As filed with the Securities and Exchange Commission on July 21, 2020.May 26, 2022

Registration Statement No. 333-238514333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

AMENDMENT NO. 2 TO:

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

JERRICK MEDIA HOLDINGS,CREATD, INC.

(Exact name of Registrantregistrant as specified in its charter)

| Nevada | 7819 | 87-0645394 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification |

2050 Center Avenue Suite 640419 Lafayette Street

Fort Lee, NJ 070246th Floor

Telephone: New York, NY 10003

(201) 258-3770

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Jeremy FrommerLaurie Weisberg

Chief Executive Officer

2050 Center Avenue Suite 640419 Lafayette Street, 6th Floor

Fort Lee, NJ 07024New York, NY 10003

Telephone: (201) 258-3770

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Joseph M. Lucosky, Esq.

Scott E. Linsky, Esq. Lucosky Brookman LLP 101 Wood Avenue South, 5th Floor

(732) 395-4400 | Spencer G. Feldman, Esq. Olshan Frome Wolosky LLP 1325 Avenue of the Americas, 15th Floor New York, NY 10019 (212) 451-2300 |

Approximate Datedate of Commencementcommencement of Proposed Saleproposed sale to the Public:public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer ☒ | Smaller reporting company | ☒ | ||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities ActAct. ☐

| Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee | ||||||

| Units, consisting of one share of common stock, par value $0.001 per share, and one warrant to purchase one share of common stock, par value $0.001 per share | ||||||||

| Common stock included as part of the Units | $ | 10,350,000 | $ | 1,343.43 | ||||

| Warrants included as part of the Units (3) | ||||||||

| Shares of common stock issuable upon exercise of the Warrants | $ | 10,350,000 | $ | 1,343.43 | ||||

| Total | $ | 20,700,000 | $ | 2,686.86 | * | |||

The Registrantregistrant hereby amends this Registration Statementregistration statement on such date or dates as may be necessary to delay its effective date until the Registrantregistrant shall file a further amendment which specifically states that this Registration Statementregistration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statementthis registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determinedetermine..

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it iswe are not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 21, 2020MAY 26, 2022

PRELIMINARY PROSPECTUS

JERRICK MEDIA HOLDINGS, INC.

Subscription Rights to Purchase Up to 20,000,000 Units

Consisting of Up to 20,000,000 Shares of Common Stock

Series A Warrants to Purchase Up to 20,000,000 Shares of Common Stock and

Series B Warrants

This prospectus relates to Purchase Up to 20,000,000 Shares of Common Stock

at a Subscription Price of $2.00 Per Unit

We are distributing, at no charge, non-transferable subscription rights entitling holders of common stock as of the sale by Jerrick Media Holdings, Inc. (the “Company” or “Jerrick”)record date of $9,000,0005:00 p.m. (Eastern time) on , 2022 and holders of certain shares of Series E Preferred Stock, common stock warrants and options, to purchase units at a subscription price of securities (the “Units”). The offering price is $$2.00 per Unit.

unit. Each Unit consistsunit will consist of (a) one share of our common stock, and (b) onea Series A warrant exercisable to purchaseacquire one share of our common stock at an exercise price equalof $3.00, and a Series B warrant exercisable to $ untilacquire one share of common stock at an exercise price of $6.00. Shares of common stock, Series A warrants and Series B warrants comprising the fifth anniversaryunits may only be purchased as a unit, but will be issued separately. We may redeem the outstanding warrants subject to the terms and conditions described in this prospectus. You will receive two subscription rights for every share of the issuance date. The shares of our common stock and warrants are immediately separable and will be issued separately but will be purchased together in this offering.

We have applied to list ourevery share of common stock issuable upon conversion or exercise of the Preferred Shares, Eligible Warrants and Eligible Options you hold as of the warrantsrecord date.

Pursuant to your subscription rights, you will have the right, which we refer to as your basic right, to purchase a number of units equal to (i) the number of shares of common stock you held as of the record date and (ii) the number of shares of common stock issuable upon conversion or exercise of the Preferred Shares, Eligible Warrants and/or Eligible Options (all as defined below) you held as of the record date. If you exercise your basic right in full, you will also have the right, or over-subscription privilege, to purchase additional units for which other rights holders do not subscribe. Once made, all exercises of rights are irrevocable.

Your basic rights and over-subscription privilege will expire if not exercised by 5:00 p.m. (Eastern time) on , 2022, unless we extend or terminate this offering. We may extend this offering for one or more additional periods in our sole discretion not to exceed 45 days from the initial expiration date. We will announce any extension in a press release issued no later than 9:00 a.m. (Eastern time) on the Nasdaq Capital Market upon our satisfactionbusiness day after the most recently announced expiration date. If this offering is not fully subscribed following the expiration date of the exchange’s initial listing criteria. If our common stock and warrants are not approvedoffering, the dealer-manager for listing onthis offering has agreed to use its commercially reasonable efforts to place any unsubscribed units at the Nasdaq Capital Market, wesubscription price for an additional period of up to 45 days. The number of units that may be sold by us during this period will not consummate this offering. No assurance can be given that our application will be approved. Upon approval to list our common stock and the warrants on the Nasdaq Capital Market, we will change our name to “Creatd, Inc.” Additionally,depend upon the securities comprisingnumber of units that are subscribed for pursuant to the Units becoming separately traded, we expect that our common stockexercise of subscription rights by shareholders and warrants will be listed on the Nasdaq Capital Market under the symbols “CRTD” and “CRTDW,” respectively.other rights holders.

Our common stock is currently quotedtraded on The OTCQB VentureNasdaq Capital Market, (the “OTCQB”), operated by OTC Markets Group,or the Nasdaq, under the symbol “JMDA”. We have assumed a public offering“CRTD.” The closing price of $ per Unit, the last reported sale price for our common stock as reported on May 26, 2022 was $1.28 per share. We are applying to list the OTCQBSeries A warrants and Series B warrants for trading on , 2020. The actual public offering price per UnitNasdaq Capital Market, but we cannot assure you that we will be determined between us and the underwriters at the time of pricing and may be at a discount to the current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicativemeet all of the final offering price.required listing standards. If we do not meet such required listing standards, we will use our commercially reasonable efforts to list the Series A warrants and Series B warrants on another suitable securities exchange or recognized trading system. Neither the subscription rights nor the units are transferable.

Quotes of our common stock trading prices on the OTCQB may not be indicative of the market price of our common stock or warrants if listed on the Nasdaq Capital Market.

Investing in our common stock is highly speculative andsecurities involves a high degree of risk. You should carefully consider the risks and uncertainties described under the headingrisks. See “Risk Factors” beginning on page 614 of this prospectus beforeprospectus. We and our board of directors are not making any recommendation regarding the exercise of your rights.

We have engaged RHK Capital, LLC doing business as RHK Noble and transacting all broker-dealer services through Noble Capital Markets, Inc., or RHK Noble, to act as dealer-manager for this offering and placement agent for any unsubscribed units. This offering is being conducted on a decisionbest-efforts basis, and we do not need to receive any minimum amount of proceeds in order to complete the offering. We have currently not entered into any standby purchase our securities.agreement, backstop commitment or similar arrangement in connection with this offering.

Continental Stock Transfer & Trust will serve as the subscription agent for this offering and an escrow agent retained by the subscription agent will hold in escrow funds received from subscribers until we complete or terminate the offering.

| Per Unit | Total(1) | |||||||

| Subscription price | $ | 2.00 | $ | 40,000,000 | ||||

| Dealer-manager fee (2) | $ | 0.16 | $ | 3,200,000 | ||||

| Proceeds to us, before expenses | $ | 0.32 | $ | 36,800,000 | ||||

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| (1) |

| (2) | We have agreed to |

The CompanyNeither the Securities and Exchange Commission nor any state securities commission has granted a 45 day optionapproved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the representative ofcontrary is a criminal offense.

If you have any questions or need further information about this offering, please call D.F. King & Co., Inc., the underwriters to purchase up to an additional shares of common stock to cover over-allotments, if any.

The underwriters expect to deliver the shares to purchasers ininformation agent for the offering, onat (212) 269-5550 (bankers and brokers) or about , 2020.(877) 283-0323 (all others) or by email at creatd@dfking.com.

Book-Running ManagerDealer-Manager

THE BENCHMARK COMPANY

The date of this prospectus is , 2020.2022.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

InUnless the context requires otherwise, references in this prospectus to “Creatd,” “our company,” “we,” “our” “us” and similar terms refer to Creatd, Inc., a Nevada corporation, and its subsidiaries, unless the context suggests otherwise references to “the Company,” “Jerrick,” “JMDA,” “we,” “us,” and “our” refer to Jerrick Media Holdings, Inc. and its consolidated subsidiaries.requires.

ii

This prospectus describes

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. Because the specific details regarding this offering, the terms and conditionsfollowing is only a summary, it does not contain all of the common stock being offered hereby and the risks of investing in the Company’s common stock. You should read this prospectus, any free writing prospectus and the additional information about the Company described in the section entitled “Where You Can Find More Information’’ before making your investment decision.

Neither the Company, nor any of its officers, directors, agents, representatives or underwriters, make any representation to you about the legality of an investment in the Company’s common stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in the Company’s common stock.

ADDITIONAL INFORMATION

Youour securities. Before making an investment decision, you should rely only oncarefully read all of the information contained in this prospectus, including the risks described under “Risk Factors” and in any accompanying prospectus supplement. No one has been authorizedour consolidated financial statements and the related notes from our 2021 Annual Report and most recent Form 10-Q, before making an investment decision.

Overview

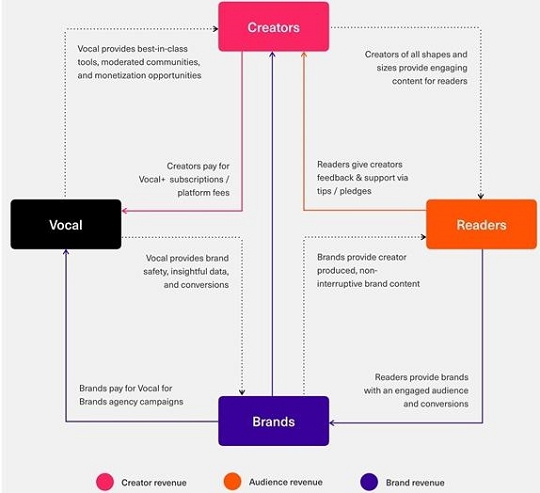

Creatd, Inc. is a company whose mission is to provide you with differenteconomic opportunities to creators and brands by multiplying the impact of platforms, people, and technology.

We operate four main business segments, or additional information. The shares‘pillars’: Creatd Labs, Creatd Partners, Creatd Ventures, and Creatd Studios. Together, Creatd’s pillars work together to create a flywheel effect, supporting our core vision of common stock are not being offeredcreating a viable ecosystem for all stakeholders in any jurisdiction where the offercreator economy.

Creator-Centric Strategy

Our purpose is not permitted. You should not assumeto empower creators to prosper through exceptional tools, built-in communities, and opportunities for monetization and audience expansion. This creator-first approach is the foundation of our culture and mission, and how we choose to allocate our resources. It governs our business model and shapes the value we provide for each of our stakeholders across Creatd’s four pillars.

Creatd Labs

Creatd Labs is dedicated to the development of technology products that support the informationcreator economy. This pillar houses Creatd’s proprietary technology platforms, including Creatd’s flagship product, Vocal.

Vocal

Vocal was built to serve as a home base for digital creators. This robust, proprietary technology platform provides best-in-class tools, safe and curated communities, and monetization opportunities that enable creators to find a receptive audience and get rewarded. Creators of all types call Vocal their home, from bloggers to social media influencers, to podcasters, founders, musicians, photographers, and more.

Since its initial launch in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of such documents.

TRADEMARKS AND TRADE NAMES

This prospectus includes trademarks that are protected under applicable intellectual property laws and are the Company’s property or the property of2016, Vocal has grown to be one of the Company’s subsidiaries. This prospectus also contains trademarks, service marks, trade names and/fastest-growing communities for content creators of all shapes and sizes. Creators can opt to use Vocal for free, or copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the Company will not assert,upgrade to the fullest extent under applicable law, its rightspremium membership tier, Vocal+. Upon joining Vocal, either as a freemium or the right of the applicable licensorpremium member, creators can immediately begin to these trademarksutilize Vocal’s storytelling tools to create and trade names.

INDUSTRY AND MARKET DATA

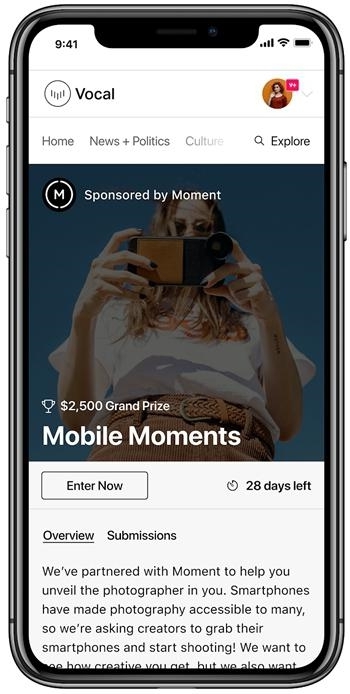

Unless otherwise indicated, information contained in this prospectus concerning the Company’s industry and the markets in which it operates, including market position and market opportunity, is based on information from management’s estimates,publish their stories, as well as benefit from industry publications and research, surveys and studies conductedVocal’s monetization features. Creatd facilitates creators’ monetization on Vocal in numerous different ways, including i) by third parties. The third-party sources fromrewarding creators for each ‘read’ their story receives; ii) via Vocal Challenges, or writing contests through which the Company has obtained information generally state that the information contained therein has been obtained from sources believed to be reliable, but the Company cannot assure you that this information is accurate or complete. The Company has not independently verified any of the data from third-party sources nor has it verified the underlying economic assumptions relied upon by those third parties. Similarly, internal company surveys, industry forecasts and market research, which the Company believes to be reliable, based upon management’s knowledge of the industry, have not been verified by any independent sources. The Company’s internal surveys are based on data it has collected over the past several years, which it believes to be reliable. Management estimates are derived from publicly available information, its knowledge of the industry, and assumptions based on such information and knowledge, which management believes to be reasonable and appropriate. However, assumptions and estimates of the Company’s future performance, and the future performance of its industry, are subject to numerous known and unknown risks and uncertainties, including those described under the heading “Risk Factors” in this prospectus and those described elsewhere in this prospectus, and the other documents the Company files with the Securities and Exchange Commission, or SEC, from time to time. Thesecreators can win cash and other important factors could resultrewards; iii) by awarding Bonuses; iv) by connecting creators with brands for opportunities to collaborate on Vocal for Brands branded content campaigns; v) through ‘Subscribe,’ which enables creators to receive payment directly from their audience via monthly subscriptions and one-off microtransactions; vi) via Vocal’s Ambassador Program, which enables creators to receive additional rewards whenever they refer a new Vocal+ member creators can immediately begin to access the numerous monetization opportunities that Vocal facilitates. Specifically, Vocal creators can earn money i) every time their story is read, ii) by competing in its estimatesChallenges, iii) by receiving Bonuses, iv) by collaborating on branded content campaigns through the company’s in-house agency, Vocal for Brands, v) through ‘Subscribe,’ which enables creators to receive payment directly from their audience via monthly subscriptions and assumptions being materially different from future results. You should readone-off microtransactions. vi) through the information contained in this prospectus completely and with the understanding that future results may be materially different and worse from what the Company expects. See the information included under the heading “Forward-Looking Statements.”Vocal Ambassador Program, which enables creators to receive additional rewards whenever they refer a new Vocal+ member.

TABLE OF CONTENTS

-i-

Vocal+

Vocal+ is Vocal’s premium membership program. Subscribers pay a membership fee to access additional premium features on the platform, including: a higher rate of earnings per read, reduced platform processing fees on tips received, eligibility to participate in exclusive Vocal+ Challenges, access to Vocal’s ‘Quick Edit’ feature for published stories, and more. The following summary highlights information contained elsewhere in this prospectus. This summary may not contain allcurrent cost of a Vocal+ membership is either $9.99 per month or $99 annually.

Moderation and Compliance

One of the key differentiating factors between Vocal and most other user-generated content platforms is the fact that each story submitted to Vocal is run through the Company’s proprietary moderation process before it goes live on the platform. The decision to implement moderation into the submission process was in direct response to the rise of misinformation and bad actors on many social platforms. In response to these inherent pitfalls within the content landscape, Vocal’s proprietary moderation system combines the algorithmic detection of copyrighted material, hate speech, graphic violence, and nudity, and human-led curation to ensure the quality and safety of each story published on Vocal, thus fostering a safe and trustworthy environment for creators, audiences, and brands. In May 2022, Creatd announced Vocal’s new integration partnership with Two Hat, a Microsoft acquiree and a leading provider of AI-assisted content moderation and protection solutions for digital communities. Through the partnership, the Company further updated its proprietary moderation technology, with the aim of ensuring that the Vocal platform remains a safe place for its creators, brand partners, and audiences.

Trust and safety are paramount to the Vocal ecosystem. We follow best practices when handling personally identifiable information, that may be important to you. You should read this entire prospectus carefully, includingwith guidance from the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”European Union’s General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Company’s historical financial statementsDigital Millennium Copyright Act (DMCA).

Platform Compliance Policies include:

| ● | Human-led, technology-assisted moderation of every story submitted; |

| ● | Algorithmic detection of hate speech, nudity, and copyright infringement; |

| ● | Brand, creator, and audience safety enforced through community watch; and |

| ● | The rejection of what we consider toxic content, with the understanding that diverse opinions are encouraged. |

Technology Development

Vocal’s proprietary technology is built on Keystone, the same underlying open-source framework used by industry leaders such as Atlassian, a $43-billion Australian technology company. Some of the key differentiating elements of Vocal’s technology are speed, sustainability, and related notes included elsewherescalability. The Company continues to invest heavily in this prospectus. In this prospectus, unless otherwise noted,research and development to continuously improve and innovate its platform, with the terms “the Company,” “Jerrick,” “we,” “us,” and “our” refer to Jerrick Media Holdings, Inc.goal of optimizing the user experience for creators.

Additionally, the Vocal platform and its consolidated subsidiaries.

Overview

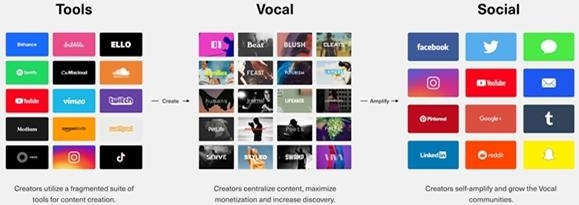

Jerrick Media Holdings, Inc. (“JMDA” or “the Company”) is the parent company and creator of the Vocal platform. The Company develops technology-based solutionsunderlying technology allows us to solve problems for the creator community, connecting creators with their ideal audiences and with the brands that want to access those audiences. Through a combination of data analysis, design, and development, the Company conceptualizes, creates, and maintains a suite of technology products and provides services that influence a global audience.

Jerrick is committed to identifying and leveraging opportunities within the digital platform and content monetization space. Our proprietary flagship technology platform is Vocal, which provides creators with storytelling tools, engaged communities, and opportunities to monetize their content. Vocal’s architecture was engineered to support a scalable and easy-to-update platform that could adapt its capacity to meet the current and growing demand for digital resources and technologies that foster virtual connection and community.

We maintain aan advantageous capital-light infrastructure by, among other things,infrastructure. By using third party cloud based service providers. As a result,providers, we are able to focus on platform and revenue growth rather than building and maintaining athe costly internal infrastructure. Similarly, whileinfrastructures that have materially affected so many legacy media platforms.

Vocal’s technology has been specifically designed and built to scale without a material corresponding increase in operational costs. While our users can embed rich media, such as video, audio, and product links, into their Vocal stories, the rich media content is hosted elsewhere (such as YouTube, Instagram, Vimeo, Shopify, Spotify, etc.). As a result,Thus, our platform can accommodate rich media content of all kinds without bearing the financial or operational costs associated with hosting the rich media itself. In addition to the benefits this framework affords to the Company, it provides the additional benefit to our content creators, in that a creator can increase their monetization; for example, a creator can embed their YouTube video into a Vocal story and thus derive earnings from both platforms when their video is viewed.

Creatd Partners

Creatd Partners houses the Company’s agency businesses, with the goal of fostering partnerships between creators and brands. Creatd Partners’ offerings include: Vocal for Brands (content marketing), WHE Agency (influencer marketing), and Seller’s Choice (performance marketing).

Vocal for Brands

All brands have a story to tell, and we leverage Vocal’s creator community to help them tell it. Vocal for Brands, Creatd’s content marketing studio, specializes in pairing leading brands with Vocal creators and influencers to produce marketing campaigns that are non-interruptive, engaging, and direct-response driven. Further, Vocal for Brands campaigns leverage Vocal’s first-party data and technology, which enables the creation of highly targeted and segmented audiences and optimized campaign results. In addition to branded story campaigns Additionally, brands can opt to collaborate with Vocal on a sponsored Challenge, prompting the creation of high-quality stories that are centered around the brand’s mission and further disseminated through creators’ respective social channels and promotional outlets.

WHE Agency

The WHE Agency (“WHE”), acquired by Creatd in 2021, was built to organically sustainfounded by Tracy Willis with the goal of supporting top creators and scale multiple lines of revenue,influencers, by connecting them with leading brands and global audiences. s. Today, WHE manages a talent roster comprising over 100 creators across numerous verticals, including family and lifestyle, music, entertainment, and celebrity categories. Since acquiring WHE, the Company has helped WHE expand into new verticals, as well as to assimilate externalfacilitated partnerships on influencers’ behalf with leading brands including CBS, Amazon, Target, Disney, Warby Parker, CVS, Kay Jewelers, Walmart, Gerber, Masterclass, Procter & Gamble, Nike, and NFL, among others.

Seller’s Choice

Seller’s Choice is Creatd Partners’ performance marketing agency specializing in DTC (direct-to-consumer) and e-commerce clientele. Seller’s Choice provides direct-to-consumer brands with design, development, strategy, and sales optimization services.

Creatd Ventures

Creatd Ventures houses Creatd’s portfolio of e-commerce businesses, both majority and minority-owned as well as associated e-commerce technology platforms and media assets into its existing infrastructure. The Company anticipates continuingsupports founders by providing capital, as well as a host of services including design and development, marketing and distribution, and go-to-market strategy.

Currently, the Creatd Ventures portfolio includes:

| ● | Camp, a direct-to-consumer (DTC) food brand which creates healthy upgrades to classic comfort food favorites. Each of Camp’s products are created with hidden servings of vegetables and contain Vitamins A, C, D, E, B1 + B6. In the fourth quarter of 2021, Camp added two new products to its expanding line of healthy, veggie-based, family-friendly foods. Currently, Camp has four flavors available for purchase: Classic Cheddar Mac ‘N’ Cheese, White Cheddar Mac ‘N’ Cheese, Vegan Cheezy Mac, and Twist Veggie Pasta. Camp, which first launched in 2020, represents the first investment within the Creatd Ventures portfolio. |

| ● | Dune Glow Remedy (“Dune”), which the Company purchased and brought to market in 2021. Dune is a beverage brand focused on promoting wellness and beauty from within. Each beverage in Dune’s product line is meticulously crafted with functional ingredients that nourish skin from the inside out and enhance one’s natural glow. In 2022, Dune announced that it continues to advance its distribution with numerous partnerships in place with retailers including lifestyle retailer Urban Outfitters and the Los Angeles-based Erewhon Market. Beyond the benefits for Dune, Creatd Ventures is leveraging these successful retail launches to create similar opportunities for Camp and Basis in brick-and-mortar retail locations. |

| ● | Basis, a hydrating electrolyte drink mix formulated using rehydration therapies developed by the World Health Organization. Acquired by the Company in first quarter 2022, Basis has a history of strong sales volume both on the brand’s website as well as through third-party distribution channels such as Amazon. Creatd’s acquisition of 100% ownership in Basis marks its third majority ownership acquisition for Creatd Ventures. |

Creatd Studios

The goal of Creatd Studios is to elevate creators’ stories to TV, film, books, podcasts, video, and more.

| ● | Transmedia Assets: With millions of compelling stories in its midst, Creatd’s technology surfaces the best candidates for transmedia adaptations, through community and creator data insights. Then, Creatd Studios helps creators tell their existing stories in new ways, by partnering them with entertainment and publishing studios to create unique content experiences that accelerate earnings, discoverability, and foster new opportunities. In 2022, Creatd Studios announced numerous upcoming production projects, including the upcoming publication of a print book featuring stories sourced from Vocal, the launch of a new podcast, with two miniseries currently in production, as well as the establishment of a graphic novel development initiative which will release its first title in Fall 2022 —Steam Wars, created by artist and independent filmmaker Larry Blamire. |

| ● | OG Gallery: The OG Collection is an extensive library of original artwork and imagery from the archives of some of the most iconic magazines of the 20th century. OG Gallery is an exploratory initiative aimed at identifying opportunities to propel the OG Collection into a new technological sphere: the NFT marketplace. |

Application of First-Party Data

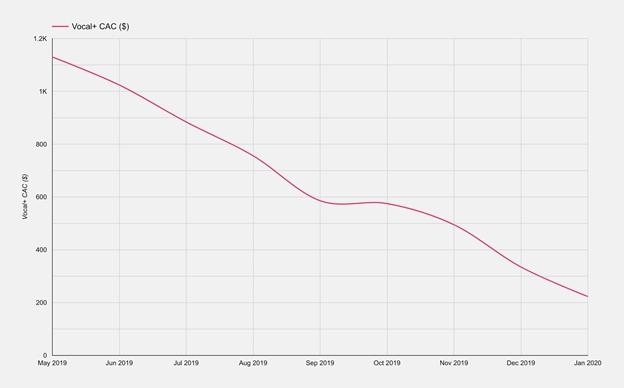

Creatd’s business intelligence and marketing teams identify and target individual creators, communities, and brands, utilizing empirical data harnessed from the Vocal platform. The team’s ability to apply its proprietary first-party data works to reduce acquisition costs for new creators and to help provide brands with conversions and an ideal targeted audience. In this way, our ability to apply first-party data is one of the value-drivers for the Company across its four business pillars.

Importantly, we do not sell the collected data, that being a common monetization opportunity for many other businesses. Instead, we use our collected first party data for the purposes of bettering the platform. Specifically, our data helps us understand the behaviors and attributes that are common among the creators, brands, and audiences within our ecosystem. We then pair our first-party Vocal data with third-party data from distribution platforms such as Facebook and Snapchat to provide a more granular profile of our creators, brands, and audiences.

It is through generating this valuable first-party data that we can continually enrich and refine our targeting capabilities for branded content promotion and creator acquisition, and specifically, to reduce our creator acquisition costs (CAC) and subscriber acquisition costs (SAC).

Competition

The idea for Vocal came as a response to what Creatd’s founders recognized as systemic flaws inherent to the digital media industry and its operational infrastructures. The depreciating value of digital media business models built on legacy technology platforms created a unique opportunity for the development of a creator-centric platform that could appeal to a global community and, at the same time, be capable of acquiring undervalued complimentary technology assets.

Creatd’s founders built the Vocal platform upon the general thesis that a closed and safe ecosystem utilizing first-party data to increase efficiencies could create a sustainable and defensible business model. Vocal was strategically developed to provide value for content creators, readers, and brands, and to serve as a home for the ever-increasing amount of digital content being produced and the libraries of digital assets lying dormant.

Vocal is most commonly discussed as a combination of:

| ● | Medium, a platform for writers built by former Twitter founder Ev Williams; |

| ● | Reddit, a social news aggregation, web content rating, and discussion website; and |

| ● | Patreon, a membership platform that provides business tools for content creators to run a subscription service. |

Creatd does not view Vocal as a substitute or competitor to segment-specific content platforms, such as Vimeo, YouTube, Instagram, Pinterest, TikTok, Spotify, or SoundCloud. We don’t want to replace anyone; we built Vocal to be accretive to the entire digital ecosystem. In fact, one of the most powerful components of our technology is the fact that Vocal makes it easy for creators to embed their existing published content, including videos, songs, podcasts, photographs, and more, directly into Vocal. We see this as a growth opportunity by building partnerships with the world’s greatest technology companies and to further spread our roots deeper into the digital landscape

Acquisition Strategy

Creatd’s hybrid finance and design culture is key to its acquisition strategy. Acquisition targets are companies that meet a set of opportunistic or financial standards or that are part of specific digital environments that are accretive and can seamlessly integrate into Creatd’s existing revenue lines. Creatd will continue to make targetedstrategic acquisitions when presented with opportunities that are in the interest of technologiesshareholder value.

Recent Developments

Nasdaq Notice of Delisting

On January 4, 2021, the Company received a letter from the staff of The Nasdaq Capital Market (the “Exchange”) notifying the Company that the Exchange had determined to delist the Company’s common stock and warrants from the Exchange based on the Company’s non-compliance with the Exchange’s (i) $5 million stockholders’ equity requirement for initial listing pursuant to Nasdaq Listing Rule 5505(b), (ii) the $2.5 million stockholders’ equity requirement or any of the alternatives for continued listing pursuant to Nasdaq Listing Rule 5550(b), and (iii) the Company’s failure to provide material information to the Exchange pursuant to Nasdaq Listing Rule 5250(a)(1).

On February 11, 2021, the Company met with the Exchange’s Hearings Panel (the “Panel”) with respect to such determination, in accordance with the Exchange’s rules and, pursuant to such request by the Company to appeal, the delisting of the Company’s securities and the Form 25 Notification of Delisting filing was stayed pending the Panel’s decision.

On March 9, 2021, the Exchange notified the Company that the Panel had determined to continue the listing of the Company on the Exchange. Notwithstanding the Panel’s determination to continue the listing of the Company’s securities on the Exchange, the Panel issued a public reprimand letter to the Company, pursuant to Listing Rule 5815(c)(1)(D), based on its finding “that the Company failed to meet the initial listing criteria with respect to stockholders’ equity and failed to provide Nasdaq with material information with respect to that deficiency.” Specifically, the Panel found that the Company failed to comply with Listing Rule 5250(a)(1), requiring it to notify Nasdaq of certain significant developments that led to the Company’s prior representations about its ability to satisfy the initial listing requirements being inaccurate. In reaching its determination to continue the listing of the Company on Nasdaq, the Panel acknowledged that the Company has since demonstrated compliance with the initial listing requirement for stockholders’ equity and all other applicable initial listing requirements. The Panel also determined that the violations were inadvertent and that the Company had relied on advice of counsel at the time in its interactions with the Nasdaq staff (“Staff”). The Panel also acknowledged the Company’s efforts to implement structural changes within the Company to avoid similar misstatements in the future and that would allow for proper accounting and disclosure on an ongoing basis.

On March 1, 2022, the Company received a letter (the “Letter”) from the staff of The Exchange notifying the Company that the Exchange has determined to delist the Company’s common stock from the Exchange based on the Company’s Market Value of Listed Securities for the 30-consecutive day period between January 15, 2022 and February 25, 2022 falling short of the requirements under Listing Rule 5550(b)(2) (the “Rule”). Although a 180-day period is typically allowed for an issuer to regain compliance, the Company is not eligible to use such compliance period, as the Exchange had instituted a Panel Monitor through March 9, 2022.

The Company pursued an appeal to the Panel of such determination, in accordance with the Exchange’s rules and, pursuant to such request by the Company to appeal, the delisting of the Company’s securities and the Form 25 Notification of Delisting filing was stayed pending the Panel’s decision.

On April 22, 2022, the Exchange notified the Company that the Panel has determined to continue the listing of the Company on the Exchange, subject to the following conditions: (i) on or before May 16, 2022, the Company will file its Quarterly Report on Form 10-Q for the period ended March 31, 2022 demonstrating compliance with Nasdaq Listing Rule 550(b)(1) requiring shareholders’ equity of $2.5 million and (ii) on or before August 29, 2022, the Company will file a Form 8-K documenting the successful completion of any fund-raising activity that has taken place since April 14, 2022 and the Company’s long-term compliance with the continued listing requirements of The Nasdaq Capital Market.

The Panel has advised that August 29, 2022 represents the full extent of the Panel’s discretion to grant continued listing during the time the Company is non-compliant and should the Company fail to demonstrate compliance by such date, the Panel will issue a final delist determination and the Company will be suspended from trading on the Exchange.

Registered Direct Offering

On March 7, 2022, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with thirteen accredited investors resulting in the raise of $2,659,750 in gross proceeds to the Company. Pursuant to the terms of the Purchase Agreement, the Company agreed to sell in a registered direct offering an aggregate of 1,519,857 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) together with warrants to purchase an aggregate of 1,519,857 shares of Common Stock (the “Warrants”) at an exercise price of $1.75 per share (collectively, the “Registered Direct Offering”). The warrants are immediately exercisable and will expire on March 9, 2027.

The Registered Direct Offering closed on March 9, 2022. Gross proceeds to the Company from the Registered Direct Offering were $2,659,750, before deducting offering expenses, which will be used for general corporate purposes, including working capital.

The shares of Common Stock were offered and sold by the Company pursuant to a prospectus supplement filed with the SEC, in connection with a takedown from the Company’s effective shelf registration statement on Form S-3, which was filed with the SEC on November 25, 2020 and subsequently declared effective on April 23, 2021 (File No. 333-250982).

Private Placement Financing

On March 1, 2022, the Company entered into securities purchase agreements with twenty-eight (28) accredited investors whereby, at the closing, such investors purchased from the Company an aggregate of (i) 1,401,457 shares of the Company’s common stock, par value $0.001 per share and (ii) 1,401,457 warrants to purchase shares of common stock, for an aggregate purchase price of $2,452,550 (the “Private Placement Financing”). Such warrants are exercisable for a term of five-years from the date of issuance, at an exercise price of $1.75 per share, and provide for cashless exercise to the extent that there is no registration statement available for the underlying shares of common stock. The Benchmark Company, LLC acted as exclusive financial advisor for the Company in connection with the Private Placement Financing and is entitled to receive 125,000 shares of common stock as compensation for its services. The closing of the Private Placement Financing occurred on March 1, 2022.

Board of Directors and Management

Appointment of New Directors

On February 17, 2022, the Board of Directors (the “Board”) of the Company appointed Joanna Bloor, Brad Justus, and Lorraine Hendrickson to serve as members of the Board. Ms. Bloor has been nominated to, and will serve as, chair of the Compensation Committee, and to be a member of the Audit Committee and Nominating & Corporate Governance Committee. Mr. Justus has been nominated, and will serve as, chair of the Nominating & Corporate Governance Committee, and to be a member of the Compensation Committee and Audit Committee. Ms. Hendrickson has been nominated to, and will serve as, chair of the Audit Committee and to be a member of the Compensation and Nominating & Corporate Governance Committee.

Departure of Directors

On July 16, 2021, Mark Patterson notified the Board of the Company of his resignation from the Board, effective July 31, 2021. Such resignation was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

February 17, 2022, the Board received notice that effective immediately, Mark Standish resigned as Chair of the Board, Chair of the Audit Committee and as a member of the Compensation Committee and Nominating & Corporate Governance Committee; Leonard Schiller resigned as member of the Board, Chair of the Compensation Committee and as a member of the Audit Committee and Nominating & Corporate Governance Committee; and LaBrena Martin resigned as a member of the Board, Chair of the Nominating & Corporate Governance Committee and as a member of the Audit Committee and Compensation Committee. Such resignations are not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Management Restructuring

On August 13, 2021, the Board approved the restructuring of the Company’s senior management team to be comprised of two Co-Chief Executive Officers and appointed Jeremy Frommer and Laurie Weisberg to such positions (the “First Restructuring”). Additionally, Justin Maury was appointed Chief Operating Officer and retains his position as President. Prior to the First Restructuring, Mr. Frommer served as the Company’s Chief Executive Officer and Ms. Weisberg served as the Company’s Chief Operating Officer. Mr. Frommer and Ms. Weisberg continue to serve as members of the Board. The Restructuring did not impact the role or functions of the Company’s Chief Financial Officer, Chelsea Pullano.

On February 17, 2022, the Board of the Company approved the restructuring of the Company’s senior management team to eliminate the Co-Chief Executive Officer role, appointing Jeremy Frommer as Executive Chairman and Founder, and appointing Laurie Weisberg as Chief Executive Officer (the “Second Restructuring”). Prior to the Second Restructuring, Mr. Frommer and Ms. Weisberg served as the Company’s co-Chief Executive Officers and Ms. Weisberg served as the Company’s Chief Operating Officer. The Second Restructuring does not impact the role or functions of the Company’s Chief Financial Officer, Chelsea Pullano, or the role or functions of the Company’s President and Chief Operating Officer, Justin Maury.

Plant Camp LLC Purchase

On June 4, 2021, the Company, through its wholly owned subsidiary, Creatd Partners, LLC, a Delaware limited liability company (the “Purchaser”), entered into a Membership Interest Purchase Agreement (the “MIPA”) with Angela Hein and Heidi Brown (the “Sellers”), pursuant to which the Purchaser acquired 841,005 common units of Plant Camp LLC, a Delaware limited liability company (“Plant Camp”) from the Sellers, resulting in the Purchaser owning 89% of the issued and outstanding equity of Plant Camp.

Simultaneous with the execution of the MIPA, and having met all conditions precedent in the MIPA, the parties to the MIPA consummated the closing of the transactions contemplated by the MIPA (the “Closing”). At the Closing, the Purchaser acquired a majority interest in Plant Camp in exchange for a cash payment to the Sellers of $300,000. The MIPA contains customary representations, warranties, covenants, indemnification and other terms for transactions of a similar nature.

On the Closing Date, the Amended and Restated Liability Company Operating Agreement of Plant Camp was amended and restated (the “Second A&R Operating Agreement”) to reflect the purchase and sale of the Membership Interests pursuant to the MIPA.

Underwritten Public Offering

On June 17, 2021, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with The Benchmark Company LLC (“Benchmark” or the “Underwriter”), pursuant to which we agreed to sell to the Underwriter in a firm commitment underwritten public offering (the “Offering”) an aggregate of 750,000 shares of the Company’s common stock, par value $0.001 per share, at a public offering price of $3.40 per share. The Company also granted the Underwriter a 30-day option to purchase up to an additional 112,500 shares of common stock to cover over-allotments, if any. The Offering closed on June 21, 2021.

Benchmark acted as sole bookrunner for the Offering. The Offering was made pursuant to a prospectus supplement dated June 17, 2021, and a base prospectus dated April 23, 2021, which is part of a registration statement on Form S-3 (File No. 333-250982) that was filed with the SEC on November 25, 2020, as amended on April 9, 2021, and declared effective by the Commission on April 23, 2021. The Underwriter received a discount in the amount of 7% of the aggregate gross proceeds received by the Company in connection with the Offering, warrants equal to 5% of the total of all shares issued in the Public Offering, including overallotment shares, exercisable six months from the date of issuance, at the price of $4.08, for a period of five years (the “Underwriter Warrants”), and reimbursement of certain expenses.

The Underwriting Agreement included customary representations, warranties and covenants, and customary conditions to closing, expense and reimbursement obligations and termination provisions. Additionally, under the terms of the Underwriting Agreement, we have agreed to indemnify the Underwriter against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments the Underwriter may be required to make in respect of these liabilities.

WHE Agency Transaction

On July 20, 2021, the Company entered into, through its wholly owned subsidiary, Creatd Partners, LLC (“Creatd Partners”), a Stock Purchase Agreement (the “Purchase Agreement”) with individuals named therein (collectively, the “Sellers”), pursuant to which Creatd Partners acquired from the Sellers, subject to the terms and conditions of the Purchase Agreement and other related agreements (the “Transaction Documents”) 1,158,000 shares of common stock of WHE Agency, Inc. (“WHE Agency”), a talent management and public relations agency that primarily focuses on representation and private companies.management of family and lifestyle-focused influencers and digital creators. The Vocal technology platform, trademark,equity interest acquired in the Transaction (as defined below) along with the Voting Agreements described below equals fifty-five (55%) of the voting power and related intellectual property are wholly ownedforty-four (44%) of the ownership of WHE Agency’s issued and operated by Jerrick. outstanding shares, determined on a fully diluted basis post-transaction.

Risks Associated with Our BusinessPursuant to the Purchase Agreement, the Sellers sold, transferred, assigned, conveyed and delivered to Creatd Partners their respective issued and outstanding shares of common stock in WHE Agency (the “Transaction”). The aggregate closing consideration of the Transaction is $1,038,271, which consists of a combination of cash, in the amount of $144,750 (“Cash Consideration”), and the remaining $893,521 issued to the Sellers in the form of 224,503 shares of the Company’s restricted common stock (“Closing Share Consideration”).

Our business isThe Transaction closed on July 23, 2021 (the “Closing”). At the Closing, Sellers received their respective portion of the aggregate closing consideration in the form of a combination of Cash Consideration and Closing Share Consideration, except for 5% of the total Closing Share Consideration that will be subject to a numbertwelve (12) month Indemnification Holdback Period.

The 224,503 shares of risksthe Company’s common stock, par value $0.001 per share, were issued as part of which you shouldthe Closing Share Consideration (the “Shares”) to the Sellers are “restricted securities,” as defined in Rule 144(a)(3) under the Securities Act of 1933, as amended (the “Act”), and accordingly the Shares may not be aware before makingresold by the Sellers without registration under the Act or an available exemption from registration. Under the Purchase Agreement, the Company will be obligated to file with the SEC within ten business days after the Closing, a decisionregistration statement on Form S-1 or Form S-3 registering the resale of the Shares by the Sellers under the Act to investcover the resale of the Shares issued to the Sellers.

The Purchase Agreement contain representations and warranties made by and to the parties thereto as of specific dates. The Purchase Agreement includes customary representations, warranties and covenants of the Company, Sellers and WHE Agency. The representations and warranties made by each party were made solely for the benefit of the other parties and (i) were not intended to be treated as categorical statements of fact, but rather as a way of allocating the risk between the parties to the Purchase Agreement if those statements prove to be inaccurate; (ii) may have been qualified in ourthe Purchase Agreement by disclosures that were made to the other party in disclosure schedules to the Purchase Agreement, and (iii) were made only as of the date of the Purchase Agreement or such other date or dates as may be specified in the Purchase Agreement.

In connection with entering into the Purchase Agreement, Creatd Partners entered into a certain Voting Agreement and Proxy (the “Voting Agreement”) with certain beneficial owners that collectively own 11% percent of WHE Agency’s issued and outstanding restricted common shares.stock (“Restricted Stockholders”). Through the Voting Agreements entered into with the Restricted Stockholders, Creatd Partners effectively controls 55% of the total voting power of the Company in the aggregate. The following,Voting Agreements generally require that the stockholders who are party to the Voting Agreements vote or cause to be voted their WHE Agency shares, and execute and deliver written consents and otherwise exercise all voting and other risks, are discussed more fullyrights with respect to the WHE Agency shares at the direction of Creatd Partners. In addition, in connection with the “Risk Factors” sectionVoting Agreements, the Restricted Stockholders delivered irrevocable proxies to Creatd Partners. The Voting Agreements terminate upon the twenty-year anniversary of this prospectus.executing the Voting Agreements.

-1-

Corporate HistoryMay 2021 Financing

On May 14, 2021 (the “Effective Date”), the Company entered into a securities purchase agreement (the “Purchase Agreement”) with three accredited investors (the “Investors”), whereby, at the closing, the Investors have agreed to purchase from the Company (i) convertible notes in the aggregate principal amount of $4,666,668 (the “Notes”), inclusive of original issuance discount, and Information(ii) 1,090,908 warrants (the “Warrants”) to purchase shares of the Company’s common stock. The Notes have a maturity date of November 14, 2022, with monthly installment payments due beginning six months from the date of issuance of the Notes. The Notes do not bear interest except in connection with a default, as described in the Notes. The Notes are convertible into shares of Common Stock at a fixed price of $5.00 per share, subject to adjustment as set forth in the Notes. The Company received $4.0 million of gross proceeds from the sale of the Notes and the Warrants, reflecting an original issuance discount on the Notes of $666,669.

We wereThe Warrants are exercisable for a term of five years from the date of issuance, at an exercise price of $4.50 per share.

Pursuant to the Purchase Agreement, on May 12, 2022, the Company filed with the SEC a registration statement covering the resale of the shares of Common Stock underlying the Notes and Warrants.

In connection with the Purchase Agreement, the Company entered into that certain Security Agreement, granting a security interest in favor of Lind Global Macro Fund, LP as agent for the Investors (“Security Agreement”); and that certain Trademark Security Agreement, granting a security interest in certain trademark collateral in favor of Lind Global Macro Fund, LP as agent for the Investors (the “Trademark Security Agreement”).

The closing of the Purchase Agreement occurred on May 17, 2021.

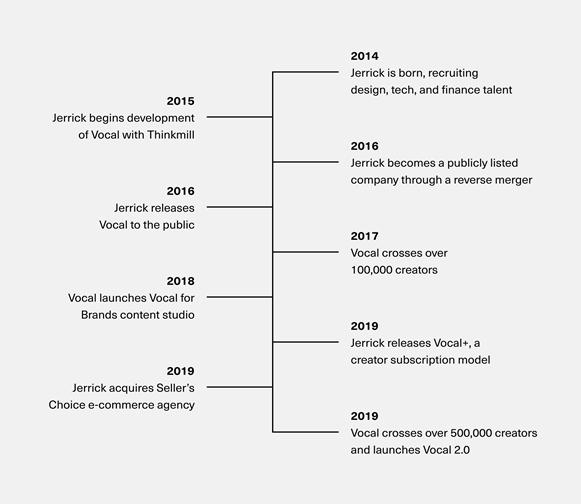

Our Corporate History

Creatd, Inc., formerly Jerrick Media Holdings, Inc. (“we,” “us,” the “Company,” or “Creatd”), is a technology company focused on the development of digital communities, marketing branded digital content, and e-commerce opportunities. Creatd’s content distribution platform, Vocal, delivers a robust long-form, digital publishing platform organized into highly engaged niche-communities capable of hosting all forms of rich media content. Through Creatd’s proprietary algorithm dynamics, Vocal enhances the visibility of content and maximizes viewership, providing advertisers access to target markets that most closely match their interests.

The Company was originally incorporated under the laws of the State of Nevada on December 30, 1999 under the name LILM, Inc. The Company changed its name on December 3, 2013 to Great Plains Holdings, Inc. (“GTPH”) as part of its plan to diversify its business.

On February 5, 2016 (the “Merger Closing“Closing Date”), we entered into an Agreement and Plan of Merger (the “Merger Agreement”) withGTPH, GPH Merger Sub, Inc., a Nevada corporation and our wholly-owned subsidiary of GTPH (“Merger Sub”), and Jerrick Ventures, Inc., a privately-held Nevada corporation headquartered in New Jersey (“Jerrick”), entered into an Agreement and Plan of Merger (the “Merger”) pursuant to which the Merger Sub was merged with and into Jerrick, with Jerrick surviving as oura wholly-owned subsidiary of GTPH (the “Merger”). PursuantGTPH acquired, pursuant to the terms of the Merger, Agreement, we acquired, through a reverse triangular merger, all of the outstanding capital stock of Jerrick in exchange for issuing Jerrick’s shareholders (the “Jerrick Shareholders”), pro-rata, a total of 28,500,000475,000 shares of ourGTPH’s common stock. Additionally, we assumedIn connection therewith, GTPH acquired 33,415 shares of Jerrick’s Series A Convertible Preferred Stock (the “Jerrick Series A Preferred”) and 8,064 shares of Series B Convertible Preferred Stock (the “Jerrick Series B Preferred”).

Upon closing of the Merger on February 5, 2016, the Company changed its business plan to our current plan.

In connection with the Merger, on the Merger Closing Date, weGTPH and Kent Campbell entered into a Spin-Off Agreement with Kent Campbell (the “Spin-Off Agreement”), pursuant to which Mr. Campbell purchased from GTPH (i) all of ourGTPH’s interest in Ashland Holdings, LLC, a Florida limited liability company, and (ii) all of ourGTPH’s interest in Lil Marc, Inc., a Utah corporation, in exchange for the cancellation of 781,81813,030 shares of our common stockGTPH’s Common Stock held by Mr. Campbell. In addition, Mr. Campbell assumed all of our debts, obligations and liabilities of GTPH, including any existing prior to the Merger, pursuant to the terms and conditions of the Spin-Off Agreement.

Upon closing of the Merger on February 5, 2016, the Company changed its business plan to that of Jerrick.

Effective February 28, 2016, weGTPH entered into an Agreement and Plan of Merger (the “Statutory Merger Agreement”), with Jerrick, pursuant to which weGTPH became the parent company of Jerrick Ventures, LLC, oura wholly-owned operating subsidiary of Jerrick (the “Statutory Merger”).

On February 28, 2016, we and GTPH changed ourits name to Jerrick Media Holdings, Inc. to better reflect ourits new business strategy.

On July 25,September 11, 2019, wethe Company acquired 100% of the membership interests of Seller’s Choice, LLC, a New Jersey limited liability company (“Seller’s Choice”). Seller’s Choice is digital e-commerce agency based in New Jersey (see Note 4).

On September 9, 2020, the Company filed a certificate of amendment to our articles of incorporation, as amended (the “Amendment”), with the Secretary of State of the State of Nevada to effectuate a one-for-twenty (1:20) reverse stock split (the “Reverse Stock Split”) of our common stock without any change to its par value. The Amendment became effective on July 30, 2019. The number of shares of authorized common stock was proportionately reduced as a result of the Reverse Stock Split. The number of shares of authorized preferred stock was not affected by the Reverse Stock Split. No fractional shares were issued in connection with the Reverse Stock Split as all fractional shares were “rounded up” to the next whole share.

All share and per share amounts for the common stock indicated in this prospectus have been retroactively restated to give effect to the Reverse Stock Split.

On July 13, 2020, upon approval from our board of directors and stockholders, we filed Second Amended and Restated Articles of Incorporation with the Secretary of State of the State of Nevada.

Upon approval to list our common stock and the warrants on the Nasdaq Capital Market, we will change our name to “Creatd, Inc.”, which became effective on September 10, 2020.

The Company’s address is 2050 Center Avenue Suite 640 Fort Lee, NJ 07024. The Company’s telephone number is (201) 258-3770. Our website is: https://jerrick.media/. The information on, or that can be accessed through, this website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase the Company’s common stock.

Employees

As of July 21, 2020, we had 21 full-time employees. None of our employees are subject to a collective bargaining agreement, and we believe that relationship with our employees to be good.

-2-

SUMMARY OF THE OFFERING

Subscription Rights

We are distributing, at no charge, non-transferable subscription rights to (i) holders of common stock as of the record date of 5:00 p.m. (Eastern time) on [●], 2022; (ii) holders of Series E Preferred Stock convertible into a total of 121,359 shares of common stock (the “Preferred Shares”); (iii) holders of warrants to purchase a total of 8,610,115 shares of common stock (the “Eligible Warrants”); and (iv) holders of options to purchase a total of 3,164,778 shares of common stock (the “Eligible Options”), who we refer to collectively as “rights holders” or “you.” Rights holders will receive two subscription rights for every share of common stock and every share of common stock issuable upon conversion or exercise of the Preferred Shares, Eligible Warrants and Eligible Options held as of the record date.

The Eligible Warrants include:

| ● |

|

| ● | warrants issued between October 12, 2017, and November 8, 2018, to | |

| ● | ||

| ||

|

| ● | warrants issued on March 14, 2018, purchase 1,667 shares of common stock at an exercise price of $12.00 per share; |

| ● | warrants issued between June 11, 2018, and July 3, 2018, to purchase a total of 3,500 shares of common stock at an exercise price of $12.00 per share; |

| ● | warrants |

| ● | warrants issued between August 31, 2018, and January 25, 2019, to purchase a total of 223,371 shares of common stock at an exercise price of $1.75 per share; |

| ● | warrants issued between February 20, 2019, and May 15, 2019, to purchase a total of 44,468 shares of common stock at an exercise price of $18.00 per share; |

| ● | warrants issued between April 12, 2019 and September 26, 2019, to purchase a total of 11,241 shares of common stock at an exercise price of $18.00 per share; |

| ● | warrants issued between July 26, 2019, to July 30, 2020, to purchase a total of 597 shares of common stock at an exercise price of $18.00 per share; |

| ● | warrants issued on February 11, 2020, to purchase a total of 6,667 shares of common stock at an exercise price of $1.75 per share; |

| ● | warrants issued on June 19, 2020, to purchase a total of 49,603 shares of common stock at an exercise price of $12.00 per share; |

| ● | warrants issued between July 29, 2020, to September 9, 2020, to purchase a total of 26,669 shares of common stock at an exercise price of $4.50 per share; |

| ● | warrants issued on December 31, 2020, to purchase a total of 471,953 shares of common stock at an exercise price of $5.15 per share; |

| ● | warrants issued on December 31, 2020, to purchase a total of 1,103,397 shares of common stock at an exercise price of $4.50 per share; |

| ● | warrants issued on May 14, 2021, to purchase a total of 970,908 shares of common stock at an exercise price of $4.50 per share; |

| ● | warrants issued on June 16, 2021, to purchase a total of 46,667 shares of common stock at an exercise price of $4.08 per share; |

| ● | warrants issued on June 21, 2021, to purchase a total of 37,500 shares of common stock at an exercise price of $5.40 per share; |

| ● | warrants issued on October 27, 2021, to purchase a total of 42,500 shares of common stock at an exercise price of $5.40 per share; |

| ● | warrants issued on March 1, 2022, to purchase a total of 1,401,457 shares of common stock at an exercise price of $1.75 per share; |

| ● | warrants issued on March 9, 2022, to purchase a total of 1,519,857 shares of common stock at an exercise price of $1.75 per share; |

| ● | warrants issued on February 25, 2020, to purchase a total of 41,665 shares of common stock at an exercise price of $15.00 per share; |

| ● | warrants issued on May 31, 2019, to purchase a total of 50 shares of common stock at an exercise price of $12.00 per share; |

| ● | warrants issued on September 15, 2020, to purchase a total of 2,542,500 shares of common stock at an exercise price of $4.50 per share; |

The Eligible Options include:

| ● | options issued between June 28, 2017 and August 28, 2017, to purchase 2,499 shares of common stock at exercise prices from $9.60 to $18.00 per share; |

| ● | options issued on October 21, 2019, to purchase 9,664 shares of common stock at exercise prices from $7.20 to $13.20 per share; |

| ● | options issued on July 29, 2020, to purchase 391,853 shares of common stock at an exercise price of $8.55 per share; |

| ● | options issued between February 4, 2021 and December 31, 2021, to purchase 347,762 shares of common stock at exercise prices from $2.09 to $14.20 per share; |

| ● | options issued on February 19, 2021 to purchase 1,473,000 shares of common stock at an exercise price of $5.65 per share; |

| ● | options issued on October 28, 2021 to purchase 540,000 shares of common stock at an exercise price of $5.00 per share; |

| ● | options issued on April 5, 2022 to purchase 400,000 shares of common stock at an exercise price of $1.75 per share. |

Your subscription rights will consist of:

| ● | your basic right, which will entitle you to purchase a number of units equal to (i) the |

| ● | your over-subscription privilege, which will be |

All units are being offered and sold at a subscription price of $2.00 per unit.

Units

Each unit will consist of:

| ● | one share of common stock; |

| ● | a Series A redeemable warrant exercisable to acquire one share of common stock at an exercise price of $3; and |

| ● | a Series B warrant exercisable to acquire one share of common stock at an exercise price of $6. |

The shares of common stock, Series A warrant and Series B warrant comprising a unit may only be purchased as a unit, but will be issued separately.

The Series A warrants and Series B warrants will be exercisable commencing on their date of issuance and expiring on [●], 2027, or are redeemed. They will be exercisable for cash or, solely during any period when a registration statement covering the issuance of the shares of common stock subject to the Series A warrants and Series B warrants is not in effect, on a cashless basis.

Exercise of Subscription Rights

Subscription rights, consisting of basic rights and over-subscription privileges, may be exercised at any time during the subscription period, which commences on [●], 2022 and expires at 5:00 p.m. (Eastern time) on [●], 2022, or the expiration date, unless we extend or terminate this offering. Once made, all exercises of subscription rights are irrevocable.

We may extend this offering for one or more additional periods in our sole discretion not to exceed 45 days from the initial expiration date. We will announce any extension in a press release issued no later than 9:00 a.m. (Eastern time) on the business day after the most recently announced expiration date.

Subscription rights may only be exercised in aggregate for whole numbers of units. Only whole numbers of shares of common stock, Series A warrants and Series B warrants exercisable for whole numbers of shares will be issuable to you in this offering; any right to a fractional share to which you would otherwise be entitled will be terminated, without consideration to you.

Transferability

Subscription Rights. The subscription rights are evidenced by a subscription certificate and are non-transferable.

Units. Shares of common stock, Series A warrants and Series B warrants comprising the units will be issued separately. Units will not be issued as a separate security and will not be transferable.

Common Stock. Shares of common stock included in units will be separately transferable following their issuance. All of the shares issued in this offering are expected to be listed on The Nasdaq Capital Market.

Series A warrants and Series B warrants (together, the “redeemable warrants”). The redeemable warrants will be separately transferable following their issuance and through [●], 2027. We are applying to list the redeemable warrants for trading on The Nasdaq Capital Market. We may not be able to meet the listing standards of The Nasdaq Capital Market with respect to the redeemable warrants. If we do not meet such required listing standards, we will use our commercially reasonable efforts to list the redeemable warrants on another suitable securities exchange or recognized trading system.

Use of Proceeds

Assuming this offering is fully subscribed, we estimate our net proceeds from the offering will total approximately $36.5 million, after deducting the dealer-manager fee of RHK Noble, as dealer-manager, and our other estimated offering expenses. We intend to use the net proceeds for sales and marketing and general working capital purposes. See “Use of Proceeds.”

Subscription Information

In order to obtain subscription information, you should contact:

| ● | D.F. King & Co., Inc. which will act as the information agent in connection with this offering, by telephone at (212) 269-5550 (bankers and brokers) or (877) 283-0323 (all others) or by email at creatd@dfking.com; or |

| ● | your broker-dealer, trust company or other nominee (including any mobile investment platform) where your subscription rights are held. |

Subscription Procedures

In order to exercise your subscription rights, including your over-subscription privilege, you should:

| ● | deliver a completed subscription certificate and the required payment to Continental Stock Transfer & Trust, the subscription agent for this offering, by the expiration date, or |

| ● | if your shares of common stock are held in an account with a broker-dealer, trust company, bank or other nominee (including any mobile investment platform) that qualifies as an Eligible Guarantor Institution under Rule 17Ad-15 under the |

If you cannot deliver your completed subscription certificate to the subscription agent prior to the expiration for the rights offering, you may follow the guaranteed delivery procedures described under “The Rights Offering—Methods for Exercising Subscription Rights—Guaranteed Delivery Procedures.”

Placement Period

If this offering is not fully subscribed following the expiration date of the offering, the dealer-manager has agreed to use its commercially reasonable efforts to place any unsubscribed units at the subscription price for an additional period of up to 45 days. The number of units that may be sold by us during this period will depend upon the number of units that are subscribed for pursuant to the exercise of subscription rights by our shareholders and other rights holders. No assurance can be given that any unsubscribed units will be sold during this period.

Important Dates

Set forth below are important dates for this offering, which generally are subject to extension:

| Record date | [●] ,2022 | |

| Expiration date | [●] ,2022 | |

| Deadline for delivery of notices of guaranteed delivery | [●] ,2022 | |

| Deadline for delivery of subscription certificates and | [●] ,2022 |

RISK FACTORS

(1)Investing in our securities involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information contained in this prospectus, before making an investment decision with respect to our securities. The occurrence of any of the following risks or those incorporated by reference, or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition, results of operations or cash flows. In any such case, the trading price of common stock, the trading price of Series A warrants and the trading price of Series B warrants, if any, could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below and those incorporated by reference.

This offering may cause the price of common stock to decline, and the price may not recover for a substantial period of time, or at all.

The subscription price of units in this offering, together with the number of shares of common stock outstanding is based on 10,147,420we propose to issue and ultimately will issue in the offering (including the number of additional shares of common stock issuedwe propose to issue and outstanding asultimately will issue upon exercise of July 21, 2020Series A warrants and/or Series B warrants), may result in an immediate decrease in the market value of the common stock. We cannot predict the effect, if any, that the availability of shares for future sale represented by the Series A warrants and excludes the following:

| ||

| ||

Except as otherwise indicated herein, all information in this prospectus reflects or assumes:

-3-

The following summary financial and operating data set forth below should be read in conjunction withoffering at an effective price per share greater than the Company’s financial statements, the notes theretoprevailing market price. Further, if a substantial number of subscription rights are exercised and the other information contained in this prospectus. The summary statement of operations data for the years ended December 31, 2019 and 2018 have been derived from the Company’s audited financial statements appearing elsewhere in this prospectus. The historical results presented below are not necessarily indicative of financial resultsexercising rights holders choose to be achieved in future periods. The financial data as of March 31, 2020 and 2019 has been derived from our unaudited financial statements and the related notes thereto, which are included elsewhere in this prospectus.

Statement of Operations Data:

The following information should be read in conjunction with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| Statement of operations data: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Revenue | $ | 453,006 | $ | 80,898 | $ | 293,142 | $ | 34,334 | ||||||||

| Operating expenses | $ | (7,669,984 | ) | $ | (5,767,153 | ) | $ | (2,119,091 | ) | $ | (1,739,328 | ) | ||||

| (Loss) income from operations | $ | (7,216,978 | ) | $ | (5,686,255 | ) | $ | (1,825,949 | ) | $ | (1,704,994 | ) | ||||

| Other expenses | $ | (818,394 | ) | $ | (6,327,287 | ) | $ | (1,160,048 | ) | $ | (1,884,441 | ) | ||||

| Net income (loss) | $ | (8,035,372 | ) | $ | (12,013,542 | ) | $ | (2,985,997 | ) | $ | (1,884,441 | ) | ||||

| Income (loss) per common share – basic and diluted(1) | $ | (0.98 | ) | $ | (4.16 | ) | $ | (0.32 | ) | $ | (0.28 | ) | ||||

| December 31, | March 31, | |||||||||||||||

| Balance sheet data: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Cash | $ | 11,637 | $ | - | $ | 118,361 | $ | 262,707 | ||||||||

| Total assets | $ | 2,572,046 | $ | 208,925 | $ | 2,836,270 | $ | 583,974 | ||||||||

| Current liabilities | $ | 10,928,830 | $ | 2,569,584 | $ | 12,809,118 | $ | 3,869,128 | ||||||||

| Total liabilities | $ | 11,130,774 | $ | 2,699,529 | $ | 13,027,333 | $ | 4,135,603 | ||||||||

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| Cash flows from operating activities data: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Net cash used in operating activities | $ | (5,957,027 | ) | $ | (4,972,814 | ) | $ | (1,314,863 | ) | $ | (1,461,053 | ) | ||||

| Net cash used in investing activities | $ | (363,288 | ) | $ | (27,605 | ) | $ | - | $ | (2,801 | ) | |||||

| Net cash provided by financing activities | $ | 6,337,947 | $ | 4,889,368 | $ | 1,430,826 | $ | 1,726,561 | ||||||||