As filed with the U.S. Securities and Exchange Commission on August 25, 2022April 5, 2024

Registration No. 333-265429

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SHUTTLE PHARMACEUTICALS HOLDINGS, INC.Shuttle Pharmaceuticals Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 82-5089826 | ||

(State or other jurisdiction of | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification |

One Research Court,401 Professional Drive, Suite 450260

Rockville, Maryland 20850Gaithersburg, MD 20879

Telephone: (240) 403-4212

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive office)offices)

Anatoly Dritschilo, M.D.

Chief Executive Officer

Shuttle Pharmaceuticals Holdings, Inc.

One Research Court, Suite 450

Rockville, Maryland 20850401 Professional Drive, Suite 260

Gaithersburg, MD 20879

(240) 403-4212

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:to:

Megan J. Penick

Dorsey & Whitney LLP

51 West 52nd Street

New York, New York 10019

(212) 415-9200

|

| |

|

| |

| ||

|

| |

|

| |

Approximate date of commencement of proposed sale to the public:public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.box: ☐

If this Formform is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Formform is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Formform is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging | ☒ |

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Sectionsection 8(a) of the Securities Act of 1933 as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Sectionsection 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

|

| |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling stockholder.

(1) Assumes the underwriter’s over-allotment option has not been exercised.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities nor may we accept offers to buy these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED |

$9,960,340

SHUTTLE PHARMACEUTICALS HOLDINGS, INC.

Subscription Rights to Purchase Up to $4,500,000 in Units

1,225,888Units

Each Unit Consisting of One ShareUp to Shares of Common Stock, and

One WarrantWarrants to Purchase One ShareUp to Shares of Common Stockstock, and Up to 44% Interest, in total, in Shuttle Diagnostics, Inc.

This is an initial public offering of Shuttle Pharmaceuticals Holdings, Inc. We are offering a total of 1,225,888 units of securities, with each unit consisting of one share(the “Company,” “we,” “us” or “our”) is distributing to the holders (collectively, the “Holders”) of our common stock, par value $0.00001 per share (“common stock”(the “Common Stock”), and anon-transferable rights (the “Rights”) to purchase up to an aggregate of $4,500,000 in units, with each unit consisting of one share of common stock, one warrant to purchase one share of our common stock. The units are being offeredstock, exercisable at an assumed combined public offering price of $8.125 per unit and a combined effective offering price of $8.115$2.35 per share, of common stock and an offering priceinterest in our wholly-owned subsidiary, Shuttle Diagnostics, Inc., such that at the conclusion of $0.01 for each warrant. The holdersthis Rights Offering, the participants in the Rights Offering will hold 44% of the warrants may purchase our common stock atequity interests in Diagnostics and the Company will own 56% of the equity interests in Diagnostics, assuming the Rights Offering is fully subscribed. You will not be entitled to receive any Rights unless you are a Holder of record as of 5:00 p.m., New York City time, on [ ], 2024 (the “Record Date”). Holders, as of the Record Date, will receive one Right for every share of Common Stock owned. For purposes of this preliminary prospectus, we have assumed an exerciseestimated per Unit Price of $[ ] which is equal to 90% of the closing price of $0.01 per share. The shares included in the units are immediately separable, as a result of which we will be issuing an aggregate of 1,225,888 shares of our common stock on [ ], 2024 (the “Estimated Per Unit Purchase Price”). As noted elsewhere in this prospectus, the Estimated Per Unit Purchase Price is subject to change when calculated on the expiration date of this offering.

The Rights will expire if they are not exercised by 5:00 p.m., New York City time, on [ ], 2024, the expected expiration date of this Rights Offering. We, in our sole discretion, may extend the period for exercising the Rights. Rights which are not exercised by the expiration date of the Rights Offering will expire and warrantswill have no value. You should carefully consider whether or not to exercise your Rights before the expiration date. Once you have exercised your Rights, your exercise may not be revoked.

Rights may only be exercised in whole numbers of shares of Common Stock, and we will not issue fractional shares. Each subscription right will entitle you to purchase 1,225,888 sharesone Unit, which we refer to as the Basic Subscription Right, at a subscription price per Unit of our common stock. It is$[ ], which we refer to as the intentionSubscription Price. If you exercise your Basic Subscription Rights in full, and any portion of the underwritersUnits remain available under the Rights Offering, you will be entitled to immediatelyan over-subscription privilege to purchase a portion of the unsubscribed Units at the Subscription Price, subject to proration and ownership limitations, which we refer to as the Over-Subscription Privilege. Each subscription right consists of a Basic Subscription Right and an Over-Subscription Privilege, which we refer to as the Subscription Right.

SRO, LLC, an entity controlled by Keith Moore, Chairman of Boustead Securities, LLC (“BSL”), our placement agent, has entered into an agreement pursuant to which it is obligated to purchase $2,250,000 Units (the “Committed Investment”) in the Rights Offering and has the ability to act as a backstop purchaser should we be unable to raise the full $4,500,000 under the Rights Offerings, including the Committed Investment. However, there can be no assurance that they will participate up to the full $4,500,000, should we be unable to raise the full amount. Aside from the aforementioned Commitment Investment, the Rights Offering is being conducted on a “best efforts” basis.

If we fail to consummate this rights offering or obtain funds from other sources during this fiscal year, we may not be able to continue as a going concern and will need to explore restructuring and reorganization initiatives. See “Risk Factors - Risks Related to this Rights Offering - If the rights offering is not consummated or we are not able to obtain alternative financing during the fiscal year ending December 31, 2024, we will not have funds to meet our working capital requirements” and “Risk Factors - Risks Related to this Rights Offering - Even if the rights offering is completed, we will require additional capital to fund our operations, and if we fail to obtain financing when needed or on acceptable terms, we will not be able to meet our working capital requirements or fund business operations.”

You should carefully consider whether to exercise your subscription rights prior to the warrantsexpiration of the rights offering. All exercises of subscription rights are irrevocable, even if the rights offering is extended by our board of directors for additional periods (not to exceed 45 days).

All subscription payments will be deposited into an account maintained by the subscription agent for the benefit of the holders exercising their subscriptions under this rights offering, and if this rights offering is not completed for any reason all funds will be promptly returned to such subscribers in the amounts advanced in connection with their respective exercises. If we amend the rights offering to allow for an extension of the rights offering for additional periods aggregating to more than 45 days, or make a fundamental change to the terms of the rights offering set forth in this prospectus, you may cancel your subscription and receive a prompt refund of any money you have advanced. We may terminate the Rights Offering at any time prior to the expiration of the Rights Offering for any reason. In the event the Rights Offering is terminated, all subscription payments received will be returned within 10 business days, without interest or deduction. We expect the Rights Offering to expire on behalf[ ], 2024.

Rights under the Basic Subscription Right will be distributed in proportion to Holders’ holdings on the Record Date. If you exercise your Basic Subscription Right in full, and other Holders do not, you will be entitled to an Over-Subscription Right to purchase a portion of their clients simultaneously with the consummationunsubscribed shares at the subscription price, subject to the availability and pro rata allocation of Common Stock among persons exercising this Over-Subscription Right. See “Questions & Answers - What are the limitations of the Over-Subscription Right?”

Exercising the Rights and investing in our Common Stock involve significant risks. We urge you to read carefully the section titled “Risk Factors” beginning on page 21 of this public offering. In addition,prospectus, the selling shareholders (as defined herein) are offering 1,311,942 shares of common stocksection titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to be sold pursuant to a separate resale prospectus. We will not receive any proceeds from the sale of the common stock to be sold by the selling stockholders.exercise your Rights.

Prior to this offering, no public market has existed for our common stock. No stockholder affiliated with managementOur Common Stock is selling shares in this offering. We have applied to list our common stock included in the units and our common stock issuable upon exercise of the warrants for tradinglisted on the Nasdaq Capital Market tier of The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “SHPH”. We do“SHPH.” On [ ], 2024, the last reported sale price of our Common Stock was $[ ]. The Rights being offered herein are non-transferrable, except that Rights will be transferable by operation of law (e.g., by death) or by such Holders that are closed-end funds to funds affiliated with such Holders. The Rights will not intend to applybe listed for listing of the warrantstrading on Nasdaq or on any other national securitiesstock exchange or trading system. Without an active trading market, the liquidity of the warrants will be limited.market. You are urged to obtain a current price quote for our Common Stock before exercising your Rights.

An investmentVstock Transfer, LLC will serve as the subscription agent (“Subscription Agent”), the information agent (“Information Agent”) and the escrow agent (the “Escrow Agent”) for this Rights Offering. The Subscription Agent will hold the funds we receive from subscribers until we complete, abandon or terminate the Rights Offering. If you want to participate in our common stock involves significant risks.this Rights Offering and you are the record holder of your securities, we recommend that you submit your subscription documents to the Subscription Agent well before the deadline. If you want to participate in this Rights Offering and you hold securities through your broker, dealer, bank, or other nominee, you should promptly contact your broker, dealer, bank, or other nominee and submit your subscription documents in accordance with the instructions and within the time period provided by your broker, dealer, bank, or other nominee. For a more detailed discussion, see “The Rights Offering - The Rights” beginning on page 32.

| Per Share | Total(2) | |||||||

| Subscription Price | $ | [ ] | $ | 4,500,000 | ||||

| Placement Agent Fees (1) | $ | [ ] | $ | 360,000 | ||||

| Proceeds to us, before expenses | $ | [ ] | $ | 4,140,000 | ||||

| (1) | In connection with this Rights Offering, we have agreed to pay to Boustead Securities, LLC, as placement agent, an aggregate cash fee equal to 8.0% of the gross proceeds received by us directly from exercises of the Subscription Rights. In addition, we agreed to pay BSL a commitment fee of $112,500, payable in cash or shares, upon the earlier of filing this registration statement or termination of this offering, and we also paid BSL $40,000 to cover its due diligence fees in advance of this Rights Offering. See “Plan of Distribution.” |

| (2) | Assumes the Rights Offering is fully subscribed but excludes proceeds from the exercise of Warrants included in the Units. |

If you have any questions or need further information about this Rights Offering, please contact the Information Agent toll-free at [ ] or via email at [ ]. It is anticipated that delivery of the shares of Common Stock purchased in this Rights Offering will be made on or about [ ], 2024 (the fifth business day following the expiration date), unless the expiration date is extended.

Our board of directors is making no recommendation regarding your exercise of the Subscription Rights. You should carefully consider whether to exercise your Subscription Rights before the risk factors beginning on page 13expiration date. You may not revoke or revise any exercises of this prospectus before you make your decision to invest in our common stock.Subscription Rights once made.

| Per Share | Total | |||||||

| Offering price | $ | 8.125 | $ | 9,960,340 | ||||

| Underwriting discounts and commissions (1) | $ | 0.568 | $ | 697,224 | ||||

| Proceeds, before expenses, to us | $ | 7.56 | $ | 9,263,116 | ||||

We have granted a 45-day option to the underwriter to purchase up to 183,883 additional units solely to cover over-allotments, if any.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and we have elected to comply with certain reduced public company reporting requirements.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of common stock against payment as set forth under “Underwriting” on or about , 2022.Placement Agent

Boustead Securities, LLC

The date of this prospectus is ____________, 2022.

TABLE OF CONTENTS

We have not, and the underwriter has not, authorized anyone to provide you with any information or to make any representation other than that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared we may authorize to be delivered or made available to you. We do not, and the underwriter does not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.any units hereunder. Our business, financial condition, results of operations and prospects may have changed since that date. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in this prospectus.

For investors outside the United States: Neither we nor the underwriterWe have not done anything that would permit a public offering of the securities or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

You should rely only on the information contained in or incorporated by reference in this prospectus. Neither we nor the underwriterprospectus and in any free writing prospectus prepared by or on behalf of us. We have not authorized any dealer, salesperson or other personanyone to provide you with information concerning us, except fordifferent from, or in addition to, that contained in or incorporated by reference in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference in this prospectus.prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus and any free writing prospectus related to this offering in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Unless otherwise indicated, any reference to Shuttle Pharmaceuticals Holdings, Inc., or as “we,” “us,” or “our” refers to Shuttle Pharmaceuticals Holdings, Inc. and its subsidiaries (“Shuttle,” “Shuttle Pharma” or the “Company”).

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate or plan to operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry, and assumptions based on such information and knowledge which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our company’s and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors” beginning on page 13.21. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements” on page 3927 below.

| i |

PUBLIC OFFERINGPROSPECTUS SUMMARY

The following summary provides an overview of all material information contained in this prospectus. It does not contain all of the information you should consider before making a decision to purchase our shares of common stock in the offering. Prior to investing in our common stock, you should carefully and thoroughly read the more detailed information in this prospectus and review our financial statements and all other information that is included in this prospectus, including the section entitled “Risk Factors” beginning at page 13.21.

Unless the context otherwise requires, references in this prospectus to “Shuttle Pharma,” “Shuttle Pharmaceuticals,” “the Company,” “we,” “our” and “us” refers to Shuttle Pharmaceuticals Holdings, Inc. and its subsidiary, Shuttle Pharmaceuticals, Inc.

Our Company

Overview

Founded in 2012 by faculty members of the Georgetown University Medical Center, Shuttle PharmaceuticalsPharma is a discovery and developmentclinical stage specialty pharmaceutical company focused on improvingleveraging our proprietary technology to develop novel therapies designed to cure cancers. Our goal is to extend the outcomesbenefits of cancer patients treatedtreatments with surgery, radiation therapy, (RT). Our mission is to improve the lives of cancer patients by developing therapies that are designed to maximize the effectiveness of RT while limiting the late effects of radiation in cancer treatment. Although RT is a proven modality for treating cancers, by developing radiation sensitizers, we aim to increase cancer cure rates, prolong patient survival and improve quality of life when used as a primary treatment, or in combination with surgery, chemotherapy and immunotherapy. Radiation therapy (“RT”) is one of the most effective modalities for treating cancers. We currentlyare developing a pipeline of products designed to address the limitations of the current cancer therapies as well as to extend to the new applications of RT. We believe that our product candidates will enable us to deliver cancer treatments that are safer, more reliable and at a greater scale than that of the current standard of care.

Our product candidates include Ropidoxuridine, Extended Bio-availability Ropidoxuridine (IPdR/TPI), and a platform of HDAC inhibitors (SP-1-161, SP-2-225 and SP-1-303). In December 2023, we submitted an Investigational New Drug (“IND”) application with the U.S. Food and Drug Administration (“FDA”) to support the next phase of development of Ropidoxuridine. In January 2024, we received the ‘Safe to Proceed’ letter from the FDA for our IND application for the Phase II study of Ropidoxuridine (IPdR) as a radiation sensitizing agent during radiotherapy in patients with newly diagnosed IDH-wildtype glioblastoma with unmethylated MGMT promoter. Receipt of the letter allows us to commence the Phase II study of Ropidoxuridine (IPdR). We have no FDA approved products and we have not yet applied for a new drug application. To date, we have been funded by investments from private investors and government contracts obtained fromreceived FDA approval of Orphan designation for Ropidoxuridine and RT for treating brain cancer (glioblastoma). We believe our management team’s expertise in radiation therapy, combined modality cancer treatment and immuno-oncology will help drive the National Institutesdevelopment and, if approved, the commercialization of Health (NIH)these potentially curative therapies for performing research. We have no product revenue and our independent auditors, in their report dated June 3, 2022, expressed doubt about our ability to continue as a going concern.patients with aggressive cancers.

Historically,Radiation Oncology has gone through transformative technological innovation over the major advances in radiation oncology have focused on improving technologylast several years to increase the amountbetter define tumors, allow improved shaping of radiation that can be administered todelivery and support dose escalation with shorter courses of treatment. Furthermore, achieving higher dose distributions within tumor volumes has reached a tumor without damaging adjacent, normal tissues. Examples of other such technologies include intensity modulated radiation therapy (IMRT), stereotactic body radiation therapy (SBRT), stereotactic radiosurgery (SRS) and proton therapy – the backbones of state-of-the-art RT. All offer improvements in physical radiation dose shaping. The basic principle underlying the effectiveness of RT for curingpractical plateau, since cancers lies in the differential cancer cell kill achieved in tumors, as compared to the effects of RT on the normal surrounding tissues, which is achievedare frequently integrated with or surrounded by delivery of highly conformal RT doses – in other words, delivery of high-dose to volumes that are shaped to conform to the target cancers while minimizing the dose to surrounding normal tissues. The treated volumes frequently includemore sensitive normal tissues thereby limiting the magnitudesand further dose escalation increases risks of the prescribed RT doses. We suggest that technological innovations to define tumor volumes and shapetissue necrosis. To increase cancer cures at maximally tolerated radiation delivery have reached an effectiveness plateau and that further improvements in RT outcomes will requiredoses, pharmacological and immunological approachesbiological modifications of cells are needed to sensitize cancers, protect normal tissues, and engage the immune system.

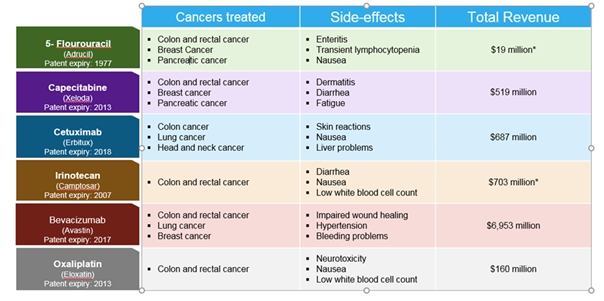

At present, the drugs being used for sensitizing cancers to RT are chemotherapeutic agents possessing radiation sensitizing properties as secondary effects. With the exception of Cituximab, a growth factor targeting monoclonal antibody biologic, all other drugs used as radiation sensitizers are used “off-label” to address the clinical need for radiation sensitizers. For example, certain chemotherapeutic agents, such as 5-fluorouracil, capecitabine and cis-platinum, are approved as single agents for cancer treatment, but are used “off-label” as radiation sensitizers in combination with RT. Treatments with such agents are associated with inherent toxicities associated with the drug’s primary, single-agent mechanisms of action.

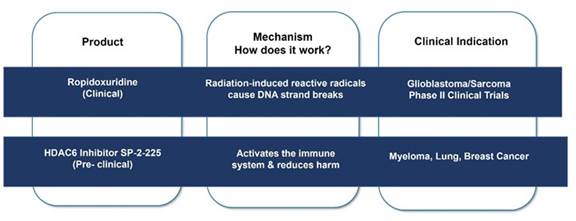

Shuttle Pharma’s platform of sensitizers offers a pipeline of product candidates designed to address the urgent clinical need and the current limitations of using “off-label” drugs with potential new sensitizer agents. Our pipeline includes Ropidoxuridine, our lead clinical sensitizer drug candidate, to sensitize rapidly growing cancer cells and selective histone deacetylase (HDAC) inhibitors to sensitize cancer cells and stimulate the immune system. Our novel technologies will be tested in combinations with radiation therapies (conventional X-ray and proton radiation therapies) and in combinations with immune-therapies. To date, Ropidoxuridine has completed a Phase I clinical trial. Our HDAC inhibitor platform drug candidates have been tested in preclinical models of solid tumor cancers. Ropidoxuridine and the selective HDAC6 inhibitor SP-2-225 are the clinical and preclinical candidate drug products we propose to develop using funding from this offering.

Our intellectual property for Ropidoxuridine includes novel formulations that show improved drug bioavailability (in a preclinical animal model) and for sensitizing cancers to proton and to conventional radiation therapies. Our HDAC inhibitor intellectual property includes new patent applications and granted patents for composition of matter and methods of use for treating cancers with HDAC inhibitors in combinations with radiation therapy.

To date, we have obtained funding for our research from private investors and Small Business Innovation Research (“SBIR”) contracts obtained through the National Institutes of Health (“NIH”) to support the development of the radiation sensitizer Ropidoxuridine in a Phase I clinical trial. We have also received awards for Phase I and II SBIR contracts for development of human cell cultures for health disparities studies and predictive biomarkers of radiation late effects through the NIH’s National Cancer Institute. The completed Phase I and II funded discovery work performed to establish “Cell-based Models for Prostate Cancer Health Disparity Research” and to develop “Predictive Biomarkers of Prostate Cancer Sensitivity for Radiation Late Effects” enables Shuttle Pharma to apply for NIH SBIR Phase II funding to develop these products for advancing basic science and clinical research.

Our Product Candidates

The U.S. Food and Drug Administration (the “FDA”) considers new molecular entities as drugs that use new and unique mechanisms of action for treating medical conditions. Our clinical stage agent, Ropidoxuridine (IPdR), increases DNA double strand breaks following radiation exposure and our inhibitors of histone deacetylases (HDACs) stimulate the immune system to produce T-lymphocytes targetingreact against antigens produced by irradiated, damaged cancer cells. Drugs that show sensitizing properties, or the ability to make cancer cells more sensitive to radiation, offer a solution to this problem. Currently, such drugs are chemotherapy agents used off-label, and many have inherent toxicities since they were designed for direct cancer treatments and not for sensitization.

Our objectiveWe are developing our products with the goal of addressing the unmet need in cancer treatment for a commercially marketable radiation response modifier solution that leads to greater sensitivity of cancer cells to ionizing radiation therapy. The goal of our products is to improveincrease the outcomestherapeutic index for patients receiving radiation and to decrease radiation-related toxicities in patients with solid tumors. Our products operate across three areas related to the treatment of cancer treatment through RT while reducing its side effects by:with RT:

| 2. | Activation of the DNA damage response pathway to kill cancer cells and protect adjacent normal cells. | |

| 3. | Activation of the immune system to kill any remaining cells after RT. |

Our platform technology allows for the creation of an inventory of products for radiation sensitizing, immune modulation, and protection of healthy tissue.

| 1 |

Our Pipeline

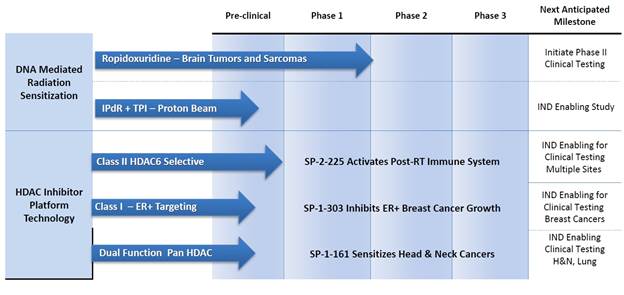

We are currently developing a pipeline of small molecule radiation sensitizers and immune response regulating drugs. Our most advanced product candidate is Ropidoxuridine, an orally available halogenated pyrimidine with strong cancer radiation sensitizing properties in preclinical studies. In addition, we have a pipeline of complimentary product candidates that we are developing to address a host of solid tumor cancer indications. Our pipeline is represented in the diagram below:

Timeline for clinical phase (Ropidoxuridine) and pre-clinical phase (HDAC inhibitors) pipeline.

Our lead product candidates include:

| ● |

| 2 |

| ● |

To our knowledge, no drug utilizing the mechanisms of our candidate small molecule drugs has received FDA approval as a radiation sensitizer. We have developed, to clinical stage, the small molecule strategies to sensitize growing cancer cells in tumors to conventional RT and to large fraction radiation therapy. The pre-clinical technology, HDAC inhibitor platform, is designed to target cancer cells while protecting healthy tissue/normal cells, thus enhancing the candidate radiation sensitizer product pipeline. The selective HDAC6 inhibitor (SP-2-225), discovered and developed by our scientists, has inhibited the growth of melanoma tumors and breast cancers in animal models by an immune stimulating mechanism.

We are focused on developing a clinical stage product candidate (Ropidoxuridine) and a pre-clinical product candidate, selective HDAC6 inhibitor (SP-2-225). We propose to develop these drug candidates as illustrated below:

Overview of Radiation Sensitizer Development

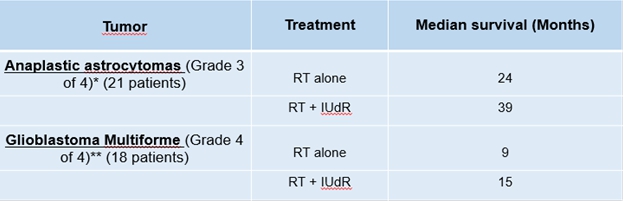

Ropidoxuridine, the clinical stage molecule, sensitizes rapidly growing cancers to radiation therapy by increasing reactive free radicals that increase DNA strand breaks. Ropidoxuridine development for treating glioblastoma will require Phase II clinical testing for use in treating brain tumors. The selective HDAC6 inhibitor, SP-2-225, a pre-clinical stage molecule, activates the innate immune system to target irradiated tumor cells by immune mechanisms.

Ropidoxuridine (IPdR)

Ropidoxuridine (IPdR) is an orally available halogenated pyrimidine (5-iodo-2-pyrimidinone-2-deoxyribose) with strong cancer radiation sensitizing properties. As a prodrug that does not become an active drug until after it is metabolized, IPdR is absorbed and metabolized to IUdR by enzymes in the liver and in cancer cells. IUdR, a halogenated pyrimidine, is incorporated into DNA by rapidly growing cancer cells. Cells that incorporate IUdR into their DNA then become more sensitive to the effects of RT. The Phase I clinical trial of Ropidoxuridine and RT, supported by an NIH SBIR contract to Shuttle Pharma, was sub-contracted to the Brown University Oncology Group (BrUOG) at the LifeSpan/Rhode Island Hospital. This Phase I clinical trial has been completed and the results were initially reported by the sub-contractor at the 30th EORTC-NCI-AACR Symposium in November 2018 and published in the medical journal Clinical Cancer Research in 2019. A maximum tolerated dose (MTD) of 1200 mg/day for 28 days was established for use in combination with radiation therapy to achieve therapeutic blood levels of IUdR.

The reported Phase I clinical trial of Ropidoxuridine in combination with RT provides the foundation for proposed Phase II clinical trials to establish the data necessary for the FDA to determine efficacy in treating brain tumors, sarcomas and pancreatic cancers, diseases that offer potential for orphan designations. The FDA granted approval of our application for orphan-drug designation for IPdR for the treatment of glioblastoma. Orphan designation protects the marketing position of Ropidoxuridine for up to seven years after marketing approval is received from the FDA. This approval integrates well into the overall intellectual property strategy for Ropidoxuridine which includes filed patent applications for “Method and Compositions for Cancer Therapies that Include Delivery of Halogenated Thymidines and Thymidine Phosphorylase Inhibitors in Combination with Radiation.” We believe that we are positioned to initiate Phase II clinical studies with Ropidoxuridine and RT in 2022.

Extended Bio-availability Ropidoxuridine (IPdR/TPI)

Ropidoxuridine and Tipiracil (IPdR/TPI) is a new combination drug formulation designed to increase the bio-availability and incorporation of IUdR into DNA. Shuttle Pharma’s preclinical studies of the combination of IPdR/TPI have shown up to 10-fold greater bioavailability of the active metabolite (IUdR) as compared to IPdR administered alone in controls. We have filed an application under the Patent Cooperation Treaty (or PCT) for the intellectual property. This new formulation will be tested in a Phase I clinical trial as a sensitizer of rectal cancers. Another nucleoside analogue, Trifluridine has been formulated in combination with Tipiracil (TAS-102) to enhance drug uptake by colon cancer cells to prolong survival in patients treated for metastatic colorectal cancers, as has been reported in the New England Journal of Medicine (N Engl J Med. 2015; 372:1909-1919). We anticipate testing for uptake of IPdR by colorectal cancer cells following administration of the IPdR/TPI drug formulation.

Proton radiation therapy is an advanced form of radiation therapy using charged proton particles (p+). Proton RT differs from conventional RT in that the radiation is delivered by a beam of protons to precisely target tumors and, due to the favorable physics of energy deposition by proton particles, there is no exit beam, resulting in less radiation to surrounding healthy tissues. The use of Proton RT is expanding rapidly in the U.S. and worldwide. According to the National Association of Proton Therapy, more than 30 facilities are currently in operation in the U.S. and an additional 30 facilities are planned for installation over the next five years. (See www.proton-therapy.org.) Much attention has been paid to proton therapy in the popular press, promoting its advantages, as well as addressing the increased health care costs. The role of a sensitizer that offers proton radiation sensitization presents an opportunity to enhance the value of proton radiation therapy as a cancer treatment modality. We believe the development of a proton therapy targeted radiation sensitizer, such as IPdR/TPI, is timely and consistent with current market needs to advance protons as a therapeutic modality.

We intend to perform clinical studies to support the development of the IPdR/TPI combination to advance this drug candidate with proton RT. The addressable market includes diseases such as brain tumors, cancers of the head and neck, GI cancers and lung cancers.

Selective HDAC Inhibitors

The roles of acetylation in the epigenetic regulation of chromatin structure and gene expression rests on the balance of activities of histone acetyltransferases (HATs) and histone deacetylases (HDACs). Increased acetylation of histones leads to changes in chromatin structure and accessibility for key cellular proteins to specific target sites. Acetylations of non-histone proteins also modulates their enzymatic activities. We have discovered novel HDAC inhibitor molecules and testing in preclinical models has shown cancer radiation sensitizing properties, normal tissue protective properties and selective HDAC6 inhibitory properties. Our HDAC inhibitor platform, described below, will be evaluated in pre-clinical studies of radiation sensitization of solid tumors and activation of the immune response to irradiated cancer cells.

| ● | ||

| ● | SP-2-225 is Shuttle Pharma’s pre-clinical class IIb selective HDAC inhibitor that selectively affects histone deacetylase HDAC6. SP-2-225 has effects on the regulation of the immune system. The interactions of RT with the immune response for cancer treatment are of great current interest, offering insight into potential mechanisms for primary site and metastatic cancer treatment. For this reason, Shuttle Pharma has selected SP-2-225 as the candidate lead HDAC inhibitor for preclinical development. We have contracted with investigators at Georgetown University to perform preclinical studies of immune activation after radiation therapy in an animal tumor model. Requests for proposals for advancing drug manufacture and IND-enabling studies have been submitted and are under review to enable drug development to a Phase I clinical trial in 2024. With the introduction of check-point inhibitors, CAR-T therapies and personalized medicine in cancer, regulation of the immune response following RT is of significant clinical and commercial interest. | |

| ● | SP-1-303 is |

Our Approach

Drug Development Projects for Radiation Treatment of Cancers

To advance researchWe believe that is complementary to ourwe have established a leadership position in radiation sensitizer discovery and development. Over approximately seven years of research, we have identified two clinical phase product candidates and discovered new pre-clinical molecules using our proprietary platform technologies to increase the therapeutic index for patients receiving radiation for treatment of solid tumors. Our development projects,strategy has four key pillars: (1) to improve the efficacy of RT by demonstrating improved disease-free survival rates in patients who undergo radiation therapy, (2) reduce the amount of radiation needed for a favorable tumor response, thereby limiting the potential for radiation related toxicities to healthy cells, (3) decrease the extent of surgery needed to remove cancers and improve quality of life, and (4) leverage our next generation technologies to create drugs that regulate the immune response assisting immune checkpoint and CAR-T therapies and other personalized medicines targeting cancers.

We propose to perform Phase I and Phase II clinical trials to advance our clinical product candidates. In addition, candidate HDAC inhibitor molecules will be tested in animal models, and IND-enabling studies will be performed to prepare for Phase I clinical trials.

To date, we have been awarded three SBIR contracts from the NIH has awarded SBIR contracts to us to develop reagents for health disparities research and to develop biomarkers of radiation sensitivity for patients treated with radiation therapy. Our scientists have been engaged in developing model human cell systems for testing radiation sensitizers in tissue cultures. This project provides an efficient and low-cost screening technology to provide data for the FDA’s determination of drug efficacy and to identify candidate lead molecules for treating prostate cancers in African-Americans. First developed at Georgetown University, the conditional cellular reprogramming (CRC) technology offers the ability to establish new cell lines from biopsies of cancers. We have obtained a sub-license from Propagenix, Inc. to establish 100 normal and cancer cell lines from prostate biopsy samples for use in screening drug candidates and for health disparities research. A more detailed description of the Propagenix license is set forth on page 60 below.

In addition, to identify patients who may be more sensitive to radiation therapy and are at a higher risk to suffer treatment-related complications, collaborative research with Georgetown University has led to discovery of metabolite biomarkers, which are predictive of patient responses to radiation therapy. A patent for the intellectual property has been submitted by Georgetown University with Shuttle Pharma scientist (Scott Grindrod, PhD) as co-inventor. Developmental work in health disparities and predictive biomarker development has been supported by NIH SBIR contracts to Shuttle Pharmaceuticals for the following areas:to:

| ● | Develop | |

| ● | Develop prostate cancer cell cultures from African-American men, with donor matched normal prostate cells, establishing 50 pairs for accelerating research to reduce prostate cancer health disparities in African-American men. This project was funded under “Moonshot” designation and Shuttle Pharma is eligible to submit an application for additional SBIR (Phase IIb) funding to establish the infrastructure required to expand and distribute cells for research purposes. Cells from African-American patients are distributed to investigators who are conducting health disparities research. |

| 3 |

| ● | Develop predictive biomarkers |

All three SBIR funded projects have been completed. The NIH’sCompany is eligible to apply for SBIR Phase IIb funding to “bridge” the funding gap should Shuttle Pharma elect to advance the “Moonshot” health disparities or the predictive biomarker project. The NIH SBIR program is designed to encourage small businesses to engage in Federal Research/Research and Development (“R/R&D”) that has the potential for commercialization. Shuttle Pharma will apply for additional NIH SBIR grants and contracts to fund advancement of these projects.

Market Opportunity

The American Cancer Society (Cancer Facts & Figures 2020) estimates 1,806,590 new cancer cases and 606,520 cancer deaths each year in the United States and, according to the American Society for Radiation Oncology, more than 50% of patients undergo RT at some point in the treatment of their diseases. RT is used to treat cancers of the lung, breast, brain, esophagus, pancreas, rectum, head and neck, uterus, lymphomas and sarcomas. At present, we are developing drug candidates to address brain, pancreas, rectum, sarcomas and lymphomas, although we may test and seek approval for our drug candidates to treat other cancers in the future.

Currently, there is only one drug (the monoclonal antibody, Cetuximab) that has received FDA approval for the radiation sensitizer indication. Cetuximab is a recombinant monoclonal antibody that binds to epidermal growth factor receptor (EGFR) and inhibits the binding of epidermal growth factor (EGF). Cetuximab is administered via intravenous infusion and is used as monotherapy or in combination with other chemotherapies or radiation therapy. In clinical trials, cetuximab was associated with serious and fatal infusion reactions, cardiopulmonary arrest or sudden death, and serious dermatologic toxicities, toxicities that have created deterrents to its use as a radiation sensitizer. Present treatment utilizes “off-label” small molecule drugs, which are cytotoxic chemotherapy agents that also sensitize, but do not have radiation sensitization as an FDA approved indication. Moreover, since “off-label” drugs are cytotoxic, they are often associated with intrinsic acute and chronic side effects. Nevertheless, these drugs have shown clinically significant improvements in disease control and survival and are typically included in standard-of-care treatment recommendations for patients with cancers of the head and neck, brain, lung, esophagus, stomach, pancreas, liver, bladder, lymphomas and sarcomas. As a result, we believe that there is a significant market opportunity for our product candidates. Based on cancer incidence data published by the American Cancer Society, we have estimated the numbers of patients presenting with local/regional disease, suitable for treatment with RT.

Estimated RT Cases by Disease Site

| Cancer Type | Cases Diagnosed Annually | Estimated RT Cases | ||||||

| Brain | 23,890 | 21,979 | ||||||

| Pancreas | 57,600 | 32,832 | ||||||

| Sarcomas | 13,130 | 4,000 | ||||||

| Rectum | 43,340 | 26,437 | ||||||

Annual cancer cases for each disease site are estimated from American Cancer Society Facts & Figures 2020 publication. The fraction of patients optimally receiving RT for each disease site were obtained from published estimates of Delaney G, Jacob S, Featherstone C, Barton M. The role of radiotherapy in cancer treatment: estimating optimal utilization from a review of evidence-based clinical guidelines. Cancer. 2005 Sep 15;104(6):1129-37. doi: 10.1002/cncr.21324. The Estimated RT cases were obtained by multiplying Cases Diagnosed Annually by the fraction receiving RT for optimal utilization.

Our Development Strategy

Our goal is to maintain and build upon our leadership position in radiation sensitization. We plan to develop Ropidoxuridine and the HDAC6 inhibitor (SP-2-225) and, if approved by the FDA, to commercialize our product candidates for the treatment of cancers. While this process may require years to complete, we believe achieving this goal could result in new radiation sensitizer and immunotherapy products for cancer treatment.products. Key elements of our strategy include:

| ● | Capitalize on Ropidoxuridine as an orally available, small molecule radiation | |

| ● | Expand our leadership position within radiation sensitizers. In addition to our traditional radiation sensitizers, we plan to advance our near-term pipeline to include radiation sensitizers for proton therapy. Proton Therapy is growing worldwide as a form of radiation therapy due to its unique beam shaping characteristics. As a result, this new technology offers a major opportunity for Shuttle Pharma to strive to develop | |

| ● | Execute a disciplined business development strategy to strengthen our portfolio of product candidates. We have built our current product pipeline through in-house discovery, development, partnerships with leading academic institutions and through |

| ● | Invest in our HDAC platform technology | |

| ● | Enter into collaborations to realize the full potential of our |

We propose the following clinical development plan to identify, develop and commercialize drugs for use in cancer treatments in combination with RT:

Develop Ropidoxuridine (IPdR) for Orphan disease indications to take to market

Develop Ropidoxuridine and tipiracil (IPdR/TPI) for colorectal cancer indications to take to market

Develop HDAC Inhibitors for use in breast cancer for immune activation after RT

Management Team

Our management team has significant experience in radiation oncology and in progressing products from early-stage research through clinical trials. Our CEO, Anatoly Dritschilo, M.D., is an experienced clinician and researcher who has held senior academic and management positions including serving as Department Chairman, Hospital Medical Director and Cancer Center Director at Georgetown University Medical Center. Prior to co-founding our company, Dr. Dritschilo was a co-founder of Oncomed, Inc., a company that became public as NeoPharm, Inc. (Nasdaq: NEOL). He has experience in providing care for patients undergoing treatment for cancers of the prostate, breast, brain, lung, sarcomas and GI systems. Dr. Dritschilo has directed basic science research supported by grants from the National Cancer Institute (“NCI”) and performed clinical trials using drugs and radiation therapy. In addition, Dr. Dritschilo served as the principal investigator of pharmaceutical industry sponsored clinical evaluations of human interferon alpha-2 (Bristol-Myers) with radiation therapy and antisense raf oligonucleotides, LErafAON (NeoPharm) with radiation therapy. He serves as a Radiation Biology and Radiation Oncology expert on committees of the NIH to review Program Project (P01) grant applications, Specialized Program of Research Excellence (SPORE) grant applications and investigator-initiated research project (R01) applications.

| 4 |

Dr. Dritschilo is supported in our clinical development effort by Tyvin Rich, MD, our Chief Clinical Officer and Medical Director. Dr. Rich is the former Professor and Chairman of the Department of Therapeutic Radiology and Oncology at the University of Virginia Health Sciences Center and proton radiation therapy specialist at the Hampton Proton Therapy Center in Hampton, Virginia. Dr. Rich has served as principal investigator on multi-modality clinical trials for the treatment of gastrointestinal (GI) cancers and helped to develop treatment with 5-fluorouracil (5-FU) as a radiation sensitizer for use with RT in the treatment of GI cancers. He has extensive cancer clinical trial experience in developing radiation sensitizer applications through his participation in the Radiation Therapy Oncology Group (RTOG). Dr. Rich is a co-inventor with scientists at the University of Virginia of the Proton Activated Atomic Medicine technology.

Our administrative services are provided by Peter Dritschilo, MBA, who has served as our President and COO since 2012. Mr. Dritschilo’s experience in hospital administration and management of medical oncology clinical services and radiation therapy facilities, including management of day-to-day operations, human resources and financial oversight. Peter Dritschilo is the son of our Chairman and CEO, Dr. Anatoly Dritschilo. The addition of Michael Vander Hoek, as our CFO and Vice President for Operations and Regulatory expands our capability to provide the level of management needed for the proposed expansion of clinical trials. Mr. Vander Hoek has served as administrative director of the Lombardi Comprehensive Cancer Center (LCC) for the past 12 years and has extensive experience in negotiations, management and supervision of Contract Research Organizations (CROs) and research contracts in general. As the administrative director of the Lombardi Comprehensive Cancer Center, Mr. Vander Hoek also served as the chief financial officer. Taken together, we believe our leadership team of highly qualified specialists will help us achieve the proposed milestones for the development of radiation sensitizer products.

Pre-IPO Bridge Financing

In December 2021, we completed a $500,000 note offering pursuant to which we sold to two accredited investors (the “Investors”) units consisting of (i) a $250,000 promissory note bearing 10% interest, repayable at the time of this offering (the “Note”)Recent Financings – Our IPO and (ii) a warrant to purchase 250,000 shares (the “Warrant Shares”) of our common stock at an exercise price of $1.00 per share (the “Warrant”). Immediately before closing on the Offering, the Notes will be repaid and cancelled in exchange for the exercise of the Warrants and issuance of the 500,000 Warrant Shares to the Investors.Post-IPO Financings

In February and MarchOn September 2, 2022, we soldclosed on our IPO of 1,225,888 units (each a total of $365,000“Unit,” and $225,000, respectively, in convertible notes (“Convertible Notes”collectively, the “Units”) to certain accredited investors, which notes will automatically convert into units,, with each unitUnit consisting of one share of the Company’s common stock and aone warrant to purchase one share of common stock, upon effectiveness of this offering at a conversionpublic offering price of $3.00$8.125 per unit (the “Conversion Units”Unit. Our IPO, which was underwritten by Boustead Securities, LLC (“Boustead”). In addition, each, resulted in gross proceeds of the Convertible Note holders will be entitled to demand registration rights,$9,960,430, before deducting underwriting discounts and we are required to register the Conversioncommissions. On September 29, 2022, Boustead exercised its overallotment option, purchasing an additional 183,883 Units, within 180 daysresulting in gross proceeds of the closing$1,494,041, before deducting underwriter commissions and discounts. As a result, our IPO raised a total of this offering. We are using the net proceeds from the Convertible Notes offering to expand our current operations, including our technology$11,454,474, before deducting underwriting discounts, commissions and intellectual property portfolio, and to fund the costs of this offering. Any funds remaining will be used for working capital and other general corporate purposes.related IPO expenses.

In August 2022,On January 11, 2023, we completedentered into a $125,000 note offeringsecurities purchase agreement (the “SPA”) with Alto Opportunity Master Fund, SPC – Segregated Master Portfolio B, a Cayman entity (the “Investor”), pursuant to which wethe Company sold to three accredited investorsthe Investor a $4.3 million convertible note (the “Investors”) units consisting of (i) a total of $125,000 in 10% promissory notes bearing 10% interest, repayable at the time of this offering (the “August“Convertible Note”) and (ii) warrantswarrant (the “Warrant”) to purchase a total of 50,0001,018,079 shares of common stock exercisable at $2.50 per share. We anticipate that the notes will be repaid upon closing of the Offering.

Boustead Securities LLC (“Boustead”) acted as placement agentCompany, in both theexchange for gross proceeds of $4.0 million (the “Investment Amount”). The Convertible Note and Warrant offeringamortizes on a monthly basis and the Convertible Notes offering, pursuantCompany can make such monthly amortization payments in cash or, subject to which Boustead waived its cash compensation related to the Note and Warrant offerings and received cash compensation of $36,500 and $22,250certain equity conditions, in each of the February and March 2022 closings, respectively, and also received warrants to purchase 10% of the total number of Conversion Shares, exercisable at the conversion price of the Convertible Notes. For the August 2022 offering, Boustead received a warrant to purchase 5,000registered shares of common stock exercisable at $2.50 per share, andor a combination thereof. For equity repayment, the Convertible Note is entitled to receive $12,500 in cash compensation, which cash compensation has been deferred.

Our Resale Offering

Certain of our shareholders will be selling through a separate prospectus (the “Resale Prospectus”) (i) 486,942convertible into shares of common stock at price per share equal to the lower of (i) $2.35 (ii) 147,50090% of the three lowest daily VWAPs of the 15 trading days prior to the payment date or (iii) 90% of the VWAP of the trading day prior to payment date. The Convertible Note is repayable over 26 months and bears interest at the rate of 5% per annum. The Warrant is exercisable for four years from the date of closing and is exercisable at $2.35 per share. In the event the Investor exercises the Warrant in full, such exercise would result in additional gross proceeds to the Company of approximately $2.4 million.

On May 10, 2023, we entered into an amendment agreement (the “Amendment Agreement”) to the SPA. Under the Amendment Agreement, the Company and the Investor amended the transaction documents as follows: (i) amended and restated Section 2 of the Warrant so as to remove a provision that would have potentially required an adjustment to the number of warrant shares exercisable under the Warrant, (ii) stipulated that the Company would obtain majority shareholder approval to issue up to an additional $10 million in convertible notes (the “Subsequent Notes”) and warrants (the “Subsequent Warrants”) equal to 42.5% of the outstanding principal value of the Subsequent Notes, which Subsequent Note and Subsequent Warrant would be sold to the Investor on substantially the same terms as the existing Convertible Note and Warrant (each as amended by the Amendment Agreement) and upon conversion and/or exercise would cause the potential issuance of in excess of 19.9% of the Company’s issued and outstanding stock, (iii) that, upon obtaining majority stockholder approval, the Company would file a Schedule 14C related to such potential issuance of the shares of common stock related to the potential sale of the Subsequent Notes and warrantsSubsequent Warrants to the Investor within 30 calendar days of entry into the Amendment Agreement, and (iv) stipulated that the Investor would release $1,500,000 in cash collateral to the Company, with $1,000,000 to be released to the Company immediately upon singing of the Amendment Agreement and $500,000 to be released upon the Company’s filing of the Schedule 14C. The Company obtained majority stockholder consent to the potential sale of the Subsequent Notes and Subsequent Warrants to the Investor in advance of entry into the Amendment Agreement.

On June 4, 2023, we entered into amendment no. 1 (“Amendment No. 1”) to the Amendment Agreement dated May 11, 2023, for purposes of amending the terms of the SPA. Under Amendment No. 1 to the Amendment Agreement, the Company and the Investor agreed as follows: (i) that Section 15(q) to the Convertible Note, which required the Company to hold the Cash Collateral in a Controlled Account Agreement (as defined in the Convertible Note), would no longer be applicable, (ii) that the Investor would stipulate the release to the Company of the remaining Cash Collateral totaling $2,924,000 (thus releasing the full amount of the Cash Collateral to the Company), and (iii) that, should the Investor exercise its option to purchase 147,500 shares of common stock, which sharesthe Subsequent Notes and warrants willSubsequent Warrants, that such Subsequent Notes would omit Section 15(q) and that the Company would not be issuable upon conversion of convertible notes, which convertible notes will automatically convert into common stock and warrants upon the effectiveness of this offering and the date of this prospectus, and (iii) 530,000 shares of common stock issuable upon exercise of warrants held by certain warrant holders, as set forth in the Resale Prospectus. We will not receiverequired to maintain any proceeds from the sales by the selling stockholders of the securities set forth in thee Resale Prospectus.controlled accounts or otherwise be subject to any controlled account agreements.

The Resale Prospectus is substantively identical to this Prospectus, except for the following principal points:

Summary Risk Factors

Our business is subject to a number of risks you should be aware of before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus at page 1321 immediately following the section entitled “Questions and Answers Related to this prospectus summary.Rights Offering.” These risks include the following:

| ● | Our ability to continue as a going concern in the near term is dependent upon us successfully raising additional equity or debt financing to fund our operations. | |

| ● | Our success is primarily dependent on | |

| ● | ||

| product sales revenue. | ||

| ● | We face competition from entities that have |

| ● | If | |

| business. | ||

| ● |

| |

| ● | If we are not able to obtain and enforce patent protection for our technologies or product candidates, development and commercialization of our product candidates may be adversely affected. | |

| ● | We | |

| put our patents and other proprietary rights at risk. | ||

| ● | ||

| harmed. | ||

| ● | We may be unable to | |

| product candidates. | ||

| ● | ||

| unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives, thereby harming our business. | ||

| ● | ||

| Our ability to obtain services, reimbursement or funding from the federal government may be impacted by possible reductions in federal spending. | ||

| ● | ||

| product candidates could be compromised. | ||

| ● | ||

| no guarantee that we will regain compliance without effectuating a reverse stock split. | ||

| ● | ||

| common stock could incur substantial losses. | ||

| ● | The | |

| equity or of debt securities that are convertible into common stock will dilute our share capital. | ||

| ● |

| 6 |

Implications of Being an Emerging Growth Company

| ● | As a smaller reporting company, and as a company with less than | ||

| ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; | ||

| ● | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| ● | not being required to comply with any mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | reduced disclosure obligations regarding executive compensation; and | |

| ● | exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of the above provisions for up to five years or until such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0$1.235 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may also choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of some reduced reporting requirements in this prospectus. Accordingly, the information contained in this prospectus may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period for adopting new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate Information

The Company was formed as a limited liability company in the state of Maryland in December 2012 and was converted to a C corporation, Shuttle Pharmaceuticals, Inc. (“Shuttle”), in August of 2016. In June 2018, Shuttle completed a share exchange with Shuttle Pharma Acquisition Corp. Inc. (“Acquisition Corp.”), pursuant to which Shuttle Pharmaceuticals, Inc. became a subsidiary of Acquisition Corp. and we subsequently changed the name of Acquisition Corp. to Shuttle Pharmaceuticals Holdings, Inc. Our executive offices are located at 1 Research Court, Suite 450, Rockville,401 Professional Drive, Gaithersburg, Maryland 2085020879 and our telephone number is (240) 403-4212. Our corporate website is www.shuttlepharma.com. Information appearing on our corporate website is not incorporated as part of this prospectus.

| 7 |

TheSummary of the Rights Offering

| Securities |

| |

| Size of Offering: | [ ] Units | |

| Subscription Price: | 90% of the VWAP of the Company’s common stock five days prior to the end of the Subscription Period. | |

| Percentage Interest in Diagnostics: | Each Unit will entitle the holder to a [ ]% equity interest in Shuttle Diagnostics such that, when all $4,500,000 in Units are sold, a total of 44% of the equity interest in Diagnostics will be distributed to the purchasers in the Rights Offering. | |

| Warrants: | Each Warrant will entitle the holder to purchase one share of our common stock at an exercise price of

| |

| 5:00 p.m., Eastern Time, , 2024 | ||

| Basic Subscription Right: | Your Basic Subscription Right will entitle you to purchase one Unit at the Subscription Price. You may exercise your Basic Subscription Right for some or all of your Subscription Rights, or you may choose not to exercise your Subscription Rights. If you choose to exercise your Subscription Rights, there is no minimum number of Units you must purchase. We | |

| Over-Subscription Privilege: | If you exercise your Basic Subscription Rights in full, you may also choose to exercise an over-subscription privilege to purchase a | |

| Expiration Date: | The Subscription Rights will expire at 5:00 p.m., Eastern Time, on , 2024. |

| 8 |

| Purchase Agreement, Committed Investor: | SRO, LLC, an entity controlled by Keith Moore, of Boustead Securities, LLC, has entered into a purchase agreement with us pursuant to which SRO, LLC has agreed to purchase at least $2.25 million of Units in In addition, the Rights Offering is backstopped by SRO, LLC, the Committed Investor such that the Committed Investor has also agreed to purchase up to See the “Purchase Agreement” and “Backstop Commitment” below. | |

Procedure for Exercising Subscription Rights: | To exercise your Subscription Rights, you must take the following steps: If you are a record holder, as of If as of the Record Date you are a beneficial owner of shares of common stock that are registered in the name of a broker, dealer, bank or other nominee, you should instruct your broker, dealer, bank or other nominee to exercise your Subscription Rights on your behalf. Please follow the instructions of your nominee, who may require that you meet a deadline earlier than 5:00 p.m., Eastern Time, on , 2024. | |

| Payment Adjustments: | If you send a payment that is insufficient to purchase | |

Delivery of Shares, Warrants and Equity Interests: | As soon as practicable after the expiration of the Rights Offering, and within five business days thereof, we expect to close on subscriptions and for the Subscription Agent to arrange for the issuance of the shares of common stock, Warrants and equity interests purchased pursuant to the Rights Offering. All shares, Warrants and equity interests that are purchased in the Rights Offering will be issued in book-entry, or uncertificated, form. If you hold your shares in the name of a bank, broker, dealer, or other nominee, DTC will credit your account with your nominee with the securities you purchased in the Rights Offering. However, since neither the Warrants nor the Equity Interests are registered, we will need to establish a separate account on your behalf with our transfer agent, Vstock Transfer LLC. |

| 9 |

| Non-transferability of Subscription Rights: | The Subscription Rights may not be sold, transferred, assigned or given away to anyone. The Subscription Rights will not be listed for trading on any stock exchange or market. | |

| Transferability of Warrants and Equity Interests: | The Warrants will be separately transferable following their issuance and for a period of three years after issuance; the Equity Interests will be separately transferable following their issuance. | |

| No Board Recommendation: | Our board of directors is not making a recommendation regarding your exercise of the Subscription Rights. You are urged to make your decision to invest based on your own assessment of our | |

| No Revocation: | Except as described below, all exercises of Subscription Rights are irrevocable, even if you later learn of information that you consider to be unfavorable to the exercise of your Subscription Rights. | |

| Dividend policy: | We have never paid cash dividends on our common stock and we do not anticipate paying any cash dividends in the foreseeable future. See the section entitled “Dividend Policy.” |

| Use of proceeds: |

$[_] million. We intend to use the net proceeds from | |

| Material U.S. Federal Income Tax Consequences: | For U.S. federal income tax purposes, we do not believe you should recognize income or loss upon receipt or exercise of a Subscription Right, but the receipt and exercise of the Subscription Rights is unclear in certain respects. You should consult your own tax advisor as to the tax consequences of the Rights Offering in light of your particular circumstances. See “Material U.S. Federal Income Tax Consequences.” | |

| Extension, Amendment and Termination: | Although we do not presently intend to do so, we may extend the Rights Offering for additional time in our sole discretion for any reason for up to an additional 45 days. For example, we may decide that changes in the market price of our common stock warrant an extension, or we may decide that the If we should make any fundamental changes to the terms set forth in this prospectus, we will (i) file a post-effective amendment to the registration statement of which this prospectus forms a part, (ii) offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions and issue a refund of any money advanced by such stockholder or eligible warrant holder, and (iii) recirculate an updated prospectus after the post-effective amendment is declared effective with the SEC. | |

| Questions: | If you have any questions about the Rights Offering, please contact the Information Agent, VStock Transfer, LLC, by mail at 18 Lafayette Place, Woodmere, New York 11598 or by email at action@vstocktranser.com. | |

| Market for Common Stock: | Our common stock is listed on the Nasdaq Capital Market under the symbol “SHPH.” | |

| Market for Warrants and Equity Interests: | There is no established public trading market for either the Warrants or the Equity Interests, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the | |

| (1) |

| ● | 1,446,155 warrants to purchase common stock; and | |

| ● | 2,221,820 shares |

| 10 |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information in other documents that we file with it. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information contained in documents filed earlier with the SEC or contained in this prospectus. We incorporate by reference in this prospectus the documents listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act prior to the termination of the offering under this prospectus; provided, however, that we are not incorporating, in each case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules:

| ● | ||

| ● |

Reverse Stock SplitAdditionally, all documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) prior to effectiveness of this registration statement, and (ii) after the effective date of this registration statement and before the termination or completion of any offering hereunder, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.”

Effective April 1, 2022,Any statement contained in this prospectus supplement, the accompanying prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement and the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement and the accompanying prospectus to the extent that a statement contained in this prospectus supplement and the accompanying prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus supplement and the accompanying prospectus modifies or supersedes the statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement and the accompanying prospectus.

We will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including exhibits to these documents. You should direct any requests for documents to Shuttle Pharmaceutical Holdings, Inc., 401 Professional Drive, Suite 260, Gaithersburg, MD 20879 or info@shuttlepharma.com.

You also may access these filings on our website at www.shuttlepharma.com. We do not incorporate the information on our website into this prospectus supplement or the accompanying prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus supplement or the accompanying prospectus (other than those filings with the SEC that we effectedspecifically incorporate by reference into this prospectus supplement and the accompanying prospectus)

| 11 |

WHERE YOU CAN FIND MORE INFORMATION

We have filed a 2-for-1 reverse stock splitregistration statement on Form S-1 with the SEC under the Securities Act of 1933, as amended. This prospectus is part of the registration statement, but the registration statement includes additional information and exhibits. We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information regarding companies, such as ours, that file documents electronically with the SEC. The website address is www.sec.gov. The information on the SEC’s website is not part of this prospectus, and any references to this website or any other website are inactive textual references only.

| 12 |

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING