As filed with the U.S. Securities and Exchange Commission on December 3, 2021 under the Securities Act of 1933, as amended.April 11, 2024

Registration No. 333-261187333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

WASHINGTON, D.C. 20549

________________________

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________

Power & Digital Infrastructure Acquisition II Corp.

Montana Technologies Corporation

(Exact name of registrant as specified in its charter)

________________________

Delaware | 3585 | 86-2962208 | ||

(State or other jurisdiction of | (Primary Standard Industrial | ( |

321 North Clark Street, Suite 2440Chicago, IL 60654(312) 262-5642

34361 Innovation Drive

Ronan, Montana

(800) 942-3083

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

________________________

Patrick C. Eilers

Jeff Gutke

Chief ExecutiveFinancial Officer321 North Clark Street, Suite 2440Chicago, IL 60654(312) 262-5642

34361 Innovation Drive

Ronan, Montana

(800) 942-3083

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________

Copies to:

Copies:Ryan J. Maierson

John M. Greer

Latham & Watkins LLP

811 Main Street, Suite 3700

Houston, TX 77002

(713) 546-5400

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement becomes effective.Statement.

________________________

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered | Amount Being Registered | Proposed Maximum Offering Price Per Security(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||||||

| Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one redeemable warrant(2) | 28,750,000 units | $ | 10.00 | $ | 287,500,000 | $ | 26,651 | |||||||

| Class A common stock included as part of the units(3) | 28,750,000 shares | — | — | — | (4) | |||||||||

| Redeemable warrants included as part of the units(3) | 14,375,000 warrants | — | — | — | (4) | |||||||||

| Class A common stock underlying redeemable warrants(3) | 14,375,000 shares | $ | 11.50 | $ | 165,312,500 | $ | 15,325 | |||||||

| Total | $ | 452,812,500 | $ | 41,976 | (5) | |||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated April11, 2024.

PROSPECTUS |

Montana Technologies Corporation

25,500,000 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

54,825,138 Shares of Class A Common Stock

11,125,000 Warrants

This prospectus relates to the issuance by Montana Technologies Corporation (“we,” “us,” “our,” the “Company,” “Registrant,” and “Montana”) of an aggregate of up to 25,500,000 shares of our Class A common stock, $0.0001 par value per share (“Class A Common Stock”), which consists of (i) up to 11,125,000 shares of Class A Common Stock that are issuable upon the exercise of 11,125,000 warrants (the “Private Placement Warrants”) originally issued in a private placement at a price of $1.00 per Private Placement Warrant in connection with the initial public offering (the “IPO”) of Power & Digital Infrastructure Acquisition II Corp., a Delaware corporation (“XPDB”), by the holders thereof, and (ii) up to 14,375,000 shares of Class A Common Stock that are issuable upon the exercise of 14,375,000 warrants (the “Public Warrants” and, together with the Private Placement Warrants, the “Warrants”) originally issued in the IPO at a price of $10.00 per unit, with each unit consisting of one share of XPDB’s Class A common stock and one-half of one Public Warrant. Each Warrant entitles the holder thereof to purchase one share of Class A Common Stock at a price of $11.50 per share.

This prospectus also relates to the offer and resale from time to time by the selling securityholders (including their transferees, donees, pledgees and other successors-in-interest) named in this prospectus (the “Selling Securityholders”) of (i) up to 54,825,138 shares of Class A Common Stock, which consists of (a) up to 31,164,761 shares of Class A Common Stock issued in connection with the Business Combination (as defined below) at an assumed value of $10.00 per share by certain of the Selling Securityholders named in this prospectus, (b) up to 4,759,642shares of Class A Common Stock issuable upon the conversion of 4,759,642shares of Class B common stock, par value $0.0001 per share, of the Company (“Class B Common Stock” and, together with Class A Common Stock, “Common Stock”) issued in connection with the Business Combination (as defined below) at an assumed value of $10.00 per share by certain of the Selling Securityholders named in this prospectus, (c) up to 6,827,969 shares of Class A Common Stock issued to the Sponsor upon the conversion of 6,827,969shares of Class B common stock, par value $0.0001 per share, of XPDB (“Founder Shares”) in connection with the consummation of the Business Combination, which Founder Shares were originally acquired at a price of $0.004 per share in connection with the initial public offering of XPDB (the “XPDB IPO”), by XPDI Sponsor II LLC (the “Sponsor”), (d) up to 90,000shares of Class A Common Stock issued to former independent directors of XPDB (the “Former Independent Directors”) upon the conversion of 90,000 Founder Shares in connection with the consummation of the Business Combination, which Founder Shares were initially acquired from the Sponsor for services rendered to XPDB at no cost, by certain of the Selling Securityholders named in this prospectus, (e) up to 269,531shares of Class A Common Stock issued to certain anchor investors in the XPDB IPO (the “Anchor Investors”) in connection with the consummation of the Business Combination, which shares were purchased from the Sponsor at a purchase price $0.004 per share concurrently with the consummation of the Business Combination, by certain of the Selling Securityholders named in this prospectus, (f) up to 11,125,000 shares of Class A Common Stock that are issuable upon the exercise of the Private Placement Warrants that were originally issued at a price of $1.00 per Warrant by certain of the Selling Securityholders named in this prospectus, and (g) up to 588,235shares of Class A Common Stock issued in the PIPE Investment (as defined below) at a purchase price of $8.50 per share by the PIPE Investor (as defined below) and (ii) up to 11,125,000 Private Placement Warrants originally issued at a price of $1.00 per Warrant by certain of the Selling Securityholders named in this prospectus.

We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus. We will receive up to approximately $293.3 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash, but not from the sale of the shares of Class A Common Stock issuable upon such exercise. Each Warrant entitles the holder thereof to purchase one share of our Class A Common Stock at a price of $11.50 per share. On April10, 2024, the closing price for our Class A Common Stock was $11.00. If the price of our Class A Common Stock remains below $11.50 per share, we believe warrant holders will be unlikely to cash exercise their Warrants, resulting in little or no cash proceeds to us.

The Selling Securityholders can sell, under this prospectus, up to (a) 54,825,138shares of Class A Common Stock constituting approximately 69.1% of our issued and outstanding shares of Common Stock and approximately 131.7% of our issued and outstanding shares of Common Stock held by non-affiliates (assuming, in each case, the exercise of

EXPLANATORYTable of Contents

all of our Warrants), in each case, as of April10, 2024 and (b) 11,125,000 Warrants constituting approximately 43.6% of our issued and outstanding Warrants as of April10, 2024. Sales of a substantial number of our shares of Class A Common Stock and/or Warrants in the public market by the Selling Securityholders and/or by our other existing securityholders, or the perception that those sales might occur, could depress the market price of our shares of Class A Common Stock and Public Warrants and could impair our ability to raise capital through the sale of additional equity securities.

The Sponsor beneficially owned approximately 18.6% of the number of shares of Common Stock issued and outstanding immediately following consummation of the Business Combination (including the redemption of shares of Class A common stock of XPDB in connection with the consummation of the Business Combination and assuming exercise of all of the Warrants), which shares of Class A Common Stock are registered for resale pursuant to this prospectus. The Sponsor will be able to sell all such registered shares (subject to contractual lockups) for so long as the registration statement of which this prospectus forms a part is available for use. See “Beneficial Ownership” and “Selling Securityholders” for additional details on the Sponsor’s beneficial ownership. We are unable to predict the effect that such sales may have on the prevailing market price of our shares of Class A Common Stock and Warrants.

The sale of all the securities being offered in this prospectus could result in a significant decline in the public trading price of our securities. Despite such a decline in the public trading price, some of the Selling Securityholders may still experience a positive rate of return on the securities they purchased due to the differences in the purchase prices described above. Based on the closing price of our Class A Common Stock of $11.00 on April10, 2024, (i) the Sponsor may experience potential profit of up to $10.996 per Founder Share (or approximately $75.1million in the aggregate based on the Sponsor’s beneficial ownership of 6,827,969 Founder Shares) with respect to sales of Class A Common Stock based on the Sponsor’s initial purchase price of approximately $0.004 per Founder Share (ii) the Former Independent Directors may experience potential profit of up to $11.00 per share (or approximately $1.0million in the aggregate based on the Former Independent Directors’ beneficial ownership of 90,000shares of Class A Common Stock) with respect to sales of Class A Common Stock based on the Former Independent Directors having acquired the shares of Class A Common Stock at no cost in exchange for services rendered to XPDB, (iii) the Anchor Investors may experience potential profit of up to $10.996 per share (or approximately $3.0million in the aggregate based on the Anchor Investors’ beneficial ownership of 269,531shares of Class A Common Stock) with respect to sales of Class A Common Stock based on the Anchor Investors’ initial purchase price of $0.004 per Founder Share and (iv) the PIPE Investor may experience potential profit of up to $2.50 per share (or approximately $1.5million in the aggregate based on the PIPE Investor’s beneficial ownership of 588,235shares of Class A Common Stock) with respect to sales of Class A Common Stock based on the PIPE Investor’s initial purchase price of $8.50 per share of Class A Common Stock. Public securityholders may not be able to experience the same positive rates of return on securities they purchase due to the low price at which the Sponsor and the PIPE Investor purchased shares of Class A Common Stock.

We are registering the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A Common Stock or Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A Common Stock or Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sales of the shares of Class A Common Stock.

We provide more information about how the Selling Securityholders may sell the shares of Class A Common Stock or Warrants in the section entitled “Plan of Distribution.”

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Our Class A Common Stock and Public Warrants are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “AIRJ” and “AIRJW,” respectively. On April10, 2024, the closing price of our Class A Common Stock was $11.00 and the closing price for our Public Warrants was $0.61.

Our business and investment in our securities involve significant risks. These risks are described in the section titled “Risk Factors” beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

Page | ||

ii | ||

iv | ||

1 | ||

4 | ||

5 | ||

30 | ||

31 | ||

32 | ||

33 | ||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 34 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 46 | |

54 | ||

67 | ||

73 | ||

76 | ||

78 | ||

80 | ||

83 | ||

92 | ||

95 | ||

95 | ||

95 | ||

F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. By using a shelf registration statement, the Selling Securityholders may sell up to (i) up to 54,825,138shares of Class A Common Stock, which consists of (a) up to 31,164,761shares of Class A Common Stock issued in connection with the Business Combination (as defined below) at an assumed value of $10.00 per share by certain of the Selling Securityholders named in this prospectus, (b) up to 4,759,642shares of Class A Common Stock issuable upon the conversion of 4,759,642shares of Class B Common Stock issued in connection with the Business Combination at an assumed value of $10.00 per share by certain of the Selling Securityholders named in this prospectus, (c) up to 6,827,969shares of Class A Common Stock issued to the Sponsor upon the conversion of 6,827,969 Founder Shares in connection with the consummation of the Business Combination, which Founder Shares were originally acquired at a price of $0.004 per share in connection with the XPDB IPO by the Sponsor, (d) up to 90,000shares of Class A Common Stock issued to the Former Independent Directors upon the conversion of 90,000 Founder Shares in connection with the consummation of the Business Combination, which Founder Shares were initially acquired from the Sponsor for services rendered to XPDB at no cost, by certain of the Selling Securityholders named in this prospectus, (e) up to 269,531shares of Class A Common Stock issued to the Anchor Investors in connection with the consummation of the Business Combination, which shares were purchased from the Sponsor at a purchase price $0.004 per share concurrently with the consummation of the Business Combination, by certain of the Selling Securityholders named in this prospectus, (f) up to 11,125,000shares of Class A Common Stock that are issuable upon the exercise of the Private Placement Warrants that were originally issued at a price of $1.00 per Warrant by certain of the Selling Securityholders named in this prospectus, and (g) up to 588,235shares of Class A Common Stock issued in the PIPE Investment at a purchase price of $8.50 per share by the PIPE Investor and (ii) up to 11,125,000 Private Placement Warrants originally issued at a price of $1.00 per Warrant by certain of the Selling Securityholders named in this prospectus. This prospectus also relates to the issuance by us of the shares of Class A Class A Common Stock issuable upon the exercise of the Warrants.

We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. We will receive up to approximately $293.3 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash, but not from the sale of the shares of Class A Common Stock issuable upon such exercise. Each Warrant entitles the holder thereof to purchase one share of our Class A Common Stock at a price of $11.50 per share. On April10, 2024, the closing price for our Class A Common Stock was $11.00. If the price of our Class A Common Stock remains below $11.50 per share, we believe warrant holders will be unlikely to cash exercise their Warrants, resulting in little or no cash proceeds to us.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. We and the Selling Securityholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains, and any post-effective amendment or any prospectus supplement may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus, any post-effective amendment or any prospectus supplement may

ii

involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any post-effective amendment and the applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

In accordance with the terms of, and transactions contemplated by, the Agreement and Plan of Merger dated as of June 5, 2023 (as amended on February 5, 2024, the “Merger Agreement”), by and among Legacy Montana (as defined below), XPDB, and XPDB Merger Sub LLC, a Delaware limited liability company and wholly-owned subsidiary of XPDB (“Merger Sub”), Merger Sub merged with and into Legacy Montana, with Legacy Montana surviving such merger and, along with the other transactions contemplated by the Merger Agreement (the “Business Combination” and, together with other transactions contemplated by the Merger Agreement, the “Transactions”), was consummated as contemplated by the Merger Agreement on March 14, 2024. In connection with the Business Combination, XPDB changed its name to “Montana Technologies Corporation.”

We own or have rights to trademarks, trade names and service marks that we use in connection with the operation of our business (including, but not limited to, our AirJoule technology and units). Our name, logos and website name and address are our trademarks or service marks. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable®,™ and℠ symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

As used in this prospectus, unless otherwise indicated or the context otherwise requires, references to “we,” “us,” “our,” the “Company,” “Registrant,” and “Montana” refer to the consolidated operations of Montana Technologies Corporation and its subsidiaries. References to “XPDB” refer to the Company prior to the consummation of the Business Combination and references to “Legacy Montana” refer to Montana Technologies, LLC prior to the consummation of the Business Combination. All references herein to the “Board” refer to the board of directors of the Company.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this prospectus, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the risks, uncertainties and assumptions described under the section in this prospectus titled “Risk Factors.” These forward-looking statements are subject to numerous risks, including, without limitation, the following:

•the ability to maintain the listing of Montana’s securities on the Nasdaq;

•privacy and data protection laws, privacy or data breaches, or the loss of data;

•the enforceability of Montana’s intellectual property, including its patents, and the potential infringement on the intellectual property rights of others;

•the price of Montana’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Montana plans to operate, variations in performance across competitors, and changes in laws and regulations, or changes in the implementation of regulations by regulatory bodies, affecting Montana’s business;

•the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather (including weather influenced by climate change), demographic trends and employee availability;

•the ability to implement business plans, forecasts, and other expectations after the completion of the Business Combination, including the possibility of cost overruns or unanticipated expenses in development programs, and the ability to identify and realize additional opportunities;

•our ability to defend ourselves against claims that we infringe, have misappropriated or otherwise violate the intellectual property rights of others;

•any defects in new products or enhancements to existing products; and

•other risks and uncertainties described in this registration statement, including those under the section entitled “Risk Factors.”

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment and a competitive industry. New risks and uncertainties may emerge from time to time, and it is not possible for management to predict all risks and uncertainties, nor can

iv

we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement we may make in this prospectus. As a result of these factors, although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances, or otherwise.

You should read this prospectus completely and with the understanding that our actual future results may be materially different from our expectations. We qualify all of our forward-looking statements by these cautionary statements. You should read this prospectus and the documents that have been filed as exhibits hereto with the understanding that the actual future results, levels of activity, performance, events and circumstances of Montana may be materially different from what is expected.

v

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that may be important to you in making your investment decision. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 5 and our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our Common Stock or Warrants.

Overview

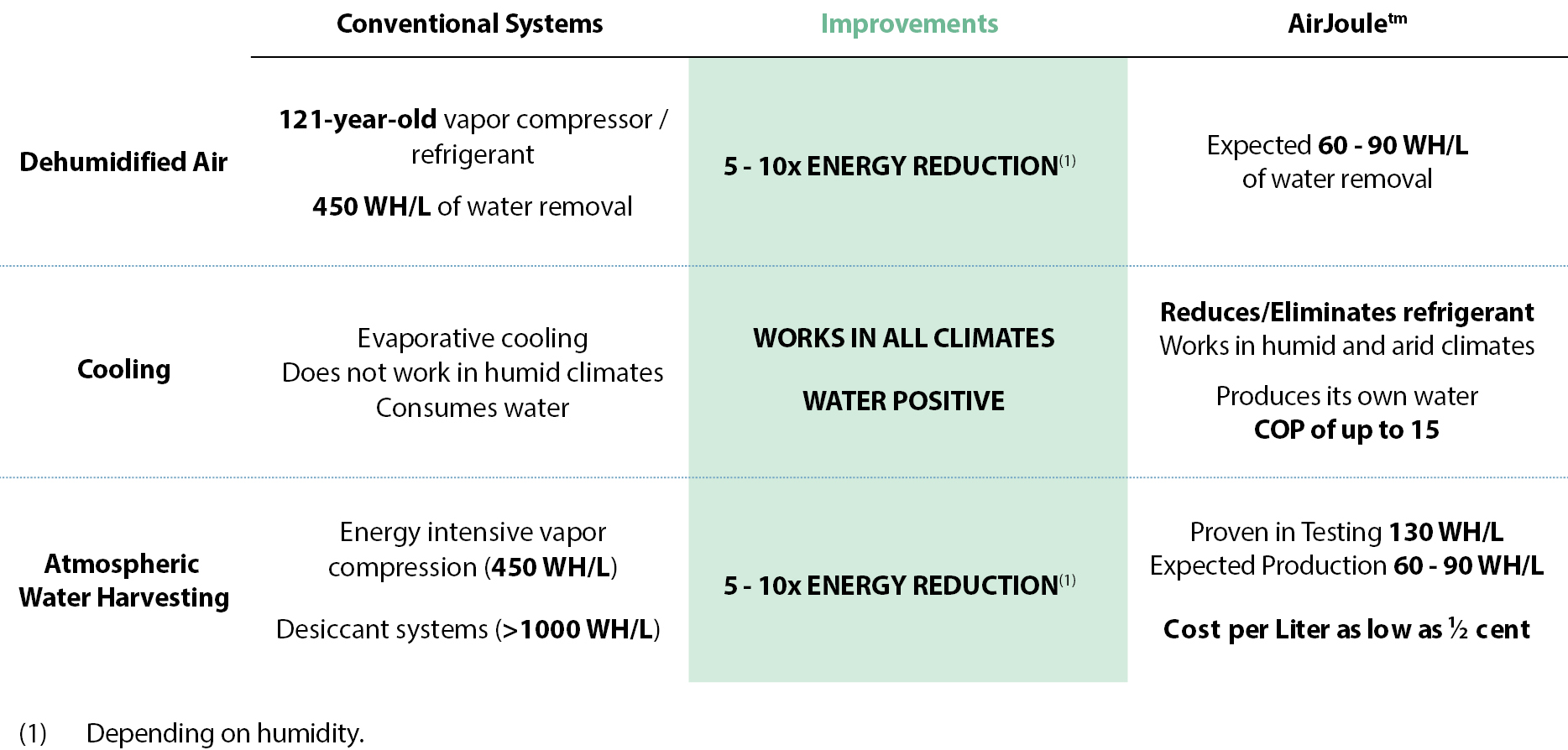

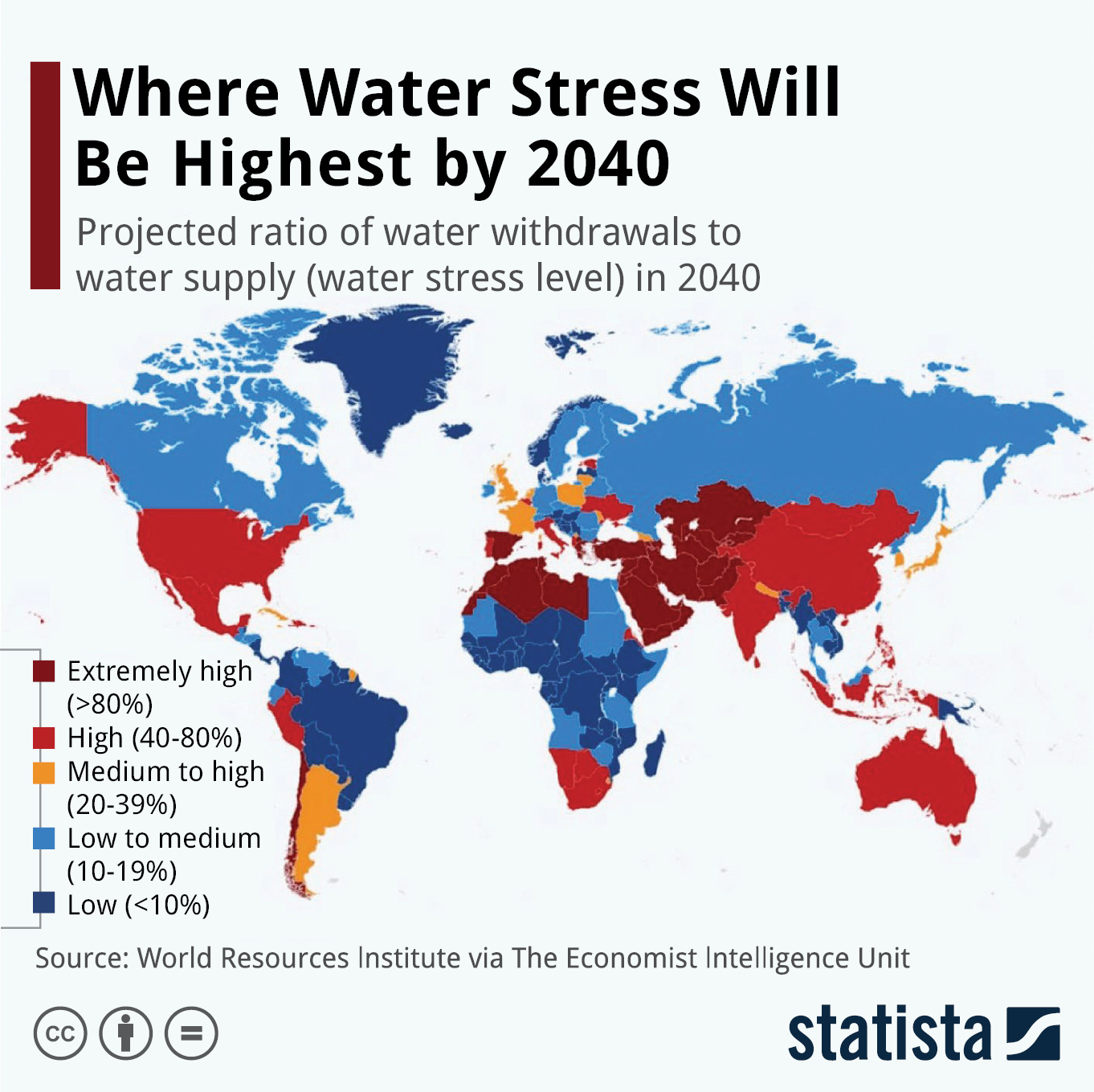

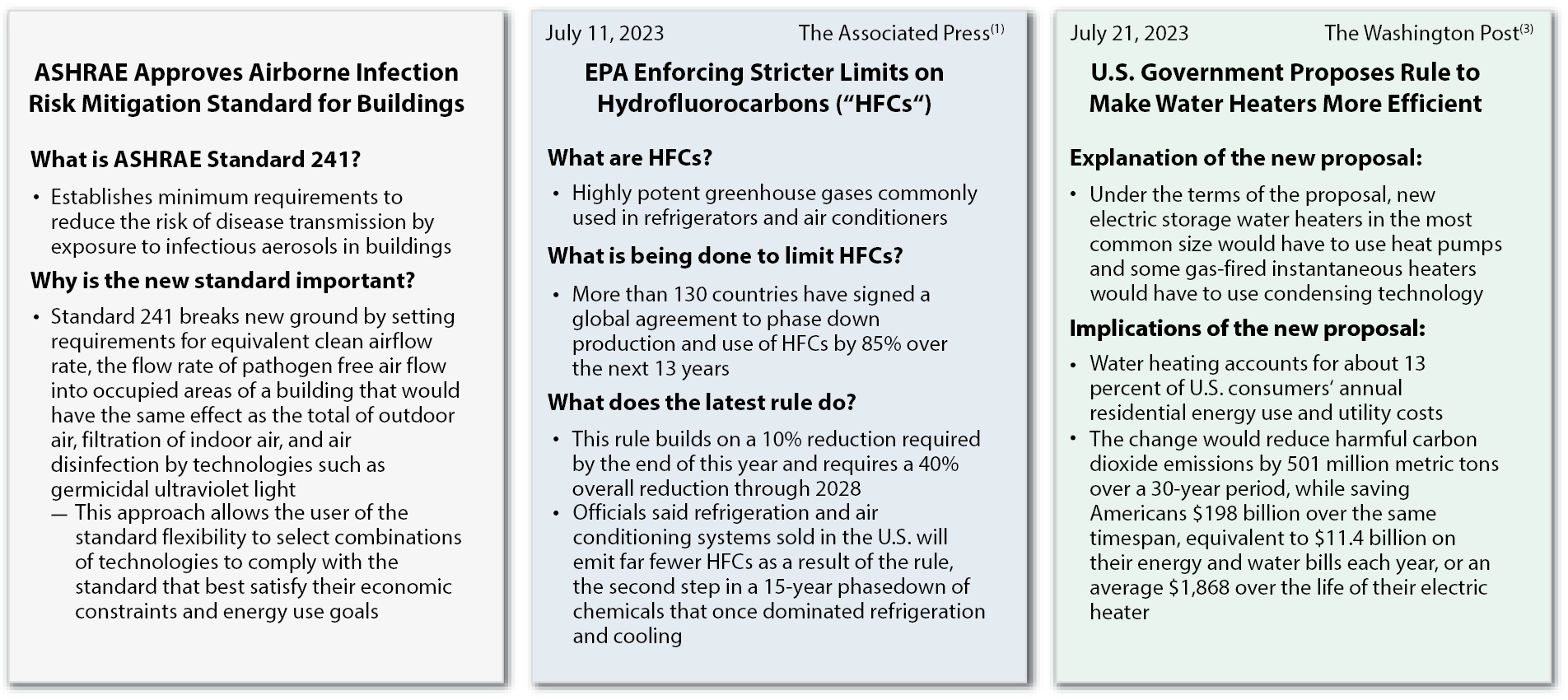

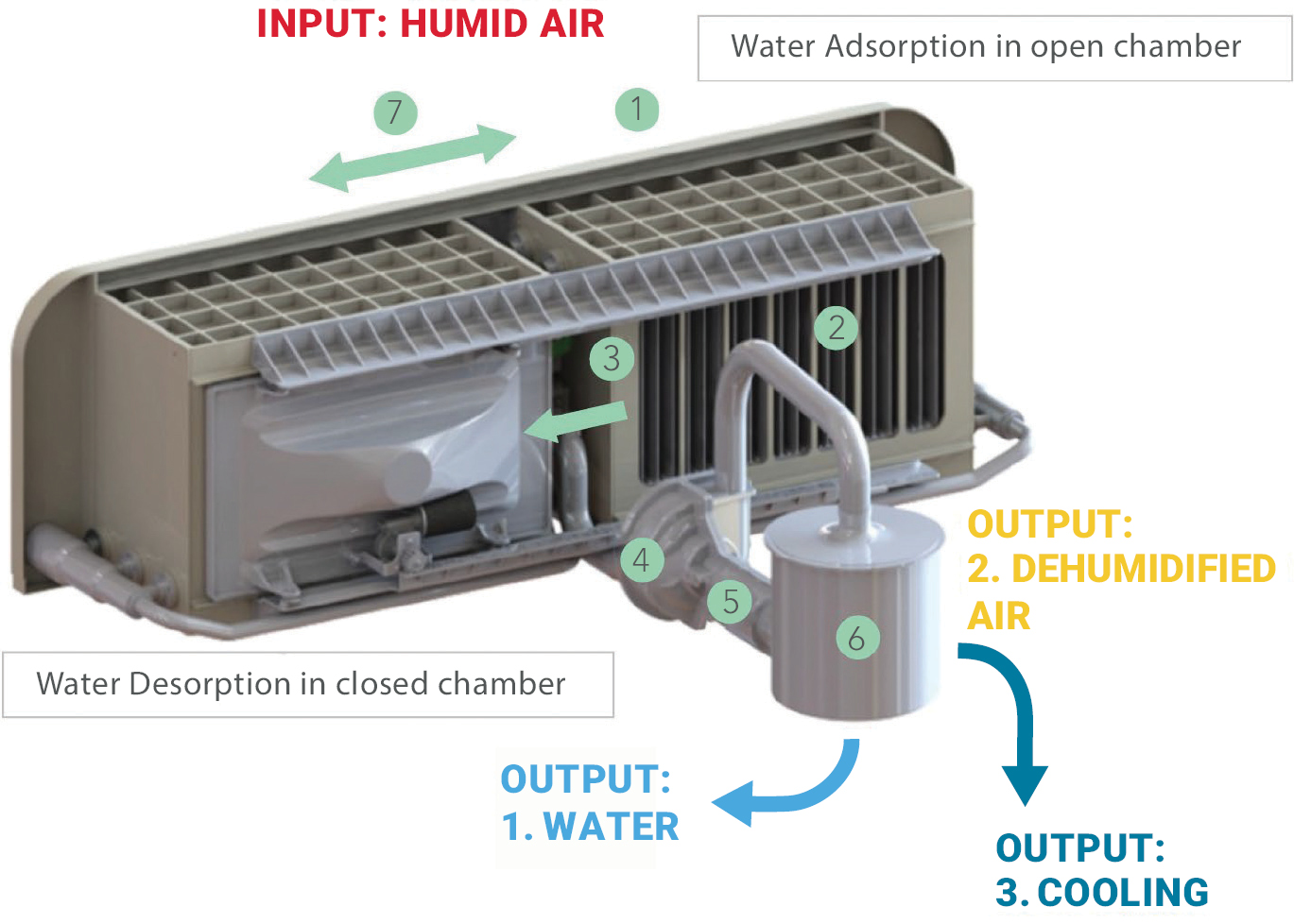

Montana is an atmospheric renewable energy and water harvesting technology company that aims to provide energy and cost-efficient and sustainable dehumidification, evaporative cooling and atmospheric water generation. As compared to currently existing heating, ventilation and air conditioning (“HVAC”) systems, our AirJoule technology is designed to reduce energy consumption, minimize/eliminate harmful refrigerants, and generate material cost efficiencies. AirJoule is a climate solution technology that harvests the untapped supply of renewable thermal energy in water vapor in the atmosphere in an effort to provide significant energy efficiency gains in HVAC, as well as a potential source of potable water. Montana is focused on scaling manufacturing through global joint ventures and deploying AirJoule units worldwide as a key part of the solution to address global warming and water scarcity.

The Business Combination and Related Transactions

On June 5, 2023, XPDB entered into the Merger Agreement with Merger Sub and Legacy Montana, pursuant to which Merger Sub would merge with and into Legacy Montana, with Legacy Montana surviving the merger as a wholly owned subsidiary of the Company. On March 14, 2024 (the “Closing Date”), pursuant to the Merger Agreement, Merger Sub merged with and into Legacy Montana, with Legacy Montana surviving the merger as a wholly owned subsidiary of XPDB (the “Closing”). In connection with the consummation of the Transactions, the Company changed its name from “Power & Digital Infrastructure Acquisition II Corp.” to “Montana Technologies Corporation.”

On March 8, 2024, in connection with the Business Combination, XPDB entered into a subscription agreement (the “PIPE Subscription Agreement”) with a certain investor (the “PIPE Investor”), pursuant to which, among other things, the PIPE Investor agreed to subscribe for and purchase from XPDB, and XPDB agreed to issue and sell to the PIPE Investor, an aggregate of 588,235 newly issued shares of Class A Common Stock (the “Committed Shares”) on the terms and subject to the conditions set forth therein. On March 14, 2024, in connection with the Business Combination, the Company consummated the issuance and sale of the Committed Shares to the PIPE Investor. At the one-year anniversary of the Closing of the Business Combination, the PIPE Investor is eligible to receive up to 840,336 additional newly issued shares of Class A Common Stock at no additional cost, subject to certain conditions set forth in the PIPE Subscription Agreement.

On March 14, 2024, in connection with the consummation of the Business Combination and as contemplated by the Merger Agreement, Montana, Sponsor, and certain other holders of Montana capital stock entered into an Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which Montana agreed to register for resale, pursuant to Rule 415 under the Securities Act, certain shares of Class A Common Stock and other equity securities of the Company that are held by the parties thereto from time to time. Pursuant to the Registration Rights Agreement, the Company agreed to file a shelf registration statement registering the resale of the Class A Common Stock (including those held as of Closing or issuable upon future exercise of the Private Placement Warrants) and the Private Placement Warrants (the “Registrable Securities”) under the Registration Rights Agreement within 30 days after the execution of the Registration Rights Agreement. At any time and from time to time when an effective shelf registration is on file with the SEC, certain stockholders may request to sell all or any portion of their Registrable Securities in an underwritten offering so long as the total offering price is reasonably expected to exceed $25.0 million. The Company also agreed to provide customary “piggyback” registration rights, subject to certain requirements and customary conditions. The Registration Rights Agreement also provides that the Company will pay certain expenses relating to such registrations and indemnify the stockholders against certain liabilities.

1

On March 14, 2024, in connection with the consummation of the Business Combination and as contemplated by the Merger Agreement, Montana, the Sponsor and certain other holders of Montana capital stock entered into lock-up agreements (the “Lock-Up Agreements”), pursuant to which the parties will be subject to certain restrictions on transfer with respect to the shares of Common Stock issued as part of the Merger Consideration (as defined below) beginning at the Closing and ending on the date that is six months after the completion of the Business Combination, and with respect to the Private Placement Warrants, thirty calendar days after the completion of the Business Combination. Following the execution of the Lock-Up Agreements in connection with the Closing, a total of approximately 32,382,023shares of the issued and outstanding Class A Common Stock were subject to the restrictions of the Lock-Up Agreements.

Summary Risk Factors

Our business is subject to a number of risks of which you should be aware before making an investment decision. In particular, you should consider the risk factors described in the section entitled “Risk Factors” beginning on page 5. Such risks include, but are not limited to, the following:

•We are a pre-revenue and development-stage company that has a limited operating history and has not yet commenced any operations, which could make it difficult to make any predictions about our future success or viability.

•We may be unable to successfully develop and commercialize our AirJoule technology.

•Our commercialization strategy relies heavily on our relationships with BASF, CATL, Carrier, GE Vernova and other third parties and partners who may not be easily replaced if our relationships terminate.

•Demand for our products may not grow or may grow at a slower rate than we anticipate.

•We are subject to risks associated with changing technology, product innovation, manufacturing techniques and operational flexibility, which may put us at a competitive disadvantage.

•We may face significant competition from established companies that have longer operating histories, customer incumbency advantages, access to and influence with governmental authorities and more capital resources than we do.

•The estimates and assumptions we use to determine the size of the total addressable market (“TAM”) are based on a number of internal and third-party estimates, which may be incorrect and such inaccuracy could materially and adversely affect our business.

•We may need to defend ourselves against claims that we infringe, have misappropriated or otherwise violate the intellectual property rights of others, which may be time-consuming and would cause us to incur substantial costs related to potential litigation or expensive licenses.

•We may be subject to cyberattacks or a failure in our information technology and data security infrastructure that could adversely affect our business and operations.

•Increased scrutiny of environmental, social, and governance (“ESG”) matters, including our completion of certain ESG initiatives, could have an adverse effect on our business, financial condition and results of operations, result in reputational harm and negatively impact the assessments made by ESG-focused investors when evaluating us.

•Our business may be affected by force majeure events outside of our control, including labor unrest, civil disorder, war, subversive activities or sabotage, climate change, including the increased frequency or severity of natural and catastrophic events, changes in climate change policies and COVID-19 and any future widespread public health crisis may negatively impact our business and operations.

•Our business is subject to liabilities and operating restrictions arising from environmental, health and safety (“EHS”) laws, regulations and permits across multiple jurisdictions.

•We may incur higher costs, including costs to comply with new or more stringent EHS laws and regulations, which may decrease our profitability.

•Our failure to protect our intellectual property rights may undermine our competitive position, and litigation associated with our intellectual property rights may be costly.

2

Corporate Information

We were incorporated under the laws of the state of Delaware on March 23, 2021 under the name “Power & Digital Infrastructure Acquisition II Corp.” Upon the Closing, we changed our name to “Montana Technologies Corporation.” Our Class A Common Stock and Public Warrants are listed on Nasdaq under the symbols “AIRJ” and “AIRJW,” respectively. Our principal executive offices are located at 34361 Innovation Drive, Ronan, MT 59864,and our telephone number is (800) 942-3083. Our website address is https://mt.energy/. The information contained in, or accessible through, our website does not constitute a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

•the option to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus;

•not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”);

•not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

•reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

•exemptions from the requirements of holding a nonbinding advisory vote of stockholders on executive compensation, stockholder approval of any golden parachute payments not previously approved and having to disclose the ratio of the compensation of our chief executive officer to the median compensation of our employees.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of the XPDB IPO. However, if (i) our annual gross revenue exceeds $1.07 billion, (ii) we issue more than $1.0 billion of non-convertible debt in any three-year period or (iii) we become a “large accelerated filer” (as defined in Rule 12b-2 under the Exchange Act) prior to the end of such five-year period, we will cease to be an emerging growth company. We will be deemed to be a “large accelerated filer” at such time that we (a) have an aggregate worldwide market value of common equity securities held by non-affiliates of $700.0 million or more as of the last business day of our most recently completed second fiscal quarter, (b) have been required to file annual and quarterly reports under the Exchange Act, for a period of at least 12 months and (c) have filed at least one annual report pursuant to the Exchange Act.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have elected to use the extended transition period for complying with new or revised accounting standards. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

3

THE OFFERING

Shares of Class A Common Stock offered by us |

| |

Shares of Class A Common Stock offered by the Selling Securityholders |

| |

Warrants offered by the Selling Securityholders |

| |

Shares of Common Stock outstanding prior |

| |

Shares of Class A Common Stock |

| |

Exercise price per Warrant | $11.50. | |

Use of proceeds | We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. We will receive up to approximately $293.3 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash, but not from the sale of the shares of Class A Common Stock issuable upon such exercise. Each Warrant entitles the holder thereof to purchase one share of our Class A Common Stock at a price of $11.50 per share. On April10, 2024, the closing price for our Class A Common Stock was $11.00. If the price of our Class A Common Stock remains below $11.50 per share, we believe warrant holders will be unlikely to cash exercise their Warrants, resulting in little or no cash proceeds to us. | |

Risk factors | You should carefully read the “Risk Factors” beginning on page 5 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our Common Stock or Warrants. | |

Nasdaq symbol for our Class A |

| |

Nasdaq symbol for our Warrants | “AIRJW” |

4

RISK FACTORS

You should carefully consider the risks and uncertainties described below and the other information in this prospectus before making an investment in our Common Stock or Warrants. Our business, financial condition, results of operations, or prospects could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our Class A Common Stock and Public Warrants could decline and you could lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors, including those set forth below.

Risks Related to this Offering by the Selling Securityholders

Sales of a substantial number of our securities in the public market by the Selling Securityholders and/or by our existing securityholders could cause the price of our shares of Class A Common Stock and Public Warrants to fall.

This prospectus relates to the offer and resale from time to time by the Selling Securityholders of (i) up to 54,825,138 shares of Class A Common Stock, constituting approximately 69.1% of our issued and outstanding shares of Class A Common Stock and approximately 131.7% of our issued and outstanding shares of Class A Common Stock held by non-affiliates (assuming, in each case, the exercise of all of our Warrants), in each case, as of April10, 2024, which consists of (a) up to 31,164,761 shares of Class A Common Stock issued in connection with the Business Combination at an assumed value of $10.00 per share by certain of the Selling Securityholders named in this prospectus, (b) up to 4,759,642shares of Class A Common Stock issuable upon the conversion of 4,759,642shares of Class B Common Stock issued in connection with the Business Combination at an assumed value of $10.00 per share by certain of the Selling Securityholders named in this prospectus, (c) up to 6,827,969 shares of Class A Common Stock issued to the Sponsor upon the conversion of 6,827,969 Founder Shares in connection with the consummation of the Business Combination, which Founder Shares were originally acquired at a price of $0.004 per share in connection with the XPDB IPO by the Sponsor, (d) up to 90,000shares of Class A Common Stock issued to the Former Independent Directors upon the conversion of 90,000 Founder Shares in connection with the consummation of the Business Combination, which Founder Shares were initially acquired from the Sponsor for services rendered to XPDB at no cost, by certain of the Selling Securityholders named in this prospectus, (e) up to 269,531shares of Class A Common Stock issued to the Anchor Investors in connection with the consummation of the Business Combination, which shares were purchased from the Sponsor at a purchase price $0.004 per share concurrently with the consummation of the Business Combination, by certain of the Selling Securityholders named in this prospectus, (f) up to 11,125,000 shares of Class A Common Stock that are issuable upon the exercise of the Private Placement Warrants that were originally issued at a price of $1.00 per Warrant by certain of the Selling Securityholders named in this prospectus, and (g) up to 588,235shares of Class A Common Stock issued in the PIPE Investment at a purchase price of $8.50 per share by the PIPE Investor and (ii) up to 11,125,000 Private Placement Warrants constituting approximately 43.6% of our issued and outstanding Warrants, which Private Placement Warrants were originally issued at a price of $1.00 per Warrant by certain of the Selling Securityholders named in this prospectus.

Sales of a substantial number of our shares of Common Stock and/or Warrants in the public market by the Selling Securityholders and/or by our other existing securityholders, or the perception that those sales might occur, could depress the market price of our shares of Class A Common Stock and Public Warrants and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that such sales may have on the prevailing market price of our shares of Class A Common Stock and Public Warrants.

The Sponsor beneficially owned approximately 18.6% of the number of shares of Common Stock issued and outstanding immediately following consummation of the Business Combination (including the redemption of shares of Class A common stock of XPDB in connection with the consummation of the Business Combination and assuming exercise in full of the Warrants), which shares of Class A Common Stock are registered for resale pursuant to this prospectus. The Sponsor will be able to sell all such registered shares (subject to contractual lockups) for so long as the registration statement of which this prospectus forms a part is available for use. See “Beneficial Ownership” and “Selling Securityholders” for additional details on the Sponsor’s beneficial ownership. We are unable to predict the effect that such sales may have on the prevailing market price of our shares of Class A Common Stock and Warrants.

5

Certain existing stockholders, including certain of the Selling Securityholders, purchased, or may purchase, securities in the Company at a price below the current trading price of such securities, and may experience a positive rate of return based on the current trading price. Future investors in the Company may not experience a similar rate of return.

Certain stockholders in the Company, including certain of the Selling Securityholders, acquired, or may acquire, shares of our Common Stock or Warrants at prices below the current trading price of our Class A Common Stock, and may experience a positive rate of return based on the current trading price. The sale of all the securities being offered in this prospectus could result in a significant decline in the public trading price of our securities. Despite such a decline in the public trading price, some of the Selling Securityholders may still experience a positive rate of return on the securities they purchased due to the differences in the purchase prices described above. Based on the closing price of our Class A Common Stock of $11.00 on April10, 2024, (i) the Sponsor may experience potential profit of up to $10.996 per share (or approximately $75.1million in the aggregate based on the Sponsor’s beneficial ownership of 6,827,969 Founder Shares) with respect to sales of Class A Common Stock based on the Sponsor’s initial purchase price of approximately $0.004 per Founder Share, (ii) the Former Independent Directors may experience potential profit of up to $11.00 per share (or approximately $1.0 million in the aggregate based on the Former Independent Directors’ beneficial ownership of 90,000shares of Class A Common Stock) with respect to sales of Class A Common Stock based on the Former Independent Directors having acquired the shares of Class A Common Stock at no cost in exchange for services rendered to XPDB, (iii) the Anchor Investors may experience potential profit of up to $10.996 per share (or approximately $3.0million in the aggregate based on the Anchor Investors’ beneficial ownership of 269,531shares of Class A Common Stock) with respect to sales of Class A Common Stock based on the Anchor Investors’ initial purchase price of $0.004 per Founder Share and (iv) the PIPE Investor may experience potential profit of up to $2.50 per share (or approximately $1.5million in the aggregate based on the PIPE Investor’s beneficial ownership of 588,235shares of Class A Common Stock) with respect to sales of Class A Common Stock based on the PIPE Investor’s initial purchase price of $8.50 per share of Class A Common Stock. Additionally, at the one-year anniversary of the closing of the Business Combination, the PIPE Investor is eligible to receive up to 840,336 additional newly issued shares of Class A Common Stock at no additional cost, subject to certain conditions set forth in the PIPE Subscription Agreement. Public securityholders may not be able to experience the same positive rates of return on securities they purchase due to the low price at which the Sponsor and the PIPE Investor purchased shares of Class A Common Stock.

Our Warrants are exercisable for shares of Class A Common Stock, which exercises will increase the number of shares of Class A Common Stock eligible for future resale in the public market and result in dilution to our existing stockholders.

The outstanding Warrants to purchase an aggregate of 25,500,000shares of Class A Common Stock become exercisable on April 13, 2024. Each Warrant entitles the holder thereof to purchase one share of our Class A Common Stock at a price of $11.50 per whole share. Warrants may be exercised only for a whole number of shares of Class A Common Stock. To the extent such warrants are exercised, additional shares of Class A Common Stock will be issued, which will result in dilution to the then existing holders of Class A Common Stock and increase the number of shares eligible for resale in the public market. Sales of substantial numbers of such shares in the public market could adversely affect the market price of Class A Common Stock.

On April10, 2024, the closing price for our Class A Common Stock was $11.00. If the price of our Class A Common Stock remains below $11.50 per share, we believe warrant holders will be unlikely to cash exercise their Warrants, resulting in little or no cash proceeds to us.

Risks Related to Our Business and Our Industry

We have not yet commenced planned business line activities and have a limited operating history, which may make it difficult to evaluate the prospects for our future viability. There is no assurance that we will successfully execute our proposed strategy.

We are a pre-revenue and development-stage company. We were established as Montana Technologies LLC in 2018, have not commenced any operations and have no history of commercializing our AirJoule technology. Our limited operating history may make it difficult for you to evaluate our current business and future prospects as we continue to grow our business. Our ability to forecast future operating results is subject to a number of uncertainties, including our ability to plan for and model future growth. We have encountered risks and uncertainties frequently experienced

6

by growing companies in rapidly evolving industries, and we will continue to encounter such risks and uncertainties as we grow our business. If our assumptions regarding these uncertainties are incorrect, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations, and our business could suffer. Consequently, any predictions we make about our future success and our viability may not be as accurate as they could be if we had an operating history.

We will initially depend on revenue generated from a single product and in the foreseeable future will be significantly dependent on a limited number of products.

After we have successfully developed and commercialized our AirJoule technology, we will initially depend on revenue generated from our AirJoule units for the foreseeable future and will be significantly dependent on a single or limited number of products. Given that, for the foreseeable future, our business will depend on a single or limited number of products, to the extent that a particular product is not well-received by the market, our sales volume, prospects, business, results of operations and financial condition could be materially and adversely affected.

We face significant barriers in our attempts to deploy our technology and may not be able to successfully develop our technology. If we cannot successfully overcome those barriers, it could adversely impact our business and operations.

The technology behind our AirJoule units is very complex, and, while we have successfully produced a prototype unit within our test facility, we are still in the process of producing a unit that delivers dehumidified air, cooling and volume of water at the energy efficiency that we are anticipating we can achieve. If we are unable to successfully develop our technology, our operating and financial results could materially differ from our expectations and our business could suffer.

Our commercialization strategy relies heavily on our relationships with BASF, CATL, Carrier, GE Vernova and other third parties and partners who may have interests that diverge from ours and who may not be easily replaced if our relationships terminate, which could adversely impact our business and financial condition.

We anticipate that the growth of our business will depend on third-party relationships, including service providers, suppliers, sellers, distributors, consultants, referral sources and other partners. In particular, our commercialization strategy relies heavily on our relationships with BASF, CATL, Carrier Corporation (collectively with its affiliates, “Carrier”) and GE Vernova (as defined below), and may rely on strategic partnerships with other entities that we may form in the future. We have entered into a development agreement with BASF for the production of engineered super-porous materials that are applied as a coating to AirJoule contactors to perform the energy and water-harvesting function, and we are continuing to work with BASF to execute an ongoing development agreement to scale for mass production and global manufacturing and supply. Additionally, we have entered into a joint venture agreement with an affiliate of CATL to manufacture and commercialize our AirJoule technology in certain countries. We and CAMT (as defined herein) have also entered into the Binding Term Sheets with Carrier, pursuant to which, among other things, the parties agreed to negotiate in good faith to finalize and enter into, as promptly as reasonably practicable, definitive agreements relating to the development of the Applicable Products (as defined in the Binding Term Sheets) and the viability of the commercialization of the Applicable Products. Subject to certain milestones to be set forth in the definitive agreements relating to the proposed collaboration, the Binding Term Sheets provide that Carrier will have (i) the exclusive right to commercialize the Applicable Products in North and South America (subject, in each case, to exclusively sourcing primary components of the AirJoule technology from Montana, its designated affiliates and joint venture entities of which Montana is a member) for a period of three years from the earlier of (a) the date of the definitive agreement relating thereto and (b) the first commercialization of the Applicable Products by Carrier and (ii) a non-exclusive right to commercialize the Applicable Products in Europe, India and the Middle East (subject, in each case, to exclusively sourcing primary components of the AirJoule technology from CAMT or its affiliates) for a period of three years from the first commercialization of the Applicable Products by Carrier. Despite entry into the Binding Term Sheets, we and CAMT ultimately may not enter into definitive agreements with Carrier on terms consistent with the Binding Term Sheets or at all. Additionally, we have entered into the following agreements with GE Vernova: (i) the A&R Joint Venture Agreement, pursuant to which, among other things, the AirJoule JV (as defined below) has the exclusive right to manufacture and supply products incorporating the combined technologies to leading original equipment manufacturers and customers in the Americas, Africa and Australia; (ii) master services agreements, pursuant to which, among other things, each party to the agreement agreed to provide certain agreed services to the AirJoule JV for a period of at least two years following the JV Closing (as defined below) (unless earlier terminated by the parties thereto); and (iii) an intellectual property agreement, pursuant to which, among other things, each of the Company and GE Vernova Parent (as defined below) agreed to license certain intellectual property to the AirJoule JV.

7

Our heavy reliance on these business partners could adversely affect our business and financial condition if any of these partners chooses to terminate its relationship with us or make material changes to its businesses, products or services in a manner that is adverse to us.

Further, while we intend to pursue additional relationships with other third parties, including relationships providing exclusive commercialization rights for AirJoule technology in other parts of the world, identifying, negotiating and documenting relationships with third parties, as well as integrating third-party products and services requires significant time and resources, and we may not be successful in doing so.

Demand for our products may not grow or may grow at a slower rate than we anticipate.

To date, we have not had any sales of our products, but we have engaged with partners like BASF, CATL, Carrier and GE Vernova and plan to engage with other tier-1 strategic partners, to assist us with the commercialization of our AirJoule units. Operating results are difficult to forecast as they generally depend on our assessment of the demand for our products. Our business may be affected by reductions in demand for our products and the price of competitors’ products as a result of a number of factors which may be difficult to predict. Similarly, our assumptions and expectations with respect to margins and the pricing of our AirJoule unit may not prove to be accurate. We may be unable to adopt measures in a timely manner to compensate for any unexpected shortfall in demand, which could ultimately cause our operating results to differ from expectations. If actual results differ from our estimates, analysts or investors may negatively react and our share price could be materially adversely affected.

Our financial results depend on successful project execution and may be adversely affected by cost overruns, failure to meet customer schedules, failure of our suppliers or partners to fulfill their obligations to us or other execution issues.

Commercialization of our AirJoule units is subject to a number of significant risks, including project delays, cost overruns, changes in scope, unanticipated site conditions, design and engineering issues, incorrect cost assumptions, increases in the cost of materials and labor, health and safety hazards, third-party performance issues and changes in laws or permitting requirements. If a third party or other subcontractor that we have contracted fails to fulfill its contractual obligations to us, we could face significant delays, cost overruns and liabilities. Our continued growth will depend in part on executing a greater volume of large projects, which will require us to expand and retain our project management and execution personnel and resources. If we are unable to manage these risks, we may incur higher costs, liquidated damages and other liabilities, which may decrease our profitability and harm our reputation.

COVID-19 and any future widespread public health crisis could negatively affect various aspects of our business, make it more difficult for us to meet our obligations to our future customers and result in reduced demand for our products.

Examples of how COVID-19 and any future widespread public health crisis may impact our business, results of operations and the price of our securities in the future include, but are not limited to:

•such event may interfere with our ability, or the ability of our employees, contractors, suppliers and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business;

•such event may cause disruptions from the temporary closure or suspension of activities related to the relocation of our facilities, third-party suppliers and manufacturers or restrictions on our employee’s and other service providers’ ability to travel; and

•such event and related government responses to address any such event may cause sudden and extreme changes in the price of our securities.

New variants of COVID-19 and other future public health crises and pandemics may affect our operating and financial results in a manner that is not presently known to us or not presently considered to be a significant risk to our operations. Furthermore, our limited operating history combined with the uncertainty created by the COVID-19 pandemic significantly increases the difficulty of forecasting operating results and of strategic planning. If we are unable to effectively predict and manage the impact of the COVID-19 pandemic and other future public health crises on our business, our results of operations and financial condition may be negatively impacted.

8

Any financial or economic crisis, or perceived threat of such a crisis, including a significant decrease in consumer confidence, may materially and adversely affect our business, financial condition and results of operations.

In recent years, global economies have suffered dramatic downturns as a result of the COVID-19 pandemic, a deterioration in the credit markets and related financial crisis, and a variety of other factors including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, inflation, ratings downgrades of certain investments and declining valuations of others. The United States and certain other governments have taken unprecedented actions in an attempt to address and rectify these extreme market and economic conditions by providing liquidity and stability to the financial markets. The outcome of the actions taken by these governments is still ongoing and, consequently, the return of adverse economic conditions may negatively impact the demand for our technology and may negatively impact our ability to raise capital, if needed, on a timely basis and on acceptable terms or at all.

Manufacturing issues not identified prior to design finalization, long-lead procurement and/or fabrication could potentially be realized during production or fabrication and may impact our deployment cost and schedule, which could adversely impact our business.

It is possible that in the future we may experience delays and other complications from our partners and third-party suppliers in the development and manufacturing of the components and other implementing technology required for deploying our AirJoule units. Any disruption or delay in the development or supply of such components and technology could result in the delay or other complication in the design, manufacture, production and delivery of our technology that could prevent us from commercializing our AirJoule units according to our planned timeline and scale. If delays like this recur or if we experience issues with planned manufacturing activities, supply of components from third parties or design and safety, we could experience issues or delays in commencing or sustaining our commercial operations.

If we encounter difficulties in scaling our production and delivery capabilities, if we fail to develop such technologies before our competitors or if such technologies fail to perform as expected, are inferior to those of our competitors or are perceived as less safe than those of our competitors, our business, reputation and financial condition could be materially and adversely impacted.

Our sales and profitability may be impacted by, and we may incur liabilities as a result of, warranty claims, product defects, recalls, improper use of our products, or our failure to meet performance guarantees or customer safety standards.

We anticipate that our customers will require product warranties as to the proper operation and conformance to specifications of the products we manufacture or install. Failure of our products to operate properly or to meet specifications of our customers or our failure to meet our performance guarantees may increase costs by requiring additional engineering resources and services, replacement of parts and equipment or monetary reimbursement to a customer, or could otherwise result in liability to our customers. There are significant uncertainties and judgments involved in estimating warranty and performance guarantee obligations, including changing product designs, differences in customer installation processes and failure to identify or disclaim certain variables. To the extent that we incur substantial warranty or performance guarantee claims in any period, our reputation, earnings and ability to obtain future business could be materially adversely affected.

Increased scrutiny of ESG matters, including our completion of certain ESG initiatives, could have an adverse effect on our business, financial condition and results of operations, result in reputational harm and negatively impact the assessments made by ESG-focused investors when evaluating us.

We are increasingly facing more stringent ESG standards, policies and expectations, and expect to continue to do so with growing operations. Companies across all industries are facing increasing scrutiny from a variety of stakeholders, including investor advocacy groups, proxy advisory firms, certain institutional investors and lenders, investment funds and other influential investors and rating agencies, related to their ESG and sustainability practices. We generally experience a strong ESG emphasis among our customers, partners and competitors. Some of these stakeholders maintain standards, policies and expectations regarding environmental matters (e.g., climate change and sustainability), social matters (e.g., diversity and human rights) and corporate governance matters (e.g., taking into account employee relations when making business and investment decisions, ethical matters and the composition of

9

the board of directors and various committees). There is no guarantee that we will be able to comply with applicable ESG standards, policies and expectations, or that we will, from the perspective of other stakeholders and the public, appear to be complying with such ESG standards, policies and expectations. If we do not adapt to or comply with investor or other stakeholder standards, policies, or expectations on ESG matters as they continue to evolve, or if we are perceived to have not responded appropriately or quickly enough to growing concern for ESG and sustainability issues, regardless of whether there is a regulatory or legal requirement to do so, we may suffer from reputational damage and our business, financial condition and/or stock price could be materially and adversely affected.

While we may at times engage in or prepare voluntary ESG initiatives and disclosures to respond to stakeholder expectations or to improve our ESG profile, such initiatives and disclosures may be costly and may not have the desired effect. Expectations regarding our management of ESG matters continues to evolve rapidly, in many instances due to factors that are beyond our control. For example, we may ultimately be unable to complete certain initiatives or targets, either on the timelines initially announced or at all, due to technological, cost, or other constraints, which may be within or outside of our control. Moreover, our ESG actions or statements may be based on expectations, assumptions, or third-party information that we currently believe to be reasonable, but which may subsequently be determined to be erroneous or be subject to misinterpretation. If we fail to, or are perceived to fail to, implement certain ESG initiatives or achieve certain ESG objectives, we may be subject to various adverse impacts, including reputational damage and potential stakeholder engagement and/or litigation, even if such initiatives are currently voluntary. Certain market participants, including major institutional investors and capital providers, use third-party benchmarks and scores to assess companies’ ESG profiles in making investment or voting decisions. Unfavorable ESG ratings could lead to increased negative investor sentiment towards us or our industry and to the diversion of investment to other industries, which could negatively impact our share price as well as our access to and cost of capital.

Moreover, because of the industry we are in, any of our operational or strategic efforts may be viewed as relating to our ESG initiatives and, even if those initiatives are undertaken voluntarily, they may still be viewed as relating to our operational and strategic efforts. This means that if we fail, or are perceived to fail, to implement certain ESG initiatives or achieve certain ESG objectives it could have a disproportionately negative impact on our business.

Actual or perceived failure to comply with ESG standards may detrimentally affect our business in a variety of ways. Among others, we could face challenges with procuring investments and financing, whether for general business purposes or for specific projects, and we could have difficulty attracting or retaining employees. Accordingly, failure to establish a sufficiently strong ESG profile relative to our peers could limit our ability to generate and successfully utilize business opportunities. We also note that divergent views regarding ESG principles are emerging in the U.S., and in particular, in U.S. state-level regulation and enforcement efforts. In the future, various U.S. regulators, state actors and other stakeholders may have views on ESG matters, the renewable energy industry, the energy transition or our business that are less favorable to our business or operations, or such stakeholders may seek to impose additional regulation and restrictions on us or our business. Any such events could have material adverse effects on our business, financial condition, results of operations, cash flow and prospects.

We also expect there will likely be increasing levels of regulation, disclosure-related and otherwise, with respect to ESG matters. We may be subject to ESG or sustainability-related regulation in multiple jurisdictions, including the U.S., and complying with these regulations in multiple jurisdictions may increase the complexity and cost of our compliance efforts. Moreover, increased regulation and increased stakeholder expectations will likely lead to increased costs as well as scrutiny that could heighten all of the risks identified in this risk factor. Additionally, many of our customers and suppliers may be subject to similar expectations, which may augment or create additional risks, including risks that may not be known to us.

Our ability to realize projects may be impaired should we fail to adhere to the common ESG standards in our industry. Moreover, such failure could result in reputational damage for us among both potential customers and investors. Any of the foregoing could have a material adverse effect on our business, financial condition, results of operations, cash flow and prospects. For further information regarding ESG-related risk, see “There are risks associated with operating in foreign countries, including those related to economic, social and/or political instability, and changes of law affecting foreign companies operating in that country. In particular, we may suffer reputational harm due to our business dealings in certain countries that have previously been associated, or perceived to have been associated, with human rights issues. Increased scrutiny and changing expectations from investors regarding environmental, social and governance (“ESG”) considerations may result in the decrease of the trading price of our securities.”

10

Physical and transition risks arising from climate change, including risks posed by the increased frequency or severity of natural and catastrophic events and regulations or policies related to climate change, may negatively impact our business and operations.