AS FILED WITH THE

As filed with the Securities and Exchange Commission on July 15, 2019

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION ON APRIL 28, 2015.

UNITED STATESSECURITIES AND EXCHANGE COMMISSION

WASHINGTON,WASHINGTON, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BARREL ENERGY, INC. |

|

Nevada

(State of other jurisdiction of incorporation)

1311

Primary Standard Industrial Classification Code Number

47-1963189

I.R.S. Employer Identification Number

|

|

|

|

|

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

|

|

Approximate dateHarpreet Sangha

Chairman

8275 S. Eastern Ave. Suite 200

Las Vegas, NV 89123

702-595-2247

(Name, address, including zip code, and telephone number, including area code, of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.agent for service)

Copies to:

Frederick C. Bauman, Attorney

Bauman & Associates Law Firm

6440 Sky Pointe Dr., Ste 140-149

Las Vegas, NV 89131

(702) 533-8372

(COVER CONTINUES ON FOLLOWING PAGE) From time to time after the effective date of this registration statement. (Approximate date of commencement of proposed sale to the public) |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statementregistration statement number of the earlier effective Registration Statementregistration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statementregistration statement number of the earlier effective Registration Statementregistration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statementregistration statement number of the earlier effective Registration Statementregistration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ¨ |

| ¨ |

| ¨ | Smaller reporting company | x |

Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered | Amount to be Registered | Proposed Maximum offering price per share (2) | Proposed Maximum aggregate offering price | Amount fee (1) | ||||||||||||

|

|

|

|

|

|

| ||||||||||

Common Stock | 8,000,000 | $ | 0.025 | $ | 200,000 | $ | 23.24 | |||||||||

Calculation of Registration Fee

Title of Each Class of Securities to be Registered |

| Amount to be Registered (1) |

|

| Proposed Maximum Offering Price per Share (2) |

|

| Proposed Aggregate Maximum Offering Price |

|

| Amount of Registration Fee (3) |

| ||||

Common stock, $.001 par value |

|

| 9,250,000 |

|

| $ | 0.216 |

|

| $ | 1,998,000 |

|

| $ | 242.16 |

|

_______

| (1) | Represents shares of our common stock being registered for resale that have been issued or will be issued to the Selling stockholder named in the registration statement. |

| (2) | Price per share shown is 80% of the lowest trading price reported in the consolidated reporting system as reported on the OTC Markets website for the 15 trading days prior to May 24, 2019. |

| (3) | Estimated solely for the purposes of computing the registration fee in accordance with Rule 457(c) of the Securities Act of 1933, as amended. |

The Registrantregistrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall thereafter become effective in accordance with sectionSection 8(a) of the Securities Act of 1933 or until the registration statementthis Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| 2 |

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities under this prospectus until the registration statement of which it is a part and filed with the Securities and Exchange Commission acting pursuantis effective. This prospectus is not an offer to such section 8(a), may determine.sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED JULY 15, 2019

BARREL ENERGY, INC.

8,000,000 SHARES OF COMMON STOCK 9,250,000 Shares of Common Stock

$0.025 per share

NO MINIMUMOffered by the Selling Stockholder

This isprospectus relates to the initial offeringresale from time to time by the selling shareholder identified herein of Commonup to an aggregate of 9,250,000 shares of common stock consisting of:

7,500,000 shares of Barrel Energy Inc.our common stock underlying an Equity Line extended by Crown Bridge Partners LLC (“CROWN BRIDGE”) for up to $3,000,000, together with 1,750,000 shares constituting the maximum commitment fee payable to Crown Bridge under the Equity Line. 175,000 of the commitment shares were initially issued at the Equity Line closing. CROWN BRIDGE has agreed to purchase these shares if put to it by us pursuant to the terms of the Equity Purchase Agreement (the “EPA”) we entered into with CROWN BRIDGE on November 13, 2018. Subject to the terms and conditions of the EPA, we have the right to "put," or sell, up to $3,000,000. We will not receive any proceeds from the resale of these shares of common stock offered by CROWN BRIDGE. We will, however, receive proceeds from the sale of shares directly to CROWN BRIDGE pursuant to the EPA. When we put an amount of shares to CROWN BRIDGE, the per share purchase price that CROWN BRIDGE will pay to us in respect of such put will be determined in accordance with a formula set forth in the Equity Purchase Agreement. There will be no public market existsunderwriter's discounts or commissions so we will receive all of the proceeds of our sale to CROWN BRIDGE. The purchase price to be paid by CROWN BRIDGE will be equal to 80% multiplied by the lowest traded price of our common stock for the securities being offered. Barrel Energy Inc. is offering10 trading days following the Clearing Date (the “Market Price”). We will be entitled to put to CROWN BRIDGE on each put the lesser of $100,000 or 200% of the average of the dollar volume on the principal trading exchange for sale a totalour common stock for the 10 trading days preceding the put date; provided that the number of 8,000,000shares to be purchased by CROWN BRIDGE shall not exceed the number of such shares that, when added to the number of shares of its Common Stock on a "self-underwritten"our common stock then beneficially owned by CROWN BRIDGE, would exceed 4.99% of the number of shares of our common stock outstanding. CROWN BRIDGE may sell any shares offered under this prospectus at prevailing market prices or privately negotiated prices. CROWN BRIDGE is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"), best effort basis. The shares will be offered at a fixed pricein connection with the resale of $.025 per share for a period not to exceed 180 days fromour common stock under the dateEPA. For more information, please see the section of this prospectus unless extended by our Boardtitled "Plan of Directors for an additional 90 days.Distribution" beginning on page 37.

ThereThe transactions by which the selling stockholder is no minimum numberacquiring their securities from us will be exempt under the registration provisions of shares required to be purchased. This offering is on a best effort basis, meaning, no minimum numberthe Securities Act by virtue of shares must be sold. See "Use of Proceeds" and "Plan of Distribution"Section 4(a)(2).

Barrel Energy Inc. is a development stage, start-up company. Any investmentWe are an "emerging growth company" under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

Investing in the shares offered hereinour common stock involves a high degree of risk. You should only purchaseconsider carefully the risk factors beginning on page 6 of this prospectus before purchasing any of the shares if you can afford a complete loss of your investment.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, RISK FACTORS SECTION, BEGINNING ON PAGE 7.

Barrel Energy Inc. qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”).offered by this prospectus.

Our independent registered accountants’ audit report stated that we have had significant operating losses, a working capital deficiencycommon stock is quoted on the OTC Pink under the symbol "BRLL". The last reported sale price of our common stock on the OTC Pink on July 15, 2019 was $0.075 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and that we are in need for a new capital raise, which raise substantial doubt about our ability to continue as a going concern.any amendments or supplements carefully before you make your investment decision.

Neither the U.S. Securities and Exchange Commission nor any state securities divisioncommission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROCEEDS

| Offering Price Per Share | Total Amount of Offering | Underwriting Commissions | Proceeds To Us | ||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Common Stock | $ | 0.025 | $ | 200,000 | $ | 0 | $ | 200,000 | ||||||||

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.The date of this prospectus is July 15, 2019

Subject to Completion, _____ 2015

TABLE OF CONTENTS

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

BARREL ENERGY INC.

14890 66a Ave.

Surrey, B.C. V3S 9Y6, Canada

SUMMARYTABLE OF PROSPECTUS

You should read the following summary together with the more detailed business information, financial statements and related notes that appear elsewhere in this prospectus. In this prospectus, unless the context otherwise denotes, references to "we," "us," "our" and "Barrel" are to Barrel Energy Inc.

GENERAL INFORMATION ABOUT OUR COMPANY

Barrel Energy Inc. was incorporated in the State of Nevada on January 27, 2014. Barrel Energy Inc. is an oil and gas company with a focus on assets located in North America. Currently the company holds oil & gas leases in Alberta, Canada and its strategy is to exploit high impact and development oil plays and liquids-rich deep basin gas plays through the development of its asset base. The company currently holds interest in 2560 acres of oil & gas leases known as the Bison Property. Our near term business strategy is to conduct exploration activities on the Bison Property.

We are a development stage company and have not yet generated any revenues. Our limited start-up operations have consisted of the formation of our business plan and acquisition of our oil and gas leases. Currently our President devotes approximately 20 hours a week to the company. We will require the funds from this offering in order to implement our business plan as discussed in the "Plan of Operation" section of this prospectus. We have been issued a "substantial doubt" going concern opinion from our auditors and our assets at September 30, 2014 consisted of $55,542.

Our administrative office of the company is currently located at the premises of our President, Gurminder Sangha, which he provides to us on a rent free basis at 14890 66a Ave., Surrey, B.C. V3S 9Y6, Canada. We plan to use these offices until we require larger space. Our fiscal year end is September 30.

THE OFFERING

Following is a brief summary of this offering. Please see the Plan of Distribution section for a more detailed description of the terms of the offering.CONTENTS

|

| |

|

| |

|

|

|

|

| |

|

| |

|

| |

|

| |

|

|

Our officer, director, control person and/or affiliates do not intend to purchase any shares in this offering.

Selected Financial Data

The Following financial information summarizes the more complete historical financial information at the end of this prospectus. The total Expenses are composed of incorporation and banking Costs.

BALANCE SHEET

| As of September 30, 2014 | ||||

| Total Assets | $ | 55,542 | ||

| Total Liabilities | $ | 68,299 | ||

| Stockholders Equity (deficit) | $ | (12,757 | ) | |

INCOME STATEMENT

Period from January 27, 2014 To September 30, 2014 | ||||

| Revenue | $ | -0- | ||

| Total Expenses | $ | (20,208 | ) | |

| Total other expenses | $ | (1,933 | ) | |

|

|

| ||

| Net Loss | $ | (22,141 | ) | |

|

|

| ||

| Foreign currency translation adjustment | $ | 395 |

| |

|

|

| ||

| Comprehensive (loss) | $ | 21,746 |

|

RISK FACTORS

An investment in these securities involves an exceptionally high degree of risk and is extremely speculative in nature. Following are what we believe are all of the material risks involved if you decide to purchase shares in this offering.

RISKS ASSOCIATED WITH OUR COMPANY

THERE CAN BE NO ASSURANCE THAT WE WILL DISCOVER OIL OR NATURAL GAS IN ANY COMMERCIAL QUANTITY ON OUR PROPERTIES.

Exploration for economic reserves of oil and natural gas is subject to a number of risks. There is competition for the acquisition of available oil and natural gas properties. Few properties that are explored are ultimately developed into producing oil and/or natural gas wells. If we cannot discover oil or natural gas in any commercial quantity thereon, our business will fail.

WE DO NOT HAVE ANY PROVEN RESERVES OF OIL OR GAS.

We do not have any proven reserves of oil or gas. There are no reserves that may be relied upon for any purpose. Accordingly, you may not reasonably assume that the Company has any reserves on its leases.

EVEN IF WE ARE ABLE TO ENGAGE IN EXPLORATION ON OUR PROPERTY AND ESTABLISH THAT IT CONTAINS OIL OR NATURAL GAS IN COMMERCIALLY EXPLOITABLE QUANTITIES, THE POTENTIAL PROFITABILITY OF OIL AND NATURAL GAS VENTURES DEPENDS UPON FACTORS BEYOND THE CONTROL OF OUR COMPANY.

The potential profitability of oil and natural gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and natural gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls or any combination of these and other factors, and respond to changes in domestic, international, political, social and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. In addition, adverse weather conditions can hinder drilling operations. These changes and events may materially affect our future financial performance. These factors cannot be accurately predicted and the combination of these factors may result in our company not receiving an adequate return on invested capital. Also even with a productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or natural gas from the well. Production from any well may be unmarketable if it is impregnated with water or other deleterious substances. Also, the marketability of oil and natural gas which may be acquired or discovered will be affected by numerous related factors, including the proximity and capacity of oil and natural gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production, environmental protection, and quality of natural gas produced all of which could result in greater expenses than revenue generated by the well.

THE MARKETABILITY OF NATURAL RESOURCES WILL BE AFFECTED BY NUMEROUS FACTORS BEYOND OUR CONTROL WHICH MAY RESULT IN US NOT RECEIVING AN ADEQUATE RETURN ON INVESTED CAPITAL TO BE PROFITABLE OR VIABLE.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include market fluctuations in oil and natural gas pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of oil and natural gas and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

OIL AND NATURAL GAS OPERATIONS ARE SUBJECT TO COMPREHENSIVE REGULATION WHICH MAY CAUSE SUBSTANTIAL DELAYS OR REQUIRE CAPITAL OUTLAYS IN EXCESS OF THOSE ANTICIPATED CAUSING AN ADVERSE EFFECT ON OUR COMPANY.

Oil and natural gas operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and natural gas operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages. To date, we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in the future and this may affect our ability to expand or maintain our operations.

EXPLORATORY DRILLING INVOLVES MANY RISKS AND WE MAY BECOME LIABLE FOR RECLAMATION OR OTHER LIABILITIES WHICH MAY HAVE AN ADVERSE EFFECT ON OUR FINANCIAL POSITION.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour natural gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot economically insure.

EXPLORATION AND PRODUCTION ACTIVITIES ARE SUBJECT TO CERTAIN ENVIRONMENTAL REGULATIONS WHICH MAY PREVENT OR DELAY THE COMMENCEMENT OR CONTINUATION OF OUR OPERATIONS.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuation of a given operation. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry.

OUR AUDITORS HAVE ISSUED A GOING CONCERN OPINION

Our independent registered accountants’ audit report stated that we have had significant operating losses, a working capital deficiency and that we are in need for a new capital raise, which raise substantial doubt about our ability to continue as a going concern. If Management is unable to address these uncertainties in a successful manner, we could go out of business, with the result that you would lose your investment.

SINCE WE ARE A DEVELOPMENT STAGE COMPANY, HAVE GENERATED NO REVENUES AND LACK AN OPERATING HISTORY, AN INVESTMENT IN THE SHARES OFFERED HEREIN IS HIGHLY RISKY AND COULD RESULT IN A COMPLETE LOSS OF YOUR INVESTMENT IF WE ARE UNSUCCESSFUL IN OUR BUSINESS PLANS.

Our company was incorporated on January 27, 2014; we have not yet commenced our exploration activities on our Bison oil and gas leases; and we have not yet realized any revenues. We have no operating history upon which an evaluation of our future prospects can be made. Based upon current plans, we expect to incur operating losses in future periods as we incur significant expenses associated with the initial startup of our business. Further, we cannot guarantee that we will be successful in realizing revenues or in achieving or sustaining positive cash flow at any time in the future. Any such failure could result in the possible closure of our business or force us to seek additional capital through loans or additional sales of our equity securities to continue business operations, which would dilute the value of any shares you purchase in this offering.

WE DO NOT YET HAVE ANY SUBSTANTIAL ASSETS BEYOND OUR OIL AND GAS LEASES AND ARE DEPENDENT UPON THE PROCEEDS OF THIS OFFERING TO FULLY FUND OUR BUSINESS. IF WE DO NOT SELL AT LEAST HALF OF THE SHARES IN THIS OFFERING AND RECEIVE AT LEAST HALF OF THE MAXIMUM PROCEEDS, WE WILL HAVE TO SEEK ALTERNATIVE FINANCING TO COMPLETE OUR BUSINESS PLANS OR ABANDON THEM.

The only cash currently available is the cash paid by our founders for the acquisition of their shares as well as loans from Mr. Sangha. In the event we do not sell all of the shares and raise the total offering proceeds, there can be no assurance that we would be able to raise the additional funding needed to implement our business plans or that unanticipated costs will not increase our projected expenses for the year following completion of this offering. Our auditors have expressed substantial doubt as to our ability to continue as a going concern.

WE CANNOT PREDICT WHEN OR IF WE WILL PRODUCE REVENUES, WHICH COULD RESULT IN A TOTAL LOSS OF YOUR INVESTMENT IF WE ARE UNSUCCESSFUL IN OUR BUSINESS PLANS.

We have not yet generated any revenues from operations. In order for us to continue with our plans and open our business, we must raise our initial capital to do so through this offering. The timing of the completion of the milestones needed to commence operations and generate revenues is contingent on the success of this offering. There can be no assurance that we will generate revenues or that revenues will be sufficient to maintain our business. As a result, you could lose all of your investment if you decide to purchase shares in this offering and we are not successful in our proposed business plans.

THE LOSS OF THE SERVICES OF GURMINDER SANGHA COULD SEVERELY IMPACT OUR BUSINESS OPERATIONS AND FUTURE DEVELOPMENT OF OUR PRODUCTS, WHICH COULD RESULT IN A LOSS OF REVENUES AND YOUR ABILITY TO EVER SELL ANY SHARES YOU PURCHASE IN THIS OFFERING.

Our performance is substantially dependent upon our President, Gurminder Sangha. The loss of his services could result in a loss of revenues, which could result in a reduction of the value of any shares you purchase in this offering.

THE SARBANES-OXLEY ACT IMPOSES SUBSTANTIAL BURDENS UPON THE COMPANY WITHOUT PROVIDING CORRESPONDING BENEFITS TO THE COMPANY.

The Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") was enacted in response to public concern regarding corporate accountability in the wake of a number of accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, provide enhanced penalties for accounting and auditing improprieties at publicly traded companies and protect investors by improving the accuracy and reliability of corporate disclosure pursuant to applicable securities laws. The Sarbanes-Oxley Act applies to all companies that file or are required to file periodic reports with the SEC under the Securities Exchange Act of 1934 (the "Exchange Act").

Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act. Since the enactment of the Sarbanes-Oxley Act has resulted in the imposition of a series of rules and regulations by the SEC that increase the responsibilities and liabilities of directors and executive officers, the perceived increased personal risk associated with these changes may deter qualified individuals from accepting such roles. Consequently, it may be more difficult for us to attract and retain qualified persons to serve as our directors or executive officers, and we may need to incur additional operating costs. This could prevent us from becoming profitable.

RISKS ASSOCIATED WITH THIS OFFERING:

THE TRADING IN OUR SHARES WILL BE REGULATED BY SECURITIES AND EXCHANGE COMMISSION RULE 15G-9 WHICH ESTABLISHED THE DEFINITION OF A "PENNY STOCK." THE EFFECTIVE RESULT BEING FEWER PURCHASERS QUALIFIED BY THEIR BROKERS TO PURCHASE OUR SHARES, AND THEREFORE A LESS LIQUID MARKET FOR OUR INVESTORS TO SELL THEIR SHARES.

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker- dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase, if at all.

WE ARE SELLING THIS OFFERING WITHOUT AN UNDERWRITER AND MAY BE UNABLE TO SELL ANY SHARES. UNLESS WE ARE SUCCESSFUL IN SELLING AT LEAST 50% OF THE SHARES AND RECEIVING $100,000 IN THE PROCEEDS FROM THIS OFFERING, WE MAY HAVE TO SEEK ALTERNATIVE FINANCING TO IMPLEMENT OUR BUSINESS PLANS.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell them through our officer and director, who will receive no commissions. He will offer the shares to friends, relatives, acquaintances and business associates, however, there is no guarantee that he will be able to sell any of the shares.

DUE TO THE LACK OF A TRADING MARKET FOR OUR SECURITIES, YOU MAY HAVE DIFFICULTY SELLING ANY SHARES YOU PURCHASE IN THIS OFFERING.

There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the effectiveness of this Registration Statement and apply to have the shares quoted on the OTC Electronic Bulletin Board (OTCBB). The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. As of the date of this filing, there have been no discussions or understandings between Barrel or anyone acting on our behalf with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

YOU WILL INCUR IMMEDIATE AND SUBSTANTIAL DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES.

Our existing stockholders acquired their shares at a cost of $0.001 per share, a cost per share substantially less than that which you will pay for the shares you purchase in this offering. Accordingly, any investment you make in these shares will result in the immediate and substantial dilution of the net tangible book value of those shares from the $0.025 you pay for them. Upon completion of the offering, the net tangible book value of your shares will be $0.0096 per share, $0.0154 less than what you paid for them.

WE WILL BE HOLDING ALL PROCEEDS FROM THE OFFERING IN A STANDARD BANK CHECKING ACCOUNT. THERE IS NO GUARANTEE THAT ALL OF THE FUNDS USED AS OUTLINED IN THE USE OF PROCEEDS TABLE WILL BE EFFECTIVE FOR DEVELOPMENT OF OUR BUSINESS DESCRIBED IN THIS PROSPECTUS.

All funds received from the sale of shares in this offering will be deposited into a standard bank checking account. We intend to use the proceeds raised in this offering for the uses set forth in the proceeds table. The failure of funds used to effectively grow our business could result in unfavorable returns or no income at all. This could have a significant adverse effect on our financial condition and could cause the price of our common stock to decline.

OUR DIRECTORS AND OFFICERS WILL CONTINUE TO EXERCISE SIGNIFICANT CONTROL OVER OUR OPERATIONS, WHICH MEANS AS A MINORITY SHAREHOLDER, YOU WOULD HAVE NO CONTROL OVER CERTAIN MATTERS REQUIRING STOCKHOLDER APPROVAL THAT COULD AFFECT YOUR ABILITY TO EVER RESELL ANY SHARES YOU PURCHASE IN THIS OFFERING.

After the completion of this offering, our management will own 55.55% of our common stock. In the event that fewer than the maximum shares of the offering are sold, management’s percentage ownership will be even higher. It will have a significant influence in determining the outcome of all corporate transactions, including the election of directors, approval of significant corporate transactions, changes in control of the company or other matters that could affect your ability to ever resell your shares. Its interests may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

FINANCIAL INDUSTRY REGULATORY AUTHORITY ("FINRA") SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT YOUR ABILITY TO BUY AND SELL OUR COMMON STOCK, WHICH COULD DEPRESS THE PRICE OF OUR SHARES.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

WE WILL INCUR ONGOING COSTS AND EXPENSES FOR SEC REPORTING AND COMPLIANCE; WITHOUT REVENUE WE MAY NOT BE ABLE TO REMAIN IN COMPLIANCE, MAKING IT DIFFICULT FOR INVESTORS TO SELL THEIR SHARES, IF AT ALL.

Our business plan allows for the estimated cost of this Registration Statement to be paid from our cash on hand. We plan to contact a market maker immediately following the effectiveness of this Registration Statement and apply to have the shares quoted on the OTC Electronic Bulletin Board. To be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all.

FORWARD LOOKING STATEMENTS

This Prospectus contains projections and statements relating to the Company that constitute "forward-looking statements." These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as "intends," "believes," "anticipates," "expects," "estimates," "may," "will," "might," "outlook," "could," "would," "pursue," "target," "project," "plan," "seek," "should," "assume," or similar terms or the negatives thereof. Such statements speak only as of the date of such statement, and the Company undertakes no ongoing obligation to update such statements. These statements appear in a number of places in this Prospectus and include statements regarding the intent, belief or current expectations of the Company, and its respective directors, officers or advisors with respect to, among other things:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Potential investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that, should conditions change or should any one or more of the risks or uncertainties materialize or should any of the underlying assumptions of the Company prove incorrect, actual results may differ materially from those projected in the forward-looking statements as a result of various factors, some of which are unknown. The factors that could adversely affect the actual results and performance of the Company include, without limitation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Potential investors are urged to carefully consider such factors. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements and the "Risk Factors" described herein.

USE OF PROCEEDS

When all the shares are sold the gross proceeds from this offering will be $200,000. We expect to disburse the proceeds from this offering in the priority set forth below. The following table shows the intended use of proceeds assuming that 25%, 50%, 75% and 100%, respectively, of the Offering is sold. In the event that only 25% is sold, the proceeds will be spent entirely on offering expense, SEC reporting and compliance and Phase 1 of the Exploration Program.

| If 25% shares sold | If 50% shares sold | If 75% shares sold | If 100% shares sold | ||||||||||||||

Description | Fees | Fees | Fees | Fees | |||||||||||||

SEC reporting and compliance | $ | 10,000 | $ | 10,000 | $ | 10,000 | $ | 10,000 | |||||||||

Offering Expenses | $ | 14,500 | $ | 14,500 | $ | 14,500 | $ | 14,500 | |||||||||

Exploration Expenses | $ | 25,500 | $ | 75,500 | $ | 125,500 | $ | 175,500 | |||||||||

Total | $ | 50,000 | $ | 100,000 | $ | 150,000 | $ | 200,000 | |||||||||

DETERMINATION OF OFFERING PRICE

The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price we took into consideration our capital structure and the amount of money we would need to implement our business plans. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering.

Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

As of December 31, 2014, the net tangible book value of our shares was $(20,928) or approximately $(0.0021) per share, based upon 10,000,000 shares outstanding.

Upon completion of this offering, but without taking into account any change in the net tangible book value after completion of this offering other than that resulting from the sale of the shares and receipt of the total proceeds of $200,000 net of the estimated $14,500 offering costs, the net tangible book value of the 18,000,000 shares to be outstanding will be $172,743, or approximately $0.0096 per Share. Accordingly, the net tangible book value of the shares held by our existing stockholders (10,000,000 shares) will be increased by $0.0109 per share without any additional investment on their part. The purchasers of shares in this offering will incur immediate dilution (a reduction in the net tangible book value per share from the offering price of $0.025 per Share) of $0.0154 per share. As a result, after completion of the offering, the net tangible book value of the shares held by purchasers in this offering would be $0.0096 per share, reflecting an immediate reduction in the $0.025 price per share they paid for their shares.

After completion of the offering, the existing shareholders will own 55.55% of the total number of shares then outstanding, for which they will have made a cash investment of $10,000, or $0.001 per Share. Upon completion of the offering, the purchasers of the shares offered hereby will own 45.45% of the total number of shares then outstanding, for which they will have made a cash investment of $200,000, or $0.025 per Share.

The following table illustrates the per share dilution to the new investors and does not give any effect to the results of any operations subsequent to December 31, 2014. The following table shows the per share dilution assuming that 25%, 50%, 75% and 100%, respectively, of the primary Offering by the Company is sold.

| 25% |

| 50% |

| 75% |

| 100% | |||||||||

| Price Paid per Share by Existing Shareholders | $ | .001 | $ | .001 | $ | .001 | $ | .001 | ||||||||

| Public Offering Price per Share | $ | .025 | $ | .025 | $ | .025 | $ | .025 | ||||||||

| Net Tangible Book Value Prior to this Offering | $ | (.0021 | ) | $ | (.0021 | ) | $ | (.0021 | ) | $ | (.0021 | ) | ||||

| Net Tangible Book Value After this Offering | $ | .0038 | $ | .006 | $ | .0085 | $ | .0104 | ||||||||

| Increase in Net Tangible Book Value per Share Attributable to cash payments from purchasers of the shares offered | $ | .0043 | $ | .0065 | $ | .0090 | $ | .0109 | ||||||||

| Immediate Dilution per Share to New Investors | $ | .022 | $ | .020 | $ | .017 | $ | .0154 |

PLAN OF DISTRIBUTION

OFFERING WILL BE SOLD BY OUR OFFICERS AND DIRECTOR

This is a self-underwritten offering. This Prospectus is part of a Prospectus that permits our Mr Sangha and Mr. Wolf to sell the Shares on behalf of the Company directly to the public, with no commission or other remuneration payable to him for any Shares that they sell.

There are no plans or arrangements to enter into any contracts or agreements to sell the Shares with a broker or dealer. Mr. Sangha and Mr. Wolf, our officers and director, will sell the shares on behalf of the Company, and they intend to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, our officers will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934.

Neither Mr. Sangha nor Mr. Wolf will register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an Issuer may participate in the offering of the Issuer's securities and not be deemed to be a broker-dealer.

|

|

|

|

|

|

|

|

|

| |

|

| |

|

|

TERMS OF THE OFFERING

The shares will be sold at the fixed price of $.025 per share until the completion of this offering.

This offering will commence on the date of this prospectus and continue for a period not to exceed 180 days (the "Expiration Date"), unless extended by our Board of Directors for an additional 90 days.

DEPOSIT OF OFFERING PROCEEDS

This is a "best effort" offering and, as such, there is no assurance that we will sell any or all of the shares.

PROCEDURES AND REQUIREMENTS FOR SUBSCRIPTION

If you decide to subscribe for any shares in this offering, you will be required to execute a Subscription Agreement and tender it, together with a check or certified funds to us. All checks for subscriptions should be made payable to Barrel Energy Inc.

DESCRIPTION OF SECURITIES

Our authorized capital stock consists of 70,000,000 shares of common stock, par value $.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share..

COMMON STOCK

The holders of our common stock

|

|

|

|

|

|

|

|

PREFERRED STOCK

No shares of preferred stock have been issued. Any preferred stock would have such rights, preferences and limitations as approved by our Board of Directors in the Designation establishing a series of preferred stock.

NON-CUMULATIVE VOTING

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event, the holders of the remaining shares will not be able to elect any of our directors.

CASH DIVIDENDS

As of the date of this prospectus, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our Board of Directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

INTEREST OF NAMED EXPERTS AND COUNSEL

None of the below described experts or counsel have been hired on a contingent basis and none of them will receive a direct or indirect interest in the Company.

Our audited financial statements for the period from inception to September 30, 2014 have been audited by MaloneBailey, LLP. We include the financial statements in reliance on their report, given upon their authority as experts in accounting and auditing.

Frederick C. Bauman, Esq. of the Bauman & Associates Law Firm has passed upon the validity of the shares being offered and certain other legal matters and is representing us in connection with this offering.

DESCRIPTION OF OUR BUSINESS

GENERAL INFORMATION

Barrel Energy Inc. was incorporated in the State of Nevada on January 27, 2014. We were formed to engage in the exploration, development and production of oil and natural gas in North America.

Barrel Energy Inc. is an oil and gas company with a focus on assets located in North America. Currently the company holds oil & gas leases in Alberta, Canada and its strategy is to exploit high impact and development oil plays and liquids-rich deep basin gas plays through the development of its asset base. The company currently holds interest in 2560 acres of oil & gas leases known as the Bison Property. Our near term business strategy is to conduct exploration activities on the Bison Property as laid out in more detail in the "Description of Property” section with the end goal being to achieve positive results during our exploration activities, we believe we will be able to either develop the Bison Property to commercial production and achieve positive cash flow.

The Bison property is located in the Province of Alberta, Canada and is comprised of four sections of interest land totalling (2,560 acres) which includes one suspended gas well in the Gilwood member of the Middle Devonian Watt Mountain Formation. The acreage is located in north western Alberta in an area called the Peace River Arch (PRA), which is a deep positive structural feature caused by mountain building to the west. It is one of only a few largescale tectonic elements in the Western Canada Sedimentary Basin that has significantly disturbed the Phanerozoic cover of the craton. The structure has influenced the location of oil and gas accumulations in strata ranging from the Middle Devonian to the Upper Cretaceous, and has long been a focus of hydrocarbon exploration in the region.

The Peace River Arch has already established facilities for natural gas gathering and compression facilities that can be accessed based on Barrel Energy’s needs. Although the Peach River Arch region boasts well established infrastructure weather conditions do play a role in our ability to access the Bison property. For instance the need to helicopter in equipment and or human resources may arise based on location or weather conditions.

Geology:

The Bison property is located in the Province of Alberta, Canada and is comprised of four sections of interest land (2,560 acres) which includes one suspended gas well in the Gilwood member of the Middle Devonian Watt Mountain Formation. The acreage is located in north western Alberta in an area called the Peace River Arch (PRA), which is a deep positive structural feature caused by mountain building to the west. Sediments shed from the Arch, during deposition were deposited in abundance in braided channels, fluvial stream channels and shallow marine environments, which created numerous hydrocarbon reservoirs in the area. Sediments were thickest adjacent to the emergent Arch with sands in of up to 180 feet in total thickness deposited in the braided channel systems coming off the structural highland. Thicknesses decreased to the east away from the source rock ultimately terminating some 75 miles east from the PRA. The Gilwood member at Bison shows approximately 7 feet of gas pay over water in the Gilwood formation and was perforated between 1468.5m and 1470.5m.

Land tenure:

The Bison leases were acquired through a private oil & gas company with an effective date of September 1, 2014. A total of 4 oil & gas leases located in Alberta, Canada were acquired totaling 2,520 acres, as follows:

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

| ||||||

|

|

|

|

| ||

|

|

|

| |||

6 | ||||||

|

|

| ||||

|

|

|

| |||

|

|

|

| |||

|

|

| ||||

| ||||||

18 | ||||||

19 | ||||||

27 | ||||||

27 | ||||||

27 | ||||||

28 | ||||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | 29 | |||||

Changes in and Disagreements with Accountants on | 31 | |||||

32 | ||||||

34 | ||||||

| 36 | |||||

37 | ||||||

Security Ownership of Certain Beneficial Owners and Management | 38 | |||||

Certain Relationships and Related Transactions and Director Independence | 39 | |||||

Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 39 | |||||

40 | ||||||

40 | ||||||

40 |

There is one well on the property, Invasion ELM Bison 10-15-95-15WSM. UWI 102/10-15-095-15W5/00. Currently the well is shut-in.

The Bison Leases were acquired pursuant to an Agreement of Purchase and Sale with Geo Fin Consulting Inc., which was an assignee of Elm Energy Management, Ltd., the original lessee. Pursuant to an operating agreement entered into by Elm Energy Management Ltd., Invasion Energy Inc. was designated as the operator. Invasion Energy Inc. subsequently amalgamated into Canadian Forest Oil Ltd., which later changed its corporate name to Lone Pine Resources Canada Ltd.

Disclosure of Oil and Gas Operations:

Reserves:

The Company did not have any reserves at December 31, 2014 . Accordingly, you may not reasonably assume that the Company has any reserves on its leases.

Production:

The Company has had not production from inception (January 27, 2014) through December 31, 2014. Following is a table showing production data from inception (January 27, 2014) through December 31, 2014:

Average Sales Price | Average Production Cost | Net Production (less royalties) | ||

2014 | 2014 | 2014 | ||

Oil per BOE | Gas per BOE* | Oil and Gas per BOE** | Oil BOE's | Gas BOE's* |

0 | 0 | 0 | 0 | 0 |

Productive Wells and Acreage as of December 31, 2014:

The Company had no producing wells at end of the fiscal year December 31, 2014.

# of Producing Wells (Gross/Net) | Gross/ Net Developed Acres-Productive | Gross/ Net Developed Acres | |||

Oil | Gas | Oil | Gas | Oil | Gas |

0 | 0 | 0 / 0 | 0 / 0 | 0 | 0 / 0 |

Developed Acreage as at December 31, 2014:

The Company’s holds an interest in -0- total gross developed acres and -0- total net developed acres; “gross acres” means acres in which the Company has a working interest and “net acres” means the Company’s aggregate working interest in the gross acres. There is one non producing well on the property.

Undeveloped Acreage as at December 31, 2014:

As at December 31, 2014 Barrel holds a total of 2,520 total gross undeveloped acres that it acquired in September, 2014. This acreage relates to the Bison leases described above.

Drilling Activity:

The Company acquired these properties in September, 2014. The Company has not yet done any drillingYou may only rely on the leases.

Present Activities:

There areinformation contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no present wells being drilled. As ofchange in our affairs since the date of this report, Barrel managementprospectus is planningcorrect as of any time after its initial exploration activities at the property.date.

Delivery Commitments:PROSPECTUS SUMMARY

This summary highlights certain information contained elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. Before investing in our common stock, you should read this entire offering carefully, especially the sections entitled "Risk Factors" beginning on page 6 and "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 30, as well our financial statements and related notes included elsewhere in this prospectus.

As used in this prospectus, references to "the Company," "BRLL", "we", "our," "ours" and "us" refer to Barrel Energy, Inc., and its subsidiaries, unless otherwise indicated.

Company Overview

BARREL ENERGY INC. is a Nevada corporation, incorporated January 17, 2014, which has engaged historically in the oil and gas sector of the energy industry through its ownership of 2560 acres of oil & gas leases known as the Bison Property in Alberta, Canada. The Company has realized no revenues from its oil and gas activities. Barrel Energy, Inc. is referred to as the “Company” or “Barrel.”

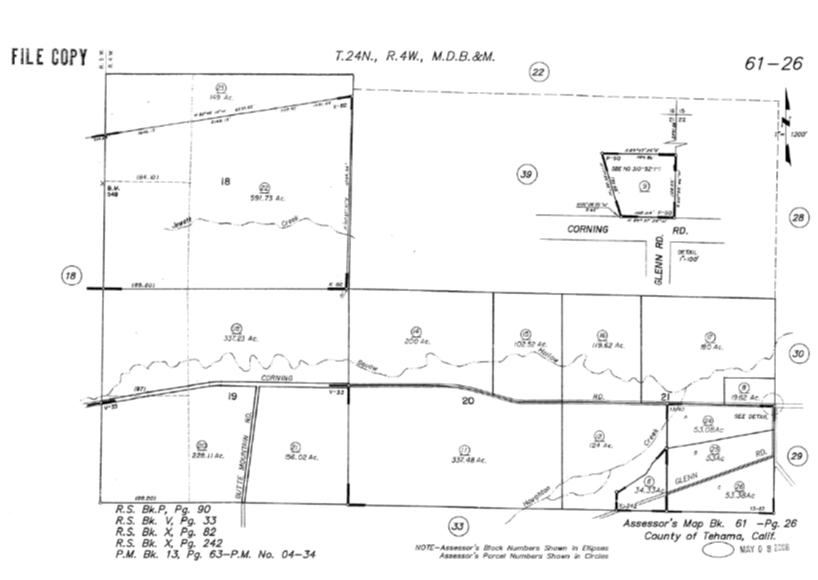

On May 14, 2019, Barrel entered into a Lease with Crocker Acana, LLC of 602 acres of land in Tehama County, California. The Company’s intent is to farm the land to grow hemp. This will require a permit from the Tehama County government, which permit has been applied for but not yet obtained. The Lease is for a term of ten calendar years. The rent is $1,000 per acre, totaling $602,000 per year, payable monthly. However, in the first lease year payment is due $200,000 on September 30th 2019. A second payment of $200,000 is due by January 30, 2020. The final payment of $202,000 is due on or before March 31, 2020.

The Land is located in an agricultural area approximately 5 miles west of the town of Cornell, California. The property is owned by Crocker Acana, LLC.

Barrel intends to grow industrial hemp and produce and distribute hemp-based, CBD wellness products. Through a vertically integrated business model, the Company intends to improve customers’ lives and meet their demands for stringent product quality, efficacy and consistency.

The Company does not have any delivery commitmentsintend to produce or any shortsell medicinal or long term contractual obligations.recreational marijuana or products derived therefrom.

Marketing:The Company’s primary products will be made from whole-plant hemp extracts containing a broad spectrum of phytocannabinoids, including CBD, terpenes, flavonoids and other minor but valuable hemp compounds. The Company believes the presence of these various compounds will work synergistically to heighten the effects of the products, making them superior to single-compound CBD isolates. Hemp extracts are produced from Industrial Hemp, which is defined as Cannabis with less than 0.3% THC. THC causes psychoactive effects when consumed and is typically associated with marijuana (i.e. Cannabis with high-THC content). The Company does not intend to produce or sell medicinal or recreational marijuana or products derived from high-THC Cannabis/marijuana plants. Industrial Hemp products have no psychoactive effects. The Company’s intended product categories may include tinctures (liquid product), capsules and topical products. Planned product categories may include powdered supplements, single-use, beverage, sport, professional (dedicated health care practitioner products) and new delivery methods. The Company’s products are intended to be distributed through an e-commerce website, select wholesalers and a variety of brick and mortar retailers. The Company intends to grow its hemp on the Tehama County, California property.

We currently do not conduct any marketing activities. We do not believe that any marketing activities will be necessary to conduct operations following on any of the properties described above. Lone Pine is currently the operation of the Bison property and will be responsible for the marketing. Should we take on the operatorship of the property then on the responsibilities would be the marketing of the oil & gas products. At this time, we have no plans for becoming an operator.

STATUS OF ANY PUBLICLY ANNOUNCED NEW PRODUCTS

We have not publicly announced any new products.

COMPETITION

Given the highly competitive nature of the oil & gas sector and our company being a new exploration stage company we face competition from numerous competitors within in the industry. We compete with junior and senior oil and gas companies, independent producers and institutional and individual investors who are actively seeking to acquire oil and gas properties throughout North America. Competition for the acquisition of oil and gas interests is strong with many oil and gas leases available in a competitive bidding process in which we may lack the financial and technological information or expertise to compete with all competitors.

| Table of Contents |

The Company has not earned any revenues to date and we do not anticipate earning revenues until such time as we have planted and harvested our first crop of hemp.

The Company maintains offices at 8275 S Eastern Ave, Suite 200, Las Vegas, Nevada 89123.

Implications of Being an Emerging Growth Company

We qualify as an "emerging growth company" as defined in the Jumpstart Our competitor oilBusiness Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and gas companiesother requirements that are otherwise applicable generally to public companies. These provisions include:

| · | being permitted to present two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure; | |

| · | reduced disclosure about our executive compensation arrangements; | |

| · | exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements; and | |

| · | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we competehave total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the last day of the fiscal year in which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or SEC, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th. We may choose to take advantage of some but not all of these exemptions. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

Where You Can Find Us

The company website is www.barrelhemp.com. The contents of this website are not incorporated into this prospectus

About This Offering

This prospectus covers the resale of 9,250,000 shares of common stock by the selling stockholder named herein.

An investment in the Company's common stock involves a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. Our business, operating results and financial condition could be harmed and the value of our stock could go down as a result of these risks. This means you could lose all or a part of your investment.

| 6 |

| Table of Contents |

Risks Related to Our Business and Industry

Industry Competition

The markets for financingbusinesses in the CBD and forhemp extracts industries are competitive and evolving. In particular, the acquisitionCompany will face strong competition from both existing and emerging companies that offer similar products to the Company. Some of oilthe Company’s current and gas propertiespotential competitors may have longer operating histories, greater financial, marketing and technicalother resources than those available to us. These competitorsand larger customer bases. Given the rapid changes affecting the global, national and regional economies generally and the CBD industry, in particular, the Company may not be able to spend greater amountscreate and maintain a competitive advantage in the marketplace. The Company’s success will depend on acquiring oil and gas interests of merit or on exploring or developing their oil and gas properties. This advantage could enable our competitors to acquire oil and gas properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. The potential for this competition could adversely impact ourits ability to attainkeep pace with any changes in such markets, especially in light of legal and regulatory changes. The Company’s success will depend on its ability to respond to, among other things, changes in the financing necessary for useconomy, market conditions and competitive pressures. Any failure to acquire further oilanticipate or respond adequately to such changes could have a material adverse effect on the Company’s financial condition, operating results, liquidity, cash flow and gas interests or explore and develop our current or future oil and gas properties.operational performance.

In addition we compete with other junior oil and gas companies for financing from a limited number of investors that are prepared to invest in companies such as ours, and this may limit our ability to raise future capital. In addition, we compete with both junior and senior.Product Viability

oil and gas companies for available resources, including, butIf the products the Company intends to sell do not limited to, professional geologists, land specialists, engineers, helicopters, float planes, oil and gas exploration supplies and drill rigs.have the physiological effects intended, the business may suffer. In general, the Company’s products will contain CBD which is classified in the United States as controlled substance. The Company’s products may contain innovative ingredients or combinations of ingredients. There is little long-term experience with human or other animal consumption of certain of these ingredients or combinations thereof in concentrated form. The Company’s products could have certain side effects if not taken as directed or if taken by a consumer that has certain medical conditions. Furthermore, there can be no assurance that any of the products, even when used as directed, will have the effects intended or will not have harmful side effects.

SOURCES AND AVAILABILITY OF PRODUCTS; DEPENDENCE ON ONE OR A FEW MAJOR SUPPLIERSAgricultural Operations Risk

There are numerous providers of geological and exploration services in Alberta, such as seismic and drilling. WeThe Company’s business will not be dependent on onethe outdoor growth and production of industrial hemp, an agricultural product. As such, the risks inherent in engaging in agricultural businesses apply to the Company. Potential risks include the risk that crops may become diseased or a few suppliers.victim to insects or other pests and contamination, or subject to extreme weather conditions such as excess rainfall, hail, freezing temperature or drought, all of which could result in low crop yields, decreased availability of industrial hemp and higher acquisition prices. There can be no guarantee that an agricultural event will not adversely affect the business and operating results.

PATENTS AND TRADEMARKSSuccess of Quality Control Systems

We do notThe quality and safety of the Company’s products will be critical to the success of the business and operations. As such, it is imperative that the Company’s service providers’ quality control systems operate effectively and successfully. Quality control systems can be negatively impacted by the design of the quality control systems, the quality training program, and adherence by employees to quality control guidelines. Although the Company strives to ensure that all of its service providers have implemented and adhere to high caliber quality control systems, any proprietary products. We currentlysignificant failure or deterioration of such quality control systems could have no patents or trademarks fora material adverse effect on our company name or brand namebusiness and operating results.

NEED FOR ANY GOVERNMENT APPROVAL OF PRINCIPAL PRODUCTSDomestic Supply Risk

Not applicable.The Company intends to use only hemp products with full compliance under federal and state regulations to be sold across the United States, and on a limited basis Internationally. The regulation of third-party suppliers may have a significant impact upon the business. Any enforcement activity or any additional uncertainties which may arise in the future, could cause substantial interruption or cessation of the business, including adverse impacts to the Company’s supply chain and distribution channels, and other civil and/or criminal penalties at the federal level.

GOVERNMENT AND INDUSTRY REGULATIONWeather Patterns

WeThe Company’s business can be affected by unusual weather patterns. The production of some of the Company’s intended products will rely on the availability and use of live plant material, which will be grown in California. Growing periods can be impacted by weather patterns and these unpredictable weather patterns may impact the Company’s ability to harvest its industrial hemp and produce products. In addition, severe weather, including drought, hail and freezing temperatures, can destroy a crop, which could result in limited quantities of hemp to process. If the Company is unable to harvest its hemp plants through its proprietary operations or contract farming arrangements, the ability to meet customer demand, generate sales and maintain operations could be impacted.

| 7 |

| Table of Contents |

Reliance on Third-Party Suppliers and Service Providers

The Company intends to maintain a full supply chain for the material portions of the production process of its products. Despite maintaining full federal compliance and legality, the Company’s suppliers and service providers may elect, at any time, to cease to engage in supply or service agreements in respect of the Company’s products. Loss of suppliers or service providers could have a material adverse effect on the business and operational results. Product Recalls Product manufacturers and distributors are sometimes required to recall or initiate returns of their products for various reasons, including product defects such as contaminations, unintended harmful side effects or interactions with other products, packaging safety and inadequate or inaccurate labeling disclosure. If any of the Company’s products are recalled, it could incur unexpected expense relating to the recall and any legal proceedings that might arise in connection with the recall. The Company may lose significant revenue due to loss of sales and may not be able to compensate for or replace that revenue. There can be no assurance that any quality, potency or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory actions or lawsuits. A recall of products could lead to adverse publicity, decreased demand for the Company’s products and could have a material adverse effect on the results of operations and financial condition.

Product Liability

The Company’s products will be produced for sale directly to end consumers, and therefore there is an inherent risk of exposure to product liability claims, regulatory action and litigation if the products are alleged to have caused loss or injury. In addition, the manufacture and sale of the Company’s products involves the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Previously unknown adverse reactions resulting from human consumption of the Company’s products alone or in combination with other medications or substances could occur. The Company may be subject to various product liability claims, including, among others, that the products caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning possible side effects or interactions with other substances. A product liability claim or regulatory action against the Company could result in increased costs, could adversely affect the Company’s reputation, and could have a material adverse effect on the business and operational results.

Effectiveness and Efficiency of Advertising and Promotional Expenditures

The Company’s future growth and profitability will depend on the effectiveness and efficiency of advertising and promotional expenditures, including the Company’s ability to (i) create greater awareness of its products; (ii) determine the appropriate creative message and media mix for future advertising expenditures; and (iii) effectively manage advertising and promotional costs in order to maintain acceptable operating margins. There can be no assurance that advertising and promotional expenditures will result in revenues in the future or will generate awareness of the Company’s technologies, products or services. In addition, no assurance can be given that the Company will be able to manage its advertising and promotional expenditures on a cost-effective basis.

Creating and Promoting Brands

Management believes that creating, maintaining and promoting the Company’s future brands will critical to expanding its customer base. Maintaining and promoting the brands will depend largely on the Company’s ability to continue to provide quality, reliable and innovative products, which we may not be successful. The Company may introduce new products that customers do not like, which may negatively affect the brands and reputation. Maintaining and enhancing the Company’s brands may require substantial investments, and these investments may not achieve the desired goals. If the Company fails to successfully promote and maintain its brand or if there are excessive expenses in this effort, the business and financial results from operations could be materially adversely affected.

| 8 |

| Table of Contents |

Changing Consumer Preferences

As a result of changing consumer preferences, many nutraceutical and other innovative products attain financial success for a limited period of time. Even if the Company’s intended products find retail success, there can be no assurance that any of the products will continue to see extended financial success. The Company’s success will be dependent upon its ability to develop new and improved product lines. Even if the Company is successful in introducing new products or further developing current products, a failure to continue to update them with compelling content could cause a decline in the products’ popularity that could reduce revenues and harm the business, operating results and financial condition. Failure to introduce new features and product lines and to achieve and sustain market acceptance could result in the Company being unable to meet consumer preferences and generate revenue, which could have a material adverse effect on profitability and financial results from operations.

Product Returns

Product returns are a customary part of any consumer business. Products may be returned for various reasons, including expiration dates or lack of sufficient sales volume. Any increase in product returns could reduce the results of operations.

Obtaining Insurance

Due to the Company’s involvement in the industrial hemp industry, it may have a difficult time obtaining the various insurances that are desired to operate the business, which may expose the Company to additional risk and financial liability. Insurance that is otherwise readily available, such as general liability, and directors and officer’s insurance, may be more difficult to find, and more expensive because of the regulatory regime applicable to the industry. There are no guarantees that the Company will be able to find such insurances in the future, or that the cost will be affordable. If the Company is forced to go without such insurances, it may prevent it from entering into certain business sectors, may inhibit growth, and may expose the Company to additional risk and financial liabilities.

The Company’s planned business will be heavily dependent upon its intangible property and technology.

The Company rwill rely upon copyrights, trade secrets, unpatented proprietary know-how and continuing innovation to protect the intangible property, technology and information that is considered important to the development of the business. The Company will rely on various methods to protect its proprietary rights, including confidentiality agreements with consultants, service providers and management that contain terms and conditions prohibiting unauthorized use and disclosure of confidential information. However, despite efforts to protect intangible property rights, unauthorized parties may attempt to copy or replicate intangible property, technology or processes. There can be no assurances that the steps taken by the Company to protect its intangible property, technology and information will be adequate to prevent misappropriation or independent third-party development of the Company’s intangible property, technology or processes. It is likely that other companies can duplicate a production process similar to the Company’s. Other companies may also be able to materially duplicate the Company’s proprietary plant strains. To the extent that any of the above would occur, revenue could be negatively affected, and in the future, the Company may have to litigate to enforce its intangible property rights, which could result in substantial costs and divert management’s attention and other resources.

Intellectual Property Claims