As filed with the Securities and Exchange Commission on November 13, 2020June 17, 2022

File 333-_______

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REZOLUTE, INC.

(Exact nameName of registrantRegistrant as specifiedSpecified in its charter)Its Charter)

| 27-3440894 | ||||

(State or

| ( | |||

| Incorporation or Organization) |

No.) |

201 Redwood Shores Parkway, Suite 315

Redwood City, CA 94065

(650) 206-4507

(Address, including zip code,Including Zip Code, and telephone number, including area codeTelephone Number, Including Area Code, of registrant’s principal executive offices)Registrant’s Principal Executive Offices)

Rezolute, Inc.

Attn: Nevan Elam CEO

Chief Executive Officer

201 Redwood Shores Parkway, Suite 315

Redwood City, CA 94065

Telephone: (650) 206-4507

(Name, address, including zip code,Address, Including Zip Code, and telephone number, including area code,Telephone Number, Including Area Code, of agentAgent for service)Service)

Copies of communications to:

Anthony W. Epps

Joshua B. Erekson

Dorsey & Whitney LLP

Attn: Anthony W. Epps & Michael L. Weiner

1400 Wewetta Street, Suite 400Wewatta St #400

Denver, CO 80202

(303) 629-3400

Approximate date of commencement of proposed sale to the public:From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment filedthereto that shall become effective upon filing with the Commission pursuant to Rule 462(d)462(e) under the Securities Act, check the following box and listbox. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, registration statement number ofcheck the earlier effective registration statement for the same offering.following box. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):Act:

| Large accelerated filer ¨ | Smaller reporting company x |

| Accelerated | |

| Emerging growth company ¨ | |

| Non-accelerated filer x | |

If an emerging growth company, indicate by check mark if the Registrantregistrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 17(a)7(a)(2)(B) of the Securities Act. ¨

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum aggregate offering price | Amount of Registration Fee | ||||||||||||

| Common stock, par value $0.001 to be offered for resale by the Selling Stockholders issued in connection with the Unit Financing (as defined herein) | 2,485,219 | $ | 20.00 | $ | 49,704,380.00 | $ | 5,422.75 | |||||||||

| Common stock, $0.001 to be offered for resale by the Selling Stockholders issuable upon the exercise of Unit Warrants (as defined herein) issued in connection with the Unit Financing. | 820,001 | $ | 19.50 | 15,990,019.50 | 1,744.51 | |||||||||||

| Total Registration Fee | $ | 7,167.26 | ||||||||||||||

ThisThe registrant hereby amends this Registration Statementregistration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statementregistration statement shall thereafter become effective in accordance with sectionSection 8(a) of the Securities Act of 1933, or until the Registration Statementthis registration statement shall become effective on such date as the commission,Securities and Exchange Commission, acting pursuant to sectionSection 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Selling StockholdersWe may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where thesuch offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 13, 2020

REZOLUTE INC.June 17, 2022

PRELIMINARY PROSPECTUS

3,305,220Up to 10,947,371 Shares of Common Stock Issuable upon Conversion of Warrants

This prospectus relates to the offer and sale, from time to time,resale of up to 3,305,22010,947,371 shares of common stock,Common Stock, par value $0.001 per share (“Common Stock”) of Rezolute, Inc., a Delaware based corporation (the “Company”) by Federated Hermes Kaufmann Small Cap Fund, Federated Hermes Kaufmann Fund, Federated Hermes Kaufmann Fund II, CDK Associates, L.L.C., by the selling stockholders named hereinThird Street Holdings LLC, Blackstone Annex Master Fund L.P., Vivo Opportunity Fund Holdings, L.P., and Adage Capital Partners LP (the “Selling Stockholders”“Selling Stockholders”) consisting of (i) 2,485,219 shares of common stock of the Company issued in connection with the Company’s unit financing that closed on October 9, 2020 (the “Unit Financing”) and (ii) 820,001 shares of common stock of the Company. The Common Stock is issuable upon the exercise of certain warrants10,947,371 Class B Warrants (the “Class B Warrants”) of the Company issued into the Unit Financing (the “UnitSelling Stockholders pursuant to the underwriting agreement dated May 1, 2022 between the Company and Jefferies LLC, as representative of the underwrites listed therein. The Class B Warrants”).

have an exercise price of $0.001 per share. We will receive the proceeds from the exercise of the Class B Warrants. We will not receive any of the proceeds from the resalesale of theseany shares of our common stockCommon Stock by the Selling Stockholders. Upon exercise we will receive the cash exercise priceStockholders pursuant to this prospectus.

Our registration of the Unit Warrants. However, ifsecurities covered by this prospectus does not mean that the Unit Warrants are exercised on a cashless basis, weSelling Stockholders will not receiveoffer or sell any cash from these exercises.

of the shares of Common Stock. The Selling Stockholders may sell or otherwise dispose of the shares of common stock or the shares of common stock issuable upon exercise of warrants coveredCommon Stock offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or interests therein onthrough any stock exchange, market or trading facility on whichother means described in this prospectus under the caption “Plan of Distribution.” The shares are traded or in private transactions. These dispositionsof Common Stock may be sold at fixed prices, at prevailing market prices prevailing at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Additional information about the Selling Stockholders, and the times and manner in which they may offer and sell shares of our common stock under this prospectus, is provided in the sections entitled “Selling Stockholders” and “Plan of Distribution” of this prospectus.

Our common stockCommon Stock is listed on theThe Nasdaq Capital Market under the symbol “RZLT”. On November 11, 2020,June 14, 2022, the last reported sale price offor our common stockCommon Stock was $3.02 per share. Each prospectus supplement to this prospectus will indicate if the securities offered thereby will be listed on the Nasdaq Capital Market was $20.00.any securities exchange.

All of the shares covered by this prospectus were issued or issuableInvesting in connection with the Unit Financing. Additional information about the Unit Financing is provided in the section entitled “Description of Unit Financing” of this prospectus.

our securities involves risks. You should consider carefully review the risks that we haveand uncertainties described inunder the section entitled “Risk Factors”heading “Risk Factors” beginning on Page 5page 10 of this prospectus, any applicable prospectus supplement or any related free writing prospectus, and in any documents incorporated by reference herein or therein before deciding whether to investinvesting in our common stock.securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is ___________, 2020__, 2022

TABLE OF CONTENTS

Page

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that this prospectus is correct as of any time after its date.

i

In this prospectus, references to the “Company,” “Rezolute,” “we,” “us,” “our” and similar terms refer to Rezolute, Inc. References to our “common stock” refer to the common stock, par value $0.001 per share, of Rezolute, Inc.

You should read this prospectus together with information incorporated herein by reference as described under the heading “Documents Incorporated by Reference” and the additional information described under the headings “Where You Can Find More Information.” If there is any inconsistency between the information in this prospectus and the documents incorporated by reference herein, you should rely on the information in this prospectus.

You should rely only on the information contained in this prospectus or incorporatedin any related free writing prospectus filed by referenceus with the Securities and Exchange Commission (“SEC”). We and the Selling Stockholders have not authorized anyone to provide you with any information or to make any representation not contained in this prospectus. We and the Selling Stockholders do not take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy securities in any jurisdiction where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of securities. You should also read and consider the information in the documents to which we have not authorizedreferred you under the caption “Where You Can Find More Information” in the prospectus.

Neither we nor the Selling Stockholders have done anything that would permit a public offering of the securities or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other personthan in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, provide information different from thatthe offering of the securities and the distribution of this prospectus outside of the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the Common Stock being offered.

Unless the context indicates otherwise, as used in this prospectus, the terms “Rezolute,” “we,” “us,” “our,” and “our business” refer to Rezolute, Inc. and its subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus is accurate as of the dates on the cover page, regardless of time of delivery of the prospectus or any sale of securities. Our business, financial condition, results of operation and prospects may have changed since those dates.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information set forth in this prospectus and the information it incorporates by reference mayherein, contain variouscertain “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act and the Private Securities Litigation Reform Act of 1934, as amended (the “Exchange Act”). Statements containing words such as “believe,” “project,1995, and are based on management’s current expectations. These forward-looking statements can be identified by the use of forward-looking terminology, including, but not limited to, “believes,” “may,” “will,” “would,” “should,” “expect,” “anticipate,” “seek,” “see,” “confidence,” “trends,” “intend,” “estimate,” “on track,” “are positioned to,” “on course,” “opportunity,” “continue,” “project,” “guidance,” “target,” “forecast,” “anticipated,” “plan,” “estimate,” “expect”“potential” and “intend” and other similar expressions constitute forward-looking statements. In particular,the negative of these forward-looking statements include, but are not limited to, the following:terms or comparable terms.

Forward-looking statements are subject toVarious factors could adversely affect our operations, business economicor financial results in the future and other risks and uncertainties, both known and unknown, andcause our actual results mayto differ materially from those contained in the forward-looking statements. Examplesstatements, including those factors discussed under “Risk Factors” and “Management’s Discussion and Analysis of risksFinancial Condition and uncertaintiesResults of Operations,” or otherwise discussed in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021, our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022, and in our other filings made from time to time with the SEC after the date of this prospectus.

For additional information about factors that could cause actual results to differ materially from historical performancethose described in the forward-looking statements, please see the documents that we have filed with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents and reports filed from time to time with the SEC.

All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We are not under any obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements include, but are not limited to, those risks described under the heading “Risk Factors” on page 5whether as a result of this prospectus, in Item 1A. of our most recent Annual Report on Form 10-K, as well as any subsequent filings with the United States Securities and Exchange Commission (the “SEC”). Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements are made. You should read carefully this prospectus and any related free writing prospectuses that we have authorized for use in connection with this offering, together with the information incorporated herein or therein by reference as described under the heading “Where You Can Find More Information,” completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify all of our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even ifchanges, new information, becomes available in the future.subsequent events or otherwise.

This summary highlights selected information about Rezolute, Inc. and a general description of the securities that may be offered for resale or other disposition by the Selling Stockholders. This summary is not complete and does not contain all of the information that may be important to you. For a more complete understanding of us and the securities offered by the Selling Stockholders, you should carefully read this entire prospectus, including the “Risk Factors” section, any applicable prospectus supplement for these securities and the other documents we refer to and incorporate by reference. In particular, we incorporate important business and financial information into this prospectus by reference.

REZOLUTE, INC.THE COMPANY

We are a clinical stageclinical-stage biopharmaceutical company specializing in the development of innovative drugdeveloping transformative therapies for metabolic diseases related to improve the lives of patients with metabolic and orphan diseases.

Recent Developments

On October 8, 2020, we filed with the Secretary of State of the State of Delaware, a Certificate of Amendment to our Certificate of Incorporation (the “Certificate of Amendment”), which was approved by the our stockholders at our special meeting of stockholders held on October 23, 2019 and by the our board of directors on October 7, 2020. The Certificate of Amendment effected a 1-for-50 reverse stock split of our common stock (the “Reverse Split”), in which every fifty (50) shares of common stock issued and outstanding as of October 9, 2020 were combined and converted into one (1) share of common stock. In connection with the Reverse Split, proportionate adjustments were made to increase the per share exercise prices and decrease the number of shares of common stock issuable upon exercise of stock options and warrants whereby approximately the same aggregate price is required to be paid for such securities upon exercise as had been payable immediately preceding the Reverse Split. While the Reverse Split decreased the number of outstanding shares of common stock, it did not change the total number of shares of common stock or preferred stock authorized for issuance by us, nor did it change the par value of the common stock or preferred stock. The first day of trading after the Reverse Stock Split was on October 13, 2020. Unless otherwise indicated, the share numbers contained herein give effect to the Reverse Split.

As described under the heading “Unit Financing”, on October 9, 2020 we issued 2,484,853 shares of common stock and 820,001 Unit Warrants which resulted in net proceeds of approximately $37.5 million.

On November 3, 2020, our shares of common stock were approved for listing on the Nasdaq Capital Market under the symbol RZLT and the initial day of trading was on November 9, 2020.chronic glucose imbalance.

Our Pipeline

Our lead clinical asset, RZ358, is an antibody therapy in Phase 2b development as a potential treatment for congenital hyperinsulinism (“CHI”HI”), an ultra-rare pediatric genetic disorder.

In February 2020, we announced the initiation of the RZ358-606 Phase 2b study (“RIZE”RIZE”) globally at multiple study centers. Prior to COVID-19, we had planned to complete the RIZE study by the middle of calendar year 2021.

In March 2020, we paused the RIZE study as a result of the COVID-19 pandemic. As the COVID-19 pandemic abatesbegan to abate in different regions, we are resumingresumed clinical activities including trial site initiations.initiations and patient enrollment in July 2021 . We reported positive topline results from the RIZE study in March 2022. These results were presented at the Pediatric Endocrine Society Meeting on May 1st, 2022.

The RIZE study was conducted primarily in a young pediatric population, average ~6.5 years of age and enrolled 23 patients across diverse genetic types. RZ358 resulted in a > 50% improvement in hypoglycemic events across all doses and approximately 75% improvement at the mid (6 mg/kg) and top (9 mg/kg) doses. Time-in-range by continuous glucose monitoring (“CGM”) improved by 8% across all doses and 16% at the top dose. Expected RZ358 concentrations were achieved and clear dose-exposure responses were observed. There were no adverse drug reactions, dose-limiting toxicities, or drug-related serious adverse events. We believe that patient enrollment will recommence bythese positive results from the end of calendar year 2020. Further, if we can begin enrolling patients on this timeframe, we believe weRIZE study will be ablePhase-3 enabling and we plan to completeinteract with the RIZE studyregulatory authorities in the second half of calendar year 2021.2022. If we obtain clearance, we will initiate our Phase 3 study in the first half of calendar year 2023.

In addition, induring the first half of calendar year 2020 we had positive interactions with the U.S.United States Food and Drug Administration (“FDA”). In June 2020, whereby we announced that FDAwere granted us Rare Pediatric Disease (“RPD”) designation for RZ358, which qualifiesqualified us to receive a priority review voucher (“PRV”) upon marketing approval of the drug in CHI.congenital HI. Such a voucher could be redeemed to receive a priority review of a subsequent marketing application for any drug candidate in any disease indication. Further,

Our second clinical asset, RZ402, is a selective and potent plasma kallikrein inhibitor (“PKI”) being developed as a potential oral therapy for the chronic treatment of diabetic macular edema (“DME”). RZ402 recently completed the Phase 1 development program. In January 2021, we submitteddosed the RIZE protocol to FDA which allows us to expand the study to clinical sitesfirst subject in the United States. We believePhase 1a study, and in May 2021 we announced positive topline results whereby single dose oral administration of RZ402 resulted in plasma concentrations that patient enrollment may commencesubstantially exceeded target pharmacologically active drug levels, demonstrating the potential for once daily dosing. RZ402 was generally safe and well-tolerated at all doses tested, without dose-limiting toxicities. In August 2021, we announced the initiation in the United StatesPhase 1b multiple-ascending dose (“MAD”) study and reported positive results in March 2022. The results further validated and supported the potential for once daily oral dosing and showed dose-dependent increases in systemic exposures, with repeat-dosing to steady-state resulting in the first quarterhighest concentrations of RZ402 explored to date, exceeding 200 ng/mL and 50 ng/mL at peak and 24-hour trough, respectively. The MAD study results showed that RZ402 was generally safe and well-tolerated, including at higher doses than previously tested in the SAD study. There were no serious adverse events, adverse drug reactions or identified risks. We are advancing developmental activities toward a Phase 2a proof-of-concept study, which we plan to initiate during the second half of calendar year 2021.

Our next program, RZ402, is an investigational new drug (“IND”) application-ready oral therapy, targeting diabetic macular edema (“DME”). Prior to COVID-19 we were planning to file the IND with the FDA in the third quarter of calendar year 2020, followed by the initiation and completion of a Phase 1 study this calendar year. However, as a result of the present uncertainties associated with COVID-19 pandemic, we have deferred filing the IND. We anticipate initiating the clinical trial for RZ402 prior to the end of the first quarter of calendar year 2021.2022.

RZ358

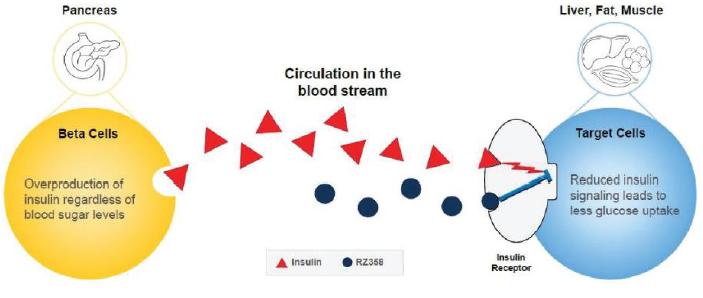

CHICongenital HI is an ultra-rare pediatric genetic disorder characterized by excessive production of insulin by the pancreas. CHI is caused by mutations in about a dozen known genes associated with pancreatic beta cells and their secretion of insulin. If untreated, itthe elevated insulin levels in these patients can lead to dangerously lowinduce extreme hypoglycemia (low blood sugar levels. Rezolute’s lead candidate, RZ358, is an antibodysugar) events, increasing the risk of neurological and developmental complications, including persistent feeding problems, learning disabilities, recurrent seizures, brain damage or even death. There are no FDA approved therapies for congenital HI, and the current standard of care treatments are suboptimal. The current treatments used by physicians includes Glucagon, Diazoxide, Somatostatin Analogues and Pancreatectomy. Each of these treatments has the following drawbacks as set forth in Phase 2b development that is designed to prevent severe, persistent low blood sugar in patients with CHI.the graphic set below.

Our lead candidate, RZ358, is an intravenously administered human monoclonal antibody that binds to a unique site (allosteric) on the insulin receptor found across effector cells throughout the body, such as in the liver, fat, and muscle. This action allows RZ358The antibody modifies insulin’s binding and signaling to counteractmaintain glucose levels in a normal range, which counteracts the effects of elevated insulin in the body. Its unique allosteric mechanism of action is reversible, depends on both insulin levels and blood sugar levels in a dose-dependent manner, and enables patients to achieve normal levels of insulin and glucose. Therefore, we believe that RZ358 is ideally suited as a potential therapy for conditions characterized by excessive insulin productionlevels, and it is being developed to treat hyperinsulinemiathe hyperinsulinism and prevent low blood sugar forcharacteristic of diseases such as CHI.congenital HI. As RZ358 acts downstream from the beta cells, across effector cells init has the liver, fat, and muscle, it maypotential to be universally effective at treating CHIcongenital HI caused by any of the underlying genetic defects.

A summary of the completed clinical studies is as follows:

Phase 1 pharmaco-kinetic studies of single intravenous doses of RZ358 at 0.1 to 9 mg/kg in healthy volunteers revealed dose-dependent pharmacokinetics with a half-life of 15 days, supporting the biweekly dosing approach. In healthy volunteers, RZ358 prevented hypoglycemia induced by insulin administration, without producing hyperglycemia. This effect showed a pharmacokinetic-pharmacodynamic (dose - response) correlation, with the hypoglycemia-blunting effects of RZ358 lasting for two weeks.

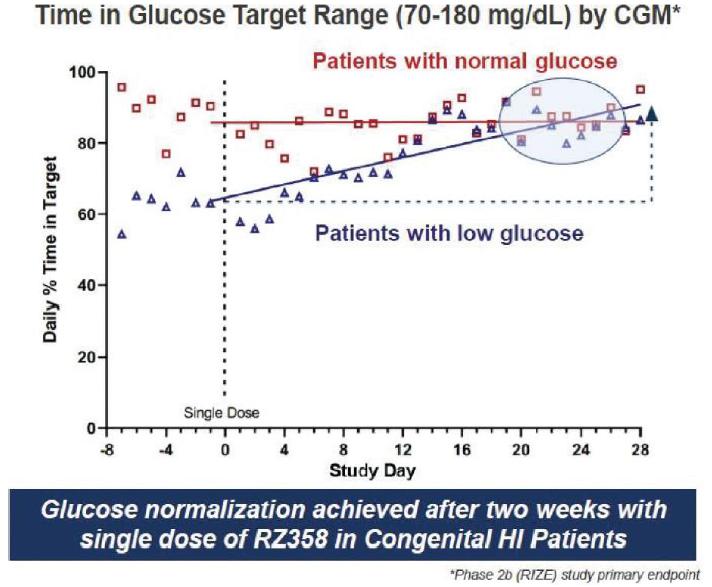

The clinical proof-of-concept of RZ358 in congenital HI was evaluated in Phase 2a studies in a total of 14 patients with congenital HI (12 years or older). The studies investigated the pharmacokinetics (PK), pharmacodynamics (PD), safety and preliminary efficacy of RZ358. RZ358 was well-tolerated in adult and pediatric patients with congenital HI who received single intravenous doses in the phase 2a studies and the PK results from the phase 2a studies were consistent with those in healthy volunteers. There was a durable dose- and disease-dependent normalization of blood sugar in patients with congenital HI who had elevated insulin levels/low blood glucose levels at baseline, with an approximate 50% improvement in hypoglycemia and near normalization of glucose control, which was sustained for more than two weeks after dosing. RZ358 did not increase blood sugar levels in patients with normal blood sugar levels at baseline. The increases in blood sugar, depended on and correlated with disease severity and RZ358 concentrations, making RZ358 uniquely suited as a potential therapy for congenital HI, a disease with known heterogeneity and variability.

The Phase 2b (RZ358-606) trial, “RIZE” study, was conducted in a repeat-dose fashion to evaluate the safety, pharmacokinetics, dose-exposure response relationship and to assess the glycemic efficacy across a range of CGM and BGM-based principle glycemic endpoints to inform Phase 3. In the study, eligible patients received RZ358 in open-label fashion in one of 4, sequentially conducted dosing cohorts of up to 8 participants per cohort. RZ358 was administered as a 30 min IV infusion every other week for an 8-week treatment exposure period. The first 3 cohorts were fixed dosing levels of RZ358, the anticipated dosing regimen. The 4th cohort was an optional cohort which was designed to explore whether there were any advantages of a fixed titration approach, should the first 3 cohorts indicate a need to do so.

The RIZE study isenrolled 23 patients and was primarily in a multi-center, open-label, repeat-dose Phase 2b studyyoung pediatric population, average ~6.5 years of RZ358age and in four sequential dosing cohortsa diverse group of patients with CHI who areacross gender and genetics. A key entry criterion was for patients to have substantial hypoglycemia to be eligible for enrollment. We observed that patients enrolled on stable background therapies had clinically-significant, and in many cases, substantial residual hypoglycemia and also, some hyperglycemia (> 180 mg/dL) at least two years oldbaseline.

Results from the RIZE study showed that target and have residual low blood sugar (<70expected RZ358 concentrations were achieved and dose-exposure dependent responses were also observed. RZ358 was generally safe and well-tolerated and there were no adverse drug reactions, adverse events leading to study discontinuations, or dose-limiting toxicities. Importantly, RZ358 demonstrated a ~50% improvement in hypoglycemia across all doses and cohorts and a ~75% improvement in hypoglycemia at the 6 mg/dL) that is inadequately controlled on existing therapies. In addition to safetykg and pharmacokinetic evaluations, continuous glucose monitoring (“CGM”) and self-monitored blood glucose will be utilized to evaluate several glycemic efficacy endpoints. The primary endpoint is the time within a glucose target9 mg/kg cohorts. Time in range of 70-180 mg/dL by CGM during weeks 4improved 8% across all doses, 16% at the top dose, and 8 of treatment compared to baseline.more significantly (>25%) in patients without baseline hyperglycemia on SOC.

RZ402

DME is a severevascular complication of diabetes marked by progressive vision loss and blindness. Consistentlya leading cause of blindness in the U.S. and elsewhere. Chronic exposure to high blood sugar levels can cause diabetic retinopathy, a complication characterized bylead to inflammation, cell damage, and the breakdown of blood vessel walls. Specifically, in DME, blood vessels behind the back of the eye become porous and permeable leading to the blood vessels inunwanted infiltration of fluid into the eye andmacula. This fluid leakage into the light-sensitive tissue known as the retina. The accumulation of fluid may lead to DME, or swelling of the macula, the part of the retina responsible for sharp, straight-ahead vision. creates distorted vision and if left untreated, could result in blindness.

Currently available treatments for DME involve frequent burdensome anti-vascular growth factor (anti- VEGF) injections into the eye or invasive laser surgery.

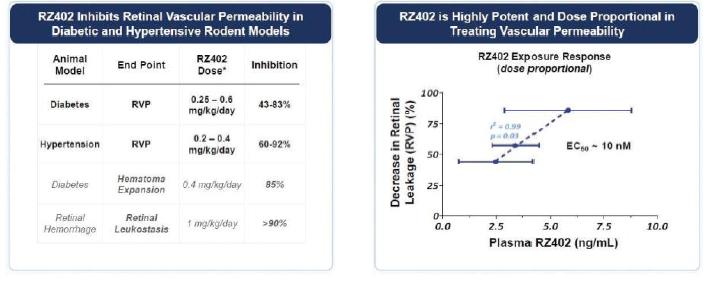

Rezolute is developing RZ402, a small molecule plasma kallikrein inhibitor (“PKI”) for use in DME. As a once-daily oral investigational therapy, RZ402 is designed to improve compliancebe a once daily oral therapy for the treatment of DME. Unlike the anti-VEGF therapies, RZ402 targets the Kallikrein - Kinin System in order to address inflammation and treatment outcomes for patients with DME. Elevated plasma levelsvascular leakage. We believe that systemic exposure through oral delivery is critical to target the microvasculature behind the back of the enzyme kallikrein have been associated with increased inflammation, vessel leakage and excess blood vessel growth in the eyes of patients with DME. Genetic and pharmacologic knockout of plasma kallikrein have been shown to protect against vascular endothelial growth factor (“VEGF”) induced retinal blood vessel leakage in murine models without damaging long-term effects.

eye. Further, as an oral therapy, RZ402 is a bioavailable small molecule inhibitor of plasma kallikrein that has shown the potential to preventsubstantially change the onsettherapeutic paradigm for patients suffering with DME by providing a convenient, self-administered treatment option to encourage patients to initiate therapy sooner, adhere to prescribed treatment guidelines, and improve overall outcomes.

In our modeling of RZ402 low nanomolar potency was exhibited in rodent DME models.

Results from the Phase 1a Single-Ascending Dose (SAD) Study (RZ402-101) were reported in May 2021. RZ402-101 was a first-in-human single-center, randomized, double-blind, placebo-controlled SAD study in healthy adult volunteers. The study objectives were to characterize the safety profile and reversepharmacokinetics of RZ402 administered as single oral doses. The study enrolled 30 subjects in three planned sequential dose- level cohorts of 25 mg, 100 mg, and 250 mg. Within each ten-subject dose cohort, subjects were randomized 8:2 to receive either RZ402 oral solution or matched placebo. After receiving single doses, participants remained in the clinic for seven days for serial pharmacokinetic and safety assessments, before completing two outpatient follow-up visits at study days 14 and 30. Dose advancement proceeded following blinded reviews of safety and pharmacokinetic data from the preceding cohort(s).

Single doses of RZ402 resulted in dose-dependent increases in systemic exposure. Plasma concentrations of RZ402 significantly exceeded the 3.5 ng/mL target concentration that was pharmacologically active in animal models of DME for a 24-hour period after receipt of RZ402. Across the dose and exposure range, there were no serious adverse events, adverse drug reactions, or discontinuations due to adverse events, and no imbalance of adverse events between the treatment and placebo control groups. Similarly, regular laboratory, hemodynamic, cardiac, and ophthalmologic safety examinations were unremarkable.

Results from the Phase 1b Multiple-Ascending Dose (MAD) Study (RZ402-102) were reported in February 2022. RZ402-102 was a single- center, randomized, double-blind, placebo-controlled, in healthy adult volunteers. The objectives of the study were to characterize the repeat-dose safety profile (including maximum tolerated dose) and pharmacokinetics of RZ402 administered as daily oral doses for two weeks. The study was conducted in 40 subjects in sequential ascending dose-level cohorts comprising ten subjects per cohort. Within each dose cohort, subjects were randomized in an 8:2 ratio to receive either RZ402 oral solution or matched placebo. Participants remained in-clinic throughout the two-week dosing period for serial pharmacokinetic and safety assessments, before completing an outpatient follow-up visit at study day 28. Blood biomarkers of target engagement (kallikrein activity) were explored as a systemic surrogate for DME, using a precedent from studies of kallikrein inhibitors in a systemic vascular leakage syndrome (hereditary angioedema). Dose advancement proceeded in staggered fashion every three weeks as appropriate, following blinded reviews of data from the preceding cohort(s).

MAD study showed dose-dependent increases in systemic exposures, with repeat-dosing to steady-state resulting in the highest concentrations of RZ402 explored to date, exceeding 200 ng/mL and 50 ng/mL at peak and 24-hour trough, respectively. Following the precedent established in systemic deliveries of PKIs in vascular diseases such as hereditary angioedema, steady-state plasma kallikrein activity in human plasma was measured on Day 14 as a biomarker of RZ402 target engagement. Daily dosing with RZ402 inhibited plasma kallikrein in a dose-dependentdose and concentration-dependent manner (r=0.74; p < 0.001). Given that the in-vivo EC90 for RZ402 in multiple rodentanimal models of whole bodyDME is ~6 ng/mL, the results at both peak and retinal vascular leakage. Target plasma24-hour trough substantially exceeded target concentrations based on a combination of in-vitro and in-vivo profiling. RZ402 was generally safe and well-tolerated, including at higher doses than previously tested in the SAD study. There were exceededno serious adverse events, adverse drug reactions or identified risks.

Competition

We face competition from pharmaceutical and biotechnology companies, academic institutions, governmental agencies, and private research organizations in recruiting and retaining highly qualified scientific personnel and consultants and in the development and acquisition of technologies.

There are a handful of companies developing therapies for 24 hours followingcongenital HI that are potential competitors to RZ358. Crinetics Pharmaceuticals Inc. is one such company.

There are a handful of companies developing oral dosingtherapies for DME that are potential competitors to the PKI therapy, KalVista Pharmaceuticals being one such company.

Government Regulation

Regulation by governmental authorities in the U.S. and other countries is a significant factor in the development, manufacture and marketing of RZ402 in monkeyspharmaceutical products. All of our potential products will require regulatory approval by governmental agencies prior to commercialization. In particular, pharmaceutical therapies are subject to rigorous preclinical testing and dogs, supporting the potential for once daily dosing in humans. Rezolute has completed a pre-IND meeting withclinical trials and other pre-market approval requirements by the FDA and regulatory authorities in foreign countries. Various federal, state and foreign statutes and regulations also govern or influence the IND-enabling toxicology studies in preparation for filing an IND.manufacturing, safety, labeling, storage, record keeping and marketing of such products.

We are also subject to various federal, state, and local laws, regulations and recommendations relating to safe working conditions; laboratory and manufacturing practices; the experimental use of animals; and the use and disposal of hazardous or potentially hazardous substances, including radioactive compounds and infectious disease agents, used in connection with our research, development and manufacturing.

Employees

As of March 31, 2022, we had 39 full-time employees, of which 28 employees were engaged in research and development, manufacturing, clinical operations and quality activities and 11 employees in general administrative functions. Of the 39 employees, all were located in the United States. We have a number of employees who hold advanced degrees, such as a Ph.D. degrees. None of our employees are covered by a collective bargaining agreement, and we have experienced no work stoppages nor are we aware of any employment circumstances that are likely to disrupt work at any of our facilities. As part of our measures to attract and retain personnel, we provide a number of benefits to our full-time employees, including health insurance, life insurance, retirement plans, paid holiday and vacation time. We believe that we maintain good relations with our employees.

Corporate Information

Our principalWe were incorporated in Delaware in 2010 and we re-incorporated in Nevada in June 2021. We maintain an executive offices areoffice located at 201 Redwood Shores Parkway, Suite 315, Redwood City, CA 94065 and our telephonephone number is (650) 206-4507. Our internetwebsite address is http://www.rezolutebio.com. The information oncontained in, or that can be accessed through, our website is not part of, and is not incorporated by reference into this prospectus, and you should not consider it part of this prospectus.document.

The Offering

Investing in sharesour securities involves a risk of loss. Before investing in our common stock involves significant risks. Please seesecurities, you should carefully consider the risk factor below and the additional risk factors set forthdescribed under the heading “Risk Factors” in Item 1A. of our most recent Annual Report on Form 10-K and in Part II, Item 1A. of our most recent Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2020, each of which are on filefiled with the SEC for the most recent year, in any applicable prospectus supplement and are incorporated by reference in this prospectus. These risks may be revised or supplemented in futureour filings ofwith the SEC, including our Quarterly Reports on Form 10-Q and AnnualCurrent Reports on Form 10-K, which8-K, together with all of the other information included in this prospectus and any prospectus supplement and the other information incorporated by reference herein and therein. These risks are not the only ones facing us. Additional risks not currently known to us or that we currently deem immaterial also may impair or harm our business and financial results. Statements in or portions of a future document incorporated by reference in this prospectus. Before makingprospectus, including, without limitation, those relating to risk factors, may update and supersede statements in and portions of this prospectus or such incorporated documents. Please also refer to the section entitled “Special Note Regarding Forward-Looking Statements.”

All of the shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for its own account. We will not receive any of the proceeds from these sales.

We will receive up to an investment decision,aggregate of approximately $10,000 from the exercise of the Class B Warrants, assuming the exercise in full of all of the Class B Warrants for cash. We expect to use the net proceeds from the exercise of the Class B Warrants for general corporate purposes.

DESCRIPTION OF TRANSACTION WITH THE SELLING STOCKHOLDERS AND WARRANTS

On May 1, 2022, we entered into an underwriting agreement with Jefferies LLC, as representative of the underwriters listed therein, relating to the issuance and sale in an underwritten registered direct offering (the “Registered Direct Offering”) by the Company of an aggregate of (i) 18,026,315 shares (the “Registered Direct Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at a public offering price of $3.80 per share, (ii) Class A pre-funded warrants (the “Class A Warrants”) to purchase up to 1,973,684 shares of Common Stock at a public offering price of $3.799 per Class A Warrant, which represents the per share public offering price for the Registered Direct Shares less the $0.001 per share exercise price for each Class A Warrant, and (iii) the Class B Warrants (together with the Class A Warrants, the “Pre-Funded Warrants”) to purchase up to 10,947,371 shares of Common Stock at a public offering price of $3.799 per Class B Warrant, which represents the per share public offering price for the Registered Direct Shares less the $0.001 per share exercise price for each Class B Warrant. The Registered Direct Shares and Pre-Funded Warrants in the Registered Direct Offering were offered pursuant to a registration statement on Form S-3 (File No. 333-251498), which was declared effective by the SEC on June 23, 2021, as supplemented by a prospectus supplement filed with the SEC on May 2, 2022 pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”).

The Registered Direct Offering closed on May 4, 2022. The net proceeds of the Registered Direct Offering to the Company, after deducting the underwriting discounts and commissions and offering expenses payable by the Company were approximately $110.5 million.

The Class B Warrants issued in the Registered Direct Offering have an exercise price of $0.001 per share, which is subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting the Common Stock and also upon any distributions for no consideration of assets to the Company's stockholders. In the event of certain corporate transactions, the holders of the Class B Warrants will be entitled to receive, upon exercise of the Class B Warrants, the kind and amount of securities, cash or other property that the holders would have received had they exercised the Class B Warrants immediately prior to such transaction. The Class B Warrants do not entitle the holders thereof to any voting rights or any of the other rights or privileges to which holders of Common Stock are entitled.

In connection with the offer of the Class B Warrants, the Company entered into a registration rights agreement (the “Class B Registration Rights Agreement”) with the purchasers of the Class B Warrants. Pursuant to the Class B Registration Rights Agreement, the Company is required to file this resale registration statement (the “Class B Registration Statement”) with the SEC to register for resale the shares issuable upon exercise of the Class B Warrants, within two days of receipt of Stockholder Approval, and to have such Class B Registration Statement declared effective within 60 days after the signing date of the underwriting agreement in the event the Class B Registration Statement is not reviewed by the SEC, or 90 days of the signing date in the event the Class B Registration Statement is reviewed by the SEC. The Company will be obligated to pay certain liquidated damages to the purchaser if the Company fails to file the Class B Registration Statement when required, fails to cause the Class B Registration Statement to be declared effective by the SEC when required, of if the Company fails to maintain the effectiveness of the Class B Registration Statement.

General

This prospectus describes the general terms of our capital stock. For a more detailed description of our capital stock, you should carefully consider these risks as well as other information we includeread the applicable provisions of the Nevada Revised Statutes, or incorporate by reference in this prospectus.NRS, and our charter and bylaws.

Common Stock

Our Certificatearticles of incorporation, as amended, (the “Articles of Incorporation”) provide authority for us to issue up to 100,000,000 shares of Common Stock, par value $0.001 per share. As of June 14, 2022, there were 33,582,831 shares of our Common Stock outstanding. Under Nevada law, stockholders generally are not personally liable for our debts or obligations solely as a result of their status as stockholders. Our outstanding shares of Common Stock are, and any shares offered by this prospectus will be, when issued and paid for, fully paid and nonassessable.

Holders of our Common Stock are entitled to one vote per share on all matters submitted to our stockholders for a vote. There are no cumulative voting rights in the election of directors. Our shares of Common Stock are entitled to receive such dividends as may be declared and paid by our Board of Directors out of funds legally available therefor and to share ratably in the net assets, if any, of Rezolute upon liquidation. Our stockholders have no preemptive rights to purchase any shares of our capital stock. Our Articles of Incorporation provides that the Eighth Judicial District Court of Chancery of the State of Delaware is the exclusive forum for certain litigation that may be initiated by our stockholders, including claims under the Securities Act, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees.

Our Certificate of Incorporation provides that the Court of Chancery of the State of DelawareClark County, Nevada shall to the fullest extent permitted by law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim for breach of a fiduciary duty owed by any of our directors, officers, employees or agents to us or our stockholders, (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law,NRS Chapters 78 or 92A, our certificateArticles of incorporation or our bylaws or (iv) any action asserting a claim governed by the internal affairs doctrine. The choice ofNotwithstanding this exclusive forum provision, may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers, employees or agents, which may discourage such lawsuits against us and our directors, officers, employees and agents. Stockholders who do bring a claim in the Court of Chancery could face additional litigation costs in pursuing any such claim, particularly if they do not reside in or near the State of Delaware. The Court of Chancery may also reach different judgments or results than would other courts, including courts where a stockholder considering an action may be located or would otherwise choose to bring the action, and such judgments or results may be more favorable to us than to our stockholders. Alternatively, if a court were to find the choice of forum provision contained in our certificate of incorporation to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could adversely affect our business and financial condition. Notwithstanding the foregoing, the exclusive forum provision shall not preclude or contract the scope of exclusive federal or concurrent jurisdiction for actions brought under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, or the respective rules and regulations promulgated thereunder.

As disclosed in our most recent Annual Report on Form 10-K, we entered into a Securities Purchase Agreement dated October 8, 2020 (the “Purchase Agreement”) by and between us and the investors identified therein (the “Investors”) pursuant to which we agreed to offer and sell to the Investors an aggregate of $41.0 million in units of the Company (the “Units”) with a per Unit price of $16.50 in the Unit Financing. Each Unit consisted of (i) one (1) share of our common stock and (ii) a Unit Warrant to purchase 0.33 shares of common stock. Each Unit Warrant is exercisable for shares of common stock at an exercise price of $19.50 per Unit Warrant share. JMP Securities LLC and Canaccord Genuity LLC served as joint placement agents (the “Placement Agents”) in the Unit Financing and Griffin Securities, Inc., served as financial advisor (the “Advisor”).

Securities Purchase Agreement

On October 9, 2020, the Unit Financing closed. We issued 2,484,853 shares of common stock and 820,001 Unit Warrants which resulted in net proceeds of approximately $37.5 million. The net proceeds received by us from the Unit Financing will be used for general corporate purposes, including working capital.

Pursuant to the terms of the Purchase Agreement, we agreed to declare the Reverse Split on or before October 23, 2020. In addition, we agreed to update the filing of our definitive listing application of our common stock with the Nasdaq Capital Market no later than October 13, 2020. We effected the Reverse Split on October 9, 2020 and we updated the filing of our definitive listing application with the Nasdaq Capital Market on October 9, 2020. On November 3, 2020, our listing application was approved and the first day of trading on the Nasdaq Capital Market was on November 9, 2020.

We also agreed to certain restrictions on future stock offerings, including that during the 60-day period following the closing of the Unit Financing, we will not issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents, subject to certain exceptions, such as the issuance of shares to employees, officers, or directors pursuant to any existing stock or option plan or the issuance of shares upon the exercise or conversion of securities outstanding as of the date of the Purchase Agreement.

The Lead Investor (as defined in the Purchase Agreement) has a right, with certain limited exceptions, so long as the Lead Investor holds at least 50% of the shares of common stock purchased by the Lead Investor on the date of the Purchase Agreement, to participate in a subsequent financing by us on a pro rata basis on the same terms as the offerees.

In connection with the Unit Financing, we paid a transaction fee of 6% of the gross proceeds of the Unit Financing, split between the Placement Agents, as well as a reimbursement for the Placement Agents’ reasonable fees and expenses in the amount of $70,000, in the aggregate. In addition, we paid a transaction fee to the Advisor in the amount of $825,000, and reimbursed CAM Capital LLC, as the Lead Investor, for its reasonable out of pocket costs and expenses of $65,000 in connection with the transactions set forth in the Purchase Agreement.

Registration Rights Agreement

In connection with the Purchase Agreement, we and the Investors entered into a Registration Rights Agreement, dated October 8, 2020 (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, we agreed to file with the SEC, within forty-five (45) days after the closing of the Unit Financing, an initial registration statement on Form S-3 covering the resale of the shares of common stock issued in the Unit Financing and the shares of common stock issuable upon the exercise of the Unit Warrants issued in the Unit Financing (the “Registration Statement”). We agreed to use commercial reasonable efforts to have the Registration Statement declared effective as soon as practicable after filing, and in any event no later than sixty (60) days after the closing of the Unit Financing.

In the event that the Registration Statement is not filed or is not declared effective in the time periods set forth above, or does not satisfy the current public information requirement pursuant to Rule 144(c)(1) as a result of which the Investors who are not affiliates are unable to sell the shares of common stock issued in the Unit Financing and the shares of common stock issuable upon the exercise of the Unit Warrants issued in the Unit Financing without restriction under Rule 144, then we shall, as the Investors’ sole remedy under the Registration Rights Agreement, pay to the Investors the amount of one percent (1%) of the aggregate purchase price paid by each such Investor, and shall make additional payments to the Investors of one percent (1%) of the aggregate purchase price paid by such Investor on each thirty (30)-day anniversary of such failure until such failure is cured. The maximum amount of such payments shall not exceed six percent (6%) of the aggregate purchase price paid by such Investor pursuant to the Purchase Agreement.

In addition, we agreed to reimburse the Investors for the reasonable fees and expenses of one counsel engaged to review the filing and effectiveness of the Registration Statement, up to an aggregate amount of $35,000.

Unit Warrants

Each Unit Warrant has an exercise price equal to $19.50 per Unit Warrant share, subject to customary adjustments for stock dividends, stock splits, subsequent rights offerings, and similar transactions. In addition, the Warrants contain customary cash and cashless exercise provisions, at the election of the holders. Each Unit Warrant is exercisable beginning on October 9, 2020 and will expire seven (7) years from the anniversary of such date. Certain Unit Warrants contains a beneficial ownership limitation blocker whereby the Unit Warrant is not exercisable if exercise will result in such holder owning more than 4.99%, 9.99%, or 14.99% of our common stock, as applicable.

Pursuant to the Unit Warrants, in the event that we (i) effect any merger or consolidation, (ii) make any disposition of all or substantially all of our assets in one or a series of related transactions, (iii) complete any purchase offer, tender offer or exchange offer for 50% or more of our outstanding common stock, (iv) effect any reclassification, reorganization or recapitalization of our common stock or any compulsory share exchange pursuant to which our common stock is effectively converted into or exchanged for other securities, cash or property, or (v) consummate a stock or share purchase agreement or other business combination whereby another person acquires more than 50% of our outstanding shares of common stock (each a “Fundamental Transaction”), then, upon any subsequent exercise of a Unit Warrant, the holder of such Unit Warrant (the “Holder”) shall have the right to receive, for each Unit Warrant share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, the alternate consideration receivable as a result of such Fundamental Transaction by a holder of the number of shares of common stock for which the Unit Warrant is exercisable immediately prior to such Fundamental Transaction. Notwithstanding anything to the contrary, in the event of a Fundamental Transaction, we shall, at the Holder’s option that is exercisable at any time concurrently with, or within 30 days after, the consummation of the Fundamental Transaction, purchase the Unit Warrant from the Holder by paying to the Holder an amount of cash equal to the Black Scholes Value (as defined in the Warrant) of the remaining unexercised portion of the Warrant on the date of the consummation of such Fundamental Transaction.

We are registering these shares pursuant to the registration rights granted to the Selling Stockholders in the Unit Financing. We will not receive any proceeds from the sale or other disposition by the Selling Stockholders of the shares of our common stock covered by this prospectus. In the event that the Unit Warrants are exercised on a cashless basis then we will not receive any proceeds from the exercise of the Unit Warrants. However, we will receive the cash exercise price of the Unit Warrants in the event the Unit Warrants are exercised for cash. Any proceeds from the exercise of the Unit Warrants will be used for general corporate purposes.

Our authorized capital stock consists of 500,000,000 shares of common stock, $0.001 par value per share, and 20,000,000 shares of preferred stock in one or more series, $0.001 par value per share.

Common Stock

As of November 12, 2020, there were 8,352,277 shares of our common stock outstanding held of record by approximately 350 stockholders. In addition, there are outstanding stock options and warrants to acquire up to an additional 2,390,766 shares of common stock.

Holders of the common stock are entitled to one vote per share on all matters submitted to the stockholders for a vote. There are no cumulative voting rights in the election of directors. The shares of common stock are entitled to receive such dividends as may be declared and paid by the Board of Directors out of funds legally available therefor and to share, ratably, in the net assets, if any, of us upon liquidation. The stockholders have no preemptive rights to purchase any shares of our capital stock.

The transfer agent for the common stock is VStock, Woodmere, New York. Our common stock is traded on the Nasdaq Capital Market and is quoted under the symbol “RZLT.”

Preferred Stock

Our certificateArticles of incorporation authorizes 20,000,000provides authority for us to issue up to 400,000 shares of preferred stock.stock, par value $0.001 per share. Our Board of Directors is authorized, without further stockholder action, to establish various series of preferred stock from time to time and to determine the rights, preferences and privileges of any unissued series including, among other matters, any dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms, the number of shares constituting any such series, and the description thereof and to issue any such shares. ThereAs of June 14, 2022, there are no issued and outstanding shares of Preferredpreferred stock and our Board of Directors has not designated any series of preferred stock for future issuance.

The rights of the holders of our Common Stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. Such rights may include voting and conversion rights which could adversely affect the holders of the Common Stock. Satisfaction of any dividend or liquidation preferences of outstanding preferred stock would reduce the amount of funds available, if any, for the payment of dividends or liquidation amounts on Common Stock.

A prospectus supplement, relating to any offered class or series of preferred stock, will specify the following terms of such class or series, as applicable:

| · | the designation of such class or series of our $0.001 par value preferred stock; |

| · | the number of shares of such class or series of preferred stock offered, the liquidation preference per share and the offering price of such class or series of preferred stock; |

| · | the dividend rate(s), period(s), and/or payment date(s) or method(s) of calculation thereof applicable to such class or series of preferred stock; |

| · | whether dividends on such class or series of preferred stock are cumulative or not and, if cumulative, the date from which dividends on such class or series of preferred stock shall accumulate; |

| · | the provision for a sinking fund, if any, for such class or series of preferred stock; |

| · | the provision for redemption, if applicable, of such class or series of preferred stock; |

| · | any listing of such class or series of preferred stock on any securities exchange; |

| · | the preemptive rights, if any, of such class or series of preferred stock; |

| · | the terms and conditions, if applicable, upon which shares such class or series of preferred stock will be convertible into shares of our Common Stock or shares of any other class or series of our stock or other securities, including the conversion price (or manner of calculation thereof); |

| · | a discussion of any additional material federal income tax consequences applicable to an investment in such class or series of preferred stock; |

| · | the relative ranking and preferences of such class or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the affairs of our Company; |

| · | any limitations on issuance of any class or series of stock ranking senior to or on parity with such class or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the affairs of our Company; |

| · | any voting rights of such class or series of preferred stock; and |

| · | any other specific terms, preferences, rights, limitations or restrictions of such class or series of preferred stock. |

Transfer Agent and Registrar

The transfer agent of our Common Stock is Issuer Direct Corporation. Their address is One Glenwood Avenue, Suite 1001, Raleigh, NC 27306.

As of November 12, 2020, Unit Warrants to purchase 820,001 shares ofThe common stock with an exercise price of $19.50 per share were outstanding. In addition, as of November 12, 2020, other warrants to purchase an aggregate of 618,307 shares at a weighted-average exercise price of $57.46 per share were outstanding. All of our outstanding warrants are currently exercisable, except to the extent that certain of the Unit Warrants are subject to a blocker provision, which restricts the exercise of a warrant if, as a result of such exercise, the warrant holder, together with its affiliates and any other person whose beneficial ownership of common stock would be aggregated with the warrant holder’s for purposes of Section 13(d) of the Exchange Act, would beneficially own in excess of 4.99%, 9.99%, or 14.99% of our then issued and outstanding shares of common stock (including the shares of common stock issuable upon such exercise), as such percentage ownership is determined in accordance with the terms of such warrant. All of our outstanding warrants contain provisions for the adjustment of the exercise price in the event of stock dividends, stock splits or similar transactions. In addition, the Unit Warrants contain a “cashless exercise” feature that allows the holders thereof to exercise the warrants without a cash payment to us under certain circumstances. For a description of the Unit Warrants please refer to “Unit Financing” in this prospectus.

This prospectus covers the offer and salebeing offered by the Selling Stockholders identified beloware those issuable to the Selling Stockholders upon exercise of 3,305,220 sharesthe Class B Warrants. For additional information regarding the issuances of our common stock.

those warrants, see “Description of Transaction and Selling Stockholders and Warrants” above. We are registering the shares of common stock in order to permit the Selling Stockholders to offer the shares of common stock underlying the Class B Warrants for resale from time to time. The registration of such common stock does not necessarily mean, however, that anyExcept for the ownership of the shares of common stock will be offered or sold byand the warrants, the Selling Stockholders. We willStockholders have not receivehad any proceeds frommaterial relationship with us within the sale of the common stock bypast three years.

The table below lists the Selling Stockholders and we have borne and will continue to bearother information regarding the costs relating tobeneficial ownership of the registrationshares of thesecommon stock by each of the Selling Stockholders. The second column lists the number of shares of common stock beneficially owned by each Selling Stockholder, based on its ownership of the shares of common stock and transfer taxes, if any. The Selling Stockholders are responsible to pay commissions and discountswarrants, as of agents or broker-dealers incurred in the saleJune 14, 2022, assuming exercise of the shares of common stock.

Except as disclosed in the footnotes below and except for the beneficial ownership of the common stock described in the table below, none of the Selling Stockholders has held any position or office or had any other material relationship with us or any of our predecessors or affiliates within the past three years. Except as disclosed in the footnotes below, no selling stockholder had a material relationship with the Company or any of its affiliates within the last three years. Unless disclosed otherwise in the footnotes to the table below, the address of the Selling Stockholders is in care of Rezolute, Inc., 201 Redwood Shores Parkway, Suite 315, Redwood City, CA 94065.

The following table and the accompanying footnotes are based in part on information supplied to us by the Selling Stockholders. The table and footnotes assume that the Selling Stockholders will sell all of the shares listed. However, because the Selling Stockholders may sell none of their shares or sell all or some of their shares under this prospectus from time to time, or in another permitted manner, we cannot assure you as to the actual number of shares that will be sold by the Selling Stockholders or that will bewarrants held by the Selling Stockholders after completionon that date, without regard to any limitations on exercises.

The third column lists the shares of any sales. We do not know how longcommon stock being offered by this prospectus by Selling Stockholders.

In accordance with the terms of a registration rights agreement with the Selling Stockholders, will holdthis prospectus generally covers the shares before selling them.

Beneficial ownership has been determined under rules promulgated by the SEC. The information does not necessarily indicate beneficial ownership for any other purpose. Under the rulesresale of the SEC, a person is deemed to be a “beneficial owner”maximum number of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. Shares of common stock issuable upon exercise of the Class B Warrants, determined as if the outstanding warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the warrants. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders pursuant to this prospectus.

Under the terms of the Class B Warrants, a Selling Stockholder may not exercise the warrants optionsto the extent such exercise would cause such Selling Stockholder, together with its affiliates and convertible securities that are currently exercisableattribution parties, to beneficially own a number of shares of common stock which would exceed 19.99% (or, at the election of the Selling Stockholder, 4.99% or convertible, or exercisable or convertible within 60 days after the date9.99%) of this prospectus, are deemedour then outstanding common stock following such exercise, excluding for purposes of computingsuch determination shares of common stock issuable upon exercise of the warrants which have not been exercised. The number of shares in the second and third columns, and the percentage beneficially owned byownership in the personfourth column, do not reflect this limitation. The Selling Stockholders may sell all, some or entity holding such securities but are not deemed outstanding for purposesnone of computing the percentage beneficially owned by any other person or entity. The inclusion of anytheir shares in this table does not constitute an admissionoffering. See "Plan of beneficial ownership by the persons named below. All of the information set forth in the table below and the related footnotes was provided to the Company by the respective named selling stockholder. Please carefully read the footnotes located below the table in conjunction with the information presented in the table.Distribution."

| Name of Selling Stockholders | Applicable Footnote | Number of Shares Beneficially Owned Before the Offering | Number of Shares Being Offered | Number of Shares Owned After the Offering (2) | Percentage of Shares Owned After the Offering (1)(2) | |||||||||||||

| Entities associated with Federated Hermes, Inc. | 3 | 1,612,122 | 1,612,122 | — | * | |||||||||||||

| CDK Associates, L.L.C. | 4 | 530,388 | 530,388 | — | * | |||||||||||||

| Third Street Holdings, LLC | 5 | 33,855 | 33,855 | — | * | |||||||||||||

| Citadel Multi-Strategy Equities Master Fund Ltd. | 6 | 403,031 | 403,031 | — | * | |||||||||||||

| Armistice Capital Master Fund Ltd. | 7 | 483,637 | 483,637 | — | * | |||||||||||||

| Biotechnology Value Fund, L.P. | 8 | 125,686 | 41,794 | 83,892 | 1.0% | |||||||||||||

| Biotechnology Value Fund II, L.P. | 9 | 87,488 | 31,621 | 55,867 | * | |||||||||||||

| Biotechnology Value Trading Fund OS, L.P. | 10 | 19,737 | 5,457 | 14,280 | * | |||||||||||||

| MSI BVF SPV, L.L.C. | 11 | 18,515 | 1,736 | 16,779 | * | |||||||||||||

| Douglas T. Lake, Jr. | 12 | 161,213 | 161,213 | — | * | |||||||||||||

| Donohoe Advisory Associates, LLC | 13 | 366 | 366 | — | * | |||||||||||||

_________________

| Name of Selling Stockholder | Number of Shares of Common Stock Owned Prior to Offering | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | Number of Shares of Common Stock Owned After Offering |

Percentage of Shares | ||||||||||||

| Federated Hermes Kaufmann Funds (3) | 10,554,327 | 3,421,053 | 7,133,274 | 21.2 | % | |||||||||||

| CDK Associates, L.L.C. (4) | 2,490,306 | 1,039,739 | 1,450,567 | 4.3 | % | |||||||||||

| Third Street Holdings LLC (5) | 158,956 | 66,366 | 92,590 | * | ||||||||||||

| Blackstone Annex Master Fund L.P. (6) | 2,631,579 | 1,093,895 | 1,537,684 | 4.6 | % | |||||||||||

| Vivo Opportunity Fund Holdings, L.P. (7) | 3,289,473 | 2,800,000 | 489,473 | 1.5 | % | |||||||||||

| Adage Capital Partners LP (8) | 3,158,008 | 2,526,318 | 631,690 | 1.9 | % | |||||||||||

| Total | 22,282,649 | 10,947,371 | 11,335,278 | 33.8 | % | |||||||||||

* Represents ownership of less than 1%.

| 1. | Applicable percentage ownership is based on |

| 2. | Assumes the sale of all shares of common stock offered in this prospectus. |

| 3. |

| 4. | The number of shares includes |

| 5. | The number of shares includes |

| 6. | The number of shares includes |

| 7. | The number of shares includes 3,289,473 shares of common stock beneficially owned by Vivo Opportunity Fund Holdings, L.P., including 2,800,000 shares of common stock issuable upon exercise of Class B Warrants, without giving effect to any beneficial ownership limitation. Dr. Gaurav Aggarwal is a |

TheEach Selling Stockholders, as used herein, include donees,Stockholder of the securities and any of their pledgees, transferees or otherassignees and successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell transfer or otherwise dispose of any or all of their shares of common stocksecurities covered hereby on the principal Trading Market or interests in shares of common stock on any other stock exchange, market or trading facility on which the sharessecurities are traded or in private transactions. These dispositionssales may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The A Selling StockholdersStockholder may use any one or more of the following methods when disposing of shares or interests therein:selling securities:

| ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short | |

| · | in transactions through broker-dealers that agree with the |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| a combination of any such methods of sale; |

| · | any other method permitted |

The Selling Stockholders may also sell securities under Rule 144 or any other exemption from timeregistration under the Securities Act, if available, rather than under this prospectus.