AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON AUGUST 7,As Filed with the Securities and Exchange Commission on October 5, 2017

FILEREGISTRATION NO. 333-XXXXXX333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALLSTATE LIFE INSURANCE COMPANY(Exact Name of Registrant)

|

|

|

| ILLINOIS |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

| 36-2554642 |

| (I.R.S. Employer Identification Number) |

C/O ALLSTATE LIFE INSURANCE COMPANY

(Exact Name of Registrant)

ILLINOIS 36-2554642

(State or Other Jurisdiction (I.R.S. Employer

of Incorporation or Organization) Identification Number)

3075 SANDERS ROAD

NORTHBROOK, ILLINOIS 60062

847-402-5000(847)402-5000

(Address, including zip code, and Phone Numbertelephone number, including area code, of Principal Executive Office)principal executive offices)

CT Corporation

C T CORPORATION208 South LaSalle Street

Suite 814

Chicago, IL 60604

312-345-4320(312) 345-4320

(Name, Complete Addressaddress, including zip code and Telephone Numbertelephone number, including area code, of Agentagent for Service)service)

COPIES TO:

JAN FISCHER-WADE, ESQUIREESQ.

ALLSTATE LIFE INSURANCE COMPANY

2940 S. 84th84 th Street

Lincoln, NE 68506-4142

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE

TO THE PUBLIC:

The annuity contracts and interests thereunder covered by this registration statement are

Approximate date of commencement of proposed sale to be issued promptly and from time to timethe public: As soon as practicable after the effective date of this registration statement.

If any of the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: / /¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. /X/x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /offering: ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: / /¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. / /

¨

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer,” “smaller reporting company" and "smaller reporting company""emerging growth company in Rule 12b-2 of the Exchange Act.

Large accelerated filer / / |

| | | | |

| | | | |

Large accelerated filer ¨ | | | | Accelerated filer ¨ |

| | |

Non-accelerated filer x | | (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

| | | | |

Emerging growth company o | | | | |

Accelerated filer / /

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Non-accelerated filer /X/ (Do not check if a smaller reporting company)

Smaller reporting company / /

CALCULATION OF REGISTRATION FEE

|

| | | | | | | |

Title of securities to be registered | Amount to be registered | | maximum offering price per unit(1) | | Proposed maximum aggregate offering price | | Proposed Amount of registration fee |

Market Value Adjusted Annuity Contracts | $319,239,639 | | $1.00 | | $319,239,639 | | $0 |

(1) Interests in the market value adjustment account are sold on a dollar basis, not on the basis of a price per share or unit. |

| | | | | | | | | |

| | | | | | | | | |

| |

Title of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit(1) | | Proposed maximum aggregate offering price | | Amount of registration fee |

| Market Value Adjusted Annuity Contracts | | $4,471,024 | | $1.00 | | $0 | | $0 |

| |

| |

| (1) | Interests in the market value adjustment account are sold on a dollar basis, not on the basis of a price per share or unit. |

This filing is being made under the Securities Act of 1933 to register $319,239,639$4,471,024 of interests in market value adjusted annuity contracts. The interests being registered herein are carried over, as unsold securities, from an existing Form S-3 registration statement of the same issuer (333-200099)(333-199265) filed on November 7,October 10, 2014. Because a filing fee of $576 previously was paid with respect to those securities, there is no filing fee under this registration statement. In accordance with Rule 415(a)415 (a)(6), the offering of securities on the earlier registration statement will be deemed terminated as of the effective date of this registration statement.

Custom Plus Annuity

This Registration Statement contains a combined prospectus under Rule 429 under the Securities Act of 1933 which relates to the Form S-3 registration statement (File No. 333-199265), initially filed October 10, 2014, by Allstate Life Insurance Company

P.O. Box 660191

Dallas, TX 75266-0191

Telephone Number: 1-800-203-0068

Fax Number: 1-866-628-1006

Prospectus dated September 7, 2017

Company. Upon effectiveness, this Registration Statement, which is a new Registration Statement, will also act as a post-effective amendment to such earlier Registration Statement.Allstate Life Insurance Company (“incorporates by reference its annual report for the year ending 12/31/16 on Form 10-K filed pursuant to Section 13(a) or Section 15(d) of Exchange Act and all documents subsequently filed by Allstate Life”)Life Insurance Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act.

Risk Factors are discussed in the sections of the prospectus included in Part 1 of this Form concerning the Market Value Adjustment option.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of each prospectus included in this registration statement. Any representation to the contrary is a criminal offense.

The principal underwriter for these securities, Allstate Distributors, L.L.C. is not required to sell any specific number or dollar amount of securities, but will use its best efforts to sell the securities offered. The offering under this registration statement will conclude three years from the effective date of this registration statement, unless terminated earlier by the Registrant. See each prospectus included in Part 1 hereof for the date of the prospectus.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission may determine.

Supplement dated November 7, 2016, to the

Prospectus for your Variable Annuity

Issued by

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

This supplement amends certain disclosure contained in the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York.

Effective December 23, 2016 (the Closure Date), the Custom Plusfollowing variable sub-accounts available in your Variable Annuity will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Invesco V.I. Core Equity Fund – Series I

Invesco V.I. Core Equity Fund – Series II

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if they withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

Dollar cost averaging, category models and/or auto-rebalancing programs, if elected by a groupContract owner prior to the Closure Date, will not be affected by the closure unless a contract owner withdraws or otherwise transfers his entire Account Value from the sub-accounts.

If you have any questions, please contact your financial professional or our Variable Annuities Service Center at (800) 457-7617. Our representatives are available to assist you Monday through Friday between 7:30 a.m. and individual flexible premium deferred annuity contract (“Contract”). This prospectus contains information about the Contract. 5:00 p.m. Central time.

Please keep itthis supplement together with your prospectus for future reference. No other action is required of you.

ALLSTATESUP5

Supplement dated April 7, 2017, to the

Prospectus for your Variable Annuity

Issued by

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

This supplement amends certain disclosure contained in the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York.

Portfolio Closure

Effective at the close of business May 10, 2017 (the Closure Date), the following variable sub-account available in your Variable Annuity will be closed for new purchase payment allocations to all Contract owners:

Putnam VT Growth and Income Fund – Class IB

As of the Closure Date, no additional purchase payments (including any type of systematic payment or rebalancing) into the sub-account will be accepted from Contract owners, including those Contract owners who have contract value invested in the sub-account as of the Closure Date.

Portfolio Merger

The Contract is no longer being offered for sale. If you have already purchased a Contract you may continuefollowing Target Fund will be merged into the Acquiring Fund as noted below, effective on or about May 15, 2017 ("Merger Date"). All references to add to it. Each additional payment mustthe Target Fund in your Annuity prospectus should be at least $1,000.

The Contracts are available through Morgan Stanley & Co. Inc., the principal underwriter for the Contracts.disregarded.

|

| |

IMPORTANT

NOTICESTarget Fund | The Securities and Exchange Commission (“SEC”) has not approved or disapproved the securities described in this prospectus, nor has it passed on the accuracy or the adequacy of this prospectus. Anyone who tells you otherwise is committing a federal crime.Acquiring Fund |

Investment in the Contracts involves serious investment risks, including possible loss of principal.Putnam VT Growth and Income Fund – Class IB |

This prospectus does not constitute an offering in any jurisdiction in which such offering may not lawfully be made. We do not authorize anyone to provide any information or representations regarding the offering described in this prospectus other than as contained in this prospectus. |

Putnam VT Equity Income Fund – Class IB

On the Merger Date, the Target Fund will no longer be available under your annuity contract, and any Contract Value allocated to the Target Fund will be transferred, as of the Merger Date, to the Acquiring Fund.

Please note that you have the ability to transfer out of the Target Fund any time prior to the Merger Date. Such transfers will be free of charge and will not count as one of your annual free transfers under your annuity contract. Also, for a period of 60 days after the Merger Date, any Contract Value that was transferred to the Acquiring Fund as the result of the merger can be transferred free of charge and will not count as one of your annual free transfers. It is important to note that any Fund into which you make your transfer will be subject to the transfer limitations described in your prospectus. Please refer to your prospectus for detailed information about investment options.

After the Merger Date, the Target Fund will no longer exist and, unless you instruct us otherwise, any outstanding instruction you have on file with us that designates the Target Fund will be deemed instruction for the Acquiring Fund. This includes, but is not limited to, systematic withdrawals and Dollar Cost Averaging.

You may wish to consult with your financial professional to determine if your existing allocation instructions should be changed before or after the Merger Date.

If you have any questions, please contact your financial professional or our Variable Annuities Service Center at (800) 457-7617. Our representatives are available to assist you Monday through Friday between 7:30 a.m. and 5:00 p.m. Central time.

Please keep this supplement together with your prospectus for future reference. No other action is required of you.

ALLSTATESUP10

Supplement dated January 3, 2014, to the

Prospectus for your Variable Annuity

Issued by

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

This supplement amends certain disclosure contained in the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York, as applicable.

Effective as of January 31, 2014 (the Closure Date), the following variable sub-accounts available in your Variable Annuity will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Oppenheimer Capital Appreciation Fund/VA—Class 2

Oppenheimer Capital Appreciation Fund/VA—Class A

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if they withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

If you have any questions, please contact your financial representative or our Variable Annuities Service Center at (800) 457-7617. Our representatives are available to assist you Monday through Friday between 7:30 a.m. and 5:00 p.m. Central time.

Dollar cost averaging and/or auto-rebalancing, if elected by a contract owner prior to the Closure Date, will not be affected by the closure.

Please keep this supplement for future reference together with your prospectus. No other action is required of you.

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

Supplement, dated October 18, 2010, to the

following Prospectuses, as supplemented:

Allstate Advisor, dated May 1, 2010 (Allstate Life Insurance Company)

Allstate Advisor, dated May 1, 2007 (Allstate Life Insurance Company of New York)

STI Classic Variable Annuity, dated May 1, 2004

Allstate Provider, dated May 1, 2004

This supplement amends the above-referenced prospectuses for certain Variable Annuity contracts issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York, as applicable.

Effective as of November 19, 2010 (the Closure Date), the following variable sub-accounts available in the above-referenced Variable Annuities will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Oppenheimer Balanced Fund/VA—Service Shares

Oppenheimer Balanced Fund/VA—Initial Shares

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if they withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

Dollar cost averaging and/or auto-rebalancing, if elected by a contract owner, will not be affected by the closure.

If you have any questions, please contact your financial representative or our Variable Annuity Service Center at (800) 457-7617. Our representatives are available to assist you from 7:30 a.m. to 5 p.m. Central time.

Please read the prospectus supplement carefully and then file it with your important papers. No other action is required of you.

Supplement, dated October 18, 2010,

to the Prospectus for your Variable Annuity

Issued by

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

LINCOLN BENEFIT LIFE COMPANY

This supplement amends the prospectus for your Variable Annuity contract issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York or Lincoln Benefit Life Company, as applicable.

Effective as of November 19, 2010 (the Closure Date), the following variable sub-accounts available in the above-referenced Variable Annuities will be closed to all contract owners except those contract owners who have contract value invested in the variable sub-accounts as of the Closure Date:

Invesco V.I. Capital Appreciation Fund—Series I

Invesco V.I. Capital Appreciation Fund—Series II

Contract owners who have contract value invested in these variable sub-accounts as of the Closure Date may continue to submit additional investments into the variable sub-accounts thereafter, although they will not be permitted to invest in the variable sub-accounts if they withdraw or otherwise transfer their entire contract value from the variable sub-accounts following the Closure Date. Contract owners who do not have contract value invested in the variable sub-accounts as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

Dollar cost averaging and/or auto-rebalancing, if elected by a contract owner, will not be affected by the closure.

If you have any questions, please contact your financial representative or our Variable Annuity Service Center at (800) 457-7617. Our representatives are available to assist you from 7:30 a.m. to 5 p.m. Central time.

Please read the prospectus supplement carefully and then file it with your important papers. No other action is required of you.

ALLSTATE LIFE INSURANCE COMPANY

ALLSTATE LIFE INSURANCE COMPANY OF NEW YORK

Supplement Dated July 23, 2010

To the following Prospectuses, as supplemented

Allstate Provider Prospectus, dated May 1, 2002

Allstate Provider Prospectus, dated May 1, 2004

Custom Portfolio Prospectus, dated April 30, 2005

STI Classic Prospectus, dated May 1, 2003

SelectDirections Prospectus, dated May 1, 2003

SelectDirections Prospectus, dated April 30, 2005

This supplement amends certain disclosure contained in the above-referenced prospectuses for certain variable annuity contracts issued by Allstate Life Insurance Company or Allstate Life Insurance Company of New York, as applicable.

Effective as of August 30, 2010 (the Closure Date), the following variable sub-accounts available, as applicable, in the above-referenced Variable Annuities will be closed to all contract owners except those contract owners who have contract value invested in either of these variable sub-accounts as of the Closure Date:

Oppenheimer High Income Fund/VA (Initial Class)

Oppenheimer Small- & Mid-Cap Growth Fund/VA (Initial Class)*

Contract owners who have contract value invested in either of these variable sub-accounts as of the Closure Date may continue to submit additional investments into the respective variable sub-account thereafter, although they will not be permitted to invest in the respective variable sub-account if they withdraw or otherwise transfer their entire contract value from the respective variable sub-account following the Closure Date. Contract owners who do not have contract value invested in the respective variable sub-account as of the Closure Date will not be permitted to invest in these variable sub-accounts thereafter.

Dollar cost averaging and/or auto-rebalancing, if elected by a contract owner, will not be affected by the closures.

If you have any questions, please contact your financial representative or our Annuities Service Center at (800) 457-7617. Our representatives are available to assist you from 7:30 a.m. to 5 p.m. Central time.

Please read the prospectus supplement carefully and then file it with your important papers. No other action is required of you

* Note: Oppenheimer Small- & Mid-Cap Growth Fund/VA was formerly known as Oppenheimer MidCap Fund/VA.

Supplement Dated December 31, 2009

To the Prospectus for Your Variable Annuity

Issued By

Allstate Life Insurance Company

Allstate Life Insurance Company of New York

Lincoln Benefit Life Company

This supplement amends the prospectus for your variable annuity contract issued by Allstate Life Insurance Company, Allstate Life Insurance Company of New York, or Lincoln Benefit Life Company.

The following provision is added to your prospectus:

WRITTEN REQUESTS AND FORMS IN GOOD ORDER. Written requests must include sufficient information and/or documentation, and be sufficiently clear, to enable us to complete your request without the need to exercise discretion on our part to carry it out. You may contact our Customer Service Center to learn what information we require for your particular request to be in “good order.” Additionally, we may require that you submit your request on our form. We reserve the right to determine whether any particular request is in good order, and to change or waive any good order requirements at any time.

If you have any questions, please contact your financial representative or call our Customer Service Center at 1-800-457-7617. If you own a Putnam contract, please call 1-800-390-1277.

For future reference, please keep this supplement together with your prospectus.

Allstate Life Insurance Company

The Allstate Advisor Variable Annuities (STI)

AIM Enhanced Choice

Allstate Provider Series

Allstate Provider Advantage/Ultra/Extra

Allstate Provider Advantage/Ultra (STI)

AIM Lifetime Series: Classic, Regal and Freedom

STI Classic

AIM Lifetime Plus

Supplement, dated May 1, 2009

This supplement amends certain disclosure contained in the prospectus for certain annuity contracts issued by Allstate Life Insurance Company.

Under the “More Information” section, the subsection entitled “Legal Matters” is deleted and replaced with the following:

LEGAL MATTERS

Certain matters of state law pertaining to the Contracts, including the validity of the Contracts and Allstate Life’s right to issue such Contracts under applicable state insurance law, have been passed upon by Susan L. Lees, General Counsel of Allstate Life.

The “Annual Reports and other Documents” section is deleted and replaced with the following:

ANNUAL REPORTS AND OTHER DOCUMENTS

Allstate Life Insurance Company (“Allstate Life”) incorporates by reference into the prospectus its latest annual report on Form 10-K filed pursuant to Section 13(a) or Section 15(d) of the Exchange Act and all other reports filed with the SEC under the Exchange Act since the end of the fiscal year covered by its latest annual report, including filings made on Form 10-Q and Form 8-K. In addition, all documents subsequently filed by Allstate Life pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act also are incorporated into the prospectus by reference. Allstate Life will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference into the prospectus but not delivered with the prospectus. Such information will be provided upon written or oral request at no cost to the requester by writing to Allstate Life, P.O. Box 758565, Topeka, KS 66675-8565 or by calling 1-800—457-7617. Allstate Life files periodic reports as required under the Securities Exchange Act of 1934. The public may read and copy any materials that Allstate Life files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy, and information statements, and other information regarding issuers that file electronically with the SEC (see http://www.sec.gov).

Allstate Life Insurance Company

STI Classic

Supplement, dated February 13, 2009

This supplement amends certain disclosure contained in the prospectus for certain annuity contracts issued by Allstate Life Insurance Company.

Under the “More Information” section, the subsection entitled “Legal Matters” is deleted and replaced with the following:

LEGAL MATTERS

Certain matters of state law pertaining to the Contracts, including the validity of the Contracts and Allstate Life’s right to issue such Contracts under applicable state insurance law, have been passed upon by Susan L. Lees, General Counsel of Allstate Life.

The “Annual Reports and Other Documents” section is deleted and replaced with the following:

ANNUAL REPORTS AND OTHER DOCUMENTS

Allstate Life Insurance Company (“Allstate Life”) incorporates by reference into the prospectus its latest annual report on Form 10-K filed pursuant to Section 13(a) or Section 15(d) of the Exchange Act and all other reports filed with the SEC under the Exchange Act since the end of the fiscal year covered by its latest annual report, including filings made on Form 10-Q and Form 8-K. In addition, all documents subsequently filed by Allstate Life pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act also are incorporated into the prospectus by reference. Allstate Life will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference into the prospectus but not delivered with the prospectus. Such information will be provided upon written or oral request at no cost to the requester by writing to Allstate Life, P.O. Box 758566, Topeka, KS 66675-8566 or by calling 1-800- 457-7617. Allstate Life files periodic reports as required under the Securities Exchange Act of 1934. The public may read and copy any materials that Allstate Life files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy, and information statements, and other information regarding issuers that file electronically with the SEC (see http://www.sec.gov).

Allstate Life Insurance Company Allstate Financial Advisors Separate Account I

Supplement, dated February 26, 2007 to The STI Classic Variable Annuity Prospectus dated May 1, 2004

This supplement amends certain disclosure contained in the above-referenced prospectus for certain variable annuity contracts (“Contracts”) issued by Allstate Life Insurance Company.

We have received notice that the Board of Trustees (“Board”) of the STI Classic Variable Trust has approved the liquidation, on or about May 1, 2007 of the following Fund portfolios:

STI Classic International Equity Fund Portfolio STI Classic Investment Bond Fund Portfolio

(collectively the “STI Classic Portfolios”)

Due to the liquidation of the STI Classic Portfolios, we will no longer accept new premiums for investment in, nor will we permit transfers to, the STI Classic International Equity Fund Sub-Account or the STI Classic Investment Grade Bond Fund Sub-Account (“STI Classic Sub-Accounts”) on or after April 27, 2007.

As the STI Classic Sub-Accounts will no longer be offered as an investment alternative, you may wish to transfer, prior to April 27, 2007 some or all of your Contract Value in the STI Classic Sub-Accounts to the other investment alternatives currently offered by your Contract. These transfers are not subject to a transfer fee. Any value remaining in the STI Classic Sub-Accounts will be transferred automatically, as of April 27, 2007, to the Federated Prime Money Fund II Sub-Account, an investment alternative already available under your Contract.

If you currently allocate Contract Value to the STI Classic Sub-Accounts through automatic additions, automatic portfolio rebalancing, dollar cost averaging or systematic withdrawal programs, your allocations in these programs will also need to be changed. If you do not change these allocations to other investment alternatives currently available under your Contract, any allocations to the STI Classic Sub-Accounts will be automatically allocated, as of April 27, 2007, to the Federated Prime Money Fund II Sub-Account.

We will send you a confirmation that shows the amount that is transferred to the Federated Prime Money Fund II Sub-Account or to the investment alternative that you chose and the date of the transaction. For additional information on how to transfer to another investment alternative, or how to make a change to your current allocation(s), please contact your financial representative or call our Customer Service Center at 1-800-203-0068.

If your Contract Value in the STI Sub-Account is transferred automatically to the Federated Prime Money Fund II Sub-Account, for 60 days following the automatic transfer, you may transfer your Contract Value in the Federated Prime Money Fund II Sub-Account to any other investment alternative(s) available under your Contract. Such transfer is not subject to a transfer fee.

Attached as Appendix A is a list of the Portfolios and Fixed Account Investment Alternatives currently available under your Contract.

Please keep this supplement for future reference together with your prospectus.

Appendix A

The STI Classic Variable Annuity contracts offer a variety of Investment Alternatives that encompass investment choices ranging from aggressive to conservative. Below is a listing of the Portfolios and Fixed Account Investment Alternatives currently available. Also included is the investment objective for each Portfolio.

For more complete information about each Portfolio, including expenses and risks associated with the Portfolio, please refer to the relevant prospectus for the Portfolio.

Portfolios

|

| | |

| | Page |

|

OverviewPortfolio | | Investment Objective |

| AIM V.I. Basic Balanced Fund - Series I | | Seeks long-term growth of capital. |

| AIM V.I. Capital Appreciation Fund - Series I | | Seeks growth of capital. |

| AIM V.I. Core Equity Fund - Series I | | Seeks growth of capital. |

| AIM V.I. High Yield Fund - Series I | | Seeks high level of current income. |

| Federated Prime Money Fund II | | Seeks current income consistent with stability of principal and liquidity. |

| Fidelity VIP Contrafund (R) Portfolio - Initial Class | | Seeks long-term capital appreciation. |

| Fidelity VIP Equity-Income Portfolio - Initial Class | | Seeks reasonable income by investing primarily in income-producing equity securities. In choosing these securities, the fund will also consider the potential for capital appreciation. The fund’s goal is to achieve a yield which exceeds the composite yield on the securities comprising the S&P 500. |

| Fidelity VIP Growth Portfolio - Initial Class | | Seeks to achieve capital appreciation. |

| Fidelity VIP High Income Portfolio - Initial Class | | Seeks high level of current income, while also considering growth of capital. |

| Fidelity VIP Index 500 Portfolio - Initial Class | | Seeks investment results that correspond to the total return of common stocks publicly traded in the United States, as represented by the Standard & Poor’s 500 (SM) Index (S&P 500 (R)). |

| Fidelity VIP Overseas Portfolio - Initial Class | | Seeks long-term growth of capital. |

| FTVIP Templeton Global Income Securities Fund - Class 2 | | Seeks high current income, consistent with preservation of capital, with capital appreciation as a secondary consideration. |

| FTVIP Templeton Growth Securities Fund - Class 2 | | Seeks long-term capital growth. |

| MFS Emerging Growth Series - Initial Class | | Seeks long-term growth of capital. |

| MFS Investors Trust Series - Initial Class | | Seeks to provide long-term growth of capital and secondarily to provide reasonable current income. |

| MFS New Discovery Series - Initial Class | | Seeks capital appreciation. |

| MFS Research Series - Initial Class | | Seeks long-term growth of capital and future income. |

| MFS Utilities Series - Initial Class | | Seeks capital growth and current income. |

| Oppenheimer MidCap Fund/VA | | Seeks capital appreciation by investing in “growth type” companies. |

| Oppenheimer Balanced Fund/VA | | Seeks a high total investment return, which includes current income and capital appreciation in the value of its shares. |

|

| | |

| | |

| Oppenheimer Capital Appreciation Fund/VA | | Seeks capital appreciation by investing in securities of well-known, established companies. |

| Oppenheimer Global Securities Fund/VA | | Seeks long-term capital appreciation by investing a substantial portion of assets in securities of foreign issuers, growth-type companies, cyclical industries and special situations that are considered to have appreciation possibilities. |

| Oppenheimer Main Street Fund (R) /VA | | Seeks high total return (which includes growth in the value of its shares as well as current income) from equity and debt securities. |

| Oppenheimer Strategic Bond Fund/VA | | Seeks a high level of current income principally derived from interest on debt securities. |

| Putnam VT Discovery Growth Fund - Class IB | | Seeks long-term growth of capital. |

| Putnam VT Diversified Income Fund - Class IB | | Seeks as high a level of current income as Putnam Management believes is consistent with preservation of capital. |

| Putnam VT Growth and Income Fund - Class IB | | Seeks capital growth and current income. |

| Putnam VT Growth Opportunities Fund - Class IB | | Seeks capital appreciation. |

| Putnam VT Health Sciences Fund - Class IB | | Seeks capital appreciation. |

| Putnam VT New Value Fund - Class IB | | Seeks long-term capital appreciation. |

| STI Classic Capital Appreciation Fund | | Seeks capital appreciation. |

| STI Classic Large Cap Relative Value Fund | | Seeks long-term capital appreciation with the secondary goal of current income. |

| STI Classic Mid-Cap Equity Fund | | Seeks capital appreciation. |

| STI Classic Small Cap Value Equity Fund | | Seeks capital appreciation with the secondary goal of current income. |

| STI Classic Large Cap Value Equity Fund | | Seeks capital appreciation with the secondary goal of current income. |

Fixed Account Options*

Standard Fixed Account Option

Dollar Cost Averaging Fixed Account Option

Market Value Adjusted Fixed Account Option

* Some fixed account options are not available in all states.

Allstate Life Insurance Company Allstate Financial Advisors Separate Account I

Supplement dated January 3, 2005 to the The STI Classic Variable Annuity Prospectus dated May 1, 2004

This supplement amends certain information contained in the prospectus for the STI Classic Variable Annuity Contracts (“Contracts”), formerly issued by Glenbrook Life and Annuity Company (“Glenbrook”). Please read this supplement carefully and retain it for future reference together with your prospectus. All capitalized terms have the same meaning as those included in the prospectus.

Merger of Glenbrook with Allstate Life

Effective January 1, 2005, Glenbrook merged with and into its parent company, Allstate Life Insurance Company (“Allstate Life”). The merger of Glenbrook and Allstate Life (the “Merger”) was approved by the boards of directors of Allstate Life and Glenbrook. The Merger also received regulatory approval from the Departments of Insurance of the States of Arizona and Illinois, the states of domicile of Glenbrook and Allstate Life, respectively.

On the date of the Merger, Allstate Life acquired from Glenbrook all of Glenbrook’s assets and became directly liable for Glenbrook’s liabilities and obligations with respect to all Contracts issued by Glenbrook.

The Merger did not affect the terms of, or the rights and obligations under your Contract, other than to reflect the change to the company that guarantees your Contract benefits from Glenbrook to Allstate Life. You will receive certificate endorsements from Allstate Life that reflect the change from Glenbrook to Allstate Life. The Merger also did not result in any adverse tax consequences for any Contract Owners.

Separate Account Consolidation

Effective January 1, 2005, and in connection with the Merger, Glenbrook Life Multi-Manager Variable Account and Glenbrook Life and Annuity Company Separate Account A combined with and into the Allstate Financial Advisors Separate Account I (“Allstate Separate Account I”), and consolidated duplicative Variable Sub-Accounts that invest in the same Portfolio (the “Consolidation”). The accumulation unit values for the Variable Sub-Accounts in which you invest did not change as a result of the Consolidation, and your Contract Value immediately after the Consolidation was the same as the value immediately before the Consolidation.

As a result of the Merger and Consolidation, your prospectus is amended as follows:

Replace all references to “Glenbrook” with “Allstate Life.” Replace all references to “Glenbrook Life and Annuity Company Separate Account A” with “Allstate Financial Advisors Separate Account I.” All references to “We,” “Us,” or “our” shall mean “Allstate Life.” All references to “the Variable Account” shall mean “Allstate Financial Advisors Separate Account I.”

Page 12: Under the heading “Financial Information” replace the last two sentences of the second paragraph with:

The financial statements of Allstate Life and Allstate Financial Advisors Separate Account I, which includes financial information giving effect to the separate account Consolidation on a pro forma basis, also appear in the Statement of Additional Information. For a free copy of the Statement of Additional Information, please write or call us at 1-800- 755-5275.

Page 16: Delete in their entirety the Sections entitled “Market Timing & Excess Trading” and “Trading Limitations” and replace them with the following:

MARKET TIMING & EXCESSIVE TRADING

The Contracts are intended for long-term investment. Market timing and excessive trading can potentially dilute the value of Variable Sub-Accounts and can disrupt management of a Portfolio and raise its expenses, which can impair Portfolio performance. Our policy is not to accept knowingly any money intended for the purpose of market timing or excessive trading. Accordingly, you should not invest in the Contract if your purpose is to engage in market timing or excessive trading, and you should refrain from such practices if you currently own a Contract.

We seek to detect market timing or excessive trading activity by reviewing trading activities. Portfolios also may report suspected market-timing or excessive trading activity to us. If, in our judgment, we determine that the transfers are part of a market timing strategy or are otherwise harmful to the underlying Portfolio, we will impose the trading limitations as described below under “Trading Limitations.” Because there is no universally accepted definition of what constitutes market timing or excessive trading, we will use our reasonable judgment based on all of the circumstances.

While we seek to deter market timing and excessive trading in Variable Sub-Accounts, not all market timing or excessive trading is identifiable or preventable. Imposition of trading limitations is triggered by the detection of market timing or excessive trading activity, and the trading limitations are not applied prior to detection of such trading activity. Therefore, our policies and procedures do not prevent such trading activity before it first occurs. To the extent that such trading activity occurs prior to detection and the imposition of trading restrictions, the portfolio may experience the adverse effects of market timing and excessive trading described above.

TRADING LIMITATIONS

We reserve the right to limit transfers among the investment alternatives in any Contract year, or to refuse any transfer request, if:

|

| | | |

| • | | we believe, in our sole discretion, that certain trading practices, such as excessive trading, by, or on behalf of, one or more Contract Owners, or a specific transfer request or group of transfer requests, may have a detrimental effect on the Accumulation Unit Values of any Variable Sub-Account or on the share prices of the corresponding Portfolio or otherwise would be to the disadvantage of other Contract Owners; or |

|

| | | |

| • | | we are informed by one or more of the Portfolios that they intend to restrict the purchase, exchange, or redemption of Portfolio shares because of excessive trading or because they believe that a specific transfer or group of transfers would have a detrimental effect on the prices of Portfolio shares. |

In making the determination that trading activity constitutes market timing or excessive trading, we will consider, among other things:

|

| | | |

| • | | the total dollar amount being transferred, both in the aggregate and in the transfer request; |

|

| | | |

| • | | the number of transfers you make over a period of time and/or the period of time between transfers (note: one set of transfers to and from a sub-account in a short period of time can constitute market timing); |

|

| | | |

| • | | whether your transfers follow a pattern that appears designed to take advantage of short term market fluctuations, particularly within certain Sub-account underlying portfolios that we have identified as being susceptible to market timing activities; |

|

| | | |

| • | | whether the manager of the underlying portfolio has indicated that the transfers interfere with portfolio management or otherwise adversely impact the portfolio; and |

|

| | | |

| • | | the investment objectives and/or size of the Sub-account underlying portfolio. |

If we determine that a contract owner has engaged in market timing or excessive trading activity, we will restrict that contract owner from making future additions or transfers into the impacted Sub-account(s). If we determine that a contract owner has engaged in a pattern of market timing or excessive trading activity involving multiple Sub-accounts, we will also require that all future transfer requests be submitted through regular U.S. mail thereby refusing to accept transfer requests via telephone, facsimile, Internet, or overnight delivery. Any Sub-account or transfer restrictions will be uniformly applied.

In our sole discretion, we may revise our Trading Limitations at any time as necessary to better deter or minimize market timing and excessive trading or to comply with regulatory requirements.

Pages 26: Under the heading “More Information,” replace the sections entitled “Glenbrook” and “The Variable Account” with the following:

ALLSTATE LIFE

Allstate Life is the issuer of the Contract. Allstate Life was organized in 1957 is a stock life insurance company under the laws of the state of Illinois. Prior to January 1, 2005, Glenbrook Life and Annuity Company (“Glenbrook”) issued the Contract. Effective January 1, 2005, Glenbrook merged with Allstate Life (“Merger”). On the date of the Merger, Allstate Life acquired from Glenbrook all of Glenbrook’s assets and became directly liable for Glenbrook’s liabilities and obligations with respect to all contracts issued by Glenbrook.

Allstate Life is a wholly owned subsidiary of Allstate Insurance Company, a stock property-liability insurance company organized under the laws of the state of Illinois. All of the capital stock issued and outstanding of Allstate Insurance Company is owned by The Allstate Corporation.

Allstate Life is licensed to operate in the District of Columbia, Puerto Rico, and all jurisdictions except the state of New York. We intend to offer the Contract in those jurisdictions in which we are licensed. Our home office is located at 3100 Sanders Road, Northbrook, Illinois 60062.

THE VARIABLE ACCOUNT

Allstate Life established the Allstate Financial Advisors Separate Account I in 1999. The Contracts were previously issued through the Glenbrook Life and Annuity Company Separate Account A. Effective January 1, 2005, Glenbrook Life Multi-Manager Variable Account and Glenbrook Life and Annuity Company Separate Account A combined with Allstate Financial Advisors Separate Account I and consolidated duplicative Variable Sub-Accounts that invest in the same Portfolio (the “Consolidation”). The Accumulation Unit Values for the Variable Sub-Accounts in which you invest did not change as a result of the Consolidation, and your Contract Value immediately after the Consolidation was the same as the value immediately before the Consolidation. We have registered the Variable Account with the SEC as a unit investment trust. The SEC does not supervise the management of the Variable Account or Allstate Life.

We own the assets of the Variable Account. The Variable Account is a segregated asset account under Illinois insurance law. That means we account for the Variable Account’s income, gains, and losses separately from the results of our other operations. It also means that only the assets of the Variable Account that are in excess of the reserves and other Contract liabilities with respect to the Variable Account are subject to liabilities relating to our other operations. Our obligations arising under the Contracts are general corporate obligations of Allstate Life.

The Variable Account consists of multiple Variable Sub-Accounts, each of which are available under the Contract. We may add new Variable Sub-Accounts or eliminate one or more of them, if we believe marketing, tax, or investment conditions so warrant. We do not guarantee the investment performance of the Variable Account, its Sub-Accounts or the Portfolios. We may use the Variable Account to fund our other annuity contracts. We will account separately for each type of annuity contract funded by the Variable Account.

THE STI CLASSIC VARIABLE ANNUITY

ALLSTATE LIFE INSURANCE COMPANY

STREET ADDRESS: 2940 S. 84TH STREET, LINCOLN, NE 68506-4142 MAILING ADDRESS:

P.O. BOX 80469, LINCOLN, NE 68501-0469 TELEPHONE NUMBER: 1-800-755-5275 PROSPECTUS DATED JANUARY 3, 2005

Allstate Life Insurance Company (“Allstate Life”) is offering the STI Classic Variable Annuity, an individual flexible premium deferred variable annuity contract (“CONTRACT”). This prospectus contains information about the Contract that you should know before investing. Please keep it for future reference. The Contract is no longer being offered for new sales. If you have already purchased the Contract, you may continue to make additional purchase payments according to your Contract.

The Contract currently offers 42 “INVESTMENT ALTERNATIVES”. The investment alternatives include 3 fixed account options (“FIXED ACCOUNT OPTIONS”) and 39 variable sub-accounts (“VARIABLE SUB-ACCOUNTS”) of the Allstate Financial Advisors Separate Account I (“VARIABLE ACCOUNT”). Each Variable Sub-Account invests exclusively in shares of one of the portfolios (“PORTFOLIOS”) of the following underlying funds (“FUNDS”)

|

| | |

| | |

| AIM VARIABLE INSURANCE FUNDS-SERIES I | | MFS(R) VARIABLE INSURANCE |

| SHARES | | TRUST(SM)-INITIAL CLASS |

| FEDERATED INSURANCE SERIES | | OPPENHEIMER VARIABLE ACCOUNT FUNDS |

| FIDELITY(R) VARIABLE INSURANCE | | PUTNAM VARIABLE TRUST-CLASS IB |

| PRODUCTS-INITIAL CLASS | | STI CLASSIC VARIABLE TRUST |

| FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST-CLASS 2 | | |

WE (Allstate Life) have filed a Statement of Additional Information, dated January 3, 2005, with the Securities and Exchange Commission (“SEC”). It contains more information about the Contract and is incorporated herein by reference, which means it is legally a part of this prospectus. Its table of contents appears on page 52 of this prospectus. For a free copy, please write or call us at the address or telephone number above, or go to the SEC’s Web site (http://www.sec.gov). You can find other information and documents about us, including documents that are legally part of this prospectus, at the SEC’s Web site.

|

| | |

| | |

| | THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THE SECURITIES DESCRIBED IN THIS PROSPECTUS, NOR HAS IT PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A FEDERAL CRIME. |

| |

| IMPORTANT NOTICES | | THE CONTRACTS MAY BE DISTRIBUTED THROUGH BROKER-DEALERS THAT HAVE RELATIONSHIPS WITH BANKS OR OTHER FINANCIAL INSTITUTIONS OR BY EMPLOYEES OF SUCH BANKS. HOWEVER, THE CONTRACTS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED BY SUCH INSTITUTIONS OR ANY FEDERAL REGULATORY AGENCY. INVESTMENT IN THE CONTRACTS INVOLVES INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL. |

THE CONTRACTS ARE NOT FDIC INSURED.

1 PROSPECTUS

TABLE OF CONTENTS

|

| | |

| |

| PAGE |

| OVERVIEW | |

| Important Terms | |

|

| The Contract at a Glance | |

|

| How the Contract Works | 5 |

|

Contract FeaturesExpense Table | 6 |

|

| Financial Information | 8 |

|

| CONTRACT FEATURES | |

| The Contract | 6 |

|

Contract Owner | 6 |

|

Annuitant | 6 |

|

Beneficiary | 6 |

|

Modification of the Contract | |

|

Assignment | |

|

Written Requests and Forms in Good Order | 8 |

|

Purchases and Contract Value | |

|

Minimum Purchase Payments | |

|

Automatic Additions Program | |

|

Allocation of Purchase Payments | 9 |

|

| Contract Value | 10 |

|

Guarantee PeriodsInvestment Alternatives | 11 |

|

Interest RatesThe Variable Sub-Accounts | 811 |

|

How We Credit InterestThe Fixed Account Options | 813 |

|

Market Value AdjustmentTransfers | 915 |

|

| Expenses | 17 |

|

Withdrawal Charge | |

| PAGE |

| Access To Your Money | 19 |

|

Premium TaxesIncome Payments | 1020 |

|

Access to Your MoneyDeath Benefits | 1022 |

|

Systematic Withdrawal ProgramOTHER INFORMATION | |

| More Information: | 25 |

|

Postponement of PaymentsAllstate Life | 25 |

|

Return of Purchase Payment GuaranteeThe Variable Account | 26 |

|

MinimumThe Portfolios | 26 |

|

The Contract Value | 1127 |

|

| Non-Qualified Annuities Held Within a Qualified Plan | 27 |

|

| Legal Matters | 27 |

|

| Taxes | 28 |

|

| Annual Reports and Other Documents | 33 |

|

| APPENDIX A - ACCUMULATION UNIT VALUES | 34 |

|

| APPENDIX B - MARKET VALUE ADJUSTMENT | 48 |

|

| STATEMENT OF ADDITIONAL INFORMATION TABLE OF CONTENTS | 50 |

|

2 PROSPECTUS

IMPORTANT TERMS

This prospectus uses a number of important terms that you may not be familiar with. The index below identifies the page that describes each term. The first use of each term in this prospectus appears in highlights.

|

| | |

| | Page |

| PAGE |

| Accumulation Phase | 6 |

|

| Accumulation Unit | 9 |

|

| Accumulation Unit Value | 9 |

|

| Anniversary Values | 24 |

|

| Annuitant | 9 |

|

| Automatic Additions Program | 10 |

|

| Automatic Portfolio Rebalancing Program | 18 |

|

| Beneficiary | 9 |

|

| Cancellation Period | 11 |

|

| Contract | 9 |

|

| Contract Anniversary | 5 |

|

| Contract Owner ("You") | 9 |

|

| Contract Value | 5 |

|

| Contract Year | 5 |

|

| Death Benefit Anniversary | 23 |

|

| Dollar Cost Averaging Program | 18 |

|

| Due Proof of Death | 23 |

|

| Enhanced Death Benefit Rider | 24 |

|

| |

| PAGE |

| Fixed Account Options | 14 |

|

| Free Withdrawal Amount | 19 |

|

| Allstate Life ("We" or "Us") | 26 |

|

| Guarantee Periods | 14 |

|

| Income Plan | 21 |

|

| Investment Alternatives | 12 |

|

| Issue Date | 6 |

|

| Market Value Adjustment | 16 |

|

| Payout Phase | 116 |

|

| Payout Start Date | 1121 |

|

Income Plans | 11 |

|

Income PaymentsPortfolios | 12 |

|

Certain Employee Benefit PlansSEC | 121 |

|

Death BenefitsSettlement Value | 1224 |

|

Death Benefit Amount | |

|

Death Benefit Options | |

|

Other Information | |

More Information | 13 |

|

Allstate Life | 13 |

|

The Contract | |

|

Annuities Held within a Qualified Plan | 14 |

|

Legal Matters | 14 |

|

Taxes | 14 |

|

Taxation of Allstate Life Insurance Company | 14 |

|

Taxation of Fixed Annuities in General | 14 |

|

Income Tax Withholding | 16 |

|

Tax Qualified Contracts | 17 |

|

Annual Reports and Other Documents | 21 |

|

Annual Statements | 21 |

|

Market Value Adjustment | 22 |

|

This prospectus uses a number of important terms with which you may not be familiar. The index below identifies the page that defines each term. Each term will appear in bold italics on the page on which it is first defined.

|

| |

| Page |

Accumulation Phase | |

Annuitant | |

Automatic Additions Program | |

Beneficiary | |

Cash Surrender Value | |

* Contract | |

Contract Owner ("You") | |

Contract Value | |

Due Proof of Death | |

|

| |

| Page |

"Guarantee Periods" | |

Income Plans | |

Issue Date | |

Market Value Adjustment | |

Payout Phase | |

Payout Start Date | |

Preferred Withdrawal Amount | |

SEC | |

| Systematic Withdrawal Program | 21 |

|

Tax Qualified ContractsValuation Date | 11 |

|

| Variable Account | 27 |

|

| Variable Sub-Account | 12 |

|

3 PROSPECTUS

| |

* | In certain states a Contract is available only as a group Contract. In these states we issued you a certificate that represents your ownership and summarizes the provisions of the group Contract. References to “Contract” in this prospectus include certificates unless the context requires otherwise. |

THE CONTRACT AT A GLANCE

The following is a snapshot of the Contract. Please read the remainder of this prospectus for more information.

| |

Flexible Payments | We have discontinued offering new Contracts. You may add to your Contract, however each payment must be at least $1,000. You must maintain a minimum account size of $1,000. |

| |

Expenses | You will bear the following expenses: |

A withdrawal charge of 6% on amounts withdrawn (with certain exceptions).

A Market Value Adjustment (which can be positive or negative) for withdrawals except those taken during the 30 day period after the expiration of a Guarantee Period.

State premium tax (if your state imposes one).

|

| | | | |

| | | |

| FLEXIBLE PAYMENTS | | You can purchase a Contract with as little as $3,000 ($2,000 for “QUALIFIED CONTRACTS,” which are Contracts issued within QUALIFIED PLANS). Before age 86, you can add to your Contract as often and as much as you like, but each payment must be at least $50. |

| | |

| RIGHT TO CANCEL | | You may cancel your Contract within 20 days of receipt or any longer period your state may require (“CANCELLATION PERIOD”). Upon cancellation, we will return your purchase payments adjusted, to the extent applicable law permits, to reflect the investment experience of any amounts allocated to the Variable Account, including the deduction of mortality and expense risk charges and administrative expense charges. |

Guaranteed Interest | |

| EXPENSES | | You will bear the following expenses: |

| |

| | • Total Variable Account annual fees equal to 1.35% of average daily net assets (1.45% if you select the ENHANCED DEATH BENEFIT RIDER) |

| |

| | • Annual contract maintenance charge of $30 (with certain exceptions) |

| |

| | • Withdrawal charges ranging from 0% to 7% of payment withdrawn (with certain exceptions) |

| |

| | • Transfer fee of $10 after 12th transfer in any CONTRACT YEAR (fee currently waived) |

| |

| | • State premium tax (if your state imposes one) In addition, each Portfolio pays expenses that you will bear indirectly if you invest in a Variable Sub-Account. |

| |

| INVESTMENT | | |

| |

| ALTERNATIVES | | The Contract offers fixed42 investment alternatives including: |

| |

| | • 3 Fixed Account Options (which credit interest at rates that we guarantee for specified periods we call “Guarantee Periods.” To find out what the current rates are on available Guarantee Periods, please call us at 1-800-654-2397.guarantee) |

| |

| | • 39 Variable Sub-Accounts investing in Portfolios offering professional money management by investment advisers: |

| |

| | • A I M Advisors, Inc. • Federated Investment Management Company • Fidelity Management & Research Company • Franklin Advisers, Inc. • MFS/TM/ Investment Management • OppenheimerFunds, Inc. • Putnam Investment Management, LLC • Templeton Global Advisors Limited • Trusco Capital Management, Inc. |

|

| | |

| |

| | | To find out current rates being paid on the Fixed Account Options or how the Variable Sub-Accounts have performed, call us at 1-800-755-5275. |

| | |

| SPECIAL SERVICES | |

Special Services | For your convenience, we offer these special services: |

Automatic Additions Program;

Systematic Withdrawal Program.

|

| | | | |

| | | • AUTOMATIC ADDITIONS PROGRAM |

| | |

| |

Income Payments | The Contract offers three income payment plans: |

life income with or without guaranteed payments (5 to 30 years);

a joint and survivor life income with or without guaranteed payments (5 to 30 years); or

guaranteed payments for a specified period (5 to 30 years)

|

| | | | |

| | | • AUTOMATIC PORTFOLIO REBALANCING PROGRAM |

| | |

| |

Death Benefits | If you or the Annuitant dies before the Payout Start Date, we will pay benefits as described in the Contract.

|

|

| | | | |

| | | • DOLLAR COST AVERAGING PROGRAM |

| | |

| | • SYSTEMATIC WITHDRAWAL PROGRAM |

Withdrawals | |

| INCOME PAYMENTS | | You can choose fixed income payments, variable income payments, or a combination of the two. You can receive your income payments in one of the following ways: |

| |

| | • life income with guaranteed payments |

| |

| | • a “joint and survivor” life income with guaranteed payments |

| |

| | • guaranteed payments for a specified period (5 to 30 years) |

| |

| DEATH BENEFITS | | If you die before the PAYOUT START DATE we will pay the death benefit described in the Contract. We offer an Enhanced Death Benefit Rider to owners of Contracts issued on or after May 1, 1997. |

| |

| TRANSFERS | | Before the Payout Start Date you may transfer your Contract value (“CONTRACT VALUE”) among the investment alternatives, with certain restrictions. No minimum applies to the amount you transfer. We do not currently impose a fee upon transfers. However, we reserve the right to charge $10 per transfer after the 12th transfer in each “CONTRACT YEAR,” which we measure from the date we issue your Contract or a Contract anniversary (“CONTRACT ANNIVERSARY”). |

| |

| WITHDRAWALS | | You may withdraw some or all of your Contract value ("Contract Value")Value at any time prior toanytime during the Accumulation Phase. Full or partial withdrawals are available under limited circumstances on or after the Payout Start Date. If |

| |

| | In general, you must withdraw Contract Value fromat least $50 at a Guarantee Period before its maturity, a withdrawal charge, Market Value Adjustment, and taxes may apply.time. Withdrawals taken prior to annuitization (referred to in this prospectus as the Payout Phase) are generally considered to come from the earnings in the Contract first. If the Contract is tax-qualified, generally all withdrawals are treated as distributions of earnings. Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59 ½,1/2 , may be subject to an additional 10% federal tax penalty. A withdrawal charge and MARKET VALUE ADJUSTMENT also may apply. |

4 PROSPECTUS

The Contract basically works in two ways.

First, the Contract can help you (we assume you are the “Contract Owner”)CONTRACT OWNER) save for retirement because you can invest in the Contractup to 42 investment alternatives and generally pay no federal income taxes on any earnings until you withdraw or otherwise access them. You do this during what we call the “Accumulation Phase”“ACCUMULATION PHASE” of the Contract. The Accumulation Phase begins on the date we issue your Contract (we call that date the “Issue Date”“ISSUE DATE”) and continues until the “Payout Start Date,” which is the date we apply your money to provide income payments. During the Accumulation Phase, you may allocate your purchase paymentpayments to any combination of available Guarantee Periods. Youthe Variable Sub-Accounts and/or Fixed Account Options. If you invest in any of the 3 Fixed Account Options, you will earn a fixed rate of interest that we declare periodically. If you invest in any of the Variable Sub-Accounts, your investment return will vary up or down depending on the performance of the corresponding Portfolios.

Second, the Contract can help you plan for retirement because you can use it to receive retirement income for life and/or for a pre-set number of years, by selecting one of the income payment options (we call these “Income Plans”(“INCOME PLANS”) described at “Income Payments - Income Plans.”on page 21. You receive income payments during what we call the “Payout Phase”“PAYOUT PHASE” of the Contract, which begins on the Payout Start Date and continues until we make the last income payment required by the Income Plan you select. During the Payout Phase, if you select a fixed income payment option, we guarantee the amount of your payments, which will remain fixed. If you select a variable income payment option, based on one or more of the Variable Sub-Accounts, the amount of your payments will vary up or down depending on the performance of the corresponding Portfolios. The amount of money you accumulate under your Contract during the Accumulation Phase and apply to an Income Plan will determine the amount of your income payments during the Payout Phase.

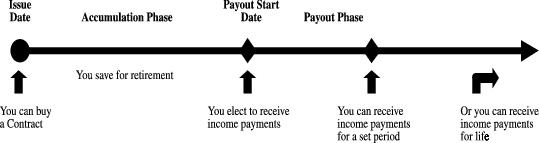

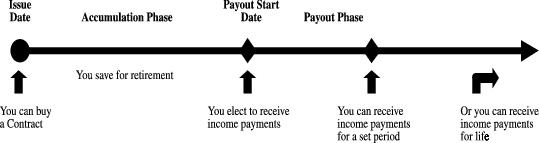

The timeline below illustrates how you might use your Contract.

|

| | | | | | | | |

| | | | | | | | |

| Issue Date | | Accumulation Phase | | Payout Start Date | | Payout Phase |

| You buy a Contract | | You save for retirement | | You elect to receive income payments or receive a lump sum payment | | You can receive income payments for a set period | | Or you can receive income payments for life |

As the Contract Owner, you exercise all of the rights and privileges provided by the Contract. If you die, any surviving Contract Owner or, if there is none, the BeneficiaryBENEFICIARY will exercise the rights and privileges provided by the Contract. See “The Contract.” In addition, if you die before the Payout Start Date, we will pay Death Benefitsa death benefit to any surviving Contract Owner or, if there is none, to your Beneficiary. (SeeSee “Death Benefits.”)

Please call us at 1-800-654-23971-800-755-5275 if you have any questionsquestion about how the Contract works.

5 PROSPECTUS

EXPENSE TABLE

The table below lists the expenses that you will bear directly or indirectly when you buy a Contract. The table and the examples that follow do not reflect premium taxes that may be imposed by the state where you reside. For more information about Variable Account expenses, see “Expenses,” below. For more information about Portfolio expenses, please refer to the accompanying prospectuses for the Portfolios.

CONTRACT OWNER TRANSACTION EXPENSES

Withdrawal Charge (as a percentage of purchase payments)*

|

| | | | | | | | | | | | | | | | |

| Number of Complete Years Since We Received Payment Being Withdrawn | | 0 | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | 7+ |

| Applicable Charge | | 7% | | 6% | | 5% | | 4% | | 3% | | 2% | | 1% | | 0% |

| Annual Contract Maintenance Charge | | $30.00** |

| Transfer Fee | | $10.00*** |

|

| |

The* | Each Contract Year, you may withdraw up to 10% of the Contract Value on the date of the first withdrawal that Year without incurring a withdrawal charge. However, any applicable Market Value Adjustment determined as of the date of withdrawal will apply. |

| ** | We will waive this charge in certain cases. See “Expenses.” |

| *** | Applies solely to the thirteenth and subsequent transfers within a Contract Year. We are currently waiving the transfer fee. |

VARIABLE ACCOUNT ANNUAL EXPENSES |

| | |

| |

| (AS A PERCENTAGE OF AVERAGE DAILY NET ASSET VALUE DEDUCTED FROM EACH VARIABLE SUB-ACCOUNT) |

| Mortality and Expense Risk Charge | 1.25 | % |

| Administrative Expense Charge | 0.10 | % |

| Total Variable Account Annual Expense | 1.35 | % |

| |

| WITH THE ENHANCED DEATH BENEFIT* | |

| |

| Mortality and Expense Risk Charge | 1.35 | % |

| Administrative Expense Charge | 0.10 | % |

| Total Variable Account Annual Expense | 1.45 | % |

|

| |

| * | The Enhanced Death Benefit Rider was available for Contracts issued on or after May 1, 1997. |

PORTFOLIO ANNUAL EXPENSES

The next table shows the minimum and maximum total operating expenses charged by the Portfolios that you may pay periodically during the time that you own the Contract. Advisers and/or other service providers of certain Portfolios may have agreed to waive their fees and/or reimburse Portfolio expenses in order to keep the Portfolios’ expenses below specified limits. The range of expenses shown in this table does not show the effect of any such fee waiver or expense reimbursement. More detail concerning each Portfolio’s fees and expenses appears in the prospectus for each Portfolio.

ANNUAL PORTFOLIO EXPENSES

|

| | | | | | |

| | | Minimum | | Maximum |

| Total Annual Portfolio Operating Expenses/(1)/ (expenses that are deducted from Portfolio assets, which may include management fees, distribution and/or services (12b-1) fees, and other expenses) | | 0.34 | % | | 3.91 | % |

|

| |

| (1) | Expenses are shown as a percentage of Portfolio average daily net assets (before any waiver or reimbursement) as of December 31, 2003. |

6 PROSPECTUS

EXAMPLE 1

This Example is intended to help you compare the cost of investing in the Contract with the cost of investing in other variable annuity contracts. These costs include Contract Owner transaction expenses, Contract fees, Variable Account annual expenses, and Portfolio fees and expenses.

The example below shows the dollar amount of expenses that you would bear directly or indirectly if you:

|

| | | |

| • | | invested $10,000 in the Contract for the time periods indicated, |

|

| | | |

| • | | earned a 5% annual return on your investment, and |

|

| | | |

| • | | surrendered your Contract, or you began receiving income payments for a specified period of less than 120 months, at the end of each time period, and |

|

| | | |

| • | | elected the Enhanced Death Benefit Rider (with total Variable Account expenses of 1.45%) |

The first line of the example assumes that the maximum fees and expenses of any of the Portfolios are charged. The second line of the example assumes that the minimum fees and expenses of any of the Portfolios are charged. Your actual expenses may be higher or lower than those shown below.

THE EXAMPLE DOES NOT INCLUDE ANY TAXES OR TAX PENALTIES YOU MAY BE REQUIRED TO PAY IF YOU SURRENDER YOUR CONTRACT

|

| | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Costs Based on Maximum Annual Portfolio Expenses | | $1,120 | | $2,086 | | $3,034 | | $5,599 |

| Costs Based on Minimum Annual Portfolio Expenses | | $752 | | $1,013 | | $1,298 | | $2,392 |

EXAMPLE 2

This Example uses the same assumptions as Example 1 above, except that it assumes you decided not to surrender your Contract, or you began receiving income payments for a specified period of at least 120 months, at the end of each time period.

|

| | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Costs Based on Maximum Annual Portfolio Expenses | | $579 | | $1,725 | | $2,853 | | $5,599 |

| Costs Based on Minimum Annual Portfolio Expenses | | $213 | | $656 | | $1,121 | | $2,392 |

PLEASE REMEMBER THAT YOU ARE LOOKING AT EXAMPLES AND NOT A REPRESENTATION OF PAST OR FUTURE EXPENSES. YOUR RATE OF RETURN MAY BE HIGHER OR LOWER THAN 5%, WHICH IS NOT GUARANTEED. THE EXAMPLES DO NOT ASSUME THAT ANY PORTFOLIO EXPENSE WAIVERS OR REIMBURSEMENT ARRANGEMENTS ARE IN EFFECT FOR THE PERIODS PRESENTED. THE ABOVE EXAMPLES ASSUME A MORTALITY AND EXPENSE RISK CHARGE OF 1.35%, AN ADMINISTRATIVE EXPENSE CHARGE OF 0.10%, AND AN ANNUAL CONTRACT MAINTENANCE CHARGE OF $30. IF THE ENHANCED DEATH BENEFIT RIDER WERE NOT ELECTED, THE EXPENSE FIGURES SHOWN ABOVE WOULD BE SLIGHTLY LOWER.

7 PROSPECTUS

FINANCIAL INFORMATION

To measure the value of your investment in the Variable Sub-Accounts during the Accumulation Phase, we use a unit of measure we call the “ACCUMULATION UNIT.” Each Variable Sub-Account has a separate value for its Accumulation Units we call “ACCUMULATION UNIT VALUE.” Accumulation Unit Value is analogous to, but not the same as, the share price of a mutual fund. Attached as Appendix A to this prospectus are tables showing the Accumulation Unit Values of each Variable Sub-Account since its inception. The financial statements of Allstate and Allstate Financial Advisors Separate Account I, which includes financial information giving effect to the separate account Consolidation on a pro forma basis, also appear in the Statement of Additional Information. For a free copy of the Statement of Additional Information, please write or call us at 1-800- 755-5275.

THE CONTRACT

CONTRACT OWNER

The Custom PlusSTI Classic Variable Annuity is a contract between you, the Contract Owner, and Allstate Life, a life insurance company. As the Contract Owner, you may exercise all of the rights and privileges provided to you by the Contract. That means it is up to you to select or change (to the extent permitted):

the amount and timing of your withdrawals,

the programs you want to use to withdraw money,the income payment plan you want to use to receive retirement income, |

| | | |

| • | | the investment alternatives during the Accumulation and Payout Phases, |

the Annuitant (either yourself or someone else) on whose life the income payments will be based,

the Beneficiary or Beneficiaries who will receive the benefits that the Contract provides when the last surviving Contract Owner dies, and |

| | | |

| • | | the amount and timing of your purchase payments and withdrawals, |

|

| | | |

| • | | the programs you want to use to invest or withdraw money, |

|

| | | |

| • | | the income payment plan you want to use to receive retirement income, |

|

| | | |

| • | | the Annuitant (either yourself or someone else) on whose life the income payments will be based, |

|

| | | |

| • | | the Beneficiary or Beneficiaries who will receive the benefits that the Contract provides when the last surviving Contract Owner dies, and |

|

| | | |

| • | | any other rights that the Contract provides. |

If you die, any surviving Contract Owner or, if none, the Beneficiary may exercise the rights and privileges provided to them by the Contract. If the sole surviving Contract Owner dies after the Payout Start Date, the Beneficiary will receive any guaranteed income payments scheduled to continue.

The Contract cannot be jointly owned by both a non-living person and a living person.Person. If the Owner is a Grantor Trust, the Owner will be considered a non-living person for purposes of the Death of Owner and Death of Annuitant provisions of your Contract. The maximum age of the oldest Contract Owner and Annuitant cannot exceed 85 as of the date we receive the completed application.

Changing ownership of this Contractcontract may cause adverse tax consequences and may not be allowed under qualified plans. Please consult with a competent tax advisor prior to making a request for a change of Contract Owner.

The Contract was available for purchasecan also be purchased as an IRA or TSA (also known as a 403(b)). The endorsements required to qualify these annuities under the Internal Revenue Code of 1986, as amended, (“Code”), may limit or modify your rights and privileges under the Contract. Allstate Life no longer issues TSA contracts.

ANNUITANT

The Annuitant is the individual whose age determines the latest Payout Start Date and whose life determines the amount and duration of income payments (other than under Income Plans with guaranteed payments for a specified period). You initially designate an Annuitant in your application. The Contract Owner (youngest Contract Owner if there is more than one) will be the Annuitant unless you name a different Annuitant. The Annuitant must be a living person.

You If the Contract Owner is a living person, you may change the Annuitant at any time prior to the Payout Start Date (only Contract Owners that are living persons or grantor trusts have this option). Once we accept your change request, any change will be effective on the date you sign the written request. We are not liable for any payment we make or other action we take before accepting any written request from you.Date. You also may designate a joint Annuitant, prior to the Payout Start Date, who is a second person on whose life income payments depend. If the Annuitant dies prior to the Payout Start Date, the new Annuitant will be:

(i) the youngest Contract Owner; otherwise,

(ii) the youngest Beneficiary.

BENEFICIARY

The Beneficiary is the person who may electselected by the Contract Owner to receive the death benefitbenefits or become the new Contract Owner, subject to the Death“Death of Owner provisionOwner” section of the Contract, if the sole surviving Contract Owner dies before the Payout Start Date. If the sole surviving Contract Owner dies after the Payout Start Date, the Beneficiaries will receive any guaranteed income payments scheduled to continue.