As filed with the Securities and Exchange Commission on November 1, 2019

Registration Statement No. 333-227874333-233987

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON OCTOBER19, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Giga-tronics Incorporated

(Exact name of Registrant as specified in its charter)

California |

| 3825 |

| 94-2656341 |

(State or other jurisdiction of incorporation or |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification No.) |

5990 Gleason Drive

Dublin, California 94568

Telephone: 925-328-4650

(Address and telephone number of principal executive offices)

John R. Regazzi

Chief Executive Officer

5990 Gleason Drive

Dublin, California 94568

Telephone: 925-328-4650

(Name, address and telephone number of agent for service)

CopyWith copies to:

David J. Gershon, Esq.

Thomas G. Reddy, Esq.

Sheppard, Mullin, Richter and

David J. Gershon, Esq. Jason Schendel, Esq. Sheppard, Mullin, Richter & Hampton LLP Four Embarcadero Center, 17th Floor San Francisco, California 94111 Telephone: (415) 434-9100 | M. Ali Panjwani, Esq. New York, NY 10036 Telephone: (212) 421-4100 |

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |||

(Do not check if a smaller reporting company) | Emerging growth company | ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Shares to be Registered (1)

| Proposed Maximum Aggregate Offering Price per Security | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | |||||||||||||

Shares of Common Stock underlying Preferred Stock (2) | 7,000,000 | $ | 0.25 | (3) | $ | 1,750,000 | $ | 212.10 | |||||||||

Shares of Common Stock underlying Warrants (4) | 2,026,887 | $ | 0.25 | (3) | $ | 506,722 | $ | 61.41 | |||||||||

Shares of Common Stock underlying Warrants (4) | 898,634 | $ | 1.78 | (3) | $ | 1,599,569 | $ | 193.87 | |||||||||

Shares of Common Stock underlying Warrants (4) | 194,437 | $ | 1.76 | (3) | $ | 342,209 | $ | 41.48 | |||||||||

Shares of Common Stock underlying Warrants (4) | 331,636 | $ | 1.15 | (3) | $ | 381,381 | $ | 46.22 | |||||||||

Common Stock, no par value (5) | 1,172,858 | $ | 0.31 | (6) | $ | 363,586 | $ | 44.07 | |||||||||

TOTAL | 11,624,452 | $ | 4,943,467 | $ | 599.15 | (7) | |||||||||||

Securities to be Registered | Shares to be | Proposed Maximum |

| Proposed Maximum Aggregate Offering Price(1) |

| Amount of Registration Fee | ||

| Common Stock, no par value per share | - | - | $3,000,000.00(2) | $363.60(3) | ||||

| Underwriter's Warrants to Purchase Common Stock | - (4) | - | ||||||

| Common Stock, no par value per share, underlying Underwriter's Warrant | $60,000(5) | $7.79 | ||||||

(1) |

|

| (2) | Includes offering price of shares of common stock |

| (3) | Previously paid. |

| (4) | In accordance with Rule 457(g) under the Securities Act, because the shares of the registrant’s common stock underlying the Representative’s Warrant are registered hereby, no separate registration fee is required with respect to the |

|

|

|

|

|

|

|

|

| Estimated solely for the purpose of calculating the registration fee |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Giga-tronics Incorporated is filing this Amendment No. 1 (the “Amendment”) to its Registration Statement on Form S-1, File No. 333-227874 (the “Registration Statement”), for the sole purpose of filing as exhibits the XBRL documents that inadvertently were omitted from the Registration Statement that was filed on October 17, 2018. Accordingly, the preliminary prospectus included in this Amendment has not changed from that filed with the Registration Statement.

The information in this preliminary prospectus is not complete and may be changed. The selling securityholdersWe may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED |

11,624,4528,700,000 Shares of Common Stock

GIGA-TRONICS INCORPORATED

GIGA-TRONICS INCORPORATED

This prospectus relates to the sale by the selling securityholders named in this prospectus (the “Selling Securityholders”) of up to 11,624,452We are offering 8,700,000 shares of our common stock at an assumed offering price of Giga-tronics Incorporated (we, the “Company” or “Giga-tronics”), including 7,000,000 shares of common stock issuable upon conversion of our 6.0% Series E Senior Convertible Voting Perpetual Preferred Stock, which we refer to as “Series E Shares,” 3,451,594 shares of common stock issuable upon exercise of common stock purchase warrants, 572,858 shares of common stock that we issued upon exercise of warrants and 600,000 shares of common stock potentially issuable as dividends on the Series E Shares. We will not receive any of the proceeds from the sale by the Selling Securityholders of such securities. However, we will receive proceeds from the exercise of the warrants if they are exercised for cash by the Selling Securityholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the selling shareholders will be borne by them.$0.29 per share.

Our Common Stockcommon stock is quoted on the OTCQB tier of the OTC Bulletin BoardMarket under the symbol GIGA.QB.GIGA. The high and low bid prices for shares of our Common Stockcommon stock on October 15, 2018,30, 2019, were $0.37$0.31 and $0.25$0.29 per share, respectively, based upon bids that represent prices quoted by broker-dealers on the OTC Bulletin Board.Market. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions. The last reported sale price of our common stock on the OTC Market on October 30, 2019 was $0.29.

The Selling Securityholdersoffering is being underwritten on a firm commitment basis. We have granted the underwriter an option to buy up to an additional 1,305,000 shares of common stock from us to cover over-allotments. The underwriter may exercise this option at any time and any broker-dealersfrom time to time during the 30-day period from the date of this prospectus.

Total | ||||||||||||

Per Share | No Exercise of Allotment | Full Exercise of Allotment | ||||||||||

Public offering price | $ | $ | $ | |||||||||

Underwriting discounts | $ | $ | $ | |||||||||

Proceeds to us, before expenses | $ | $ | $ | |||||||||

We have also agreed to issue to Roth Capital Partners, LLC a warrant to purchase a number of shares of our common stock, that participate in the distributionequals 2% of the securities may be deemednumber of shares of our common stock to be “underwriters” as that term is definedsold in Section 2(a)(11) of the Securities Act of 1933, as amended.this offering. In addition, we have agreed to reimburse Roth Capital Partners, LLC for certain expenses. See “Underwriting” on page 34 for additional information.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 117 of this prospectus, together with the other risks and uncertainties described in this prospectus, before making a decision to purchase our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Delivery of the shares is expected to be made to the purchasers on or about [●], 2019.

Roth Capital Partners

The date of this prospectus is October 17[●], 2018.2019

TABLE OF CONTENTS

Page No. | |

About This Prospectus | v |

Prospectus Summary | 1 |

Summary of the Offering | 5 |

Incorporation of Certain Information by Reference | 6 |

Risk Factors | 7 |

Cautionary Note Regarding Forward-Looking Statement | 17 |

Capitalization | 18 |

Dilution | 19 |

Use of Proceeds | 20 |

Market for Registrant’s Common Equity and Related Shareholder Matters | 21 |

Business | 21 |

Management | 30 |

Security Ownership of Certain Beneficial Owners and Management | 31 |

Underwriting | 34 |

Description of Securities | 38 |

Legal Matters | 42 |

Experts | 42 |

Where You Can Find More Information | 42 |

ABOUT THIS PROSPECTUS

In this prospectus, unless the context suggests otherwise or unless otherwise noted, references to “the Company,” “we,” “us,” and “our” refer to Giga-tronics Incorporated and its consolidated subsidiaries.

This prospectus describes the specific details regarding this offering and the terms and conditions of the common stock being offered hereby and the risks of investing in our common stock. You should read this prospectus, any free writing prospectus and the additional information about us described in the section entitled ‘‘Where You Can Find More Information’’ before making your investment decision.

Neither we, nor any of our officers, directors, agents or representatives make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

ADDITIONAL INFORMATION

You should rely only on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement.free writing prospectus. No one has been authorized to provide you with different or additional information. The shares of common stock are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any free writing prospectus supplement is accurate as of any date other than the date on the front of such documents.

TRADEMARKS AND TRADE NAMES

This prospectus includes trademarks which are protected under applicable intellectual property laws and are our property or the property of our subsidiaries. This prospectus also contains trademarks, service marks, trade names and/or copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including market position and market opportunity, is based on information from our management’s estimates, as well as from industry publications and research, surveys and studies conducted by third parties. The third-party sources from which we have obtained information generally state that the information contained therein has been obtained from sources believed to be reliable, but we cannot assure you that this information is accurate or complete. We have not independently verified any of the data from third-party sources nor have we verified the underlying economic assumptions relied upon by those third parties. However, assumptions and estimates of our future performance, and the future performance of our industry, are subject to numerous known and unknown risks and uncertainties, including those described under the heading “Risk Factors” in this prospectus and those described elsewhere in this prospectus, and the other documents we file with the Securities and Exchange Commission, or SEC, from time to time. These and other important factors could result in our estimates and assumptions being materially different from future results. You should read the information contained in, or incorporated by reference into, this prospectus completely and with the understanding that future results may be materially different and materially worse from what we expect. See the information included under the heading “Forward-Looking“Cautionary Note Regarding Forward-Looking Statements.”

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements. These statements relate to future events or future predictions, including events or predictions relating to our future financial performance, and are based on current expectations, estimates, forecasts and projections about us, our future performance, our beliefs and management’s assumptions. They are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “feel,” “confident,” “estimate,” “intend,” “predict,” “forecast,” “project,” “potential” or “continue” or the negative of such terms or other variations on these words or comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks described under “Risk Factors” that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In addition to the risks described in Risk Factors, important factors to consider and evaluate in such forward-looking statements include: (i) general economic conditions and changes in the external competitive market factors which might impact our results of operations; (ii) unanticipated working capital or other cash requirements including those created by our failure to adequately anticipate the costs associated with product development and other critical activities; (iii) changes in our corporate strategy or an inability to execute our strategy due to unanticipated changes; and (iv) our failure to complete any or all sales or shipments of products or on the terms currently contemplated. In light of these risks and uncertainties, many of which are described in greater detail elsewhere in the section titled Risk Factors, we cannot assure you that the forward-looking statements contained in this prospectus will in fact transpire.

Although we believe that the expectations reflected in the forward-looking statements are reasonable as of the date of this prospectus, we cannot guarantee future results, levels of activity, performance or achievements. We will update or revise the forward-looking statements to the extent required by applicable law.

TABLE OF CONTENTS

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical filings, financial statements and related notes included elsewhere in the documents incorporated into this prospectus and incorporated hereby by reference. In this prospectus, unless otherwise noted or the context requires,, the terms “Company,” “Giga-tronics“Giga-tronics Incorporated,” “we,” “us,” and “our” refer to Giga-tronics Incorporated and its consolidated subsidiaries.

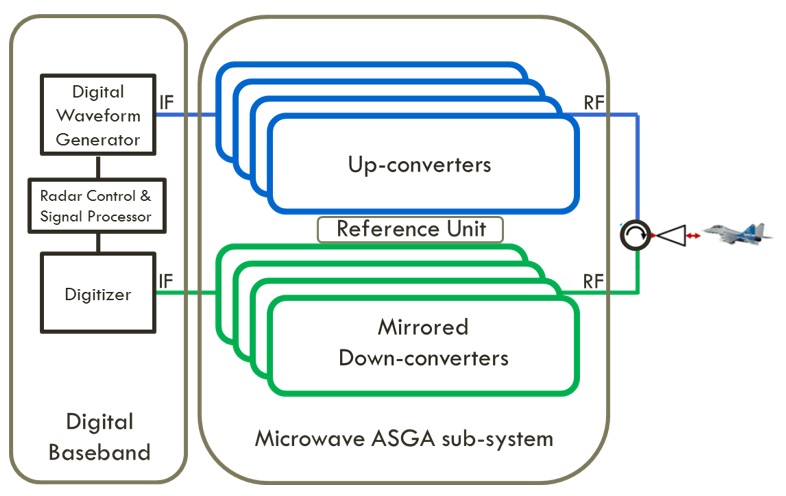

The Company

We manufacture specialized electronics equipment for use in military defense applications. Our operations consistGiga-tronics Incorporated consists of two business segments, thosethe operation of our subsidiary, Microsource Inc. (“Microsource”), and those of our Giga-tronics Division.Division, which we refer to as Giga-tronics. Our Microsource operation designs and manufactures custom microwave products for military airborne applications while Giga-tronics designs and manufactures real time solutions for RADAR/Electronic Warfare, or EW, test and evaluation in a laboratory setting.

Microsource

Microsource develops YIG (Yttrium, Iron, Garnet) tuned oscillators, filters, and manufactures custom microwave synthesizersproducts for operational use in airborne military defense applications. Microsource’s two largest customers are prime contractors for which we developare a sole-source developer and manufacture YIGmanufacturer of RADAR filters used in fighter jet aircrafts.aircraft. Revenues from Microsource comprised a majority of our revenues for the fiscal years ended March 31, 201830, 2019 and March 25, 2017.31, 2018.

Giga-tronics Division

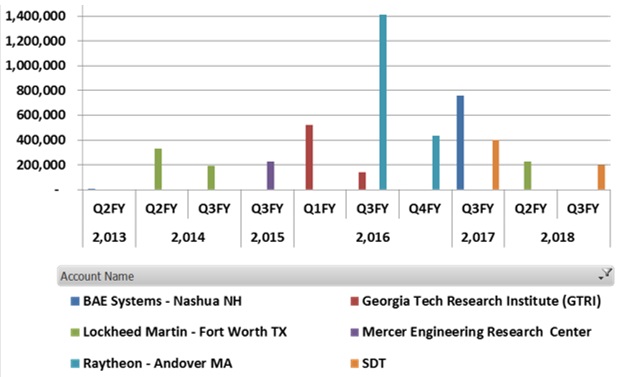

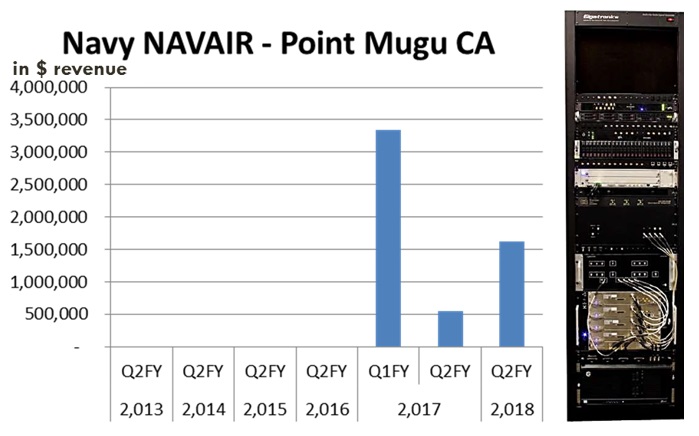

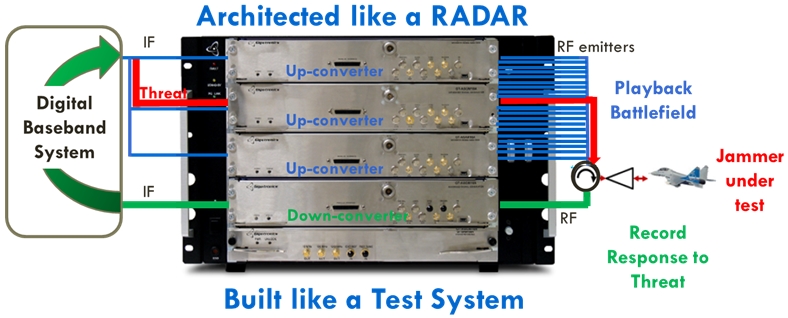

Our Giga-tronics Division designs, manufactures and markets a family of functional test productssystems and integrates those test systems along with third party hardware and software to create full test solutions for the RADAR and electronic warfare, or RADAR/EW segment of the defense electronics market. Our RADAR/EW test productssolutions are used to evaluate and improve the performance of RADAR and Electronic Warfare, or EW systems.systems, such as RADAR jammers. Giga-tronics Division customers include major defense prime defense contractors, the United States armed services and research institutes.

Corporate Offices

Our principal executive offices are located at 5990 Gleason Drive, Dublin, California 94568 and our telephone number at that location is (925) 328-4650. Our website address is http://www.Giga-tronics.com.www.gigatronics.com. The information contained on our website is not part of, or incorporated by reference into, this prospectus.

Our History

Giga-tronics Incorporated was incorporated in the State of California on March 5, 1980. Our original product line consisted of general purposegeneral-purpose parametric test products used for the design, production, repair and maintenance of products in the aerospace and telecommunications equipment marketplace. In 1998 we acquired Microsource, which develops YIG tuned oscillators, filters andcustom microwave synthesizersproducts for use in RADARaerospace, communications and test applications.

WeIn 2012, we began development of a test platform for evaluating RADAR/EW systems using our technical resources and industry expertise related to microwave products developed within our two divisions. As a small company, we believe the functional RADAR/EW test and evaluation market offers greater long-term opportunities for revenue growth and improved gross margins compared to the general purpose parametricour original general-purpose commodity test equipment marketplace. Beginning in 2011,products. As a result, we chose to focus on the development of RADAR/EW defense industry products. Using technological resourcesdivested our general-purpose test product lines between calendar years 2015 and industry expertise related to RADAR developed within our Microsource division, we began to develop products for RADAR/EW test applications, which together comprise our Advanced Signal Generation and Analysis (“ASGA”) systems. We also sold or eliminated the substantial majority of our original general purpose test products between 2013 and 2016 because of lack of growth potential and poor gross margins. For example, we sold our SCPM product line in 2013; we sold our Power Meters and Amplifiers business in 2015; and we sold our Switch product line to Astronics in 2016.2017.

We have experienced significant operating losses. Developing the ASGA product platformlosses to date, of which $23.8 million was incurred between 2012 and 2018 fiscal years while we were developing our RADAR/EW test system, which required more expensiveinvestment and took more time thatthan we anticipated, and the operating revenue of our Giga-tronics Division decreased as we exited our legacy test equipment businesses.initially anticipated. We have however, continued to see increasing operating revenue from sales of Microsource’s RADAR filter products as our customers upgraded the fighter jets’ RADAR systems under the United States Government’s RADAR Modernization Program for prior generation fighter aircraft such as the F/A-18E, F-15D and F-16 jets. In addition to providing cash to help fund the development of the ASGA product platform, the sale of our legacy general-purpose test product lines has allowed us to significantly reduce our headcount and operating expenses. For example, our operating expenses for fiscal 2018 were 15% lower than those for the 2017 fiscal year and 30% lower compared to the 2016 fiscal year.

We substantially completed the initial development of our ASGARADAR/EW test system, andwhich began shipping in 2016. Through March 31, 2018, weWe have delivered our new ASGARADAR/EW test systems to eight customers, generating approximately $10$11.2 million in revenue.revenue from January 1, 2016 through March 30, 2019.

Corporate Strategy

Our objective iscorporate objectives are to (1) maintain ourand expand Microsource’s position as a solesole-source provider of RADAR filter solutionscustom microwave products to the prime contractors responsible for prior generations ofmaintaining the fourth generation United States Air Force and United States Navy fighter jet aircraftjets and (2) become a leading supplier of electronic test systems to government facilities and defense prime contractors tasked with evaluating and improving the performance of RADAR/EW systems. Key elements of our strategy include the following:

We believe that several aspects ofPenetrate our Microwave Advanced Signal Generation and Analysis (ASGA) simulation platform are unique. The platform interface is digital and may be customized and scaled with relative ease compared to traditional test systems.Core Markets

To sell our new specialized testing products, we are changing our approach to sales. We are developing a field salesforce, locating personnel near key military and OEM customers within the RADAR/EW marketplace. This salesforce will have the technical expertise needed to properly understand our customers’ needs and provide the optimal solution to position our complex and innovative platform. Members of our salesforce have the security clearances required to enter classified facilities and to hold the necessary conversations with customers to understand their requirements.Microsource

Our customers includeThe United States Government is supporting upgrades to the US Navy, US Air Force and US Army and prime contractors and test directorates who are developing the devices being tested at military bases. We believe we have the opportunity to expand into new international markets with our functional RADAR/EW test solutions. To do so, we will rely on our relationships at key prime contractors and military customers in France, Israel, Italy and the United Kingdom, for example. We also expect to use sales representative organizations that have relationships with prime contractors and technical expertise in radar testing.

Microsource provides RADAR filter solutions for the F-15,onboard fourth generation fighter jets (F-15, F-16 and F-18 aircraft as theiraircraft) to extend the useful life of these aircraft. Microsource provides a RADAR filter which is designed to solve an interference problem that arises when the RADAR systems on these aircraft are upgraded. We expectbelieve that our filter technology will continue to be a significant source of our revenue because a large number of these aircraft have yet to be upgraded. In addition, we may be able to sell our RADAR filters internationally as the RADAR systems of foreign forces’the United States’ allies F-15, F-16 and F-18 aircraft are upgraded. We may also have the opportunity to develop and sell RADAR filters to customers for other types of aircrafts.

Giga-tronics

We may also deploybelieve we can become a leading supplier of test solutions for evaluating RADAR and EW systems due to the recent investment we have made in our RADAR/EW functional test platform, which addresses the technology from ourshift towards adaptive RADAR/EW systems occurring today in defense electronics. This shift in technology limits the effectiveness of traditional test systems, which do not actively interact with the RADAR/EW systems being tested.

Modern RADAR and EW systems are adopting the same digital technology that has revolutionized communications and consumer electronics and are now beginning to employ machine learning and artificial intelligence technology. Just as autonomous cars represented a big step up in test complexity for automotive manufacturers, this new technology represents a significant increase in complexity for the prime contractors who design the next generation of RADAR and EW systems and for the government test facilities tasked with evaluating them. Traditional RADAR and EW test solutions cannot be used to fully evaluate these advanced defense systems because they lack the required level of control and real-time behavior to force the device under test through all its modes. In contrast, we specifically designed the Giga-tronics RADAR/EW test platform miniaturizedto incorporate the needed control and real-time behavior into the fabric of its architecture. Rather than using analog test approaches such as synthesizers, modulators and spectrum analyzers like traditional test solutions, the Giga-tronics RADAR/EW test platform mirrors the architecture of a modern RADAR and EW system. This architecture allows the Giga-tronics RADAR/EW test solution to provide real-time responses and closed-loop behavior that, to our knowledge, are unavailable from any competitor.

Refine our Sales Strategy

Marketing new specialized testing solutions required us to move away from the sales approach we originally used to sell our parametric test products. As such, over time, we changed our sales team to a business development team comprised of people who know our customers and potential customers, understand their needs and are able to propose test solutions. Members of our salesforce have the security clearances required to enter classified facilities and to discuss customers’ needs, enabling us to understand their requirements. We are locating sales personnel near key military bases and near prime contractors.

Provide Proactive Customer Support

Because of the complexity of our test solutions, key customers prefer to have Giga-tronics engineers nearby to support the test systems and to develop enhancements and upgrades. We recently established an R&D development center. in Nashua, New Hampshire to provide support to customers with operations on the East Coast with the goal of developing a recurring revenue stream from improvements and customizations requested by our customers.

We are also developing strategic relationships with on-base contractors to provide on-site support for our fielded test systems. We believe this is critical to the success of operating systems with this level of complexity. We plan to establish additional locations as our customer base grows.

Expand the Microsource Component Business

We believe our RADAR filter technology is positioned well with prime fighter aircraft manufacturers and expect it will continue to be a major source of our revenue. Our long-term growth strategy is to take microwave technology from the RADAR/EW test platform and deploy it in miniature and ruggedized withform, similar to our chip and wire technology,Microsource RADAR filters, to provide additional Microwave modulesoperational capabilities to the prime contractors tofor whom we currently provide our test solutions.

Recent Developments

Going ConcernSummary Risk Factors

We have sustained recurring operating losses, raisingInvesting in our common stock involves substantial doubt about risk, and our business is subject to numerous risks and uncertainties, including those listed in the section entitled “Risk Factors” and elsewhere in this prospectus. These risks include, among other things:

the risk that customers may delay or cancel orders for our products or services;

any issue that compromises our relationships with the U.S. federal government, its agencies or defense contractors providing products and services to these agencies;

changes in governmental priorities that shift expenditures away from national defense;

failure by us or our employees to obtain and maintain necessary security clearances or certifications;

failure to comply with numerous laws and regulations;

our ability to continue as a going concern. We incurred net losses of $3.1 million in fiscal 2018,compete effectively against competitors with greater resources than ours;

any inability to attract, train or retain employees with the requisite skills, experience and $1.5 million in fiscal 2017. These losses have contributed to an accumulated deficit of $28.7 million as of March 31, 2018.security clearances; and

internal system or service failures and security breaches.

Recent Securities Issuances and Oher Recent Events

The Company’s financial statements for all periods have been prepared assuming that we will continue as a going concern. Our continuation as a going concern is dependent upon us reducing expenses, raising additional capital to fund future operations and recognizing revenue from sales and other factors, as discussed in Note 2 to our Audited Consolidated Financial Statements as of and for the Fiscal Years EndedBetween March 31, 2018 and March 25, 2017 attached to this prospectus. We have utilized cash in operating activities of $1.6 million and $945,000 during the fiscal year ended March 31, 2018 and the three months ended June 30, 2018 and2019, we had $748,000 cash on hand as of our most recently completed fiscal quarter, which ended June 30, 2018.

Sales of Series E Shares

We sold 100,000 shares of our 6.0% Series E Senior Convertible Voting Perpetual Preferred Stock, or Series E Shares, on March 26, 2018Preferred Stock, to accredited investors in a private placement discussed elsewhere in this prospectusat the price of which $1.1 million (in$25.00 per share for aggregate gross proceeds) was received during March 2018 and $220,000 (in gross proceeds) was received duringproceeds of $2.5 million. Shares of our first fiscal quarter ended JuneSeries E Preferred Stock accrue dividends at the rate of 6% per annum. There are currently 97,800 shares of our Series E Preferred Stock outstanding.

Beginning on September 30, 2018, resulting in cash on hand2019, we offered holders of $1.5 millionour Series E Preferred Stock the opportunity to exchange all or some of their Series E Preferred Shares for shares of our common stock at March 31, 2018 and $748,000the rate of cash on hand as150 shares of June 30, 2018. Since June 30, 2018, we raised an additional $531,105 of capital through September 28, 2018 through additional salescommon stock for each shares of Series E Shares andPreferred Share, along with an additional number of shares of common stock representing payment of accrued but unpaid dividends on the exerciseSeries E Preferred Stock. This offer to exchange is conditioned upon us selling at least $2.0 million of warrants to purchase our common stock.stock in this offering and is expected to be effective upon the completion of this offering. Holders of 88,600 shares of our Series E Preferred Stock have elected to exchange their shares of Series E Preferred Stock in this offer to exchange. As a result, we expect that we will issue approximately 13,470,000 of shares of our common stock in exchange for 88,600 shares of our Series Preferred Stock upon the completion of this offering, and that 9,200 shares of our Series E Preferred Stock will remain outstanding.

On September 24, 2019, we amended our articles of our articles of incorporation to increase the number of shares of common stock that we are authorized to issue from 40 million shares to 200 million shares. Our shareholders approved this amendment at our annual meeting of shareholders on September 19, 2019.

At our September 19, 2019 annual meeting of shareholders, our shareholders also approved a reverse stock split of our common stock in the range of 1 for 10 shares of common stock to 1 for 20 shares of common stock. In accordance with such shareholder approval, our board of directors has the authority to determine the final ratio of the stock split within this range and whether and when to complete the reverse stock split, provided that it is completed on or prior to March 31, 2020. Our board has not chosen a ratio or decided whether or when to complete the reverse stock split. We will not complete the reverse stock split prior to the completion of this offering. If we complete the reverse stock split, the number of shares authorized for issuance under our articles of incorporation will decrease at the same ratio as the reverse stock split.

SUMMARY OF THE OFFERING

|

| ||

| |||

Offering price: | $0.29 per share | ||

Common stock outstanding before this offering: | 13,215,188 shares as of October 31, 2019 | ||

| |||

| 35,388,600 shares. If the underwriter’s over-allotment option is exercised in full, the total number of shares of common stock outstanding |

| |

|

| ||

| We have granted a 30-day option to the |

| |

|

| ||

Use of | We | ||

|

| ||

Dividend | We have never declared any cash dividends on our common stock. We currently intend to use all available funds and any future earnings for use in financing the growth of our business and do not anticipate paying any cash dividends for the foreseeable future. See “Dividend Policy.” | ||

|

| ||

OTCQB Trading | GIGA | ||

Risk | An investment in the Company’s common stock involves a high degree of risk. You should carefully read the “Risk Factors” section beginning on page |

(1) Beginning on September 30, 2019, we offered holders of our Series E Preferred Stock the opportunity to exchange all or some of their shares of Series E Preferred Stock for shares of our common stock at the rate of 150 shares of common stock for each share of Series E Preferred Stock held by them plus an additional number of shares of our common stock having a market value equal to the accrued but unpaid dividends, which were $0.52 per share of Series E Preferred Stock as of October 30, 2019. Holders of 88,600 shares of our Series E Preferred Stock have elected to exchange their shares for common stock. This offer to exchange is conditioned and would be effective upon the completion of our sale of at least $2.0 million of our common stock in this offering. The number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 13,215,188 shares of common stock outstanding as of October 30, 2019, and, except as otherwise indicated, all information in this prospectus, reflects and assumes (1) an offering price of $0.29 per share of common stock, and (2) the exchange of 88,600 outstanding shares of our Series E Preferred Stock for 13,470,000 shares of our common stock.

In addition, unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding is based on 10,939,011 sharesimmediately after the completion of common stock issued and outstanding as of September 28, 2018 and does not include the following: 2,237,700this offering:

● excludes 3,550,000 shares of common stock issuable upon exercise of stock options outstanding options, 3,451,594at June 29, 2019 at a weighted average exercise price of $0.39 per share;

● excludes 1,686,000 shares of common stock issuable upon exercise of outstanding warrants, 8,853,351 shares of common stock issuable upon conversion of all ofreserved at June 29, 2019 available for future awards under our outstanding preferred shares, 572,858 shares recently issued upon exercise of warrants,2018 Equity Incentive Plan; and 600,000 shares of common stock potentially issuable as dividends on the Series E Shares.

(2) Reflects● assumes the number of shares of common stock outstanding assuming the conversion orunderwriters do not exercise of optionstheir overallotment option to purchase 2,237,700up to 1,305,000 additional shares of common stock, warrants to purchase 3,451,594 shares of common stock, 8,853,351 shares of common stock issuable upon conversion of all of our outstanding preferred shares, 572,858 shares recently issued upon exercise of warrants, and 600,000 shares of common stock potentially issuable as dividends on the Series E Shares that were outstanding as of September 28, 2018.from us.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows use to “incorporate by reference” the information we have filed with the SEC, which means that we can disclose important information to you by referring you to those documents. The information that the Company incorporates by reference is an important part of this prospectus, and information that it files later with the SEC will automatically update and supersede this information. The documents the Company is incorporating by reference are:

● | Our Annual Report on Form 10-K for the fiscal year ended March |

● | Our Quarterly Report on Form 10-Q for the fiscal quarter ended June 29, 2019 filed with the SEC on August |

● | Our Current |

● | Portions of our definitive Proxy Statement on Schedule 14A filed with the SEC on July 26, 2019 which are incorporated by reference into our Annual Report on Form 10-K; and |

● | The description of our common stock included in the registration statement on Form 8-A filed on July 31, 1984 and any amendment or report filed for the purpose of updating such description. |

Additionally, all documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) after (i) the date of the initial registration statement and prior to effectiveness of the registration statement, and (ii) the date of this prospectus and before the termination or completion of any offering hereunder, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.”

We will provide, without charge, to each person to whom a copy of this prospectus is delivered, including any beneficial owner, upon the written or oral request of such person, a copy of any or all of the documents incorporated by reference herein, including exhibits. Requests should be directed to: Attention: Investor Relations, 5990 Gleason Drive, Dublin, California 94568. The documents incorporated by reference may be accessed at our website at www.Giga-tronics.com.www.gigatronics.com.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this prospectus, before purchasing shares of our common stock. There are numerous and varied risks that may prevent us from achieving our goals. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Related to the Company’s Business

Our recurring operating losses have raised substantial doubt regarding our ability to continue as a going concern.

We have sustained recurring operating losses, raising substantial doubt about our ability to continue as a going concern. We incurred net losses of $3.1 million in fiscal 2018, $1.5 million in fiscal 2017 and $287,000 for the quarter ended June 30, 2018. These losses have contributed to an accumulated deficit of $28.7 million as of March 31, 2018 and $27.8 million as of June 30, 2018.

The Company’s financial statements for all periods have been prepared assuming the Company will continue as a going concern. As discussed in Note 2 to our Audited Consolidated Financial Statements at and for the fiscal years ended March 31, 2018 and March 25, 2017 and Note 2 to our unaudited Condensed Consolidated Financial Statements at and for the period ended June 30, 2018, each of which is included with this prospectus, our continuation as a going concern depends upon our reducing expenses, raising additional capital to fund future operations and recognizing sufficient revenue from sales. We have utilized cash in operating activities of $1.6 million and $945,000 during the fiscal year ended March 31, 2018 and the three months ended June 30, 2018. As of June 30, 2018, we had a total shareholders’ equity of $1,297,000 and an accumulated deficit of $27,793,000.We sold shares of our Series E Shares on March 26, 2018 in a private placement discussed elsewhere in this prospectus, resulting in cash on hand of $1,485,000 at March 31, 2018 and we raised an additional $235,075 of capital through June 30, 2018 through additional sales of Series E Shares and the exercise of warrants to purchase our common stock.

Beginning in fiscal 2012, we invested primarily in the development of our Advanced Signal Generation and Analysis, or ASGA, system product platform for RADAR/EW test applications (which we formerly referred to as “Hydra”) because we believe it possesses greater long-term opportunities for revenue growth and improved gross margins compared to our previous general-purpose test product lines, the substantial majority of which have been sold. Through March 31, 2018, we had spent over $13 million towards the development of the ASGA system product platform. Although we anticipate long-term revenue growth and improved gross margins from the new ASGA product platform, delays in completing it have also contributed to our losses. We have also experienced delays in the development of features, receipt of orders, and shipments for the new ASGA system products. These delays have significantly contributed to a decrease in working capital from $620,000 at March 25, 2017 to ($386,000) at March 31, 2018. Although ASGA system products have now shipped to several customers, potential delays in the refinement of further features, longer than anticipated sales cycles, or the ability to generate shipments in significant quantities, could significantly contribute to additional future losses.

To address these matters, our management has taken several actions to provide additional liquidity and reduce costs and expenses going forward. These actions are described in the section of this prospectus titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 2 to our Audited Consolidated Financial Statements at and for the fiscal year ended March 31, 2018 and March 25, 2017 attached to this prospectus

We have significant working capital requirements and have experienced operating losses. If we continue to experience operating losses, it could have a material adverse effect on its business, financial condition and results of operations.

We are dependent upon obtaining revenues from sales and raising additional capital to meet our working capital needs. Since 2011, we have relied on a series of private placements, legacy product line sales, and loans to fund our operating cash flow deficits. There is no assurance that we will generate the necessary net income or operating cash flows to meet our working capital requirements and pay our debts as they become due in the future due to a variety of factors and other factors discussed in this “Risk Factors” section.

To bring the RADAR/EW product platform to its full potential, we may need to seek additional working capital; however, there are no assurances that such working capital will be available, or on terms acceptable to us. We may also be required to further reduce expenses if our RADAR/EW product platform sales goals are not achieved and could, for example, choose to focus solely on our profitable Microsource component business segment to generate profits and cash from operating activities. As part of such a restructuring, management believes the microwave components which the Company developed for the RADAR/EW test products could be a source of future growth for the Microsource business segment.

To address these matters, we have taken several actions to provide additional liquidity and reduce costs and expenses going forward. These actions are described in the section of this prospectus titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 2 to our audited financial statements for the fiscal years ended March 31, 2018 and March 25, 2017 attached to this prospectus. We cannot assure you, however, that we will be able to successfully take any of these actions, including adjusting expenses sufficiently or in a timely manner, or raising additional equity, increasing borrowings or completing a financing on any terms or on terms that are acceptable to us. Our inability to take these actions as and when necessary would materially adversely affect our liquidity, results of operations, financial condition and ability to operate.

Holders of our Series E Shares have voting rights and preferences that may limit our access to additional capital and their interests may conflict with those of our other shareholders.

We must obtain the approval of the holders of our Series E Shares to complete certain types of transactions. For example, the Certificate of Determination for our Series E Shares prohibits us from issuing any shares having preferences that are superior to or on parity with our Series E Shares. Upon a liquidation of the Company, a sale of our Microsource business line, or sale of our Simulation and Electronic Warfare (formerly known as Hydra) business line, the holders of Series E Shares would be entitled to receive their full liquidation preference of $37.50 per Series E Share, or approximately $2.6 million in the aggregate from the liquidation or sale proceeds before we would be permitted to make distributions to holders of our common stock or other series of preferred shares. In addition, under the terms of our Investor Rights Agreement with the holders of our Series E Shares, we are required to obtain the approval of holders representing 66.6% of the Series E Shares to incur any additional indebtedness, other than commercial bank debt or trade debt.

These restrictions could make it more difficult to raise capital through sales of new series of preferred stock or debt without the approval of the holders of our Series E Shares, who interests may be different than those of our other shareholders who are not entitled to similar preferences or approval rights.

Our sales cycles can be long and unpredictableand our sales efforts require considerable time and expense. As a result, our sales and revenue are difficult to predict and may vary substantially from period to period, which may cause our operating results to fluctuate significantly.

The timing of our revenues is difficult to predict. Most of our revenues result from a limited number of relatively large orders that we receive from prime defense contractors. We spend substantial time and resources on our sales efforts without any assurance that our efforts will produce any sales. In addition, purchases of our products are frequently subject to budget constraints, multiple approvals, and unplanned administrative, processing and other delays. Even if we receive a purchase order, there may be circumstances or terms relating to the purchase that delay our ability to recognize revenue from that purchase, which makes our revenue difficult to forecast. Our financial condition may also cause potential customers to delay, postpone or decide against placing orders for our products. As a result, it is difficult to predict whether a sale will be completed, the particular fiscal period in which a sale will be completed or the fiscal period in which revenue from a sale will be recognized. For these reasons, our operating results may vary significantly from quarter to quarter.

Our board of directors and its Audit and Nominating Committees are comprised of directors, a majority of whom are not considered to be independent under the standards of the Nasdaq Stock Market.

The rules applicable to companies with securities listed on certain securities exchanges require that a listed company’s board of directors meet certain independence standards. For example, the Nasdaq Stock Market, where our common stock was listed until 2017, requires that the majority of a company’s directors be independent and that a company’s nominating, audit and compensation committee be comprised entirely of independent directors. We are no longer required to comply with these independence standards because our common stock is no longer listed on the Nasdaq Stock Market. We would not meet these standards if they applied to use because a majority of our board of directors would not be considered to be independent under Nasdaq’s standards and our audit and nominating and governance committees include directors who would not be considered independent under Nasdaq’s independence standards. See “Management - Committees of the Board of Directors” and “—Independence of Board of Directors.” Accordingly, you may not have the same protections afforded to shareholders of companies that have or that are required to have a board and committees that satisfy Nasdaq’s independence standards.

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer.

In the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information and that of our customers and business partners, some of which is stored on our network and some of which is stored with our third-party vendors. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to operator error, malfeasance or other disruptions. Any such breach could compromise our network and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in competitive hardship, legal claims or proceedings, liability under laws that protect the confidentiality of information, disrupt our operations, and damage our reputation, which could adversely affect our business.

If we are deemed to infringe on the proprietary rights of third parties, we could incur unanticipated expense and be prevented from providing our products and services.

We could be subject to intellectual property infringement claims as the number of our competitors grows and if our products or the functionality of our products overlap with patents of our competitors. While we do not believe that we have infringed or are infringing on any proprietary rights of third parties, we cannot assure you that infringement claims will not be asserted against us or that those claims will be unsuccessful. We could incur substantial costs and diversion of management resources defending any infringement claims whether or not such claims are ultimately successful. Furthermore, a party making a claim against us could secure a judgment awarding substantial damages, as well as injunctive or other equitable relief that could effectively block our ability to provide products or services. In addition, we cannot assure you that licenses for any intellectual property of third parties that might be required for our products or services will be available on commercially reasonable terms, or at all.

Our business depends on our intellectual property rights, and if we are unable to protect them, our competitive position may suffer.Corporate Strategy

Our business plan is predicated on our proprietary technology. Accordingly, protecting our intellectual property rights is criticalcorporate objectives are to our continued success(1) maintain and our ability to maintain our competitive position. Our goal is to protect our proprietary rights through a combination of patent, trademark, trade secret and copyright law, confidentiality agreements and technical measures. We generally enter into non-disclosure agreements with our employees, consultants and suppliers and limit access to our trade secrets and technology. We cannot assure you that the steps we have taken will prevent misappropriation of our technology. Misappropriation of our intellectual property would have an adverse effect on our competitive position.

If we lose the services of our Chief Executive Officer, Chief Financial Officeror other key personnel, we may be unable to replace them, and our business, financial condition and results of operations may be adversely affected.

Our success largely depends on the continued skills, experience, efforts and policies of our management and other key personnel and our ability to continue to attract, motivate and retain highly qualified employees. In particular, the services of John Regazzi, our Chief Executive Officer, and Lutz Henckels, our Chief Financial Officer, are integral to the execution of our business strategy. We believe that the loss of the services of Mr. Regazzi or Dr. Henckels could adversely affect our business, financial condition and results of operations. We cannot assure you that Mr. Regazzi or Dr. Henckels or our other executive officers will continue to provide services to the Company. We do not maintain key man insurance for any of our key personnel.

Our directors and executive officers and their affiliates beneficially own a significant number of shares of our common stock. Their interests may conflict with our outside shareholders, who may be unable to influence management and exercise control over our business.

As of the date of this prospectus, our executive officers and directors beneficially own approximately 12% of our shares of common stock. As a result, our executive officers and directors may be able to: affect the election or defeat the election of our directors, amend or prevent amendment to our certificates of incorporation or bylaws, effect or prevent a merger, sale of assets or other corporate transaction, and control the outcome of any other matter submitted to the shareholders for vote. Accordingly, our outside shareholders may be unable to influence management and exercise control over our business.

We do not intend to pay cash dividends to our shareholders, so you will not receive any return on your investment in our common stock prior to selling your shares.

We have never paid any dividends to our common shareholders and do not foresee doing so. We currently intend to retain any future earnings for funding growth and, therefore, do not expect to pay any cash dividends in the foreseeable future. If we determine that we will pay cash dividends to the holders of our common stock, we cannot assure that such cash dividends will be paid on a regular basis. The success of your investment in the Company will likely depend entirely upon any future appreciation. As a result, you will not receive any return on your investment prior to selling your shares in our Company and, for the other reasons discussed in this “Risk Factors” section, you may not receive any return on your investment even when you sell your shares in our Company.

We require additional capital to support our current operations and this capital has not been readily available.

We will require additional debt or equity financing to fund our current operations. Our recent history of losses, changes to our product focus and the development of new products makes it difficult to evaluate our current business model and future prospects. Accordingly, investors should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies developing new products as we have, in fact, encountered. Potential investors should carefully consider the risks and uncertainties that a company with limited funds and recently developed products, will face. In particular, potential investors should consider that there is a significant risk that we will not be able to:

|

| |

|

| |

|

| |

|

|

If we raise additional funds through further issuances of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our existing capital stock. Any debt financing secured by us in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. In addition, we may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to support our current operations and to respond to business challenges would be significantly limited. If we cannot access the capital necessary to support our business, we would be forced to curtail our business activities or even shut down operations. If we cannot execute any one of the foregoing or similar matters relating to our business, the business may fail, in which case you would lose the entire amount of your investment in the Company.

If we fail to maintain an effective system of internal controls, we may not be able to report our financial results accurately or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. With each prospective acquisition, we will conduct whatever due diligence is necessary or prudent to assure us that the acquisition target can comply with the internal controls requirements of The Sarbanes-Oxley Act of 2002. Notwithstanding our diligence, certain internal controls deficiencies may not be detected. As a result, any internal control deficiencies may adversely affect our financial condition, results of operations and access to capital. We have not performed an in-depth analysis to determine if historical undiscovered failures of internal controls exist, and may in the future discover areas of our internal controls that need improvement.

Risks Related to Our Securities

Our stock price may be volatile and you may not be able to resell your shares at or above the purchase price.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. Our stock at any time has historically traded on low volume on the OTCQB Market and, previously, on the NASDAQ Capital Market. Market and volume fluctuations may also materially and adversely affect the market price of our common stock.

We are subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

Our common stock is subject to the provisions of Section 15(g) of the Exchange Act and Rule 15g-9 thereunder, commonly referred to as the “penny stock rule”. Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

Because our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker dealers must make a special suitability determination for the purchase of securities and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document prepared by the SEC relating to the penny stock market. A broker dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock and may affect the ability of our shareholders to sell their shares.

Consequently, these rules may restrict the ability or willingness of a broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of our shareholders to sell their shares of common stock.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of shares of common stock by the Selling Securityholders. However, we will receive proceeds from the exercise of the warrants if they are exercised for cash by the Selling Securityholders, and will use such proceeds for working capital purposes.

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

Common Stock Market Prices

Our common stock is traded on the OTCQB market under the symbol “GIGA”. The number of record holders of our common stock as September 28, 2018 was approximately 10,939,011. A significantly larger number of shareholders may be “street name” or beneficial holders, whose shares of record are held by banks, brokers and other financial institutions. The following table shows the high and low closing bid quotations for the common stock during the indicated fiscal periods. These quotations reflect inter-dealer prices without mark-ups, mark-downs, or commission and may not reflect actual transactions.

Fiscal Quarter | High | Low | |||||||

2019 Fiscal Year | |||||||||

Third Quarter | September 30, 2018 – December 29, 2018 (through October 15, 2018) | $ | 0.35 | $ | 0.26 | ||||

Second Quarter | July 1, 2018 – September 29, 2018 | 0.46 | 0.30 | ||||||

First Quarter | April 1, 2018 – June 30, 2018 | 0.35 | 0.23 | ||||||

2018 Fiscal Year | |||||||||

Fourth Quarter | December 31, 2017 – March 31, 2018 | $ | 0.42 | $ | 0.26 | ||||

Third Quarter | October 1, 2017 – December 30, 2017 | 0.85 | 0.37 | ||||||

Second Quarter | June 25, 2017 – September 30, 2017 | 0.89 | 0.58 | ||||||

First Quarter | March 26, 2017 – June 24, 2017 | 0.90 | 0.73 | ||||||

2017 Fiscal Year | |||||||||

Fourth Quarter | December 25, 2016 – March 25, 2017 | $ | 1.07 | $ | 0.65 | ||||

Third Quarter | September 25, 2016 – December 24, 2016 | 0.95 | 0.63 | ||||||

Second Quarter | June 26, 2016 – September 24, 2016 | 1.15 | 0.93 | ||||||

First Quarter | March 27, 2016 – June 25, 2016 | 1.47 | 1.06 | ||||||

Dividend Policy

We have not paid cash dividends on our common stock in the past and have no current plans to do so in the future, believing our available capital is best used to fund our operations, including product development and enhancements. In addition, in the absence of positive retained earnings, California law permits payment of cash dividends on our common stock only to the extent total assets exceed the sum of total liabilities and the liquidation preference amounts of preferred securities. At June 30, 2018, the Company’s assets were less than this sum by $4.2 million. Our Series E Shares provide for semi-annual 6% cash dividends based on the original purchase price of $25.00 per share, however we expect that we will exercise our right to pay any such dividends in shares of our common stock instead of cash for the foreseeable future.

Penny Stock

Our common stock is subject to the provisions of Section 15(g) of the Exchange Act and Rule 15g-9 thereunder, commonly referred to as the “penny stock rule.” Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules. Because our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker dealers must make a special suitability determination for the purchase of securities and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document prepared by the SEC relating to the penny stock market. A broker dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock and may affect the ability of our shareholders to sell their shares.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our audited (and unaudited) financial statements and the related notes that are incorporated by reference into this prospectus. All dollar amounts in this registration statement refer to U.S. dollars unless otherwise indicated.

Overview and Refocusing of Giga-tronics

We produce YIG (Yttrium, Iron, Garnet) tuned oscillators, RADAR filters, and microwave synthesizers for use in military defense applications. We also produce sophisticated functional test systems which are primarily used in RADAR/EW test applications. We have two reporting segments: Microsource and the Giga-tronics Division.

|

|

|

|

Our Giga-tronics Division’s RADAR/EW test and simulation products have been our principal new product development initiative since 2011. Between 2013 and 2016, we sold the substantial majority of our original broad product line of general purpose parametric test products used for the design, production, repair and maintenance of aerospace and telecommunications equipment because of lack of growth potential and poor gross margins. We believe the RADAR/EW test product market possesses greater long-term opportunities for revenue growth and improved gross margins compared to the general purpose test equipment marketplace. We believe that customer spending for RADAR/EW systems, including our test and simulation products, will grow in future years due to the increasing complexity of RADAR signals and foreign investment in new technology which may increase customer demand for more sophisticated test solutions.

The sales of our legacy general-purpose test product lines allowed us to significantly reduce our headcount and operating expenses during fiscal years 2018 and 2017. For example, our operating expenses for fiscal 2018 were 15% lower as compared to fiscal year 2017 and 30% lower as compared to fiscal year 2016.

Although we believe our functional RADAR/EW test products have the potential to significantly grow our sales revenue, we have experienced significant delays in developing, manufacturing, and receiving orders for these products. These RADAR/EW test products are the most technically complex and advanced products that we have developed and manufactured, and we have experienced delays in efficiently manufacturing these products and bringing them to market. These products are priced significantly higher than our previous general-purpose test products, and we have experienced longer than anticipated procurement cycles in the RADAR/EW market we service. The delays in the development, refinement and manufacturing of the RADAR/EW platform products, along with the longer than anticipated procurement cycles, contributed to the significant operating losses in fiscal years 2018 and 2017. Through March 31, 2018, we delivered our new RADAR/EW test products to multiple customers resulting in approximately $10 million in revenue. Additionally, we have recently restructured and refocused our sales force to focus on selling complete custom test solutions to defense agencies and prime contractors as opposed to selling test instruments.

We also anticipate growth in our Microsource RADAR filter business based on our order backlog as of June 30, 2018 and the potential for additional future orders for existing products and related services.

Significant Orders

Both Microsource and the Giga-tronics Division generally receive a limited number of large customer orders each year. The timing of orders, and any associated milestones achievement, can cause significant differences in orders received, backlog, sales, deferred revenue, inventory and cash flow when comparing one fiscal period to another. Below is a review of recently received significant orders at March 31, 2018:

Microsource

In fiscal 2015, Microsource received a $6.5 million order for non-recurring engineering services and for delivery of a limited number of flight-qualified prototype hardware from a prime defense contractor to develop a variant of our high performance, fast tuning YIG RADAR filters for a fighter jet aircraft platform. In fiscal 2016 our Microsource business unit also finalized an associated multiyear $10.0 million YIG production order. We began shipping the shipping the 2106 YIG production order in the second quarter of fiscal 2017 and anticipate shipping the remainder through fiscal 2020.

In the first quarter of fiscal 2017, Microsource received a $4.5 million YIG RADAR filter we have been manufacturing for a fighter jet platform since fiscal 2014. We shipped approximately $4.1 million of this order in fiscal 2017 and shipped the remainder in the first quarter of fiscal 2018.

In July 2016, Microsource received a $1.9 million non-recurring engineering order associated with redesigning a component of its high performance YIG filter used on a fighter jet aircraft platform. Of this non-recurring engineering services service order, we delivered services of approximately $884,000 and $816,000 in fiscal years 2017 and 2018, respectively, and expect to deliver the remaining services during fiscal 2019.

In September 2017, Microsource received a $4.8 million order for continuing the YIG RADAR filter for a fighter jet platform. The Company expects to begin initial shipments of these filters in the fourth quarter of fiscal 2018 and ship the bulk of the order over the succeeding 9 to 12 month period.

In February 2018, Microsource received a $1.6 million YIG RADAR filter order from one of our customers. We expect to start shipping this order in the second quarter of fiscal 2019.

Giga-tronics Division

In June 2016, the Giga-tronics Division received a $3.3 million order from the U.S. Navy for our Real-Time Threat Emulation System (TEmS) which is a combination of the ASGA hardware platform, along with software developed and licensed to us from a major aerospace and defense company. The complete order included ASGA blades, along with engineering services to integrate the Real-Time TEmS product with additional third-party hardware and software for the customer. We fulfilled the order during the fourth quarter of our 2017 fiscal year. In July 2016, we received an additional order for $542,000 from the U.S. Navy for our ASG hardware only platform. We fulfilled this order in the second quarter of our 2017 fiscal year.

In July 2017, the Giga-tronics Division received a follow on $1.7 million order from the U.S. Navy for our TEmS product. We fulfilled this order during the third quarter of fiscal 2018.

Critical Accounting Policies

Our discussion and analysis of our financial condition and the results of operations are based upon our Audited Consolidated Financial Statements as of and for the Years Ended March 31, 2018 and March 25, 2017, which we refer to as our 2018 Audited Financial Statements, included in this prospectus and the data used to prepare them. The 2018 Audited Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States and management is required to make judgments, estimates and assumptions in the course of such preparation. The Summary of Significant Accounting Policies included with the 2018 Audited Financial Statements describes the significant accounting policies and methods used in the preparation of the consolidated financial statements. On an ongoing basis, we re-evaluate our judgments, estimates and assumptions. We base our judgment and estimates on historical experience, knowledge of current conditions, and our beliefs of what could occur in the future considering available information. Actual results may differ from these estimates under different assumptions or conditions. We have identified the following as our critical accounting policies:

Revenue Recognition