Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre- Effective Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

BUNKER HILL MINING CORP.

(Exact name of registrant as specified in its charter)

nevada

(JurisdictionState or other jurisdiction of incorporation or organization)

| 1041 | 32-0196442 | |

(Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

82 Richmond Street East,

Toronto, Ontario, Canada M5C 1P1

Tel: (416)477-7771

(Address, including zip code, and telephone number, including area code, of registrant’s principal businessexecutive offices)

416-477-7771

(Registrant’s telephone number, including area code)

J.P. Galda

c/o J.P. Galda & Co.,

40 E. Lancaster Avenue LTW 22

Ardmore, PA19003

Tel: (215) 815-1534

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of Communications to:

J.P. Galda & Co. Attn: J.P. Galda, Esq.

40 East Montgomery Avenue LTW 220

J.P. Galda & Co. Attn: J.P. Galda, Esq. 40 East Montgomery Avenue LTW 220 Ardmore, PA 19003 Tel: (215) 815-1534 Email: jpjalda@jpgaldaco.com | Brian Boonstra, Esq. Edward Shaoul, Esq. Davis Graham & Stubbs LLP 1550 Seventeenth Street, Suite 500 Denver, CO 80202 Tel: (303) 892-9400 Email: brian.boonstra@dgslaw.com edward.shaoul@dgslaw.com |

Ardmore, PA 19003

Tel: (215) 815-1534

Email: jpjalda@jpgaldaco.com

Approximate date of commencement of proposed sale of the securities to the public: From time to time commencing as soon as possible after the registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

CALCULATION OF REGISTRATION FEEIndicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Title of each class of securities to be registered | Amount to be registered | Proposed price per share(2) | Proposed maximum aggregate offering price(2) | Amount of registration fee(2) | ||||||||||||

| Common stock, without par value | 40,690,160 | (1) | $ | .1962 | $ | 7,983,409 | $ | 740.02 | (3) | |||||||

| Large accelerated filer ☐ | Accelerated filer ☐ | |||

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |||

| Emerging growth company ☐ |

(1) Represents additional shares that may be resoldIf an emerging growth company, indicate by check mark if the selling shareholders named herein under “Selling Securityholders” which were issued in private placements subsequentregistrant has elected not to December 2020 (the “Newly Registered Securities”). Inuse the event of stock splits, stock dividendsextended transition period for complying with any new or similar transactions involving the Common Shares, the number of Common Shares registered shall, unless otherwise expresslyrevised financial accounting standards provided automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended, on the basisSection 13(a) of the average of the high and low price reported on November 19, 2021 on the OTC QB for the common stock, par value $0.0001 per share, of the Registrant.

(3) Previously paid.

Pursuant to Rule 429(a) of the Securities Act, the prospectus included in this registration statement is a combined prospectus relating to the Newly Registered Securities and common shares that were issued in private placements prior to December 28, 2020 (the “Previously Registered Shares”). Pursuant to Rule 429(b), this registration statement, upon effectiveness, also constitutes a post-effective amendment to the registrant’s Registration Statement on Form S-1, File No. 333-249682, initially filed on October 27, 2020 and declared effective on December 28, 2020 (the “Prior Registration Statement”), which post-effective amendment shall hereafter become effective concurrently with the effectiveness of this registration statement and in accordance with Section 8(c) of the SecuritiesExchange Act. As of the date of this Registration Statement, 107,550,103 of the Previously Registered Shares (including 93,643,588 of the Common Shares issuable upon exercise of warrants) remain unsold.☐

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectusProspectus is not complete and may be changed. The selling shareholders named herein may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectusProspectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated February 4, 2022June 12, 2023

PRELIMINARY PROSPECTUS

PROSPECTUS

BUNKER HILL MINING CORP.

33,900,595 Common Shares

113,637,668112,082,390 Shares of Common Share Issuable Pursuant to Common Share Purchase WarrantsStock

92,172,716 Shares of Common Stock Issuable upon Exercise of Warrants

This prospectusProspectus (this “Prospectus”“Prospectus”) relates to the resale of shares of common shares in the capitalstock (“Common Shares”) of Bunker Hill Mining Corp. (“we”we”, “our”“our” or the “Company”) (“Common Shares”“Company”) and Common Shares issuable upon exercise of Common Sharecommon stock purchase warrants (the “Warrants”“Warrants”) held by selling shareholders which were issued by the Company in previous private placement transactions by the selling security holders named herein under “Selling Shareholders and Certain Beneficial Owners” (the “Selling Shareholders”“Selling Shareholders”)., including Common Shares issuable upon exercise of special warrants of the Company (the “Special Warrants”) issued on March 27, 2023 that will be automatically exercised (without payment of any further consideration and subject to customary anti-dilution adjustments) into one unit of the Company (a “Unit”) comprised of one Common Share (each, a “Unit Share”) and one common stock purchase warrant of the Company (each, a “Warrant”) on the date (the “Automatic Exercise Date”) that is the earlier of: (i) the date that is three business days following the date on which we have obtained notification that the registration statement of which this Prospectus is a part has been declared effective by the SEC (as hereinafter defined); and (ii) September 27, 2023. Each whole Warrant entitles the holder thereof to acquire one Common Share (a “Warrant Share”, and together with the Unit Shares, the “Underlying Shares”) at an exercise price of C$0.15 per Warrant Share until March 27, 2026, subject to adjustment in certain events. In addition, in the event that effectiveness of the registration statement of which this Prospectus is a part is not obtained on or before 5:00 p.m. (EST) on July 27, 2023, each unexercised Special Warrant will be deemed exercised on the Automatic Exercise Date into 1.2 Units. We will not receive any proceeds from the resale of thesethe Common Shares, although we may receive proceeds from the exercise of the warrants.

The selling shareholders may offer all or part of the Common Shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. The Company is paying for all registration, listing and qualification fees, printing fees and legal fees.

Our Common Shares are quoted on the OTC QBOTCQB under the ticker symbol “BHLL.” On February 3, 2022,June 9, 2023, the closing price of our Common Shares was U.S. $0.25US$0.185 per Common Share.

We are a “smaller reporting company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements. The purchase of the securities offered through this Prospectus involves a high degree of risk. See section entitled “Risk Factors” starting on page 11.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Dated: Dated , 2023February 4, 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectusProspectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”“SEC”) pursuant to which the selling shareholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus.Prospectus. You should not assume that the information contained in this prospectusProspectus is accurate on any date subsequent to the date set forth on the front cover of this prospectusProspectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectusProspectus is delivered or common shares are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectusProspectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where You Can Find Additional Information.”

We have not authorized anyone to give any information or to make any representation to you other than those contained in this prospectus.Prospectus. You must not rely upon any information or representation not contained in this prospectus.Prospectus. This prospectusProspectus does not constitute an offer to sell or the solicitation of an offer to buy any of our common shares other than the shares of our common stock covered hereby, nor does this prospectusProspectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectusProspectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectusProspectus applicable to those jurisdictions.

PROSPECTUS SUMMARY

This summary description about us and our business highlights selected information contained elsewhere in this prospectusProspectus To understand this offering fully, you should read carefully the entire prospectus,Prospectus, including “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” Unless the context indicates or suggests otherwise, references to “we,” “our,” “us,” the “Company,” or the “Registrant” refer to Bunker Hill Mining Corp., a Nevada corporation, and its subsidiaries. References to “$” refer to monetary amounts expressed in U.S. dollars. All references to “C$” refer to monetary amounts expressed in Canadian dollars.

Note Regarding Financial Statements

On February 12, 2021, the Company’s Board of Directors (the “Board”) approved a change in our fiscal year end from the last day of June to a calendar fiscal year ending on the last day of December of each year, effective January 1, 2021. In this report, references to “fiscal year” refer to years ending June 30. References in this report to the “transition period” refer to the six-month period ended December 31, 2020.Our Business

Our Business

The Company was incorporated for the purpose of engaging in mineral exploration and development activities. The Company’s sole focus is the development and restart of its 100% owned flagship asset, the Bunker Hill mine (the “Mine”“Mine”), as described below.

On August 28, 2017, the Company announced that it signed a definitive agreement with Placer Mining Corporation (“Placer Mining”), the current owner of the Mine, for the lease and option to purchase the Mine in Idaho, (the “Lease and Option Agreement”).USA. The Mine remains the largest single producing mine by tonnage in the Coeur d’Alene lead, zincSilver Valley region of northwest Idaho, producing over 165 million ounces of silver and silver mining district in Northern Idaho. Historically5 million tons of base metals between 1885 and according1981. The Bunker Hill Mine is located within Operable Unit 2 of the Bunker Hill Superfund site (EPA National Priorities Listing IDD048340921), where cleanup activities have been completed.

In early 2020, a new management team comprised of former executives from Barrick Gold Corp. assumed leadership of the Company. Since that time, the Company conducted multiple exploration campaigns, published multiple economic studies and Mineral Resource Estimates, and advanced the rehabilitation and development of the Mine. In December 2021, it announced a project finance package with Sprott Private Resource Streaming & Royalty Corp. (“Sprott”), an amended Settlement Agreement with the U.S. Environmental Protection Agency (“the EPA”), and the purchase of the Bunker Hill Mine, setting the stage for a rapid restart of the Mine.

In January 2022, with the closing of the purchase of the Bunker Hill Mine, the funding of the $8,000,000 Royalty Convertible Debenture and $6,000,000 Series Convertible Debenture, and the announcement of a Memorandum (“MOU”) for the purchase of the Pend Oreille process plant from a subsidiary of Teck Resources Limited, the Company embarked on a program of activities with the goal of achieving a restart of the Mine. Key milestones and achievements from January 2022 onwards have included the closing of the purchase of the Pend Oreille process plant, the demobilization of the process plant to the Bunker Hill Mines Annual Report 1980,site, the completion of demolition activities at the Pend Oreille site, a Prefeasibility Study envisaging the restart of the Mine, produced over 35,000,000 tonnesand the completion of ore grading on average 8.76% lead, 3.67% zinc,the primary portion of the ramp decline connecting the 5 and 155 g/t silver. The Mine is6 Levels of the Company’s only focus, with a view to raising capital to rehabilitate the mine and put it back into production.Bunker Hill Mine.

On November 1, 2019,The Company was incorporated for the initial purpose of engaging in mineral exploration activities at the Mine. The Company has moved into the development stage concurrent with (i) purchasing the Mine and a process plant, (ii) completing successive technical and economic studies, including a Prefeasibility Study, (iii) delineating mineral reserves, and (iv) conducting the program of activities outlined above.

Lease and Option Agreement was amended (the “Amended Agreement”). Under the termsPurchase of the Amended Agreement,Bunker Hill Mine

The Company purchased the Bunker Hill Mine in January 2022, as described below.

Prior to purchasing the Mine, the Company has anhad entered into a series of agreements with Placer Mining Corporation (“Placer Mining”), the prior owner, for the lease and option to purchase the marketable assetsMine. The first of the Mine for a purchase price of $11,000,000 at any time prior to the expiration of the Amended Agreement, payable $6,200,000 in cash,these agreements was announced on August 28, 2017, with subsequent amendments and/or extensions announced on November 1, 2019, July 7, 2020, and $4,800,000 in unregistered Common Shares of the Company (calculated using the market price at the time of exercise of the purchase option). Upon signing the Amended Agreement, the Company paid a one-time, non-refundable cash payment of $300,000 to Placer Mining. This payment will be applied to the cash portion of the purchase price upon execution of the purchase option. In the event the Company elects not to exercise the purchase option, the payment shall be treated as an additional care and maintenance payment. An additional term of the Amended Agreement provides for the elimination of all royalty payments that were to be paid to Placer Mining.November 20, 2020.

Under the terms of the Amended Agreement, during the term of the lease, the Company must make care and maintenance payments in the amount of $60,000 monthly plus other expenses, i.e. taxes, utilities and mine rescue payments.

On July 27, 2020, the Company announced that it secured, for a $150,000 cash payment, a further extension to the Lease and Option, Amended and Extension Agreements to purchase the Mine from Placer Mining (the “Second Extension”). The Second Extension is for a further 18 months and is in addition to the 6-month extension. This Second Extension expires on August 1, 2022. This Second Extension provides the Company with more time to invest the proceeds of the ongoing financing in ways that compile and digitize fully over 95 years of historical and geological data, verify the historical reserves, and explore the high-grade silver targets within the Mine complex.

On November 20, 2020 the Company successfully renegotiated the amended agreement (the “Amended Agreement. Under the new terms, theAgreement”), a purchase price has been decreased from $11,000,000 toof $7,700,000 was agreed, with $5,700,000 payable in cash (with an aggregate of $300,000 to be credited toward the purchase price of the Mine as having been previously paid by the Company and an aggregate of $5,400,000 payable in cash outstanding)Company) and $2,000,000 in Common Sharesshares of common stock of the Company. The reference price for the payment in Company (“Common Shares will be based on the share price of the last equity raise before the option is exercised.”). The Company will continue to make a monthly care and maintenance payment of $60,000 to the Lessor in return for on-going technical support to the Company. Under this amendment to the Amended Agreement, the Company’s contingent obligation to settle $1,787,300 of accrued payments due to the Lessor has been waived. Further, under the amendment to the Amended Agreement, the Company isagreed to make an advance payment of $2,000,000, to Placer Mining, which shall be credited toward the purchase price of the Mine, when the Company elects to exercise its purchase right. In the event that the Company irrevocably elects not to exercise its purchase right, the advance payment of $2,000,000 will be repaid to the Company within twelve months from the date of such election. The Company made this advance payment, which had the effect of decreasing the remaining amount payable to purchase the Mine to an aggregate of $3,400,000 payable in cash and $2,000,000 in Common Shares of the Company.

As a part of the purchase price, theThe Amended Agreement also requiresrequired payments pursuant to an agreement with the U.S. Environmental Protection Agency (“EPA”)EPA whereby for so long as the Company leases, owns and/or occupies the Mine, the Company willwould make payments to the EPA on behalf of Placer Mining in satisfaction of the EPA’s claim for cost recovery. These payments, if all are made, will total $20,000,000. The agreement calls for payments starting with $1,000,000 30 days after a fully ratified agreement was signed (which payment was made) followed by $2,000,000 on November 1, 2018 and $3,000,000 on each of the next 5 anniversaries with a final $2,000,000 payment on November 1, 2024. In addition to these payments, the Company is to make semi-annual payments of $480,000 on June 1 and December 1 of each year, to cover the EPA’s estimated costs of maintaining and treating water at thehistorical water treatment facilitycost recovery in accordance with a true-up to be paid by the Company once the actual costs are determined. The November 1, 2018, December 1, 2018, June 1, 2019, November 1, 2019, November 1, 2020, and November 1, 2021 payments were not made, and the Company engaged in discussionsSettlement Agreement reached with the EPA in an effort2018. Immediately prior to reschedule these payments in ways that enable the sustainable operationpurchase of the Mine, the Company’s liability to EPA in this regard totaled $11,000,000.

| 2 |

The Company completed the purchase of the Bunker Hill Mine on January 7, 2022. The terms of the purchase price were modified to $5,400,000 in cash, from $3,400,000 of cash and $2,000,000 of Common Shares. Concurrent with the purchase of the Mine, the Company assumed incremental liabilities of $8,000,000 to the EPA, consistent with the terms of the amended Settlement Agreement with the EPA that was executed in December 2021 (see “EPA 2018 Settlement Agreement & 2021 Amended Settlement Agreement” section below).

EPA 2018 Settlement Agreement & 2021 Amended Settlement Agreement

Bunker Hill entered into a Settlement Agreement and Order on Consent with the EPA on May 15, 2018. This agreement limits the Company’s exposure to the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) liability for past environmental damage to the mine site and surrounding area to obligations that include:

| ● | Payment of $20,000,000 for historical water treatment cost recovery for amounts paid by the EPA from 1995 to 2017 | |

| ● | Payment for water treatment services provided by the EPA at the Central Treatment Plant (“CTP”) in Kellogg, Idaho until such time that Bunker Hill either purchases or leases the CTP or builds a separate EPA-approved water treatment facility | |

| ● | Conducting a work program as described in the Ongoing Environmental Activities section of this study |

In December 2021, in conjunction with its intention to purchase the mine complex, the Company entered into an amended Settlement Agreement (the “Amendment”) between the Company, Idaho Department of Environmental Quality, US Department of Justice and the EPA modifying the payment schedule and payment terms for recovery of historical environmental response costs at Bunker Hill Mine incurred by the EPA. With the purchase of the mine in early 2022, the remaining payments of the EPA cost recovery liability were assumed by the Company, resulting in a total of $19,000,000 liability to the Company, an increase of $8,000,000. The new payment schedule included a $2,000,000 payment to the EPA within 30 days of execution of this amendment, which was made.

The remaining $17,000,000 will be paid on the following dates:

| Date | Amount | |||

| November 1, 2024 | $ | 3,000,000 | ||

| November 1, 2025 | $ | 3,000,000 | ||

| November 1, 2026 | $ | 3,000,000 | ||

| November 1, 2027 | $ | 3,000,000 | ||

| November 1, 2028 | $ | 3,000,000 | ||

| November 1, 2029 | $ | 2,000,000 plus accrued interest | ||

The resumption of payments in 2024 was agreed in order to allow the Company to generate sufficient revenue from mining activities at the Bunker Hill Mine to address remaining payment obligations from free cash flow.

The changes in payment terms and schedule were contingent upon the Company securing financial assurance in the form of performance bonds or letters of credit deemed acceptable to the EPA totaling $17,000,000, corresponding to the Company’s cost recovery obligations to be paid in 2024 through 2029 as outlined above. Should the Company fail to make its scheduled payment, the EPA can draw against this financial assurance. The amount of the bonds or letters of credit will decrease over time as individual payments are made. If the Company failed to post the final financial assurance within 180 days of the execution of the Amendment, the terms of the original agreement would be reinstated.

In June 2022, the Company was successful in obtaining financial assurance. Specifically, a $9,999,000 payment bond and a $7,001,000 letter of credit were secured and provided to the EPA. This milestone provides for the Company to recognize the effects of the change in terms of the EPA liability as outlined in the December 20, 2021, agreement. Once the financial assurance was put into place, the restructuring of the payment stream under the Amendment occurred with the entire $17,000,000 liability being recognized as long-term in nature. The aforementioned payment bond and letter of credit were secured by $2,475,000 and $7,001,000 of cash deposits, respectively as of September 30, 2022.

| 3 |

In October 2022, the Company reported that it had been successful in securing a new payment bond to replace the aforementioned $7,001,000 letter of credit, in two stages. Initially, the letter of credit was reduced to $2,000,001 as a viable long-term business.result of a new $5,000,000 payment bond obtained through an insurance company. The collateral for the new payment bond is comprised of a $2,000,000 letter of credit and land pledged by third parties, with whom the Company has entered into a financing cooperation agreement that contemplates a monthly fee of $20,000 (payable in cash or common shares of the Company, at the Company’s election). The new payment bond is scheduled to increase to $7,001,000 (from $5,000,000) upon the advance of the multi-metals stream from Sprott Private Resource Streaming & Royalty Corp.

Project Finance Package with Sprott Private Resource Streaming & Royalty Corp.

On December 20, 2021, the Company announced the execution ofexecuted a non-binding term sheet outlining a $50 million non-dilutive$50,000,000 project finance package the execution of a settlement agreement amendment with the EPA, and the execution of an agreement to purchase of the Bunker Hill Mine.

The non-binding term sheet with Sprott Private Resource Streaming and Royalty Corp. (“Sprott Streaming” or “SRSR”). The non-binding term sheet with SRSR”) outlined a $50,000,000 project financing package that the Company expects to fulfill the majority of its funding requirements to restart the Bunker Hill Mine. The financing packageterm sheet consisted of aan $8,000,000 royalty convertible debenture (the “Royalty Convertible DebentureRCD”), a $5,000,000 convertible debenture (the “Convertible DebentureCD1”), and a multi-metals stream of up to $37,000,000 (the “Stream”, together with). The CD1 was subsequently increased to $6,000,000, increasing the Royalty Convertible Debentureproject financing package to $51,000,000.

On June 17, 2022, the Company consummated a new $15,000,000 convertible debenture (the “CD2”). As a result, total potential funding from SRSR was further increased to $66,000,000 including the RCD, CD1, CD2 and the Convertible Debenture,Stream (together, the “Project Financing Package”). The closing for Royalty Convertible Debenture, the Convertible Debenture and the Stream are conditional on a number of matters, including the finalization of definitive documentation, regulatory and stock exchange approvals, and closing of the purchase of Bunker Hill Mine.

Subject toThe Company closed the settlement of definitive documentation with SRSR, the Company expects that $8,000,000 will be advanced under the Royalty Convertible Debenture inRCD on January 7, 2022. The Royalty Convertible Debenture will initially bearRCD bears interest at an annual rate of 9.0%, payable in cash or Common Shares at the Company’s option, until such time that SRSR elects to convert a royalty, with such conversion option expiring at the earlier of advancement of the Stream or 18 months.July 7, 2023 (subsequently amended as described below). In the event of conversion, the Royalty Convertible DebentureRCD will cease to exist and the Company will grant a royalty for 1.85% of life-of-mine gross revenue from mining claims considered to be historically worked, contiguous to current accessible underground development, and covered by the Company’s 2021 ground geophysical survey (the “SRSR Royalty”). A 1.35% rate will apply to claims outside of these areas. The Royalty Convertible Debenture willRCD was initially be secured by a share pledge of the Company’s operating subsidiary, Silver Valley, until such time that a full security package iswas put in place.place concurrent with the consummation of the CD1. In the event of non-conversion, the principal of the Royalty Convertible DebentureRCD will be repayable in cash.

SubjectConcurrent with the funding of the CD2 in June 2022, the Company and SRSR agreed to a number of amendments to the settlementterms of the definitive documentation with SRSR,RCD, including an amendment of the maturity date from July 7, 2023, to March 31, 2025. The parties also agreed to a Royalty Put Option such that in the event the RCD is converted into a royalty as described above, the holder of the royalty will be entitled to resell the royalty to the Company expects that an aggregate amount of $5,000,000 will be advancedfor $8,000,000 upon default under the Convertible DebentureCD1 or CD2 until such time that the CD1 and CD2 are paid in full.

The Company closed the $6,000,000 CD1 on January 2022.28, 2022, which was increased from the previously announced $5,000,000. The Convertible Debenture will initially bearCD1 bears interest at an annual rate of 7.5%, payable in cash or shares at the Company’s option, and matures on July 7, 2023 (subsequently amended, as described below). The CD1 is secured by a maturity of 18 months from the closingpledge of the Royalty Convertible Debenture.Company’s properties and assets. Until the closing of the Stream, the Convertible Debenture isCD1 was to be convertible into Common Shares at a price of C$0.30 per Common Share, subject to stock exchange approval.approval (subsequently amended, as described below). Alternatively, SRSR may elect to retire the Convertible DebentureCD1 with the cash proceeds from the Stream. The Company may elect to repay the Convertible DebentureCD1 early; if SRSR elects not to exercise its conversion option at such time, a minimum of 12 months of interest would apply.

Concurrent with the funding of the CD2 in June 2022, the Company and SRSR agreed to a number of amendments to the terms of the CD1, including that the maturity date would be amended from July 7, 2023, to March 31, 2025, and that the CD1 would remain outstanding until the new maturity date regardless of whether the Stream is advanced, unless the Company elects to exercise its option of early repayment.

The Company closed the $15,000,000 CD2 on June 17, 2022. The CD2 bears interest at an annual rate of 10.5%, payable in cash or shares at the Company’s option, and matures on March 31, 2025. The CD2 is secured by a pledge of the Company’s properties and assets. The repayment terms include 3 quarterly payments of $2,000,000 each beginning June 30, 2024, and $9,000,000 on the maturity date. Concurrent with the funding of the CD2 in June 2022, the Company and SRSR agreed that the minimum quantity of metal delivered under the Stream, if advanced, will increase by 10% relative to the amounts noted above.

| 4 |

Subject to SRSR internal approvals, further technical and other diligence, and satisfactory definitive documentation,On December 6, 2022, the Company expectsclosed a new $5,000,000 loan facility with Sprott (the “Bridge Loan”). The Bridge Loan, which was primarily utilized to closepay outstanding water treatment payables to the EPA, is secured by the same security package that is in place with respect to the RCD, CD1, and CD2. The Bridge Loan bears interest at a rate of 10.5% per annum and matures at the earlier of (i) the advance of the Stream, or (ii) June 30, 2024. In addition, the minimum quantity of metal delivered under the Stream, if advanced, would increase by 5% relative to amounts previously announced.

The non-binding term sheet (taking into account subsequent amendments concurrent with closing of the CD2 and Bridge Loan, as outlined above) also envisaged that a formal construction decision being made by early Q2 2022. A minimum of $27,000,000 and a maximum of $37,000,000 (the “Stream Amount”) willwould be made available under the Stream, at the Company’s option, once the conditions of availability of the Stream have been satisfied. Assumingsatisfied including confirmation of full project funding by an independent engineer appointed by SRSR. Thereunder, if the Company draws the maximum funding of $37,000,000, is drawn, the Stream would apply to 10% of payable metals sold until a minimum quantity of metal is delivered consisting of, individually, 5563.5 million pounds of zinc, 3540.4 million pounds of lead, and 11.2 million ounces of silver.silver (including amendments agreed concurrent with closing of the CD2 and Bridge Loan, as described above). Thereafter, the Stream would apply to 2% of payable metals sold. If the Company elects to draw less than $37,000,000 under the Stream, the percentage and quantities of payable metals streamed will adjust pro-rata. The delivery price of streamed metals will be 20% of the applicable spot price. The Company may buy back 50% of the Stream Amount at a 1.40x multiple of the Stream Amount between the second and third anniversary of the date of funding, and at a 1.65x multiple of the Stream Amount between the third and fourth anniversary of the date of funding.

The Company willterms of the Project Financing Package are envisaged to be permitted to incur additional indebtedness of $15,000,000 and a cost over-run facility of $13,000,000 from other financing counterparties.further amended, as described in the Recent Developments section below.

Effective December 19, 2021, the Company entered into an amended Settlement Agreement between the Company, Idaho Department of Environmental Quality, US Department of Justice and the EPA (the “Amended Settlement”). Upon entering the Amended Settlement, the Company is now fully compliant with its payment obligations to these parties. The Amended Settlement modifies the payment schedule and payment terms for recovery of historical environmental response costs at Bunker Hill Mine by the EPA. A total of $19,000,000 remains to be paid by the Company. The new payment schedule includes at $2,000,000 payment to the EPA within 30 days of the execution of this Amended Settlement. The remaining $17,000,000 will be paid on the following dates:

The Amended Settlement includes additional payment for outstanding water treatment costs that have been incurred over the period from 2018 through 2020. This $2,900,000 payment will be made within 90 days of execution of this Amended Settlement.

In addition to the changes in payment terms and schedule, the Company has committed to securing financial assurance in the form of performance bonds or letters of credit deemed acceptable to the EPA. The financial assurance will total $17,000,000, corresponding to the Company’s obligations to be paid in the 2024-2029 period as outlined above, that can be drawn on by the EPA in the event of non-performance by the Company (the “Financial Assurance”). The amount of the bonds will decrease over time as individual payments are made. If the Company does not post the Financial Assurance within 90 days of execution of the Amended Settlement, it must issue an irrevocable letter of credit for $9,000,000. The EPA may draw on this letter of credit after an additional 90 days if the Company is unable to either put the Financial Assurance in place or make payment for the full $17,000,000 of remaining historical cost recovery sums. In the event neither occurs, the terms of the initial Settlement Agreement will be reinstated.

The Company has concluded the negotiation of commercial terms with two counterparties for the full $17,000,000 Financial Assurance, with finalization expected in 2022 contingent on full project funding for the restart of the Bunker Hill Mine being in place.

With the execution of the Amended Settlement and the expected receipt of $8,000,000 proceeds from the Royalty Convertible Debenture, the Company has exercised its option to purchase the Bunker Hill Mine from Placer Mining and a definitive agreement has been signed by both parties. The terms of the purchase were modified to $5,400,000 in cash, from $3,400,000 of cash and $2,000,000 of Common Shares.

On January 10, 2022, the Company announced that following the approval of the transaction by Placer Mining Corp. shareholders and satisfaction of other closing conditions, the purchase of the Bunker Hill Mine closed on Friday, January 7th. Concurrently, the Royalty Convertible Debenture in the amount of $8,000,000 also closed as definitive documentation and all closing conditions were met.

On January 31, 2022, the Company announced that following the satisfaction of all closing conditions, including completion of definitive documentation and a full security package, the Convertible Debenture closed on January 28, 2022. The parties agreed to amend the funding to $6,000,000, an increase of $1,000,000 from the previously envisaged amount of $5,000,000, reflecting increased demand from Sprott and other investors. The terms of the Convertible Debenture are unchanged from the Company’s news release of December 20, 2021 as described above.

In support of plans to rapidly restart the Mine, throughout 2020 and 2021 the Company worked systematically through 2020 and 2021 to delineate mineral resources and conduct various technical studies. If successful in closing the $50 million financing package and the purchase of the Bunker Hill Mine, together with securing additional financing requirements, management believes that it is well positioned to execute this strategy.

Between April and July 2020, the Company worked to validate in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) standards up to 9 million tons of primarily zinc ore contained within the UTZ, Quill and Newgard Ore Bodies. This involved over 9,000 feet of drilling from Underground and extensive sampling from the many open stopes above the water-level. These zones could provide the majority of the early feed if the Company were to achieve a restart of the Mine.

On September 28, 2020, the Company announced its maiden mineral resources estimate consisting of a total of 8.9 million tons in the Inferred category, containing 11 million ounces of silver, 880 million pounds of zinc, and 410 million pounds of lead, which represented the result of the Company’s extensive drilling and sampling efforts conducted between April and July 2020.

On November 12, 2020, the Company announced the launch of a Preliminary Economic Assessment (“PEA”) to assess the potential for a rapid restart of the Mine for minimal capital by focusing on the de-watered upper areas of the Mine, utilizing existing infrastructure, and based on truck haulage and toll milling methods.Process Plant

On January 26, 2021, the Company reported continued progress towards completing the previously announced PEA, and further detail regarding the potential parameters of the restart, including: i) low up-front capital costs through utilization of existing infrastructure, potentially enabling a rapid production restart; ii) a staged approach to mining, potentially supporting a long-life operation; iii) underground processing and tailings deposition with potential for high recovery rates; iv) development of a sustainable operation with minimal environmental footprint; and v) potential increase in the existing resource base.

On March 19, 2021, the Company announced a mineral resource estimate consisting of a total of: 4.4 million tons in the Indicated category, containing 3.0 million ounces of silver, 487 million pounds of zinc, and 176 million pounds of lead; 5.6 million tons in the Inferred category, containing 8.3 million ounces of silver, 548 million pounds of zinc, and 312 million pounds of lead.

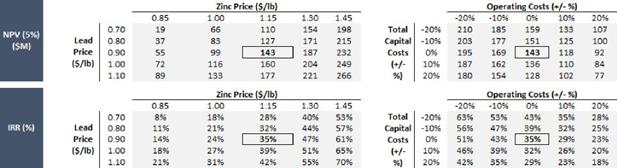

On April 20, 2021, the Company announced the results of its PEA for the Mine. The PEA contemplates a $42 million initial capital cost (including 20% contingency) to rapidly restart the Mine, generating approximately $20 million of annual average free cash flow over a 10-year mine life, and producing over 550 million pounds of zinc, 290 million pounds of lead, and 7 million ounces of silver at all-in sustaining costs of $0.65 per payable pound of zinc (net of by-products). The PEA contemplates a low environmental footprint, long-term water management solution, and significant positive economic impact for the Shoshone County, Idaho community. The PEA is based on the Mineral Resource Estimate described above and published on May 3, 2021, following the drilling program conducted in 2020 and early 2021 to validate the historical reserves. The PEA includes a mining inventory of 5.5Mt, which represents a portion of the 4.4Mt Indicated mineral resource and 5.6Mt Inferred mineral resource that comprise the Mineral Resource Estimate. The PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the project described in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

On May 3, 2021, the Company filed a technical report with further detail regarding the mineral resource estimate announced on March 19, 2021, entitled “Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” with an effective date of March 22, 2021. This technical report was prepared in accordance with the requirements of subpart 1300 of Regulation S-K (the “SEC Mining Modernization Rules”) and Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”).

On June 4, 2021, the Company filed a technical report entitled “Technical Report And Preliminary Economic Assessment For Underground Milling And Concentration Of Lead, Silver And Zinc At The Bunker Hill Mine, Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” in support of the PEA that it announced on April 20, 2021 (as described above). This technical report was prepared in accordance with the requirements of the SEC Mining Modernization Rules and NI 43-101

On September 20, 2021, the Company announced the results of an updated PEA for the Mine. The updated PEA contemplates a $44 million initial capital cost (including 20% contingency) to rapidly restart the Mine, generating approximately $25 million of annual average free cash flow over an 11-year mine life, and producing over 590 million pounds of zinc, 320 million pounds of lead, and 8 million ounces of silver at all-in sustaining costs of $0.47 per payable pound of zinc (net of by-products). As with the PEA published on June 4, 2021, the updated PEA is based on the Mineral Resource Estimate described above and published on May 3, 2021, following the drilling program conducted in 2020 and early 2021 to validate the historical reserves. The PEA includes a mining inventory of 6.4Mt, which represents a portion of the 4.4Mt Indicated mineral resource and 5.6Mt Inferred mineral resource that comprise the Mineral Resource Estimate.

On November 3, 2021, the Company filed a technical report entitled “Technical Report And Preliminary Economic Assessment For Underground Milling And Concentration Of Lead, Silver And Zinc At The Bunker Hill Mine, Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” in support of the updated PEA that it announced on September 20, 2021 (as described above).

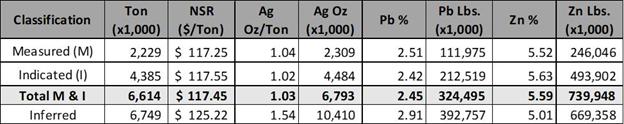

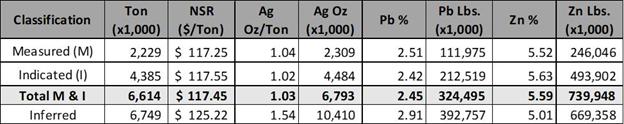

On November 30, 2021, the Company announced the completion of an updated mineral resource estimate (the “Mineral Resource Estimate” or “MRE”) for the Bunker Hill Mine consisting of a total of: 6.6 million tons in the Measured and Indicated category, containing 6.8 million ounces of silver, 740 million pounds of zinc, and 324 million pounds of lead; 6.7 million tons in the Inferred category, containing 10.4 million ounces of silver, 669 million pounds of zinc, and 392 million pounds of lead.

On December 29, 2021, the Company filed a technical report entitled “Technical Report And Preliminary Economic Assessment For Underground Milling And Concentration Of Lead, Silver And Zinc At The Bunker Hill Mine, Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” (the “Technical Report” or “Bunker Hill Technical Report”) in support of the updated MRE that it announced on November 30, 2021 (as described above). This technical report was prepared in accordance with the requirements of the SEC Mining Modernization Rules and NI-43-101 and is filed as an exhibit to the Registration Statement of which this prospectus is a part.

On January 31,25, 2022, the Company announced the signing ofthat it had entered into a non-binding Memorandum of Understanding (“MOU”MOU”) with Teck Resources Limited (“Teck”Teck”) for the purchase of a comprehensive package of equipment and parts inventory from its Pend Oreille site (the “Process Plant”) in eastern Washington State, approximately 145 miles from the Bunker Hill Mine by road. The package comprises substantially all processing equipment of value located at the site, including complete crushing, grinding and flotation circuits suitable for a planned ~1,500 tpdton-per-day operation at Bunker Hill, and total inventory of nearly 10,000 components and parts for mill, assay lab, conveyer, field instruments, and electrical spares. The MOU is non-binding and outlinesCompany paid a purchase price under two scenarios, at Teck’s option: an all-cash $2.75 million purchase price, or a $3.0 million purchase price comprised of cash and Bunker Hill shares. Each option includes a $0.5 million$500,000 non-refundable deposit which has been paid by the Company. If the parties do not agree on definitive documentation by March 1, 2022, Teck may pursue alternative options including negotiations with third parties.

Silver-Focused Exploration

With the completion of exploration drilling related to the MRE, the Company’s exploration strategy has been focused on high-grade silver targets within the upper areas of the Mine that have been identified by the data review and digitization process. The aim of this program is to identify, develop and add high-grade silver resources in ways that materially increase the relative quantity of silver resources relative to lead and zinc.

Consistent with that strategy and concurrent with the announcement of the updated mineral resources estimate, the Company announced the identification of a new silver exploration opportunity in the hanging wall of the Cate Fault which it intends to include in its ongoing drilling campaign. In conjunction with this drilling campaign, continued digitization, geologic modeling and interpretation will continue to focus on identifying additional high grade silver exploration targets.January 2022.

On March 29, 2021,31, 2022, the Company announced multiple high-grade silver mineralization results through chip-channel samplingthat it had reached an agreement with a subsidiary of newly accessible areasTeck to satisfy the remaining purchase price for the Process Plant by way of an equity issuance of the Mine identified throughCompany. Teck will receive 10,416,667 units of the Company (the “Teck Units”) at a deemed issue price of C$0.30 per unit. Each Teck Unit consists of one Common Share and one Common Share purchase warrant (the “Teck Warrants”). Each whole Teck Warrant entitles the holder to acquire one Common Share at a price of C$0.37 per Common Share for a period of three years. The equity issuance and purchase of the Process Plant occurred on May 13, 2022.

On August 30, 2022, the Company entered into an agreement to purchase a ball mill from D’Angelo International LLC for $675,000. The purchase of the mill is to be made in three cash payments. The first two payments were made as follows:

| ● | $100,000 on September 15, 2022, as a non-refundable deposit | |

| ● | $100,000 on October 13, 2022, as a refundable deposit |

The Company has not made the final payment of $475,000 as of the issuance of this report.

Recent Developments

Project Finance Package

On May 23, 2023, the Company announced that it had entered into a non-binding term sheet (the “Term Sheet”) with Sprott Private Resource Streaming & Royalty Corp. (“Sprott Streaming”) for an upsized $67 million project financing package. The package consists of a $46 million multi-metals stream (the “Stream”) and a commitment for a $21 million new debt facility (the “Debt Facility”) that will be available for draw, subject to certain terms and conditions, for two years at the Company’s proprietary 3D digitization program,election. Including the previously funded $8 million Royalty Convertible Debenture (the “RCD”), $6 million Series 1 Convertible Debenture (the “CD1”), and as$15 million Series 2 Convertible Debenture (the “CD2”), Sprott Streaming’s total commitment to the Bunker Hill Mine restart would increase to $96 million.

| 5 |

Pursuant to the Term Sheet, the maximum amount under the Stream will be increased from $37 million to $46 million (the “Stream Amount”). The terms of the Stream are unchanged from those announced in December 2021, applying to 10% of payable metals sold until a minimum quantity of metal is delivered consisting of, individually, approximately 63.5 million pounds of zinc, 40.4 million pounds of lead, and 1.2 million ounces of silver. Thereafter, the Stream would apply to 2% of payable metals sold. The delivery price of streamed metals will be 20% of the applicable spot price. The Company may buy back 50% of the Stream Amount at a 1.40x multiple of the Stream Amount between the second and third anniversary of the date of funding, and at a 1.65x multiple of the Stream Amount between the third and fourth anniversary of the date of funding.

As previously contemplated, upon funding of the Stream, the RCD will be repaid by the Company, and the Company will grant a royalty for 1.85% of life-of-mine gross revenue (the “Royalty”) from mining claims considered to be historically worked (the “Primary Claims”), contiguous to current accessible underground development, and covered by the Company’s 2021 ground geophysical survey. A 1.35% rate will apply to claims outside of these areas (the “Secondary Claims”). The previously announced royalty put option permits Sprott Streaming to resell the Royalty to the Company for $8 million upon default under the CD1 or CD2 until such time that they are repaid in full.

The Debt Facility consists of a $21 million facility that will be available for draw at the Company’s election for a period of two years. Any amounts drawn will bear interest of 10% per annum, payable annually in cash or capitalized until three years from closing of the Debt Facility at the Company’s election, and thereafter payable in cash only. The maturity date of any drawings under the Debt Facility will be four years from closing of the Debt Facility. For every $5 million or part of its ongoing silver-focused drilling program. An area was identifiedthereof advanced under the Debt Facility, the Company will grant a new 0.5% life-of-mine gross revenue royalty, on the 9-levelsame terms as the Royalty, to a maximum of 2.0% on the Primary Claims and 1.4% on the Secondary Claims. The Company may buy back 50% of these royalties for $20 million.

Pursuant to the Term Sheet, the parties have also agreed to extend the maturities of the CD1 and CD2 to March 31, 2026, when the full $6 million and $15 million, respectively, will become due.

The Term Sheet is subject to the negotiation of definitive transaction documents and the approval of those documents by the Company’s board of directors. The closing of the Stream, Debt Facility, and other transactions contemplated by the Term Sheet are conditional on the satisfaction of a number of conditions, including satisfactory completion of due diligence acceptable to Sprott, finalization of definitive transaction documents, and regulatory and stock exchange approvals.

Concentrate Offtake Agreement and Offtake Financing Discussions

On May 23, 2023, the Company announced that resulted in ten separate chip samples greater than 900 g/t AgEq(1), each with minimum 0.6m length. Mineralization remains open up dip, down dipTeck Resources Limited (“Teck”) exercised its option to acquire 100% of the zinc and along strikelead concentrate production from the sampling location.Bunker Hill Mine for a five-year period. The Company also reported drill results includingtransaction is subject to the negotiation of definitive transaction documents and the approval of those documents by the Company’s board of directors. The transaction would secure a 3.8m intercept with a grade of 996.6 g/t AgEq(1), intersected atlong-term, sustainable revenue source for the down-dip extension of the UTZ zone at the 5-level. The Company will continue to report mineralized drill intercepts concurrent with its ongoing exploration program that is currently envisaged to comprise 10,000 to 12,000 feet in 2021.Bunk Hill Mine.

The Company remains in discussions with potential providers of offtake financing. Any agreement with a metal trader, in lieu of the Debt Facility, would be subject to approval by Teck and Sprott Streaming.

Business Operations

The Mine is a zinc-lead-silver Mine. When back in production, the Company intends to mill mineral resources on-site to produce both zinc and lead-silver concentrates which will then be shipped to a third-party smelter for processing.

Infrastructure

The Mine includes all mining rights and claims, surface rights, fee parcels, mineral interests, easements, existing infrastructure at Milo Gulch, and the majority of machinery and buildings at the Kellogg Tunnel portal level, as well as all equipment and infrastructure anywhere underground at the Bunker Hill Mine Complex. It also includes all current and historic data relating to the Bunker Hill Mine Complex, such as drill logs, reports, maps, and similar information located at the Mine site or any other location.

| 6 |

For further detail, please refer to the “Project Infrastructure” section below.

Government Regulation and Approval

Exploration and development activities, and any future mining operations, are subject to extensive laws and regulations governing the protection of the environment, waste disposal, worker safety, mine construction, and protection of endangered and protected species. The Company has made, and expects to make in the future, significant expenditures to comply with such laws and regulations. Future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have an adverse impact on the Company’s financial condition or results of operations.

It may be necessary to obtain the following environmental permits or approved plans prior to commencement of mine operations:

| ● | Reclamation and Closure Plan | |

| ● | Water Discharge Permit | |

| ● | Air Quality Operating Permit | |

| ● | Industrial Artificial (tailings) pond permit | |

| ● | Obtaining Water Rights for Operations |

If these permits are required, there can be no assurance that the Company will be able to obtain them in a timely manner or at all. For further detail, please refer to the “Environmental Studies and Permitting” section of the “Technical Report Summary” below.

Property Description

The Company has mineral rights to approximately 440 patented mining claims covering over 5700 acres. Of these claims, 35 include surface ownership of approximately 259 acres. It also has certain parcels of fee property which include mineral and surface rights but not patented mining claims. Mining claims and fee properties are located in Townships 47, 48 North, Range 2 East, Townships 47, 48 North, Range 3 East, Boise Meridian, Shoshone County, Idaho.

Patented mining claims in the State of Idaho do not require permits for underground mining activities to commence on private lands. Other permits associated with underground mining may be required, such as water discharge and site disturbance permits. The water discharge is being handled by the EPA at the existing CTP. The Company expects to take on the water treatment responsibility in the future and obtain an appropriate discharge permit.

For further detail, please refer to the “Property Description and Ownership” section of the “Technical Report Summary” below.

Competition

The Company competes with other mining and exploration companies in connection with the acquisition of mining claims and leases on zinc and other base and precious metals prospects as well as in connection with the recruitment and retention of qualified employees. Many of these companies are much larger than the Company, have greater financial resources and have been in the mining business for much longer than it has. As such, these competitors may be in a better position through size, finances and experience to acquire suitable exploration and development properties. The Company may not be able to compete against these companies in acquiring new properties and/or qualified people to work on its current project, or any other properties that may be acquired in the future.

| 7 |

On August 23, 2021,Given the Company announced further drill results, including intercepts from silver-lead vein extensions delineated through testingsize of the down-dipworld market for base precious metals such as silver, lead and off-set portionszinc, relative to the number of individual producers and consumers, it is believed that no single company has sufficient market influence to significantly affect the Jersey-Deadwood vein system on the 9-level.

Water Management Optimization

In September 2020, the Company began its water management program with the goalprice or supply of improving the understanding of the Mine’s water system and enacting immediate improvementthese metals in the water quality of effluent leaving the Mine for treatment at the Central Treatment Plant (“CTP”). Informed by historical research provided by the EPA, the Company initiated a study of the water system of the Mine to: i) identify of the areas where sulphuric acid (Acid Mine Drainage, or “AMD”) is generated in the greatest and most concentrated quantities, and ii) understand the general flow paths of AMD on its way through and out of the mine as it travels to the CTP.world market.

Leveraging its improved understanding through this study, on February 11, 2021 the Company announced the successful commissioning of a water pre-treatment plant located within the Mine, designed to significantly improve the quality of Mine water discharge, which in turn would support a rapid restart of the Mine. Specifically, the water pre-treatment plant achieves this goal by reducing significantly the amount of treatment required at the CTP, and the associated costs, before the Mine water is discharged into the south fork of the Coeur D’Alene River, removing over 70% of the metals from water before it leaves the Mine, with the potential for further improvements.Employees

In an effort to improve transparency to all stakeholders with regard toThe Company has ten employees. The balance of the results of this system, the Company launched a water quality tracking platform on its website on March 15, 2021, which uploads real-time data every five minutes and provides an interactive database to allow detailed historical analysis.Company’s operations is contracted for as consultants.

Smaller Reporting Company Status

Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”“Exchange Act”) defines a “smaller reporting company” as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

| ● | had a public float of less than $75,000,000 as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or | |

| ● | in the case of an initial registration statement under the United States Securities Act of 1933, as amended (the | |

| ● | in the case of an issuer whose public float as calculated under the first and second bulleted paragraph |

As a smaller reporting company, we will not be required and may not include a Compensation Discussion and Analysis section in our proxy statements; we will provide only two years of financial statements; and we need not provide the table of selected financial data. We also will have other “scaled” disclosure requirements that are less comprehensive than issuers that are not smaller reporting companies which could make our Common Shares less attractive to potential investors, which could make it more difficult for our shareholders to sell their shares.

| 8 |

SUMMARY OF THE OFFERING

Common Shares offered by Selling | ||||

| ● | ||||

| ● | ||||

| ● | ||||

| ||||

| ● | ||||

| ● | ||||

| ● | ||||

| ● | ||||

| ● | ||||

| Common Shares outstanding before the offering | ||

| Offering Price | Determined at the time of sale by the selling shareholders. | |

| Use of proceeds | We will not receive any proceeds from the sale of shares by the selling shareholders, although we may receive proceeds from the exercise of common | |

| BNKR | ||

| BHLL | ||

| Risk Factors | The Common Shares offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”. |

| 9 |

SUMMARY OF FINANCIAL INFORMATION

The following selected financial information is derived from the Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction with the Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus. The amounts below are expressed in United States dollars.

| Nine Months Ended | Six Months Ended | Nine Months Ended | Six Months Ended | (As restated)Year Ended | (As restated)Year Ended | Three Months Ended | Three Months Ended | Year Ended | Year Ended | |||||||||||||||||||||||||||||||

| 30-Sep-21 | 31-Dec-20 | 30-Sep-20 | 31-Dec-19 | 30-Jun-20 | 30-Jun-19 | 31-Mar-23 | 31-Mar-22 | 31-Dec-22 | 31-Dec-21 | |||||||||||||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||||||||||||

| Operating Statement Data: | ||||||||||||||||||||||||||||||||||||||||

| Revenues | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | ||||||||||||||||||||||||||||||

| Loss from operations | 12,384,474 | 9,454,396 | 11,058,237 | 5,841,502 | 10,793,823 | 8,113,926 | (2,185,488 | ) | (5,486,674 | ) | (16,487,161 | ) | (18,752,504 | ) | ||||||||||||||||||||||||||

| Net income (loss) | 9,843,495 | (2,164,454 | ) | (13,848,837 | ) | (17,740,813 | ) | (31,321,791 | ) | (8,442,320 | ) | 1,791,149 | (2,880,886 | ) | 898,591 | (6,402,277 | ) | |||||||||||||||||||||||

| Net income (loss) per common share - basic | 0.06 | (0.02 | ) | (0.16 | ) | (0.31 | ) | (0.47 | ) | (2.14 | ) | |||||||||||||||||||||||||||||

| - fully diluted | 0.06 | (0.02 | ) | (0.16 | ) | (0.31 | ) | (0.47 | ) | (2.14 | ) | |||||||||||||||||||||||||||||

| Net income (loss) per common share – basic and fully diluted | 0.01 | (0.02 | ) | 0.00 | (0.04 | ) | ||||||||||||||||||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||||||||||||||||||||||

| Total assets | 5,510,252 | 6,709,016 | 9,507,375 | 490,312 | 732,884 | 227,090 | 36,929,798 | 19,089,557 | 32,929,892 | 4,071,796 | ||||||||||||||||||||||||||||||

| Total liabilities | 23,596,319 | 38,246,613 | 41,798,019 | 23,825,049 | 33,974,803 | 8,437,600 | 56,152,235 | 54,291,835 | 59,106,835 | 38,314,164 | ||||||||||||||||||||||||||||||

| Total shareholders’ deficiency | 18,086,067 | 31,537,597 | 32,290,644 | 23,334,737 | 33,241,919 | 8,210,510 | 19,222,437 | 35,202,278 | 26,176,943 | 34,242,368 | ||||||||||||||||||||||||||||||

| Total number of common shares issued and outstanding | 164,435,442 | 143,117,068 | 137,544,088 | 69,817,196 | 79,259,940 | 15,811,396 | 256,099,174 | 164,435,442 | 229,501,661 | 164,435,826 | ||||||||||||||||||||||||||||||

As described in the notes to the Financial Statements, the Financial Statements for the years ended June 30, 2020 and June 30, 2019 have been restated.

| 10 |

RISK FACTORS

You should carefully consider the risks described below together with all other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward- looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward- looking statements. While the risks described below are the ones we believe are most important for you to consider, these risks are not the only ones that we face. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our Common Shares could decline, and you may lose all or part of your investment.

General Risk Factors

The Company’s ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany the Company’s Financial Statements disclose a going concern qualification to its ability to continue in business. The accompanying Financial Statements have been prepared under the assumption that the Company will continue as a going concern. The Company is an exploration and development stage company and has incurred losses since its inception. The Company has incurred losses resulting in an accumulated deficit of $56,245,378$71,592,559 as of September 30, 2021December 31, 2022 and further losses are anticipated in the development of its business.

The Company currently has no historical recurring source of revenue and its ability to continue as a going concern is dependent on its ability to raise capital to fund its future exploration and working capital requirements or its ability to profitably execute its business plan. The Company’s plans for the long-term return to and continuation as a going concern include financing its future operations through sales of its Common Shares and/or debt and the eventual profitable exploitation of the Mine. Additionally, the volatility in capital markets and general economic conditions in the U.S. and elsewhere can pose significant challenges to raising the required funds. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s consolidated financial statements do not give effect to any adjustments required to realize its assets and discharge its liabilities in other than the normal course of business and at amounts different from those reflected in the accompanying Financial Statements.

The Company will require significant additional capital to fund its business plan.short-term obligations, continue its operations and remain in compliance with its debt agreements.

Neither the Company nor any of the directors of the Company nor any other party can provide any guarantee or assurance, that the Company will be able to raise sufficient capital to satisfy the Company’s short-term obligations. The Company does not have sufficient funds to satisfy its short-term financial obligations, even after consideration of its recently completed equity financing. As at December 31, 2022, the Company had $708,105 in cash and total current liabilities of $10,155,582 and total liabilities of $59,106,835. The Company will be required to expend significant funds to determine whether proven and probable mineral reserves exist at its properties,likely require additional capital by the end of the second quarter of 2023 in order to continue exploration and,its operations. Further, if warranted, to develop its existing properties, and to identify and acquirethe Company does not raise sufficient additional properties to diversify its property portfolio. Thecapital, the Company anticipates that it will be required to make substantial capital expenditures for the continued exploration and, if warranted, development of the Mine. The Company has spent and will be required to continue to expend significant amounts of capital for drilling, geological, and geochemical analysis, assaying, and feasibility studies with regard to the resultsin breach of its exploration atdebt agreements, including under the Mine. The Company may not benefit from some of these investments if it is unable to identify commercially exploitable mineral reserves.RCD, CD1, CD2 and Bridge Loan.

The Company’s ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of metals. Capital markets worldwide were adversely affected by substantial losses by financial institutions, caused by investments in asset-backed securities and remnants from those losses continue to impact the ability for the Company to raise capital. The Company may not be successful in obtainingable to secure the requiredStream or alternative funding from Sprott or another capital provider.

Neither the Company nor any of the directors of the Company nor any other party can provide any guarantee or assurance that the Stream, the final contemplated tranche of the full $66,000,000 project financing package will be finalized or if itclose, or any other funding from Sprott. The Stream remains subject to Sprott internal approvals, full project funding, further technical and other due diligence and satisfactory documentation. If the Stream, or a portion thereof, does not close there is no guarantee that alternative capital can obtain such financing, such financing may not be raised on terms that are favorable to us.the Company, or at all.

Any additional equity funding, for which there can be no guarantee or assurance with regard to any amount or terms thereof, will dilute existing shareholders.

| 11 |

A concentrate offtake agreement with Teck Resources may not be reached, which could result in less favorable commercial terms for the sale of concentrates envisaged to be produced by the Bunker Hill Mine and could also impact the Company’s ability to secure offtake financing. Regardless of actions taken by Teck, there can be no assurance that the Company will be able to secure or close offtake financing, which could have an adverse effect on the Company’s financial position and negative impact the Company’s ability to secure additional funding from Sprott or an alternative capital provider.

The Company may not be able to execute a concentrate offtake agreement for the sale of concentrates to Teck Resources at its Trail smelter, as contemplated with Teck’s option to acquire 100% of zinc and lead concentrate produced in the first five years at the Bunker Hill Mine. If such an agreement cannot be reached, the Company may not be able to sell its zinc and lead concentrate to Teck, which could result in difficulties securing alternative commercial arrangements for the sale of concentrate, less favorable commercial terms in the event that alternative commercial arrangements can be secured, and/or higher transportation and other costs. In addition, the Company may not be able to secure or close offtake financing, regardless of whether an agreement is reached with Teck; the terms of any offtake financing might not be favorable to the Company; and/or the Company may incur substantial fees and costs related to such financing. The Company’s inability to accesssecure or close offtake financing, or arrange a suitable alternative, may have an adverse effect on the Company’s operations and financial position, including its ability to secure the Stream from Sprott.

The Bunker Hill Mine restart is now expected to take place in 2024, with first concentrate production targeted for mid-2024. Changes to this timeline, or other factors impacting the restart project budget, could increase the Company’s required capital needs through the completion of the project, which would adversely affect the Company’s ability to secure additional funding, thereby adversely affecting its financial condition.

On February 28, 2023, the Company announced that primarily due to the inability to procure certain long-lead items that were planned to be ordered by February 2023, and longer estimated delivery times thereof, the Company now expects the Bunker Hill Mine restart to be achieved in 2024. On March 10, 2023, the Company announced that it has maintained the integrity of its total pre-production budget, under the assumption of first concentrate production in the second quarter of 2024.

In the event that the Company is unable to secure sufficient funding to materially advance the restart of the Mine in the second quarter of 2023, from Sprott or an alternative capital forprovider, it is likely that the restart timeline will be further delayed with a potentially materially adverse effect on the pre-production budget.

Notwithstanding financing-related risks, the Company’s pre-production budget estimates are subject to change based on factors beyond its operationscontrol, including but not limited to cost inflation and supply chain dynamics. An increase in the Company’s pre-production budget estimates could have a materially adverse impact on its ability to secure project financing. This could have a material adverse effect on its financial condition, results of operations, or prospects. Sales of substantial amounts of securities may have a highly dilutive effect on the Company’s ownership or share structure. Sales of a large number of shares of the Company’s Common Shares in the public markets, or the potential for such sales, could decrease the trading price of the Common Shares and could impair the Company’s ability to raise capital through future sales of Common Shares. The Company has not yet commenced commercial production at any of its properties and, therefore, has not generated positive cash flows to date and has no reasonable prospects of doing so unless successful commercial production can be achieved at the Mine. The Company expects to continue to incur negative investing and operating cash flows until such time as it enters into successful commercial production. This will require the Company to deploy its working capital to fund such negative cash flow and to seek additional sources of financing. There is no assurance that any such financing sources will be available or sufficient to meet the Company’s requirements.requirements, or if available, available upon terms acceptable to the Company. There is no assurance that the Company will be able to continue to raise equity capital or to secure additional debt financing, or that the Company will not continue to incur losses.

NeitherPayment bonds securing $17,000,000 due by the Company nor any ofto the directors of the Company nor any other party can provide any guaranteeEPA for cost recovery may not be renewable or assurance that the $50 million project financing package willmay only be finalized or close, as the Project Financing Package remains subject to SRSR internal approvals, further technical and other due diligence and satisfactory documentation. If the Project Financing Package does not close there is no guarantee that capital can be raisedrenewable on terms favourablethat are unfavorable to the Company, which would adversely affect its financial condition or cause a default under the revised settlement agreement with the EPA and Sprott.

In 2022, the Company secured financial assurance in the form of payment bonds in accordance with the revised settlement agreement with the EPA, in relation to $17,000,000 of payments due to the EPA for cost recovery between 2024-2029. These bonds are renewed annually, and currently require $6,476,000 of collateral in the form of letters of credit. To the extent that the parties providing the payment bonds demand additional collateral beyond the current requirements, or other unfavorable terms or conditions, the Company may not be able to renew the payment bonds on favorable conditions, or at all. Any additional equity funding will dilute existing shareholders.

The purchase of the Bunker Hill Mine may not occur as contemplated, or at all