5,000,000 Shares

Class A Common Stock

$ per Share

As filed with the Securities and Exchange Commission on April 17, 2008

Registration No. 333-149092June 8, 2016

Registration No. ______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

WASHINGTON, DC 20549

AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

UNDER THE SECURITIES ACT OF 1933

REAL GOODS SOLAR, INC.

(Exact name of registrant as specified in its charter)

| Colorado | 26-1851813 | |||

| (State or other jurisdiction of

| (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) |

Identification Number) |

360 Interlocken Boulevard

Broomfield,

833 West South Boulder Road

Louisville, Colorado 8002180027

(303) 222-8300

(303) 222-8400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive

offices)

Jirka RysavyMichael J. McCloskey

ChairmanGeneral Counsel

Real Goods Solar, Inc.

360 Interlocken Boulevard833 West South Boulder Road

Broomfield,Louisville, Colorado 8002180027

(303) 222-8300

(303) 222-8400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Copies to:Rikard Lundberg, Esq.

Brownstein Hyatt Farber Schreck, LLP

410 Seventeenth Street, Suite 2200

Denver, Colorado 80202

(303) 223-1100

|

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement becomes effective.Registration Statement.

If any of the securities being registered on this form are to bebeing offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.¨

If this formForm is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ _________________

If this formForm is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ _________________

If this formForm is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ _________________

CALCULATION OF REGISTRATION FEE

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(1) | ||||

Class A common stock, par value $.0001 par value | $69,000,000 | $ | 2,712 | (3) | ||

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) |

| CALCULATION OF REGISTRATION FEE | ||

| Title of each class of Securities to be Registered (1) | Proposed maximum aggregate offering price (2) | Amount of registration fee (3) |

| Class A Common Stock, par value $0.0001 per share | ||

| Series H Warrants to Purchase Class A Common Stock | ||

| Common Stock, par value $0.0001 per share, issuable under the Series H Warrants | ||

| Total | $10,000,000 | $1,007 |

| (1) | This Registration Statement also relates to an indeterminate number of shares of the registrant’s Class A Common Stock that may be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions in accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Estimated solely for |

| (3) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Sectionsection 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Sectionsection 8(a), shallmay determine.

The information in this prospectus is not complete and may be changed.changed without notice. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offeroffers to buy these securities in any state where the offer or sale of these securities is not permitted.

PRELIMINARY PROSPECTUS

|

|

This is the initial public offering ofSubject to completion, dated June 8, 2016

PRELIMINARY PROSPECTUS

Units, Common Stock and Series H Warrants to Purchase Common Stock

(___ shares of Class A common stock by Real Goods Solar, Inc.Common Stock underlying the Series H Warrants)

We are offering 5,000,000 sharesan aggregate of up to $___ of units, or “Units,” each consisting of (i) one share of our Class A common stock. We expectCommon Stock, par value $0.0001 per share, or “Common Stock” and (ii) a Series H Warrant to purchase __% of one share of our Common Stock. An investor who, together with certain “attribution parties,” would beneficially own in excess of 9.99% of the initial publicnumber of shares of Common Stock outstanding immediately after the closing of this offering priceas a result of its purchase of Units will receive shares of Common Stock in an amount up to such 9.99% cap and the balance of the shares of Common Stock such investor would have received at closing but for the 9.99% cap will be issued and placed into escrow with our transfer agent pursuant to the terms of an escrow agreement to be between $10.00delivered to such investor from time to time provided that at any time such investor together with certain “attribution parties” would not beneficially own, after any such delivery, more than 9.99% of the issued and $12.00 per share. Prioroutstanding shares of Common Stock. The Units will not be issued or certificated. The Common Stock and Series H Warrants are immediately separable and will be issued separately, but will be purchased together as a unit in this offering. This prospectus also covers up to this offering, there has been no public market for our Class A common stock.___shares of Common Stock issuable upon exercise of the Series H Warrants.

We have applied to have our Class A common stock included for quotation

Our Common Stock is listed on the Nasdaq GlobalThe NASDAQ Capital Market under the symbol “RSOL.“RGSE.” On June 6, 2016, the last reported sale price of our Common Stock was $4.98 per share. There is no established public trading market for the Units or the Series H Warrants and we do not expect a market to develop. In addition, we do not intend to list the Units or any or the Series H Warrants on The NASDAQ Capital Market, any other national securities exchange or any other nationally recognized trading system.

Investing in our Class A common stocksecurities involves a high degree of risk. See “Risk Factors” beginning on page 8 to read about factors you should consider before buying shares5 of our Class A common stock.this prospectus and in the documents incorporated by reference herein and therein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined ifpassed upon the adequacy or accuracy of this prospectus is truthful or complete.prospectus. Any representation to the contrary is a criminal offense.

| 3 |

Roth Capital Partners, LLC, which we refer to as the “placement agent,” has agreed to act as the exclusive placement agent in connection with this offering. The placement agent is not required to sell any specific number or dollar amount of Units, but will use its reasonable best efforts to sell the Units. The placement agent may engage one or more sub-agents or selected dealers in connection with this offering. There is no minimum purchase requirement for this offering. We have agreed to pay the placement agent the placement agent fee set forth in the table below, which assumes that we sell all of the securities we are offering.

| Per | Total | |||||||

| $ | $ | ||||||

| $ | $ | ||||||

Proceeds, before expenses, to | $ | $ | ||||||

We have granted the underwriters the right to purchase up to 750,000 additional shares of our Class A common stock to cover any over-allotments. The underwriters can exercise this right at any time within 30 days after this offering. We expect that delivery of the shares will be made to investors on or about , 2008.

ThinkPanmure, LLC

Canaccord Adams

Broadpoint.

, 2008

| (1) | We have also agreed to issue to the placement agent warrants to purchase up to an aggregate of 5.0% of the aggregate number of shares of Common Stock sold in this offering as part of the Units, and to reimburse the placement agent for certain of its expenses. |

The above summary of offering proceeds to us does not give effect to any exercise of the warrants being issued in this offering. We estimate the total expenses of this offering, including placement agent fees and expenses, will be approximately $____. Delivery of the Common Stock and the Series H Warrants is expected to be made on or before _____, 2016 subject to customary closing conditions. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. This offering will terminate on ____, 2016, unless the offering is fully subscribed before that date or we decide to terminate the offering prior to that date. In either event, the offering may be closed without further notice to you.

Roth Capital Partners, LLC

_____, 2016

| 4 |

| 5 |

Except where the context requires otherwise, in this prospectus the terms “Company,” “our company,” “Real Goods Solar,” “we,” “us,” and “our” refer to Real Goods Solar, Inc., a Colorado corporation, and where appropriate, its direct and indirect subsidiaries.

You should rely only on the information contained in this prospectus or to which we have referred you, including any free writing prospectus that we file with the Securities and Exchange Commission relating toincorporated by reference in this prospectus. We have not, and the underwriters have not authorized any other person to provide you with different information. Thisinformation or to make any representations other than those contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. For further information, please see the section of this prospectus isentitled “Where You Can Find More Information.” We are not making an offer to sell nor is it seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. The

You should not assume that the information containedappearing in this prospectus is correctaccurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations, and prospects may have changed since those dates.

This prospectus contains trademarks, tradenames, service marks, and service names of the Company.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements that involve risks and uncertainties. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they provide our current beliefs, expectations, assumptions and forecasts about future events, and include statements regarding our future results of operations and financial position, business strategy, budgets, projected costs, plans and objectives of management for future operations. The words “believe,” “plan,” “estimate,” “expect,” “future,” “intend,” “may,” “will” and similar expressions as they relate to us are intended to identify such forward-looking statements. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, without limitation, the following: our ability to operate with our existing financial resources or raise funds to meet our financial obligations and implement our strategy; our history of operating losses; our ability to achieve profitability; our success in implementing our plans to increase future sales, installations and revenue and to decrease costs; the impact of our present indebtedness and projected future borrowings on our financial health and our ability to pay interest and principal on our indebtedness, including our convertible notes due April 1, 2019; restrictions imposed by our present indebtedness; our ability to satisfy the conditions under the convertible notes due April 1, 2019 permitting release of funds from the restricted collateral account and for payments to be made in shares of our Class A common stock; restrictions on certain transactions and potential premiums and penalties under the terms of our convertible notes due April 1, 2019, our Series G Warrants and registration rights agreements with the holders of our convertible notes due April 1, 2019 and our Series G Warrants; rules, regulations and policies pertaining to electricity pricing and technical interconnection of customer-owned electricity generation such as net energy metering; the continuation and level of government subsidies and incentives for solar energy; our failure to timely or accurately complete financing paperwork on behalf of customers; the adoption and general demand for solar energy; the impact of a drop in the price of conventional energy on demand for solar energy systems; existing and new regulations impacting solar installations including electric codes; delays or cancellations for system installations where revenue is recognized on a percentage-of-completion basis; seasonality of customer demand and adverse weather conditions inhibiting our ability to install solar energy systems; changing and updating technologies and the issues presented by these new technologies related to customer demand and our product offering; geographic concentration of revenue from the sale of solar energy systems in east coast states, Hawaii and California; loss of key personnel and ability to attract necessary personnel; loss or suspension of licenses required for installation of solar energy systems; adverse outcomes arising from litigation and legal disputes; our ability to continue to obtain services and components from suppliers, installers and other vendors; disruption of our supply chain from equipment manufacturers and potential shortages of components for solar energy systems; conditions affecting international trade having an adverse effect on the supply or pricing of components for solar energy systems; factors impacting the timely installation of solar energy systems; competition; costs associated with safety and construction risks; continued access to competitive third party financiers to finance customer solar installations; our ability to meet customer expectations; risks and liabilities associated with placing employees and technicians in our customers’ homes and businesses; product liability claims; warranty claims and failure by manufacturers to perform under their warranties to us; increases in interest rates and tightening credit markets; continued or future non-compliance with Nasdaq’s continued listing requirements; our inability to maintain effective disclosure controls and procedures and internal control over financial reporting; volatile market price of our Class A common stock; possibility of future dilutive issuances of securities and its impact on our ability to obtain additional financing; the low likelihood that we will pay any cash dividends on our Class A common stock for the foreseeable future; compliance with public reporting requirements; anti-takeover provisions in our organizational documents; the significant ownership and voting power of our Class A common stock held by Riverside Renewable Energy Investments, LLC (“Riverside”); and such other factors as discussed throughout Part I, Item 1A, Risk Factors and Part II, Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2015 and Part I, Item 2, Management’s Discussion and Analysis of Financial Conditions and Results of Operations and Part II, Item 1A, Risk Factors included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016.

| 1 |

Any forward-looking statement made by us in this prospectus and the documents incorporated by reference herein is based only on information currently available to us and speaks only as of the date on the front cover, but information may have changed sincewhich it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that date. Information contained in our website does not constitute part of this prospectus.

Until , all dealers that effect transactions in these securities, whether or not participating in this offering, may be requiredmade from time to delivertime, whether as a prospectus. result of new information, future developments or otherwise.

[Remainder of page intentionally left blank.]

| 2 |

This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outsidesummary highlights important features of the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution ofinformation included or incorporated by reference in this prospectus.

This prospectus includes market and industry data that we obtained from periodic industry publications, third-party studies and surveys, governmental agency sources, filings of public companies in our industry and internal company surveys that we believe to be reliable as Because it is a summary, it may not contain all of the date ofinformation that may be important to you. You should carefully read this prospectus. Industry publications and surveys generally state thatentire prospectus, including the information contained therein has been obtained from sources believed to be reliable.section entitled “Risk Factors.”

Overview of our Company

i

This summary highlights information contained elsewhere in this prospectus that we consider important to investors. You should read the entire prospectus carefully, including the “Risk Factors” section and our financial statements and the related notes to those statements, before making an investment decision. References in this prospectus to “Real Goods,” “we,” “us,” “our” or “our company” refer to Real Goods Solar, Inc., its predecessors and its consolidated subsidiaries, unless we indicate otherwise. We are a Colorado corporation formed on January 29, 2008 and a wholly owned subsidiary of Gaiam, Inc. which is a publicly traded company. Prior to January 29, 2008, we did not exist as a separate legal entity and have no history of operating as a stand-alone business. The unaudited consolidated pro forma statement of operations for the year ended December 31, 2007 gives pro forma effect to the acquisitions of Marin Solar, Inc., or Marin Solar, and Carlson Solar, described below, as if the acquisitions had been completed as of January 1, 2007.

Overview

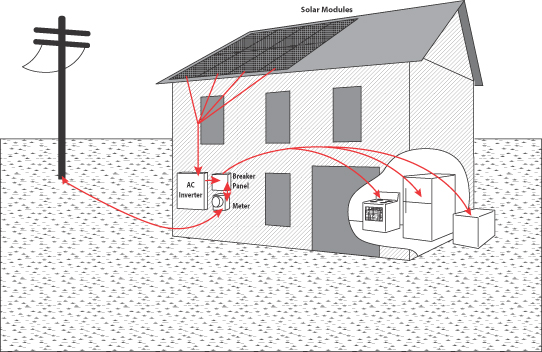

We are a leading residential and small commercial solar energy integrator.engineering, procurement and construction firm. We also perform most of our own sales and marketing activities to generate leads and secure projects. We offer turnkey services, to our solar energy system customers, including design, procurement, permitting, build-out, grid connection, financing referrals and warranty and customer satisfaction activities. Our solar energy systems use high-quality solar PV modules from manufacturers such as Sharp, SunPower and Kyocera Solar.photovoltaic modules. We use proven technologies and techniques to help customers achieve meaningful savings by reducing their utility costs. In addition, we help customers lower their emissions output and reliance upon fossil fuel energy sources.

We, including our predecessors, have 30more than 35 years of experience in residential solar energy beginning withand trace our sale inroots to 1978, ofwhen Real Goods Trading Corporation sold the first solar photovoltaic or PV, panels in the United States. We believe that we have designed and installed more residential solar energy systems in the United States than any other company, including more than 2,400over 25,000 residential and small commercial solar energy systems. In addition, we have sold a variety of solar products to more than 30,000 customerssystems since our founding.

For

During 2014, we discontinued our entire former Commercial segment and sold the fiscal year ended December 31, 2007,assets associated with our net revenue was $18.9 million, and for the fiscal year ended December 31, 2006, our net revenue was $16.8 million. On a pro forma basis (giving effect to the acquisitions of Marin Solar and Carlson Solar as if such transactions had occurred on January 1, 2007), for the fiscal year ended December 31, 2007, our net revenue was $32.7 million and we generated a 30.0% gross margin and $1.0 million of income from operations. Immediately after the completion of this offering, after applicationcatalog segment (a portion of the net proceeds of this offering, we will have $29.8 million of cash and no outstanding debt.

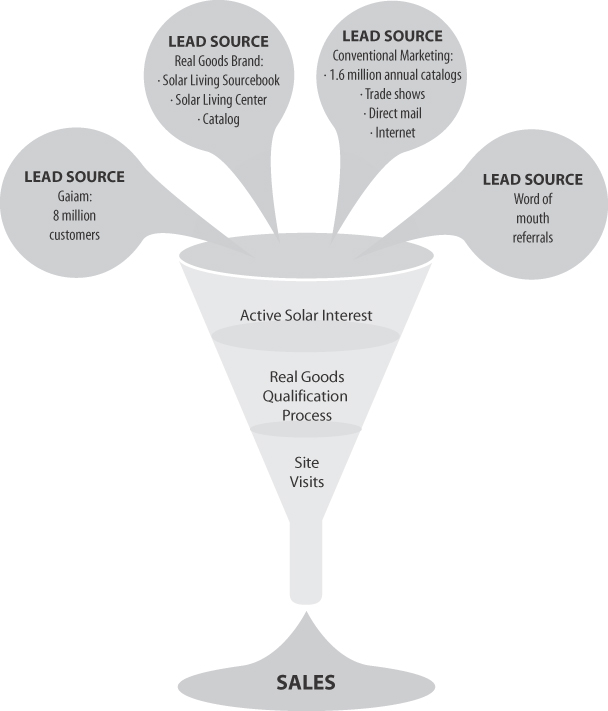

Our focused customer acquisition approach and our efficiency in converting leads into customers enable us to have what we believe are low customer acquisition costs. We believe that our Real Goods brand has a national reputation for the highest quality customer service in the solar energy market, which leads to a significant number of word-of-mouth referrals and new customers. In addition, our parent company, Gaiam, is a leader in the sustainable and renewable energy lifestyle market and has a base of over 8 million direct customers, providing us additional lead generation for potential solar energy customers. We also generate leads by selling solar and other renewable energy and sustainable living products and resources through our nationally distributed catalog and website. We believe that this cross-marketing ability lowers our customer acquisition costs to below what we estimate they would be if we were to rely solely on traditional marketing methods such as print, radio, television and Internet search words. Our Solar Living Center in Hopland, California features interactive demonstrations for renewable energy and environmentally sensible technologies and is the largest facility of its kind, with approximately 2 million visitors since it opened in 1996.

Market Opportunity

We believe that as demand for electric power increases, the electric power industry will face various challenges.Other segment). As a result of aging infrastructure and high energy demand, customers are facing rising electricity rates, creating economic pressures for consumers and businesses alike. In addition, concerns about global warming and greenhouse gas emissions have resulted in international efforts to reduce such emissions, and various states have enacted stricter emissions control laws or mandated that utilities generate a certain amount of power from renewable sources, suchthis major strategic shift, we now operate as solar energy.

Becausethree reportable segments: (1) Residential – the solar energy industry offers solutions to these challenges, we believe it has extremely large growth potential. Currently, only approximately one-tenth of one percent of the world’s power is generated from solar energy sources. The global solar energy market is estimated to grow to between $19 billion and $32 billion by 2011, with annual solar energy installations reaching between 4.2 and 7.6 gigawatts, or GW, by 2011, compared to 1.7 GW in 2006, according to Solarbuzz, an international solar energy research and consulting company.

We expect that a number of factors will contribute to growth in the solar energy industry. A variety of initiatives have been enacted by the federal government and various states, municipalities and utilities that encourage or require the installation of grid-tied solar energy systems. For example, the California Solar Initiative, or CSI, adopted in 2007 provides for the expenditure of up to $3.4 billion in incentives for solar energy system installations by 2017. It is common for financial incentives to be required under such initiatives, including rebates, tax credits, net metering, time-of-use credits, performance-based incentives, renewable energy credits and property tax exemptions. These incentives make the purchase of solar energy systems more affordablefor homeowners, including lease financing thereof, and open additional solar marketsfor small businesses (small commercial) in the United States.

We believe that growth incontinental U.S.; (2) Sunetric – the solar energy industry also faces challenges. The decision to install a solar energy system represents a significant investment for many customers. In addition, financing sources specifically forinstallation of solar energy systems are currently limited. The solar energy industry is significantly driven by federal, statefor both homeowners and local regulationsbusiness owners (commercial) in Hawaii; and incentives,(3) Other – catalog, for 2014, and changes in these regulations and incentives could adversely affect the demand for solar energy systems and the growth of the industry. Also, the manufacture of solar PV modules depends on the availability of silicon, an essential raw material. Currently, there is a global shortage of silicon, which has resulted in some price increases and limited availability of solar PV modules.

Growth Strategy

Our goal is to continue to build on our industry-leading position and be the largest and most profitable residential solar energy integrator in the United States. We intend to pursue the following strategies to achieve this goal:corporate operations.

|

|

|

|

|

|

|

Competitive Advantages

We believe that we have a number of advantages over our competitors, including the following:

|

|

|

|

|

|

Corporate Information

We are currently a wholly owned subsidiary of Gaiam. We were incorporated in Colorado in 2008 as a successor to a business that began in 1978. Our principal executive offices are located at 360 Interlocken Boulevard, Broomfield, Colorado 80021, and our833 West South Boulder Road, Louisville, CO 80027-2452. Our telephone number at that location is (303) 222-8400. Our operations headquarters are located at 13771 South Highway 101, Hopland, California 95449, and our telephone number at that location is (888) 507-2561.222-8300. Our website iswww.realgoodssolar.com. www.rgsenergy.com. The information available on or that can be accessed through our website and the information that is contained in the “Solar Living Sourcebook” is not incorporated by reference into and is notintended to be a part of this prospectus, and you should not be consideredrely on any of the information provided there in making your decision to invest in our securities. Our website address referenced above is intended to be part of this prospectus. Our trade names or trademarks include “Real Goods,” “Real Goods Solar,” “Real Goods Renewables”an inactive textual reference only and “Own Your Power.” This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intendan active hyperlink to our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.website.

Recent Development

On June 2, 2016, the Company executed a reverse stock split of all outstanding shares of the Company’s Common Stock at a ratio of one-for-twenty, whereby twenty shares of Common Stock were combined into one share of Common Stock. The reverse split was authorized by a vote of the Company’s shareholders on May 27, 2016. The Company did not decrease its authorized shares of capital stock in connection with the reverse stock split. Share amounts set forth herein are presented to reflect the reverse split in all periods presented.

The Offering

| Real Goods Solar, Inc. | |

| Units Offered | $___________ of Units, each consisting of (i) one share of our Common Stock and (ii) a Series H Warrant to purchase __% of one share of our Common Stock | |

| Securities Purchase Agreement | Investors purchasing a minimum of $___ of Units in the offering will enter into a Securities Purchase Agreement with us whereas investors purchasing less than that will purchase securities solely under this prospectus. | |

| Series H Warrant Terms | Each Unit contains a Series H Warrant to purchase __% of one share of Common Stock at an initial exercise price of $___ per share. The Series H Warrants will be exercisable beginning on the six-month anniversary after issuance and will expire three years following the initial exercisability date. The Series H Warrants will be issued in certificated form. See “Description of the Securities We are Offering – Description of Warrants – Series H Warrants.” |

|

| An investor who, together with certain “attribution parties,” would beneficially own in excess of 9.99% of the number of shares of Common Stock outstanding immediately after the closing of this offering as a result of its purchase of Units will receive shares of Common Stock in an amount up to such 9.99% cap and the balance of the shares of Common Stock such investor would have received at closing but for the 9.99% cap will be issued and placed into escrow with our transfer agent pursuant to the terms of an escrow agreement to be delivered to such investor from time to time provided that any such time such investor, together with certain “attribution parties,” would not beneficially own, after such delivery, more than 9.99% of the issued and outstanding Common Stock. | |

| Absence of Market for the Units and the Series H Warrants | The Units and the Series H Warrants are a new issue of securities and currently there is no market for the securities. We do not intend to list or qualify for quotation the Units or any of the Series H Warrants on any securities exchange or market | |

| Common Stock outstanding immediately before this offering | 657,243 | |

| Common Stock outstanding immediately after this offering | ___. An estimated ____ shares |

|

| Use of | General corporate |

|

Risk Factors | Investing in our securities involves a high degree of risk. See “Risk Factors” below and under similar headings in the | |

| Market for our Common Stock and Symbol | The NASDAQ Capital Market, symbol “RGSE” |

| 4 |

The number of shares of our Class A common stock that willCommon Stock to be outstanding immediately after this offering excludes the following:as shown above is based on 657,243 shares outstanding as of June 6, 2016, and exclude as of that date:

|

| |||

| • | 85,031 shares of our Common Stock available for future issuance under our 2008 Long-Term Incentive | |

| • | 62,209 shares of our Common Stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $409.00 per share; | |

| • | 756 shares of our Common Stock currently issuable to | |

Except as otherwise indicated, allthe number of the informationshares of Common Stock presented in this prospectus assumes noexcludes the shares of Common Stock issuable upon exercise of the underwriters’ over-allotment option.

Summary Consolidated Financial Data

The following tables present summary historical consolidated financial data regarding our business. You should read the summary consolidated financial data presented below together with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, all included elsewhere in this prospectus.

We derived the summary consolidated statements of operations data for each of the years ended December 31, 2005, 2006, and 2007Series H Warrants and the actual amounts forplacement agent warrants. To the summary consolidated balance sheet data as of December 31, 2007 from our audited consolidated financial statements included elsewhereextent any shares are placed into escrow in connection with this prospectus. We derived the summary consolidated statement of operations data for the year ended December 31, 2004 from our unaudited financial statements, whichoffering, such shares are not included in this prospectus,issued and the unaudited pro forma amounts for the summary consolidated statement of operations and balance sheet data as of and for the year ended December 31, 2007 from the unaudited pro forma consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial data for 2007 includes the effects of the Marin Solar acquisition from the November 2007 date of the transaction.

Our audited and unaudited consolidated financial statements include allocations of certain Gaiam expenses, including costs of fulfillment, customer service, financial and other administrative services, and income taxes. The expense allocations are based on what we and Gaiam considered to be reasonable reflections of the utilization of services provided or the benefits received by us. The historical financial information in our audited and unaudited consolidated financial statements may not be indicative of what our results of operations, financial position, changes in equity and cash flows will be in the future, or what they would have been had we been a separate stand-alone entity during the periods presented.outstanding.

| Years ended December 31, | ||||||||||||||||

| (in thousands, except per share data) | 2004 | 2005 | 2006 | 2007 | Pro Forma 2007(1) | |||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||||

Net revenue | $ | 9,268 | $ | 12,114 | $ | 16,812 | $ | 18,922 | $ | 32,745 | ||||||

Cost of goods sold | 5,730 | 7,763 | 10,862 | 12,426 | 22,935 | |||||||||||

Gross profit | 3,538

| 4,351 | 5,950 | 6,496 | 9,810 | |||||||||||

Expenses: | ||||||||||||||||

Selling and operating | 2,987 | 3,464 | 4,964 | 5,728 | 7,916 | |||||||||||

General and administrative | 480 | 492 | 567 | 582 | 905 | |||||||||||

Total expenses | 3,467 | 3,956 | 5,531 | 6,310 | 8,821 | |||||||||||

Income from operations | 71 | 395 | 419 | 186 | 989 | |||||||||||

Other expense | — | — | — | — | 32 | |||||||||||

Income before income taxes and minority interest | 71 | 395 | 419 | 186 | 957 | |||||||||||

Income tax expense | 30 | 159 | 169 | 84 | 389 | |||||||||||

Minority interest in net income of consolidated subsidiary, net of income taxes | — | — | — | — | (77 | ) | ||||||||||

Net income | $ | 41 | $ | 236 | $ | 250 | $ | 102 | $ | 491 | ||||||

Net income per share(2): | ||||||||||||||||

Basic and diluted | $ | 0.00 | $ | 0.02 | $ | 0.03 | $ | 0.01 | $ | 0.05 | ||||||

Weighted average shares outstanding(2): | ||||||||||||||||

Basic and diluted | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | |||||||||||

|

|

|

|

| As of December 31, 2007 | ||||||||||||

| (in thousands) | Actual(1) | Pro Forma(1) | Pro Forma As Adjusted(2) | |||||||||

(unaudited) | ||||||||||||

Consolidated Balance Sheet Data: | ||||||||||||

Cash and cash equivalents | $ | 542 | $ | 542 | $ | 29,769 | ||||||

Working capital (deficit) | (11,266 | ) | (13,488 | ) | 35,391 | |||||||

Deferred tax assets | 2,478 | 2,478 | — | (3) | ||||||||

Total assets | 20,986 | 25,371 | 52,120 | |||||||||

Deferred tax liabilities | — | — | 279 | (3) | ||||||||

Payable to Gaiam | 16,286 | 19,823 | — | |||||||||

Minority interest | — | 371 | 371 | |||||||||

Total liabilities | 19,336 | 23,350 | 3,806 | |||||||||

Total shareholders’ equity | 1,650 | 1,650 | 47,943 | |||||||||

|

|

|

|

|

|

An investment in our Class A common stock offered by this prospectussecurities involves a substantial riskhigh degree of loss. Yourisk. Before making an investment decision you should carefully read and consider thesethe risks factors,described below, together with all of the other information included or incorporated by reference in this prospectus, before you decide to purchase sharesincluding, without limitation, the risk factors in the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are on file with the SEC. If any of our Class A common stock. We believe the risks and uncertainties described below are thelisted in our most significant ones we face. The occurrence ofrecent Annual Report on Form 10-K or Quarterly Report on Form 10-Q or any of the following factorsrisks actually occur, our business, financial condition, and/or results of operations could harm our business.suffer. In that case, the tradingmarket price of our Class A common stockCommon Stock could decline, and you couldmay lose all or part of your investment.

Risk Factors Related to Our Business and Our Industry

Our business prospects could be harmed if solar energy is not widely adopted or sufficient demand You should read the section entitled “Special Note Regarding Forward-Looking Statements” above for solar energy systems does not develop or takes longer to develop than we anticipate.

The solar energy market is at a relatively early stagediscussion of development, and the extent to which solar energy will be widely adopted and the extent to which demand for solar energy systems will increasewhat types of statements are uncertain. If solar energy does not achieve widespread adoption or demand for solar energy systems fails to develop sufficiently, we may be unable to grow our business at the rate we desire. In addition, demand for solar energy systems in our targeted markets may not develop or may develop to a lesser extent or more slowly than we anticipate. Many factors may affect the demand for solar energy systems, including the following:

|

|

|

|

|

|

A drop in the retail price of conventional energy or non-solar renewable energy sources may negatively impact our business.

The demand for our solar energy systems depends in part on the price of conventional energy, which affects return on investment resulting from the purchase of solar energy systems. Fluctuations in economic and market conditions that impact the prices of conventional and non-solar renewable energy sources, such as decreases in the prices of oil and other fossil fuels, could cause the demand for solar energy systems to decline, which would have a negative impact on our business. Changes in utility electric rates could also have a negative effect on our business.

Risk factors

The reduction, elimination or expiration of government subsidies and economic incentives for solar energy systems could reduce the demand for our products.

Government subsidies are an important factor in the economic determination to purchase a solar energy system. Certain states, including California and Colorado, localities and utilities offer incentives to offset a portion of the cost of qualified solar energy systems. These incentives can take many forms, including direct rebates, state tax credits, system performance payments and renewable energy credits, or RECs. The reduction or elimination of such incentives or delays or interruptions in the implementation of favorable federal or state laws could substantially increase the cost of our systems to our customers, resulting in a significant reduction in demand for our solar energy systems, which would negatively impact our business.

Existing regulations, and changes to such regulations, may present technical, regulatory and economic barriers to the installation of solar energy systems, which may significantly reduce demand for our solar energy systems.

The installation of solar energy systems is subject to oversight and regulation under local ordinances; building, zoning and fire codes; environmental protection regulation; utility interconnection requirements for metering; and other rules and regulations. We attempt to keep up-to-date about these requirements on a national, state and local level and must design and install our solar energy systems to comply with varying standards. Certain cities may have ordinances that prevent or increase the cost of installation of our solar energy systems. In addition, new government regulations or utility policies pertaining to the installation of solar energy systems are unpredictable and may result in significant additional expenses or delays, which could cause a significant reduction in demand for solar energy systems.

Existing regulations and policies pertaining to electricity pricing and technical interconnection of customer-owned electricity generation and changes to these regulations and policies may deter the purchase and use of solar energy systems and negatively impact development of the solar energy industry.

The market for solar energy systems is heavily influenced by foreign, federal, state and local government regulations and policies concerning the electric utility industry,forward-looking statements, as well as policies adopted by electric utilities. These regulations and policies often relate to electricity pricing and technical interconnectionthe significance of customer-owned electricity generation. For example, there currently exist metering caps in certain jurisdictions, which limit the aggregate amount of power that may be sold by solar power generators into the electric grid. These regulations and policies have been modifiedsuch statements in the pastcontext of this prospectus. Additional risks and may be modified in the future in ways that could deter purchases of solar energy systems and investment in the research and development of solar energy technology. For example, without a mandated regulatory exception for solar energy systems, utility customers are often charged interconnection or standby fees for putting distributed power generation on the electric utility grid. Such fees could increase the cost to our customers of using solar energy systems and make them less desirable, thereby harming our business, operating results and financial condition. Changes in net metering policies could also deter the purchase and use of solar energy systems. In addition, electricity generated by solar energy systems competes primarily with expensive peak hour electricity rates rather than with the less expensive average price of electricity. Modifications to the peak hour pricing policies of utilities, such as to a flat rate, would require solar energy systems to achieve lower prices in order to compete with the price of electricity.

Our inability to respond to changing technologies and issues presented by new technologies could harm our business.

The solar energy industry is subject to technological change. If we rely on products and technologies that are not attractive to customers, or if we are unable to respond appropriately to changing technologies and changes in product function and quality, we may not be successful in capturing or retaining a significant market share. In addition, any new technologies utilized in our solar energy systems may not perform as expected or as desired, in which event our adoption of such products or technologies may harm our business.

Risk factors

We derive all of the revenue from our solar energy integration services from sales in two states.

We currently derive all of the revenue from our solar energy integration services from projects in California and Colorado. This geographic concentration exposes us to growth rates, economic conditions, and other factors that may be specific to those states to which we would be less subject if we were more geographically diversified. The growth of our business will require us to expand our operations in California and Colorado and to commence operations in other states. Any geographic expansion effortsuncertainties that we may make maydo not be successful, which would limit our growth opportunities.

Our success may depend in part on our ability to continue to make successful acquisitions.

As part of our business strategy, we plan to expand our operations through strategic acquisitions in our current markets and in new geographic markets. We acquired Marin Solar in November 2007 and Carlson Solar in January 2008. We cannot accurately predict the timing, size and success of our acquisition efforts. Our acquisition strategy involves significant risks, including the following:

|

|

|

|

|

|

|

|

|

These risks, as well as other circumstances that often accompany expansion through acquisitions, could inhibit our growth and negatively impact our operating results. In addition, the size, timing and success of any future acquisitions may cause substantial fluctuations in our operating results from quarter to quarter. Consequently, our operating results for any quarter may not be indicative of the results that may be achieved for any subsequent quarter or for a full fiscal year. These fluctuations could adversely affect the market price of our Class A common stock.

Our failure to integrate the operations of acquired businesses successfully into our operations or to manage our anticipated growth effectively could materially and adversely affect our business and operating results.

In order to pursue a successful acquisition strategy, we must integrate the operations of acquired businesses into our operations, including centralizing certain functions to achieve cost savings and pursuing programs and processes that leverage our revenue and growth opportunities. The integration of the management, operations, and facilities of acquired businesses with our own could involve difficulties, which could adversely affect our growth rate and operating results. We may be unable to complete effectively the integration of the management, operations, facilities and accounting and information systems of acquired businesses with our own; to manage efficiently the combined operations of the acquired businesses with our operations; to achieve our operating, growth and performance goals for acquired businesses; to achieve additional

Risk factors

revenue as a result of our expanded operations; or to achieve operating efficiencies or otherwise realize cost savings as a result of anticipated acquisition synergies. Our rate of growth and operating performance may suffer if we fail to manage acquired businesses profitably without substantial additional costs or operational problems or to implement effectively combined growth and operating strategies.

We may require significant additional funds, the amount of which will depend upon our working capital and general corporate needs and the size, timing and structure of future acquisitions.

Our operations may not generate sufficient cash to enable us to operate or expand our business. Any borrowings made to finance future acquisitions or for operations could make us more vulnerable to a downturn in our operating results, a downturn in economic conditions or increases in interest rates on future borrowings. If our cash flow from operations is insufficient to meet our debt service requirements, we could be required to sell additional equity securities, refinance our obligations or dispose of assets in order to meet our debt service requirements. Adequate financing may not be available if and when we need it or may not be available on terms acceptable to us. In addition, our operations may not generate sufficient cash for our acquisition plans. The extent to which we would be able or willing to use our equity to consummate future acquisitions will depend on the market price of our equity from time to time and the willingness of potential sellers to accept our equity as full or partial payment. Using our equity for this purpose also may result in significant dilution to our shareholders. To the extent that we are unable to use our equity to make future acquisitions, our ability to grow through acquisitionscurrently deem immaterial may be limited by the extent to which we are able to raise capital for this purpose through debt or equity financings. The failure to obtain sufficient financing on favorable terms and conditions couldalso have a material adverse effect on our business, financial condition, operating results and growth prospects.business.

Risks Related to this Offering

The lossManagement will have broad discretion as to the use of or failure to hire additional personnel could materially and adversely affect our business, operating results and our ability to expand.

The expansion of our business could place a significant strain on our managerial, financial and personnel resources, particularly given our current reliance on our Chairman, Jirka Rysavy, who also is the Chairman and Chief Executive Officer of Gaiam. To reach our goals, we must successfully recruit, train, motivate and retain additional employees, including management and technical personnel, integrate new employees into our overall operations and enhance our financial and accounting systems, controls and reporting systems. While we believe we have personnel sufficient for the current requirements of our business, expansion of our business could require us to employ additional personnel. The loss of personnel or our failure to hire additional personnel could materially and adversely affect our business, operating results and our ability to expand.

Our success depends on the value of our Real Goods brand.

We depend on the name recognition of our Real Goods brand in our marketing efforts. Maintaining and building recognition of our brand are important to expanding our customer base. If the value of our brand were adversely affected, our ability to attract customers would be negatively impacted and our growth could be impaired.

We depend upon a limited number of suppliers for the components used in our solar energy systems.

We rely on third-party suppliers for components used in our solar energy systems. Sharp, SunPower and Kyocera Solar currently account for over 90% of our purchases of solar PV modules; and Xantrex, Fronius, PVPowered and SMA currently account for over 90% of our purchases of inverters. The failure of our suppliers to supply us with components in a timely manner or on commercially reasonable terms could result in lost orders, delay our project schedules and harm our operating results and business expansion efforts. Our orders with certain of our suppliers may represent a very small portion of their

Risk factors

total business. As a result, these suppliers may not give priority to our business, leading to potential delays in or cancellation of our orders. If any of our suppliers were to fail to supply our needs on a timely basis or to cease providing us key components we use, we would be required to secure alternative sources of supply. We may have difficulty securing alternative sources of supply in a timely manner and on commercially reasonable terms. If this were to occur, our business would be harmed.

Shortages in the supply of silicon could adversely affect the availability and cost of the solar PV modules used in our solar energy systems.

Shortages of silicon could adversely affect the availability and cost of the solar PV modules we use in our solar energy systems. Manufacturers of solar PV modules depend upon the availability and pricing of silicon, one of the primary materials used in the manufacture of solar PV modules. The worldwide market for silicon from time to time experiences a shortage of supply, primarily because of demand for silicon by the semiconductor industry. Shortages of silicon cause the prices for solar PV modules to increase and supplies to become difficult to obtain. While we have been able to obtain sufficient supplies of solar PV modules to satisfy our needs to date, this may not be the case in the future. Future increases in the price of silicon could result in an increase in costs to us, price increases to our customers or reduced margins.

Because the solar energy system installation market is highly competitive and has low barriers to entry, we may face the loss of market share or reduced margins.

The solar energy system installation market is highly competitive and fragmented with low barriers to entry. We currently compete with a large number of relatively small installers and integrators, some of which do not have extensive industry experience and may lack adequate systems and capital, but some of which benefit from operating efficiencies or from having lower overhead, which enables them to offer lower prices. As the solar energy industry expands and industry consolidation occurs, we are more likely to encounter competition from larger companies, some of which may have greater financial, technical and marketing resources and greater name recognition than we do.

We believe that our ability to compete depends in part on a number of factors outside of our control, including the following:

|

|

|

|

Competition in the solar energy system installation market may increase in the future as a result of low barriers to entry. Increased industry competition could result in reductions in price, margins, and market share and in greater competition for qualified personnel. Our business and operating results would be adversely affected if we are unable to compete effectively.

Our failure to meet customer expectations in the performance of our services, and the risks and liabilities associated with placing our employees and technicians in our customers’ homes and businesses could give rise to claims against us.

Our failure or inability to meet customer expectations in the performance of our services could damage our reputation or result in claims against us. In addition, we are subject to various risks and liabilities associated with our employees and technicians providing installation services in the homes and businesses of our customers, including possible claims of errors and omissions, harassment, theft of customer property, criminal activity and other claims.

Risk factors

Product liability claims against us could result in adverse publicity and potentially significant monetary damages.

As a seller of consumer products, we face an inherent risk of exposure to product liability claims in the event that our solar energy systems’ use results in injuries. Since solar energy systems are electricity producing devices, it is possible that our products could result in injury, whether by product malfunctions, defects, improper installation or other causes. If such injuries or claims of injuries were to occur, we could incur monetary damages and our business could be adversely affected by any resulting negative publicity. The successful assertion of product liability claims against us also could result in potentially significant monetary damages and, if our insurance protection is inadequate to cover these claims, could require us to make significant payments from our own resources.

We may be subject to unexpected warranty expenses or service claims that could reduce our profits.

As a result of the length of the warranty periods we provide, we bear the risk of warranty claims long after we have completed the installation of a solar energy system. Our current standard warranty for our installation services includes a 10-year warranty period for defects in material and workmanship in California and a five-year warranty period for defects in material and workmanship in Colorado. In addition, most manufacturers of solar PV modules offer a 25-year warranty period for declines in power performance. Although we maintain a warranty reserve for potential warranty or service claims and we have not had material warranty claims in the past, claims in excess of our reserve could adversely affect our operating results. Our failure to predict accurately future warranty claims could result in unexpected volatility in our financial condition.

We rely upon our catalog and Internet sales channels for potential customers, and interruptions or failures associated with these sales channels could adversely impact our overall business.

We rely upon our Real Goods catalog and Internet channels to increase the awareness of the Real Goods brand and generate potential solar energy system purchaser leads. We believe these cross-marketing channels provide us with an advantage over our competitors because customers that purchase products through these channels may become potential buyers of solar energy systems. As a result, interruptions or failures associated with these channels could have an adverse impact on our business that goes beyond their normal contribution to our revenue.

We rely on communications and shipping networks to deliver our products.

Given our emphasis on customer service, the efficient and uninterrupted operation of order-processing and fulfillment functions is critical to our catalog and Internet business. To maintain a high level of customer service, we rely on a number of third-party service providers, such as delivery companies, telecommunications companies and printers. Any interruption in services from our principal third-party service providers, including delays or disruptions resulting from labor disputes, power outages, human error, adverse weather conditions or natural disasters, could materially and adversely affect our business. In addition, products that we source overseas must be shipped to our distribution center by freight carriers, and a work stoppage or political unrest could adversely affect our ability to fulfill our customer orders.

An increase in interest rates could make it difficult for customers to finance the cost of solar energy systems and could reduce demand for our services and products.

Some of our prospective customers may depend on debt financing, such as home equity loans, to fund the initial capital expenditure required to purchase a solar energy system. Third-party financing sources specifically for solar energy systems are currently limited. Currently, approximately 40% of our customers rely on some form of third-party financing, including home equity loans, to purchase solar energy systems. The lack of financing sources or an increase in interest rates could make it difficult or more costly for our potential customers to secure the financing necessary to purchase a solar energy system on favorable terms, or at all, thus lowering demand for our services and products and negatively impacting our business.

Risk factors

Risk Factors Related to our Relationship with Gaiam

Our historical financial information as a business conducted by Gaiam may not be representative of our results as an independent public company.

The historical financial information included in this prospectus does not necessarily reflect what our financial position, operating results or cash flows would have been had we been an independent entity during the historical periods presented. The historical costs and expenses reflected in our consolidated financial statements include amounts for certain corporate functions historically provided by Gaiam, including costs of fulfillment, systems, finance and other administrative services, and income taxes. These expense allocations were developed on the basis of what we and Gaiam considered to be reasonable prices for the utilization of services provided or the benefits received by us. The historical financial information in our audited and unaudited consolidated financial statements may not be indicative of what our results of operations, financial position, changes in equity and cash flows would have been had we been a separate stand-alone entity during the periods presented or will be in the future. We have not made adjustments to reflect many significant changes that will occur in our cost structure, funding and operations as a result of our separation from Gaiam, including changes in our employee base, changes in our tax structure, potential increased costs associated with reduced economies of scale and increased costs associated with being a publicly traded, stand-alone company, such as audit fees, directors and officers insurance costs and compliance costs, nor have we made offsetting adjustments to reflect the benefits of and income expectednet proceeds from this offering, as these factors are presently difficult to quantify.

Our ability to operate our business effectively may suffer if we or Gaiam terminate our intercorporate services agreement, or if we are unable to establish on a cost-effective basis our own administrative and other support functions in order to operate as a stand-alone company after the expiration or termination of our intercorporate services agreement with Gaiam.

As a wholly owned subsidiary of Gaiam, we have relied on administrative and other resources of Gaiam to operate our business. In connection with this offering, we will enter into an intercorporate services agreement to retain the ability for specified periods to use certain Gaiam resources. We may elect to continue this agreement for eighteen months following the completion of this offering and, provided we are not in material default under this agreement, Gaiam may not terminate this agreement during this time if it owns more than 20% of our outstanding common equity. Any decision by us to terminate this agreement would be approved by disinterested members of our management and board of directors under our procedures regarding related party transactions. After the expiration or termination of this agreement, we will need to create our own administrative and other support systems or contract with third parties to replace Gaiam’s services. In addition, we must also establish disclosure controls and procedures and internal controls over financial reporting as part of our becoming a separate public company. These services may not be provided at the same level as when we were a wholly owned subsidiary of Gaiam, and we may not be able to obtainuse the same benefits that we received priorproceeds effectively.

Our management will have broad discretion as to the separation. These services may not be sufficient to meet our needs, and after our agreement with Gaiam expires or is terminated, we may not be able to replace these services at all or obtain these services at prices and on terms as favorable as we currently have with Gaiam. Any failure or significant downtimeapplication of the net proceeds from this offering. Investors in our own administrative systems or in Gaiam’s administrative systems during the transitional period could result in unexpected costs, impact our results or prevent us from paying our suppliers or employees and performing other administrative services on a timely basis.

The agreement we will enter into with Gaiam may be amended by the parties. While we are controlled by Gaiam, we may not have the leverage to negotiate amendments to this agreement if required on terms as favorable to us as those we would negotiate with an unaffiliated third party.

Risk factors

Our inability to resolve any disputes that arise between us and Gaiam with respect to our past and ongoing relationships may result in a reduction of our revenue, and such disputes may also result in claims for indemnification.

Disputes may arise between Gaiam and us in a number of areas relating to our past and ongoing relationships, including the following:

|

|

|

|

|

|

|

We may not be able to resolve any potential conflicts, and even if we do, the resolution may be less favorable than if we were dealing with an unaffiliated party. In addition, we will have indemnification obligations under the tax, intercorporate services and registration rights agreements we will enter into with Gaiam, and disputes between us and Gaiam may result in claims for indemnification. However, we do not currently expect that these indemnification obligations will materially affect our potential liability compared to what it would be if we did not enter into these agreements with Gaiam.

Some of our directors and executive officers may have conflicts of interest because of their ownership of Gaiam common stock, options to acquire Gaiam common stock and positions with Gaiam.

Some of our directors and executive officers own Gaiam common stock and options to purchase Gaiam common stock. In addition, some of our directors are also directors of Gaiam. Ownership of Gaiam common stock and options to purchase Gaiam common stock by our directors and officers after this offering and the presence of directors of Gaiam on our board of directors could create, or appear to create, conflicts of interest with respect to matters involving both us and Gaiam. For example, corporate opportunities may arise that are applicable or complementary to both of our businesses and that each business would be free to pursue, such as the potential acquisition of a particular business or technology focused on environmental sustainability including renewable energy sources, energy efficiency or energy use reduction. However, Gaiam does not intend to acquire businesses that are focused on solar energy. We have not established at this time any procedural mechanisms to address actual or perceived conflicts of interest of these directors and officers and expect that our board of directors, in the exercise of its fiduciary duties, will determine how to address any actual or perceived conflicts of interest on a case-by-case basis. If any corporate opportunity arises and if our directors and officers do not pursue it on our behalf, weshareholders may not become aware of,agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may potentially lose, a significant business opportunity.use the net proceeds for corporate purposes that may not increase our profitability or market value.

Risk Factors Related to this Offering

Gaiam controls us, and its interests may conflict with or differ from your interests as a shareholder.

Gaiam holds 100% of the currently outstanding shares of our common stock, consisting of 7,846,707 shares of our Class A common stock and 2,153,293 shares of our Class B common stock. The holders of our Class A common stock and our Class B common stock have substantially similar rights, preferences, and privileges except with respect to voting and conversion rights and other protective provisions as set forthInvestors in this prospectus. Each share of Class B common stock has ten votes per share,offering will experience immediate and each share of Class A common stock has one vote per share. Each share of Class B common stock is convertible

Risk factorssubstantial dilution.

at any time into one share of Class A common stock. In addition, if Gaiam transfers shares of our Class B common stock, it must elect whether or not to transfer the shares as Class B common stock or convert those shares into Class A common stock. The Class A common stock has no conversion rights. Immediately after completion of this offering, Gaiam will beneficially own approximately 66.7% of our outstanding shares of common stock, assuming Gaiam’s Class B common stock were converted into Class A common stock. In addition, immediately following this offering and assuming no conversion of any shares of Class B common stock that are currently outstanding, Gaiam will have approximately 85.5% of the total voting power of our common stock voting as a single class. Consequently, Gaiam will be able to exert substantial influence over our company and control matters requiring approval by our shareholders, including the election of directors, increasing our authorized capital stock, financing activities, a merger or sale of our assets and the number of shares available for issuance under our Incentive Plan. Our articles of incorporation provide that our board of directors may authorize the issuance of preferred stock, subject only to the approval of holders of our Class B common stock. As a result of Gaiam’s control, no change of control of our company can occur without Gaiam’s consent. Our Chairman, Jirka Rysavy, who is also the Chairman and Chief Executive Officer of Gaiam, currently owns approximately 25% of the outstanding equity, and in excess of 50% of the voting power, of Gaiam.

Gaiam’s and Mr. Rysavy’s voting control may discourage transactions involving a change of control of our company, including transactions in which you as a holder of our Class A common stock might otherwise receive a premium for your shares over the then current market price. Gaiam is not prohibited from selling a controlling interest in our company to a third party and may do so without your approval and without providing for a purchase of your shares of Class A common stock. Accordingly, your shares of Class A common stock may be worth less than they would be if Gaiam did not maintain voting control over us.

Because there is no existing market for our Class A common stock, our initial public offering price may not be indicative of the market price of our Class A common stock after this offering, which may decrease significantly.

PriorUnits offered pursuant to this offering, there has not been a public market for our Class A common stock, and an active trading market may not develop or be sustained after this offering. The initial public offering price forprospectus is substantially higher than the Class A common stock will be determined by negotiations between us and the representativesnet tangible book value per share of the underwriters and may not be indicative of prices that will prevailCommon Stock included in the open market following this offering. We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on the Nasdaq Global Market or otherwise or how liquid that market might become. The lack of an active market may reduce the value of your shares and impair your ability to sell your shares at the time or price at which you wish to sell them. An inactive market may also impair our ability to raise capital by selling additional shares of our Class A common stock and may impair our ability to acquire or invest in other companies, products or technologies by using our Class A common stock as consideration.

The market price of our Class A common stock may be volatile, which could result in substantial losses for investors.

The market price of our Class A common stock is likely to be volatile and could fluctuate widely in response to various factors, many of which are beyond our control, including the following:

|

|

|

|

|

Risk factors

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition, the stock market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies and industries. These fluctuations may include a so-called “bubble market” in which investors temporarily raise the price of the stocks of companies in certain industries, such as the renewable energy industry, to unsustainable levels. These market fluctuations may significantly affect the market price of our Class A common stock.

IfUnits. Therefore, if you purchase our Class A common stockUnits in this offering, you will incur immediate and substantial dilution in the net tangible book value per share of your shares.

The initialCommon Stock from the price per Unit that you pay for the securities. Based on the sale of $___ Units at a public offering price of $___ per Unit in this offering, you will suffer immediate dilution of approximately $(___) per share in the net tangible book value of the Common Stock. Moreover, as described under “Prospectus Summary — The Offering,” we have a substantial number of stock options, warrants to purchase Common Stock and convertible notes convertible into Common Stock outstanding. If the holders of outstanding options, warrants and convertible notes exercise or converts those options, warrants or convertible notes at prices below the public offering price, you will incur further dilution.

| 5 |

The offering price determined for this offering is not an indication of our Class A commonvalue.

The per-Unit offering price and the initial exercise price of the Series H Warrants may not necessarily bear any relationship to the book value of our assets, past operations, cash flows, losses, financial condition or any other established criteria for value. You should not consider the offering price as an indication of the value of the Common Stock. After the date of this prospectus, the Common Stock may trade at prices above or below the offering price.

There is a limited public trading market for the Common Stock.

The Common Stock is currently traded on The NASDAQ Capital Market under the trading symbol “RGSE.” There is a limited public trading market for the Common Stock. Without an active trading market, there can be no assurance of any liquidity or resale value of the Common Stock, and shareholders may be required to hold shares of the Common Stock for an indefinite period of time.

Risk Related to the Units and the Series H Warrants

There is no public market for the Units and the Series H Warrants.

There is no established public trading market for the Units and the Series H Warrants offered by this prospectus and we do not expect a market to develop. In addition, we do not intend to apply to list the Units or the Series H Warrants on any national securities exchange or other nationally recognized trading system, including The NASDAQ Capital Market. Without an active market, the liquidity of the Units and the Series H Warrants will be limited.

As a holder of the Series H Warrants you have no voting rights.

You will have no voting rights as a holder of the Series H Warrants. Our Common Stock is currently the only class of our securities that carries full voting rights.

Investors will not be entitled to voting or economic rights of escrowed shares in this offering.

Investors who, together with certain “attribution parties,” would beneficially own in excess of 9.99% of the number of shares of Common Stock outstanding immediately after the closing of this offering as a result of its purchase of Units will receive shares of Common Stock in an amount up to such 9.99% cap and the balance of the shares of Common Stock such investors would have received at closing but for the 9.99% cap will be issued and placed into escrow with our transfer agent pursuant to the terms of an escrow agreement to be delivered to such investors from time to time provided that any such investors, together with certain “attribution parties”, would not beneficially own, after such delivery, more than 9.99% of the issued and outstanding shares of Common Stock. Investors will not be entitled to vote or benefit economically from the shares of Common Stock so long as they are held in escrow with the transfer agent.

If our Common Stock is delisted, your ability to transfer or sell the Series H Warrants may be limited and the market value of the Series H Warrants will likely be materially adversely affected.

We expect that the value of the Series H Warrants to some extent is tied to the perceived value of its exercise features. If our Common Stock is delisted from The NASDAQ Capital Market, your ability to transfer or sell the Series H Warrants may be limited and the market value of the Series H Warrants will likely be materially adversely affected.

We expect that the market value of the Series H Warrants will be significantly affected by changes in the market price of our Common Stock, which could change substantially at any time.