As filed with the Securities and Exchange Commission on July 23, 2021October 13, 2023.

Registration No. 333- 257722333-274871

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

(Amendment No. 1)1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BIOFRONTERA INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 47-3765675 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

120 Presidential Way, Suite 330

Woburn, MA01801

Telephone: 781-245-1325781-245-1325

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Prof. Dr. Hermann LübbertLuebbert

Chairman and Chief Executive Officer

Biofrontera Inc.

120 Presidential Way, Suite 330

Woburn, MA01801

Telephone: 781-245-1325781-245-1325

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Stephen E. Older, Esq.

McGuireWoods LLP 1251 Avenue of the Americas 20th Floor New York, NY 10020 Telephone: | Daniel Hakansson Corporate Counsel Biofrontera Inc. 120 Presidential Way, Suite 330 Woburn, MA 01801 Telephone: 781-486-1510 |

Tyler J. Vivian, Esq. Faegre Drinker Biddle & Reath LLP 2200 Wells Fargo Center 90 South Seventh Street Minneapolis, Minnesota 55402 (612) 766-7000 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: AS SOON AS PRACTICABLE AFTER THIS REGISTRATION STATEMENT IS DECLARED EFFECTIVE.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [ ]☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company | Emerging growth company |

If an emerging growth company, that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2)(3) | ||||||

| Common Stock, par value $0.001 value per share | $ | 25,000,000 | $ | 2,727.50 | ||||

| Underwriters’ common stock purchase warrants (4)(5) | ||||||||

| Common stock including in underwriters’ common stock purchase warrants | ||||||||

| |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion.

Dated October 13, 2023

Up to 2,300,000 Shares of Common Stock

or

SubjectUp to Completion.

Dated , 2021.

Shares

2,300,000 Pre-Funded Warrants to Purchase Common Stock

This is an initial public offeringUp to 2,300,000 Warrants to Purchase Common Stock

Up to 2,300,000 Shares of sharesCommon Stock Underlying the Warrants

Up to 2,300,000 Shares of common stock of Biofrontera Inc.Common Stock Underlying the Pre-Funded Warrants

We are offering on a best efforts basis up to 2,300,000 shares of our common stock.stock, par value $0.001 (the “Common Stock”) and up to 2,300,000 warrants to purchase up to 2,300,000 shares of our common stock, at a combined offering price of $ per share and accompanying warrant. Each warrant will have an exercise price of $ (between 100% and 120% of the combined public offering price per share and accompanying warrant), will be exercisable immediately and will expire five years from the date of issuance.

Immediately afterWe are also offering to those purchasers, if any, whose purchase of shares in this offering assuming an offering size set forth above, Biofrontera AG, our parent companywould otherwise result in such purchaser, together with its affiliates and sole existing stockholder, will own approximately %certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. As aCommon Stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants in lieu of shares that would otherwise result we expect to remain a “controlled company” withinin such purchaser’s beneficial ownership exceeding 4.99% (or, at the meaningelection of the corporate governance standardspurchaser, 9.99%) of our outstanding shares of Common Stock. The Nasdaqcombined purchase price of each pre-funded warrant and accompanying warrant will be equal to the combined purchase price per share and accompanying warrant being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the pre-funded warrants are exercised in full.

For each pre-funded warrant we sell, the number of shares of Common Stock Marketwe are offering will be decreased on a one-for-one basis. The shares of Common Stock or pre-funded warrants and the accompanying warrants can only be purchased together in this offering, but the securities will be issued separately. The shares of Common Stock issuable from time to time upon exercise of the warrants and the pre-funded warrants are also being offered by this prospectus.

The shares of Common Stock and accompanying warrants and the pre-funded warrants and accompanying warrants, respectively, will be offered at a fixed combined purchase price and are expected to be issued in a single closing. The offer will terminate on November 1, 2023, unless completed sooner or unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We expect this offering to be completed not later than two business days following the commencement of sales in this offering (after the effective date of the registration statement of which this prospectus forms a part), and we will deliver all securities to be issued in connection with this offering delivery versus payment/ receipt versus payment upon receipt by us of investor funds. Accordingly, neither we nor the Placement Agent (as defined below) have made any arrangements to place investor funds in an escrow account or trust account since the Placement Agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We have engaged Roth Capital Partners, LLC (“Nasdaq”(the “Placement Agent”). to act as our sole placement agent in connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the securities we are offering, and the Placement Agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the Placement Agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. We will bear all costs associated with the offering. See “Principal StockholdersPlan of Distribution.” beginning on page 107 of this prospectus for more information regarding these arrangements.

Prior to this offering, there has been no public market for ourOur common stock. Itstock is currently estimated thatquoted on the initial public offeringNasdaq Capital Market under the symbol “BFRI.” On October 3, 2023, the last reported sale price per share of our common stock was $8.49. The actual combined public offering price per share or pre-funded warrant, as the case may be, and accompanying warrant in this offering will be determined between $us, the Placement Agent and $ .. We have appliedthe investors in this offering at the time of pricing, and may be at a discount to listthe current market price for our common stockCommon Stock. Therefore, the recent market price used throughout this preliminary prospectus as an assumed combined per share and accompanying warrant offering price may not be indicative of the final combined offering price. There is no established public trading market for the warrants to be issued in this offering or the pre-funded warrants, and we do not expect such a market to develop. In addition, we do not intend to apply for a listing of the warrants issued in this offering or the pre-funded warrants on The Nasdaq Capital Market under the symbol “BFRI.”any national securities exchange or other nationally recognized trading system.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, and a “smaller reporting company”, as defined under applicable federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements. See “Summary—Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in our common stocksecurities involves a high degree of risk. See “Risk Factors” beginning on page 813 to read about factors you should consider before buying shares of our common stock.securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Per Share and Accompanying Warrant(s) | Per Pre- Funded Warrant and Accompanying Warrant(s) | Total | ||||||||||

| $ | $ | |||||||||||

| $ | ||||||||||||

| Placement agent fees (1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to Biofrontera Inc.(2) | $ | $ | $ | |||||||||

(1) See “Plan of Distribution” for a description of the compensation payable | |

To the extent that the underwriters sell more than shares of our common stock, the underwriters have the option to purchase up to an additional shares from us at the initial price to the Placement Agent.

(2) Because there is no minimum number of securities or amount of proceeds required as a condition to closing of this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the underwriting discount, to cover over-allotments.total maximum offering amounts set forth above. See “Plan of Distribution” for more information.

The underwriters expect to deliverWe expects the sharesdelivery of our common stockthe securities against payment will be made in New York, New York on or about , 2021.2023.

Roth Capital Partners

Prospectus dated , 2021.2023.

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any related free writing prospectuses.free-writing prospectus. We and the underwritersPlacement Agent take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares and warrants offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not done anything that would permit this offering or the possession or distribution of this prospectus or any free writingfree-writing prospectus that we may provide to you in connection with thisthe offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stockand warrants and the distribution of this prospectus outside the United States. See “Underwriting“Plan of Distribution.”.”

As used in this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” the “Company,” “Biofrontera” and similar references refer to Biofrontera Inc. References in this prospectus to the “Biofrontera Group” refer to Biofrontera AG and its consolidated subsidiaries, Biofrontera Pharma GmbH (individually, “Biofrontera Pharma”), Biofrontera Bioscience GmbH (individually “Biofrontera Bioscience”), Biofrontera Neuroscience GmbH, (individually “Biofrontera Neuroscience”), and Biofrontera Development GmbH (individually “Biofrontera Development”).GmbH. References in this prospectus to “Ferrer” refer to Ferrer Internacional S.A. References in this prospectus to Biofrontera’s “Licensors”“Licensors” refer collectively to Biofrontera Pharma, Biofrontera Bioscience and Ferrer. References in this prospectus to “Maruho”“Ameluz Licensor” refer collectively to Maruho Co., Ltd.,Biofrontera Pharma and references to “Maruho Deutschland” refer to Maruho Deutschland GmbH, Maruho’s wholly owned subsidiary.Biofrontera Bioscience. References in this prospectus to “Cutanea” refer to Cutanea Life Sciences, Inc., which was acquired by Biofrontera in 2019 (“Cutanea acquisition”).2019.

Our financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or GAAP. Our fiscal year ends on December 31 of each year. References to fiscal 2019years 2021 and 20202022 are references to the years ended December 31, 20192021 and 2020.2022. Our most recent fiscal year ended on December 31, 2020.2022.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our financial statements included elsewhere in this prospectus. Certain other amounts that appear in this prospectus may not sum due to rounding.

We have rights to trademarks and trade names that we use in connection with the operation of our business, including our corporate name, logos, product names and website names. Trademarks and trade names appearing in this prospectus are the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred to in this annual report are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights, or the rights of the applicable licensor, to such trademarks and trade names.

| ii |

SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our common stock.securities. You should read and carefully consider the entire prospectus carefully, includingbefore making an investment decision, especially the information in “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the relatedaccompanying notes, which are included elsewhere in this prospectus, before making an investment decision.prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

OverviewWe effected a 1-for-20 reverse stock split of our outstanding common stock on July 3, 2023 (the “reverse stock split”). The conversion and/or exercise prices of our issued and outstanding convertible securities, including shares issuable upon exercise of outstanding stock options and warrants have been adjusted accordingly. Unless otherwise indicated, all share amounts and per share amounts set forth in this prospectus, as well as any corresponding exercise price data, give effect to the reverse stock split.

Overview

We are a U.S.-based biopharmaceutical company specializing in the commercializationcommercializing a portfolio of pharmaceutical products for the treatment of dermatological conditions in particular, diseases caused primarily by exposure to sunlight that result in sun damage to the skin. Ourwith a focus on photodynamic therapy (“PDT”) and topical antibiotics. The Company’s licensed products focus onare used for the treatment of actinic keratoses, which are pre-cancerous skin lesions, that can sometimes lead to skin cancer. We also market a topical antibiotic for treatment ofas well as impetigo, a bacterial skin infection. In May 2023, the Company began research and development (“R&D”) activities to support PDT growth and will continue to opportunistically invest in these activities going forward. Our research and development program currently aims to improve the capabilities of our BF-RhodoLED® lamps to better fulfill the needs of dermatologists and improve the effectiveness of our commercial team by letting sales representatives carry approved devices with them allowing for easier product demonstrations and evaluations.

Our principal licensed product is Ameluz®, which is a prescription drug approved for use in combination with our licensor’s medical device, which has been approved by the U.S. Food and Drug Administration (the “FDA”), the BF-RhodoLEDRhodoLED®lamp series, for photodynamic therapy, or PDT (when used together, “Ameluz®PDT”) in. In the United States, the Ameluz® PDT treatment is used for the lesion-directed and field-directed treatment of actinic keratosiskeratoses (“AK”) of mild-to-moderate severity on the face and scalp. AKs are premalignant lesions of the skin that can potentially develop into skin cancer (squamous cell carcinoma) if left untreated.1 International treatment guidelines list photodynamic therapy as the highly recommended treatment for AK, especially multiple AKs and the surrounding photodamaged skin.2We are currently selling Ameluz® Ameluz® for this indication in the U.S. under an exclusive amended and restated license and supply agreement or (“Ameluz LSA, byLSA”) between Biofrontera, Inc. and among us, Biofrontera Pharma GmbH and Biofrontera Bioscience GmbH dated as of June 16, 2021. See “Business—Commercial Partners and Agreements—Biofrontera Pharma and Biofrontera Bioscience” in this prospectus for more information. Under the Ameluz LSA, we holdLicensors.

AKs are superficial potentially pre-cancerous skin lesions caused by chronic sun exposure that may, if left untreated, develop into a form of potentially life-threatening skin cancer called squamous cell carcinoma. AK is the exclusive license to sell Ameluz® andmost frequent indication treated by dermatologists for patients older than 45. Actinic keratoses typically appear on sun-exposed areas, such as the BF-RhodoLED® lamp for all indications currently approved byface, bald scalp, arms or the FDA as well as all future FDA-approved indications. As further described below, under the Ameluz LSA, further extensionsback of the approved indications for Ameluz® hands, and are often elevated, flaky, and rough in texture, and appear on the skin as hyperpigmented spots. If left untreated, 0.025-16% of AKs can transform into squamous cell carcinoma (SCC) and as such can be regarded as pre-cancerous lesions. AKs are typically treated with cryotherapy, self-applied topical drugs, or PDT and these treatments can be used in combination.

In general, photodynamic therapy is a two-step process:

● the first step is the application of a drug known as a “photosensitizer,” or a pre-cursor of this type of drug, which tends to accumulate in cancerous cells; and

1 Fuchs & Marmur, Dermatol Surg. 2007 Sep; 33(9):1099-101. doi: 10.1111/j.1524-4725.2007.33224.x

2 Werner RN, et al. J Eur Acad Dermatol Venereol. 2015 Nov;29(11):2069-2079. doi:10.1111/jdv.13180.

| 1 |

● the second step is activation of the photosensitizer by controlled exposure to a selective light source in the United States are anticipated.presence of oxygen.

During this process, energy from the light activates the photosensitizer. In photodynamic therapy, the activated photosensitizer transfers energy to oxygen molecules found in cells, converting the oxygen into highly reactive oxygen species (“ROS”), which destroys or alters the sensitized cells. Photodynamic therapy can be a highly selective treatment that targets specific cells while minimizing damage to normal surrounding tissues. It also can allow for multiple courses of therapy. Hence the mode of action of photodynamic therapy requires destruction of the altered cells. Temporary local skin reactions and inflammation of the treated area might be expected. The Ameluz® PDT therapy is highly effective with patients experiencing up to 91% clearance after one or two treatments3 with limited or no scarring.4 The therapy also may provide protection from potentially fatal progress of mild or invisible AKs. For patients treated with the combination of Ameluz® and BF-RhodoLED, 91% of those patients achieved 100% clearance twelve weeks after treatment, compared to 22% of patients treated with the vehicle who achieved 100% clearance twelve weeks after treatment., 94.3% of lesions were 100% cleared twelve weeks after treatment with Ameluz® PDT therapy compared to 32.5% of lesions that were 100% cleared twelve weeks after treatment with a placebo. 63% of patients who achieved 100% clearance remained 100% cleared twelve months after the Ameluz® PDT treatment.

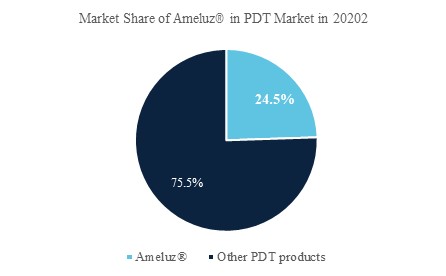

AK currently affects approximately 58 million Americans which leads to roughly 13 million treatments annually.5 Cryotherapy is the traditional and most common form of treatment but may not be as effective and may leave scarring and cannot be applied to larger fields; cryotherapy is estimated to be approximately 86% of the market. Topical medications which patients apply to the lesions up to multiple times per day for up to several weeks, constitute approximately 12% of the market. PDT is approximately 2% of the market. The total market size is estimated to be roughly $4 billion for the three therapy types. Our primary competitor in the PDT space is Levulan® and the associated light, Blu-U®. Levulan® is approved for spot-therapy of mild to moderate AK on the face and scalp and AK on the upper extremities

Our goal is to continue expansion in the current PDT market share and focus on converting cryotherapy treatments of more than 14 lesions as a field therapy such as Ameluz® PDT could be more effective. Between the current PDT market and the >14 lesion cryotherapy market, our targeted market is about 11% or $500 million of the total AK market (consisting of the current PDT market at $100 million and the portion of the market attributed to cryotherapy treatments of more than 14 lesions at $500 million, assuming a tube price of $346).6

Our second prescription drug licensed product in our portfolio is Xepi® (ozenoxacin cream, 1%), a topical non-fluorinated quinolone that inhibits bacterial growth. Currently, no antibiotic resistance against Xepi® is known and it has been specifically approved by the FDA for the treatment of impetigo, a common skin infection, due to Staphylococcus aureus or streptococcusStreptococcus pyogenes. It is approved for use in the United States in adults and children 2 months and older. We are currently selling Xepi® for this indication in the U.S.United States under an exclusive license and supply agreement, or as amended (“Xepi LSA,LSA”), with Ferrer that was assumed by Biofrontera on March 25, 2019 through our acquisition of Cutanea Life Sciences, Inc. See “Business—Commercial PartnersCutanea. There has been limited revenue during the current reporting periods and Agreements—recent developments with the third-party manufacturer that was providing our supply of Xepi® have resulted in further delays of our commercialization of the product. However, Ferrer Internacional S.A. ”is qualifying a new contract manufacturer, Cambrex, which is expected to begin production early 2024.

Impetigo is a common and highly contagious bacterial skin infection caused by bacteria. The bacteria that can cause impetigo include Group A beta-hemolytic streptococcus and Staphylococcus aureus. It occurs most frequently in this prospectuschildren 2 to 5 years old, but people of any age can be affected and even more than once. Impetigo causes red sores that most often appear on the face, neck, arms, and legs. These sores can turn into blisters that open and form a yellowish crust. Transmission of the disease is by direct contact and poor hygiene can increase the spread. Although impetigo is a year-round disease, it occurs most often during the warm weather months.7 Although impetigo rarely leads to serious complications, effective treatment with drugs like Xepi® can shorten how long impetigo lasts.

We are a sales organization with focus on commercializing our portfolio of licensed products that are already FDA-approved. Predefined research and development efforts for more information. Acquisition detailslabel extensions in order to optimize the market positioning of the products are described in “Management’s Discussionthe responsibility of the respective licensor and Analysis of Financial Condition and Results of Operations—Key factors affecting our performance—Cutanea Life Sciences, Inc. Transactions” section within this prospectus.are governed by the respective LSAs.

As mentioned above, on March 25, 2019, we acquired Cutanea

3 For full prescribing information for Ameluz, please see https://bit.ly/AmeluzPI.

4 Reinhold et al. Br. J. Derm. 2016 Oct; 175(4): 696-705. DOI 10.1111/bjd. 14498.

5www.skincancer.org/skin-cancer-information/actinic-keratosis.

6 Market data accessible from Maruho Co., Ltd. In November 2018, Cutanea had just launched XepiCMS and IQVIA, 2020.

®7, a prescription cream for the treatment of impetigo. The acquisition of Cutanea Life Sciences, Inc. in March 2019 has enabled usHow to market an FDA-approved drug that has already been introduced in the U.S. market. We believe that Xepi® has the potential to be another innovative product with a large market potential in our portfolio.Treat Impetigo and Control This Common Skin Infection | FDA

As a licensee,Under the Ameluz LSA, we rely on our licensorshold the exclusive license to conduct clinical trials in order to pursue extensions to the current product indications approved by the FDA. Currently, Biofrontera AG (through its wholly owned subsidiary Biofrontera Bioscience GmbH) is conducting or preparing for the following development pipeline with respect to our flagship licensed productsell Ameluz® and the BF-RhodoLEDRhodoLED®lamp: lamp series comprising the RhodoLED® and the new, more advanced RhodoLED® XL (targeted launch in Q2 2024) in the United States for all indications currently approved by the FDA as well as all future FDA-approved indications identified under the Ameluz LSA.

A summary of our understanding of the Ameluz Licensor’s clinical trials is below:

| Indication / | Clinical Phase | Approval | |||||||||||||||

| Product | comments | Pre-clinical | I | II | III | process | Status | ||||||||||

| Ameluz® | Superficial basal cell carcinoma | ● | Clinical Study Report (“CSR”) expected Q3 2024 | ||||||||||||||

| Ameluz® | ● | Safety study | |||||||||||||||

| Ameluz® | ● | CSR expected mid 2025 | |||||||||||||||

| Ameluz® | |||||||||||||||||

| ● | Trunk & extremities with 1-3 tubes; First patient dosed January 2023; CSR expected mid 2025 | ||||||||||||||||

| Ameluz® | ● | Combination daylight and | |||||||||||||||

| Ameluz® | Squamous cell carcinoma in situ | ● | Plan to start enrollment in | ||||||||||||||

WeIn late October 2021, the new, larger RhodoLED® XL was approved by the FDA in combination with Ameluz® for the treatment of mild and moderate actinic keratoses on the face and scalp, which corresponds to the current approval of Ameluz®. The new PDT-lamp enables the illumination of larger areas, thus allowing the simultaneous treatment of several actinic keratoses distant from each other. The smaller BF-RhodoLED® model will continue to be offered in the U.S. market. Additionally, our licensor has been granted a patent for a pain-reduced PDT procedure that combines daylight and conventional PDT and, if the respective Phase III trial leads to inclusion of the procedure into the Ameluz® label, may provide further patent protection until 2039. Furthermore, the FDA recently approved a new formulation of Ameluz® that lacks propylene glycol and reduces the accumulation of certain contaminants over time. The new formulation will be implemented in all US productions of Ameluz® starting in 2024. A corresponding patent application has been filed which, if granted by the U.S. Patent and Trademark Office, will extend protection of Ameluz® to 2043.

Currently, there are no clinical trials being conducted for Xepi®, and we are unaware of any immediate or near-term plans of Ferrer for a US-marketU.S.-market focused development pipeline.

Our Strategy

Our principal objective is to increaseimprove patient outcomes by increasing the sales of our licensed products. The key elements of our strategy include the following:

| ● | ||

| ● | ||

| ● | opportunistically add complementary products or services to our portfolio by acquiring or licensing IP to further leverage our commercial infrastructure and customer relationships |

| 3 |

By executing these three strategic objectives, we will fuel company growth, deepen our trusted relationships in the dermatology community, and above all, help patients live healthier, more fulfilling lives.

Company History and Management Team

We were formed in March 2015 as Biofrontera Inc., a Delaware corporation, a wholly-owned subsidiary of Biofrontera AG. Our Chairman and Chief Executive Officer is Professor Hermann Lübbert Ph.D. Prof. Dr. Lübbert founded Biofrontera AG in 1997 and has been managing the Company ever since.

As depicted in the organizational chart below and described in “Business—Group structure”, prior to the consummation of this initial public offering, we are a member of the “Biofrontera Group” which consists of a parent company, Biofrontera AG, and five wholly owned subsidiaries, including us.

Biofrontera AG is a holding company that is responsible for the management, strategic planning, internal control and risk management of its subsidiaries and ensures the necessary financing needs are met. Biofrontera Bioscience GmbH carries out research and development tasks as well as all regulatory functions for the Biofrontera Group and holds the Ameluz® patents, the international approvals for Ameluz®, and the combination approval for Ameluz® and the BF-RhodoLED® lamp in the US. Pursuant to a license agreement with Biofrontera Bioscience GmbH, Biofrontera Pharma GmbH, which is also the holder of the patents and CE certificate of the BF-RhodoLED® lamp, bears the responsibility for the production, further licensing and marketing of Biofrontera Group’s approved products. Biofrontera Inc. is responsible for the marketing of all Biofrontera Group products in the United States, including the licensed drug Xepi®.

Upon consummation of the initial public offering, we will no longer be a wholly owned subsidiary of Biofrontera AG, a stock corporation organized under the laws of Germany. On November 2, 2021, we consummated our initial public offering and subsequently we ceased to be deemed a company controlled by Biofrontera AG. However,As of October 4, 2023, Biofrontera AG will continue to hold %holds approximately 29.2% of the outstanding shares of our common stock. In addition,With our national commercial team, we have entered intogenerate revenue by selling our licensed products directly to dermatology offices and groups.

Biofrontera Inc. includes its wholly owned subsidiary Bio-FRI GmbH, a Master Contract Services Agreement, or Services Agreement, which replaceslimited liability company organized under the laws of Germany. Our subsidiary, Bio-FRI was formed on February 9, 2022, as a German presence to facilitate our previous intercompany services agreement, enabling us to continue to userelationship with the Biofrontera Group’s IT resourcesAmeluz Licensor.

Our management team includes Prof. Dr. Hermann Luebbert as wellChairman and Chief Executive Officer and Fred Leffler as providing access to the Biofrontera Group’s resources with respect to quality management, regulatory affairs and medical affairs. Our quality assurance agreement with Biofrontera Pharma GmbH will also continue to be in effect following the consummation of the initial public offering.Chief Financial Officer.

Summary Risk Factors

Investing in our common stock involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading “Risk Factors” included elsewhere in this prospectus may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks include the following:

| ● | Currently, our sole source of revenue |

| ● | Certain important patents for our licensed product Ameluz® expired in 2019. Although the process of developing generic topical dermatological products for the first time presents specific challenges that may deter potential generic competitors, generic versions of Ameluz®may enter the market following the recent expiration of these patents. If this happens, we may need to reduce the price of Ameluz® significantly and may lose significant market share. | |

| ● | Our business depends substantially on the success of our principal licensed product Ameluz®. If the | |

| ● | The | |

| ● | If our Licensors or our Licensors’ manufacturing partners, as applicable, fail to manufacture Ameluz®, | |

| ● |

| 4 |

| ● | ||

| The COVID-19 global pandemic | ||

| ● | We are fully dependent on our collaboration with the | |

| ● | ||

| Insurance coverage and medical expense reimbursement may be limited or unavailable in certain market segments for our licensed products, which could make it difficult for us to sell our licensed products. | ||

| ● | Healthcare legislative changes may have a material adverse effect on our business and results of operations. | |

| ● | We face significant competition from other pharmaceutical and medical device companies and our operating results will suffer if we fail to compete effectively. We also must compete with existing treatments, such as simple curettage and cryotherapy, which do not involve the use of a drug but have gained significant market acceptance. |

| ● | ||

| We have a history of operating losses and anticipate that we will continue to incur operating losses in the future and may never sustain profitability. | ||

| ● | There is substantial doubt about our ability to continue as a “going concern.” | |

| ● | If we fail to obtain additional financing, we may be unable to support the levels of marketing we currently spend on Ameluz or complete the commercialization of Xepi® and other products we may license. | |

| ● | We | |

| ● | As of October 4, 2023, Biofrontera AG | |

| ● | Future sales and issuances of our common stock or rights to purchase our common stock, including pursuant to our equity incentive plans, could result in additional dilution of the percentage ownership of our stockholders and could cause the stock price of our common stock to decline. | |

| ● |

|

| ● | Our charter documents and Delaware law could prevent a takeover that stockholders consider favorable and could also reduce the market price of our stock. | |

| ● | Our amended and restated certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for substantially all disputes between us and our stockholders, which could limit our stockholders’ ability to obtain a | |

| ● | Many of the | |

| ● | The warrants are speculative in nature. |

Our Corporate Information

We were incorporated in March 2015 and commenced operations in May 2016. Our first commercial licensed product launch was in October 2016. Our corporate headquarters are located at 120 Presidential Way, Suite 330, Woburn, Massachusetts 01801. Our telephone number is 781-245-1325. Our principal website address is www.biofrontera-us.com. The information on or accessed through our website is not incorporated in this prospectus or the registration statement of which this prospectus forms a part.

Recent Developments

Preliminary Results for Three and Nine Months Period Ending September 30, 2023

We are in the process of finalizing our results for the quarter ended September 30, 2023. Set forth below are certain preliminary estimates of our results of operations for the quarter and nine months ended September 30, 2023 as compared to our historical results of operations for the corresponding periods ended September 30, 2022. These preliminary estimates of selected financial information set forth below are based only on currently available information and do not present all necessary information for an understanding of our financial condition as of September 30, 2023 or our results of operations for the quarter or nine months ended September 30, 2023. We have provided a range, rather than a specific amount, for the preliminary estimates for this unaudited financial data primarily because our financial closing procedures for the quarter ended September 30, 2023 are not yet complete and, as a result, our final results upon completion of our closing procedures may vary from the preliminary estimates.

All of the preliminary estimated selected results and information set forth below has been prepared by and is the responsibility of management. Marcum LLP has not audited, reviewed, or performed any procedures with respect to the preliminary estimated selected results set forth below. Accordingly, Marcum LLP does not express an opinion or any other form of assurance with respect thereto. We expect to complete our financial statements for the quarter ended September 30, 2023 subsequent to the completion of this offering. While we are currently unaware of any items that would require us to make adjustments to the selected financial information set forth below, it is possible that we or our independent registered public accounting firm may identify such items as we complete our financial statements and any resulting changes could be material. Accordingly, undue reliance should not be placed on these preliminary estimates. These preliminary estimates are not necessarily indicative of any future period and should be read together with “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and our financial statements and related notes included in this Registration Statement.

We estimate that for the quarter ended September 30, 2023:

| ● | our Total revenues, net will be between $8.7 million and $9.0 million, an increase of approximately 101% to 108% compared to $4.3 million for the quarter ended September 30, 2022; | |

| ● | our Total operating expenses will be between $13.4 million and $13.7 million, as compared to $8.0 million for the quarter ended September 30, 2022; and | |

| ● | our Net loss will be between $5.9 million and $6.2 million, as compared to $2.6 million for the quarter ended September 30, 2022. |

We estimate that for the nine months ended September 30, 2023:

| ● | our Total revenues, net will be between $23.3 million and $23.6 million, representing growth of approximately 25% to 27% as compared to $18.5 million for the nine months ended September 30, 2022; | |

| ● | our Total operating expenses will be between $42.2 million and $42.5 million, as compared to $31.5 million for the nine months ended September 30, 2022; and | |

| ● | our Net loss will be between $23.2 million and $23.5 million, as compared to $2.1 million for the nine months ended September 30, 2022. |

We have deployed 55 RhodoLED lamps in the second quarter of 2023, compared to 18 RhodoLED lamps in the second quarter of 2022. In the nine months period ended September 30, 2023, we deployed 101 lamps, compared to 36 RhodoLED lamps in the corresponding period in 2022, which is a 180% increase over the same period.

In the second quarter of 2023 we sold 18,100 tubes of Ameluz®, compared to 12,700 tubes in the second quarter of 2022. We sold approximately 29,000 tubes of Ameluz® in the third quarter of 2023, compared to approximately 13,000 tubes of Ameluz® in the second quarter of 2022.

We also onboarded 9 new additional territory managers early in the second quarter of 2023, as well as 3 medical science liaisons, and initiated a field reimbursement team.

Amendment to Settlement Agreement

On October 12, 2023, we entered into an amendment (the “Amendment”) to the settlement agreement dated as of April 11, 2023 (the “Settlement Agreement”) among us, Biofrontera AG, a significant stockholder of the Company and certain members of our board of directors.

Pursuant to the Amendment, the search for an additional independent director to be mutually selected by us and Biofrontera AG, which was to occur in 2023, will now take place at a mutually agreed time that is no earlier than January 1, 2024 and no later than September 1, 2024. The candidate will be selected by means of the search process set forth in the Amendment and will be nominated at our 2024 annual meeting to serve as a Class III Director.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting and other requirements that are otherwise generally applicable to public companies. As a result:

| ● | we are permitted to provide only two years of audited financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in any registration statement or report prior to the filing of our first annual report on Form 10-K; | |

| ● | we are not required to engage an auditor to report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; | |

| ● | we are not required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., critical audit matters); |

| ● | ||

| we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” and | ||

| ● | we are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement to disclose the correlation between executive compensation and performance and the requirement to present a comparison of our Chief Executive Officer’s compensation to our median employee compensation. |

We may take advantage of these reduced reporting and other requirements until the last day of our fiscal year following the fifth anniversary of the completion of thisour initial public offering, or such earlier time that we are no longer an emerging growth company. However, if certain events occur prior to the end of such five-year period, including if we have greater than or equal to $1.07$1.235 billion in annual gross revenue, have greater than or equal to $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to adopt the reduced requirements with respect to our financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in this prospectus. As a result, the information that we provide to stockholders may be different from the information you may receive from other public companies in which you hold equity.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to take advantage of the longer phase-in periods for the adoption of new or revised financial accounting standards under the JOBS Act until we are no longer an emerging growth company. Our election to use the phase-in periods permitted by this election may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the longer phase-in periods permitted under the JOBS Act and who will comply with new or revised financial accounting standards. If we were to subsequently elect instead to comply with public company effective dates, such election would be irrevocable pursuant to the JOBS Act.

We are also a “smaller reporting company” as defined in the rules promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as our voting and non-voting common stock held by non-affiliates on the last business day of our second fiscal quarter is less than $250.0 million, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and nonvoting common stock held by non-affiliates on the last business day of our second fiscal quarter in that fiscal year is less than $700.0 million.

| 6 |

The Offering

| Issuer | Biofrontera Inc. | |

| Securities offered by us | Up to 2,300,000 shares of Common Stock and up to 2,300,000 accompanying warrants to purchase up to 2,300,000 shares of Common Stock on a “reasonable best efforts” basis. The warrants offered hereby are exercisable immediately, have an exercise price equal to $ (between 100% and 120% of the combined public offering price per share and accompanying warrant), and expire five years after the date of issuance. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the warrants. For more information regarding the warrants, you should carefully read the section titled “Description of Securities and Certificate of Incorporation” in this prospectus. | |

| We are also offering to those purchasers, if any, whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Common Stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded units (each pre-funded unit consisting of one pre-funded warrant to purchase one share of Common Stock and one warrant to purchase one share of Common Stock), in lieu of units that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Common Stock. | ||

| Pre-funded warrants offered by us | The combined purchase price of each pre-funded warrant and accompanying warrant will be equal to the price per share and accompanying warrant being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants offered hereby will be immediately exercisable and may be exercised at any time, and from time to time, until all of the pre-funded warrants are exercised in full. For each pre-funded warrant and accompanying warrant we sell, the number of shares we are offering will be decreased on a one-for-one basis. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the pre-funded warrants. For more information regarding the pre-funded warrants, you should carefully read the section titled “Description of Securities to be Registered” in this prospectus. |

| Reasonable best efforts offering | We have agreed to issue and sell the securities offered hereby to the purchasers through the Placement Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but will use their reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” beginning on page 107 of this prospectus. | |

| Common stock | 1,367,628 shares. | |

| Common stock to be outstanding after this offering if the maximum number of shares are sold | ||

| Common stock to be outstanding after this offering if 10% of the maximum number of shares are sold | Up to 1,597,628 shares (assuming the sale of 10% of the maximum number of shares of common stock in this offering, at the assumed combined public offering price of $6.72, the closing sale price of our shares of common stock on Nasdaq on October 13, 2023, and no sale of any pre-funded warrants but excluding the number of shares of common stock issuable upon exercise of warrants sold in this offering) | |

| Common stock to be outstanding after this offering if 25% of the maximum number of shares are sold | Up to 1,942,628 shares (assuming the sale of 25% of the maximum number of shares of common stock in this offering, at the assumed combined public offering price of $6.72, the closing sale price of our shares of common stock on Nasdaq on October 13, 2023, and no sale of any pre-funded warrants but excluding the number of shares of common stock issuable upon exercise of warrants sold in this offering) | |

| Common stock to be outstanding after this offering if 50% of the maximum number of shares are sold | Up to 2,517,628 shares (assuming the sale of 50% of the maximum number of shares of common stock in this offering, at the assumed combined public offering price of $6.72, the closing sale price of our shares of common stock on Nasdaq on October 13, 2023, and no sale of any pre-funded warrants but excluding the number of shares of common stock issuable upon exercise of warrants sold in this offering) | |

| Common stock to be outstanding after this offering if 75% of the maximum number of shares are sold | Up to 3,092,628 Shares (assuming the sale of 75% of the maximum number of shares of common stock in this offering, at the assumed combined public offering price of $6.72, the closing sale price of our shares of common stock on Nasdaq on October 13, 2023, and no sale of any pre-funded warrants but excluding the number of shares of common stock issuable upon exercise of warrants sold in this offering) |

| 8 |

| Use of proceeds | We We currently intend to use the

| |

| ||

Lock-up agreements | We and our directors and executive officers have agreed, subject to certain exceptions, not to sell, transfer or dispose of any shares of our common stock, or securities convertible into, exchangeable or exercisable for any shares of our common stock for a period of | |

|

| |

| Risk factors | See “Risk Factors” beginning on page | |

| “BFRI” |

The number of shares of common stock to be outstanding after this offering is based on 8,000,0001,367,628 shares of our common stock outstanding as of June 30, 2021, andOctober 13, 2023. The number of shares of common stock to be outstanding after this offering excludes:

| ● | shares of our common stock issuable upon exercise of the warrants, including pre-funded warrants, if any, sold in this offering; | |

| ● | 20,182 shares of our common stock as of October 13, 2023, underlying the Unit Purchase Options issued in connection with our initial public offering and the November 2021 Private Placement; | |

| ● | 152,301 shares of our common stock available for future issuance under |

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus assumes or gives effect to:

| ||

| ● | ||

Summary Financial Data

The following tables present our summary financial data. We have derived the summary statements of operations data for the fiscal years ended December 31, 20192022 and 20202021 and the summary balance sheet data as of December 31, 20192022 and 20202021 from our audited financial statements included elsewhere in this prospectus. We have derived the summary statements of operations data for the threesix months ended March 31, 2020June 30, 2023 and 20212022 and the summary balance sheet data as of March 31, 2021June 30, 2023 from our unaudited financial statements included elsewhere in this prospectus. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” in this prospectus. Our historical results for any prior period are not necessarily indicative of our future results. The summary financial data in this section are not intended to replace our financial statements and related notes included elsewhere in this prospectus.

Statement of Operations Data:

| Statement of Operations Data: (U.S. dollars in thousands except share and | Year ended December 31, | Three months ended March 31, | ||||||||||||||

per share data) | 2019 | 2020 | 2020 | 2021 | ||||||||||||

| Product revenues, net | $ | 26,131 | $ | 18,787 | $ | 4,608 | $ | 4,731 | ||||||||

| Related party revenues | 50 | 62 | 15 | 13 | ||||||||||||

| Total revenues, net | 26,181 | 18,849 | 4,623 | 4,744 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Cost of revenues, related party | 11,330 | 8,313 | 2,268 | 2,408 | ||||||||||||

| Cost of revenues, other | 1,078 | 753 | 119 | 163 | ||||||||||||

| Selling, general and administrative | 28,041 | 17,706 | 5,884 | 4,758 | ||||||||||||

| Selling, general and administrative, related party | 654 | 411 | 99 | 164 | ||||||||||||

| Restructuring costs | 3,531 | 1,132 | 312 | 281 | ||||||||||||

| Change in fair value of contingent consideration | 962 | 140 | (262 | ) | 498 | |||||||||||

| Total operating expenses | 45,596 | 28,455 | 8,420 | 8,272 | ||||||||||||

| Loss from operations | (19,415 | ) | (9,606 | ) | (3,797 | (3,528 | ) | |||||||||

| Other income (expense) | ||||||||||||||||

| Interest expense, net | (2,134 | ) | (2,869 | ) | (660 | ) | (84 | ) | ||||||||

| Bargain purchase gain | 5,710 | - | - | - | ||||||||||||

| Other income, net | 4,890 | 1,552 | 354 | 79 | ||||||||||||

| Total other income (expense) | 8,466 | (1,317 | ) | (306 | ) | (5 | ) | |||||||||

| Loss before income taxes | (10,949 | ) | (10,923 | ) | (4,103 | ) | (3,533 | ) | ||||||||

| Income tax expenses | 33 | 64 | 1 | 1 | ||||||||||||

| Net loss | $ | (10,982 | ) | $ | (10,987 | ) | $ | (4,104 | ) | $ | (3,534 | ) | ||||

| Basic and diluted net loss per share | $ | (10,981.99 | ) | $ | (479.48 | ) | $ | (4,104.40 | ) | $ | (0.44 | ) | ||||

| (Shares used in computing basic and diluted loss per share) | 1,000 | 22,915 | 1,000 | 8,000,000 | ||||||||||||

(U.S. dollars in thousands except share | Year ended December 31, | Six months ended June 30, | ||||||||||||||

| and per share data) | 2022 | 2021 | 2023 | 2022 | ||||||||||||

| Product revenues, net | $ | 28,541 | $ | 24,043 | $ | 14,544 | $ | 14,177 | ||||||||

| Related party revenues | 133 | 57 | 36 | 31 | ||||||||||||

| Total revenues, net | 28,674 | 24,100 | 14,580 | 14,208 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Cost of revenues, related party | 14,618 | 12,222 | 7,319 | 7,377 | ||||||||||||

| Cost of revenues, other | 567 | 520 | 167 | 327 | ||||||||||||

| Selling, general and administrative | 35,137 | 36,512 | 21,254 | 17,285 | ||||||||||||

| Selling, general and administrative, related party | 733 | 697 | 119 | 441 | ||||||||||||

| Restructuring costs | — | 752 | — | — | ||||||||||||

| Research and development | — | — | 11 | — | ||||||||||||

| Change in fair value of contingent consideration | (3,800 | ) | (1,402 | ) | (100 | ) | (1,900 | ) | ||||||||

| Total operating expenses | 47,255 | 49,301 | 28,770 | 23,530 | ||||||||||||

| Loss from operations | (18,581 | ) | (25,201 | ) | (14,190 | ) | (9,322 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Change in fair value of warrant liabilities | 19,017 | (12,801 | ) | 1,403 | 14,082 | |||||||||||

| Warrant inducement expense | (2,629 | ) | — | — | — | |||||||||||

| Change in fair value of investment related party | 1,747 | — | (4,424 | ) | — | |||||||||||

| Interest expense, net | (195 | ) | (344 | ) | (114 | ) | (71 | ) | ||||||||

| Other income (expense), net | 33 | 689 | 30 | 52 | ||||||||||||

| Total other income (expense) | 17,973 | (12,456 | ) | (3,105 | ) | 14,063 | ||||||||||

| Income (loss) before income taxes | (608 | ) | (37,657 | ) | (17,295 | ) | 4,741 | |||||||||

| Income tax expenses | 32 | 56 | 20 | 30 | ||||||||||||

| Net income (loss) | $ | (640 | ) | $ | (37,713 | ) | $ | (17,315 | ) | $ | 4,711 | |||||

| Income (loss) per share | ||||||||||||||||

| Basic | $ | (0.61 | ) | $ | (85.63 | ) | $ | (12.73 | ) | $ | 5.24 | |||||

| Diluted | (0.61 | ) | $ | (85.63 | ) | $ | (12.73 | ) | $ | 5.22 | ||||||

| Weighted-average common shares outstanding: | ||||||||||||||||

| Basic | 1,056,988 | 440,412 | 1,359,894 | 898,444 | ||||||||||||

| Diluted | 1,056,988 | 440,412 | 1,359,894 | 902,209 | ||||||||||||

| Balance Sheet Data: | ||||||||

| As of June 30, 2023 | ||||||||

| (U.S. dollars in thousands except share and per share data) | Actual | As adjusted(1)(2) | ||||||

| Cash and cash equivalents(3) | $ | 4,453 | $ | |||||

| Investment, related party | 5,935 | |||||||

| Accounts receivable, net | 2,193 | |||||||

| Other receivables, related party | 4,001 | |||||||

| Inventories, net | 14,785 | |||||||

| Prepaid expenses and other current assets | 929 | |||||||

| Non-current assets | 4,609 | |||||||

| Total assets | $ | 36,905 | $ | |||||

| Accounts payable | 1,243 | |||||||

| Accounts payable, related parties | 4,657 | |||||||

| Acquisition contract liabilities, net | 7,121 | |||||||

| Operating lease liabilities | 489 | |||||||

| Accrued expenses and other current liabilities | 10,736 | |||||||

| Line of credit | 1,106 | |||||||

| Long-term liabilities | 4,380 | |||||||

| Total liabilities | $ | 29,732 | ||||||

| Total stockholders’ equity | $ | 7,173 | ||||||

| Balance Sheet Data: | As of March 31, 2021 | |||||||

| (U.S. dollars in thousands except share and per share data) | Actual | As adjusted | ||||||

| Cash and cash equivalents | $ | 4,637 | ||||||

| Accounts receivable, net | 1,742 | |||||||

| Accounts receivable, related party | 168 | |||||||

| Inventories | 8,425 | |||||||

| Prepaid expenses and other current assets | 1,130 | |||||||

| Non-current assets | 4,694 | |||||||

| Total assets | $ | 20,796 | ||||||

| Accounts payable | 483 | |||||||

| Accounts payable, related parties | 332 | |||||||

| Accrued expenses and other current liabilities | 3,235 | |||||||

| Long-term liabilities | 14,452 | |||||||

| Total liabilities | $ | 18,502 | ||||||

| Total stockholders’ equity | $ | 2,294 | ||||||

See Note 19, Net Loss per Share to our financial statements for a description of the method used to compute basic and diluted net loss per common share.

(1) The as adjusted data reflect (i) the sale of shares of common stock in this offering at an assumed initiala combined public offering price of $ per share and accompanying warrant, after deducting underwriting discounts and commissionsplacement agent fees and estimated offering expenses.

(2) A $1.00 increase (decrease) in the assumed initialcombined public offering price of $ per share and accompanying warrant, would increase (decrease) the net proceeds to us from this offeringcash and cash equivalents and total stockholders’ equity by approximately $ ,million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissionsplacement agent fees and estimated offering expenses payable by us.

| (3) | The Company considers all highly liquid investments purchased with an original maturity of three or less months at the time of purchase to be cash equivalents. |

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP, we believe the non-GAAP measures of Adjusted Operating Expenses and Adjusted General & Administrative (“G&A”) are useful in evaluating our operating performance. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non-GAAP information to supplement their GAAP results. The non-GAAP financial information is presented for supplemental informational purposes only, and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly-titled non-GAAP measures used by other companies. A reconciliation is provided below for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Adjusted Operating Expenses is a supplemental measure of operating expenses that is not prepared in accordance with GAAP and that does not represent, and should not be considered as, an alternative to operating expenses, as determined in accordance with GAAP. We define Adjusted Operating Expenses as total operating expenses adjusted for cost of goods sold, non-recurring expenses (legal expenses and restructuring costs) and non-cash expenses.

Adjusted G&A is a supplemental measure of selling, general and administrative expenses that is not prepared in accordance with GAAP and that does not represent, and should not be considered as, an alternative to selling, general and administrative expenses, as determined in accordance with GAAP. We define Adjusted G&A as selling, general and administrative expenses adjusted for sales and marketing expenses, non-recurring expense (legal expenses and restructuring costs) and non-cash expenses.

We use Adjusted Operating Expenses and Adjusted G&A to understand and evaluate our core operating performance and trends and to prepare and approve our annual budget. We believe Adjusted Operating Expenses and Adjusted G&A are useful measures to us and to our investors to assist in evaluating our core operating performance because it provides consistency and direct comparability with our past financial performance and between fiscal periods, as the metric eliminates the effects of variability of inventory, sales and marketing expenses. legal expenses and restructuring costs, which may fluctuate for reasons unrelated to overall operating performance.

Adjusted Operating Expenses and Adjusted G&A have limitations as analytical tools, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Because of these imitations, Adjusting Operating Expenses and Adjusted G&A should not be considered as replacements for total operating expenses and selling, general and administrative expense, each as determined by GAAP, or as a measure of our profitability. We compensate for these limitations by relying primarily on our GAAP results and using non-GAAP measures only for supplemental purposes.

Non-GAAP Reconciliation: Adjusted Operating Expenses and Adjusted SG&A

Year Ended December 31, | Six Months Ended June 30, | |||||||||||

| 2021 | 2022 | 2023 | ||||||||||

| Total operating expenses | 49.3 | 47.3 | 28.8 | |||||||||

| Less: COGS | (12.7 | ) | (15.2 | ) | (7.5 | ) | ||||||

| Less: Legal Expenses | (11.3 | ) | (1.2 | ) | (2.2 | ) | ||||||

| Less: Restructuring | (0.8 | ) | - | (0.5 | ) | |||||||

| Less: Non-cash | 0.8 | 1.4 | (1.0 | ) | ||||||||

| Adjusted Operating Expenses | 25.3 | 32.3 | 17.6 | |||||||||

| Selling, General & Administrative expenses | 36.6 | 32.1 | 21.3 | |||||||||

| Less: Sales & Marketing | (16.7 | ) | (17.0 | ) | (11.3 | ) | ||||||

| Less: Legal Expenses | (11.3 | ) | (1.2 | ) | (2.2 | ) | ||||||

| Less: Restructuring | (0.8 | ) | - | (0.5 | ) | |||||||

| Less: Non-cash | 0.8 | 1.4 | (1.0 | ) | ||||||||

| Adjusted G&A | 8.7 | 15.3 | 6.2 | |||||||||

| 12 |

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes and the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our common stock.Common Stock. The occurrence of any of the events or developments described below could materially and adversely affect our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

Our business, isresults of operations and financial condition and the industry in which we operate are subject to a numbervarious risks. We have listed below (in order of risks and uncertainties. The following is a summaryimportance or probability of occurrence) the most significant risk factors applicable to us, but they do not constitute all of the principalrisks that may be applicable to us. New risks may emerge from time to time, and it is not possible for us to predict all potential risks or to assess the likely impact of all risks. You should read this summary together with the more detailed description of each risk factors described in this sectionfactor contained below. Some of these material risks include::

Risks Related to the License and Supply Agreements and our Licensed Products

| ● | Currently, our sole source of revenue | |

| ● | Certain important patents for our licensed product Ameluz® expired in 2019. Although the process of developing generic topical dermatological products for the first time presents specific challenges that may deter potential generic competitors, generic versions of Ameluz®may enter the market following the recent expiration of these patents. If this happens, we may need to reduce the price of Ameluz® significantly and may lose significant market share. | |

| ● | Our business depends substantially on the success of our principal licensed product Ameluz®. If | |

| ● | The | |

| ● | If our Licensors or our Licensors’ manufacturing partners, as applicable, fail to manufacture Ameluz®, | |

| ● |

| 13 |

Risks Related to Our Business and Strategy

| ● | The COVID-19 global pandemic | |

| ● | ||

| Insurance coverage and medical expense reimbursement may be limited or unavailable in certain market segments for our licensed products, which could make it difficult for us to sell our licensed products. | ||

| ● | We are fully dependent on our collaboration with the | |

| ● | Healthcare legislative changes may have a material adverse effect on our business and results of operations. | |

| ● | We face significant competition from other pharmaceutical and medical device companies and our operating results will suffer if we fail to compete effectively. We also must compete with existing treatments, such as simple curettage and cryotherapy, which do not involve the use of a drug but have gained significant market acceptance. |

| ● | The U.S. market size for Ameluz® for the treatment of actinic keratosis may be smaller than we have estimated. | |

| ● | If our Licensors face allegations of noncompliance with the law and encounter sanctions, their reputation, revenues and liquidity may suffer, and our licensed products could be subject to restrictions or withdrawal from the market. | |

| ● | Even if our Licensors obtain regulatory approvals for our licensed products and product candidates, or approvals extending their indications, they may not gain market acceptance among hospitals, physicians, health care payors, patients and others in the medical community. | |

| ● | A recall of our licensed drug or medical device products, or the discovery of serious safety issues with our licensed drug or medical device products, could have a significant negative impact on us. | |

| ● | Our licensed medical device product, the | |

| ● | We are highly dependent on our key personnel, and if we are not successful in attracting and retaining highly qualified personnel, we may be unable to successfully implement our business strategy. | |

| ● | Our business and operations would suffer in the event of system failures, cyber-attacks or a deficiency in our cyber-security. | |

| ● | The results of our research and development efforts are uncertain and there can be no assurance they will enhance the commercial success of our products. |

Risks Related to Our Financial Position and Capital Requirements

| ● | There is substantial doubt about our ability to continue as a “going concern.” | |

| ● | We have a history of operating losses and anticipate that we will continue to incur operating losses in the future and may never sustain profitability. | |

| ● | If we fail to obtain additional financing, we may be unable to | |

| ● | Our existing and any future indebtedness could adversely affect our ability to operate our business. | |

| ● | The valuation of our equity investments is subject to volatility. |

| 14 |

Risks Related to Corporate Governance, Including Being a Public Company

| ● | We | |

| ● | We have incurred, and will continue to incur, increased costs as a result of operating as a public company, and our management | |

| ● | As a result of becoming a public company, we | |

| ● | We are an emerging growth company and smaller reporting company we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies or smaller reporting companies will make our common stock less attractive to investors. |

Risks Related to Thisthe Offering and the Ownership of Our Common Stock

| ● | As of October 4, 2023, Biofrontera AG | |

| ● |

| |

| Future sales and issuances of our common stock or rights to purchase our common stock, including pursuant to our equity incentive plans, could result in additional dilution of the percentage ownership of our stockholders and could cause the stock price of our common stock to decline. | ||

| ● | Our stockholder rights plan, or “poison pill,” includes terms and conditions which could discourage a takeover or other transaction that stockholders may consider favorable. | |

| ● | Our charter documents and Delaware law could prevent a takeover that stockholders consider favorable and could also reduce the market price of our stock. | |

| ● | Our amended and restated certificate of incorporation |

Risks Related to the License and Supply Agreements and Our Licensed Products

Currently, our sole source of revenue areis from sales of products we license from other companies. If we fail to comply with our obligations in the agreements under which we license rights from such third parties, or if the license agreements are terminated for other reasons, we could lose license rights that are important to our business.

We are a party to license agreements with Biofrontera Pharma and Biofrontera Bioscience (for Ameluz®)and the RhodoLED® lamp series) and with Ferrer (for Xepi®) and expect to enter into additional licenses in the future. Our existing license agreements impose, and we expect that future license agreements will impose, on us various development, regulatory diligence obligations, payment of milestones or royalties and other obligations. If we fail to comply with our obligations under our license agreements, or we are subject to a bankruptcy or insolvency, the licensor may have the right to terminate the license. In the event that any of our existing or future important licenses were to be terminated by the licensor, we would likely need to cease further commercialization of the related licensed product or be required to spend significant time and resources to modify the licensed product to not use the rights under the terminated license. In the case of marketed products that depend upon a license agreement, we could be required to cease our commercialization activities, including sale of the affected product. For a summary of the terms of the license agreements, see “Business-Commercial Partners and Agreements”.

| 15 |

Disputes may arise between us and any of our Licensors regarding intellectual property subject to such agreements, including:

| ● | the scope of rights granted under the agreement and other interpretation-related issues; | |

| ● | whether and the extent to which our technology and processes infringe on intellectual property of the licensor that is not subject to the agreement; | |

| ● | our right to sublicense patent and other rights to third parties; | |

| ● | our diligence obligations with respect to the use of the licensed intellectual property, and what activities satisfy those diligence obligations; | |

| ● | the ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our Licensors and us, should any such joint creation occur; | |

| ● | our right to transfer or assign the license; and | |

| ● | the effects of termination. |

These, or other disputes over intellectual property that we have licensed may prevent or impair our ability to maintain our current arrangements on acceptable terms or may impair the value of the arrangement to us. Any such dispute, or termination of a necessary license, could have a material adverse effect on our business, financial condition and results of operationsoperations.

Certain important patents for our licensed product Ameluz® expired in 2019. Although the process of developing generic topical dermatological products for the first time presents specific challenges that may deter potential generic competitors, generic versions of Ameluz® may enter the market following the recent expiration of these patents. If this happens, we may need to reduce the price of Ameluz® significantly and may lose significant market share.