As filed with the Securities and Exchange Commission on September 4, 2008May 25, 2011

Registration No. 333-152397333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REXNORD HOLDINGS, INC.CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 3560 | 20-5197013 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

Rexnord Holdings, Inc.

4701 West Greenfield Avenue

Milwaukee, WI 53214

(414) 643-3000

(Address, including zip code, and telephone number, including area code, of Registrant’sregistrant’s principal executive offices)

Robert A. HittPatricia M. Whaley

Vice President, General Counsel and Chief Executive OfficerSecretary

Rexnord Holdings, Inc.Corporation

4701 West Greenfield Avenue

Milwaukee, WI 53214

(414) 643-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

O’Melveny & Myers LLP 7 Times Square New York, New York 10036 (212) 326-2000 |

Quarles & Brady LLP

(414) 277-5000 |

New York, New York (212) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer (Do not check if a smaller reporting company) | x | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

| Title of each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (a) (b) | Amount of Registration Fee (c) | Title of each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (a)(b) | Amount of Registration Fee (c) | |||||||

Common stock, $0.01 par value per share | $ | 750,000,000 | $ | 29,475 | Common stock, $0.01 par value per share | $700,000,000 | $81,270 | |||||

| (a) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act of 1933. |

| (b) | Including shares of common stock which may be purchased by the underwriters to cover over-allotments, if any. |

| (c) | Previously paid $29,475 by wire transfer on July 9, 2008 in connection with the Registrant’s Form S-1, Registration No. 333-152397 filed on July 18, 2008. |

The Registrantregistrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrantregistrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it iswe are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated September 4, 2008May 25, 2011

PROSPECTUS

Shares

Rexnord Holdings, Inc.Corporation

Common Stock

This is Rexnord Holdings, Inc.’sCorporation’s initial public offering. Rexnord Holdings, Inc.Corporation is selling all of the shares being offered hereby.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for our common stock. We intend to apply to list our common stock on the New York Stock Exchange under the symbol “RXN.” Following the public offering, Rexnord Holdings, Inc. will remain a “controlled company” as defined under the New York Stock Exchange listing rules, and Apollo Management, L.P. and its affiliates will beneficially own % of its outstanding shares of common stock assuming the underwriters do not exercise their over-allotment option.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 1816 of this prospectus.

| Per Share | Total | |||||||

Public offering price | $ | $ | ||||||

Underwriting | $ | $ | ||||||

Proceeds, before expenses, to Rexnord | $ | $ | ||||||

The underwriters may also purchase up to an additional shares from Rexnord Holdings, Inc.us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments.

The shares will be ready for delivery on or about , 2008.2011.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011.

TABLE OF CONTENTS

| ||||

| ||||

| ||||

|

|

| ||||

The date of this prospectus is , 2008.

| 1 | ||||

| 16 | ||||

| 32 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 40 | |||

| 42 | ||||

| 59 | ||||

| 77 | ||||

| 83 | |||

| 100 | ||||

| 102 | |||

| 105 | ||||

| 109 | ||||

| 115 | ||||

| 117 | |||

| 120 | ||||

| 125 | ||||

| 125 | ||||

| 125 |

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Dealer Prospectus Delivery Obligations

Until , 2008,2011 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’sdealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

i

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes estimates ofindustry data that we obtained from periodic industry publications and internal company surveys. This prospectus includes market share and industry data and forecasts that we obtained fromprepared primarily based on management’s knowledge of the industry publications and surveys and internal company sources.industry data. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein.reliable. Unless otherwise noted, all information regardingstatements as to our market share isand market position relative to our competitors are approximated and based on management estimates using the latest marketabove-mentioned latest-available third-party data currently availableand our internal analyses and estimates.

i

While we are not aware of any misstatements regarding any industry data presented herein, our estimates, in particular as they relate to us, and all market share data isand our general expectations, involve risks and uncertainties and are subject to change based on net salesvarious factors, including those discussed under “Risk Factors,” “Cautionary Notice Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the applicable market.this prospectus.

TRADEMARKS

The following terms used in this prospectus are our power transmissionProcess & Motion Control trademarks: Falk® Rexnord®, Rex®, Falk™Prager™, MBRenew®, DuralonFlatTop™, Steelflex®, Thomas®, Omega®, Viva®, Wrapflex®, Lifelign®, True Torque®, Addax®, Shafer®, PSI®, Cartriseal®, Planetgear™, Drive One®, Steelflex®, Lifelign®, A+Plus®, Stearns®, Berg® and Highfield®, Prager™, Renew®, Stephan™, Wrapflex®, True Torque®, Freedom™, ModulFlex™, TableTop®, Mat Top®, RexnordAutogard®. The following terms used in this prospectus are our water managementWater Management trademarks: Zurn®, Wilkins®, Aquaflush®, AquaspecAquaSense®, AquaVantage®, Zurn One®, Zurn One Systems®, AquasenseEcoVantage®, AquavantageHydroVantage™, AquaSpec®, Aquavantage AV®, Ecovantage®, ChecktronicRodney Hunt® , Cam-Seal®, Zurn PEX®, Flo Thru®, Hi-Cap®, Pressure-Tru®, Aqua-Gard®, Golden Anderson™ and Rodney HuntFontaine®. All other trademarks appearing in this prospectus are the property of their holders.

ii

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and consolidated financial statements included elsewhere in this prospectus. This summary is not complete and may not contain all of the information that may be important to you. You should read the entire prospectus, including the “Risk Factors” section and our consolidated financial statements and notes to those statements, before making an investment decision.

On July 21, 2006 (the “Merger Date”), affiliates of Apollo Management, L.P. (“Apollo”), George M. Sherman and certain members of management acquired RBS Global, Inc. (“RBS Global”) through the merger of Chase Merger Sub, Inc., an indirect, wholly-owned subsidiary of an Apollo affiliate, Rexnord Holdings, Inc. (“Rexnord Holdings”), with and into RBS Global (the “Merger”), and RBS Global became an indirect, wholly-owned subsidiary of Rexnord Holdings. Unless otherwise noted, “Rexnord,” “we,” “us,” “our” and the “Company” mean Rexnord Corporation (formerly known as Rexnord Holdings, Inc.) and its predecessors and consolidated subsidiaries, including RBS Global, Inc. (“RBS Global”) and Rexnord LLC, and “Rexnord Holdings”Corporation” means Rexnord Holdings, Inc.Corporation and its predecessors but not its subsidiaries. As used in this prospectus, “fiscal year” refers to our fiscal year ending March 31 of the corresponding calendar year (for example, “fiscal year 2008”2011” or “fiscal 2008”2011” means the period from April 1, 20072010 to March 31, 2008)2011).

Unless otherwise indicated, the information contained in this prospectus assumes that (i) the underwriters’ over-allotment option iswill not be exercised, (ii) the number of our authorized shares of capital stock iswill have been increased to shares of common stock and shares of preferred stock pursuant to our amended and restated certificate of incorporation, and (iii) each share of common stock then outstanding isimmediately prior to the for one stock split will have been split into shares of common stock.

Our Company

We believe we areRexnord is a leading, globalgrowth-oriented, multi-platform industrial company strategically positioned withinwith what we believe are leading market shares and highly trusted brands that serve a diverse array of global end-markets. Our heritage of innovation and specification have allowed us to provide highly engineered, mission critical solutions to customers for decades and affords us the marketsprivilege of having long-term, valued relationships with market leaders. We operate our company in a disciplined way and industries we serve. Currently,the Rexnord Business System (“RBS”) is our business is comprisedoperating philosophy. Grounded in the spirit of two strategic platforms: (i) Power Transmission, which produces gears, couplings, industrial bearings, aerospace bearingscontinuous improvement, RBS creates a scalable, process-based framework that focuses on driving superior customer satisfaction and seals, flattop, special components and industrial chain and conveying equipment, and (ii) Water Management, which produces professional grade specification plumbing, water treatment and waste water control products. financial results by targeting world-class operating performance throughout all aspects of our business.

Our strategy is to build the Company around multi-billion dollar,multiple, global strategic platforms that participate in end marketsend-markets with above averagesustainable growth characteristics where we are, or have the opportunity to become, the industry leader. We have successfully completeda track record of acquiring and integrated several acquisitionsintegrating companies and expect to continue to pursue strategic acquisitions within our existing platforms that will expand our geographic presence, broaden our product lines and allow us to move into adjacent markets. Over time, we anticipate adding additional strategic platforms to our Company. Currently, our business is comprised of two platforms, Process & Motion Control and Water Management.

We believe that we have one of the broadest portfolios of highly engineered, mission and project critical Process & Motion Control products in the industrial and aerospace end-markets. Our Process & Motion Control product portfolio includes gears, couplings, industrial bearings, aerospace bearings and seals, FlatTop™ modular belting, engineered chain and conveying equipment. Our Water Management platform is a leader in the multi-billion dollar, specification-driven, non-residential construction market for water management products. Through recent acquisitions, we have gained entry into the municipal water and wastewater treatment markets. Our Water Management product portfolio includes professional grade specification drainage products, flush valves and faucet products, backflow prevention pressure release valves, Pex piping and engineered valves and gates for the water and wastewater treatment market.

1

Our products are generally “specified” or requested by end-users across both of our strategic platforms as a result of their reliable performance in demanding environments, our custom application engineering capabilities and our ability to provide global customer support. Typically, our Process & Motion Control products are initially incorporated into products sold by original equipment manufacturers (“OEMs”) or sold to end-users as critical components in large, complex systems where the cost of failure or downtime is high and thereafter replaced through industrial distributors as they are consumed or require replacement.

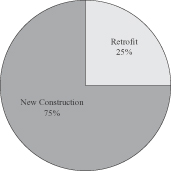

The demand for our Water Management products is primarily driven by new infrastructure, the retro-fit of existing structures to make them more energy and water efficient, commercial construction and, to a lesser extent, residential construction. We believe we have become a market leader in the industry by meeting the stringent third party regulatory, building and plumbing code requirements and subsequently achieving specification of our products into projects and applications.

We are led by an experienced, high caliberhigh-caliber management team that employs RBS as a proven operating system, the Rexnord Business System, or RBS, modeled after the Danaher Business System of the Danaher Corporation. RBS was established by George Sherman, our Non-Executive Chairman of the Board and the former CEO of the Danaher Corporation from 1990 to 2001. RBS is designedphilosophy to drive excellence and world class performance in all aspects of our business by focusing on customer satisfaction or the “Voice of the Customer,” while seekingCustomer” process and ensuring superior customer satisfaction. Our global footprint encompasses 36 principal Process & Motion Control manufacturing, warehouse and repair facilities located around the world and 23 principal Water Management manufacturing and warehouse facilities which allow us to continuously improvemeet the needs of our growth, quality, delivery and cost.increasingly global customer base as well as our distribution channel partners.

We believe we have a sustainable competitive advantage in both of our platforms as a result of the following attributes:

We are a leading designer, manufacturer and marketer of highly-engineered, end userend-user and/or third-party specified products that are missionmission- or project-critical for applications where the cost of failure or downtime is high;high or there is a requirement to provide and enhance water quality, safety, flow control and conservation.

We believe our portfolio includes premier and widely known brands in the Power TransmissionProcess & Motion Control and Water Management markets in which we participate, as well as one of the broadest and most extensive product offerings;offerings.

We estimate that over 85% of our total net sales come from products in which we have leading market share positions;positions.

We believe we have established a sustainable revenue profile. Within our Process & Motion Control platform, we have an extensive installed base of our products that provides us the opportunity to capture significant, recurring aftermarket revenues at attractive margins as a result of a “like-for-like” replacement dynamic;dynamic. Within our Water Management platform, we pursue the retrofit of existing structures to improve water conservation and efficiency, thereby reducing our exposure to the new construction cycle.

We have extensive distribution networks in both of our platforms – platforms—in Power TransmissionProcess & Motion Control, we have over 4002,600 distributor customers with nearly 2,500 brancheslocations serving our customers globally and, in Water Management, we have more than 5501,100 independent sales representatives across approximately 170210 sales agencies that work directly with our in-house technical team to drive specification of our products.

Our global footprint encompasses 28 Power Transmission manufacturing, four Power Transmission repair facilities located around the world, 21 Water Management manufacturing and warehouse facilities in North America and an engineering and sourcing center in Zhuhai, China, which allow us to meet the needs of our increasingly global customer base as well as our distribution channel partners. We employ approximately 7,4006,300 employees andacross 59 locations around the world. For the fiscal year ended March 31, 2011, we generated net sales of $1.9$1.7 billion, income from operations of $219.1 million and a net loss of $51.3 million. Fiscal 2011 results reflect the effect of a $100.8 million loss on debt extinguishment recorded during the year as a result of the early repayment of debt pursuant to cash tender offers. We generated net sales of $1.5 billion, income from operations of $161.4 million and net income of $0.3$88.1 million for the fiscal year ended March 31, 20082010. Fiscal 2010 results reflect the effect of a $167.8 million gain on debt extinguishment recorded during the year as a result of a repurchase and net salesextinguishment of $496.1 milliondebt and a debt exchange offer.

2

In addition to net income of $0.2 million for the three months ended June 28, 2008. We had(loss), we believe Adjusted EBITDA (as defined on page 14is an important measure under “Summary Historicalour senior secured credit facilities, as our ability to incur certain types of acquisition debt or subordinated debt, make certain types of acquisitions or asset exchanges, operate our business and Unaudited Financial and Other Data”)make dividends or other distributions, all of $389.6 million forwhich will impact our financial performance, is impacted by our Adjusted EBITDA, as our lenders measure our performance by comparing the twelve months ended June 28, 2008, and net income for the same twelve-month periodratio of $7.9 million.our senior secured bank debt to our Adjusted EBITDA. Adjusted EBITDA for the twelve months ended June 28, 2008 includes: $6.8 million of pro forma adjustments to give full year effect toMarch 31, 2011 was $335.7 million. For the acquisition of GA on Januarytwelve months ended March 31, 2008 and $8.3 million of out of period business interruption recoveries that relate to fiscal 2007 but are required to be reported in the period the proceeds were received, which was fiscal 2008. For a description of why we believe2010, Adjusted EBITDA is important to an understandingwas $285.0 million. For more information on these and other adjustments and the limitations of our performance,Adjusted EBITDA, see footnote 7“Management’s Discussion and Analysis of “Summary HistoricalFinancial Condition and Unaudited Financial and Other Data.Results of Operations—Covenant Compliance.”

Our Strategic Platforms

An overview of our two existing strategic platforms is outlined below:

Power TransmissionProcess & Motion Control

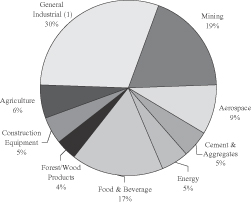

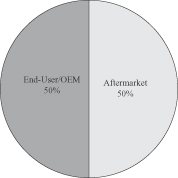

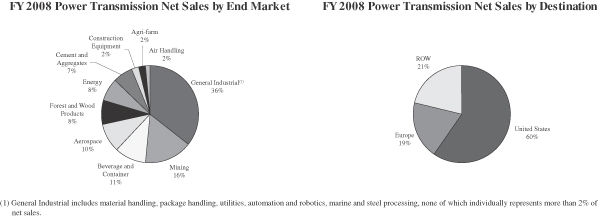

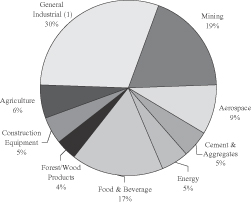

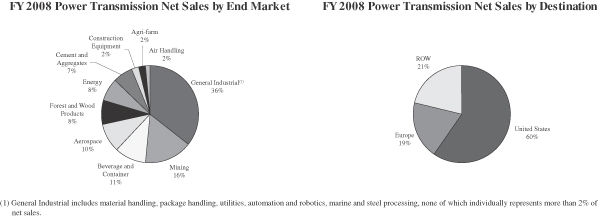

Our Power Transmission productsProcess & Motion Control platform designs, manufactures, markets and services specified, highly-engineered mechanical components used within complex systems where our customers’ reliability requirements and cost of failure or downtime is high. The Process & Motion Control product portfolio includes gears, couplings, industrial bearings, aerospace bearings and seals, FlatTop™ modular belting, engineered chain and conveying equipment and are marketed and sold globally under several brands, such asincluding Rexnord®, Rex®, Falk™® and Link-Belt®. We sell our Power TransmissionProcess & Motion Control products into a diverse group of attractive end market industries. Over the past several years, both our customer base, as well as many of our end markets have grown faster than the underlying economic growth in the United States. Our international net sales (as measured on a destination basis) have grown from 34% of Power Transmission net sales in fiscal 2006 to 40% in fiscal 2008.end-markets, including mining, general industrial applications, cement and aggregate, agriculture, forest and wood products, petrochemical, energy, food and beverage, aerospace and wind energy.

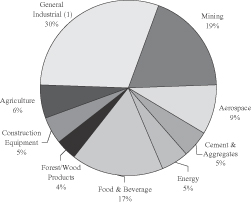

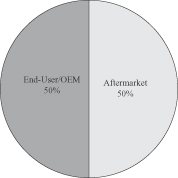

FY2011 Process & Motion Control Net Sales by End-Market | FY2011 Process & Motion Control Net Sales End-User/OEM vs. Aftermarket | |

|  |

| (1) | General Industrial includes, but is not limited to, material handling, package handling, utilities, automation and robotics, marine and steel processing, none of which individually represented more than 2% of fiscal 2011 net sales. |

Set forth below are our Power Transmission net sales for fiscal 2008 by end market and by geographic destination:

Over the past century, weWe have established long-term relationships with original equipment manufacturers, or OEMs and end usersend-users serving a wide variety of industries. As a result of our long-term relationshiprelationships with OEMs and end users,end-users, we have created a significant installed base for our Power TransmissionProcess & Motion Control products, which are consumed or worn out in use and have a relatively predictable replacement cycle. We believe this replacement dynamic drives recurring aftermarket demand for our products through our distribution customers, which weproducts. We estimate account forthat approximately 45%50% of our North American Power TransmissionProcess & Motion Control net sales.sales are to distributors, who primarily serve the end-user/OEM aftermarket demand for our products.

3

Most of our products are critical components in large scale manufacturing processes, where the cost of component failure and resulting down-time is high. We believe our reputation for superior quality, productsapplication expertise and our ability to meet lead times as short as one daytime expectations are highly valued by our customers, as demonstrated by their strong preference to replace their worn Rexnord products forwith new Rexnord products, or “like-for-like” product replacements. We believe this replacement dynamic for our customers’ preference to replace “like-for-like” products, combined with our significant installed base, enables us to achieve premium pricing, generategenerates a source of recurring revenue and provides us with a competitive advantage. We believe the majority of our products are purchased by customers as part of their regular maintenance budgetsbudget, and in many cases do not represent significant capital expenditures.

Water Management

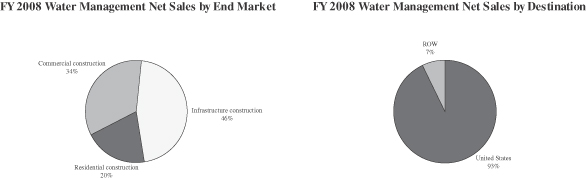

Our Water Management platform designs, procures, manufactures and markets products that provide and enhance water quality, safety, flow control and conservation. The Water Management product portfolio includes professional grade specification drainage products, flush valves and faucet products, engineered valves and gates for the water and wastewater treatment market and Pex piping and are marketed and sold through widely recognized brand names, including Zurn®, Wilkins®, Aquaflush®, Aquasense®, Aquavantage®, Zurn One Systems®, Ecovantage®, Aquaspec®, Zurn PEX®, Checktronic® , Cam-Seal®, Rodney Hunt® and Golden Anderson™Fontaine®.

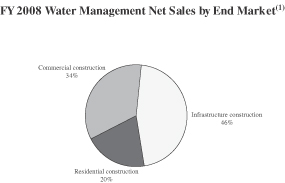

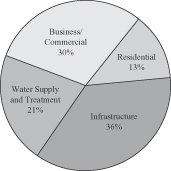

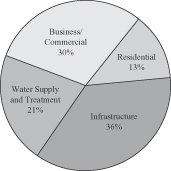

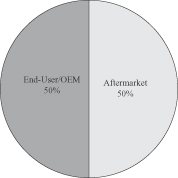

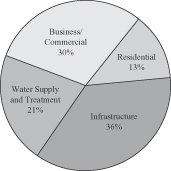

Set forth below are our Water Management net sales for fiscal 2008 by end market:

Over the past century, we believethe businesses that comprise our Water Management platform hashave established itselfthemselves as an innovatorinnovators and leading designer, manufacturerdesigners, manufacturers and distributordistributors of highly engineered water products and solutions that deliver water conservation, safety & hygiene,control the flow, delivery, treatment and control & comfort. The demand for our Water Management productsconservation of water to the infrastructure construction (which is primarily driven by new infrastructure,comprised of various segments, including those identified as “Water Supply and Treatment” in the chart below), commercial construction and, to a lesser extent, the residential construction.

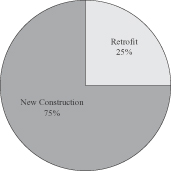

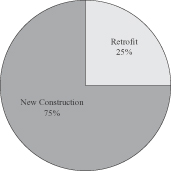

construction end-markets. Segments of the infrastructure end marketend-market include: municipal water and wastewater, transportation, government, health care and education. Segments of the commercial construction end marketend-market include: lodging, retail, dining, sports arenas, and warehouse/office. In addition to our broader growth strategy, we believe there is a significant opportunityThe demand for future growth in our Water Management platformproducts is primarily driven by sellingnew infrastructure, the retro-fit of existing structures to make them more energy and distributingwater efficient, commercial construction and, to a number of our products into the expanding renovation and repair market.lesser extent, residential construction.

FY2011 Water Management Net Sales by End-Market | FY2011 Water Management Net Sales New Construction vs. Retrofit | |

|  |

Our Water Management products are principally specification-driven and project-critical and typically account forrepresent a low percentage of the overall project cost. We believe these characteristics, coupled with our extensive distribution network, create a high level of end-user loyalty for our products and allow us to maintain leading market shares in the majority of our product lines andlines. We believe we have become a market leader in the industry by meeting the stringent third party regulatory, building and plumbing code requirements and subsequently achieving specification of our products into projects and applications. The majority of these stringent testing and regulatory

Through

4

approval processes are completed through the University of Southern California (“USC”), the International Association of Plumbing and Mechanical Codes (“IAPMO”), the National Sanitation Foundation (“NSF”), the Underwriters Laboratories (“UL”), Factory Mutual (“FM”), or the American Waterworks Association (“AWWA”), prior to the commercialization of our products.

Our Water Management platform has an extensive network of more than 550approximately 1,100 independent sales representatives across 170approximately 210 sales agencies in North America we maintain high product availability for our customers andwho work closely together with local engineers, contractors, builders and architects to specify, or “spec in”,“spec-in,” our Water Management products for use in construction projects. ItApproximately 85% of our Water Management platform net sales come from products that are specified for use in projects by engineers, contractors, owners or architects. Specifically, it has been our experience that, once an architect, engineer, contractor builder or architectowner has specified our productsproduct with satisfactory results, theythat person will generally continue to use our products in future projects. We derive approximately 80%The inclusion of our Water Management platform net sales from “spec-in” products and believe that the combination of our “spec-in” business model, our extensive distribution network andwith project specifications, combined with our ability to innovate, engineer and deliver superior quality products and systems that save time and money for engineers, contractors, builders and architects, has resulted in growing demand for our Water Management products andproducts. Our distribution model is predicated upon maintaining high product availability near our customers. We believe that this model provides us with a sustainable competitive advantage.advantage as we are able to meet our customer demand with local inventory at significantly reduced lead times as compared to others in our industry.

Our Markets

We evaluate our competitive position in our markets based upon the markets we serve.on available market data, relevant benchmarks compared to our relative peer group and industry trends. We generally do not participate in segments of our served markets that are thought of as commodities or in applications that do not require differentiation based on product quality, reliability and innovation. In both of our platforms, we believe the end marketsend-markets we serve span a broad and diverse array of commercial and industrial end marketsend-markets with solid fundamental long-term growth characteristics.

Power TransmissionProcess & Motion Control Market

According to Industrial Market Information, Inc.,Within the North American Power Transmissionoverall Process & Motion Control market, generates approximately $103 billion in annual net sales. Of this overall estimated Power Transmission market,we estimate that the relevant or servedaddressable North American market for our current product offerings is approximately $5$5.0 billion in net sales per year. Globally, we estimate our servedaddressable market to be approximately $12$12.0 billion in net sales per year. The Power Transmission market for Process & Motion Control products is relativelyvery fragmented with most participants having single or limited product lines and serving specific geographic markets. While there are numerous competitors with limited product offerings, there are only a few national and international competitors of a size comparable to us. While we compete with certain domestic and international competitors across a portion of our product lines, we do not believe that any one competitor directly competes with us on all of our product lines. The industry’s customer base is broadly diversified across many sectors of the economy. We believe that growth in the Power TransmissionProcess & Motion Control market is closely tied to overall growth in industrial production,

which fundamentally, we believe has significant long-term growth fundamentals.potential. In addition, we believe that Power TransmissionProcess & Motion Control manufacturers who innovate to meet the changes in customer demands and focus on higher growth end marketsend-markets can grow at rates faster than overall U.S.United States industrial production.

Our Power Transmission products are generally critical components in the machinery or plant in which they operate, yet they typically account for a low percentage of an end user’s total production cost. We believe, because the costs associated with Power Transmission product failure to the end user can be substantial, end users in most of the markets we serve focus on Power Transmission products with superior quality, reliability and availability, rather than considering price alone, when making a purchasing decision.

The Power TransmissionProcess & Motion Control market is also characterized by the need for sophisticated engineering experience, the ability to produce a broad number of niche products with very little lead time and long-standing customer relationships. We believe entry into our markets by competitors with lower labor costs, including foreign competitors, will be limited due to the fact that we manufacture highly specialized niche products that are critical components in large scale manufacturing processes, where the cost of component failure and resulting downtime is high. In addition, we believe there is an industry trend of customers increasingly consolidating their vendor bases, which we believe should allow suppliers with broader product offerings, like us, to capture additional market share.

5

Water Management Market

According toWithin the U.S. Census Bureau, U.S. non-residential construction expenditures were approximately $637.5 billion in 2007. Weoverall Water Management market, we estimate that the relevantaddressable North American market within U.S. non-residential construction for all of our Water Managementcurrent product offerings is approximately $4.5 billion.

$2.3 billion in net sales per year. Globally, we estimate our addressable market to be approximately $3.0 billion in net sales per year. We believe the segmentmarkets in which our Water Management platform participates isare relatively fragmented and that most of our competitors offer more limited product lines. While we compete with certain of our competitors across a portionbroad range of industries and product lines. Although competition exists across all of our product lines,Water Management businesses, we do not believe that any one competitor directly competes with us across all of our product lines. We believe that, by focusing our efforts and resources towards end-markets that have above average growth characteristics, we can continue to grow our platform at rates above the growth rate of the overall market and the growth rate of our competition.

We believe the areas of the water managementWater Management industry in which we compete are tied to growth in infrastructure and commercial construction, which we believe have significant long-term growth fundamentals. Historically, the infrastructure and commercial construction industry has been more stable and less vulnerable to down-cycles than the residential construction industry. Compared to residential construction cycles, downturns in infrastructure and commercial construction have been shorter and less severe, than in residential construction, and upturns have lasted longer and had higher peaks in terms of spending as well as units and square footage. In addition, through successful new product innovation, we believe that water management manufacturers are able to grow at a faster pace than the broader infrastructure and commercial construction markets, as well as mitigate downturns in the cycle.

The Water management products tend to be project-critical, highly engineered and high value-add and typically are a low percentage of overall project cost. We believe the combination of these features creates a high level of end user loyalty. Demand for these products is influenced by regulatory, building and plumbing code requirements. Many water management products must be tested and approved by the University of Southern California (“USC”), the National Sanitation Foundation (“NSF”) or the American Waterworks Association (“AWWA”) before they may be sold. In addition, many of these products must meet detailed specifications set by water management engineers, contractors, builders and architects.

The water managementManagement industry’s specification-driven end marketsend-markets require manufacturers to work closely with engineers, contractors, builders and architects in local markets across the United States to design specific applications on a project-by-project basis. As a result, building and maintaining a network of relationships with architects, engineers, contractors builders and architectsbuilders who specify or “spec-in” products for use in construction projects and having the flexibility in design and product innovation isare critical to compete effectively.effectively in the market. Companies with a strong network of such relationships have a competitive advantage. Specifically, it has been our experience that, once an engineer, contractor, builder or architect has specified our product with satisfactory results, that person often will continue to use our products in future projects.

Our Competitive Strengths

Key characteristics of our business that we believe provide us with a competitive advantage and position us for future growth include the following:

The Rexnord Business System.We manageoperate our company within a managementdisciplined way. The Rexnord Business System is our operating philosophy we call RBS.and it creates a scalable, process-based framework that focuses on driving superior customer satisfaction and financial results by targeting world-class operating performance. RBS is based on the following principles: (1) a culture that embraces Kaizen, the Japanese philosophy of continuous improvement; (2) strategy deployment—a long-term strategic planning process that determines annual improvement priorities and the actions necessary to achieve those priorities; (2) measuring our performance based on customer satisfaction, or the “Voice of the Customer;” (3) involvement of all of our associates in the execution of our strategy; and (4) developinga culture that embraces Kaizen, the Japanese philosophy of continuous improvement. We believe applying RBS can yield superior growth, quality, delivery and resourcing “break-throughs”—potential new products or other initiatives that drive organic sales growth opportunities;cost positions relative to our competition, resulting in enhanced profitability and (5) measuring our performance based on “Voiceultimately the creation of the Customer.”stockholder value. As we have applied RBS over the past fiveseveral years, we have experienced significant improvements in growth, productivity, cost reduction and asset efficiency and believe there are substantial opportunities to continue to improve our performance as we continue to apply RBS.

Experienced, High-Caliber Management Team. Our management team is led by Bob Hitt,Todd Adams, President and Chief Executive Officer and Director.Officer. George Sherman, our Non-Executive Chairman of the Board and, formerfrom 1990 to 2001, the CEO of the Danaher Corporation, from 1990 to 2001, oversees thiscollaborates with the management team and plays a key role in establishingto establish the strategic

6

direction of the Company. Other members of the management team include Todd Adams, SeniorMichael Shapiro, Vice President and Chief Financial Officer, Praveen Jeyarajah, Executive Vice President—Corporate and Business Development and George Moore, Executive Vice President, and Alex P. Marini, who became the President of our Water Management Group upon completion of the Zurn acquisition and previously served as the President and Chief Executive Officer for Jacuzzi Brands, Inc. (“JBI”).President. We believe the overall talent level within our organization is a competitive strength, and we have added a number of experienced key managers across our platforms over the past several years. George M.Mr. Sherman and the management team currently maintain a significant equity investment in the Company. As of March 31, 2008,2011, their ownership interest represented approximately 20% of our common stock on a fully diluted basis.

Strong Financial Performance and Free Cash Flow.Since implementing RBS, we have established a solid track-record of delivering strong financial performance measured in terms of net sales growth, margin expansion and free cash flow conversion (cash flow from operations less capital expenditures compared to net income). Since fiscal 2004, net sales have grown at a compound annual growth rate or CAGR, of 27%13% inclusive of acquisitions, and Adjusted EBITDA margins (Adjusted EBITDA divided by net sales) have expanded to 20.6%19.8%. Additionally, we have consistently delivered strong free cash flow over the past fiveseveral years by improving working capital performance and reducingmaintaining capital expenditures through productivity and capacity improvements.at reasonable levels. By continually focusing on improving our overall operating performance and free cash flow conversion, we believe we can create substantial long-term shareholderstockholder value by using our cash flows to manage our leverage, as well as to drive growth through acquisitions over time.

Leading Market Positions in Diversified End Markets.End-Markets.Our high-margin performance is driven by industry leading positions in the diversified end marketsend-markets in which we compete. We estimate that greater than 85% of our net sales are derived from products in which we have leading market share positions. We believe we have achieved leadership positions in these markets because ofthrough our focus on customer satisfaction, extensive offering of quality products, ability to service our customers globally, positive brand perception, highly engineered product lines, extensive specification workefforts and market/application experience. We serve a diverse set of end marketsend-markets with our largest single end market,end-market, mining, accounting for 11%13% of consolidated net sales in fiscal 2008.2011.

Broad Portfolio of Highly Engineered, Specification-Driven Products.We believe we offer one of the broadest portfolios of highly engineered, specification-driven, project-critical products in the end marketsend-markets we serve. Our array of product applications, knowledge and expertise applied across our extensive portfolio of products allows us to work closely with our customers to design and develop solutions tailored to their individual specifications. Within our Water Management platform, our representatives work directly with engineers,

contractors, builders and architects to “spec-in” our Water Management products early in the design phase of a project. We have found that once these customers have specified a company’s product with satisfactory results, they will generally use that company’s products in future projects. Furthermore, we believe our strong application engineering and new product development capabilities have contributed to our reputation as an innovator in each of our end markets.end-markets.

Large Installed Base, Extensive Distribution Network and Strong Aftermarket Revenues.Over the past century we have established relationships with OEMs and end users servingend-users across a wide varietydiverse group of Power Transmission industries,end-markets, creating a significant installed base for our Power TransmissionProcess & Motion Control products. This installed base generates significant aftermarket sales for us, becauseas our Power TransmissionProcess & Motion Control products are consumed in use and must be replaced in relatively predictable cycles. In order to provide our customers with superior service, we have cultivated relationships with over 400 distributors worldwide who sell Power Transmission products through nearly 2,500 branches. This distribution network is essential to2,600 distributor locations serving our success in meeting lead times as short as one day. We believe our installed Power Transmission base, end user preference and product line breadth make our product portfolio an attractive package to distributors in the Power Transmission industry.customers globally. Our Water Management platform has 2123 manufacturing and warehouse facilities and uses approximately 7090 third-party distribution facilities at which it maintains inventory. This broad distribution network provides us with a competitive advantage and drives demand for our Water Management products by allowing quick delivery of project-critical Water Management products to our customers facing short lead times. In addition, we believe this extensive distribution network also provides us with an opportunity to capitalize on the expanding renovation and repair market as building owners begin to upgrade existing commercial and institutional bathroom fixtures with high efficiency systems.

7

Significant Experience Identifying and Integrating Strategic Acquisitions.We have successfully completed and integrated several acquisitions from May 2005 to the presentin recent years totaling more than $1.3 billion of total transaction value.value, including our $942.5 million acquisition of Zurn. These strategic acquisitions have allowed us to establish and expand our Water Management platform, widen our geographic presence, broaden our product lines and, in other instances, to move into adjacent markets. In the past three fiscal years,Since 2005, we have completed four strategic acquisitions that have significantly expanded our Power TransmissionProcess & Motion Control platform and established and expanded our Water Management platform. TheseWe believe these acquisitions have created significant shareholderstockholder value through the implementation of RBS operating principles, which has resulted in identifying and achieving cost synergies, as well as driving growth and operational and working capital improvements.

Our Business Strategy

We strive to create shareholderstockholder value by seeking to deliver sales growth, profitability and asset efficiency, which we believe will result in upper quartilesuperior financial performance and free cash flow generation when compared to other leading multi-platform industrial companies by driving the following key strategies:

Continue to Apply the Rexnord Business System. The core of our business strategy is to continue to apply RBS to strive for world class performance in quality, delivery and cost throughout our platforms. We believe that as we pursue world class performance throughout all aspects of our business and listen to the “Voice of the Customer,” we can deliver significant organic net sales growth, continued margin expansion and significant free cash flow generation while improving customer satisfaction.

Drive Profitable Growth. Our key growth strategies are:

| • | Accelerate Growth in Key Vertical |

| • | Product Innovation and Resourcing “Break-throughs”—We intend to continue to invest in strong application engineering and new product development capabilities |

| • | Drive Specification for Our Products—We intend to increase our installed base and grow aftermarket revenues by continuing to partner with OEMs to specify our |

| • | Expand Internationally—We believe there is substantial growth potential outside the United States for many of our existing products by expanding distribution, further penetrating key vertical |

| • | Pursue Strategic Acquisitions—We believe the fragmented nature of our |

Platform Focused Strategies. We intend to build our business around leadership positions in platforms that participate in multi-billion dollar, global, growing end markets.end-markets. Within our two existing platforms, we expect to continue to leverage our overall market presence and competitive position to provide further growth and diversification and increase our market share.

Acquisition History

8

The Rexnord Business System.We have successfully completed and integrated several acquisitions and expect to continue to pursue strategic acquisitions insideoperate our existing platforms to expand our geographic presence, broaden our product lines or allow us to move into adjacent markets. In the past three fiscal years we have completed four acquisitions that have significantly expanded our Power Transmission platform and established our Water Management platform. In May 2005, whilecompany in a disciplined way through the Rexnord companies were still ownedBusiness System. RBS is our operating philosophy and it creates a scalable, process-based framework that focuses on driving superior customer satisfaction and financial results by targeting world-class operating performance. We believe applying RBS can yield superior growth, quality, delivery and cost positions relative to our competition, resulting in enhanced profitability and ultimately the creation of stockholder value.

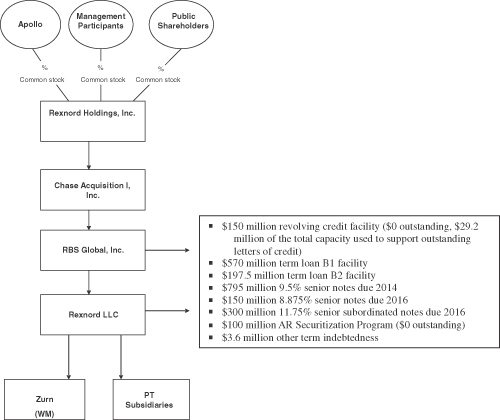

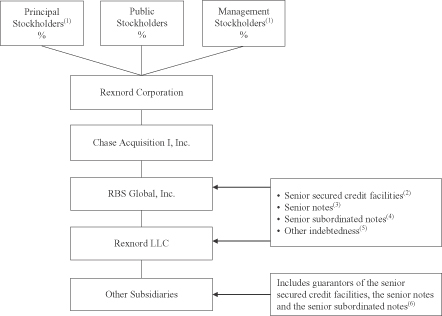

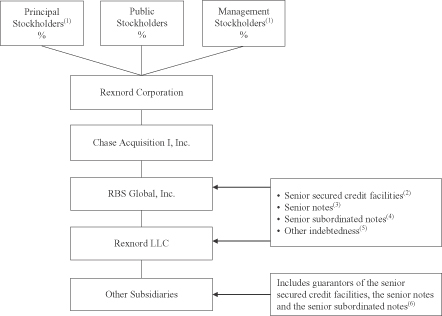

Our Ownership Structure

The Carlyle Group, Rexnord LLC acquired Falk for approximately $300 million. Falk significantly enhancedchart below is a summary of our position as a leading manufacturerorganizational structure after giving effect to this offering and the redemption and prepayment of highly engineered Power Transmission products. By combiningall of our leadership positions in flattop chain, industrial bearings, non-lubricated couplings and industrial chain with Falk’s complementary leadership positions in gears and lubricated couplings, as well as a growing gear repair business, the Falk acquisition resulted in a comprehensive, market-leading product portfolio that we believePIK toggle senior indebtedness, which is expected to be one of the broadestcompleted in the Power Transmission industry. Our Power Transmission group also acquiredfirst quarter of fiscal 2012 as described in “Capitalization.” Unless otherwise indicated, the Dalong Chain Company, located in China, in May 2006 for approximately $6 million. The acquisitionindebtedness information below is as of Dalong has provided us manufacturing capabilities in Asia with respect to flattop chain, conveying equipment and industrial chain. In February 2007, approximately seven months after Apollo acquired the Rexnord companies from The Carlyle Group in the Merger, we established our Water Management platform through the acquisition of Zurn for approximately $940 million. Zurn is a leader in the multi-billion dollar non-residential construction and replacement market for plumbing fixtures and fittings. Zurn designs and manufactures plumbing products used in industrial and commercial construction, renovation and facilities maintenance markets in North America and holds a leading market position across most of its businesses. Our Water Management platform was then expanded through ourMarch 31, 2011.

| (1) | Includes investment funds affiliated with, or co-investment vehicles managed by, Apollo Management VI, L.P., an affiliate of Apollo Management, L.P., which, as of March 31, 2011, collectively beneficially owned 93.8% of our common stock, with the balance beneficially owned by the management stockholders. |

| (2) | As of March 31, 2011, $761.5 million was outstanding. |

| (3) | As of March 31, 2011, $1,147.0 million was outstanding. |

| (4) | As of March 31, 2011, $300.0 million was outstanding. We intend to use a portion of the proceeds of this offering to redeem $300.0 million in principal amount of the 11.75% senior subordinated notes due 2016. |

| (5) | As of March 31, 2011, $12.4 million was outstanding. Primarily consists of foreign borrowings and capitalized lease obligations. |

| (6) | Guarantors of the senior secured credit facilities, the senior notes and the senior subordinated notes include substantially all of the domestic operating subsidiaries of RBS Global as of the date of this prospectus other than Rexnord LLC, which is a co-issuer of the notes, but do not include any of its foreign subsidiaries. |

9

acquisition of GA Industries, Inc. in January 2008 for approximately $74 million. This acquisition expanded our Water Management platform into the water and wastewater markets, specifically in municipal, hydropower and industrial environments.

Our Principal StockholderStockholders

Our principal stockholders are investment funds affiliated with, or co-investment vehicles managed by, Apollo Management L.P., including Apollo Investment Fund VI, L.P., an affiliate of Apollo Management, L.P., which we collectively refer to herein as “Apollo” (unless the context otherwise indicates) and which prior to this offering collectively beneficially own 93.7%owned 93.8% of our common stock and will beneficially own % or shares of our common stock after this offering, assuming the underwriters do not exercise their over-allotment option. Apollo Investment Fund VI, L.P., which is the sole member of one of our principal stockholders, is an investment fund with committed capital, along with its co-investment affiliates, of over $11approximately $10.1 billion. Apollo Management, L.P., is an affiliate of Apollo Global Management, LLC, a leading global alternative asset manager with offices in New York, Los Angeles, London, Frankfurt, ParisLuxembourg, Singapore, Hong Kong and Singapore.Mumbai. As of March 31, 2011, Apollo Global Management, LLC hasand its subsidiaries have assets under management in excess of $40approximately $70 billion in private equity, hedge funds, distressed debt and mezzanine funds invested across a core group of industries where Apollo Global Management, LLC has considerable knowledge and resources.

We currently have a management consulting agreement with Apollo for advisory and consulting services. Since entering into the agreement through March 31, 2008, we have paid or accrued $4.4 million in fees plus out-of-pocket expenses under the agreement, which Apollo intends to terminate upon completion of this offering. Upon termination of the agreement, Apollo will receive $20.0 million. Apollo also currently holds a portion of our PIK toggle senior indebtedness due 2013, which we intend to repay with a portion of the proceeds of this offering. As of the date of this prospectus, Apollo and its affiliates held approximately $40.0 million of this PIK toggle senior indebtedness. See “Related Party Transactions” for more detail regarding our arrangements with Apollo.

Risk Factors

Investing in our common stock involves substantial risk. Our ability to execute our strategy is also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. These risks include, among others:

Our substantial indebtedness could have a material adverse effect on our operations, which could prevent us from satisfying our debt obligations and have a material adverse effect on the value of our common stock. Our business may not generate sufficient cash flow from operations to meet our debt service and other obligations, and currently anticipated cost savings and operating improvements may not be realized on schedule, or at all.

Our business and financial performance depend on general economic conditions and other market factors beyond our control. Any sustained weakness in demand or downturn or uncertainty in the economy generally would materially reduce our net sales and profitability.

We face significant competition from numerous companies both on the international and national level.levels. Some of our competitors have achieved substantially more market penetration in certain of the markets in which we operate, and some of our competitors have greater financial and other resources than we do. We cannot provide assurance that we will be able to maintain or increase the current market share of our products successfully in the future.

Our business depends on general economic conditions and other market factors beyond our control. Our financial performance depends, in large part, on conditions in the markets that we serve in the U.S. and the global economy generally. Any sustained weakness in demand or downturn or uncertainty in the economy generally would materially reduce our net sales and profitability.

Some of the industries we serve are highly cyclical, such as the aerospace, energy and industrial equipment industries. Any declines in commercial, institutional or residential construction starts or demand for replacement building and home improvement products may impact us in a material adverse manner, and there can be no assurance that any such adverse effects would not continue for a prolonged period of time.

|

If any of the foregoing risks or the risks described under the heading “Risk Factors” were to occur, you may lose part or all of your investment. You should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors” on page 16 before making an investment decision.

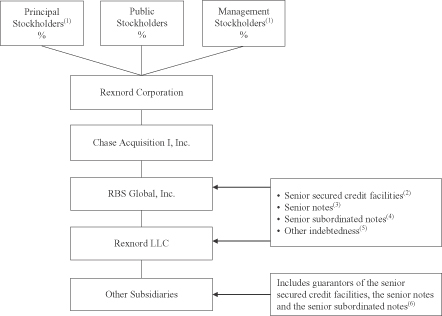

Corporate Structure

The following diagram sets forth our corporate structure and pro forma indebtedness assuming that we had completed this offering and used a portion of the net proceeds to repay Rexnord Holdings’ indebtedness on June 28, 2008.

Additional Information

Rexnord HoldingsCorporation is a Delaware corporation. Our principal executive offices are located at 4701 West Greenfield Avenue, Milwaukee, Wisconsin 53214. Our telephone number is (414) 643-3000. Our website is located at www.rexnord.com; however, the information on our website is not part of this document, and you should rely only on the information contained in this document and the documents to which we refer you.

11

The Offering

Issuer | Rexnord |

Common stock offered by us | shares. |

Common stock to be outstanding immediately after the offering | shares. |

Underwriters’ option to purchase additional shares of common stock in this offering | We have granted to the underwriters a 30-day option to purchase up to additional shares |

Common stock voting rights | Each share of our common stock will entitle its holder to one vote. |

Dividend policy | We currently intend to retain all future earnings, if any, for use in the operation of our business and to fund future growth. |

Use of proceeds | We estimate that our net proceeds from this offering |

NYSE symbol | “ |

Risk factors | You should carefully read and consider the information set forth under “Risk Factors” beginning on page 16 of this prospectus and all other information set forth in this prospectus before deciding to invest in our common stock. |

12

Except as otherwise indicated, all of the information in this prospectus assumes:

a for one stock split described below has been completed;

no exercise of the underwriters’ over-allotment option to purchase up to additional shares of common stock to cover over-allotments of shares;

thean initial offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus; and

our amended and restated certificate of incorporation and amended and restated bylaws are in effect, pursuant to which the provisions described under “Description of Capital Stock” will become operative.

Prior to completion of this offering, we will effect a stock split whereby holders of our outstanding shares of common stock will receive shares of common stock for each share they currently hold. The number of shares of common stock to be outstanding after completion of this offering is based on shares of our common stock to be sold in this offering and, except where we state otherwise, the information with respect to our common stock we present in this prospectus:

does not give effect to shares of our common stock issuable upon the exercise of outstanding options as of , 2008,2011, at a weighted-average exercise price of $ per share; and

does not give effect to shares of common stock reserved for future issuance under the Rexnord HoldingsCorporation’s 2006 Stock Option Plan.

13

Summary Historical and Unaudited Financial and Other Data

The summary historical financial data for the fiscal years ended March 31, 2006, 20072009, 2010 and 20082011 have been derived from our consolidated financial statements and related notes thereto which have been audited by Ernst & Young LLP, an independent registered public accounting firm and are included elsewhere in this prospectus. The summary historical financial data for the three months ended June 30, 2007 and June 28, 2008 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Results for the three months ended June 30, 2007 and June 28, 2008 are not necessarily indicative of the results that may be expected for the entire year. The period from April 1, 2006 to July 21, 2006 includes the accounts of RBS Global prior to the Merger. The period from July 22, 2006 to March 31, 2007 includes the accounts of RBS Global after the Merger. The two periods account for our fiscal year ended March 31, 2007. We refer to the financial statements prior to the Merger as “Predecessor.”

The following data should be read in conjunction with “Risk Factors,” “Selected Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto included elsewhere in this prospectus.

| Predecessor (1) | Successor | |||||||||||||||||||||||||

| Year Ended March 31, 2006 (2) | Period from April 1, 2006 through July 21, 2006 | Period from July 22, 2006 through March 31, 2007 (3) | Year Ended March 31, 2008 (4) | Three Months Ended June 30, 2007 | Three Months Ended June 28, 2008 | |||||||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||||||||

Net sales | $ | 1,081.4 | $ | 334.2 | $ | 921.5 | $ | 1,853.5 | $ | 448.2 | $ | 496.1 | ||||||||||||||

Cost of sales (5) | 742.3 | 237.7 | 628.2 | 1,250.4 | 306.2 | 334.2 | ||||||||||||||||||||

Gross profit | 339.1 | 96.5 | 293.3 | 603.1 | 142.0 | 161.9 | ||||||||||||||||||||

Selling, general and administrative expenses | 187.8 | 63.1 | 159.3 | 312.2 | 78.1 | 86.1 | ||||||||||||||||||||

Restructuring and other similar costs | 31.1 | — | — | — | — | — | ||||||||||||||||||||

Curtailment gain | — | — | — | — | — | — | ||||||||||||||||||||

Loss on divestiture | — | — | — | 11.2 | — | — | ||||||||||||||||||||

(Gain) on Canal Street accident, net | — | — | (6.0 | ) | (29.2 | ) | (8.1 | ) | — | |||||||||||||||||

Transaction-related costs | — | 62.7 | — | — | — | — | ||||||||||||||||||||

Amortization of intangible assets | 15.7 | 5.0 | 26.9 | 49.9 | 12.9 | 12.5 | ||||||||||||||||||||

Income (loss) from operations | 104.5 | (34.3 | ) | 113.1 | 259.0 | 59.1 | 63.3 | |||||||||||||||||||

Non-operating income (expense): | ||||||||||||||||||||||||||

Interest expense, net (6) | (61.5 | ) | (21.0 | ) | (109.8 | ) | (254.3 | ) | (64.1 | ) | (58.2 | ) | ||||||||||||||

Other income (expense), net | (3.8 | ) | (0.4 | ) | 5.7 | (5.3 | ) | (2.9 | ) | (2.2 | ) | |||||||||||||||

Income (loss) before income taxes | 39.2 | (55.7 | ) | 9.0 | (0.6 | ) | (7.9 | ) | 2.9 | |||||||||||||||||

Provision (benefit) for income taxes | 16.3 | (16.1 | ) | 9.2 | (0.9 | ) | (0.5 | ) | 2.7 | |||||||||||||||||

Net income (loss) | $ | 22.9 | $ | (39.6 | ) | $ | (0.2 | ) | $ | 0.3 | $ | (7.4 | ) | $ | 0.2 | |||||||||||

(dollars in millions) | Year Ended March 31, 2009 (1)(2) | Year Ended March 31, 2010 (1) | Year Ended March 31, 2011 | |||||||||

Statement of Operations: | ||||||||||||

Net Sales | $ | 1,882.0 | $ | 1,510.0 | $ | 1,699.6 | ||||||

Cost of Sales | 1,290.1 | 994.4 | 1,102.8 | |||||||||

Gross Profit | 591.9 | 515.6 | 596.8 | |||||||||

Selling, General and Administrative Expenses | 467.8 | 297.7 | 329.1 | |||||||||

Intangible Impairment Charges | 422.0 | — | — | |||||||||

Restructuring and Other Similar Costs | 24.5 | 6.8 | — | |||||||||

Amortization of Intangible Assets | 48.9 | 49.7 | 48.6 | |||||||||

(Loss) Income from Operations | (371.3 | ) | 161.4 | 219.1 | ||||||||

Non-Operating Income (Expense): | ||||||||||||

Interest Expense, net | (230.4 | ) | (194.2 | ) | (180.8 | ) | ||||||

Gain (Loss) on debt extinguishment | 103.7 | 167.8 | (100.8 | ) | ||||||||

Other (Expense) Income, net | (3.0 | ) | (16.4 | ) | 1.1 | |||||||

(Loss) Income Before Income Taxes | (501.0 | ) | 118.6 | (61.4 | ) | |||||||

(Benefit) Provision for Income Taxes | (72.0 | ) | 30.5 | (10.1 | ) | |||||||

Net (Loss) Income | $ | (429.0 | ) | $ | 88.1 | $ | (51.3 | ) | ||||

Other Data: | ||||||||||||

Net Cash (Used for) Provided by: | ||||||||||||

Operating Activities | 155.0 | 155.5 | 164.5 | |||||||||

Investing Activities | (54.5 | ) | (22.0 | ) | (35.5 | ) | ||||||

Financing Activities | 36.6 | (161.5 | ) | (6.9 | ) | |||||||

Depreciation and Amortization of Intangible Assets | 109.6 | 109.3 | 106.1 | |||||||||

Capital Expenditures | 39.1 | 22.0 | 37.6 | |||||||||

14

| Predecessor (1) | Successor | |||||||||||||||||||||

| Year Ended March 31, 2006 (2) | Period from April 1, 2006 through July 21, 2006 | Period from July 22, 2006 through March 31, 2007 (3) | Year Ended March 31, 2008 (4) | Three Months Ended June 30, 2007 | Three Months Ended June 28, 2008 | |||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||

Net income (loss) per share: | ||||||||||||||||||||||

Basic | ||||||||||||||||||||||

Diluted | ||||||||||||||||||||||

Weighted-average number of shares outstanding: | ||||||||||||||||||||||

Basic | ||||||||||||||||||||||

Effect of dilutive stock options | ||||||||||||||||||||||

Diluted | ||||||||||||||||||||||

Other Data: | ||||||||||||||||||||||

Net cash provided by (used for): | ||||||||||||||||||||||

Operating activities | 91.9 | (4.4 | ) | 63.4 | 232.7 | 33.1 | 19.0 | |||||||||||||||

Investing activities | (336.1 | ) | (15.7 | ) | (1,925.5 | ) | (121.6 | ) | (8.3 | ) | (10.1 | ) | ||||||||||

Financing activities | 240.6 | 8.2 | 1,909.0 | (15.6 | ) | (12.4 | ) | (0.1 | ) | |||||||||||||

Depreciation and amortization of intangible assets | 58.7 | 19.0 | 63.0 | 104.1 | 27.0 | 27.1 | ||||||||||||||||

Capital expenditures | 37.1 | 11.7 | 28.0 | 54.9 | 8.3 | 11.0 | ||||||||||||||||

| Twelve Months Ended June 28, 2008 | ||||||||||||||||||||||

Adjusted EBITDA (7) | $ | 389.6 | ||||||||||||||||||||

| As of June 28, 2008 | ||||||||||||||||||||||

| Actual (4) | As Adjusted (10) | |||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||||

Cash | $ | 165.5 | $ | |||||||||||||||||||

Working capital (8) | 476.3 | |||||||||||||||||||||

Total assets | 3,839.0 | |||||||||||||||||||||

Total debt (9) | 2,550.1 | |||||||||||||||||||||

Stockholders’ equity | 280.8 | |||||||||||||||||||||

| March 31 | ||||||||||||

(dollars in millions) | 2009 | 2010 | 2011 | |||||||||

Balance Sheet Data: | ||||||||||||

Cash and Cash Equivalents | $ | 287.9 | $ | 263.9 | $ | 391.0 | ||||||

Working Capital (3) | 555.2 | 481.9 | 483.6 | |||||||||

Total Assets | 3,218.8 | 3,016.5 | 3,099.7 | |||||||||

Total Debt (4) | 2,526.1 | 2,215.5 | 2,314.1 | |||||||||

Stockholders’ Equity (Deficit) | (177.8 | ) | (57.5 | ) | (88.2 | ) | ||||||

| (1) | Financial data for fiscal 2009 and 2010 has been adjusted for our voluntary change in accounting for actuarial gains and losses related to our pension and other postretirement benefit plans. See Note 2 to our audited consolidated financial statements included elsewhere in this prospectus. |

| (2) | Consolidated financial data as of and for |

| (in millions) | Three Months Ended June 30, 2007 | Year Ended March 31, 2008 | Three Months Ended June 28, 2008 | Twelve Months Ended June 28, 2008 | ||||||||||

Net income | $ | (7.4 | ) | $ | 0.3 | $ | 0.2 | $ | 7.9 | |||||

Interest expense, net | 64.1 | 254.3 | 58.2 | 248.4 | ||||||||||

Provision (benefit) for income taxes | (0.5 | ) | (0.9 | ) | 2.7 | 2.3 | ||||||||

Depreciation and amortization | 27.0 | 104.1 | 27.1 | 104.2 | ||||||||||

EBITDA | $ | 83.2 | $ | 357.8 | $ | 88.2 | $ | 362.8 | ||||||

| (in millions) | Three Months Ended June 30, 2007 | Year Ended March 31, 2008 | Three Months Ended June 28, 2008 | Twelve Months Ended June 28, 2008 | ||||||||

Adjustments to EBITDA: | ||||||||||||

(Gain) on Canal Street facility accident, net | (8.1 | ) | (29.2 | ) | — | (21.1 | ) | |||||

Business interruption insurance recoveries related to fiscal 2008 (a) | 2.5 | 2.8 | — | 0.3 | ||||||||

Loss on divestiture (b) | — | 11.2 | — | 11.2 | ||||||||

Stock option expense | 1.8 | 7.4 | 1.8 | 7.4 | ||||||||

Impact of inventory fair value adjustment (c) | 19.0 | 20.0 | 1.6 | 2.6 | ||||||||

LIFO income (d) | (14.3 | ) | (9.5 | ) | 1.9 | 6.7 | ||||||

CDSOA recovery (e) | — | (1.4 | ) | — | (1.4 | ) | ||||||

Other expense, net (f) | 2.9 | 6.7 | 2.2 | 6.0 | ||||||||

Subtotal (g) | $ | 374.5 | ||||||||||

Other senior secured facility adjustments: | ||||||||||||

Business interruption insurance recoveries related to fiscal 2007 (h) | — | 8.3 | — | 8.3 | ||||||||

Pro forma adjustments to give full year effect to the acquisition of GA (i) | 1.8 | 8.6 | — | 6.8 | ||||||||

Adjusted EBITDA | $ | 389.6 | ||||||||||

| Three Months Ended June 30, 2007 | Year Ended March 31, 2008 | Three Months Ended June 28, 2008 | Twelve Months Ended June 28, 2008 | |||||||||||||

Management fee expense | $ | 0.8 | $ | 3.0 | $ | 0.8 | $ | 3.0 | ||||||||

Losses on sales of fixed assets | 0.1 | 0.3 | 0.3 | 0.5 | ||||||||||||

Foreign currency transaction losses | 2.5 | 5.1 | 1.1 | 3.7 | ||||||||||||

Equity in earnings of unconsolidated subsidiaries | (0.2 | ) | (1.1 | ) | 0.2 | (0.7 | ) | |||||||||

Miscellaneous income | (0.3 | ) | (0.6 | ) | (0.2 | ) | (0.5 | ) | ||||||||

| $ | 2.9 | $ | 6.7 | $ | 2.2 | $ | 6.0 | |||||||||

| Represents total current assets less total current liabilities. |

| Total debt represents long-term debt plus the current portion of long-term debt. |

In addition to net (loss) income, we believe Adjusted EBITDA is an important measure under our senior secured credit facilities, as our ability to incur certain types of acquisition debt or subordinated debt, make certain types of acquisitions or asset exchanges, operate our business and make dividends or other distributions, all of which will impact our financial performance, is impacted by our Adjusted EBITDA, as our lenders measure our performance by comparing the ratio of our net senior secured bank debt to our Adjusted EBITDA. We reported Adjusted EBITDA of $335.7 million in fiscal 2011. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Covenant Compliance.”

15

Investing in our common stock involves a high degree of risk. You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before investing in our common stock. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition, results of operations or cash flows. Any of the following risks could materially and adversely affect our business, financial condition, results of operations or cash flows. In such a case, you may lose part or all of your original investment.

Risks Related to Our Business

Our substantial leverage exposes us to interest rate risk andindebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our obligations under our indebtedness.making debt service payments.

We are a highly leveraged company. As of March 31, 2008 and June 28, 2008 we had $2,536.8 million and $2,550.1 million of outstanding indebtedness, respectively, and our fiscal 2009 debt service payment obligations at March 31, 2008 were $175.2 million (including approximately $125.1 million of debt service on fixed rate obligations). Interest on our PIK Toggle senior indebtedness is currently paid in kind and this interest is not included in the debt service payment obligations. As of June 28, 2008, after giving pro forma effect to this offering and the use of the net proceeds therefrom, we would have had $2,024.1 million of outstanding indebtedness. Our ability to generate sufficient cash flow from operations to make scheduled payments on our debt will depend on a range of economic, competitive and business factors, many of which are outside our control. Our business may not generate sufficient cash flow from operations to meet our debt service and other obligations, and currently anticipated cost savings and operating improvements may not be realized on schedule, or at all. If we are unable to meet our expenses and debt service and other obligations, we may need to refinance all or a portion of our indebtedness on or before maturity, sell assets or raise equity. Furthermore, Apollo has no obligation to provide us with debt or equity financing and we therefore may be unable to generate sufficient cash to service all of our indebtedness. We may not be able to refinance any of our indebtedness, sell assets or raise equity on commercially reasonable terms or at all, which could cause us to default on our obligations and impair our liquidity. Our inability to generate sufficient cash flow to satisfy our debt obligations or to refinance our obligations on commercially reasonable terms would have a material adverse effect on our business, financial condition, results of operations or cash flows.

Our substantial indebtedness could also have other important consequences with respect to our ability to manage our business successfully, including the following:

it may limit our ability to borrow money for our working capital, capital expenditures, debt service requirements, strategic initiatives or other purposes;

it may make it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under our senior secured credit facilities, the indentures governing our senior notes, senior subordinated notes and our other indebtedness;

a substantial portion of our cash flow from operations will be dedicated to the repayment of our indebtedness and so will not be available for other purposes;

it may limit our flexibility in planning for, or reacting to, changes in our operations or business;

we are and will continue to be more highly leveraged than some of our competitors which may place us at a competitive disadvantage;

it may make us more vulnerable to further downturns in our business or the economy;

it may restrict us from making strategic acquisitions, introducing new technologies or exploiting business opportunities; and

it, may limit, along with the financial and other restrictive covenants in the documents governing our indebtedness, among other things, may limit our ability to borrow additional funds or dispose of assets.

16

Furthermore, our interest expense could increase if interest rates increase because a portion of the debt under our senior secured credit facilities is unhedged variable-rate debt. For the last several quarters, interest rates have been subject to extreme volatility which may intensify this risk. Also, we may still incur significantly more debt, which could intensify the risks described above. See “DescriptionFor more information, see Note 10 to our audited consolidated financial statements included elsewhere in this prospectus.

Weak economic and financial market conditions have impacted our business operations and may adversely affect our results of Certain Indebtedness.”operations and financial condition.