Indexlaunched in 2006, as well as the Los Angeles Expansion Market that we expect to

Financial StatementsBUSINESS

MetroPCS

launch in the second or third quarter of 2007. During the year ended December 31, 2005, we had $266.5 million in capital expenditures. These capital expenditures were primarily for the expansion and improvement of our existing network infrastructure and costs associated with the construction of the Tampa/Sarasota, Dallas/Ft. Worth and Detroit Expansion Markets.

Other Acquisitions and Dispositions. On April 19, 2004, we acquired four PCS licenses for an aggregate purchase price of $11.5 million. The PCS licenses cover 15 MHz of spectrum in each of the basic trading areas of Modesto, Merced, Eureka, and Redding, California.

On October 29, 2004, we acquired two PCS licenses for an aggregate purchase price of $43.5 million. The PCS licenses cover 10 MHz of spectrum in each of the basic trading areas of Tampa-St. Petersburg-Clearwater, Florida, and Sarasota-Bradenton, Florida.

On November 28, 2004, we executed a license purchase agreement by which we agreed to acquire 10 MHz of PCS spectrum in the basic trading area of Detroit, Michigan and certain counties of the basic trading area of Dallas/Ft. Worth, Texas for $230.0 million pursuant to a two-step, tax-deferred, like-kind exchange transaction under Section 1031 of the Internal Revenue Code of 1986, as amended.

On December 20, 2004, we acquired a PCS license for a purchase price of $8.5 million. The PCS license covers 20 MHz of PCS spectrum in the basic trading area of Daytona Beach, Florida.

On May 11, 2005, we completed the sale of a 10 MHz portion of our 30 MHz PCS license in the San Francisco — Oakland — San Jose basic trading area for cash consideration of $230.0 million. The sale was structured as a like-kind exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, through which our right, title and interest in and to the divested PCS spectrum was exchanged for the PCS spectrum acquired in Dallas/Ft. Worth, Texas and Detroit, Michigan through a license purchase agreement for an aggregate purchase price of $230.0 million. The purchase of the PCS spectrum in Dallas/Ft. Worth and Detroit was accomplished in two steps with the first step of the exchange occurring on February 23, 2005 and the second step occurring on May 11, 2005 when we consummated the sale of 10 MHz of PCS spectrum for the San Francisco — Oakland — San Jose basic trading area. The sale of PCS spectrum resulted in a gain on disposal of asset in the amount of $228.2 million.

On July 7, 2005, we acquired a 10 MHz F-Block PCS license for Grayson and Fannin counties in the basic trading area of Sherman-Denison, Texas for an aggregate purchase price of $0.9 million.

On August 12, 2005, we closed on the purchase of a 10 MHz F-Block PCS license in the basic trading area of Bakersfield, California for an aggregate purchase price of $4.0 million.

On December 21, 2005, the FCC granted Royal Street 10 MHz of PCS spectrum in each of the Los Angeles, California; Orlando, Lakeland-Winter Haven, Jacksonville, Melbourne-Titusville, and Gainesville, Florida basic trading areas. Royal Street, as the high bidder in Auction 58, had paid approximately $294.0 million to the FCC for these PCS licenses.

On August 7, 2006, we acquired a 10 MHz PCS license in the basic trading area of Ocala, Florida in exchange for a 10 MHz portion of our 30 MHz PCS license in the basic trading area of Athens, Georgia. We are amongpaid $0.2 million at the fastest growing wireless communications providersclosing of this agreement.

On November 29, 2006, we were granted AWS licenses as a result of FCC Auction 66, for a total aggregate purchase price of approximately $1.4 billion. These new licenses cover six of the 25 largest metropolitan areas in the United States. The east coast expansion opportunities include the entire east coast corridor from Philadelphia to Boston, including New York City, as well as the entire states of New York, Connecticut and Massachusetts. In the western United States, the new expansion opportunities include the San Diego, Portland, Seattle and Las Vegas metropolitan areas. The balance supplements or expands the geographic boundaries of our existing operations in Dallas/Ft. Worth, Detroit, Los Angeles, San Francisco and Sacramento.

87

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Contractual Obligations and Commercial Commitments

The following table provides aggregate information about our contractual obligations as of December 31, 2006. See Note 10 to our annual consolidated financial statements included elsewhere in this offering circular.

| | | | | | | | | | | | | | | | | | | | | |

| | | Payments Due by Period | |

| | | | | | Less Than

| | | 1 - 3

| | | 3 - 5

| | | More Than

| |

| | | Total | | | 1 Year | | | Years | | | Years | | | 5 Years | |

| | | (In thousands) | |

| |

Contractual Obligations: | | | | | | | | | | | | | | | | | | | | |

| Long-term debt, including current portion | | $ | 2,596,000 | | | $ | 16,000 | | | $ | 32,000 | | | $ | 32,000 | | | $ | 2,516,000 | |

| Interest expense on long-term debt(1) | | | 1,601,613 | | | | 218,185 | | | | 436,370 | | | | 436,370 | | | | 510,688 | |

| Operating leases | | | 728,204 | | | | 88,639 | | | | 180,873 | | | | 179,277 | | | | 279,415 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total cash contractual obligations | | $ | 4,925,817 | | | $ | 322,824 | | | $ | 649,243 | | | $ | 647,647 | | | $ | 3,306,103 | |

| | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Interest expense on long-term debt includes future interest payments on outstanding obligations under our senior secured credit facility and 91/4% senior notes. The senior secured credit facility bears interest at a floating rate tied to a fixed spread to the London Inter Bank Offered Rate. The interest expense presented in this table is based on the rates at December 31, 2006 which was 7.875% for the senior secured credit facility. |

Inflation

We believe that inflation has not materially affected our operations.

Effect of New Accounting Standards

In February 2006, the FASB issued SFAS No. 155,“Accounting for Certain Hybrid Financial Instruments — an amendment of FASB Statements No. 133 and 140”(“SFAS No. 155”). SFAS No. 155 permits fair value remeasurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation, clarifies which interest-only strips and principal-only strips are not subject to the requirements of SFAS No. 133, establishes a requirement to evaluate interests in securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation, clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives, and amends FASB Statement No. 140 to eliminate the prohibition on a qualifying special purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. SFAS No. 155 is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. The adoption of this statement did not have any impact on our financial condition or results of operations.

In March 2006, the FASB issued SFAS No. 156,“Accounting for Servicing of Financial Assets — an amendment ofFASBStatement No. 140”(“SFAS No. 156”). SFAS No. 156 amends SFAS No. 140 to require that all separately recognized servicing assets and servicing liabilities be initially measured at fair value, if practicable. SFAS No. 156 permits, but does not require, the subsequent measurement of separately recognized servicing assets and servicing liabilities at fair value. Under SFAS No. 156, an entity can elect subsequent fair value measurement to account for its separately recognized servicing assets and servicing liabilities. Adoption of SFAS No. 156 is required as of the beginning of the first fiscal year that begins after September 15, 2006. The adoption of this statement did not have any impact on our financial condition or results of operations.

88

In July 2006, the FASB issued Interpretation No. 48“Accounting for Uncertainty in Income Taxes,”(“FIN No. 48”), which clarifies the accounting for uncertainty in income taxes recognized in the financial statements in accordance with SFAS No. 109. FIN No. 48 provides guidance on the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN No. 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosures, and transition. FIN No. 48 is effective for fiscal years beginning after December 15, 2006. The adoption of this Interpretation did not have a material effect on our financial condition or results of operations.

In September 2006, the Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin No. 108, “Consideringthe Effects of Prior Year Misstatements When Quantifying Misstatements in the Current Year Financial Statements,”(“SAB 108”), which addresses how the effects of prior year uncorrected misstatements should be considered when quantifying misstatements in current year financial statements. SAB 108 requires companies to quantify misstatements using a balance sheet and income statement approach and to evaluate whether either approach results in quantifying an error that is material in light of relevant quantitative and qualitative factors. When the effect of initial adoption is material, companies may record the effect as a cumulative effect adjustment to beginning of year retained earnings. SAB 108 is effective for annual financial statements covering the first fiscal year ending after November 15, 2006. We adopted this interpretation as of December 31, 2006. The adoption of this statement did not have any impact on our financial condition or results of operations.

In September 2006, the FASB issued SFAS No. 157,“Fair Value Measurements,”(“SFAS No. 157”), which defines fair value, establishes a framework for measuring fair value in GAAP and expands disclosure about fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. We will be required to adopt SFAS No. 157 in the first quarter of fiscal year 2008. We have not completed our evaluation of the effect of SFAS No. 157.

In February 2007, the FASB issued SFAS No. 159,“The Fair Value Option for Financial Assets and Financial Liabilities — Including an amendment of FASB Statement No. 115,”(“SFAS No. 159”), which permits entities to choose to measure many financial instruments and certain other items at fair value. The objective of SFAS No. 159 is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. We will be required to adopt SFAS No. 159 on January 1, 2008. We have not completed our evaluation of the effect of SFAS No. 159.

Quantitative and Qualitative Disclosures about Market Risk

Market risk is the potential loss arising from adverse changes in market prices and rates, including interest rates. We do not routinely enter into derivatives or other financial instruments for trading, speculative or hedging purposes, unless it is required by our credit agreements. We do not currently conduct business internationally, so we are generally not subject to foreign currency exchange rate risk.

As of December 31, 2006, we had approximately $1.6 billion in outstanding indebtedness under our senior secured credit facility that bears interest at floating rates based on the London Inter Bank Offered Rate, or LIBOR, plus 2.50%. The interest rate on the outstanding debt under our senior secured credit facility as of December 31, 2006 was 7.875%. On November 21, 2006, to manage our interest rate risk exposure and fulfill a requirement of our senior secured credit facility, we entered into a three-year interest rate protection agreement. This agreement covers a notional amount of $1.0 billion and effectively converts this portion of our variable rate debt to fixed rate debt at an annual percentage growthrate of 7.419%. The quarterly interest settlement periods begin on February 1, 2007. The interest rate swap agreement expires in customers2010. If market LIBOR rates increase 100 basis points over the rates in effect at December 31, 2006, annual interest expense on the approximately $600.0 million in variable rate debt would increase approximately $6.0 million.

89

Change in Accountants

On June 13, 2005, PricewaterhouseCoopers LLP, or PwC, our independent auditor for 2002 and revenue. 2003, declined to stand for re-election as our independent registered public accounting firm. PwC’s tenure as our independent registered public accounting firm was to end upon completion of the financial statement audit for 2004. On January 4, 2006, PwC was dismissed by us from performing the audit for the year ended December 31, 2004. Our audit committee participated in and approved the decision to change its independent registered public accounting firm for the audit for the year ended December 31, 2004.

PwC’s reports on our consolidated financial statements as of and for the year ended December 31, 2003 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principle. During the fiscal year ended December 31, 2003 and through January 4, 2006, there were no disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of PwC, would have caused PwC to make reference thereto in their reports on the financial statements for such years.

As defined in Item 304(a)(1)(v) ofRegulation S-K of the SEC, there was a reportable event related to five material weaknesses in our internal control over financial reporting for the fiscal year ended December 31, 2004. The material weaknesses related to deficiencies in our information technology and accounting control environments, insufficient “tone at the top,” a lack of automation in the revenue reporting process and deficiencies in our accounting for income taxes. The subject matter of the material weaknesses was discussed with PwC by our management and audit committee of the board of directors. We authorized PwC to fully respond to the inquiries of our newly appointed independent auditor, Deloitte & Touche, LLP, or Deloitte.

In August 2005, Deloitte was appointed by the audit committee of MetroPCS Communications’ board of directors as its independent auditor for the audit of the fiscal year ending December 31, 2005. On January 4, 2006, Deloitte was appointed by the audit committee of MetroPCS Communications’ board of directors as its independent auditor for the audit of the fiscal year ended December 31, 2004.

90

BUSINESS

General

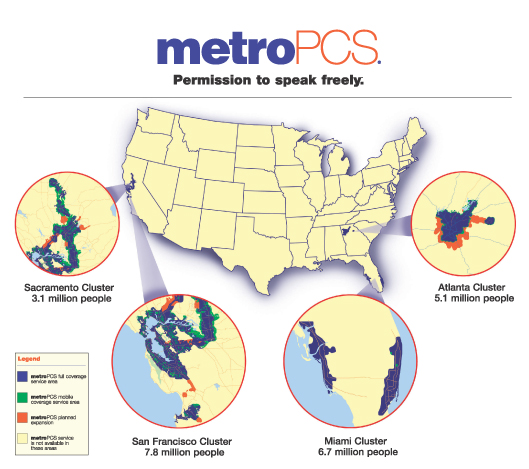

We offer wireless voice and databroadband personal communication services, or PCS, on a no-contract,no long-term contract, flat rate, unlimited usage basis in selected major metropolitan markets in the United States. Since we launched our wireless service in 2002 we have been among the fastest growing wireless broadband PCS providers in the United States as measured by growth in subscribers and revenues. We reached one million customers in January 2004, 1.5 million customers in February 2005, two million customers in February 2006, 2.5 million customers in August 2006 and three million customers in January 2007. We currently offer our services in the greater San Francisco, Miami, Tampa/Sarasota/Orlando, Atlanta, Sacramento, Dallas/Ft. Worth, and Detroit metropolitan areas, which include a total licensed population of approximately 43 million. We launched service in the Miami, Atlanta and Sacramento metropolitan areas which include a total population of 22.6 million people. We launched service in all of these areas in the first quarter of 2002, except for2002; in San Francisco in September 2002; in Tampa/Sarasota in October 2005; in Dallas/Ft. Worth in March 2006; in Detroit in April 2006; and, through a wholesale arrangement with Royal Street, in Orlando and portions of northern Florida in November 2006. In 2005, Royal Street Communications, a company in which we launched in September 2002. We recently acquired four additionalown a non-controlling 85% limited liability company member interest, but only elect two of the five members of the management committee, was granted licenses by the FCC for the Los Angeles basic trading area and various basic trading areas inthroughout northern California that have a total population of 1.2 million people. We areFlorida. Royal Street is in the process of planning network deploymentbuilding infrastructure in Los Angeles and have not begunexpects to providecommence commercial service in these areas.late second or most likely third quarter of 2007. We reported positive net income and adjusted EBITDA after four quarters of operations and one million customers after eight quarters of operations. As of March 31, 2004, we had approximately 1.2 million customers. We believehave a wholesale arrangement that we reached these growth and profitability milestones significantly faster than any other U.S. wireless carrier and that our no-contract, flat rate, unlimited usage service offering will allow us to continuesell MetroPCS-branded service to penetrate our existing markets and further drive our growth and profitability. In addition, we believe ourthe public on up to 85% of the service capacity provided by the Royal Street systems.

Our wireless services

can be successfully introduced in new markets, and we continue to assess attractive expansion opportunities.We provide wireless voice and data services to thetarget a mass market which we believe is largely underserved by traditional wireless carriers. We operate principally through two subsidiaries and hold PCS licenses in 15 subsidiaries. Our service, branded under the “metroPCS”“MetroPCS” name, allows our customers to place unlimited wirelesslocal calls from within a local callingour service area, and to receive unlimited calls from any area for awhile in our local service areas, under simple and affordable flat monthly rate plan of $35.plans starting at $30 per month. For an additional $5 to $20 per month, our customers may select a service plan that offers additional services, such as the ability to place unlimited long distance calls from within aour local service calling area to any number in the continental United States.States or unlimited voicemail, caller ID, call waiting, text messaging, mobile Internet browsing, pushe-mail and picture and multimedia messaging. For additional fees, we also provide caller ID, voicemail,international long distance and text messaging, camera functions,ringtones, ring back tones, downloads, of ringtones, games and content applications, international long distancemobile Internet browsing, unlimited directory assistance and other value-added services. Our callingcustomers also have access, on a prepaid basis, to nationwide roaming. Our rate plans differentiate usour service from the more complex plans and long-term contracts required by most other traditional wireless carriers. Our customers pay for our service in advance, eliminating any customercustomer-related credit exposure, and we do not require a long-term service contract. Ourexposure.

As of December 31, 2006, our customers

currently averagein all metropolitan areas averaged approximately

1,8002,000 minutes of use per month, compared to approximately

675875 minutes per month for customers of

traditionalthe national wireless carriers. We believe that average monthly usage by our customers also exceeds the average monthly usage for typical wireline customers. Average usage by our customers indicates that a

majoritysubstantial number of our customers use our services as their primary telecommunications service, and our customer surveys indicate that a significant number of our customers use us as their primary

telecommunications service provider, and our customer survey results indicate that approximately 35% of our customers use us as theiror sole telecommunications service provider.

Competitive StrengthsWe believe our

Our business

model has many competitive strengths that

we believe distinguish us from

otherour primary wireless

carriersbroadband PCS competitors and will allow us to

successfully execute our business strategy

successfully, including:

Our Flat RateFixed Price Unlimited Service Plans.. We believe our service offering that provides unlimited usage from within a local calling area represents a compelling value proposition for our customers that differs substantially from the offerings of the national wireless broadband PCS carriers and traditional wireline carriers. Our service model results in average per minute costs to our customers that are significantly lower than the average per minute costs of other traditional wireless broadband PCS carriers. We believe that many prospective customers

91

refrain from subscribing to, or extensively utilizing, traditional wireless communications services because of high prices, long-term contract requirements, confusing calling plans and wirelinesignificant cash deposit requirements for credit challenged customers. Our simple, cost-effective rate plans, combined with our pay in advance no long-term contract service model, allow us to attract many of these customers.

Our Densely Populated Markets. We believe the high relative population density of our markets results in increased efficiencies in network deployment, operations and product distribution. We believe we have one of the highest aggregate population densities of any major wireless carrier in the United States in our Core and Expansion Markets. The aggregate population density across the licensed areas we currently serve and plan to serve in our Core Markets and Expansion Markets is approximately 339 people per square mile, which is nearly four times higher than the national average of 84 people per square mile. Our high relative population density and efficient network design resulted in cumulative capital expenditures per covered person as of December 31, 2006 of approximately $41.00, which we believe enhances our overall return on capital. The opportunities on which we plan to focus initially in our Auction 66 Markets will have population density characteristics similar to our Core and Expansion Markets.

Our Cost Leadership Position. We believe we are one of the lowest cost providers of wireless broadband PCS services in the United States, which allows us to offer our services at affordable prices while maintaining cash profits per customer as a percentage of revenues per customer that are among the highest in the wireless industry. For the year ended December 31, 2006, our CPU was $19.65, which represents an average cost per minute of service on our network of approximately one cent. For the year ended December 31, 2006, our CPGA was $117.58, which we believe to be among the lowest in the industry. We believe our operating strategy, network design and rapidly increasing scale, together with the high relative population density of our markets, will continue to contribute to our cost leadership position. For a discussion of CPU and CPGA, and their respective reconciliations to cost of service and selling expenses, please read “Summary Historical Financial and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Reconciliation of Non-GAAP Financial Measures.”

Our Spectrum Portfolio. We hold or have access to wireless licenses covering a population of approximately 140 million in the United States. These licenses cover nine of the top 12 and 14 of the top 25 most populous metropolitan areas in the United States, including New York (#1), Los Angeles (#2), San Francisco (#4), Dallas/Ft. Worth (#5), Philadelphia (#6), Atlanta (#9), Detroit (#10), Boston (#11), Miami (#12), Seattle (#15), San Diego (#16), Tampa (#20), Sacramento (#24) and Portland (#25), as well as Las Vegas (#31).

Our Advanced CDMA Network. We deploy an advanced CDMA network in each of our Core and Expansion Markets that is designed to provide the capacity necessary to satisfy the usage requirements of our customers. We believe CDMA technology provides us with substantially more voice and data capacity per MHz of spectrum than other commonly deployed wireless broadband PCS technology. We believe that the combination of our network technology, network design and spectrum depth will continue to allow us to serve efficiently the high usage demands of our rapidly growing customer base into the future.

Business Strategy

We believe the following components of our business strategy provide the foundation for our continued rapid growth:

Continue to Target Underserved Customer Segments in our Markets. We target a mass market which we believe is largely underserved by traditional wireless carriers. We believe that our rapid growth to over 3.0 million customers since our initial service launch in 2002 demonstrates the substantial demand in the United States for our innovative wireless services. We believe our rapid adoption rates and customer mix indicate that our service is expanding the overall size of the wireless market and better meeting the needs of many existing wireless users. Our average monthly usage by our customers for all markets is approximately 2,000 minutes per month, and our recent customer surveys indicate that over 80% of our customers use us as their primary phone service and that over 50% of our customers have eliminated their traditional landline

92

phone service. Approximately 65% of our customers are first time wireless users, while the balance have switched to our service from another wireless carrier.

Offer Affordable, Fixed Price Unlimited Service Plans With No Long-Term Service Contract Requirement. We plan to continue to offer our fixed price, unlimited wireless service plans, which we believe represent an attractive and differentiated offering to a large segment of the population. Our service is designed to provide mobile functionality while eliminating the gap between traditional wireless and wireline

pricing, which wepricing. We believe

this stimulates

usage ofthe demand for our wireless service,

contributes to the continuing growth of our subscriber base and will

contribute to drivingincrease the overall wireless adoption

levels in our

markets to levels comparable to the adoption rates currently experienced in Europe. We also believe that our ability to capture approximately 1.2 million customers to date demonstrates the substantial demand for our service offering.markets.

Our Focus on Densely Populated Markets. Our current service areas include fourRemain One of the

25 most populous metropolitan areasLowest Cost Wireless Service Providers in the United

States: San Francisco, Miami, Atlanta and Sacramento. We believe the high relative population density of our market clusters results in increased efficiencies in network deployment, operating costs and product distribution. As of March 31, 2004, our markets had an average population density of335 POPs per square mile, over four times the national average. In addition, the population of our markets is growing at an average of 1.5 times faster than the national average and the average household income in our markets is $5,000 above the national average according to the Paul Kagan Associates, Inc. Wireless Telecom Atlas & Databook 2002. Based on these statistics, we believe our market profile is the most attractive of any U.S. wireless carrier. We believe significant opportunities exist to expand into other markets with similar characteristics.

Our Cost Leadership PositionStates.. We believe our operating strategy, network design and high relative population density and spectrum positionin our markets have enabled us to become, and will enable us to continue to be, one of the lowest cost providerproviders of wireless broadband PCS services in the United States. We also believe our rapidly increasing scale will allow us to continue to drive our per customerper-customer operating costs down in the future. For the three months ended March 31, 2004, our cost per gross addition, or CPGA, was $97 compared to an average of $345 for our three largest national competitors. In addition, ourwe will seek to maintain operating costs per customer that are substantially below the serviceoperating costs of our national wireless broadband PCS competitors. We believe that our industry leading cost position provides us and will continue to provide us with a sustainable competitive advantage in our markets.

advantage.

Our State-of-the-Art CDMA 1XRTT NetworkExpand into Attractive Markets.. We have

deployedbeen successful in acquiring or gaining access to spectrum in a

100% code division multiple access radio transmission technology, or CDMA 1XRTT, network in eachnumber of new metropolitan areas which share the high relative population density and customer characteristics of our

markets that is designed specifically to provide the capacity necessary to satisfy the usage requirements of our customers. CDMA 1XRTT technology provides substantially more voice and data capacity than other commonly deployed wireless technologies and provides us with a network capacity advantage in our markets. Our CDMA 1XRTT network, which provides the most efficient use of spectrum, currently allows us to rapidly and cost-effectively add network capacity without adding incremental cell sites. We believe that the combination of our network technology, network design and spectrum depth will allow us to efficiently serve the high usage demands of our rapidly growing customer base into the future.Our Deep Spectrum Portfolio. We currently hold 30 MHz of spectrum in 13 of our 18 license areas even though our business plan generally requires only 20 MHz of spectrum in our major markets. This excess spectrum provides us with the flexibility to swap or sell 10 MHz or more of spectrum in selected markets to support future expansion or investment initiatives without materially impacting our business plan. For example, in February 2002, we completed our only spectrum sale to date, selling 10 MHz of excess spectrum in our Atlanta market for $290.0 million.

Business Strategy

We believe the following components of our business strategy will allow us to continue our rapid, profitable growth:

Continue to Target Underserved Customer Segments in OurCore Markets. We believe there is substantial demand in the United States for our affordable wireless services, as demonstrated by the fact that we have been among the leaders of the U.S. wireless industry in incremental market penetration in every quarter since we launched operations. Historically, approximately 40% of our gross customer additions have been first time wireless customers, while the remainder have switched from traditional wireless carriers. We believe our rapid adoption ratesearly experience in Tampa/Sarasota, Dallas/Ft. Worth and customer mix demonstrate thatDetroit, where, as of December 31, 2006, we have added approximately 640,000 new subscribers since the launch of service, demonstrates our ability to successfully expand our service is expanding the overall size of the wireless market as well as better meeting the needs of many existing wireless users.

Offer Affordable, Fixed Price Calling Plans Without Long-Term Service Contracts. We believe that our fixed price, unlimited service represents an attractive offering to a large segment of the population. Our service results in average per minute usage costs to our customers that are significantly lower than the average per minute rates of other wireless operators. We believe that many prospective customers refrain from subscribing to or extensively using traditional wireless communications services due to high prices or unattractive and confusing calling plans, and that our simple, cost- effective service will allow us to attract many of these customers and continue our rapid growth.

Maintain Our Positionas the Lowest Cost Wireless Telephone Services Provider in the United States. We are the lowest cost provider of wireless services in the United States, which allows us to offer our services at affordable prices while maintaining cash profit margins per customer that are among the highest in the industry. Our operating strategy, network design, spectrum portfolio and rapidly increasing scale, together with the population density of our markets, should allow us to continue to maintain our cost leadership position and further reduce our per customer operating costs in the future.

Expand into Attractive Markets Through Acquisitions and Spectrum Swaps. We believe the success of our business model can be replicated in markets outside of our existing footprint. We expect that attractive expansion opportunities will become available. We plan to target expansion markets that complement our existing footprint or can be operated as a stand alone cluster with growth and profitability characteristics similar to our existing markets. Part of the proceeds from this offering may be used to fund expansion into new markets, and we may also choose to swap a portion of our existing excess spectrum for spectrum in new markets.

metropolitan areas.

General Wireless, Inc., or GWI, was formed in 1994 for the purpose of bidding on, acquiring and operating broadband PCS licenses as a “small business”very small business under the FCC’s “designated entity”designated entity rules. In 1995, GWI formed GW1, Inc. as a wholly-owned subsidiary, and shortly afterwards changed GW1, Inc.’s name to GWI PCS, Inc., or GWI PCS. In 1996, weGWI PCS participated in the FCC’s C-Block auctions of broadband PCS spectrum licenses. Although the auctions in which we werelicenses and was declared the high bidder concludedon licenses for the Miami, Atlanta, Sacramento and San Francisco metropolitan areas. In 1999, GWI PCS changed its name to MetroPCS Wireless, Inc. and GWI changed its name to MetroPCS, Inc.

In March 2004, MetroPCS, Inc. formed MetroPCS Communications as a wholly-owned subsidiary of MetroPCS, Inc. and in

May 1996,July 2004 a wholly-owned subsidiary of MetroPCS Communications, Inc., MPCS Holdco Merger Sub, Inc., merged into MetroPCS, Inc. and MetroPCS, Inc. was the

FCC did not issue the licenses to us until January 1997, by which time the market value of PCS licenses had declined dramatically due to, among other things, the FCC’s intervening auction of licenses in the D-, E- and F-Blocks. In connection with the C-Block auction, each of our license holding subsidiaries had executed a separate promissory note payable to the FCC in an amount equal to the purchase price of that subsidiary’s FCC license. As a result, we were unable to obtain the financing necessary to service our debt to the FCC and build our networks.In October 1997, after repeated efforts to obtain a commercially viable restructuring of our debt to the FCC, the subsidiaries in which we hold our FCC licenses each filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code. In January 1998, we filed our own voluntary Chapter 11 petition, joining our license subsidiaries’ bankruptcy proceedings.

surviving corporation. As a result of proceedings commenced in the bankruptcy court, it was determined that, after crediting the $106.0 million we had paid to the FCC as down payments for our licenses, the total amount owed by us to the FCC was $60.0 million. In September 1998, the bankruptcy court confirmed our plan of reorganization and we emerged from bankruptcy in October 1998.

On July 13, 2004,this merger, MetroPCS, Inc. became a wholly ownedwholly-owned subsidiary of MetroPCS Communications, Inc. In August 2006, MetroPCS Communications, Inc. formed MetroPCS V, Inc., as a wholly-owned subsidiary which indirectly, through a series of no longer existing wholly-owned subsidiaries, held all of the common stock of MetroPCS Wireless, Inc.

In November 2006, as part of the restructuring associated with the issuance of the 91/4% senior notes and the senior secured credit facility, MetroPCS, Inc. was merged

into MetroPCS Wireless, Inc., with MetroPCS

Wireless, Inc.

such thatsurviving, and MetroPCS V, Inc. was renamed MetroPCS, Inc.

became a wholly owned subsidiaryMetroPCS Wireless, Inc.’s business constitutes substantially all of the business of MetroPCS Communications, Inc. and

all of the holders of capital stockits wholly- owned subsidiary, and parent of MetroPCS

Wireless, Inc., MetroPCS, Inc.

became holders of capital stock of(formerly known as MetroPCS

Communications,V, Inc.

), and we continue to conduct business under the MetroPCS brand.

Voice ServicesServices.. We provide affordable, reliable, and high-quality wireless communicationsbroadband PCS services which consists of two primary pricing plans.through the service plans detailed in the chart below. All service plans are“paid-in-advance” and do not require a long-term contract. Our basic $35lowest priced $30 per month service offeringplan allows our customers to place unlimited local calls within our calling area andbut without the ability to receive unlimited calls from anywhere in the world. In November 2003, we beganadd additional features. For an additional $5 to market a $40$20 per month, a

93

subscriber may select a service offering in allplan which provides more flexibility and options such as nationwide long distance calling, unlimited text messaging (domestic and international), voicemail, caller ID, call waiting, picture and multimedia messaging, mobile Internet browsing, pushe-mail, data and other a la carte options on a prepaid basis. Our most popular service plans currently are our unlimited $40 and $45 service plans which offer unlimited local and long distance calling, text and picture messaging, enhanced voice mail, caller ID, call waiting and 3-way calling. As of December 31, 2006, over 85% of our marketscustomers had selected either our $40 or $45 rate plans. On February 22, 2007 we introduced our new $50 service plan which includes unlimited mobile Internet browsing and pushe-mail in addition to the services included in our $45 service plan. It is too early to judge the impact that allowsthis new service plan will have on our customerscurrent service plan mix.

MetroPCS Service Plans

| | | | | | | | | | | | | | | | | | | | |

Product | | $30/Month | | | $35/Month | | | $40/Month | | | $45/Month | | | $50/Month | |

|

| Unlimited local calling | | | X | | | | X | | | | X | | | | X | | | | X | |

| Unlimited nationwide long distance calling(1) | | | | | | | | | | | X | | | | X | | | | X | |

| Unlimited domestic text messaging | | | | | | | | | | | | | | | X | | | | X | |

| Unlimited picture messaging | | | | | | | | | | | | | | | X | | | | X | |

| Enhanced voicemail | | | | | | | | | | | | | | | X | | | | X | |

| 3-way calling | | | | | | | | | | | | | | | X | | | | X | |

| Caller ID | | | | | | | | | | | | | | | X | | | | X | |

| Call waiting | | | | | | | | | | | | | | | X | | | | X | |

| Mobile Internet browsing | | | | | | | | | | | | | | | | | | | X | |

Pushe-mail | | | | | | | | | | | | | | | | | | | X | |

| Additional calling features available | | | | | | | X | | | | X | | | | X | | | | X | |

| | |

| (1) | | Includes only the continental United States. |

Currently, in our San Francisco, Sacramento, and Dallas/Ft. Worth metropolitan areas we have added to placethe $35 service plan unlimited calls from our coverage area to anywherelong distance in the continental United States, to the $40 service plan unlimited short message and multimedia message services, and to receivethe $45 service plan unlimited calls from anywhere in the world. Both plans are paid for in advancemobile Internet browsing and do not require a long-term service contract. international short message service.

Our

local outbound calling areas extend in most cases beyond the boundaries of our actual license

footprint.area. For example, customers in our San Francisco and Sacramento markets may place unlimited

local calls

while inside our service area to areas throughout

the majority of northern California

for which ourwithout incurring toll charges. Our wireline competitors generally would impose toll

charges.Customers oncharges for calls within this area, while our basic $35 per month plan desiring long distance and international calling service may choose a pre-paid option, allowing them to place calls anywhere in the world at favorable rates. Customers on our $40 per month plan who desire international calling service may also choose this pre-paid option for international calling service. treats these as local calls.

Customers who travel outside of theirour coverage area may roam onto other wireless networks in two ways. First, a customer may purchase service directly from a manual roaming provider in that area by providing the carrier on those networksprovider with a credit card number, thereby allowingwhich allows that carrierprovider to bill themthe customer directly for theirany roaming charges. WeIf the customer chooses this option, we incur no costs, nor do we receive any revenues,revenues. Second, a customer may subscribe to our nationwide roaming service, branded as “TravelTalk,” under which we provide voice roaming service through agreements with other wireless carriers. We launched our TravelTalk roaming service on a prepaid basis in April 2006. Under this option, the customer makes a deposit in a prepaid account and may access our nationwide roaming service when traveling outside our local service area. We incur costs for providing, and earn revenue from, this nationwide roaming service in excess of our costs. Due to charges imposed by our roaming suppliers, our nationwide roaming service is not cost effective for customers utilize these third-partywho travel frequently outside our local service area, but the ability to roam nationwide on a prepaid basis expands the market to those customers that may find occasional roaming services.beneficial.

94

Data ServicesServices.. Our data services include:

| | |

| | Ÿ | • | services provided through the binary runtime environmentBinary Runtime Environment for wireless,Wireless, or BREW, development platform, including ringtones, games and content applications; |

|

| | Ÿ | • | text messaging services (domestic and international), which allow the customer to send and receive alphanumeric messages which can be received, stored and displayed onthat the handset can receive, store and display on demand; and |

|

| | Ÿ | • | multimedia messaging services, which allow the customer to send and receive messages containing photographs.photographs; |

|

| • | mobile Internet browsing; and |

|

| • | pushe-mail. |

Custom Calling FeaturesFeatures.. We offer other custom calling features, including caller ID, call waiting, three-way calling, distinctive

ringtones, ring

back tones and voicemail.

Advanced HandsetsHandsets.. We sell a variety of handsets manufactured

primarily by

Nokia, Kyocera, Audiovox, LG and Sony Ericssonnationally recognized handset manufacturers for use on our network, including models that provide color screens, camera phones and other features

to facilitatefacilitating digital

data transmission.data. All of the handsets we offer are CDMA 1XRTT

compliant.compliant and are capable of providing the location data mandated by the FCC’s wirelessE-911 rules and regulations.

Core and Expansion Markets

Our strategy has been to offer our services in major metropolitan markets and their surrounding areas, which we refer to as clusters. Within our Core Markets we operate three separate clusters, which include Georgia (Atlanta), South Florida (Miami) and Northern California (San Francisco and Sacramento). We

continue to evaluate new productinitially launched our service in South Florida, Georgia and

service offerings in order to enhance customer satisfaction and attract new customers. For example, in March 2004, we launched, on a trial basis, a limited usage offering in which customers purchase 250 minutesthe Sacramento area of

local and long distance usage per month for $25 instead of our traditional unlimited usage offerings. We believe that this offering will help us to retain existing customers and attract new customers who do not require unlimited usage or who are unwilling or unable to pay for our traditional unlimited usage plans.FCC Licenses

Fourteen of our wholly-owned license subsidiaries each hold one 30 MHz PCS license, with the exception of one subsidiary that holds a license for 20 MHz as a result of the February 2002 sale of 10 MHz of spectrum in our Atlanta market. Six licenses permit wireless operationsNorthern California in the greaterfirst quarter of 2002 and launched the San Francisco and Sacramento metropolitan area in September of 2002. These Core Market clusters five permit wireless operations in the greater Miami metropolitan cluster and three permit wireless operations in the Atlanta metropolitan cluster. The licenses have an initial term of ten years after the initial grant date in January 1997, and, subject to applicable conditions, may be renewed. Each FCC license is essential to our ability to operate and conduct our business in the area covered by that license. See “Risk Factors—Risks Related to Our Business” and “Legislation and Government Regulations.”

On April 15, 2004, we acquired, through a wholly-owned subsidiary, four additional 15 MHz licenses for areas in northern California (Merced, Modesto, Eureka and Redding), with a totallicensed population of approximately 1.226 million people. Asof which our networks currently cover approximately 22 million. Our Core Market clusters have an average population density of 271 people per square mile, compared to the national average of 84, enjoy average annualized population growth of 1.8% compared to the national average of 1.1% and have a median household income of $53,000 compared to a national average of $47,000.

Beginning in the second half of 2004, we began to acquire licenses opportunistically for new markets that shared characteristics similar to our existing Core Markets. In addition to these acquisitions, we also entered into agreements with

our otherRoyal Street Communications, a company in which we own a non-controlling 85% limited liability company member interest, which was granted broadband PCS licenses

these licensesby the FCC in December 2005 following FCC Auction 58. For a discussion of Royal Street and Auction 58, please see “— Auction 58 and Royal Street.” We have

an initial terma wholesale agreement with Royal Street that allows us to purchase up to 85% of

ten years afterRoyal Street’s service capacity and sell it on a retail basis under the

initial grant dateMetroPCS brand in

January 1997geographic areas where Royal Street was granted FCC licenses. Our Expansion Markets include Tampa/Sarasota/Orlando, Dallas/Ft. Worth, Detroit, portions of Northern Florida, which are geographically complementary to our South Florida cluster, as well as Los Angeles, which is geographically complementary to our Northern California cluster. Within our Expansion Markets we operate or will operate four new separate clusters: Northern and

subjectCentral Florida, Dallas/Ft. Worth, Detroit and Southern California. As of November 2006, we had launched our service in all of our major Expansion Markets except for Los Angeles, which we expect to

applicable conditions, may be renewed. We paid an aggregate cash purchase price of $10.9 million for this acquisition. We arelaunch in the

processsecond or third quarter of

planning network deployment and have not begun to provide service in these areas.On July 8, 2004, we entered into an agreement2007 through our wholesale arrangement with NextWave Telecom, Inc. and certain of its affiliates to acquire two 10 MHz PCS licenses for the Tampa-St. Petersburg-Clearwater, Florida area, and the Sarasota-Bradenton, Florida area. These areasRoyal Street. Our Expansion Markets have a totallicensed population of approximately 3.340 million, people. These licenses

date, including our operations in Orlando and portions of northern Florida. Together, our Core and Expansion Markets have an initial termaverage population density of ten years after339 people per square mile, compared to the initial grant date in January 1997,national average of 84, enjoy average annualized population growth of 1.7% compared to the national average of 1.1% and subjecthave a median household income of $50,000 compared to applicable conditions, may be renewed. We agreed to pay a cash purchase pricenational average of $43.5 million for this acquisition. Consummation of this acquisition is subject to satisfaction of several conditions, including approval by the FCC and approval by the bankruptcy court in which NextWave’s Chapter 11 bankruptcy cases are pending.

Markets

Our FCC licenses cover four clusters encompassing the greater metropolitan areas of San Francisco, Miami, Atlanta and Sacramento.$47,000. We believe our marketsall of these Expansion Markets are particularly attractive because of their high population densities, attractive customer demographics,

95

high historical and projected population growth rates, favorable business climates and long commuting times relative to national averages.

The table below provides a metropolitan area by metropolitan area overview of our Core and Expansion Markets (excluding Auction 66 Markets) including the FCC basic trading area (BTA) identification number, the number of people, or POPs, the POP density, the annualized POP growth rate, the spectrum depth and each metropolitan area’s actual or expected launch date. For our Expansion Markets we have noted whether we are the FCC license holder in each metropolitan area or if we will provide our services in that metropolitan area through our agreements with Royal Street, which holds the license. It should also be noted that all of the licensed spectrum shown below in our Core and Expansion Markets is in the 1900 MHz PCS band and that the metropolitan area classifications in the table below conform to the FCC’s basic trading area (BTA) geographic areas for PCS spectrum.

96

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Annualized

| | | | | | | |

| | | | | | POPs

| | | POP

| | | POP

| | | | | | Launch

| |

Metropolitan Area | | BTA | | | (’000s)(1) | | | Density(3) | | | Growth(4) | | | MHz | | | Date | |

| |

Core Markets: | | | | | | | | | | | | | | | | | | | | | | | | |

Georgia: | | | | | | | | | | | | | | | | | | | | | | | | |

| Atlanta, GA | | | 24 | | | | 5,213.8 | | | | 474 | | | | 2.53 | % | | | 20 | | | | Q1 2002 | |

| Gainesville, GA | | | 160 | | | | 304.9 | | | | 187 | | | | 3.15 | % | | | 30 | | | | Q1 2002 | |

| Athens, GA | | | 22 | | | | 232.1 | | | | 169 | | | | 1.70 | % | | | 20 | | | | Q1 2002 | |

South Florida: | | | | | | | | | | | | | | | | | | | | | | | | |

| Miami-Fort Lauderdale, FL | | | 293 | | | | 4,415.8 | | | | 1,051 | | | | 1.69 | % | | | 30 | | | | Q1 2002 | |

| West Palm Beach, FL | | | 469 | | | | 1,334.9 | | | | 483 | | | | 2.05 | % | | | 30 | | | | Q1 2002 | |

| Fort Myers, FL | | | 151 | | | | 748.5 | | | | 219 | | | | 2.61 | % | | | 30 | | | | Q1 2004 | |

Fort Pierce-Vero Beach, FL | | | 152 | | | | 497.3 | | | | 305 | | | | 2.13 | % | | | 30 | | | | Q1 2004 | |

| Naples, FL | | | 313 | | | | 322.2 | | | | 162 | | | | 3.63 | % | | | 30 | | | | Q1 2004 | |

Northern California: | | | | | | | | | | | | | | | | | | | | | | | | |

| San Fran.-Oak.-S.J., CA | | | 404 | | | | 7,501.4 | | | | 553 | | | | 0.57 | % | | | 20 | | | | Q3 2002 | |

| Sacramento, CA | | | 389 | | | | 2,388.0 | | | | 150 | | | | 2.65 | % | | | 30 | | | | Q1 2002 | |

| Stockton, CA | | | 434 | | | | 752.6 | | | | 309 | | | | 3.25 | % | | | 30 | | | | Q1 2002 | |

| Modesto, CA | | | 303 | | | | 604.2 | | | | 162 | | | | 2.79 | % | | | 15 | | | | Q1 2005 | |

| Salinas-Monterey, CA | | | 397 | | | | 434.2 | | | | 131 | | | | 1.21 | % | | | 30 | | | | Q1 2002 | |

| Redding, CA | | | 371 | | | | 304.3 | | | | 19 | | | | 1.47 | % | | | 30 | | | | Q4 2006 | |

| Merced, CA | | | 291 | | | | 269.3 | | | | 79 | | | | 2.53 | % | | | 15 | | | | Q1 2005 | |

| Chico-Oroville, CA | | | 79 | | | | 246.9 | | | | 83 | | | | 1.13 | % | | | 30 | | | | Q1 2002 | |

| Eureka, CA | | | 134 | | | | 155.8 | | | | 34 | | | | 0.18 | % | | | 15 | | | | TBD | |

| Yuba City-Marysville, CA | | | 485 | | | | 155.3 | | | | 125 | | | | 1.68 | % | | | 30 | | | | Q1 2002 | |

Expansion Markets: | | | | | | | | | | | | | | | | | | | | | | | | |

Central and Northern Florida: | | | | | | | | | | | | | | | | | | | | | | | | |

| Tampa-St. Petersburg, FL | | | 440 | | | | 2,915.0 | | | | 602 | | | | 1.59 | % | | | 10 | | | | Q4 2005 | |

| Sarasota-Bradenton, FL | | | 408 | | | | 708.0 | | | | 362 | | | | 1.97 | % | | | 10 | | | | Q4 2005 | |

| Daytona Beach, FL | | | 107 | | | | 559.1 | | | | 349 | | | | 1.92 | % | | | 20 | | | | TBD | |

| Ocala, FL | | | 326 | | | | 297.0 | | | | 184 | | | | 2.09 | % | | | 10 | | | | TBD | |

| Jacksonville, FL(2) | | | 212 | | | | 1,525.9 | | | | 192 | | | | 1.78 | % | | | 10 | | | | TBD | |

| Lakeland-Winter Haven, FL(2) | | | 239 | | | | 525.1 | | | | 288 | | | | 1.27 | % | | | 10 | | | | Q4 2006 | |

| Melbourne-Titusville, FL(2) | | | 289 | | | | 530.1 | | | | 533 | | | | 1.65 | % | | | 10 | | | | TBD | |

| Gainesville, FL(2) | | | 159 | | | | 339.6 | | | | 94 | | | | 0.92 | % | | | 10 | | | | TBD | |

| Orlando, FL(2) | | | 336 | | | | 2,010.0 | | | | 493 | | | | 2.54 | % | | | 10 | | | | Q4 2006 | |

Dallas/Ft. Worth: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dallas/Ft. Worth, TX(5) | | | 101 | | | | 6,028.9 | | | | 727 | | | | 2.56 | % | | | 10 | | | | Q1 2006 | |

| Sherman-Denison, TX(6) | | | 418 | | | | 190.1 | | | | 70 | | | | 0.99 | % | | | 10 | | | | Q1 2006 | |

Detroit: | | | | | | | | | | | | | | | | | | | | | | | | |

| Detroit, MI | | | 112 | | | | 5,095.3 | | | | 826 | | | | 0.41 | % | | | 10 | | | | Q2 2006 | |

Southern California: | | | | | | | | | | | | | | | | | | | | | | | | |

| Los Angeles, CA(2) | | | 262 | | | | 18,261.0 | | | | 413 | | | | 1.66 | % | | | 10 | | | | Q2/Q3 2007 | |

| Bakersfield, CA | | | 28 | | | | 752.0 | | | | 92 | | | | 1.95 | % | | | 10 | | | | TBD | |

Source: Kagan 2005 Wireless Telecom Atlas and Databook.

| | |

| (1) | | POPs based on 2005 population data and increased based on annualized POP growth rates. |

|

| (2) | | License granted to Royal Street. |

|

| (3) | | Calculated as number of POPs divided by square miles. |

|

| (4) | | Estimatedaverage 2003-2008 annual population growth. |

|

| (5) | | The Dallas/Ft. Worth license is comprised of the counties which make up CMA9. |

|

| (6) | | Comprised of Grayson and Fannin counties only. |

97

Core and Expansion Market Launch Experience

When we launched our Core Markets in 2002 we had limited access to capital. As a result, as we prepared to launch each market, we limited our initial network coverage, pre and post launch expenditures on advertising and the number of distribution outlets. This strategy allowed us to protect our limited capital and closely regulate our post launch investments in both additional network coverage as well as our costs of customer acquisition. Our licensed population coverage at the time of launch across our Core Markets was between approximately 65% and 70%. In addition, the CDMA 1XRTT technology we deployed in our network was relatively new at the time we launched our Core Markets. As a result, at the time we launched each of our Core Markets, we were able to offer only a single handset and a single $35 per month rate plan which we believe limited the initial attractiveness of our service. In spite of these challenges, the demand for our service exceeded our initial expectations and the average customer penetration levels of our Core Markets at the end of 12 months of operations for each of our Core Markets as a percentage of covered population was approximately 4%. In the fourth quarter of 2003, we were able to raise additional capital, which allowed us to expand our network coverage and increase our distribution presence. As of December 31, 2006, our Core Market operations had achieved customer penetration levels as a percentage of covered population of 10.2%, representing an increase of 1.4% in incremental penetration over the marketsprior year. As of March 31, 2007, we currently servehad 2.5 million subscribers in our Core Markets which represented customer penetration as a percentage of covered population of 11.0%.

In early 2005, as we began to plan our network deployment and service launch in our Expansion Markets, we had sufficient liquidity to more effectively execute our build-out and launch strategy. We were also able to apply the lessons we learned from the launch and operations of our Core Markets to improve our execution plan for our Expansion Markets. As a result, we launched our Expansion Markets with higher initial population coverage of between approximately 80% and 90%. We also elected to deploy additional network equipment in certain high population areas in order to provide higher quality in-building coverage, increase by approximately 20% our average number of distribution locations per one million covered population at the time of launch, and offer a broader selection of monthly rate plans and handsets. These factors allowed us to initially target a larger population of potential customers and provide a more robust service offering at the launch dates. As a result of these changes, we are experiencing higher levels of initial customer penetration in our Expansion Markets than we experienced in our Core Markets, based on our performance to date in the Tampa/Sarasota/Orlando, Dallas, and Detroit metropolitan areas.

Los Angeles, California, the second most populous market in the United States, is growingthe only one of our major Expansion Markets that we have not yet launched. We plan to launch the Los Angeles metropolitan area in the second or third quarter of 2007. We anticipate covering a population of 11 to 12 million at launch and is expected to continue to grow atincrease population coverage over time. Los Angeles will represent the eighth top 25 metropolitan area launched by us. We believe that the Los Angeles metropolitan area could prove to be our most successful launch to date, based on its high population density and attractive demographics.

Auction 66 Markets

At the conclusion of FCC Auction 66 in September 2006, we were declared the high bidder on eight additional FCC licenses for total aggregate winning bids of approximately $1.4 billion, and, in November 2006, we were granted all eight of these licenses. The spectrum licenses granted as a result of Auction 66 are in the advanced wireless services, or AWS, band which includes the 1710 to 1755 MHz frequencies as well as the 2110 to 2155 MHz frequencies. These frequency ranges are near the PCS band in which we operate our Core and Expansion Markets, and we believe this spectrum to have similar technical properties to the PCS spectrum we are currently licensed to operate. We can offer the same PCS services on these AWS licenses as we offer on our other PCS spectrum and can offer additional advanced services. The AWS licenses awarded by the FCC in Auction 66 were divided into geographic areas which are different from the geographic areas associated with PCS licenses. The map below describes the geographic coverage of our Auction 66 licenses and shows the relationship between these new AWS licenses and our existing Core and Expansion Markets.

98

Our Auction 66 licenses cover a total unique population of approximately 117 million. New expansion opportunities in geographic areas outside of our Core and Expansion Markets represent approximately 69 million of the total covered population of our Auction 66 Markets, as described in the chart below. Our expansion opportunities as a result of Auction 66 cover six of the top 25 metropolitan market areas in the United States, including the entire east coast corridor from Philadelphia to Boston, including New York City, as well as the entire states of New York, Connecticut and Massachusetts. Together our east coast expansion opportunities cover a geographic area of approximately 50 million people. In the Western United States our new expansion opportunities cover a geographic area of approximately 19 million people, including the San Diego, Portland, Seattle and Las Vegas metropolitan areas.

The balance of our Auction 66 Markets, which covers a population of approximately 48 million, supplements or expands the geographic boundaries of our existing operations in Dallas/Ft. Worth, Detroit, San Francisco and Sacramento, and Royal Street’s license area in Los Angeles. Given our performance in the Core and Expansion Markets to date, we expect this additional spectrum to provide us with enhanced operating flexibility, reduced capital expenditure requirements in existing licensed areas and an averageexpanded service area relative to our position prior to Auction 66. We intend to focus our build-out strategy in our new Auction 66 Markets initially on licenses with a total population of 1.5 times faster thanapproximately 40 million in major metropolitan areas which we believe offer us the national averageopportunity to achieve financial results similar to our existing Core and Expansion Markets, with a primary focus on the New York, Philadelphia, Boston and Las Vegas metropolitan areas. Of the approximately 40 million total population, we are targeting launch of operations with an initial population of approximately 30 to 32 million by late 2008 or early 2009.

| | | | | | | | | | | | | | | |

| | | Purchase

| | | Spectrum

| | | | |

License | | Price $ | | | MHz | | | Population | |

| |

| REA 1 | | Northeast | | | 552,694,000 | | | | 10 | | | | 50,058,090 | |

| REA 6 | | West | | | 355,726,000 | | | | 10 | | | | 49,999,164 | |

| EA 10 | | New York-No. New Jer.-Long Island,

NY-NJ-CT-PA-MA-VT(1) | | | 363,945,000 | | | | 10 | | | | 25,712,577 | |

| EA 57 | | Detroit-Ann Arbor-Flint, MI | | | 50,317,000 | | | | 10 | | | | 6,963,637 | |

| EA 127 | | Dallas/Ft. Worth, TX-AR-OK | | | 49,766,000 | | | | 10 | | | | 7,645,530 | |

| EA 62 | | Grand Rapids-Muskegon-Holland, MI | | | 7,920,000 | | | | 10 | | | | 1,881,991 | |

| EA 153 | | Las Vegas, NV-AZ-UT(1) | | | 10,420,000 | | | | 10 | | | | 1,709,797 | |

| EA 88 | | Shreveport-Bossier City, LA-AR | | | 622,000 | | | | 10 | | | | 573,616 | |

99

Source: FCC Auction 66 Website

| | |

| (1) | | Licenses overlap other Auction 66 licenses |

The New York EA overlaps that portion of the Northeast REA surrounding the greater New York metropolitan area. The Las Vegas EA also overlaps that portion of the West REA that also covers Las Vegas. As a result, we have 20 MHz of spectrum in these metropolitan areas which we believe will facilitate a more efficient rollout and allow us to more effectively scale our operations.

There are incumbent governmental and non-governmental users in the AWS band. The relocation of incumbent governmental users will be funded by the proceeds of Auction 66, although certain governmental users will not be required to relocate. The non-governmental incumbent licensees will need to be relocated pursuant to the FCC’s approved spectrum relocation order, which may require us to pay for their relocation expenses which we currently estimate to be approximately $40 to $60 million, and which requires voluntary negotiation for the periodfirst three years before the commercial incumbents are subject to mandatory relocation.

Auction 58 and Royal Street

In January 2005, the FCC conducted Auction 58 for wireless broadband PCS spectrum. Auction 58 was the first significant FCC auction for wireless broadband PCS spectrum since Auction 35 in 2001. Auction 58, like other major auctions conducted by the FCC, was designed to allow small businesses, very small businesses and other so called designated entities, or DEs, to acquire spectrum and construct wireless networks to promote competition with existing carriers. To that end, the FCC designated certain blocks of 2001wireless broadband PCS spectrum for which only DEs could apply. Qualified DEs were able to bid on these restricted or “closed” licenses which were not available to other bidders who did not qualify as DEs. In addition, very small business DEs were permitted to apply for and bid on “open” licenses with a bidding credit of 25% of the gross bid price. We entered into a cooperative arrangement with an unaffiliated very small business entrepreneur and invested in Royal Street, a DE that qualified to bid on “closed” licenses and was eligible for the 25% bidding credit on “open” licenses. We own a non-controlling 85% limited liability company member interest in Royal Street and may elect only two of the five members to Royal Street Communications’ management committee, which has the full power to direct the management of Royal Street Communications. C9 Wireless, LLC, or C9, has control over the operations of Royal Street because it has the right to elect three of the five members of Royal Street Communications’ management committee. C9 has the right to put all or part of its ownership interest in Royal Street Communications to us, but due to regulatory restrictions, we have no corresponding right to call C9’s ownership interest in Royal Street Communications. The put right has been structured so that its exercise will not adversely affect Royal Street’s continued eligibility as a very small business designated entity during periods where such eligibility is required. If C9 exercises its put right, we will be required to pay a fixed return on C9’s invested capital in Royal Street Communications, which fixed return diminishes annually beginning in the sixth year following the grant of Royal Street’s FCC licenses. These put rights expire in June 2012.

Auction 58 was completed in February 2005, and Royal Street made its final payment to the FCC for the licenses it won in Auction 58 in March 2005. In December 2005, Royal Street was granted the following licenses on which it was the high bidder at the conclusion of Auction 58: Los Angeles, California; and Orlando, Jacksonville, Lakeland-Winter Haven, Melbourne-Titusville and Gainesville, Florida basic trading areas.

Royal Street Communications holds all of the Auction 58 licenses through 2006.its wholly-owned subsidiaries and has entered into certain cooperative agreements with us relating to the financing, design, construction and operation of the networks. The Royal Street agreements are based on a “wholesale model” in which Royal Street plans to sell up to 85% of its engineered service capacity on a wholesale basis to us, which we in turn will market on a retail basis under the MetroPCS-brand to our customers within the covered area. In addition, the Royal Street agreements contemplate that MetroPCS, at Royal Street’s request and at all times subject to Royal Street’s direction and control, will build-out the networks, provide information to Royal Street relating to the budgets and business plans as well as arrange for administrative, clerical, accounting, credit, collection,

100

operational, engineering, maintenance, repair, and technical services. We do not own or control the Royal Street licenses. However, pursuant to contractual arrangements with Royal Street, we have access, via the wholesale arrangement, to as much as 85% of the engineered service capacity of Royal Street’s network with the remaining 15% reserved by Royal Street to sell to other parties.

Also, pursuant to another of the Royal Street agreements, upon Royal Street’s request, we will provide financing for the acquisition and build-out of licenses won in Auction 58. As of December 31, 2006 the maximum amount that Royal Street may borrow from us under the loan agreement is approximately $500 million. As of December 31, 2006 Royal Street has borrowed $394 million from us under the loan agreement, approximately $294 million of which was used for the acquisition of new licenses. In March 2007, Royal Street borrowed an additional $70 million from us under the loan agreement. Interest accrues under the loan agreement at a rate equal to 11% per annum, compounded quarterly. Royal Street has commenced repayment of that portion of the loans related to the Orlando and Lakeland-Winter Haven markets. The following table sets forth information regardingproceeds from this loan are to be used by Royal Street to make payments for the licenses won in Auction 58, to finance the build-out and operation of the Royal Street network infrastructure, and to make payments under the loan until Royal Street has positive free cash flow.

License Term

All of the broadband PCS licenses held by us and by Royal Street have an initial term of ten years after the initial grant date (which varies by license, but the initial San Francisco, Sacramento, Miami and Atlanta licenses were granted in January 1997), and, subject to applicable conditions, may be renewed at the end of their terms. The AWS licenses granted in Auction 66 have an initial term of fifteen years after the initial grant of the license. Each FCC license is essential to our

licensed marketsand Royal Street’s ability to operate and conduct our and Royal Street’s business in the area covered by that license. We continue to file renewal applications for our broadband PCS licenses as

the windows to file renewal applications open. One application has been granted and one application is currently pending for those licenses that expire in April 2007 and the FCC has granted all of

March 31, 2004(1): | | | | | | | | | |

| | | 2002 POPs(2)

| | MHz in

Market

| | 2001-2006

Annual

Population

Growth

Rate(2)

| | | Population

Density(3)

|

| | | (In thousands) | | | | | | | |

San Francisco Cluster: | | | | | | | | | |

San Francisco—Oakland—San Jose | | 7,375.9 | | 30 | | 1.05 | % | | 544 |

Salinas—Monterey | | 410.1 | | 30 | | 1.03 | % | | 124 |

| | |

| | | | | | | |

Subtotals/Average | | 7,786.0 | | | | 1.05 | % | | 462 |

Miami Cluster: | | | | | | | | | |

Miami—Fort Lauderdale | | 4,073.0 | | 30 | | 1.62 | % | | 970 |

West Palm Beach | | 1,213.6 | | 30 | | 2.02 | % | | 439 |

Fort Myers | | 654.7 | | 30 | | 2.04 | % | | 191 |

Fort Pierce—Vero Beach | | 447.9 | | 30 | | 1.86 | % | | 274 |

Naples | | 268.1 | | 30 | | 3.01 | % | | 134 |

| | |

| | | | | | | |

Subtotals/Average | | 6,657.3 | | | | 1.81 | % | | 475 |

Atlanta Cluster: | | | | | | | | | |

Atlanta | | 4,612.8 | | 20 | | 2.31 | % | | 420 |

Gainesville | | 259.4 | | 30 | | 2.53 | % | | 159 |

Athens | | 214.7 | | 30 | | 1.85 | % | | 156 |

| | |

| | | | | | | |

Subtotals/Average | | 5,086.9 | | | | 2.30 | % | | 364 |

Sacramento Cluster: | | | | | | | | | |

Sacramento | | 2,059.0 | | 30 | | 1.45 | % | | 129 |

Stockton | | 619.6 | | 30 | | 1.31 | % | | 254 |

Chico—Oroville | | 233.4 | | 30 | | 0.96 | % | | 79 |

Yuba City—Marysville | | 141.9 | | 30 | | 1.09 | % | | 114 |

| | |

| | | | | | | |

Subtotals/Average | | 3,053.9 | | | | 1.37 | % | | 135 |

Totals/Average | | 22,584.1 | | | | 1.60 | % | | 335 |

U.S. Totals/Average | | 291,248.0 | | | | 1.06 | % | | 82 |

(1) | The data in the above table does not include the 15 MHz licenses we recently acquired for four areas in northern California (Merced, Modesto, Eureka and Redding), with a total population of 1.2 million people. We are in the process of planning network deployment and have not begun to provide service in these areas. |

(2) | Source: Paul Kagan Associates, Inc. Wireless Telecom Atlas & Databook 2002. |

(3) | Number of POPs per square mile as of December 31, 2001. |

the renewal applications for those licenses that expired in January 2007. For a discussion of general licensing requirements, please see “— General Licensing Requirements and Broadband Spectrum Allocations.”

Distribution and Marketing We offer our

wirelessproducts and services under the

“metroPCS”“MetroPCS” brand

bothindirectly through

indirectapproximately 2,000 independent retail outlets and directly to our customers through

company-operated95 Company-operated retail stores.

At May 31, 2004, our distribution outletsincluded approximately 1,370 indirect retailers and 50 MetroPCS retail locations. Our indirect distribution outlets include a range of local, regional and national mass market retailers and specialty stores. For 2003, approximately 76%A significant portion of our gross customer additions have been added through our indirect distribution outlets and for the twelve months ended December 31, 2006, 84% of our gross customer additions were added through indirect channels. We have over 2,000 locations where customers can make their monthly payments, and many of these locations also serve as distribution points for our products and services. Our cost to distribute through direct and indirect distribution outlets. Wechannels is substantially similar, and we believe our mix of indirect and direct distribution providesallows us with the ability to reach the largest number of potential customers in our markets at a low relative cost. We plan to increase our number of indirect distribution outlets and company-operated stores.

Company-operated stores in both Core and Expansion Markets and in new markets acquired in the future, such as the Auction 66 Markets.

We

engage in local advertising in orderadvertise locally to develop our brand and support our indirect and direct distribution channels. We

advertise primarily

advertise through

local radio, cable,

television, outdoor and local print media. In addition, we believe we have benefited from a significant number of

word-of-mouth customer referrals.

Customer Care, Billing and Support SystemsOur

We use several outsourcing solutions to efficiently deliver quality service and support to our customers as part of our strategy of establishing and maintaining our leadership position as a low cost telecommunications

101

provider while ensuring high customer satisfaction

levels, has led us to pursue several outsourcing solutions to efficiently deliver quality service and support to our customers.levels. We outsource some or all of the following back office and support functions to nationally recognized third-party providers:

| | |

| | Ÿ• | | Customer CareCare.. Our We have outsourcing contracts with two nationally recognized call center vendors. These call centers are staffed with professional and bilingual customer service personnel, who are available to assist our customers 24 hours a day, 365 days a year. We also provide automated voice response services to assist our customers with routine information requests. We believe providing quality customer service is an important element in overall customer satisfaction.satisfaction and retention, and we regularly review performance of our call center vendors. |

|

| | Ÿ• | | BillingBilling.. We utilize a nationally recognized third-party billing platform, that enables us to billbills, monitors and monitoranalyzes payments from our customers. We offer our customers the option of receiving web-based and short messaging service-basedbillsas well as traditional paper bills. We also offer our customers the option of automatic payment of their bills via credit or debit cards. Very few of our customers utilize paper bills and substantially all of our customers receive their bills through the mail. We believeshort message service included with our current billing arrangement will provide us with sufficient scale as our business continues to grow.wireless service. |

|

| | Ÿ• | | Payment ProcessingProcessing.. Customers may pay their bills by credit card, debit card, check or cash. We have over 1,0002,000 locations where our customers who chosechoosing to pay cash for their monthly service in cash can make their payments. Many of these locationsalsoserve as distribution points for our products and services and are therefore conveniently locatedmaking them convenient for our customers to makecustomer payments. In addition, customersCustomers may also make payments at any of the more than 3,000 Western Union locations throughout our markets.metropolitan service areas. |

|

| | Ÿ• | | LogisticsLogistics.. We outsource the logistics associated with the shipping of handsets and accessories to our distribution channels.channels to a nationally recognized logistics provider. |

We believe we were the first U.S. wireless

broadband PCS carrier to have 100% of our customers on a CDMA 1XRTT network. We began

to build outbuilding our network in 2001, shortly after other CDMA carriers began

to upgradeupgrading their networks to 1XRTT. As a result, we

were able to deploybelieve we deployed our network with third generation capabilities at a

fraction of themuch lower cost