As filed with the Securities and Exchange Commission on June 13, 2022August 10, 2023

Registration No. 333-262639333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1/AS-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

GROM SOCIAL ENTERPRISES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Florida | 7370 | 46-5542401 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

2060 NW Boca Raton Blvd.,Suite #6

Boca Raton,, Florida33431

(561) (561) 287-5776

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Darren Marks

Chief Executive Officer

Grom Social Enterprises, Inc.

2060 NW Boca Raton Blvd., Suite #6

Boca Raton, Florida 33431

(561) 287-5776

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Please send copies of all communications to:

Joseph M. Lucosky, Esq. Soyoung Lee, Esq. Lucosky Brookman LLP

| Ross D. Carmel, Esq. Philip Magri, Esq. Carmel, Milazzo & Feil LLP 55 W 39th Street, 4th Floor New York, NY 10018 Tel: 212-658-0458 Fax: 646-838-1314 |

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”,filer,” “accelerated filer”,filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED |

Up to [ ] Units

Each Unit consisting of:

3,544,423 SharesOne share of Common Stock

One Series A Warrant to purchase one share of Common Stock

One Series B Warrant to purchase one share of Common Stock

Up to [ ] Pre-Funded Units

Each Pre-Funded Unit consisting of:

One Pre-Funded Warrant purchase one share of Common Stock

One Series A Warrant to purchase one share of Common Stock

One Series B Warrant to purchase one share of Common Stock

Shares of Common Stock Underlying Series A Warrant and Series B Warrant and

Shares of Common Stock Underlying the Pre-Funded Warrants

GROM SOCIAL ENTERPRISES, INC.

This prospectus relates

We are offering in a firm commitment underwritten offering up to the resale, from time to time, by the selling stockholder named herein[ ] units (the “Selling Stockholder”“Units”) of, each Unit consisting of: (i) an aggregateone share of 3,240,741 shares of our common stock, par value $0.001 per share issuable upon the conversion of certain outstanding convertible promissory notes(the “Common Stock”); and (ii) One Series A Warrant, each Series A Warrant to purchase one share of Common Stock (“Series A Warrant”); and aggregate(iii) One Series B Warrant, each Series B Warrant to purchase one share of 303,682 shares of common stock issuable upon exercise of certain outstanding warrants (theCommon Stock, (“Series B Warrant,” together with Series A Warrant, the “Warrants”). Each Warrant is exercisable at an exercise price of $[ ] per share ([ ]% of the offering price per Unit). The Warrants will be immediately exercisable from the date of issuance and will expire five (5) years after the date of issuance. We are offering each Unit at an assumed public offering price of $[ ] per Unit.

We are not sellingalso offering the opportunity to purchase, if the purchaser so chooses and in lieu of Units, up to [ ] pre-funded units (the “Pre-Funded Units”) to purchasers whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following the consummation of this offering. Each Pre-Funded Unit consists of: (i) one pre-funded warrant exercisable for one share of Common Stock (the “Pre-Funded Warrants”); (ii) one Series A Warrant; and (iii) one Series B Warrant. The purchase price of each Pre-Funded Unit is equal to the price per Unit being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-Funded Warrant included in the Pre-Funded Unit is $0.001 per share. The Pre-Funded Warrants will be immediately exercisable and may be exercised at any securities under this prospectus andtime until all of the Pre-Funded Warrants are exercised in full.

For each Pre-Funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. Because we will issue one Series A Warrant and one Series B Warrant as part of each Unit or Pre-Funded Unit, the number of Series A Warrants and Series B Warrants sold in this offering will not receive proceeds fromchange as a result of a change in the salemix of the shares of our common stock byUnits and Pre-Funded Units sold.

We are also registering the Selling Stockholder. However, we may receive proceedsCommon Stock issuable from the cashtime to time upon exercise of the Warrants which, if exercisedand Pre-Funded Warrants included in cash at the current applicable exercise price with respect to allUnits and Pre-Funded Units offered hereby. See “Description of the 303,682 shares of common stock, would result in gross proceeds to us of approximately $[1,275,464].

We will pay the expenses of registering the shares of common stock offered by this prospectus, but all selling and other expenses incurred by the Selling Stockholder will be paid by the Selling Stockholder. The Selling Stockholder may sell our shares of common stock offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means describedSecurities” in this prospectus under “Plan of Distribution.” The prices at which the Selling Stockholder may sell shares will be determined by the prevailing market price for our common stock or in negotiated transactions.more information.

Our common stockCommon Stock is quotedlisted on The Nasdaq Capital Market, or Nasdaq,“Nasdaq,” under the symbol “GROM.” On May 17, 2022August [ ], 2023, the last reported sale price for our common stockCommon Stock on Nasdaq was $0.60.$[ ] per share.

The Units and the Pre-Funded Units have no stand-alone rights and will not be issued or certificated. The shares of Common Stock or Pre-Funded Warrants, as the case may be, and the Warrants can only be purchased together in this offering but the securities contained in the Units or Pre-Funded Units will be issued separately. There is no established public trading market for the Units, Pre-Funded Units, Warrants or Pre-Funded Warrants and we do not expect markets to develop. Without an active trading market, the liquidity of these securities will be limited. In addition, we do not intend to list these securities on Nasdaq, any other national securities exchange or any other trading system.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 139 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Per Pre-Funded Unit | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriter fees (1) | $ | $ | $ | |||||||||

| Proceeds to us, before expenses (2) | $ | $ | $ | |||||||||

____________________

| (1) | We have agreed to reimburse EF Hutton, division of Benchmark Investments, LLC, the representative of the underwriters in this offering (the “Representative”) for certain of its offering-related expenses. See “Underwriting” for additional information and a description of the compensation payable to the Underwriter. |

| (2) | We estimate the total expenses of this offering payable by us, excluding the underwriter fee, will be approximately $[ ]. |

We have granted a 45-day option to the underwriters to purchase up to [ ] shares of Common Stock and/or Pre-Funded Warrants to purchase [ ] shares of Common Stock and/or Warrants to purchase [ ] shares of Common Stock solely to cover over-allotments, if any, less underwriting discounts and commissions.

We anticipate that delivery of the securities against payment will be made on or about _____, 2023.

Sole book-runner

EF Hutton

division of Benchmark Investments, LLC

The date of this prospectus is _______________, 2022.2023.

GROM SOCIAL ENTERPRISES, INC.

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). You should read this prospectus and the information and documents incorporated herein by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find Additional Information” and “Incorporation of Certain Documents by Reference” in this prospectus.

You should rely only on the information contained in or incorporated by reference into this prospectus. Neither we nor the selling stockholder named herein (the “Selling Stockholder”)We have not authorized anyone to provide you with information different from, or in addition to, that contained in or incorporated by reference into this prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference into this prospectus is current only as of their respective dates or on the date or dates that are specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

The Selling Stockholder are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither we nor the Selling Stockholder have done anything that would permit this offering (the “Offering”) or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe any restrictions relating to this Offering and the distribution of this prospectus applicable to that jurisdiction.

If required, each time the Selling Stockholder offer shares of common stock, we will provide you with, in addition to this prospectus, a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize the Selling Stockholder to use one or more free writing prospectuses to be provided to you that may contain material information relating to that offering. We may also use a prospectus supplement and any related free writing prospectus to add, update or change any of the information contained in this prospectus or in documents we have incorporated by reference. This prospectus, together with any applicable prospectus supplements, any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this prospectus and any prospectus supplement together with the additional information described below under the section entitled “Incorporation of Certain Documents by Reference” before buying any of the securities offered.

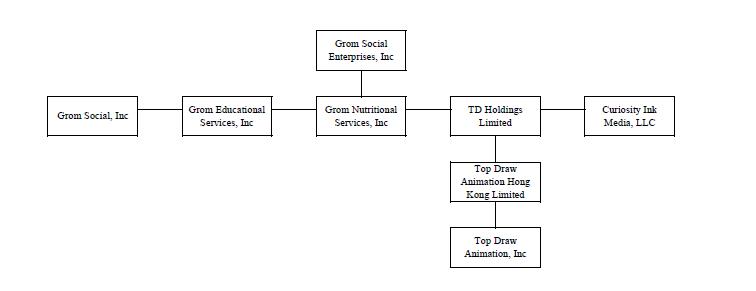

Unless the context otherwise requires, the terms “the Company,” “we,” “us” and “our” refer to Grom Social Enterprises, Inc. and our subsidiaries.following operating subsidiaries: Grom Social, Inc., TD Holdings Limited, Grom Educational Services, Inc., Grom Nutritional Services, Inc. and Curiosity Inc Media, LLC.

Unless otherwise indicated, information contained in this prospectus or incorporated by reference herein concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

| 1 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

When used in this prospectus, including the documents that we have incorporated by reference, in future filings with the SEC or in press releases or other written or oral communications, statements which are not historical in nature, including those containing words such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters, are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our trends, liquidity and capital resources, among others, contain forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Examples of forward-looking statements include, but are not limited to, statements about the following:

| our ability to continue as a going concern; | ||

| · | our prospects, including our future business, revenues, expenses, net income, earnings per share, gross margins, profitability, cash flows, cash position, liquidity, financial condition and results of operations, our targeted growth rate and our goals for future revenues and earnings; |

| the potential impact of COVID-19 on our business and results of operations; |

| the effects on our business, financial condition and results of operations of current and future economic, business, market and regulatory conditions; |

| Our ability to regain compliance with Nasdaq’s $1.00 minimum bid requirement under Nasdaq Listing Rule 5550(a)(2), and to maintain our compliance with other Nasdaq continued listing requirements; | ||

| · | the effects of fluctuations in sales on our business, revenues, expenses, net income, earnings per share, margins, profitability, cash flows, capital expenditures, liquidity, financial condition and results of operations; |

| our products and services, including their quality and performance in absolute terms and as compared to competitive alternatives, and their ability to meet our customers’ requirements, and our ability to successfully develop and market new products, services, technologies and systems; |

| our markets, including our market position and our market share; |

| our ability to successfully develop, operate, grow and diversify our operations and businesses; |

| our business plans, strategies, goals and objectives, and our ability to successfully achieve them; |

| our ability to maintain, protect, and enhance our brand and intellectual property; |

| the sufficiency of our capital resources, including our cash and cash equivalents, funds generated from operations, availability of borrowings under our credit and financing arrangements and other capital resources, to meet our future working capital, capital expenditure, lease and debt service and business growth needs; |

| the value of our assets and businesses, including the revenues, profits and cash flows they are capable of delivering in the future; |

| the effects on our business operations, financial results, and prospects of business acquisitions, combinations, sales, alliances, ventures and other similar business transactions and relationships; |

| industry trends and customer preferences and the demand for our products and services; and |

| the nature and intensity of our competition, and our ability to successfully compete in our markets. |

| 2 |

These statements are necessarily subjective, are based upon our current plans, intentions, objectives, goals, strategies, beliefs, projections and expectations, and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly-available information with respect to the factors upon which our business strategy is based, or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that may cause actual results, our performance or achievements, or industry results to differ materially from those contemplated by such forward-looking statements include, without limitation, those discussed under the caption “Risk Factors"“Risk Factors” in this prospectus as well as other risks and factors identified from time to time in our SEC filings.

| 3 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock.Common Stock. We urge you to read this entire prospectus and the documents incorporated by reference herein carefully, including the financial statements and notes to those financial statements incorporated by reference herein and therein. Please read the section of this prospectus entitled “Risk Factors”“Risk Factors” for more information about important risks that you should consider before investing in our common stock.Common Stock. All share and per share information in this prospectus reflects the reverse stock split of our outstanding Common Stock at a ratio of 1-for-[ ] effected on [ ], 2023 unless noted otherwise.

Overview

We were incorporated in the State of Florida on April 14, 2014 as Illuminationunder the name “Illumination America, Inc. We changed our name to Grom Social Enterprises, Inc. on”

On August 17, 2017, in connection with our acquisition ofwe acquired Grom Holdings, Inc., a Delaware corporation (“Grom Holdings”).

Effective August 17, 2017, we acquired Grom Holdings, pursuant to the terms of a share exchange agreement (the “Share Exchange Agreement”) entered into on May 15, 2017 (the “Share Exchange”). In connection with the Share Exchange, the Company issuedacquired 100% of the outstanding shares of capital stock of Grom Holdings from Grom Holdings’ stockholders in exchange for an aggregate of 3,464,184115,473 shares of its common stock to the Grom Holdings stockholders, pro rata to their respective ownership percentage of Grom Holdings. EachCommon Stock, par value $0.001 per share, of Grom Holdings was exchanged for approximately 0.1303 shares of our common stock.the Company. As a result of the Share Exchange, the stockholders of Grom Holdings ownedacquired approximately 92% of the Company’s issuedthen-issued and outstanding shares of common stock at such time.Common Stock and Grom Holdings became a wholly-owned subsidiary of the Company. In connection with the Share Exchange, on August 17, 2017, we changed our name to Grom Social Enterprises, Inc.

We are a media, technology and entertainment company that focuses on (i) delivering content to children under the age of 13 years in a safe secure platform that is compliant with the Children’s Online Privacy Protection Act (“COPPA”) and can be monitored by parents or guardians, (ii) creating, acquiring, and developing the commercial potential of Kids & Family entertainment properties and associated business opportunities, (iii) providing world class animation services, and (iv) offering protective web filtering solutions to block unwanted or inappropriate content. We conduct our business through our five operatingfollowing subsidiaries:

| · | Grom Social, Inc. (“Grom Social”), incorporated in the State of Florida on March 5, 2012, operates our social media network designed for children under the age of 13 years. |

| · | TD Holdings Limited (“TD Holdings”), incorporated in Hong Kong on September 15, 2005, operates through its two wholly-owned subsidiaries: (i) Top Draw Animation Hong Kong Limited, a Hong Kong corporation (“Top Draw HK”), and (ii) Top Draw Animation, Inc., a Philippines corporation (“Top Draw Philippines”). The group’s principal activities are the production of animated films and |

| · | Grom Educational Services, Inc. (“GES”), incorporated in the State of Florida on January 17, 2017, operates our web filtering services provided to schools and government agencies. |

| · | Grom Nutritional Services, Inc. (“GNS”), incorporated in the State of Florida on April 19, 2017, intends to market and distribute nutritional supplements to children. GNS has been nonoperational since its inception. |

| · | Curiosity Ink Media, LLC (“CIM”), organized in the State of Delaware on January 5, 2017, develops, acquires, builds, grows and maximizes the short, mid and long-term commercial potential of kids and family entertainment properties and associated business opportunities. |

We own 100% of each of Grom Social, TD Holdings, GES and GNS, and 80% of CIM.

| 4 |

Recent Developments

Reverse Stock SplitPIPE Offering and Related Waiver

On April 7, 2021, our board of directorsJanuary 25, 2023, we consummated a private placement (the “Board”“PIPE Offering”) approved, and, on April 8, 2021, our shareholders approved, a reverse stock split at a ratio of no less than 1-for-2 and no more than 1-for-50. On May 6, 2021,pursuant to the Board fixed the ratio for a reverse stock split at 1-for-32, and, on May 7, 2021, we filed a certificate of amendment to our articles of incorporation with the Secretary of Stateterms of the State of Florida to effect the reverse stock split, which became effectiveSecurities Purchase Agreement dated as of May 13, 2021. Our common stock began being quoted on the OTCQB on a post-reverse split basis on May 19, 2021.

Listing on the Nasdaq Capital Market

On June 17, 2021, our common stock and registeredJanuary 25, 2023 (the “2023 SPA”) that we entered into with institutional investors, in which we issued (i) 100,000 shares of Common Stock; (ii) 100,000 purchase warrants began trading on the Nasdaq Capital Market under the symbols “GROM” and “GROMW,” respectively.

Registered Offering

On June 21, 2021 (in this case, the “Closing Date”(the “Purchase Warrants”), we sold to purchase an aggregate of 2,409,639 units175,000 shares of Common Stock; and (iii) 1,227,434 pre-funded warrants (the “Units”“Pre-Funded Warrants”), at a to purchase an aggregate of 2,148,010 shares of Common Stock. The purchase price of each share of Common Stock and associated Purchase Warrant was $2.26. The purchase of each share of Common Stock and associated Pre-funded Warrant was $2.25. The aggregate gross proceeds of the PIPE Offering was approximately $3 million, before deducting fees to the public of $4.15 per Unit (the “Underwritten Offering”), each Unit consisting of one share of common stockplacement agent and a warrant to purchase one share of common stock at an exercise price of $4.565 per share pursuant to an underwriting agreement, dated as of June 16, 2021 (the “Underwriting Agreement”), between us andother expenses payable by us. EF Hutton, division of Benchmark Investments, LLC, acted as representative (the “EF Hutton”) of the several underwriters named in the Underwriting Agreement. In addition, pursuant to the Underwriting Agreement, we granted EF Hutton a 45-day option to purchase up to 361,445 additional Units of common stock and warrants, to cover over-allotmentsexclusive placement agent in connection with the Offering, which EF Hutton exercised with respect to warrants exercisable for up to an additional 361,445 shares on the Closing Date.PIPE Offering.

The sharesIn connection with the PIPE Offering, we entered into a Waiver (the “Waiver”) with L1 Capital Global Opportunities Master Fund (“L1”) waiving certain provisions of the Securities Purchase Agreement dated as of September 14, 2021 (the “2021 SPA”), by and the warrants were offeredbetween us and soldL1. Pursuant to the public pursuantterms of the Waiver, L1 waived certain provisions of the 2021 SPA and in consideration thereof, we (i) issued 150,000 purchase warrants substantially similar to our registration statement on Form S-1, as amended (File No. 333-253154), filed by usthe Purchase Warrants issued in connection with the SEC under the Securities Act, which became effective on June 16, 2021.

On the Closing Date, we received gross proceeds2023 SPA; and (ii) paid a cash fee of approximately $10,000,000, before deducting underwriting discounts and commissions of 8% of the gross proceeds and estimated offering expenses. We are using the net proceeds from the Underwritten Offering primarily for sales and marketing activities, product development, acquisition of, or investment in, technologies, solutions, or businesses that complement our business, and for working capital and general corporate purposes.$50,000 to L1.

Pursuant to the Underwriting2023 SPA, we are obligated to hold a special stockholders’ meeting no later than 60 days following the date of the Purchase Agreement we issued to EF Hutton five-year warrants to purchase up to 144,578 shares (6%solicit the approval of the issuance of the shares, soldWarrants and the shares of Common Stock underlying the Warrants in compliance with the rules of The Nasdaq Stock Market LLC (without regard to any limitations on exercise set forth in the Underwritten Offering),Warrants or the Prefunded Warrants). On March 27, 2023 we held a special meeting of stockholders and the stockholders approved the PIPE Offering.

In connection with the PIPE Offering, we entered into a Registration Rights Agreement with the Purchasers, dated January 25, 2023 (the “Registration Rights Agreement”). The Registration Rights Agreement provides that we shall file a registration statement covering the resale of all of the Registrable Securities (as defined in the Registration Rights Agreement) with the SEC. The Registration Statement was filed and declared effective by the SEC on February 9, 2023.

Notice of Delisting of Failure to Satisfy a Continued Listing Rule or Standard

On April 10, 2023, we received a deficiency letter (the “Notice”) from the Closing Date. EF Hutton’s warrantsListing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq Stock Market”) notifying us that, based upon the closing bid price of our Common Stock, for the last 30 consecutive business days, we are exercisable at $4.15not currently in compliance with the requirement to maintain a minimum bid price of $1.00 per share and are subject to a lock-up for 180 days from the commencement of salescontinued listing on Nasdaq as set forth in the Underwritten Offering, including a mandatory lock-up period in accordance with FINRANasdaq Listing Rule 5110(e)5550(a)(2) (the “Minimum Bid Requirement”).

The total expensesNotice has no immediate effect on the continued listing status of our Common Stock on Nasdaq, and, therefore, our listing remains fully effective.

We are provided a compliance period of 180 calendar days from the date of the Underwritten Offering were approximately $1,162,738, which includedNotice, or until October 9, 2023, to regain compliance with Nasdaq Listing Rule 5550(a)(2). If at any time before October 9, 2023, the underwriting discountsclosing bid price of our Common Stock closes at or above $1.00 per share for a minimum of 10 consecutive business days, subject to Nasdaq’s discretion to extend this period pursuant to Nasdaq Listing Rule 5810(c)(3)(H), Nasdaq will provide written notification that we have achieved compliance with the Minimum Bid Requirement, and commissions and EF Hutton’s reimbursable expenses relating to the Underwritten Offering.matter would be resolved.

On July 15, 2021, EF Hutton exercised in fullIf we do not regain compliance with the over-allotment optionMinimum Bid Requirement during the initial 180 calendar day compliance period, we may be eligible for an additional 180 calendar day compliance period. To qualify, we would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq, with respect to all 361,445 additional shares. After giving effect to the full exerciseexception of the over-allotment option,Minimum Bid Requirement, and would need to provide written notice of our intention to cure the total number of Units solddeficiency during the second compliance period, by us in the Underwritten Offering was 2,771,084, for total gross proceeds to us of approximately $11,500,000, before deducting underwriting discounts and commissions and other offering expenses payable by us.

effecting a reverse stock split, if necessary.

| 5 |

We intend to actively monitor the closing bid price of our Common Stock and will evaluate available options to regain compliance with the Minimum Bid Requirement On [ ], 2023 the Board effected a 1-for-[ ] reverse stock split in connection with this offering and our continued listing of our Common Stock on Nasdaq. However, there can be no assurance that we will regain compliance with the Minimum Bid Requirement during the initial or additional 180 calendar day compliance period, secure the additional 180 calendar day compliance period, or maintain compliance with the other Nasdaq listing requirements. If we do not regain compliance with the Minimum Bid Requirement within the allotted compliance periods, including any extensions that may be granted by Nasdaq, Nasdaq will provide notice that our Common Stock will be subject to delisting. We would then be entitled to appeal that determination to a Nasdaq hearings panel.

If our Common Stock ceases to be listed for trading on Nasdaq, we expect that the Common Stock would be traded on one of the three tiered marketplaces of the OTC Markets Group.

Curiosity AcquisitionReverse Stock Split

On July 29, 2021, we entered into a membership interest purchase agreement (in this case,June 23, 2023, our Board and shareholders approved the “Purchase Agreement”) with CIM, and the holdersgranting of all of CIM’s outstanding membership interests (the “Sellers”), for the purchase of 80% of CIM’s outstanding membership interests (the “Purchased Interests”) from the Sellers (the “Acquisition).

On August 19, 2021, pursuantauthority to the termsBoard to amend our articles of incorporation to effect a reverse stock split of the Purchase Agreement, we consummated the Acquisitionissued and acquired the Purchased Interests in consideration for the issuance to the Sellers of an aggregate of 1,771,883 shares of our common stock to the Sellers, pro rata to their membership interests immediately prior to the closing of the Acquisition. The shares were valued at $2.82 per share which represents to the 20-day volume-weighted average price of our common stock on August 19, 2021.

Pursuant to the Purchase Agreement, the Company also paid $400,000 and issued an 8% eighteen-month convertible promissory note in the principal amount $278,000 (the “Note”) to pay-down and refinance certain outstanding loans and advances previously made to CIM by two of the Sellers, Russell Hicks and Brett Watts.

The Note is convertible into shares of our common stock at a conversion price of $3.28 per share, but may not be converted if, after giving effect to such conversion, the noteholder and its affiliates would beneficially own in excess of 9.99% of our outstanding common stock. The Note may be prepaid at any time, in whole or in part. The Note is subordinate to our senior indebtedness.

The Sellers also have the ability to earn up to $17,500,000 (payable 50% in cash and 50% in stock) upon the achievement of certain performance milestones as of December 31, 2025.

Separation Agreement and Departure of Director

On July 26, 2021, Melvin Leiner resigned as Chief Financial Officer, Secretary and Treasurer of the Company. Mr. Leiner remains the Company’s Executive Vice President and Chief Operating Officer, and a director.

On July 26, 2021, effective immediately upon Mr. Leiner’s resignation, Jason Williams was appointed the Company’s Chief Financial Officer, Secretary and Treasurer.

On April 22, 2022, we entered into an Executive Separation Agreement with Melvin Leiner (the “Separation Agreement”), pursuant to which Mr. Leiner retired from his positions as our Executive Vice President and Chief Operating Officer. Pursuant to the Separation Agreement, Mr. Leiner’s employment with us ended on April 22, 2022 and Mr. Leiner is to receive separation payments over a 9 month period equal to his base salary, as well as certain limited health benefits.

In accordance with the Separation Agreement, we will pay to Mr. Leiner the sum of $236,250 in biweekly installments over the 9 month period beginning on our first regular pay period after April 22, 2022 and ending on January 13, 2023. The Separation Agreement also contains non-disparagement covenants and a mutual release of claims by the parties thereto.

On the same day, Mr. Leiner resigned from our Board of Directors, effectively immediately. Mr. Leiner did not resign as a result of any disagreement with us on any matter relating to our operations, policies or practices.

Payoff of TDH Sellers Notes

On August 18, 2021, the Company paid the holders of certain secured promissory notes (the “TDH Secured Notes”) an aggregate of $834,759.77, representing all remaining amounts due and payable under the TDH Secured Notes. Upon receipt of such payment by the holders of the TDH Secured Notes, the pledged shares of TDH Holdings and its subsidiary, Top Draw HK were released from escrow, and the holders of the TDH Secured Notes had no further security interest in the assets of the Company or its subsidiaries.

L1 Capital Financing

Closing of First Tranche

On September 14, 2021, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with L1 Capital Global Opportunities Master Fund (“L1 Capital”), pursuant to which it sold L1 Capital (i) a 10% Original Issue Discount Senior Secured Convertible Note in the principal amount of $4,400,000, due March 13, 2023 (the “Original Note”), and (ii) a five-year warrant to purchase 813,278 shares of our common stock at an exercise price of $4.20 per share (the “Original Warrant”), for consideration of $3,960,000 (the “First Tranche”).

EF Hutton acted as exclusive placement agent for the offering and received a fee of $316,800.

The Original Note is convertible into common stock at a rate of $4.20 per share (the “Conversion Price”), and is repayable in 18 equal monthly installments, in cash, or, at our discretion, and if the Equity Conditions described below are met, by issuance of shares of common stock at a price equal to 95% of the volume weighted average price (“VWAP”) prior to the respective monthly redemption dates (with a floor of $1.92), multiplied by 102% of the amount due on such date. In the event that the 10-day VWAP drops below $1.92, we will have the right to pay in shares of common stock at said VWAP, with any shortfall to be paid in cash. The Conversion Price may be adjusted in the event of dilutive issuances but in no event to less than $0.54. In addition, under the terms of the Original Note, L1 Capital had the right to accelerate up to 3 of the monthly payments. Neither the Company, nor L1 Capital, may convert any portion of the Original Note to the extent that, after giving effect to such conversion, L1 Capital (together with any affiliated parties) would beneficially own in excess of 4.99% of our outstanding common stock.

The Equity Conditions required to be met in order for us to redeem the Original Note with shares of common stock in lieu of a monthly cash payment, include, without limitation, that (i) a registration statement must be in effect with respect to the resale of the shares issuable upon conversion or redemption of the Original Note (or, that an exemption under Rule 144 is available), and (ii) that the average daily trading volume of our common stock will be at least $250,000 immediately prior to the date of the monthly redemption.

The Original Warrant has the same anti-dilution protection as the Original Note and same adjustment floor. The Original Warrant is exercisable for cash, or on a cashless basis only for so long as no registration statement covering resale of the shares is in effect. L1 Capital shall not have the right to exercise any portion of the Original Warrant to the extent that, after giving effect to such exercise, L1 Capital (together with any affiliated parties), would beneficially own in excess of 4.99% of our outstanding common stock.

We entered into a Security Agreement with L1 Capital pursuant to which L1 Capital was granted a security interest in all of the assets of Grom and certain of its subsidiaries. As further inducement for L1 Capital to enter into the Security Agreement, certain of our pre-existing secured creditors agreed to give up their exclusive senior security interest in the assets of TD Holdings, in exchange for a shared senior secured interest with L1 Capital on a pari pasu basis on all of our assets. Repayment of the Note is also guaranteed by certain subsidiaries of Grom pursuant to a subsidiary guaranty.

We agreed to file a registration statement with the SEC within 35 days of the closing of the First Tranche registering all First Tranche Conversion Shares and First Tranche Warrant Shares for resale, to go effective no later than 75 days after the closing of the First Tranche.

The Purchase Agreement also contemplated the purchase by L1 Capital (the “Second Tranche”) of an additional 10% Original Issue Discount Senior Secured Convertible Note in the principal amount of $1,500,000, and warrants to purchase approximately 277,000 shares (presuming current market prices) of common stock on identical terms to the Original Note and Warrant, subject to, and upon receipt of, shareholder approval under Nasdaq rules and effectiveness of a registration statement covering the resale of the shares issuable under the Original Note and Warrant issued in the First Tranche.

Amendment to Purchase Agreement and Original Note

On October 20, 2021, we entered into an Amended and Restated Purchase Agreement with LI Capital (the “Amended Purchase Agreement”), pursuant to which the amount of the proposed Second Tranche investment was increased from $1,500,000 to $6,000,000. In the event that the conditions to closing the Second Tranche investment are satisfied, we intend on issuing (i) a 10% Original Issue Discount Senior Secured Convertible Note in the principal amount of $6,000,000 (the “Additional Note”), identical to the Original Note, but due 18 months from the closing of the Second Tranche, and (ii) a five-year warrant to purchase 1,041,194 at an exercise price of $4.20 per share (the “Additional Warrant”), for consideration of $5,400,000.

The closing of the Second Tranche is subject to a registration statement being declared effective by the SEC covering the shares issuable upon conversion or redemption of the Original Note and Original Warrant, shareholder consent being obtained as required by Nasdaq Rule 5635(d), and a limitation on the principal amount of notes that may be issued to no more than 30% of the Company’s market capitalization as reported by Bloomberg L.P., which requirement may be waived by L1 Capital.

The conversion and redemption terms, as well as all other material terms of the Additional Note, and exercise price of terms of the warrants to be issued in the Second Tranche, are identical in all other material respects as the originally issued note and warrants, except for the amendments provided herein.

As of October 20, 2021, and as part of the terms of the Amended Purchase Agreement, the Original Note was amended (the “Amended Original Note”) to increase the monthly redemption amount for the 18 monthly installments from $275,000 to $280,500. In addition, the Amended Original Note provides that, in the event that the Second Tranche closes, the Equity Conditions required to be satisfied in order for us to elect to make monthly note payments by issuance of common stock in lieu of cash (and in addition to the requirement that a registration statement is in effect or an exemption exists) the average trading volume of our common stock must be at least $550,000 (increased from $250,000) during the five trading days prior to the respective monthly redemption. Except as described above, the other terms of the Original Note as previously disclosed remain in full force and effect. In addition, if the Second Tranche is consummated, L1 Capital will have the right to accelerate up to 6 of the monthly payments as opposed to just 3.

Closing of Second Tranche

On January 20, 2022 (the “Second Tranche Closing”) we closed on the Second Tranche of the offering with L1 Capital, resulting in the issuance of (i) a $1,750,000 10% Original Issue Discount Senior Secured Convertible Note, due July 20, 2023, (the “Second Tranche Note”); and (ii) a five year warrant to purchase 303,682 shares of our Common Stock, at an exercise priceby a ratio of $4.20 per share (the “Second Tranche Warrants”), in exchange for consideration of $1,575,000 (i.e. the face amountno less the 10% Original Issue Discount of $175,000).

In connectionthan 1-for-2 and no more than 1-for-20, with the Second Tranche Closing,exact ratio to be determined by the Company paid to EF Hutton a fee of $126,000.

The Second Tranche Note is convertible into our common stock at a rate of $4.20 per share (the “Conversion Price”) into 416,667 shares of common stock (the “Second Tranche Conversion Shares”) and, is repayableBoard in equal monthly installments of $111,563 commencing on the date that the SEC declares a registration statement with respect to the resale of such shares effective, with all remaining amounts due on July 20, 2023. The Second Tranche Note is repayable by payment of cash, or, at ourits sole discretion, and if the below listed “Equity Conditions” are met, by issuance of shares of the commonwith such reverse stock at a price of 95% of the lowest daily VWAP during the ten-trading day period priorsplit to the respective monthly redemption dates (with a floor of $1.92) multiplied by 102% of the amount due on such date. In the event that the ten-trading day VWAP drops below $1.92 we will have the right to pay in stockbe effective at such ten-trading day VWAP with any shortfall paidtime and date, if at all, as determined by the Board in cash. The Conversion Price may be adjusted in the event of dilutive issuances but in no event to less than $0.54 (the “Monthly Conversion Price”).

If we elect to repay the entire Second Tranche Note by issuance of shares, presuming recent stock prices, an aggregate of approximately 3,240,741 shares may be issued over 14 months plus interest.

Our right to make monthly payments in stock in lieu of cash for the Second Tranche Note is conditioned on certain conditions (the “Equity Conditions”). The Equity Conditions required to be met each month in order to redeem the Second Tranche Note with stock in lieu of a monthly cash payment, among other conditions set forth therein, include without limitation, that a registration statement be in effect with respect to the resale of the shares issuable upon conversion or redemption of the Second Tranche Note (or, that an exemption under Rule 144 is available), that no default be in effect, that the average daily trading volume of ourstock would have to be at least $550,000 during the five trading days prior to the respective monthly redemption and that the outstanding principal amounts of the First Tranche Note and Second Tranche Note combined, shall not exceed 30% of the market capitalization of our Common Stock as reported on Bloomberg L.P., which percentage is subject to increase by LI Capital at its sole discretion.

Other provisionsThe reverse stock split would not have any impact on the number of the Second Tranche Note,authorized shares of Common Stock which is similar in terms to the First Tranche Note, include that the Second Tranche Note Conversion Price is subject to full anti-dilution price protectionsremains at 500,000,000 shares. Unless otherwise noted, and other than in the eventfinancial statements and the notes thereto, the share and per share information in this prospectus reflects the proposed reverse stock split of financings that are below the Conversion Price withour outstanding Common Stock at a floorratio of $0.54.1-for-[ ].

In the event of an Event of Default as defined in the notes, if the stock price is below the Conversion Price at the time of default and only for so long as a default is continuing, the Second Tranche Notes would be convertible at a rate of 80% of the lowest VWAP in the ten prior trading days, provided, that if the default is cured the default conversion rate elevates back to the normal Conversion PriceStrategic Partnership

As part of the Second Tranche Closing, the Company issued Second Tranche Warrants exercisable for five years from the date of issuance, at $4.20 per share which carry the same anti-dilution protection as the Second Tranche Notes, subjectWe continue to the same adjustment floor. The Second Tranche Warrants are exercisable via cashless exercise only for so long as no registration statement covering resale of the shares is in effect.

The Company is requiredevaluate strategic acquisition opportunities to file a registration statement with the SEC which shall be declared effective on or prior to 75 days the closing of the Second Tranche.

The Second Tranche Note continues to be subject to (i) the repaymenthelp accelerate our growth and performance guarantees by the subsidiaries of the Company pursuant to a subsidiary guaranty and, (ii) the Security Agreement pursuant to which the LI Capital was granted a security interest in all of the assets of the Company and certain of its subsidiaries, each ascomplement our existing business. We recently entered into in connectiona strategic advisory partnership with an association of churches to achieve the First Tranche closing on September 14, 2021.

Risks Associated With Our Business

Our business is subjecthighest possible social impact by utilizing all metrics available for values-based investors, including a biblically responsible investing (or “BRI”) score for us and our operations. Once we have established a rating, together we will create a program to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the section of this prospectus titled “Risk Factors,” which begins on page 10 of this prospectusincrease our exposure and includes:market our services to their member organizations and other affiliates.

Our Corporate Information

Our principal executive offices are located at 2060 NW Boca Raton, Suite #6, Boca Raton, Florida 33431. Our telephone number is (561) 287-5776. Our website address is www.gromsocial.com. Information contained in, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

Emerging GrowthSmaller Reporting Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). We will remain an emerging growth company until the earlier of (i) December 31, 2022, the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before December 31, 2022. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

For as long as we continue to be an emerging growth company, we expect that we will take advantage of the reduced disclosure obligations available to us as a result of that classification. We have taken advantage of certain of those reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

The Offering

| Warrants offered by us: | Series A Warrants to purchase an aggregate of up to [ ] shares of our Common Stock, subject to adjustment as set forth therein. Each share of Common Stock and each Pre-Funded Warrant to purchase one Common Stock is being issued together with a Series A Warrant to purchase one share of our Common Stock. Each Series A Warrant will have an exercise price of $[ ] per share (representing [ ]% of the offering price per Unit), will be immediately exercisable from the date of issuance and will expire on the fifth anniversary of the original issuance date. Each Series A Warrant is exercisable for one Common Stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our Common Stock. On or after the thirty (30) day anniversary of the date of issuance, a holder of the Series A Warrant may also provide notice and elect an “alternative cashless exercise” on or after the earlier of the thirty day anniversary of the date of the initial exercise date. In such event, the aggregate number of warrant shares issuable in such alternative cashless exercise shall equal the product of (x) the aggregate number of Series A Warrant shares that would be issuable upon exercise of the Series A Warrant if such exercise were by means of a cash exercise rather than a cashless exercise and (y) 0.50. Series B Warrant to purchase an aggregate of up to [ ] shares of our Common Stock, subject to adjustment as set forth therein. Each Common Stock and each pre-funded warrant to purchase one share of Common Stock is being issued together with a Series B Warrant to purchase for one share of our Common Stock. Each Series B Warrant will have an exercise price of $[ ] per share (representing [ ]% of the offering price per Unit), will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. Each Series B Warrant is exercisable for one share of Common Stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our Common Stock. [Subject to certain exemptions outlined in the Warrants, if we sell, enter into an agreement to sell, or grant any option to purchase, or sell, enter into an agreement to sell, or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any shares of Common Stock or Common Stock Equivalents (as defined in the Warrant), at an effective price per share less than the exercise price of the Warrant then in effect, the exercise price of the Warrant shall be reduced to equal the effective price per share in such dilutive issuance; provided however in no event shall the exercise price of the Warrant be less than [ ]. The Common Stock and Pre-Funded Warrants, and the accompanying Warrants, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates to the offering of the Common Stock issuable upon exercise of the Warrants. |

| 7 |

| Common Stock outstanding prior to this offering: | 8,992,861 shares | |

| Common | ||

| Use of Proceeds: | We | |

| Risk Factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section on page | |

| Trading | Our | |

| Reverse Stock Split: | On June 23, 2023 our Board and shareholders approved the granting of authority to the Board to amend our articles of incorporation to effect a reverse stock split of the issued and outstanding shares of our Common Stock, by a ratio of no less than 1-for-2 and no more than 1-for-20, with the exact ratio to be determined by the Board in its sole discretion, and with such reverse stock split to be effective at such time and date, if at all, as determined by the Board in its sole discretion. On [ ], 2023 the Board effected a 1-for-[ ] reverse stock split in connection with this offering and our continued listing of our Common Stock on Nasdaq. Unless noted otherwise, the share and per share information in this prospectus gives effect to the 1-for-[ ] reverse stock split, with fractional shares resulting from the reverse stock split being rounded up to the nearest whole number. |

(1) The shares of common stockCommon Stock outstanding and the shares of common stockCommon Stock to be outstanding after this offering is based on 18,760,403[ ] shares outstanding as of May 17, 2022March 31, 2023. The number does not give effect to our 1-for-[ ] reverse stock split and excludes an aggregate of up to approximately 11,267,285[ ] shares of common stockCommon Stock based upon the following:

| (i) | ||

| (ii) | ||

| (iii) | 5,629 shares of | |

| (iv) | ||

Except as otherwise indicated herein, all information in this prospectus assumes no sale of pre-funded warrants, which, if sold, would reduce the number of shares of Common Stock that we are offering on a one-for-one basis, no exercise of the warrants issued in this offering, and no exercise of options issued under our Plan or of warrants described above.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before investing in our common stockCommon Stock and warrants, you should carefully consider the risks described below, as well as the other information in this prospectus, including our consolidated financial statements and the related notes. In addition, we may face additional risks and uncertainties not currently known to us, or which as of the date of this registration statement we might not consider significant, which may adversely affect our business. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case the trading price of our common stockCommon Stock and warrants could decline due to any of these risks or uncertainties, and you may lose part or all of your investment.

Risks Related to our Business and IndustryThis Offering, Ownership of Our Securities

Our independent auditors have expressed theirconcurred with our management’s assessment that raises concern as to our ability to continue as a going concern.concern.

On a consolidated basis, the Company haswe have incurred significant operating losses since inception. The Company’sOur financial statements do not include any adjustments that might result from the outcome of this uncertainty. As of December 31, 2022, we have an accumulated deficit of $83.5 million.

Because the Company doeswe do not expect that existing operational cash flow will be sufficient to fund presently anticipated operations, this raises substantial doubt about the Company’sour ability to continue as a going concern. Therefore, the Companywe will need to raise additional funds and isare currently exploring alternative sources of financing. Historically, the Company haswe have raised capital through private placements of itsour equity securities and convertible notes and through officer loans as an interim measure to finance working capital needs and may continue to raise additional capital through the sale of common stock or other securities and by obtaining short-term loans. The CompanyWe will be required to continue to do so until itsour consolidated operations become profitable.

These factors, among others, raise substantial doubt about the Company’sour ability to continue as a going concern. If we are unable to obtain sufficient funding, our business, prospects, financial condition and results of operations will be materially and adversely affected, and we may be unable to continue as a going concern.

We have identified a material weakness inIf we are unable to maintain compliance with all applicable continued listing requirements and standards of Nasdaq, our internal control over financial reporting. This material weaknessCommon Stock could continue to adversely affect our ability to report our results of operations and financial condition accurately and in a timely manner.be delisted from Nasdaq.

Our managementCommon Stock is responsible for establishinglisted on The Nasdaq Capital Market under the symbol “GROM.” In order to maintain that listing, we must satisfy minimum financial and maintaining adequate internal control over financial reporting designedother continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’ equity, minimum share price, and certain corporate governance requirements. There can be no assurances that we will be able to provide reasonable assurance regardingremain in compliance with Nasdaq’s listing standards or if we do later fail to comply and subsequently regain compliance with Nasdaq’s listing standards, that we will be able to continue to comply with the reliabilityapplicable listing standards. If we are unable to maintain compliance with these Nasdaq requirements, our Common Stock will be delisted from Nasdaq.

On April 10, 2023, we received a deficiency letter (the “Notice”) from the Listing Qualifications Department (the “Staff”) of financial reporting andThe Nasdaq Stock Market LLC (“Nasdaq Stock Market”) notifying us that, based upon the preparation of financial statements for external purposes in accordance with GAAP. Our management is likewise required, on a quarterly basis, to evaluate the effectivenessclosing bid price of our internal controls andCommon Stock, for the last 30 consecutive business days, we are not currently in compliance with the requirement to disclose any changes and material weaknesses identified through such evaluationmaintain a minimum bid price of $1.00 per share for continued listing on The Nasdaq Capital Market (“Nasdaq”), as set forth in those internal controls. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Requirement”).

As described elsewhere in this prospectus, we identified a material weakness in our internal control over financial reporting related to functional controls and segregation of duties. As a result of this material weakness, our management concluded that our internal control over financial reporting was not effective as of December 21, 2021.

Any failure to maintain such internal control could adversely impact our ability to report our financial position and results from operations on a timely and accurate basis, which could result a material adverse effect on our business. If our financial statements are not accurate, investors may not have a complete understanding of our operations. Likewise, if our financial statements are not filed on a timely basis, we could be subject to sanctions or investigations by Nasdaq, the SEC or other regulatory authorities. In addition, we would likely incur additional accounting, legal and other costs in connection with any remediation steps. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which could have a negativeThe Notice has no immediate effect on the tradingcontinued listing status of our Common Stock on Nasdaq, and, therefore, our listing remains fully effective.

We are provided a compliance period of 180 calendar days from the date of the Notice, or until October 9, 2023, to regain compliance with Nasdaq Listing Rule 5550(a)(2). If at any time before October 9, 2023, the closing bid price of our stock.Common Stock closes at or above $1.00 per share for a minimum of 10 consecutive business days, subject to Nasdaq’s discretion to extend this period pursuant to Nasdaq Listing Rule 5810(c)(3)(H), Nasdaq will provide written notification that we have achieved compliance with the Minimum Bid Requirement, and the matter would be resolved.

If we do not regain compliance with the Minimum Bid Requirement during the initial 180 calendar day compliance period, we may be eligible for an additional 180 calendar day compliance period. To qualify, we would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq, with the exception of the Minimum Bid Requirement, and would need to provide written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary.

To respondWe intend to this material weakness, we have devoted, and plan to continue to devote, significant effort and resources toactively monitor the remediation and improvementclosing bid price of our internal control over financial reporting. While we have processesCommon Stock and will evaluate available options to identify and appropriately apply applicable accounting requirements, we plan to enhance these processes to better evaluate our research and understanding ofregain compliance with the nuances of the complex accounting standards that apply to our financial statements. Our plans at this time include providing enhanced access to accounting literature, research materials and documents and increased communication among our personnel and third-party professionals with whom we consult regarding complex accounting applications. Additionally, we have hired, and plan to continue to hire, as resources permit, qualified accounting personnel to better manage our functional controls and segregate responsibilities. The elements of our remediation plan can only be accomplished over time, and we can offer no assurance that these initiatives will ultimately have the intended effects.

We can give no assurance that the measures we have taken and plan to take in the future will remediate the material weakness identified or that any additional material weaknesses or restatements of financial results will not arise in the future due to a failure to implement and maintain adequate internal control over financial reporting or circumvention of these controls. In addition, even if we are successful in strengthening our controls and procedures, in the future those controls and procedures may not be adequate to prevent or identify irregularities or errors or to facilitate the fair presentation of our financial statements.

Our obligations to L1 Capital and other noteholders are secured by a security interest in substantially all of our assets, so if we default on those obligations, the noteholders could foreclose on, liquidate and/or take possession of our assets. If that were to happen, we could be forced to curtail, or even to cease, our operations

On September 14, 2021, the Company entered into a Securities Purchase Agreement with L1 Capital, pursuant to which it issued L1 Capital a 10% Original Issue Discount Senior Secured Convertible Promissory Note in the principal amount of $4,400,000 (the “L1 Capital Note”), which matures on March 13, 2023. Simultaneously, the Company entered into a Security Agreement with L1 Capital, pursuant to which L1 Capital was granted a security interest in all of the assets of the Company and certain of its subsidiaries to secure repayment of amounts due under the L1 Capital Note. As further inducement for L1 Capital to enter into the Security Agreement, certain of the Company’s pre-existing secured creditors (the “Additional Noteholders”), holding convertible promissory notes in the aggregate principal amount of $438,560 (the “Additional Notes”), agreed to give up their exclusive senior security interest in the assets of the Company’s subsidiary TD Holdings, in exchange for a shared senior secured interest with L1 Capital on a pari pasu basis on all assets of the Company. The Securities Purchase Agreement contemplated a closing of a second tranche of the offering (the “Second Tranche Closing”) of up to an additional $6,000,000 principal amount of Notes identical to the First Tranche Note. On January 20, 2022 the Company and LI Capital closed on the Second Tranche Closing, resulting in the issuance of a $1,750,000 10% Original Issue Discount Senior Secured Convertible Note, Due July 20, 2023, (the “Second Tranche Note”). As a result, if we default on our obligations under the L1 Capital Note, the Second Tranche Note and/or the Additional Notes, L1 Capital and the Additional Noteholders, as applicable, could foreclose on their security interests and liquidate or take possession of some or all of the assets of the Company and its subsidiaries, which would harm our business, financial condition and results of operations and could require us to curtail, or even to cease our operations.

Our future performance will depend on the continued engagement of key members of the management team of the Company.

Our future performance depends to a large extent on the continued services of members of the Company’s current management and other key personnel, including Zachary Marks. While we have employment agreements with certain of our executive officers and key employees, the failure to secure the continued services of these or other key personnel for any reason, could have a material adverse effect on our business, operations, and prospects. We currently do not carry “key man insurance” on any of our executives.

Failure to manage our growth effectively could cause our business to suffer and have an adverse effect on our financial condition and operating results.

Failure to manage our growth effectively could cause our business to suffer and have an adverse effect on our financial condition and operating results. To manage our growth effectively, we must continually evaluate and evolve our business and manage our employees, operations, finances, technology and development, and capital investments efficiently. Our efficiency, productivity and the quality of our Grom Social platform, animation business and web filtering user services and content may be adversely impacted if we fail to appropriately coordinate across our business operations. Additionally, rapid growth may place a strain on our resources, infrastructure, and ability to maintain the quality of our Grom Social platform. If and when our structure becomes more complex as we add additional staff, we will need to improve our operational, financial and management controls as well as our reporting systems and procedures. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating revenues.

Future business acquisitions, strategic investments or alliances, if any, as well as business acquisition transactions, could disrupt our business and may not succeed in generating the intended benefits and may, therefore, adversely affect our business, revenue and results of operations.

We completed the acquisition of TD Holdings in 2016, and recently acquired 80% of Curiosity. In the future, we may explore potential acquisitions of companies or technologies, strategic investments, or alliances to strengthen our business. Acquisitions involve numerous risks, any of which could harm our business, including:

Failure to appropriately mitigate these risks or other issues related to such strategic investments and acquisitions could result in reducing or completely eliminating any anticipated benefits of transactions and harm our business generally. Future acquisitions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses or the impairment of goodwill, any of which could harm our business, financial condition, and operating results.

We face intense competition in all aspects of our business including competition in the animation and web filtering businesses. If we do not provide features and content that will engage and attract users, advertisers and developers we may not remain competitive, and our potential revenues and operating results could be adversely affected.

We face intense competition in almost every aspect of our business, including from companies such as Facebook, YouTube, Twitter and Google, which offer a variety of Internet products, services, content, and online advertising offerings, as well as from mobile companies and smaller Internet companies that offer products and services that may compete directly with Grom Social for users, such as Yoursphere, Fanlala, Franktown Rocks and Sweety High. As we introduce new services and products, as our existing services and products evolve, or as other companies introduce new products and services, we may become subject to additional competition.

Some of our current and potential competitors have significantly greater resources and better competitive positions than we do. These factors may allow our competitors to respond more effectively than us to new or emerging technologies and changes in market requirements. Our competitors may develop products, features, or services that are similar to ours or that achieve greater market acceptance, may undertake more far-reaching and successful product development efforts or marketing campaigns, or may adopt more aggressive pricing policies. In addition, our users, content providers or application developers may use information shared by our users through Grom Social in order to develop products or features that compete with us. Certain competitors, including Facebook, could use strong or dominant positions in one or more markets to gain a competitive advantage against us in areas where we operate, including by creating a social networking experience similar to ours with similar content and features. As a result, our competitors may acquire and engage users at the expense of the growth or engagement of our user base, which may negatively affect our business and financial results.

We believe that our ability to compete effectively depends upon many factors, including:

If we are not able to effectively compete, our user base and level of user engagement may decrease, which could make us less attractive to developers and advertisers and materially and adversely affect our revenue and results of operations.

We are a holding company organized in Florida, with no operations of our own, and we depend on our subsidiaries, incorporated in Hong Kong, Manila and Florida for cash to fund our operations.

Our operations are conducted entirely through our subsidiaries and our ability to generate cash to fund operations or to meet debt service obligations is dependent on the earnings and the receipt of funds from our subsidiaries. Deterioration in the financial condition, earnings or cash flow of TD Holdings and its subsidiaries for any reason could limit or impair their ability to make payments to us. Additionally, to the extent that we need funds and our subsidiaries are restricted from making such distributions under applicable law or regulation or are otherwise unable to provide such funds, it could materially adversely affect our business, financial condition, results of operations or prospects.