As filed with the Securities and Exchange Commission on July 25, 2016March 28, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DCD.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GALENA BIOPHARMA, INC.SELLAS Life Sciences Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-8099512 | |

(State or other jurisdiction

| ( Identification |

2000 Crow Canyon Place,

7 Times Square, Suite 3802503

San Ramon, California 94583New York, New York 10036

(855) 855-4253(646) 200-5278

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark W. Schwartz, Ph.D.Angelos M. Stergiou, M.D., ScD h.c.

President and Chief Executive Officer

Galena Biopharma, Inc.7 Times Square, Suite 2503

2000 Crow Canyon Place, Suite 380New York, New York 10036

San Ramon, California 94583

(855) 855-4253(646) 200-5278

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joel I. Papernik, Esq.

Daniel A. Bagliebter, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

919 Third Avenue

New York, New York 10022

(212) 935-3000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.box: ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company” and “emerging growth company” inRule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ||||

| Non-accelerated filer | x | Smaller reporting company | x | |||

| Emerging growth company | ¨ |

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of each class of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per share(2) | Proposed maximum aggregate offering price(2) | Amount of registration fee | ||||

Common stock, par value $0.0001 per share | 3,658,012 shares | $0.4075 | $1,490,640.20 | $150.11 | ||||

| ||||||||

| ||||||||

The Registrant hereby amends this registration statement on such dateIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or dates as may be necessaryrevised financial accounting standards provided pursuant to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)7(a)(2)(B) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.Act. ¨

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. WeA registration statement relating to these securities has been filed with the Securities and Exchange Commission. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission isdeclares the registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 25, 2016MARCH 28, 2024

PROSPECTUS

3,658,01213,029,316 Shares of Common Stock

ThisThe selling stockholders of SELLAS Life Sciences Group, Inc. (“SELLAS,” “we,” “us” or the “Company”) listed beginning on page 11 of this prospectus relates to themay offer and saleresell under this prospectus up to 13,029,316 shares of our Common Stock issuable upon exercise of warrants acquired by certain of the selling stockholders identified inunder the Purchase Agreement (defined below) (the “Warrants”). The selling stockholders acquired the Warrants from us pursuant to a Securities Purchase Agreement (the “Purchase Agreement”), dated March 15, 2024, by and among the Company and the investors listed therein (the “Investors”).

We are registering the resale of the shares of Common Stock covered by this prospectus as required by the Purchase Agreement. The selling stockholders will receive all of up to 3,658,012the proceeds from any sales of the shares of our common stock.offered hereby. We are not selling any securities under this prospectus and will not receive any of the proceeds, frombut we will incur expenses in connection with the saleoffering. To the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of shares by the selling stockholders.Warrants.

The selling stockholders may sell these shares through public or private transactions at market prices prevailing at the time of sale or at negotiated prices. The timing and amount of any sale are within the sole discretion of the selling stockholders. Our registration of the shares of common stock described inCommon Stock covered by this prospectus in a numberdoes not mean that the selling stockholders will offer or sell any of different ways and at varying prices. Seethe shares. For further information regarding the possible methods by which the shares may be distributed, see “Plan of Distribution” for more information about how the selling stockholders may sell the sharesbeginning on page 13 of common stock being offered pursuant to this prospectus.

We will pay the expenses incurred in registering the shares, including legal and accounting fees. See “Plan of Distribution”.

Our common stockCommon Stock is tradedlisted on The NASDAQNasdaq Capital Market under the symbol “GALE.“SLS.” On July 22, 2016, the closingThe last reported sale price of our common stockCommon Stock on The NASDAQ Capital MarketMarch 27, 2024 was $0.45.$1.03 per share.

An investmentInvesting in our common stockCommon Stock is highly speculative and involves a highsignificant degree of risk. See “Risk Factors”Please consider carefully the specific factors set forth under “Risk Factors” beginning on page 116 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.prospectus and in our filings with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.2024

TABLEOF CONTENTSTable of Contents

This prospectus is part of thea registration statement on Form S-3 that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the selling stockholder named herein may, from time to time, offer and sell or the SEC. As permitted by the rules and regulationsotherwise dispose of the SEC, the registration statement filedshares of our Common Stock (“Shares”) covered by us includes additional information not contained in this prospectus.

If information in this prospectus is inconsistent with any document incorporated by reference that was filed with the SEC before the date of this prospectus, you should rely on this prospectus. This prospectus and the documents incorporated by reference into this prospectus include important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents to which we have referred you in the section of this prospectus entitled “Where You Can Find More Information.”

You should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We have not authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained or incorporated by reference in this prospectus is accurate as ofon any date other than as ofsubsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or Shares are sold or otherwise disposed of on a later date.

This prospectus does not contain all of the information included in the caseregistration statement. For a more complete understanding of the offering of the Shares, you should refer to the registration statement including the exhibits. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the dateregistration statement of such documents regardless of the time of delivery ofwhich this prospectus or any saleis a part, and you may obtain copies of our shares of common stock. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

documents as described below under the heading “Where You Can Find More Information.” We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in thisthe accompanying prospectus were made solely for the benefit of the parties to such agreement, including in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs. It is important for you to read and consider all information contained in this prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” in this prospectus.

Unless otherwise indicated,

The selling stockholders named in this prospectus may sell up to 13,029,316 shares of our Common Stock issuable upon exercise of warrants to purchase shares of our Common Stock from time to time. This prospectus also covers any shares of Common Stock that may become issuable as a result of share splits, share dividends, or similar transactions. We have agreed to pay the expenses incurred in registering these shares, including legal and accounting fees.

We and the selling stockholders have not authorized anyone to give any information or to make any representation to you other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus concerningdoes not constitute an offer to sell or the solicitation of an offer to buy any of our industry,shares of Common Stock other than the Shares covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

This prospectus, including our general expectations and market opportunity, isthe documents incorporated by reference herein, include statements that are based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition,various assumptions and estimates that are subject to numerous known and unknown risks and uncertainties. Some of ourthese risks and our industry’s future performanceuncertainties are necessarily uncertain due to a variety of factors, including those described in the section entitled “Risk Factors” beginning on page 116 of this prospectus.prospectus and as described in Part I, Item 1A (Risk Factors) of our most recent Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 28, 2024, as updated by our subsequent filings with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These and other important factors could cause our future performanceresults to differbe materially different from ourthe results expected as a result of, or implied by, these assumptions and estimates.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus supplement, the accompanying prospectus and the information incorporated by referenced herein or therein to “SELLAS,” “the Company,” “we,” “us,” “our” and similar terms refer to SELLAS Life Sciences Group, Inc. and, where appropriate, our subsidiaries.

| 1 |

This summary description about us and our business highlights selected information appearingcontained elsewhere in this prospectus or incorporated by reference into this prospectus andprospectus. It does not contain all of the information that may be important to you or that you should consider before investing in our common stock. This prospectus includes or incorporatessecurities. Important information is incorporated by reference information about the securities we areinto this prospectus. To understand this offering as well as information regarding our business and detailed financial data. Before making an investment decision,fully, you should read thiscarefully the entire prospectus, and the information incorporated by reference herein in their entirety, including “Risk Factors” beginningand “Cautionary Note Regarding Forward-Looking Statements,” together with the additional information described under “Information Incorporated by Reference.”

Overview

We are a late-stage clinical biopharmaceutical company focused on page 11the development of this prospectus.novel therapeutics for a broad range of cancer indications. Our product candidates currently include galinpepimut-S, or GPS, a peptide immunotherapy directed against the Wilms tumor 1, or WT1, antigen, and SLS009 (formerly, GFH009), a highly selective small molecule cyclin-dependent kinase 9, or CDK9, inhibitor.

About Galena

OverviewGalinpepimut-S

Galena Biopharma, Inc. (“we,” “us,” “our,” “Galena” or the “company”)

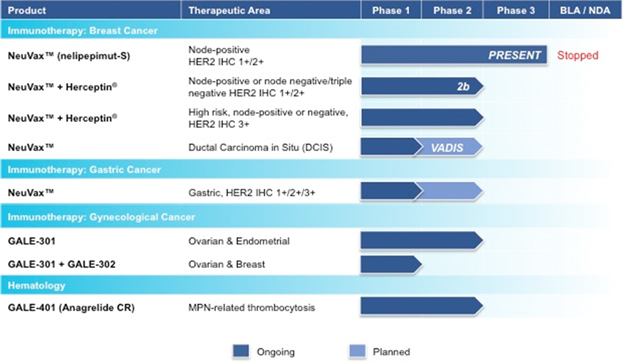

Our lead product candidate, GPS, is a biopharmaceutical company committed tocancer immunotherapeutic agent licensed from Memorial Sloan Kettering Cancer Center, or MSK, that targets the development and commercializationWT1 protein, which is present in 20 or more cancer types. Based on its mechanism of targeted oncology therapeutics that address major unmet medical needs. Galena’s development portfolio is focused primarily on addressing the rapidly growing patient populations of cancer survivors by harnessing the power of the immune system to prevent cancer recurrence. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including novel cancer immunotherapy programs led by NeuVax™ (nelipepimut-S), GALE-301 and GALE-302. The company is also developing a hematology asset, GALE-401, a controlled release version of the approved drug anagrelide for the treatment of patients with thrombocythemia, secondary to myeloproliferative disorders, to reduce the elevated platelet count. NeuVax is currently in several concurrent Phase 2 trials ongoing bothaction as a singledirectly immunizing agent, andGPS has potential as a monotherapy or in combination with other therapies. GALE-301 is inimmunotherapeutic agents to address a Phase 2a clinical trial in ovarian and endometrialbroad spectrum of hematologic, or blood, cancers, and in a Phase 1b clinical trial given sequentially with GALE-302.GALE-401 has completed a Phase 2 trial.

We are seeking to build value for shareholders through pursuit of the following objectives:

The chart below summarizes the current status of our clinical development pipeline:indications.

Novel Cancer Immunotherapies

Our targeted cancer immunotherapy approach is currently based upon two key areas: preventing secondary recurrence of cancer, which is becoming increasingly important as the number of cancer survivors continues to grow; and, primary prevention intended to treat breast cancer earlier in the treatment spectrum. Once a patient’s tumor becomes metastatic, the outcome is often fatal, making the prevention of recurrence a potentially critical component of overall patient care. Our programs primarily target patients in the adjuvant (after-surgery) setting who have relatively healthy immune systems, but may still have residual disease. Minimal residual disease, or single cancer cells (occult cancer cells) or micrometastasis, that are undetectable by current radiographic scanning technologies, can result in disease recurrence.

Our therapies utilize an immunodominant peptide combined with the immune adjuvant, recombinant human granulocyte macrophage-colony stimulating factor (rhGM-CSF), and work by harnessing the patient’s own immune system to seek out and attack any residual cancer cells. Using peptide immunogens has many potential clinical advantages, including a favorable safety profile, since these drugs may lack the toxicities typical of most cancer therapies. They also have the potential to evoke long-lasting protection through activation of the immune system and a convenient, intradermal mode of delivery. We are currently engaged in multiple clinical trials with NeuVax™ (nelipepimut-S), GALE-301, and GALE-302, targeting the prevention of recurrence in breast, gastric, ovarian and endometrial cancers.

NeuVax™ (nelipepimut-S)

NeuVax™ (nelipepimut-S) is a cancer immunotherapy targeting human epidermal growth factor receptor (HER2) expressing cancers. NeuVax is the immunodominant nonapeptide derived from the extracellular domain of the HER2 protein, a well-established and validated target for therapeutic intervention in breast and gastric carcinomas. The NeuVax vaccine is combined with GM-CSF for injection under the skin, or intradermal administration. Data has shown that an increased presence of circulating tumor cells (CTCs) may predict Disease Free Survival (DFS) and Overall Survival (OS) suggesting a presence of isolated micrometastases, not detectable clinically, but, over time, can lead to recurrence, most often in distant sites. After binding to the specific HLA molecules on antigen presenting cells, the nelipepimut-S sequence stimulates specific cytotoxic T lymphocyte, or CTLs, causing significant clonal expansion. These activated CTLs recognize, neutralize and destroy, through cell lysis, HER2 expressing cancer cells, including occult cancer cells and micrometastatic foci. The nelipepimut immune response can also generate CTLs to other immunogenic peptides through inter- and intra-antigenic epitope spreading.

Breast Cancer: According to the National Cancer Institute (NCI), over 230,000 women in the U.S. are diagnosed with breast cancer annually. While improved diagnostics and targeted therapies have decreased breast cancer mortality in the U.S., metastatic breast cancer remains incurable. Approximately 75% to 80% of breast cancer patients have tissue test positive for some increased amount of the HER2 receptor, which is associated with disease progression and decreased survival. Only approximately 20% to 30% of all breast cancer patients—those with HER2 immunohistochemistry (IHC) 3+ disease, or IHC 2+ and fluorescence in situ hybridization (FISH) amplified—have a HER2 directed, approved treatment option available after their initial standard of care. This leaves the majority of breast cancer patients with low-to-intermediate HER2 expression (IHC 1+/2+) ineligible for therapy and without an effective targeted treatment option to prevent cancer recurrence.

We have multiple trials currently ongoing with NeuVax. On June 24, 2016, the assembled Independent Data Monitoring Committee, or IDMC, met to conduct a pre-planned safety and futility analysis of the Phase 3 PRESENT (Prevention of Recurrence in Early-Stage, Node- Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) clinical trial. On June 27, 2016, the IDMC recommended that the Phase 3 trial “be stopped for futility unless it is determined that there has been a systematic reversal in the study drug treatments in the two arms, in which case the IDMC should reevaluate the clinical evidence.” We have stopped the PRESENT trial, and initiated an investigation into the causes of the recommendation. We currently have two additional Phase 2 breast cancer trials ongoing with NeuVax in combination with trastuzumab (Herceptin®; Genentech/Roche) targeting the prevention of recurrence in expanded indications.

We also recently announced our intent to initiate a Phase 2 trial with NeuVax as a single agent in patients with ductal carcinoma in situ, or DCIS, in collaboration with the NCI, potentially positioning NeuVax as a treatment for earlier stage disease. The trial will have an immunological endpoint evaluating NeuVax peptide-specific cytotoxic T lymphocyte (CTL; CD8+ T-cell) response in vaccinated patients. DCIS is defined by the NCI as a noninvasive condition in which abnormal cells are found in the lining of a breast duct, and is the most common type of breast cancer. The abnormal cells have not spread outside the duct to other tissues in the breast. In some cases, DCIS may become invasive cancer and spread to other tissues, and at this time, there is no way to know which lesions could become invasive. Current treatment options for DCIS include breast-conserving surgery and radiation therapy with or without tamoxifen, breast-conserving surgery without radiation therapy, or total mastectomy with or without tamoxifen. According to the American Cancer Society, in 2015 there were over 60,000 diagnoses of DCIS.

Gastric Cancer: According to the NCI, gastric (stomach) cancer is a disease in which malignant (cancer) cells form in the lining of the stomach. Almost all gastric cancers are adenocarcinomas (cancers that begin in cells that make and release mucus and other fluids). Other types of gastric cancer are gastrointestinal carcinoid tumors, gastrointestinal stromal tumors, and lymphomas. Infection with bacteria called Helicobacter pylori (H. pylori) is a common cause of gastric cancer and age, diet, and stomach disease can affect the risk of developing gastric cancer. Gastric cancer is often diagnosed at an advanced stage because there are no early signs or symptoms. Gastric, or stomach cancer, is the second-most common cancer among males and third-most common among females in Asia and worldwide with over 63,000 new cases a year in India, where an initial clinical trial of NeuVax will be run. Overexpression of the HER2 receptor occurs in approximately 20% of gastric and gastro-esophageal junction adenocarcinomas, predominantly those of the intestinal type. Overall, without regard to the stage of cancer, only approximately 28% of patients with stomach cancer live at least five years following diagnosis and new adjuvant treatments are needed to prevent disease recurrence.

We currently have a number of ongoing or planned clinical trials designed to expand the clinical and geographical footprint of NeuVax:

GALE-301 and GALE-302

Our second immunotherapy franchise targets folate binding protein (FBP) receptor-alpha. FBP is a well-validated therapeutic target that is highly over-expressed in ovarian, endometrial and breast cancers, and is the source of immunogenic peptides that can stimulate cytotoxic T lymphocytes to recognize and destroy FBP-expressing cancer cells. Current treatments after surgery for these diseases are principally with platinum based chemotherapeutic agents. These patients suffer a high recurrence rate and most relapse with an extremely poor prognosis. GALE-301 and GALE-302 are immunogenic peptides that consist of a peptide derived from FBP combined with GM-CSF for the prevention of cancer recurrence in the adjuvant setting. GALE-301 is the E39 peptide, while GALE-302 is an attenuated version of this peptide, known as E39. Two trials are ongoing with our FBP peptides: theGALE-301 Phase 2a portion of the Phase 1/2a clinical trial is ongoing in ovarian and endometrial adenocarcinomas, and the GALE-301 plus GALE-302 Phase 1b clinical trial is ongoing in breast and ovarian cancers.

Ovarian Cancer: According to the NCI Surveillance, Epidemiology, and End Results (SEER) Program, new cases of ovarian cancer occur at an annual rate of 11.9 per 100,000 womenJanuary 2020, we commenced in the United States with an estimated 22,280 cases for 2016. Although ovarian cancer represents about 1.3% of all cancers, it represents about 2.4% of all cancer deaths, or an estimated 14,180 deaths in 2015. Approximately 1.3% of women will be diagnosed with ovarian cancer at some point during their lifetime (2010 - 2012 data). The prevalence of ovarian cancer in the U.S. is about 192,000 women, and the five-year survivorship for women with ovarian cancer is 45.6%. Due to the lack of specific symptoms, the majority of ovarian cancer patients are diagnosed at later stages of the disease, with an estimated 80% of women presenting with advanced-stage (III or IV) disease. These patients have their tumors routinely surgically debulked to minimal residual disease, and then are treated with platinum- and/or taxane-based chemotherapy. While many patients respond to this treatment regimen and become clinically free-of-disease, the majority of these patients will relapse. Depending upon their level of residual disease, the risk for recurrence after completion of primary therapy is approximately 70%. Unfortunately for these women, once the disease recurs, treatment options are limited and the disease is most likely incurable. According to the NCI SEER Program, new cases of endometrial cancer occur at an annual rate of 25.1 per 100,000 women in the U.S., with an estimated 54,870 cases for 2015. Although endometrial cancer represents about 3.3% of all cancers, it represents about 1.7% of all cancer deaths, or an estimated 10,170 deaths in 2015. Approximately 2.8% of women will be diagnosed with endometrial cancer at some point during their lifetime (2010 - 2012 data). The prevalence of endometrial cancer in the U.S. is about 620,000 women.

Hematology

GALE-401 (anagrelide controlled release (CR))

GALE-401 (Anagrelide Controlled Release) contains the active ingredient anagrelide, an FDA-approved product, for the treatment of patients with myeloproliferative neoplasms (MPNs) to lower abnormally elevated platelet levels. The currently available immediate release (IR) version of anagrelide causes adverse events that are believed to be dose and plasma concentration dependent. These adverse events may limit the use of the IR version of the drug. Therefore, reducing the maximum concentration (Cmax) is hypothesized to reduce the side effects, but preserve efficacy, potentially allowing a broader use of the drug. Multiple Phase 1 studies in 98 healthy subjects have shown GALE-401 reduces the Cmax of anagrelide following oral administration, appears to be well tolerated at the doses administered, and to be capable of reducing platelet levels. The Phase 1 program provided the desired PK/PD (pharmacokinetic/pharmacodynamic) profile to enable the initiation of a Phase 2 proof-of-concept trial. The Phase 2, open label single arm, proof-of-conceptrandomized Phase 3 clinical trial, enrolled 18 patients in the United StatesREGAL study, for the treatment of thrombocytosis, or elevated platelet countsGPS monotherapy in patients with MPNs. Final safety and efficacy data from this pilot Phase 2 trial was presented in December 2015 and demonstrated a prolonged clinical benefit with a potentially improved safety profile. The follow-up portion of the Phase 2 is now complete and we plan to submit a final Phase 2 manuscript at the end of 2016. We continue to review our data and are analyzing the treatment landscape for MPNs, with a current focus on Essential Thrombocythemia (ET). We are planning to meet with the FDA later this year to discuss our Phase 2 data, our development opportunities in MPN patients, and confirm the 505(b)2 regulatory pathway for approval.

MPNs are a closely related group of hematological malignancies in which the bone marrow cells that produce the body’s blood cells develop and function abnormally. The main MPNs are ET, Polycythemia Vera (PV), Primary Myelofibrosis (PMF), and Chronic Myelogenous Leukemia (CML), all of which are associated with high platelet counts. ET is an acquired disease of the bone marrow and is associated with vascular complications including thrombosis and bleeding events. The MPNs are progressive blood cancers that can strike anyone at any age.

Alliance Partners in Therapeutic Areas

We are actively looking to leverage our technology platforms by seeking to work with pharmaceutical and biotechnology partners in a number of therapeutic areas in oncology. Our team has experience targeting products in multiple indications, and based on this experience, we believe we can expand the clinical utility of our current development candidates as well as discover more drug candidates by working with partners than we can develop with our own resources. We are seeking to work with partnersacute myeloid leukemia, or AML, in the discovery and developmentmaintenance setting after achievement of drugs insecond complete remission, or CR2, following successful completion of second-line antileukemic therapy. Patients are randomized to receive either GPS or best available treatment, or BAT. We expect this study will be used as the basis for submission of a number of therapeutic areas and technology platforms.

Intellectual Property

Patents and other intellectual property rights are crucial to our success. It is our policy to protect our intellectual property rights through available means, including filing and prosecuting patent applications in the U.S. and other countries, protecting trade secrets, and utilizing regulatory protections such as data exclusivity. We also include restrictions regarding use and disclosure of our proprietary information in our contracts with third parties, and utilize customary confidentiality agreements with our employees, consultants, clinical investigators and scientific advisors to protect our confidential information and know-how. Together with our licensors, we also rely on trade secrets to protect our combined technology especially where we do not believe patent protection is appropriateBiologics License Application, or obtainable. It is our policy to operate without infringing on, or misappropriating, the proprietary rights of others. The following chart summarizes our intellectual property rights. The patents for the products are for the U.S. and certain foreign countries:

|

|

|

| |||

Out-License Agreements

Teva Pharmaceuticals

Effective December 3, 2012, we entered into a license and supply agreement with ABIC Marketing Limited, a subsidiary of Teva Pharmaceuticals (“ABIC”). Under the agreement, we granted ABIC exclusive rights to seek marketing approval in Israel for our NeuVax product candidate for the treatment of breast cancer following its approval by the FDA or the European Medicines Agency, and to market, sell and distribute NeuVax in Israel assuming such approval is obtained. ABIC’s rights also include a right of first refusal in Israel for all future indications for which NeuVax may be approved.

Under the license and supply agreement, ABIC will assume responsibility for regulatory registration of NeuVax in Israel, provide financial support for local development, and commercialize the product in the region in exchange for making royalty payments to us based on future sales of NeuVax. ABIC also agrees in the license and supply agreement to purchase all supplies of NeuVax from us at a price determined accordingBLA, subject to a specified formula.

Dr. Reddy’s Laboratories Ltd.

Effective January 14, 2014, we entered into a strategic developmentstatistically significant and commercialization partnership with Dr. Reddy’s Laboratories Ltd. (“Dr. Reddy’s”), under which we licensed commercial rights in India to Dr. Reddy’s for NeuVax in breastclinically meaningful data outcome and gastric cancers. Under the agreement, Dr. Reddy’s will lead the Phase 2 development of NeuVax in India in gastric cancer, significantly expanding the potential patient population addressable with NeuVax.

Kwangdong Pharmaceutical Co., Ltd.

Effective April 30, 2009, we entered into a license agreement with Kwangdong Pharmaceutical Co, Ltd (Kwangdong). Under the agreement, we granted Kwangdong exclusive rights to seek marketing approval in The Republic of Korea (South Korea) for our NeuVax product candidate for the treatment of breast cancer following its approval by the FDA or the European Medicines Agency, and to market, sell and distribute NeuVax in South Korea assuming such approval is obtained.

Recent Developments (in reverse chronological order)

Discontinued NeuVax™ (nelipepimut-S) Phase 3, PRESENT Interim Analysis based on Independent Data Monitoring Committee Recommendation

On June 24, 2016, the assembled IDMC met to conduct a pre-planned safety and futility analysis of the Phase 3 PRESENT (Prevention ofRecurrence in Early-Stage, Node- Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) Trial. On June 27, 2016, the IDMC recommended that the study be stopped for futility unless it is determined that there has been a systematic reversal in the study drug treatments in the two arms, in which case the IDMC should reevaluate the clinical evidence. We have stopped the PRESENT Trial, and initiated an investigation into the causes of the recommendation.

Derivative and Securities Litigation – The U.S. District Court for the District of Oregon granted final approval of the settlements previously reported.

On December 3, 2015, we reached an agreement in principle to settle the consolidated shareholder derivative action, In reGalena Biopharma, Inc. Derivative Litigation, Civil Action No. 3:14-cv-00382-SI against us and certain of our current and former officers and directors. Following the hearing on June 23, 2016, on June 24, 2016, the U.S. District Court for the District of Oregon entered a final order and judgment in In re Galena Biopharma, Inc. Derivative Litigation, granting final approval to the settlement. On the same day, the Court also issued an opinion and order awarding attorney’s fees of $4.5 million plus costs, which will be paid by our insurance carriers. The settlement includes a payment of $15 million in cash by our insurance carriers, which we will use to fund a portion of the class action settlement, and cancellation of 1,200,000 outstanding director stock options. The settlement also requires that we adopt and implement certain corporate governance measures. The settlement does not include any admission of wrongdoing or liability on the part of us or the individual defendants and includes a full release of us and the current and former officers and directors in connection with the allegations made in the consolidated federal derivative actions and state court derivative actions.

On December 3, 2015, we also agreed in principal to resolve and settle the securities putative class action lawsuit,In re Galena Biopharma, Inc. Securities Litigation, Civil Action No. 3:14-cv-00367-SI, against us, certain of our current and former officers and directors and other defendants in the United States District Court for the District of Oregon. Following the hearing on June 23, 2016, on June 24, 2016, the U.S. District Court for the District of Oregon entered a final order and partial judgment in In re Galena Biopharma, Inc. Securities Litigation, granting final approval of the settlement. On the same day, the Court also issued an opinion and order awarding attorney’s fees of $4.5 million plus costs, which is paid out of the settlement funds. The agreement provides for a settlement payment of $20 million to the class and the dismissal of all claims against us and the other defendants in connection with the consolidated federal securities class actions. Of the $20 million settlement payment to the class, $16.7 million was paid by our insurance carriers and $2.3 million in cash was paid by us on July 1, 2016, along with $1 million in shares of our common stock (480,053 shares) paid by us on July 6, 2016. We will be responsible for defense costs and any settlements or judgments incurred for any related opt-out lawsuits.

Securities Litigation Opt Out Claims

We have resolved claims brought by shareholders and others that relate to the securities litigation mentioned above in one case for $150,000 plus $150,000 in shares (291,262) of our common stock, and in another case for $1.5 million in shares of our common stock (3,366,750 shares). The shares issued in connection with such settlements are included in the offering covered by this prospectus. The settlements do not include any admission of wrongdoing or liability on the part of us or any of the current or former directors and officers and includes a full release of us and the current and former directors and officers in connection with the allegations made. We are not aware of any other claims made by shareholders who have opted out of the securities litigation.

Presented GALE-401 Combined Safety Data

On June 13, 2016 we presented combined safety data from our GALE-401 clinical trials at the European Hematology Association 21stCongress. A total of six trials have been run with GALE-401, five Phase 1 trials in healthy volunteers (N=98), and one Phase 2 single arm, open label pilot study in MPN patients (N=18). The poster, entitled, “Anagrelide Controlled Release (GALE-401) Safety Profile Consistently Well Tolerated in Myeloproliferative Neoplasms Patients and Healthy Volunteers” was designed to characterize the safety profile of GALE-401 in all subjects treated to date. The results demonstrated that GALE-401 is well tolerated in MPN patients as well as in healthy volunteers and we observed predominantly mild to moderate toxicities that did not reveal any unexpected AEs.

Received Two Orphan Drug Designations for GALE-301 and GALE-301/GALE-302

On June 10, 2016, we announced that the U.S. Food and Drug Administration, or the FDA. The primary endpoint of the REGAL study is overall survival, or OS. We planned to enroll approximately 125 to 140 patients at approximately 95 clinical sites in North America, Europe and Asia with a planned interim safety, efficacy and futility analysis after 60 events (deaths). In March 2024, we announced the completion of enrollment. Under our current assumptions with respect to enrollment and the estimated survival times for both the treated and control groups in the study, we believe, after discussions with our external statisticians and experts, that the planned interim analysis after 60 events (deaths) per the protocol will occur in the first half of 2024 and the final analysis after 80 events will occur by the end of 2024. Because these analyses are event driven, they are difficult to predict with any certainty and may occur at a different time than currently expected.

In December 2020, we entered into an exclusive license agreement with 3D Medicines Inc., or 3D Medicines, a China-based biopharmaceutical company developing next-generation immuno-oncology drugs, for the development and commercialization of GPS, as well as the Company’s next generation heptavalent immunotherapeutic GPS+, which is at preclinical stage, across all therapeutic and diagnostic uses in mainland China, Hong Kong, Macau and Taiwan, which we refer to as Greater China. We have retained sole rights to GPS and GPS+ outside of Greater China. In November 2022, we announced that we had agreed with 3D Medicines for 3D Medicines to participate in the REGAL study through the inclusion of approximately 20 patients from mainland China. Although the REGAL study has completed enrollment as announced in March 2024, in accordance with the predetermined statistical analysis plan, 3D Medicines may still enroll patients in mainland China. The timing of such participation and patient enrollment by 3D Medicines, if at all, cannot be predicted with certainty. In December 2023, we announced that we had commenced a binding arbitration proceeding against 3D Medicines to resolve a dispute regarding, among other things, the trigger and payment of relevant milestone payments due to us under the 3D Medicines Agreement. As of March 15, 2024, we have received an aggregate of $10.5 million in upfront and milestone payments under our license agreement with 3D Medicines, or the 3D Medicines Agreement, and a total of $191.5 million in potential future development, regulatory and sales milestones, not including future royalties, remains under the license agreement, which milestones are variable in nature and not under our control.

| 2 |

In December 2018, pursuant to a Clinical Trial Collaboration and Supply Agreement, we initiated a Phase 1/2 multi-arm "basket" type clinical study of GPS in combination with Merck & Co., Inc.’s anti-PD-1 therapy, pembrolizumab (Keytruda®). In 2020, we, together with Merck, determined to focus on ovarian cancer (second or third line). In November 2022, we reported topline clinical and initial immune response data from this study, which showed that treatment with the combination of GPS and pembrolizumab compared favorably to treatment with anti-PD-1 therapy alone in a similar patient population. In November 2023, additional immunobiological and clinical data from the study was presented at the International Gynecologic Cancer Society 2023 Annual Global Meeting which showed a correlation between immune response and progression free survival, or PFS.

In February 2020, a Phase 1 open-label investigator-sponsored clinical trial of GPS, in combination with Bristol-Myers Squibb’s anti-PD-1 therapy, nivolumab (Opdivo®), in patients with malignant pleural mesothelioma, or MPM, who harbor relapsed or refractory disease after having received frontline standard of care multimodality therapy was commenced at MSK. Enrollment of a target total of 10 evaluable patients was completed at the end of 2022. We reported positive topline safety and efficacy data from this study in June 2023 and positive follow-up immune response and survival data in December 2023.

GPS was granted Orphan Drug Designations, or ODD, from the FDA, granted two orphan-drugas well as orphan medicines designations from the European Medicines Agency, or EMA, for GPS in AML, MPM, and multiple myeloma, or MM, as well as Fast Track designations for Galena’s two cancer immunotherapy peptides derivedAML, MPM, and MM from Folate Binding Protein (FBP)the FDA.

SLS009

On March 31, 2022, we entered into an exclusive license agreement, or the GenFleet Agreement, with GenFleet Therapeutics (Shanghai), Inc., or GenFleet, a clinical-stage biotechnology company developing cutting-edge therapeutics in oncology and immunology, that grants rights to us for the treatment (including preventiondevelopment and commercialization of recurrence)SLS009, a highly selective small molecule CDK9 inhibitor, across all therapeutic and diagnostic uses worldwide, except for Greater China.

CDK9 activity has been shown to correlate negatively with OS in a number of ovarian cancer: onecancer types, including hematologic cancers, such as AML and lymphomas, as well as solid cancers, such as osteosarcoma, pediatric soft tissue sarcomas, melanoma, endometrial, lung, prostate, breast and ovarian. As demonstrated in preclinical and clinical data, to date, SLS009’s high selectivity has the potential to reduce toxicity as compared to older CDK9 inhibitors and other next-generation CDK9 inhibitors currently in clinical development and to potentially be more efficacious.

We completed a Phase 1 dose-escalating clinical trial in the United States and China for GALE-301 (E39),SLS009 in mid-2023 and onereported positive safety and efficacy data for GALE-301 (E39)both patient cohorts, that is relapsed and/or refractory AML and GALE-302 (E39’).refractory lymphoma. We also established in the trial a recommended Phase 2 dose, or RP2D, of 60 mg for AML and 100 mg for lymphomas.

Presented GALE-301

In the second quarter of 2023, we commenced an open label, single arm, multi-center Phase 1/2a Primary Analysis

On June 6, 2016, we presented the primary analysis from the Company’s GALE-301 Phase 1/2a clinical trial of SLS009 in combination with venetoclax and azacitidine, or aza/ven, in AML patients who failed or did not respond to treatment with venetoclax-based therapies. The Phase 2a trial is evaluating safety, tolerability and efficacy at two dose levels, 45 mg once weekly, and 60 mg once weekly or 30 mg twice a week.

In the American Societyfourth quarter of Clinical Oncology Annual Meeting 2016. The poster, entitled, “The primary analysis2023, we announced the dosing of the first patient in a phase I/IIa dose findingPhase 1b/2 open-label, single arm trial in relapsed/refractory, or r/r, peripheral T-cell lymphoma, or PTCL, which will enroll up to 95 patients to evaluate safety and efficacy and, based on results, may serve as a registrational study. This study is fully funded by GenFleet and is being conducted in China.

In March 2024, we announced positive topline data from the Phase 2a clinical trial of SLS009 in combination with aza/ven in r/r/ AML. A total of 21 patients were enrolled in the study as of March 15, 2024: 10 in the 45 mg safety cohort and 11 in the 60 mg cohort (30 mg twice a folate binding protein vaccine, E39 + GM-CSFweek or 60 mg once a week). Response rates observed in ovarianthe three cohorts were 10% in the 45 mg once a week safety dose cohort (dose level below the RP2D), 20% in the 60 mg once a week dose cohort, and endometrial cancer50% in the 30 mg twice a week dose cohort. Additionally, we observed strong anti-leukemic activity, which is defined as 50% or more bone marrow blast reduction in 67% of patients to prevent recurrence,” demonstrated thatacross all dose levels. Median OS has not been reached in any of the vaccine is well toleratedcohorts and immunogenic. Inthe first patient enrolled in the study who achieved a CR continues on the study and remains leukemia-free 9 months after enrollment. During the trial, we identified potential biomarkers currently undergoing testing as predictive markers in the most recent portion of the study. Patients with the identified biomarkers exhibited significantly higher response rates: 100% response rate at the optimal dose group,level (30 mg twice a week) and 57% response rate across all dose levels. Furthermore, we have clarified the results demonstrate potential clinical benefitproposed biological basis and mechanism of action for GALE-301SLS009 activity in patients with these biomarkers. The relevant biomarkers are present in multiple hematologic and solid cancer indications, with a substantial proportion of patients exhibiting them in additional indications, ranging up to prevent recurrence~50% of patients in these patients,some indications.

SLS009 was granted ODD for AML and that boosters may sustain this effect.PTCL and Fast Track designations for r/r AML and r/r PTCL by the FDA.

| 3 |

Recent Developments

Received Fast Track Designation for NeuVax™ (nelipepimut-S) PRESENT Clinical TrialJanuary 2024 Registered Direct Offering

On June 1, 2016,January 4, 2024, we announced thatentered into Securities Purchase Agreements with certain investors (the “January Investors”), pursuant to which we agreed to issue and sell, in a registered direct offering by the FDA has designated NeuVax™ (nelipepimut-S)Company directly to the January Investors (the “January Registered Offering”), combined GM-CSF, as a Fast Track development program for the treatment(i) an aggregate of patients with early stage, node positive breast cancer with low to intermediate HER2 expression, otherwise known as HER2 1+ or 2+, following standard of care.

Recent Operating Results and Financial Condition

We had cash and cash equivalents of approximately $19.6 million as of June 30, 2016. In addition, we had approximately $24 million of restricted cash that is reserved for a lender who has the option to redeem all, or part, of such amount within 30 days of our public announcement on June 29, 2016, of the discontinuation of the Phase 3 PRESENT Trial upon the IDMC’s recommendation dated June 27, 2016. As of the date of this prospectus, the lender has not redeemed the approximately $24 million in full or in part.

We had no revenue for the quarter ending June 30, 2016, and our cash burn from operations for the quarter ending June 30, 2016 was approximately $13 million. In addition, we paid off our loan with Oxford Finance LLC for a total of $3.1 million. The Company has stopped the PRESENT Trial and is running an investigation that is estimated to cost between $250,000 and $500,000 over the next three months. Depending on the outcome of the investigation, the estimated cost to close out the PRESENT Trial will be between $4 million to $7 million. On July 1, 2016, we paid $2.3 million for the securities class action settlement. We believe that our existing cash and cash equivalents together with the net proceeds of $11.7 million we received on July 13, 2016 from selling 28,000,00010,130,000 shares of common stock and 14,000,000(ii) an aggregate of 1,870,000 pre-funded warrants exercisable for shares of common stock (the “January Pre-Funded Warrants”), together with warrants (the “July Financing”“January Common Warrants”) should be sufficient to fund our operations for at least six months. This projection is based on our current planned operations, stopping the PRESENT Trial and investigationpurchase up to 12,000,000 shares of the causes of the failure of such clinical trial, anticipated payments for defense costs for the cooperation and discussions with the staff in the SEC investigation and other governmental investigations, and is subject to changes in our plans and uncertainties inherent in our business. We will need to seek to replenish our existing cash and cash equivalents priorcommon stock, to the endJanuary Investors. Each share of 2016. We also have funding available under our purchase agreement with Lincoln Park Capital Fund, LLCcommon stock and sales agreements with MLV & Co.accompanying January Common Warrant was sold at a combined offering price of $0.75, and Maxim Group LLC described ineach January Pre-Funded Warrant and accompanying January Common Warrant was sold at a combined offering price of $0.7499. Each January Common Warrant has an exercise price of $0.75 and was exercisable immediately on the previously filed prospectuses, but there is no guarantee that such fundingissuance date and will be availableexpire five years from the issuance date. The aggregate gross proceeds to us on favorable terms or will be sufficient to meet all of our future funding needs. Additionally, in connection with the July Financing, we have agreed not to issue any shares of our common stock (including under our purchase agreement with Lincoln Park Capital Fund, LLC and under our sales agreements with MLV & Co. and Maxim Group LLC) for a period of 75 days from the date ofJanuary Registered Offering were approximately $9.0 million before deducting the closing of the July Financing. At our annual meeting of stockholders adjourned on July 15, 2016, our stockholders approved an increase in our authorized common stock from 275,000,000 to 350,000,000. We are not able to predict whether these additional shares will be sufficient based upon our current stock price to meet the Company’s ongoing financing requirements to maintain the Company’s operations.

If we fail to obtain additional future funding when needed, we could be forced to scale back or terminate our operations, or to seek to merge with or to be acquired by another company. We may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our common stock holders losing their entire investment. There is no guaranty that we will become profitable or secure additional financing.

Senior Secured DebenturesMarch 2024 Registered Direct Offering and Concurrent Private Placement

On May 10, 2016,March 15, 2024, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with JGB (Cayman) Newton Ltd.institutional investors (the “Investors”), or JGB, pursuant to which we sold, atagreed to issue and sell, in a 6.375% original issue discount, a total of $25,530,000 Senior Secured Debentures, orregistered direct offering by the Debentures, and warrants to purchase up to 2.0 million shares of our common stock. Net proceeds to us from sale of the Debentures, after payment of commissions and legal fees, were approximately $23,400,000. The Debentures mature November 10, 2018, and accrue interest at 9% per year and contain no conversion features to shares of our common stock.

The Debentures carry an interest only period of six months following which the holder shall have the rights, at its option, to require us to redeem up to $1,100,000 of the outstanding principal amount of these Debentures. Interest is payable at the end of each month based on the outstanding principal. We are required to promptly, but in any event no more than three trading days after the holder delivers a redemption notice to us, to pay the applicable redemption amount in cash or, at our election and subject to certain conditions, in shares of our common stock. If we elect to pay the redemption amount in shares of our common stock, then the shares will be delivered at the lesser of A) 7.5% discountCompany directly to the averageInvestors (the “Registered Offering”), (i) an aggregate of the 3 lowest volume weighted average prices over the prior 20 trading days or B) a 7.5% discount to the prior trading day’s volume weighted average price. We may only opt for payment in11,000,000 shares of common stock if certain equity conditions are met.

As noted above, because the interim analysisand (ii) an aggregate of the PRESENT Trial resulted in a discontinuation2,029,316 pre-funded warrants exercisable for shares of the study, JGB has the right to require us to prepay in cash all, or any portion, of the outstanding principal amount of this Debenture funded in cash by JGB on the closing date, plus all accrued and unpaid interest. If JGB elects such prepayment of the Debentures, then the number of shares subjectcommon stock (the “Pre-Funded Warrants”) to the warrants issuedInvestors. Each share of common stock was sold at an offering price of $1.535, and each Pre-Funded Warrant was sold at an offering price of $1.5349. In a concurrent private placement (the “Private Placement” and together with the Registered Offering, the “Offerings”), we agreed to issue to the holder will be reduced in proportionInvestors warrants exercisable for up to the percentagean aggregate of principal required and accrued interest to be prepaid by us. In addition to the Debenture, JGB received a Series A warrant to purchase 1 million13,029,316 shares upon the closing on the sale of the Debenturescommon stock (the “Common Warrants”) at an exercise price of $1.51. The Series A warrant is$1.41 per share. Each Common Warrant was exercisable beginning November 10, 2016immediately on the issuance date and for a period ofwill expire five years thereafter. Additionally,and six months from the issuance date. The aggregate gross proceeds to us from the Offerings were approximately $20.0 million before deducting the placement agent’s fees and related offering expenses.

Smaller reporting company

We are a “smaller reporting company” as defined in accordance with the termsSecurities Exchange Act of 1934, as amended, or the Exchange Act. We may take advantage of certain of the Securities Purchase Agreement, we issuedscaled disclosures available to JGB a Series B warrantsmaller reporting companies and will be able to purchase 1take advantage of these scaled disclosures for so long as our voting and non-voting Common Stock held by non-affiliates is less than $250.0 million shares uponmeasured on the last business day of our announcementsecond fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and non-voting Common Stock held by non-affiliates is less than $700.0 million measured on June 29, 2016,the last business day of the interim analysis conducted by the Independent Data Monitoring Committee of the PRESENT Trial at an exercise price of $0.43. The Series B warrant is exercisable beginning November 10, 2016 and for a period of five years thereafter.our second fiscal quarter.

Risks Associated with Our Business

Our obligations under the Debentures can be acceleratedbusiness and our ability to implement our business strategy are subject to numerous risks, as more fully described in the event we undergo a changesection entitled “Risk Factors” in controlthis prospectus and other customary events of default. In the event of default and acceleration of our obligations, we would be required to pay an amount equal to 103.5% of all amounts of principal and interest then outstanding under the Debentures in cash. Our obligations under the Debentures are secured under a Security Agreement by a senior lien on all of our assets, including all of our interests in our consolidated subsidiaries.most recent Annual Report on Form 10-K incorporated herein by reference. You should read these risks before you invest in our securities. We must also have maintained a minimum of $24.0 million in cash through the date of the public announcement of the interim analysis of the PRESENT Trial. If the trial had not been discontinued as a result of the interim analysis then the minimum cash requirement would have been reducedmay be unable, for many reasons, including those that are beyond our control, to $12.0 million.implement our business strategy.

Armentum Partners, LLC, or Armentum, acted as the placement agent in the offering of the Debentures and we agreed to pay Armentum a fee equal to 2% of the funds received from the sale of the Debentures. We paid half of the placement fee upon funding with the remaining payable unless we prepay the loan, or any portion, of all outstanding principal amounts of the Debentures if the PRESENT trial is discontinued for certain specified reasons.

Corporate Information

We were incorporated on April 3, 2006 in Delaware as Argonaut Pharmaceuticals, Inc. On November 28, 2006, we changed our name to RXi Pharmaceuticals Corporation and began operations January 2007. On September 26, 2011, we changed our name to Galena Biopharma, Inc. In December 2017, we completed a business combination with SELLAS Life Sciences Group, Ltd., and changed our name to “SELLAS Life Sciences Group, Inc.”

Our principal executive offices are located at 2000 Crow Canyon Place,7 Times Square, Suite 380, San Ramon, California 94583,2503, New York, NY 10036, and our phone number is (855) 855-4253.(646) 200-5278. Our website address is www.galenabiopharma.com. We dowww.sellaslifesciences.com. The information contained on, or that can be accessed through, our website is not incorporate the information on our websitepart of, and is not incorporated by reference into, this prospectus and you should not consider such informationbe considered to be part of this prospectus.

We were incorporated as Argonaut Pharmaceuticals, Inc. in Delaware on April 3, 2006 and changed our name to RXi Pharmaceuticals Corporation on November 28, 2006. On September 26, 2011, we changed our company name from RXi Pharmaceuticals Corporation to Galena Biopharma, Inc.

| 4 |

| Shares of Common | ||

| Common Stock to be Outstanding Immediately after this Offering, Assuming Cash Exercise of the Warrants | 69,296,986 shares of Common Stock. | |

| Use of | We will not receive | |

| Nasdaq Capital Market | SLS | |

| Risk | Investing in our | |

The number of shares of common stockour Common Stock shown above to beissued and outstanding after this offeringin the table above is based on 181,837,11756,267,670 shares of our Common Stock outstanding as of March 31, 201625, 2024 and excludes as of such date:excludes:

| · | 2,267,670 shares of Common Stock issuable upon exercise of outstanding options; |

| · | 766,641 shares of Common Stock issuable upon vesting of outstanding restricted stock units; and |

| · | warrants outstanding for the purchase of an aggregate of 41,801,843 shares of Common Stock. |

Throughout this prospectus, when we refer to the shares of our common stock subjectCommon Stock being registered on behalf of the selling stockholders for offer and sale, we are referring to outstanding options having a weighted-average exercise price of $2.59 per share;

The number of shares of common stock issuable upon the exercise of our outstanding warrants and the exercise prices thereof are subject to adjustment in certain circumstances.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the other documents we have filed with the SEC that are incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties,selling stockholders, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. All statements other than statementsthe shares of historical fact are statements that could be deemed forward-looking statements, including any projections of financing needs, revenue, expenses, earnings or losses from operations, or other financial items, any statementsCommon Stock issuable upon exercise of the plans, strategiesWarrants, each as described under “The Offering” and objectives of management for future operations, any statements concerning product research, development and commercialization plans and timelines, any statements regarding safety and efficacy of product candidates, any statements of expectation or belief and any statements of assumptions underlying any of“Selling Stockholders.” When we refer to the foregoing. In addition, forward-looking statements may containselling stockholders in this prospectus, we are referring to the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “project,” “will be,” “will continue,” “will result,” “seek,” “could,” “may,” “might,” or any variations of such words or other words with similar meanings. All forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements and risk factors set forth under “Risk Factors” and elsewhereselling stockholders identified in this prospectus and, set forthas applicable, their donees, pledgees, transferees or other successors-in-interest selling shares of Common Stock or interests in our Form 10-K forshares of Common Stock received after the year ended December 31, 2015 and subsequent Quarterly Reports on Form 10-Q filed with the SEC. See “Where You Can Find More Information” and “Incorporationdate of Certain Documents by Reference” in this prospectus for information on how to access or obtain our reports filed with the SEC.

Given their inherent uncertainty, you should not place undue reliance on these forward-looking statements. You should read this prospectus and the documents that we reference in this prospectus with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this prospectus, whethera selling stockholder as a result of new information, future eventsgift, pledge, partnership distribution or otherwise.other transfer.

| 5 |

Investing in our securities involves significant risks. Before making an investment decision,a high degree of risk. You should carefully consider and evaluate all of the information contained in this prospectus and in the documents we incorporate by reference into this prospectus before you decide to purchase our securities. In particular, you should carefully consider and evaluate the risks and uncertainties described below, together withunder the information underheading “Risk Factors” in our most recent Annual Report on Form 10-K10-K. Each of the risks described in these sections and subsequent Quarterly Reports on Form 10-Qdocuments could materially and the other information incorporated by reference in this prospectus. Some of these factors relate principally to our business and the industry in which we operate. Other factors relate principally to your investment in our common stock. If any of these risks were to occur,adversely affect our business, financial condition, results of operations cash flowsand prospects, and could result in a partial or prospects could be materially and adversely affected. In such case, you may lose all or partcomplete loss of your investment.

| 6 |

On March 15, 2024, we entered into the Purchase Agreement with the Investors, pursuant to which we issued and sold, in a registered direct offering directly to the Investors (the “Registered Offering”), (i) an aggregate of 11,000,000 shares of our common stock at an offering price of $1.535 per share and (ii) an aggregate of 2,029,316 pre-funded warrants exercisable for shares of common stock (the “Pre-Funded Warrants”) at an offering price of $1.5349 per Pre-Funded Warrant, for net proceeds of approximately $18.4 million after deducting the placement agent’s fee and estimated offering expenses payable by us.

In a concurrent private placement (the “Private Placement” and together with the Registered Offering, the “Offerings”), we agreed to issue to the Investors who participated in the Registered Offering Warrants exercisable for an aggregate of 13,029,316 shares of Common Stock at an exercise price of $1.41 per share. Each Warrant was exercisable immediately on the issuance date and will expire five years and six months from the issuance date.

In connection with the Offerings, we entered into a placement agency agreement (the “Placement Agent Agreement”) with A.G.P./Alliance Global Partners (the “Placement Agent”), pursuant to which the Placement Agent acted as the exclusive placement agent in connection with the Offerings. Pursuant to the Placement Agent Agreement, we agreed to pay the Placement Agent a fee equal to 7.0% of the aggregate gross proceeds from the Offerings.

Pursuant to the terms of the Purchase Agreement, we agreed to use commercially reasonable efforts to cause a registration statement providing for the resale by holders of shares of our Common Stock issuable upon the exercise of the Warrants, to become effective 30 days (or, in the event of a “full review” by the SEC, within 60 days) following the closing of the Offerings and to keep such registration statement effective at all times.

The foregoing descriptions of the form of Purchase Agreement, the Placement Agent Agreement and the form of Warrant are not complete and are subject to and qualified in their entirety by reference to the form of Purchase Agreement, the form of Placement Agent Agreement and the form of Warrant, respectively, copies of which are attached as Exhibits 1.1, 4.2 and 10.1, respectively, to the Current Report on Form 8-K dated March 15, 2024, and are incorporated herein by reference.

| 7 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, the applicable prospectus supplement, and the documented incorporated by reference, including statements regarding our future financial condition, business strategy and plans, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “positioned,” “potential,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks described below andin the section titled “Risk Factors” contained in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q are notand incorporated by reference in this prospectus, as the only ones facing us. Additionalsame may be amended, supplemented or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus, regarding, among other things:

| · | our future financial and business performance; |

| · | strategic plans for our business and product candidates; |

| · | our ability to develop or commercialize products; |

| · | the expected results and timing of clinical trials and nonclinical studies; |

| · | our ability to comply with the terms of our license agreements; |

| · | developments and projections relating to our competitors and industry; |

| · | our expectations regarding our ability to obtain, develop and maintain intellectual property protection and not infringe on the rights of others; |

| · | our ability to retain and attract highly-skilled executive officers and employees; |

| · | our future capital requirements and the timing of those requirements and sources and uses of cash; |

| · | our ability to obtain funding for our operations; |

| · | changes in applicable laws or regulations; |

| · | risks associated with preclinical or clinical development and trials; |

| · | changes in the assumptions underlying our expectations regarding our future business or business model; |

| · | our ability to develop, manufacture and commercialize product candidates; |

| · | general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; |

| · | changes in applicable laws or regulations; |

| 8 |

| · | the impact of natural disasters, including climate change, and the impact of health epidemics, on our business; |

| · | the size and growth potential of the markets for our products, and our ability to serve those markets; |

| · | market acceptance of our planned products; |

| · | our ability to raise capital; |

| · | the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and |

| · | other risks and uncertainties set forth herein in the section entitled “Risk Factors.” |

These risks are not presently known to usexhaustive. Other sections of this prospectus, the applicable prospectus supplement, or the documents incorporated herein by reference may include additional factors that we currently deem immaterial may also materially and adversely affectcould harm our business and operations.

Risks Relatingfinancial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to Our Former Commercial Operations

We are subject to U.S. federaltime, and state health care fraud and abuse and false claims laws and regulations, and we recently have been subpoenaed in connection with marketing and promotional practices related to Abstral. Prosecutions under such laws have increased in recent years and we may become subject to such prosecutions or related litigation under these laws. If we haveit is not fully complied with such laws, we could face substantial penalties.

Our former commercial operations are subject to various U.S. federal and state fraud and abuse laws, including, without limitation, the federal False Claims Act, federal Anti-Kickback Statute, and the federal Sunshine Act.

A federal investigation of two of the high-prescribing physicianspossible for Abstral has resulted in the criminal prosecution of the two physicians for alleged violations of the federal False Claims Act and other federal statutes. The criminal trial is set for October 2016. We have received a trial subpoena for documents in connection with that investigation and we have been in contact with the U.S. Attorney’s Office for the Southern District of Alabama, which is handling the criminal trial, and are cooperating in the production of documents. On April 28, 2016, a second superseding indictment was filed in the criminal case, which added additional information about the defendant physicians and provided information regarding the facts and circumstances involving a rebate agreement between the Company and the defendant physicians’ pharmacy as well as their ownership of our stock. Certain former employees have received trial subpoenas to appear at the trial and provide oral testimony. We have agreed to reimburse those former employees’ attorney’s fees. To our knowledge, we are not a target or subject of that investigation.