INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Commission allows us to “incorporate by reference” into this prospectus the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information in documents that we subsequently file with the SEC. The addressCommission will automatically update and supersede information in this prospectus. We incorporate by reference into this prospectus the documents listed below and any future filings made by us with the Commission under Section 13(a), 13(c), 14 or 15(d) of the website is www.sec.gov.

CONSOLIDATED FINANCIAL STATEMENTS

Index

Amyris, Inc.

ReportExchange Act (other than those documents or the portions of Independent Registered Public Accounting Firm

To the Board of Directorsthose documents furnished and Stockholders of

Amyris, Inc.

In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of operations, of convertible preferred stock, redeemable noncontrolling interest and deficit, and of cash flows present fairly, in all material respects, the financial position of Amyris, Inc. and its subsidiaries at December 31, 2009 and December 31, 2008, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2009 in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statementsnot filed in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

As discussed in Note 2Commission rules) prior to the consolidated financial statements, the Company changed the manner in which it accounts for noncontrolling interest in 2009.

/s/ PricewaterhouseCoopers LLP

San Jose, California

April 16, 2010, except for the tenth

paragraphtermination of Note 19 to the

consolidated financial statements

as to which the date is

June 22, 2010

Amyris, Inc.

Consolidated Balance Sheets

In Thousands, Except Share and Per Share Amounts

| | | | | | | | | | | | | | | | |

| | | December 31,

2008 | | | December 31,

2009 | | | June 30,

2010 | | | Pro Forma

Stockholders’

Equity as of

June 30,

2010 | |

| | | | | | | | | (Unaudited) | | | (Unaudited) | |

Assets | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 17,899 | | | $ | 19,188 | | | $ | 112,242 | | | | | |

Short-term investments | | | 19,291 | | | | 48,022 | | | | 95,303 | | | | | |

Accounts receivable | | | 787 | | | | 1,372 | | | | 3,082 | | | | | |

Inventories | | | 1,420 | | | | 2,298 | | | | 2,728 | | | | | |

Prepaid expenses and other current assets | | | 1,556 | | | | 3,983 | | | | 3,664 | | | | | |

| | | | | | | | | | | | | | | | |

Total current assets | | | 40,953 | | | | 74,863 | | | | 217,019 | | | | | |

Property and equipment, net | | | 41,565 | | | | 42,560 | | | | 44,242 | | | | | |

Restricted cash | | | 2,748 | | | | 4,506 | | | | 4,520 | | | | | |

Long-term investments | | | 12,950 | | | | — | | | | 7,995 | | | | | |

Other assets | | | 607 | | | | 230 | | | | 31,212 | | | | | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 98,823 | | | $ | 122,159 | | | $ | 304,988 | | | | | |

| | | | | | | | | | | | | | | | |

Liabilities, Convertible Preferred Stock, Redeemable Noncontrolling Interest and Equity (Deficit) | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | |

Accounts payable | | $ | 2,617 | | | $ | 1,709 | | | $ | 2,507 | | | | | |

Deferred revenue | | | — | | | | 378 | | | | 565 | | | | | |

Accrued and other current liabilities | | | 5,083 | | | | 10,445 | | | | 11,959 | | | | | |

Capital lease obligation, current portion | | | 557 | | | | 2,251 | | | | 2,810 | | | | | |

Debt, current portion | | | 340 | | | | 9,018 | | | | 1,260 | | | | | |

| | | | | | | | | | | | | | | | |

Total current liabilities | | | 8,597 | | | | 23,801 | | | | 19,101 | | | | | |

Capital lease obligation, net of current portion | | | 3,041 | | | | 4,977 | | | | 4,605 | | | | | |

Long-term debt, net of current portion | | | 2,809 | | | | 4,362 | | | | 4,173 | | | | | |

Convertible preferred stock warrant liability | | | 2,132 | | | | 2,740 | | | | 3,281 | | | $ | — | |

Deferred rent, net of current portion | | | 12,154 | | | | 8,828 | | | | 8,450 | | | | | |

Deferred revenue | | | — | | | | — | | | | 1,412 | | | | | |

Restructuring liability | | | — | | | | 4,486 | | | | 4,335 | | | | | |

Other liabilities | | | 797 | | | | 1,553 | | | | 1,822 | | | | | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 29,530 | | | | 50,747 | | | | 47,179 | | | | | |

| | | | | | | | | | | | | | | | |

Commitments and contingencies (Note 5) | | | | | | | | | | | | | | | | |

Convertible preferred stock—$0.0001 par value, 16,104,641 authorized as of December 31, 2008, 21,080,641 shares authorized as of December 31, 2009 and 30,963,903 shares authorized as of June 30, 2010 (unaudited); 13,681,658 and 18,365,222 shares issued and outstanding as of December 31, 2008 and 2009, respectively (aggregate liquidation value of $126,225 and $185,566 as of December 31, 2008 and 2009, respectively); 28,487,517 shares issued and outstanding as of June 30, 2010 (unaudited) (aggregate liquidation value of $370,255) no shares issued and outstanding, pro forma (unaudited) | | | 121,436 | | | | 179,651 | | | | 391,411 | | | | — | |

Redeemable noncontrolling interest | | | — | | | | 5,506 | | | | 12,248 | | | | — | |

| | | | |

Stockholders’ Equity (Deficit): | | | | | | | | | | | | | | | | |

Common stock— $0.0001 par value; 28,000,000 and 33,000,000 shares authorized as of December 31, 2008 and 2009, respectively and 70,000,000 authorized as of June 30, 2010; 5,015,576 and 5,114,205 shares issued and outstanding as of December 31, 2008 and 2009, respectively and 5,271,249 shares issued and outstanding as of June 30, 2010 (unaudited); 70,000,000 shares authorized, 35,133,225 shares issued and outstanding, pro forma (unaudited) | | | 1 | | | | 1 | | | | 1 | | | | 4 | |

Additional paid-in capital | | | 3,164 | | | | 5,366 | | | | 9,758 | | | | 416,695 | |

Accumulated other comprehensive income (loss) | | | (468 | ) | | | 1,336 | | | | 916 | | | | 916 | |

Accumulated deficit | | | (55,989 | ) | | | (120,448 | ) | | | (156,544 | ) | | | (156,544 | ) |

| | | | | | | | | | | | | | | | |

Total Amyris, Inc. stockholders’ equity (deficit) | | | (53,292 | ) | | | (113,745 | ) | | | (145,869 | ) | | | 261,071 | |

| | | | | | | | | | | | | | | | |

Noncontrolling interest | | | 1,149 | | | | — | | | | 19 | | | | 19 | |

| | | | | | | | | | | | | | | | |

Total equity (deficit) | | | (52,143 | ) | | | (113,745 | ) | | | (145,850 | ) | | $ | 261,090 | |

| | | | | | | | | | | | | | | | |

Total liabilities, convertible preferred stock, redeemable noncontrolling interest and equity (deficit) | | $ | 98,823 | | | $ | 122,159 | | | $ | 304,988 | | | | | |

| | | | | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

Amyris, Inc.

Consolidated Statements of Operations

In Thousands, Except Share and Per Share Amounts

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | | | Six Months Ended June 30, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2009 | | | 2010 | |

| | | | | | | | | | | | (Unaudited) | |

Revenues | | | | | | | | | | | | | | | | | | | | |

Product sales | | $ | — | | | $ | 10,680 | | | $ | 61,689 | | | $ | 21,527 | | | $ | 19,982 | |

Collaborative research services | | | 6,046 | | | | 3,008 | | | | 2,919 | | | | 1,367 | | | | 1,401 | |

Government grants | | | 138 | | | | 204 | | | | — | | | | — | | | | 4,974 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 6,184 | | | | 13,892 | | | | 64,608 | | | | 22,894 | | |

| 26,357

|

|

Cost and operating expenses | | | | | | | | | | | | | | | | | | | | |

Cost of product sales | | | — | | | | 10,364 | | | | 60,428 | | | | 20,875 | | | | 20,132 | |

Research and development | | | 8,662 | | | | 30,306 | | | | 38,263 | | | | 17,510 | | | | 23,591 | |

Sales, general and administrative | | | 10,522 | | | | 16,622 | | | | 23,558 | | | | 9,274 | | | | 18,902 | |

Restructuring and asset impairment charges | | | — | | | | — | | | | 5,768 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total cost and operating expenses | | | 19,184 | | | | 57,292 | | | | 128,017 | | |

| 47,659

|

| | | 62,625 | |

| | | | | | | | | | | | | | | | | | | | |

Loss from operations | | | (13,000 | ) | | | (43,400 | ) | | | (63,409 | ) | | | (24,765 | ) | | | (36,268 | ) |

Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 1,178 | | | | 1,378 | | | | 448 | | | | 329 | | | | 562 | |

Interest expense | | | (28 | ) | | | (377 | ) | | | (1,218 | ) | | | (563 | ) | | | (760 | ) |

Other income (expense), net | | | 76 | | | | (144 | ) | | | (621 | ) | | | 221 | | | | (60 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total other income (expense) | | | 1,226 | | | | 857 | | | | (1,391 | ) | | | (13 | ) | | | (258 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (11,774 | ) | | | (42,543 | ) | | | (64,800 | ) | | | (24,778 | ) | | | (36,526 | ) |

Benefit from income taxes | | | — | | | | (207 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (11,774 | ) | | $ | (42,336 | ) | | $ | (64,800 | ) | | $ | (24,778 | ) | | $ | (36,526 | ) |

Loss attributable to noncontrolling interest | | | — | | | | (472 | ) | | | (341 | ) | | | (221 | ) | | | (430 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss attributable to Amyris, Inc. stockholders | | $ | (11,774 | ) | | $ | (41,864 | ) | | $ | (64,459 | ) | | $ | (24,557 | ) | | $ | (36,096 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss per share of common stock attributable to Amyris, Inc. stockholders, basic and diluted | | $ | (3.28 | ) | | $ | (9.91 | ) | | $ | (13.56 | ) | | $ | (5.27 | ) | | $ | (7.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average shares of common stock outstanding used in computing net loss per share of common stock, basic and diluted | | | 3,592,932 | | | | 4,223,533 | | | | 4,753,085 | | | | 4,661,704 | | | | 5,034,163 | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma net loss per share of common stock attributable to Amyris, Inc. stockholders, basic and diluted (unaudited) | | | | | | | | | | $ | (3.16 | ) | | | | | | $ | (1.36 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average shares of common stock outstanding used in computing pro forma net loss per share of common stock, basic and diluted (unaudited) | | | | | | | | | | | 20,279,433 | | | | | | | | 26,583,633 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

Amyris, Inc.

Consolidated Statements of Convertible Preferred Stock, Redeemable Noncontrolling Interest and Deficit

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Convertible

Preferred Stock | | | Redeemable

Noncontrolling

Interest | | | | | Common Stock | | Additional

Paid-in

Capital | | | Accumulated

Deficit | | | Accumulated

Other

Comprehensive

Income (Loss) | | | Noncontrolling

Interest | | | Total

Deficit | |

| (In Thousands, Except Share and Per Share Amounts) | | Shares | | Amount | | | | | Shares | | | Amount | | | | | |

January 1, 2007 | | 2,992,176 | | $ | 6,397 | | | $ | — | | | | | 4,503,917 | | | $ | 1 | | $ | 50 | | | $ | (2,351 | ) | | $ | — | | | $ | — | | | $ | (2,300 | ) |

Issuance of Series A convertible preferred stock at $2.174 per share for cash and services, net of issuance costs of $21 | | 6,482,824 | | | 14,073 | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of Series B convertible preferred stock at $24.88 per share for cash and services, net of issuance costs of $89 | | 1,517,093 | | | 37,656 | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of common stock upon exercise of stock options, net of restricted stocks | | — | | | — | | | | — | | | | | 361,723 | | | | — | | | 219 | | | | — | | | | — | | | | — | | | | 219 | |

Repurchase of common stock | | — | | | — | | | | — | | | | | (20,625 | ) | | | — | | | (2 | ) | | | — | | | | — | | | | — | | | | (2 | ) |

Stock-based compensation | | — | | | — | | | | — | | | | | — | | | | — | | | 546 | | | | — | | | | — | | | | — | | | | 546 | |

Components of other comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in unrealized gain on investments | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | — | | | | 10 | | | | — | | | | 10 | |

Net loss | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | (11,774 | ) | | | — | | | | — | | | | (11,774 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (11,764 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2007 | | 10,992,093 | | | 58,126 | | | | — | | | | | 4,845,015 | | | | 1 | | | 813 | | | | (14,125 | ) | | | 10 | | | | — | | | | (13,301 | ) |

Issuance of Series B convertible preferred stock at $24.88 per share for cash, net of issuance costs of $80 | | 150,724 | | | 3,670 | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of Series B-1 convertible preferred stock at $25.26 per share for cash, net of issuance costs of $2,746 | | 2,538,841 | | | 61,385 | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of warrants in connection with issuance of Series B-1 convertible preferred stock | | — | | | (1,745 | ) | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of common stock upon exercise of stock options, net of restricted stocks | | — | | | — | | | | — | | | | | 172,059 | | | | — | | | 326 | | | | — | | | | — | | | | — | | | | 326 | |

Repurchase of common stock | | — | | | — | | | | — | | | | | (1,498 | ) | | | — | | | (2 | ) | | | — | | | | — | | | | — | | | | (2 | ) |

Stock-based compensation | | — | | | — | | | | — | | | | | — | | | | — | | | 2,027 | | | | — | | | | — | | | | — | | | | 2,027 | |

Sale of noncontrolling interest | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | 1,621 | | | | 1,621 | |

Components of other comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in unrealized gain on investments | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | — | | | | 77 | | | | — | | | | 77 | |

Foreign currency translation adjustment | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | — | | | | (555 | ) | | | — | | | | (555 | ) |

Net loss | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | (41,864 | ) | | | — | | | | (472 | ) | | | (42,336 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (42,814 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2008 | | 13,681,658 | | | 121,436 | | | | — | | | | | 5,015,576 | | | | 1 | | | 3,164 | | | | (55,989 | ) | | | (468 | ) | | | 1,149 | | | | (52,143 | ) |

Issuance of Series B-1 convertible preferred stock at $25.26 per share for cash, net of issuance costs of $103 | | 76,880 | | | 1,840 | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of Series C convertible preferred stock at $12.46 per share for cash, net of issuance costs of $956 | | 4,606,684 | | | 56,443 | | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of warrants in connection with issuance of Series B-1 convertible preferred stock | | — | | | (68 | ) | | | — | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of common stock upon exercise of stock options, net of restricted stock | | — | | | — | | | | — | | | | | 127,515 | | | | — | | | 284 | | | | — | | | | — | | | | — | | | | 284 | |

Repurchase of common stock | | — | | | — | | | | — | | | | | (28,886 | ) | | | — | | | (9 | ) | | | — | | | | — | | | | — | | | | (9 | ) |

Stock-based compensation | | — | | | — | | | | — | | | | | — | | | | — | | | 3,299 | | | | — | | | | — | | | | — | | | | 3,299 | |

Proceeds from redeemable noncontrolling interest | | — | | | — | | | | 5,626 | | | | | — | | | | — | | | — | | | | — | | | | — | | | | — | | | | — | |

Purchase of noncontrolling interest | | — | | | — | | | | — | | | | | — | | | | — | | | (1,372 | ) | | | — | | | | — | | | | (928 | ) | | | (2,300 | ) |

Components of other comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in unrealized loss on investments | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | — | | | | (84 | ) | | | — | | | | (84 | ) |

Foreign currency translation adjustment | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | | — | | | | 1,888 | | | | — | | | | 1,888 | |

Net loss | | — | | | — | | | | (120 | ) | | | | — | | | | — | | | — | | | | (64,459 | ) | | | — | | | | (221 | ) | | | (64,680 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (62,876 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2009 | | 18,365,222 | | $ | 179,651 | | | $ | 5,506 | | | | | 5,114,205 | | | $ | 1 | | $ | 5,366 | | | $ | (120,448 | ) | | $ | 1,336 | | | $ | — | | | $ | (113,745 | ) |

Amyris, Inc.

Consolidated Statements of Convertible Preferred Stock, Redeemable Noncontrolling Interest and Deficit—(Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Convertible

Preferred Stock | | | Redeemable

Noncontrolling

Interest | | | | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | | Accumulated

Other

Comprehensive

Income (Loss) | | | Noncontrolling

Interest | | | Total

Deficit | |

| (In Thousands, Except Share and Per Share Amounts) | | Shares | | Amount | | | | | Shares | | | Amount | | | | | |

December 31, 2009 | | 18,365,222 | | $ | 179,651 | | | $ | 5,506 | | | | | 5,114,205 | | | $ | 1 | | $ | 5,366 | | $ | (120,448 | ) | | $ | 1,336 | | | $ | — | | | $ | (113,745 | ) |

Issuance of Series C convertible preferred stock at $12.46 per shares for cash, net of issuance costs of $5 (unaudited) | | 295,981 | | | 3,683 | | | | — | | | | | — | | | | — | | | — | | | — | | | | — | | | | — | | | | — | |

Issuance of Series C-1 convertible preferred stock at $17.56 per shares for cash, net of issuance costs of $68 (unaudited) | | 2,724,766 | | | 47,779 | | | | — | | | | | — | | | | — | | | — | | | — | | | | — | | | | — | | | | — | |

Issuance of Series D convertible preferred stock at $18.75 per shares for cash and deferred charge asset of $27,909, net of issuance costs of $258 (unaudited) | | 7,101,548 | | | 160,805 | | | | — | | | | | — | | | | — | | | — | | | — | | | | — | | | | — | | | | — | |

Issuance of warrants in connection with issuance of Series C convertible preferred stock (unaudited) | | — | | | (507 | ) | | | — | | | | | — | | | | — | | | — | | | — | | | | — | | | | — | | | | — | |

Issuance of common stock upon exercise of stock options, net of restricted stock (unaudited) | | — | | | — | | | | — | | | | | 22,707 | | | | — | | | 90 | | | — | | | | — | | | | — | | | | 90 | |

Repurchase of common stock (unaudited) | | — | | | — | | | | — | | | | | (10,367 | ) | | | — | | | — | | | — | | | | — | | | | — | | | | — | |

Shares issued from restricted stock unit settlement (unaudited) | | — | | | — | | | | — | | | | | 144,704 | | | | — | | | — | | | — | | | | — | | | | — | | | | — | |

Stock-based compensation (unaudited) | | — | | | — | | | | | | | | | — | | | | — | | | 4,302 | | | — | | | | | | | | | | | | 4,302 | |

Proceeds from noncontrolling interest (unaudited) | | — | | | — | | | | 7,041 | | | | | — | | | | — | | | — | | | — | | | | — | | | | 28 | | | | 28 | |

Components of other comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Change in unrealized loss on investments (unaudited) | | — | | | — | | | | — | | | | | — | | | | — | | | — | | | — | | | | (3 | ) | | | — | | | | (3 | ) |

Foreign currency translation adjustment (unaudited) | | — | | | — | | | | 121 | | | | | — | | | | — | | | — | | | — | | | | (417 | ) | | | — | | | | (417 | ) |

Net loss (unaudited) | | — | | | — | | | | (420 | ) | | | | — | | | | — | | | — | | | (36,096 | ) | | | — | | | | (9 | ) | | | (36,105 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive loss (unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (36,525 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

June 30, 2010 | | 28,487,517 | | $ | 391,411 | | | $ | 12,248 | | | | | 5,271,249 | | | $ | 1 | | $ | 9,758 | | $ | (156,544 | ) | | $ | 916 | | | $ | 19 | | | $ | (145,850 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

Amyris, Inc.

Consolidated Statements of Cash Flows

In Thousands

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | | | Six Months Ended June 30, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2009 | | | 2010 | |

| | | | | | | | | | | | (Unaudited) | |

Operating activities | | | | | | | | | | | | | | | | | | | | |

Net loss. | | $ | (11,774 | ) | | $ | (42,336 | ) | | $ | (64,800 | ) | | $ | (24,778 | ) | | $ | (36,526 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | | | | | | | | | | | | | |

Convertible preferred stock issued for services | | | 255 | | | | — | | | | — | | | | — | | | | — | |

Convertible preferred stock warrants | | | — | | | | 274 | | | | 62 | | | | — | | | | 33 | |

Depreciation and amortization | | | 634 | | | | 2,627 | | | | 5,775 | | | | 2,847 | | | | 3,421 | |

Loss on disposal of property and equipment | | | — | | | | 144 | | | | 12 | | | | — | | | | — | |

Loss on the sale of investments | | | — | | | | — | | | | — | | | | — | | | | (1 | ) |

Stock-based compensation | | | 546 | | | | 2,027 | | | | 3,299 | | | | 1,177 | | | | 4,302 | |

Amortization of premium (discount) on investments | | | 402 | | | | (400 | ) | | | 191 | | | | (30 | ) | | | 378 | |

Change in fair value of convertible preferred stock warrant liability | | | — | | | | 114 | | | | 445 | | | | (333 | ) | | | 34 | |

Restructuring and asset impairment charges | | | — | | | | — | | | | 356 | | | | — | | | | — | |

Other noncash expenses | | | — | | | | — | | | | 219 | | | | 157 | | | | 40 | |

Changes in assets and liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts receivable, net | | | — | | | | (787 | ) | | | (585 | ) | | | (5,042 | ) | | | (1,710 | ) |

Inventories | | | — | | | | (1,420 | ) | | | (878 | ) | | | (3,330 | ) | | | (430 | ) |

Prepaid expenses and other assets | | | (103 | ) | | | (1,943 | ) | | | 972 | | | | (536 | ) | | | (1,266 | ) |

Accounts payable | | | 114 | | | | 1,278 | | | | (997 | ) | | | (34 | ) | | | 735 | |

Restructuring | | | — | | | | — | | | | 5,078 | | | | — | | | | (359 | ) |

Accrued and other long-term liabilities | | | 2,303 | | | | 2,114 | | | | 4,470 | | | | 496 | | | | 1,440 | |

Deferred revenue | | | (1,903 | ) | | | (1,355 | ) | | | 378 | | | | 1,430 | | | | 1,599 | |

Deferred rent | | | — | | | | 784 | | | | 285 | | | | (407 | ) | | | (275 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash used in operating activities | | $ | (9,526 | ) | | $ | (38,879 | ) | | $ | (45,718 | ) | | $ | (28,383 | ) | | $ | (28,585 | ) |

| | | | | | | | | | | | | | | | | | | | |

Investing activities | | | | | | | | | | | | | | | | | | | | |

Purchase of short-term investments | | $ | (120,901 | ) | | $ | (48,153 | ) | | $ | (47,996 | ) | | $ | (8,284 | ) | | $ | (81,429 | ) |

Maturities of short-term investments | | | 88,258 | | | | 52,746 | | | | 31,690 | | | | 20,500 | | | | 18,061 | |

Sales of short-term investments | |

| 2,950

|

| | | 8,905 | | | | 250 | | | | — | | | | 15,708 | |

Purchases of long-term investments | | | (8,750 | ) | | | (6,200 | ) | | | — | | | | — | | | | (7,995 | ) |

Sales and maturities of long-term investments | | | — | | | | 2,000 | | | | — | | | | — | | | | — | |

Change in restricted cash | | | (736 | ) | | | (1,962 | ) | | | (1,758 | ) | | | (260 | ) | | | (14 | ) |

Purchase of property and equipment, net of disposals | | | (2,464 | ) | | | (21,996 | ) | | | (7,608 | ) | | | (4,256 | ) | | | (4,608 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) investing activities | | $ | (41,643 | ) | | $ | (14,660 | ) | | $ | (25,422 | ) | | $ | 7,700 | | | $ | (60,277 | ) |

| | | | | | | | | | | | | | | | | | | | |

Financing activities | | | | | | | | | | | | | | | | | | | | |

Proceeds from issuance of convertible preferred stock, net of issuance costs | | $ | 51,474 | | | $ | 65,055 | | | $ | 58,283 | | | $ | 1,845 | | | $ | 184,616 | |

Proceeds from issuance of common stock, net of repurchases | | | 217 | | | | 586 | | | | 113 | | | | 2 | | | | 70 | |

Purchase of noncontrolling interest | | | — | | | | — | | | | (2,300 | ) | | | (2,300 | ) | | | — | |

Proceeds from equipment financing | | | — | | | | 1,220 | | | | 4,763 | | | | 4,280 | | | | 1,446 | |

Principal payments on capital leases | | | (152 | ) | | | (378 | ) | | | (1,134 | ) | | | (447 | ) | | | (1,258 | ) |

Proceeds from debt | | | — | | | | — | | | | 9,643 | | | | 8,643 | | | | — | |

Principal payments on debt | | | — | | | | (125 | ) | | | (985 | ) | | | (276 | ) | | | (8,498 | ) |

Deferred offering costs | | | — | | | | — | | | | — | | | | — | | | | (1,446 | ) |

Proceeds from sale of noncontrolling interest | | | — | | | | 1,621 | | | | 3,090 | | | | — | | | | 7,069 | |

| | | | | | | | | | | | | | | | | | | | |

Net cash provided by financing activities | | $ | 51,539 | | | $ | 67,979 | | | $ | 71,473 | | | $ | 11,747 | | | $ | 181,999 | |

| | | | | | | | | | | | | | | | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | $ | — | | | $ | (555 | ) | | $ | 956 | | | $ | 214 | | | $ | (83 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 370 | | | | 13,885 | | | | 1,289 | | | | (8,722 | ) | | | 93,054 | |

Cash and cash equivalents at beginning of period | | | 3,644 | | | | 4,014 | | | | 17,899 | | | | 17,899 | | | | 19,188 | |

| | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 4,014 | | | $ | 17,899 | | | $ | 19,188 | | | $ | 9,177 | | | $ | 112,242 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

Amyris, Inc.

Consolidated Statements of Cash Flows—(Continued)

In Thousands

| | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | | | Six Months Ended June 30, | |

| | | 2007 | | 2008 | | 2009 | | | 2009 | | | 2010 | |

| | | | | | | | | | (Unaudited) | |

Supplemental disclosures of cash flow information: | | | | | | | | | | | | | | | | | | |

Cash paid for interest | | $ | 18 | | $ | 320 | | $ | 1,204 | | | $ | 557 | | | $ | 760 | |

| | | | | | | | | | | | | | | | | | |

Cash paid for income taxes, net of refunds | | $ | — | | $ | — | | $ | 27 | | | $ | 30 | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

Supplemental disclosure of noncash investing and financing activities: | | | | | | | | | | | | | | | | | | |

Convertible preferred stock issued for services | | $ | 255 | | $ | — | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

Stock receivable for noncontrolling interest | | $ | — | | $ | — | | $ | 2,536 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

Additions to property and equipment under capital lease obligations | | $ | 807 | | $ | 2,101 | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

Additions to property and equipment under notes payable | | $ | — | | $ | 3,274 | | $ | 1,038 | | | $ | 677 | | | $ | 211 | |

| | | | | | | | | | | | | | | | | | |

Additions to property and equipment under tenant improvement allowances | | $ | — | | $ | 11,370 | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

Acquisitions of assets under accounts payable | | $ | 411 | | $ | 731 | | $ | 20 | | | $ | 29 | | | $ | 529 | |

| | | | | | | | | | | | | | | | | | |

Financing of insurance premium under notes payable | | $ | — | | $ | — | | $ | 378 | | | $ | 378 | | | $ | 101 | |

| | | | | | | | | | | | | | | | | | |

Change in unrealized gain (loss) on investments | | $ | 10 | | $ | 77 | | $ | (84 | ) | | $ | (85 | ) | | $ | (3 | ) |

| | | | | | | | | | | | | | | | | | |

Asset retirement obligation | | $ | — | | $ | 470 | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | |

Warrants issued in connection with the issuance of convertible preferred stock | | $ | — | | $ | 1,745 | | $ | 68 | | | $ | 68 | | | $ | 507 | |

| | | | | | | | | | | | | | | | | | |

Accrued deferred offering costs | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | 1,546 | |

| | | | | | | | | | | | | | | | | | |

Accrued Series D preferred stock issuance costs | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | 258 | |

| | | | | | | | | | | | | | | | | | |

Financing of rent payments under notes payable | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | 239 | |

| | | | | | | | | | | | | | | | | | |

Deferred charge asset related to issuance of Series D preferred stock | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | 27,909 | |

| | | | | | | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

Amyris, Inc.

Notes to Consolidated Financial Statements

1. The Company and Basis of Presentation

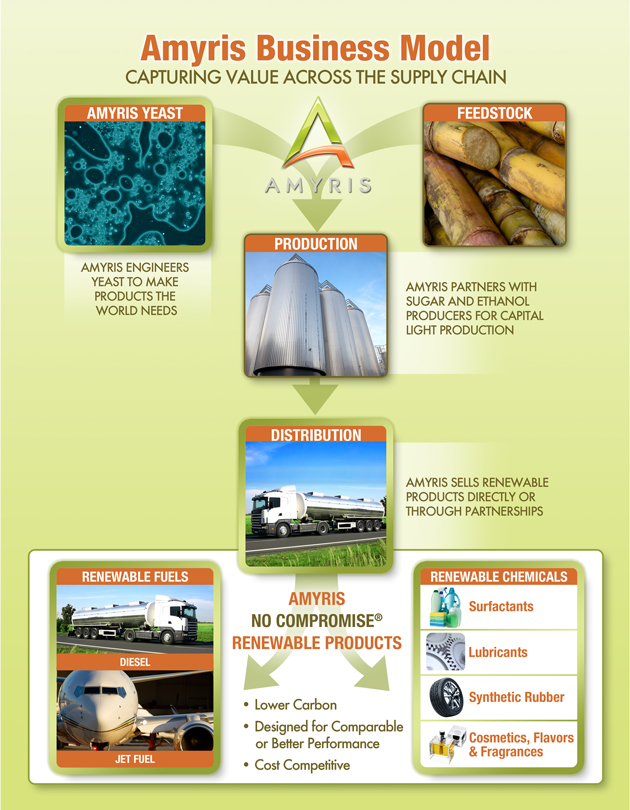

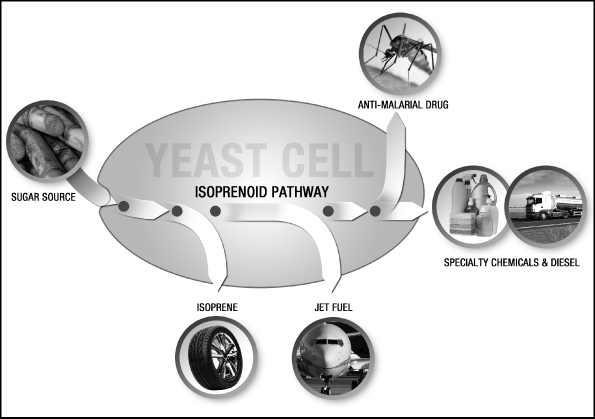

Amyris, Inc. (the “Company”) was incorporated in the State of California on July 17, 2003 for the purpose of leveraging breakthroughs in synthetic biology to develop and provide renewable compounds for a variety of markets. The Company is currently building and applying its industrial synthetic biology platform to provide alternatives to select petroleum-sourced products used in specialty chemical and transportation fuel markets worldwide. The Company’s first commercialization efforts have been focused on a molecule called farnesene, which forms the basis for a wide range of products varying from specialty chemical applications to transportation fuels, such as diesel. While the Company’s platform is able to use a wide variety of feedstocks, the Company has focused initially on Brazilian sugarcane. The Company intends to secure access to this feedstock and to expand its production capacity by working with existing sugar and ethanol mill owners to build new, adjacent bolt-on facilities at their existing mills in return for a share of the higher gross margin the Company believes it will realize from the sale of our renewable products. The Company’s first such arrangement is its joint venture with Usina São Martinho (see Note 19).

In February 2008, the Company incorporated a wholly owned subsidiary, Amyris Fuels, Inc., a Delaware corporation, which is engaged in marketing and distribution of certain fuels. In September 2008, the Company established a wholly owned subsidiary, Amyris Fuels, LLC, a Delaware limited liability company into which it merged Amyris Fuels, Inc. In March 2008, the Company formed a subsidiary, Amyris Pesquisa e Desenvolvimento de Biocombustíveis Ltda., for the purpose of manufacturing and trading transportation fuels from sugarcane feedstock in Brazil and abroad (see Note 16). In March 2008, the Company sold a 30% interest to Crystalsev and the subsidiary was renamed Amyris-Crystalsev Pesquisa e Desenvolvimento de Biocombustiveis Ltda. (“ACB”). The Company invested $3.8 million of cash for a 70% interest in ACB, and Crystalsev contributed $1.6 million of cash for the remaining 30% interest.

In April 2009, the Company re-purchased Crystalsev’s 30% interest in ACB for $2.3 million resulting in Amyris Brasil becoming a wholly-owned subsidiary again. The purchase of the noncontrolling interest was treated as an equity transaction and the fair value of the consideration paid of $2.3 million was recorded as a reduction of the carrying value of the noncontrolling interest and additional paid-in capital. In December 2009, ACB was renamed Amyris Brasil S.A.

On December 22, 2009, the Company sold a 4.8% interest in Amyris Brasil for BRL$10.0 million. The redeemable noncontrolling interest is reported in the mezzanine equity section of the consolidated balance sheet because the Company is subject to a contingent put option under which it may be required to repurchase an interest in Amyris Brasil from the noncontrolling interest holder.

In March 2010, the Company sold an incremental 3.4% interest in Amyris Brasil for BRL $3.0 million (unaudited). In May 2010, Amyris Brasil sold an additional 1,111,111 shares of its stock, an incremental 4.07% interest, for BRL $10.0 million (unaudited).

In 2010, the Company was awarded a $24.3 million “Integrated Bio-Refinery” grant from the U.S. Department of Energy (“DOE”). Under this grant, the Company is required to fund an additional $10.6 million in cost sharing expenses. According to the terms of the DOE grant, the Company is required to maintain a cash balance of $8.7 million, calculated as a percentage of the total project costs, to cover potential contingencies and cost overruns. These funds are not legally restricted but they must be available and unrestricted during the term of the project. The Company’s obligation for this cost share is contingent on reimbursement for project costs incurred. As of December 31, 2009, no amounts had been provided from the DOE. During the six months ended June 30, 2010 the Company recognized $5.0 million (unaudited) in revenue under this grant.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

2. Summary of Significant Accounting Policies

Basis of Presentation and Use of Estimates

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and includeoffering, including all adjustments necessary for the fair presentation of the Company’s consolidated financial position, results of operations and cash flows for the periods presented. The consolidated financial statements include the accounts of the Company, wholly- owned subsidiaries and one majority-owned subsidiary. All intercompany accounts and transactions have been eliminated in consolidation. In preparing the consolidated financial statements, management must make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as offilings made after the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Principals of Consolidations

The consolidated financial statements of the Company include the accounts of Amyris, Inc., its subsidiaries and variable interest entity (“VIE”) where the Company is considered the primary beneficiary, after elimination of intercompany accounts and transactions. Disclosure regarding the Company’s participation in VIE is included in Note 16.

Unaudited Interim Financial Information

The consolidated financial statements as of June 30, 2010, and for the six months ended June 30, 2010 and June 30, 2009 are unaudited. All disclosures as of June 30, 2010, and for the six month periods ended June 30, 2009 and June 30, 2010, presented in the notes to the financial statements are unaudited. The unaudited interim financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all normal recurring adjustments necessary for a fair statement of the Company’s financial position as of June 30, 2010 and results of operations and cash flows for the six months ended June 30, 2009 and June 30, 2010. The results of operations for the six months ended June 30, 2010 are not necessarily indicative of the results to be expected for the year ended December 31, 2010 or for other interim periods or for future years.

Unaudited Pro Forma Information

The June 30, 2010 unaudited pro forma stockholders’ equity has been prepared assuming that upon the completion of a qualifying initial public offering (i) all of the Company’s convertible preferred stock outstanding will automatically convert into shares of common stock, (ii) the Company’s convertible preferred stock warrants will become warrants for common stock (see Note 10), and (iii) shares of Amyris Brasil held by third parties will convert into shares of the Company’s common stock (see Note 16). The June 30, 2010 unaudited pro forma stockholders’ equity reflects the (i) the conversion of all 28,487,517 outstanding shares of preferred stock into 29,000,821 shares of common stock, the reclassification of the preferred stock warrant liability to additional paid-in capital and reclassification of redeemable noncontrolling interest to common stock and additional paid-in capital immediately prior to the completion of the initial public offering.

Significant Risks and Uncertainties

The Company is subject to certain risks and uncertainties that could have a material and adverse effect on the Company’s future financial position or results of operations. Factors that could affect the Company’s future operating results and cause actual results to vary materially from expectations include, but are not limited to, limited operating history, delays or greater than anticipated expenses associated with the completion of new production facilities and the time to complete scale up of production following completion of a new production

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

facility, disruptions in the production process at any facility where we produce our products, the timing, size and mix of sales to customers for our products, fluctuations in foreign currency exchange rates, gains or losses associated with our hedging activities, especially in Amyris Fuels, fluctuations in the price of and demand for ethanol, as well as petroleum-based and other products for which our products are alternatives, seasonal production and sale of our products, the effects of competitive pricing pressures, including decreases in average selling prices of our products, unanticipated expenses associated with changes in governmental regulations and environmental, health and safety requirements, reductions or changes to existing fuel and chemical regulations and policies, departure of executives or other key management employees, our ability to use our net operating loss carry forwards to offset future taxable income, our ability to integrate businesses that we may acquire and risks associated with the international aspects of our business.

Certain products developed by the Company may require approvals from the Environmental Protection Agency or other United States or international regulatory agencies prior to commercial sales. There can be no assurance the Company’s future products will receive the necessary approvals. If the Company was denied approval or approval was delayed, it may have a material adverse impact on the Company.

To achieve profitable operations, the Company must successfully develop, manufacture and market its products. There can be no assurance that any such products can be developed or manufactured at an acceptable cost and with appropriate performance characteristics, or that such products will be successfully marketed. These factors could have a material adverse effect upon the Company’s future financial results.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist primarily of cash and cash equivalents, short-term and long-term investments, accounts receivable, derivatives and financial instruments. The Company places its cash equivalents and investments with high credit quality financial institutions and, by policy, limits the amount of credit exposure with any one financial institution. Deposits held with banks may exceed the amount of insurance provided on such deposits. The Company has not experienced any losses on its deposits of cash and cash equivalents.

The Company’s accounts receivable are derived from customers located in the United States. The Company performs ongoing credit evaluation of its customers, does not require collateral, and maintains allowances for potential credit losses on customer accounts when deemed necessary. To date, there have been no such losses and the Company has not recorded an allowance for doubtful accounts.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

Customers representing greater than 10% of accounts receivable were as follows (in percentages):

| | | | | | |

| | | December 31, | | June 30, |

Customers AR | | 2008 | | 2009 | | 2010 |

| | | | | | | (Unaudited) |

Customer A | | 10 | | * | | 15 |

Customer B | | 15 | | * | | * |

Customer C | | * | | 51 | | * |

Customer D | | 12 | | * | | * |

Customer E | | * | | 17 | | * |

Customer F | | 14 | | * | | * |

Customer G | | 20 | | * | | * |

Customer H | | 26 | | * | | * |

Customer I | | * | | * | | 15 |

Customer J | | * | | * | | 23 |

Customer K | | * | | * | | 11 |

Customers representing greater than 10% of revenues were as follows (in percentages):

| | | | | | |

| | | Years Ended

December 31, | | Six Months Ended

June 30, |

Customers | | 2008 | | 2009 | | 2010 |

| | | | | | | (Unaudited) |

Customer A | | 33 | | 33 | | * |

Customer B | | 30 | | * | | * |

Customer C | | * | | 22 | | 40 |

Customer D | | 21 | | * | | * |

Customer E | | * | | * | | 12 |

The Company is exposed to counterparty credit risk on all of its derivative commodity instruments. The Company has established and maintains strict counterparty credit guidelines and enters into agreements only with counterparties that are investment grade or better. The Company does not require collateral under these agreements.

Fair Value of Financial Instruments

The Company measures certain financial assets and liabilities at fair value based on the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. Financial instruments are primarily comprised of commercial paper, government bonds and notes, auction rate securities (“ARS”), rights to sell its ARS (“Put Option”), derivatives and convertible preferred stock warrants. Where available, fair value is based on or derived from observable market prices or other observable inputs. Where observable prices or inputs are not available valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

The carrying amounts of the Company’s financial instruments, including cash and cash equivalents, accounts receivable, prepaid expenses, accounts payable and accrued liabilities, approximate fair value due to their relatively short maturities, and market interest rates if applicable. Based on the borrowing rates currently available to the Company for debt with similar terms, the carrying value of the notes payable and credit facility approximates its fair value. The carrying amount of the convertible preferred stock warrant liability represents its estimated fair value.

Cash and Cash Equivalents

All highly liquid investments purchased with an original maturity date of three months or less at the date of purchase are considered to be cash equivalents. Cash and cash equivalents consist of money market funds, commercial paper, U.S. Government agency securities and various deposit accounts.

Investments

Investments with original maturities greater than 90 days that mature less than one year from the consolidated balance sheet date are classified as short-term investments. The Company classifies investments as short-term or long-term based upon whether such assets are reasonably expected to be realized in cash or sold or consumed during the normal cycle of business. The Company invests its excess cash balances primarily in short- term investment grade commercial paper, U.S. Government agency securities and notes and ARS. The Company classifies all of its investments, other than ARS, as available-for-sale and records such assets at estimated fair value in the consolidated balance sheets, with unrealized gains and losses, if any, reported as a component of accumulated other comprehensive income (loss) in stockholders’ deficit. Debt securities are adjusted for amortization of premiums and accretion of discounts and such amortization and accretion are reported as a component of interest income. Realized gains and losses and declines in value that are considered to be other than temporary are recognized in the statements of operations. The cost of securities sold is determined on the specific identification method. There were no significant realized gains or losses from sales of debt securities during the years ended December 31, 2007, 2008 and 2009 and the six months ended June 30, 2010 (unaudited). As of December 31, 2008 and 2009 and June 30, 2010, the Company did not have any other-than-temporary declines in the fair value of its debt securities.

The Company classifies the ARS as trading securities and records all changes in fair value as component of other income (expense), net. The underlying securities have stated or contractual maturities that are generally greater than one year. The Company estimates the fair value of the ARS using a discounted cash flow model incorporating assumptions that market participants would use in their estimates of fair value. The Company has a Put Option to sell its ARS at par value. The Company has accounted for the Put Option as a freestanding financial instrument and elected to record it at fair value with changes in fair value recorded as a component of other income (expense), net (see Note 3).

Restricted Cash

Cash accounts that are restricted as to withdrawal or usage are presented as restricted cash. As of December 31, 2008 and 2009 and June 30, 2010, the Company had $2.7 million, $4.5 million and $4.5 million (unaudited), respectively, of restricted cash held by a bank in certificate of deposits as collateral for certain of its facility and capital lease agreements.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

Inventories

Inventories, which consist of ethanol, are stated at the lower of cost or market. Cost is computed on a first-in, first-out basis. Inventory costs include costs such as transportation and storage costs incurred in bringing the inventory to its existing location.

Derivative Instruments

The Company is exposed to market risks related to price volatility of ethanol. The Company makes limited use of derivative instruments, which include futures positions on the New York Mercantile Exchange and the CME/Chicago Board of Trade. The Company does not engage in speculative derivative activities, and the majority of the Company’s activity in derivative commodity instruments is intended to manage the financial risk posed by physical transactions and inventory. Changes in the fair value of the derivative contracts are recognized currently in the consolidated statements of operations as specific hedge accounting criteria are not met.

Asset Retirement Obligations

The fair value of the asset retirement obligation is recognized in the period in which it is incurred if a reasonable estimate of fair value can be made. In addition, the associated asset retirement cost is added to the carrying amount of the associated asset and this additional carrying amount is amortized over the life of the asset. The Company’s asset retirement obligations are associated with its commitment to return property subject to the operating lease in Brazil to its original condition upon lease termination.

As of December 31, 2008 and 2009 and June 30, 2010 the Company has recorded asset retirement obligations of $499,000, $746,000 and $762,000 (unaudited), respectively. The related leasehold improvements are being amortized to depreciation expense over the term of the lease or the useful life of the assets, whichever is shorter. Related amortization expense was $0, $106,000 and $175,000 for the years ended December 31, 2007, 2008 and 2009, respectively, and $102,000 (unaudited) for the six months ended June 30, 2010.

Property and equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation and amortization is computed using the straight-line method over the estimated useful lives of the related assets. Maintenance and repairs are charged to expense as incurred, and improvements and betterments are capitalized. When assets are retired or otherwise disposed of, the cost and accumulated depreciation are removed from the balance sheet and any resulting gain or loss is reflected in operations in the period realized.

Leasehold improvements are amortized on a straight-line basis over the terms of the lease, or the useful life of the assets, whichever is shorter. Depreciation and amortization periods for the Company’s property and equipment are as follows:

| | |

Furniture and office equipment

| | 5 years |

Computers and software

| | 3-5 years |

Research and laboratory equipment

| | 7 years |

Computers and software includes internal-use software that is acquired, internally developed or modified to meet the Company’s internal needs. Amortization commences when the software is ready for its intended use and the amortization period is the estimated useful life of the software, generally three to five years. Capitalized costs primarily include contract labor and payroll costs of the individuals dedicated to the development of internal-use

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

software. Capitalized software totaled approximately $0, $0.6 million, and $1.1 million as of December 31, 2007, 2008 and 2009, respectively, and $1.4 million (unaudited) as of June 30, 2010 related to software development costs pertaining to the installation of a new financial reporting system.

Impairment of Long-Lived Assets

The Company periodically reviews property and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset are impaired or the estimated useful lives are no longer appropriate. If indicators of impairment exist and the undiscounted projected cash flows associated with such assets are less than the carrying amount of the asset, an impairment loss is recorded to write the asset down to their estimated fair values. Fair value is estimated based on discounted future cash flows. Impairment charges of $0, $0 and $3,075,000 were recorded during the years ended December 31, 2007, 2008 and 2009, respectively, and zero (unaudited) for six months ended June 30, 2010.

Convertible Preferred Stock Warrant Liability

The Company accounts for its freestanding warrants for shares of the Company’s convertible preferred stock that are contingently redeemable as liabilities at fair value on the consolidated balance sheets. The warrants are subject to re-measurement at each balance sheet date and the change in fair value, if any, is recognized as other income (expense), net. The Company will continue to adjust the liability for changes in fair value until the earlier of (i) exercise of the warrants, (ii) conversion into warrants to purchase common stock, or (iii) expiration of the warrants. Upon conversion, the convertible preferred stock warrant liability will be reclassified to additional paid-in capital.

Convertible Preferred Stock

The holders of the Company’s outstanding convertible preferred stock, voting or consenting together as a separate class, control the vote of the Company’s stockholders. As a result, the holders of all series of the Company’s convertible preferred stock can force a change in control that would trigger liquidation. As redemption of the convertible preferred stock through liquidation is outside the control of the Company, all shares of convertible preferred stock have been presented outside of stockholders’ deficit in the Company’s consolidated balance sheets. All series of convertible preferred stock are collectively referred to in the consolidated financial statements as convertible preferred stock.

Noncontrolling Interest and Redeemable Noncontrolling Interest

As of January 1, 2009, the Company adopted the new accounting standard which establishes accounting and reporting standards for noncontrolling interests in consolidated financial statements. These provisions require that the carrying value of noncontrolling interests to be removed from the mezzanine equity section of the consolidated balance sheet and reclassified as equity, and that consolidated net income be recast to include net income attributable to the noncontrolling interests. The standard requires retrospective presentation and disclosure of existing noncontrolling interests. Accordingly, the Company presented noncontrolling interests as a separate component of equity (deficit) and has also presented net loss attributable to the noncontrolling interest in the consolidated statement of operations. Upon adoption, the noncontrolling interest of $1.1 million was reclassified to a component of total equity (deficit) in the consolidated balance sheet from the mezzanine equity section.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

In accordance with accounting and reporting standards for redeemable equity instruments, a noncontrolling interest with redemption features (“redeemable noncontrolling interest”), such as a put option, that is not solely within the control of the Company, is required to be reported in the mezzanine equity section of the consolidated balance sheet.

Changes in noncontrolling interest ownership that do not result in a change of control and where there is a difference between fair value and carrying value are accounted for as equity transactions.

On April 14, 2010, the Company entered into a joint venture with Usina São Martinho. The carrying value of noncontrolling interest from this joint venture is recorded in the equity section of the consolidated balance sheet (see Note 8).

Revenue Recognition

The Company recognizes revenue from the sale of ethanol and delivery of research and development services and governmental grants. Ethanol sales consists of sales to customers through purchase from third-party suppliers in which the Company takes physical control of the ethanol and accepts risk of loss. Revenue is recognized when all of the following criteria are met: persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the fee is fixed or determinable and collectability is reasonably assured.

If sales arrangements contain multiple elements, the Company evaluates whether the components of each arrangement represent separate units of accounting. To date the Company has determined that all revenue arrangements should be accounted for as a single unit of accounting.

Product Sales

The Company sells ethanol under short-term agreements at prevailing market prices. Revenues are recognized, net of discounts and allowances, once passage of title and risk of loss has occurred and contractually specified acceptance criteria have been met, provided all other revenue recognition criteria have also been met.

Collaborative Research Services

Revenue from collaborative research services is recognized as the services are performed consistent with the performance requirements of the contract. In cases where the planned levels of research services fluctuate over the research term, the Company recognizes revenue using the proportionate performance method based upon actual efforts to date relative to the amount of expected effort to be incurred by the Company. When up-front payments are received and the planned levels of research services do not fluctuate over the research term, revenue is recorded on a ratable basis over the arrangement term, up to the amount of cash received. When up-front payments are received and the planned levels of research services fluctuate over the research term, revenue is recorded using the proportionate performance method, up to the amount of cash received. Where arrangements include milestones that are determined to be substantive and at risk at the inception of the arrangement, revenue is recognized upon achievement of the milestone and is limited to those amounts whereby collectability is reasonably assured.

Government grants

Government grants are agreements that generally provide cost reimbursement for certain types of expenditures in return for research and development activities over a contractually defined period. Revenues

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

from government grants are recognized in the period during which the related costs are incurred, provided that the conditions under which the government grants were provided have been met and only perfunctory obligations are outstanding.

Cost of Product Sales

Cost of product sales consists primarily of cost of purchased ethanol, terminal fees paid for storage and handling, transportation costs between terminals and changes in the fair value of the derivative commodity instruments.

Shipping and handling costs charged to customers are recorded as revenues. Shipping costs are included in cost of product revenues. Such charges were not significant in any of the periods presented.

Costs of Start-Up Activities

Start-up activities are defined as those one-time activities related to opening a new facility, introducing a new product or service, conducting business in a new territory, conducting business with a new class of customer or beneficiary, initiating a new process in an existing facility, commencing some new operation or activities related to organizing a new entity All the costs associated with a potential site are expensed, until the site is considered viable by management, at which time costs would be considered for capitalization based on authoritative accounting literature.

Research and Development

Research and development costs are expensed as incurred and include costs associated with research performed pursuant to collaborative agreements. Research and development costs consist of direct and indirect internal costs related to specific projects as well as fees paid to other entities that conduct certain research activities on the Company’s behalf.

Income taxes

The Company accounts for income taxes under the asset and liability method, which requires, among other things, that deferred income taxes be provided for temporary differences between the tax basis of the Company’s assets and liabilities and their financial statement reported amounts. In addition, deferred tax assets are recorded for the future benefit of utilizing net operating losses and research and development credit carryforwards. A valuation allowance is provided against deferred tax assets unless it is more likely than not that they will be realized.

Effective January 1, 2007, the Company adopted the accounting guidance for uncertainties in income taxes, which prescribes a recognition threshold and measurement process for recording uncertain tax positions taken, or expected to be taken in a tax return, in the consolidated financial statements. Additionally, the guidance also prescribes new treatment for the derecognition, classification, accounting in interim periods and disclosure requirements for uncertain tax positions. The Company accrues for the estimated amount of taxes for uncertain tax positions if it is more likely than not that the Company would be required to pay such additional taxes. An uncertain tax position will not be recognized if it has a less than 50% likelihood of being sustained.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

Currency Translation

The functional currency of the Company’s majority-owned subsidiary in Brazil is the Brazilian real. Accordingly, asset and liability accounts of those operations are translated into United States dollars using the current exchange rate in effect at the balance sheet date and equity accounts are translated into United States dollars using historical rates. The revenues and expenses are translated using the average exchange rates in effect during the period, and gains and losses from foreign currency translation adjustments are included as a component of accumulated other comprehensive income (loss) in the consolidated balance sheets.

Comprehensive Income (Loss)

Comprehensive income (loss) represents all changes in stockholders’ deficit except those resulting from investments or contributions by stockholders. The Company’s unrealized gains and losses on available-for-sale securities and foreign currency translation adjustments represent the components of comprehensive income (loss) excluded from the Company’s net loss and have been disclosed in the consolidated statements of convertible preferred stock, redeemable noncontrolling interest and deficit for all periods presented.

The components of accumulated other comprehensive income (loss) are as follows (in thousands):

| | | | | | | | | | | | | | |

| | | December 31, | | June 30, |

| | | 2008 | | | 2009 | | 2009 | | | 2010 |

| | | | | | | | (Unaudited) |

Foreign currency translation adjustment | | $ | (555 | ) | | $ | 1,333 | | $ | (337 | ) | | $ | 916 |

Accumulated unrealized gain (loss) on investment | | | 87 | | | | 3 | | | (2 | ) | | | — |

| | | | | | | | | | | | | | |

Total accumulated other comprehensive income (loss) | | $ | (468 | ) | | $ | 1,336 | | $ | (339 | ) | | $ | 916 |

| | | | | | | | | | | | | | |

Stock-Based compensation

The Company accounts for stock-based compensation arrangements with employees using a fair value method which requires the recognition of compensation expense for costs related to all stock-based payments including stock options. The fair value method requires the Company to estimate the fair value of stock-based payment awards on the date of grant using an option pricing model. The Company uses the Black-Scholes pricing model to estimate the fair value of options granted that are expensed on a straight-line basis over the vesting period.

The Company accounts for stock options issued to nonemployees based on the estimated fair value of the awards using the Black-Scholes option pricing model. The Company accounts for restricted stock units, issued to nonemployees based on the estimated fair value of the Company’s common stock. The measurement of stock-based compensation is subject to periodic adjustments as the underlying equity instruments vest, and the resulting change in value, if any, is recognized in the Company’s consolidated statements of operations during the period the related services are rendered.

Net Loss per Share and Unaudited Pro Forma Net Loss per Share of Common Stock

Basic net loss per share of common stock is computed by dividing the Company’s net loss attributable to Amyris, Inc. stockholders by the weighted-average number of shares of common stock outstanding during the period. Diluted net loss per share of common stock is computed by giving effect to all potentially dilutive securities, including stock options, restricted stock units, warrants and convertible preferred stock. Basic and diluted net loss per share of common stock attributable to Amyris, Inc. stockholders was the same for all periods

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

presented as the inclusion of all potentially dilutive securities outstanding was anti-dilutive. As such, the numerator and the denominator used in computing both basic and diluted net loss are the same for each period presented.

The calculations for the unaudited pro forma basic and diluted net loss per share of common stock attributable to Amyris, Inc. stockholders assume the conversion of all outstanding shares of convertible preferred stock into shares of common stock, as if the conversions had occurred at the beginning of the period or the issuance date for Series B-1, Series C, Series C-1 and Series D convertible preferred stock issued during the year ended December 31, 2009 and the six months ended June 30, 2010 (unaudited), and the conversion of Amyris Brasil shares held by third parties. Also, the numerator in the pro forma basic and diluted net loss per share calculation has been adjusted to remove gains and losses resulting from re-measurements of the convertible preferred stock warrant liability as these measurements would no longer be required when the convertible preferred stock warrants become warrants to purchase shares of the Company’s common stock.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

The following table presents the calculation of historical and pro forma basic and diluted net loss per share of common stock attributable to Amyris, Inc. stockholders (in thousands, except share and per share amounts):

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2009 | | | 2010 | |

| | | | | | | | | | | | (Unaudited) | |

Actual: | | | | | | | | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | | | | | | | | |

Net loss attributable to Amyris, Inc. stockholders | | $ | (11,774 | ) | | $ | (41,864 | ) | | $ | (64,459 | ) | | $ | (24,557 | ) | | $ | (36,096 | ) |

| | | | | | | | | | | | | | | | | | | | |

Denominator: | | | | | | | | | | | | | | | | | | | | |

Weighted-average shares of common stock outstanding used in computing net loss per share of common stock, basic and diluted | | | 3,592,932 | | | | 4,223,533 | | | | 4,753,085 | | | | 4,661,704 | | | | 5,034,163 | |

| | | | | | | | | | | | | | | | | | | | |

Net loss per share of common stock attributable to Amyris, Inc. stockholders, basic and diluted | | $ | (3.28 | ) | | $ | (9.91 | ) | | $ | (13.56 | ) | | $ | (5.27 | ) | | $ | (7.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Pro Forma: | | | | | | | | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | | | | | | | | |

Net loss attributable to Amyris, Inc. stockholders | | | | | | | | | | $ | (64,459 | ) | | | | | | $ | (36,096 | ) |

| | | | | |

Less: Change in fair value of convertible preferred stock warrant liability (unaudited) | | | | | | | | | | | (445 | ) | | | | | | | (34 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss used in computing pro forma net loss per share of common stock attributable to Amyris, Inc. stockholders, basic and diluted (unaudited) | | | | | | | | | | $ | (64,014 | ) | | | | | | $ | (36,062 | ) |

| | | | | | | | | | | | | | | | | | | | |

Denominator: | | | | | | | | | | | | | | | | | | | | |

Weighted-average shares of common stock outstanding used in computing net loss per share of common stock, basic and diluted | | | | | | | | | | | 4,753,085 | | | | | | | | 5,034,163 | |

| | | | | |

Add: Pro forma adjustment to reflect weighted-average effect of assumed conversion of convertible preferred stock (unaudited) | | | | | | | | | | | 15,517,824 | | | | | | | | 21,049,293 | |

| | | | | |

Add: Pro forma adjustment to reflect weighted-average effect of conversion of Amyris Brasil shares (unaudited) | | | | | | | | | | | 8,524 | | | | | | | | 500,177 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average shares of common stock used in computing pro forma net loss per share of common stock, basic and diluted (unaudited) | | | | | | | | | | | 20,279,433 | | | | | | | | 26,583,633 | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma net loss per share of common stock attributable to Amyris, Inc. stockholders, basic and diluted (unaudited) | | | | | | | | | | $ | (3.16 | ) | | | | | | $ | (1.36 | ) |

| | | | | | | | | | | | | | | | | | | | |

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

The following outstanding shares of potentially dilutive securities were excluded from the computation of diluted net loss per share of common stock for the periods presented because including them would have been antidilutive:

| | | | | | | | | | |

| | | Years Ended December 31, | | Six Months Ended June 30, |

| | | 2007 | | 2008 | | 2009 | | 2009 | | 2010 |

| | | | | | | | | (Unaudited) |

Convertible preferred stock (as converted basis)* | | 11,171,110 | | 14,185,660 | | 18,878,526 | | 14,271,843 | | 29,000,821 |

Period-end stock options to purchase common stock | | 2,628,910 | | 3,628,169 | | 4,446,894 | | 3,513,088 | | 6,275,730 |

Period-end common stock subject to repurchase | | 964,525 | | 505,035 | | 132,038 | | 254,543 | | 47,695 |

Convertible preferred stock warrants (as converted basis)* | | — | | 129,272 | | 146,447 | | 133,580 | | 195,604 |

Period-end restricted stock units | | — | | 50,000 | | 50,000 | | 50,000 | | 31,568 |

| | | | | | | | | | |

Total | | 14,764,545 | | 18,498,136 | | 23,653,905 | | 18,223,054 | | 35,551,418 |

| | | | | | | | | | |

| * | | The convertible preferred stock and convertible preferred stock warrants were computed on an as converted basis using the conversion ratios in effect as of June 30, 2010 for all periods presented. See Note 9 for conversion ratios. |

Recent accounting pronouncements

In June 2009, the FASB issued a new accounting standard that requires a qualitative approach to identifying a controlling financial interest in a VIE and requires ongoing assessment of whether an interest in a VIE makes the holder the primary beneficiary of the VIE. The new accounting standard is effective for the Company on January 1, 2010. The adoption of the standard had no impact on the Company’s consolidated financial position, results of operations or cash flows.

In October 2009, the FASB issued a new accounting standard that changes the accounting for arrangements with multiple deliverables. Specifically, the new accounting standard requires an entity to allocate arrangement consideration at the inception of an arrangement to all of its deliverables based on their relative selling prices. In addition, the new standard eliminates the use of the residual method of allocation and requires the relative-selling-price method in all circumstances in which an entity recognizes revenue for an arrangement with multiple deliverables. In October 2009, the FASB also issued a new accounting standard that changes revenue recognition for tangible products containing software and hardware elements. Specifically, if certain requirements are met, revenue arrangements that contain tangible products with software elements that are essential to the functionality of the products are scoped out of the existing software revenue recognition accounting guidance and will be accounted for under these new accounting standards. Both standards will be effective for the Company in the first quarter of 2011. Early adoption is permitted. The Company is currently assessing the impact that the adoption of these standards will have on its consolidated financial statements.

In January 2010, the FASB issued an amendment to an accounting standard which requires new disclosures for fair value measures and provides clarification for existing disclosure requirements. Specifically, this amendment require an entity to disclose separately the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements and to describe the reasons for the transfers; and to disclose separately information about purchases, sales, issuances and settlements in the reconciliation for fair value measurements

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)

using significant unobservable inputs, or Level 3 inputs. This amendment clarifies existing disclosure requirements for the level of disaggregation used for classes of assets and liabilities measured at fair value and requires disclosure about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements using Level 2 and Level 3 inputs. The adoption of this amendment will not impact the Company’s consolidated financial statements.

In April 2010, the FASB issued an accounting standard update related to revenue recognition under the milestone method. The standard provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. Research or development arrangements frequently include payment provisions whereby a portion or all of the consideration is contingent upon milestone events such as successful completion of phases in a study or achieving a specific result from the research or development efforts. The amendments in this standards provide guidance on the criteria that should be met for determining whether the milestone method of revenue recognition is appropriate. The standard is effective for fiscal years and interim periods within those years beginning on or after June 15, 2010, with early adoption permitted, and applies to milestones achieved on or after that time. The Company is currently evaluating the impact of the implementation of this guidance on its consolidated financial statements.

3. Fair Value of Financial Instruments

Assets and liabilities recorded at fair value in the consolidated financial statements are categorized based upon the level of judgment associated with the inputs used to measure their fair value. Hierarchical levels which are directly related to the amount of subjectivity associated with the inputs to the valuation of these assets or liabilities are as follows:

Level 1—Observable inputs, such as quoted prices in active markets for identical assets or liabilities.

Level 2—Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Amyris, Inc.

Notes to Consolidated Financial Statements—(Continued)