As filed with the Securities and Exchange Commission on July 3, 2013January 10, 2024.

Registration No. 333-188838333-275443

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVOKE PHARMA, INC.

(Exact name of registrant as specified in its charter)

Delaware | 2834 | 20-8447886 | ||

(State or other jurisdiction of

| (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

12555 High Bluff Drive,

420 Stevens Avenue, Suite 385230

San Diego,Solana Beach, CA 9213092075

(760) 487-1255Telephone: (858) 345-1494

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David A. Gonyer, R.Ph.

President and Chief Executive Officer and Director

Evoke Pharma, Inc.

12555 High Bluff Drive,420 Stevens Avenue, Suite 385230

San Diego,Solana Beach, CA 9213092075

(760) 487-1255Telephone: (858) 345-1494

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| ||||

Matthew T. Bush Cheston J. Larson

Latham

San Diego, CA 92130 (858) 523-5400 |

|

New York, (212) | ||

Approximate date of commencement of proposed sale to the public:As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this formForm are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨☒

If this formForm is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this formForm is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this formForm is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| ||||

Title of Each Class of Securities To Be Registered | Proposed Maximum Aggregate | Amount of Registration Fee(2) | ||

Common Stock, $0.0001 par value per share(3) | $23,000,000 | $3,137.20 | ||

Representative’s Warrant to Purchase Common Stock(4) | — | — | ||

Common Stock Underlying Representative’s Warrant(3)(5) | 920,000 | 125.49 | ||

Total | $23,920,000 | $3,262.69(6) | ||

| ||||

| ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities or the solicitation ofand it is not soliciting an offer to buy these securities in any state in which suchjurisdiction where the offer solicitation or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED |

SharesUp to 8,333,000 Common Stock Units

Each Common Stock Unit Consisting of One Share of Common Stock

One Series A Warrant to Purchase One Share of Common Stock

One Series B Warrant to Purchase One Share of Common Stock

One Series C Warrant to Purchase One Share of Common Stock

Up to 24,999,000 Shares of Common Stock Underlying the Series A Warrants, Series B Warrants and Series C Warrants

and

Up to 8,333,000 PFW Units

Each PFW Unit Consisting of One Pre-Funded Warrant to Purchase One Share of Common Stock

One Series A Warrant to Purchase One Share of Common Stock

One Series B Warrant to Purchase One Share of Common Stock

One Series C Warrant to Purchase One Share of Common Stock

Up to 33,332,000 Shares of Common Stock Underlying the Pre-Funded Warrants, Series A Warrants, Series B Warrants and Series C Warrants

Evoke Pharma, Inc.

This isWe are also offering to each purchaser whose purchase of Common Stock Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, up to 8,333,000 pre-funded warrant units (the “PFW Units” and together with the Common Stock Units, the “Units”), in lieu of Common Stock Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock. Each PFW Unit consists of: (i): pre-funded warrants to purchase one share of our common stock (the “Pre-Funded Warrants”), (ii) a firm commitment initial public offeringSeries A Warrant to purchase one share of our common stock, (iii) a Series B Warrant to purchase one share of our common stock, and (iv) a Series C Warrant to purchase one share of our common stock. NoThe Common Warrants included in the PFW Units are identical to the Common Warrants included in the Common Stock Units. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%, 14.99%, or 19.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock at an exercise price of $0.0001 per share of common stock. The public market currently exists foroffering price per PFW Unit is equal to the public offering price per Common Stock Unit less $0.0001. Each Pre-Funded Warrant will be exercisable upon issuance and will expire when exercised in full. We are also offering the shares of our common stock. Westock that are issuable from time to time upon exercise of the Pre-Funded Warrants. For each PFW Unit we sell, the number of Common Stock Units we are offering allwill be decreased on a one-for-one basis.

Because a Series A Warrant, Series B Warrant and Series C Warrant are being sold together in this offering with each Common Stock Unit and, in the alternative, each PFW Unit, the number of Series A Warrants, Series B Warrants and Series C Warrants sold in this offering will not change as a result of a change in the mix of the Common Stock Units and PFW Units sold. The shares of common stock in the Common Stock Units or the Pre-Funded Warrants in the PFW Units, as applicable, and the accompanying Common Warrants, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance; provided that a Series C Warrant may not be separated from the corresponding Series B Warrant until such Series B Warrant has been exercised.

Neither the Common Stock Units nor the PFW Units will be issued or certificated. The Common Stock Units, the PFW Units, the shares of common stock, offered by this prospectus. We expect the public offering price to be between $Common Warrants, the Pre-Funded Warrants and $ per share.

We have applied to list ourshares of common stock underlying the Common Warrants and Pre-Funded Warrants are sometimes collectively referred to herein as the “securities.”

Our common stock is listed on The NASDAQNasdaq Capital Market under the symbol “EVOK.”“EVOK”. The closing price of our common stock on January 9, 2024, as reported by The Nasdaq Capital Market, was $0.90 per share. There is no established public trading market for the Pre-Funded Warrants or the Common Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Pre-Funded Warrants or the Common Warrants on any securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and the Common Warrants will be limited.

The public offering price per Common Stock Unit and any PFW Units, and the accompanying Common Warrants will be determined by us at the time of pricing, may be at a discount to the current market price of our common stock, and the recent market price of our common stock used throughout this prospectus may not be indicative of the final public offering price of the Common Stock Units or PFW Units.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus and the documents incorporated by reference into this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

We are an emerging growth companya “smaller reporting company” as that term is used in the Jumpstart Our Business Startups Act of 2012,defined under federal securities law and as such, we have elected to take advantage ofcomply with certain reduced public company reporting requirements for this prospectus and future filingsavailable to smaller reporting companies. See the section titled “Prospectus Summary — Implications of Being a Smaller Reporting Company.”

Before investing in our common stock, you should carefully read the discussion of “Risk Factors” beginning on page9.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or determined ifpassed upon the adequacy or accuracy of this prospectus is truthful or complete.prospectus. Any representation to the contrary is a criminal offense.

| Per Common | Per PFW | ||||||||||||

Stock Unit | Unit | Total | ||||||||||||

Public offering price | $ | $ | $ | |||||||||||

Underwriting discounts and commissions(1) | $ | $ | $ | |||||||||||

Proceeds to | $ | $ | ||||||||||||

$ |

We have granted a 30-day option

(1) In addition to the representativeunderwriting discount above, we have also agreed to pay the underwriters a cash fee of 5.0% of the underwritersaggregate gross proceeds received upon the exercise of the Series B Warrants. Does not include 0.75% management fee payable to purchase upthe representatives of the underwriters. See “Underwriting” beginning on page 49 of this prospectus for additional information regarding the compensation payable to additional shares of common stock solely to cover over-allotments, if any.the underwriters

The underwriters are offering the common stock as set forth under “Underwriting.” Delivery ofexpect to deliver the shares will be madeto purchasers on or about , 2013.2024.

Aegis Capital Corp

TABLE OF CONTENTSBook-Running Managers

Craig-Hallum | Laidlaw & Company (UK) Ltd. |

____________________________

The date of this prospectus is , 2024.

TABLE OF CONTENTS

Page | ||||

1 | ||||

9 | ||||

13 | ||||

14 | ||||

15 | ||||

16 | ||||

18 | ||||

| ||||

24 | ||||

| 40 | |||

Material U.S. Federal Income Tax Consequences | 42 | |||

49 | ||||

53 | ||||

54 | ||||

55 | ||||

| 56 | |||

____________________________

Neither we nor the underwriters have authorized anyone to provide you withany information that is different from thator to make any representations other than those contained in or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may authorizegive you. This prospectus is an offer to be deliveredsell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or made available to you. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the informationincorporated by reference in this prospectus or in any applicable free writing prospectus that we may authorize to be deliveredis current only as of its date, regardless of its time of delivery or made available to you. Neither the delivery of this prospectus nor theany sale of our common stock meanssecurities. Our business, financial condition, results of operations and prospects may have changed since that date.

To the extent there is a conflict between the information contained in this prospectus, oron the one hand, and the information contained in any free writing prospectus is correct afterdocument incorporated by reference filed with the Securities and Exchange Commission (“SEC”) before the date of this prospectus, or such free writing prospectus. This prospectus is not an offer to sell oron the solicitation of an offer to buyother hand, you should rely on the shares of common stock in any circumstances under which the offer or solicitation is unlawful.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

We use our registered trademark, EVOKE PHARMA, in this prospectus. This prospectus also includes trademarks, tradenamesIf any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the late date modifies or supersedes the earlier statement.

We have not and service marksthe underwriters have not taken any action that are the propertywould permit this offering or possession or distribution of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the® and ™ symbols, but those references are not intended to indicate, in any way,jurisdiction where action for that we will not assert,purpose is required, other than in the United States. Persons who have come into possession of this prospectus in a jurisdiction outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the fullest extent under applicable law,registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

i

PROSPECTUS SUMMARY

ThisThe following summary highlights information contained elsewhere in this prospectus.prospectus and in documents incorporated by reference. This summary doesis not complete and may not contain all of the information you should consider before investing in our common stock.securities. You should read this entire prospectus and the documents incorporated by reference in this prospectus carefully, especially the sectionrisks of investing in this prospectus entitledour securities discussed under the heading “Risk Factors” beginning on page 9factors,” and our financial statements and the related notes thereto appearing at the end ofincorporated by reference in this prospectus before making an investment decision. As used in this prospectus, unlessExcept as otherwise indicated herein or as the context otherwise requires, references in this prospectus and the documents incorporated by reference in this prospectus to “Evoke Pharma,” “Evoke,” “the Company,” “we,” “us,” “our,” “our company”“us” and “Evoke”“our” refer to Evoke Pharma, Inc.

Overview

Overview

We are a specialty pharmaceutical company focused primarily on the development and commercialization of drugs to treat gastrointestinal or GI,(“GI”) disorders and diseases. We areSince our inception, we have devoted our efforts to developing EVK-001, a metoclopramideour sole product, Gimoti® (metoclopramide) nasal spray, the first and only nasally-administered product indicated for the relief of symptoms associatedin adults with acute and recurrent diabetic gastroparesisgastroparesis. In June 2020, we received approval from the U.S. Food and Drug Administration (“FDA”) for our 505(b)(2) New Drug Application for Gimoti (the “Gimoti NDA”). We launched commercial sales of Gimoti in women with diabetes mellitus. the United States in October 2020 through our commercial partner, Eversana Life Science Services, LLC (“Eversana”).

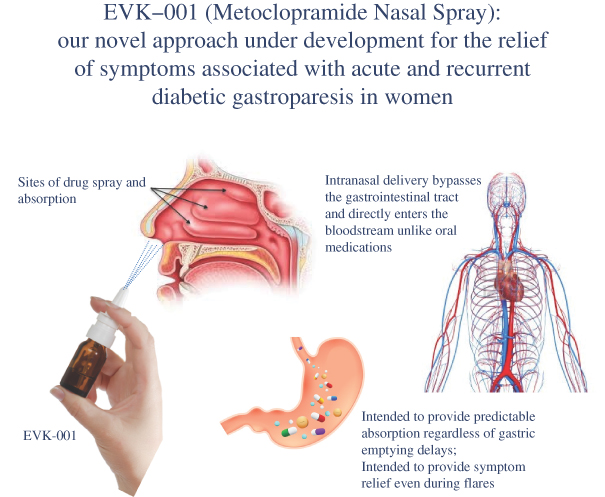

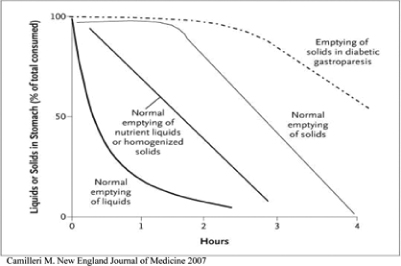

Diabetic gastroparesis is a GI disorder afflictingaffecting millions of suffererspatients worldwide, in which thefood in an individual’s stomach takes too long to empty its contents resulting in serious digestive system symptoms. Metoclopramide is the only product currently approved in the United States to treat gastroparesis, and is currently available only in oral and intravenous forms. EVK-001 is a novel formulation of this drug, designed to provide systemic delivery of metoclopramide through intranasal administration.

Gastroparesis

Gastroparesis is a condition of delayed gastric emptying in the absence of mechanical obstruction. Gastroparesis results in food remaining in the stomach for a longer time than normal, yielding a variety of symptoms. serious GI symptoms and systemic metabolic complications. The gastric delay caused by gastroparesis can also compromise absorption of orally administered medications. In May 2023, we reported results from a study conducted by Eversana which showed diabetic gastroparesis patients taking Gimoti had significantly fewer physician office visits, emergency department visits, and inpatient hospitalizations compared to patients taking oral metoclopramide. This overall lower health resource utilization reduced patient and payor costs by approximately $15,000 during a six-month time period for patients taking Gimoti compared to patients taking oral metoclopramide.

Gastroparesis is a common problemfrequently occurs in individuals with diabetes, but is also is observed in patients with prior gastric surgery, a preceding infectious illness, pseudo-obstruction, collagen vascular disorders and anorexia nervosa. In some patients with gastroparesis, no cause can be identified, which is referred to as idiopathic gastroparesis. According to the American Motility Society Task Force on Gastroparesis, the prevalence of gastroparesis is estimated to be up to 4% of the United States population. SymptomsSigns and symptoms of gastroparesis may include nausea, vomiting,early satiety, bloating, prolonged fullness, upper abdominal pain, bloating, early satiety, lackvomiting and retching. Patients may experience any combination of appetite,signs and weight loss. The disorder cansymptoms with varying frequency and degrees of severity.

In addition, we believe the increased use of GLP-1 (glucagon-like peptide-1) agonists could increase the number of people suffering from gastroparesis. GLP-1 receptor agonists affect glucose control through several mechanisms, including enhancement of glucose-dependent insulin secretion, slowed gastric emptying, and reduction of postprandial glucagon and food intake. Slow gastric emptying may potentially lead to considerable pain and discomfort, poor nutrition, impaired glycemic control and diminished quality of life. Accordingsymptoms similar to gastroparesis. Although definitive evidence attributing GLP-1 agonists specifically to causing gastroparesis is limited, a 2008recent study published in theAmerican Journal of Gastroenterology, it is estimatedthe American Medical Association found that hospitalization costsuse of GLP-1 agonists for weight loss compared with use of bupropion-naltrexone was associated with increased risk of pancreatitis, bowel obstruction and gastroparesis. While these adverse events from GLP-1 agonists are rare, we believe it could have an impact on the gastroparesis exceed $3.5 billion annually.market, considering the increased use, the large population expected to be treated and the incidence rate.

Patients with diabetic gastroparesis may experience impaired glucose control due to unpredictable gastric emptying and altered absorption of orally administered drugs, which may affect the severity of their signs and symptoms. Any combination of issues or signs and symptoms may cause complications such as malnutrition, esophagitis, and Mallory‑Weiss tears. Gastroparesis adversely affects the lives of patients with the disease, resulting in decreased social interaction, poor work functionality, and the development of anxiety and/or depression.

EVK-001: Metoclopramide Nasal Spray

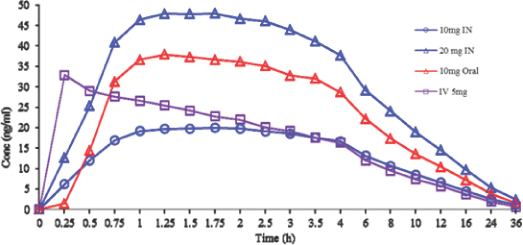

We believe intranasalnasal spray administration has the potential to offerprovide our target population of diabetic gastroparesis patients with a preferred treatment option because,over the tablet formulation for several important reasons: (1) unlike oral

1

metoclopramide EVK-001tablets which may be absorbed erratically due to gastroparesis itself, Gimoti is designed to effectively bypass the digestive system andto allow for more predictable absorption without needing to determine if a patient’s stomach is functioning; (2) during episodes of vomiting, Gimoti may provide predictable drug administration of our proprietaryabsorption through the nasal mucosa; and (3) for gastroparesis patients experiencing nausea and are not wanting to swallow a pill or water, a nasal spray formulation acrossmay be better tolerated than an oral medication.

In January 2020, we entered into a commercial services agreement with Eversana (as amended to date, the thin mucosa“Eversana Agreement”) for the commercialization of Gimoti. Pursuant to the Eversana Agreement, Eversana commercializes and distributes Gimoti in the nasal cavity. Intranasal drug delivery effectively bypassesUnited States. Eversana also manages the gut, unlike oral formulations which might be delayed in absorption duemarketing of Gimoti to gastroparesis itself. For patients suffering from nausea and vomiting, EVK-001 is designed to allow for rapid and predictable drug administration.

We have evaluated EVK-001 in a multicenter, randomized, double-blind, placebo-controlled parallel group, dose-ranging Phase 2b clinical trial in 287 patients with diabetic gastroparesis where EVK-001 was observed to be effective in improving the most prevalent and clinically relevant symptoms associated with gastroparesis in women while exhibiting a favorable safety profile.

We plan to initiate a Phase 3 trial of EVK-001 in female patients with symptoms associated with acute and recurrent diabetic gastroparesis in the second half of 2013. We anticipate receiving topline data from this trial in late 2014 or early 2015. We will need to successfully complete this trial,targeted health care providers, as well as a thorough QT study, which

- 2 -

is an evaluationthe sales and distribution of cardiac safety, before we are able to submit a new drug application, or NDA, to the U.S. Food and Drug Administration, or FDA, for EVK-001. Approval of an NDA is required in order for us to commercially market EVK-001Gimoti in the United States. In addition, based2020, we borrowed $5 million from Eversana pursuant to a revolving credit facility (the “Eversana Credit Facility”) which expires on our discussions withDecember 31, 2026, unless terminated earlier pursuant to its terms. The maturity date of all amounts, including interest, borrowed under the FDA, and to assess safety of EVK-001 in men, we plan to conduct a similar companion study for safety and efficacy in diabetic men with gastroparesis. We anticipate this trialEversana Credit Facility will be conducted concurrently with90 days after the Phase 3 trial in women. The completionexpiration or earlier termination of the male companion trialEversana Agreement. As of September 30, 2023, there were approximately $60.4 million in cumulative unreimbursed commercialization costs under the agreement (“Cumulative Deferred Costs”), to be payable only as net product profits are recognized, or upon certain termination events as described below. The Eversana Agreement terminates on December 31, 2026, unless terminated earlier pursuant to its terms. Among other reasons, either party has the right to terminate the Eversana Agreement upon 30 days prior written notice if the net profit under the agreement is not requirednegative for submissionany two consecutive calendar quarters (the “Net Profit Quarterly Termination Right”). As of September 30, 2023, either party had the right to exercise the Net Profit Quarterly Termination Right, which either party could have done until November 29, 2023, which was the end of the NDA for EVK-001; however, we expect to include safety data from this trial in our NDA submission for EVK-001.

At this time, due to60-day period following the risks inherent in the drug development process, we are unable to estimate with any certainty the costs we will incur in the continued development of EVK-001 for potential commercialization. However, we currently estimate the costs to complete our Phase 3 clinical trial in women, our companion clinical trial in men and a thorough QT study of EVK-001 will be approximately $15.0 million.

Our Strategy

Our objective is to develop and bring to market products to treat acute and chronic GI motility disorders that are not satisfactorily treated with current therapies and that represent significant market opportunities. Our business strategy is to:

continue development and pursue regulatory approval for EVK-001;

seek partnerships to accelerate and maximize the potential for EVK-001;

explore building in-house capabilities to potentially commercialize EVK-001 in the United States;

explore regulatory approval of EVK-001 outside the United States; and

evaluate the development and/or commercialization of other therapies for GI motility disorders.

Risks Related to Our Business

Our ability to implement our business strategy is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, among others:

Our business is entirely dependent on the success of a single product candidate, EVK-001, which has not yet entered a Phase 3 clinical trial; and we cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, EVK-001.

The results observed in female patients with symptoms associated with acute and recurrent diabetic gastroparesis in our Phase 2b clinical trial of EVK-001 may not be predictiveend of the safety and efficacy results in our planned Phase 3 clinical trial.

We believe, based on our current operating plan, that the net proceeds from this offering and our existing cash and cash equivalents, together with interest thereon, will only be sufficient to fund our operations for approximately 12 months after the date of this prospectus.

We will require substantial additional funding, including to complete our planned Phase 3 clinical trial of EVK-001 as well as finance additional development requirements, and may be unable to raise capital when needed, which would force us to suspend our planned Phase 3 clinical trial and otherwise delay, reduce or eliminate our development program for EVK-001.

We have no approved products and no product revenue to date, and we may never become profitable. Our recurring losses from operations have raised substantial doubt regarding our ability to continue as a going concern.

- 3 -

We face significant competition from other pharmaceutical companies, and we anticipate that EVK-001, if approved, would compete directly with metoclopramide, erythromycin and domperidone.quarter. Each of these products is available under various trade names sold by several major pharmaceutical companies, including generic manufacturers.

It is difficult and costly to protect our intellectual property rights, and we cannot ensure the protection of these rights; any impairment of our intellectual property rights would materially affect our business.

We currently have only two full-time employees, and therefore rely andparty will continue to rely on outsourcing arrangementshave the option to exercise this termination right for many of our activities, including clinical development and supply of EVK-001.

Corporate Information

Our principal executive offices are located at 12555 High Bluff Drive, Suite 385, San Diego, CA 92130, and our telephone number is (760) 487-1255. Our website address iswww.evokepharma.com. The information contained in, or accessible through, our website does not constitute part of this prospectus.

Implications of being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations in this prospectus;

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act;

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We may take advantage of these provisions until the last day of our fiscal year60-day period following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, which such fifth anniversary will occur in 2018. However, if certain events occur prior to the end of future quarters so long as the net profit under the agreement remains negative for consecutive quarters. Either party may also terminate the Eversana Agreement upon a change of control of our ownership. In the event that we initiate such five-year period,termination, we shall pay to Eversana a one-time payment equal to all of Eversana’s unreimbursed costs (including the Cumulative Deferred Costs) plus a portion of Eversana’s commercialization costs incurred in the 12 months prior to termination. If Eversana initiates such termination following a change of control, none of the Cumulative Deferred Costs incurred by Eversana will be due from Evoke. If Eversana terminates the agreement due to an uncured material breach by us or if we terminate the Eversana Agreement in certain circumstances, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billionexercise the Net Profit Quarterly Termination Right, we have agreed to reimburse Eversana for its unreimbursed commercialization costs for the prior twelve-month period and certain other costs. Upon expiration of the agreement, none of the Cumulative Deferred Costs incurred by Eversana will be due from Evoke. Upon expiration or we issue more than $1.0 billiontermination of non-convertible debt in any three-year period,the agreement, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligationsretain all profits from product sales and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

- 4 -

The Offering

|

|

|

|

|

|

The number of shares of our common stock to be outstanding after this offering is based on 3,681,752 shares of our common stock outstanding as of March 31, 2013 and excludes:

123,250 shares of common stock issuable upon exercise of stock options outstanding as of March 31, 2013, at a weighted-average exercise price of $0.40 per share;

510,000 shares of our common stock reserved for future issuance under our 2013 Equity Incentive Award Plan, which will become effective on the day prior to the public trading date of our common stock;

30,000 shares of common stock reserved for future issuance under our 2013 Employee Stock Purchase Plan, which will become effective on the day prior to the public trading date of our common stock;

22,000 shares of common stock issuable upon exercise of warrants outstanding as of March 31, 2013, at a weighted-average exercise price of $7.50 per share; and

shares of common stock issuable upon exercise of a warrant to be issued to the representative in connection with this offering, at an exercise price per share equal to 175% of the public offering price.

Unless otherwise indicated, this prospectus reflects and assumes the following:

the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the closing of this offering;

the automatic conversion of all outstanding shares of our Series A convertible preferred stock into 2,439,002 shares of our common stock immediately prior to the closing of the offering;

the adjustment of outstanding warrants to purchase shares of our Series A convertible preferred stock into warrants to purchase 22,000 shares of common stock upon the closing of this offering;

a one-for-five reverse stock split of our common stock to be effected before the completion of this offering;

- 5 -

no exercise of the outstanding options or warrants described above; and

no exercise by the underwriters of their option to purchase additional shares of our common stock to cover over-allotments, if any.

- 6 -

Summary Financial Data

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. We have derived the statements of operations data for the years ended December 31, 2011 and 2012 and the balance sheet data as of December 31, 2012 from our audited financial statements appearing elsewhere in this prospectus. We have derived the statements of operations data for the three months ended March 31, 2012 and 2013 and the period from January 29, 2007 (inception) to March 31, 2013 and balance sheet data as of March 31, 2013 from our unaudited financial statements appearing elsewhere in this prospectus. The unaudited financial statements have been prepared on a basis consistent with our audited financial statements included in this prospectus and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary to fairly state our financial position as of March 31, 2013 and results of operations for the three months ended March 31, 2012 and 2013. You should read this data together with our financial statements and related notes appearing elsewhere in this prospectus and the sections in this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not necessarily indicative of our future results.

| Years Ended December 31, | Three Months Ended March 31, | Period From January 29, 2007 (Inception) to March 31, 2013 | ||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Operating expenses: | ||||||||||||||||||||

Research and development | $ | 1,844,044 | $ | 1,165,645 | $ | 297,285 | $ | 110,981 | $ | 16,102,510 | ||||||||||

General and administrative | 570,524 | 836,781 | 205,137 | 221,049 | 3,525,582 | |||||||||||||||

Purchase of in-process research and development | — | — | — | — | 650,000 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total operating expenses | 2,414,568 | 2,002,426 | 502,422 | 332,030 | 20,278,092 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss from operations | (2,414,568 | ) | (2,002,426 | ) | (502,422 | ) | (332,030 | ) | (20,278,092 | ) | ||||||||||

Total other income (expense) | 13,324 | (15,102 | ) | 2,264 | (161,962 | ) | (70,903 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss and comprehensive loss | $ | (2,401,244 | ) | $ | (2,017,528 | ) | $ | (500,158 | ) | $ | (493,992 | ) | $ | (20,348,995 | ) | |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss per common share, basic and diluted(1) | $ | (2.18 | ) | $ | (1.79 | ) | $ | (0.45 | ) | $ | (0.44 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||||||

Weighted-average shares used to compute basic and diluted net loss per share(1) | 1,102,625 | 1,124,000 | 1,118,375 | 1,133,375 | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Pro forma net loss per common share, basic and diluted (unaudited)(1) | $ | (0.57 | ) | $ | (0.10 | ) | ||||||||||||||

|

|

|

| |||||||||||||||||

Weighted-average shares used to compute pro forma net loss per common share, basic and diluted (unaudited)(1) | 3,563,002 | 3,572,377 | ||||||||||||||||||

|

|

|

| |||||||||||||||||

- 7 -

| As of March 31, 2013 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(1)(2) | ||||||||||

Balance Sheet Data: | ||||||||||||

Cash and cash equivalents | $ | 1,669,518 | $ | 1,669,518 | $ | |||||||

Working capital (deficit) | 1,001,053 | 1,001,053 | ||||||||||

Total assets | 1,680,018 | 1,680,018 | ||||||||||

Current liabilities (including warrant liability) | 668,465 | 439,465 | ||||||||||

Long-term debt, net of debt discount | 2,936,607 | 2,936,607 | ||||||||||

Convertible preferred stock | 18,225,166 | — | ||||||||||

Deficit accumulated during the development stage | (20,348,995 | ) | (20,348,995 | ) | ||||||||

Total stockholders’ deficit | (20,150,220 | ) | (1,696,054 | ) | ||||||||

- 8 -

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes and “Management’s Discussion and Analysis of Results of Operations and Financial Condition,” before deciding whether to invest in our common stock. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Related to our Business, including the Development, Regulatory Approval and Potential Commercialization of our Product Candidate, EVK-001

Our business is entirely dependent on the success of a single product candidate, EVK-001, which has not yet entered a Phase 3 clinical trial. We cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, EVK-001.

We have only one product candidate: EVK-001, a metoclopramide nasal spray to treat female patients with symptoms associated with acute and recurrent diabetic gastroparesis. We are entirely dependent on successful continued development and regulatory approval of this product candidate for our future business success. We have invested, and will continue to invest, a significant portion of our time and financial resources in the development of EVK-001. We will need to raise sufficient funds for, and successfully enroll and complete, our planned Phase 3 clinical trial of EVK-001, which we intend to commence in the second half of 2013. The future regulatory and commercial success of this product candidate is subject to a number of risks, including the following:

we may not have sufficient financial and other resources to complete the Phase 3 clinical trial;

we may not be able to provide acceptable evidence of safety and efficacy for EVK-001;

the results of our planned clinical trials may not confirm the positive results of earlier clinical trials, particularly because we will utilize a modified patient report outcomes, or PRO, instrument for our planned Phase 3 clinical trial compared to our Phase 2b clinical trial;

variability in patients, adjustments to clinical trial procedures and inclusion of additional clinical trial sites;

the results of our clinical trial may not meet the level of statistical or clinical significance required by the U.S. Food and Drug Administration, or FDA, for marketing approval;

we may be required to undertake additional clinical trials and other studies of EVK-001 before we can submit a new drug application, or NDA, to the FDA or receive approval of the NDA;

patients in our clinical trials may die or suffer other adverse effects for reasons that may or may not be related to EVK-001, such as dysgeusia, headache, diarrhea, nasal discomfort, tremor, myoclonus, somnolence, rhinorrhea, throat irritation, and fatigue;

if approved, EVK-001 will compete with well-established products already approved for marketing by the FDA, including oral and intravenous forms of metoclopramide, the same active ingredient in the nasal spray for EVK-001;

we may not be able to obtain, maintain and enforce our patents and other intellectual property rights; and

we may not be able to obtain and maintain commercial manufacturing arrangements with third-party manufacturers or establish commercial-scale manufacturing capabilities.

- 9 -

Of the large number of drugs in development in this industry, only a small percentage result in the submission of an NDA to the FDA and even fewer are approved for commercialization. Furthermore, even if we do receive regulatory approval to market EVK-001, any such approval may be subject to limitations on the indicated uses for which we may market the product.

We will require substantial additional funding and may be unable to raise capital when needed, which would force us to suspend our Phase 3 clinical trial and otherwise delay, reduce or eliminate our development program for EVK-001.

Our operations have consumed substantial amounts of cash since inception. To date, our operations have been primarily financed through the proceeds from the sale of our common and preferred stock, and borrowings under our loan and financing agreements with Silicon Valley Bank and a prior lender. We believe, based on our current operating plan, that the net proceeds from this offering and our existing cash and cash equivalents, together with interest thereon, will be sufficient to fund our operations for approximately 12 months after the date of this prospectus, although there can be no assurance in that regard. Because we expect our planned Phase 3 clinical trial of EVK-001 to commence in the second half of 2013 with an approximately 12 month enrollment period, we will need to obtain additional funds to complete this trial as well as finance any additional development requirements requested by the FDA.

Our estimates of the amount of cash necessary to fund our activities may prove to be wrong, and we could spend our available financial resources much faster than we currently expect. Our future funding requirements will depend on many factors, including, but not limited to:

the rate of progress and cost of our Phase 3 clinical trial and any other clinical requirements for EVK-001;

the timing of regulatory approval, if granted, of EVK-001 or any other product candidates;

the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights associated with EVK-001;

the costs and timing of completion of outsourced commercial manufacturing supply arrangements for EVK-001;

costs associated with any other product candidates that we may develop, in-license or acquire;

the effect of competing technological and market developments; and

the terms and timing of any collaborative, licensing, co-promotion or other arrangements that we may establish.

The results observed in female patients with symptoms associated with acute and recurrent diabetic gastroparesis in our Phase 2b clinical trial of EVK-001 may not be predictive of the safety and efficacy results in our planned Phase 3 clinical trial.

A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in earlier-stage development. We currently plan to commence one Phase 3 clinical trial in female patients with symptoms associated with acute and recurrent diabetic gastroparesis in the second half of 2013. Our Phase 2b clinical trial of EVK-001 for the treatment of diabetic gastroparesis showed statistically significant improvement in clinically meaningful endpoints in female patients. This was a pre-specified analyses of the primary efficacy endpoint performed on a gender subgroup of the intent to treat, or ITT population. Due to a large placebo response in male patients, EVK-001 did not achieve the primary endpoint in the ITT population for all subjects in this Phase 2b clinical trial.

This risk may be particularly significant for us because the primary endpoint in our planned Phase 3 clinical trial is not identical to the primary endpoint used in our Phase 2b trial. In our Phase 2b clinical trial, the primary

- 10 -

endpoint was the Gastroparesis Cardinal Symptom Index Daily Diary, or GCSI-DD, a PRO instrument. The GCSI-DD is a composite of clinically relevant diabetic gastroparesis symptoms which patients rate according to severity. Based on our discussions with the FDA, the primary endpoint for our Phase 3 trial will be the Gastroparesis Symptom Assessment, or GSA, which is a PRO instrument derived from the GCSI-DD. We have analyzed our Phase 2b data utilizing the GSA’s methodology. Although we observed statistically significant and nearly identical statistical improvement in the GSA compared to the GCSI-DD in females in our Phase 2b trial, we cannot assure you that our Phase 3 trials will achieve positive results.

A number of factors could contribute to a lack of favorable safety and efficacy results in our planned Phase 3 trial. For example:

a multicenter trial could result in increased variability due to varying site characteristics, such as local standards of care;

a multicenter trial could result in increased variability due to varying patient characteristics including demographic factors, health status, underlying reason for disease state and concomitant medications; and

diagnosis of diabetic gastroparesis by physicians, including use of gastric emptying tests, could select for a patient population that differs from those patients included within previous clinical trials.

If we are not able to obtain regulatory approval for EVK-001, we will not be able to commercialize this product candidate and our ability to generate revenue will be limited.

We have not submitted an NDA or received regulatory approval to market any product candidates in any jurisdiction. We are not permitted to market EVK-001 in the United States until we receive approval of an NDA for the product candidate in a particular indication from the FDA. To date, we have completed one Phase 2 clinical trial for EVK-001 in diabetic subjects with gastroparesis and acquired the results from a separate Phase 2 clinical trial in diabetic patients with gastroparesis. In the Phase 2 clinical trial that we performed ourselves, which concluded in 2011, EVK-001 failed to meet the primary endpoint for the trial. Although an overall improvement in symptoms was observed in EVK-001-treated patients with diabetic gastroparesis compared to placebo in this second Phase 2 clinical trial, the difference was not statistically significant due to a high placebo response among male subjects. The earlier Phase 2 clinical trial performed by Questcor Pharmaceuticals, Inc., or Questcor, was a multicenter, randomized, open-label, parallel design study. This head-to-head study compared the efficacy and safety of two doses of metoclopramide nasal spray, 10 mg and 20 mg, with the FDA-approved 10 mg metoclopramide tablet. Although data from the earlier Phase 2 clinical trial will be referenced in the EVK-001 NDA, the open-label study design limits the importance of the efficacy results in the NDA.

We currently plan to commence one Phase 3 clinical trial in female patients with symptoms associated with acute and recurrent diabetic gastroparesis in the second half of 2013. There is no guarantee that this Phase 3 clinical trial or any other future trials will be successful or that regulators will agree with our assessment of the clinical trials for EVK-001 conducted to date. In addition, we have only limited experience in filing the applications necessary to gain regulatory approvals and expect to rely on consultants and third party contract research organizations to assist us in this process. The FDA and other regulators have substantial discretion in the approval process and may refuse to accept any application or may decide that our data is insufficient for approval and require additional clinical trials, or preclinical or other studies.

Varying interpretation of the data obtained from preclinical and clinical testing could delay, limit or prevent regulatory approval of a product candidate. Furthermore, we have acquired our rights to EVK-001 from Questcor who acquired its rights from a predecessor. Thus, much of the preclinical and a portion of the clinical data relating to EVK-001 that we would expect to submit in an NDA for EVK-001 was obtained from studies conducted before we owned the rights to the product candidate and, accordingly, was prepared and managed by others. These predecessors may not have applied the same resources and given the same attention to this development program as we would have if we had been in control from inception.

- 11 -

EVK-001 and the activities associated with its development and potential commercialization, including its testing, manufacture, safety, efficacy, recordkeeping, labeling, storage, approval, advertising, promotion, sale and distribution, are subject to comprehensive regulation by the FDA and other regulatory agencies in the United States and by comparable authorities in other countries. Failure to obtain regulatory marketing approval for EVK-001 will prevent us from commercializing the product candidate, and our ability to generate revenue will be materially impaired.

The FDA may impose requirements on our clinical trials that are difficult to comply with, which could harm our business.

The requirements that the FDA may impose on clinical trials for EVK-001 are uncertain. We currently plan to conduct one Phase 3 trial in adult female subjects with diabetic gastroparesis, which we believe will be sufficient for NDA submission. We plan to initiate the four-week, multicenter, randomized, double-blind, placebo-controlled, parallel Phase 3 clinical trial to evaluate the efficacy, safety and population pharmacokinetics of EVK-001 in adult female subjects with diabetic gastroparesis in the second half of 2013. Although we believe successful results from this single Phase 3 clinical trial will be sufficient to allow us to submit an NDA for EVK-001, it is possible the FDA will require additional clinical testing before submission or approval of the NDA. In addition, based on discussions with the FDA, we also plan to conduct a similar study for safety and efficacy in adult male subjects with diabetic gastroparesis. If we are unable to comply with the FDA’s requirements, we will not be able to obtain approval for EVK-001 and our business will suffer.

Any termination or suspension of, or delays in the commencement or completion of, our planned Phase 3 clinical trial could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects.

Delays in the commencement or completion of our planned Phase 3 clinical trial for EVK-001 could significantly affect our product development costs. We do not know whether our planned trial will begin on time or be completed on schedule, if at all. The commencement and completion of clinical trials can be delayed for a number of reasons, including delays related to:

the FDA failing to grant permission to proceed and placing the clinical trial on hold;

subjects failing to enroll or remain in our trial at the rate we expect;

subjects choosing an alternative treatment for the indication for which we are developing EVK-001, or participating in competing clinical trials;

subjects experiencing severe or unexpected drug-related adverse effects;

a facility manufacturing EVK-001 or any of its components being ordered by the FDA or other government or regulatory authorities to temporarily or permanently shut down due to violations of current Good Manufacturing Practices, or cGMP, or other applicable requirements, or infections or cross-contaminations of product candidate in the manufacturing process;

any changes to our manufacturing process that may be necessary or desired;

third-party clinical investigators losing their license or permits necessary to perform our clinical trials, not performing our clinical trials on our anticipated schedule or consistent with the clinical trial protocol, Good Clinical Practice and regulatory requirements, or other third parties not performing data collection and analysis in a timely or accurate manner;

inspections of clinical trial sites by the FDA or the finding of regulatory violations by the FDA or an institutional review board, or IRB, that require us to undertake corrective action, result in suspension or termination of one or more sites or the imposition of a clinical hold on the entire trial, or that prohibit us from using some or all of the data in support of our marketing applications;

- 12 -

third-party contractors becoming debarred or suspended or otherwise penalized by the FDA or other government or regulatory authorities for violations of regulatory requirements, in which case we may need to find a substitute contractor, and we may not be able to use some or any of the data produced by such contractors in support of our marketing applications; or

one or more IRBs refusing to approve, suspending or terminating the trial at an investigational site, precluding enrollment of additional subjects, or withdrawing its approval of the trial.

Product development costs will increase if we have delays in testing or approval of EVK-001 or if we need to perform more or larger clinical trials than planned. Additionally, changes in regulatory requirements and policies may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for reexamination, which may impact the costs, timing or successful completion of a clinical trial. If we experience delays in completion of or if we, the FDA or other regulatory authorities, the IRB, or other reviewing entities, or any of our clinical trial sites suspend or terminate any of our clinical trials, the commercial prospects for our product candidate may be harmed and our ability to generate product revenues will be delayed. In addition, many of the factors that cause, or lead to, termination or suspension of, or a delay in the commencement or completion of, clinical trials may also ultimately lead to the denial of regulatory approval of a product candidate. Also if one or more clinical trials are delayed, our competitors may be able to bring products to market before we do, and the commercial viability of EVK-001 could be significantly reduced.

Final marketing approval for EVK-001 by the FDA or other regulatory authorities for commercial use may be delayed, limited, or denied, any of which would adversely affect our ability to generate operating revenues.

After the completion of our Phase 3 clinical trial and, assuming the results of the trial are successful, the submission of an NDA, we cannot predict whether or when we will obtain regulatory approval to commercialize EVK-001 and we cannot, therefore, predict the timing of any future revenue. Because EVK-001 is our only product candidate this risk is particularly significant for us. We cannot commercialize EVK-001 until the appropriate regulatory authorities have reviewed and approved the applications for this product candidate. We cannot assure you that the regulatory agencies will complete their review processes in a timely manner or that we will obtain regulatory approval for EVK-001. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials and FDA regulatory review. If marketing approval for EVK-001 is delayed, limited or denied, our ability to market the product candidate, and our ability to generate product sales, would be adversely affected.

Even if we obtain marketing approval for EVK-001, it could be subject to restrictions or withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our product candidate, when and if EVK-001 is approved.

Even if U.S. regulatory approval is obtained, the FDA may still impose significant restrictions on EVK-001’s indicated uses or marketing or impose ongoing requirements for potentially costly and time consuming post-approval studies, post-market surveillance or clinical trials. EVK-001 will also be subject to ongoing FDA requirements governing the labeling, packaging, storage, distribution, safety surveillance, advertising, promotion, recordkeeping and reporting of safety and other post-market information. In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with cGMP requirements relating to quality control, quality assurance and corresponding maintenance of records and documents. If we or a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, the manufacturing facility or us, including requesting recall or withdrawal of the product from the market or suspension of manufacturing.

- 13 -

If we or the manufacturing facilities for EVK-001 fail to comply with applicable regulatory requirements, a regulatory agency may:

issue warning letters or untitled letters;

seek an injunction or impose civil or criminal penalties or monetary fines;

suspend or withdraw regulatory approval;

suspend any ongoing clinical trials;

refuse to approve pending applications or supplements or applications filed by us;

suspend or impose restrictions on operations, including costly new manufacturing requirements; or

seize or detain products, refuse to permit the import or export of product, or request us to initiate a product recall.

The occurrence of any event or penalty described above may inhibit our ability to commercialize our products and generate revenue.

The FDA has the authority to require a risk evaluation and mitigation strategy plan as part of an NDA or after approval, which may impose further requirements or restrictions on the distribution or use of an approved drug, such as limiting prescribing to certain physicians or medical centers that have undergone specialized training, limiting treatment to patients who meet certain safe-use criteria and requiring treated patients to enroll in a registry. In March 2009, the FDA informed drug manufacturers that it will require a REMS for metoclopramide drug products. The FDA’s authority to take this action is based on risk management and post market safety provisions within the FDAAA. The REMS consists of a Medication Guide, elements to assure safe use (including an education program for prescribers and materials for prescribers to educate patients), and a timetable for submission of assessments of at least six months, 12 months, and annually after the REMS is approved. We intend to submit a REMS at the time of the NDA submission for EVK-001.

In addition, if EVK-001 is approved, our product labeling, advertising and promotion would be subject to regulatory requirements and continuing regulatory review. The FDA strictly regulates the promotional claims that may be made about prescription products. In particular, a product may not be promoted for uses that are not approved by the FDA as reflected in the product’s approved labeling. If we receive marketing approval for EVK-001, physicians may nevertheless prescribe it to their patients in a manner that is inconsistent with the approved label. If we are found to have promoted such off-label uses, we may become subject to significant liability. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant sanctions. The federal government has levied large civil and criminal fines against companies for alleged improper promotion and has enjoined several companies from engaging in off-label promotion. The FDA has also requested that companies enter into consent decrees or permanent injunctions under which specified promotional conduct is changed or curtailed.

Even if we receive regulatory approval for EVK-001, we still may not be able to successfully commercialize it and the revenue that we generate from its sales, if any, will be limited.

EVK-001’s commercial success will depend upon the acceptance of the product candidate by the medical community, including physicians, patients and health care payors. The degree of market acceptance of our product candidate will depend on a number of factors, including:

demonstration of clinical efficacy and safety compared to other more-established products;

the limitation of our targeted patient population to women-only;

limitations or warnings contained in any FDA-approved labeling, including the potential boxed warning on all metoclopramide product labels concerning the chance of tardive dyskinesia, or TD, for patients taking these products;

- 14 -

acceptance of a new formulation by health care providers and their patients;

the prevalence and severity of any adverse effects;

new procedures or methods of treatment that may be more effective in treating or may reduce the incidences of diabetic gastroparesis;

pricing and cost-effectiveness;

the effectiveness of our or any future collaborators’ sales and marketing strategies;

our ability to obtain and maintain sufficient third-party coverage or reimbursement from government health care programs, including Medicare and Medicaid, private health insurers and other third-party payors; and

the willingness of patients to pay out-of-pocket in the absence of third-party coverage.

If EVK-001 is approved, but does not achieve an adequate level of acceptance by physicians, health care payors and patients, we may not generate sufficient revenue, and we may not be able to achieve or sustain profitability. Our efforts to educate the medical community and third-party payors on the benefits of EVK-001 may require significant resources and may never be successful. In addition, our ability to successfully commercialize our product candidate will depend on our ability to manufacture our products, differentiate our products from competing products and defend the intellectual property of our products.

It will be difficult for us to profitably sell EVK-001 if reimbursement is limited.

Market acceptance andgenerated modest sales of our product candidate will depend on reimbursement policies and may be affected by healthcare reform measures. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which medications they will pay for and establish reimbursement levels. A primary trend in the U.S. healthcare industry and elsewhere is cost containment. Government authorities and these third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payors have been challenging the prices charged for products. They may also refuse to provide any coverage of uses of approved products for medical indications other than those for which the FDA has granted marketing approval. This trend may impact the reimbursement for treatments for GI disorders especially, including EVK-001, as physicians typically focus on symptoms rather than underlying conditions when treating patients with these disorders and drugs are often prescribed for uses outside of their approved indications. In instances where alternative products are available, it may be required that those alternative treatment options are tried before reimbursement is available for EVK-001. Although EVK-001 is a novel nasal spray formulation of metoclopramide, this is the same active ingredient that is already available in other treatments for gastroparesis that are already widely available at generic prices. We cannot be sure that reimbursement will be available for our EVK-001 and, if reimbursement is available, the level of reimbursement. Reimbursement may impact the demand for, or the price of, this product candidate. In addition, in certain foreign countries, particularly the countries of the European Union, the pricing of prescription pharmaceuticals is subject to governmental control. If reimbursement is not available or is available only to limited levels, we may not be able to successfully commercialize our product candidate.

We rely and will continue to rely on outsourcing arrangements for many of our activities, including clinical development and supply of EVK-001.

We have only two full-time employees and, as a result, we rely on outsourcing arrangements for a significant portion of our activities, including clinical research, data collection and analysis and manufacturing as well as function as a public company. We may have limited control over these third parties and we cannot guarantee that they will perform their obligations in an effective and timely manner.

- 15 -

We expect to retain a contract research organization, or CRO, to conduct our planned Phase 3 clinical trial of EVK-001. We will be required to reach agreement on acceptable terms with prospective CROs as well as clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites. We will need assistance from our CRO in obtaining IRB approval at each clinical trial site and will rely on our CRO to recruiting suitable patients to participate the proposed trial.

The manufacture of pharmaceutical products requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. We do not own or operate manufacturing facilities for the production of any component of EVK-001, including metoclopramide, the nasal spray device or associated bottle, nor do we have plans to develop our own manufacturing operations in the foreseeable future. We currently depend on third-party contract manufacturers for all of our required raw materials, drug substance and drug product for our clinical trials. For EVK-001, we are currently using, and relying on, single suppliers and single manufacturers for starting materials, the final drug substance and nasal spray delivery device. Although potential alternative suppliers and manufacturers for some components have been identified, we have not qualified these vendors to date. If we were required to change vendors, it could result in a failure to meet regulatory requirements or projected timelines and necessary quality standards for successful manufacturing of the various required lots of material for our development and commercialization efforts.

We do not have any current contractual relationships for the manufacture of commercial supplies of EVK-001. If EVK-001 is approved for sale by any regulatory agency, we intend to enter into agreements with third-party contract manufacturers for commercial production. The number of third-party manufacturers with the expertise, required regulatory approvals and facilities to manufacture bulk drug substance on a commercial scale is limited. We have identified one manufacturer for potentially providing commercial supplies of EVK-001; however no alternative providers have been identified to date. If we are unable to come to terms on commercial supplier with this manufacturer, we would have to find replacements, which could delay the commercialization of our product candidate.

In addition, our reliance on third party CROs and contract manufacturing organizations, or CMOs, entails further risks including:

non-compliance by third parties with regulatory and quality control standards;

breach by third parties of our agreements with them;

termination or non-renewal of an agreement with third parties; and

sanctions imposed by regulatory authorities if compounds supplied or manufactured by a third party supplier or manufacturer fail to comply with applicable regulatory standards.

We face substantial competition, which may result in others selling their products more effectively than we do, and in others discovering, developing or commercializing product candidates before, or more successfully, than we do.

Our future success depends on our ability to demonstrate and maintain a competitive advantage with respect to the design, development and commercialization of EVK-001. We anticipate that EVK-001, if approved, would compete directly with metoclopramide, erythromycin and domperidone, each of which is available under various trade names sold by several major pharmaceutical companies, including generic manufacturers. Metoclopramide is the only molecule currently approved in the United States to treat gastroparesis. Metoclopramide is generically-available and indicated for the relief of symptoms associated with acute and recurrent diabetic gastroparesis, without the limitation of use in women only.

- 16 -

Many of our potential competitors have substantially greater financial, technical and personnel resources than we have. In addition, many of these competitors have significantly greater commercial infrastructures than we have. We will not be able to compete successfully unless we successfully:

assure health care providers, patients and health care payors that EVK-001 is beneficial compared to other products in the market;

obtain patent and/or other proprietary protection for EVK-001;

obtain and maintain required regulatory approvals for the product candidate; and

collaborate with others to effectively market, sell and distribute EVK-001.

Established competitors may invest heavily to quickly discover and develop novel compounds that could make our product candidate obsolete. In addition to our EVK-001 product candidate, we are aware of other development candidates in clinical development. Any of these product candidates could advance through clinical development faster than EVK-001 and, if approved, could attain faster and greater market acceptance than our product candidate. If we are not able to compete effectively against our current and future competitors, our business will not grow and our financial condition and operations will suffer.

We have no sales, marketing or distribution capabilities currently and we will have to invest significant resources to develop these capabilities.

Currently, we have no internal sales, marketing or distribution capabilities. If EVK-001 ultimately receives regulatory approval, we may not be able to effectively market and distribute the product candidate. We will have to invest significant amounts of financial and management resources to develop internal sales, distribution and marketing capabilities, some of which will be committed prior to any confirmation that EVK-001 will be approved. We may not be able to hire consultants or external service providers to assist us in sales, marketing and distribution functions on acceptable financial terms or at all. Even if we determine to perform sales, marketing and distribution functions ourselves, we could face a number of additional related risks, including:

inability to attract and build an effective marketing department or sales force;

the cost of establishing a marketing department or sales force may exceed our available financial resources and the revenues generated by EVK-001 or any other product candidates that we may develop, in-license or acquire; and

our direct sales and marketing efforts may not be successful.

If we fail to attract and retain senior management and key commercial personnel, we may be unable to successfully complete the development of EVK-001 and commercialize this product candidate.

Our success depends in part on our continued ability to attract, retain and motivate highly qualified management, clinical and commercial personnel. We are highly dependent upon our senior management team composed of two individuals: David Gonyer, our President and Chief Executive Officer, and Matt D’Onofrio, our Executive Vice President and Chief Business Officer. The loss of services of either of these individuals could delay or prevent the successful development of EVK-001 or the commercialization of this product candidate, if approved.

We will need to hire and retain qualified personnel. We could experience problems in the future attracting and retaining qualified employees. For example, competition for qualified personnel in the biotechnology and pharmaceuticals field is intense, particularly in the San Diego, California area where we are headquartered. We may not be able to attract and retain quality personnel on acceptable terms who have the expertise we need to sustain and grow our business.

- 17 -

We may encounter difficulties in managing our growth and expanding our operations successfully.