As filed with the Securities and Exchange Commission on September 14, 2011February 24, 2012

Registration No. 333-175932

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 12

to

FORM S-1

REGISTRATION STATEMENT

under

The Securities Act of 1933

VOCERA COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3669 | 94-3354663 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary standard industrial code number) | (I.R.S. employer identification no.) |

525 Race Street

San Jose, CA 95126

(408) 882-5100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Robert J. Zollars

Chairman and Chief Executive Officer

Vocera Communications, Inc.

525 Race Street

San Jose, CA 95126

(408) 882-5100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gordon K. Davidson, Esq. Daniel J. Winnike, Esq. Fenwick & West LLP 801 California Street Mountain View, CA 94041 (650) 988-8500 | Jay M. Spitzen, Esq. General Counsel and Corporate Secretary Vocera Communications, Inc. 525 Race Street San Jose, CA 95126 (408) 882-5100 | Eric C. Jensen, Esq. Matthew B. Hemington, Esq. John T. McKenna, Esq. Cooley LLP Five Palo Alto Square 3000 El Camino Real Palo Alto, CA 94304 (650) 843-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

|

| ||||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||||

Common Stock, par value $0.0003 per share . | $80,000,000 | $9,288.00 | $80,000,000 | $9,168.00 | ||||

|

|

| ||||||

|

|

| ||||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (2) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 14, 2011February 24, 2012

Prospectus

shares

Common stock

This is an initial public offering of shares of common stock of Vocera Communications, Inc. We are selling shares of common stock, and the selling stockholders are selling shares of common stock. The estimated initial public offering price is between $ and $ per share.

We have applied for the listing of our common stock on the New York Stock Exchange under the symbol “VCRA.”

| Per share | Total | |||||||

Initial public offering price | $ | $ | ||||||

Underwriting discounts and commissions | $ | $ | ||||||

Proceeds to us, before expenses | $ | $ | ||||||

Proceeds to selling stockholders | $ | $ | ||||||

We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

Investing in our common stock involves a high degree of risk. See “Risk factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| J.P. Morgan | Piper Jaffray |

| Baird | William Blair & Company | Morgan Keegan | ||||

, 20112012

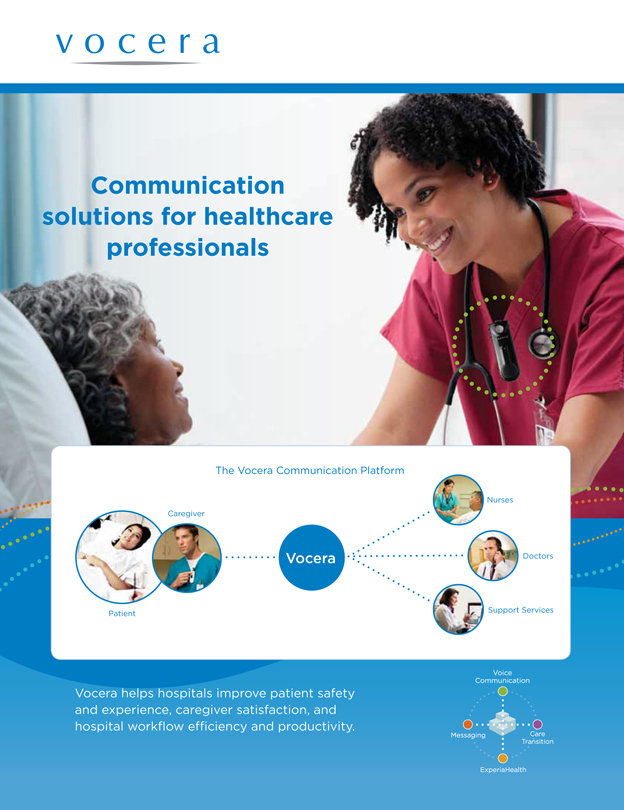

VOCera

Communication solutions for healthcare professionals

The Vocera Communication Platform

Caregiver

Patient

Vocera

Nurses

Doctors

Support Services

Vocera helps hospitals improve patient safety and experience, caregiver satisfaction, and hospital workflow e_ciencyefficiency and productivity.

| Page | ||||

| 1 | ||||

| 13 | ||||

Special note regarding forward-looking statements and industry data | ||||

Management’s discussion and analysis of financial condition and results of operations | ||||

Material U.S. federal income tax consequences to non-U.S. holders | ||||

| F-1 | ||||

i

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including “Risk factors” and our consolidated financial statements and related notes, before making an investment decision.

Overview

We are a provider of mobile communication solutions focused on addressing critical communication challenges facing hospitals today. We help our customers improve patient safety and satisfaction, and increase hospital efficiency and productivity through our Voice Communication solution and new Messaging and Care Transition solutions. Our Voice Communication solution, which includes a lightweight, wearable, voice-controlled communication badge and a software platform, enables users to connect instantly with other hospital staff simply by saying the name, function or group name of the desired recipient. Our Messaging solution securely delivers text messages and alerts directly to and from smartphones, replacing legacy pagers. Our Care Transition solution is a hosted voice and text based software application that captures, manages and monitors patient information when responsibility for the patient is transferred or “handed-off” from one caregiver to another.another, or when the patient is discharged from the hospital.

Effective communication is extremely important in hospitals but is difficult to achieve given their mobile and widely dispersed staff. Nurses, doctors and other caregivers have responsibilities throughout the hospital, from the emergency department, operating rooms and patient recovery rooms to nursing stations and other locations inside and outside the hospital. Communication challenges are compounded by the critical nature of the information conveyed, and the need for around-the-clock patient care and seamless patient transitions at shift change and in transfers between departments.

Hospital communications are typically conducted through disparate components, including overhead paging, pagers and mobile phones, often relying on written records of who is serving in specific roles during a particular shift. These legacy communication methods are inefficient, often unreliable, noisy and do not provide “closed loop” communication (in which a caller knows if a message has reached its intended recipient). These communication deficiencies can negatively impact patient safety, delay patient care and result in operational inefficiencies. Our communication platform helps hospitals increase productivity and reduce costs by streamlining operations, and improves patient and staff satisfaction by creating a differentiated “Vocera hospital” experience.

At the core of our Voice Communication solution is a patent-protected software platform that we introduced in 2002. We have significantly enhanced and added features and functionality to this solution through ongoing development based on frequent interactions with our customers. Our software platform is built upon a scalable architecture and recognizes more than 100 voice commands. Users can instantly communicate with others using the Vocera communication badge the Vocera Wi-Fi smartphone or through Vocera Connect client applications available for BlackBerry, iPhone and Android smartphones, as well as Cisco wireless IP phones and other mobile devices. Our Voice

Communication solution can also be integrated with nurse call and other clinical systems to immediately and efficiently alert hospital workers to patient needs.

Our solutions are deployed in over 750800 hospitals and healthcare facilities, including large hospital systems, and small and medium-sized local hospitals, as well as in over 100 non-healthcareand a small number of clinics, surgery centers and aged-care facilities. We sell our solutions to healthcare customers primarily through our direct sales force in the United States, and through direct sales and select distribution channels in international markets. In 2010, we generated revenue of $56.8 million, representing growth of 38.1% over 2009, and net income of $1.2 million. In the first six months of 2011, we generated revenue of $37.4$79.5 million, representing 45.9% growth of 40.0% over the first six months of 2010, and a net loss of $1.3$2.5 million.

Industry overview

Effective communication is extremely important among mobile and widely dispersed healthcare professionals in hospitals. As of MarchDecember 31, 2011, there were over 6,8006,900 hospitals in the United States. We believe that a combination of policy changes through healthcare reform, demographic trends and downward pressure on healthcare reimbursement is increasing financial pressure on hospitals and other healthcare providers. Furthermore, the nursing shortage in the United States, with over 115,000 openings, can detract from the patient experience and place further strain on hospital operations. Patients are increasingly selecting hospitals and healthcare providers based on quality of care, cost and overall experience with the provider. In addition, healthcare reform initiatives incorporate financial incentives for hospitals to improve the quality of care and patient satisfaction. These forces are driving hospitals to manage their operations more efficiently and to seek ways to improve staff and patient satisfaction through process improvements and technology solutions.

The primary communication methods used in hospitals have changed very little in decades. Traditionally, communication inside of a hospital has followed a hub and spoke model in which caregivers are required to leave the patient’s bedside and return to the nursing station in order to attempt to speak with other healthcare professionals. Communication challenges are compounded by the critical nature of the information conveyed, and the need for around-the-clock patient care and seamless patient transitions at shift change and in transfers between departments.

Traditional methods of hospital communication create several impediments to effective care and can degrade patient and caregiver satisfaction:

| • | Time away from the bedside. We believe that inefficient communication processes are one of the main factors that take the nurse away from the patient, which can be both stressful to the patient and frustrating to the nurse, potentially impacting safety and quality of care. |

| • | Inability to reach the appropriate caregiver in a timely manner. With numerous people involved in the delivery of patient care in a hospital, valuable time can be lost identifying, locating and contacting the appropriate nurse, physician or other caregiver. |

| • | Noisy environments. Traditional communication methods, which rely on overhead paging and device alarms, create noise in the hospital that can result in increased patient stress levels and staff frustration. Excessive noise can prevent patients from getting uninterrupted sleep and lengthen recovery time, resulting in an increased length of hospital stay. |

| • | Lack of closed loop communication. Confirmation that the appropriate caregiver has received the transmitted information is typically not provided by traditional communication methods, adversely affecting patient care through delays and miscommunication. |

Shortcomings in hospital communication not only cause inconvenience and frustration, but can also lead to medical errors and hospital inefficiencies. The Joint Commission, an independent healthcare accreditation organization, reported that in reports of over 8002,600 sentinel events in hospitals in 2010,reported from 2009 through the third quarter of 2011, communication issues were involvedidentified as one of the root causes in 82%69% of the events. In addition, communication problems can lead to delays in preparing, or identifying the availability of, critical hospital resources such as operating rooms or emergency rooms, leading to lost revenue opportunities. A 2010 University of Maryland study found that U.S. hospitals waste over $12 billion annually as a result of communication inefficiency among care providers.

Benefits of our solutions

We believe our solutions provide the following key benefits:

| • | Improve patient safety. The ability for users of our solutions to instantly connect with the right resources in a closed loop communication process can help reduce medical errors and accidental deaths. |

| • | Enhance patient experience. Hospitals can improve patient satisfaction through reduced noise levels, more caregiver time at the patient’s bedside, faster response times and improved communication links between the patient and nurse. |

| • | Improve caregiver job satisfaction. By replacing the traditional hub and spoke communication model, our Voice Communication solution enables caregivers to communicate more efficiently, spend more time caring for the patient at the bedside and walk fewer miles per shift, thus improving job satisfaction and employee retention. |

| • | Increase revenue and reduce expenses. Hospital resources can be used more efficiently by improving workflow processes, such as increasing operating room turnover, which can lead to higher revenue and lower operating expenses. |

Our strengths

We believe that we have the following key competitive strengths:

| • | Unified communication solutions focused on the requirements of healthcare providers. We provide solutions tailored to address communication and workflow challenges within hospitals. These solutions can be integrated with many of our customers’ clinical systems. Our healthcare market focus has led to the development of a platform that facilitates point-of-care communication, improves patient safety and satisfaction and increases hospital efficiency and productivity. |

| • | Comprehensive proprietary communication solutions. Since our founding in 2000, we have built a unique, comprehensive unified communication solution consisting of our software platform, wearable communication badge |

|

| • | Broad and loyal customer base. We have a broad and diverse customer base ranging from large hospital systems to small local hospitals and other healthcare facilities. Our customers represent an aggregate of over |

| • | Recognized and trusted brand. Our brand is recognized and endorsed among healthcare professionals as a trusted provider of healthcare communication solutions. Even among non-Vocera hospitals, we have a very strong brand reputation. In a survey we commissioned in 2010, we were the vendor most frequently mentioned by chief information officers, clinicians and other information technology decision makers at non-Vocera hospitals, when asked who they would consider for voice communication solutions. In addition, we have received the exclusive endorsement of AHA Solutions, a subsidiary of the American Hospital Association, for our Voice Communication and Care Transition solutions. |

| • | Experienced management team. Our management team has developed a culture of innovation with a focus on delivering value and service for our customers. Our management team includes industry executives with operational experience, understanding of the U.S. and international healthcare and technology markets and extensive relationships with hospitals, which we believe provides us with significant competitive advantages. |

Our strategy

Our goal is to extend our leadership position as a provider of communication solutions in the healthcare market. Key elements of our strategy include:

| • | Expand our business to new U.S. healthcare customers. As of |

| • | Further penetrate our existing installed customer base. Typically, our customers initially deploy our Voice Communication solution in a few departments of a hospital and gradually expand to additional departments, or additional hospitals within a healthcare system, as they come to fully appreciate the value of our solutions. A key part of our sales strategy includes promoting further adoption of our Voice Communication solution and demonstrating the value of our new Messaging and Care Transition solutions to our existing customers. |

| • | Extend our technology advantage and create new product solutions. We intend to continue our investment in research and development to enhance the functionality of our communication solutions and increase the value we provide to our customers. We plan to invest in product upgrades, product line extensions and new solutions to enhance our portfolio, such as our recent introduction of client applications for the BlackBerry, iPhone and Android mobile platforms. In October 2011, we introduced the Vocera B3000 badge, our fourth generation communication badge. |

| • | Pursue acquisitions of complementary businesses, technologies and assets. In 2010, we completed four small acquisitions to expand our offerings, demonstrating that we can successfully source, acquire and integrate complementary businesses, technologies and assets. We intend to continue to pursue acquisition opportunities that we believe can accelerate the growth of our business. |

| • | Grow our international healthcare presence. In addition to our core U.S. market, we sell primarily into other English-speaking markets, including Canada, the United Kingdom, Australia, the Republic of Ireland and New Zealand. As of |

| • | Expand our communication solutions in non-healthcare markets. While our current focus is on the healthcare market, we believe that our communication solutions can also provide value in non-healthcare markets, such as hospitality, retail and libraries. |

Risk factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks highlighted in the section titled “Risk factors” following this prospectus summary before making an investment decision. These risks include:

We have incurred significant losses since our inception, and if we cannot achieve and maintain profitability, our business will be harmed and our stock price could decline.

We depend on sales of our Voice Communication solution in the healthcare market for substantially all of our revenue, and any decrease in its sales would harm our business.

If we fail to offer high-quality services and support for our Voice Communication solution, our ability to sell our solution could be harmed.

We depend on a number of sole source and limited source suppliers for several hardware and software components of our Voice Communication solution and on a single contract manufacturer. If we are unable to obtain these components or encounter problems with our contract manufacturer, our business and operating results could be harmed.

If we fail to successfully develop and introduce new solutions and features to existing solutions, our revenue, operating results and reputation could suffer.

Corporate information

We were incorporated in Delaware in February 2000. Our principal executive offices are located at 525 Race Street, San Jose, CA 95126, and our telephone number is (408) 882-5100. Our website address is www.vocera.com. The information on, or that can be accessed through, our website is not incorporated by reference into this prospectus and should not be considered to be a part of this prospectus.

Unless otherwise indicated, the terms “Vocera,” “we,” “us” and “our” refer to Vocera Communications, Inc., a Delaware corporation, together with its consolidated subsidiaries.

Vocera® and ExperiaHealth® are our primary registered trademarks in the United States. Other trademarks appearing in this prospectus are the property of their respective holders.

The offering

Common stock offered by us | shares |

Common stock offered by the selling stockholders | shares |

Over-allotment option | shares |

Common stock to be outstanding after this offering | shares |

Use of proceeds | We expect to use the net proceeds from this offering for general corporate purposes, including repayment in full of outstanding borrowings under our credit facility and working capital. We may also use a portion of the net proceeds to acquire or invest in complementary businesses, technologies or assets. We will not receive any of the proceeds from the sale of shares by the selling stockholders. |

Risk Factors | You should carefully read the section titled “Risk factors” together with all of the other information set forth in this prospectus before deciding to invest in shares of our common stock. |

Proposed NYSE symbol | VCRA |

The shares of our common stock to be outstanding after this offering are based on 100,417,134100,182,702 shares of our common stock outstanding as of June 30,December 31, 2011 and exclude:

19,868,14722,850,255 shares issuable upon the exercise of stock options outstanding as of June 30,December 31, 2011, with a weighted average exercise price of $0.40$0.59 per share

1,280,3791,279,885 shares issuable upon the exercise of warrants outstanding as of June 30,December 31, 2011, with a weighted average exercise price of $1.03 per share

shares to be reserved for issuance under our 2011 Equity Incentive Plan and our 2011 Employee Stock Purchase Plan, each of which will become effective on the first day that our common stock is publicly traded and contains provisions that will automatically increase its share reserve each year, as more fully described in “Executive compensation—Employee benefit plans”

Unless otherwise noted, all information in this prospectus assumes:

no exercise of the underwriters’ over-allotment option

the conversion of all outstanding shares of our preferred stock into an aggregate of 77,498,25277,498,746 shares of our common stock immediately upon the closing of this offering

a -for- reverse split of our capital stock, to be effected prior to the closing of this offering

the filing of our restated certificate of incorporation, which will occur immediately upon the closing of this offering

no exercise of options, warrants or rights outstanding as of the date of this prospectus

Summary consolidated financial data

The following tables summarize our consolidated financial data and should be read together with “Selected consolidated financial data,” “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and related notes, each included elsewhere in this prospectus.

We derived the consolidated statements of operations data for the years ended December 31, 2008, 2009, 2010 and 20102011 from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statements of operations data for the six months ended June 30, 2010 and 2011 and the consolidated balance sheet data as of June 30, 2011 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited consolidated financial statements on the same basis as the audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments, that in our opinion are necessary to state fairly the financial information set forth in those statements. Our historical results are not necessarily indicative of the results we expect in the future, and our interim results should not necessarily be considered indicative of results we expect for the full year.

We derived the pro forma share and per share data for the year ended December 31, 2010 and the six months ended June 30, 2011 from the unaudited pro forma net income (loss) per share information in Note 3 of our “Notes to consolidated financial statements” in our audited financial statements included elsewhere in this prospectus. The pro forma share and per share data give effect to (i) the reclassification of our preferred stock warrant liability to additional paid-in capital upon conversion of our preferred stock warrants to common stock warrants, (ii) the conversion of all outstanding shares of our convertible preferred stock into shares of our common stock and (iii) the repayment in full of outstanding borrowings under our credit facility using proceeds from this offering as if all such transactions had occurred on January 1, 2010.2011.

| Years ended December 31, | Six months ended June 30, | |||||||||||||||||||

| (in thousands, except per share data) | 2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||

| ||||||||||||||||||||

Consolidated statements of operations data: | ||||||||||||||||||||

Revenue | ||||||||||||||||||||

Product | $ | 28,352 | $ | 25,985 | $ | 35,516 | $ | 16,019 | $ | 23,561 | ||||||||||

Service | 11,474 | 15,154 | 21,287 | 9,616 | 13,835 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total revenue | 39,826 | 41,139 | 56,803 | 25,635 | 37,396 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cost of revenue | ||||||||||||||||||||

Product | 15,542 | 11,546 | 13,004 | 5,873 | 8,187 | |||||||||||||||

Service | 4,225 | 4,320 | 8,171 | 3,220 | 6,199 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total cost of revenue | 19,767 | 15,866 | 21,175 | 9,093 | 14,386 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross profit | 20,059 | 25,273 | 35,628 | 16,542 | 23,010 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating expenses | ||||||||||||||||||||

Research and development | 7,353 | 5,992 | 6,698 | 3,272 | 4,591 | |||||||||||||||

Sales and marketing | 15,394 | 16,468 | 20,953 | 8,772 | 13,175 | |||||||||||||||

General and administrative | 3,456 | 3,489 | 6,723 | 1,989 | 5,081 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total operating expenses | 26,203 | 25,949 | 34,374 | 14,033 | 22,847 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) from operations | (6,144 | ) | (676 | ) | 1,254 | 2,509 | 163 | |||||||||||||

Interest income | 182 | 52 | 33 | 19 | 8 | |||||||||||||||

Interest expense | (143 | ) | (141 | ) | (77 | ) | (42 | ) | (122 | ) | ||||||||||

Other income (expense), net | (208 | ) | (227 | ) | (367 | ) | (251 | ) | (1,217 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) before income taxes | (6,313 | ) | (992 | ) | 843 | 2,235 | (1,168 | ) | ||||||||||||

Benefit (provision) for income taxes | — | — | 367 | (21 | ) | (174 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income (loss) | $ | (6,313 | ) | $ | (992 | ) | $ | 1,210 | $ | 2,214 | $ | (1,342 | ) | |||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income (loss) per share | ||||||||||||||||||||

Basic and diluted | $ | (0.52 | ) | $ | (0.08 | ) | $ | 0.00 | $ | 0.00 | $ | (0.07 | ) | |||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Weighted average shares outstanding | ||||||||||||||||||||

Basic | 12,085 | 12,234 | 13,342 | 12,981 | 18,989 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Diluted | 12,085 | 12,234 | 17,080 | 16,052 | 18,989 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Pro forma net income per share (unaudited) | ||||||||||||||||||||

Basic | $ | $ | ||||||||||||||||||

|

|

|

| |||||||||||||||||

Diluted | $ | $ | ||||||||||||||||||

|

|

|

| |||||||||||||||||

Pro forma weighted average shares outstanding (unaudited) | ||||||||||||||||||||

Basic | ||||||||||||||||||||

|

|

|

| |||||||||||||||||

Diluted | ||||||||||||||||||||

|

|

|

| |||||||||||||||||

Other financial data: | ||||||||||||||||||||

Adjusted EBITDA(1) | $ | (4,800 | ) | $ | 578 | $ | 3,821 | $ | 3,073 | $ | 1,773 | |||||||||

| ||||||||||||||||||||

| Years ended December 31, | ||||||||||||

| (in thousands, except per share data) | 2009 | 2010 | 2011 | |||||||||

| ||||||||||||

Consolidated statements of operations data: | ||||||||||||

Revenue | ||||||||||||

Product | $ | 25,985 | $ | 35,516 | $ | 50,322 | ||||||

Service | 15,154 | 21,287 | 29,181 | |||||||||

|

|

|

|

|

| |||||||

Total revenue | 41,139 | 56,803 | 79,503 | |||||||||

|

|

|

|

|

| |||||||

Cost of revenue | ||||||||||||

Product | 11,546 | 12,222 | 17,465 | |||||||||

Service | 4,320 | 8,953 | 14,042 | |||||||||

|

|

|

|

|

| |||||||

Total cost of revenue | 15,866 | 21,175 | 31,507 | |||||||||

|

|

|

|

|

| |||||||

Gross profit | 25,273 | 35,628 | 47,996 | |||||||||

|

|

|

|

|

| |||||||

Operating expenses | ||||||||||||

Research and development | 5,992 | 6,698 | 9,335 | |||||||||

Sales and marketing | 16,468 | 20,953 | 28,151 | |||||||||

General and administrative | 3,489 | 6,723 | 11,316 | |||||||||

|

|

|

|

|

| |||||||

Total operating expenses | 25,949 | 34,374 | 48,802 | |||||||||

|

|

|

|

|

| |||||||

Income (loss) from operations | (676 | ) | 1,254 | (806 | ) | |||||||

Interest income | 52 | 33 | 17 | |||||||||

Interest expense | (141 | ) | (77 | ) | (332 | ) | ||||||

Other income (expense), net | (227 | ) | (367 | ) | (1,073 | ) | ||||||

|

|

|

|

|

| |||||||

Income (loss) before income taxes | (992 | ) | 843 | (2,194 | ) | |||||||

Benefit (provision) for income taxes | — | 367 | (285 | ) | ||||||||

|

|

|

|

|

| |||||||

Net income (loss) | $ | (992 | ) | $ | 1,210 | $ | (2,479 | ) | ||||

|

|

|

|

|

| |||||||

Net income (loss) per common share | ||||||||||||

Basic and diluted | $ | (0.08 | )�� | $ | 0.00 | $ | (0.12 | ) | ||||

|

|

|

|

|

| |||||||

Weighted average shares used to compute net income (loss) per common share | ||||||||||||

Basic | 12,234 | 13,342 | 20,325 | |||||||||

|

|

|

|

|

| |||||||

Diluted | 12,234 | 17,080 | 20,325 | |||||||||

|

|

|

|

|

| |||||||

Pro forma net loss per share (unaudited) | ||||||||||||

Basic | $ | |||||||||||

|

| |||||||||||

Diluted | $ | |||||||||||

|

| |||||||||||

Pro forma weighted average shares used to compute net loss per share (unaudited) | ||||||||||||

Basic | ||||||||||||

|

| |||||||||||

Diluted | ||||||||||||

|

| |||||||||||

Other financial data: | ||||||||||||

Adjusted EBITDA(1) | $ | 578 | $ | 3,821 | $ | 3,020 | ||||||

| ||||||||||||

| (1) | Please see ”Adjusted EBITDA” below for more information and for a reconciliation of net income (loss) to adjusted EBITDA. |

Consolidated balance sheet data as of June 30,December 31, 2011 are presented below:

on an actual basis

on a pro forma basis to reflect the reclassification of the preferred stock warrant liability to additional paid-in capital upon conversion of our preferred stock warrants to common stock warrants and the conversion of all outstanding shares of our preferred stock into 77,498,25277,498,746 shares of our common stock, each immediately upon the closing of this offering as if the reclassification and conversion had occurred on June 30,December 31, 2011

on a pro forma as adjusted basis to further reflect (i) the sale by us of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us; and (ii) the application of $ million of the net proceeds from this offering to repay in full outstanding borrowings under our credit facility

June 30, 2011 (in thousands) | Actual | Pro forma | Pro forma as adjusted(1) | |||||||||||||||||||||

December 31, 2011 (in thousands) | Actual | Pro forma | Pro forma as adjusted(1) | |||||||||||||||||||||

|

|

| ||||||||||||||||||||||

Consolidated balance sheet data: | ||||||||||||||||||||||||

Cash and cash equivalents | $ | 11,835 | $ | 11,835 | $ | $ | 14,898 | $ | 14,898 | $ | ||||||||||||||

Total assets | 45,318 | 45,318 | 49,818 | 49,818 | ||||||||||||||||||||

Total borrowings | 9,333 | 9,333 | 8,333 | 8,333 | ||||||||||||||||||||

Convertible preferred stock warrant liability | 2,073 | — | 1,853 | — | ||||||||||||||||||||

Convertible preferred stock | 53,013 | — | 53,013 | — | ||||||||||||||||||||

Total stockholders’ equity (deficit) | (50,065 | ) | 5,021 | (49,399 | ) | 5,467 | ||||||||||||||||||

|

|

| ||||||||||||||||||||||

| (1) | Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease, respectively, our cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions. |

Adjusted EBITDA

To provide investors with additional information about our financial results, we disclose within this prospectus adjusted EBITDA, a non-GAAP financial measure. We present adjusted EBITDA because it is used by our board of directors and management to evaluate our operating performance, and we consider it an important supplemental measure of our performance. In addition, adjusted EBITDA is a financial measure used by the compensation committee of the board of directors to pay bonuses under our executive bonus plan. For 2010,2011, the compensation committee made adjustments in addition to those reflected in the table below.

Our management uses adjusted EBITDA:

as a measure of operating performance to assist in comparing performance from period to period on a consistent basis

as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations

Adjusted EBITDA is not in accordance with, or an alternative to, measures prepared in accordance with GAAP. In addition, this non-GAAP measure is not based on any comprehensive set of accounting rules or principles. As a non-GAAP measure, adjusted EBITDA has limitations in that it does not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. In particular:

Adjusted EBITDA does not reflect interest income we earn on cash and cash equivalents, interest expense, or the cash requirements necessary to service interest or principal payments, on our debt.

Adjusted EBITDA does not reflect the amounts we paid in taxes or other components of our tax provision.

Adjusted EBITDA does not reflect all of our cash expenditures, or future requirements for capital expenditures.

Adjusted EBITDA does not include amortization expense from acquired intangible assets.

Adjusted EBITDA does not include the impact of stock-based compensation.

Others may calculate adjusted EBITDA differently than we do and these calculations may not be comparable to our adjusted EBITDA metric.

Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including net income (loss) and our financial results presented in accordance with GAAP.

The table below presents a reconciliation of net income (loss) to adjusted EBITDA for each of the periods indicated:

| Years ended December 31, | Six months ended June 30, | Years ended December 31, | ||||||||||||||||||||||||||||||

| (in thousands) | 2008 | 2009 | 2010 | 2010 | 2011 | 2009 | 2010 | 2011 | ||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||

Net income (loss) | $ | (6,313 | ) | $ | (992 | ) | $ | 1,210 | $ | 2,214 | $ | (1,342 | ) | $ | (992 | ) | $ | 1,210 | $ | (2,479 | ) | |||||||||||

Interest income | (182 | ) | (52 | ) | (33 | ) | (19 | ) | (8 | ) | (52 | ) | (33 | ) | (17 | ) | ||||||||||||||||

Interest expense | 143 | 141 | 77 | 42 | 122 | 141 | 77 | 332 | ||||||||||||||||||||||||

Provision (benefit) for income taxes | — | — | (367 | ) | 21 | 174 | — | (367 | ) | 285 | ||||||||||||||||||||||

Depreciation and amortization | 809 | 754 | 732 | 368 | 309 | 754 | 732 | 1,004 | ||||||||||||||||||||||||

Amortization of purchased intangibles | — | — | 223 | — | 502 | — | 223 | 1,006 | ||||||||||||||||||||||||

Stock-based compensation | 481 | 492 | 508 | 238 | 378 | 492 | 508 | 1,458 | ||||||||||||||||||||||||

Acquisition related costs(1) | — | — | 1,047 | — | — | — | 1,047 | — | ||||||||||||||||||||||||

Change in fair value of warrant and option liabilities | 262 | 235 | 424 | 209 | 1,638 | 235 | 424 | 1,431 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Adjusted EBITDA | $ | (4,800 | ) | $ | 578 | $ | 3,821 | $ | 3,073 | $ | 1,773 | $ | 578 | $ | 3,821 | $ | 3,020 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||

| (1) | Acquisition related costs consist of third-party costs we incurred in connection with acquisitions we completed in 2010. |

You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. Our business, financial condition and results of operations could be materially and adversely affected if any of the following risks, or other risks and uncertainties that are not yet identified or that we currently think are immaterial, actually occur. In that event, the trading price of our shares may decline, and you may lose part or all of your investment.

Risks related to our business and industry

We have incurred significant losses since inception, and may incur losses in the future.

We have incurred significant losses since our inception and may incur losses in the future as we continue to grow our business. As of December 31, 2010 and June 30, 2011, we had an accumulated deficit of $54.4 million and $55.7 million, respectively.$56.9 million. We expect our expenses to increase due to the hiring of additional personnel and the additional operational and reporting costs associated with being a public company. If we cannot achieve and maintain profitability, our business will be harmed and our stock price could decline.

Our ability to achieve and maintain profitability in the future depends upon continued demand for our communication solutions from existing and new customers. Further market adoption of our solutions, including increased penetration within our existing customers, depends upon our ability to improve patient safety and satisfaction and increase hospital efficiency and productivity. In addition, our profitability will be affected by, among other things, our ability to execute on our business strategy, the timing and size of orders, the pricing and costs of our solutions, and the extent to which we invest in sales and marketing, research and development and general and administrative resources.

We depend on sales of our Voice Communication solution in the healthcare market for substantially all of our revenue, and any decrease in its sales would harm our business.

To date, substantially all of our revenue has been derived from sales of our Voice Communication solution to the healthcare market and, in particular, hospitals. Any decrease in revenue from sales of our Voice Communication solution would harm our business. For 2010 and the six months ended June 30, 2011, sales of our Voice Communication solution to the healthcare market accounted for 97.8%96.9% and 98.0%90.4% of our revenue, respectively. In addition, we obtained a significant portion of these sales from existing hospital customers. We only recently began offering our Messaging and Care Transition solutions, and we anticipate that sales of our Voice Communication solution will represent a significant portion of our revenue for the foreseeable future. While we are evaluating new solutions for non-healthcare markets, we may not be successful in applying our technology to these markets. In any event, we do not anticipate that sales of our Voice Communication solution in non-healthcare markets will represent a significant portion of our revenue for the foreseeable future.

Our success depends in part upon the deployment of our Voice Communication solution by new hospital customers, the expansion and upgrade of our solution at existing customers, and our ability to continue to provide on a timely basis cost-effective solutions that meet the requirements of our hospital customers. Our Voice Communication solution requires a substantial

upfront investment by customers. Typically, our hospital customers initially deploy our solutions

for specific users in specific departments before expanding our solution into other departments or for other users. The cost of the initial deployment depends on the number of users and departments involved, the size and age of the hospital and the condition of the existing wireless infrastructure, if any, within the hospital. During 2010,2011, the initial purchase order for new hospital deployments of our Voice Communication solution ranged from approximately $75,000$50,000 to approximately $1.2$2.7 million, with an average initial deployment cost of approximately $250,000,$360,000, which amounts do not include any additional investment in wireless infrastructure that may have been required in order to implement our solution.

Even if hospital personnel determine that our Voice Communication solution provides compelling benefits over their existing communications methods, their hospitals may not have, or may not be willing to spend, the resources necessary to install and maintain wireless infrastructure to initially deploy and support our solution or expand our solution to other departments or users. Hospitals are currently facing significant budget constraints, ever increasing demands from a growing number of patients, and impediments to obtaining reimbursements for their services. We believe hospitals are currently allocating funds for capital and infrastructure improvements to benefit from recently enacted electronic medical records incentives, which may impact their ability to purchase and deploy our solutions. We might not be able to sustain or increase our revenue from sales of our Voice Communication solution, or achieve the growth rates that we envision, if hospitals continue to face significant budgetary constraints and reduce their spending on communications systems.

Our sales cycle can be lengthy and unpredictable, which may cause our revenue and operating results to fluctuate significantly.

Our sales cycles can be lengthy and unpredictable. Our sales efforts involve educating our customers about the use and benefits of our solutions, including the technical capabilities of our solutions and the potential cost savings and productivity gains achievable by deploying them. Customers typically undertake a significant evaluation process, which frequently involves not only our solutions but also their existing communications methods and those of our competitors, and can result in a lengthy sales cycle of nine to 12 months or more. We spend substantial time, effort and money in our sales efforts without any assurance that our efforts will produce any sales. In addition, purchases of our solutions are frequently subject to budget constraints, multiple approvals, and unplanned administrative, processing and other delays. As a result, our revenue and operating results may vary significantly from quarter to quarter.

If we fail to increase market awareness of our brand and solutions, and expand our sales and marketing operations, our business could be harmed.

We intend to continue to add personnel and expend resources in sales and marketing as we focus on expanding awareness of our brand and solutions and capitalize on sales opportunities with new and existing customers. Our efforts to improve sales of our solutions will result in an increase in our sales and marketing expense and general and administrative expense, and these efforts may not be successful. Some newly hired sales and marketing personnel may subsequently be determined to be unproductive and have to be replaced, resulting in operational and sales delays and incremental costs. If we are unable to significantly increase the awareness of our brand and solutions or effectively manage the costs associated with these efforts, our business, financial condition and operating results could be harmed.

If we fail to offer high-quality services and support for our Voice Communication solution, our ability to sell our solution will be harmed.

Our ability to sell our Voice Communication solution is dependent upon our professional services and technical support teams providing high-quality services and support. Our professional services team assists our customers with their wireless infrastructure assessment, clinical workflow design, communication solution configuration, training and project management during the pre-deployment and deployment stages. Once our solution is deployed within a customer’s facility, the customer typically depends on our technical support team to help resolve technical issues, assist in optimizing the use of our solution and facilitate adoption of new functionality. If we do not effectively assist our customers in deploying our solution, succeed in helping our customers quickly resolve technical and other post-deployment issues, or provide effective ongoing support services, our ability to expand the use of our solution with existing customers and to sell our solution to new customers will be harmed. If deployment of our solution is unsatisfactory, as has been the case with certain third-party deployments in the past, we may incur significant costs to attain and sustain customer satisfaction. As we rapidly hire new services and support personnel, we may inadvertently hire underperforming people who will have to be replaced, leading in some instances to slower growth, additional costs and poor customer relations. In addition, the failure of channel partners to provide high-quality services and support in markets outside the United States could also harm sales of our solution.

We depend on a number of sole source and limited source suppliers, and if we are unable to source our components from them, our business and operating results could be harmed.

We depend on sole and limited source suppliers for several hardware components of our Voice Communication solution, including our batteries and integrated circuits. We purchase inventory generally through individual purchase orders. Any of these suppliers could cease production of our components, experience capacity constraints, material shortages, work stoppages, financial difficulties, cost increases or other reductions or disruptions in output, cease operations or be acquired by, or enter into exclusive arrangements with, a competitor. These suppliers typically rely on purchase orders rather than long-term contracts with their suppliers, and as a result, even if available, the supplier may not be able to secure sufficient materials at reasonable prices or of acceptable quality to build our components in a timely manner. Any of these circumstances could cause interruptions or delays in the delivery of our solutions to our customers, and this may force us to seek components from alternative sources, which may not have the required specifications, or be available in time to meet demand or on commercially reasonable terms, if at all. Any of these circumstances may also force us to redesign our solutions if a component becomes unavailable in order to incorporate a component from an alternative source.

Our solutions incorporate multiple software components obtained from licensors on a non-exclusive basis, such as voice recognition software, software supporting the runtime execution of our software platform, and database and reporting software. Our license agreements can be terminated for cause. In many cases, these license agreements specify a limited term and are only renewable beyond that term with the consent of the licensor. If a licensor terminates a license agreement for cause, objects to its renewal, or conditions renewal on modified terms and conditions, we may be unable to obtain licenses for equivalent software components on reasonable terms and conditions, including licensing fees, warranties or protection from infringement claims. Some licensors may discontinue licensing their software to us or support of the software version used in our solutions. In such circumstances, we may need

to redesign our solutions at substantial cost to incorporate alternative software components or be subject to higher royalty costs. Any of these circumstances could adversely affect the cost and availability of our solutions.

Third-party licensors generally require us to incorporate specific license terms and conditions in our agreements with our customers. If we are alleged to have failed to incorporate these license terms and conditions, we may be subject to claims by these licensors, incur significant legal costs defending ourselves against such claims and, if such claims are successful, be subject to termination of licenses, monetary damages, or an injunction against the continued distribution of one or more of our solutions.

Because we depend upon a contract manufacturer, our operations could be harmed and we could lose sales if we encounter problems with this manufacturer.

We do not have internal manufacturing capabilities and rely upon a contract manufacturer, SMTC Corporation, to produce the primary hardware component of our Voice Communication solution. We have entered into a manufacturing agreement with SMTC that is terminable by either party with advance notice and that may also be terminated for a material uncured breach. We also rely on original design manufacturers, or ODMs, to produce accessories, including batteries, chargers and attachments. If SMTC or an ODM is unable or unwilling to continue manufacturing components of our solutions in the volumes that we require, fails to meet our quality specifications or significantly increases its prices, we may not be able to deliver our solution to our customers with the quantities, quality and performance that they expect in a timely manner. As a result, we could lose sales and our operating results could be harmed.

SMTC or ODMs may experience problems that could impact the quantity and quality of components of our Voice Communication solution, including disruptions in their manufacturing operations due to equipment breakdowns, labor strikes or shortages, component or material shortages and cost increases. SMTC and these ODMs generally rely on purchase orders rather than long-term contracts with their suppliers, and as a result, may not be able to secure sufficient components or other materials at reasonable prices or of acceptable quality to build components of our solutions in a timely manner. The majority of the components of our Voice Communication solution are manufactured in Asia or Mexico and adverse changes in political or economic circumstances in those locations could also disrupt our supply and quality of components of our solutions. In October 2011, we introduced the B3000 badge. Initial production of this product has commenced with SMTC in the United States, with production transitioning to Mexico in 2012. Companies occasionally encounter unexpected difficulties in ramping up to volume production of new products, and we may experience such difficulties with the B3000 badge. SMTC and our ODMs also manufacture products for other companies. Generally, our orders represent a relatively small percentage of the overall orders received by SMTC and these ODMs from their customers; therefore, fulfilling our orders may not be a priority in the event SMTC or an ODM is constrained in its ability to fulfill all of its customer obligations. In addition, if SMTC or an ODM is unable or unwilling to continue manufacturing components of our solutions, we may have to identify one or more alternative manufacturers. The process of identifying and qualifying a new contract manufacturer or ODM can be time consuming, and we may not be able to substitute suitable alternative manufacturers in a timely manner or at an acceptable cost. Additionally, transitioning to a new manufacturer may cause us to incur additional costs and delays if the new manufacturer has difficulty manufacturing components of our solutions to our specifications or quality standards.

If we fail to forecast our manufacturing requirements accurately, or fail to properly manage our inventory with our contract manufacturer, we could incur additional costs and experience manufacturing delays, which can adversely affect our operating results.

We place orders with our contract manufacturer, SMTC, and we and SMTC place orders with suppliers based on forecasts of customer demand. Because of our international low cost sourcing strategy, our lead times are long and cause substantially more risk to forecasting accuracy than would result were lead times shorter. Our forecasts are based on multiple assumptions, each of which may introduce errors into our estimates affecting our ability to meet our customers’ demands for our solutions. If demand for our solutions increases significantly, we may not be able to meet demand on a timely basis, and we may need to expend a significant amount of time working with our customers to allocate limited supply and maintain positive customer relations, or we may incur additional costs in order to expedite the manufacture and delivery of additional inventory. If we underestimate customer demand, our contract manufacturer may have inadequate materials and subcomponents on hand to produce components of our solutions, which could result in manufacturing interruptions, shipment delays, deferral or loss of revenue, and damage to our customer relationships. Conversely, if we overestimate customer demand, we and SMTC may purchase more inventory than required for actual customer orders, resulting in excess or obsolete inventory, thereby increasing our costs and harming our operating results.

If hospitals do not have and are not willing to install the wireless infrastructure required to operate our Voice Communication solution, then they may experience technical problems or not purchase our solution at all.

The effectiveness of our Voice Communication solution depends upon the quality and compatibility of the communications environment of our healthcare customers. Our solutions require voice-grade wireless, or Wi-Fi, installed through large enterprise environments, which can vary from hospital to hospital and from department to department within a hospital. Many hospitals have not installed a voice-grade wireless infrastructure. If potential customers do not have a wireless network that can properly and fully interoperate with our Voice Communication solution, then such a network must be installed, or an existing Wi-Fi network must be upgraded, for example, by adding access points in stairwells, for our Voice Communication solution to be fully functional. The additional cost of installing or upgrading a Wi-Fi network may dissuade potential customers from installing our solution. Furthermore, if changes to a customer’s physical or information technology environment cause integration issues or degrade the effectiveness of our solution, or if the customer fails to upgrade its environment as may be required for software releases or updates, the customer may not be able to fully utilize our solution or may experience technical problems. If such circumstances arise, prospective customers may not purchase or existing customers may not expand their use of or deploy upgraded versions of our Voice Communication solution, thereby harming our business and operating results.

If we fail to achieve certification for certain U.S. federal standards, our sales to U.S. government customers will suffer.

We believe that a significant opportunity exists to sell our products to healthcare facilities in the Veterans Administration and Department of Defense, or DoD. These customers require independent certification of compliance with particular requirements relating to encryption, security, interoperability and scalability. These requirements include compliance with Federal Information Processing Standard, or FIPS, 140-2 and, as to DoD facilities, certification by the Joint Interoperability and Test Command, or JITC, of DoD and under the DoD Information Assurance

Certification and Accreditation Process, or DIACAP. We are in the process of completing full certification of our Voice Communication solution under these standards for use with the B2000 badge, and will undertake to achieve certification for the B3000 badge and future products as well. A failure on our part to comply in a timely manner with these requirements, both as to current products and as to new product versions, could adversely impact our revenue.

We plan to opportunistically expand our communications solutions in non-healthcare markets, but this expansion may not be successful.

We are currently focused on selling our communications solutions to the healthcare market. We are evaluating how to further serve non-healthcare markets, but we plan to address non-healthcare markets opportunistically. We may not be successful in further penetrating the current non-healthcare markets we serve or in selling our solutions to new markets. For the six months ended June 30, 2011, we hadOur Voice Communication solution has been deployed in over 100 customers in non-healthcare verticals,markets, including hospitality, retail and libraries, accountinglibraries. Total revenue from non-healthcare customers accounted for 2.0%2.9% of our revenue.revenue in 2011. If we cannot maintain these

customers by providing communications solutions that meet their requirements, if we cannot successfully expand our communications solutions in non-healthcare markets, or if our solutions are adopted more slowly than we anticipate, we may not obtain significant revenue from these markets. We may experience challenges as we expand in non-healthcare markets, including pricing pressure on our solutions and technical issues as we adapt our solutions for the requirements of new markets. Our communications solutions also may not contain the functionality required by these non-healthcare markets or may not sufficiently differentiate us from competing solutions such that customers can justify deploying our solutions.

If we fail to successfully develop and introduce new solutions and features to existing solutions, our revenue, operating results and reputation could suffer.

Our success depends, in part, upon our ability to develop and introduce new solutions and features to existing solutions that meet existing and new customer requirements. We may not be able to develop and introduce new solutions or features on a timely basis or in response to customers’ changing requirements, or that sufficiently differentiate us from competing solutions such that customers can justify deploying our solutions. We may experience technical problems and additional costs as we introduce new features to our software platform, deploy future models of our wireless badges and integrate new solutions with existing customer clinical systems and workflows. In addition, we may face technical difficulties as we expand into non-English speaking countries and incorporate non-English speech recognition capabilities into our Voice Communication solution. Any new wireless badges may alsoOur recently introduced B3000 badge will reduce demand for our existing B2000 badges, and we must therefore successfully manage the transition from existing badges, avoid excessive inventory levels and ensure that sufficient supplies of new badges can be delivered to meet customer demand. We also may incur substantial costs or delays in the manufacture of components ofthe B3000 badge and any additional new products or models as we seek to optimize production methods and processes at our contract manufacturer. In addition, we expect that we will at least initially achieve lower gross margins on new models, while endeavoring to reduce manufacturing costs over time. If any of these problems were to arise, our revenue, operating results and reputation could suffer.

If we do not achieve the anticipated strategic or financial benefits from our acquisitions or if we cannot successfully integrate them, our business and operating results could be harmed.

We have acquired, and in the future may acquire, complementary businesses, technologies or assets that we believe to be strategic, such as our four acquisitions completed in 2010. We may not achieve the anticipated strategic or financial benefits, or be successful in integrating any acquired businesses, technologies or assets. If we cannot effectively integrate our Voice Communication solution with our new Messaging and Care Transition solutions and successfully market and sell these solutions, we may not achieve market acceptance for, or significant revenue from, these new solutions.

Integrating newly acquired businesses, technologies and assets could strain our resources, could be expensive and time consuming, and might not be successful. Our recent acquisitions expose us, and if we acquire or invest in additional businesses, technologies or assets, we will be further exposed, to a number of risks, including that we may:

experience technical issues as we integrate acquired businesses, technologies or assets into our existing communications solutions

encounter difficulties leveraging our existing sales and marketing organizations, and direct sales channels, to increase our revenue from acquired businesses, technologies or assets

find that the acquisition does not further our business strategy, we overpaid for the acquisition or the economic conditions underlying our acquisition decision have changed

have difficulty retaining the key personnel of acquired businesses

suffer disruption to our ongoing business and diversion of our management’s attention as a result of transition or integration issues and the challenges of managing geographically or culturally diverse enterprises

experience unforeseen and significant problems or liabilities associated with quality, technology and legal contingencies relating to the acquisition, such as intellectual property or employment matters

In addition, from time to time we may enter into negotiations for acquisitions that are not ultimately consummated. These negotiations could result in significant diversion of management time, as well as substantial out-of-pocket costs. If we were to proceed with one or more significant acquisitions in which the consideration included cash, we could be required to use a substantial portion of our available cash, including the proceeds of this offering. To the extent we issue shares of capital stock or other rights to purchase capital stock, including options and warrants, the ownership of existing stockholders would be diluted. In addition, acquisitions may result in the incurrence of debt, contingent liabilities, large write-offs, or other unanticipated costs, events or circumstances, any of which could harm our operating results.

If we are not able to manage our growth effectively, or if our business does not grow as we expect, our operating results will suffer.

We have experienced significant revenue growth in a short period of time. Our revenue increased from $39.8$41.1 million for 20082009 to $56.8$79.5 million for 2010, and from $25.6 million for the six months ended June 30, 2010 to $37.4 million for the six months ended June 30, 2011. During these periods, we significantly expanded our operations. For example, in order to transition, to a direct sales model for the U.S. healthcare market in place of a reselleroperations and indirect sales model, we more than doubled the number of our employees from 123 as of January 1, 2009 to 268290 as of June 30,December 31, 2011.

Our rapid growth has placed, and will continue to place, a significant strain on our management systems, infrastructure and other resources. We plan to hire additional direct sales and marketing

personnel domestically and internationally, acquire complementary businesses, technologies or assets, and increase our investment in research and development. Our future operating results depend to a large extent on our ability to successfully implement these plans and manage our anticipated expansion. To do so successfully we must, among other things:

manage our expenses in line with our operating plans and current business environment

maintain and enhance our operational, financial and management controls, reporting systems and procedures

integrate acquired businesses, technologies or assets

manage operations in multiple locations and time zones

develop and deliver new solutions and enhancements to existing solutions efficiently and reliably

We anticipate implementing a new enterprise resource planning application, or ERP, beginning in 2012. We may experience difficulties in implementing the ERP, and we may fail to gain the efficiencies the implementation is designed to produce. The implementation could also be disruptive to our operations, including the ability to timely ship and track product orders to our customers, project inventory requirements, manage our supply chain and otherwise adequately service our customers.

We expect to incur costs associated with thesethe investments made to support our growth before the anticipated benefits or the returns are realized, if at all. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities or develop new solutions or enhancements to

existing solutions. We may also fail to satisfy customer requirements, maintain quality, execute our business plan or respond to competitive pressures, which could result in lower revenue and a decline in the share price of our common stock.

We generally recognize revenue from maintenance and support contracts for our Voice Communication solution over the contract term, and changes in sales may not be immediately reflected in our operating results.

We generally recognize revenue from our customer maintenance and support contracts for our Voice Communication solution ratably over the contract term, which is typically 12 months, in some cases subject to an early termination right. For 2010 and the six months ended June 30, 2011, revenue from our maintenance and support contracts accounted for 30.7% and 27.2%27.0% of our revenue, respectively. A portion of the revenue we report in each quarter is derived from the recognition of deferred revenue relating to maintenance and support contracts entered into during previous quarters. Consequently, a decline in new or renewed maintenance and support by our customers in any one quarter may not be immediately reflected in our revenue for that quarter. Such a decline, however, will negatively affect our revenue in future quarters. Accordingly, the effect of significant downturns in sales and market acceptance of our services and potential changes in our rate of renewals may not be fully reflected in our operating results until future periods.

Our revenue and operating results have fluctuated, and are likely to continue to fluctuate, which may make our quarterly results difficult to predict, cause us to miss analyst expectations and cause the price of our common stock to decline.

Our operating results may be difficult to predict, even in the near term, and are likely to fluctuate as a result of a variety of factors, many of which are outside of our control. We have historically obtained substantially all of our revenue from the sale of our Voice Communication

solution, which we anticipate will represent the most significant portion of our revenue for the foreseeable future, as we only recently began offering our Messaging and Care Transition solutions.

Comparisons of our revenue and operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indication of our future performance. Each of the following factors, among others, could cause our operating results to fluctuate from quarter to quarter:

the financial health of our healthcare customers and budgetary constraints on their ability to upgrade their communications

changes in the regulatory environment affecting our healthcare customers, including impediments to their ability to obtain reimbursement for their services

our ability to expand our sales and marketing operations

the procurement and deployment cycles of our healthcare customers and the length of our sales cycles

variations in the amount of orders booked in a prior quarter but not delivered until later quarters

our mix of solutions and pricing, including discounts by us or our competitors

our ability to forecast demand and manage lead times for the manufacture of our solutions

our ability to develop and introduce new solutions and features to existing solutions that achieve market acceptance

Our success depends upon our ability to attract, integrate and retain key personnel, and our failure to do so could harm our ability to grow our business.

Our success depends, in part, on the continuing services of our senior management and other key personnel, including in particular our executive officers and founder,co-founder, as identified under “Management—Executive officers and directors,” and our ability to continue to attract, integrate and retain highly skilled personnel, particularly in engineering, sales and marketing. Competition for highly skilled personnel is intense, particularly in the Silicon Valley where our headquarters are located. If we fail to attract, integrate and retain key personnel, our ability to grow our business could be harmed.

The members of our senior management and other key personnel are at-will employees, and may terminate their employment at any time without notice. If they terminate their employment, we may not be able to find qualified individuals to replace them on a timely basis or at all and our senior management may need to divert their attention from other aspects of our business. Former employees may also become employees of a competitor. We may also have to pay additional compensation to attract and retain key personnel. We also anticipate hiring additional engineering, marketing and sales personnel to grow our business. Often, significant amounts of time and resources are required to train these personnel. We may incur significant costs to attract, integrate and retain them, and we may lose them to a competitor or another company before we realize the benefit of our investments in them.

We primarily compete in the rapidly evolving and competitive healthcare market, and if we fail to effectively respond to competitive pressures, our business and operating results could be harmed.

We believe that at this time the primary competition for our Voice Communication solution consists of traditional methods using wired phones, pagers and overhead intercoms. While we believe that our system is superior to these legacy methods, our solution requires a significant infrastructure investment by a hospital and many hospitals may not recognize the value of implementing our solution.

Manufacturers and distributors of product categories such as cellular phones, pagers, mobile radios, and in-building wireless telephones attempt to sell their products to hospitals as components of an overall communication system. Of these product categories, in-building wireless telephones represent the most significant competition for the sale of our solution. The market for in-building wireless phones is dominated by large horizontal communications companies such as Cisco Systems, Ascom and Polycom. In addition, while smartphones and tablets are not at present direct competitors, their proliferation may make them a de facto standard for hospital workflow, thereby making our solution less attractive to customers.

While we do not have a directly comparable competitor that provides a richly featured voice communication system for the healthcare market, we could face such competition in the future. Potential competitors in the healthcare or communications markets include large, multinational companies with significantly more resources to dedicate to product development and sales and marketing. These companies may have existing relationships within the hospital, which may

enhance their ability to gain a foothold in our market. Customers may prefer to purchase a more highly integrated or bundled solution from a single provider or an existing supplier rather than a new supplier, regardless of performance or features.

Accordingly, if we fail to effectively respond to competitive pressures, we could experience pricing pressure, reduced profit margins, higher sales and marketing expenses, lower revenue and the loss of market share, any of which would harm our business, operating results or financial condition.

Our international operations subject us, and may increasingly subject us in the future, to operational, financial, economic and political risks abroad.

Although we derive a relatively small portion of our revenue from customers outside the United States, we believe that non-U.S. customers could represent an increasing share of our revenue in the future. During 2010 and the six months ended June 30, 2011, we obtained 9.7% and 8.4%7.3% of our revenue, respectively, from customers outside of the United States, including Canada, the United Kingdom, Australia, the Republic of Ireland and New Zealand. Accordingly, we are subject to risks and challenges that we would not otherwise face if we conducted our business solely in the United States, including:

challenges incorporating non-English speech recognition capabilities into our solutions as we expand into non-English speaking countries

difficulties integrating our solutions with wireless infrastructures with which we do not have experience

difficulties integrating local dialing plans and applicable PBX standards

challenges associated with delivering support, training and documentation in several languages

difficulties in staffing and managing personnel and resellers