| ● | Platform Processing Fees and Microtransactions:With Tipping and other types of microtransactions, audiences can engage and support their favorite Vocal creators by actively investing in their creativity. Vocal takes a platform processing fee on all transactions. Each Tip sent on Vocal generates revenue for the Company in the form of platform processing fees. For Vocal Free creators, we retain a 7% platform processing fee for every Tip exchanged. For Vocal+ creators, we retain a 2.9% platform processing fee.Vocal utilizes Stripe for payment processing, which currently supports Apple Pay and Google Wallet.

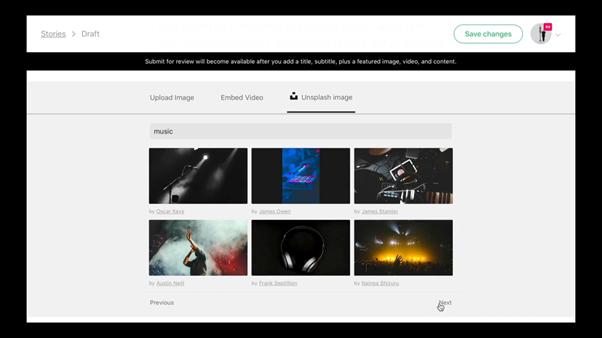

Additional applications for microtransactions on Vocal are in development, including the enablement of gated premium content, recurring Tips, affiliate marketing features for brands, and incentivization fees for new creator referrals.

Affiliate sales:

Vocal generates revenue through affiliate marketing relationships, which pays the Company a percentage of purchases made on our platform. Affiliate relationships include Amazon, Skimlinks, Tune, and more. This represents a unique opportunity in the post-pandemic environment where brands need expansive distribution pipelines such as Vocal to reach broader audiences.

E-commerce:

Our e-commerce strategy involves revitalizing archival imagery and media content in dormant legacy portfolios. Our curation and data capabilities have helped us create scalable and definable value for our internal collection of media assets through financing, trademarking, licensing, and production opportunities. Jerrick, or ‘Creatd,’ has an exclusive license to leverage the stories housed on Vocal, reimagining them for films, episodic shows, games, graphic novels, collectibles, books, and more.

Growth Strategy:

Continued growth is likely to be achieved by focusing on the following key areas:

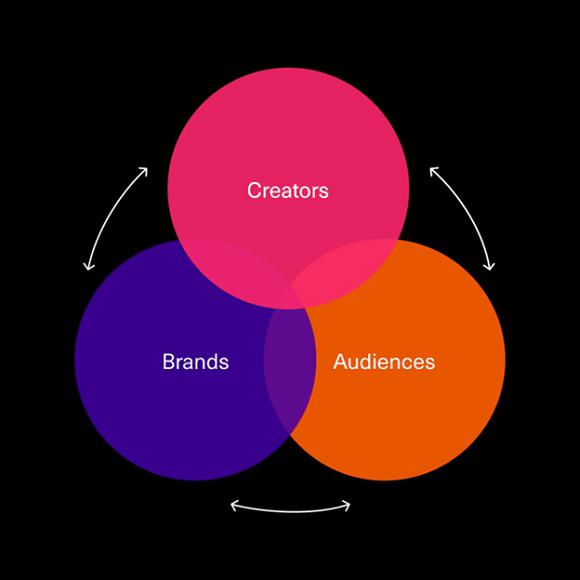

| ● | Creator Growth: Vocal brings new creators, their audience, and brands to its platform through organic growth, performance marketing, and brand-building campaigns that drive awareness. As the Vocal team continues to collect first-party behavioral data, we are able to further refine an ideal user profile and hone a specific targeting strategy to effectively scale the platform’s creator base. Our product roadmap includes new features that will work to incentivize creators to help us expand the Vocal network organically; upcoming features include creator referrals and gated content, which will enable creators to utilize Vocal’s microtransaction capabilities to charge recurring fees for exclusive content, similar to the model used by companies like Patreon and Cameo). With these new features, creators will have further opportunities to get discovered and earn on Vocal, which works to the benefit of the entire platform. |

| ● | Brand Partnerships: Continued investment in new product offerings for brand storytelling on Vocal with the goal of increasing the value to brands in the form of analytics, audience engagement,platform processing fees. For Vocal Free creators, we retain a 7% platform processing fee for every Tip exchanged. For Vocal+ creators, we retain a 2.9% platform processing fee. |

| ● | Affiliate sales: Vocal generates revenue through affiliate marketing relationships, which pays the Company a percentage of purchases made on our platform. Affiliate relationships include Amazon, Skimlinks, Tune, and conversion data for their products and services. Themore. This represents a unique opportunity in the post-pandemic environment where brands need expansive distribution pipelines such as Vocal for Brands in-house content studio is constantly evolving in order to elevate brand relationships, both qualitatively and quantitatively.reach broader audiences. |

| ● | Licensing and Transmedia Opportunities: In collaboration with other productionE-commerce: Our e-commerce strategy involves revitalizing archival imagery and media companies, as well as withcontent in dormant legacy portfolios. Our curation and data capabilities have helped us create scalable and definable value for our expanding user base, we lookinternal collection of media assets through financing, trademarking, licensing, and production opportunities. Creatd has an exclusive license to leverage the stories housed on Vocal, reimagining them for content that can be leveraged for adaptation to film, television, digital shorts,films, episodic shows, games, graphic novels, collectibles, books, and comic series. We believe that Vocal’s ever-expanding community of creators and influencers affords us with the unique opportunity to cultivate these relationships. This initiative is referred to by the Company as Recreatd. more. |

Acquisition Strategy Creatd’s hybrid finance and design culture is key to its acquisition strategy. Acquisition targets are companies that meet a set of opportunistic or financial standards or that are part of specific digital environments that are accretive and can seamlessly integrate into Creatd’s existing revenue lines. Creatd will continue to make strategic acquisitions when presented with opportunities that are in the interest of shareholder value. | ● | White Label Opportunities: White-labeling Vocal’s underlying platform architecture can be utilized for application in a range of industries, including use by sports franchises, trade companies, education organizations, companies in the financial sector, and others. An example of a white label installation of Vocal currently on our drawing board is a platform called Give. The idea behind Give is to borrow Vocal’s topic-specific community structure and adapt it for the non-profit sector. The Give platform would function as a network of vetted, verified organizations for which creators can raise awareness, funding or discussions using Vocal’s existing features like storytelling tools, community engagement, and microtransactions. Give will provide charities with the tools and resources to capture attention and donations in what is a saturated non-profit space. |

44We were originally incorporated under the laws of the State of Nevada on December 30, 1999 under the name LILM, Inc. The Company changed its name on December 3, 2013 to Great Plains Holdings, Inc.

On February 5, 2016 (the “Merger Closing Date”), we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with GPH Merger Sub, Inc., a Nevada corporation and our wholly-owned subsidiary (“Merger Sub”), and Jerrick Ventures, Inc., a privately-held Nevada corporation headquartered in New Jersey (“Jerrick”), pursuant to which the Merger Sub was merged with and into Jerrick, with Jerrick surviving as our wholly-owned subsidiary (the “Merger”). Pursuant to the terms of the Merger Agreement, we acquired, through a reverse triangular merger, all of the outstanding capital stock of Jerrick in exchange for issuing Jerrick’s shareholders (the “Jerrick Shareholders”), pro-rata, a total of 475,000 shares of our common stock, par value $0.001 per share (“Common Stock”). Additionally, we assumed 33,415 shares of Jerrick’s Series A Convertible Preferred Stock (the “Jerrick Series A Preferred”) and 8,064 shares of Series B Convertible Preferred Stock (the “Jerrick Series B Preferred”). Upon closing of the Merger on February 5, 2016, the Company changed its business plan to our current plan.

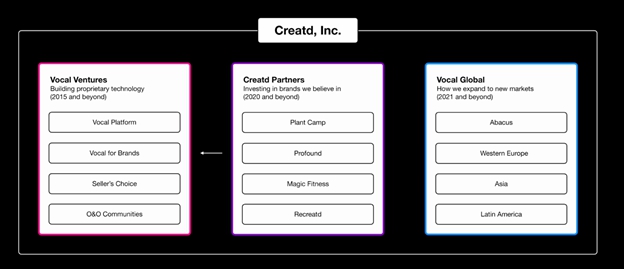

| ● | Vocal Global: Vocal Global is Creatd’s new market expansion strategy for applying Vocal’s technology to international platform opportunities. While the U.S., U.K., and Canada represent the vast majority of our audience, we believe there will be significant demand for our product in overseas markets–including Asia, the Middle East, and South America–particularly for foreign language installations of the product, an initiative which Creatd refers to as “Content Without Borders.” These projects will be executed through Abacus, our Australia-based subsidiary that will focus on ideating our global opportunities and Content Without Borders strategy. The unique cost structure and geographical advantage of Abacus, which has a close relationship with our development partners, Thinkmill, is crucial in enabling generating rapid responses to the growing need for secure, moderated social platforms for the international user base. The Australian government provides an incentive credit for technology based R&D that further fuels the development of platforms for bespoke foreign language installations and other white label opportunities. |

In connection with the Merger, on the Merger Closing Date, we entered into a Spin-Off Agreement with Kent Campbell (the “Spin-Off Agreement”), pursuant to which Mr. Campbell purchased (i) all of our interest in Ashland Holdings, LLC, a Florida limited liability company, and (ii) all of our interest in Lil Marc, Inc., a Utah corporation, in exchange for the cancellation of 13,030 shares of our common stock held by Mr. Campbell. In addition, Mr. Campbell assumed all of our debts, obligations and liabilities, including any existing prior to the Merger, pursuant to the terms and conditions of the Spin-Off Agreement. | ● | Acquisitions: Our acquisition of Seller’s Choice in September 2019 successfully expanded our brand product offering and client network. Future acquisition targets include creator platforms, content communities, data science companies, and digital marketing agencies. |

Effective February 28, 2016, we entered into an Agreement and Plan of Merger (the “Statutory Merger Agreement”), pursuant to which we became the parent company of Jerrick Ventures, LLC, our wholly-owned operating subsidiary (the “Statutory Merger”). | ● | Created Partners: Created Partners invests in early stage startups who are passionate about solving problems with technology. The Company leverages the Vocal technology and resources, housed under the ‘Vocal Ventures’ umbrella, to help DTC businesses thrive. Most of these partnerships take shape as some combination of sweat equity for the contribution of non-monetary resources and nominal capital investment. |

On February 28, 2016, we changed our name to Jerrick Media Holdings, Inc. to better reflect our new business strategy. Currently,On July 25, 2019, we filed a certificate of amendment to our articles of incorporation, as amended (the “Amendment”), with the Secretary of State of the State of Nevada to effectuate a one-for-twenty (1:20) reverse stock split (the “Reverse Stock Split”) of our common stock without any change to its par value. The Amendment became effective on July 30, 2019. The number of shares of authorized common stock was proportionately reduced as a result of the Reverse Stock Split. The number of shares of authorized preferred stock was not affected by the Reverse Stock Split. No fractional shares were issued in connection with the Reverse Stock Split as all fractional shares were “rounded up” to the next whole share.

All share and per share amounts for the common stock indicated in this prospectus have been retroactively restated to give effect to the Reverse Stock Split. On September 11, 2019, the Company has begun exploring long-term partnershipsacquired 100% of the membership interests of Seller’s Choice, LLC, a New Jersey limited liability company (“Seller’s Choice”). Seller’s Choice is digital e-commerce agency based in New Jersey. On July 13, 2020, upon approval from our board of directors and stockholders, we filed Second Amended and Restated Articles of Incorporation with the following Creatd Partners: Secretary of State of the State of Nevada for the purpose of increasing our authorized shares of Common Stock to 100,000,000. | o | Plant Camp, whose mission is to give kid-friendly categories a nutritious makeover, and turn childhood classics like mac and cheese into complete, wholesome, veggie-packed healthy meals— without your kids realizing a thing. Plant Camp is currently in development with our award winning agency partner Brains on Fire and is projected to launch Q3 2020. The company has previously completed a seed financing from industry veterans. |

| o | Magic Fitness is an iOS and Android application that is changing the way fitness is done. With Magic, users pair up with certified fitness trainers for live, 1x1 personal training sessions conducted via video-call. There are no generic routines or pre-recorded workout videos; instead, Magic users enjoy a personalized virtual session, and the expertise of experienced trainers there to guide, correct and motivate them, and only them. |

| o | Profound, who is a potential Creatd Partner, is disrupting the sports drink category by focusing on a long-neglected audience within sports–women. Profound’s line of functional, stylish, and sustainably packaged sports beverages are healthy, hydrating, and specifically formulated to fit the needs of women and support women’s fitness and active lifestyle. Profound is currently in development and is projected to launch Q4 2020. The company has previously completed a seed financing from industry veterans.

|

| o | Comhear is on a mission is to harness the power of audio technology to make content experiences more intelligent. Their patented audio technology leverages data to create customized sound fields that suit the listener’s physical environment and personal preference, fostering dynamic and adaptive content experiences for the consumer. |

45On August 13, 2020, we filed a certificate of amendment to our second amended and restated articles of incorporation (the “Amendment”), with the Secretary of State of the State of Nevada to effectuate a one-for-three (1:3) reverse stock split (the “August 2020 Reverse Stock Split”) of our common stock without any change to its par value. The Amendment became effective on August 17, 2020. No fractional shares were issued in connection with the August 2020 Reverse Stock Split as all fractional shares were rounded down to the next whole share. All share and per share amounts of our common stock listed in this prospectus have been adjusted to give effect to the August 2020 Reverse Stock Split.

On September 9, 2020, the Company filed a certificate of amendment with the Secretary of State of the State of Nevada to change our name to “Creatd, Inc.”, which became effective on September 10, 2020. Recent Developments Resignation of Chief Executive Officer and Director

On August 9, 2022, Laurie Weisberg, the Company’s Chief Executive Officer and a member of the Board, notified the Company of her intention to resign from the positions of Chief Executive Officer, director, and any other positions held with the Company or any of its subsidiaries, regardless of whether Ms. Weisberg had been appointed. Such resignations are to become effective on a date to be determined following further discussion with the Board, but in no event later than August 31, 2022.

Appointment of Chief Executive Officer

Effective upon Ms. Weisberg’s resignation as Chief Executive Officer, Jeremy Frommer, currently the Company’s Executive Chairman, will be appointed as Chief Executive Officer, pursuant to the Board’s approval.

Jeremy Frommer Mr. Frommer was appointed Executive Chairman in February 2022 and has been a member of our board of directors since February 2016. Previously, he served as our Chief Executive Officer from February 2016 to August 2021, and Co-Chief Executive Officer from August 2021 to February 2022. Mr. Frommer has over 20 years of experience in the financial technology industry. Previously, Mr. Frommer held key leadership roles in the investment banking and trading divisions of large financial institutions. From 2009 to 2012, Mr. Frommer was briefly retired until beginning concept formation for Jerrick Ventures which he officially founded in 2013. From 2007 to 2009, Mr. Frommer was Managing Director of Global Prime Services at RBC Capital Markets, the investment banking arm of the Royal Bank of Canada, the largest financial institution in Canada, after the sale of Carlin Financial Group, a professional trading firm. From 2004 to 2007, Mr. Frommer was the Chief Executive Officer of Carlin Financial Group after the sale of NextGen Trading, a software development company focused on building equity trading platforms. From 2002 to 2004, Mr. Frommer was Founder and Chief Executive Officer of NextGen Trading. From 2000 to 2002, he was Managing Director of Merger Arbitrage Trading at Bank of America, a financial services firm. Mr. Frommer was also a director of LionEye Capital, a hedge fund from June 2012 to June 2014. He holds a B.A. from the University of Albany. We believe Mr. Frommer is qualified to serve on our board of directors due to his financial and leadership experience.

Appointment of Director

Effective upon Ms. Weisberg’s resignation as a director, Justin Maury, currently the Company’s President and Chief Operating Officer, will be appointed to the Board, pursuant to the Board’s approval.

Justin Maury Mr. Maury has served as our President since January 2019 and was appointed Chief Operating Officer in August 2021. A full-stack designer and product developer by training, Mr. Maury partnered with Jeremy Frommer and founded the Company in 2013, having brought with him 10 years of experience in the creative industry. Since joining Creatd in 2013, Mr. Maury has been an instrumental force in the Company’s business and revenue expansion, and has overseen the Company’s product development since inception, including overseeing the design, development, launch, and ongoing growth of the Company’s flagship product, Vocal, the innovative creator that, under Mr. Maury’s leadership, has grown to a community of over 1.5 million users with a total audience reach of over 175 million. As a director, we believe Mr. Maury will add considerable value, including through by providing a unique perspective into Creatd’s product performance and evolution and by providing invaluable direct input to help guide the Company’s ongoing refinement of its technology roadmap and maturation of its business model. Trigger of Price Reset On July 29, 2022, the Company announced that it was not moving forward with its previously announced Rights Offering. In doing so, it triggered a price reset in the July 2022 Financing and the May 2022 Securities Purchase Agreement. As a result of this price reset, the May 2022 Securities Purchase Agreement debentures now have a conversion price of $1.00, and both the Series C and Series D warrants have exercise prices of $0.96. As a result of the price reset, the July 2022 Financing debentures now have a conversion price of $1.25, and both the Series E and Series F warrants have exercise prices of $1.01. July 2022 Financing On July 25, 2022 (the “Effective Date”), the Company entered into and closed securities purchase agreements (each, a “Purchase Agreement”) with five accredited investors (the “Investors”), whereby the Investors purchased from the Company for an aggregate of $1,935,019 in subscription amount (i) debentures in the principal amount of $2,150,000 (the “Debentures”); (ii) 1,075,000 Series E Common Stock Purchase Warrants to purchase shares of the Common Stock (the “Series E Warrants”); and (iii) 1,075,000 Series F Common Stock Purchase Warrants to purchase shares of Common Stock (the “Series F Warrants”, and collectively with the Series E Warrants, the “Warrants”). The Company and the Investors also entered into registration rights agreements (each, a “Registration Rights Agreement”) pursuant to the Purchase Agreement. The Debentures have an original issue discount of 10%, have a maturity date of November 30, 2022, may be extended by six months at the Company’s option subject to certain conditions, and are convertible into shares of Common Stock at a conversion price of $2.00 per share, subject to adjustment upon certain events including a one-time adjustment to the price of the Common Stock offered in the Rights Offering (as defined therein), with such adjusted conversion price not to be lower than $1.25. The Warrants are immediately exercisable for a term of five years until July 25, 2027. The Series E Warrants are exercisable at an exercise price of $3.00, subject to adjustment upon certain events including a one-time adjustment to the price of the Common Stock offered in the Rights Offering, with such adjusted exercise price not to be lower than $1.01. The Series F Warrants are exercisable at an exercise price of $6.00 subject to adjustment upon certain events including a one-time adjustment to the price of the Common Stock offered in the Rights Offering, with such adjusted exercise price not to be lower than $1.01. The Warrants provide for cashless exercise to the extent that there is no registration statement available for the underlying shares of Common Stock. The shares underlying the Debentures, the Series E Warrants and the Series F Warrants are to be registered within 90 days of the Effective Date. The representations and warranties contained in the Purchase Agreement were made by the parties to, and solely for the benefit of, the other in the context of all of the terms and conditions of the Purchase Agreement and in the context of the specific relationship between the parties. The provisions of the Purchase Agreement, including the representations and warranties contained therein, are not for the benefit of any party other than the parties to the Purchase Agreement. The Purchase Agreement is not intended for investors and the public to obtain factual information about the current state of affairs of the parties. Additionally, in connection with the Purchase Agreements, the subsidiaries of the Company delivered a guarantee (the “Guarantee”) in favor of the Investors whereby each such subsidiary guaranteed the full payment and performance of all obligations of the Company pursuant to the Purchase Agreement.

Nasdaq - Continued Listing

On March 1, 2022, the Company received a letter from the staff of The Nasdaq Capital Market (the “Exchange”) notifying the Company that the Exchange has determined to delist the Company’s common stock from the Exchange based on the Company’s Market Value of Listed Securities for the 30-consecutive day period between January 15, 2022 and February 25, 2022 falling short of the requirements under Listing Rule 5550(b)(2) (the “Rule”). Although a 180-day period is typically allowed for an issuer to regain compliance, the Company was not eligible to use such compliance period, as the Exchange had instituted a Panel Monitor through March 9, 2022. The Company pursued an appeal to the Nasdaq Hearings Panel (the “Panel”) of such determination, in accordance with the Exchange’s rules and, pursuant to such request by the Company to appeal, the delisting of the Company’s securities and the Form 25 Notification of Delisting filing was stayed pending the Panel’s decision. On April 22, 2022, the Exchange notified the Company that the Panel has determined to continue the listing of the Company on the Exchange, subject to the following conditions: (i) on or before May 16, 2022, the Company will file its Quarterly Report on Form 10-Q for the period ended March 31, 2022 demonstrating compliance with Nasdaq Listing Rule 550(b)(1) requiring shareholders’ equity of $2.5 million and (ii) on or before August 29, 2022, the Company will file a Form 8-K documenting the successful completion of any fund-raising activity that has taken place since April 14, 2022 and the Company’s long-term compliance with the continued listing requirements of the Nasdaq Capital Market. The Panel has advised that August 29, 2022 represents the full extent of the Panel’s discretion to grant continued listing during the time the Company is non-compliant and should the Company fail to demonstrate compliance by such date, the Panel will issue a final delist determination and the Company will be suspended from trading on the Exchange. Securities Purchase Agreement On May 31, 2022, the Company entered into and closed securities purchase agreements (each, a “Purchase Agreement”) with eight accredited investors (the “Investors”), whereby the Investors purchased from the Company for an aggregate of $3,600,036 in subscription amount (i) debentures in the principal amount of $4,000,000 (the “Debentures”); (ii) 2,000,000 Series C Common Stock Purchase Warrants to purchase shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) (the “Series C Warrants”); and (iii) 2,000,000 Series D Common Stock Purchase Warrants to purchase shares of Common Stock (the “Series D Warrants”, and collectively with the Series C Warrants, the “Warrants”). The Company and the Investors also entered into registration rights agreements (each, a “Registration Rights Agreement”) pursuant to the Purchase Agreement. The Debentures have an original issue discount of 10%, have a term of six months with a maturity date of November 30, 2022, may be extended by six months at the Company’s option subject to certain conditions, and are convertible into shares of Common Stock at a conversion price of $2.00 per share, subject to adjustment upon certain events including a one-time adjustment to the price of the Common Stock offered in the Rights Offering (as defined therein), with such adjusted conversion price not to be lower than $1.00. The Warrants are exercisable for a term of five years from the initial exercise date of November 30, 2022, until November 30, 2027. The Series C Warrants are exercisable at an exercise price of $3.00, subject to adjustment upon certain events including a one-time adjustment to the price of the Common Stock offered in the Rights Offering, with such adjusted exercise price not to be lower than $0.96. The Series D Warrants are exercisable at an exercise price of $6.00 subject to adjustment upon certain events including a one-time adjustment to the price of the Common Stock offered in the Rights Offering, with such adjusted exercise price not to be lower than $0.96. The Warrants provide for cashless exercise to the extent that there is no registration statement available for the underlying shares of Common Stock. The shares underlying the Debentures, the Series C Warrants and the Series D Warrants are to be registered within 90 days of the Effective Date. Additionally, in connection with the Purchase Agreements, the subsidiaries of the Company delivered a guarantee (the “Guarantee”) in favor of the Investors whereby each such subsidiary guaranteed the full payment and performance of all obligations of the Company pursuant to the Purchase Agreement. The Debentures, Warrants, Common Stock underlying the Debentures and the Common Stock underlying the Warrants were not registered under the Securities Act, but qualified for exemption under Section 4(a)(2) and Rule 506 promulgated thereunder. The Company is relying on this exemption from registration for private placements based in part on the representations made by Investors, including representations with respect to each Investor’s status as an accredited investor, as such term is defined in Rule 501(a) of the Securities Act, and each Investor’s investment intent.

Employees As of June 30, 2022, we had 45 full-time employees and 17 part-time employees. None of our employees are subject to a collective bargaining agreement, and we believe our relationship with our employees to be good. We believe that our future success will depend in part on our continued ability to attract, hire and retain qualified personnel. Our human capital resources objectives include identifying, recruiting, retaining, incentivizing and integrating our existing and new employees, advisors and consultants. The principal purposes of our equity and cash incentive plans are to attract, retain and reward personnel through the granting of stock-based and cash-based compensation awards, in order to increase stockholder value and the success of our company by motivating such individuals to perform to the best of their abilities and achieve our objectives. Facilities Our corporate headquarters consists of a total of approximately 8,000 square feet and is located at 419 Lafayette Street, 6th Floor, New York, NY 10003. The current lease term is effective May 1, 2022 through April 30, 2029, with monthly rent of $39,000 for the first year of the leasing period, and an increase in rent of 3% for every year thereafter. Previously in 2022, the Company also had additional office space located at 648 Broadway, Suite 200, New York, NY 10012. The lease term was effective September 9, 2021 through September 9, 2022, with monthly rent of $12,955 for the leasing period. During 2021, the Company also had additional office space located at 2050 Center Ave, Suite 640 and Suite 660, Fort Lee, NJ 07024. The lease term was effective June 5, 2018 through July 5, 2023, with monthly rent of $7,693 for the first year and increases at a rate of 3% for each subsequent year thereafter. Subsequent to December 31, 2021, the Company reached an agreement with the landlord at the New Jersey location to terminate the lease effective February 28, 2022. Legal Proceedings From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. Except as set forth below, we are currently not aware of any such legal proceedings or claims that will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results. On or about August 30, 2021, Robert W. Monster and Anonymize, Inc. (“Monster”) filed a lawsuit in the United States District Court for the Western District of Washington at Seattle, Robert W. Monster, et al. v. Creatd, Inc., et al. (Western District of Washington at Seattle 2:21-CV-1177). The Complaint alleges, among other things, that action for Declaratory Judgment under 28 U.S.C. § 2201 that Monster’s registration and use of the internet domain name VOCL.COM (the “Domain Name”) does not violate Creatd’s rights under the Anticybersquatting Consumer Protection Act (“ACPA”), 15 U.S.C. § 1125(d), or otherwise under the Lanham Act, 15 U.S.C. § 1051 et seq. Creatd claims trademark rights and certain other rights with respect to the term and the domain name VOCL.COM. Monster seeks a determination by the Court that Monster’s registration and/or use of VOCL.COM is not, and has not been in violation of the ACPA, and that Plaintiffs’ use of VOCL.COM constitutes neither a violation of the ACPA nor trademark infringement or dilution under the Lanham Act. Creatd believes the lawsuit lacks merit and will vigorously challenge the action. At this time, we are unable to estimate potential damage exposure, if any, related to the litigation. Corporate Information We were originally incorporated under the lawsThe Company’s address is 419 Lafayette Street, 6th Floor, New York, NY 10003. The Company’s telephone number is (201) 258-3770. Our website is https://creatd.com. The information on, or that can be accessed through, this website is not part of the State of Nevadathis prospectus, and you should not rely on December 30, 1999 under the name LILM, Inc. The Company changed its name on December 3, 2013 to Great Plains Holdings, Inc.

On February 5, 2016 (the “Merger Closing Date”), we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with GPH Merger Sub, Inc., a Nevada corporation and our wholly-owned subsidiary (“Merger Sub”), and Jerrick Ventures, Inc., a privately-held Nevada corporation headquartered in New Jersey (“Jerrick”), pursuant to which the Merger Sub was merged with and into Jerrick, with Jerrick surviving as our wholly-owned subsidiary (the “Merger”). Pursuant to the terms of the Merger Agreement, we acquired, through a reverse triangular merger, all of the outstanding capital stock of Jerrick in exchange for issuing Jerrick’s shareholders (the “Jerrick Shareholders”), pro-rata, a total of 28,500,000 shares of our common stock. Additionally, we assumed 33,415 shares of Jerrick’s Series A Convertible Preferred Stock (the “Jerrick Series A Preferred”) and 8,064 shares of Series B Convertible Preferred Stock (the “Jerrick Series B Preferred”).

Upon closing of the Merger on February 5, 2016, the Company changed its business plan to our current plan.

In connection with the Merger, on the Merger Closing Date, we entered into a Spin-Off Agreement with Kent Campbell (the “Spin-Off Agreement”), pursuant to which Mr. Campbell purchased (i) all of our interest in Ashland Holdings, LLC, a Florida limited liability company, and (ii) all of our interest in Lil Marc, Inc., a Utah corporation, in exchange for the cancellation of 781,818 shares of our common stock held by Mr. Campbell. In addition, Mr. Campbell assumed all of our debts, obligations and liabilities, including any existing prior to the Merger, pursuant to the terms and conditions of the Spin-Off Agreement.

Effective February 28, 2016, we entered into an Agreement and Plan of Merger (the “Statutory Merger Agreement”), pursuant to which we became the parent company of Jerrick Ventures, LLC, our wholly-owned operating subsidiary (the “Statutory Merger”).

On February 28, 2016, we changed our name to Jerrick Media Holdings, Inc. to better reflect our new business strategy.

Employees

As of August 18, 2020, we had 23 full-time employees. None of our employees are subject to a collective bargaining agreement, and we believe that relationship with our employees to be good.

Description of Property

Our corporate headquarters consists of a total of 3,000 square feet and is located at 2050 Center Ave, Suite 640 and Suite 660, Fort Lee, NJ 07024. The current lease term is effective June 5, 2018 through July 5, 2023, with monthly rent of $7,693 for the first year and increases at a rate of 3% for each subsequent year thereafter.

Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. Except as set forth below, we are currently not aware of any such legal proceedings or claims that will have, individually orinformation in making the aggregate, a material adverse effect on our business, financial condition or operating results.

On June 25, 2020, Home Revolution, LLC (“Home Revolution”) filed a lawsuit indecision whether to purchase the United States District Court for the District of New Jersey (the “Court”), entitled Home Revolution, LLC, et al v. Jerrick Media Holdings, Inc. et al, Case No. 2:20-cv-07775-JMV-MF (the “Action”). The complaint for the lawsuit alleges, among other things, that the Company breached the Membership Interest Purchase Agreement, as modified, and ancillary transaction documents in connection with the acquisition of Seller’s Choice, LLC, from Home Revolution in September 2019. The complaint additionally alleges violation of the New Jersey Uniform Securities Law, violations of the Exchange Act and Rule 10b-5 thereunder, fraud, equitable accounting, breach of fiduciary duty, conversion and unjust enrichment.securities.

The Company continues to believe that the Action lacks merit and has moved to dismiss the Action. In the event this Action is not summarily dismissed, Jerrick intends to vigorously challenge it. At this time, the Company is unable to estimate potential damage exposure, if any, related to the litigation.

In addition to the existing claim for damages contained in the Complaint, on July 29, 2020, Home Revolution moved, by order to show cause, for preliminary injunctive relief. On August 13, 2020, the Court denied Home Revolution’s request for a preliminary injunction.

46

MANAGEMENT The following table and biographical summaries set forth information, including principal occupation and business experience, about our directors and executive officers as of the date of this prospectus: | Name | | Age | | Positions | Jeremy FrommerLaurie Weisberg | | 5153 | | Chief Executive Officer, Director | Mark StandishJeremy Frommer | | 5853 | | Executive Chairman of the Board of Directors | Leonard SchillerJoanna Bloor | | 7852 | | Director | Laurie WeisbergBrad Justus | | 5161 | | Director | Mark PattersonLorraine Hendrickson | | 6856 | | Director | | Justin Maury | | 3133 | | Chief Operating Officer & President | | Chelsea Pullano | | 2931 | | Chief Financial Officer |

Jeremy FrommerLaurie Weisberg – Chief Executive Officer and Director

Mr. FrommerMs. Weisberg was elected to our board of directors in July 2020 and has served asbeen our Chief Executive Officer since 2022. Previously, she held the position of Co-Chief Executive Officer from August 2021 to February 2022, and Chief Operating Officer from September 2020 to August 2021. Weisberg, who has served as the Chief Sales Officer at Intent since February 2019, has spent over 25 years at the forefront of sales and marketing innovation in the technology space, having held leadership positions at various technology companies including Thrive Global, Curalate, and Oracle Data Cloud. From October 2010 to April 2015, Ms. Weisberg was a member of the executive leadership team at Datalogix, leading up to its acquisition by Oracle in 2015, at which point she assumed the role of VP of Oracle Data Cloud. Additionally, Ms. Weisberg has served on the Advisory Board at Crowdsmart, an intelligent data-driven investment prediction platform since April 2019. Ms. Weisberg was born and educated in England. We believe Ms. Weisberg is qualified to serve on our board of directors due to her extensive global sales and brand marketing expertise as well as her leadership experience working within the technology space.

Jeremy Frommer – Executive Chairman and Co-Founder Mr. Frommer was appointed Executive Chairman in February 2022 and has been a member of our board of directors since February 2016. Previously, he served as our Chief Executive Officer from February 2016 to August 2021, and Co-Chief Executive Officer from August 2021 to February 2022. Mr. Frommer has over 20 years of experience in the financial technology industry. Previously, Mr. Frommer held key leadershipsleadership roles in the investment banking and trading divisions of large financial institutions. From 2009 to 2012, Mr. Frommer was briefly retired until beginning concept formation for Jerrick Ventures which he officially founded in 2013. From 2007 to 2009, Mr. Frommer was Managing Director of Global Prime Services at RBC Capital Markets, the investment banking arm of the Royal Bank of Canada, the largest financial institution in Canada, after the sale of Carlin Financial Group, a professional trading firm. From 2004 to 2007, Mr. Frommer was the Chief Executive Officer of Carlin Financial Group after the sale of NextGen Trading, a software development company focused on building equity trading platforms. From 2002 to 2004, Mr. Frommer was Founder and Chief Executive Officer of NextGen Trading. From 2000 to 2002, he was Managing Director of Merger Arbitrage Trading at Bank of America, a financial services firm. Mr. Frommer was also a director of LionEye Capital, a hedge fund from June 2012 to June 2014. He holds a B.A. from the University of Albany. We believe Mr. Frommer is qualified to serve on our board of directors due to his financial and leadership experience. Mark StandishJoanna Bloor – ChairmanDirector

Ms. Bloor, age 52, Founder and CEO of the BoardThe Amplify Lab, combines over 7 years of Directors Mr. Standish was elected to our board of directorsexperience in July 2020 and serves as its Chairman. He has servedTechnology senior management following a 15-year career as a Senior PartnerExecutive in Operations and Marketing. Previously, she had been involved in three companies in the Technology and Media industry, holding positions including VP of Sales Operations, AVP of Sales Operations and Director of Sales Operations, and board member. From 2010 through 2015, she held the position of VP of Sales Operations at Pandora, a technology and entertainment company. From 2000 to 2010, Ms. Bloor was the AVP of Sales Operations for HHM Capital since January 2017. Additionally,CBS Interactive, Inc., a Digital Media and News organization. From 2000 to 2001, she was the Director of Sales Operations for OpenTable.com, an online restaurant reservation company. Joanna is also currently the Founder and CEO of The Amplify Lab., a career coaching company rooted in technology, data, and human experiences. We believe Joanna will be invaluable assisting Creatd shape and implement company culture transformation, overall operations, and human capital management. She has also had specific and deep experience in scaling revenue and implementing teams for numerous public and private companies, including leading technology companies and consumer brands that generate multi-million to hundreds of millions in annual revenue.

Brad Justus – Director Mr. Justus, age 61, most recently Director of International Publishing at Riot Games, combines over 13 years of executive management experience in the game development and publishing industries with more than 10 years in multiple C-Suite officer roles. Previously, he has served as a memberhad been involved in 3 companies in the technology and gaming industry, holding positions including Vice President of the Board of Directors for LightPoint Financial Technology LLC since January 2017.Marketing and Brand Experience, Chief Marketing Officer, Chief Executive Officer, and Senior Vice President. From February 2015 to December 2016, he served as Managing PartnerChief Experience Officer at Radiant Entertainment, a gaming company that was acquired by Riot Games in 2016. From 2012 to 2014, Mr. Justus was VP of Marketing and Brand Experience at ROBLOX Corporation, a digital community, and gaming company. From 2009 to 2012, he was Chief Information OfficersMarketing Officer at ClearStreet, Inc., a fintech startup company. From 2006 through 2007, Mr. Justus was the Senior Vice President for Deimos Asset Management LLC. In 1995Art.com, an online art marketplace. From 2004 to 2005, he joinedwas President and CEO for Informative, Inc., an online technology survey company. Previously, he was Senior Vice President at LEGO, an industry-leading toy company from 1999 to 2004. Since 2016 Mr. Justus held titles including Director, Brand Marketing and Director, International Publishing at Riot Games, a video game company where he also led the Royal Bankcreator-driven global launch of Canada and served as Co-Chief Executive Officerthe blockbuster game VALORANT in 2020. Mr. Justus holds a Bachelor of RBC Capital MarketsArts cum laude in Political Science from 2008 to 2014. He studied banking and finance at Croydon College in England in 1983.Amherst College. We believe Mr. Standish is qualifiedJustus will be a strong addition to serve as a memberCreatd’s board of our boarddirectors because of his extensive financial industryexperience leading branding, marketing, and leadership experience.product development teams at numerous direct to consumer companies. Many of these companies are tech- and community-focused, just like Creatd. He will also advise on overall online strategy and revenue growth.

Leonard SchillerLorraine Hendrickson – Director

Mr. Schiller isLorraine Hendrickson, age 56, combines over 20 years of experience in the Chairmaninvestment banking industry, having held numerous senior management and executive positions including Chief Administration Officer, Vice President of our boardBusiness Development, Corporate Relations, and Investment Strategy as well as various Director positions. From 2004 to 2006, Ms. Hendrickson served as Vice President Investment Strategy & Corporate Relations at Merrill Lynch Investment Management. From 2006 to 2011, Ms. Hendrickson was Director at BNY Mellon. An investment management firm. From 2011 to 2012, she moved to Hong Kong with BNY Mellon to become their Chief Administration Officer, Global Distribution. From 20014 to 2015, Ms. Hendrickson moved to become a Director, within the Investment Management Advisory division of directors. He is PresidentDeloitte UK, the leading London-based international consulting firm. She was subsequently recruited by a client and, Managing Partner of the Chicago law firm of Schiller, Strauss and Lavin PC and has been associated with the firm since 1977. Mr. Schiller also hasfrom 2015-2018, served as the PresidentProgram Director of The Dearborn Group,London CIV (Collective Investment Vehicle), the City of London’s first alternative asset management company owned and operated by the local government. She holds a residential property management and real estate company with properties locatedBachelor of Science in the Midwest. Mr. Schiller has also been involved in the ownership of residential properties and commercial properties throughout the country. Mr. Schiller has acted as a principal in numerous private loan transactions and has been responsible for the structure, and management of these transactions. Mr. Schiller has also served as a member of the Board of Directors of IMALL, an internet search engine company, which was acquired by Excite@Home. He also served as a member of the Board of AccuMed International, Inc., a company which manufactured and marketed medical diagnostic screening products, which was acquired by Molecular Diagnostics, Inc. He presently serves as a director of Milestone Scientific, Inc., a Delaware company. We believe Mr. Schiller is qualified to serve on our board of directors due to his legal and business experience.

Laurie Weisberg – Director

Ms. Weisberg was elected to our board of directors in July 2020. Weisberg, who has served as the Chief Sales Officer at Intent since February 2019, has spent over 25 years at the forefront of sales and marketing innovation in the technology space, having held leadership positions at various technology companies including Thrive Global, Curalate, and Oracle Data Cloud. From October 2010 to April 2015, Ms. Weisberg was a member of the executive leadership team at Datalogix, leading up to its acquisition by Oracle in 2015, at which point she assumed the role of VP of Oracle Data Cloud. Additionally, Ms. Weisberg has served on the Advisory Board at Crowdsmart, an intelligent data-driven investment prediction platform since April 2019. Ms. Weisberg was born and educated in England.Finance from Rider University. We believe Ms. Weisberg is qualified to serve on our board of directors due toHendrickson will add considerable value, including through her extensive global salescomprehensive and brand marketing expertise as well as her leadership experience working within the technology space.

Mark Patterson – Director

Mr. Patterson was elected to our board of directors in July 2020. Mr. Patterson, a private equity and hedge fund businessman, co-founded MatlinPatterson Global Advisors, a leading private equity firm in the distressed investing space in 2002. Early in his career, Patterson worked in leveraged finance at Credit Suisse, Scully Brothers & Foss, Salomon Brothers, and Bankers Trust. During his tenure as chairman and chief executive of MatlinPatterson’s asset management division, Mr. Patterson expanded the firm’s portfolio beyond distressed debt, implementing other investment strategies such as credit trading, securitized credit, and senior credit. Mark Patterson currently holds the position of Non-Executive Chairman of MatlinPatterson Asset Management. Mr. Patterson received degrees in Law and Economics from Stellenbosch University in South Africa and an M.B.A. from New York University’s Stern School of Business. We believe Mr. Patterson is qualified to serve on our board of directors due to his extensive experience in financial markets,diverse investment management experience, deep knowledge of governance and his corporate governanceregulatory frameworks, and broad experience on various boards.with business development, operations, and executive leadership.

Justin Maury – PresidentChief Operating Officer and Co-Founder Mr. Maury has served as our President since January 2019.2019, and was appointed Chief Operating Officer in August 2021. He is a full stack design director with an expertise in product development. With over ten years of design and product management experience in the creative industry, Mr. Maury’s passion for the creative arts and technology ultimately resulted in the vision for Vocal. Since joining JerrickCreatd in 2013, Maury has overseen the development and launch of the company’s flagship product, Vocal, an innovative platform that provides storytelling tools and engaged communities for creators and brands to get discovered while funding their creativity. Under Maury’s supervision, Vocal has achieved growth to over 380,000 creators across 34 genre-specific communities in its first two years since launch. Chelsea Pullano – Chief Financial Officer Ms. Pullano has been our Chief Financial Officer since June 2020. She has a long history of leadership at Jerrick,Creatd, serving as a member of the Company’s Management Committee for four years. Prior to her current role, Ms. Pullano was an integral member of our finance department since 2017, most recently serving as our Head of Corporate Finance, a role in which she coordinated our periodic reports under the Exchange Act and other financial matters. Prior to joining the Finance Department, Ms. Pullano was a member of our operations team from 2015 to 2017. She holds a B.A. from the State University of New York College at Geneseo. Director Terms; Qualifications Members of our board of directors serve until the next annual meeting of stockholders, or until their successors have been duly elected. When considering whether directors and nominees have the experience, qualifications, attributes and skills to enable the board of directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the board of directors focuses primarily on the industry and transactional experience, and other background, in addition to any unique skills or attributes associated with a director. Director or Officer Involvement in Certain Legal Proceedings There are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is averseadverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. No director or executive officer has been convicted of a criminal offense or is the subject of a pending criminal proceeding during the past ten years. No director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities during the past ten years. No director or officer has been found by a court to have violated a federal or state securities or commodities law during the past ten years. Directors and Officers Liability Insurance The Company has directors’ and officers’ liability insurance insuring its directors and officers against liability for acts or omissions in their capacities as directors or officers, subject to certain exclusions. Such insurance also insures the Company against losses, which it may incur in indemnifying its officers and directors. In addition, officers and directors also have indemnification rights under applicable laws, and the Company’s Second Amended and Restated Articles of Incorporation and Amended and Restated Bylaws.

Director Independence The listing rules of The Nasdaq Stock Market LLC (“Nasdaq”) require that independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of Nasdaq require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and governance committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our board of directors has undertaken a review of the independence of our directors and considered whether any director has a material relationship with it that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, the board of directors has determined that Leonard Shiller, Mark Standish, Laurie Weisberg,Joanna Bloor, Brad Justus and Mark PattersonLorraine Hendrickson are “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing standards of Nasdaq. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of the Company’s capital stock by each non-employee director, and any transactions involving them described in the section captioned “—Certain relationships and related transactions and director independence.” Board Committees Upon the consummation of this Offering, theThe Company’s Board will establishhas established three standing committees: Audit, Compensation, and Nominating and Corporate Governance. Each of the committees will operateoperates pursuant to its charter. The committee charters will be reviewed annually by the Nominating and Corporate Governance Committee. If appropriate, and in consultation with the chairs of the other committees, the Nominating and Corporate Governance Committee may propose revisions to the charters. The responsibilities of each committee are described in more detail below.

Nasdaq permits a phase-in period of up to one year for an issuer registering securities in an initial public offering to meet the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee independence requirements. Under the initial public offering phase-in period, only one member of each committee is required to satisfy the heightened independence requirements at the time our registration statement becomes effective, a majority of the members of each committee must satisfy the heightened independence requirements within 90 days following the effectiveness of our registration statement, and all members of each committee must satisfy the heightened independence requirements within one year from the effectiveness of our registration statement. Audit Committee The Audit Committee, among other things, will be responsible for: | | ● | appointing;Appointing; approving the compensation of; overseeing the work of; and assessing the independence, qualifications, and performance of the independent auditor; |

| | ● | reviewingReviewing the internal audit function, including its independence, plans, and budget; |

| | ● | approving,Approving, in advance, audit and any permissible non-audit services performed by our independent auditor; |

| | ● | reviewingReviewing our internal controls with the independent auditor, the internal auditor, and management; |

| | ● | reviewingReviewing the adequacy of our accounting and financial controls as reported by the independent auditor, the internal auditor, and management; |

| | ● | overseeingOverseeing our financial compliance system; and |

| | ● | overseeingOverseeing our major risk exposures regarding the Company’s accounting and financial reporting policies, the activities of our internal audit function, and information technology. |

The board of directors has affirmatively determined that each member of the Audit Committee meets the additional independence criteria applicable to audit committee members under SEC rules and Nasdaq listing rules. Effective upon the completion of this offering theThe board of directors will adopthas adopted a written charter setting forth the authority and responsibilities of the Audit Committee. The Board has affirmatively determined that each member of the Audit Committee is financially literate, and that Mr. StandishMs. Hendrickson meets the qualifications of an Audit Committee financial expert. The Audit Committee will consistconsists of Ms. Bloor, Mr. Standish, Mr. Schiller,Justus and Ms. Weisberg, and Mr. Patterson. Mr. Standish will chairHendrickson. Ms. Hendrickson chairs the Audit Committee. We believe that after consummation of this offering, the functioning of the Audit Committee will complycomplies with the applicable requirements of the rules and regulations of the Nasdaq listing rules and the SEC.

Compensation Committee The Compensation Committee will be responsible for: | | ● | reviewingReviewing and making recommendations to the Board with respect to the compensation of our officers and directors, including the CEO; |

| | ● | overseeingOverseeing and administering the Company’s executive compensation plans, including equity-based awards; |

| | ● | negotiatingNegotiating and overseeing employment agreements with officers and directors; and |

| | ● | overseeingOverseeing how the Company’s compensation policies and practices may affect the Company’s risk management practices and/or risk-taking incentives. |

Effective upon the completion of this offering, theThe board of directors will adopthas adopted a written charter setting forth the authority and responsibilities of the Compensation Committee.

The Compensation Committee will consistconsists of Ms. Bloor, Mr. Standish, Mr. Schiller,Justus and Ms. Weisberg, and Mr. Patterson. Mr. Patterson will serveHendrickson. Ms. Bloor serves as chairman of the Compensation Committee. The board of directors has affirmatively determined that each member of the Compensation Committee meets the independence criteria applicable to compensation committee members under SEC rules and Nasdaq listing rules. The Company believes that after the consummation of the offering, the composition of the Compensation Committee will meetmeets the requirements for independence under, and the functioning of such Compensation Committee will comply with, any applicable requirements of the rules and regulations of Nasdaq listing rules and the SEC. Nominating and Corporate Governance Committee The Nominating and Corporate Governance Committee, among other things, will beis responsible for: | | ● | reviewingReviewing and assessing the development of the executive officers and considering and making recommendations to the Board regarding promotion and succession issues; |

| | ● | evaluating | | ● | Evaluating and reporting to the Board on the performance and effectiveness of the directors, committees and the Board as a whole; |

| | ● | working | | ● | Working with the Board to determine the appropriate and desirable mix of characteristics, skills, expertise and experience, including diversity considerations, for the full Board and each committee; |

| | ● | annually | | ● | Annually presenting to the Board a list of individuals recommended to be nominated for election to the Board; |

| | ● | reviewing, | | ● | Reviewing, evaluating, and recommending changes to the Company’s Corporate Governance Principles and Committee Charters; |

| | ● | recommending | | ● | Recommending to the Board individuals to be elected to fill vacancies and newly created directorships; |

| | ● | overseeing | | ● | Overseeing the Company’s compliance program, including the Code of Conduct; and |

| | ● | overseeing | | ● | Overseeing and evaluating how the Company’s corporate governance and legal and regulatory compliance policies and practices, including leadership, structure, and succession planning, may affect the Company’s major risk exposures. |

Effective upon completion of this offering., theThe board of directors will adopthas adopted a written charter setting forth the authority and responsibilities of the Corporate Governance/Nominating Committee.

The Nominating and Corporate Governance Committee will consistconsists of Ms. Bloor, Mr. Standish,Justus and Ms. Hendrickson. Mr. Schiller, Ms. Weisberg, and Mr. Patterson. Ms. Weisberg will serveJustus serves as chairman.chair. The Company’s board of directors has determined that each member of the Nominating and Corporate Governance Committee is independent within the meaning of the independent director guidelines of Nasdaq listing rules.

Compensation Committee Interlocks and Insider Participation None of the Company’s executive officers serves, or in the past has served, as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of the Company’s board of directors or its compensation committee. None of the members of the Company’s compensation committee is, or has ever been, an officer or employee of the company. Code of Business Conduct and Ethics Prior to the completion of this offering, theThe Company’s Board of Directors will adopthas adopted a code of business conduct and ethics applicable to its employees, directors and officers, in accordance with applicable U.S. federal securities laws and the corporate governance rules of Nasdaq. The code of business conduct and ethics will be publicly available on the Company’s website. Any substantive amendments or waivers of the code of business conduct and ethics or code of ethics for senior financial officers may be made only by the Company’s board of directors and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of Nasdaq.

Corporate Governance Guidelines Prior to the completion of this offering, theThe Company’s board of directors will adopthas adopted corporate governance guidelines in accordance with the corporate governance rules of Nasdaq.

51Delinquent Section 16(A) Reports.

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who beneficially own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC and are required to furnish copies to the Company. Based solely on the review of the Changes of Beneficial Ownership disclosures on Forms 3, 4 and 5 filed with the Securities and Exchange Commission, the following persons filed the following number of transactions on Section 16 beneficial ownership disclosure filings late for transactions: | ● | Mr. Mark Standish filed one Form 4 late with respect to one transaction; |

| ● | Mr. Arthur Rosen filed one Form 5 for late filings with respect to five transactions; and |

| ● | Mr. Eric Ellis Goldberg filed one Form 4 for late filings with respect to two transactions, and one Form 3 late with respect to two transactions. |

EXECUTIVE COMPENSATION Summary Compensation Table

The following summary compensation table sets forth all compensation awarded to, earned by, or paidinformation is related to the named executive officerscompensation paid, distributed or accrued by us duringfor the years ended December 31, 2019,2021 and 2018.December 31, 2020 for our Chief Executive Officer (principal executive officer) serving during the year ended December 31, 2021 and the three other executive officers serving at December 31, 2021 whose total compensation exceeded $100,000 (the “Named Executive Officers”). Name

and

Principal

Position | | Year | | Salary

($) | | | Bonus

($) | | | Stock

Awards

($) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | Nonqualified

Deferred

Compensation

Earnings

($) | | | All Other

Compensation

($) | | | Total

($) | | | Jeremy Frommer | | 2019 | | $ | 168,269 | | | $ | 300,080 | | | | - | | | | - | | | | - | | | | - | | | $ | 104,667 | (1) | | $ | 573,016 | | | Chief Executive Officer | | 2018 | | $ | 152,879 | | | $ | 135,700 | | | | - | | | | - | | | | - | | | | - | | | $ | 96,463 | (3) | | $ | 385,042 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Rick Schwartz | | 2019 | | $ | 33,642 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 9,708 | | | $ | 43,350 | | | Former President | | 2018 | | $ | 124,476 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 124,476 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Justin Maury | | 2019 | | $ | 117,751 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 8,094 | (4) | | $ | 125,845 | | | President | | 2018 | | $ | 90,846 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 90,846 | |

| Name and Principal Position | | Year | | | Salary

($) | | | Bonus

($) | | | Stock

Awards

($) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | Nonqualified

Deferred

Compensation

Earnings

($) | | | All Other

Compensation

($) | | | Total

($) | | | Laurie Weisberg | | | 2021 | | | $ | 313,750 | | | $ | 25,000 | | | $ | 20,226 | | | $ | 763,894 | | | | - | | | | - | | | $ | 24,925 | (1) | | $ | 1,147,795 | | | Chief Executive Officer | | | 2020 | | | $ | 60,577 | | | $ | - | | | | - | | | | - | | | | - | | | | - | | | $ | 7,875 | (2) | | $ | 68,452 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Justin Maury | | | 2021 | | | $ | 306,923 | | | $ | 5,000 | | | | - | | | $ | 1,479,328 | | | | - | | | | - | | | $ | 7,919 | (3) | | $ | 1,799,170 | | | President & Chief Operating Officer | | | 2020 | | | $ | 147,009 | | | | - | | | $ | 412,204 | (9) | | $ | 713,563 | | | | - | | | | - | | | $ | 7,920 | (4) | | $ | 1,280,696 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Chelsea Pullano | | | 2021 | | | $ | 207,616 | | | $ | - | | | | - | | | $ | 610,052 | | | | - | | | | - | | | $ | 7,632 | (5) | | $ | 825,300 | | | Chief Financial Officer | | | 2020 | | | $ | 123,500 | | | | - | | | $ | 38,050 | (10) | | $ | 522,121 | | | | - | | | | - | | | $ | 1,908 | (6) | | $ | 685,579 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Jeremy Frommer | | | 2021 | | | $ | 665,433 | | | $ | 200,000 | | | | - | | | $ | 1,709,628 | | | | - | | | | - | | | $ | 98,237 | (7) | | $ | 2,673,298 | | | Executive Chairman | | | 2020 | | | $ | 234,231 | | | $ | 182,000 | | | $ | 469,255 | (11) | | $ | 931,339 | | | | - | | | | - | | | $ | 86,686 | (8) | | $ | 1,903,511 | |

| (1) | The $24,925 includes payment to Ms. Weisberg for health insurance. |

| (2) | The $7,875 includes payment to Ms. Weisberg for health insurance. | | | (1) | | (3) | The $104,667$7,919 includes payment to Mr. Maury for health insurance. | | | | (4) | The $7,920 includes payment to Mr. Maury for health insurance. | | | | (5) | The $7,632 includes payment to Ms. Pullano for health insurance. | | | | (6) | The $1,908 includes payment to Ms. Pullano for health insurance. | | | | (7) | The $98,237 includes payment to Mr. Frommer for living expenses, health insurance and a vehicle allowance. |

| | (2) | | (8) | The $9,708 includes payment to Mr. Schwartz for health insurance. |

| (3) | The $96,463$86,686 includes payment to Mr. Frommer for living expenses, health insurance and a vehicle allowance. |

| | (4) | | (9) | The $8,094 includes paymentOn May 13, 2020, the Company exchanged 167,955 stock options for 251,933 shares of Common Stock. $403,604 is attributable to Mr. Maurythis exchange. $8,660 of this amount is attributable to the issuance of shares in lieu of wages. | | | | (10) | On May 13, 2020, the Company exchanged 14,205 stock options for health insurance.21,308 shares of Common Stock. | | | | (11) | On May 13, 2020, the Company exchanged 200,000 stock options for 300,000 shares of Common Stock. $456,134 is attributable to this exchange. $12,121 of this amount is attributable to the issuance of shares in lieu of wages. |

Employment Agreements As of August 18, 2020,December 31, 2021, the Company hashad not entered into any employment agreements, but intends on enteringhas entered into such agreements with its Chief Executive Officer, Executive Chairman, President& Chief Operating Officer, and President by the end of fiscal year 2020.Chief Financial Officer subsequent to December 31, 2021. 52

2020 Equity Incentive Plan Our 2020 Equity Incentive Plan (the “2020 Plan”) provides for the issuance of incentive stock options, non-statutory stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), and other stock-based awards and there are 2,500,000 shares originally reserved under the 2020 Plan.

No further awards may be issued under the Jerrick Ventures 2015 Incentive and Award Plan (the “2015 Plan”), but all awards under the 2015 Plan that are outstanding as of the Effective Date will continue to be governed by the terms, conditions and procedures set forth in the 2015 Plan and any applicable award agreement. Outstanding Equity Awards at Fiscal Year-End 20192021 At December 31, 2019,2021, we had outstanding equity awards as follows: | Name | | Number

of

Securities

Underlying

Unexercised

Options

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable | | | Equity

Incentive

Plan

Awards:

Number

of

Securities

Underlying

Unexercised

Unearned

Options | | | Weighted Average

Exercise Price | | | Expiration

Date | | Number

of Shares

or Units

of Stock

That

Have

Not

Vested | | | Market

Value

of

Shares

or Units

of Stock

That

Have

Not

Vested | | | Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

That

Have

Not

Vested | | | Equity

Incentive

Plan

Awards:

Market

or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights

That

Have

Not

Vested | | | Jeremy Frommer (1) | | | 66,666 | | | | - | | | | 66,666 | | | $ | 22.5 | | | May 22, 2022 | | | - | | | $ | - | | | | - | | | | - | | | Rick Schwartz (1) | | | 66,666 | | | | - | | | | 66,666 | | | $ | 22.5 | | | May 22, 2022 | | | - | | | $ | - | | | | - | | | | - | | | Justin Maury (2) | | | 55,985 | | | | - | | | | 55,985 | | | $ | 29.7 | | | May 22, 2022 | | | - | | | | - | | | | - | | | | - | |

| Name | | Number

of

Securities

Underlying

Unexercised

Options

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable | | | Equity

Incentive

Plan

Awards:

Number

of

Securities

Underlying

Unexercised

Unearned

Options | | | Weighted Average

Exercise Price | | | Expiration

Date | | Number

of Shares

or Units

of Stock

That

Have

Not

Vested | | | Market

Value

of

Shares

or Units

of Stock

That

Have

Not

Vested | | | Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

That

Have

Not

Vested | | | Equity

Incentive

Plan

Awards:

Market

or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights

That

Have

Not

Vested | | | Jeremy Frommer (1) | | | 210,188 | | | | 400,000 | | | | - | | | $ | 5.94 | | | February 19,

2028 (5) | | | - | | | $ | - | | | | - | | | | - | | | Laurie Weisberg (2) | | | 137,667 | | | | 87,083 | | | | - | | | $ | 7.13 | | | February 19,

2028 (6) | | | - | | | $ | - | | | | - | | | | - | | | Justin Maury (3) | | | 149,333 | | | | 374,000 | | | | - | | | $ | 5.93 | | | February 19,

2028 (7) | | | - | | | $ | - | | | | - | | | | - | | | Chelsea Pullano (4) | | | 87,000 | | | | 150,000 | | | | - | | | $ | 4.37 | | | February 19,

2028 (8) | | | - | | | $ | - | | | | - | | | | - | |

| (1) | (1) | Effective February 5, 2016, to August 13, 2021, Jeremy Frommer was appointed as our Chief Executive Officer. Starting August 13, 2021, Jeremy Frommer was appointed Co-Chief Executive Officer and Rick Schwartzwith Laurie Weisberg. | | | | (2) | Effective September 28, 2020, to August 13, 2021, Laurie Weisberg was appointed as our President.Chief Operating Officer. Starting August 13, 2021, Laurie Weisberg Co-Chief Executive Officer with Jeremy Frommer. | |

| (2) | | (3) | OnEffective January 31, 2019, Rick Schwartz resigned from his position as President. The Board of Directors appointedto August 13, 2021, Justin Maury was appointed as Presidentour President. Starting August 13, 2021, Justin Maury was appointed Chief Operating Officer in addition to President. | | | | (4) | Effective June 29, 2020, Chelsea Pullano was appointed Chief Financial Officer. | | | | (5) | 121,000 options expire on the same date.October 28, 2026, 200,000 options expire on February 19, 2027, 200,000 options expire on February 19, 2028. | | | | (6) | 53,750 options expire on February 4, 2026, 121,000 options expire on October 28, 2026, 25,000 options expire on February 19, 2027, 25,000 options expire on February 19, 2028. | | | | (7) | 81,000 options expire on October 28, 2026, 187,000 options expire on February 19, 2027, 187,000 options expire on February 19, 2028. | | | | (8) | 37,000 options expire on October 28, 2026, 75,000 options expire on February 19, 2027, 75,000 options expire on February 19, 2028. |

Director Compensation The following table presents the total compensation for each person who served as a non-employee member of our board of directors and received compensation for such service during the fiscal year ended December 31, 2019.2021. Other than as set forth in the table and described more fully below, we did not pay any compensation, make any equity awards or non-equity awards to, or pay any other compensation to any of the non-employee members of our board of directors in 2019.2021. | Director | | Option

Awards (1) | | | Fees

Earned or

Paid in

Cash | | | Total | | | Andrew Taffin(2) | | $ | 3,021 | | | $ | - | | | $ | 3,021 | | | Leonard Schiller | | $ | - | | | $ | - | | | $ | - | |

| Director | | Option

Awards (1) | | | Fees

Earned or

Paid in Cash | | | Total | | | Mark Standish (4) | | $ | 340,414 | | | $ | - | | | $ | 340,414 | | | Mark Patterson (2) | | $ | 131,845 | | | $ | - | | | $ | 131,845 | | | Leonard Schiller (4) | | $ | 171,453 | | | $ | - | | | $ | 171,453 | | | LaBrena Martin (4) | | $ | 169,078 | | | $ | - | | | $ | 169,078 | | | Laurie Weisberg (3) | | $ | 763,894 | | | $ | - | | | $ | 763,894 | |

| (1) | (1) | Amounts shown in this column do not reflect dollar amounts actually received by our non-employee directors. Instead, these amounts represent the aggregate grant date fair value of stock option awards determined in accordance with FASB ASC Topic 718. |

| | | (2) | Mr. TaffinMark Patterson resigned from ourthe board of directors effective July 31, 2021. | | | | (3) | Laurie Weisberg was appointed the Company’s Chief Operating Officer on October 23, 2019.September 28, 2020. | | | | (4) | Mark Standish, Leonard Schiller, and LaBrena Martin resigned from the board of directors subsequent to December 31, 2021. |

SHARES ELIGIBLE FOR FUTURE SALE

Prior to this offering, there has been limited public market for the Company’s common stock, and a liquid trading market for its common stock may not develop or be sustained after this offering. Future sales of substantial amounts of the Company’s common stock in the public market, or the anticipation of these sales, could materially and adversely affect market prices prevailing from time to time, and could impair the Company’s ability to raise capital through sales of equity or equity-related securities.

Only a limited number of shares of the Company’s common stock will be available for sale in the public market for a period of several months after completion of this offering due to contractual and legal restrictions on resale described below. Nevertheless, sales of a substantial number of shares of the Company’s common stock in the public market after such restrictions lapse, or the perception that those sales may occur, could materially and adversely affect the prevailing market price of its common stock. Although the Company intends to list its common stock on The Nasdaq Capital Market, the Company cannot assure you that there will be an active market for its common stock.

Of the shares to be outstanding immediately after the completion of this offering, we expect that the shares to be sold in this offering will be freely tradable without restriction under the Securities Act unless purchased by our “affiliates,” as that term is defined in Rule 144 under the Securities Act; these restricted securities may be sold in the public market only if registered or pursuant to an exemption from registration, such as Rule 144 or Rule 701 under the Securities Act.

Rule 144