As filed with the Securities and Exchange Commission on December 29, 2011March 14, 2012

Registration No. 333-176603

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 34

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Forum Energy Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3533 | 61-1488595 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

920 Memorial City Way, Suite 800

Houston, Texas 77024

(281) 949-2500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James L. McCulloch

Senior Vice President, General Counsel and Secretary

Forum Energy Technologies, Inc.

920 Memorial City Way, Suite 800

Houston, Texas 77024

(281) 949-2500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

W. Matthew Strock Sarah K. Morgan Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 | J. David Kirkland, Jr. Tull R. Florey Baker Botts L.L.P. 910 Louisiana Houston, Texas 77002-4995 (713) 229-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box:¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we and the selling stockholders are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated December 29, 2011March 14, 2012

Prospectus

shares

Forum Energy Technologies, Inc.

Common stock

Forum Energy Technologies, Inc. is offering shares of its common stock and the selling stockholders are offering shares of common stock. This is an initial public offering of our common stock. We anticipate that the initial public offering price of our common stock will be between $ and $ per share. In addition, we intend to offer to sell $50 million of shares of our common stock in a private placement to a private equity firm concurrently with this offering.

We have been approved to list our common stock on the New York Stock Exchange under the symbol “FET.”

| Per share | Total | |||||||

Initial public offering price | $ | $ | ||||||

Underwriting discounts and commissions | $ | $ | ||||||

Proceeds to Forum Energy Technologies, Inc., before expenses | $ | $ | ||||||

Proceeds to selling stockholders, before expenses | $ | $ | ||||||

Forum Energy Technologies, Inc. has granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock and the selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

Delivery of the shares of common stock is expected to be made on or about , 2012.

Investing in our common stock involves risks. See “Risk factors” beginning on page 22.23.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| J.P. Morgan | ||||||||

| BofA Merrill Lynch | ||||||||

| Credit Suisse | ||||||||

| Citigroup | ||||||||

| Deutsche Bank Securities | ||||||||

Senior Co-Managers

Simmons & Company International | Tudor, Pickering, Holt & Co. |

Junior Co-Managers

Capital One Southcoast | Dahlman Rose & Company | FBR | ||

Howard Weil Incorporated | Johnson Rice & Company L.L.C. |

, 2012

| 1 | ||||

| 16 | ||||

Management’s discussion and analysis of financial condition and results of operations | ||||

| 169 | ||||

| 171 | ||||

| 178 | ||||

Material U.S. federal income and estate tax considerations to non-U.S. holders | 180 | |||

| 184 | ||||

| 192 | ||||

| 192 | ||||

| 193 | ||||

| F-1 | ||||

| A-1 | ||||

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor any of the selling stockholders has authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We and the selling stockholders are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock.

Until , 2012, all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Industry and market data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates and our management’s understanding of industry conditions.

ii

This summary provides a brief overview of information contained elsewhere in this prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk factors,” “Cautionary note regarding forward-looking statements” and “Management’s discussion and analysis of financial condition and results of operations” and the historical consolidated financial statements and related notes thereto included elsewhere in this prospectus. Unless otherwise indicated, information presented in this prospectus assumes that the underwriters’ option to purchase additional common stock is not exercised. We have provided definitions for certain industry terms used in this prospectus in the “Glossary” beginning on page A-1 of this prospectus.

In this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our” and the “Company” refer to Forum Energy Technologies, Inc. and its subsidiaries. In this prospectus, unless the context otherwise requires, the term “SCF” refers to SCF-V, L.P., SCF-VI, L.P. and SCF-VII, L.P., collectively, or any of them individually.

Unless the context otherwise requires, the pro forma financial and operational data presented in this prospectus give effect to: (i) our acquisition of: Wood Flowline Products, LLC, completed in February 2011 (the “Wood Flowline Acquisition”); Phoinix Global LLC, completed in April 2011 (the “Phoinix Acquisition”); Specialist ROV Tooling Services, Ltd., completed in May 2011 (the “Specialist Acquisition”); Cannon Services LP, completed in July 2011 (the “Cannon Acquisition”); SVP Products Inc., completed in July 2011 (the “SVP Acquisition”); AMC Global Group Ltd., completed in July 2011 (the “AMC Acquisition”); P-Quip Ltd., completed in July 2011 (the “P-Quip Acquisition”); and Davis-Lynch LLC, completed in July 2011 (the “Davis-Lynch Acquisition”); and (ii) this offering, the concurrent private placement and the use of proceeds therefrom, in each case as described in our unaudited pro forma condensed combined financial data included elsewhere in this prospectus. We refer to the transactions described in the preceding clause (i) as the “2011 Acquisitions.” Please read “Management’s discussion and analysis of financial condition and results of operations—Recent acquisitions.2011 Acquisitions.”

Forum Energy Technologies, Inc.

Overview

We are a global oilfield products company, serving the subsea, drilling, completion, production and processinfrastructure sectors of the oil and natural gas industry. We design and manufacture products, and engage in aftermarket services, parts supply and related services that complement our product offering. Our product offering and related services include a mix of highly engineered capital products and frequently replaced items that are consumed in the exploration and development of oil and natural gas reserves. In 2010,2011, approximately 41%40% of our pro forma revenue was derived from the sale of capital products, while approximately 52%53% was derived from consumable products, spare parts or aftermarket services, with the balance of the revenue coming from rental or other sources. Our capital products are directed at drilling rig new build, upgrade and refurbishment projects; subsea construction and development services; the placement of production equipment on a per well basis; and downstream capital projects. Our highly engineered systems are critical components used on drilling rigs or in the course of subsea

operations, while our consumable products are vital to maintaining efficient and safe operations at well sites, within the supporting infrastructure and at processing centers and refineries. Our revenues are generated throughout land and offshore markets and across several international regions, with 43%39% of our 20102011 pro forma revenue derived outside of the United States.

We seek to design, manufacture and supply reliable, cost effective products that create value for our broad and diverse customer base, which includes oil and gas operators, land and offshore drilling contractors, well service, stimulation and intervention service providers, subsea construction and service companies, pipeline operators and refinery and petrochemical plant operators, among others. We believe that we differentiate ourselves from our competitors on the basis of the quality of our products, the level of related service and support we provide and the collaborative approach we take with our customers to help them solve critical problems. Our goal is to be the supplier of choice for our customers by offering innovative, reliable and cost effective products, and by investing in long-term relationships that add value to our customers’ operations.

Our business consists of two segments:

Drilling and Subsea Segment. We design and manufacture products and provide related services to the drilling, well construction, completion, intervention and subsea construction and services markets. This segment contributed $626$755 million, or 66%61% to our 20102011 pro forma revenue.

| • | Subsea technologies. We design and manufacture subsea capital equipment; specialty components and tooling; and applied products for subsea pipelines; and we also provide a broad suite of complementary subsea technical services and rental items. We have a core focus on the design and manufacture of unmanned submarines known in the industry as remotely operated vehicles (“ROVs”) as well as other specialty subsea vehicles. We believe that our Perry™ and Sub-Atlantic™ vehicle brands are among the most respected in the industry. Our related technical services complement our vehicle offering by providing the market with a broad selection of critical product solutions and rental items that enhance our customers’ ability to operate in harsh subsea environments. We have a long tradition of working with customers to develop innovative product solutions to address the increasingly complex challenges of deepwater operations. |

| • | Downhole |

| • | Drilling |

Production and Infrastructure Segment. We design and manufacture products and provide related equipment and services to the well stimulation, completion, production and infrastructure markets. This segment contributed $329$491 million, or 34%39% to our 20102011 pro forma revenue.

| • | Flow equipment. We design, manufacture and provide flow equipment to the well stimulation, testing and flowback markets. Our product offering includes the critical components typically found in the flow equipment train from the well stimulation pressure pump to the manifold at the wellhead. These components routinely encounter high pressures, requiring frequent refurbishment or replacement. We also provide related flow equipment recertification and refurbishment services, which are critical to the safe and reliable operation of well completion activities. |

| • |

|

| • | Valve solutions. We design, manufacture and provide a wide range of industrial valves that principally serve the upstream, midstream and downstream markets of the oil and gas value chain. We provide a comprehensive suite of ball, gate, globe, check and butterfly valves across a wide range of sizes and applications. Our manufacturing and supply chain systems enable us to design and produce high-quality, engineered valves, as well as provide standardized products, while maintaining competitive pricing and minimizing capital requirements. |

The following table summarizes our key product lines, grouped by our two business segments:

| Drilling and | Production and | |||||||||

| ||||||||||

| Drilling | Downhole | Subsea technologies | Flow equipment | Surface equipment | Valve solutions | |||||

| ||||||||||

• Tubular handling equipment

• Wrangler™ Roughnecks

• Wrangler™ Catwalks

• Specialized torque machines and bucking units

• Crane systems

• Drill floor instrumentation and monitoring systems

• Choke and kill manifold mud systems

• Coiled tubing and wireline blowout preventers

• Drilling and production valves, chokes and flowline connections

• Centrifugal pumps and fluid end-components

• Patented mud pump liner retention and mud pump rod piston systems

• Specialty oilfield bearings |

• Davis-Lynch™ float equipment

• Centralizers

• Stage cementing tools

• Inflatable packers

• Flotation collars

• Cementing plugs

• Fill and circulate tools for running casing

• Casing hangars

• Surge reduction equipment

• Cannon™ downhole protection systems

• Customized downhole protection installation tools |

• Perry™

•

• Remote

• Specialty

• Subsea

• Rescue

• Tether

• ROV

• Standardized

• Dynamic

• Geotechnical

• Related |

• Triplex and

• Swivel

• Pup joints

• Swages

• Hammer

• Crossovers

•

• Chokes

• Relief valves

• Bull plugs

• Pressure

• Flowback

• Flow | • Pressure vessels

• Tanks

• Separators

• Vapor

• Scrubbers

• Well test

• Compressor

• Pipeline

• EDGE™

• Lease • Processing

|

• Flanged

• Threaded and

• Butterfly

• Metal seated

• Trunnion

• Full opening

• Pressure seal

• Cast iron | |||||

Current trends in our industry

We are currently focused on the following trends that we believe will positively affect our business in the coming years. The majority of these are secular growth trends that we believe will outpace general industry growth.

| • | Increasing complexity of well construction. As conventional sources of oil and gas are depleted, our industry continues to develop new well construction technologies and techniques that allow operators to recover more hydrocarbons from each well and make previously uneconomic reservoirs profitable. These techniques, most pronounced in the global deepwater and North American land market, include drilling deeper, more highly deviated well paths |

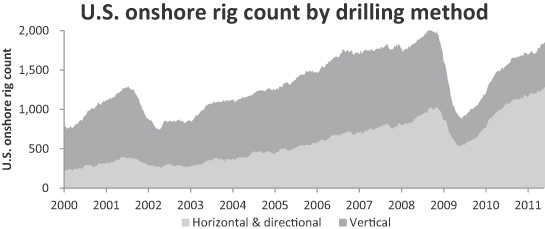

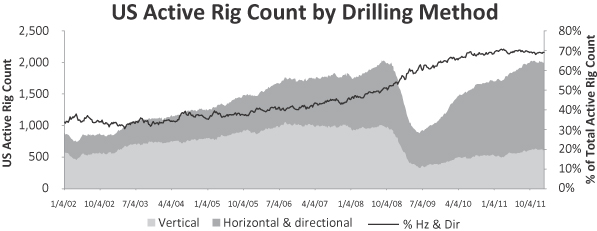

| • | Growing service intensity associated with unconventional resources. The dramatic growth in the development of unconventional shale and tight sand formations, principally in North America, is placing increasing demands on the service equipment. In the U.S., |

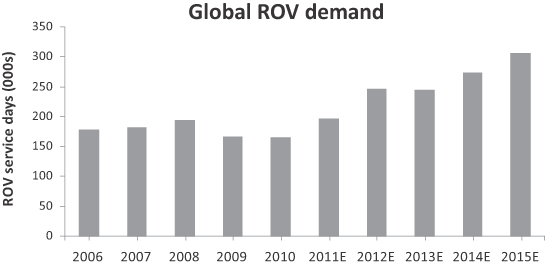

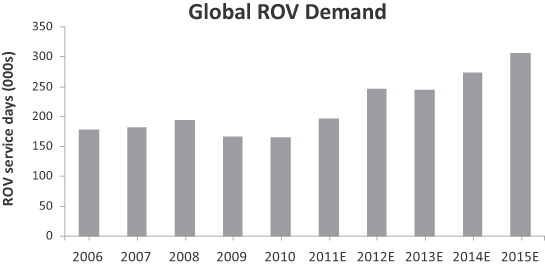

| • | Increasing investment in subsea equipment and related services. As the industry develops more deepwater fields, the amount of subsea infrastructure is expected to continue to increase and the ability of service companies and producers to control operations in a safe and effective manner will become more challenging. Subsea infrastructure is also becoming more complex given the focus on larger, more interconnected fields in ultra deepwater environments. This growing complexity is expected to result in greater demand for technologies and products, such as ROVs, that are specifically designed to help service companies and producers gain situational awareness and preserve operational effectiveness. In addition, maintaining and servicing this additional subsea infrastructure is expected to become a larger market as the number of subsea well completions increases and the population of producing subsea wells ages. |

| • | Heightened focus on product maintenance and certification. Our customers and the relevant regulatory authorities are increasingly focused on product and equipment integrity, particularly in applications or environments in which products are exposed to high pressure, high temperature or corrosive elements. We have observed many of our customers implementing more regular and rigorous maintenance and recertification programs for equipment with long useful lives, which we believe could increase the demand for aftermarket services and parts across many product categories. |

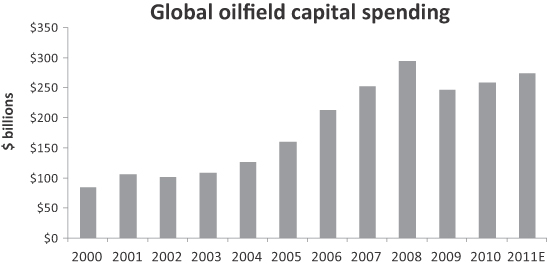

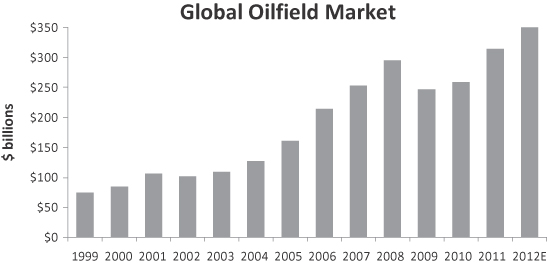

| • | Increased capital spending in the oil and gas industry. The growing global demand for energy has resulted in substantial capital spending increases by oil and natural gas producers. |

According to Spears & Associates, annual global oilfield capital spending has increased from $85 billion in 2000 to |

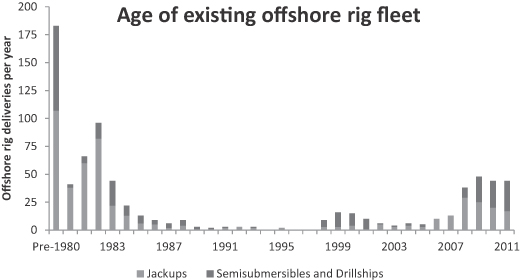

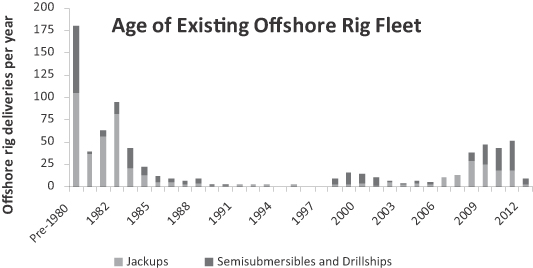

| • | Recovery in global drilling activity and new rig replacement cycle. As global drilling activity has steadily recovered since the 2009 economic downturn, there has been a corresponding increase in new build rig activity as operators require newer technology to meet increasingly challenging drilling conditions, with a focus on mobility, drilling efficiency, power and safety. According to RigLogix, as of |

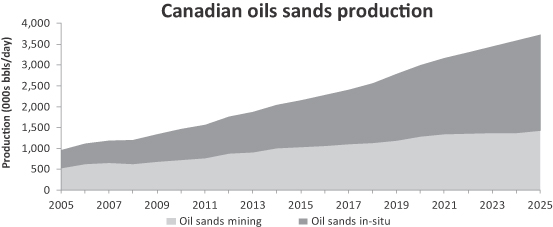

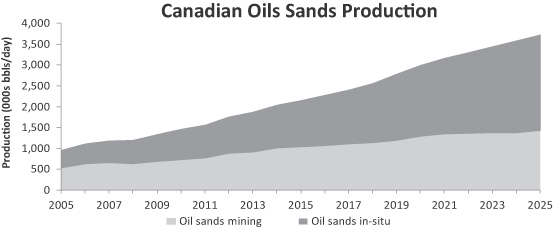

| • | Development of heavy oil reserves in Canada. Canadian heavy oil reserves offer a large, stable and reliable source of oil for North America. Recent advances in technologies and development practices have lowered both the cost of producing these reserves and the environmental impact of these operations. The lowered cost of production, combined with a stable and robust outlook for oil prices, have enabled the heavy oil producers to undertake long-term development initiatives. The Canadian Association of Petroleum Producers (“CAPP”) has estimated total Canadian heavy oil crude production, including oils sands, will increase from 1,845 Mbpd in 2010 to |

While we believe that these trends will benefit us, our markets may be adversely affected by industry conditions that are beyond our control. Any prolonged substantial reduction in oil and gas prices would likely affect oil and gas drilling and production levels and therefore would affect demand for the products and services we provide. For more information on this and other risks to our business and our industry, please read “Risk factors—Risks related to our business.”

Our business strategy

Our objective is to build a leading global oilfield products company that supplies high quality, mission critical products and related aftermarket services, serving customers globally across the oil and gas value chain. We intend to accomplish that objective and capitalize on the key long-term industry growth trends through the execution of the following strategic elements:

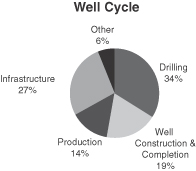

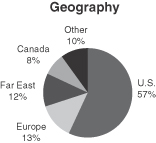

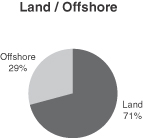

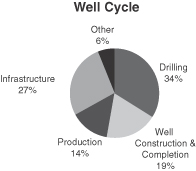

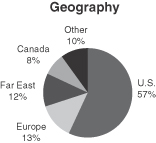

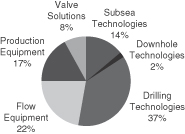

Tailor our product offering and capacity to customer spending. On an annual basis, we conduct a bottoms-up analysis of the sources and drivers of our revenue. Our analysis is focused on various types of revenue splits and exposures, including: (1) phases of the life cycle of the well; (2) geographic exposure by shipment destination; (3) land or offshore application; and (4) product purchase cycles; and (5) commodity mix.cycles. This process relies on a combination of financial analysis and management estimation. Our analysis of our 20102011 pro forma revenues is as follows:

|  | |||

|  | |||

| ||||

As part of the bottoms-up analysis described above, we also estimate the broad industry drivers of our business. We believe that our 20102011 pro forma revenue growth was strongly driven by North American unconventional resource developments and global deepwater development activity, shallow offshore activity and international land activity, with lessermeaningful contributions from Canadian

heavy oil developments and downstream activity. Although acquisitions may cause fluctuations in our business mix, we intend to preserve and enhance the diversity of our business as a core part of our strategy. We believe this diversity reduces the impact of the volatility of any single equipment spend cycle or well cycle phase or equipment spend cycle on our financial performance. A description of how we define each of the categories within each revenue split above is included in the “Glossary” beginning on page A-1 of this prospectus.

Leverage our product lines’ strengths across our platform. Each of our respectiveOur product lines hashave particular strengths that can be leveraged across theour entire platform. We intend to cross-fertilize technologies, share product development initiatives and leverage key geographic, supply chain and customer strengths to grow and improve the profitability of our overall business.

Expand our geographic presence. We intend to enhance our access to key global markets and to grow or establish our presence across thekey North American unconventional resource basins. We also plan to build upon our existing presence in the North American, North Sea, Middle East, South American and Asia Pacific regions through deployment of sales, distribution, service and manufacturing resources. We believe this expansion will provide more points of contact with our customers, allowing us to respond more quickly to their needs.

Invest in manufacturing capacity and excellence. We focus on the continuous improvement of our manufacturing processes and quality controls, which are vital to ensuring product reliability. We also continue to invest in expanding our manufacturing capacity by increasing output, upgrading machinery or adding “roofline” in strategically important geographies. We believe that in certain product lines, particularly those sold into the North American unconventional resource plays, locating manufacturing and service capabilities in close proximity to field locations improves response time, reduces freight costs and enhances customer service.

Pursue disciplined growth through acquisitions. We have a track record of successfully growing our earnings and product offerings by making attractive acquisitions. We intend to continue to selectively pursue acquisitions that increase our exposure to the most important growth trends in the oil and gas industry, fill critical product gaps andor expand our geographic scope. With a strong balance sheet and sufficient financial resources, we believe that we can continue to acquire companies in high growth product areas and expose the acquired product lines to new customers and distribution channels, while preserving the entrepreneurial attributes that made them attractive on a stand-alone basis.

Develop new products. We conduct strategic reviews to identify underserved market opportunities and invest in continuous product development efforts. While our product development efforts involve formal research and engineering projects, we most often generate product development ideas, concepts and opportunities while working closely with our customers in the normal course of business. Our focus on customer service as well as our strong aftermarket offering facilitates product development opportunities that may not be captured as part of a formalized research and engineering project. We believe this process allows us to enhance our exposure to key secular trends and serve our customers’ needs more effectively. We have developed strong working relationships with our major customers, several of which routinely approach us with requests for solutions to specific application challenges. We plan to continue to improve our new product engineering capabilities and leverage our expertise to address customer needs. Recent examples include the landoffshore and offshoreland versions of our Wrangler

Roughneck™, a critical makeup and breakout tool for tubulars on a drilling rig, and our subsea ROVDrill™, a unique tool designed to perform subsea drilling functions independent of the support vessel while using only the associated ROV for power and control.

Focus on product quality and customer service. We have a track record of providing innovative, reliable, fit-for-purpose products at competitive prices while remaining responsive to the needs of our customers. We work closely and flexibly with our customers on delivery timing and service after the sale. We seek to ensure that our businesses have the facilities and personnel to maintain the highest level of safety, quality and service as we grow around the world.

Our competitive strengths

We believe that we are well positioned to execute our strategy based on the following competitive strengths:

Broad product offering with exposure to key long-term industry trends and a diverse customer base. Our exposure to a mix of consumable products, capital products and aftermarket parts and services enables us to participate in the construction, capacity expansion, maintenance, upgrade and refurbishment phases of the energy cycle. In addition, we have exposure to multiple sectors of the oil and gas industry and a diverse mix of customers across the full oil and gas value chain. We believe our broad product offering, diversified exposure to industry trends and extensive customer base reduces our dependence on any one phase, purchase cycle, segment or region and should result in more stable financial results.

Focus on critical peripheral products. Many of our products, particularly those serving the drilling and well stimulation markets, are non-discretionary components that represent a small percentage of the life cycle cost associated with large capital equipment. We believe that focusing on specialized, peripheral products affords us full exposure to the most powerful investment trends in the oil and gas industry while insulating us from the intense competitive environment and construction risks often associated with selling the largest capital equipment packages.

Solid base of recurring revenues from consumable products. In 2010,2011, we generated approximately 52%53% of our pro forma revenues from consumable products, spare parts or aftermarket parts and services, which are critical to large capital equipment or energy infrastructure. In some cases, these products must be replaced multiple times throughout the life cycle of the related capital equipment or infrastructure installations. These products have replacement cycles ranging from a few months to a few years, resulting in a stable base of recurring revenues. We often complement these products with a recertification and refurbishment service, which helps us preserve strong customer relations. We have also observed that our customers often return to the same vendors for replacement parts, lending further revenue stability and visibility.

Experienced management team with proven public company track record. Our executive officers and senior operational managers have an average of over 30 years of experience in the oilfield manufacturing and service industry. Each of our top three operational executives served as the chief operational officer of one or more large publicly held oilfield service companies or of a significant division thereof. We believe their collective background provides our management team with an in-depth understanding of our customers’ needs, enhances our ability to deliver customer-driven solutions and allows us to operate effectively throughout industry cycles. Several

members of our management team were executives or directors at one of the five companies that combined to form Forum Energy Technologies, Inc. in August 2010.

Multiple avenues for growth and strong cash flows. We are focused on a core set of product platforms that we believe offer strong long-term growth. The breadth of our product offering affords us multiple organic growth avenues in which to deploy our capital, and we invest in the highest value opportunities that meet our return objectives and further our strategic goals. Similarly, we believe the scope of available acquisition opportunities will be enhanced by the numerous strategic directions available to us. In the face of particularly strong competition for acquisitions in a specific sector, we can deploy capital to other areas of our Company that afford better relative value. We also believe that our breadth and size allows us to meaningfully change

our financial profile and business composition with modestly sized acquisitions. Finally, our manufacturing operations are not capital intensive to maintain or expand, which allows us to generate strong cash flow. This provides us with capacity to finance organic growth opportunities with internally generated resources.

Proven ability to grow earnings and improve product offering through a focused acquisition strategy. We have a strong track record of strategically targeting key product opportunities, completing accretive transactions and effectively integrating these businesses. We have a disciplined acquisition strategy that allows us to develop proprietary deal flow by identifying emerging industry trends, identifying existing platforms positioned to capitalize on these trends, and in some cases isolating acquisition opportunities that are largely missed by our competitors due to smaller size and scale. Each of the original five companies that combined to form Forum Energy Technologies, Inc. was itself the result of a similar acquisition strategy focused on a specific industry growth theme. Our current acquisition strategy is a continuation of that successful model. Since the Combination in August 2010, we have completed eight acquisitions, three of which were focused on enhancing existing product offerings, while the remaining five permitted us to establish two new product offering platforms:offerings: downhole productstechnologies and flow equipment related to well stimulation. These new offerings enhanced our exposure to the growing well completion market.

Customer responsive product innovation. We have grown our business by being responsive to customer needs and developing strong relationships at multiple levels of our customers’ organizations. We believe our ability to develop new products is enhanced because of these customer relationships. Our experienced engineering and technical staff has partnered with our customers to design and develop new products that add value to their operations or reduce their total cost of doing business. As a result, we have developed and commercialized a number of new products that have improved the efficiency and safety of our customers’ operations including our powered Wrangler™ catwalk and iron roughnecks, powered mousehole tool, Perry ROVDrill™, low profile urban gas processing unit and others.

Recent developments

| • | Acquisition opportunity. Consistent with our acquisition strategy, we are continuously engaged in discussions with potential sellers regarding our possible purchase of assets and operations that are strategic and complementary to our existing operations. We have entered into a non-binding letter of intent and are currently in negotiations with the owners of a privately-held oilfield services company. This company provides products and services that are complementary to, but not the same as, certain of our existing product lines. We have not completed our due diligence, including our evaluation of the financial performance of the assets, and we have not reached agreement with the owners on all material business points. Based on the information provided to us to date, we believe that the aggregate value for the company is in the range of $115 million to $140 million, and we expect to pay the purchase price in cash using available cash and borrowings from our senior secured credit facility. We have not signed a purchase and sale agreement with respect to this potential acquisition and if we do, we expect such agreement would be subject to customary conditions to closing. We cannot provide any assurance that we will successfully complete these negotiations, execute a definitive purchase and sale agreement or ultimately close an acquisition in the near term or at all. |

| • | Established consumable flow equipment product line. In late 2010, we launched a strategic effort to expand our product offering to include consumable products used in the well stimulation and completion processes. Our initial focus was on the consumable flow equipment and pressure control equipment used in the well stimulation, testing and flowback processes. In 2011, we closed three acquisitions to form our core platform with an aggregate capital deployment of approximately $115 million. Taken together, these acquisitions have established |

our consumable flow equipment platform within our Production and Infrastructure Segment. These acquisitions provide us with a full product offering, expert managers, key customer relationships and critical expertise in the design, engineering and manufacture of the full range and sizes of flow equipment. Moreover, as recertification and refurbishment operations are critical to ensuring the reliable and safe operation of a pressure pumping company’s fleet, we operate a fleet of sophisticated mobile recertification and refurbishment tractor trailers, which we can deploy to the customer’s yard or to the well site. |

| • | Established downhole |

| • | Strengthened subsea |

| • | Strengthened drilling |

| • | Recent product developments. We invest in continuous product development efforts to enhance our exposure to key, long-term growth trends in the oil and natural gas industry and support our ability to serve our customers needs more effectively. Recent product developments include: |

| • | “Tomahawk” Observation Class ROV. In March 2012, we launched a new multi-role observation class ROV called the Tomahawk. The Tomahawk is the latest addition to our long line of Sub-Atlantic™ branded observation class ROVs, which includes the Comanche, |

Mohican, Super Mohawk, Mohawk, Mojave and Navajo Electric ROV Systems. We developed the Tomahawk in response to our customers’ needs for a dependable and adaptable multi-role ROV that can deploy and operate in demanding environments. The Tomahawk uses the subCAN™ high-speed communications data network system. Rated to a depth of 3,000 metres, the Tomahawk is designed for survey, well intervention and drilling support operations in deep-water conditions, such as in Brazil, West Africa and the Gulf of Mexico. |

| • | ROVDrill™ achieves technical milestone. The ROVDrill™ is a unique tool designed to perform subsea drilling functions independent of the support vessel while using only the associated ROV for power and control. During the first quarter of 2011, the ROVDrill™ successfully completed a drilling program to validate subsurface mineral deposits for a mining customer. We believe this technology also has significant applications outside the mining industry, implications for the existing seafloor coring market and applications for use in better understanding geologic fault lines. |

| • | Wrangler™ roughneck completes initial drilling |

a vital piece of drilling rig equipment. We designed this product to meet the growing need for a high-torque tool optimized for drilling complex wells. Our initial unit successfully concluded a three well land drilling program for a key customer during which it completed over 4,000 connections. We also recently developed and sold an offshore version of this tool to a major contractor. We believe this technology has significant applications in unconventional resource basins and in the growing offshore drilling market. |

Risk factors

Investing in our common stock involves risks. In particular, the following considerations may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decrease in the price of our common stock and result in a loss of all or a portion of your investment:

We derive a substantial portion of our revenues from companies in or affiliated with the oil and natural gas industry, a historically cyclical industry, with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. As a result, this cyclicality may cause fluctuations in our revenues and results of our operations.

Our inability to control the inherent risks of acquiring and integrating businesses could disrupt our business, dilute stockholder value and adversely affect our operating results going forward.

Our operating history may not be sufficient for investors to evaluate our business and prospects.

Growing our business organically through the expansion of our existing product lines and facilities subjects us to risks of construction delaydelays and cost overruns.

We may be unable to employ a sufficient number of skilled and qualified workers.

The current pace of spending for drilling rigs and other capital intensive equipment may not be sustainable over time, and our financial results may suffer to the extent they are dependent on sales of such equipment.

Our business depends upon our ability to obtain key raw materials and specialized equipment from suppliers. Increased costs of raw materials and other components may result in increased operating expenses.

We are subject to the risk of supplier concentration.

Our operations and our customers’ operations are subject to a variety of governmental laws and regulations that may increase our costs, limit the demand for our products and services or restrict our operations.

The markets in which we operate are highly competitive, and some of our competitors hold substantial market share and have substantially greater resources than we do. We may not be able to compete successfully in this environment and, in particular, against a much larger competitor.

L.E. Simmons & Associates, Incorporated (“LESA”), through SCF, will control the outcome of stockholder voting and may exercise this voting power in a manner adverse to you.

We have renounced any interest in specified business opportunities, and SCF and its director nominees on our board of directors generally have no obligation to offer us those opportunities. LESA may allocate any potential opportunities to its other portfolio companies where LESA determines, in its discretion, such opportunities are the most logical strategic and operational fit.

For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our common stock, see “Risk factors” beginning on page 2221 and “Cautionary note regarding forward-looking statements.”

The combination

SCF Partners, L.P. (“SCF Partners”) is a private equity firm that has specialized in investments in the oilfield services sector since it was founded in 1989. From May 2005 to August 2007, SCF Partners made investments in product and manufacturing companies targeted at specific oilfield growth trends. During that time, SCF Partners acquired Forum Oilfield Technologies, Inc. (“FOT”), Global Flow Technologies, Inc. (“Global Flow”), Triton Group Holdings, LLC (“Triton”), Allied Production Services, Inc. (“Allied”) and Subsea Services International, Inc. (“Subsea”). In addition to growing organically after their acquisition by SCF Partners, FOT, Global Flow, Triton, Allied and Subsea completed, in the aggregate, 28 acquisitions from May 2005 to January 2009. For more information regarding the development of FOT, Global Flow, Triton, Allied and Subsea through organic growth and acquisitions please read “Business—Business history.”

Beginning in 2009, and in collaboration with SCF Partners, several of the companies initiated long-term strategic discussions concerning the formation of a broadly based oilfield products company that would be capitalized to take advantage of growth opportunities as the industry recovered from the industry wide downcycle that occurred in 2009. On August 2, 2010, each of FOT,

Global Flow, Triton, Allied and Subsea were combined (referred to in this prospectus as the “Combination”). In the Combination, FOT became the parent company and was renamed Forum Energy Technologies, Inc.

The strategic rationale for the Combination was based on the following key objectives and benefits:

| • | Increase access to growth capital. Many of the Combination companies projected that there would be significant growth opportunities |

| • | Enhance ability to serve our customers and improve cross selling of products. A larger platform with better financing would instill greater confidence in customers and better position the business to pursue |

programs, consumable product inventory management and other long-term strategic supplier arrangements. In addition, access to a more expansive geographic platform would provide several of the Combination companies with a greater capacity to provide aftermarket service. Finally, the management teams believed that we would have more opportunities to reach certain targeted customers and the ability to leverage those interactions to drive incremental revenue opportunities. For example, management believed that Allied’s customer relationships with producers would provide introductory opportunities for Global Flow’s valve business, which generally is pulled through distribution companies to the producer. |

| • | Leverage the strengths of each company across the combined Company. Each of the Combination companies had particular strengths, many of which would benefit one or more of the others. For example, the controls technology expertise imbedded within Triton’s ROV development group could provide FOT’s tubular handling capital equipment development effort with access to highly skilled engineers who had solutions to controls technology challenges. A second example involved Global Flow’s robust supply chain system, which involved outsourced manufacturing and critical vendor relationships in Asia. The combined management believed that access to this supply chain and the knowledge that produced it would accelerate similar efforts across the other companies. |

| • | Enhance financial stability. Each of the Combination companies was subject to different industry drivers, many of which have historically experienced different cycles. The management teams believed that a combined company participating in each of these varying cycles would provide an enhanced measure of stability to the business and to the long-term planning process by decreasing the volatility of its financial results. |

| • | Internally source products. Some of the Combination companies used products of other Combination companies in their manufacturing process. The management teams believed there would be an opportunity to generate incremental business by internally sourcing some of these products. |

Having concluded the Combination, we believe that the investment thesis and the associated operational benefits to us have been proven. As integration has proceeded, we have discovered benefits and opportunities incremental to those described above. We believe that the operational and financial benefits realized through the Combination have: (1) enhanced our growth potential; (2) offered ongoing synergistic opportunities; (3) provided the opportunity to develop broader and more diversified product lines; (4) enabled us to compete with larger companies; (5) provided an opportunity to leverage discrete internal initiatives across a broader platform; and (6) established a good foundation for long-term growth. Several of these opportunities are under development and we believe that there will be strong benefits to the business as we continue to grow.

Stock split

Prior to the completion of this offering, we expect our board to approve a proposal to amend our certificate of incorporation to give effect to a for stock split of our issued and outstanding common stock. For additional information, see “Stock split.”

Corporate information

Our principal executive offices are located at 920 Memorial City Way, Suite 800, Houston, Texas 77024, and our telephone number at that address is (281) 949-2500. Our website is available athttp://www.f-e-t.com. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

Common stock offered by Forum Energy Technologies, Inc. | shares ( shares if the underwriters’ option is exercised in full) |

Common stock offered by the selling stockholders | shares ( shares if the underwriters’ option is exercised in full) |

Total common stock offered | shares ( shares if the underwriters’ option is exercised in full) |

Common stock to be outstanding after the offering | shares ( shares if the underwriters’ option is exercised in full), including shares to be sold in a concurrent private placement. See ”—Concurrent Private Placement.” |

Common stock owned by the selling stockholders after the offering | shares ( shares if the underwriters’ option allotment is exercised in full) |

Over-allotment option | We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of our common stock and the selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to additional shares of our common stock. |

Use of proceeds | We will receive net proceeds of approximately $ million from the sale of the common stock by us in this offering, assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and after deducting estimated expenses and underwriting discounts and commissions. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $ million. We intend to use all of the net proceeds from this offering and any proceeds from any exercise of the underwriters’ option to purchase additional common stock from us to repay outstanding borrowings under the revolving portion of our senior secured credit facility. We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders. See “Use of proceeds.” |

Dividend policy | We do not anticipate paying any cash dividends on our common stock. In addition, our senior secured credit facility contains restrictions on making cash dividends. |

Risk factors | You should carefully read and consider the information beginning on page |

New York Stock Exchange (“NYSE”) symbol | FET |

Concurrent Private Placement | We intend to offer to sell $50 million of shares of our common stock at the public offering price less the underwriting discount, or shares of our common stock assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), in a private placement to a private equity firm not affiliated with SCF concurrently with this offering. We intend to use the net proceeds from the concurrent private placement to repay outstanding borrowings under the revolving portion of our senior secured credit facility. If the price at which we offer the shares of common stock to the public is above the range set forth on the cover of this prospectus, the purchaser may elect not to purchase any shares of our common stock or to buy only a portion of the shares offered to it. The shares of common stock to be sold in the concurrent private placement are not being offered pursuant to this prospectus and will be subject to certain restrictions on resale in accordance with the Securities Act of 1933, as amended (the “Securities Act”). |

Conflicts of interest | We may use more than 5% of the net proceeds of this offering to repay indebtedness owed by us to affiliates of the underwriters that are lenders under our credit agreement. See “Use of proceeds.” Accordingly, this offering will be made in compliance with the applicable provisions of Rule 5121 of the Financial Industry Regulatory Authority, Inc. This rule requires that a “qualified independent underwriter” meeting certain standards participate in the preparation of the registration statement and prospectus and exercise the usual standards of due diligence with respect thereto. Tudor, Pickering, Holt & Co. Securities, Inc. has agreed to act as a “qualified independent underwriter” within the meaning of Rule 5121 in connection with this offering. See “Underwriting (conflicts of interest).” |

Other Outstanding Shares

The number of shares of common stock that will be outstanding after the offering and the concurrent private placement includes shares of restricted common stock issued to officers and other employees under our stock incentive plan that are subject to vesting. As of December 27, 2011,March 9, 2012, there were 16,64516,644 shares of restricted stock outstanding that remain subject to vesting.

The number of shares of common stock that will be outstanding after the offering excludes:

209,804206,847 shares issuable upon the exercise of options outstanding as of December 27, 2011March 9, 2012 under our stock incentive plan;

193,292193,214 shares issuable upon the exercise of warrants outstanding as of December 27, 2011;March 9, 2012;

an aggregate of 173,551176,509 shares of common stock reserved and available for future issuance as of December 27, 2011March 9, 2012 under our stock incentive plan; and

an aggregate of up to 15,253 shares, which may be issued as contingent consideration based on certain operating results of companies previously acquired.

Summary historical and pro forma financial data

You should read the following summary historical consolidated and pro forma condensed combined financial data in conjunction with “Unaudited pro forma condensed combined financial data,” “Selected historical consolidated financial data,” “Management’s discussion and analysis of financial condition and results of operations” and the historical consolidated combined financial statements and related notes thereto included elsewhere in this prospectus. The financial data included in this prospectus may not be indicative of our future results of operations, financial position and cash flows.

The summary historical financial data as of December 31, 20092010 and 20102011 and for the years ended December 31, 2008, 2009, 2010 and 20102011 are derived from our audited consolidated financial statements and the related notes thereto included elsewhere in this prospectus. The historical financial data as of September 30, 2011 and for the nine months ended September 30, 2010 and 2011 are derived from our unaudited consolidated financial statements and the related notes thereto included elsewhere in this prospectus, have been prepared on a basis consistent with the audited financial statements and the notes thereto and include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the financial data.

The summary pro forma condensed combined financial data for the year ended December 31, 2010 and the nine months ended September 30, 2011 are derived from the unaudited pro forma financial statements of Forum Energy Technologies, Inc. included in this prospectus under “Unaudited pro forma condensed combined financial data.” The pro forma financial data for the year ended December 31, 2010 gives effect to the 2011 Acquisitions, the issuance by us of shares of common stock pursuant to this offering and the application of the net proceeds therefrom as described in “Use of proceeds,” in each case as if each such transaction had occurred on January 1, 2010. The pro forma financial data for the nine months ended September 30, 2011 gives effect to the 2011 Acquisitions, the issuance by us of shares of common stock pursuant to this offering and the concurrent private placement and the application of the net proceeds therefrom as described in “Use of proceeds,”proceeds” and “—The offering—Concurrent private placement, “ respectively, in each case as if each such transaction had occurred on January 1, 2011. For additional information regarding the estimates and adjustments made to prepare the pro forma financial data, please see “Unaudited pro forma condensed combined financial data” included elsewhere in this prospectus.

| Actual | Pro forma | Actual | Pro forma | |||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, | Nine months ended September 30, | Year ended December 31, | Nine months ended September 30, | Year ended December 31, | Year ended December 31, | |||||||||||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | 2010 | 2011 | 2009 | 2010 | 2011 | 2011 | ||||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share information) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Statement of income data: | ||||||||||||||||||||||||||||||||||||||||||||

Net sales | $ | 972,551 | $ | 677,378 | $ | 747,335 | $ | 545,751 | $ | 791,412 | $ | 955,449 | $ | 909,026 | $ | 677,378 | $ | 747,335 | $ | 1,128,131 | $ | 1,245,745 | ||||||||||||||||||||||

Cost of sales | 691,824 | 491,463 | 533,078 | 390,851 | 542,832 | 637,111 | 596,824 | 491,463 | 533,078 | 765,670 | 819,662 | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Gross profit | 280,727 | 185,915 | 214,257 | 154,900 | 248,580 | 318,338 | 312,202 | 185,915 | 214,257 | 362,461 | 426,083 | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Operating expenses | ||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | 146,943 | 128,562 | 141,441 | 100,263 | 129,626 | 185,571 | 152,762 | 128,562 | 141,441 | 186,774 | 209,821 | |||||||||||||||||||||||||||||||||

Contingent consideration | — | — | — | — | 6,000 | — | 6,000 | — | — | 12,100 | 12,100 | |||||||||||||||||||||||||||||||||

Transaction expenses | — | — | — | — | 3,434 | — | — | — | — | 3,608 | — | |||||||||||||||||||||||||||||||||

Impairment of goodwill and other intangible assets | 44,015 | 7,009 | — | — | — | — | 7,009 | — | — | — | ||||||||||||||||||||||||||||||||||

(Gain) loss on sales of assets | (619 | ) | 137 | (461 | ) | (471 | ) | (520 | ) | (461 | ) | (520 | ) | 137 | (461 | ) | (634 | ) | (634 | ) | ||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Total operating expenses | 190,339 | 135,708 | 140,980 | 99,792 | 138,540 | 185,110 | 158,242 | 135,708 | 140,980 | 201,848 | 221,287 | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Income from operations | 90,388 | 50,207 | 73,277 | 55,108 | 110,040 | 133,228 | 153,960 | 50,207 | 73,277 | 160,613 | 204,796 | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Other expense | ||||||||||||||||||||||||||||||||||||||||||||

Expenses related to the Combination | — | — | 6,968 | 6,919 | — | 6,968 | — | — | 6,968 | — | — | |||||||||||||||||||||||||||||||||

Deferred loan costs written off | — | — | 6,082 | 6,082 | — | 6,082 | — | — | 6,082 | — | — | |||||||||||||||||||||||||||||||||

Interest expense | 24,704 | 19,451 | 18,189 | 15,417 | 13,723 | 31,747 | 20,830 | 19,451 | 18,189 | 19,532 | 25,272 | |||||||||||||||||||||||||||||||||

Other, net | (2,065 | ) | (1,088 | ) | (2,308 | ) | (2,189 | ) | 1,261 | (2,486 | ) | 1,175 | (1,088 | ) | (2,308 | ) | 378 | 292 | ||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Total other expense | 22,639 | 18,363 | 28,931 | 26,229 | 14,984 | 42,311 | 22,005 | 18,363 | 28,931 | 19,910 | 25,564 | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Income from continuing operations before income taxes | 67,749 | 31,844 | 44,346 | 28,879 | 95,056 | 90,917 | 131,955 | 31,844 | 44,346 | 140,703 | 179,232 | |||||||||||||||||||||||||||||||||

Provision for income tax expense | 32,938 | 11,011 | 20,297 | 15,685 | 33,176 | 35,715 | 45,456 | 11,011 | 20,297 | 47,110 | 59,961 | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Income from continuing operations | 34,811 | 20,833 | 24,049 | 13,194 | 61,880 | 55,202 | 86,499 | 20,833 | 24,049 | 93,593 | 119,271 | |||||||||||||||||||||||||||||||||

Loss from discontinued operations, net of taxes | (396 | ) | (1,342 | ) | — | — | — | — | — | (1,342 | ) | — | — | — | ||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Net income | 34,415 | 19,491 | 24,049 | 13,194 | 61,880 | 55,202 | 86,499 | 19,491 | 24,049 | 93,593 | 119,271 | |||||||||||||||||||||||||||||||||

Less: Income attributable to noncontrolling interest | (39 | ) | (155 | ) | (111 | ) | (123 | ) | (267 | ) | (111 | ) | (267 | ) | (155 | ) | (111 | ) | (251 | ) | (251 | ) | ||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Net income attributable to common stockholders | $ | 34,376 | $ | 19,336 | $ | 23,938 | $ | 13,071 | $ | 61,613 | $ | 55,091 | $ | 86,232 | $ | 19,336 | $ | 23,938 | $ | 93,342 | $ | 119,020 | ||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Weighted average shares outstanding | ||||||||||||||||||||||||||||||||||||||||||||

Basic | 1,232 | 1,304 | 1,454 | 1,422 | 1,671 | 1,304 | 1,454 | 1,710 | ||||||||||||||||||||||||||||||||||||

Diluted | 1,261 | 1,322 | 1,468 | 1,424 | 1,769 | 1,322 | 1,468 | 1,824 | ||||||||||||||||||||||||||||||||||||

Earnings per share | ||||||||||||||||||||||||||||||||||||||||||||

Basic | $ | 27.90 | $ | 14.83 | $ | 16.46 | $ | 9.19 | $ | 36.87 | $ | 14.83 | $ | 16.46 | $ | 54.59 | $ | |||||||||||||||||||||||||||

Diluted | 27.26 | 14.63 | 16.31 | 9.18 | 34.83 | 14.63 | 16.31 | 51.17 | ||||||||||||||||||||||||||||||||||||

| As of December 31, | As of December 31, | |||||||||||||||||||

| 2009 | 2010 | As of September 30, 2011 | 2010 | 2011 | ||||||||||||||||

| (in thousands) | (unaudited) | |||||||||||||||||||

|

|

| ||||||||||||||||||

Balance sheet data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 26,894 | $ | 20,348 | $ | 36,928 | $ | 20,348 | $ | 20,548 | ||||||||||

Net property, plant and equipment | 96,747 | 90,632 | 121,679 | 90,632 | 124,840 | |||||||||||||||

Total assets | 840,226 | 818,332 | 1,564,106 | 818,332 | 1,607,315 | |||||||||||||||

Long-term debt | 236,937 | 204,715 | 684,295 | 204,715 | 660,379 | |||||||||||||||

Total stockholders’ equity | 401,927 | 462,523 | 619,650 | 462,523 | 654,493 | |||||||||||||||

|

|

| ||||||||||||||||||

| Pro forma | Pro forma | |||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, | Nine months ended September 30, | Year ended December 31, | Nine months ended September 30, | Year ended December 31, | Year ended December 31, | |||||||||||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | 2010 | 2011 | 2009 | 2010 | 2011 | 2011 | ||||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Other financial data: | ||||||||||||||||||||||||||||||||||||||||||||

Net cash provided by operating activities | $ | 112,463 | $ | 107,751 | $ | 65,981 | $ | 27,892 | $ | 18,624 | $ | 107,751 | $ | 65,981 | $ | 39,275 | ||||||||||||||||||||||||||||

Net cash used in investing activities | $ | (160,937 | ) | $ | (10,914 | ) | $ | (19,216 | ) | $ | (8,941 | ) | $ | (534,681 | ) | $ | (10,914 | ) | $ | (19,216 | ) | $ | (550,114 | ) | ||||||||||||||||||||

Net cash provided by / (used in) financing activities | $ | 58,871 | $ | (94,532 | ) | $ | (54,265 | ) | $ | (26,465 | ) | $ | 531,947 | $ | (94,532 | ) | $ | (54,265 | ) | $ | 510,148 | |||||||||||||||||||||||

EBITDA(1) (unaudited) | $ | 127,328 | $ | 89,578 | $ | 95,640 | $ | 68,930 | $ | 136,458 | $ | 170,345 | $ | 187,870 | $ | 89,578 | $ | 95,640 | $ | 200,759 | $ | 252,345 | ||||||||||||||||||||||

Adjusted EBITDA (1) (unaudited) | $ | 171,343 | $ | 96,587 | $ | 108,690 | $ | 81,931 | $ | 145,892 | $ | 183,395 | $ | 193,870 | $ | 96,587 | $ | 108,690 | $ | 216,467 | $ | 264,445 | ||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||||||||||||||

| (1) | EBITDA and Adjusted EBITDA are non-GAAP financial measures. For definitions and a reconciliation of these measures to our net income, see “—Non-GAAP financial measure” below. |

Non-GAAP financial measure

EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies.

We define EBITDA as net income attributable to common stockholders before interest expense, taxes, depreciation and amortization and loss from discontinued operations. EBITDA is not a measure of net income or cash flows as determined by U.S. generally accepted accounting principles (“GAAP”).

We define Adjusted EBITDA as EBITDA discussed above further adjusted for (1) impairment loss related to goodwill and other intangible assets, (2) expenses related to the Combination, (3) deferred loan costs written-off (4) contingent consideration for acquisitions and (5) transaction expenses for acquisitions.

Management believes EBITDA and Adjusted EBITDA are useful because they allow us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above from net income in arriving at these measures because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. These measures should not be considered as an alternative to, or more meaningful than, net income or cash flows from operating activities as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from these measures are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of these measures. Our computations of these measures may not be comparable to other similarly titled measures of other companies. We believe that these are widely followed measures of operating performance and may also be used by investors to measure our ability to meet debt service requirements.

The following tables present a reconciliation of the non-GAAP financial measure of EBITDA and Adjusted EBITDA to the GAAP financial measure of net income.

| Pro forma | Pro forma | |||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, | Nine months ended September 30, | Year ended December 31, | Nine months ended September 30, | Year ended December 31, | Year ended December 31, | |||||||||||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | 2010 | 2011 | 2009 | 2010 | 2011 | 2011 | ||||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||||||||||||||

EBITDA Reconciliation: | ||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to common stockholders | $ | 34,376 | $ | 19,336 | $ | 23,938 | $ | 13,071 | $ | 61,613 | $ | 55,091 | $ | 86,232 | $ | 19,336 | $ | 23,938 | $ | 93,342 | $ | 119,020 | ||||||||||||||||||||||

Interest expense | 24,704 | 19,451 | 18,189 | 15,417 | 13,723 | 31,747 | 20,830 | 19,451 | 18,189 | 19,532 | 25,272 | |||||||||||||||||||||||||||||||||

Depreciation and amortization | 34,914 | 38,438 | 33,216 | 24,757 | 27,946 | 47,792 | 35,352 | 38,438 | 33,216 | 40,775 | 48,092 | |||||||||||||||||||||||||||||||||

Income tax expense | 32,938 | 11,011 | 20,297 | 15,685 | 33,176 | 35,715 | 45,456 | 11,011 | 20,297 | 47,110 | 59,961 | |||||||||||||||||||||||||||||||||

Loss from discontinued operation | 396 | 1,342 | — | — | — | — | — | 1,342 | — | — | — | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

EBITDA | $ | 127,328 | $ | 89,578 | $ | 95,640 | $ | 68,930 | $ | 136,458 | $ | 170,345 | $ | 187,870 | $ | 89,578 | $ | 95,640 | $ | 200,759 | $ | 252,345 | ||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA Reconciliation: | ||||||||||||||||||||||||||||||||||||||||||||

EBITDA | $ | 127,328 | $ | 89,578 | $ | 95,640 | $ | 68,930 | $ | 136,458 | $ | 170,345 | $ | 187,870 | $ | 89,578 | $ | 95,640 | $ | 200,759 | $ | 252,345 | ||||||||||||||||||||||

Impairment of goodwill and other intangible assets | 44,015 | 7,009 | — | — | — | — | — | 7,009 | — | — | — | |||||||||||||||||||||||||||||||||

Expenses related to the Combination | — | — | 6,968 | 6,919 | — | 6,968 | — | — | 6,968 | — | — | |||||||||||||||||||||||||||||||||

Deferred loan costs written off | — | — | 6,082 | 6,082 | — | 6,082 | — | — | 6,082 | — | — | |||||||||||||||||||||||||||||||||

Contingent consideration for acquisitions | — | — | — | — | 6,000 | — | 6,000 | — | — | 12,100 | 12,100 | |||||||||||||||||||||||||||||||||

Transaction expenses for acquisitions | — | — | — | — | 3,434 | — | — | — | — | 3,608 | — | |||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA | $ | 171,343 | $ | 96,587 | $ | 108,690 | $ | 81,931 | $ | 145,892 | $ | 183,395 | $ | 193,870 | $ | 96,587 | $ | 108,690 | $ | 216,467 | $ | 264,445 | ||||||||||||||||||||||

You should carefully consider the risks described below before making an investment decision. Our business, financial condition, results of operations or cash flow could be materially adversely affected by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks related to our business

We derive a substantial portion of our revenues from companies in or affiliated with the oil and natural gas industry, a historically cyclical industry, with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. As a result, this cyclicality may cause fluctuations in our revenues and results of our operations.

We have experienced, and expect to continue to experience, fluctuations in revenues and operating results due to economic and business cycles. The willingness of oil and natural gas operators to make capital expenditures to explore for and produce oil and natural gas and the willingness of oilfield service companies to invest in capital equipment depends largely upon prevailing industry conditions that are influenced by numerous factors over which we have no control, such as:

the supply of and demand for oil and natural gas;

the level of prices, and expectations about future prices, of oil and natural gas;

the cost of exploring for, developing, producing and delivering oil and natural gas;

the level of drilling activity and drilling day rates;

the expected decline rates of current and future production;

the discovery rates of new oil and natural gas reserves;

the ability of our customers to access new markets or areas of production or to continue to access current markets;

weather conditions, including hurricanes, that can affect oil and natural gas operations over a wide area;

more stringent restrictions in environmental regulation on activities that may impact the environment;

moratoriums on drilling activity resulting in a cessation or disruption of operations;

domestic and worldwide economic conditions;

political instability in oil and natural gas producing countries;

conservation measures and technological advances affecting energy consumption;

the price and availability of alternative fuels; and

merger and divestiture activity among oil and natural gas producers and drilling contractors.

The oil and natural gas industry historically has experienced significant volatility. For example, since January 1, 2008, the WTI Cushing crude oil spot price has ranged from a low of $30.52 per

Bbl on December 23, 2008 to a high of $146.30 per Bbl on July 11, 2008. Since January 1, 2008, the Henry Hub natural gas spot price has ranged from a low of $1.64 per Mcf on September 4, 2009 to a high of $13.41 per Mcf on July 2, 2008. The Henry Hub natural gas spot price on December 9, 2011March 8, 2012 was $3.41$2.22 per MMBtu, while the WTI Cushing crude oil spot price on December 9, 2011March 8, 2012 was $98.34$106.58 per barrel.

The recent substantial decrease in North American natural gas prices has resulted in a drop in drilling activity in certain North American areas that primarily produce dry gas, such as the Haynesville shale basin in Louisiana, the Fayetteville shale gas basin in Arkansas and the dry gas portion of the Marcellus shale basin in the Northeast. We have seen a decrease in activity from customers who conduct operations in those areas, some of whom previously provided substantial revenues to us. A continuation of these low natural gas prices, or a further weakening of them, could cause other customers to curtail drilling and reduce our revenues further from these areas. Any prolonged reduction in the overall level of exploration and development activities, whether resulting from changes in oil and natural gas prices or otherwise, could adversely impact our business in many ways by negatively affecting:

revenues, cash flows, and profitability;

the ability to maintain or increase borrowing capacity;

the ability to obtain additional capital to finance our business and the cost of that capital; and

the ability to attract and retain skilled personnel needed in the event of an upturn in the demand for services.

Our inability to control the inherent risks of acquiring and integrating businesses could disrupt our business, dilute stockholder value and adversely affect our operating results going forward.

We have pursued and intend to continue to pursue strategic acquisitions of complementary assets and businesses in the future, which could distract management from day-to-day tasks. Acquisitions involve numerous risks, including:

unanticipated costs and exposure to unforeseen liabilities;

difficulty in integrating the operations and assets of the acquired businesses;

potential loss of key employees and customers of the acquired company;

potential inability to properly establish and maintain effective internal controls over an acquired company; and

risk of entering markets in which we have limited prior experience.

Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our business. In addition, we may incur liabilities arising from events prior to the acquisition or prior to our establishment of adequate compliance oversight. While we generally seek to obtain indemnities for liabilities for events occurring before such acquisitions, these are limited in amount and duration or may be held to be unenforceable or the seller may not be able to indemnify us. We may also incur indebtedness to finance future acquisitions and also may issue equity securities in connection with such acquisitions. Debt service requirements could represent a burden on our results of operations and financial condition and the issuance of additional equity securities could be dilutive to our existing stockholders.

In addition to potential future acquisitions, the ongoing integration of our business in connection with the Combination and the eight acquisitions we have completed since the Combination presents a number of risks that could affect our results of operations. In particular, integrating the businesses from the Combination and our subsequent acquisitions is difficult and involves a number of special risks, including the diversion of management’s attention to the assimilation of the operations, the unpredictability of costs related to the Combination and our subsequent acquisitions and the difficulty of integration of the businesses, products, services,

technology and employees. The ability to achieve the anticipated benefits of the Combination and each of our other recent acquisitions will depend, in part, upon whether the integration of the various businesses, products, services, technology and employees is accomplished in an efficient and effective manner, and there can be no assurance that this will occur.

The difficulties of such integration may be increased by the geographic breadth of the combined operations and the necessity of integrating and combining different corporate cultures. The inability of management to successfully integrate any one or all of the businesses could have a material adverse effect on our business, operating results and financial condition. Moreover, there can be no assurance that we will be able to gain market share or penetrate new markets successfully or that we will obtain the anticipated or desired benefits of the Combination and our other recent or future acquisitions. Despite management’s belief that each of our products, services and operations will provide an increased breadth of services and sufficient “critical mass” in key operating areas, there can be no assurance that each of the services will gain acceptance by our other business segments or our current customers or that they will enable us to gain market share or penetrate new markets. If we fail to manage these risks successfully, our results of operations could be adversely affected.

Our operating history may not be sufficient for investors to evaluate our business and prospects.