As filed with the Securities and Exchange Commission on July 22, 2013February 24, 2015

Registration No. 333-189395333-201731

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO.Amendment No. 1

TOto

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

OPEXA THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Texas | 2834 | 76-0333165 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

2635 Technology Forest Blvd.

The Woodlands, Texas 77381

(281) 272-9331

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Neil K. Warma

President and Chief Executive Officer

OPEXA THERAPEUTICS, INC.

2635 Technology Forest Blvd.

The Woodlands, Texas 77381

(281) 272-9331

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Mike Hird, Esq. Gabriella A. Lombardi, Esq. Patty M. DeGaetano, Esq. Pillsbury Winthrop Shaw Pittman LLP 12255 El Camino Real, Suite 300 San Diego, CA 92130 (619) 234-5000 |

Lili Taheri, Esq. Loeb &

New York, NY (212) |

Approximate date of commencement of proposed sale to the public:As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x | |||||

(Do not check if a smaller reporting company) | ||||||||

CALCULATION OF REGISTRATION FEE

| ||||

| Title of Each Class of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2)(4) | ||

Common Stock, $0.01 par value(3) | $17,250,000 | $2,352.90 | ||

| ||||

| ||||

| ||||||||

Title of each class of securities to be registered | Amount to be Registered | Proposed Maximum Per Unit | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(5) | ||||

Units, each consisting of one share of common stock, par value $0.01 per share (“Common Stock”) and one warrant to purchase one share of common stock (“Units”) | 28,776,419 | $0.70 | $20,143,493 | $2,340.67 | ||||

Non-transferable Rights to purchase Units(2) | – | – | – | – | ||||

Common Stock included as part of the Units | 28,776,419 | Included with Units above | Included with Units above | – | ||||

Warrants included as part of the Units(3) | 28,776,419 | Included with Units above | Included with Units above | – | ||||

Common Stock issuable upon exercise of the Warrants included in the Units(1)(4) | 28,776,419 | $1.50 | $43,164,629 | $5,015.73 | ||||

Total | $63,308,122 | $7,356.40 | ||||||

| ||||||||

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) |

| (2) | Non-transferable Rights to subscribe for Units are being issued without consideration. Pursuant to Rule 457(g) under the Act, no separate registration fee is required for the Rights because the Rights are being registered in the same registration statement as the common stock of the Registrant underlying the Rights. |

| (3) | Pursuant to Rule |

| (4) | In addition to the shares of Common Stock set forth in this table, pursuant to Rule 416 under the |

| Previously |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED |

9,300,000 Shares

Common Stock

We are offering 9,300,000 sharesdistributing to holders of our common stock. Ourstock and to holders of certain of our outstanding warrants who are entitled to participate in this offering pursuant to the terms of such warrants (Series L), at no charge,non-transferable subscription rights to purchase units. Each unit, which we refer to as a Unit, consists of one share of common stock is listed onand one tradable warrant representing the NASDAQ Capital Market under the symbol “OPXA.” On July 19, 2013, the last reported sales price for ourright to purchase one share of common stock, was $1.61which we refer to as the Warrants. We refer to the offering that is the subject of this prospectus as the Rights Offering. In the Rights Offering, you will receive one subscription right for each share of common stock or each share of common stock underlying our Series L warrants owned at 5:00 p.m., Eastern Time, on March 13, 2015, the record date of the Rights Offering, or the Record Date. The common stock and the Warrants comprising the Units will separate upon the exercise of the rights and the Units will not trade as a separate security. The subscription rights will not be tradable.

Each subscription right will entitle you to purchase one Unit, which we refer to as the Basic Subscription Right, at a subscription price per share.Unit of $0.70, which we refer to as the Subscription Price. The Warrants entitle the holder to purchase one share of common stock at an exercise price of (i) $0.50 per share from the date of issuance through June 30, 2016 and (ii) $1.50 per share from July 1, 2016 through their expiration three years from the date of issuance. If you exercise your Basic Subscription Rights in full, and other shareholders or warrant holders do not fully exercise their Basic Subscription Rights, you will be entitled to an over-subscription privilege to purchase a portion of the unsubscribed Units at the Subscription Price, subject to proration and ownership limitations, which we refer to as the Over-Subscription Privilege. Each subscription right consists of a Basic Subscription Right and an Over-Subscription Privilege, which we refer to as the Subscription Right.

The Subscription Rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on April 8, 2015. We may extend the Rights Offering for additional periods in our sole discretion. Once made, all exercises of Subscription Rights are irrevocable.

We have not entered into any standby purchase agreement or other similar arrangement in connection with the Rights Offering. The Rights Offering is being conducted on a best-efforts basis and there is no minimum amount of proceeds necessary to be received in order for us to close the Rights Offering.

We have engaged Maxim Group LLC and National Securities Corporation to act as dealer-managers in the Rights Offering.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 14 in21 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Continental Stock Transfer & Trust Company will serve as the Subscription Agent for the Rights Offering. The Subscription Agent will hold the funds we receive from subscribers until we complete, abandon or terminate the Rights Offering. Advantage Proxy, Inc. will serve as Information Agent for the Rights Offering. If you want to participate in this Rights Offering and you are the record holder of your shares or Series L warrants, we recommend that you submit your subscription documents to the Subscription Agent well before the deadline. If you want to participate in this Rights Offering and you hold shares through your broker, dealer, bank, or other nominee, you should promptly contact your broker, dealer, bank, or other nominee and submit your subscription documents in accordance with the instructions and within the time period provided by your broker, dealer, bank, or other nominee. For a detailed discussion, see “The Rights Offering – The Subscription Rights.”

Our board of directors reserves the right to terminate the Rights Offering for any reason any time before the closing of the Rights Offering. If we terminate the Rights Offering, all subscription payments received will be returned within 10 business days, without interest or penalty. We expect the Rights Offering to expire on or about April 8, 2015, subject to our right to extend the Rights Offering as described above.

Our common stock is listed on The NASDAQ Capital Market, or NASDAQ, under the symbol “OPXA.” On February 20, 2015, the last reported sale price of our common stock was $0.73 per share. We have applied to list the Warrants on NASDAQ following their issuance under the symbol “OPXAW.” The Subscription Rights are non-transferrable and will not be listed for trading on NASDAQ or any other stock exchange or market. You are urged to obtain a current price quote for our common stock before exercising your Subscription Rights.

| Per Unit | Total(2) | |||||||

Subscription price | $ | 0.70 | $ | 20,143,493 | ||||

Dealer-Manager fees and expenses (1) | $ | 0.05 | $ | 1,560,403 | ||||

Proceeds to us, before expenses | $ | 0.65 | $ | 18,583,090 | ||||

| (1) | In connection with this Rights Offering, we have agreed to pay fees to the dealer-managers as follows: (i) to Maxim Group LLC, a cash fee equal to (a) 1% of the gross proceeds received by us directly from exercises of the Subscription Rights if the amount of such gross proceeds is less than $6 million; (b) 4% of the gross proceeds received by us directly from exercises of the Subscription Rights if the amount of such gross proceeds is at least $6 million but less than $10 million; and (c) 4.5% of the gross proceeds received by us directly from exercises of the Subscription Rights if the amount of such gross proceeds is at least $10 million; (ii) to National Securities Corporation, a cash fee equal to 2.75% of the gross proceeds received by us directly from exercises of the Subscription Rights if the amount of such gross proceeds is at least $6 million. We have also agreed to reimburse the dealer-managers for their expenses as follows: (i) up to $50,000 if the gross proceeds received by us directly from exercises of the Subscription Rights is less than $6 million; and (ii) up to $100,000 if the gross proceeds received by us directly from exercises of the Subscription Rights is at least $6 million. See “Plan of Distribution.” |

| (2) | Assumes the Rights Offering is fully subscribed, but excludes proceeds from the exercise of Warrants included within the Units. |

Our board of directors is making no recommendation regarding your exercise of the Subscription Rights. You should carefully consider whether to exercise your Subscription Rights before the expiration date. You may not revoke or revise any exercises of Subscription Rights once made unless we terminate the Rights Offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Dealer-Managers

| Maxim Group LLC | ||||||||

| ||||||||

| ||||||||

| National Securities Corp. | |||||||

We have granted a 30-day option to the representative of the underwriters to purchase up to 1,395,000 additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares of common to purchasers in this offering on or about , 2013.

Aegis Capital Corp

The date of this Prospectus is , 2013

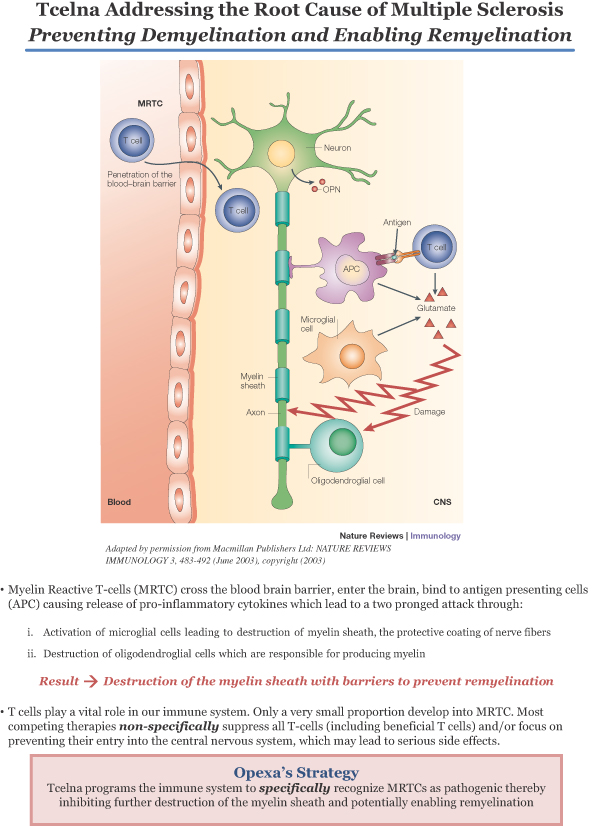

Degrade Myelin and Damage Myelin Producing Cells

Adapted by permission from Macmillan Publishers Ltd: NATURE REVIEWS

IMMUNOLOGY 3, 483-492 (June 2003), copyright (2003)

| ¡ | Destruction of myelin sheath, the protective coating of nerve fibers |

| ¡ | Destruction of oligodendroglial cells, which are responsible for producing myelin |

Opexa’s Strategy Tcelna programs the immune system tospecifically recognize MRTCs as pathogenic thereby inhibiting further destruction of the myelin sheath and potentially enabling remyelination |

| Page |

| 1 | |||

Market Price of our Common Stock and Related Stockholder Matters | ||||

| ||||

ABOUT THIS PROSPECTUS

The registration statement we filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the headingheadings “Where You Can Find More Information,”Information” and “Incorporation by Reference” before making your investment decision.

You should rely only on the information provided in this prospectus or in a prospectus supplement or amendment thereto. We have not authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any state where the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date hereof. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless the context otherwise requires, references in this prospectus to “Opexa,” “the Company,” “we,” “us” and “our” refer to Opexa Therapeutics, Inc. Tcelna® is a registered trademark of Opexa and ImmPathTM® and Precision ImmunotherapyTM® are service marks of Opexa. All other product and company names are trademarks of their respective owners.

i

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

The following are examples of what we anticipate will be common questions about the Rights Offering. The answers are based on selected information included elsewhere in this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the Rights Offering. This prospectus and the documents incorporated by reference into this prospectus contain more detailed descriptions of the terms and conditions of the Rights Offering and provides additional information about us and our business, including potential risks related to the Rights Offering, the Units offered hereby, and our business. We urge you to read this entire prospectus and the documents incorporated by reference into this prospectus.

Why are we conducting the Rights Offering?

We are conducting the Rights Offering to raise additional capital:

What is the Rights Offering?

We are distributing, at no charge, to record holders of our common stock and to holders of certain of our outstanding warrants (Series L) who are entitled to participate in this Rights Offering pursuant to the terms of such warrants, non-transferable Subscription Rights to purchase Units at a price of $0.70 per whole Unit. The Subscription Rights will not be tradable. Each Unit consists of one share of common stock and one Warrant representing the right to purchase one share of common stock. Upon closing of the Rights Offering, the common stock and Warrants will immediately separate. We have applied to list the Warrants on NASDAQ under the symbol “OPXAW.” You will receive one Subscription Right for each share of common stock or each share of common stock underlying our Series L warrants that you owned as of 5:00 p.m., Eastern Time, on the Record Date. Each Subscription Right entitles the record holder or holder of a Series L warrant to a Basic Subscription Right and an Over-Subscription Privilege.

What are the Basic Subscription Rights?

For each whole share you owned or whole share underlying our Series L warrants you owned as of the Record Date, you will receive one Basic Subscription Right, which gives you the opportunity to purchase one share of our common stock and to receive one Warrant to purchase one additional share of our common stock for a price of $0.70 per Unit. For example, if you owned 100 shares of common stock as of the Record Date, you will receive 100 Subscription Rights and will have the right to purchase 100 shares of our common stock and Warrants to purchase 100 shares of our common stock for $0.70 per whole Unit (or a total payment of $70.00). You may exercise all or a portion of your Basic Subscription Rights or you may choose not to exercise any Basic Subscription Rights at all.

If you are a record holder or a holder of Series L warrants, the number of shares you may purchase pursuant to your Basic Subscription Rights is indicated on the enclosed Rights Certificate. If you hold your

shares in the name of a broker, dealer, bank, or other nominee who uses the services of the Depository Trust Company, or DTC, you will not receive a Rights Certificate. Instead, DTC will issue one Subscription Right to your nominee record holder for each share of our common stock that you own as of the Record Date. If you are not contacted by your nominee, you should contact your nominee as soon as possible.

What is the Over-Subscription Privilege?

If you exercise your Basic Subscription Rights in full, you may also choose to exercise your Over-Subscription Privilege to purchase a portion of any Units that the other record holders and applicable warrant holders do not purchase through the exercise of their Basic Subscription Rights. You should indicate on your Rights Certificate, or the form provided by your nominee if your shares are held in the name of a nominee, how many additional Units you would like to purchase pursuant to your Over-Subscription Privilege.

Subject to stock ownership limitations, if sufficient Units are available, we will seek to honor your Over-Subscription request in full. If Over-Subscription requests exceed the number of Units available, however, we will allocate the available Units pro-rata among the record holders and applicable warrant holders exercising the Over-Subscription Privilege in proportion to the number of shares of our common stock each of those record holders owned or the number of shares of our common stock underlying our Series L warrants held by each of those warrant holders on the Record Date, relative to the number of shares owned or shares underlying Series L warrants on the Record Date by all record holders and Series L warrant holders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any record holders or Series L warrant holders receiving a greater number of Units than the record holder or Series L warrant holder subscribed for pursuant to the exercise of the Over-Subscription Privilege, then such record holder or Series L warrant holder will be allocated only that number of Units for which the record holder or Series L warrant holder oversubscribed, and the remaining Units will be allocated among all other record holders and Series L warrant holders exercising the Over-Subscription Privilege on the same pro rata basis described above. The proration process will be repeated until all Units have been allocated. See “The Rights Offering—Limitation on the Purchase of Units” for a description of certain stock ownership limitations.

To properly exercise your Over-Subscription Privilege, you must deliver to the Subscription Agent the subscription payment related to your Over-Subscription Privilege before the Rights Offering expires. See “The Rights Offering—The Subscription Rights—Over-Subscription Privilege.” To the extent you properly exercise your Over-Subscription Privilege for an amount of Units that exceeds the number of unsubscribed Units available to you, any excess subscription payments will be returned to you within 10 business days after the expiration of the Rights Offering, without interest or penalty.

Continental Stock Transfer & Trust Company, our Subscription Agent for the Rights Offering, will determine the Over-Subscription allocation based on the formula described above.

What are the terms of the Warrants?

Each Warrant entitles the holder to purchase one share of common stock at an exercise price of (i) $0.50 per share from the date of issuance through June 30, 2016 and (ii) $1.50 per share from July 1, 2016 through their expiration three years from the date of issuance. The Warrants will be exercisable for cash, or, solely during any period when a registration statement for the exercise of the Warrants is not in effect, on a cashless basis. We may redeem the Warrants for $0.01 per Warrant if our common stock closes above $2.50 per share for 10 consecutive trading days.

Will fractional shares be issued upon exercise of Subscription Rights or upon the exercise of Warrants?

No. We will not issue fractional shares of common stock in the Rights Offering. Rights holders will only be entitled to purchase a number of Units representing a whole number of shares of common stock, rounded down to the nearest whole number of Units a holder would otherwise be entitled to purchase. Any excess

subscription payments received by the Subscription Agent will be returned within 10 business days after expiration of the Rights Offering, without interest or penalty. Similarly, no fractional shares of common stock will be issued in connection with the exercise of a Warrant. Instead, for any such fractional share that would otherwise have been issuable upon exercise of the Warrant, the holder will be entitled to a cash payment equal to the pro-rated per share market price of the common stock on the last trading day preceding the exercise.

What effect will the Rights Offering have on our outstanding common stock?

Based on 28,234,751 shares of common stock outstanding as of February 20, 2015, as well as Series L warrants to purchase 541,668 shares of common stock outstanding on that date, assuming no other transactions by us involving our common stock prior to the expiration of the Rights Offering, if the Rights Offering is fully subscribed, 57,011,170 shares of our common stock will be issued and outstanding and Warrants to purchase an additional 28,776,419 shares of our common stock will be outstanding stock (excluding the 3,046,801 currently outstanding warrants). The exact number of shares and Warrants that we will issue in this Rights Offering will depend on the number of Units that are subscribed for in the Rights Offering.

How was the Subscription Price determined?

In determining the Subscription Price, the directors considered, among other things, the following factors:

In conjunction with the review of these factors, the board of directors also reviewed our history and prospects, including our past and present earnings and cash requirements, our prospects for the future, the outlook for our industry and our current financial condition. The board of directors also believed that the Subscription Price should be designed to provide an incentive to our current shareholders and holders of our Series L warrants to participate in the Rights Offering and exercise their Basic Subscription Right and their Over-Subscription Privilege.

The Subscription Price does not necessarily bear any relationship to any established criteria for value. You should not consider the Subscription Price as an indication of actual value of our company or our common stock. We cannot assure you that the market price of our common stock will not decline during or after the Rights Offering. You should obtain a current price quote for our common stock before exercising your Subscription Rights and make your own assessment of our business and financial condition, our prospects for the future, and the terms of this Rights Offering. Once made, all exercises of Subscription Rights are irrevocable.

Am I required to exercise all of the Basic Subscription Rights I receive in the Rights Offering?

No. You may exercise any number of your Basic Subscription Rights, or you may choose not to exercise any Basic Subscription Rights. If you do not exercise any Basic Subscription Rights, the number of shares of our common stock or number of shares underlying our Series L warrants you own will not change. However, if you

choose to not exercise your Basic Subscription Rights in full, your proportionate ownership interest in our company will decrease. If you do not exercise your Basic Subscription Rights in full, you will not be entitled to exercise your Over-Subscription Privilege.

How soon must I act to exercise my Subscription Rights?

If you received a Rights Certificate and elect to exercise any or all of your Subscription Rights, the Subscription Agent must receive your completed and signed Rights Certificate and payment for both your Basic Subscription Rights and any Over-Subscription Privilege you elect to exercise, including final clearance of any uncertified check, before the Rights Offering expires on April 8, 2015, at 5:00 p.m., Eastern Time. If you hold your shares in the name of a broker, dealer, custodian bank, or other nominee, your nominee may establish a deadline before the expiration of the Rights Offering by which you must provide it with your instructions to exercise your Subscription Rights, along with the required subscription payment.

May I transfer my Subscription Rights?

No. The Subscription Rights may be exercised only by the shareholders to whom they are distributed, and they may not be sold, transferred, assigned or given away to anyone else, other than by operation of law. As a result, Rights Certificates may be completed only by the shareholder who receives the certificate. The Subscription Rights will not be listed for trading on any stock exchange or market.

Will our directors and executive officers participate in the Rights Offering?

To the extent they hold common stock as of the Record Date, our directors and executive officers will be entitled to participate in the Rights Offering on the same terms and conditions applicable to other Rights holders. While none of our directors or executive officers has entered into any binding commitment or agreement to exercise Subscription Rights received in the Rights Offering, certain directors and executive officers have indicated an interest in participating (although the number of Units represented by such indications of interest would not be material to the overall Rights Offering).

Has the board of directors made a recommendation to shareholders and warrant holders regarding the Rights Offering?

No. Our board of directors is not making a recommendation regarding your exercise of the Subscription Rights. Stockholders and holders of our Series L warrants who exercise Subscription Rights will incur investment risk on new money invested. We cannot predict the price at which our shares of common stock will trade after the Rights Offering. On February 20, 2015, the closing price of our common stock was $0.73 per share. The market price for our common stock may be above the Subscription Price or may be below the Subscription Price. If you exercise your Subscription Rights, you may not be able to sell the underlying shares of our common stock or Warrants in the future at the same price or a higher price. You should make your decision based on your assessment of our business and financial condition, our prospects for the future, the terms of the Rights Offering and the information contained in this prospectus. See “Risk Factors” for discussion of some of the risks involved in investing in our securities.

How do I exercise my Subscription Rights?

If you are a shareholder of record (meaning you hold your shares of our common stock in your name and not through a broker, dealer, bank, or other nominee) or a holder of our Series L warrants and you wish to participate in the Rights Offering, you must deliver a properly completed and signed Rights Certificate, together with payment of the Subscription Price for both your Basic Subscription Rights and any Over-Subscription Privilege you elect to exercise, to the Subscription Agent before 5:00 p.m., Eastern Time, on April 8, 2015. If you are exercising your Subscription Rights through your broker, dealer, bank, or other nominee, you should promptly contact your broker, dealer, bank, or other nominee and submit your subscription documents and

payment for the Units subscribed for in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee.

What if my shares are held in “street name”?

If you hold your shares of our common stock in the name of a broker, dealer, bank, or other nominee, then your broker, dealer, bank, or other nominee is the record holder of the shares you own. The record holder must exercise the Subscription Rights on your behalf. Therefore, you will need to have your record holder act for you.

If you wish to participate in this Rights Offering and purchase Units, please promptly contact the record holder of your shares. We will ask the record holder of your shares, who may be your broker, dealer, bank, or other nominee, to notify you of this Rights Offering.

What form of payment is required?

You must timely pay the full Subscription Price for the full number of Units you wish to acquired pursuant to the exercise of Subscription Rights by delivering to the Subscription Agent a:

If you send payment by personal uncertified check, payment will not be deemed to have been delivered to the Subscription Agent until the check has cleared.

If you send a payment that is insufficient to purchase the number of Units you requested, or if the number of Units you requested is not specified in the forms, the payment received will be applied to exercise your Subscription Rights to the fullest extent possible based on the amount of the payment received.

When will I receive my new shares of common stock and Warrants?

The Subscription Agent will arrange for the issuance of the common stock and Warrants as soon as practicable after the expiration of the Rights Offering, payment for the Units subscribed for has cleared, and all prorating calculations and reductions contemplated by the terms of the Rights Offering have been effected. All shares and Warrants that you purchase in the Rights Offering will be issued in book-entry, or uncertificated, form meaning that you will receive a direct registration (DRS) account statement from our transfer agent reflecting ownership of these securities if you are a holder of record of shares or Series L warrants. If you hold your shares in the name of a broker, dealer, bank, or other nominee, DTC will credit your account with your nominee with the securities you purchase in the Rights Offering.

After I send in my payment and Rights Certificate to the Subscription Agent, may I cancel my exercise of Subscription Rights?

No. Exercises of Subscription Rights are irrevocable unless the Rights Offering is terminated, even if you later learn information that you consider to be unfavorable to the exercise of your Subscription Rights. You should not exercise your Subscription Rights unless you are certain that you wish to purchase Units at the Subscription Price.

How much will our company receive from the Rights Offering?

Assuming that all 28,776,419 Units are sold in the Rights Offering, we estimate that the proceeds from the Rights Offering will be approximately $17.8 million, based on the Subscription Price of $0.70 per Unit, after deducting fees and expenses payable to the dealer-managers, and after deducting other expenses payable by us and excluding any proceeds received upon exercise of any Warrants.

Are there risks in exercising my Subscription Rights?

Yes. The exercise of your Subscription Rights involves risks. Exercising your Subscription Rights involves the purchase of additional shares of our common stock and Warrants to purchase common stock and you should consider this investment as carefully as you would consider any other investment. We cannot assure you that the market price of our common stock will exceed the Subscription Price, nor can we assure you that the market price of our common stock will not further decline during or after the Rights Offering. We also cannot assure you that you will be able to sell shares of our common stock or Warrants purchased in the Rights Offering at a price equal to or greater than the Subscription Price. In addition, you should carefully consider the risks described under the heading “Risk Factors” for discussion of some of the risks involved in investing in our securities.

Can the board of directors terminate or extend the Rights Offering?

Yes. Our board of directors may decide to terminate the Rights Offering at any time and for any reason before the expiration of the Rights Offering. We also have the right to extend the Rights Offering for additional periods in our sole discretion. We do not presently intend to extend the Rights Offering. We will notify shareholders and warrant holders if the Rights Offering is terminated or extended by issuing a press release.

If the Rights Offering is not completed or is terminated, will my subscription payment be refunded to me?

Yes. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. If we do not complete the Rights Offering, all subscription payments received by the Subscription Agent will be returned within 10 business days after the termination or expiration of the Rights Offering, without interest or penalty. If you own shares in “street name,” it may take longer for you to receive your subscription payment because the Subscription Agent will return payments through the record holder of your shares.

How do I exercise my Rights if I live outside the United States?

The Subscription Agent will hold Rights Certificates for shareholders having addresses outside the United States. To exercise Subscription Rights, foreign shareholders must notify the Subscription Agent and timely follow other procedures described in the section entitled “The Rights Offering – Foreign Shareholders.”

What fees or charges apply if I purchase shares in the Rights Offering?

We are not charging any fee or sales commission to issue Subscription Rights to you or to issue shares or Warrants to you if you exercise your Subscription Rights. If you exercise your Subscription Rights through a broker, dealer, custodian bank, or other nominee, you are responsible for paying any fees your broker, dealer, bank, or other nominee may charge you.

What are the U.S. federal income tax consequences of exercising my Subscription Rights?

For U.S. federal income tax purposes, we do not believe you should recognize income or loss in connection with the receipt or exercise of Subscription Rights in the Rights Offering. You should consult your tax advisor as to the tax consequences of the Rights Offering in light of your particular circumstances. For a detailed discussion, see “Material U.S. Federal Income Tax Consequences.”

To whom should I send my forms and payment?

If your shares are held in the name of a broker, dealer, bank, or other nominee, then you should send your subscription documents and subscription payment to that broker, dealer, bank, or other nominee. If you are the record holder or a holder of our Series L warrants, then you should send your subscription documents, Rights Certificate, and subscription payment to the Subscription Agent hand delivery, first class mail or courier service to:

Continental Stock Transfer & Trust Company

17 Battery Place—8th Floor

New York, NY 10004

Attn: Corporate Actions Department

Telephone: (917) 262-2378

You or, if applicable, your nominee are solely responsible for completing delivery to the Subscription Agent of your subscription documents, Rights Certificate and payment. You should allow sufficient time for delivery of your subscription materials to the Subscription Agent and clearance of payment before the expiration of the Rights Offering at 5:00 p.m. Eastern Time on April 8, 2015.

Whom should I contact if I have other questions?

If you have other questions or need assistance, please contact the Information Agent:

Advantage Proxy, Inc.

(877) 870-8565 (toll free)

(206) 870-8565 (collect)

Who are the dealer-managers?

Maxim Group LLC and National Securities Corporation will act as dealer-managers for the Rights Offering. Under the terms and subject to the conditions contained in the dealer-manager agreement, the dealer-managers will use their best efforts to solicit the exercise of Subscription Rights. We have agreed to pay the dealer-managers for certain fees for acting as dealer-managers and to reimburse the dealer-managers for certain out-of-pocket expenses incurred in connection with this offering. The dealer-managers are not underwriting or placing any of the Subscription Rights or the shares of our common stock or Warrants being issued in this offering and do not make any recommendation with respect to such Subscription Rights (including with respect to the exercise or expiration of such Subscription Rights), shares of common stock or Warrants.

This summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before you decide to invest in our common stock,Units, you should read this entire prospectus carefully, including the section entitled “Risk Factors,”Factors” and our consolidated financial statements and the related notes.any information incorporated by reference herein.

Our Business

Opexa is a biopharmaceutical company developing a personalized immunotherapy with the potential to treat major illnesses, including multiple sclerosis (MS) as well as other autoimmune diseases such as neuromyelitis optica (NMO). This therapy isThese therapies are based on our proprietary T-cell technology. Our mission is to lead the field of Precision ImmunotherapyTM® by aligning the interests of patients, employees and shareholders. Information related to our product candidate,candidates, Tcelna®, and OPX-212, is preliminary and investigative. Tcelna hasand OPX-212 have not been approved by the U.S. Food and Drug Administration (FDA) or other global regulatory agencies for marketing.

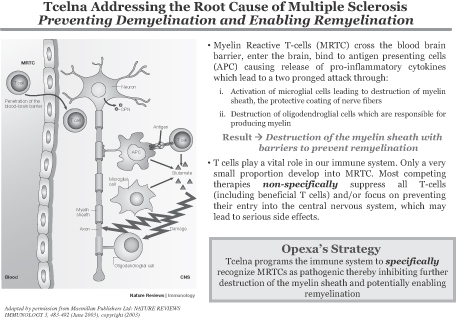

MS is a chronic, often disablingan inflammatory autoimmune disease that affectsof the central nervous system (CNS), which is made up of the brain, spinal cord and optic nerves.nerves, with a clinically heterogeneous and unpredictable course that persists for decades. MS attacks the covering surrounding nerve cells, or myelin sheaths, leading to loss of myelin (demyelination) and nerve damage. In addition to demyelination, the neuropathology of MS is characterized by variable loss of oligodendroglial cells and axonal degeneration and manifests in neurological deficits. Symptoms may be mild, such as numbness in the limbs, or severe, such as paralysis or loss of vision. This inflammatory, demyelinating, autoimmune disease has varied clinical presentations, ranging from relapses and remissions (relapsing remitting MS, or RRMS) to slow accumulation of disability with or without relapses (secondary progressive MS, or SPMS). There are approximately 450,000 MS patients in North America and over 2,000,000 patients worldwide according to estimates from The progress, severity and specific symptomsNational MS Society. The portion of the MS are unpredictable and vary from one personpatient population that can be classified as SPMS is estimated by various industry sources to another. be between 30-45% of the total MS patient population.

We believe that our lead product candidate, Tcelna, has the potential to fundamentally address the root cause of MS by stopping the demyelination process and in supporting the generation of new myelin sheaths where demyelination has occurred (remyelination).

Tcelna is an autologous T-cell immunotherapy that is currently being developed for the treatment of Secondary Progressive MS (SPMS)SPMS and is specifically tailored to each patient’s immune response profile to myelin. Tcelna is designed to reduce the number and/or functional activity of specific subsets of myelin-reactive T-cells (MRTCs) known to attack myelin. This technology was originally licensed from Baylor College of Medicine in 2001.

Tcelna is manufactured using our proprietary method for the production of an autologous T-cell product, which comprises the collection of blood from the MS patient and the expansion of MRTCs from the blood. Upon completion of the manufacturing process, an annual course of therapy consisting of five doses is cryopreserved. At each dosing time point, a single dose of Tcelna is formulated and attenuated by irradiation before returning the final product to the clinical site for subcutaneous administration to the patient.

Tcelna has received Fast Track designation from the FDA in SPMS, and we believe it is positioned as a potential first-to-market personalized T-cell therapy for MS patients. The FDA’s Fast Track program is designed to facilitate the development and expedite the review of drug candidates intended to treat serious or life-threatening conditions and that demonstrate the potential to address unmet medical needs.

Opexa was incorporated in Texas in March 1991. Our principal executive offices

In addition to our ongoing clinical development of Tcelna, we announced on September 8, 2014, that we are located at 2635 Technology Forest Blvd., The Woodlands, Texas 77381, and our telephone number is (281) 775-0600.

T-Cell Therapy and Tcelna

Tcelna is a novelalso developing OPX-212 as an autologous T-cell immunotherapy in Phase IIb clinical development for the treatment of NMO. NMO is an autoimmune disorder in which immune system cells and antibodies attack and destroy astrocytic/myelin cells in the optic nerves and the spinal cord leading to demyelination and loss of axons. There are currently no FDA-approved therapies for NMO, other than to treat an attack while it is happening, to reduce symptoms and to prevent relapses. OPX-212 is specifically tailored to each patient’s immune response to a protein, aquaporin-4, which is the targeted antigen in NMO. In NMO, the immune system recognizes aquaporin-4 as foreign, thus triggering the attack. We believe a mechanism of action of OPX-212 may be to reduce the number and/or regulate aquaporin-4 reactive T-cells (ARTCs), thereby reducing the frequency of clinical relapses and subsequent progression in disability. See “—NMO – OPX-212” below for more information on our development plans for OPX-212 in NMO.

Multiple Sclerosis—Background

MS is a disease that is more common in females than males (2:1) between the ages of 20 and 40, with a peak onset of approximately 25 years of age. MS frequently causes impairment of motor, sensory, coordination and balance, visual, and/or cognitive functions, as well as urinary (bladder) or bowel dysfunction and symptoms of fatigue. The identified autoimmune mechanisms directed at myelin tissue of the CNS may play an important role in the pathogenesis of MS. Epidemiologic studies suggest that a variety of genetic, immunologic, and environmental factors including viral infections may play a role in defining the etiology and in triggering the onset and progression of MS.

At the onset of MS, approximately 85% of MS patients with SPMS. Ithave RRMS. Without disease-modifying medication, one-half of these RRMS patients will develop steadily progressive disease, SPMS, within 10 years, increasing to 90% within 25 years of MS diagnosis. The MS drug market was approximately $13 billion in 2012 and is also positionedforecasted to enter Phase III clinicalreach as much as $16 billion by 2015.

MS remains a challenging autoimmune disease to treat because the pathophysiologic mechanisms are diverse, and the chronic, unpredictable course of the disease makes it difficult to determine whether the favorable effects of short-term treatment will be sustained. Therapies that are easy to use and can safely prevent or stop the progression of disease represent the greatest unmet need in MS.

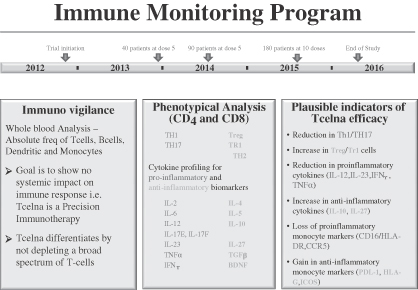

In recent years, the understanding of MS pathogenesis has evolved to comprise an initial, T-cell-mediated inflammatory activity followed by selective demyelination (erosion of the myelin coating of the nerve fibers) and then neurodegeneration. The discovery of disease-relevant immune responses has accelerated the development of targeted therapeutic products for the treatment of patients with relapsing remitting MS (RRMS), subjectthe early stages of MS. Some subjects, who have the appropriate genetic background, have increased susceptibility for the in vivo activation and expansion of MRTCs. These MRTCs may remain dormant, but at some point they are activated in the periphery, thus enabling them to cross the blood-brain barrier and infiltrate the healthy tissue of the brain and spinal cord. The cascade of pathogenic events leads to demyelination of protrusions from nerve cells called axons, which causes nerve impulse transmissions to diffuse into the tissue resulting in disability to the availability of sufficient resources.individual.

Tcelna for MS

We believe that Tcelna works selectively on the MRTCs by harnessing the body’s natural immune defense system and feedback mechanisms to deplete these T-cells and induce favorable immune regulatory responses by rebalancing the immune system. Tcelna is a personalized therapyimmunotherapy that is specifically tailored to each patient’s disease profile. Tcelna is manufactured by using ImmPathTM®, our proprietary

method for the production of a patient-specific T-cell immunotherapy which encompasses the collection of blood from the MS patient, isolation of peripheral blood mononuclear cells, generation of an autologous pool of MRTCs raised against selected peptides from myelin basic protein (MBP), myelin oligodendrocyte glycoprotein (MOG) and

proteolipid protein (PLP), expanding these MRTCs to a therapeutic dose ex-vivo, and attenuating them with gamma irradiation to prevent DNA replication and thereby cellular proliferation. These attenuated MRTCs are then injected subcutaneously into the returnbody in therapeutic dosages. The body recognizes specific T-cell receptor molecules of these expanded, irradiated T-cells back toMRTCs as immunogenic and initiates an immune response reaction against them, resulting in the patient. These attenuated T-cellsdepletion and/or immunosuppression of circulating MRTCs carrying the peptide-specific T-cell receptor molecules. In addition, we believe that T-cell activation molecules on the surface of the activated MRTCs promote anti-inflammatory responses. We believe that because the therapy uses an individual’s own cells, the only direct identifiable side effect observed thus far is injection site reactions which typically are reintroduced into the patient via subcutaneous injection to triggerminor and generally clear within 24 hours.

Tcelna Clinical Development Program

Tcelna is a therapeutic immune system response.

Abili-T Trial: Phase IIb Clinical Studynovel T-cell immunotherapy in Patients with SPMS

In September 2012, we announced the initiation of a Phase IIb clinical trialdevelopment for the treatment of patients with SPMS. It is also positioned to enter Phase III clinical development for the treatment of patients with RRMS, subject to the availability of sufficient resources or a strategic partnering commitment.

The Tcelna clinical development program spans studies conducted by Baylor College of Medicine and by Opexa.

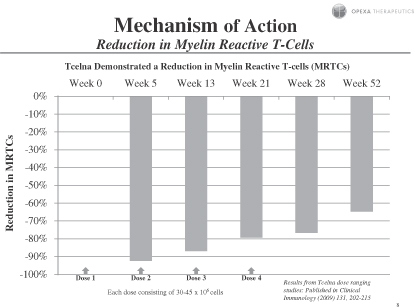

Summary of Phase I Dose Escalation Study in MS

A Phase 1 dose escalation study completed in 2006 was conducted in patients with both RRMS and SPMS who were intolerant or unresponsive to current approved therapies for MS. The open-label, dose escalation study evaluated safety and clinical benefit by administering a primary series of four treatments at one of three dose levels administered at baseline and weeks 4, 8 and 12. Results of the efficacy analyses provide some evidence of the effectiveness of Tcelna in the treatment of MS. Data from the Phase I study evaluating the Expanded Disability Status Scale (EDSS) showed improvements in some subjects in comparison to baseline for weeks 20 and 28.

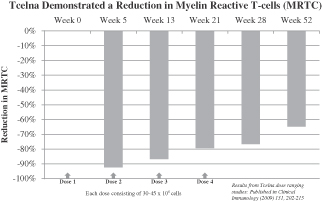

Subjects showed statistically significant improvement in overall reduction of MRTC counts over baseline at all visits through week 52 for subjects receiving 30-45 million cells per dose, as assessed by total MRTC count percentage changes. These data indicate that Tcelna treatment causes a depletion or immunomodulation of these cells, most obvious at time points closer to the injections. These findings were published in Clinical Immunology (2009) 131, 202-215.

Overall, results of the safety analyses indicate that treatment with Tcelna is well-tolerated. Reported adverse events were mostly mild or moderate in intensity. Mild injection site reactions were observed but all resolved rapidly without treatment. In conclusion, data from this study suggest that Tcelna is safe for the treatment of MS.

Summary of Phase I/IIA Clinical Trial Data in MS

The second clinical study performed by Opexa was an open-label extension study completed in 2007 to treat patients who were previously treated with T-cell immunotherapy but who saw a rebound in MRTC activity. The purpose of this extension study was to continue evaluating the efficacy, safety and tolerability of Tcelna in patients with SPMS. The trial is entitled: A Phase II Double-Blind, Placebo Controlled Multi-Center Study to EvaluateRRMS and SPMS with repeated administration of Tcelna. Results of the Efficacy and Safetystudy provide evidence of the effectiveness of Tcelna in Subjectsthe treatment of MS with Secondary Progressiverepeated dosing. Improvements from baseline at both week 28 and week 52 of the extension study were observed for the frequency of MS exacerbations, or annualized relapse rate (ARR). Evaluation of the Multiple Sclerosis Impact Scale (MSIS-29) component scores suggests a trend for Tcelna therapy in the improvement of physical and psychological parameters assessed by the MSIS-29. The EDSS score analysis revealed an upward trend for the percentage of subjects that reported improvement and sustained improvement over baseline as a result of Tcelna treatment.

Subjects showed statistically significant reduction over baseline in the MRTC counts for each time point through month nine of the extension study. Overall, results of the safety analyses indicate that repeated treatment with Tcelna is well-tolerated. Reported adverse events (AEs) were mostly mild or moderate in intensity. Mild injection site reactions were observed but all resolved rapidly without treatment. Furthermore, results from this study suggest that repeated dosing of Tcelna has been nameda substantive effect in reduction of ARR in subjects with MS and was well-tolerated.

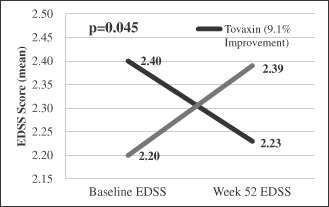

Summary of TERMS Phase IIb Clinical Trial Data in RRMS

Tovaxin for Early Relapsing Multiple Sclerosis (TERMS) was a Phase IIb clinical study of Tcelna in RRMS patients completed in 2008. Although the “Abili-T” trial. The Abili-T trial is a double-blind, 1:1 randomized, placebo-controlled study did not show statistical significance in SPMS patients who demonstrateits primary endpoint (the cumulative number of gadolinium-enhanced brain lesions using magnetic resonance imaging (MRI) scans summed at various points in the study), the study showed compelling evidence of disease progressionefficacy in various clinical and other MRI endpoints.

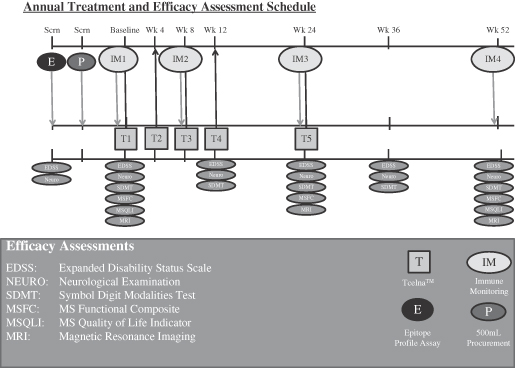

The TERMS study was a multi-center, randomized, double blind, placebo-controlled trial in 150 patients with RRMS or without associated relapses.high risk Clinically Isolated Syndrome. The trial is expectedinclusion criteria for TERMS was an EDSS score of 0 to enroll 180 patients who have Expanded Disability Status Scale (EDSS) scores between 3.0 and 6.0 at approximately 30 leading clinical sites in the U.S. and Canada. According to the study protocol, patients will receive two annual courses of Tcelna treatment consisting5.5. Patients received a total of five subcutaneous injections per year at weeks 0, 4, 8, 12 and 24.

The primary efficacy endpoint of Key results from the TERMS trial is the percentage of brain volume change (whole brain atrophy) at 24 months. Study investigators will also measure several important secondary outcomes commonly associated with MS including sustained disease progression as measured by EDSS, changes in EDSS, time to sustained progression, annualized relapse rate (ARR), change in Multiple Sclerosis Functional Composite (MSFC) assessment of disability and change in Symbol Digit Modality Test. Data on certain exploratory endpoints such as quality of life metrics as measured by the Multiple Sclerosis Quality of Life Inventory (MSQLI), magnetic resonance imaging (MRI) measures and immune monitoring metrics are also being collected.included:

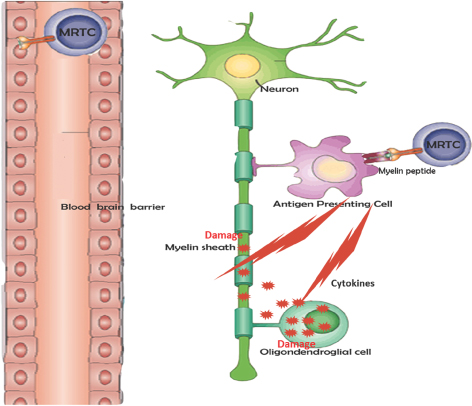

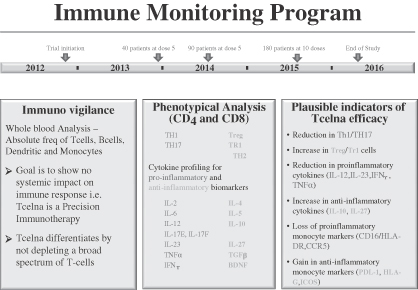

As part ofIn the Abili-T trial, we are undertaking a comprehensive immune monitoring program formodified intent to treat patient population consisting of all patients enrolledwho received at least one dose of study product and had at least one MRI scan at week 28 or later (n=142), the ARR for Tcelna-treated patients was 0.214 as compared to 0.339 for placebo-treated patients, which represented a 37% decrease in ARR for Tcelna as compared to placebo in the study. The goals of this program aregeneral population;

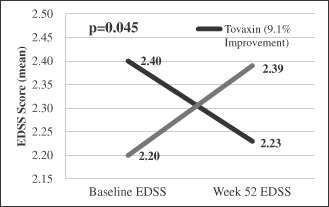

| • | In a prospective group of patients with more active disease (ARR>1, n=50), Tcelna demonstrated a 55% reduction in ARR as compared to placebo, an 88% reduction in whole brain atrophy and a statistically significant improvement in disability (EDSS) compared to placebo (p<0.045) at week 52 during the 24-week period following the administration of the full course of treatment; and |

We remain committed to further understand the biology behind the mechanism of action for Tcelna and to possibly identify novel biomarkers that are dominant in the pathophysiology of SPMS patients. The program encompasses an analysis of various pro-inflammatory and anti-inflammatory biomarkers. We believe that the blinded data, which will be analyzed during the course of the trial, may potentially signal responders and non-responders. Directional movement of certain biomarkers, when corroborated with final clinical trial data, may be indicative of responders and disease stabilization or progression. A summary of pro-inflammatory and anti-inflammatory biomarkers to be studied, with their potential outcomes, is set forth in the graphic below.

As of July 19, 2013, the Abili-T clinical trial has randomized 65 patients. A scheduled Data Safety Monitoring Board meeting took place during the week of May 20, 2013, and a recommendation was made to continue the study. The Abili-T clinical study in North America of Tcelna is expected to complete enrollment of 180 patients by late 2013 or early 2014, with the resulting top-line data expected to be available in the first half of 2016.

During the first quarter of 2013, the pace of on-boarding clinical sites for the Abili-T clinical study was tempered pending the completion of our negotiations with Ares Trading SA (“Merck”), a wholly owned subsidiary of Merck Serono S.A., for the Option (see “—Option and License Agreement with Merck Serono”) as well as financial considerations. Upon receipt of the upfront payment of $5 million for granting the Option, we were able to refocus on execution of the Abili-T clinical trial, including enrollment. The future costs of the study, which have been impacted by a slowed rate of enrollment prior to receipt of the upfront payment of $5 million for granting the Option, as well as the ongoing expenses of our operations through the expected completion date of the study and release of top-line data, are estimated as of June 30, 2013 to be between $30-$32 million. Our existing resources are not adequate to permit us to complete such study or the majority of it. We anticipate that up to $3.6 million of the proceeds from the offering could be used for the repayment of convertible debt and at least $9.8 million of the proceeds from the offering will be applied to funding the continuation of the clinical study as well as the ongoing expenses of our operations during such development and for general corporate purposes. We will need to secure significant additional resources to complete the trial and support our operations during the pendency of the trial. There can be no assurance that any such financings or potential opportunities and alternatives can be consummated on acceptable terms, if at all. We believe we have sufficient liquidity to

support our clinical trial activities into the fourth quarter of 2013. Given our need for substantial amounts of capital to continue the Abili-T clinical study in North America of Tcelna in SPMS, we intend to continue to explore potential opportunities and alternatives to obtain the significant additional resources, including one or more additional financings, that will be necessary to complete the Abili-T study and to support our operations during the pendency of such study.

Option and License Agreement with Merck Serono

On February 4, 2013, we entered into an Option and License Agreement with Merck. Pursuant to the agreement, Merck has an option (the “Option”) to acquire an exclusive, worldwide (excluding Japan) license of our Tcelna program for the treatment of MS. The Option may be exercised by Merck prior to or upon completion of our ongoing Abili-T trial of Tcelna in patients with SPMS.

Under the terms of the agreement, we received an upfront payment of $5 million for granting the Option. If the Option is exercised, Merck would pay us an upfront license fee of $25 million unless Merck is unable to advance directly into a Phase III clinical trial of Tcelna for SPMS without a further Phase II clinical trial (as determined by Merck), in which event the upfront license fee would be $15 million. After exercising the Option, Merck would be solely responsible for funding development, regulatory and commercialization activities for Tcelna in MS, although we would retain an option to co-fund certain development in exchange for increased royalty rates. We would also retain rights to Tcelna in Japan, certain rights with respect to the manufacture of Tcelna, and rights to use for other indications outside of MS.

Based upon the achievement of development milestones by Merck for Tcelna in SPMS, we would be eligible to receive one-time milestone payments totaling up to $70 million as follows: (i) milestone payments aggregating $35 million if Tcelna is submitted for regulatory approval and commercialized in the United States; (ii) milestone payments aggregating $30 million if Tcelna is submitted for regulatory approval in Europe and commercialized in at least three major countries in Europe; and (iii) a milestone payment of $5 million if Tcelna is commercialized in certain markets outside of the United States and Europe. If Merck elects to develop and commercializeadvancing Tcelna in RRMS we would be eligible to receive milestone payments aggregating up to $40 million based uponat a later date assuming the achievement by Merckavailability of various development, regulatory and first commercial sale milestones.

If Tcelna receives regulatory approval andsufficient resources or a strategic partnering commitment. For Opexa, however, SPMS is commercialized by Merck, we would be eligible to receive royalties pursuant to a tiered structure at rates ranging from 8% to 15% of annual net sales, with step-ups over such range occurring when annual net sales exceed $500 million, $1 billion and $2 billion. Any royalties would be subject to offset or reduction in various situations, including if third party rights are required or if patent protection is not available in an applicable jurisdiction. We would also be responsible for royalty obligations to certain third parties, such as Baylor College of Medicine fromarea which we originally licensed related technology. If we were to exercise an option to co-fund certain of Merck’s development, the royalty rates payable by Merck would be increased to rates ranging from 10% to 18%. In addition to royalty payments, we would be eligible to receive one-time commercial milestones totaling up to $85 million, with $55 million of such milestones achievable at annual net sales targets in excess of $1 billion.believe represents a higher unmet medical need.

SPMS Overview and Tcelna Mechanism of Action

SPMS is characterized by a steady accrual of irreversible disability, despite, in some cases, relapses followed by remissions or clinical plateaus. Older age at onset of MS diagnosis is the strongest predictor of conversion to SPMS. Males have a shorter time to conversion to SPMS compared with females. Available immunomodulating and immunosuppressive therapies used for RRMS have not been effective in SPMS. In clinical trials, these therapies have demonstrated anti-inflammatory properties as measured by the reduction in number and volume of contrast-enhancing or acutely inflammatory CNS lesions most commonly seen in patients

with RRMS. The typical SPMS patient, however, has little or no radiographic evidence of acute inflammation. It is commonly observed that contrast-enhancing CNS lesions are uncommon among these patients, despite a clearly deteriorating neurologic course.

The lack of effect of conventional MS therapeutics in SPMS suggests that the cerebral deterioration characterizing progressive disease may be driven by factors other than acute inflammation. For instance, the immunopathology of SPMS is more consistent with a transition to a chronic T-cell dependent inflammatory type, which may encompass the innate immune response and persistent activation of microglia cells. Meningeal follicles close to cortical gray matter lesions suggests that adaptive immune responses involving antibody and complement contribute to progression in SPMS. Furthermore, chronic MRTCs may be contributing to the development of both innate and adaptive immune responses persisting in the CNS.

Radiographic features that stand out among patients with SPMS include significantly more atrophy of gray matter compared with RRMS patients. Of note, long-term disability in MS in general appears more closely correlated to gray matter atrophy than to white matter inflammation. Such atrophy may be suggestive of progressive clinical disability. Both clinically and radiographically, SPMS represents a disease process with certain features distinct from those of RRMS, and one with extremely limited treatment options.

Tcelna immunotherapy in SPMS may reduce the drivers of this chronic disease by down-regulating anti-myelin immunity through priming regulatory responses that may act in the periphery as well as within the CNS. We believe that our clinical results show therapeutic subcutaneous dosing of 30-45 million cells of Tcelna stimulates host reactivity to the over-represented MRTCs and, as a consequence, a dominant negative regulatory T-cell response is induced leading to down-regulation of similar endogenous disease-causing MRTCs.

We believe that Tcelna has the potential to induce an up-regulation of regulatory cells, such as Foxp3+ Treg cells and IL-10 secreting Tr1 cells, which may effect a reduction in inflammation and provide neuroprotection should they gain entry to the CNS. Data from our TERMS study showed statistically significant changes from baseline (p=0.02) in Foxp3+ Treg cells for the subset of Tcelna patients who had ARR>1. >1. The placebo arm for this subset was not statistically different from its baseline levels. Three SPMS patients from prior clinical studies, whose blood samples were analyzed to measure Tr1 cells prior to treatment and post treatment, showed an increase in the levels of Tr1 cells from non-detectable levels to the range of healthy donor samples. These three patients who had relapses in the preceding 12-24 month period remained relapse free during the 52-week assessment period and also showed a 57% to 67% reduction in MRTCs.

Current Treatment Options for SPMS

Only one product, mitoxantrone, is currently approved for the indication of SPMS.SPMS in the U.S. However, as ofsince 2005, this drug carries a black box warning, due to significant risks of decreased systolic function, heart failure, and leukemia. The American Academy of Neurology has issued a report indicating that these risks are even higher than suggested in the original report leading to the black box warning. Hence, a safe and effective treatment for SPMS remains a significant unmet medical need.

Tcelna Clinical Overview in SPMS

In multiple previously conducted clinical trials for the treatment of patients with MS (which have been weighted significantly toward patients with RRMS), Tcelna has demonstrated one of the safest side effect profiles for any marketed or development-stage MS therapy, as well as encouraging efficacy signals. A total of 144 MS patients have received Tcelna in previously conducted Opexa trials for RRMS and SPMS. The therapy has been well-tolerated in all subjects and has demonstrated an excellent overall safety profile. The most common side effect is mild to moderate irritation at the site of injection, which is typically resolved in 24 hours. Tcelna has been administered to a total of 36 subjects with SPMS across three previous clinical studies.

In a pooled assessment of data from 36 SPMS patients treated in Phase I open label studies at the Baylor College of Medicine completed in 1998 and in Opexa sponsoredOpexa-sponsored studies completed in 2006 and 2007,

approximately 80% of the 35 SPMS patients who completed two years of treatment showed disease stabilization

as measured by EDSS following two years of treatment with Tcelna, with the other 20% showing signs of progression. This compares to historical control data which showed a progression rate of 40% in SPMS patients (as reported in ESIMS Study published in Hommes Lancet 2004). The 10 SPMS patients in Opexa sponsored studies showed a substantial reduction in ARR at two years from 0.5 to an ARR less than 0.1. Only 1 out of the 10 patients experienced one episode of relapse during the two years of assessment. This same cohort showed no worsening of physical or psychological condition (key quality of life indicators as measured by the MS Impact Scale) after two years of treatment with Tcelna. Additionally, there were no reported serious adverse events (SAEs) in any of the patients. Based on preliminary data suggesting stabilized or improved disability among SPMS subjects receiving Tcelna, we believe that further development of this product candidate in SPMS is warranted.

Summary ofAbili-T Trial: Phase I Dose EscalationIIb Clinical Study in MSPatients with SPMS

A Phase 1 dose escalation study completed in 2006 was conducted in patients with both RRMS and SPMS who were intolerant or unresponsive to current approved therapies for MS. The open-label, dose escalation study evaluated safety and clinical benefit by administeringIn September 2012, we announced the initiation of a primary series of four treatments at one of three dose levels administered at baseline and weeks four, eight, and twelve. Results of the efficacy analyses provide some evidence of the effectiveness of Tcelna in the treatment of MS. The follow-on TERMS Phase IIb clinical study provided further encouraging signs of efficacy in ARR and Multiple Sclerosis Impact Scale (MSIS-29). Data from the Phase I study evaluating the EDSS showed improvements in some subjects in comparison to baseline for weeks 20 and 28.

Subjects showed statistically significant improvement in overall reduction of MRTC counts over baseline at all visits through week 52 for subjects receiving 30-45 million cells per dose, as assessed by total MRTC count percentage changes. These data indicate that Tcelna treatment causes a depletion or immunomodulation of these cells, most obvious at time points closer to the injections. These findings, which demonstrate that administration of Tcelna induces a reduction in MRTCs, were published in Clinical Immunology (2009) 131, 202-215.

Overall, results of the safety analyses indicate that treatment with Tcelna is well-tolerated. Reported adverse events were mostly mild or moderate in intensity. Mild injection site reactions were observed but all resolved rapidly without treatment. In conclusion, data from this study suggest that Tcelna is safe for the treatment of MS.

Summary of Phase I/IIA Clinical Trial Data in MS

The second clinical study performed by Opexa was an open-label extension study completed in 2007 to treat patients who were previously treated with T-cell immunotherapy but who saw a rebound in MRTC activity. The

purpose of this extension study was to continue evaluating the efficacy, safety and tolerabilitytrial of Tcelna in patients with RRMSSPMS. The trial is entitled: A Phase II Double-Blind, Placebo Controlled Multi-Center Study to Evaluate the Efficacy and SPMS with repeated administration of Tcelna. Results of the study provide evidence of the effectivenessSafety of Tcelna in Subjects with Secondary Progressive Multiple Sclerosis and has been named the treatment“Abili-T” trial. The Abili-T trial is a double-blind, 1:1 randomized, placebo-controlled study in SPMS patients who demonstrate evidence of MSdisease progression with repeated dosing. Improvements from baselineor without associated relapses. The trial is being conducted at both week 28 and week 52 of the extension study were observed for the frequency of MS exacerbations (ARR). Evaluation of MSIS-29 component scores suggests a trend for Tcelna therapyapproximately 35 leading clinical sites in the improvement of physicalU.S. and psychological parameters assessed byCanada and has enrolled patients who have Expanded Disability Status Scale (EDSS) scores between 3.0 and 6.0. According to the MSIS-29. The EDSS score analysis revealed an upward trend for the percentage of subjects that reported improvement and sustained improvement over baseline as a resultstudy protocol, patients are receiving two annual courses of Tcelna treatment.

Subjects showed statistically significant improvement over baseline in the MRTC counts for each time point through month nine of the extension study. These results indicate that Tcelna treatment results in a statistically significant impact on these cells.

Overall, results of the safety analyses indicate that repeated treatment with Tcelna is well-tolerated. Reported adverse events (AEs) were mostly mild or moderate in intensity. Mild injection site reactions were observed but all resolved rapidly without treatment. Furthermore, results from this study suggest that repeated dosing of Tcelna has a substantive effect in reduction of ARR in subjects with MS and was well-tolerated.

Summary of TERMS Phase IIb Clinical Trial Data in RRMS

Tovaxin for Early Relapsing Multiple Sclerosis (TERMS) was a Phase IIb clinical study of Tcelna in RRMS patients completed in 2008. Although the study did not show statistical significance in its primary endpoint (the cumulative number of gadolinium-enhanced brain lesions using MRI scans summed at various points in the study), the study showed compelling evidence of efficacy in various clinical and other MRI endpoints.

The TERMS study was a multi-center, randomized, double blind, placebo-controlled trial in 150 patients with RRMS or high risk Clinically Isolated Syndrome. Patients received a totalconsisting of five subcutaneous injections per year at weeks 0, 4, 8, 12 and 24. Key results from

The primary efficacy endpoint of the TERMS trial included:is the percentage of brain volume change (whole brain atrophy) at 24 months. Study investigators will also measure several important secondary outcomes commonly associated with MS including sustained disease progression as measured by EDSS, changes in EDSS, time to sustained progression, ARR, change in Multiple Sclerosis Functional Composite (MSFC) assessment of disability and change in Symbol Digit Modality Test. Data on certain exploratory endpoints such as quality of life metrics as measured by the Multiple Sclerosis Quality of Life Inventory (MSQLI), MRI measures and immune monitoring metrics are also being collected.

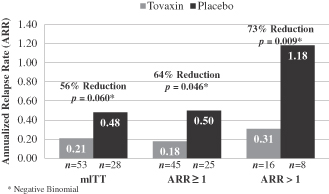

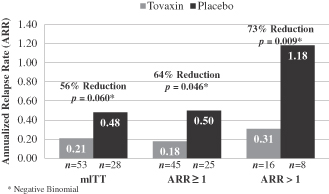

InAs part of the modified intent to treat patient population consisting ofAbili-T trial, we are undertaking a comprehensive immune monitoring program for all patients who received at least one doseenrolled in the study. The goals of study product and had at least one MRI scan at week 28 or later (n=142),this program are to further understand the ARR for Tcelna-treated patients was 0.214 as compared to 0.339 for placebo-treated patients, which represented a 37% decrease in ARRbiology behind the mechanism of action for Tcelna as comparedand to placebopossibly identify novel biomarkers that are dominant in the general population;

|

pathophysiology of SPMS patients. The program encompasses an analysis of various pro-inflammatory and anti-inflammatory biomarkers and biomarker data is being gathered during the course of the trial on a blinded basis. We believe that directional movement of certain biomarkers, when corroborated with final clinical trial data, may be indicative of responders and disease stabilization or progression.

Option and License Agreement with Merck Serono

On February 4, 2013, we entered into an Option and License Agreement with Ares Trading SA (“Merck Serono”), a wholly owned subsidiary of Merck Serono S.A. Pursuant to the agreement, Merck Serono has an option (the “Option”) to acquire an exclusive, worldwide (excluding Japan) license of our Tcelna program for the treatment of MS. The Option may be exercised by Merck Serono prior to or upon completion of our ongoing Abili-T trial of Tcelna in patients with SPMS. Under the terms of the agreement, we received an upfront payment

Inof $5 million for granting the Option. If the Option is exercised, Merck Serono would pay us an upfront license fee of $25 million unless Merck Serono is unable to advance directly into a retrospective analysisPhase III clinical trial of Tcelna for SPMS without a further Phase II clinical trial (as determined by Merck Serono), in patients naïvewhich event the upfront license fee would be $15 million. After exercising the Option, Merck Serono would be solely responsible for funding development, regulatory and commercialization activities for Tcelna in MS, although we would retain an option to previous disease modifying treatment,co-fund certain development in exchange for increased royalty rates. We would also retain rights to Tcelna in Japan, certain rights with respect to the results showed that patients, when treated withmanufacture of Tcelna, hadand rights to use for other indications outside of MS.

Based upon the achievement of development milestones by Merck Serono for Tcelna in SPMS, we would be eligible to receive one-time milestone payments totaling up to $70 million as follows: (i) milestone payments aggregating $35 million if Tcelna is submitted for regulatory approval and commercialized in the United States; (ii) milestone payments aggregating $30 million if Tcelna is submitted for regulatory approval in Europe and commercialized in at least three major countries in Europe; and (iii) a 56%milestone payment of $5 million if Tcelna is commercialized in certain markets outside of the United States and Europe. If Merck Serono elects to 73% reduction in ARR versus placebo for the various subsetsdevelop and p values ranged from 0.009 to 0.06.

We remain committed to further advancingcommercialize Tcelna in RRMS, we would be eligible to receive milestone payments aggregating up to $40 million based upon the achievement by Merck Serono of various development, regulatory and first commercial sale milestones.