As filed with the Securities and Exchange Commission on November 12, 2019

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact Name of Registrant as Specified in Its Charter)

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Statement. If any of the securities being registered on box.þ If this

☐ If this If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.☐ CALCULATION OF REGISTRATION FEE

(1) Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

(3) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. (4) We have agreed to issue, upon the closing of this offering, warrants to The Benchmark Company, LLC entitling it to purchase a The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and SUBJECT TO COMPLETION, DATED NOVEMBER 12, 2019 PRELIMINARY PROSPECTUS Shares

Common Stock

We are offering Prior to this offering,

so listed. Our common stock is currently listed on the OTCQB Marketplace (the “OTCQB”) under the symbol “NUZE.” We have assumed a public offering price of $11.00 per share, the last reported sale price for our common stock as reported on the OTCQB on October 22, 2019 (which does not give effect to the reverse stock split described below due to the absence of sale price data following the effectiveness of the reverse stock split). The actual public offering price per share will be We completed a l-for-3 reverse stock split on October 28, 2019, which became effective on November 12, 2019. All share and per share information in this prospectus (except the last reported sale price for our

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

____________

We have granted a 45-day option to the underwriters to purchase up to an additional shares of common stock solely to cover overallotments, if any, at the public offering price, less underwriting discounts and commissions.

Delivery of the shares offered hereby will be made on or about , 2019. Sole Book-Running Manager The Benchmark Company

Prospectus dated , 2019

TABLE OF CONTENTS

We

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, filings of public companies in our industry and internal company surveys. These sources may include government and industry sources. Industry publications and surveys generally state that the

Until , 2019 (25 days after the date of this prospectus), all dealers that buy, sell or trade our i

Unless the context otherwise requires, the terms NuZee, the Company, our company, we, us, and our, refer to NuZee, Inc. We completed a l-for-3 reverse stock split on Overview Our Company We We believe we are the only commercial-scale producer of single serve drip cup coffee and that we have contractual protections and certain other advantages in place within the North American market, as outlined by the factors described below. As we have with Kraft Heinz, and in particular their Gevalia Kaffe brand, and Royal Cup Coffee & Tea, we intend to leverage our position to be the commercial manufacturer of choice for major companies seeking to enter the single serve drip cup market in North America. We target existing large, high-margin companies and are paid per-package based on the number of single serve pour over drip cups produced by us. Accordingly, we consider our business model to be a form of tolling arrangement, as we receive a fee for every single serve drip cup our co-packing customers sell in the North American market. While we financially benefit from the We may also consider co-packaging other products that are complementary to single serve pour over drip coffee and provides us with a deeper access to our customers, such as tea bag coffee.

Single serve pour over coffee, or hand drip coffee, is a traditional and time-honored technique that pours hot water onto ground coffee with a filter. Proponents of drip coffee believe this method makes better coffee. Single serve pour over coffee uses the same technique without a machine, with the coffee flowing straight into a cup using only hot water and the prepacked coffee filter. The image below compares our single serve pour over coffee to other varieties of hot beverages.

Moreover, we believe the The saturation of coffee pods in the North American market, coupled with changing tastes, provides our single serve drip cups with a substantial market opportunity in North America. Our single serve drip cup solution also has a number of advantages over other single serve coffee alternatives: Our single serve drip coffee packaging is fully recyclable and does not use any plastics. The majority of the packaging is paper based and biodegradable, while the foil used to package the filter for freshness is recyclable. Our solution is portable and does not require a machine. Therefore, the consumer investment required to try our product is very minimal (as opposed to machine based solutions). Single serve drip cups can easily travel and have a number of consume-later applications not available to machine based solutions (camping, travel, office, etc.). We believe single serve drip coffee is more hygienic than other, machine-based single serve alternatives. For example, the use of a

cup level.

We own sophisticated packing equipment developed by East Asian companies for pour over coffee production. We believe these manufacturers are the world leaders for supplying pour over coffee production. We have entered into a written exclusivity agreement with the premier supplier of the We received Level 2 SQF Certification from the Safe Quality Food Institute, which is a customary requirement to produce for large multi-national and international companies. Obtaining Level 2 SQF Certification may take more than a year to achieve. We are also certified as fair trade, organic, kosher and halal. Our primary focus is the development of single serve pour over coffee in the North American market targeting the individual consumer for use at home and office or other settings that would benefit from single serve pour over products, such as our recent expansion into the lodging market through our arrangement with Royal Cup Coffee & Tea, and positioning ourselves as the leading commercial-scale co-packer of single serve pour over coffee products. We may also look to co-package other products that are complementary to single serve pour over drip coffee and provides us with a deeper access to our customers, such as tea bag coffee. The competitive landscape for our services and products can be illustrated as follows:

Since 2016, we have been primarily focused on single serve pour over coffee production. Over this time we have developed expertise in the operation of our sophisticated packing equipment and the related production of the single serve pour over product at both our Vista, California facility and at our production operations in Korea. We plan to carry over this expertise to our recently announced Plano, Texas manufacturing facility, which will serve as our new single serve pour over co-packing hub and corporate headquarters to capture the location’s logistical advantages and lower cost structure. Our sources of revenue Co-packing We operate as a third-party contract packager for the finished goods of other major companies operating in the coffee beverage industry. Under these arrangements, we produce and package coffee products according to our customers’ formulations and specifications. We currently focus on fostering co-packing arrangements with larger companies developing pour over coffee products. For example, we recently entered into co-packing agreements with Kraft Heinz, under their Gevalia Kafee® brand, and Royal Cup Coffee & Tea. In addition to larger companies, we package for smaller companies that have significant growth potential. For example, we started packaging for Copper Cow in July 2017 and continue to do so today. Copper Cow started with smaller batch, single product SKUs but over the years has meaningfully increased order sizes as well as the number of SKUs. We are continually looking for new exciting companies to work with and grow with like Copper Cow. NuZee branded products We have developed products and brands for the primary reason of providing completed finished products to showcase to potential co-packing customers. Our products effectively serve as a sort of “sample” to potential customers that include high quality packaging and coffee. We have received indications of interest from some potential customers in co-packing single serve coffee under the customer’s brand using coffee sourced by us as opposed to the customer providing the coffee, which is how we typically co-pack for customers. Barista.Our Barista line of products is a high end product line that, in addition to showcasing our production expertise, also includes what we believe to be some of the best coffee available in a single serve application in the world. We plan to sell Barista via traditional retail channels that do not use “pay for placement” distributors. We also have a number of potential co-packing opportunities in which our customers would contract for us to replicate one or more of our Barista products with their foil and packing, providing further evidence of the high-quality nature of this line and coffee. We expect the Barista product line to be our flagship products that are both sold directly to consumers and used as a sales Twin Peaks.We currently sell our Twin Peaks single serve pour over coffee exclusively via Amazon, under Amazon’s accelerator program. This program commenced in Pine Ranch. Pine Ranch is a tea bag-style coffee that is available in two distinct roasts: a medium roast called “Smooth Blend” and a dark roast called “Bold Blend”. We introduced this product line in the third quarter of 2019. The brand is initially being sold to retailers and at wholesale, and we plan to offer it direct to consumers in 2020. Pine Ranch is available in dispense boxes that are suitable for offices and retail stores. Pine Ranch is also a zero-landfill product that we can showcase to potential co-packing customers as an alternative to the pour over format. We commenced production for our first tea bag style co-packing customer Recent momentum and current co-packing clients

A select list of our current co-packing customers include: Gevalia Kafee (Kraft Heinz), Royal Cup Coffee & Tea, Copper Cow Coffee, Alumbre Coffee, C&C Hawaii Coffee, Lion Coffee, Idyllwild Coffee and

We Our competitive strengths

We believe that the •Favorable industry trends benefit us.With changing consumer preferences over the last decade that include a greater demand for higher quality coffee alternatives as well as greater flexibility and convenience, we believe we provide a unique alternative to non-single serve drip products currently on the •Exclusivity provides us protection in our core market.We have an exclusive agreement with the world’s leading manufacturer of equipment and filters used in packaging single serve pour over coffee. We believe that this agreement along with our operating expertise and SQF Level 2 certifications provide us with meaningful protections from the entry of potential competitors in our core North American market. •Significant production and operational experience in single serve pour over coffee.We have been producing single serve pour over coffee for almost four years in increasing scale and complexity. We believe the process and equipment for producing pour over single serve coffee is •Co-packing agreements with large international companies.We have recently announced a co-packing agreement with a large international company. We believe that as our potential co-packing customers continue to realize that we have the pack for large international companies almost always meet or exceed the standards required to co-pack for any other customer. We also believe that as our co-packing customers’ competitors realize they have a single serve pour over •Food grade SQF Level 2 certification. SQF Level 2 certification can take up to a

•Our Japanese and Korean subsidiaries support our U.S. operations. We have a sales office in Japan and a manufacturing and sales office in Korea. We source our manufacturing equipment and filters from East Asian companies, and have an exclusive agreement with FUSO, a Japanese manufacturer. We believe that having offices in Japan and Korea provides us with direct access to Our business strategy

We intend to •Continually grow our base of large national or international co-packing customers.We have recently announced a

•Co-pack for smaller scale, rapidly growing, innovative coffee customers and

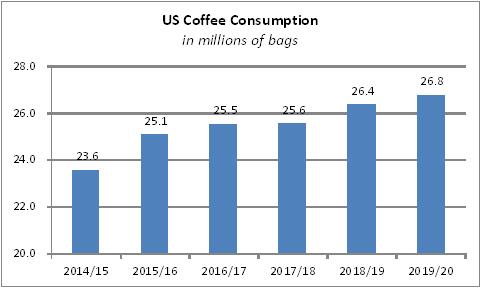

•Increase our production capacity in response to growing demand for co-packing.We have entered into a lease for our planned manufacturing hub in Plano, Texas. We have started to order equipment, begin the SQF Level 2 certification process and begin other processes to have the facility operational by our second fiscal quarter of the upcoming fiscal year (on or •Strategically grow and expand our international operations that are strategic to our vision.We plan to strategically grow our current international operations as well as potentially expand international if this growth or expansion is strategic to our vision. We believe the Korean market, albeit competitive, still has significant growth potential as well as strong market acceptance for coffee and single serve pour overs. As we look at other potential international manufacturing locations, we look for characteristics similar to the Korean and U.S. markets. •Strategically increase the sales of our proprietary brands.We plan to continue to increase the sales of our proprietary brands without utilizing “pay for placement” distributors. We anticipate our direct sales of our proprietary products will benefit as we increase our co-packing revenues because our co-packing customers will help educate consumers on the benefits of single serve pour coffee. We plan to increase our effort on direct sales methodically and concurrently as we increase co-packing revenues and volume. Industry Coffee consumption is at an all-time high. According to the United States Department of Agriculture (USDA), global coffee consumption is forecast to reach a record 167.9 million bags in 2019/20 (a bag is equivalent to 60 kilograms). The United States is the country with the highest consumption with 26.8 million bags forecast for 2019/20, up from 23.6 million in 2014/15 (a 2.6 percent compound annual growth rate, or CAGR)1.

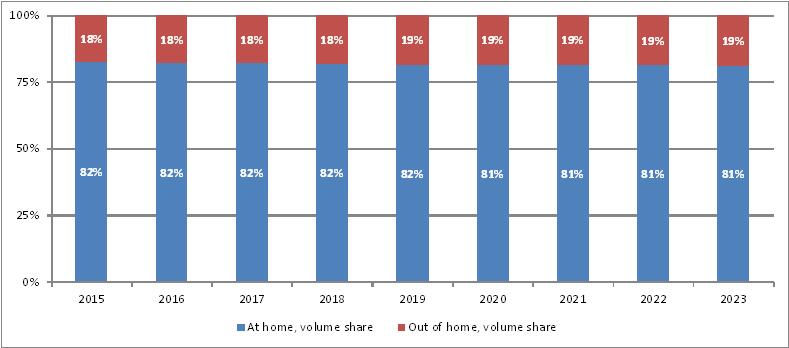

An estimated 63 percent of American adults drink coffee on a daily basis3, and an increasing number of consumers seem to be seeking bolder and more unique coffee experiences. This is evidenced by more Americans’ gourmet coffee consumption reaching a 60/40 advantage over traditional non-gourmet coffee for the first time in the 69-year history of the National Coffee Association’s annual report on coffee consumption.4 The “at home” segment continues to dominate coffee consumption, with 81 percent of volume consumption attributable to the

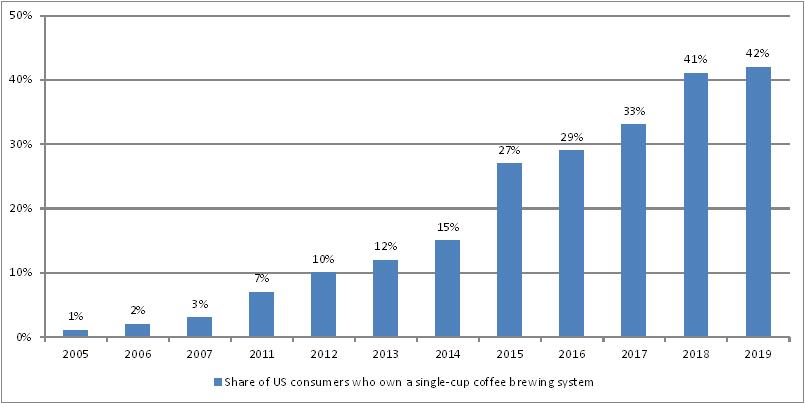

1 “Coffee: World Markets and Trade”, United States Department of Agriculture, Foreign Agricultural Service, June 2019 – https://downloads.usda.library.cornell.edu/usda-esmis/files/m900nt40f/xk81jw68v/kp78gs60d/coffee.pdf 2 Statista, August 2019 – https://www.statista.com/outlook/30010000/100/coffee/worldwide#market-revenue 3 National Coffee Association blog, March 2019 – https://nationalcoffee.blog/2019/03/09/national-coffee-drinking-trends-2019/ 4 Roast Magazine, March 2019 – https://dailycoffeenews.com/2019/03/11/2019-coffee-and-beverage-trends-inside-the-ncas-annual-report/ 5 Statista, August 2019 – https://www.statista.com/outlook/30010000/100/coffee/worldwide#market-revenue Single-serve coffee brewing has grown in popularity in recent years, and single-serve brewing machines were the second most popular brewing system after standard drip coffee makers, with 26 percent of American coffee drinkers using them in 2018.6 Additionally, and according to an online survey by the National Coffee Association, 42 percent of US households owned a single-cup coffee brewing machine in 2019, up from 1 percent in 2005 and 15 percent in 2014.7

While consumers have been purchasing single-serve coffee machines to recreate the café style experience at home, there has been an increased focus on environmental sustainability and demand for eco-friendly products. The2019 Retail and Sustainability Survey by CGS showed that more than two-thirds of respondents consider sustainability when making a purchase and are willing to pay more for sustainable products.8 In another recent survey of US and UK consumers by Globalwebindex, 42 percent of consumers said that products that have packaging made from recycled products and/or sustainable materials are important in their day-to-day shopping, and more than half said they have reduced the amount of disposable plastic they use in the past 12 months.9 Greenpeace USA considered coffee pods as “one of the best examples of unnecessary single-use plastics that are polluting our planet” and the big producers of pods having been seeking eco-friendly alternatives.10 Sustainability is expected to continue to be a big trend in the coffee pod market, especially as some cities and local governments consider bans on the use of single-use plastic pods (akin to bans on plastic straws and plastic bags) and as consumers become increasingly concerned about throwing used plastic pods in landfills.11 We believe that many of the prevalent industry trends – the continued consumption and market growth, the prevalence of “at home” consumption, the popularity of single-serve coffee brewing, the increased focus on unique coffee experiences, and consumers’ shift to eco-friendly and sustainable alternatives – will be Our Risks and History of Losses Investing in our common stock involves a high degree of risk. You should carefully consider the •Our ability to sustain our recent growth rates and manage our rapid growth; 6Statista, March 2019 – https://www.statista.com/topics/2219/single-serve-coffee-market/ 7Statista, August 2019 – https://www.statista.com/statistics/316217/us-ownership-of-single-cup-brewing-systems/ 8CGS, January 2019 – https://www.globenewswire.com/news-release/2019/01/10/1686144/0/en/CGS-Survey-Reveals-Sustainability-Is-Driving-Demand-and-Customer-Loyalty.html 9GLobalwebindex, April 2019 – https://blog.globalwebindex.com/chart-of-the-week/lifting-the-lid-on-sustainable-packaging/ 10USA Today, March 2019 – https://www.usatoday.com/story/tech/2019/03/13/heres-why-your-used-k-cups-coffee-pods-arent-usually-recycled/3067283002/ 11Food Dive, September 2018 – https://www.fooddive.com/news/coffee-pods-lose-ground-as-consumers-look-for-sustainable-premium-java-exp/531816/ •Our ability to obtain sufficient funding to expand our business and respond to business opportunities; •Our ability to acquire new customers or retain existing customers in a cost-effective manner; •Our ability to successfully improve our production efficiencies and economies of •Our ability to manage our supply chain to continue to satisfy our future operation needs; and

We have incurred net losses since our inception in 2011, including net losses of $3.6 million and $1.8 million for the years ended September 30, 2018 and 2017, respectively, and $13.4 million for the nine months ended June 30, 2019. As of June 30, 2019, our accumulated deficit was approximately $26.0 million. We Recent Developments Reverse Stock Split On October 28, 2019, we completed a l-for-3 reverse stock split, which became effective on November 12, 2019 (the “Reverse Split”). The accompanying financial statements and notes to the

Private Placement Transaction On November 7, 2019, we completed a private placement financing transaction pursuant to which we issued approximately 111,738 shares of Corporate information We Our corporate website is www.mynuzee.com. Information contained on, THE OFFERING SUMMARY

All share and per share information in this prospectus (except the last reported sale price for our common stock) has been retroactively adjusted to give effect to the Reverse Split, including the financial statements and notes thereto. The number of shares of common stock to be outstanding immediately after this offering is based upon 13,587,580 shares outstanding as of June 30, 2019, and excludes the following: •1,787,334 shares of our common stock issuable upon the exercise of options outstanding as of June 30, 2019, with a weighted-average exercise price of $6.90 per share; •1,544,333 shares of our common stock reserved for future grant or issuance under the NuZee, Inc. 2013 Stock Incentive Plan (the “2013 Plan”); •3,333,334 shares of our common stock reserved for future grant or issuance under the NuZee, Inc. 2019 Stock Incentive Plan (the “2019 Plan”); and •300,000 shares of our common stock issuable upon the exercise of options that we expect to grant upon the pricing of this offering to our directors, executive officers and certain other employees at an exercise price equal to the public offering price of this offering. Unless otherwise indicated, this prospectus reflects and assumes the following: •no exercise of outstanding options; and •no exercise by the underwriters of their over-allotment option. SUMMARY CONSOLIDATED FINANCIAL DATA The following tables summarize our consolidated financial data for the periods ended and as of the dates indicated. We have derived the statements of operations data for the years ended September 30, 2018 and 2017 and the balance sheet data as of September 30, 2018 from our audited financial statements included elsewhere in this prospectus. We have derived the statements of operations data for the nine months ended June 30, 2019 and 2018 and the balance sheet data as of June 30, 2019 from our unaudited interim financial statements included elsewhere in this prospectus. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are not necessarily indicative of results to be expected for any period in the future and the results for the nine months ended June 30, 2019 are not necessarily indicative of the results that may be expected for the full year or any other period. You should read this information together with our financial statements and related notes appearing elsewhere in this prospectus and the information in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Before you invest in our common stock, you should understand the high degree of risk involved. You should carefully consider the following risks and other information in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before you decide to purchase shares of our common stock. The following risks may adversely impact our business and financial condition. As a result, the trading price of our common stock could decline and you could lose part or all of your investment. Risks Related to Our Financial Condition and Capital Requirements We have limited operating history, which may

We

effectively manage our business and recruit and retain sales and marketing, recruit and retain sales personnel and appropriate distributor relationships; successfully develop and protect our intellectual property portfolio; successfully provide high levels of service as our business expands; and successfully address other If we do not address these risks successfully, it could have a material adverse effect on our business and financial We have a history of net losses. We expect to continue to incur net losses in the future and we may never generate sufficient revenue from the commercialization of our single serve pour over coffee products or co-packing services to achieve or sustain profitability. We have incurred net losses since our inception in 2013, including net losses of $3.6 million and $1.8 million for the years ended September 30, 2018 and 2017, respectively, and $13.4 million for the nine months ended June 30, 2019. As of June 30, 2019, our accumulated deficit was approximately $26.0 million. We expect to incur significant sales and marketing expenses prior to recording sufficient revenue from our operations to offset these expenses. In the United States, we expect to incur additional losses as a result of the costs associated with operating as an exchange-listed public company following this offering. These losses have had, and will continue to have, an adverse effect on our working capital, total assets and stockholders’ equity (deficit). Our ability to become and remain profitable will depend on our ability to generate significantly higher revenues from the sales of our pour over coffee products and co-packing services, which depends upon a number of factors, including but not limited to successful sales, manufacturing, marketing and distribution of our products and services. Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then sustain profitability would have a material adverse effect on our business and financial condition. Our independent auditor’s report for the fiscal year ended September 30, 2018 includes an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Due to the uncertainty of our ability to meet our current operating and capital expenses, in their report on our audited annual financial statements as of and for the year ended September 30, 2018, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Recurring losses from operations raise substantial doubt about our ability to continue as a going concern. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. In addition, the inclusion of an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern and our lack of cash resources may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties. We may need to raise additional capital to fund our existing operations, market our products and expand our operations. We believe that the net proceeds of this offering, together with our existing cash balances, will be sufficient to cover our cash needs for at least the next 12-24 months. If our available cash balances, net proceeds from this offering and anticipated cash flow from operations are lower than we anticipate, including due to changes in our business plan, a lower demand for our products or other risks described in this prospectus, we may seek to raise additional capital sooner than currently expected. We may also consider raising additional capital in the future to expand our business, to pursue strategic investments, to take advantage of financing opportunities or for other reasons, including to: fund development of our products; acquire, license or invest in technologies or intellectual property relating to our existing products; acquire or invest in complementary businesses or assets; and finance capital expenditures and general and administrative expenses. Our present and future funding requirements will depend on many factors, including: success of our current marketing efforts; our revenue growth rate and ability to generate cash flows from product sales; effects of competing technological and market developments; and changes in regulatory oversight applicable to our products. The various alternatives for raising additional capital include short-term or long-term debt financings, equity offerings, collaborations or licensing arrangements and each one carries potential risks. If we raise funds by issuing equity securities, our stockholders will be further diluted. Any equity securities issued also could provide for rights, preferences or privileges senior to those of holders of our common stock. If we raise funds by issuing debt securities, those debt securities would have rights, preferences and privileges senior to those of holders of our common stock. The terms of debt securities issued or borrowings pursuant to a credit agreement could impose significant restrictions on our operations or our ability to issue additional equity securities or issue additional indebtedness. We may also be required under additional debt financing to grant security interests on our assets, including our intellectual property. If we raise funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our intellectual property, or grant licenses on terms that are not favorable to us which could lower the economic value of those items to us. The credit markets and the financial services industry have in the past experienced turmoil and upheaval characterized by the bankruptcy, failure, collapse, or sale of various financial institutions and intervention from the U.S. federal government. These events typically make equity and debt financing more difficult to obtain. Accordingly, additional equity or debt financing might not be available on reasonable terms, if at all. If we cannot secure additional funding when needed, including due to changes in our business plan, a lower demand for our products or other risks described in this prospectus, we may have to delay, reduce the scope of or eliminate one or more sales and marketing initiatives and development programs, which would have a materially adverse effect on our business. Our ability to use our net operating loss carryforwards to offset future taxable income may be subject to certain limitations. In general, under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), a corporation that undergoes an “ownership change” is subject to annual limitations on its ability to use its pre-change net operating loss carryforwards, or NOLs, or other tax attributes to offset future taxable income or reduce taxes. Our past issuances of stock and other changes in our stock ownership may have resulted in ownership changes within the meaning of Section 382 of the Code; accordingly, our pre-change NOLs may be subject to limitation under Section 382. State NOL carryforwards may be similarly limited. Furthermore, the closing of this offering, alone or together with transactions in our stock that have occurred in the past and may occur in the future, may trigger an ownership change pursuant to Section 382. Because of the cost and complexity involved in the analysis of a Section 382 ownership change and the fact that we do not have any taxable income to offset, we have not undertaken a study to assess whether an “ownership change” has occurred or whether there have been multiple ownership changes since we became a “loss corporation” as defined in Section 382. Shares issued in this offering or future changes in our stock ownership (either in combination with this offering or separately) could result in ownership changes under Section 382 of the Code further limiting our ability to utilize our NOLs. Furthermore, our ability to use NOLs of companies that we may acquire in the future may be subject to limitations. For these reasons, even if we attain profitability, we may not be able to use a material portion of our NOLs, and this would reduce our earnings potentially affect and the valuation of our stock. Risks Related to Our Business Continued innovation and the successful development and timely launch of new products and product extensions are critical to our financial results and achievement of Achievement of our growth strategy is dependent, among other things, on our ability to extend the product offerings of our existing brands and introduce innovative new products. Although we devote significant focus to the development of new products, we may not be successful in developing innovative new products or our new products may not be commercially successful. Additionally, our new product introductions are often time sensitive, and thus failure to deliver innovations on schedule could be detrimental to our ability to successfully launch such new products and retain partners, in addition to potentially harming our reputation and customer loyalty. Our financial results and our ability to maintain or improve our competitive position will depend on our ability to effectively gauge the direction of our key marketplaces and successfully identify, develop, manufacture, market and sell new or improved products in these changing marketplaces. Our future financial results are difficult to predict, and failure to meet market expectations for our financial performance or our publicly announced guidance may cause the price of our stock to decline. As we and our industry evolve, we expect to face new challenges with respect to our introduction of innovative products and the changing competitive landscape within the single serve category and the beverage industry. These challenges can occur at various stages, including design, supply chain and sales cycle. Our public forecasts regarding the expected performance of our business and future operating results are forward-looking statements subject to risks and uncertainties, including the risks and uncertainties described in our filings with the SEC and in our other public statements, and necessarily reflect current assumptions and judgments that may prove incorrect. As a result, there can be no assurance that our performance will be consistent with any public forecasts or that any variation from such forecasts will not be material and adverse. Failure to meet expectations, particularly with respect to operating margins, earnings per share, operating cash flows and net revenues may result in a decline and/or increased volatility in the price of our stock. In addition, price and volume fluctuations in the stock market as a whole may affect the price of our stock in ways that may be unrelated to our financial performance. Increased competition, including as a result of industry consolidation, could hurt our businesses. The beverage industry is intensely competitive and we Our success depends, in part, on our relationships with the manufacturers of our packing equipment, including our exclusivity arrangement. We source our sophisticated packing equipment from companies located in East Asia. Furthermore, we have entered into an exclusivity agreement with the primary manufacturer of the co-packing equipment we use in our operations, which we believe significantly restricts our North American competitors’ access to this equipment. Our exclusivity agreement does not apply to two companies that had previously purchased packing equipment from this manufacturer, and that may compete with our products and services. However, availability is in general extremely limited for equipment of the top quality offered by this manufacturer, though other manufacturers do offer lower-grade alternatives. Our exclusivity agreement may be terminated with limited notice, and we may not be able to

Changes in the beverage environment and retail landscape could impact our financial results. The beverage environment is rapidly evolving as a result of, among other things, changes in consumer preferences; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing pressures. In addition, the beverage retail landscape is dynamic and constantly evolving, not only in emerging and developing marketplaces, where modern trade is growing at a faster pace than traditional trade outlets, but also in developed marketplaces, where discounters and value stores, as well as the volume of transactions through e-commerce, are growing at a rapid pace. If we are unable to successfully adapt to the rapidly changing environment and retail landscape, our share of sales, volume growth and overall financial results could be negatively affected. Sales to a limited number of customers represent a significant portion of our net sales. The loss of a key customer, including by consolidation in the retail channel, and efforts by our customers to improve their profitability could reduce sales of NuZee branded products and adversely affect our financial performance. Sales to relatively few customers account for a significant percentage of our net sales, and our success depends in part on our ability to maintain good relationships with these and other key retail and grocery customers. Currently, Amazon and our www.coffeeblenders.com website are our only established domestic retail channels for direct sales to consumers of NuZee branded products. However, we can provide no assurance that any of these customers or any of our other customers will continue to utilize our products or our services at current levels, or at all. Although we generally enter into master agreements with our key customers, these agreements govern the terms and conditions of the relationship and typically do not contain minimum purchase requirements. The loss of one or more of our key customers, or cancellation of or reduction in the amount of purchase by our key customers, could have an adverse effect on our results of operations and financial condition. In addition, because of the competitive environment facing retailers, many of our customers have increasingly sought to improve their profitability through increased promotional programs, pricing concessions, more favorable trade terms and increased emphasis on private label products. To the extent we provide concessions or trade terms that are favorable to customers, our margins would be reduced. Further, if we are unable to continue to offer terms that are acceptable to our significant customers or our customers determine that they need fewer inventories to service consumers, these customers could reduce purchases of our products or may increase purchases of products from our competitors, which would harm our sales and profitability. Our Our growth and profitability depend on the performance of third-parties and our relationship with them. A significant portion of our distribution network, and correspondingly our success in distributing our pour over coffee products, depends on the performance of third-parties. Any non-performance or deficient performance by such parties may undermine our operations and profitability, and may result in total loss to your investment. To distribute our product, we use a broker-distributor-retailer network whereby brokers represent our products to distributors and retailers who, in turn, sell our product to consumers. The success of this network depends on the performance of this network of brokers, distributors and retailers. There is a risk that a broker, distributor or retailer may refuse to or cease to market or carry our product, or that any such entity may not adequately perform its functions within the Furthermore, such third-parties’ financial position or market share may deteriorate, which could adversely affect our distribution, marketing and sale activities. We must also maintain good commercial relationships with third-party brokers, distributors and retailers so that they will promote and carry our product. Any adverse consequences resulting from the performance of The loss of Our success depends on the skills, experience and performance of Due to the specialized nature of the business and our small size, we are highly dependent upon our ability to attract and retain qualified sales and marketing, technical and managerial personnel. The loss of the services of existing personnel, as well as the failure to recruit key sales, marketing, technical and managerial personnel in a timely manner would be detrimental to our development and could have a material adverse effect on our business and financial condition. Our anticipated growth and expansion into areas and activities requiring additional expertise, such as sales and marketing, may require the addition of new management personnel, both domestic and international. All of our employees may terminate their employment at any time with short or no advance notice. We may have difficulties locating, recruiting or retaining qualified sales people. Recruiting and retention difficulties will limit our ability to support our development and sales programs and to build a commercially viable business.

Orders covered by firm purchase orders are generally not cancelable; however, customers may decide to delay or cancel orders. In the event that we experience any delays or cancellations, we may have difficulty enforcing the provisions of the purchase order and our revenues could decline substantially. Any such decline could result in us incurring net losses, increasing our accumulated deficit and needing to raise additional capital to fund our operations. Because our management structure is not centralized, the management of our business operations may be more expensive and more difficult. As part of our strategy to attract the most qualified individuals, we do not require the members of our management team to relocate to a particular geographic area. Accordingly, the members of our management team are geographically dispersed. This decentralized structure might cause additional expenses in the conduct of our business, and may also delay communication between members of our management team, lower the quality of our management decisions or decrease our ability to take action quickly. Product safety and quality concerns could negatively affect our business. Our success depends in part on our ability to maintain consumer confidence in the safety and quality of all of our products. While we are committed to the safety and quality of our products, we may not achieve our product safety and quality standards. Product safety or quality issues, or mislabeling, actual or perceived, or allegations of product contamination or quality or safety issues, even when false or unfounded, could subject us to product liability and consumer claims, negative publicity, a loss of consumer confidence and trust, may require us from time to time to conduct costly recalls from some or all of the channels in which the affected product was distributed, could damage the goodwill associated with our brands, and may cause consumers to choose other products. Such issues could result in the destruction of product inventory and lost sales due to the unavailability of product for a period of time, which could cause our business to suffer and affect our results of operations. Increases in the cost of high-quality coffee beans or other commodities or decreases in the availability of high quality coffee beans or other commodities could have an adverse impact on our business and financial results. We purchase, roast, and sell high-quality whole bean coffee and related coffee products. The price of coffee is subject to significant volatility, and may increase due to the factors described below. The high-quality coffee beans we seek tend to trade on a negotiated basis at a premium above the commodity trading price of coffee as quoted on the Intercontinental Exchange, also known as the “C” price of coffee. This premium depends upon the supply and demand at the time of purchase and the amount of Price increases may not be sufficient to offset cost increases and maintain profitability or may result in sales volume declines. We may be able to pass some or all raw materials, energy and other input cost increases to customers by increasing the selling prices of our products or decreasing the size of our products; however, higher product prices or decreased product sizes may also result in a reduction in sales volume and/or consumption. If we are not able to increase our selling prices or reduce product sizes sufficiently to offset increased raw material, energy or other input costs, including but not limited to packaging, direct labor, overhead and employee benefits, or if our sales volume decreases significantly, there could be a negative impact on our results of operations and financial condition. We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy. While we are currently a small company and, therefore, limited in our product development, marketing and sales activities, we anticipate growth in our business operations commensurate with the expansion of our sales and support operations and distribution network and the commercialization of new pour over coffee products. Since our inception in 2011, we have increased the number of our full- and part-time employees to 27 as of September 30, 2019, and we expect to continue hiring new employees and independent contractors to support our anticipated growth. This future growth could impose significant added responsibilities on members of our existing management and create strain on our organizational, administrative and operational infrastructure, including sales and marketing, quality control, and customer service. Our ability to manage our growth properly will require us to continue to improve our operational, financial and management controls, as well as our reporting systems and procedures, which prior to this offering have been determined to be inadequate. Our status as an exchange-listed public company will Any failure by us to accurately forecast customer demand for our products, or to quickly adjust to forecast changes, could adversely affect our business and financial results. There is inherent risk in forecasting demand due to the uncertainties involved in assessing the current level of maturity of the single serve component of our business. We set target levels for the manufacture of our pour over coffee products and for the purchase of coffee in advance of customer orders based upon our forecasts of customer demand and those of our business partners. If our forecasts exceed demand, we could experience excess inventory in the short-term, excess manufacturing capacity in the short and long-term, and/or price decreases, all of which could impact our financial performance. Alternatively, if demand exceeds our forecasts significantly beyond our current manufacturing capacity, we may not be able to satisfy customer demand, which could result in a loss of share if our competitors are able to meet customer demands. A failure to accurately predict the level of demand for our products could adversely affect our net revenues and net income. We may not be able to adequately protect our intellectual property rights, and our competitors may be able to offer similar products and services, which would harm our competitive position. Our success depends in part upon our intellectual property rights. We rely primarily on trademark, trade secret laws, confidentiality procedures, license agreements and contractual provisions to establish and protect our proprietary rights over our products, procedures and services. Other persons could copy or otherwise obtain and use our intellectual properties without authorization, or create intellectual properties similar to ours independently. We may also pursue the registration of our domain names, trademarks and service marks in other jurisdictions, including the United States. However, we cannot assure you that we will be able to We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations. We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how or other intellectual property rights held by third parties. We may be from time to time subject to legal proceedings and claims relating to the intellectual property rights of others. There may be third-party intellectual property that is infringed by our products, services or other aspects of our business. There could also be existing patents or other intellectual property rights of which we are not aware that our products may inadvertently infringe. We cannot assure you that holders of the relevant intellectual property rights purportedly relating to some aspect of our technology platform or business, if any such holders exist, would not seek to enforce such intellectual property rights against us in the United States or any other jurisdiction. We also cannot be certain that our efforts will be effective in completely preventing the infringement of trademarks, patents, copyrights, know-how or other intellectual property rights held by third parties. If we are found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. In addition, we may incur significant expenses, and may be forced to divert management’s time and other resources from our business and operations to defend against these third-party infringement claims, regardless of their merits. Successful infringement or licensing claims made against us may result in significant monetary liabilities and may materially disrupt our business and operations by restricting or prohibiting our use of the intellectual property in question. Failure to comply with applicable transfer pricing and similar regulations could harm our business and financial results. In many countries, including the United States, we are subject to transfer pricing and other tax regulations designed to ensure that appropriate levels of income are reported as earned and are taxed accordingly.Although we believe that we are in substantial compliance with all applicable regulations and restrictions, we are subject to the risk that governmental authorities could audit our transfer pricing and related practices and assert that additional taxes are owed.In the event that the audits or assessments are concluded adversely to us, we may or may not be able to offset or mitigate the consolidated effect of foreign income tax assessments through the use of U.S. foreign tax credits. Because the laws and regulations governing U.S. foreign tax credits are complex and subject to periodic legislative amendment, we cannot be sure that we would in fact be able to take advantage of any foreign tax credits in the future. Our business operations are conducted in multiple languages and could be disrupted due to miscommunications or translation errors. The success of our business depends in part on our marketing efforts in the United States and If we Our businesses involve the physical or electronic break-ins; cyber-attacks; catastrophic events; or breaches due to employee error or malfeasance or other attempts to harm our systems. Cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to information technology networks and systems to more sophisticated and targeted measures, known as advanced persistent threats, directed at the Company, its products, its customers and/or its third-party service providers. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures in time. We could also experience a loss of critical data and delays or interruptions in our ability to manage inventories or process transactions. Some of our commercial partners, such as those that help us deliver our website, may receive or store information provided by us or our users through If our systems are harmed or fail to function properly, we may need to expend significant financial resources to repair or replace systems or to otherwise protect against security breaches or to address problems caused by breaches. If we

If we fail to comply with FDA regulations our business could suffer. The manufacture and marketing of beverage and nutraceutical products are subject to extensive regulation by the U.S. Food and Drug Administration (“FDA”) and foreign and state regulatory authorities. In the United States, beverage and nutraceutical companies such as ours must comply with laws and regulations promulgated by the FDA. These laws and regulations require various authorizations prior to a product being marketed in the United States. Manufacturing facilities and practices are also subject to FDA regulations. The FDA regulates the clinical testing, manufacture, labeling, sale, distribution and promotion of nutraceutical and, to the extent applicable, beverage products in the United States. Any failure by us to comply with regulatory requirements, including any future changes to such requirements, could have a material adverse effect on our business, prospects, financial condition and results of operations. Even after clearance or approval of a product, we are subject to continuing regulation by the FDA, including the requirements of registering our facilities and listing our products with the FDA. We are subject to reporting regulations. These regulations require us to report to the FDA if any of our products may have caused or contributed to a death or serious injury and such product or a similar product that we market would likely cause or contribute to a death or serious injury. Unless an exemption applies, we must report corrections and removals to the FDA where the correction or removal was initiated to reduce a risk to health posed by the product or to remedy a violation of the Food, Drug and Cosmetic Act. The FDA also requires that we maintain records of corrections or removals, regardless of whether such corrections and removals are required to be reported to the FDA. In addition, the FDA closely regulates promotion and advertising, and our promotional and advertising activities could come under scrutiny by the FDA. The FDA also requires that manufacturing be in compliance with its Quality System Regulation, or QSR. The QSR covers the methods and documentation of the design, testing, control, manufacturing, labeling, quality assurance, packaging, storage and shipping of our products. Any failure by us to maintain compliance with the QSR requirements could result in the shutdown of, or restrictions on, our manufacturing operations, to the extent we have any, and the recall or seizure of our products, which would have a material adverse effect on our business. In the event that one of our suppliers fails to maintain compliance with our quality requirements, we may have to qualify a new supplier and could experience manufacturing delays as a result. The FDA has broad enforcement powers. If we violate applicable regulatory requirements, the FDA may bring enforcement actions against us, which could have a material adverse effect on our business, prospects, financial condition and results of operations. Violations of regulatory requirements, at any stage, including after approval, may result in various adverse consequences, including the delay by a regulatory agency in approving or refusal to approve a product, withdrawal or recall of an approved product from the market, or other voluntary agency-initiated action that could delay further development or marketing, as well as the imposition of criminal penalties. The health benefits of the functional ingredients in our products are not guaranteed. Although clinical studies indicate certain ingredients used in our products may have health benefits, there is no guarantee that a consumer of our products will experience such health benefits. Additionally, negative publicity, opposing studies concerning any of our ingredients or negative changes in consumers’ perception of the health benefits of our products may result in loss of market share or potential market share and negatively impact our operations. Changes in regulatory standards could adversely affect our business. Our business is subject to extensive domestic and international regulatory requirements regarding distribution, production, labeling and marketing. Changes to regulation of the beverage industry could include increased limitations on advertising and promotional activities or other non-tariff measures that could adversely impact our business. In addition, we face government regulations pertaining to the health and safety of our employees and our consumers as well as regulations addressing the impact of our business on the environment, domestically as well as internationally. Compliance with these health, safety and environmental regulations may require us to alter our manufacturing processes and our sourcing. Such actions could adversely impact our results of operations, cash flows and financial condition, and our inability to effectively and timely comply with such regulations could adversely impact our competitive position. Significant additional labeling or warning requirements or limitations on the availability of our products may inhibit sales of affected products. Various jurisdictions may seek to adopt significant additional product labeling (such as requiring labeling of products that contain genetically modified organisms) or warning requirements or limitations on the availability of our products relating to the content or perceived adverse health consequences of certain of our products. If these types of requirements become applicable to one or more of our major products under current or future environmental or health laws or regulations, they may inhibit sales of such products. One such law, which is in effect in California and is known as Proposition 65, requires that a warning appear on any product sold in California that contains a substance that, in the view of the state, causes cancer or birth defects. The state maintains lists of these substances and periodically adds other substances to these lists. Proposition 65 exposes all food and beverage producers to the possibility of having to provide warnings on their products in California because it does not provide for any generally applicable quantitative threshold below which the presence of a listed substance is exempt from the warning requirement. Consequently, the detection of even a trace amount of a listed substance can subject an affected product to the requirement of a warning label. However, Proposition 65 does not require a warning if the manufacturer of a product can demonstrate that the use of the product in question exposes consumers to a daily quantity of a listed substance that is below a “safe harbor” threshold that may be established, is naturally occurring, is the result of necessary cooking, or is subject to another applicable exception. While currently substances created by and inherent in the processes of roasting coffee beans or brewing coffee have been determined by the State of California not to pose a significant risk, such chemicals could be added to the Proposition 65 lists in the future.With respect to substances that have not yet been listed under Proposition 65, the Company takes the position that listing is not scientifically justified. The State of California or other parties, however, may take a contrary position. If we were required to add Proposition 65 warnings on the labels of one or more of our beverage products produced for sale in California, the resulting consumer reaction to the warnings and possible adverse publicity could negatively affect our sales both in California and in other marketplaces. Our international sales and operations subject us to various additional legal, regulatory, financial and other risks. We operate globally and are attempting to develop products in multiple countries. Consequently, we face complex legal and regulatory requirements in multiple jurisdictions, which may expose us to certain financial and other risks. International operations are subject to a variety of risks, including: foreign currency exchange rate fluctuations; greater difficulty in overseeing foreign operations; logistical and communications challenges; potential adverse changes in laws and regulatory practices, including export license requirements, trade barriers, tariffs and tax laws; burdens and costs of compliance with a variety of foreign laws; ��political and economic instability; foreign tax laws and potential increased costs associated with overlapping tax structures; greater difficulty in protecting intellectual property; the risk of third-party disputes over ownership of intellectual property and infringement of third-party intellectual property by our products; and general social, economic and political conditions in these foreign markets. Employment litigation and unfavorable publicity could negatively affect our future business. Employees may, from time to time, bring lawsuits against us regarding injury, creation of a hostile work place, discrimination, wage and hour, sexual harassment and other employment issues. In recent years there has been an increase in the number of discrimination and harassment claims generally. Coupled with the expansion of social media platforms and similar devices that allow individuals access to a broad audience, these claims have had a significant negative impact on some businesses. Companies that have faced employment or harassment related lawsuits have had to terminate management or other key personnel and have suffered reputational harm that has negatively impacted their sales. If we were to face any employment related claims, our business could be negatively affected. Risks Related to this Offering and Ownership of our Common StockRisks Related to this Offering and Ownership of our Common Stock Our common stock presently is listed for trading on the OTCQB which means you may not be able to resell shares of our common stock publicly, if at all, at times or prices you feel are fair and appropriate. While our intention is to list our common stock on a national securities exchange, our common stock presently is listed for trading on the OTC Market’s OTCQB service. A listing on the OTC Markets is generally understood to be a less active, and therefore less liquid, trading market than other types of markets such as a stock exchange. Compared to a listing on a stock exchange, a listing on the OTC Markets can be expected to have an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us and our common stock. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock. In addition, we have had small trading volume in our common stock, which makes it difficult for our stockholders to sell their shares as and when they choose. Small trading volumes generally depress market prices. As a result, we believe that you may not be able to resell shares of our common stock publicly, if at all, at times or prices that you feel are fair or appropriate. While we are seeking to list our common stock on a national securities exchange, there is no assurance that our securities will ever be listed on a major stock exchange. While we are seeking to list our common stock on a national securities exchange, we cannot ensure that we will be able to satisfy the listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock are otherwise rejected for listing, our common stock will continue to trade on the OTC Markets, in which event the trading price of our common stock could suffer, the trading market for our common stock may be less liquid, and our common stock price may be subject to increased volatility. The market price of our stock may be volatile, and you could lose all or part of your investment. Further, we do not know whether an active, liquid and orderly trading market will develop for our securities or what the market price of our securities will be and as a result it may be difficult for you to sell your shares of our securities. Prior to this offering there has been a limited public market for shares of our securities. Although we intend to apply to have our securities listed on a national securities exchange, an active trading market for our shares may never develop or be sustained following this offering. You may not be able to sell your shares quickly or at the market price if trading in shares of our securities is not active. The public offering price for our securities will be determined through negotiations with the underwriters, and the negotiated price may not be indicative of the market price of the securities after the offering. As a result of these and other factors, you may be unable to resell your shares of our securities at or above the public offering price. Further, an inactive market may also impair our ability to raise capital by selling shares of our securities and may impair our ability to enter into strategic partnerships or acquire companies or products by using shares of our securities as consideration, which could have a material adverse effect on our business, financial condition, and results of operations. In addition, the trading price of our common stock following this offering is likely to be highly volatile and subject to wide fluctuations in response to various factors, some of which we cannot control. In addition to the factors discussed in this “Risk Factors” section and elsewhere in this prospectus, these factors include but are not limited to: the success of, or developments in, competitive products or technologies; regulatory actions with respect to our products and our competitors; the level of success of our marketing strategy; announcements by us or our competitors of significant acquisitions, strategic collaborations, joint ventures or capital commitments; regulatory or legal developments in the United States and other countries; recruitment or departure of key personnel; expenses related to any of our development programs and our business in general; actual or anticipated changes in financial estimates, development timelines or recommendations by securities analysts; failure to meet or exceed financial estimates and projections of the investment community or that we provide to the public; variations in our financial results or those of companies that are perceived to be similar to us; fluctuations in the valuation of companies perceived by investors to be comparable to us; share price and volume fluctuations attributable to inconsistent trading volume levels of our shares; our ability or failure to raise additional capital in equity or debt transactions; costs associated with our sales and marketing initiatives; costs and timing of obtaining and maintaining FDA and other regulatory clearances and approvals for our products; sales of our common stock by us, our insiders or our other stockholders; and general economic, industry and market conditions. In addition, the stock market in general has in the past experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the relevant companies. Broad market and industry factors may negatively affect the market price of our common stock, regardless of our actual operating performance. The realization of any of the above risks or any of a broad range of other risks, including those described in this “Risk Factors” section, could have a dramatic and material adverse impact on the market price of our common stock. Sales of our currently issued and outstanding stock may become freely tradable pursuant to Rule 144 and sales of such shares may have a depressive effect on the share price of our common stock. Substantially all of the outstanding shares of common stock are “restricted securities” within the meaning of Rule 144. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. Rule 144 provides in essence that a non-affiliate who has held restricted securities for a period of at least six months may sell their shares of common stock. Under Rule 144, affiliates who have held restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four-calendar week rule does not apply to companies quoted on the OTC Markets). A sale under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop. If equity research analysts do not publish research or reports about our business or if they issue unfavorable commentary or downgrade our common stock, the price of our common stock could decline. The trading market for our common stock will rely in part on the research and reports that equity research analysts publish about us and our business. We do not control these analysts. The price of our common stock could decline if one or more equity analysts downgrade our common stock or if analysts issue other unfavorable commentary or cease publishing reports about us or our business. We have broad discretion in the use of the net proceeds from this offering and may not use them effectively, which could affect our results of operations and cause our stock price to decline. Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds.” We intend to use the net proceeds from this offering for working capital and general corporate purposes. As a result, you will be relying upon management’s judgment with only limited information about our specific intentions for the use of the balance of the net proceeds of this offering. You will not have the opportunity, as part of your investment decision, to assess whether we are using the proceeds appropriately. Our management might not apply our net proceeds in ways that ultimately increase the value of your investment. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline. We may be subject to securities litigation, which is expensive and could divert management attention. The market price of our common stock may be volatile, and in the past, companies that have experienced volatility in the market price of their stock have been subject to securities litigation, including but not limited to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management’s attention from other business concerns, which could have a material adverse effect on our business and financial condition. Our principal stockholder and management, including our Chief Executive Officer in particular, own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval. Prior to this offering, our executive officers, directors, holders of 5% or more of our capital stock and their respective affiliates beneficially owned approximately 38.6% of our voting stock and, upon completion of this offering, that same group will hold approximately % of our outstanding voting stock (assuming no exercise of the underwriters’ over-allotment option, no exercise of outstanding options and no purchases of shares in this offering by any of this group), in each case assuming a public offering price of $11.00 per share, which is the last reported sale price of our common stock on the OTCQB on October 22, 2019 (which does not give effect to the Reverse Split due to the absence of sale price data following the effectiveness of the Reverse Split). Our Chief Executive Officer and Chairman of the Board of Directors individually beneficially owned approximately 34.9% of our voting stock prior to this offering, and will hold approximately % of our outstanding voting stock following this offering. This concentration of control creates a number of risks. After this offering, this group of stockholders will have the ability to exert significant influence over us through this ownership position. These stockholders may be able to exert significant influence over all matters requiring stockholder approval, including with respect to elections of directors, amendments of our organizational documents, or approval of any merger, sale of assets or other major corporate transaction, and our stockholders may find it difficult to replace members of management should our stockholders disagree with the manner in which the Company is operated. Furthermore, this concentration of ownership may prevent or discourage unsolicited acquisition proposals or offers for our common stock that you may feel are in your best interest as one of our stockholders. The interests of this group of stockholders may not always coincide with your interests or the interests of other stockholders and they may act in a manner that advances their best interests and not necessarily those of other stockholders. Sales of a substantial number of shares of our common stock in the public market could cause our stock price to fall. Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. After this offering, we will have outstanding shares of common stock based on the number of shares outstanding as of June 30, 2019. This includes the shares that we sell in this offering, which may be resold in the public market immediately without restriction, unless purchased by our affiliates. Of the remaining shares, shares of our common stock are currently restricted as a result of