Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on April 4, 2006

Registration No. 333-129831

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION ON JANUARY 21, 1998

REGISTRATION NO. 333-

================================================================================

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

Washington, D.C. 20549

------------------------

AMENDMENT NO. 1

TO

FORM S-3

REGISTRATION STATEMENT

Under the

Securities Act of 1933

SkyWest, Inc.

(Exact name of registrant as specified in its charter)

| Utah (State or other jurisdiction of incorporation or organization) | 87-0292166 (I.R.S. employer identification number) |

444 South River Road

St. George, Utah 84790

(435) 634-3200

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Bradford R. RICH

EXECUTIVE VICE PRESIDENT,

CHIEF FINANCIAL OFFICER AND TREASURER

SKYWEST, INC.

Rich

Executive Vice President, Chief Financial Officer and Treasurer

SkyWest, Inc.

444 SOUTH RIVER ROAD

ST. GEORGE, UTAHSouth River Road

St. George, Utah 84790

(435) 634-3000

(NAME, ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE NUMBER,

INCLUDING AREA CODE, OF REGISTRANT'S PRINCIPAL EXECUTIVE OFFICES AND AGENT FOR

SERVICE)

COPIES TO:

634-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to: | ||

| Brian G. Seth R. King, Esq. PARR WADDOUPS BROWN GEE & LOVELESS 185 Salt Lake City, Utah 84111 (801) 532-7840 | Mark C. Smith, Esq. Allison R. Schneirov, Esq. SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP Four Times Square New York, New York 10036 (212) 735-3000 | |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

------------------------Statement as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: [ ]o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: [ ]o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]o

If delivery ofthis Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the prospectus is expected to be madeCommission pursuant to Rule 434,

please462(e) under the Securities Act, check the following box: [ ]

o

If this Form is a post-effective amendment to registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: o

CALCULATION OF REGISTRATION FEE

=================================================================================================================

PROPOSED

TITLE OF EACH CLASS PROPOSED MAXIMUM MAXIMUM

OF SECURITIES TO BE AMOUNT TO BE OFFERING PRICE PER AGGREGATE OFFERING AMOUNT OF

REGISTERED REGISTERED(1) SHARE(2) PRICE(2) REGISTRATION FEE

- -----------------------------------------------------------------------------------------------------------------

Common Stock, no par

value.................. 1,610,000 $31.0625 $50,010,625 $14,753

=================================================================================================================

| Title of each class of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per share(2) | Proposed maximum aggregate offering price(2) | Amount of registration fee | ||||

|---|---|---|---|---|---|---|---|---|

| Common Stock, no par value | 4,600,000 | $32.24 | $148,304,000 | $17,456(3) | ||||

- (1)

- Includes

210,000600,000 shares which theUnderwritersunderwriters have the option to purchase solely to coverover-allotments,overallotments, if any. - (2)

- Estimated

pursuant to Rule 457(c)solely for the purpose of calculating the registration fee in accordance with Rule 457(c) based on the averageof thehigh and low reported sales pricesfor the Common Stock, as reportedof our common stock ontheThe Nasdaq National Market onJanuary 14, 1998. THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE. ================================================================================2 INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION OR AMENDMENT. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED PRIOR TO THE TIME THE REGISTRATION STATEMENT BECOMES EFFECTIVE. THIS PROSPECTUS SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR SHALL THERE BE ANY SALE OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH STATE. SUBJECT TO COMPLETION, DATED JANUARY 21, 1998 1,400,000 SHARES [LOGO] COMMON STOCK ------------------------ AllNovember 17, 2005. - (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the 1,400,000 sharesSecurities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion

Preliminary Prospectus dated April 4, 2006

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

P R O S P E C T U S

4,000,000 Shares

Common Stock (the "Common Stock") of

SkyWest, Inc. (the "Company") offered herebyis selling all of the shares.

The shares are being sold by the Company. The

Common Stock is quoted on theThe Nasdaq National Market under the symbol "SKYW." On January 20, 1998,March 31, 2006, the last sale price of the Common Stockshares as reported on theby The Nasdaq National Market was $36.875$29.27 per share. See "Price Range

Investing in our common stock involves risks that are described in the "Risk Factors" section beginning on page 11 of Common Stockthis prospectus.

| Per Share | Total | |||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discount | $ | $ | ||

| Proceeds, before expenses, to SkyWest, Inc. | $ | $ |

The underwriters may also purchase up to an additional 600,000 shares from us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments.

Neither the Securities and Dividends."

SEE "RISK FACTORS" BEGINNING ON PAGE 7 FOR A DISCUSSION OF CERTAIN FACTORS

THAT SHOULD BE CONSIDERED BY PROSPECTIVE PURCHASERS OF THE COMMON STOCK OFFERED

HEREBY.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND

EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES

AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE

ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

The shares will be ready for delivery on or about April , 2006.

| Merrill Lynch & Co. | Raymond James |

The date of this prospectus is April , 2006.

We are a descriptionholding company that operates two independent, wholly-owned subsidiaries, SkyWest Airlines and Atlantic Southeast Airlines, with a total fleet of approximately 380 aircraft and approximately 13,650 employees as of December 31, 2005. Our fleet consists of Bombardier CRJ200 Regional Jets seating 40 or 50 passengers ("CRJ200s"), Bombardier CRJ700 Regional Jets seating 66 or 70 passengers ("CRJ700s"), Embraer EMB-120 Brasilia turboprops seating 30 passengers ("Brasilia turboprops") and Avions de Transport 72-210 turboprops seating 66 passengers ("ATR-72 turboprops"). We provide on each of these aircraft types flight attendant service, as well as in-flight amenities such as snack and beverage service, lavatory facilities and overhead storage.

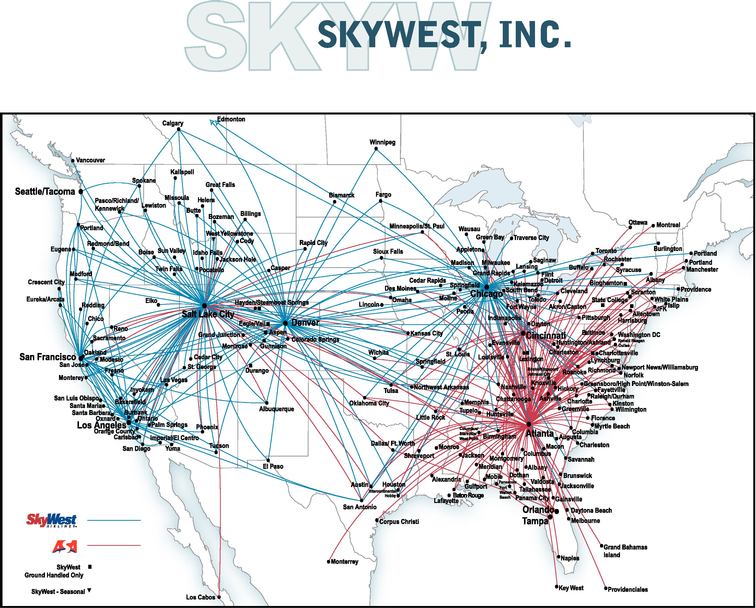

We operate approximately 2,350 total daily flights as The Delta Connection® in Atlanta, Salt Lake City and Cincinnati, and as United Express® in Chicago (O'Hare), Denver, Los Angeles, San Francisco, Portland and Seattle/Tacoma under code-share agreements with Delta Air Lines and United Air Lines. We provide scheduled air service to 218 destinations in the United States, Canada, Mexico and the Caribbean. We have obtained federal registration of the indemnification arrangementsSkyWest®, SkyWest Airlines®, Atlantic Southeast Airlines® and ASA® trademarks. Delta®, Delta Connection® and The Delta Connection® are trademarks of Delta Air Lines, Inc. United® and United Express® are trademarks of United Air Lines, Inc. All other trademarks and service marks appearing in this prospectus are the property of their respective holders.

You should rely only on the information contained or incorporated by reference in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition and prospects may have changed since that date.

This summary contains basic information about our company and this offering, but does not contain all of the information that you should consider before investing in our common stock. You should read this summary, together with the Underwritersentire prospectus, including "Risk Factors" and other matters.

(2) Before deducting offering expenses payablethe information incorporated by reference into this prospectus as described below under "Incorporation Of Certain Information By Reference," for important information regarding our company and the Company estimatedcommon stock being sold in this offering. Unless otherwise indicated, "we," "us", "our" and similar terms refer to be

$350,000.

(3) The Company has grantedSkyWest, Inc. and our subsidiaries; "SkyWest Airlines" refers to our wholly-owned subsidiary SkyWest Airlines, Inc.; and "ASA" refers to our wholly-owned subsidiary Atlantic Southeast Airlines, Inc. Unless otherwise indicated, all information in this prospectus assumes that the Underwriters a 30-dayunderwriters' overallotment option to purchase up to 210,000 additional600,000 shares of Common Stock solely to cover over-allotments,

if any. If such option is exercised in full, the total Price to Public,

Underwriting Discount and Proceeds tofrom us will not be exercised.

Our Company will be $ ,

$ and $ , respectively. See "Underwriting."

------------------------

The Common Stock is offered severally by the Underwriters named herein,

subject to prior sale, when, as and if delivered and accepted by them, subject

to their right to reject orders, in whole or in part, and to certain other

conditions. It is expected

We are a holding company that delivery of certificates representing the Common

Stock will be made on or about , 1998.

THE ROBINSON-HUMPHREY COMPANY SBC WARBURG DILLON READ INC.

, 1998

3

[THREE MAPS IDENTIFYING ROUTES SERVED BY SKYWEST AIRLINES, INC.]

SkyWest Airlines, Inc. operates as the Delta Connection(R) in Salt Lake

City and Los Angeles, as United Express(R) in Los Angeles and as the Continental

Connection(TM) in selected California markets, providing scheduled air service

to 46 cities in 12 western states and Canada. On January 19, 1998, SkyWest

executed an agreement to operate as United Express at United's San Francisco

hub, beginning June 1, 1998.

------------------------

CERTAIN PERSONS PARTICIPATING IN THIS OFFERING MAY ENGAGE IN TRANSACTIONS

THAT STABILIZE, MAINTAIN OR OTHERWISE AFFECT THE PRICE OF THE COMMON STOCK,

INCLUDING STABILIZING BIDS, SYNDICATE-COVERING TRANSACTIONS, SHORT-COVERING

TRANSACTIONS AND THE IMPOSITION OF PENALTY BIDS. FOR A DESCRIPTION OF THESE

ACTIVITIES, SEE "UNDERWRITING."

IN CONNECTION WITH THIS OFFERING, CERTAIN UNDERWRITERS AND SELLING GROUP

MEMBERS (IF ANY) MAY ENGAGE IN PASSIVE MARKET MAKING TRANSACTIONS IN THE COMMON

STOCK ON THE NASDAQ NATIONAL MARKET IN ACCORDANCE WITH RULE 103 OF REGULATION M.

SEE "UNDERWRITING."

2

4

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by the more detailed

information and financial data appearing elsewhere in this Prospectus and in the

documents and financial statements incorporated by reference herein. The

"Company" refers to SkyWest, Inc. and itstwo independent, wholly-owned subsidiaries, SkyWest Airlines Inc.

("SkyWest"), Scenicand ASA. SkyWest Airlines Inc. ("Scenic") and National Parks Transportation,

Inc. ("NPT"). Unless otherwise noted, the information in this Prospectus does

not give effect to the exercise of the Underwriters' over-allotment option. The

Company's fiscal year ends on March 31. The term "fiscal 1997" refers to the

Company's fiscal year ended on March 31, 1997.

THE COMPANY

SkyWest operates aASA are regional airlineairlines offering scheduled passenger service primarilywith approximately 2,350 daily departures to 218 destinations in the western United States. SkyWest has been a code-sharing partnerStates, Canada, Mexico and the Caribbean. Substantially all of our flights are operated as either Delta Connection or United Express under code-share arrangements with Delta Air Lines, Inc. ("Delta") and Continental Airlines, Inc.

("Continental") since 1987 and 1995, respectively. Effective October 1, 1997,

SkyWest expanded its operations through a code-sharing agreement withor United Airlines,Air Lines, Inc. ("United"), with significant presence in their key domestic hubs and focus cities. SkyWest Airlines and ASA provide regional flying to our partners, primarily under long-term, fixed-fee code-share agreements that we believe improve our ability to accurately forecast our revenue stream. Under this type of agreement, our partners assume many of the most common financial risks inherent to our industry, including those relating to fuel prices, airfares and passenger load factors.

SkyWest Airlines and ASA have developed industry-leading reputations for providing quality, low-cost regional airline service during their long operating histories—SkyWest Airlines has been flying since 1972 and ASA since 1979. As of December 31, 2005, our consolidated fleet consisted of a total of 380 aircraft, of which 224 were in service with Delta and 156 were in service with United. We currently operate one type of regional jet aircraft in two differently sized configurations, the 40-and 50-seat CRJ200s and the 66- and 70-seat CRJ700s, and two types of turboprop aircraft, the 30-seat Brasilia turboprops and the 66-seat ATR-72 turboprops (which we expect to remove from service by August 2007). SkyWest offersAirlines and ASA have combined firm orders to acquire 15 additional CRJ700s and 17 Bombardier CRJ900 Regional Jets ("CRJ900s"), which can be delivered in configurations ranging between 70 and 90 seats, over the next two years and ASA is committed to sublease six additional CRJ200s from Delta commencing in 2006. We have agreements with Delta or United to place all of these aircraft into service upon their delivery. In addition, we have options to acquire 70 additional CRJ900s. We presently anticipate that delivery dates for these aircraft could start in May 2007 and continue through April 2010; however, actual delivery dates remain subject to final determination as agreed upon by us and our code-share partners. We believe that these option aircraft position us to capitalize on additional growth opportunities with our existing and other potential code-share partners.

The following table summarizes certain key elements of the SkyWest Airlines and ASA operations as of December 31, 2005.

| SkyWest Airlines | Atlantic Southeast Airlines | |||

|---|---|---|---|---|

| Partners | Delta, United | Delta | ||

Contract Terms | Delta—Effective through September 2020 Assumed by Delta with Bankruptcy Court approval | Delta—Effective through September 2020 Assumed by Delta with Bankruptcy Court approval | ||

United—Expires incrementally in December 2011, 2013 and 2015 Approved in Bankruptcy Court | ||||

Aircraft (number of planes) | 66-passenger CRJ700s (42) (all United) | 70-passenger CRJ700s (35) | ||

50-passenger CRJ200s (123) (57 Delta, 66 United) | 40- and 50-passenger CRJ200s (106) | |||

30-passenger Brasilia turboprops (62) (14 Delta, 48 United) | 66-passenger ATR-72 turboprops (12) (which we expect to remove from service by August 2007) | |||

Average daily scheduled departures | United:1,100 Delta:400 Total:1,500 | Delta:850 Total:850 | ||

Hubs/Focus Cities | Chicago (O'Hare), Denver, Los Angeles, San Francisco, Portland, Seattle/Tacoma, Salt Lake City | Atlanta, Salt Lake City, Cincinnati | ||

Employees | Approximately 8,100 employees(1) | Approximately 5,550 employees(1) | ||

Passengers carried in 2005 | 16.6 million | 12.0 million |

- (1)

- Full-time equivalent

Our Acquisition of Atlantic Southeast Airlines

On September 7, 2005, we completed the acquisition of ASA from Delta for $421.3 million in cash. Additionally, as part of the purchase, we paid $5.3 million of transaction fees and ASA retained approximately $1.25 billion in long-term debt. In addition, we returned to Delta $50 million in deposits that Delta had previously paid on future ASA aircraft deliveries. The combination of SkyWest Airlines and ASA created the largest regional airline in the United States. In addition to the potential benefits of scale that our increased size provides us, the combination of SkyWest Airlines and ASA presents us with new opportunities for growth through our two separate, geographically-focused regional airline platforms—SkyWest Airlines in the Western United States and ASA in the Eastern United States. Although we currently intend to operate the two subsidiaries as separate and independent entities, the skills and knowledge built by these organizations over the years will be available to benefit both. We believe the ASA acquisition also established us as Delta's most important regional airline partner,

based on our percentage of Delta's total regional capacity. We now provide the vast majority of regional airline service for Delta in Atlanta, its most important eastern hub, and Salt Lake City, its most important western hub. In connection with the ASA acquisition, we established new, separate, but substantially similar, long-term fixed-fee Delta Connection Agreements with Delta for both SkyWest Airlines and ASA. Under the agreements, which have initial terms of 15 years (subject to certain extension and termination rights), Delta has agreed that ASA will provide at least 80% of all Delta Connection departures from Atlanta and that at least 50% of ASA's Delta Connection departures will be from Atlanta. We also obtained control of 26 gates in the Hartsfield-Jackson International Airport located in Atlanta, from which we currently provide service to Delta. Delta has committed to provide to us opportunities to utilize 28 additional regional jets in our fleet by the end of 2007. Delta has also agreed that, starting in 2008, ASA is guaranteed to maintain its percentage of total Delta Connection flights that it has in 2007, so long as its bid for additional regional flying is competitive with other regional carriers.

SkyWest Airlines provides regional jet and turboprop service in the Western United States with the exception of flying provided to United out of its Chicago (O'Hare) hub. SkyWest Airlines offered approximately 1,500 daily scheduled departures as of December 31, 2005, of which approximately 1,100 were United Express flights and approximately 400 were Delta Connection flights. SkyWest Airlines' operations are conducted from hubs located in Chicago (O'Hare), Denver, Los Angeles, San Francisco, Portland, Seattle/Tacoma and Salt Lake City. SkyWest Airlines' fleet as of December 31, 2005 consisted of 42 70-seat CRJ700s, all of which were flown for United; 123 50-seat CRJ200s, of which 66 were flown for United and 57 were flown for Delta, and 62 30-seat Brasilia turboprops, of which 48 were flown for United and 14 were flown for Delta. SkyWest Airlines conducts its Delta code-share operations pursuant to the terms of a convenient scheduleDelta Connection Agreement which obligates Delta to compensate SkyWest Airlines for its direct costs associated with operating Delta Connection flights, plus a payment based on block hours flown. SkyWest Airlines' United operations are conducted under a United Express Agreement pursuant to which SkyWest Airlines is paid primarily on a fee-per-completed block hour and frequent

flights designeddeparture basis plus a margin based on performance incentives. Under the United Express Agreement, excess margins over certain percentages must be returned or shared with United, depending on various conditions.

ASA largely provides regional jet service in the United States east of the Mississippi River, with the exception of flying provided to maximize connecting and local traffic. OperatingDelta out of its Salt Lake City hub. ASA offered more than 850 daily scheduled departures as of December 31, 2005, all of which were Delta Connection flights. ASA's operations are conducted primarily from its hubs located in Atlanta, Salt Lake City and Los Angeles, SkyWest serves 46 cities in 12

statesCincinnati. ASA's fleet as of December 31, 2005 consisted of 35 70-seat CRJ700s, 106 40 and Canada50-seat CRJ200s, and twelve ATR-72 turboprops (which we expect to remove from service by August 2007), all of which were flown for Delta. Under the terms of the ASA Delta Connection Agreement, Delta has agreed to compensate ASA for its direct costs associated with approximately 580 daily flights. In Salt Lake City and

Los Angeles, SkyWest isoperating Delta Connection flights, plus, if ASA completes a certain minimum percentage of its Delta Connection flights, a specified margin on such costs. Additionally, the ASA Delta Connection Agreement provides for incentive compensation upon satisfaction of certain performance goals. Under the ASA Delta Connection Agreement, excess margins over certain percentages must be returned or shared with Delta, depending on various conditions.

We believe our primary strengths are:

• Largest U.S. Regional Airline with Strong Partner Relationships. As a result of our acquisition of ASA, we are the largest regional airline with market sharesin the United States, measured by the number of passengers enplanedcarried. On a combined pro forma basis for the year ended December 31, 2005, SkyWest Airlines and ASA carried in excess of 99%28 million passengers and 33%, respectively.produced more than 18 billion

"available seat miles," which represents the number of seats available for passengers, multiplied by the number of miles those seats are flown ("ASMs"). We believe the increased scale of our operations will enable us to further reduce our unit costs by more efficiently spreading our overhead and leveraging our operations, which in turn will allow us to offer our services to our partners at even more competitive costs going forward. Based on our consistent provision of high-quality, low-cost regional airline services, we have established strong code-share relationships with our current partners Delta and United, who are currently the world's second and third-largest airlines, respectively, measured by the number of passengers carried. SkyWest operatesAirlines has been a code-share partner with Delta since 1987 and with United since 1997, while ASA has been a code-share partner with Delta since 1984. At the end of 2005, we accounted for approximately 50% of Delta's and approximately 58% of United's regional flight departures, which, we believe, makes us the most important regional partner of both airlines. In addition, our dominant position in our partners' hubs and focus cities, including ASA's position in Atlanta, further reinforces our importance as an integral part of our partners' networks.

• Two Strong Operating Platforms with Significant Growth Opportunities. During more than 30 years of flight operations, SkyWest Airlines has established a strong regional airline platform in the Western United States. ASA has established its operational strength in the Eastern United States, where it holds the largest market share of all regional carriers serving Atlanta's Hartsfield-Jackson International Airport. Concentrating our operations geographically, with one platform serving the Western United States and another serving the Eastern United States, enables us to reduce our unit costs by minimizing our number of crew bases and maintenance and other facilities, and by utilizing our human and capital resources more efficiently. We believe our code-share agreements position us for continued growth of both platforms. For instance, beyond the 38 committed aircraft additions in our contracts, the ASA Delta Connection Agreement contains provisions enabling ASA to maintain its percentage of total Delta Connection flights that it has in 2007, so long as its bid for additional regional flying is competitive with other regional carriers. Moreover, we believe the combination of the two platforms will allow us to capitalize on operational efficiencies in order to reduce costs, which, coupled with our strong financial resources, will provide us with opportunities to expand service to our existing partners or add new partners.

• Long-Term, Fixed-Fee Code-Share Agreements. We have entered into long-term, fixed-fee code-share agreements with both Delta and United that are subject to us maintaining specified performance levels. Our Delta Connection Agreements provide for minimum aircraft utilization at fixed rates, reimbursement of direct operating costs (such as fuel) and provide a more predictable revenue stream than the historically utilized "pro-rate" revenue-sharing arrangements. Under our code-share agreements, we authorize our partners to identify our flights and fares under their flight designation codes in the central reservation systems, and we are authorized to paint our aircraft in the livery of our partners, to use their service marks and to market ourselves as a code-share carrier for our partners. Notably, our Delta Connection Agreements have been assumed by Delta with U.S. Bankruptcy Court approval, and SkyWest Airlines' United Express Agreement was approved by the U.S. Bankruptcy Court prior to its execution. We believe these court orders significantly reduce the possibility that our code-share agreements will be disrupted by the Delta Connection in Salt Lake City and Los Angeles, as United Express in Los Angelesbankruptcy proceedings, and as the Continental Connection in selected California markets. On January 19,

1998, SkyWest executedincrease our prospects for long-term revenue stability and visibility.

• Experienced Management Team. The four members of our senior management team possess an addendum to its agreement with United, expanding

SkyWest's United Express operations to include approximately 168 daily flights

connecting twelve California markets with United's San Francisco hub beginning

June 1, 1998. To support operations at the San Francisco hub, SkyWest expects to

acquire 17 additional aircraft and spend approximately $12 million for related

ground and maintenance facilities, support equipment and spare parts inventory.

SkyWest operates oneaverage of the youngest fleets26 years of operating experience in the airline industry. Since 1987, SkyWest Airlines' management team has successfully managed through several industry consistingcycles while delivering industry-leading operational performance, consistent profitability and significant value to shareholders.

• High-Quality Service. We strive to deliver high-quality service in every aspect of fifty 30-seat Embraer EMB-120 Brasilia turbo-prop aircraft

("Brasilias") with an average age of 4.4 years and ten 50-seat Canadair Regional

Jets ("CRJs") with an average age of 3.1 years. In December 1996, SkyWest

completed a strategic transition out ofour operations. During the 19-seat Fairchild Metroliner III

("Metroliner") turbo-prop aircraft, which reduced the number of aircraft types

operated by SkyWest from three to two. The transition enabled SkyWest to upgrade

to an all cabin-class fleet of larger aircraft with higher operating

efficiencies and greater passenger acceptance. "Cabin-class" aircraft offer

stand-up headroom, overhead and under-seat storage, lavatories and flight

attendant service.

The addition of United as a code-sharing partner and the completion of

SkyWest's transition to an all cabin-class fleet, together with other factors,

contributed to the Company's achievement of record consolidated operating

revenues and net income for the nine monthsyear ended December 31, 1997.

Consolidated operating revenues increased 7.4% to $225.7 million from $210.0

million2005, SkyWest Airlines' average on-time performance ratio was 63.8% and net income increased 91.9% to $17.3 million from $9.0 million forits flight completion ratio was 98.1%. During the nine monthsyear ended December 31, 19972005,

SkyWest Airlines' aircraft in revenue service operated an average of 9.45 hours per day, which we believe is among the highest aircraft utilization rates in the regional airline industry. In March 2005, SkyWest Airlines was named the 2004 Regional Airline of the Year byRegional Airline World Magazine. In February 2005 and 1996, respectively.

The key elements2006, SkyWest Airlines was named the number one on-time mainland airline in the United States for 2004 and 2005, respectively, by the U.S. Department of SkyWest'sTransportation. ASA is committed to high-quality service, and we believe the combination of the SkyWest Airlines and ASA platforms presents an opportunity for both carriers to enhance the quality of their service.

• Financial Resources and Flexibility. Due in part to our success in implementing our business strategy, are:

-we possess financial resources and flexibility which distinguish us from many other regional and major carriers and which constitute a competitive advantage. At December 31, 2005, after giving effect to this offering, we would have had cash and marketable securities of approximately $320.7 million, which would have represented 16.3% of our revenues during the year ended December 31, 2005. The strength of our balance sheet and credit profile have enabled us to enter into lease and other financing transactions on terms we believe are more favorable than the terms available to many other carriers. Many major carriers currently face significant financial challenges and are experiencing difficulty financing the acquisition and operation of aircraft for themselves and their regional partners. As a result, regional carriers themselves are increasingly financing the expansion and operation of the fleet serving the major carrier's passengers. Our lower aircraft ownership costs can be shared with our partners, which we believe represents a competitive advantage when we seek additional growth. We believe our financial flexibility also allows us to take advantage of growth opportunities—such as the acquisition of ASA or placing a large aircraft order—that we might otherwise be unable to pursue if we did not possess these financial resources.

Our business strategy consists of the following elements:

• Capitalize on Relationshipsthe ASA Acquisition to Reduce Operating Costs. We believe our acquisition of ASA provides a number of significant opportunities to reduce the unit operating costs of both the SkyWest Airlines and ASA platforms without compromising passenger safety, service quality or operational reliability. Among those opportunities, we intend to focus our initial cost reduction efforts in four key areas:

- 1.

- improve the utilization of our equipment and facilities through the refinement of operational processes, elimination of redundancies and collaborative identification and implementation of operational best practices;

- 2.

- increase employee productivity by incorporating best practices, efficiently utilizing our employees to support both operating platforms, and providing incentive-based compensation and benefits that are competitive with

Code-Sharing Partners. Historically, SkyWest's growth has been assistedpackages offered by other regional carriers with whom we compete; - 3.

- leverage our position as the

development of code-sharing agreementslargest U.S. regional carrier to allocate overhead and administrative expenses over a substantially larger platform, thereby reducing unit costs; and - 4.

- reduce our aircraft acquisition and financing costs by continuing to strengthen our balance sheet through the proceeds raised from this offering and by refinancing our debt and lease obligations where appropriate.

• Expand Existing and Develop New Code-Share Agreements. We enjoy strong relationships with Delta, Unitedour existing code-share partners and Continental. SkyWest views the recent addition of United

as a code-sharing partner as a significant opportunity to further increase its

traffic and profitability by serving United's Los Angeles and San Francisco hubs

and to develop code-sharing relationships in other hubs served by United.

SkyWest workswork closely with its code-sharingthese partners to expand service to their existing markets, open new markets and schedule frequent, convenient and profitablefrequent flights. SkyWest believes thatWe view the continued development of our Delta and United relationships as significant opportunities to achieve stable, long-term growth of our business. We believe the principal reason itSkyWest Airlines has

attracted multiple code-sharingcode-share partners is its delivery of high-quality, reliable

service. SkyWest's competitive fares and ability to offer passengers

participation in the frequent flyer programs of Delta, United and Continental

are attractive incentives for passengers to fly on SkyWest. SkyWest also

believesmaintain a competitive cost structure while delivering high-quality customer service. We believe that multiple code-sharingcode-share agreements with major carriers diversifies financial and operating riskrisks by reducing reliance on a single major carrier. 3

5

- Expand Fleet SizeThis diversification may also allow us to grow at a faster rate and Increase Utilizationnot be limited by the rate at which any single partner can, or wishes to, Serve Newgrow. We intend to explore opportunities to develop additional code-share relationships with other carriers to the extent they are consistent with our business strategy.

• Focus on Larger Gauge Aircraft. We operate a greater number of large gauge regional jets than any other U.S. carrier. Large gauge regional jets, which seat approximately 70 or more passengers, offer significant opportunities for revenue and Existing

Markets. SkyWest seeksprofitability growth among major and regional carriers. Most major carriers, including Delta and United, have recognized the growth opportunities created by larger regional aircraft and are exploring opportunities to expandadd larger gauge regional jets, flown by themselves or their regional partners, to their flight systems. As of December 31, 2005, we operated a total of 77 CRJ700s, and we believe the expansion of our CRJ700 fleet will create growth opportunities in many markets in which we are the most competitive provider. For us, the operational commonality of CRJ700s and CRJ200s, which we have been flying and maintaining for more efficiently utilize its Brasilia and

CRJ aircraft to serve existing and new, profitable markets. SkyWest believes

that Brasilias are most efficiently used on shorter stage lengthsthen eleven years, offers additional operating efficiencies which we believe will enable us to provide frequentlarger gauge services at lower costs than our competitors. SkyWest Airlines and convenient service. For example, as SkyWest commenced service as

United ExpressASA have combined firm orders to acquire 15 additional CRJ700s and 17 CRJ900s over the next two years and ASA is committed to sublease six additional CRJ200s from Delta commencing in Los Angeles2006. In addition, we have options to acquire 70 additional CRJ900s, which can be configured to seat between 70 and 90 passengers. We believe the strength of our balance sheet has provided us the flexibility to place aircraft orders on a scale and timetable not easily matched by our competitors.

• Operate Limited Fleet Types. As of December 31, 2005, we operated 380 aircraft, principally of just two types, Bombardier Regional Jets and Brasilia turboprops. By simplifying our fleet, we believe we are able to limit our operating costs due to efficiencies in October 1997, Brasilias were shiftedemployee training, aircraft maintenance, lower spare parts inventory requirements and aircraft scheduling. While ASA currently operates twelve ATR-72 turboprops, we expect to remove these aircraft from less

efficient, non-hub based routes to more efficient Los Angeles hub and spoke

routes connecting with SkyWest's code-sharing partners. SkyWest's expanded role

as United Express in San Francisco will require the addition of 17 Brasilias by

June 1, 1998. CRJs are utilized on longer routes to supplement existing service by majorAugust 2007.

• Maintain a Positive Employee Culture. We believe our employees have been, and will continue to be, a key to our success. While none of the employees of SkyWest Airlines are represented by a union and ASA's pilots, flight attendants and flight controllers are all unionized, we believe that we offer our employees in both our operating subsidiaries substantially similar compensation and benefits packages that we believe differentiate us from other carriers and make us an attractive place to replace larger jets on routes where service is

discontinued by major carriers, to replace SkyWest's Brasilias as markets grow,work and to develop new markets. SkyWest believes its utilizationbuild a career. With the expansion of CRJs is amongour operations resulting from our acquisition of ASA, the highestbest efforts of all regional carriers operating CRJs.

- Increase Profitability.of our employees will be required to achieve the potential benefits envisioned by the transaction and continue to make our business successful. We believe that these factors, in combination with our historically low employee turnover rate, are a significant reason that neither SkyWest focuses on increasing profitability

through maximizing revenues per available seat mile ("RASM") and minimizing

costs per available seat mile ("CASM"). Revenues are maximized by delivery of

reliable, on-time flights, excellent customer service, efficient utilization ofAirlines nor ASA has ever had a revenue management system andwork stoppage due to a strike or other labor dispute.

Growth Opportunities

During the development of profitable code-sharing

relationships. SkyWest uses its recently acquired state-of-the-art revenue

management system to analyze markets and booking patterns and assist in

scheduling and seat inventory management to maximize revenues. The Company

believes SkyWest's development of multiple code-sharing relationships has

resulted in increased revenues without a proportionate increase in costs. A

Company-wide emphasis on cost management and more efficient utilization of

existing resources, together with the completed transition from three to two

aircraft types, has resulted in lower overhead and lower unit costs while

maintaining excellent customer service. CASM has declined in each fiscal year

since 1993 and decreased from 16.2c for the nine monthsfour years ended December 31, 19962005, our total operating revenues expanded at a compounded annual rate of 34.4% and the number of daily flights we operated increased from approximately 1,000 at the end of 2001 to 15.8c for the nine months endedapproximately 2,350 as of December 31, 1997. These reductions in CASM2005. With the exception of our acquisition of ASA, our growth during that five-year period was internally generated. We believe there are additional opportunities for expansion of our operations, consisting primarily of:

• Delivery of Aircraft Under Firm Order. We have been achieved notwithstanding a decline in stage lengths as Brasiliasfirm orders to acquire 15 additional CRJ700s and 17 CRJ900s during the two-year period ending December 31, 2007. We have been shiftedalso obtained the right to shorter hub and spoke routessublease from Delta six additional CRJ200s. We have agreements with Delta or

United to increase utilization.

- Provide Excellent Customer Service. SkyWest believes its insistence on

excellent customerplace all 38 of these aircraft into revenue service, in every aspect of its operations (including

personnel, flight equipment, in-flight amenities, baggage handling and on-time

performance and flight completion ratios) has increased customer loyalty.

SkyWest also believesunder long-term, fixed-fee contracts, promptly following their delivery.

• Potential Opportunities from Delta's Restructuring. We believe that excellent customer service is largely responsible for

its multiple code-sharing relationships as Delta United and Continental seek to

build customer loyalty and preference by partnering with high-qualityrestructures its fleet under bankruptcy protection, there may be new regional flying contracts that become available for qualified regional carriers. ASA holds certain rights to maintain its proportion of overall Delta regional flights, as well as its proportion of Atlanta regional flights. This may help ASA compete for new flying mandates, if any, that come into existence at Delta.

• Scope Clause Relief. "Scope clauses" are elements of major airlines' labor contracts with their own pilots that place restrictions on the number and size of aircraft, or the amount of flight activity, that can be operated by major airlines' regional airline contractors such as ASA and SkyWest completed its transition to an all cabin-class fleet in

December 1996, in part to provide larger,Airlines. Greater liberalization of scope clauses generally creates more comfortable aircraftbusiness opportunities for its

passengers. SkyWest believes that, for the nine months ended December 31, 1997,

its on-time performance ratio and flight completion ratio were the highest of

all regional airlines at 95.5% and 98.5%, respectively. SkyWest has achieved

these performance measures by operating oneairlines. Since 2001, five of the youngest fleets insix major national airlines (American Airlines, Inc. ("American Airlines"), United, Delta, Northwest Airlines, Inc. ("Northwest") and US Airways, Inc. ("US Airways")) have successfully achieved some scope clause liberalization. If further efforts by major airlines to relax scope clause restrictions are successful, it may create incremental opportunities for regional airlines.

• Narrowbody Replacement Flying. A meaningful portion of the recent growth of the regional airline industry resulted from the replacement of major airline-operated narrowbody jet aircraft (such as 737s, DC9s, MD80s and continuing its commitmentA319s) with regional airline-operated jets on the same route. The major airlines have effected this change in equipment in an effort to high quality maintenance.

ADDITIONAL BUSINESSES

The Company isachieve an advantage in trip costs, unit costs, frequency or a combination of these benefits. At present, the six major national airlines have a significant number of narrowbody aircraft that are more than 15 years old in their fleets. Such older aircraft are frequently less fuel- and maintenance-efficient than new aircraft. If major airlines decide to substitute newer regional airline-operated equipment for any portion of these older narrowbody aircraft upon their retirement, it may create incremental opportunities for regional airlines.

Our executive offices, which also engaged in other transportation-related businesses

through two wholly-owned subsidiaries. Scenic provides air tours and general

aviation services toserve as the Grand Canyon and other scenic regions of northern

Arizona, southern Utah and southern Nevada. Scenic operates 41 aircraft,

including 18 specially modified VistaLiner sight-seeing airplanes. NPT provides

car rental services through a fleet of Avis vehicles located at six airports

served by SkyWest. During the nine months ended December 31, 1997, Scenic and

NPT generated combined revenues of $27.9 million, representing 12.4% of the

Company's consolidated revenues for the period.

The principal executive offices of the CompanySkyWest Airlines, are located at 444 South River Road, St. George, Utah 84790, and the Company's84790. Our primary telephone number is (435) 634-3000.

4

6

THE OFFERING

634-3000 and our website address is www.skywest.com. ASA's executive offices are located at 100 Hartsfield Centre Parkway, Suite 800, Atlanta, Georgia 30354. ASA's primary telephone number is (404) 766-1400, and its website address is www.flyasa.com. The information on these websites is not part of this prospectus.

The Offering

The following information, which is based on the number of shares outstanding as of March 31, 2006, assumes that the underwriters do not exercise their overallotment option to purchase 600,000 additional shares. Please see "Underwriting" for more information concerning this option.

| Common by | 4,000,000 shares | |

Common | 63,596,298 shares(1) | |

Use of | We estimate that our net proceeds from this offering will be approximately $111 million. We intend to use these net proceeds for repayment of | |

Risk factors | See "Risk Factors" and other information included in this prospectus for discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | |

Nasdaq National Market | "SKYW" | |

Overallotment option | 600,000 shares subject to the underwriters' overallotment option may be sold by us. |

- (1)

Excludes 583,865 - The number of shares outstanding after the offering excludes 6,301,002 shares of

Common Stockcommon stock reserved for issuance upon exercise of outstanding stock options with an estimated weighted average exercise price of $18.38 per share.

Summary Consolidated Financial and 287,195 sharesOperating Data

| | Historical | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Years Ended December 31, | |||||||||||

| | 2003(1) | 2004(1) | 2005(2) | |||||||||

| | (in thousands, except share, per share and airline operating data) | |||||||||||

| Consolidated Statements of Income: | ||||||||||||

| Operating revenues | $ | 888,026 | $ | 1,156,044 | $ | 1,964,048 | ||||||

| Operating income | 108,480 | 144,776 | 220,408 | |||||||||

| Net income | 66,787 | 81,952 | 112,267 | |||||||||

| Net income per common share: | ||||||||||||

| Basic | 1.16 | 1.42 | 1.94 | |||||||||

| Diluted | 1.15 | 1.40 | 1.90 | |||||||||

| Dividends declared per common share | $ | 0.08 | $ | 0.12 | $ | 0.12 | ||||||

| Weighted average number of shares outstanding: | ||||||||||||

| Basic | 57,745 | 57,858 | 57,851 | |||||||||

| Diluted | 58,127 | 58,350 | 58,933 | |||||||||

| Other Financial Data: | ||||||||||||

| Net cash from (used in): | ||||||||||||

| Operating activities | 157,743 | 246,866 | 207,534 | |||||||||

| Investing activities | (811,690 | ) | (285,321 | ) | (422,453 | ) | ||||||

| Financing activities | 635,394 | 39,068 | 242,513 | |||||||||

| Airline Operating Data: | ||||||||||||

| Passengers carried | 10,738,691 | 13,424,520 | 20,343,975 | |||||||||

| Revenue passenger miles (000s)(3) | 4,222,669 | 5,546,069 | 9,538,906 | |||||||||

| Available seat miles (000s)(4) | 5,875,029 | 7,546,318 | 12,718,973 | |||||||||

| Passenger load factor(5) | 71.9 | % | 73.5 | % | 75.0 | % | ||||||

| Revenue per available seat mile(6) | 15.1 | ¢ | 15.3 | ¢ | 15.4 | ¢ | ||||||

| Cost per available seat mile(7) | 13.4 | ¢ | 13.6 | ¢ | 14.1 | ¢ | ||||||

| EBITDA(8) | 193,797 | 231,643 | 348,231 | |||||||||

| EBITDAR(8) | 318,733 | 377,584 | 558,462 | |||||||||

| Average passenger trip length (miles) | 393 | 413 | 469 | |||||||||

| Number of aircraft in service (end of period): | ||||||||||||

| Bombardier Regional Jets: | ||||||||||||

| Owned | 30 | 32 | 119 | |||||||||

| Leased | 79 | 101 | 187 | |||||||||

| Brasilia Turboprops: | ||||||||||||

| Owned | 21 | 21 | 14 | |||||||||

| Leased | 55 | 52 | 48 | |||||||||

| ATR-72 Turboprops (Leased) | 0 | 0 | 12 | |||||||||

| Total Aircraft | 185 | 206 | 380 | |||||||||

| | As of December 31, 2005 | |||||

|---|---|---|---|---|---|---|

| | Actual | As Adjusted(9) | ||||

| | (in thousands) | |||||

| Consolidated Balance Sheet Information: | ||||||

| Cash and marketable securities | $ | 299,668 | $ | 320,687 | ||

| Aircraft and other equipment, net | 2,552,522 | 2,552,522 | ||||

| Total assets | 3,320,646 | 3,341,665 | ||||

| Long-term debt, including current maturities(10) | 1,753,903 | 1,753,903 | ||||

| Lines of credit | 90,000 | — | ||||

| Total stockholders equity | $ | 913,198 | $ | 1,024,217 | ||

- (1)

- Reflects our operations for periods prior to our acquisition of

Common Stock availableASA. Does not reflect the financial or operating performance of ASA. - (2)

- Includes financial and operating performance of ASA for the

future grantlast 115 days ofstock options under2005, since theCompany's stock option plans at January 16, 1998 . RISK FACTORS See "Risk Factors" beginningacquisition by SkyWest, Inc. - (3)

- Revenue passengers multiplied by miles carried.

- (4)

- Passenger seats available multiplied by miles flown.

- (5)

- Revenue passenger miles divided by available seat miles.

- (6)

- Total airline operating revenues divided by available seat miles.

- (7)

- Total operating and interest expenses divided by available seat miles. Total operating and interest expenses is not a calculation based on

page 7 for a discussion of certain factors thatgenerally accepted accounting principles and should not be considered as an alternative to total operating expenses. Cost per available seat mile utilizing this measurement is included as it is a measurement recognized byprospective purchasers oftheCommon Stock offered hereby. FORWARD-LOOKING STATEMENTS This Prospectus contains various forward-looking statementsinvesting public. - (8)

- EBITDA represents earnings before interest expense, income taxes, depreciation and

information that are based on management's belief, as well as assumptions made by and information currently available to management. When used in this document, the words "anticipate," "estimate," "project," "expect," and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Such statements are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, projected or expected. Among the key factors that may have a direct bearing on the Company's operating results are the risks and uncertainties described under "Risk Factors," including, among other things, changes in SkyWest's code-sharing relationships, fluctuations in the economy and the demand for air travel, the degree and nature of competition and SkyWest's ability to expand services in new and existing markets and to maintain profit margins in the face of pricing pressures. PROPRIETARY MARKS Delta(R), Delta Connection(R) and The Delta Connection(R) are trademarks of Delta Air Lines, Inc. United(R) and United Express(R)are trademarks of United Airlines, Inc. Continental(R) and Continental Connection(TM) are trademarks of Continental Airlines, Inc. 57 SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA (IN THOUSANDS, EXCEPT PER SHARE AND AIRLINE OPERATING DATA)NINE MONTHS ENDED YEAR ENDED MARCH 31, DECEMBER 31, ------------------------------------------------------------- ---------------------- 1993 1994 1995 1996 1997 1996 1997 --------- --------- --------- --------- --------- --------- ---------CONSOLIDATED STATEMENTS OF INCOME DATA: Operating revenues(1)......... $ 146,800 $ 182,908 $ 218,075 $ 245,520 $ 278,110 $ 210,039 $ 225,683 Operating income.............. 11,465 24,680 20,341 5,710(2) 15,417 13,941 26,703 Net income.................... 6,704 14,396 13,701 4,366(2) 10,111 9,003 17,277 Net income per common share(3): Basic....................... $ 0.85 $ 1.46 $ 1.23 $ 0.42(2) $ 1.00 $ 0.89 $ 1.70 Diluted..................... 0.83 1.43 1.22 0.42(2) 1.00 0.89 1.68 OTHER FINANCIAL DATA: EBITDAR(4).................... $ 39,057 $ 56,325 $ 63,932 $ 57,725(2) $ 75,419 $ 59,436 $ 73,120 AIRLINE OPERATING DATA(5): Passengers carried............ 1,523,384 1,730,993 2,073,885 2,340,366 2,656,602 1,986,371 2,228,741 Revenue passenger miles (000)....................... 294,276 345,414 488,901 617,136 717,322 540,043 567,437 Available seat miles (000).... 669,724 727,059 976,095 1,254,334 1,413,170 1,053,935 1,113,486 Passenger load factor......... 43.9% 47.5% 50.1% 49.2% 50.8% 51.2% 51.0% Breakeven load factor......... 41.1% 41.2% 45.5% 48.4% 47.9% 48.2% 45.2% Yield per revenue passenger mile.............. 45.0c 43.9c 36.3c 33.2c 33.3c 32.9c 34.2c Revenue per available seat mile........................ 20.5c 21.6c 18.8c 16.9c 17.3c 17.3c 17.8c Cost per available seat mile........................ 19.1c 18.8c 17.1c 16.6c 16.3c 16.2c 15.8c Average passenger trip length...................... 193 200 236 264 270 272 255 Number of aircraft (end of period): Embraer Brasilia............ 19 23 28 35 50 47 50 Canadair Regional Jet....... - 4 6 10 10 10 10 Fairchild Metroliner III.... 31 28 26 18 - 5 - -- -- -- -- -- -- -- Total aircraft.......... 50 55 60 63 60 62 60AS OF DECEMBER 31, 1997 ----------------------- AS ACTUAL ADJUSTED(6) -------- -----------CONSOLIDATED BALANCE SHEET DATA: Working capital........................................... $ 68,730 $117,295 Property and equipment, net............................... 140,297 140,297 Total assets.............................................. 260,933 309,498 Long-term debt, less current maturities................... 51,248 51,248 Stockholders' equity...................................... 142,541 191,106- --------------- (1) Reflects the reclassification of non-airline commissions expense against non-airline operating revenues. (2) Includes $6.2 million of pre-tax fleet restructuring and transition expenses related to the replacement of the Metroliner turbo-prop aircraft. (3) Reflects restated net income per common share amounts as required by Statement of Financial Accounting Standards No. 128. (4)amortization. EBITDAR represents earnings before interest expense, income taxes, depreciation, amortization and aircraft rents.(5) Excludes the operations of Scenic and NPT. For definitions of the airline operating terms used in this table, seeSee "Selected Consolidated Financial and OperatingData." (6)Data" herein for a reconciliation of EBITDA and EBITDAR to net cash from operating activities for the periods indicated. EBITDA and EBITDAR are not calculations based on generally accepted accounting principles and should not be considered as alternatives to cash flow as a measure of liquidity. In addition, our calculations may not be comparable to other similarly titled measures of other companies. EBITDA and EBITDAR are included as supplemental disclosures because they may provide useful information regarding our ability to service debt and lease payments and to fund capital expenditures. Our ability to service debt and lease payments and to fund capital expenditures in the future, however, may be affected by other operating or legal requirements or uncertainties. Currently, aircraft and engine ownership costs are our most significant cash expenditure. In addition, EBITDA and EBITDAR are well recognized performance measurements in the regional airline industry and, consequently, we have provided this information. - (9)

- Adjusted to reflect the sale of

the 1,400,000sharesofferedwe are offering hereby at an assumed offering price of$36.875$29.27 per share, and the application of the estimated net proceeds therefrom.See "Use - (10)

- At December 31, 2005, 247 of

Proceeds." 68 RISK FACTORSthe aircraft operated by SkyWest Airlines and ASA were financed through operating leases. In addition to our indebtedness, at December 31, 2005, we had approximately $3.2 billion of mandatory future minimum payments under operating leases, primarily for aircraft and ground facilities. At a 7% discount factor, the present value of these obligations would be equal to approximately $2.1 billion.

Before you invest in our common stock, you should be aware that such investment involves a high degree of risk, including the risks described below. You should consider carefully these risk factors, together with all of the other information containedincluded in this Prospectus,prospectus, before you decide to purchase any shares of our common stock. Additional risks and uncertainties not presently known to us or that we currently do not deem material may also impair our business operations. If any of the following factors should be considered carefully in evaluating an investment inrisks we describe below occur, or if any unforeseen risk develops, our operating results may suffer, our financial condition may deteriorate, the Company.

DEPENDENCE ON CODE-SHARING RELATIONSHIPS

SkyWest istrading price of our common stock may decline and you may lose all or part of your investment.

Risks Related to Our Operations

We are highly dependent on relationships createdDelta and United.

If any of our code-share agreements are terminated pursuant to the terms of those agreements, due to the bankruptcy and restructuring proceedings of Delta and United, or otherwise, we would be significantly impacted and likely would not have an immediate source of revenue or earnings to offset such loss. A termination of any of these agreements would have a material adverse effect on our financial condition, operating revenues and net income unless we are able to enter into satisfactory substitute arrangements for the utilization of the affected aircraft by code-sharing agreements

withother code-share partners, or, alternatively, obtain the airport facilities and gates and make the other arrangements necessary to fly as an independent airline. We may not be able to enter into substitute code-share arrangements, and any such arrangements we might secure may not be as favorable to us as our current agreements. Operating our airline independent from major partners would be a significant departure from our business plan, would likely be very difficult and may require significant time and resources, which may not be available to us at that point.

The current terms of the SkyWest Airlines and ASA Delta United and Continental (the "Code-Sharing Agreements") forConnection Agreements are subject to certain early termination provisions. Delta's termination rights include cross-termination rights (meaning that a substantial portionbreach by SkyWest Airlines or ASA of its business. Under SkyWest's Code-SharingDelta Connection Agreement withcould, under certain circumstances, permit Delta (the "Delta Agreement")to terminate both Delta Connection Agreements), the right to terminate each of the agreements upon the occurrence of certain force majeure events (including certain labor-related events) that prevent SkyWest Airlines or ASA from performance for certain periods and the right to terminate each of the agreements if SkyWest Airlines or ASA, as applicable, fails to maintain competitive base rate costs, subject to certain rights of SkyWest Airlines to take corrective action to reimburse Delta is not prohibited from competing on routes

served by SkyWest.for lost revenues. The current term of the Deltaour United Express Agreement continues until April 2002,

but is subject to certain early termination in various circumstances including 180 days'

notice by either party for any or no reason; provided, however, that Delta may

not terminate the Delta Agreement prior to April 1999, except for cause, as

defined in the Delta Agreement. The term of SkyWest's Code-Sharing Agreement

with United (the "United Express Agreement") is for five years ending in

September 2002 for Los Angeles operationsprovisions and ten years ending in May 2008 for

San Francisco operations, subject to termination by United upon 180 days' prior

notice.subsequent renewals. United may however, terminate the United Express Agreement for cause

upon 30 days' written notice. Any material modificationdue to or termination of the

Code-Sharing Agreements, any substantial decrease in the number of routes servedan uncured breach by SkyWest or SkyWest's code-sharing partners at hubs served by SkyWest or the

occurrenceAirlines of any event adversely affecting eithercertain operational and performance provisions, including measures and standards related to flight completions, baggage handling and on-time arrivals.

We currently use Delta's and United's systems, facilities and services to support a significant portion of our operations, including airport and terminal facilities and operations, information technology support, ticketing and reservations, scheduling, dispatching, fuel purchasing and ground handling services. If Delta or United generallywere to cease any of these operations or no longer provide these services to us, due to termination of one of our code-share agreements, a strike by Delta or United personnel or for any other reason, we may not be able to replace these services on terms and conditions as favorable as those we currently receive, or at all. Since our revenues and operating profits are dependent on our level of flight operations, we could then be forced to significantly reduce our operations. Furthermore, upon certain terminations of our code-share agreements, Delta and United could require us to sell or assign to them facilities and inventories, including maintenance facilities, we use in connection with the code-share services we provide. As a result, in order to offer airline service after termination of any of our code-share agreements, we may have to replace these airport facilities, assets and services. We may be unable to arrange such replacements on satisfactory terms, or at all.

We may be negatively impacted by the troubled financial condition, bankruptcy proceedings and restructurings of Delta and United.

Substantially all of our revenues are attributable to our code-share agreements with Delta, which is currently reorganizing under Chapter 11 of the U.S. Bankruptcy Code, and United, which recently emerged from bankruptcy proceedings. The U.S. Bankruptcy Courts charged with administration of the Delta and United bankruptcy cases have entered final orders approving the assumption of our code-share agreements. Notwithstanding those approvals, these bankruptcies and restructurings present considerable continuing risks and uncertainties for our code-share agreements and, consequently, for our operations.

Although a plan of reorganization has been confirmed in the United bankruptcy proceedings, which became effective on February 1, 2006 (subject to pending appeal), and Delta reports that it intends to reorganize and emerge from its bankruptcy proceedings, there is no assurance that either of United or Delta will ultimately succeed in its reorganization efforts or that either Delta or United will remain a going concern over the long term. Likewise, even though both Delta and United have assumed our code-share agreements with bankruptcy court approval, there is no assurance that these agreements will survive the Chapter 11 cases. For example, the Delta reorganization could be converted to liquidation, or Delta could liquidate some or all of its assets through one or more transactions with one or more third parties with bankruptcy court approval. In addition, Delta may not be able to confirm and consummate a successful plan of reorganization that provides for continued performance of its obligations under its code-share agreements with us. In the event United is not able to perform successfully under the terms of its plan of reorganization, assumption of our United Express Agreement could be subjected to similar risks.

Other aspects of the Delta and United bankruptcies and reorganizations pose additional risks to our code-share agreements. Delta may not be able to obtain bankruptcy court approval of various motions necessary for it to administer its bankruptcy case. As a consequence, Delta may not be able to maintain normal commercial terms with vendors and service providers, including other code-share partners, that are critical to its operations. Delta also may be unable to reach satisfactory resolutions of disputes arising out of collective bargaining agreements or to obtain sufficient financing to fund its business while it reorganizes. These and other factors not identified here could delay the resolution of the Delta bankruptcy and reorganization significantly and could threaten Delta's operations. As to United, even though a plan of reorganization has been confirmed in the United bankruptcy proceedings, and there is no assurance that United will be able to operate successfully under the terms of its confirmed plan.

In light of the importance of our code-share agreements with Delta and United to our business, the termination of these agreements or the failure of Delta to ultimately emerge from its bankruptcy proceeding could jeopardize our operations. Such events could leave us unable to operate much of our current aircraft fleet and the additional aircraft we are obligated to purchase. As a result, these events could have a material adverse effect on our operations and financial condition.

Even though United has emerged from bankruptcy proceedings and if Delta is ultimately able to emerge from its bankruptcy proceedings, their respective financial positions will continue to pose risks for our operations. Serial bankruptcies are not unprecedented in the Company. See

"Business -- Code-Sharing Agreements."

ABILITY TO IMPLEMENT EXPANSIONcommercial airline industry, and Delta and/or United could file for bankruptcy again after emergence from Chapter 11, in which case our code-share agreements could be subject to termination under the U.S. Bankruptcy Code. Regardless of whether subsequent bankruptcy filings prove to be necessary, Delta and United have required, and will likely continue to require, our participation in efforts to reduce costs and improve their respective financial positions. These efforts could result in lower utilization rates of our aircraft, lower departure rates on the contract flying portion of our business, and more volatile operating margins. We believe that any of these developments could have a negative effect on many aspects of our operations and financial performance.

We may not achieve the potential benefits of the ASA acquisition.

Our achievement of the potential benefits of the ASA acquisition will depend, in substantial part, on our ability to successfully implement our business strategy, including improving the utilization of equipment and facilities, increasing employee productivity and allocating overhead and administrative expenses over a larger platform. We will be unable to achieve the potential benefits of the ASA acquisition unless we are able to efficiently integrate the SkyWest Airlines and ASA operating platforms in a timely manner. The Company's principal growth strategy isintegration of SkyWest Airlines and ASA may be costly, complex and time-consuming, and the managements of SkyWest Airlines and ASA will have to devote substantial effort to such integration. If we are not able to successfully achieve these objectives, the potential benefits of the ASA acquisition may not be realized fully or at all, or they may take longer to realize than expected. In addition, assumptions underlying estimates of expected cost savings and expected revenues may be inaccurate, or general industry and business conditions may deteriorate. Our combined operations with ASA may experience increased competition that limits our ability to expand SkyWest'sour business. We cannot assure you that the ASA acquisition will result in combined results of operations and financial condition consistent with our expectations or superior to supportwhat we and ASA could have achieved independently. Nor do we represent to you that any estimates or projections we have developed or presented in connection with the operationsASA acquisition can or will be achieved.

The amounts we receive under our code-share agreements may be less than the actual amounts of its code-sharing partners. Such expansion, whichthe corresponding costs we incur.

Under our code-share agreements with Delta and United, we are compensated for certain costs we incur in providing services. With respect to costs that are defined as "pass-through" costs, our code-share partner is obligated to pay to us the actual amount of the cost (and, with respect to the ASA Delta Connection Agreement, a pre-determined rate of return based upon the actual costs we incur). With respect to other costs, our code-share partner is obligated to pay to us amounts based, in part, on pre-determined rates for certain costs. During the year ended December 31, 2005, approximately 50% of our costs were pass-through costs and 50% of our costs were reimbursable at pre-determined rates. These pre-determined rates may not be based on the actual expenses we incur in delivering the associated services. If we incur expenses that are greater than the pre-determined reimbursement amounts payable by our code-share partners, our financial results will likely consistbe negatively affected.

We have a significant amount of entry into new markets and developmentcontractual obligations.

As of existing

markets, will require additional aircraft and facilities for passenger

ticketing, check-in and boarding and aircraft maintenance and storage,

additional rights to use gatesDecember 31, 2005, we had a total of approximately $1.8 billion in the markets to be served by SkyWest and

additional personnel. In particular, SkyWest recently announced its intention to

expand its operations to include service as a United Express carrier at United's

San Francisco hub, which, if implemented, would requiretotal long-term debt obligations. Substantially all of this long-term debt was incurred in connection with the acquisition of 17

additional Brasilias,aircraft, engines and related spare parts including debt assumed in the acquisitionASA acquisition. We also have significant long-term lease obligations primarily relating to our aircraft fleet. These leases are classified as operating leases and therefore are not reflected as liabilities in our condensed consolidated balance sheets. At December 31, 2005, we had 247 aircraft under lease, with remaining terms ranging from one to 18 years. Future minimum lease payments due under all long-term operating leases were approximately $3.2 billion at December 31, 2005. At a 7% discount factor, the present value of additional maintenance facilities, the

employmentthese lease obligations was equal to approximately $2.1 billion at December 31, 2005. As of more than 475 additional employees (consistingDecember 31, 2005, we had commitments of approximately 200 pilots$838 million to purchase 15 CRJ700s and 17 CRJ900s and to lease six CRJ200's, together with related flight attendants, 50 maintenance personnelequipment. We expect to complete these deliveries by April 2007. Our high level of fixed obligations could impact our ability to obtain additional financing to support additional expansion plans or divert cash flows from operations and 225 customerexpansion plans to service personnel)the fixed obligations.

There are risks associated with our regional jet strategy, including potential oversupply and possible passenger dissatisfaction.

Our selection of Bombardier Regional Jets as the integrationprimary aircraft for our existing operations and projected growth involves risks, including the possibility that there may be an oversupply of regional jets available for sale in the foreseeable future, due, in part, to the financial difficulties of regional and major airlines, including Delta, United, Northwest, Comair, Inc. ("Comair"), Mesaba Aviation, Inc., and FLYi, Inc., which is in the process of liquidating its regional jet fleet. A large supply of regional jets may allow other carriers, or even new carriers, to acquire aircraft for unusually low acquisition costs, allowing them to compete more effectively in the industry, which may ultimately harm our operations and financial performance.

Our regional jet strategy also presents the risk that passengers may find the Bombardier Regional Jets to be less attractive than other aircraft, including other regional jets. Recently, several other models of regional jets have been introduced by manufacturers other than Bombardier. If passengers develop a preference for other regional jet models, our results of operation and financial condition could be negatively impacted.

We may be limited from expanding our flying within the Delta and United flight systems, and there are constraints on our ability to provide airline services to airlines other than Delta and United.

Additional growth opportunities within the Delta and United flight systems are limited by various factors. Except as currently contemplated by our existing code-share agreements, we cannot assure that Delta or United will contract with us to fly any additional aircraft. We may not receive additional growth opportunities, or may agree to modifications to our code-share agreements that reduce certain benefits to us in order to obtain additional aircraft, or for other reasons. Furthermore, the troubled financial condition, bankruptcies and restructurings of Delta and United may reduce the growth of regional flying within their flight systems. Given the troubled nature of the airline industry, we believe that some of our competitors may be more inclined to accept reduced margins and less favorable contract terms in order to secure new or additional code-share operations. Even if we are offered growth opportunities by our major partners, those opportunities may involve economic terms or financing commitments that are unacceptable to us. Any one or more of these factors may reduce or eliminate our ability to expand our flight operations with our existing code-share partners. Additionally, even if Delta and/or United choose to expand our fleet on terms acceptable to us, they may be allowed at any time to subsequently reduce the number of aircraft facilities and

employees into SkyWest's existing operations. There cancovered by our code-share agreements. We also cannot assure you that we will be no assurance that

SkyWest can profitably integrate this growth. The Company presently estimates

that the cost of acquiringable to obtain the additional ground and maintenance facilities, including gates and support equipment, and spare parts inventory required for the San Francisco