As filed with the Securities and Exchange Commission on July 12,August 1, 2011

Registration No. 333-174493

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 23

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DELPHI AUTOMOTIVE PLC

(Exact Name of Registrant as Specified in Its Charter)

| | | | |

| Jersey | | 3714 | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

| | Courtney Road Hoath Way Gillingham, Kent ME8 0RU United Kingdom 011-44-163-423-4422 | | |

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

KEVIN P. CLARK

Vice President and Chief Financial

Officer

c/o Delphi Automotive LLP

5725 Delphi Drive

Troy, MI 48098

(248) 813-2000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| | | | |

David M. Sherbin Vice President, General Counsel, Secretary and Chief Compliance Officer c/o Delphi Automotive LLP 5725 Delphi Drive Troy, MI 48098 (248) 813-2000 | | Michael Kaplan Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 | | Richard B. Aftanas Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer x (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

| | | | |

| |

Title Of Each Class Of Securities To Be Registered | | Proposed Maximum

Aggregate Offering Price(1) | | Amount Of

Registration Fee(2)(3) |

Ordinary Shares, par value $0.01 per share | | $100,000,000 | | $11,610 |

| |

| |

| (1) | Includes offering price of additional shares, if any, that may be purchased by the underwriters. |

| (2) | Calculated pursuant to Rule 457(o) under the Securities Act based on an estimate of the maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated July 12,August 1, 2011.

SHARES

DELPHI AUTOMOTIVE PLC

Ordinary Shares

This is an initial public offering of ordinary shares of Delphi Automotive PLC.

Delphi Automotive PLC is offering of the shares to be sold in the offering. The selling shareholders identified in this prospectus are offering an additional shares. Delphi Automotive PLC will not receive any of the proceeds from the sale of the shares being sold by the selling shareholders.

Prior to this offering, there has been no public market for the ordinary shares. It is currently estimated that the initial public offering price per share will be between $ and $ . Delphi Automotive PLC intends to list the ordinary shares on The New York Stock Exchange under the symbol “DLPH”.

See “Risk Factors” on page 16 to read about factors you should consider before buying ordinary shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions (1) | | $ | | | | $ | | |

Proceeds, before expenses, to Delphi Automotive PLC | | $ | | | | $ | | |

Proceeds, before expenses, to the selling shareholders (1) | | $ | | | | $ | | |

| (1) | The selling shareholders will not pay any underwriting discount on the shares sold by them. In lieu thereof, Delphi Automotive PLC will pay a commission with respect to such shares to the underwriters. See “Underwriting.” |

To the extent that the underwriters sell more than ordinary shares, the underwriters have the option to purchase up to an additional shares from Delphi Automotive PLC and shares from the selling shareholders at the initial public offering price less the underwriting discount and any commissions payable by Delphi Automotive PLC.

The underwriters expect to deliver the shares against payment in New York, New York on , 2011.

| | | | |

| Goldman, Sachs & Co. | | J.P. Morgan |

| |

| BofA Merrill Lynch | | Barclays Capital |

| | | | |

| |

Citi | | Deutsche Bank Securities |

Morgan Stanley

| | | | | | | | |

| Baird | | Credit Suisse | | Lazard Capital Markets | | | UBS Investment Bank | |

| | | | | | | | |

| CRT Capital Group LLC | | Guggenheim Securities | | Houlihan Lokey | | | RBC Capital Markets | |

| | | | | | | | |

| Scotia Capital | | Ticonderoga Securities | | The Williams Capital Group, L.P. | | | UniCredit Capital Markets | |

Prospectus dated , 2011.

TABLE OF CONTENTS

Through and including , 2011 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

ABOUT THIS PROSPECTUS

In this prospectus, “Delphi,” the “Company,” the “Successor,” “we,” “us” and “our” refer to Delphi Automotive PLC, a public limited company which was formed under the laws of Jersey on May 19, 2011, together with the entities that will become its subsidiaries following the completion of this offering. Delphi Automotive PLC will, in connection with this offering, acquire all membership interests in Delphi Automotive LLP, a limited liability partnership incorporated under the laws of England and Wales which was formed on August 19, 2009 for the purpose of acquiring certain assets of the former Delphi Corporation. The former Delphi Corporation and, as the context may require, its subsidiaries and affiliates, are referred to herein as the “Predecessor” or “Old Delphi”. As the context may require, references to “Delphi”, “the Company”, “us”, “we” and “our” may also include the Predecessor.

We and the selling shareholders have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the selling shareholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling shareholders are offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares offered hereby.

The directors of the Company have taken all reasonable care to ensure that the facts stated in this prospectus are true and accurate in all material respects, and that there are no other facts the omission of which would make misleading any statement in this prospectus, whether of facts or of opinion. All the directors accept responsibility accordingly.

i

A copy of this document has been delivered to the registrar of companies in Jersey in accordance with Article 5 of the Companies (General Provisions) (Jersey) Order 2002, and he has given, and has not withdrawn, his consent to its circulation. The Jersey Financial Services Commission has given, and has not withdrawn, its consent under Article 2 of the Control of Borrowing (Jersey) Order 1958 to the issue of the ordinary shares. It must be distinctly understood that, in giving these consents, neither the registrar of companies in Jersey nor the Jersey Financial Services Commission takes any responsibility for the financial soundness of the Company or for the correctness of any statements made, or opinions expressed, with regard to it.

If you are in any doubt about the contents of this prospectus, you should consult your stockbroker, bank manager, solicitor, lawyer, accountant or other financial advisor.

MARKET AND INDUSTRY DATA

In this prospectus, we refer to information regarding market data obtained from internal sources, market research, publicly available information and industry publications, including industry data derived from information provided by J. D. Power & Associates, which we refer to as J. D. Power & Associates, and The Freedonia Group, Inc., Cleveland, OH, which we refer to as The Freedonia Group. Market share data included in this prospectus about our product lines and segments is based in large part on internal analyses as there is limited public information about such market share. We estimate the size of the applicable market based on our general market knowledge of our competitors and their capacities. We further estimate our market share and position based on our understanding regarding business awards to our competitors. Accordingly, figures for our market share are estimates. While we believe our estimates of market share to be accurate in all material respects, because this data is based on a number of estimates there can be no assurance that the actual market share data will not be materially different. Estimates are inherently uncertain, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. We believe that these sources and estimates are reliable but have not independently verified them.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that you should consider before deciding to invest in our ordinary shares. You should read this entire prospectus carefully, including the “Risk Factors” section and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included elsewhere in this prospectus.

Our Company

We are a leading global vehicle components manufacturer and provide electrical and electronic, powertrain, safety and thermal technology solutions to the global automotive and commercial vehicle markets. We are one of the largest vehicle component manufacturers, and our customers include the 25 largest automotive original equipment manufacturers (“OEMs”) in the world. We operate 110 manufacturing facilities and 15 major technical centers utilizing a regional service model that enables us to efficiently and effectively serve our global customers from low cost countries. We have a presence in 30 countries and have over 16,000 scientists, engineers and technicians focused on developing market relevant product solutions for our customers. In line with the growth in the emerging markets, we have been increasing our focus on these markets, in particular in China, where we have a major manufacturing base and strong customer relationships.

We believe we are well-positioned for growth from increasing global vehicle production volumes, increased demand for our Safe, Green and Connected products which are being added to vehicle content, and new business wins with existing and new customers. In order to transform its business portfolio and rationalize its cost structure, the former Delphi Corporation and certain of its U.S. subsidiaries filed for Chapter 11 protection in October 2005. As a result of the actions taken by the Predecessor and Delphi Automotive LLP’s continuing efforts following its acquisition of the majority of the Predecessor’s businesses in October 2009, we have substantially reduced our costs, aligned our product offerings with the faster-growing industry mega trends and re-aligned our manufacturing footprint into an efficient regional service model, allowing us to increase our profit margins. For the threesix months ended March 31,June 30, 2011, we generated revenue of $4.0$8.2 billion, net income of $310$626 million, and EBITDA (as defined in “Summary Historical Consolidated Financial Data” in this prospectus) of $529$1,073 million, with gross margins of 16.1%16.3% and EBITDA margins of 13.2%13.1%, and for the year ended December 31, 2010, we generated revenue of $13.8 billion, net income of $703 million, and EBITDA of $1.4 billion, with gross margins of 14.8% and EBITDA margins of 9.9%.

We believe the automotive industry is being shaped by increasing government regulations for vehicle safety, fuel efficiency and emissions control, as well as rapidly increasing consumer demand for connectivity. These industry mega trends, which we refer to as “Safe,” “Green” and “Connected,” are driving higher growth in products that address these trends than growth in the automotive industry overall. We have reorganized our business into four diversified segments, which enable us to develop solutions and manufacture highly-engineered products that enable our customers to respond to these mega trends:

| | • | | Electrical / Electronic Architecture—This segment provides complete design of the vehicle’s electrical architecture, including connectors, wiring assemblies and harnesses, electrical centers and hybrid power distribution systems. Our products provide the critical electrical and electronics backbone that supports increased vehicle content and electrification, reduced emissions and higher fuel economy through weight savings. For the threesix months ended March 31,June 30, 2011 and the year ended December 31, 2010, our revenues in this segment were $1,613$3,354 million and $5,620 million, respectively, and segment EBITDA was $240$457 million and $650 million, respectively, with EBITDA margins of 14.9%13.6% and 11.6%, respectively. |

| | • | | Powertrain Systems—This segment provides systems integration of full end-to-end gasoline and diesel engine management systems including fuel handling, fuel injection, combustion, electronic controls |

| | and test and validation capabilities. We design solutions to optimize powertrain power and performance while helping our customers meet new emissions and fuel economy regulations. For the threesix months ended March 31,June 30, 2011 and the year ended December 31, 2010, our revenues in this segment were $1,237$2,546 million and $4,086 million, respectively, and segment EBITDA was $132$320 million and $361 million, respectively, with EBITDA margins of 10.7%12.6% and 8.8%, respectively. |

| | • | | Electronics and Safety—This segment provides critical components, systems and advanced software for passenger safety, security, comfort and infotainment, as well as vehicle operation, including body controls, reception systems, audio/video/navigation systems, hybrid vehicle power electronics, displays and mechatronics. Our products integrate and optimize electronic content, which improves fuel economy, reduces emissions, increases safety and provides occupant infotainment and connectivity. For the threesix months ended March 31,June 30, 2011 and the year ended December 31, 2010, our revenues in this segment were $762$1,526 million and $2,721 million, respectively, and segment EBITDA was $105$198 million and $247 million, respectively, with EBITDA margins of 13.8%13.0% and 9.1%, respectively. |

| | • | | Thermal Systems—This segment provides powertrain cooling and heating, ventilating and air conditioning (“HVAC”) systems, such as compressors, systems and controls, and heat exchangers for the vehicle markets. Our products improve the efficiency by which the powertrain and cabin temperatures are managed, which are critical factors in achieving increased fuel economy and reduced emissions. For the threesix months ended March 31,June 30, 2011 and the year ended December 31, 2010, our revenues in this segment were $449$922 million and $1,603 million, respectively, and segment EBITDA was $52$98 million and $109 million, respectively, with EBITDA margins of 11.6%10.6% and 6.8%, respectively. |

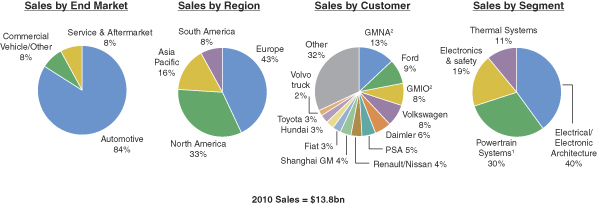

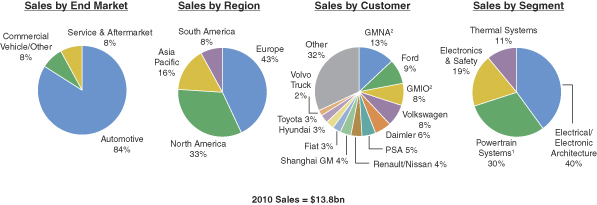

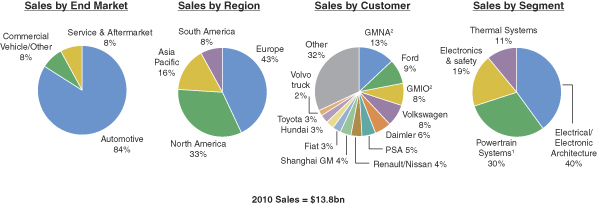

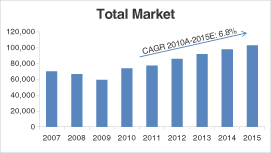

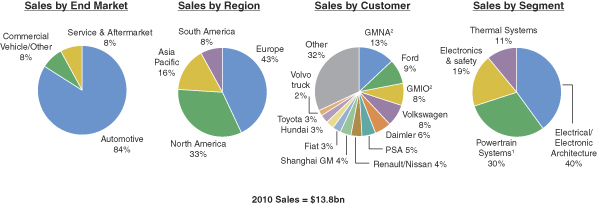

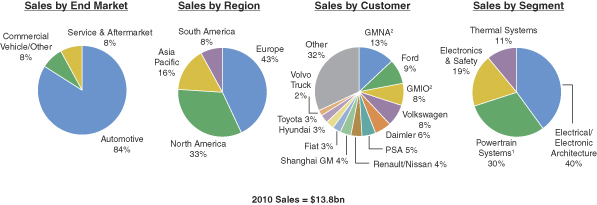

Our business is diversified across end-markets, regions, customers, vehicle platforms and products. Our customer base includes the 25 largest automotive OEMs in the world, and, in 2010, 24% of our net sales came from emerging markets (Asia Pacific and South America). Our six largest platforms in 2010 were with six different OEMs. In addition, in 2010 our products were found in 17 of the 20 top-selling vehicle models in the United States, in all of the 20 top-selling vehicle models in Europe and in 13 of the 20 top-selling vehicle models in China. We have further diversified our business by increasing our sales in the commercial vehicle market, which is typically on a different business cycle than the light vehicle market and has grown to 8% of our 2010 net sales. In addition, approximately 8% of our 2010 net sales arewere to the aftermarket, which meets the ongoing need for replacement parts required for vehicle servicing.

| (1) | Includes aftermarket sales, which comprised 8% of our 2010 revenue. |

| (2) | General Motors North America (“GMNA”) and General Motors International Operations (“GMIO”) are segments of General Motors Company (“GM”) and together represent 21% of our 2010 revenue. |

We have substantially restructured and transformed our business to achieve a lean cost structure and global footprint to compete profitably in our industry. Since 2005, we have reduced our product lines from 119 to 33, exited 11 businesses, closed over 70 sites, and decreased our global headcount, including temporary employees, by approximately 27%25%. As a result of our transformation, 91% of our hourly workforce is now located in low cost countries. In addition, approximately 30% of our hourly workforce is composed of temporary employees, making it easier for us to flex our workforce as volumes change. We no longer have any employees represented by the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (“UAW”). In addition, we do not have any significant U.S. defined benefit pension or workforce postretirement health care benefits or employer-paid postretirement basic life insurance benefits (“OPEB”) obligations.

We have established a worldwide design and manufacturing footprint with a regional service model that enables us to efficiently and effectively serve our global customers from low cost countries. This regional model is structured primarily to service the North American market from Mexico, the South American market from Brazil, the European market from Eastern Europe and North Africa, and the Asia Pacific market from China. Our global scale and regional service model enables us to engineer globally and execute regionally to serve the largest OEMs, which are seeking suppliers that can serve them on a worldwide basis. Our footprint also enables us to adapt to the regional design variations the global OEMs require and serve the emerging market OEMs.

Together, our cost reductions and re-alignment of our manufacturing footprint have substantially increased our profit margins and operational flexibility. Our business model is now designed to be profitable at all points in the normal automotive business cycle. For example, in 2010, we would have maintained positive EBITDA even if volumes were 30% below actual industry production volumes (or global production of 55 million vehicles rather than 78 million vehicles), assuming constant pricing and product and regional mix and based on our fixed cost structure in 2010 of approximately $3.2 billion and our variable costs which approximated two-thirds of sales in 2010; actual pricing, product and regional mix would likely differ in any future downturn. Our business model also has operating leverage, from which we believe we will benefit as our production volumes increase due to forecasted industry growth, content growth, and new business wins. We do not believe we will need to add substantial manufacturing capacity over the next several years to support this growth. We have had significant success winning new business with existing and new customers on both global platforms and on regional specific platforms. In 2010, we won business that we estimate will represent $20 billion of gross anticipated revenues based on expected volumes and assumed pricing. In the first quarterhalf of 2011, this trend accelerated, with another $6.6$14.4 billion in new business awards, based on expected volumes and assumed pricing. Actual results could vary if these assumptions prove incorrect. See “Risk Factors—Risks Related to Business Environment and Economic Conditions—Continued pricing pressures, OEM cost reduction initiatives and the ability of OEMs to re-source or cancel vehicle programs may result in lower than anticipated margins, or losses, which may have a significant negative impact on our business.” We believe our operating leverage will enable us to generate increased profitability and higher margins from these new business wins.

Our Industry

Demand for vehicle component parts from OEMs is generally a function of the number of vehicles produced and trends in content per vehicle, which can be affected by a number of factors including social, political and economic conditions.

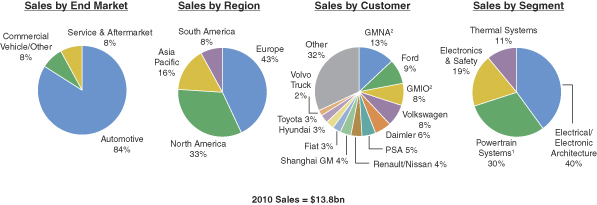

Recovery of Developed Markets and Continued Emerging Markets Growth

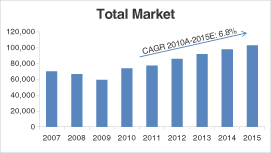

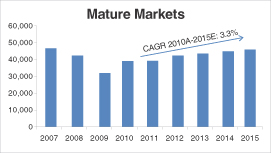

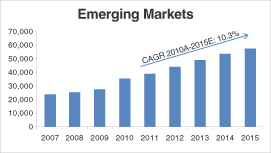

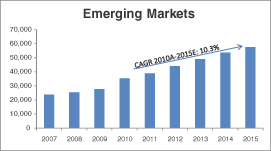

According to J.D. Power & Associates, global vehicle production is forecast to grow at a compound annual growth rate (“CAGR”) of 6.8% from 2010 to 2015. In the near term, the mature markets, including North America and Western Europe, are expected to grow at 3.3% from 2010 to 2015 for an increase of approximately 6.9 million units, while the emerging markets are forecast to grow at 10.3% during the same period, for an increase of approximately 22.2 million units. However, current OEM production volumes in North America and

Western Europe continue to be substantially less than OEM production volumes prior to the disruptions in the economic and credit markets experienced in 2008 and 2009. We expect that nearly half of our total future growth will be generated from emerging markets, especially China, which now represents a larger market for automotive components than either the United States or Japan. As a consequence of this shift in demand, many automotive manufacturing and supply companies have located operations in China and have entered into strategic partnerships and supply arrangements designed to support increased production. The total market and the relative growth in the emerging markets are shown in the illustrations below.

Source: J.D. Power & Associates

Note: Vehicles in thousands. “Mature markets” refers to Australia, Japan, South Korea, North America (including Mexico) and Western Europe. “Emerging markets” refers to the rest of the world.

Demand for Increased Safety

OEMs continue to focus on improving occupant and pedestrian safety in order to meet increasingly stringent regulatory requirements in various markets, such as the recent proposal by the U.S. National Highway Traffic Safety Administration to mandate rear view cameras in all vehicles by 2014. As a result, suppliers are focused on developing technologies aimed at protecting vehicle occupants when a crash occurs, as well as those that proactively mitigate the risk of a crash occurring. Examples of new and alternative technologies are lane departure warning systems and collision avoidance technologies, which incorporate sophisticated electronics and advanced software. According to The Freedonia Group, the value of safety and security electronics content globally is expected to grow (based on increasing production and increased content per vehicle) in excess of 13% CAGR from 2009 to 2014, a trend which favors suppliers with the ability to fulfill demand for these important components and systems.

Trend of Increased Fuel Efficiency and Reduced Emissions

OEMs also continue to focus on improving fuel efficiency and reducing emissions in order to meet increasingly stringent regulatory requirements in various markets. On a worldwide basis, the relevant authorities

in the European Union, the United States, China, India, Japan, Brazil, South Korea and Argentina have already instituted regulations requiring further reductions in emissions and/or increased fuel economy through 2014. In many cases, the same authorities have initiated legislation that would further tighten the standards through 2020 and beyond. Based on proposed European legislation, we believe OEMs may be required to reduce fleet average CO2 emissions for passenger cars by nearly 40% from 140 grams/kilometer, or approximately 39 miles/gallon, in 2008 to 85 grams/kilometer, or over 60 miles/gallon, by 2020. Based on the current regulatory environment, we believe that OEMs in other parts of the world, including the U.S. and China, will be subject to even greater reductions in CO2 emissions from their current levels over the next ten years. These standards will require meaningful innovation as OEMs and suppliers are forced to find ways to improve thermal management, engine management, electrical power consumption, vehicle weight and integration of alternative powertrains (e.g., electric/hybrid engines). According to The Freedonia Group, the value (i.e., the absolute dollar amount of demand, which may grow based on vehicle sales, more content per vehicle and higher prices for content) of powertrain and emissions electronics systems content globally, including fuel injection systems and engine management systems, is expected to grow (based on increasing production and increased content per vehicle) in excess of 11% CAGR from 2009 to 2014. We expect that as the market for these products expands, we will have the opportunity to obtain proportional growth in prices and margins in these areas, subject to competitive market dynamics.

Trend Towards Connectivity

The technology content of vehicles continues to increase as consumers demand greater safety, personalization, infotainment, productivity and convenience while driving. The automotive industry is focused on developing technologies designed to seamlessly integrate the highly complex electronic world in which automotive consumers live in the cars they drive, so that time in a vehicle is more productive and enjoyable. Advanced technologies offering mobile voice and data communication, while minimizing driver distraction, such as those used in our mobile electronics products coupled with global positioning systems and in-vehicle infotainment will continue to grow in importance. These and other related products are leading to higher electronic content per vehicle. According to The Freedonia Group, the value of OEM-installed infotainment systems globally, including communication and navigation equipment, backup monitors and heads up displays, entertainment systems, and other comfort and convenience systems are expected to increase (based on increasing production and increased content per vehicle) at CAGRs of approximately 20%, 28%, 10%, and 14%, respectively, from 2009 to 2014.

Standardization of Sourcing by OEMs

Many OEMs are adopting global vehicle platforms to increase standardization, reduce per unit cost and increase capital efficiency and profitability. As a result, OEMs are selecting suppliers that have the capability to manufacture products on a worldwide basis as well as the flexibility to adapt to regional variations. Suppliers with global scale and strong design, engineering and manufacturing capabilities, are best positioned to benefit from this trend. OEMs are also increasingly looking to their suppliers to simplify vehicle design and assembly processes to reduce costs. As a result, suppliers that sell vehicle components directly to manufacturers (Tier I suppliers) have assumed many of the design, engineering, research and development and assembly functions traditionally performed by vehicle manufacturers. Suppliers that can provide fully-engineered solutions, systems and pre-assembled combinations of component parts are positioned to leverage the trend toward system sourcing.

Our Competitive Strengths

Global Market Leader

We are one of the world’s largest vehicle component manufacturers. We estimate that we hold the #1 or #2 position in product categories representing over 70% of our 2010 net sales, including electrical/electronic

distribution systems, automotive connection systems, diesel engine management systems, and infotainment & driver interface. In addition, in 2010 our products were found in 17 of the 20 top-selling vehicle models in the United States, in all of the 20 top-selling vehicle models in Europe and in 13 of the 20 top-selling vehicle models in China.

Product Portfolio Tied to the Key Industry Mega Trends

Our product offerings satisfy the OEMs’ need to meet increasingly stringent government regulations and fulfill consumer preferences for products that address the mega trends of Safe, Green and Connected, leading to increased content per vehicle, greater profitability and higher margins. With these offerings, we are well-positioned to capitalize on demand for increased safety, fuel efficiency, emissions control and connectivity to the global information network. There has been a substantial increase in vehicle content and electrification requiring a complex and reliable electrical architecture and systems to operate, such as hybrid power electronics, electrical vehicle monitoring, lane departure warning systems, integrated electronic displays, navigation systems and consumer electronics. Our ability to design a reliable electrical architecture that optimizes power distribution and/or consumption is key to satisfying the OEMs’ need to reduce emissions while continuing to meet the demands of consumers. Additionally, our Powertrain Systems and Thermal Systems segments are also focused on addressing the demand for increased fuel efficiency and emission control by controlling fuel consumption and heat dissipation, which are principal factors influencing fuel efficiency and emissions.

Global and Diverse Customer Base

Our customer base includes the 25 largest automotive OEMs in the world. Our long-standing relationships with both the leading global OEMs and regional OEMs position us to benefit from the cyclical recovery in North America and Europe and secular growth in emerging markets. Our six largest platforms in 2010 were with six different OEMs. Our top five customers are Daimler AG (“Daimler”), Ford Motor Company (“Ford”), General Motors Company (“GM”), PSA Peugeot Citroën (“Peugeot”) and Volkswagen Group (“VW”), collectively representing 49% of our 2010 revenue, with our largest customer representing only 21% of our 2010 revenue. We have further diversified our business by increasing our sales in the commercial vehicle market, which is typically on a different business cycle than the light vehicle market and now representsrepresented 8% of our 2010 net sales. In addition, approximately 8% of our 2010 net sales arewere to the aftermarket.

We have substantially expanded our presence in emerging markets to enable us to capture the rapid growth principally in China, Brazil, India and Russia. Our presence in these countries will, for example, enable us to continue growing our market share among the regional automotive OEMs in these countries, including AVTOVAZ, Brilliance China, Changan, Chery, China FAW, Geely, Mahindra & Mahindra, Tata Motors and Ulyanovsk.

Global Manufacturing Footprint and Regional Service Model

We have a global manufacturing footprint and regional service model that enable us to efficiently and effectively operate from primarily low cost countries. We operate 110 manufacturing facilities and 15 major technical centers with a presence in 30 countries throughout the world. We have located these technical and manufacturing facilities in close proximity to our customers, enabling us to rapidly meet customer support requirements and satisfy regional variations in global vehicle platforms, while minimizing supply chain costs. Our global footprint enables us to serve the global OEMs on a worldwide basis along with gaining market share with the emerging market OEMs. This regional model has largely migrated to service the North American market out of Mexico, the South American market out of Brazil, the European market out of Eastern Europe and North Africa and the Asia Pacific market out of China.

Leading Supplier in the China Automotive Market

We have a strong presence in China, where we have operated for nearly 20 years. All of our business segments have operations and sales in China, where we employ approximately 21,000 people (including temporary workers), including approximately 2,800 scientists, engineers and technicians. Our strong engineering capabilities allow us to provide full product design and system integration to the regional OEMs.OEMs in China. As a result, we are a supplier to every major automotive OEM in China, with whom we have well-established relationships, with all of the major automotive OEMs in China, including: Brilliance China, Changan, Chery, China FAW, Geely, Shanghai General Motors and Shanghai Volkswagen. The Delphi brand is recognized by OEMs in China as a leading supplier, and we estimate that we hold the #1 or #2 position in product categories representing over 75% of our 2010 China revenues. We conduct our business through twofully consolidated, wholly-owned subsidiaries and 12 majority controlled joint ventures.ventures over which we have management control. Our local partners in the joint ventures are not our competitors. This legal entity structure gives us control over our strategy and operational activities in the region. We generated approximately $1.8 billion in revenue from China in 2010. In support of our growing revenue, we anticipate these subsidiariesour facilities in China will expand their operations with the addition of four new manufacturing sites over the next two years. This legal entity structure gives us control over our strategy and operational activities in the region and results in consolidation of revenue and earnings in our financial statements. We generated approximately $1.8 billion in revenue from China in 2010. With only 21 of our 33 offered products currently locally manufactured, we believe we have the opportunity to expand additional product lines into China, and as a result, we see further growth potential.

Lean and Flexible Cost Structure

We have a world-class, lean manufacturing system that allows us to provide customers with quality products and just-in-time delivery at competitive costs. In 2010, we largely completed our restructuring activities, resulting in a lower fixed cost base, improved manufacturing footprint and reduced overhead. We dramatically reduced our U.S. and Western European footprints, realigned our selling, general and administrative cost structure and increased the variable nature of our employee base. As a result, 91% of our hourly workforce is located in low cost countries. Furthermore, we have substantial operational flexibility by leveraging a large workforce of temporary workers, which represented approximately 30% of the hourly workforce as of March 31,June 30, 2011. We are focused on maintaining a low fixed cost base to minimize our EBITDA breakeven, which we estimate to be 30% below the current production volumes, assuming constant product mix and based on 2010 results. We believe that our lean cost structure will allow us to remain profitable at all points of the traditional vehicle industry production cycle.

World-Class Engineering Capabilities

Our history and culture of innovation have enabled us to develop significant intellectual property and design and development expertise to provide advanced technology solutions that meet the demands of our customers. We have a team of more than 16,000 scientists, engineers and technicians focused on developing leading product solutions for our key markets, located at 15 major technical centers in Brazil, China, France, Germany, India, Luxembourg, Mexico, Poland, South Korea, the United Kingdom and the United States. We invest approximately $1 billion annually in engineering to maintain our portfolio of innovative products, and currently own approximately 6,000 patents. We also encourage “open innovation” and collaborate extensively with peers in the industry, government agencies and academic institutions. Our technology competencies are recognized by both customers and government agencies, who have co-invested approximately $300 million of additional funds annually in new product development, increasing our total spend accordingly, accelerating the pace of innovation and reducing the risk associated with successful commercialization of technological breakthroughs. One example of co-investment is that we received an $89 million grant from the U.S. Department of Energy for reimbursement for up to 50% of the project costs associated with the development and manufacturing of power electronics related to electric and hybrid electric vehicles.

Our heritage includes the first factory installed radio, and we were a developer and designer of digital satellite radios, non-CFC refrigerant systems, high efficiency heat & mass exchangers, halogen free cables, dual

mode electronically scanning radar, gas direct injection, power electronics & high voltage architectures for hybrid electric vehicles and electric vehicles. We have been recognized for our long history of innovation as a winner of the prestigious Automotive News PACE Award. The Automotive News PACE awards honor superior innovation, technological advancement and business performance in the automotive industry and is judged by an independent panel of industry experts. Over the past two years we have been a winner three times and over the 17-year history of the PACE awards, we have received more awards than any other automotive supplier. In 2010, we launched approximately 800 new product programs around the globe. Our future pipeline has promise in collision mitigation with auto braking, electric cam phasing, software defined radio, 2-step continuous variable valvetrain, ammonia and particulate sensors, high power density inverter switches for hybrid electric vehicles and other Safe, Green and Connected solutions.

Significant Operating Leverage Leading to Higher Margins

Our business model has generated strong margins. We believe our operating leverage will enable us to generate increased profitability from higher OEM production volumes, increased content per vehicle and new business wins, and our profitability has been increasing with these trends. We generated gross margins of 16.1%16.3% for the threesix months ended March 31,June 30, 2011 as compared to 14.8% for the year ended December 31, 2010, and EBITDA margins of 13.2%13.1% as compared to 9.9% for the year ended December 31, 2010. Segment EBITDA margins were greater than 10% in each of our operating segments for the threesix months ended March 31,June 30, 2011.

Strong Cash Flow Generation and Balance Sheet

Our margins have also translated to strong cash flow generation. In 2010, we generated $781 million in cash flow before financing (which is defined as cash flows from operating activities and cash flows from investing activities (excluding investments in time deposits)). Furthermore, we have a strong balance sheet with gross debt of $2.5$2.2 billion and substantial liquidity of $2.5 billion as of March 31,June 30, 2011, (in each case after giving effect to the modification of our Credit Agreement and issuance of Senior Notes (each as defined and described below) on May 17, 2011), and no significant U.S. defined benefit or OPEB liabilities. We intend to maintain strong financial discipline targeting industry-leading earnings growth, cash flow generation and return on invested capital and to maintain sufficient liquidity to sustain our financial flexibility throughout the industry cycle.

Experienced Management Team

Our management team has significant experience, a deep understanding of the vehicle components industry and a firm focus on sustaining our leadership and financial strength. This team has been responsible for implementing the key operational restructuring initiatives that have positioned us for sustainable leadership in our industry with a strong and competitive financial profile. Key accomplishments since 2005 have included:

Aligning our portfolio with the mega trends—Safe, Green and Connected—by reducing our business units from 27 to 10 and our product lines from 119 to 33;

Diversifying our geographic, product and customer mix, resulting in only 33% of our 2010 net sales generated in the North American market and 21% from our largest customer;

Reducing our cost structure by repositioning 91% of our hourly workforce in low cost countries; reducing our manufacturing space by 62%, or 42 million square feet; and reducing total headcount by approximately 27%25%;

Sustaining our commitment to innovation by investing approximately $1 billion annually in engineering; and

Generating a record level of business bookings, including $20 billion in 2010 and $6.6$14.4 billion in the first quarterhalf of 2011.

Our Strategy

Our strategy is to develop and manufacture innovative market-relevant products for a diverse base of customers around the globe and leverage our lean and flexible cost structure to achieve strong earnings growth and returns on invested capital. Through our culture of innovation and world class engineering capabilities we will continue to employ our rigorous, forward-looking product development process to deliver new technologies that provide solutions to OEMs.

Leverage Our Engineering and Technological Prowess

We will continue to leverage our strong product portfolio tied to the industry’s key mega trends with our global footprint to increase our revenues. We remain committed to sustaining our substantial annual investment in research and development to maintain and enhance our leadership in each of our product lines. We expect to introduce new products and customized solutions that enable OEMs to meet the increasing fuel economy and emissions regulations as well as consumer demand for increased connectivity and active safety features. We will continue to focus on identifying the next market trends that we believe will position us to capture new growth.

Capitalize on Our Scale, Global Footprint and Established Position in Emerging Markets

We intend to generate sustained growth by capitalizing on the breadth and scale of our operating capabilities, our global footprint that provides us the important proximity to our customers’ manufacturing facilities and allows us to serve them in every region of the world in which they operate, and our established presence in high growth emerging markets.

We are one of only a few vehicle component manufacturers with the resources and scale of operations to provide our customers with complete end-to-end systems solutions. From the development and design of innovative new products, to world class engineering, manufacturing and supply-chain management capabilities, we have significant resources that we use to help our customers meet the changing demands of the market. We have engineering and production capabilities in every major auto-producing market in the world, including North America, South America, Europe and Asia. As a result, we are able to capitalize on the global standardization of vehicle platforms by the largest OEMs, while adapting our products for regional variations and regional OEMs.

We continue to expand our significant presence in emerging markets, positioning us to benefit from the expected growth opportunities in these regions. We will accomplish this by capitalizing on our long-standing relationships with the global OEMs and further enhancing our positions with the emerging market OEMs, thereby continuing to expand our worldwide leadership. We will continue to build upon our extensive geographic reach to capitalize on the fast-growing automotive markets, particularly in China, Brazil, India and Russia. We believe that our presence in low cost countries positions us to realize incremental margin improvements as the global balance of automotive production shifts towards the emerging markets.

Leverage Our Lean and Flexible Cost Structure to Deliver Profitability and Cash Flow

We recognize the importance of maintaining a lean and flexible cost structure in order to deliver stable earnings and cash flow in a cyclical industry. We intend to focus on maximizing manufacturing output to meet increasing production requirements with minimal additions to our fixed-cost base. We will continue to utilize a meaningful amount of temporary workers to ensure we have the appropriate operational flexibility to scale our operations so that we maintain our profitability as industry production levels increase or contract.

Target the Right Business with the Right Customers

We are strategic in pursuing new business and customers. We conduct in-depth analysis of market share and product trends by region in order to prioritize research, development and engineering spend for the customers that we believe will be successful. We collaborate with these customers in our 15 major technical centers around the world to help develop innovative product solutions for their needs. As more OEMs design vehicles for global platforms, where the same vehicle architecture is shared among different regions, we are well suited to provide global design and engineering support while manufacturing these products for a specific regional market. In addition we are disciplined in our pursuit of new business to ensure that we earn appropriate returns on capital. We have a rigorous internal approval process that requires senior executive review and approval to ensure consistency with our strategic and financial goals.

Pursue Selected Acquisitions and Strategic Alliances

Acquisitions and strategic alliances represent an important element of our business strategy and we believe we have the financial flexibility to pursue these opportunities with our current capital structure and liquidity profile. We believe that there are opportunities to grow through acquisitions, given the trend by OEMs to source globally and from a smaller number of suppliers, and that strategic alliances will allow us to pursue new opportunities faster and with less risk and investment. We intend to pursue selected transactions that leverage our technology capabilities, enhance our customer base, geographic penetration and scale to complement our current businesses. These complementary opportunities will provide us with access to new technologies, expand our presence in existing markets and enable us to establish a presence in adjacent markets.

Our History and Structure

On August 19, 2009, Delphi Automotive LLP, a limited liability partnership organized under the laws of England and Wales, was formed for the purpose of acquiring certain assets and subsidiaries of the Predecessor, which had filed for bankruptcy protection. At this time, three firms, GM and affiliates of Silver Point Capital and Elliott Management, agreed to take a controlling stake in Delphi Automotive LLP. These three equity holders had jointly established a plan to fund the restructuring and repositioning of the business. As a part of this plan, these equityholders established a board of proven senior executives to assist the management team in the continued restructuring of the business.

On October 6, 2009, Delphi Automotive LLP acquired the major portion of the business of the Predecessor, other than the global steering business, the U.S. manufacturing facilities in which the hourly employees were represented by the UAW and certain non-productive U.S. assets, and Delphi Automotive LLP issued membership interests to a group of investors consisting of lenders to the Predecessor, GM and the Pension Benefit Guaranty Corporation (the “PBGC”).

On May 19, 2011, Delphi Automotive PLC, a Jersey public limited company, was formed. Delphi Automotive PLC has nominal assets and no liabilities and has conducted no operations prior to completion of this offering. Immediately prior to the closing of this offering, it will acquire all of the outstanding unitsmembership interests of Delphi Automotive LLP from its existing unitequity holders in exchange for ordinary shares and, as a result, Delphi Automotive LLP will become a wholly-owned subsidiary of Delphi Automotive PLC. All historical financial information presented in this prospectus for periods subsequent to October 6, 2009 is that of Delphi Automotive LLP.

Recent Developments

On March 31, 2011, Delphi Automotive LLP redeemed the membership interests owned by GM and the PBGC for $3.8 billion and $594 million, respectively. In addition, on April 26, 2011, Delphi Automotive LLP amended its limited liability partnership agreement to adjust the distribution rights among the holders of the remaining classes of membership interests and to modify and normalize governance rights by eliminating special control rights held by affiliates of Silver Point Capital and Elliott Management to more closely reflect a typical public company.

On March 31, 2011, Delphi Corporation, a wholly-owned U.S. subsidiary of Delphi Automotive LLP, entered into a credit agreement (the “Credit Agreement”) with JPMorgan Chase Bank, N.A. that provided for a $500 million undrawn revolver and $2.5 billion in funded term loans, guaranteed by Delphi Automotive LLP and certain of its existing and future subsidiaries. The $2.5 billion in term loan proceeds, along with existing cash, were utilized to finance the redemptions of the membership interests owned by GM and PBGC and repayment of our 12.00% unsecured notes due 2014. On May 17, 2011, the Credit Agreement was modified to increase the amount of commitments on the revolver to $1.2 billion, to reduce the amount of the term loans to $1.2 billion and to reduce certain interest rates applicable to the term loans.

On May 17, 2011, Delphi Corporation issued $500 million of 5.875% senior notes due 2019 and $500 million of 6.125% senior notes due 2021 (collectively, the “Senior Notes”) in a transaction exempt from registration under Rule 144A and Regulation S of the Securities Act of 1933, as amended (the “Securities Act”). The Senior Notes are fully and unconditionally guaranteed, jointly and severally, by Delphi Automotive LLP and certain of its existing and future subsidiaries. The net proceeds of approximately $1.0 billion, together with cash on hand, were used to pay down amounts outstanding under the Credit Agreement.

Risks Affecting Us

Investing in securities involves substantial risk, and our business is subject to numerous risks and uncertainties. Investors should carefully consider the information set forth in this prospectus and, in particular the information under the heading “Risk Factors.”

Company Information

Our principal executive offices are located at Courtney Road, Hoath Way, Gillingham, Kent ME8 0RU, United Kingdomand our telephone number is 011-44-163-423-4422. Our register of members is kept at our registered office, which is Queensway House, Hilgrove Street, St Helier, Jersey JE1 1ES, Channel Islands.

Our internet address iswww.delphi.com. The information on our website and any other website that is referred to in this prospectus is not part of this prospectus.

THE OFFERING

| | |

| |

Ordinary shares offered by us | | shares |

| |

Ordinary shares offered by the selling shareholders | | shares |

| |

Total ordinary shares offered | | shares |

| |

Ordinary shares to be outstanding after this offering | | shares |

| |

Option to purchase additional shares | | shares from us and shares from the selling shareholders |

| |

Use of proceeds | | Our net proceeds from the offering will be approximately $ , or approximately $ if the underwriters exercise their option to purchase additional shares in full. We intend to use the net proceeds for general corporate purposes, primarily to fund our operations, to acquire capital equipment and to repay debt. We will not receive any proceeds from the ordinary shares being sold by the selling shareholders. |

| |

Dividend policy | | We do not intend to pay dividends on our ordinary shares. We plan to retain any earnings for use in the operation of our business and to fund future growth. |

| |

NYSE symbol | | We intend to list our ordinary shares on The New York Stock Exchange, or NYSE, under the symbol “DLPH”. |

Unless we specifically state otherwise and except for historical financial information, the information in this prospectus reflects or assumes our issuance of ordinary shares to Delphi Automotive LLP’s equityholders (assuming that the offering is priced at the midpoint of the range set forth on the cover of this prospectus) in connection with this offering in exchange for all of the equity interests in Delphi Automotive LLP, including shares issued to our directors who are holders of its Class E-1 membership interests and remaining shares issued to its other equityholders. A $1.00 increase (decrease) in the offering price, holding the number of shares offered constant, would increase (decrease) the number of shares issued to our existing equityholders to and the number of shares issued to our directors who are holders of its Class E-1 membership interests to .

Unless we specifically state otherwise, the information in this prospectus does not take into account:

the issuance of up to additional ordinary shares that the underwriters have the option to purchase from us; and

shares reserved for issuance pursuant to awards under our existing Management Value Creation Plan, or Value Creation Plan (which provides for issuances of equity and/or cash to members of our management based on the value of the Company at December 31, 2012, including the amounts used to repurchase unitsmembership interests of Delphi Automotive LLP prior to the date of this offering), based on an offering price at the midpoint of the range set forth on the cover of this prospectus. A $1.00 increase (decrease) in the offering price, holding the number of ordinary shares offered constant, would increase (decrease) the number of ordinary shares reserved for issuance under this plan by .

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

Delphi Automotive PLC was formed on May 19, 2011, has nominal assets and no liabilities and will conduct no operations prior to the completion of this offering. Accordingly, the following presents historical financial information for Delphi Automotive LLP, which will become a wholly-owned subsidiary of Delphi Automotive PLC immediately prior to completion of this offering.

The following selected consolidated financial data of the Successor and the Predecessor have been derived from the audited and unaudited consolidated financial statements of the Successor and the Predecessor and should be read in conjunction with, and are qualified by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Unaudited Pro Forma Condensed Consolidated Financial Information” and the consolidated financial statements and notes thereto included elsewhere in this prospectus.

| | | | Successor | | | | Predecessor(1) | | | Successor | | | | Predecessor(1) | |

| | | Three months

ended March 31, | | Year ended

December 31,

2010 | | | Period from

August 19 to

December 31,

2009 | | | | | Period from

January 1 to

October 6, 2009 | | | Year ended

December 31,

2008 | | | Six months

ended June 30, | | Year ended

December 31,

2010 | | | Period from

August 19 to

December 31,

2009 | | | | | Period from

January 1 to

October 6, 2009 | | | Year ended

December 31,

2008 | |

| | 2011 | | 2010 | | | 2011 | | 2010 | |

| | | (dollars in millions, except per share data) | | | | (dollars in millions, except per

share data) | | | (dollars in millions, except per share data) | | | | (dollars in millions, except per

share data) | |

Statements of operations data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 3,997 | | | $ | 3,410 | | | $ | 13,817 | | | $ | 3,421 | | | | | $ | 8,334 | | | $ | 16,808 | | | $ | 8,210 | | | $ | 6,856 | | | $ | 13,817 | | | $ | 3,421 | | | | | $ | 8,334 | | | $ | 16,808 | |

Depreciation and amortization | | | 117 | | | | 99 | | | | 421 | | | | 139 | | | | | | 540 | | | | 822 | | | | 233 | | | | 206 | | | | 421 | | | | 139 | | | | | | 540 | | | | 822 | |

Operating income (loss) | | | 412 | | | | 324 | | | | 940 | | | | (10 | ) | | | | | (1,118 | ) | | | (1,425 | ) | | | 840 | | | | 621 | | | | 940 | | | | (10 | ) | | | | | (1,118 | ) | | | (1,425 | ) |

Interest expense | | | (6 | ) | | | (8 | ) | | | (30 | ) | | | (8 | ) | | | | | — | | | | (434 | ) | | | (47 | ) | | | (16 | ) | | | (30 | ) | | | (8 | ) | | | | | — | | | | (434 | ) |

Reorganization items, net | | | — | | | | — | | | | — | | | | — | | | | | | 10,210 | | | | 5,147 | | | | — | | | | — | | | | — | | | | — | | | | | | 10,210 | | | | 5,147 | |

Income (loss) from continuing operations | | | 310 | | | | 235 | | | | 703 | | | | (3 | ) | | | | | 9,391 | | | | 3,163 | | | | 626 | | | | 468 | | | | 703 | | | | (3 | ) | | | | | 9,391 | | | | 3,163 | |

Net income (loss) | | | 310 | | | | 235 | | | | 703 | | | | (3 | ) | | | | | 9,347 | | | | 3,066 | | | | 626 | | | | 468 | | | | 703 | | | | (3 | ) | | | | | 9,347 | | | | 3,066 | |

Net income attributable to noncontrolling interests | | | 19 | | | | 20 | | | | 72 | | | | 15 | | | | | | 29 | | | | 29 | | | | 37 | | | | 39 | | | | 72 | | | | 15 | | | | | | 29 | | | | 29 | |

Net income (loss) attributable to Successor/Predecessor | | | 291 | | | | 215 | | | | 631 | | | | (18 | ) | | | | | 9,318 | | | | 3,037 | | | | 589 | | | | 429 | | | | 631 | | | | (18 | ) | | | | | 9,318 | | | | 3,037 | |

| | | | | | |

Net income (loss) per membership interests unit and per share data: (actual) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A net income (loss) per membership interests unit | | $ | 43.50 | | | $ | 21.50 | | | $ | 65.35 | | | $ | (1.80 | ) | | | | | — | | | | — | | | $ | 43.50 | | | $ | 42.90 | | | $ | 65.35 | | | $ | (1.80 | ) | | | | | — | | | | — | |

Class B net income (loss) per membership interests unit | | | 531.79 | | | | 394.22 | | | | 1,156.98 | | | | (33.00 | ) | | | | | — | | | | — | | | | 1,370.85 | | | | 786.60 | | | | 1,156.98 | | | | (33.00 | ) | | | | | — | | | | — | |

Class C net income (loss) per membership interests unit | | | 253.78 | | | | 376.25 | | | | 1,064.88 | | | | (31.50 | ) | | | | | — | | | | — | | | | 253.78 | | | | 750.75 | | | | 1,064.88 | | | | (31.50 | ) | | | | | — | | | | — | |

Class E-1 net income per membership interests unit | | | 40.42 | | | | — | | | | — | | | | — | | | | | | — | | | | ��� | | | | 63.40 | | | | — | | | | — | | | | — | | | | | | — | | | | — | |

Income (loss) from continuing operations attributable to Predecessor | | | — | | | | — | | | | — | | | | — | | | | | $ | 16.58 | | | $ | 5.55 | | | | — | | | | — | | | | — | | | | — | | | | | $ | 16.58 | | | $ | 5.55 | |

Loss from discontinued operations attributable to Predecessor | | | — | | | | — | | | | — | | | | — | | | | | | (0.08 | ) | | | (0.17 | ) | | | — | | | | — | | | | — | | | | — | | | | | | (0.08 | ) | | | (0.17 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic and diluted income (loss) per share attributable to Predecessor | | | — | | | | — | | | | — | | | | — | | | | | $ | 16.50 | | | $ | 5.38 | | | | — | | | | — | | | | — | | | | — | | | | | $ | 16.50 | | | $ | 5.38 | |

| | | | | | |

Per share data: (pro forma)(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations attributable to Successor | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from discontinued operations attributable to Successor | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) per share attributable to Successor | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares outstanding | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Other financial data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents (as of period end) | | $ | 1,633 | | | $ | 3,296 | | | $ | 3,219 | | | $ | 3,107 | | | | | $ | — | | | $ | 959 | | | $ | 1,322 | | | $ | 3,383 | | | $ | 3,219 | | | $ | 3,107 | | | | | $ | — | | | $ | 959 | |

Capital expenditures | | | 181 | | | | 93 | | | | 500 | | | | 88 | | | | | | 321 | | | | 771 | | | | 292 | | | | 179 | | | | 500 | | | | 88 | | | | | | 321 | | | | 771 | |

EBITDA(3) | | | 529 | | | | 423 | | | | 1,361 | | | | 129 | | | | | | (514 | ) | | | (211 | ) | | | 1,073 | | | | 827 | | | | 1,361 | | | | 129 | | | | | | (514 | ) | | | (211 | ) |

Adjusted EBITDA(3) | | | 538 | | | | 456 | | | | 1,633 | | | | 313 | | | | | | (229 | ) | | | 269 | | | | 1,090 | | | | 900 | | | | 1,633 | | | | 313 | | | | | | (229 | ) | | | 269 | |

EBITDA margin(4) | | | 13.2 | % | | | 12.4 | % | | | 9.9 | % | | | 3.8 | % | | | | | (6.2 | %) | | | (1.3 | %) | | | 13.1 | % | | | 12.1 | % | | | 9.9 | % | | | 3.8 | % | | | | | (6.2 | %) | | | (1.3 | %) |

Adjusted EBITDA margin(4) | | | 13.5 | % | | | 13.4 | % | | | 11.8 | % | | | 9.1 | % | | | | | (2.7 | %) | | | 1.6 | % | | | 13.3 | % | | | 13.1 | % | | | 11.8 | % | | | 9.1 | % | | | | | (2.7 | %) | | | 1.6 | % |

Net cash provided by (used in) operating activities | | $ | 156 | | | $ | 246 | | | $ | 1,142 | | | $ | 159 | | | | | $ | (257 | ) | | $ | 455 | | | $ | 499 | | | $ | 626 | | | $ | 1,142 | | | $ | 159 | | | | | $ | (257 | ) | | $ | 455 | |

Net cash provided by (used in) investing activities | | | 433 | | | | (98 | ) | | | (911 | ) | | | 885 | | | | | | (1,052 | ) | | | (958 | ) | | | 311 | | | | (260 | ) | | | (911 | ) | | | 885 | | | | | | (1,052 | ) | | | (958 | ) |

Net cash provided by (used in) financing activities | | | (2,204 | ) | | | 52 | | | | (126 | ) | | | 2,062 | | | | | | 315 | | | | 465 | | | | (2,757 | ) | | | (47 | ) | | | (126 | ) | | | 2,062 | | | | | | 315 | | | | 465 | |

| | | | Successor | | | Successor | |

| | | As of March 31, 2011 | | | As of June 30, 2011 | |

| | | Historical | | | As

adjusted(5) | | | As further

adjusted(6) | | | Historical | | | As

adjusted(5) | |

| | | (dollars in millions) | | | (dollars in millions) | |

Balance sheet and employment data: | | | | | | | | | | |

Cash and cash equivalents | | $ | 1,633 | | | $ | 1,336 | | | $ | | | | $ | 1,322 | | | $ | | |

Total assets | | $ | 9,724 | | | $ | 9,441 | | | $ | | | | $ | 9,627 | | | $ | | |

Total debt | | $ | 2,751 | | | $ | 2,468 | | | $ | | | | $ | 2,236 | | | $ | | |

Working capital(7)(6) | | $ | 1,453 | | | $ | 1,453 | | | $ | | | | $ | 1,444 | | | $ | | |

Owners’ equity | | $ | 1,907 | | | $ | 1,907 | | | $ | | | | $ | 2,242 | | | $ | | |

Global employees | | | 100,630 | | | | 100,630 | | | | 100,630 | | | | 101,000 | | | | 101,000 | |

| (1) | The Predecessor adopted the accounting guidance in Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) 852,Reorganizations, effective October 8, 2005 and has segregated in the financial statements for all reporting periods subsequent to such date and through the consummation of the transactions pursuant to the Modified Plan (as defined in “Note 1. General and Acquisition of Predecessor Businesses” to the audited consolidated financial statements included herein), transactions and events that were directly associated with the reorganization from the ongoing operations of the business. Our consolidated financial statements are not comparable to the consolidated financial statements of the Predecessor due to the effects of the consummation of the Modified Plan and the change in the basis of presentation. For more information, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| (2) | Reflects issuance of ordinary shares in exchange for Delphi Automotive LLP membership interests and ordinary shares in this offering. |

| (3) | Our management utilizes operating income before depreciation and amortization, including long-lived asset and goodwill impairment (“EBITDA”) to evaluate performance. EBITDA was used as a performance indicator for the threesix months ended March 31,June 30, 2011. |

“Adjusted EBITDA” means operating income before depreciation and amortization, including long-lived asset and goodwill impairment, transformation and rationalization charges related to plant consolidations, plant wind-downs and discontinued operations. Through December 31, 2010, our management relied on Adjusted EBITDA as a key performance measure. Our management believed that Adjusted EBITDA was a meaningful measure of performance and it was used by management and the Board of Managers of Delphi Automotive LLP to analyze Company and stand-alone segment operating performance and for planning and forecasting purposes. Effective January 1, 2011, our management began utilizing EBITDA as a key performance measure because our restructuring was substantially completed in 2010. EBITDA and Adjusted EBITDA should not be considered substitutes for results prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and should not be considered alternatives to net income (loss) attributable to Successor/Predecessor, which is the most directly comparable financial measure to EBITDA and Adjusted EBITDA that is in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA, as determined and measured by us, should also not be compared to similarly titled measures reported by other companies.

In the threesix months ended March 31,June 30, 2011, we reached a final customer commercial settlement that resulted in an unusual warranty expense of $76 million. This amount adversely affected EBITDA and Adjusted EBITDA in such period.

The reconciliation of Adjusted EBITDA to EBITDA includes other transformation and rationalization costs related to 1) the implementation of information technology systems to support finance, manufacturing and product development initiatives, 2) certain plant consolidations and closure costs and 3) consolidation of many staff administrative functions into a global business service group. The reconciliation of EBITDA and Adjusted EBITDA to net income (loss) attributable to Successor/Predecessor follows:

| | | | Successor | | | | Predecessor | | | Successor | | | | Predecessor | |

| | | Three months

ended March 31, | | Year ended

December 31,

2010 | | | Period from

August 19 to

December 31,

2009 | | | | | Period from

January 1 to

October 6,

2009 | | | Year ended

December 31,

2008 | | | Six months

ended June 30, | | Year ended

December 31,

2010 | | | Period from

August 19 to

December 31,

2009 | | | | | Period from

January 1 to

October 6,

2009 | | | Year ended

December 31,

2008 | |

| | 2011 | | 2010 | | | 2011 | | 2010 | |

| | | (in millions) | | | | (in millions) | | | (in millions) | | | | (in millions) | |

Adjusted EBITDA | | $ | 538 | | | $ | 456 | | | $ | 1,633 | | | $ | 313 | | | | | $ | (229 | ) | | $ | 269 | | | $ | 1,090 | | | $ | 900 | | | $ | 1,633 | | | $ | 313 | | | | | $ | (229 | ) | | $ | 269 | |

Transformation and rationalization charges: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Employee termination benefits and other exit costs | | | (9) | | | | (26 | ) | | | (224 | ) | | | (126 | ) | | | | | (235 | ) | | | (326 | ) | | | (17) | | | | (56 | ) | | | (224 | ) | | | (126 | ) | | | | | (235 | ) | | | (326 | ) |

Other transformation and rationalization costs | | | — | | | | (7 | ) | | | (48 | ) | | | (58 | ) | | | | | (50 | ) | | | (154 | ) | | | — | | | | (17 | ) | | | (48 | ) | | | (58 | ) | | | | | (50 | ) | | | (154 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 529 | | | $ | 423 | | | $ | 1,361 | | | $ | 129 | | | | | $ | (514 | ) | | $ | (211 | ) | | $ | 1,073 | | | $ | 827 | | | $ | 1,361 | | | $ | 129 | | | | | $ | (514 | ) | | $ | (211 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | (117 | ) | | | (99 | ) | | | (421 | ) | | | (139 | ) | | | | | (540 | ) | | | (822 | ) | | | (233 | ) | | | (206 | ) | | | (421 | ) | | | (139 | ) | | | | | (540 | ) | | | (822 | ) |

Goodwill impairment charges | | | — | | | | — | | | | — | | | | — | | | | | | — | | | | (325 | ) | | | — | | | | — | | | | — | | | | — | | | | | | — | | | | (325 | ) |

Discontinued operations | | | — | | | | — | | | | — | | | | — | | | | | | (64 | ) | | | (67 | ) | | | — | | | | — | | | | — | | | | — | | | | | | (64 | ) | | | (67 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | 412 | | | $ | 324 | | | $ | 940 | | | $ | (10 | ) | | | | $ | (1,118 | ) | | $ | (1,425 | ) | | $ | 840 | | | $ | 621 | | | $ | 940 | | | $ | (10 | ) | | | | $ | (1,118 | ) | | $ | (1,425 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (6 | ) | | | (8 | ) | | | (30 | ) | | | (8 | ) | | | | | — | | | | (434 | ) | | | (47 | ) | | | (16 | ) | | | (30 | ) | | | (8 | ) | | | | | — | | | | (434 | ) |

Other income, net | | | 3 | | | | 2 | | | | 34 | | | | (17 | ) | | | | | 24 | | | | 9 | | |

Other (expense) income, net | | | | (1 | ) | | | 2 | | | | 34 | | | | (17 | ) | | | | | 24 | | | | 9 | |

Reorganization items | | | — | | | | — | | | | — | | | | — | | | | | | 10,210 | | | | 5,147 | | | | — | | | | — | | | | — | | | | — | | | | | | 10,210 | | | | 5,147 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes and equity income | | | 409 | | | | 318 | | | | 944 | | | | (35 | ) | | | | | 9,116 | | | | 3,297 | | | | 792 | | | | 607 | | | | 944 | | | | (35 | ) | | | | | 9,116 | | | | 3,297 | |

Income tax (expense) benefit | | | (116 | ) | | | (85 | ) | | | (258 | ) | | | 27 | | | | | | 311 | | | | (163 | ) | | | (189 | ) | | | (147 | ) | | | (258 | ) | | | 27 | | | | | | 311 | | | | (163 | ) |

Equity income (loss), net of tax | | | 17 | | | | 2 | | | | 17 | | | | 5 | | | | | | (36 | ) | | | 29 | | | | 23 | | | | 8 | | | | 17 | | | | 5 | | | | | | (36 | ) | | | 29 | |

Loss from discontinued operations, net of tax | | | — | | | | — | | | | — | | | | — | | | | | | (44 | ) | | | (97 | ) | | | — | | | | — | | | | — | | | | — | | | | | | (44 | ) | | | (97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 310 | | | $ | 235 | | | $ | 703 | | | $ | (3 | ) | | | | $ | 9,347 | | | $ | 3,066 | | | $ | 626 | | | $ | 468 | | | $ | 703 | | | $ | (3 | ) | | | | $ | 9,347 | | | $ | 3,066 | |

Net income attributable to noncontrolling interest | | | 19 | | | | 20 | | | | 72 | | | | 15 | | | | | | 29 | | | | 29 | | | | 37 | | | | 39 | | | | 72 | | | | 15 | | | | | | 29 | | | | 29 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to Successor/Predecessor | | $ | 291 | | | $ | 215 | | | $ | 631 | | | $ | (18 | ) | | | | $ | 9,318 | | | $ | 3,037 | | | $ | 589 | | | $ | 429 | | | $ | 631 | | | $ | (18 | ) | | | | $ | 9,318 | | | $ | 3,037 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (4) | EBITDA margin is defined as EBITDA as a percentage of revenues. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of revenues. |

| (5) | Gives effect to the modification of our credit agreement and the issuance of senior notes on May 17, 2011. See “Unaudited Pro Forma Condensed Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” |

(6) | Gives effect to this offering and the application of proceeds therefrom. See “Unaudited Pro Forma Condensed Consolidated Financial Information.” |

(7)(6) | Working capital is calculated herein as accounts receivable plus inventories less accounts payable. |

| (7) | Excludes approximately 38,000 temporary and contract workers. |

RISK FACTORS

An investment in our ordinary shares involves a high degree of risk. You should consider carefully the following information about these risks, and the other information included in this prospectus in its entirety before investing in our ordinary shares. Any of the risks we describe below could cause our business, financial condition and/or operating results to suffer. The market price of our ordinary shares could decline if one or more of these risks and uncertainties develop into actual events. You could lose all or part of your investment.

Risks Related to Business Environment and Economic Conditions

The cyclical nature of automotive sales and production can adversely affect our business.

Our business is directly related to automotive sales and automotive vehicle production by our customers. Automotive sales and production are highly cyclical and, in addition to general economic conditions, also depend on other factors, such as consumer confidence and consumer preferences. Lower global automotive sales result in substantially all of our automotive OEM customers significantly lowering vehicle production schedules, which has a direct impact on our earnings and cash flows. The most recent example of this was the 2009 downturn in which North American and Western Europe automotive production declined approximately 43% and 26%, respectively, below production levels in 2007. While the industry is recovering from the 2009 downturn, production volumes in North America and Western Europe remain below levels experienced prior to 2009. In addition, automotive sales and production can be affected by labor relations issues, regulatory requirements, trade agreements, the availability of consumer financing and other factors. Economic declines that result in a significant reduction in automotive sales and production by our customers have in the past had, and may in the future have, an adverse effect on our business, results of operations and financial condition.

Our sales are also affected by inventory levels and OEMs’ production levels. We cannot predict when OEMs will decide to increase or decrease inventory levels or whether new inventory levels will approximate historical inventory levels. Uncertainty and other unexpected fluctuations could have a material adverse effect on our business and financial condition.

A prolonged economic downturn or economic uncertainty could adversely affect our business and cause us to require additional sources of financing, which may not be available.