AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON AUGUST 7,As Filed with the Securities and Exchange Commission on October 5, 2017

FILEREGISTRATION NO. 333-XXXXXX333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALLSTATE LIFE INSURANCE COMPANY(Exact Name of Registrant)

|

|

|

| ILLINOIS |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

| 36-2554642 |

| (I.R.S. Employer Identification Number) |

C/O ALLSTATE LIFE INSURANCE COMPANY

(Exact Name of Registrant)

ILLINOIS 36-2554642

(State or Other Jurisdiction (I.R.S. Employer

of Incorporation or Organization) Identification Number)

3075 SANDERS ROAD

NORTHBROOK, ILLINOIS 60062

847-402-5000(847)402-5000

(Address, including zip code, and Phone Numbertelephone number, including area code, of Principal Executive Office)principal executive offices)

CT Corporation

C T CORPORATION208 South LaSalle Street

Suite 814

Chicago, IL 60604

312-345-4320(312) 345-4320

(Name, Complete Addressaddress, including zip code and Telephone Numbertelephone number, including area code, of Agentagent for Service)service)

COPIES TO:

JAN FISCHER-WADE, ESQUIREESQ.

ALLSTATE LIFE INSURANCE COMPANY

2940 S. 84th84 th Street

Lincoln, NE 68506-4142

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE

TO THE PUBLIC:

The annuity contracts and interests thereunder covered by this registration statement are

Approximate date of commencement of proposed sale to be issued promptly and from time to timethe public: As soon as practicable after the effective date of this registration statement.

If any of the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: / /¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. /X/x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /offering: ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: / /¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. / /

¨

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer”, “smaller reporting company”, and "smaller reporting"emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer / / |

| | | | |

| | | | |

Large accelerated filer ¨ | | | | Accelerated filer ¨ |

| | |

Non-accelerated filer x | | (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

| | |

Emerging growth company ¨ | | | | |

Accelerated filer / /If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Non-accelerated filer /X/ (Do not check if a smaller reporting company)

Smaller reporting company / /

CALCULATION OF REGISTRATION FEE

|

| | | | | | | |

Title of securities to be registered | Amount to be registered | | maximum offering price per unit(1) | | Proposed maximum aggregate offering price | | Proposed Amount of registration fee |

Market Value Adjusted Annuity Contracts | $319,239,639 | | $1.00 | | $319,239,639 | | $0 |

|

| | | | | | | | | |

| | | | | | | | | |

| |

Title of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit(1) | | Proposed maximum aggregate offering price | | Amount of registration fee |

| Market Value Adjusted Annuity Contracts | | $3,184,255 | | $1.00 | | $1,100,000 | | $136.95 |

| |

| |

| (1) | Interests in the market value adjustment account are sold on a dollar basis, not on the basis of a price per share or unit. |

(1) Interests in the market value adjustment account are sold on a dollar basis, not on the basis of a price per share or unit.

This filing is being made under the Securities Act of 1933 to register $319,239,639$1,100,000 of interests in market value adjusted annuity contracts. The interests being registered hereinUnder rule 457(o) under the Securities Act of 1933, the filing fee set forth above was calculated based on the maximum aggregate offering price of $1,100,000. In addition to the new securities, referenced above, that we are carriedregistering herewith, we are carrying over asto this registration statement $2,084,255 of unsold securities from an existing Form S-3 registration statement of the same issuer (333-200099)#333-199260 filed on November 7, 2014. Because aOctober 10, 2014, for which the filing fee of $268 previously was paid with respect to those securities, there is no filing fee under this registration statement.paid. In accordance with Rule 415(a)415 (a)(6), the offering of securities on the earlier registration statement will be deemed terminated as of the effective date of this registration statement.

Custom Plus Annuity

This Registration Statement contains a combined prospectus under Rule 429 under the Securities Act of 1933 which relates to the Form S-3 registration statement (File No. 333-199260), initially filed October 10, 2014, by Allstate Life Insurance Company

P.O. Box 660191

Dallas, TX 75266-0191

Telephone Number: 1-800-203-0068

Fax Number: 1-866-628-1006

Prospectus dated September 7, 2017

Company. Upon effectiveness, this Registration Statement, which is a new Registration Statement, will also act as a post-effective amendment to such earlier Registration Statement.Allstate Life Insurance Company (“incorporates by reference its annual report for the year ending 12/31/16 on Form 10-K filed pursuant to Section 13(a) or Section 15(d) of Exchange Act and all documents subsequently filed by Allstate Life”)Life Insurance Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act.

Risk Factors are discussed in the sections of the prospectus included in Part 1 of this Form concerning the Market Value Adjustment option.

Neither the Securities and Exchange Commission nor any state securities commission has issuedapproved or disapproved of these securities or passed upon the Custom Plus Annuity,adequacy or accuracy of each prospectus included in this registration statement. Any representation to the contrary is a group and individual flexible premium deferred annuity contract (“Contract”). This prospectus contains information about the Contract. Please keep it for future reference.criminal offense.

The Contract is no longer being offered for sale. If you have already purchased a Contract you may continue to add to it. Each additional payment must be at least $1,000.

The Contracts are available through Morgan Stanley & Co. Inc., the principal underwriter for these securities, Allstate Distributors, L.L.C. is not required to sell any specific number or dollar amount of securities, but will use its best efforts to sell the Contracts.securities offered. The offering under this registration statement will conclude three years from the effective date of this registration statement, unless terminated earlier by the Registrant. See each prospectus included in Part 1 hereof for the date of the prospectus.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission may determine.

|

| |

IMPORTANT

NOTICES | The Securities and Exchange Commission (“SEC”) has not approved or disapproved the securities described in this prospectus, nor has it passed on the accuracy or the adequacy of this prospectus. Anyone who tells you otherwise is committing a federal crime. |

Investment in the Contracts involves serious investment risks, including possible loss of principal. |

This prospectus does not constitute an offering in any jurisdiction in which such offering may not lawfully be made. We do not authorize anyone to provide any information or representations regarding the offering described in this prospectus other than as contained in this prospectus. |

Supplement dated November 7, 2016, to the

Prospectus for your Variable Annuity

Issued by

|

| | |

| Page |

ALLSTATE LIFE INSURANCE COMPANY ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

This supplement amends certain disclosure contained in the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York.

Effective December 23, 2016 (the Closure Date), the following variable sub-accounts available in your Variable Annuity will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Invesco V.I. Core Equity Fund – Series I Invesco V.I. Core Equity Fund – Series II

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if they withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

Dollar cost averaging, category models and/or auto-rebalancing programs, if elected by a Contract owner prior to the Closure Date, will not be affected by the closure unless a contract owner withdraws or otherwise transfers his entire Account Value from the sub-accounts.

If you have any questions, please contact your financial professional or our Variable Annuities Service Center at (800) 457-7617. Our representatives are available to assist you Monday through Friday between 7:30 a.m. and 5:00 p.m. Central time.

Please keep this supplement together with your prospectus for future reference. No other action is required of you.

|

Overview | |

Important Terms | |

|

The Contract at a Glance | |

|

How the Contract Works | 5 |

|

Contract Features | |

The Contract | 6 |

|

Contract Owner | 6 |

|

Annuitant | 6 |

|

Beneficiary | 6 |

|

Modification of the Contract | |

|

Assignment | |

|

Written Requests and Forms in Good Order | |

|

Purchases and Contract Value | |

|

Minimum Purchase Payments | |

|

Automatic Additions Program | |

|

Allocation of Purchase Payments | |

|

Contract Value | |

|

Guarantee Periods | |

|

Interest Rates | 8 |

|

How We Credit Interest | 8 |

|

Market Value Adjustment | 9 |

|

Expenses | |

|

Withdrawal Charge | |

|

Premium Taxes | 10 |

|

Access to Your Money | 10 |

|

Systematic Withdrawal Program | |

|

Postponement of Payments | |

|

Return of Purchase Payment Guarantee | |

|

Minimum Contract Value | 11 |

|

|

| | |

| Page |

Payout Phase | 11 |

|

Payout Start Date | 11 |

|

Income Plans | 11 |

|

Income Payments | 12 |

|

Certain Employee Benefit Plans | 12 |

|

Death Benefits | 12 |

|

Death Benefit Amount | |

|

Death Benefit Options | |

|

Other Information | |

More Information | 13 |

|

Allstate Life | 13 |

|

The Contract | |

|

Annuities Held within a Qualified Plan | 14 |

|

Legal Matters | 14 |

|

Taxes | 14 |

|

Taxation of Allstate Life Insurance Company | 14 |

|

Taxation of Fixed Annuities in General | 14 |

|

Income Tax Withholding | 16 |

|

Tax Qualified Contracts | 17 |

|

Annual Reports and Other Documents | 21 |

|

Annual Statements | 21 |

|

Market Value Adjustment | 22 |

|

ALLSTATESUP5

Supplement dated August 7, 2015, to the Prospectus for your Variable Annuity This prospectus uses a number of important terms with which you may not be familiar. The index below identifies the page that defines each term. Each term will appear in bold italics on the page on which it is first defined.

|

| |

| Page |

Accumulation Phase | |

Annuitant | |

Automatic Additions Program | |

Beneficiary | |

Cash Surrender Value | |

* Contract | |

Contract Owner ("You") | |

Contract Value | |

Due Proof of Death | |

|

| |

| Page |

"Guarantee Periods" | |

Income Plans | |

Issue Date | |

Market Value Adjustment | |

Payout Phase | |

Payout Start Date | |

Preferred Withdrawal Amount | |

SEC | |

Systematic Withdrawal Program | |

Tax Qualified Contracts | |

| |

* | In certain states a Contract is available only as a group Contract. In these states we issued you a certificate that represents your ownership and summarizes the provisions of the group Contract. References to “Contract” in this prospectus include certificates unless the context requires otherwise. |

Issued by

ALLSTATE LIFE INSURANCE COMPANY The following is a snapshot of the Contract. Please read the remainder of this prospectus for more information.

| |

Flexible Payments | We have discontinued offering new Contracts. You may add to your Contract, however each payment must be at least $1,000. You must maintain a minimum account size of $1,000. |

| |

Expenses | You will bear the following expenses: |

A withdrawal charge of 6% on amounts withdrawn (with certain exceptions).

A Market Value Adjustment (which can be positive or negative) for withdrawals except those taken during the 30 day period after the expiration of a Guarantee Period.

State premium tax (if your state imposes one).

| |

Guaranteed Interest | The Contract offers fixed interest rates that we guarantee for specified periods we call “Guarantee Periods.” To find out what the current rates are on available Guarantee Periods, please call us at 1-800-654-2397.

|

| |

Special Services | For your convenience, we offer these special services: |

Automatic Additions Program;

Systematic Withdrawal Program.

| |

Income Payments | The Contract offers three income payment plans: |

life income with or without guaranteed payments (5 to 30 years);

a joint and survivor life income with or without guaranteed payments (5 to 30 years); or

guaranteed payments for a specified period (5 to 30 years)

| |

Death Benefits | If you or the Annuitant dies before the Payout Start Date, we will pay benefits as described in the Contract.

|

| |

Withdrawals | You may withdraw some or all of your Contract value ("Contract Value") at any time prior to the Payout Start Date. If you withdraw Contract Value from a Guarantee Period before its maturity, a withdrawal charge, Market Value Adjustment, and taxes may apply. Withdrawals taken prior to annuitization (referred to in this prospectus as the Payout Phase) are generally considered to come from the earnings in the Contract first. If the Contract is tax-qualified, generally all withdrawals are treated as distributions of earnings. Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59 ½, may be subject to an additional 10% federal tax penalty.

|

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

This supplement amends certain disclosure contained in the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York.

Effective September 1, 2015 (the Closure Date), the following variable sub-accounts available in your Variable Annuity will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date: The Contract basically works in two ways.

First,Invesco V.I. Mid Cap Core Equity Fund – Series I

Invesco V.I. Mid Cap Core Equity Fund – Series II

Contract owners who have contract value invested in these variable sub-account as of the Contract can help you (we assume you areClosure Date may continue to submit additional investments into the “Contract Owner”) save for retirement because you canvariable sub-accounts thereafter, although they will not be permitted to invest in the Contract and generally pay no federal income taxes on any earnings until youvariable sub-accounts if they withdraw or otherwise access them. Youtransfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do this during what we callnot have contract value invested in the “Accumulation Phase”variable sub-accounts as of the Contract. The Accumulation Phase begins onClosure Date will not be permitted to invest in these variable sub-accounts thereafter.

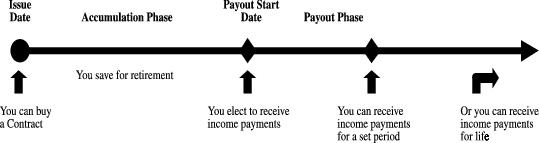

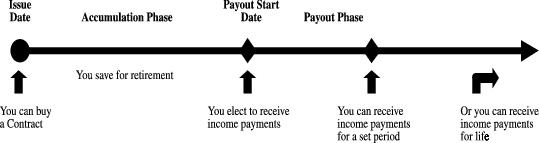

Dollar cost averaging and/or auto-rebalancing programs, if elected by a Contract owner prior to the date we issue your Contract (we call that date the “Issue Date”) and continues until the “Payout StartClosure Date,” which is the date we apply your money to provide income payments. During the Accumulation Phase, you may allocate your purchase payment to any combination of available Guarantee Periods. You will earn a fixed rate of interest that we declare periodically.

Second, the Contract can help you plan for retirement because you can use it to receive retirement income for life and/ or for a pre-set number of years by selecting one of the income payment options (we call these “Income Plans”) described at “Income Payments - Income Plans.” You receive income payments during what we call the “Payout Phase” of the Contract, which begins on the Payout Start Date and continues until we make the last income payment requirednot be affected by the Income Plan you select. Duringclosure unless a contract owner withdraws or otherwise transfers his entire Account Value from the Payout Phase we guarantee the amount of your payments, which will remain fixed. The amount of money you accumulate under your Contract during the Accumulation Phase and apply to an Income Plan will determine the amount of your income payments during the Payout Phase.sub-account.

The timeline below illustrates how you might use your Contract.

As the Contract Owner, you exercise all of the rights and privileges provided by the Contract. If you die, any surviving Contract Owner or, if none, the Beneficiary will exercise the rights and privileges provided by the Contract. See “The Contract.” In addition, if you die before the Payout Start Date we will pay Death Benefits to any surviving Contract Owner or, if there is none, to your Beneficiary. (See “Death Benefits.”)

Please call us at 1-800-654-2397 if you have any questions, about how the Contract works.please contact your financial representative or our Variable Annuities Service Center at (800) 457-7617. Our representatives are available to assist you Monday through Friday between 7:30 a.m. and 5:00 p.m. Central time.

Please keep this supplement for future reference together with your prospectus. No other action is required of you.

CONTRACT OWNER

The Custom Plus

Supplement, dated July 6, 2011,

to the Prospectus for your Variable Annuity is

Issued by

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

LINCOLN BENEFIT LIFE COMPANY

This supplement amends the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York or Lincoln Benefit Life Company, as applicable.

Effective as of August 19, 2011 (the Closure Date), the following variable sub-accounts available in your Variable Annuity will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Invesco V.I. Basic Value Fund-Series I

Invesco V.I. Basic Value Fund-Series II

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if they withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

Dollar cost averaging and/or auto-rebalancing, if elected by a contract between you, the Contract Owner, and Allstate Life, a life insurance company. As the Contract Owner, you may exercise all of the rights and privileges provided to youowner, will not be affected by the Contract. That means it is up to you to select or change (to the extent permitted):

the amount and timing of your withdrawals,

the programs you want to use to withdraw money,

the income payment plan you want to use to receive retirement income,

the Annuitant (either yourself or someone else) on whose life the income payments will be based,

the Beneficiary or Beneficiaries who will receive the benefits that the Contract provides when the last surviving Contract Owner dies, and

any other rights that the Contract provides.closure.

If you die,have any surviving Contract Ownerquestions, please contact your financial representative or if none,our Variable Annuity Service Center at (800) 457-7617. Our representatives are available to assist you from 7:30 a.m. to 5 p.m. Central time.

Please read the Beneficiary may exercise the rightsprospectus supplement carefully and privileges provided to them by the Contract. If the sole surviving Contract Owner dies after the Payout Start Date, the Beneficiary will receive any guaranteed income payments scheduled to continue.

The Contract cannot be jointly owned by both a non-living person and a living person.

Changing ownership of this Contract may cause adverse tax consequences and may not be allowed under qualified plans. Please consultthen file it with a competent tax advisor prior to making a request for a change of Contract Owner.

The Contract was available for purchase as an IRA or TSA (also known as a 403(b)). The endorsements required to qualify these annuities under the Internal Revenue Code of 1986, as amended, (“Code”) may limit or modify your rights and privileges under the Contract. Allstate Life no longer issues TSA contracts.

ANNUITANT

The Annuitant is the individual whose life determines the amount and duration of income payments (other than under Income Plans with guaranteed payments for a specified period). You initially designate an Annuitant in your application. The Contract Owner (youngest Contract Owner if there is more than one) will be the Annuitant unless you name a different Annuitant. The Annuitant must be a living person.

You may change the Annuitant at any time prior to the Payout Start Date (only Contract Owners that are living persons or grantor trusts have this option). Once we accept your change request, any change will be effective on the date you sign the written request. We are not liable for any payment we make orimportant papers. No other action we take before accepting any written request fromis required of you. You also may designate a joint Annuitant, who is a second person on whose life income payments depend.

BENEFICIARY

The Beneficiary is the person who may elect to receive the death benefit or become the new Contract Owner subject to the Death of Owner provision if the sole surviving Contract Owner dies before the Payout Start Date. If the sole surviving Contract Owner dies after the Payout Start Date, the Beneficiaries will receive any guaranteed income payments scheduled to continue.

You may name one or more Beneficiaries when you apply for a Contract. You may change or add Beneficiaries at any time, unless you have designated an irrevocable Beneficiary. We will provide a change of beneficiary request form to be signed by you and filed with us. Until we receive your written request to change a Beneficiary, we are entitled to rely on the most recent Beneficiary information in our files. Once we accept your change request, any change will be effective on the date you sign the written request. We are not liable for any payment we make or other action we take before accepting any written request from you. Accordingly, if you wish to change your Beneficiary, you should deliver your written notice to us promptly. If the Contract Owner is a living person, we will determine the Beneficiary from the most recent request of the Contract Owner.

You may restrict income payments to Beneficiaries by providing us with a written request. Once we accept the written request, the restriction will take effect as of the date you signed the request. Any restriction is subject to any payment made by us or any other action we take before we accept the request.

If the Contract Owner is a grantor trust, then the Beneficiary will be that same trust. If the Contract Owner is a non-living person other than a grantor trust, the Contract Owner is also the Beneficiary.

If you did not name a Beneficiary or if the named Beneficiary is no longer living when the sole surviving Contract Owner dies, the Beneficiary will be:

your spouse or, if he or she is no longer alive,

Supplement, dated October 18, 2010,

to the Prospectus for your surviving children equally,Variable Annuity

Issued by

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

LINCOLN BENEFIT LIFE COMPANY

This supplement amends the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York or Lincoln Benefit Life Company, as applicable.

Effective as of November 19, 2010 (the Closure Date), the following variable sub-accounts available in the above-referenced Variable Annuities will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Invesco V.I. Capital Appreciation Fund-Series I

Invesco V.I. Capital Appreciation Fund-Series II

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if youthey withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have no surviving children,contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

your estate.Dollar cost averaging and/or auto-rebalancing, if elected by a contract owner, will not be affected by the closure.

Children, as used in this prospectus, are natural and adopted children only, either minor or adult.

If more than one Beneficiary survives you, we will divide the death benefit among the surviving Beneficiaries according to your most recent written instructions. If you have not given us written instructions in a form satisfactoryany questions, please contact your financial representative or our Variable Annuity Service Center at (800) 457-7617. Our representatives are available to us, we will payassist you from 7:30 a.m. to 5 p.m. Central time.

Please read the death benefit in equal amounts to the surviving Beneficiaries.

For purposes of the Contract, in determining whether a living person, including a Contract Owner, Beneficiary, or Annuitant ("Living Person A") has survived another living person, including a Contract Owner, Beneficiary, or Annuitant (Living Person B"), Living Person A must survive Living Person B by at least 24 hours. Otherwise, Living Person A will be conclusively deemed to have predeceased Living Person B.

MODIFICATION OF THE CONTRACT

Only an officer of Allstate Life may approve a change in or waive any provision of the Contract. Any change or waiver must be in writing. None of our agents has the authority to change or waive the provisions of the Contract. We may not change the terms of the Contract without your consent, except to conform the Contract to applicable law or changes in the law or except as otherwise permitted in the Contract. If a provision of the Contract is inconsistent with state law, we will follow state law.

ASSIGNMENT

You may assign an interest in your Contract. No Beneficiary may assign benefits under the Contract until they are due. We will not be bound by any assignment until you sign itprospectus supplement carefully and then file it with us. We are not responsible for the validityyour important papers. No other action is required of any assignment. Federal law prohibits or restricts the assignment of benefits under many types of retirement plans and the terms of such plans may themselves contain restrictions on assignments. An assignment may also result in taxes or tax penalties. You should consult with an attorney before assigning your Contract.you.

Supplement Dated December 31, 2009

To the Prospectus for Your Variable Annuity

Issued By

Allstate Life Insurance Company

Allstate Life Insurance Company of New York

Lincoln Benefit Life Company

This supplement amends the prospectus for your variable annuity contract issued by Allstate Life Insurance Company, Allstate Life Insurance Company of New York, or Lincoln Benefit Life Company.

The following provision is added to your prospectus:

WRITTEN REQUESTS AND FORMS IN GOOD ORDERORDER. Written requests must include sufficient information and/or documentation, and be sufficiently clear, to enable us to complete your request without the need to exercise discretion on our part to carry it out. You may contact our Customer Service Center to learn what information we require for your particular request to be in “good order.” Additionally, we may require that you submit your request on our form. We reserve the right to determine whether any particular request is in good order, and to change or waive any good order requirements at any time.

If you have any questions, please contact your financial representative or call our Customer Service Center at 1-800-755-5275.

|

|

Purchases and Contract Value |

MINIMUM PURCHASE PAYMENTS

All subsequent purchase payments must be at least $1,000. You may make purchase payments at any time prior to the Payout Start Date. We reserve the right to limit the maximum amount and number of purchase payments we will accept.

AUTOMATIC ADDITIONS PROGRAM

You may make subsequent purchase payments by automatically transferring money from your bank account. Please1-800-457-7617. If you own a Putnam contract, please call or write us for an enrollment form.

ALLOCATION OF PURCHASE PAYMENTS1-800-390-1277.

For each purchase payment, you must select a Guarantee Period. A Guarantee Period is a period of years during which you will earn a guaranteed interest rate onfuture reference, please keep this supplement together with your money. You must allocate at least $1,000 to any one Guarantee Period at the time you make your purchase payment or select a renewal Guarantee Period.

We will apply your purchase payment to the Guarantee Period you select within 7 days of the receipt of the payment and required information.

CONTRACT VALUE

Your Contract Value at any time during the Accumulation Phase is equal to the sum of the purchase payments you have invested in the Guarantee Periods, plus earnings thereon, and less any amounts previously withdrawn.

Each payment allocated to a Guarantee Period earns interest at a specified rate that we guarantee. Guarantee Periods may range from 1 to 10 years. You must select a Guarantee Period for each purchase payment.

Amounts allocated to Guarantee Periods become part of our general account, which supports our insurance and annuity obligations. The general account consists of our general assets other than those in segregated asset accounts. We have sole discretion to invest the assets of the general account, subject to applicable law. You do not share in the investment experience of the general account.prospectus.

You must allocate at least $1,000 to an available Guarantee Period at the time you make a purchase payment or select a renewal Guarantee Period.

INTEREST RATES

We will tell you what interest rates and Guarantee Periods we are offering at a particular time. We will not change the interest rate that we credit to a particular investment until the end of the relevant Guarantee Period. We may declare different interest rates for Guarantee Periods of the same length that begin at different times.

We have no specific formula for determining the rate of interest that we will declare initially or in the future. We will set those interest rates based on investment returns available at the time of the determination. In addition, we may consider various other factors in determining interest rates including regulatory and tax requirements, sales commissions and administrative expenses, general economic trends, and competitive factors. We determine the interest rates to be declared in our sole discretion. We can neither predict nor guarantee what those rates will be in the future. For current interest rate information, please contact Allstate Life at 1-800-654-2397.

HOW WE CREDIT INTEREST

We will credit interest to your initial purchase payment from the Issue Date. We will credit interest to your additional purchase payments from the date we receive them. We will credit interest daily to each amount allocated to a Guarantee Period at a rate that compounds to the annual interest rate that we declared at the beginning of the applicable Guarantee Period.

The following example illustrates how a $10,000 purchase payment would grow, if allocated to a 5 year Guarantee Period, crediting a hypothetical 4.5% annual interest rate:

|

| |

Purchase Payment | $10,000 |

Guarantee Period | 5 Years |

Annualized Effective Interest Rate | 4.50% |

|

| | | | | |

End of Contract Year |

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

Beginning Contract Value | $10,000.00 | | | | |

× (1 + Annual Interest Rate) | 1.045 | | | | |

| $10,450.00 | | | | |

Contract Value at end of Contract Year | | $10,450.00 | | | |

× (1 + Annual Interest Rate) | | 1.045 | | | |

| | $10,920.25 | | | |

Contract Value at end of Contract Year | | | $10,920.25 | | |

× (1 + Annual Interest Rate) | | | 1.045 | | |

| | | $11,411.66 | | |

Contract Value at end of Contract Year | | | | $11,411.66 | |

× (1 + Annual Interest Rate) | | | | 1.045 | |

| | | | $11,925.19 | |

Contract Value at end of Contract Year | | | | | $11,925.19 |

× (1 + Annual Interest Rate) | | | | | 1.045 |

| | | | | $12,461.82 |

Total Interest Credited During Guarantee Period = $2,461.82 ($12,461.82-$10,000)

This example assumes no withdrawals during the entire 5 year Guarantee Period. If you were to make a partial withdrawal, you may be required to pay a withdrawal charge. In addition, the amount withdrawn may be increased or decreased by a Market Value Adjustment that reflects changes in interest rates since the time you invested the amount withdrawn (see "Market Value Adjustment"). The hypothetical annual interest rate is for illustrative purposes only and is not intended to predict future interest rates to be declared under the Contract. Actual interest rates declared for any given Guarantee Period may be more or less than shown above.

RENEWALS

Before the end of each Guarantee Period, we will mail you a notice informing you of the options available to you for the expiring Guarantee Period. During the 30-day period after the end of the Guarantee Period, you may:

| |

1) | Take no action. We will automatically apply your money to a new Guarantee Period of the same length as the expiring Guarantee Period or, if unavailable, into a Guarantee Period of the next shortest term currently offered. The new Guarantee Period will begin on the day the previous Guarantee Period ends. The new interest rate will be our then current declared rate for a Guarantee Period of that length; or |

| |

2) | Instruct us to apply your money to one or more new Guarantee Periods that may be available. The new Guarantee Period(s) will begin on the day the previous Guarantee Period(s) ends. The new interest rate for each new Guarantee Period will be our then current declared rates for that Guarantee Period; or |

| |

3) | Withdraw all or a portion of your money from the expired Guarantee Period without incurring a Market Value Adjustment (or a withdrawal charge to the extent of the Free Withdrawal Amount). Amounts withdrawn will be deemed withdrawn on the day the Guarantee Period expired. Amounts not withdrawn will be applied to a new Guarantee Period of the same length as the previous Guarantee Period or, if unavailable, into a Guarantee Period of the next shortest term currently offered. The new Guarantee Period will begin on the day the previous Guarantee Period ends. |

MARKET VALUE ADJUSTMENT

All withdrawals from a Guarantee Period, other than those taken within the first 30 days of a renewal Guarantee Period are subject to a Market Value Adjustment. A Market Value Adjustment also may apply upon payment of a death benefit and when you apply your Contract Value to an Income Plan (other than during the 30 day period described above).

We will not apply the Market Value Adjustment to withdrawals you make:

to satisfy IRS minimum distribution rules for this Contract; or

within the Preferred Withdrawal Amount, described under “Expenses”, below.

We apply the Market Value Adjustment to reflect changes in interest rates from the time the amount being withdrawn was allocated to a Guarantee Period to the time you withdraw it.

We calculate the Market Value Adjustment by comparing the interest rate for the Guarantee Period at its inception to the interest rate for a period equal to the time remaining in the Guarantee Period when you remove your money, as determined under the Contract.

The Market Value Adjustment may be positive or negative, depending on changes in interest rates. As such, you bear the investment risk associated with changes in interest rates. If interest rates increase significantly from the time you make a purchase payment, the Market Value Adjustment, any applicable withdrawal charge, premium taxes, and income tax withholding (if applicable) could reduce the amount you receive upon full withdrawal of your Contract Value to an amount that is less than the sum of your purchase payments plus interest earned under your Contract. However, we guarantee that the amount received upon surrender (prior to any withholding and before deduction for any applicable premium taxes) will be at least equal to the purchase payments less any prior partial withdrawals.

Generally, if the annual interest rate for the Guarantee Period at the time you allocate your purchase payment is lower than the applicable current annual interest rate for a period equal to the time remaining in the Guarantee Period, then the Market Value Adjustment will result in a lower amount payable to you. Conversely, if the annual interest rate for the Guarantee Period at the time you allocate your purchase payment is higher than the applicable current annual interest rate, then the Market Value Adjustment will result in a higher amount payable to you.

For example, assume that you purchase a Contract and select an initial Guarantee Period of 5 years that has an annual interest rate of 4.50%. Assume that at the end of 3 years, you make a partial withdrawal, in excess of the Preferred Withdrawal Amount. If, at that later time, the current interest rate for a 2 year Guarantee Period is 4.00%, then the Market Value Adjustment will be positive, which will result in an increase in the amount payable to you. Conversely, if the current interest rate for the 2 year Guarantee Period is 5.00%, then the Market Value Adjustment will be negative, which will result in a decrease in the amount payable to you.

The formula for calculating Market Value Adjustments is set forth in Appendix A to this prospectus, which also contains additional examples of the application of the Market Value Adjustment.

As a Contract Owner, you will bear the charges and expenses described below.

WITHDRAWAL CHARGE

During the Accumulation Phase, we may assess a withdrawal charge equal to 6% of all amounts withdrawn or surrendered. However, each year you may withdraw up to 10% of the money initially allocated to the Guarantee Period from which you are making the withdrawal, without paying a withdrawal charge. We measure each year from the commencement of the relevant Guarantee Period. Unused portions of this 10% “Preferred Withdrawal Amount” are not carried forward to future years or other Guarantee Periods. We will deduct withdrawal charges, if applicable, from the amount paid unless you instruct otherwise.

We also do not apply a withdrawal charge in the following situations:

on the Payout Start Date;

the death of the Contract Owner or the Annuitant;

withdrawals taken to satisfy IRS minimum distribution rules for the Contract; or

withdrawals from a renewal Guarantee Period made within the first 30 days of such Period.

We use the amounts obtained from the withdrawal charge to recover the cost of sales commissions and other promotional or distribution expenses associated with marketing the Contracts.

Withdrawals may be subject to tax penalties or income tax and a Market Value Adjustment. Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59 ½, may be subject to an additional 10% federal tax penalty. You should consult your own tax counsel or other tax advisers regarding any withdrawals.

PREMIUM TAXES

Some states and other governmental entities (e.g., municipalities) charge premium taxes or similar taxes. We are responsible for paying these taxes and will deduct them from your Contract Value. Some of these taxes are due when the Contract is issued, others are due when income payments begin or upon surrender. Our current practice is not to charge anyone for these taxes until income payments begin or when a total withdrawal occurs, including payment upon death.

We may, sometime in the future, discontinue this practice and deduct premium taxes from the purchase payments. Premium taxes generally range from 0% to 4%, depending on the state or other governmental entity (as applicable).

At the Payout Start Date, we deduct the charge for any applicable premium taxes from the total Contract Value before applying the Contract Value to an Income Plan.

You can withdraw some or all of your money at any time prior to the Payout Start Date. You may not make any withdrawals or surrender your Contract once the Payout Phase has begun.

You must specify the Guarantee Period from which you would like to withdraw your money. If the amount you withdraw reduces the amount invested in any Guarantee Period to less than $1,000, we will treat the withdrawal request as a request to withdraw the entire amount in that Guarantee Period.

The amount you receive may be reduced by a withdrawal charge, income tax withholding, and any premium taxes. The amount you receive may be increased or reduced by a Market Value Adjustment. If you request a total withdrawal, we may require you to return your Contract to us.

Withdrawals taken prior to annuitization (referred to in this prospectus as the Payout Phase) are generally considered to come from the earnings in the Contract first. If the Contract is tax-qualified, generally all withdrawals are treated as distributions of earnings. Distributions taken prior to age 59 ½ may be subject to an additional 10% federal tax penalty.

Please consult your tax advisor before taking any withdrawal.

SYSTEMATIC WITHDRAWAL PROGRAM

You may choose to receive systematic withdrawal payments on a monthly, quarterly, semi-annual, or annual basis at any time prior to the Payout Start Date. The minimum amount of each systematic withdrawal is $100. We will deposit systematic withdrawal payments into the Contract Owner's bank account. Please consult your tax advisor before taking any withdrawal.

Withdrawals taken prior to annuitization (referred to in this prospectus as the Payout Phase) are generally considered to come from the earnings in the Contract first. If the Contract is tax-qualified, generally all withdrawals are treated as distributions of earnings. Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax penalty.

We may modify or suspend the Systematic Withdrawal Program and charge a processing fee for the service. If we modify or suspend the Systematic Withdrawal Program, existing systematic withdrawal payments will not be affected.

POSTPONEMENT OF PAYMENTS

We may defer payment of withdrawals for up to six months from the date we receive your withdrawal request or such shorter time as the law may allow.

RETURN OF PURCHASE PAYMENT GUARANTEE

When you withdraw your money, a withdrawal charge and a Market Value Adjustment, may apply. If you decide to surrender your Contract, we guarantee that the “Cash Surrender Value” of your Contract, which is the Contract Value, adjusted by any Market Value Adjustment, less withdrawal charges and premium taxes will never be less than the sum of your initial and any subsequent purchase payments, less amounts previously withdrawn (prior to withholding and the deduction of any applicable taxes). Premium taxes and income tax withheld may reduce the amount you receive on surrender to less than the sum of your initial and any subsequent purchase payments. This guarantee does not apply to earnings on purchase payments. The renewal of a Guarantee Period does not in any way change this guarantee.

MINIMUM CONTRACT VALUE

If the amount you withdraw reduces your Contract Value to less than $1,000, we may treat it as a request to withdraw your entire Contract Value. Your Contract will terminate if you withdraw all of your Contract Value. We will, however, ask you to confirm your withdrawal request before terminating your Contract. Before terminating any Contract whose value has been reduced by withdrawals to less than $1,000, we would inform you in writing of our intention to terminate your Contract and give you at least 30 days in which to make an additional purchase payment to restore your Contract’s value to the contractual minimum of $1,000. If we terminate your Contract, we will distribute to you its Contract Value, adjusted by any Market Value Adjustment, less withdrawal and other charges and applicable taxes.

PAYOUT START DATE

The Payout Start Date is the day that we apply your money to provide income payments under an Income Plan. The Payout Start Date must be:

at least 30 days after the Issue Date; and

no later than the Annuitant’s 90th birthday, or

the 10th Contract anniversary, if later.

You may change the Payout Start Date at any time by notifying us in writing of the change at least 30 days before the new Payout Start Date. Absent a change, we will use the Payout Start Date stated in your Contract.

INCOME PLANS

An Income Plan is a series of scheduled payments to you or someone you designate. You may choose only one Income Plan. You may choose and change your choice of Income Plan until 30 days before the Payout Start Date. If you do not select an Income Plan, we will make income payments in accordance with Income Plan 1 with guaranteed payments for 10 years. After the Payout Start Date, you may not make withdrawals or change your choice of Income Plan.

A portion of each payment will be considered taxable and the remaining portion will be a non-taxable return of your investment in the Contract, which is also called the “basis”. Once the investment in the Contract is depleted, all remaining payments will be fully taxable. If the Contract is tax-qualified, generally, all payments will be fully taxable. Taxable payments taken prior to age 59½, may be subject to an additional 10% federal tax penalty.

Income Plan 1 - Life Income with Guaranteed Payments. Under this plan, we make periodic income payments for at least as long as the Annuitant lives. If the Annuitant dies in the Payout Phase, we will continue to pay income payments until the guaranteed number of payments has been paid.

Income Plan 2 - Joint and Survivor Life Income with Guaranteed Payments. Under this plan, we make periodic income payments for at least as long as either the Annuitant or the joint Annuitant lives. If both the Annuitant and joint Annuitant die in the Payout Phase, we will continue to pay the income payments until the guaranteed number of payments has been paid.

Income Plan 3 - Guaranteed Payments for a Specified Period. Under this plan, we make periodic income payments for the period you have chosen. These payments do not depend on the Annuitant’s life. The shortest number of months guaranteed is 60; the longest number of months guaranteed is 360.

The length of any Guaranteed Payment Period under your selected Income Plan generally will affect the dollar amount of each income payment. As a general rule, longer guarantee periods result in lower income payments, all other things being equal. For example, if you choose an Income Plan with payments that depend on the life of the Annuitant but with no minimum specified period for guaranteed payments, the income payments generally will be greater than the income payments made under the same Income Plan with a minimum specified period for guaranteed payments. As a general rule, plans with a joint Annuitant also will result in lower income payments. Income plans may vary from state to state.

We may make other Income Plans available, including ones that you and we agree upon. You may obtain information about them by writing or calling us.

If you choose Income Plan 1 or 2, or, if available, another Income Plan with payments that continue for the life of the Annuitant or joint Annuitant, we will require proof of age and sex of the Annuitant or joint Annuitant before starting income payments, and may require proof that the Annuitant or joint Annuitant are alive before we make each payment. Please note that under such Income Plans, if you elect to take no guaranteed payments, it is possible that the payee could receive no income payments if the Annuitant and any joint Annuitant both die before the first income payment, or only one income payment if they die before the second income payment, and so on.

We will apply your Contract Value, adjusted by any Market Value Adjustment, less applicable taxes, to your Income Plan on the Payout Start Date. If your initial monthly payments would be less than $20, and state law permits, we may:

terminate your Contract and pay you the Contract Value, adjusted by any Market Value Adjustment and less any applicable taxes, in a lump sum instead of the periodic payments you have chosen, or

reduce the frequency of your payments so that each payment will be at least $20.

INCOME PAYMENTS

Subject to your Income Plan selection, we guarantee income payment amounts for the duration of the Income Plan. We calculate income payments by:

adjusting your Contract Value on the Payout Start Date by any applicable Market Value Adjustment;

deducting any applicable premium tax; and

applying the resulting amount to the greater of (a) the appropriate value from the income payment table in your Contract or (b) such other value as we are offering at that time.

We may defer making fixed income payments for a period of up to six months or such shorter time as state law may require. If we defer payments for 30 days or more, we will pay interest as required by law from the date we receive the withdrawal request to the date we make payment.

CERTAIN EMPLOYEE BENEFIT PLANS

The Contract offered by this prospectus contains income payment tables that provide for different payments to men and women of the same age, except in states that require unisex tables. We reserve the right to use income payment tables that do not distinguish on the basis of sex, to the extent permitted by law. In certain employment-related situations, employers are required by law to use the same income payment tables for men and women. Accordingly, if the Contract is used in connection with an employment-related retirement or benefit plan and we do not offer unisex annuity tables in your state, you should consult with legal counsel as to whether the Contract is appropriate.

We will pay a death benefit if, prior to the Payout Start Date:

| |

1) | the Contract Owner dies; or |

We will pay the death benefit to the new Contract Owner as determined immediately after the death. The new Contract Owner would be a surviving Contract Owner or, if none, the Beneficiary.

DEATH BENEFIT AMOUNT

Prior to the Payout Start Date, the death benefit is equal to the Contract Value plus any positive Market Value Adjustment applied in excess of the Free Withdrawal Amount. Any applicable taxes may be deducted.

A claim for the settlement of the death benefit must include "Due Proof of Death." We will accept the following documentation as Due Proof of Death:

a certified copy of the death certificate;

a certified copy of a decree of a court of competent jurisdiction as to the finding of death; or

any other proof acceptable to us.

DEATH BENEFIT OPTIONS

Upon death of the Contract Owner, the new Contract Owner generally has the following 3 options:

| |

1. | receive the Cash Surrender Value within 5 years of the date of death; |

| |

2. | receive the Death Benefit in a lump sum; or |

| |

3. | apply the Death Benefit to an Income Plan, with income payments beginning within one year of the date of death. |

Income payments must be made over the life of the new Contract Owner, or a period not to exceed the life expectancy of the new Contract Owner.

Options 2 and 3 above are only available if we receive Due Proof of Death within 180 days of the date of death. We reserve the right to waive or extend the 180 day limit on a non-discriminatory basis. Please refer to your Contract for more details on the above options, including terms that apply to grantor trusts.

If the new Contract Owner is a non-living person (other than a grantor trust), the new Contract Owner must elect to receive the Death Benefit in a lump sum.

If the surviving spouse of the deceased Contract Owner is the new Contract Owner, then the spouse may elect Options 2 or 3 listed above or may continue the Contract in the Accumulation Phase as if the death had not occurred. If there is no Annuitant at that time, the new Annuitant will be the surviving spouse, unless the new Contract Owner names a different annuitant. If the Contract is continued in the Accumulation Phase, the surviving spouse may make a single withdrawal of any amount within 1 year of the date of death without incurring a withdrawal charge.

However, any applicable Market Value Adjustment, determined as of the date of the withdrawal, will apply. The single withdrawal amount is in addition to the annual Preferred Withdrawal Amount.

If the Contract Owner is not the Annuitant and the Annuitant dies, then the Contract Owner has the following 3 options:

| |

1. | continue the Contract as if the death had not occurred; |

| |

2. | receive the Death Benefit in a lump sum; or |

| |

3. | apply the Death Benefit to an Income Plan, which must begin within 1 year of the date of death and must be for a period equal to or less than the life expectancy of the Contract Owner. |

The Contract Owner has 60 days from the date Allstate Life receives Due Proof of Death to select an income plan without incurring a tax on the entire gain in the Contract. If the Contract Owner elects to continue the Contract they will be taxed on the entire gain in the Contract computed on the date of continuance. We are required to report such gain to the IRS as income to the Contract Owner. An additional 10% federal tax penalty may apply if the Contract Owner is under age 59 ½. Any amount included in the Contract Owner's gross income as a result of a Contract continuance will increase the investment in the Contract for future distributions.

For Options 1 and 3, the new Annuitant will be the youngest Contract Owner unless the Contract Owner names a different Annuitant. Options 1 and 3 are not available if the Contract Owner is a non-living person (other than a grantor trust).

Options 2 and 3 above are available only if we receive Due Proof of Death within 180 days of the date of death. We reserve the right to waive or extend the 180 day limit on a non-discriminatory basis. Please refer to your Contract for more details on the above options, including terms that apply to grantor trusts.

ALLSTATE LIFE

Allstate Life isInsurance Company

The Allstate Advisor Variable Annuities (STI)

AIM Enhanced Choice

Allstate Provider Series

Allstate Provider Advantage/Ultra/Extra

Allstate Provider Advantage/Ultra (STI)

AIM Lifetime Series: Classic, Regal and Freedom

STI Classic

AIM Lifetime Plus

Supplement, dated May 1, 2009

This supplement amends certain disclosure contained in the issuer of the Contract.prospectus for certain annuity contracts issued by Allstate Life was organized in 1957 as a stock life insurance company underInsurance Company.

Under the laws of“More Information” section, the State of Illinois.

Allstate Lifesubsection entitled “Legal Matters” is a wholly owned subsidiary of Allstate Insurance Company, a stock property-liability insurance company organized under the laws of the State of Illinois. All of the capital stock issueddeleted and outstanding of Allstate Insurance Company is owned by The Allstate Corporation.

Allstate Life is licensed to operate in the District of Columbia, Puerto Rico, and all jurisdictions except the State of New York. We intend to offer the Contract in those jurisdictions in which we are licensed. Our home office is located at 3075 Sanders Road, Northbrook, Illinois, 60062.

THE CONTRACT

Distribution. Morgan Stanley & Co. Inc., located at 1585 Broadway, New York, NY 10036, serves as principal underwriter of the Contracts. Morgan Stanley & Co. Inc. is a wholly owned subsidiary of Morgan Stanley Dean Witter & Co. Morgan Stanley & Co. Inc. is a registered broker-dealer under the Securities Exchange Act of 1934, as amended (“Exchange Act”) and is a member of FINRA. Morgan Stanley & Co. Inc. is also registeredreplaced with the Securities and Exchange Commission as an investment adviser.

We may pay broker-dealers up to a maximum sales commission of 8% on subsequent purchase payments or upon renewal of a Guarantee Period. The underwriting agreement with Morgan Stanley & Co. Inc. provides that we will reimburse Morgan Stanley & Co. Inc. for any liability to Contract Owners arising out of services rendered or Contracts issued.

Administration. We have primary responsibility for all administration of the Contracts. We provide the following administrative services, among others:

issuance of the Contracts;

maintenance of Contract Owner records;

Contract Owner services; and

preparation of Contract Owner reports.

You should notify us promptly in writing of any address change. You should read your statements and confirmations carefully and verify their accuracy. You should contact us promptly if you have a question about a periodic statement. We will investigate all complaints and make any necessary adjustments retroactively, but you must notify us of a potential error within a reasonable time

after the date of the questioned statement. If you wait too long, we reserve the right to make the adjustment as of the date that we receive notice of the potential error.

ANNUITIES HELD WITHIN A QUALIFIED PLAN

If you use the Contract within an employer sponsored qualified retirement plan, the plan may impose different or additional conditions or limitations on withdrawals, waivers of withdrawal charges, death benefits, Payout Start Dates, income payments, and other Contract features. In addition, adverse tax consequences may result if qualified plan limits on distributions and other conditions are not met. Please consult your qualified plan administrator for more information. Allstate Life no longer issues deferred annuities to employer sponsored qualified retirement plans.

LEGAL MATTERS

Certain matters of state law pertaining to the Contracts, including the validity of the Contracts and Allstate Life’s right to issue such Contracts under applicable state insurance law, have been passed upon by Angela K. Fontana, Vice President,Susan L. Lees, General Counsel and Secretary of Allstate Life.

The following discussion is general and is not intended as tax advice. Allstate Life makes no guarantee regarding the tax treatment of any Contract or transaction involving a Contract.

Federal, state, local“Annual Reports and other tax consequences of ownership or receipt of distributions under an annuity contract depend on your individual circumstances. If you are concerned about any tax consequences with regard to your individual circumstances, you should consult a competent tax adviser.

TAXATION OF ALLSTATE LIFE INSURANCE COMPANY

Allstate LifeDocuments” section is taxed as a life insurance company under Part I of Subchapter L of the Code.

TAXATION OF FIXED ANNUITIES IN GENERAL

Tax Deferral. Generally, you are not taxed on increases in the Contract Value until a distribution occurs. This rule applies only where the Contract Owner is a natural person.

Non-Natural Owners. Non-natural owners are also referred to as Non Living Owners in this prospectus. As a general rule, annuity contracts owned by non-natural persons such as corporations, trusts, or other entities are not treated as annuity contracts for federal income tax purposes. The income on such contracts does not enjoy tax deferraldeleted and is taxed as ordinary income received or accrued by the non-natural owner during the taxable year.

Exceptions to the Non-Natural Owner Rule. There are several exceptions to the general rule that annuity contracts held by a non-natural owner are not treated as annuity contracts for federal income tax purposes. Contracts will generally be treated as held by a natural person if the nominal owner is a trust or other entity which holds the contract as agent for a natural person. However, this special exception will not apply in the case of an employer who is the nominal owner of an annuity contract under a non-qualified deferred compensation arrangement for its employees. Other exceptions to the non-natural owner rule are: (1) contracts acquired by an estate of a decedent by reason of the death of the decedent; (2) certain qualified contracts; (3) contracts purchased by employers upon the termination of certain Qualified Plans; (4) certain contracts used in connection with structured settlement agreements; and (5) immediate annuity contracts, purchased with a single premium, when the annuity starting date is no later than a year from purchase of the annuity and substantially equal periodic payments are made, not less frequently than annually, during the annuity period.

Grantor Trust Owned Annuity. Contracts owned by a grantor trust are considered owned by a non-natural owner. Grantor trust owned contracts receive tax deferral as described in the Exceptions to the Non-Natural Owner Rule section. In accordancereplaced with the Code, upon the death of the annuitant, the death benefit must be paid. According to your Contract, the Death Benefit is paid to the surviving Contract Owner. Since the trust will be the surviving Contract Owner in all cases, the Death Benefit will be payable to the trust notwithstanding any beneficiary designation on the annuity contract. A trust, including a grantor trust, has two options for receiving any death benefits: 1) a lump sum payment; or 2) payment deferred up to five years from date of death.following:

Taxation of Partial and Full Withdrawals. If you make a partial withdrawal under a non-Qualified Contract, amounts received are taxable to the extent the Contract Value, without regard to surrender charges, exceeds the investment in the Contract. The investment in the Contract is the gross premium paid for the contract minus any amounts previously received from the Contract if such amounts were properly excluded from your gross income. If you make a total withdrawal under a non‑Qualified Contract, the amount received will be taxable only to the extent it exceeds the investment in the Contract.

You should contact a competent tax advisor about the potential tax consequences of a Market Value Adjustment, as no definitive guidance exists on the proper tax treatment of Market Value Adjustments.

Taxation of Annuity Payments. Generally, the rule for income taxation of annuity payments received from a non-Qualified Contract provides for the return of your investment in the Contract in equal tax-free amounts over the payment period. The balance of each payment received is taxable. For fixed annuity payments, the amount excluded from income is determined by multiplying the payment by the ratio of the investment in the Contract (adjusted for any refund feature or period certain) to the total expected value of annuity

payments for the term of the Contract. The annuity payments will be fully taxable after the total amount of the investment in the Contract is excluded using these ratios. The federal tax treatment of annuity payments is unclear in some respects. As a result, if the IRS should provide further guidance, it is possible that the amount we calculate and report to the IRS as taxable could be different. If you die, and annuity payments cease before the total amount of the investment in the Contract is recovered, the unrecovered amount will be allowed as a deduction for your last taxable year.

Partial Annuitization. An individual may partially annuitize their non-qualified annuity if the contract permits. The Small Business Jobs Act of 2010 included a provision which allows for a portion of a non-qualified annuity to be annuitized while the balance is not annuitized. The annuitized portion must be paid out over 10 or more years or over the lives of one of more individuals. The annuitized portion of the contract is treated as a separate contract for purposes of determining taxability of the payments under Section 72 of the Code. We do not currently permit partial annuitization.

Withdrawals After the Payout Start Date. Federal tax law is unclear regarding the taxation of any additional withdrawal received after the Payout Start Date. It is possible that a greater or lesser portion of such a payment could be taxable than the amount we determine.

Distribution at Death Rules. In order to be considered an annuity contract for federal income tax purposes, the Contract must provide:

if any Contract Owner dies on or after the Payout Start Date but before the entire interest in the Contract has been distributed, the remaining portion of such interest must be distributed at least as rapidly as under the method of distribution being used as of the date of the Contract Owner’s death;

if any Contract Owner dies prior to the Payout Start Date, the entire interest in the Contract will be distributed within 5 years after the date of the Contract Owner’s death. These requirements are satisfied if any portion of the Contract Owner’s interest that is payable to (or for the benefit of) a designated Beneficiary is distributed over the life of such Beneficiary (or over a period not extending beyond the life expectancy of the Beneficiary) and the distributions begin within 1 year of the Contract Owner’s death. If the Contract Owner’s designated Beneficiary is the surviving spouse (as defined by federal law) of the Contract Owner, the Contract may be continued with the surviving spouse as the new Contract Owner;

if the Contract Owner is a non-natural person, then the Annuitant will be treated as the Contract Owner for purposes of applying the distribution at death rules. In addition, a change in the Annuitant on a Contract owned by a non-natural person will trigger the rules under death of the Contract Owner.

Under Section 3 of the Federal Defense of Marriage Act (“DOMA”), same sex marriages under state law were not recognized for purposes of federal law. In 2013 the U.S. Supreme Court struck down Section 3 of DOMA as unconstitutional in United States v. Windsor thereby recognizing a valid same sex marriage for federal law purposes. On June 26, 2015, the Supreme Court ruled in Obergefell v.Hodges that same-sex couples have a constitutional right to marry, thus requiring all states to allow same-sex marriage. These decisions mean that the federal and state tax law provisions applicable to an opposite sex spouse will also apply to a same sex spouse. Please note that a civil union or domestic partnership is generally not recognized as a marriage.

Please consult with your tax or legal adviser for additional information.

Taxation of Annuity Death Benefits. Death Benefit amounts are included in income as follows:

if distributed in a lump sum, the amounts are taxed in the same manner as a total withdrawal, or

if distributed under an Income Plan, the amounts are taxed in the same manner as annuity payments.

Medicare Tax on Net Investment Income. The Patient Protection and Affordable Care Act, enacted in 2010, included a Medicare tax on investment income. This tax assesses a 3.8% surtax on the lesser of (1) net investment income or (2) the excess of “modified adjusted gross income” over a threshold amount. The “threshold amount” is $250,000 for married taxpayers filing jointly, $125,000 for married taxpayers filing separately, $200,000 for single taxpayers, and approximately $12,500 for trusts. The taxable portion of payments received as a withdrawal, surrender, annuity payment, death benefit payment or any other actual or deemed distribution under the contract will be considered investment income for purposes of this surtax.

Penalty Tax on Premature Distributions. A 10% penalty tax applies to the taxable amount of any premature distribution from a non-Qualified Contract. The penalty tax generally applies to any distribution made prior to the date you attain age 59½. However, no penalty tax is incurred on distributions:

made on or after the date the Contract Owner attains age 59½,

made as a result of the Contract Owner’s death or becoming totally disabled,

made in substantially equal periodic payments (as defined by the Code) over the Contract Owner’s life or life expectancy, or over the joint lives or joint life expectancies of the Contract Owner and the Beneficiary,

made under an immediate annuity (as defined by the Code), or

attributable to investment in the Contract before August 14, 1982.

You should consult a competent tax advisor to determine how these exceptions may apply to your situation.

Substantially Equal Periodic Payments. With respect to non‑Qualified Contracts using substantially equal periodic payments or immediate annuity payments as an exception to the penalty tax on premature distributions, any additional withdrawal or other material modification of the payment stream would violate the requirement that payments must be substantially equal. Failure to meet this requirement would mean that the income portion of each payment received prior to the later of 5 years or the Contract Owner’s attaining age 59½ would be subject to a 10% penalty tax unless another exception to the penalty tax applied. The tax for the year of the modification is increased by the penalty tax that would have been imposed without the exception, plus interest for the years in which the exception was used. A material modification does not include permitted changes described in published IRS rulings. Not all products may offer a substantially equal periodic payment stream. You should consult a competent tax advisor prior to creating or modifying a substantially equal periodic payment stream.

Tax Free Exchanges under Internal Revenue Code Section 1035. A 1035 exchange is a tax-free exchange of a non‑Qualified life insurance contract, endowment contract or annuity contract into a non-Qualified annuity contract, including tax-free exchanges of annuity death benefits for a Beneficiary Annuity. The contract owner(s) must be the same on the old and new contracts. Basis from the old contract carries over to the new contract so long as we receive that information from the relinquishing company. If basis information is never received, we will assume that all exchanged funds represent earnings and will allocate no cost basis to them.

Partial Exchanges. The IRS has issued rulings that permit partial exchanges of annuity contracts. Effective October 24, 2011, the provisions of Revenue Procedure 2011-38 indicate that a partial exchange, from one deferred annuity contract to another deferred annuity contract will qualify for tax deferral. If a distribution from either contract occurs during the 180 day period following the date of the 1035 transfer, the IRS will apply general tax principles to determine substance and treatment of the transfer. This may include disqualifying the original 1035 exchange or treating the withdrawn funds as a distribution from the original contract. You should consult with a competent tax advisor with respect to withdrawals or surrenders during this 180 day time frame.

If a partial exchange is retroactively negated, the amount originally transferred to the recipient contract is treated as a withdrawal from the source contract, taxable to the extent of any gain in that contract on the date of the exchange. An additional 10% tax penalty may also apply if the Contract Owner is under age 59 ½. Your Contract may not permit partial exchanges, please contact us for more information.

Partial exchange from a deferred annuity to long-term care contract. The IRS confirmed in Notice 2011-68 that partial exchanges from a deferred annuity contract to a qualified long-term care insurance contract can qualify as tax-free exchanges under section 1035.

You are strongly urged to consult a competent tax advisor before entering into any transaction of this type.

Taxation of Ownership Changes. If you transfer a non‑Qualified Contract without full and adequate consideration to a person other than your spouse (or to a former spouse incident to a divorce), you will be taxed on the difference between the Contract Value and the investment in the Contract at the time of transfer. Any assignment or pledge (or agreement to assign or pledge) of the Contract Value is taxed as a withdrawal of such amount or portion and may also incur the 10% penalty tax.

Aggregation of Annuity Contracts. The Code requires that all non-qualified deferred annuity contracts issued by Allstate Life (or its affiliates) to the same Contract Owner during any calendar year be aggregated and treated as one annuity contract for purposes of determining the taxable amount of a distribution.

INCOME TAX WITHHOLDING

Generally, Allstate Life is required to withhold federal income tax at a rate of 10% from all non-annuitized distributions. The customer may elect out of withholding by completing and signing a withholding election form. If no election is made, we will automatically withhold the required 10% of the taxable amount. If no election is made or no U.S. taxpayer identification number is provided we will automatically withhold the required 10% of the taxable amount. In certain states, if there is federal withholding, then state withholding is also mandatory.