REGISTRATION STATEMENT NO. 333-[·Ÿ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

METROPOLITAN LIFE INSURANCE COMPANY

(Exact name of registrant as specified in its charter)

New York

NEW YORK

(State or other jurisdiction of incorporation or organization)

13-5581829

13-5581829

(I.R.S. Employer Identification Number)

200 Park Avenue, New York, New York 10166

200 PARK AVENUE, NEW YORK, NEW YORK 10166,

(212) 578-3067

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

RICARDO A. ANZALDUA

GENERAL COUNSEL

METROPOLITAN LIFE INSURANCE COMPANY

200 PARK AVENUE, NEW YORK, NEW YORKPark Avenue, New York, New York 10166

(212) 578-3067

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Diane E. Ambler, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006

AS SOON AS PRACTICABLE FOLLOWING THE EFFECTIVENESS OF THE REGISTRATION STATEMENT

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than offered only in connection with dividend or interest

reinvestment plans, check the following box:x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE | PROPOSED MAXIMUM | PROPOSED PRICE | AMOUNT OF REGISTRATION FEE(2) | ||||

Fixed Account Units with a | $100,000,000 | Not applicable | $100,000,000 | $12,880 |

| ||||||||

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE REGISTERED | PROPOSED MAXIMUM OFFERING PRICE PER UNIT(1) | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE | AMOUNT OF REGISTRATION FEE(2) | ||||

Modified Guaranteed Annuity Contract | $250,000,000 | Not applicable | $250,000,000 | $29,050 | ||||

| ||||||||

| ||||||||

| 1. | Interests are sold on a dollar for dollar basis and not on the basis of a price per share or unit. |

| 2. | Pursuant to Rule 457(p) under the Securities Act of 1933, the filing fee is offset by the filing fee previously paid in connection with the |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Metropolitan Life Insurance CompanyMETLIFE SHIELD LEVEL SELECTORSMANNUITY

Registered Fixed Account OptionMetLife Shield Level Selector

For Use With Gold Track Select Variable SMAnnuity Contracts

The Registered Fixed Account Option described in this prospectus is available only in conjunction with the Gold Track Select group variablean individual single premium deferred index-linked separate account annuity contractscontract (the “Contracts” and/or “Certificates”“Contract”) issued by Metropolitan Life Insurance Company (the “Company”(“MLIC”, “we” or “us”).

This Contract is available for use in connection with Non-Qualified Plans, Traditional IRAs and funded by Metropolitan Life Separate Account E (“Separate Account E”). The Company may, in the future, offer the Registered Fixed Account Option to additional contracts funded through other separate accounts. The specific features of the Contract and the Separate Account are disclosed in greater detail in the Contract prospectus.We reserve the right with 30 days advance written notice to restrict Purchase Payments into the Registered Fixed Account Option or to make transfers from the Separate Account Options into the Registered Fixed Account Option whenever the credited interest rate is equal to the minimum Guaranteed Interest Rate specified in Your Contract. We will provide advance written notice if this restriction is subsequently lifted. We reserve the right to restrict the availability of the Registered Fixed Account Option after issue.Roth IRAs. This version of the Contract is only available in New York State.state.

The group annuity Contracts may be issued to Contract Owners on an unallocated or allocated basis. Under an unallocated Contract, Cash Value records are kept for a plan or group as a whole. Under an allocated Contract, Cash Value records are kept for You as an individual.

This prospectus explains:

the Registered Fixed Account Option

Metropolitan Life Insurance Company— RISK (SEE PAGE 6)

the interest rates

transfers to and from the Registered Fixed Account Option

surrenders

Market Value Adjustment

other aspects of the Registered Fixed Account Option

Your Contract is issued by the Company whichMLIC is located at 200 Park Avenue, New York, NY 10166-0188. Telephone Number, 1-800-842-9406.The telephone number is1-800-343-8496. MetLife Investors Distribution Company, 5 Park Plaza, Suite 1900, Irvine, CA 92614,1095 Avenue of the Americas, New York, NY 10036, is the principal underwriter and distributor of the Contracts.

TheRisk Factors for this Contract appear on Page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Mutual funds, annuities and insurance products are not deposits of any bank, and are not insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”) or any other government agency. You may lose money invested in the Contract.

The Contracts may be distributed through broker-dealers that have relationships with banks or other financial institutions or by employees of such banks. However, the Contracts are not deposits or obligations of, or guaranteed by such institutions or any Federal regulatory agency. Investment in the Contracts involves investment risks, including possible loss of principal.

The principal underwriter of the Contract is MetLife Investors Distribution Company. The offering of the Contract is intended to be continuous.

Prospectus dated December [ • ], 2013—], 2015

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| 8 | |||

| 8 | |||

| ||||

| ||||

| ||||

| ||||

| 10 | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| 13 | |||

| 13 | |||

| 13 | |||

| 13 | |||

| 13 | |||

| 13 | ||||

| 14 | ||||

| ||||

| ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 51 | |||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 |

2

In this prospectus, the following capitalized terms have the indicated meanings:

Account Value. The total of the Fixed Account Value and the value of the Shield Option(s) under the Contract during the Accumulation PeriodPeriod.

Accrued Cap Rate.— The portion of the Cap Rate that has accrued from the Term Start Date to any day within the Term. This is the maximum Index Performance that may be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is greater than zero. The Accrued Cap Rate is equal to the Cap Rate multiplied by the number of days elapsed since the Term Start Date, divided by the total number of days in the Term.

Accrued Shield Rate. The portion of the Shield Rate that has accrued from the Term Start Date to any day within the Term. This is the amount that will be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is less than zero. The Accrued Shield Rate is equal to the Shield Rate multiplied by the number of days elapsed since the Term Start Date, divided by the total number of days in the Term.

Accrued Step Rate. The portion of the Step Rate that has accrued from the Term Start Date to any day within the Term. This is the rate that will be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is equal to or greater than zero. The Accrued Step Rate is equal to the Step Rate multiplied by the number of days elapsed since the Term Start Date, divided by the total number of days in the Term.

Accumulation Period. The period beforeprior to the commencement of Annuity Payments.Date.

AnnuitantAnnuitant.— A person The natural person(s) listed on the Contract Schedule on whose life the Maturity Date depends and AnnuityIncome Payments are made.based. Any reference to Annuitant will also include any Joint Annuitant under an Annuity Option.

Annuity PaymentsDate.— A series of periodic payments (a) for life; (b) for life with a minimum number of payments; (c) fordate on which you choose to begin receiving Income Payments. If we agree, you may change the joint lifetime ofAnnuity Date, subject to certain requirements. If you do not choose an Annuity Date, the Annuitant and another person, and thereafter duringAnnuity Date will be the lifetime ofAnnuity Date indicated on the survivor; or (d) for a fixed period.Contract Schedule.

Annuity PeriodService Office.— The period duringoffice indicated on the Contract Schedule to which Annuity Payments are made.notices and requests must be sent, or as otherwise changed by Notice from us.

Beneficiary(ies)Beneficiary.— The person(s) or trustee designatedentity(ies) you name to receive any remaining contractual benefits in the event of a Participant’s, Annuitant’s or Contract Owner’s death as applicable.

Cash Surrender Value— The Cash Value less any amounts deducted upon a withdrawal or surrender, outstanding loans, if availablebenefit payable under the Contract any applicable Premium Taxesupon the death of the Owner or other surrender charges not previously deducted.a Joint Owner, or in certain circumstances, an Annuitant.

Cash ValueBusiness Day.— The value Our “business day” is generally any day the NYSE is open for regular trading. For purposes of administrative requests and transactions, a Business Day ends at 4:00 PM Eastern Standard Time. If the accumulation units in Your account (orSEC determines the existence of emergency conditions on any day, and consequently, the NYSE does not open, then that day is not a Participant’s Individual Account, if applicable) less any reductions for administrative charges.Business Day.

CodeCap Rate.— The maximum rate that may be credited at the Term End Date based on Index Performance. The Cap Rate may vary between Shield Options and it is not an annual rate.

Code. The Internal Revenue Code of 1986, as amended, and all related laws and regulations, which are in effect during the term of thisthe Contract.

Company (We, Us, Our)Commodity Index.— Metropolitan Life Insurance Company (“MetLife”). An Index based on the performance of commodities.

Competing FundContract.— Any investment option under the Plan, which in Our opinion, consists primarily The legal agreement between you and MetLife. It contains relevant provisions of fixed income securities and/or money market instruments.

Contract(s) — Gold Track Select variableyour deferred annuity.

Contract DateAnniversary.— The date on which An anniversary of the Contract is issued. For certain group Contracts, it is the date on which the Contract becomes effective, as shown on the specifications pageIssue Date of the Contract.

Contract OwnerSchedule.— The person named in the Contract (on the specifications page, which may be the Participant if so authorized). For certain group Contracts, the Contract Owner is the trustee or other entity which owns theschedule attached to your Contract. Any reference in this prospectus to the Contract includes the underlying Certificate. Certificates are issued to Participants under group allocated Contracts.

Contract YearYear.— A continuous twelve -monthone-year period beginningstarting on the ContractIssue Date and on each anniversary thereof. Contract Year also means certificate year.Anniversary thereafter.

Declared Interest Rate(s)Death Benefit Amount.— One For the standard death benefit, the Account Value, and, for the optional Return of Premium death benefit, the greater of the Account Value or more rates of interest which may be declaredyour Purchase Payment (reduced proportionately by the Company. Such rates will never be less thanpercentage reduction in Account Value of the Guaranteed Interest Rate stated inShield Option(s) and the ContractFixed Account for each partial withdrawal (including any applicable Withdrawal Charge)) determined as of the end of the Business Day on which we have received Notice of due proof of death and may apply to some oran acceptable election for the payment method.

Exchange Act. Securities Exchange Act of 1934, as amended.

FDIC. Federal Deposit Insurance Corporation.

FINRA. Financial Industry Regulatory Authority.

Fixed Account. An account, if available, that consists of all of the valuesassets under the RegisteredContract other than those in the Separate Account. You may allocate your Purchase Payment or transfer your Investment Amount to the Fixed Account. The Fixed Account Option for periodsis part of time determined by the Company.General Account assets of MLIC.

ERISAFixed Account Value.— The Employee Retirement Income Security Actinitial Fixed Account Value is the amount of 1974,your Purchase Payment initially allocated to the Fixed Account. Thereafter, the Fixed Account Value equals: (a) the initial Fixed Account Value or the Fixed Account Value on the most recent Contract Anniversary, including any transfers, whichever is applicable; plus (b) any interest credited by us; less (c) the amount of any withdrawals including any Withdrawal Charges; and less (d) any Premium or Other Taxes, if applicable.

Free Withdrawal Amount. The Free Withdrawal Amount in the first Contract Year is zero. Thereafter, the Free Withdrawal Amount each Contract Year is equal to 10% of your Account Value as amended,of the prior Contract Anniversary, less the total amount withdrawn from the Account Value in the current Contract Year. The Free Withdrawal Amount is non-cumulative and all related laws and regulations which are in effect during the term of this Contract.is not carried over to other Contract Years.

General AccountAccount.— The General Account of MLIC.

Good Order. A request or transaction generally is considered in “Good Order” if it complies with our administrative procedures and the Companyrequired information is complete and accurate. A request or transaction may be rejected or delayed if not in Good Order. If you have any questions, you should contact us or your sales representative before submitting the form or request.

Income Payments. A series of payments made by us during the Income Period, which we guarantee as to dollar amount.

Income Period. A period starting on the Annuity Date during which Income Payments are payable.

Index. We currently offer Shield Options based on two types of indices: Securities Indices and a Commodity Index. In the future we may offer Shield Options based on other types of Indices. We may also add other indices for new Contracts at our discretion.

Index Performance. The percentage change in the Index Value measured from the Term Start Date to any day, including the Term End Date, within the Term. Index Performance can be positive, zero or negative.

Index Value. The Index Value of an Index, on a Business Day, is the published closing value of the Index on that holds valuesBusiness Day. The Index Value on any day that is not a Business Day is the value as of the prior Business Day.

Interest Rate Term. The length of time over which the current Fixed Account interest rate is guaranteed. No Interest Rate Term will extend beyond the Annuity Date. The minimum Interest Rate Term depends on the date your Contract is issued but will not be less than one (1) year.

Interest Rate Term End Date. The Contract Anniversary on which an Interest Rate Term ends.

Interest Rate Term Start Date. The Contract Anniversary on which an Interest Rate Term is established. If chosen at issue, the initial Interest Rate Term Start Date begins on the Issue Date or otherwise it will begin on the first Contract Anniversary in which you make the allocation to the Fixed Account.

Interim Value. For each Shield Option, the value we assign on any Business Day prior to the Term End Date. During the Transfer Period, the Interim Value of each Shield Option will equal the Investment Amount in that Shield Option. After the Transfer Period, the Interim Value of that Shield Option is equal to the Investment Amount in the Shield Option, adjusted for the Index Performance of the associated Index and subject to the applicable Accrued Shield Rate, Accrued Cap Rate or Accrued Step Rate. The Interim Value is the amount that is available for annuitization, death benefits, withdrawals and Surrenders.

Investment Amount. The Investment Amount, for each Shield Option, is the amount that is allocated to the Shield Option and subsequently reflects all withdrawals and adjustments at the Term End Date. The Investment Amount will be reduced for any withdrawal by the same percentage that the withdrawal reduces the Interim Value attributable to the Registered Fixed Accountthat Shield Option.

Guarantee PeriodIssue Date.— The period during which a Guaranteed Interest Ratedate the Contract is credited.issued.

Guaranteed Interest RateJoint Annuitant.— The annual effective interest rate credited during the Guarantee Period.

Home Office— The principal executive offices of Metropolitan Life Insurance Company located at 200 Park Avenue, New York, NY 10166-0188. The office that administers Your Contract If there is located at 4700 Westown Parkway, Ste. 200, West Des Moines, Iowa 50266.

Market Adjusted Value— The valuemore than one Annuitant, each Annuitant will be a Joint Annuitant of funds held in the Registered Fixed Account Option increased or decreased by the Market Value Adjustment.

Market Value Adjustment— The Market Value Adjustment reflects the relationship, at the time of surrender, between the rate of interest credited to funds on deposit under the Registered Fixed Account Option at the time of discontinuance to the rate of interest credited on new deposits at the time of discontinuance.

3

Maturity Date— The date on which the Annuity Payments are to begin.

Participant— An eligible person who is a member in a tax qualified Plan under Sections 401, 403(b) or 457 of the Code, or a nonqualified deferred compensation Plan.

Participant’s Individual Account— An account to which amounts are credited to a Participant or Beneficiary under the Contract.

PlanJoint Owner.— If there is more than one Owner, each Owner will be a Joint Owner of the Contract. Joint Owners are limited to natural persons.

Maturity Date. The PlanMaturity Date is specified in your Contract and is the first day of the calendar month following the Annuitant’s 90th birthday or 10 years from the arrangement useddate we issue your Contract, whichever is later. The Contract will be annuitized at the Maturity Date.

MetLife (“MLIC”, “we”, “us”, “our”). Metropolitan Life Insurance Company.

Minimum Account Value. $2,000. If your Account Value falls below the Minimum Account Value as a result of a withdrawal we will treat the withdrawal request as a request for a full withdrawal.

Minimum Allocation. $500.

Minimum Guaranteed Cap Rate. The actual Minimum Guaranteed Cap Rate for your Contract is the amount shown on your Contract Schedule but will not be less than 1% for Shield Options with a 1-Year term, 3% for Shield Options with a 3-Year term and 6% for Shield Options with a 6-Year term.

Minimum Guaranteed Interest Rate. The current Minimum Guaranteed Interest Rate will not be less than 1%. This interest rate is guaranteed to be a rate not less than the minimum interest rate allowed by state law—see Appendix D. The actual Minimum Guaranteed Interest Rate for your Contract is the amount shown on your Contract Schedule and applies only to amounts in the Fixed Account.

Minimum Guaranteed Step Rate. The actual Minimum Guaranteed Step Rate for your Contract is the amount shown on your Contract Schedule but will not be less than 1% for Shield Options with a 1-Year term and 3% for Shield Options with a 3-Year term.

Minimum Partial Withdrawal Amount. $500.

MLIDC. MetLife Investors Distribution Company.

MSI. MetLife Securities, Inc.

NES. New England Financial® licensed sales representatives who are associated with New England Securities Corporation.

Notice. Any form of communication providing information we need, either in a retirement plansigned writing or program wherebyanother manner that we approve in advance. All Notices to us must be sent to our Annuity Service Office and received in Good Order. To be effective for a Business Day, a Notice must be received in Good Order prior to the Purchase Payments and any gainsend of that Business Day.

NYSE. New York Stock Exchange.

Owner (“you”, “yours”). The person(s) entitled to the ownership rights under the Contract. Subject to our administrative procedures, we may also permit ownership by a corporation – a type of non-natural person. If Joint Owners are intendednamed, all references to qualify under Sections 401, 403(b)Owner shall mean Joint Owners.

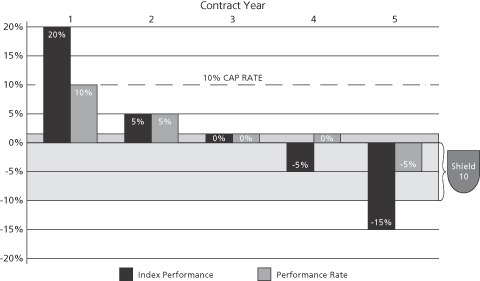

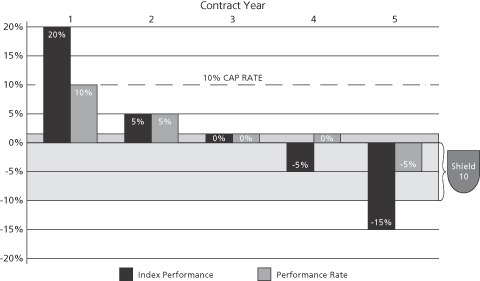

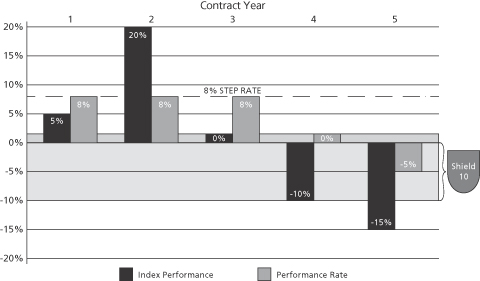

Performance Rate. The rate credited at the Term End Date. The Performance Rate is based on the Index Performance, adjusted for the applicable Shield Rate, Cap Rate or 457Step Rate. The Performance Rate can be positive, zero or negative. At the end of the Code.Term, any increase or reduction in the Investment Amount in a particular Shield Option is determined by multiplying the Performance Rate by the Investment Amount of the Shield Option on the last day of the Term.

Plan AdministratorPerformance Rate Adjustment.— The corporation or other entity so specifiedadjustment made to the Investment Amount for each Shield Option on any day during the Term, up to, and including, the Term End Date. Prior to the Term End Date, this adjustment is based on the applicationIndex Performance of the associated Index for a particular Term, subject to any applicable Accrued Shield Rate, Accrued Cap Rate or purchase order. If noneAccrued Step Rate. On the Term End Date, this adjustment is specified,based on the Plan TrusteePerformance Rate. This adjustment can be positive, zero or negative. When the Performance Rate Adjustment is positive we may also refer to this adjustment as “earnings.” When the Plan Administrator.

Plan Termination— Termination of Your Plan, including partial Plan Termination,Performance Rate Adjustment is negative we may also refer to this adjustment as determined by Us.

Plan Trustee— The trustee specified in the Contract specifications.“losses.”

Premium TaxTax.— The amount of tax, if any, charged by the state or municipality. Generally, We will deduct any applicable Premium Tax from the Cash Value either upon surrender, annuitization, death, or at the time a Purchase Payment is made, but no earlier than when We have the liability under state law. New York state does not currently assess premium taxesPremium Taxes on Purchase Payments You make.Payments.

Purchase PaymentsPayment.— The premium paymentsamount paid to us under the Contract as consideration for the benefits it provides.

Rate Crediting Type. Either the Cap Rate or the Step Rate.

RMD. Required Minimum Distribution.

SEC. Securities and Exchange Commission.

Securities Indices. Indices based on the performance of securities.

Separate Account. The separate account is MLIC Separate Account SA II.

Shield 10. A Shield Rate where negative Index Performance of up to 10% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 90% of your Investment Amount.

Shield 15. A Shield Rate where negative Index Performance of up to 15% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 85% of your Investment Amount.

Shield 25. A Shield Rate where negative Index Performance of up to 25% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 75% of your Investment Amount.

Shield Rate. The amount of any negative Index Performance that is absorbed by us at the Term End Date. Any negative Index Performance beyond the Shield Rate will reduce the Investment Amount associated with the Shield Option. The Shield Rate may vary between Shield Options and it is not an annual rate. We currently offer the following Shield Rates: Shield 10, Shield 15 and Shield 25.

Shield Option. You may allocate your Purchase Payment or transfer your Investment Amount to one or more of the available Shield Options. Each Shield Option has an associated Term, Index, Shield Rate and either a Cap Rate or Step Rate.

Step Rate. The rate credited at the Term End Date if the Index Performance is equal to or greater than zero. The Step Rate may vary between Shield Options and it is not an annual rate.

Surrender. A full withdrawal of your Account Value.

Term. The Term is the number of years that the Shield Option is in effect. We currently offer Terms of 1 year, 3 years or 6 years. The Initial Term(s) begin on the Issue Date.

Term End Date. The Contract Anniversary on which a Shield Option ends.

Term Start Date. The Contract Anniversary on which a Shield Option is established. The initial Term Start Date(s) begins on the Issue Date, and thereafter, will be the Contract Anniversary coinciding with the term duration of the current Term you have selected.

Transfer Period. The five (5) calendar days following the Contract Anniversary coinciding with the Term End Date for each applicable Shield Option and/or the Interest Rate Term End Date for the Fixed Account, during the Accumulation Period.

Withdrawal Charge. A charge applied to the Contract.percentage of the amount withdrawn from your Account Value in a Contract Year in excess of the Free Withdrawal Amount.

SeparateThe MetLife Shield Level SelectorSMAnnuity is an individual single premium deferred index-linked separate account annuity contract (the “Contract”) issued by MLIC, that provides for the accumulation of retirement savings. The Contract is intended for retirement or other long term investment purposes.

This version of the Contract is only available in New York state.

The Contract offers various Shield Options, which permit Owners to potentially receive interest equal to the percentage returns of certain Securities Indices and a Commodity Index, up to a Cap Rate or Step Rate, with certain guarantees against negative returns—guarantees we call “Shield Rates.” We currently offer Shield Options with Terms of 1, 3, or 6 years in length. A Fixed Account— Metropolitan Life Separate that guarantees a fixed rate of interest may also be available. Unless you allocate your Purchase Payment to the Fixed Account, E (“Separateyou may lose money by investing in the Contract.

The Cap Rate and Step Rate (each, a “Rate Crediting Type”) are the two ways we offer that you can potentially receive interest based on the upside performance of an Index. The Cap Rate is the maximum rate that may be credited at the Term End Date based on Index Performance and the Step Rate is the rate credited at the Term End Date if the Index Performance is equal to or greater than zero. (See “Key Features of the Contract—Rate Crediting Type” below.)

You may withdraw a portion or all of your Account E”)Value at any time until you commence receiving Income Payments, subject to an adjustment to the Investment Amounts. Depending on the performance of the Indices you choose, this adjustment may be substantial. Withdrawal Charges may also apply.

When you purchase the Contract, you can choose between the standard death benefit and an optional Return of Premium death benefit. The standard death benefit is the Account Value, however, if you select the Return of Premium death benefit, the death benefit will be the greater of your (i) Account Value or (ii) Purchase Payment, reduced proportionately by the percentage reduction in Account Value of the Shield Option(s) and the Fixed Account for each partial withdrawal (including any applicable Withdrawal Charge).

Like all annuity contracts the Contract offers a range of annuity options, which provide Income Payments for your lifetime.

See “SPECIAL TERMS” in this prospectus for more detailed explanations of the terms associated with the Shield Options.

The following chart describes the key features of the Contract. Please read this prospectus for more detailed information about the Contract.

Separate Key Features of the Contract

| Contract | Individual single premium deferred index-linked separate account annuity contract. | |

| Purchase Payment | The minimum Purchase Payment: $25,000. Prior approval required for a Purchase Payment of less than $25,000 or $1,000,000 or more. | |

| Owner and Annuitant Issue Ages | 0-85 | |

| Contract Periods | The Contract has two periods: • The Accumulation Period, the period prior to the Annuity Date; and • The Income Period, which begins on the Annuity Date and during which Income Payments are provided. | |

| Account Value | The total of the Fixed Account Value and the value of the Shield Option(s) under the Contract during the Accumulation Period. | |

| Shield Option | Each Shield Option has an associated Term, Index, Shield Rate and Rate Crediting Type. | |

Term | The Term may be 1, 3, or 6 years in length. | |

Index | The current Indices are as follows: • S&P 500® Index (Price Return Index); • Russell 2000® Index (Price Return Index); • NASDAQ-100 Index® (Price Return Index); • MSCI EAFE Index (Price Return Index); and • Bloomberg Commodity IndexSM (Price Return Index). |

Shield Rate We currently offer different levels of protection at maturity: Shield 10 — A Shield Rate where negative Index Performance of up to 10% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 90% of your Investment Amount. Shield 15 — A Shield Rate where negative Index Performance of up to 15% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 85% of your Investment Amount. Shield 25 — A Shield Rate where negative Index Performance of up to 25% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 75% of your Investment Amount. Rate Crediting Type The Withdrawal Charge is calculated at the time of each withdrawal in accordance with the following: See “WITHDRAWAL PROVISIONS — When No Withdrawal Charge Applies” for a list of Withdrawal Charge waivers. You can choose an Annuity Option. After Income Payments begin, you cannot change the Annuity Option. You can choose one of the following Annuity Options on a fixed payment basis or any other Annuity Option acceptable to us: (i) Life Annuity; (ii) Life Annuity with 10 Years of Income Payments Guaranteed; (iii) Joint and Last Survivor Annuity; and (iv) Joint and Last Survivor Annuity with 10 Years of Income Payments Guaranteed. A Shield Option can only have one associated Rate Crediting Type: either a Cap Rate or a Step Rate. Interim Value For each Shield Option, the value we assign on any Business Day prior to the Term End Date. The Interim Value of a Shield Option is equal to the Investment Amount in the Shield Option, adjusted for the Index Performance of the associated Index and subject to the applicable Accrued Shield Rate, Accrued Cap Rate or Accrued Step Rate. Transfers During the Accumulation Period you may make transfers to the Fixed Account and/or to new Shield Option(s) during the Transfer Period. The effective date of such transfer is the first day of the Interest Rate Term and/or a Term(s) in which the transfer is made. Fixed Account See Appendix D. Access to Your Money You may withdraw some or all of your money at any time prior to the Annuity Date. For any withdrawal, a Performance Rate Adjustment, as of the date of the withdrawal, will apply. In addition, a withdrawal taken in excess of the Free Withdrawal Amount may be subject to a Withdrawal Charge. Withdrawal Charge A percentage charge applied to withdrawals in excess of the Free Withdrawal Amount. Number of Complete Contract Years since Issue Date Withdrawal Charge percentage 0 7% 1 7% 2 6% 3 6% 4 5% 5 5% 6 or more 0% Death Benefits The standard death benefit or the optional Return of Premium death benefit. Annuity Options

| Charges and Expenses | You will bear the following charges and expenses: (i) Withdrawal Charges; (ii) Premium and Other Taxes; and (iii) Lower Cap Rates and Step Rates if the Return of Premium death benefit is selected. | |||||||

| Your Right to Cancel | You may cancel the Contract within 10 days after receiving it by mailing or delivering the Contract to either us or the agent who sold it. This is known as a “free look.” You will receive whatever your Contract is worth plus the sum of all fees, taxes and charges deducted from the Purchase Payment, as of the effective date of the free look, on the Business Day we receive your Contract and we will not deduct a Withdrawal Charge. | |||||||

The purchase of the Contract involves certain risks. You should carefully consider the following factors, in addition to the matters set forth elsewhere in the prospectus, prior to purchasing the Contract.

Risk of loss

There is a risk of substantial loss of your principal (unless you allocated your Purchase Payment to the Fixed Account) because you agree to absorb all losses that exceed the Shield Rate for the Shield Options you select under the Contract. This means that if a negative Index Performance for a Shield Option— A funding option available under Your Contract, you select exceeds the valuecorresponding Shield Rate at the Term End Date, you will bear the portion of which varies with the investment experienceloss that exceeds the Shield Rate.

No ownership of the underlying mutual fund.securities

Written Request— Written instructionsWhen you purchase the Contract and allocate your Purchase Payment to a Shield Option(s), you will not be investing in the Index for the Shield Options you select or information sent to Us in a formmutual fund or exchange traded fund that tracks the Index for the Shield Options you select. Your Performance Rate Adjustment for a Shield Option is limited by a Cap Rate or Step Rate, which means your Investment Amount will be lower than if you had invested in a mutual fund or exchange traded fund designed to track the performance of the applicable Index and content satisfactorythe performance is greater than your Cap Rate or Step Rate.

Cost of optional death benefit

If you purchase a Contract with the optional Return of Premium death benefit, the Cap Rates and Step Rates set for your Shield Options under the Contract will be lower than the Cap Rates and Step Rates that you would have received had you purchased the Contract without this optional death benefit. In deciding whether to Uspurchase the optional death benefit, you should consider the desirability of the benefit, relative to the generally lower Cap Rates and received in good order at Our Home Office.

You, Your — In this prospectus, depending onStep Rates that will be set under your Contract for the context, “You” is the ownerlife of the Contract as compared to a Contract purchased without such benefit, and your needs.

Withdrawal Charges

You may withdraw some or all of your money at any time prior to the Participant or AnnuitantAnnuity Date, however, any applicable Withdrawal Charge is calculated as a percentage of the amount withdrawn. After the first Contract Year, the Contract provides for whoma limited free access to your money, called the Free Withdrawal Amount. If you withdraw an amount that is invested under certain group arrangements. In cases where We are referringgreater than the Free Withdrawal Amount for your Contract, you may be subject to giving instructions or making paymentsa Withdrawal Charge which will reduce the amount that is payable to Us for qualified Contracts or Contracts usedyou. For example, assume you make a $1,000 Purchase Payment at Contract issue. If your Account Value is $800 in connection withnon-qualified deferred compensation plans or qualified excess benefit arrangements, “You” means the trustee or employer. Under certain group arrangements wherebeginning of the Participant or Annuitantfifth (5th) Contract Year and you take a full withdrawal from your Contract, the Free Withdrawal Amount is permitted$80 (10% of $800) and a Withdrawal Charge percentage of 5% is applied to choose among Separatethe remaining amount. This is a 5% reduction of your Account Options, “You” meansValue, less the Participant or Annuitant who is giving Us instructions about the Separate Account Options. In connection withFree Withdrawal Amount ($720 = $800 – $80). The Withdrawal Charge would be $36 (5% of $720). This results in a Plan Termination,cash value of $764 paid to you ($764 = $800 – $36). If you make a withdrawal before a Term End Date, a Performance Rate Adjustment, as of the date of the withdrawal, will apply. A Performance Rate Adjustment may result in a loss that is greater than the Accrued Shield Rate when Index Performance is negative on the date of the withdrawal. Performance Rate Adjustments, at the time of the withdrawal, may decrease the amount that is payable to you.

Effect of Withdrawals

The method we use in calculating your Interim Value may result in an amount that is less than the amount you would receive had you held the investment until the Term End Date. If you take a withdrawal when Index Performance is negative, your remaining Investment Amount may be significantly less than if you waited to take the withdrawal when Index Performance was positive.

If you take a withdrawal, including RMDs, your Account Value will be reduced by the amount withdrawn proportionately from your Shield Options and Fixed Account unless you tell us from which options, in which you currently have any Account Value, where the withdrawal should be taken.

If you die (unless you selected the optional Return of Premium death benefit), make a withdrawal or Surrender your Contract prior to the Term End Date, we will pay the Interim Value, which may be less than if you held the Contract until all of your Shield Options reached their Term End Dates.

If your Contract is annuitized prior to a Term End Date, we will use the Interim Value to calculate the Income Payments you will receive based on the applicable Annuity Option. In deciding on an Annuity Date, you should take into consideration the Term End Dates of your Shield Options relative to the Annuity Date you have chosen.

The calculation of the Interim Value will be based on Index Performance and the applicable Accrued Shield Rate, Accrued Cap Rate or cash distribution under such Plan Termination, “You”Accrued Step Rate as of the date of the calculation. Shield Rates, Cap Rates and Step Rates accrue during the Term and only reach full accrual on the last day of a Term. If negative Index Performance is constant during the Term, the Interim Value will be lower the earlier a withdrawal is made during the Term because the Shield Rate is accruing during this period. Also, withdrawals prior to the Term End Date, when Index Performance is positive, are subject to an Accrued Cap Rate or Accrued Step Rate based on the period those amounts were invested in the Shield Option. This means the Participant whoearlier you take a withdrawal the lesser extent to which any positive Index Performance is reflected in your Account Value due to the accruing of the Cap Rate or Step Rate.

If your Account Value falls below the Minimum Account Value as a result of a withdrawal, we may terminate your Contract.

Limitations on Transfers

You may make transfers between the Fixed Account and the Shield Option(s) only during the Transfer Period. You cannot make transfers outside the Transfer Period and you cannot transfer out of a current Shield Option to another Shield Option or the Fixed Account until the Term End Date of the current Shield Option and you cannot transfer out of the Fixed Account to a Shield Option until the Interest Rate Term End Date (which will not be less than one (1) year). In both cases, the amount transferred, can only be transferred to new Shield Options or the Fixed Account and not a Shield Option, you may currently have, whose Term has receivednot ended as of the date you would like to transfer such amount. This may limit your ability to react to market conditions.

In addition, you should understand that for renewals into the same Shield Option, a new Cap Rate or Step Rate, as applicable, will be declared and will go into effect on the Contract Anniversary that coincides with the beginning of the new Shield Option.

Availability of Shield Options

A Shield Option will always be available; however, we may stop offering certain Shield Option(s). Consequently, a particular Shield Option may not be available for you to transfer your Investment Amount or cash distribution.Fixed Account Value into after a Term End Date or the Interest Rate Term End Date. If the same Shield Option is no longer available at the Term End Date, the Investment Amount in the applicable Shield Option(s) will automatically transfer into the Fixed Account at the Term End Date, unless you instruct us otherwise. The amounts transferred to the Fixed Account must remain in the Fixed Account until the Interest Rate Term End Date (which, currently, will not be less than one (1) year). The Investment Amount held in the Fixed Account may earn a return that is less than the return you might have earned if those amounts were held in a Shield Option. If we exercise this right, your ability to increase your Account Value and, consequently, increase your death benefit will be limited. If the Fixed Account is not available, the Investment Amount will automatically transfer into the Shield Option with, in order of priority, the shortest Term, the highest Shield Rate and the lowest Cap Rate, from the Shield Options available at the Term End Date, unless you instruct us otherwise.

An Index may be substituted

4We have the right to substitute a comparable index prior to the Term End Date if any Index is discontinued or, at our sole discretion, we determine that our use of such Index should be discontinued, or if the calculation of an Index is substantially changed. We would attempt to choose a substitute index that has a similar investment objective and risk profile to the replaced index. Upon substitution of an Index, we will calculate your Index Performance on the replaced Index up until the date of substitution and the substitute Index from the date of substitution to the Term End Date. An Index substitution will not change the Shield Rate, Cap Rate or Step Rate for an existing Shield Option. The performance of the new Index may not be as good as the one that it substituted and as a result your Index Performance may have been better if there had been no substitution.

No company other than MLIC has any legal responsibility to pay amounts that MLIC owes under the Contract. An Owner should look to the financial strength of MLIC for its claims-paying ability.

This prospectus describes the Registered Fixed Account Option availableMetLife Shield Level SelectorSMAnnuity issued by us and describes all the material features of the Contract. The MetLife Shield Level SelectorSMAnnuity is a contract between you as the Owner, and us, the insurance company, where you agree to make a companionPurchase Payment to us and we agree to make a series of Income Payments at a later date you select (the “Annuity Date”).

The Contract, with Gold Track Select variablelike all deferred annuity contracts, available in New York State,has two periods: the Accumulation Period and registered with the Securities and Exchange Commission. The Contracts are used with:

qualified pension and profit-sharing Plans;

tax-deferred annuity Plans (for public school teachers and employees and employees of certain other tax-exempt and qualifying employers); and

deferred compensation Plans of state and local governments.

Metropolitan Life Insurance Company (“We” or the “Company”) issues the Contracts. Purchase Payments made under the Contracts and directed to the Registered Fixed Account Option become a part of the Company’s General Account. Purchase Payments may also be allocated to one or more Separate Account Options. The variable annuity contract and underlying mutual funds are described in a separate prospectus. Please read all prospectuses carefully.

Income Period. During the Accumulation Period, Account Value accumulates on a tax-deferred basis and is taxed as income when you make a withdrawal. If you make a withdrawal during the RegisteredAccumulation Period, we may assess a Withdrawal Charge of up to 7%. Withdrawals, depending on the amount and timing, may negatively impact the benefits and guarantees provided by your Contract. You should carefully consider whether a withdrawal under a particular circumstance will have any negative impact to your benefits or guarantees. The Income Period occurs when you or a designated payee begin receiving regular Income Payments from your Contract.

The maximum issue age for this Contract is 85.

When you purchase the Contract, you can choose one or more of the available Shield Options and the Fixed Account. A Purchase Payment applied to the Shield Options is allocated to the Separate Account. You do not share in the investment performance of assets allocated to the Separate Account. We are obligated to pay all money we owe under the Contract, including death benefits and income payments. Any such amount that exceeds the assets in the Separate Account is paid from our General Account, subject to our financial strength and claims-paying ability and our long-term ability to make such payments, and is not guaranteed by any other party. (See “THE SEPARATE ACCOUNT.”)

The Contract is intended for retirement savings or other long-term investment purposes. The Contract benefits from tax deferral. Tax deferral means that you are not taxed on Account Value or appreciation on the assets in your Contract until you take money out of your Contract. Non-qualified annuity Contracts owned by corporations do not receive tax deferral on earnings. In addition, for any tax qualified account (e.g., an IRA), the tax deferred accrual feature is provided by the tax qualified retirement plan. Therefore, there should be reasons other than tax deferral for acquiring the Contract by a corporation or within a qualified plan. (See “FEDERAL TAX CONSIDERATIONS.”)

The Contract also contains a Fixed Account. The Fixed Account Option provides for Purchase Payments to be credited withis not offered by this prospectus. The Fixed Account offers an initial interest rate that is declared quarterly, and that rate is guaranteed for a 12-month period. We guarantee that the initial credited interest rate will never be less than theby us. The minimum interest rate permitted under New York law.

Atdepends on the end ofdate your Contract is issued and is currently 1% annually. Your registered representative can tell you the 12-month Guarantee Period, a renewalcurrent and minimum interest raterates that apply. If you select the Fixed Account, your money will be determined byplaced with our other General Account assets, and the Company. We guarantee that the renewal interest rate will never be less than the minimum interest rate permitted under New York law. At the endamount of the initial Guarantee Period, the first renewal rate will be guaranteedmoney you are able to the end of the calendar year. The second and all subsequent renewal rates will be declared each January 1 thereafter, and will be guaranteed through December 31 of that year. The rates of interest credited will affect a contract or account’s Cash Value. (See “Cash Values”.) Such rates may also be used to determine amounts payable upon termination of the contracts. (See “Surrenders —accumulate in your Contract Termination”.)

In the future, the Company may decide to offer the Registered Fixed Account Option with guaranteed rates that are declared on a calendar quarter basis and applied to all Purchase Payments for the remainder of the calendar quarter. At the end of such calendar quarter, the Company will declare a new guarantee rate that will be applied to all new Purchase Payments allocated to the Registered Fixed Account Option for the following calendar quarter, as well as Purchase Payments that were previously applied to the Registered Fixed Account Option.

Generally, the Company intends to invest assets directed to the Registered Fixed Account Option in investment-grade securities. The Company has no specific formula for determining the initial interest rates or renewal interest rates. However, such a determination will generally reflect interest rates available on the types of debt instruments in which the Company intends to invest the amounts directed to the Registered Fixed Account Option. In addition, the Company’s management may also consider various other factors in determining these rates for a given period, including regulatory and tax requirements; sales commission and administrative expenses borne by the Company; general economic trends; and competitive factors. (See “Investments by the Company”.)

The Contract Owner or Participant, if so authorized, may, during the Accumulation Period directdepends upon the total interest credited to your Contract. The Fixed Account is part of our General Account. Our General Account consists of all orassets owned by us other than those in the Separate Account and our other separate accounts. We have sole discretion over the investment of assets in the General Account and the Separate Account. If you select an Annuity Option during the Income Period, payments are made from our General Account assets.

The amount of the Income Payments you receive during the Income Period from an Income Payment option will remain level for the entire Income Period, subject to the payout chosen. (See “Income Payments (The Income Period)” for more information.)

As Owner, you exercise all interests and rights under the Contract. You can change the Owner at any time, subject to our underwriting requirements. The Contract may be owned generally by Joint Owners (limited to natural persons). (See “OWNERSHIP PROVISIONS.”)

Exchanges. Generally you can exchange one annuity contract for another in a portiontax-free exchange under Section 1035 of the Code. Before making an exchange, you should compare both annuities carefully. If you exchange another annuity for the one described in this prospectus, you might have to pay a withdrawal charge on your old annuity, and there will be a new Withdrawal Charge period for the Contract. Other charges may be higher (or lower) and the benefits may be different. Also, because we will not issue the Contract until we have received the initial premium from your existing insurance company, the issuance of the Contract may be delayed. Generally, it is not advisable to purchase a Contract as a replacement for an existing annuity contract. Before you exchange another annuity for our Contract, ask your registered representative whether the exchange would be advantageous, given the Contract features, benefits and charges.

Exchange Programs. From time to time we may offer programs under which certain annuity contracts previously issued by us or account’s Cash Value underone of our affiliates may be exchanged for the Registered Fixed Account OptionContracts offered by this prospectus. Currently, with respect to exchanges from certain of our annuity contracts to the Contract, an existing contract is eligible for exchange if a surrender of the existing contract would not trigger a withdrawal charge. You should carefully consider whether an exchange is appropriate for you by comparing the benefits and other guarantees provided by the contract you currently own to the benefits and guarantees that would be provided by the new Contract offered by this prospectus. Then, you should compare the fees and charges of your current contract to the fees and charges of the new Contract, which may be higher than your current contract. The programs we offer will be made available on terms and conditions determined by us, and any such programs will comply with applicable law. We believe the exchanges will be tax free for Federal income tax purposes; however, you should consult your tax advisor before making any such exchange.

The Contract may not be available for purchase through your broker dealer (“selling firm”) during certain periods. There are a number of reasons why the Contract periodically may not be available, including that the insurance company wants to limit the volume of sales of the Contract. You may wish to speak to your registered representative about how this may affect your purchase. For example, you may be required to submit your purchase application in Good Order prior to or on a stipulated date in order to purchase a Contract, and a delay in such process could result in your not being able to purchase a Contract. Your selling firm may offer the Contract with a lower maximum issue age for the Contract and certain riders compared to what other selling firms may offer.

A Purchase Payment is the total amount of money you give us to invest in the Contract. The Purchase Payment is due on the date the Contract is issued.

The minimum Purchase Payment we will accept is $25,000.

If you want to make a Purchase Payment of less than $25,000 or, $1,000,000 or more, you will need our prior approval.

We reserve the right to refuse a Purchase Payment made via a personal check in excess of $100,000. A Purchase Payment over $100,000 may be accepted in other forms, including, but not limited to, EFT/wire transfers, certified checks, corporate checks, and checks written on financial institutions.

We will not accept a Purchase Payment made with cash, money orders, or travelers checks.

Corporations may purchase the Contract; however, we will not accept a Purchase Payment made by a corporation to fund any type of qualified or non-qualified retirement plan.

We reserve the right to reject any application.

Allocation of the Purchase Payment

You may allocate your Purchase Payment to one or more of the available Shield Options or into the Fixed Account. On your Issue Date, your Purchase Payment is allocated to the Shield Option(s) and/or the Fixed Account, as you specified on the application, unless we receive Notice of any changes from you before we have issued your Contract. All allocations must be in whole percentages that total 100% or in whole dollars. Once your Purchase Payment is allocated to the Shield Options and/or the Fixed Account, they become part of your Account Value.

The MetLife Shield Level SelectorSMAnnuity is not a variable annuity where your account value varies based on the investment optionsperformance of the Separateunderlying portfolios you choose, rather the Shield Options offer potential interest based upon index performance. This potential interest—the Performance Rate Adjustment—may be a positive or negative percentage or zero. You may allocate your Purchase Payment to one or more of the Shield Options we currently offer and the Fixed Account. No surrender chargesBased upon the Index Performance of the Index associated with the Shield Option, a Performance Rate Adjustment will be deductedapplied to the Investment Amount in that Shield Option on any day during the Term that you make a withdrawal from the Shield Option, Surrender your Contract, annuitize your Contract, a Death Benefit is paid or the Term ends. Given that Index Performance may be positive, zero or negative, your Performance Rate Adjustment may be positive, zero or negative. It is possible for you to lose a portion of the Purchase Payment and any earnings invested in the Contract. The Performance Rate Adjustment is based on a certain amount of protection against decreases in an Index Value and a limitation on potential interest based on an Index Value. The extent of the downside protection varies by the Shield Rate you select. If you access amounts in the Shield Options before the Term End Date, we will instead calculate an Interim Value on each Business Day between the Term Start Date and the Term End Date. (See “Interim Value Calculation.”)

You have the opportunity to allocate your Investment Amount to any of the Shield Options described below, subject to the requirements, limitations and procedures disclosed in the prospectus. We are not obligated to offer any one particular Shield Option. Each Shield Option has an associated (i) Term, (ii) Index, (iii) Shield Rate and (iv) Rate Crediting Type.

The following chart lists the Shield Options (each of which is issued with a Cap Rate unless otherwise noted) currently available:

| SHIELD OPTIONS | ||

TERM | INDEX | |

SHIELD 25 (up to 25% downside protection) | ||

6 Year | S&P 500® Index Russell 2000® Index MSCI EAFE Index | |

SHIELD 15 (up to 15% downside protection) | ||

3 Year | S&P 500® Index Russell 2000® Index MSCI EAFE Index | |

6 Year | S&P 500® Index Russell 2000® Index MSCI EAFE Index | |

SHIELD 10 (up to 10% downside protection) | ||

1 Year | S&P 500® Index S&P 500® Index Step Rate Russell 2000® Index NASDAQ-100 Index® MSCI EAFE Index Bloomberg Commodity IndexSM | |

3 Year | S&P 500® Index S&P 500® Index / Step Rate Russell 2000® Index NASDAQ-100 Index® MSCI EAFE Index Bloomberg Commodity IndexSM | |

6 Year | S&P 500® Index Russell 2000® Index MSCI EAFE Index | |

The Indices are described in more detail below, under the heading “Indices.” For each new Shield Option we declare a new Cap Rate or a new Step Rate, as applicable, for each Term. The initial Cap Rate or Step Rate, as applicable, for each Shield Option is declared on the Issue Date. Thereafter the Cap Rate or Step Rate, as applicable, for each subsequent Shield Option is declared for each subsequent Term. See “Cap Rate” and “Step Rate”.

Please note, Shield Options with higher Shield Rates tend to have lower Cap Rates and Step Rates, as applicable, than other Shield Options that use the same Index and Term but provide lower Shield Rates. For example, a S&P 500® Index with a 3 year Term and a Shield 15 will tend to have a Cap Rate that is lower than a S&P 500® Index with a 3 year Term and a Shield 10.

A Shield Option will always be available; however, we reserve the right to change the duration of any new Shield Options, stop offering any of the Shield Options or suspend offering any of the Shield Options temporarily. We may also add Shield Options in the future.

The Term is the number of years that a Shield Option is in effect. For specific Shield Options we currently offer Terms of 1 year, 3 years or 6 years. An Initial Term(s) begins on the Issue Date. A Term ends and a subsequent Term begins, on the Contract Anniversary coinciding with the term duration of the then current Term for the Shield Option you have selected.

Each Shield Option will have a Term Start Date, which is the Contract Anniversary on which a Shield Option is established. The initial Term Start Date(s) begins on the Issue Date, and thereafter, will be the Contract Anniversary coinciding with the term duration of the Term for the Shield Option completed.

The Contract Anniversary on which a Shield Option ends. We will send you written Notice thirty (30) days in advance of the maturing Shield Options in which you are currently invested. At the Term End Date, the Investment Amount allocated to the Shield Option that has reached its Term End Date will automatically be renewed into the same Shield Option unless you elect to transfer such transfers. However, thereamount into a different Shield Option(s) or the Fixed Account. If the same Shield Option is no longer available at the Term End Date, the Investment Amount will automatically transfer into the Fixed Account at the Term End Date, unless you instruct us otherwise. The amounts transferred to the Fixed Account must remain in the Fixed Account until the Interest Rate Term End Date (which, currently, will not be less than one (1) year). If the Fixed Account is not available, the Investment Amount will automatically transfer into the Shield Option with, in order of priority, the shortest Term, the highest Shield Rate and the lowest Cap Rate, from the Shield Options available at the Term End Date, unless you instruct us otherwise. You have the Transfer Period to notify us that you want to transfer some or all of your Investment Amount to a new Shield Option(s) or the Fixed Account. For renewals into the same Shield Option, a new Cap Rate or Step Rate, as applicable, will be declared and will go into effect on the Contract Anniversary that coincides with the beginning of the new Term in the Shield Option that just ended. The amount transferred to the new Shield Option is the Investment Amount as of the Contract Anniversary.

The Performance Rate of a Shield Option is based on the performance of the associated Index. We currently offer Shield Options based on two types of Indices: Indices based on the performance of securities (the “Securities Indices”) and an Index based on the performance of commodities (the “Commodity Index”). In the future we may offer Shield Options based on other types of indices. We may also add or remove indices for new Contracts at our discretion.

Securities Indices.

The following Securities Indices are restrictions whichcurrently available:

S&P 500® Index (Price Return Index). The S&P 500® Index includes 500 large cap stocks from leading companies in leading industries of the U.S. economy, capturing approximately 80% coverage of U.S. equities. The S&P 500® Index does not include dividends declared by any of the companies in this Index.

Russell 2000® Index (Price Return Index). The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index does not include dividends declared by any of the companies in this Index.

NASDAQ-100 Index® (Price Return Index). The NASDAQ-100 Index® includes 100 of the largest domestic and international non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies. The NASDAQ-100 Index® does not include dividends declared by any of the companies in this Index.

MSCI EAFE Index (Price Return Index). The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. As of the date of this prospectus the MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The MSCI EAFE Index does not include dividends declared by any of the companies in this Index.

Commodities Index.

The following Commodity Index is currently available:

Bloomberg Commodity IndexSM(Price Return Index). The Bloomberg Commodity IndexSMis a broadly diversified representation of commodity market as an asset class. The index is composed of futures contracts on physical commodities. As of the date of this Prospectus, the index consists of 22 commodities: Aluminum, Brent Crude, Chicago Wheat, Coffee, Cotton, Corn, Copper (COMEX), Gold, Kansas City Wheat, Lean Hogs, Live Cattle, Nickel, Natural Gas, RBOB Gasoline, Silver, Soybeans, Soybean Meal, Soybean Oil, Sugar, ULS Diesel, WTI Crude Oil and Zinc. The Bloomberg Commodity IndexSMreflects the return of underlying commodity futures prices.

See Appendix A for important information regarding the publishers of the Indices.

Discontinuation or Substantial Change to an Index. If any Index is discontinued or, we determine that our use of such Index should be discontinued, or if the calculation of an Index is substantially changed, we may limitsubstitute a comparable index with a similar investment objective and risk profile. We will send you (i) written Notice thirty (30) days in advance of such substitution if we determine such Index should be discontinued and (ii) reasonable written Notice relative to the notice we receive under our license agreements with the publishers of the Indices if an Index is discontinued. Upon substitution of an Index, we will calculate your Index Performance on the existing Index up until the date of substitution and the substitute Index from the date of substitution to the Term End Date. The Index Performance as of the Term End Date will be equal to the return from having invested in the initial Index up to the substitution date and then investing in the substitute Index from the date of substitution to the Term End Date assuming no withdrawals or transfers based on the following formula: (initial Index at Index substitution date ÷ initial Index at Term Start Date) x (substituted Index at Term End Date ÷ substituted Index at substitution date)– 1. An Index substitution will not change the Term, Shield Rate, Cap Rate or Step Rate for an existing Shield Option.

See Appendix B for an Index substitution Investment Amount example.

The Index Value of an Index, on a Business Day, is the published closing value of the Index on that Business Day. The Index Value on any day that is not a Business Day is the value as of the prior Business Day. We will use consistent sources to obtain Index Values. If these sources are no longer available for specific indices, we will select an alternative published source(s) for these Index Values.

The Performance Rate of a Shield Option is based on the performance of an Index. Index Performance is the percentage change in an Index Value measured from the Term Start Date to any day, including the Term End Date, within the Term. The Index Performance can be positive, zero or negative.

The Shield Rate is accrued from the Term Start Date to the Term End Date, and the full Shield Rate only applies if you hold the Shield Option until the Term End Date. The Shield Rate for each Shield Option is the amount of any negative Index Performance that is absorbed by us at the Term End Date. Any negative Index Performance

beyond the Shield Rate will reduce the Investment Amount. You should also keep in mind that if Index Performance is negative, the Performance Rate can never be greater than zero.

We currently offer the following Shield Rates—Shield 10, Shield 15 and Shield 25:

Shield Rate | Downside Protection | |

Shield 10 | up to 10% | |

Shield 15 | up to 15% | |

Shield 25 | up to 25% |

For example, a -15% Index Performance with a 10% Shield Rate will result in a -5% Performance Rate; or,a -10% Index Performance with a 25% Shield Rate will result in a 0% Performance Rate. The Shield Rate may vary between Shield Options and it is not an annual rate.

In deciding whether to choose a Shield Option with a higher Shield Rate, you should consider that Shield Options with higher Shield Rates tend to have lower Cap Rates and Step Rates, as applicable, than Shield Options with lower Shield Rates that have the same index and term.

The Cap Rate is the maximum rate that may be so directedcredited at the Term End Date based on Index Performance. For example, a 15% Index Performance with a 10% Cap Rate will result in a 10% Performance Rate; or, a 5% Index Performance with a 10% Cap Rate will result in a 5% Performance Rate.The Cap Rate may vary between Shield Options and transfers may be deferred in certain cases. (See “Transfersit is not an annual rate. The Cap Rate is measured from the RegisteredTerm Start Date to the Term End Date, and the full Cap Rate only applies if you hold the Shield Option until the Term End Date. For renewals into the same Shield Option a new Cap Rate is declared for each subsequent Term, and such rate will not be less than the Minimum Guaranteed Cap Rate stated in your Contract, but will not be less than 1% for Shield Options with a1-Year term, 3% for Shield Options with a 3-Year term and 6% for Shield Options with a 6-Year term. A thirty (30) day advance written Notice will be mailed to you indicating your maturing Shield Options and how you can obtain the new Cap Rates and Step Rates for the available Shield Options and the interest rate for the Fixed Account Option”.)Account. At the Term End Date, the Investment Amount will automatically be renewed into the same Shield Option, with the new Cap Rate, unless you elect to transfer such amount into a different Shield Option(s) or the Fixed Account. See “TRANSFERS.”

Distributions and transfersStep Rate

The Step Rate is the rate credited at the Term End Date if the Index Performance is equal to or greater than zero. For example, a 15% Index Performance with a 10% Step Rate will result in a 10% Performance Rate; or, a 5% Index Performance with a 10% Step Rate will result in a 10% Performance Rate. The Step Rate is measured from the RegisteredTerm Start Date to the Term End Date, and the full Step Rate only applies if you hold the Shield Option until the Term End Date.The Step Rate may vary between Shield Options and it is not an annual rate. For renewals into the same Shield Option a new Step Rate is declared for each subsequent Term, and such rate will not be less than Minimum Guaranteed Step Rate stated in your Contract, but will not be less than 1% for Shield Options with a1-Year term and 3% for Shield Options with a 3-Year term. A thirty (30) day advance written Notice will be mailed to you indicating your maturing Shield Options and how you can obtain the new Step Rates and Cap Rates for the available Shield Options and the interest rate for the Fixed AccountAccount. At the Term End Date, the Investment Amount will automatically be renewed into the same Shield Option, with the new Step Rate, unless you elect to transfer such amount into a different Shield Option(s) or the Fixed Account. See “TRANSFERS.”

In deciding whether to purchase a Shield Option with a Cap Rate or a Step Rate, you should consider that Step Rates are generally lower than Cap Rates. If Index Performance is equal to or greater than zero but less than the Step Rate, and you chose a Cap Rate for your Shield Option, your Performance Rate Adjustment will be lower than it otherwise would be had you chosen a Step Rate. Alternatively, if the Index Performance is positive and exceeds the Step Rate, and you chose a Step Rate for your Shield Option, your Performance Rate Adjustment will be lower than it would otherwise be had you chosen a Cap Rate. For example, if you chose a Shield Option with a 10% Cap Rate and there is a 15% Index Performance, your Performance Rate is 10%; however, if instead you were to choose a Shield Option with an 8% Step Rate, your Performance Rate would instead be 8%. Alternatively, if you chose a Shield Option with a 10% Cap Rate and there is a 0% Index Performance your Performance Rate is 0%; however, if instead you were to choose a Shield Option with an 8% Step Rate, your Performance Rate would be 8%.

In addition, if you purchase a Contract with the optional Return of Premium death benefit, the Cap Rates and Step Rates set for your Shield Options under the Contract will be lower than the Cap Rates and Step Rates that you would have received had you purchased the Contract without this optional death benefit.

ADDITION OR DISCONTINUANCE OF A SHIELD OPTION

A Shield Option will always be available; however, we can add or discontinue any Shield Option. When a change is made onto a last-in, first-out basis. WeShield Option or an Index, or changed subsequent to the Issue Date, we will determinesend a notification describing any changes to the Cash Surrender ValueShield Option, as required by law. This change will take effect under your Contract as of the next valuationContract Anniversary for any allowable transfers into the Shield Option(s). If you are currently allocated in a Shield Option which is no longer available, you will remain in that Shield Option until the Term End Date, but that Shield Option will no longer be available following the Term End Date. For more on transfers and renewals, see “TRANSFERS.”

The Investment Amount, for each Shield Option, is the amount that is allocated to the Shield Option and subsequently reflects all withdrawals and adjustments at the Term End Date. The Investment Amount will be reduced for any withdrawal by the same percentage that the withdrawal reduces the Interim Value attributable to that Shield Option.

CALCULATING YOUR INVESTMENT AMOUNT ON A TERM END DATE

On the Term End Date, we apply the Performance Rate Adjustment to your Investment Amount. The Performance Rate Adjustment is based on the Performance Rate, which is the rate credited at the Term End Date. The Performance Rate is determined by the Index Performance adjusted for the applicable Shield Rate, Cap Rate or Step Rate. The Performance Rate can be positive, zero or negative and is determined as follows:

| Shield Option type: | If Index Performance (can be positive, zero or negative) is: | Performance Rate will equal: | ||

| Shield Options with a Cap Rate | less than or equal to zero | the lesser of: zero or the Index Performance increased by the Shield Rate (For example: a -15% Index Performance with a Shield 10 will result in a -5% Performance Rate. The Performance Rate can never be greater than zero if the Index Performance is negative.) | ||

| greater than zero and less than the Cap Rate | the Index Performance | |||

| greater than zero and equals or exceeds the Cap Rate | the Cap Rate | |||