.

The occurrencepredict the extent of any of the aforementioned events could adversely affectfuture losses or when we will become profitable, if at all.

We expect to continue to incur significant losses until we are able to commercialize our product candidates, which we may not be successful in achieving. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the research and development of our RA product candidate or any other product candidate; | |

| ● | expand the scope of our current clinical studies for our RA product candidate or any other product candidate; | |

| ● | seek regulatory and marketing approvals for our product candidates that successfully complete clinical studies; |

| ● | seek to maintain, protect, and expand our intellectual property portfolio; | |

| ● | seek to attract and retain skilled personnel; and | |

| ● | create additional infrastructure to support our operations as a reporting company and our product candidate development and planned future commercialization efforts. |

We have not generated revenue from any product candidate yet and may never be profitable.

Our ability to become profitable depends upon our ability to meetgenerate revenue. We do not expect to generate significant revenue unless or until we obtain marketing approval of, and commercialize, our business plans and achieve a profitable level of operations.

IF WE ARE UNABLE TO OBTAIN THE NECESSARY FINANCING TO IMPLEMENT OUR BUSINESS

PLAN WE WILL NOT HAVE THE MONEY TO PAY OUR ONGOING EXPENSES AND WE MAY GO OUT OF

BUSINESS.RA product candidate or any other product candidate that we may seek to develop. Our budgeted expenditures for the next twelve months are $922,000 of which we

have prepaid $200,000 for our research and development costs which are included

in the statement of operations under product development and prepaid $50,000 in

Consulting Fees which is included in the balance sheet and we anticipate needing

approximately $21,243.32 for expenses associated with this Registration

Statement (See ITEM 13 "Other Expenses if Issuance and Distribution").

Therefore, we presently have a budgeted shortfall of $32,503.68.

Because we have not generated anyability to generate future revenue from product candidate sales depends heavily on our business,success in many areas, including but not limited to:

| ● | obtaining favorable results from and progress the pre-clinical and clinical development of our product candidate(s); | |

| ● | developing and obtaining regulatory approval for registration studies protocols for our product candidate(s); |

| ● | subject to successful completion of registration and clinical trials of our RA product candidate, applying for and obtaining marketing approval; | |

| ● | establishing and maintaining supply and manufacturing relationships with third parties that can provide adequate (in amount and quality) products, and at acceptable costs, to support market demand for our product candidates, if marketing approval is received; |

| ● | identifying, assessing, acquiring and/or developing new product candidate(s); | |

| ● | accurately identifying demand for our product candidate(s); | |

| ● | continued consumer interest in treatments to the symptoms of RA; | |

| ● | obtaining market acceptance of our product candidates, if approved for marketing, as viable treatment options; | |

| ● | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter; and | |

| ● | attracting, hiring and retaining qualified personnel. |

We do not believe that our current cash on hand will be sufficient to fund our projected operating requirements. This raises substantial doubt about our ability to continue as a going concern. In addition, the report of our independent registered public accounting firm contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

We do not believe that our current cash on hand will be sufficient to fund our projected operating requirements. This raises substantial doubt about our ability to continue as a going concern. In addition, the report of our independent registered public accounting firm on our audited financial statements for each of the two years ended December 31, 2021 and we are 6-8

months away2020 contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our audited financial statements do not include any adjustments that might result from being inthe outcome of the uncertainty regarding our ability to continue as a position to generate revenues, we will needgoing concern. This going concern opinion could materially limit our ability to raise additional funds forthrough the future developmentissuance of our business and to respond to

unanticipated requirementsequity or expenses. Management estimates that our current

cash balances will be exhausted by April 2009 provided we do not have any

unanticipated expenses. We do not currently have any arrangements for financing

and we can provide no assurance to investors we will be able to find such

financing.

Our ability to successfully develop our product and to eventually produce and

sell it to generate operating revenues dependsdebt securities or otherwise. Further reports on our ability to obtain the

necessary financing to implement our business plan. Given that we have no

operating history, no revenues and only losses to date, wefinancial statements may not be able to

achieve this goal, and if this occurs we will not be able to pay for our

operations and we may go out of business. We will likely need to issue

additional equity securities in the future to raise the necessary funds. We do

not currently have any arrangements for additional financing and we can provide

no assurance to investors we will be able to find such financing if further

funding is required. Obtaining additional financing would be subject to a number

of factors, including investor acceptance of our product and our business model.

The issuance of additional equity securities by us would result in a significant

dilution in the equity interests of our current stockholders. The resale of

shares by our existing shareholders pursuant to this prospectus may result in

significant downward pressure on the price of our common stock and cause

negative impact on our ability to sell additional equity securities. Obtaining

loans will increase our liabilities and future cash commitments.

There can be no assurance that capital will continue to be available if

necessary to meet future funding needs or, if the capital is available, that it

will be on terms acceptable to us. If we are unable to obtain financing in the

amounts and on terms deemed acceptable to us, we may be forced to scale back or

cease operations, which might result in the loss of some or all of your

investment in our common stock.

IF OUR ESTIMATES RELATED TO EXPENDITURES ARE ERRONEOUS OUR BUSINESS WILL FAIL

AND YOU WILL LOSE YOUR ENTIRE INVESTMENT.

4

Our success is dependent in part upon the accuracy of our management's estimates

of expenditures, which are currently budgeted at $922,000, of which $250,000 has

been prepaid for the next 12 months for our business plan andinclude an additional

$21,243.32. (See "Plan of Operation".) If such estimates are erroneous or

inaccurate we may not be able to carry out our business plan, which could, in a

worst-case scenario, result in the failure of our business and you losing your

entire investment.

OUR BUSINESS MODEL MAY NOT BE SUFFICIENT TO ENSURE OUR SUCCESS IN OUR INTENDED

MARKET.

Our survival is currently dependent upon the success of our efforts to gain

market acceptance of one product that ultimately represents a small sector in

the overall charger industry. Should our services be too narrowly focused or

should the target market not be as responsive as we anticipate, we may not have

in place alternate products or services that we can offer to ensure our

survival.

IF WE ARE UNABLE TO COMPLETE THE DEVELOPMENT OF OUR PRODUCT WE WILL NOT BE ABLE

TO GENERATE REVENUES AND YOU WILL LOSE YOUR INVESTMENT.

We have not completed the development of our proposed product and we have no

definitive contracts or licenses for the sale or use of our product. The success

of our proposed business will depend on its completion and the acceptance of our

product by the general public. Achieving such acceptance will require

significant marketing investment. Our product, once developed and tested, may

not be accepted by our customers at sufficient levels to support our operations

and build our business. If the proposed product that we will develop is not

accepted at sufficient levels, our business will fail.

WE ARE DEPENDENT ON REVENUES GENERATED BY A SOLE PRODUCT AND THUS WE ARE SUBJECT

TO MANY ASSOCIATED RISKS.

Our revenue will be generated through the sale of our man-powered charger.

Unless we expand our product offerings to include related or other products, our

likely source of revenues for the foreseeable future will continue to be

generated by the man-powered charger. Accordingly, 100% of our revenue will be

dependent upon the sale of our sole product.

If potential users are satisfied with other means for charging their cell phone

battery we may not be able to sell our product.

* If technological developments render man-powered chargers obsolete,

our business could fail;

* our patent application is unsuccessful, our business could fail.

Thus, we may expand our financial resources on marketing and advertising without

generating concomitant revenues. If we cannot generate sufficient revenues to

cover our overhead, manufacturing and operating costs, we will fail.

THERE ARE LOW BARRIERS TO ENTRY INTO THE MAN-POWERED CHARGER INDUSTRY AND, AS A

RESULT, MANY COMPANIES MAY BE ABLE TO COMPETE WITH US ON LIMITED FINANCIAL

RESOURCES.

Our product does not require large capital expenditures for its development or

manufacture. As a result, barriers to entering this industry may be low. If the

intellectual property protectionexplanatory paragraph with respect to the man-powered charger product

does not prove effective, a competitor with limited financial resources may be

able to successfully compete with us.

BECAUSE OUR EXECUTIVE OFFICERS AND DIRECTORS LIVE OUTSIDE OF THE UNITED STATES,

YOU MAY HAVE NO EFFECTIVE RECOURSE AGAINST THEM FOR MISCONDUCT AND MAY NOT BE

ABLE TO ENFORCE JUDGMENT AND CIVIL LIABILITIES AGAINST THEM. INVESTORS MAY NOT

BE ABLE TO RECEIVE COMPENSATION FOR DAMAGES TO THE VALUE OF THEIR INVESTMENT

CAUSED BY WRONGFUL ACTIONS BY OUR DIRECTORS AND OFFICERS.

Both of our directors and officers live outside of the United States. Mr. Guy

Ofir, our President and a director is a national and a resident of Israel, and

all or a substantial portion of his assets are located outside of the United

States. Mr. Emanuel Cohen, our Secretary, Treasurer and a director is a national

and a resident of Israel, and all or a substantial portion of his assets are

5

located outside of the United States. As a result, it may be difficult for

investors to enforce within the United States any judgments obtained against our

directors or officers, or obtain judgments against them outside of the United

States that are predicated upon the civil liability provisions of the securities

laws of the United States or any state thereof. Investors may not be able to

receive compensation for damages to the value of their investment caused by

wrongful actions by our directors and officers.

BECAUSE WE HAVE TWO DIRECTORS, DEADLOCKS MAY OCCUR IN OUR BOARD'S

DECISION-MAKING PROCESS, WHICH MAY DELAY OR PREVENT CRITICAL DECISIONS FROM

BEING MADE.

Since we currently only have an even number of directors, deadlocks may occur

when such directors disagree on a particular decision or course of action. Our

Articles and By-Laws do not contain any mechanisms for resolving potential

deadlocks. While our directors are under a duty to act in the best interest of

our company, any deadlocks may impede the further development of our business in

that such deadlocks may delay or prevent critical decisions regarding our

development.

BECAUSE OUR EXECUTIVE OFFICERS ARE EMPLOYED ELSEWHERE, THEY WILL BE UNABLE TO

DEVOTE THEIR SERVICES TO OUR COMPANY ON A FULL TIME BASIS AND THE PERFORMANCE OF

OUR BUSINESS MAY SUFFER, OUR BUSINESS COULD FAIL AND INVESTORS COULD LOSE THEIR

ENTIRE INVESTMENT.

Mr. Guy Ofir, our President and director is employed elsewhere and he will be

unable to devote his services to our company on a full time basis. Mr. Guy Ofir

currently devotes approximately 30 to 40 hours a week to our company. Mr.

Emanuel Cohen, our Secretary, Treasurer and a director, is employed elsewhere

and he will be unable to devote his services to our company on a full time

basis. Mr. Emanuel Cohen currently devotes 15 to 20 hours a week to our company.

As a result, the management of our company could under-perform, our business

could fail and investors could lose their entire investment.

OUR EXECUTIVE OFFICERS HAVE NO EXPERIENCE OR TECHNICAL TRAINING IN THE

DEVELOPMENT, MAINTENANCE AND MARKETING OF MAN-POWERED CHARGER OR IN OPERATING

BUSINESSES THAT SELL PRODUCTS OR SERVICES TO WHOLESALES. THIS COULD CAUSE THEM

TO MAKE INEXPERIENCED OR UNINFORMED DECISIONS THAT HAVE BAD RESULTS FOR OUR

COMPANY. AS A RESULT, OUR OPERATIONS COULD SUFFER IRREPARABLE HARM AND MAY CAUSE

US TO SUSPEND OR CEASE OPERATIONS, WHICH COULD CAUSE INVESTORS TO LOSE THEIR

ENTIRE INVESTMENT.

Mr. Guy Ofir, our President and director and Mr. Emanuel Cohen, our Secretary,

Treasurer and director, have no experience or technical training in the

development, maintenance and marketing of man-powered charger or in operating

businesses that sell products or services to wholesales. Due to their lack of

experience and knowledge in these areas, our executive officers could make the

wrong decisions regarding the development, operation and marketing of our

products and the operation of our business, which could lead to irreparable

damage to our business. Consequently, our operations could suffer irreparable

harm from mistakes made by our executive officers and we may have to suspend or

cease operations, which could cause investors to lose their entire investment.

WE DEPEND HEAVILY ON MR. GUY OFIR AND MR. EMANUEL COHEN. THE LOSS OF EITHER

PERSON WILL HAVE A SUBSTANTIAL NEGATIVE EFFECT ON OUR BUSINESS AND MAY CAUSE OUR

BUSINESS TO FAIL.

We depend entirely on Mr. Ofir and Mr. Cohen for all of our operations. The loss

of either person will have a substantial negative effect on the company and may

cause our business to fail. Our officers did not receive any compensation for

their services and it is highly unlikely that they will receive any compensation

unless and until we generate substantial revenues.

We do not have any employment agreements or maintain key person life insurance

policies on our officers. If our officers do not devote sufficient time towards

our business, we may never be able to effectuate our business plan.

BECAUSE OUR EXECUTIVE OFFICERS CONTROL A LARGE PERCENTAGE OF OUR COMMON STOCK,

THEY HAVE THE ABILITY TO INFLUENCE MATTERS AFFECTING OUR SHAREHOLDERS.

6

Our executive officers, in the aggregate, beneficially own approximately 43% of

the issued and outstanding shares of our common stock. As a result, they have

the ability to influence matters affecting our shareholders, including the

election of our directors, the acquisition or disposition of our assets, and the

future issuance of our shares. Because our executive officers control such

shares, investors may find it difficult to replace our management if they

disagree with the way our business is being operated.

WE HAVE A GOING CONCERN OPINION FROM OUR AUDITORS, INDICATING THE POSSIBILITY

THAT WE MAY NOT BE ABLE TO CONTINUE TO OPERATE.

The Company has incurred net losses of $1,474,354 for the period from May 17,

2007 (inception) to June 30, 2008. We anticipate generating losses for the next

12 months. Therefore, we may be unable to continue operations in the future as a

going concern. No adjustment has been made in the accompanying financial

statements to the amounts and classification of assets and liabilities which

could result should we be unable to continue as a going concern. If we cannot continue as a viable entity,going concern, our shareholdersinvestors may lose some or all of their entire investment in our Common Stock. Until we can generate significant revenues, if ever, we expect to satisfy our future cash needs through debt or equity financing. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the Company.

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM HAS EXPRESSED SUBSTANTIAL

DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN, WHICH MAY HINDER OUR

ABILITY TO OBTAIN FUTURE FINANCING.

Forscope of, or eliminate research or development plans for, or commercialization efforts with respect to our products.

We expect that we will need to raise substantial additional funding before we can expect to complete the perioddevelopment of our RA product candidate or any other product candidate. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product candidate development efforts or other operations.

As of December 31, 2022, our cash and cash equivalent were approximately $0.15 million and we had a working capital of $0.13 million and an accumulated deficit of $2.67 million]. Based upon our currently expected level of operating expenditures, we expect that our existing cash and cash equivalents will only be sufficient to fund operations through June 2022. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future funding requirements will depend on many factors, including but not limited to:

| ● | our clinical trial results; | |

| ● | the cost, timing and outcomes of seeking marketing approval of any product candidate for which we may seek marketing approval and the costs associated with our plans to have third parties commercialize any approved product candidate(s); |

| ● | the cost of filing and prosecuting patent applications and the cost of defending patents, if any; | |

| ● | development of other early-stage development product candidates; | |

| ● | subject to receipt of marketing approval, revenue received from sales of approved products, if any, in the future; | |

| ● | any product liability or other lawsuits related to our products; | |

| ● | the expenses needed to attract and retain skilled personnel; and | |

| ● | the costs associated with being a reporting company. |

Any additional fundraising efforts may divert our management from May 17, 2007 (inception)their day-to-day activities, which may adversely affect our ability to March 31, 2008,develop and commercialize our independent

registered public accounting firm has expressed substantial doubt aboutproduct candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all, during or after the COVID-19 pandemic. Moreover, the terms of any financing may adversely affect the holdings or the rights of holders of our securities and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the trading price of our shares to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the development or commercialization, if any, of any product candidates or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

The lack of an existing trading market could adversely impact our ability to raise working capital and adversely impact our ability to continue as a going concern. Such doubt was expressed as a resultoperations.

Our Common Stock is not currently traded on any national securities exchange and is not quoted on any over-the-counter market (see “Risks Related to Ownership of Our Securities – Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws” for additional information). Because our recurring losses and cash flow deficiencies since our inception. We continue

to experience net losses. Our ability to continue as a going concernCommon Stock is subject

to our ability to generate a profit and/or obtain necessary funding from outside

sources, including obtaining additional funding from the sale of our securities,

future sales of our product or obtaining loans and grants from various financial

institutions whenever possible. Ifconsidered illiquid, we continue to incur losses,may find it will become

increasinglymore difficult for us to achieve our goals and there can be no assurance

that our business plan will materialize.

WE WILL BE HEAVILY DEPENDENT ON CONTRACTING WITH THIRD PARTY FIRM(S) TO

MANUFACTURE COMPONENTS FOR US. IF WE ARE UNABLE TO LOCATE, HIRE AND RETAIN THESE

FIRM(S), OUR BUSINESS WILL FAIL.

We intend to hire a third party firm(s) to manufacture the components of our

product. Should we be unable to contract qualified third parties firm(s) to

manufacture because we are unable to find them, are unable to attract them to

our company or are unable to afford them, we will never become profitable and

our business will fail.

RISKS ASSOCIATED WITH OUR COMMON STOCK

BECAUSE WE CAN ISSUE ADDITIONAL COMMON SHARES, PURCHASERS OF OUR COMMON STOCK

MAY INCUR IMMEDIATE DILUTION AND MAY EXPERIENCE FURTHER DILUTION.

We are authorized to issue up to 1,000,000,000 common shares, of which

93,186,070 are issued and outstanding. Our board of directors has the authority

to cause our company to issue additional shares of common stock without the

consent of any of our shareholders. Consequently, our shareholders may

experience dilution in their ownership of our company in the future.

A DECLINE IN THE PRICE OF OUR COMMON STOCK COULD AFFECT OUR ABILITY TO RAISE

FURTHER WORKING CAPITAL AND ADVERSELY IMPACT OUR ABILITY TO CONTINUE OPERATIONS.

A prolonged decline in the price of our common stock could result in a reduction

in the liquidity of our common stock and a reduction in our ability to raise capital. Because a significant portion of our operations has been and will be

financed through the sale of equity securities, a decline in the price of our

common stock could be especially detrimental to our liquidity and our

operations. Such reductions may force us to reallocate funds from other planned

uses and may have a significant negative effect on our business plans and

operations, including our ability to develop new products and continue our

current operations. If our stock price declines, we can offer no assurance that

we will be able to raise additional capital or generate funds from operations

sufficient to meet our obligations. If we are unable to raise sufficient capital in the future, we may not be able to have the resources to continue our normal operations.

7

The

Risks Related to Product Development, Regulatory Approval and Commercialization

We are heavily dependent on the success of our product candidates, which are in various stages of pre-clinical development. We cannot give any assurance that any of our product candidates will proceed to clinical development or that they will receive regulatory approval, which is necessary before they can be commercialized.

Since its inception, Raphael Israel has invested substantially all of its efforts and financial resources to design and develop its product candidates, including conducting preclinical studies and providing general and administrative support for these operations. Our future success is dependent on our ability to continue these operations, and more specifically, to successfully complete pre-clinical and clinical development of our product candidates, which will require coordination from applicable regulatory agencies, obtain regulatory approval for, and then successfully commercialize one or more product candidates for which we receive regulatory approval. We currently generate no revenue from, and we may never be able to generate revenue.

Our RA product candidate and the product candidate that we are seeking to develop for the treatment of inflammation associated with COVID-19 are both in pre-clinical development and will require clinical development (and in some cases additional pre-clinical development), management of non-clinical, clinical and manufacturing activities, regulatory approval, obtaining adequate manufacturing supply, building of a commercial organization and significant marketing efforts before we generate any revenue from product candidate sales. It may be months or years before a pivotal study is initiated, if at all. Any clinical trials in the United States will require the approval of an Investigational New Drug, or IND, application by the FDA, and we cannot assure that we will obtain such approval in a timely manner, or at all. We are not permitted to market priceor promote any of our product candidates before we receive regulatory approval from the FDA or comparable foreign regulatory authorities, and we may never receive such regulatory approval for any of our product candidates.

We as a company have never submitted marketing applications to the FDA or comparable foreign regulatory authorities. We cannot be certain that any of our product candidates will be successful in clinical studies or receive regulatory approval or what regulatory pathway the regulatory authorities shall designate for our common stockproduct candidates. Further, our product candidates may not receive regulatory approval even if they are successful in clinical studies. If we do not receive regulatory approvals for our product candidates, we may not be able to continue our operations.