As filed with the Securities and Exchange Commission on June 14, 2021.May 7, 2024

Registration No. 333- 256691333-275761

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1S-1/A

(Amendment No. 1)4)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

EzFill Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 83-4260623 | |||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

2125 Biscayne Blvd, #30967 NW 183rd St.,

Miami FL 33137, Florida33169

305-791-1169305-791-1169

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael McConnellYehuda Levy

Chief Executive Officer

EzFill Holdings, Inc.

2125 Biscayne Blvd, #30967 NW 183rd St.,

Miami FL 33137, Florida33169

305-791-1169305-791-1169

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq. | Mitchell S. Nussbaum, Esq. | |

| Jeff Cahlon, Esq. | Norwood P. Beveridge, Esq. | |

| Sichenzia Ross Ference Carmel LLP | Lili Taheri, Esq. | |

| 1185 Avenue of the Americas | Loeb & Loeb LLP | |

| New York, New York 10036 | 345 Park Avenue | |

| Tel: (212) 930-9700

|

New York, New York 10154 | |

| Tel: (212) 407-4000

|

(Approximate date of commencement of proposed sale to the public)

As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [ ]☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer | |

| Non-accelerated filer | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [X]☒

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||||||

Common Stock, par value $0.0001 per share | $ | 28,750,000 | $ | 3,136.63 | ||||

| Total | $ | 28,750,000 | $ | 3,136.63 | (3) | |||

The registrantRegistrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the registrantRegistrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statementRegistration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. WeThese securities may not sell these securitiesbe sold until the registration statement relating to these securities filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION |

6,250,000 6,355,932 Shares

Common Stock

EzFill Holdings, Inc.

This is a firm commitment initial public offering of our common stock. No public market currently exists for our common stock. We are offering all of the shares of common stock offered by this prospectus. We expect thehave assumed a public offering price to be $4.00of $2.36 per share.share, based on the last reported sale price of our common stock on May 1, 2024.

We have applied to list our Common Stock

Our common stock is listed on the Nasdaq Capital Market under the symbol “EZFL”. No assurance can be given that our application will be approved. We believe that upon completionOn May 6, 2024, the last reported sales price of the offering contemplated by this prospectus, we will meet the standards for listing on the Nasdaq Capital Market, however, we cannot guarantee that we will be successful in listing our common the Nasdaq Capital Market. We will not consummate this offering unless our common stock on Nasdaq was $2.77 per share.

The final public offering price of the shares of common stock in this offering will be listed ondetermined through negotiation between us and the Nasdaq Capital Market.representative of the underwriters in the offering and the recent market price used throughout this prospectus may not be indicative of the final offering price.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 65 of this prospectus, and under similar headings in any amendments or supplements to this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | ||||||||||

| Public offering price | $ | $ | |||||||||

| Underwriting discounts and commissions(1) | $ | $ | |||||||||

| Proceeds to us, before expenses | $ | $ | |||||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to ThinkEquity |

We have granted a 45 day option to the Representative to purchase a maximum of 937,500953,389 additional shares of common stock at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the securities to purchasers in the offering on or about , 2021.2024.

ThinkEquity

The date of this prospectus is , 20212024

TABLE OF CONTENTS

| i |

We use our registered trademark, EzFill, in this prospectus. This prospectus also includes trademarks, tradenamestrade names and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

You should rely only on the information contained in this prospectus. We have not, and the underwriter hasunderwriters have not, authorized anyone to provide you with any information other than that contained in this prospectus or in any applicable prospectus supplement or free writing prospectus prepared by or on behalf of us to which we have referred you.prospectus. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not, and the underwriter is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not, and the underwriter hasunderwriters have not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby the distribution of this prospectus outside the United States.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Information contained in, and that can be accessed through, our web site www. https://ezfillapp.com/ezfl.com/ shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the shares offered hereunder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements reflect our current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability to complete capital raising transactions; and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations. Actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements.

| ii |

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read the following summary together with the more detailed information regarding us and our common stock being sold in the offering, including the risks of investing in our common stock discussed under “Risk Factors,” beginning on page 65 and our historical and pro forma condensed combined financial statements and the related notes appearing elsewhere in this prospectus, before making an investment decision. For convenience, in this prospectus, unless the context suggests otherwise, the terms “we,” “our,” “our company,” “Company” and “us” and “EzFill” refer to EzFill Holdings Inc., a Delaware corporation on a consolidated basis with its wholly-owned subsidiary Neighborhood Fuel Holdings LLC a Nevada limited liability company, as applicable.corporation.

A 1:3.76 reverse stock split of our common stock will be effected prior to the closing of this offering. All share amounts in this prospectus have been retroactively adjusted to give effect to this reverse stock split except for the financial statements and notes thereto.Overview

Overview

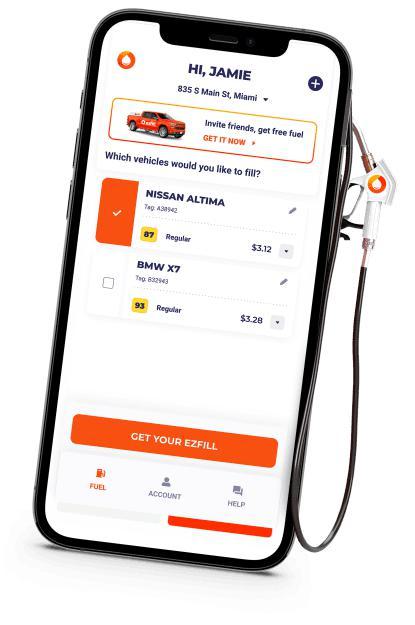

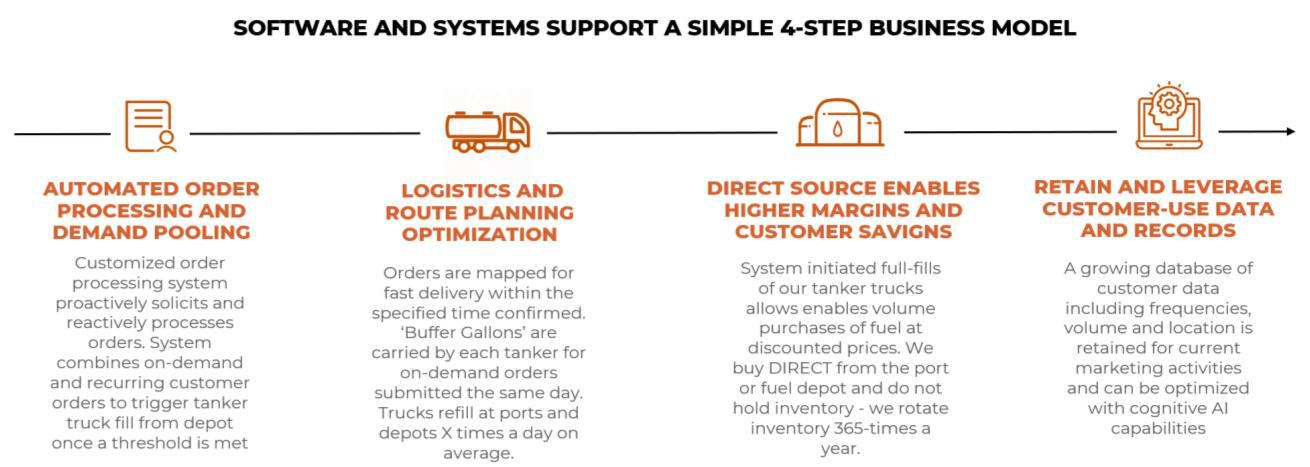

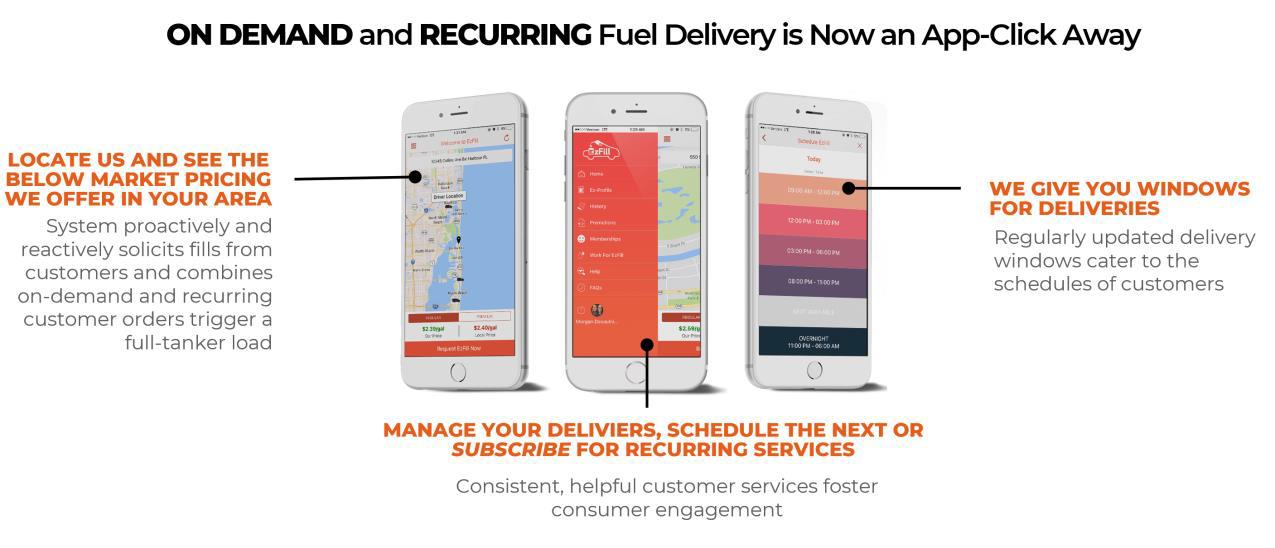

EzFill is a leading app-based mobile-fueling company based in South Florida and the only company which provides fuel-delivery ‘on-demand’ or ‘in subscription’ to customers in three high-volume verticals – CONSUMER, COMMERCIAL and SPECIALTY. We are capitalizing on the ever-increasing trend in ‘at home’ or ‘at work’ delivery of products to enable this convenience in the $500 B (according to market estimates) market segment of fueling services. We believe consumers and commerce’s pain points in the time, risk and costs of fueling at stations can be resolved by our on-demand and subscription-based fuel delivery services.

Our app-based interface provides customers the ability to select the time and location of their fueling needs, whether their service request is ‘on demand’ or structured within routine delivery schedules based on their fuel consumption patterns. We streamline our logistics and fuel purchasing with proprietary, backend software which manages customer accounts and mobilizes our fleet of 13almost 40 delivery trucks. The Company plans to acquire additional trucks to the extent supported by business growth and available resources. We are able to achieve volume discounted truckloads of fuel at depots, with subsequent delivery of this fuel to customers at home, work or business locations using our team of trained and certified drivers. We have a strong foothold in the South Florida market and are currently the dominant player in the areaarea. We are open in West Palm Beach, Jacksonville, Orlando and Tampa, with a plan to continue growing strategically in major metros and metropolitan statistical areas (“MSAs”) across the continental USin Florida and beyond.eventually other states.

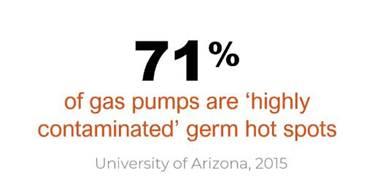

Our mission isWe have begun to disrupt the gas station fueling model by providing consumers and businesses the convenience of gas fueling services brought directly to their locations. EzFill provides a safe, convenient and touch-free way for consumers to fuel their cars. For our commercial and specialty customers, at-site delivery of fuel during the down-times of their vehicles provides operators the benefit of beginning their daily operations with fully-fueled vehicles at cost-savings versus traditional fueling options.

On August 10, 2023, the Company, the members (the “Members”) of NextNRG Holding Corp. (formerly Next Charging LLC (“NextNRG”)) and Michael Farkas, as the representative of the Members, entered into an exchange agreement, and on November 2, 2023, the Members, NextNRG, and Mr. Farkas entered into an amended and restated exchange agreement (as amended and restated, the “Exchange Agreement”), pursuant to which the Company agreed to acquire from the Members 100% of the membership interests of NextNRG (the “Membership Interests”) in exchange for the issuance (the “Share Exchange”) by the Company to the Members of an aggregate of 100 million shares of common stock of the Company. In the event NextNRG completes the acquisition of the acquisition target as set forth in the Exchange Agreement’s disclosure schedules (directly or indirectly through NextNRG or through a subsidiary of NextNRG) prior to the Closing, then 70,000,000 shares will vest on the closing date, and the remaining 30,000,000 shares will be subject to vesting or forfeiture. In the event NextNRG does not complete such acquisition prior to the closing, then 35,000,000 shares will vest on the closing date, and the remaining 65,000,000 shares will be subject to vesting or forfeiture (such shares subject to vesting or forfeiture, the “Restricted Shares”).

The Restricted Shares will vest, if at all, according to the following schedule:

(1) In the event NextNRG does not complete the acquisition of the acquisition target as set forth in the Exchange Agreement’s disclosure schedules (directly or indirectly through NextNRG or through a subsidiary of NextNRG) prior to the closing, then 35,000,000 of the Restricted Shares will vest upon the Company (directly or indirectly through NextNRG or a subsidiary of NextNRG), completing the acquisition of such acquisition target. In the event that Mr. Farkas determines that such an acquisition target is not capable of being acquired, either prior to or after the closing, then the Mr. Farkas and the Company will negotiate in good faith to determine a replacement acquisition target, which replacement would thereafter be considered as the acquisition target under the Exchange Agreement; and

| 1 |

(2) 30,000,000 Restricted Shares will vest upon the Company commercially deploying the third solar, wireless electric vehicle charging, microgrid, and/or battery storage system (such systems as more specifically defined under the Exchange Agreement).

As an additional condition to be satisfied prior to the closing, NextNRG is also required to take actions to record the assignment to itself of a patent mentioned in the Exchange Agreement.

Mr. Farkas is the Chief Executive Officer of NextNRG and is a significant lender to the Company and is the beneficial owner of approximately 24% of the Company’s common stock (see “Certain Relationships and Related Transactions” and “Security Ownership of Certain Beneficial Owners and Management”). At closing, the Company has agreed to appoint Mr. Farkas to the board of directors as Executive Chairman and to appoint him Chief Executive Officer of the Company. The closing of the transactions contemplated under the Exchange Agreement are subject to certain customary closing conditions, including (i) that the Company file a Certificate of Amendment with the Secretary of State of the State of Delaware to increase its authorized common stock from 50 million shares to 500 million shares (ii) the receipt of the requisite third-party consents, and (iii) compliance with the rules and regulations of The Nasdaq Stock Market (“Nasdaq”), which includes the filing of an Initial Listing Application with Nasdaq and approval of such application by Nasdaq. Upon consummation of the transactions contemplated by the Exchange Agreement, NextNRG will become a wholly-owned subsidiary of the Company.

NextNRG is a renewable energy company formed by Michael D. Farkas. NextNRG is a development stage enterprise which has plans to develop and deploy wireless electric vehicle charging technology coupled with battery storage and solar energy solutions. In furtherance of this objective, in November 2023 NextNRG (through its controlled entity Next NRG, LLC) entered into a stock purchase agreement to acquire STAT-EI, Inc. (“SEI”), a development stage enterprise party to certain licenses from the Florida International University Board of Trustees and Florida International University to develop certain smart microgrid and wireless charging technologies for a purchase price of $5.5 million in cash. The licenses purchased from SEI are exclusive and worldwide, and require milestone payments of $75,000 upon the achievement of $2.0 million in net revenues and an annual royalty payment of $50,000 in 2024, $60,000 in 2025 and $75,000 for each year thereafter (in the case of microgrid technologies) and $40,000 in 2024, $50,000 in 2025 and $60,000 for each year thereafter (in the case of the wireless charging technologies), subject to the receipt of change of control fee ($350,000 in the case of microgrid technologies and $300,000 in the case of the wireless charging technologies) in each case payable upon the acquisition of SEI by NextNRG. NextNRG’s acquisition of SEI closed on January 19, 2024. The acquisition of SEI will be accounted for as an asset acquisition because substantially all of the fair value of the gross assets acquired consist of license agreements and the acquisition includes only inputs with no substantiative process that significantly contributes to the ability to create outputs. Further, while there is no guarantee that the NextNRG transaction will close, or that the combined entities (including SEI) will be successful, if the NextNRG transaction closes, we believe EzFill is poised to become the touchless fueling provider for all types of vehicles, both internal combustion and electric.

As used in this prospectus, references to NextNRG following our acquisition thereof include SEI unless otherwise indicated.

The Share Exchange, if it is completed, will result in substantial dilution to our shareholders See “Risk Factors—Risks Related to the Pending Acquisition of NextNRG.”

For the year ended December 31, 2020, the Company had a net loss of $7,254,006. At December 31, 2020, the Company had an accumulated deficit of $7,956,000 and a working capital deficit of $2,536,743. For the quarter ended March 31, 2021, the Company had a net loss of $1,348,155. At March 31, 2021, the Company had an accumulated deficit of $9,304,155 and a working capital deficit of $2,735,874. The Company anticipates that it will continue to incur losses in future periods until the Company is successful in significantly increasing its revenues, if ever, particularly in light of the adverse impact of the Covid-19 pandemic on its Company’s operations. We currently spend approximately $300,000-350,000 a month on our operations and we believe that with the additional capital expected from this offering, we will have enough capital to fund our operations for the foreseeable future.

Risks Associated With Our Business and This Offering

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include, but are not limited to:

| ● | ||

| ● | We will require substantial additional capital to support our operations and growth plans, and such capital may not be available on terms acceptable to us, if at all. This could hamper our growth and adversely affect our business. | |

| ● | Operating and litigation risks may not be covered by insurance. | |

| ● | Future climate change laws and regulations and the market response to these changes may negatively impact our operations. | |

| ● | The Share Exchange, if completed, will result in significant dilution to the Company’s stockholders. | |

| ● | High fuel prices can lead to customer conservation and attrition, resulting in reduced demand for our product. | |

| ● | Low fuel prices may also | |

| ● | The concentration of sales in certain large customers could result in significantly lower future | |

| ● | Changes in commodity market prices may have a negative effect on our liquidity. | |

| ● | The decline of the retail fuel market may impact our potential to get new customers. |

| 2 |

| ● | Competition in the mobile fuel delivery industry may negatively impact our operations. | |

| ● | Our auditors have issued a going concern opinion on our financial statements. |

| ● | Our current dependence on a | |

| ● | ||

| Local governments may make and enforce laws and regulations that ban mobile fuel delivery. | ||

| ● | The Company’s common stock is concentrated in a small number of shareholders. | |

| ● | ||

| Additional stock offerings in the future may dilute your percentage ownership of our company. |

JOBS Act

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, of 1933, as amended (or the “Securities Act”), for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act, which such fifth anniversary will occur in 2026. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and, as long as we continue to qualify as an emerging growth company, we may elect to take advantage of this and other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We are also a “smaller reporting company,” as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemedremain a smaller reporting company until our public float exceeds $75 million on the last day of our second fiscal quarter in the preceding fiscal year in which (1) the market value of our shares held by non-affiliates equals or exceeds $250 million as of the prior June 30th and our annual revenues equaled or exceeded $100 million during such completed fiscal year, or (2) the market value of our shares held by non-affiliates equals or exceeds $700 million as of the prior June 30th, regardless of our annual revenues during such completed fiscal year. Such reduced disclosure and corporate governance obligations may make it more challenging for investors to analyze our results of operations and financial prospects.

THE OFFERING

| Issuer | EzFill Holdings, Inc. | |

Common stock offered by us | ||

| Over-allotment option | We have granted a 45-day option to the representative of the underwriters to purchase a maximum of | |

| Common stock to be outstanding immediately after this offering | ||

Use of proceeds | We intend to use the net proceeds from this offering for acquisitions, debt repayment, and general corporate purposes, including working capital. See “Use of Proceeds” on page | |

| We, | |

| Market | Our shares are listed on the Nasdaq Capital Market |

The number of shares of common stock shown above to be outstanding after this offering is based on 18,750,0004,812,192 shares outstanding as of May 28, 20211, 2024 and excludes as of that date (all amounts after giving effect to our proposed 1:3.76 reverse stock split):excludes:

| ● | |

| ● | |

| ● | |

| ● | Warrants to purchase |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares of common stock or the exercise of any Representative Warrants.

SUMMARY FINANCIAL DATA

The following summary financial data for the year ended December 31, 2020 and the period from March 28, 2019 (inception) to December 31, 2019 and the balance sheet data as of December 31, 2020 and December 31, 2019 are derived from our audited financial statements included elsewhere in this prospectus. The summary financial data as of March 31, 2021 for the three months ended March 31, 2021 and 2020 have been derived from unaudited financial statements included elsewhere in this prospectus. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the information under the captions “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results.

Statements of Operations Data

For the three months ended March 31, 2021 | For the three months ended March 31, 2020 | For the year ended December 31, 2020 | For the period from March 28, 2019 through December 31, 2019 | |||||||||||||

| Revenue | $ | 1,521,819 | $ | 695,567 | $ | 3,586,244 | $ | 1,221,285 | ||||||||

| Loss before income taxes | $ | (1,348,155 | ) | $ | (382,886 | ) | $ | (7,254,006 | ) | $ | (701,994 | ) | ||||

| Net loss | $ | (1,348,155 | ) | $ | (382,886 | ) | $ | (7,254,006 | ) | $ | (701,994 | ) | ||||

| Net loss per share | $ | (0.02 | ) | $ | (0.01 | ) | $ | (0.19 | ) | $ | (0.02 | ) | ||||

| Proforma net loss per share | $ | (0.04 | ) | $ | (0.03 | ) | $ | (0.18 | ) | $ | (0.05 | ) | ||||

| Weighted average number of shares | 65,290,896 | 33,002,649 | 38,108,425 | 29,803,362 | ||||||||||||

| Proforma weighted average number of shares | 17,392,354 | 8,791,329 | 10,151,418 | 7,939,095 | ||||||||||||

| Adjusted EBITDA, non-GAAP | $ | (699,605 | ) | $ | (277,742 | ) | $ | (1,856,427 | ) | $ | (416,271 | ) | ||||

Pro forma per share data gives effect to the 1:3.76 reverse stock split to be consummated after the effective date of the registration statement of which this prospectus is a part and prior to the consummation of this offering. Pro forma net loss per share consists of net loss divided by the pro forma basic and diluted weighted average number of shares used in computing net loss per share.

Non-GAAP Financial Measures

Adjusted EBITDA is a non-GAAP financial measure which we use in our financial performance analyses. This measure should not be considered a substitute for GAAP-basis measures nor should it be viewed as a substitute for operating results determined in accordance with GAAP. We believe that the presentation of Adjusted EBITDA, a non-GAAP financial measure that excludes the impact of net interest expense, taxes, depreciation, amortization and stock compensation expense, provides useful supplemental information that is essential to a proper understanding of our financial results. Non-GAAP measures are not formally defined by GAAP, and other entities may use calculation methods that differ from ours for the purposes of calculating Adjusted EBITDA. As a complement to GAAP financial measures, we believe that Adjusted EBITDA assists investors who follow the practice of some investment analysts who adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability.

| 4 |

The following is a reconciliation of net loss to the non-GAAP financial measure referred to in this prospectus as Adjusted EBITDA for the years ended December 31, 2019 and 2020 and for the three months ended March 31, 2020 and 2021:

For the period from | ||||||||||||||||

| For the three | For the three | For the | March 28, 2019 | |||||||||||||

months ended | months ended | year ended | through | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Net loss | $ | (1,348,155 | ) | $ | (382,886 | ) | $ | (7,254,006 | ) | $ | (701,994 | ) | ||||

| Depreciation and amortization | 118,744 | 87,071 | 451,533 | 165,230 | ||||||||||||

| Interest expense | 112,344 | 18,073 | 321,338 | 63,292 | ||||||||||||

| Stock compensation | 417,462 | - | 4,624,708 | 57,201 | ||||||||||||

| Adjusted EBITDA | $ | (699,605 | ) | $ | (277,742 | ) | $ | (1,856,427 | ) | $ | (416,271 | ) | ||||

Balance Sheet Data

| As of March 31, 2021 | As of | |||||||

| (unaudited) | ||||||||

| Cash | $ | 230,826 | $ | 22,596,729 | ||||

| Total assets | $ | 2,183,357 | $ | 24,549,260 | ||||

| Total liabilities | $ | 3,965,794 | $ | 3,965,794 | ||||

| Total stockholders’ equity (deficit) | $ | (1,782,437 | ) | $ | 20,583,466 | |||

Proforma gives effect to the sale of shares in this offering at an assumed price of $4.00 per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Any investment in our securities involves a high degree of risk. You should carefully consider the risks described below as well as other information provided to you in this document, including information in the section of this document entitled “Information Regarding Forward Looking Statements.” If any of the following risks actually occur, the Company’s business, financial condition or results of operations could be materially adversely affected, the value of the Company’s Common Stock could decline, and you may lose all or part of your investment.

Our business, financial condition or operating results could be materially adversely affected by any of these risks. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in our securities.

Risks Related to Our Business

We will require substantial additional capital to support our operations and growth plans, and such capital may not be available on terms acceptable to us, if at all. This could hamper our growth and adversely affect our business.

An occurrence

Revenues generated from our operations are not presently sufficient to sustain our operations and our current liabilities substantially exceeded our current assets as of an uncontrolled eventDecember 31, 2023. Therefore, we will need to raise additional capital in the future to continue our operations. We anticipate that our principal sources of liquidity will only be sufficient to fund our activities through May 31, 2024. In order to have sufficient cash to fund our operations beyond May 31, 2024, we will need to raise additional equity or debt capital. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. We will be required to pursue sources of additional capital through various means, including debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as the covid-19 pandemic, is likely to negatively affect our operations

The coronavirus pandemic mayconvertible notes and warrants, which will adversely impact our financial condition. Our ability to obtain needed financing may be impaired by such factors as the capital markets and our history of losses, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to curtail or cease operations.

Uncertain geopolitical conditions could adversely affect our results of operations.

Uncertain geopolitical conditions, including the war in Israel and invasion of Ukraine, sanctions, and other potential impacts on this region’s economic environment and currencies, may cause demand for our products and services byto be volatile, cause abrupt changes in our current customers,customers’ buying patterns, and interrupt our ability to find new clients,supply products or limit customers’ access to financial resources and ability to satisfy obligations to us. Specifically, terrorist attacks, the outbreak of war, or the existence of international hostilities could damage the world economy, adversely affect the availability of and demand for crude oil and petroleum products and adversely affect both the price of our fuel and our revenues. This is due in partability to restrictions such as: social distancing requirements; stay at home orders and the shutdown of non-essential businesses and the impact these restrictions have on peoples’ and companies’ driving habits and their need for gasoline for their personal cars, fleets, and boats. Therefore, our current customers may not need our services as often and we may have trouble attracting new customers. If our customers need less gas and we have trouble finding new customers, this may negatively impact our operations and revenues. Due to various restrictions resulting from the Covid-19 and people continuing to work from home even after the restrictions have been lifted, the Company has not had the number of car fuels at office parks compared to prior periods. The reduced number of office park fuels has been partially offset by increased sales to large delivery service fleets. However, the margins on sales to large delivery service fleets are lower than the margins on individual customer deliveries at office parks. The Company anticipates that post-COVID-19 its customer base will normalize again. This event has had a significant impact on the business. In addition to the loss of office park customers, the Company has also experienced, from time to time, staff absences because of staff quarantine. This has not had a significant impact.obtain fuel.

Operating and litigation risks may not be covered by insurance.

Our operations are subject to all of the operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing combustible liquids such as gasoline for use by consumers. These risks could result in substantial losses due to personal injury and/or loss of life, and severe damage to and destruction of property and equipment arising from explosions and other catastrophic events, including acts of terrorism. Additionally, environmental contamination could result in future legal proceedings. There can be no assurance that our insurance coverage will be adequate to protect us from all material expenses related to pending and future claims or that such levels of insurance would be available in the future at economical prices. Moreover, defense and settlement costs may be substantial, even with respect to claims and investigations that have no merit. If we cannot resolve these matters favorably, our business, financial condition, results of operations and future prospects may be materially adversely affected.

Future climate change laws and regulations and the market response to these changes may negatively impact our operations.

Increased regulation of GHGgreenhouse (GHG) emissions, from products such as petroleum and diesel, could impose significant additional costs on us, our suppliers, and our customers. Some states have adopted laws and regulations regulating the emission of GHGs for some industry sectors. mandatoryMandatory reporting by our customers and suppliers could have an effect on our operations or financial condition.

The adoption of additional federal or state climate change legislation or regulatory programs to reduce emissions of GHGs could also require the Companyus or itsour suppliers to incur increased capital and operating costs, with resulting impact on product price and demand. The impact of new legislation and regulations will depend on a number of factors, including (i) which industry sectors would be impacted, (ii) the timing of required compliance, (iii) the overall GHG emissions cap level, (iv) the allocation of emission allowances to specific sources, and (v) the costs and opportunities associated with compliance. At this time, we cannot predict the effect that climate change regulation may have on our business, financial condition or operations in the future.

Our auditors have issuedincluded an explanatory paragraph in their opinion regarding our ability to continue as a going concern opinion on our audited financial statements.concern. If we are unable to continue as a going concern, our securities will have little or no value.

Although M&K CPA’s, PLLC, our independent registered public accounting firm for the fiscal year ended December 31, 2023, has included an explanatory paragraph in their opinion that accompanies our audited consolidated financial statements as of and for the year ended December 31, 2020 were prepared under the assumption2023, indicating that we would continue our operations as a going concern, the report of our independent registered public accounting firm that accompanies our financial statements for the year ended December 31, 2020 contains a going concern qualification in which such firm expressedcurrent liquidity position raises substantial doubt about our ability to continue as a going concern, based on the financial statements at that time. For the year ended December 31, 2020, the Company hadconcern. If we are unable to improve our liquidity position, we may not be able to continue as a net loss of $7,254,006. For the quarter ended March 31, 2021, The Company had a net loss of $1,348,155. At December 31, 2020, the Company had an accumulated deficit of $7,956,000 and a working capital deficit of $2,459,829 and at March 31, 2021, the Company had an accumulated deficit of $9,304,155 and a working capital deficit of $2,735,874. going concern.

We anticipate that we will continue to incurgenerate operating losses and use cash in future periods untiloperations through the foreseeable future. As further set forth above, we are successful in significantly increasing our revenues, particularly in light of the adverse impact of the Covid-19 pandemic on our operations. There are no assurancesanticipate that we will be able to raise our revenues to a level which supports profitable operations and provides sufficient funds to pay its obligations. Our prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. In addition, continued operations and our ability to continue as a going concernneed significant additional capital by May 31, 2024, or we may be dependent on our abilityrequired to obtain additional financing in the near future and thereafter, and there are no assurances that such financing will be available to us at allcurtail or will be available in sufficient amounts or on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we are unable to generate additional funds in the future through sales of our products, financings or from other sources or transactions, we will exhaust our resources and will be unable to continuecease operations. At the present time, the amount of capital the Company has available at its disposal will last no longer than one year if substantial debt or equity financing is not achieved. We believe that the proceeds from this offering will be sufficient to fund our operations for significantly more than the next year. If we cannot continue as a going concern, our shareholders would likely lose most or all of their investment in us.

If we are unable to protect our information technology systems against service interruption, misappropriation of data, or breaches of security resulting from cyber security attacks or other events, or we encounter other unforeseen difficulties in the operation of our information technology systems, our operations could be disrupted, our business and reputation may suffer, and our internal controls could be adversely affected.

In the ordinary course of business, we rely on information technology systems, including the Internet and third-party hosted services, to support a variety of business processes and activities and to store sensitive data, including (i) intellectual property, (ii) our proprietary business information and that of our suppliers and business partners, (iii) personally identifiable information of our customers and employees, and (iv) data with respect to invoicing and the collection of payments, accounting, procurement, and supply chain activities. In addition, we rely on our information technology systems to process financial information and results of operations for internal reporting purposes and to comply with financial reporting, legal, and tax requirements. Despite our security measures, our information technology systems may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, sabotage, or other disruptions. A loss of our information technology systems, or temporary interruptions in the operation of our information technology systems, misappropriation of data, or breaches of security could have a material adverse effect on our business, financial condition, results of operations, and reputation.

Moreover, the efficient execution of our business is dependent upon the proper functioning of our internal systems. Any significant failure or malfunction of this information technology system may result in disruptions of our operations. Our results of operations could be adversely affected if we encounter unforeseen problems with respect to the operation of this system.

High fuel prices can lead to customer conservation and attrition, resulting in reduced demand for our product.

Prices for fuel are subject to volatile fluctuations in response to changes in supply and other market conditions. During periods of high fuel costs our prices generally increase. High prices can lead to customer conservation and attrition, resulting in reduced demand for our product.

Low fuel prices may also result in less demand for our product.

Low fuel prices may lead to us being unable to attract customers due to the fact that we charge a delivery price that may make our pricing less competitive.

| 6 |

Changes in commodity market prices may have a negative effect on our liquidity.gross margin.

Our current fuel supplier agreement setsagreements set terms and establishes formulas based on Oil Price Information Service (OPIS) pricing as of the time of wholesale acquisition, and we do not store inventory. OPIS is a leading source for worldwide petroleum pricing. There is a mark-up for retail fuel prices above wholesale cost, per standard practice in the retail fuel distribution model. Cost of goods sold includes direct labor, including drivers. Our gross margin as a percentage of revenue decreases as a result of increase in fuel costs.

The December 31, 2020, financial statements reflect higher revenue and positive gross margin. As the company continues to grow revenue, the margin is expected to increase as driver utilization improves.

The decline of the retail fuel market may impact our potential to get new customers.

The retail gasoline industry has been declining over the past several years, with no or modest growth or decline in total demand foreseen in the next several years. Accordingly, we expect that year-to-year industry volumes will be principally affected by weather patterns. Therefore, our ability to grow within the industry is dependent on our ability to acquire other retail distributors and to achieve internal growth, which includes the success of our sales and marketing programs designed to attract and retain customers. Any failure to retain and grow our customer base would have an adverse effect on our results.

Competition in the fuel delivery industry may negatively impact our operations.

We compete with other mobile fuel delivery companies nationwide. There is little to no barrier to entry and therefore, our competition in the industry may grow. Our ability to compete in our current markets and expand to new markets may be negatively impacted by our competitors’ successes. Additionally, fuel competes with other sources of energy, some of which are less costly on an equivalent energy basis. In addition, we cannot predict the effect that the development of alternative energy sources might have on our operations. We compete for customers against suppliers of electricity. Electricity is becoming a competitor of fuel. The convenience and efficiency of electricity make it an attractive energy source for vehicle drivers. The expansion of the electric vehicle industry may have a negative impact on our customer base.

Our trucks transport hazardous flammable fuel.fuel, which may cause environmental damage and liability to us.

Due to the hazardous nature and flammability of our product, we face the risk of a simple accident causing serious damage to life and property. Additionally, a spill of our product may result in environmental damage, the liability for which our Company may not be able to overcome. If we are involved in a spill, leak, fire, explosion or other accident involving hazardous substances or if there are releases of fuel or fuel products we own or are transporting, our operations could be disrupted and we could be subject to material liabilities, such as the cost of investigating and remediating contaminated properties or claims by customers, employees or others who may have been injured, or whose property may have been damaged. These liabilities, to the extent not covered by insurance, could have a material adverse effect on our business, financial condition and results of operations. Some environmental laws impose strict liability, which means we could have liability without regard to whether we were negligent or at fault.

In addition, compliance with existing and future environmental laws regulating fuel storage terminals, fuel delivery vessels and/or storage tanks that we own or operate may require significant capital expenditures and increased operating and maintenance costs. The remediation and other costs required to clean up or treat contaminated sites could be substantial and may not be covered by insurance.

Our cash flow and net income may decrease if we are forced to comply with new governmental regulation surrounding the transportation of fuel.

We are subject to various federal, state, and local safety, health, transportation, and environmental laws and regulations governing the storage, distribution, and transportation of fuel. It is possible we will incur increased costs as a result of complying with new safety, health, transportation and environmental regulations and such costs will reduce our net income. It is also possible that material environmental liabilities will be incurred, including those relating to claims for damages to property and persons.

Our current dependence on a single fuel supplier increases our risk of an interruption in fuel supply, impacting our operations.

During 2019, 2020 andAlthough we are in the first quarterprocess of 2021 (andestablishing other sources, we expect to continue tocurrently purchase from a singular source into 2021), the Company purchased almost all of itsour fuel needs from onetwo principal suppliersuppliers in Florida, MacMillan Oil Company, LLC.Florida. We do not have a written agreement with MacMillan,the largest supplier, and as such, if fuel from this source was interrupted, the cost of procuring replacement fuel and transporting that fuel from alternative locations might be materially higher and, at least on a short-term basis, our earnings could be negatively affected. This supplier is also a shareholder in the Company.

Our profitability is subject to fuel pricing and inventory risk.

The retail fuel business is a “margin-based” business in which gross profits are dependent upon the excess of the sales price over the fuel supply costs. Fuel is a commodity, and, as such, its unit price is subject to volatile fluctuations in response to changes in supply or other market conditions. We have no control over supplies, commodity prices or market conditions. Consequently, the unit price of the fuel that we and other marketers purchase can change rapidly over a short period of time, including daily.

Loss of a major customer could result in a decrease in our future sales and earnings.

In any given quarter or year, sales of our products may be concentrated in a few major customers. We are dependent on certain largeanticipate that a limited number of customers in any given period may account for a significantsubstantial portion of our total net revenue

For for the three months ended March 31, 2021,foreseeable future. The business risks associated with this concentration, including increased credit risks for these and other customers and the possibility of related bad debt write-offs, could negatively affect our margins and profits. Additionally, the Company had onedoes not have any long-term agreements with its customers. All customer agreements are cancelable at any time by either party and as such there cannot be any assurance that made up 55% of revenue. Forany customer will continue to use the year ended December 31, 2020, the Company had two customers that made up 38% and 11% of revenue, respectively.

Company’s services. The loss of a significantmajor customer, whether through competition or consolidation, or a termination in sales to any major customer, could haveresult in a material negative impact ondecrease of our future revenues.sales and earnings.

We operate in a new industry segment and may be subject to new and existing laws, regulations and oversight

Local governments

The Company operates in a new industry segment, on-demand mobile fuel delivery, in which new state and local law adoptions are occurring. Effective December 31, 2020, Florida adopted Florida Fire Prevention Code (“Code”) Section 42.12 recognizing and setting various requirements for the consumer on-demand mobile fuel delivery business. Permitting authority is contemplated under an “Authority Having Jurisdiction” (“AHJ”). Other pre-existing Code provisions similarly contemplate AHJ permitting for commercial mobile fueling. Miami-Dade County, where most of our business is conducted, adopted the Code by reference. Unlike some other states and counties, neither Florida nor Miami-Dade County have designated an AHJ for mobile fueling. Miami-Dade’s extensive permitting and fee schedule does not contemplate or assert permitting authority over mobile fueling, consumer or commercial. We may make and enforce lawsbe subject to oversight, including audits, in existing or future areas of operation. If we cannot comply with the Code, or County, State or Federal rules and regulations that ban retail fuel delivery.

At any time, local governmentsor the laws, rules and regulations or oversight in the areas in which we currently operate can pass laws, rules, or regulations which ban retail fuel delivery. If this happens,may seek to operate, we could lose the ability to service those areas and our earnings could be affected.

Our License Agreement with Fuel Butler may be terminated and as such our expansion plans into the state of New York may be delayed

On April 7, 2021, the Company entered into a Technology License Agreement with Fuel Butler LLC (“Technology Agreement”). Under the Technology Agreement, the Company licensed proprietary technology that the Company believes will allow the Company to provide its fuel service in high density areas like New York City. Fuel Butler has delivered a purported notice of termination of the Technology Agreement based on certain alleged breaches arising from our failure to issue equity securities to Fuel Butler. We have been in communications with Fuel Butler regarding the termination of the Technology Agreement and continue to believe that the Company is in compliance with the Technology Agreement and that the Technology Agreement continues to be in force. While we contest Fuel Butler’s claims of breach and contend that in fact Fuel Butler is in breach, we have communicated to Fuel Butler that we wish to terminate the Technology Agreement. We have sent a proposal to Fuel Butler whereby we will cease utilizing the Technology and Fuel Butler will return any shares it received under the Technology Agreement. However, to date, the Company has not had further communications with Fuel Butler regarding this matter. Currently, the Company does not expect to expand into the state of New York for the foreseeable future.

| 8 |

Risks Related to the Pending Acquisition of NextNRG

Neither the Company’s board of directors nor any committee thereof obtained a fairness opinion (or any similar report or appraisal) in determining whether or not to pursue the acquisition of NextNRG, which is owned by the Company’s largest shareholder. Consequently, you have no assurance from an independent source that the price the Company is paying for NextNRG is fair to the Company — and, by extension, its securityholders — from a financial point of view.

Neither the Company’s board of directors nor any committee thereof is required to obtain an opinion (or any similar report) from an independent investment banking or accounting firm that the price that the Company is paying for NextNRG is fair to the Company from a financial point of view, although pursuant to Nasdaq Rule 5630 the Company is required to conduct an appropriate review and oversight of all related party transactions for potential conflict of interest situations on an ongoing basis by the Company’s audit committee or another independent body of the board of directors. In analyzing the acquisition of NextNRG, the Company’s board of directors reviewed summaries of due diligence results and financial analyses prepared by management. The Company’s board of directors also consulted with legal counsel and with the Company management and considered a number of factors, uncertainty and risks and concluded that the acquisition of NextNRG was in the best interest of the Company’s stockholders. The Company’s board of directors believes that because of the professional experience and background of its directors, it was qualified to conclude that the acquisition of NextNRG was fair from a financial perspective to its stockholders. Accordingly, investors will be relying solely on the judgment of the Company’s board of directors in valuing NextNRG, and the Company’s board of directors may not have properly valued such acquisition. As a result, the terms may not be fair from a financial point of view to the public stockholders of the Company.

If the conditions to completion of the Share Exchange are not met, the Share Exchange may not occur.

Although the Share Exchange was approved by the stockholders of the Company and the members of NextNRG, specified conditions must be satisfied or waived to complete the Share Exchange. These conditions are described in detail in the Exchange Agreement and in addition to stockholder and member consent, include among other requirements, (i) receipt of requisite regulatory approvals and no law or order preventing the transactions, (ii) the representations and warranties of the representative of the members of NextNRG and of such members being true and correct as of the date of the Exchange Agreement and as of the Closing in all material respects, (iii) the Company having amended its Certificate of Incorporation to increase its authorized share capital and having completed and filed a listing of additional securities with Nasdaq and the waiting period thereunder shall have expired, and the Company shall have completed such additional requirements of Nasdaq such that the Share Exchange may be consummated in compliance with the rules and regulations of Nasdaq, (iv) no Material Adverse Effect with respect to NextNRG, (v) the members of the post-Closing board being elected or appointed, and (vi) NextNRG shall have provided to the Company audited financial statements for NextNRG and related auditor reports thereon from a Public Company Accounting Oversight Board-registered auditor, which consents to the inclusion of its statements in SEC public filings, for each of the two most recently ended fiscal years and any other period audited or unaudited but reviewed financials are required to be included in the Company’s SEC filings following the closing pursuant to applicable law, and unaudited statements for any other required interim periods. The Company and NextNRG cannot assure you that all of the conditions will be satisfied. If the conditions are not satisfied or waived, the Share Exchange may not occur, or may be delayed and such delay may cause the Company and NextNRG to each lose some or all of the intended benefits of the Share Exchange.

The Share Exchange, if it is completed, will result in significant dilution to the Company’s stockholders.

Pursuant to the Share Exchange, the Company will issue up to an aggregate of 100,000,000 shares of common stock to the Members of NextNRG, including 35-65 million shares that will be subject to vesting or forfeiture (see “Prospectus Summary”) pursuant to future milestones. Based on 4,812,192 shares of common stock outstanding as of May 1, 2024 and assuming (i) the issuance of 6,355,932 shares in this offering and (ii) the issuance of all 100,000,000 shares pursuant to the Share Exchange, following this offering and the closing of the Share Exchange, the Company will have 111,168,124 shares of common stock issued and outstanding. Of such shares, 6,355,932 shares (5.7%) will be beneficially owned by investors in this offering, 601,931 shares (0.5%) will be beneficially owned by current officers and directors of the Company, 101,171,567 shares (91.0%) will be beneficially owned by the Members of NextNRG (including shares held by entities controlled by Michael Farkas, the Chief Executive Officer of NextNRG), and 3,039,694 shares (2.7%) will be beneficially owned by other current shareholders of the Company.

In addition, in connection with the approval of the Share Exchange our stockholders have approved an increase in the number of shares that may be issued under our equity incentive plan from 900,000 shares to 2.9 million shares. Issuance of awards regarding such additional shares will result in further dilution to stockholders, including investors in this offering.

| 9 |

NextNRG has a very limited operating history, which makes it difficult to evaluate its business and prospects.

NextNRG has a very limited operating history, which makes it difficult to evaluate its business and prospects or forecast its future results. NextNRG is subject to the same risks and uncertainties frequently encountered by new companies in rapidly evolving markets. NextNRG’s financial results in any given quarter can be influenced by numerous factors, many of which it is unable to predict or are outside of its control, including:

| ● | perceptions about EV quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of EVs; | |

| ● | the limited range over which EVs may be driven on a single battery charge and concerns about running out of power while in use; | |

| ● | concerns regarding the stability of the electrical grid; | |

| ● | improvements in the fuel economy of the internal combustion engine; | |

| ● | consumers’ desire and ability to purchase a luxury automobile or one that is perceived as exclusive; | |

| ● | the environmental consciousness of consumers; | |

| ● | volatility in the cost of oil and gasoline; | |

| ● | consumers’ perceptions of the dependency of the United States on oil from unstable or hostile countries and the impact of international conflicts; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | access to charging stations, standardization of EV charging systems and consumers’ perceptions about convenience and cost to charge an EV; and | |

| ● | the availability of tax and other governmental incentives to purchase and operate EVs or future regulation requiring increased use of nonpolluting vehicles. |

To date, NextNRG has not generated significant revenues or achieved profitability, and may never generate significant revenues or become profitable.

NextNRG has incurred net losses since inception and may not be able to achieve or maintain profitability in the future. NextNRG’s expenses will likely increase in the future as it develops and launches its products, expands into new markets, increases its sales and marketing efforts and continues to invest in technology. These efforts to grow its business may be more costly than NextNRG expects and may not result in increased revenue or growth in its business. NextNRG will likely be required to make significant capital investments and incur recurring or new costs, and its investments (if any) may not generate sufficient returns and its results of operations, financial condition and liquidity may be adversely affected. Any failure to increase revenues sufficiently to keep pace with such investments and other expenses could prevent NextNRG from achieving or maintaining profitability or positive cash flow on a consistent basis or at all. If NextNRG is unable to successfully address these risks and challenges as it encounters them, its business, financial condition, results of operations and prospects could be adversely affected. If it is unable to generate adequate revenue growth and manage expenses, NextNRG may continue to incur net losses in the future, which may be substantial, and it may never be able to achieve or maintain profitability. NextNRG also expects its costs and expenses to increase in future periods, which could negatively affect future results of operations if revenues do not increase. In particular, NextNRG intends to continue to expend significant funds to further develop its technology. Furthermore, if NextNRG’s future growth and operating performance fail to meet investor or analyst expectations, or if it has future negative cash flow or losses resulting from investment in technology or expanding operations, this could have a material adverse effect on its business, financial condition and results of operations.

The market for NextNRG’s platform and services may not be as large as NextNRG believes it to be.

We believe the market for our values-aligned platform is substantial, but it is still relatively new, and it is uncertain to what extent or how widespread market acceptance of our platform will be or how long such acceptance, if achieved, may be sustained. Our success will depend on the willingness of people to widely adopt the NextNRG experience, values and the products and services that we offer through our platform. If the public does not perceive our products and services sold through our platform to be beneficial, or chooses not to adopt them as a result of concerns regarding privacy, accessibility, or for other reasons, including an unwillingness to confirm that they respect our five core values or as a result of negative incidents or experiences they encounter through our platform, or instead opt to use alternatives to our platform, then the market for our platform may not continue to grow, may grow slower than we expect, or may not achieve the growth potential we expect, any of which could materially adversely affect our business, financial condition, and results of operations.

NextNRG has limited experience with respect to determining the optimal prices and pricing structures for its products and services, which may impact its financial results.

NextNRG expects that it may need to change its pricing model from time to time, including as a result of competition, global economic conditions, changes in product mix or pricing studies. Similarly, as NextNRG introduces new products and services, it may have difficulty determining the appropriate price structure for future products and services, including because we may pursue business lines or enter markets in which NextNRG’s current management team has limited prior experience. In addition, as new and existing competitors introduce new products or services that compete with NextNRG’s, or revise their pricing structures, it may be unable to attract new customers at the same price or based on the same pricing model as it has used historically. As a result, NextNRG may be required from time to time to revise its pricing structure or reduce prices, which could adversely affect its business, operating results, and financial condition.

NextNRG is in a highly competitive EV charging services industry and there can be no assurance that it will be able to compete with many of its competitors which are larger and have greater financial resources.

NextNRG faces strong competition from competitors in the EV charging services industry, including competitors who could duplicate its model. Many of these competitors may have substantially greater financial, marketing and development resources and other capabilities than NextNRG. In addition, there are very few barriers to entry into the market for its services. There can be no assurance, therefore, that any of NextNRG’s current and future competitors, many of whom may have far greater resources, will not independently develop services that are substantially equivalent or superior to its services.

NextNRG’s competitors may be able to provide customers with different or greater capabilities or benefits than it can provide in areas such as technical qualifications, past contract performance, geographic presence and driver price. Further, many of its competitors may be able to utilize substantially greater resources and economies of scale to develop competing products and technologies, divert sales away from NextNRG by winning broader contracts or hire away our employees by offering more lucrative compensation packages. In the event that the market for EV charging stations expands, NextNRG expects that competition will intensify as additional competitors enter the market and current competitors expand their product lines. In order to secure contracts successfully when competing with larger, well-financed companies, NextNRG may be forced to agree to contractual terms that provide for lower aggregate payments to it over the life of the contract, which could adversely affect its margins. NextNRG’s failure to compete effectively with respect to any of these or other factors could have a material adverse effect on its business, prospects, financial condition or operating results.

NextNRG’s revenue growth ultimately depends on consumers’ willingness to adopt electric vehicles in a market which is still in its early stages.

NextNRG’s growth is highly dependent upon the adoption by consumers of EVs, and it is subject to a risk of any reduced demand for EVs. If the market for EVs does not gain broader market acceptance or develops slower than expected, NextNRG’s business, prospects, financial condition and operating results will be harmed. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements, long development cycles for EV original equipment manufacturers, and changing consumer demands and behaviors. Factors that may influence the purchase and use of alternative fuel vehicles, specifically EVs, include:

| ● | perceptions about EV quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of EVs; | |

| ● | the limited range over which EVs may be driven on a single battery charge and concerns about running out of power while in use; | |

| ● | concerns regarding the stability of the electrical grid; | |

| ● | improvements in the fuel economy of the internal combustion engine; | |

| ● | consumers’ desire and ability to purchase a luxury automobile or one that is perceived as exclusive; | |

| ● | the environmental consciousness of consumers; | |

| ● | volatility in the cost of oil and gasoline; | |

| ● | consumers’ perceptions of the dependency of the United States on oil from unstable or hostile countries and the impact of international conflicts; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | access to charging stations, standardization of EV charging systems and consumers’ perceptions about convenience and cost to charge an EV; and | |

| ● | the availability of tax and other governmental incentives to purchase and operate EVs or future regulation requiring increased use of nonpolluting vehicles. |

The influence of any of the factors described above may negatively impact the widespread consumer adoption of EVs, which would materially and adversely affect NextNRG’s business, operating results, financial condition and prospects.

Risks Related to Ownership of Our Common Stock and this Offering

Our stock price is expected to fluctuate significantly.

Prior to this offering, you could not buy or sell ourOur common stock publicly. We have applied to list our common stockwas approved for listing on theThe Nasdaq Capital Market; however, thereMarket under the symbol “EZFL” and began trading on September 15, 2021. There can be no assurance given that our application will be approved or that an active trading market for our shares will develop or be sustained following this offering. We negotiated and determined the initial public offering price with the underwriters based on several factors. This price may vary from the market price of our common stock after this offering. You may be unable to sell your shares of common stock at or above the initial offering price.sustained. The market price of shares of our common stock could be subject to wide fluctuations in response to many risk factors listed in this section, and others beyond our control, including:

| ● | actual or anticipated fluctuations in our financial condition and operating results; | |

| ● | ||

| ● | actual or anticipated changes in our growth rate relative to our competitors; | |

| ● | competition from existing companies in the space or new competitors that may emerge; | |

| ● | issuance of new or updated research or reports by securities analysts; | |

| ● | fluctuations in the valuation of companies perceived by investors to be comparable to us; | |

| ● | share price and volume fluctuations attributable to inconsistent trading volume levels of our shares; | |

| ● | additions or departures of key management or technology personnel; | |

| ● | disputes or other developments related to proprietary rights, including |

| ● | announcement or expectation of additional debt or equity financing efforts; | |

| ● | sales of our common stock by us, our insiders or our other stockholders; and | |