As filed with the Securities and Exchange Commission on May 1, 2017August 7, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Aeglea BioTherapeutics, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 46-4312787 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

901 S. MoPac Expressway221 Crescent Street

Barton Oaks Plaza OneBuilding 17, Suite 102B

Suite 250Waltham, MA 02453

Austin, TX 78746

(512) 942-2935

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David G. Lowe, Ph.D.Jonathan D. Alspaugh

President and Chief ExecutiveFinancial Officer

Aeglea BioTherapeutics, Inc.

901 S. MoPac Expressway221 Crescent Street

Barton Oaks Plaza OneBuilding 17, Suite 102B

Suite 250Waltham, MA 02453

Austin, TX 78746

(512) 942-2935

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Ryan A. Murr

| | |

Robert A. Freedman, Esq.

Branden C. Berns Gibson, Dunn & Crutcher LLP 555 Mission Street, Suite 3000 San Francisco, California 94105 (415) 393-8373 Effie Toshav, Esq.

Fenwick & West LLP

801 California Street

Mountain View, California 94041

(650) 988-8500

| | Charles N. York II

Chief Financial Officer

Aeglea BioTherapeutics, Inc.

901 S. MoPac Expressway

Barton Oaks Plaza One

Suite 250

Austin, TX 78746

(512) 942-2935

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering: ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.box: ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I. D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.box: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

| Large accelerated filer | | ☐ | | | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☒ | | (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐☒ |

| | | |

| | | | Emerging growth company | | ☒ | | | | | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒☐

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to be Registered (1) | | Amount to be

Registered (1)(2) | | Proposed Maximum

Offering Price Per Security (3) | | Proposed Maximum

Aggregate Offering Price (3) | | Amount of

Registration Fee (4) |

Common stock, $0.0001 par value per share | | | | | | | | |

Preferred stock, $0.0001 par value per share | | | | | | | | |

Debt securities | | | | | | | | |

Warrants | | | | | | | | |

Subscription rights | | | | | | | | |

Units | | | | | | | | |

Total | | | | | | $150,000,000 | | $17,385 |

|

|

(1) | There is being registered hereunder an indeterminate number of shares of (a) common stock, (b) preferred stock, (c) debt securities, (d) warrants to purchase common stock, preferred stock or debt securities of the Registrant, (e) subscription rights to purchase common stock, preferred stock or debt securities of the Registrant, and (f) units, consisting of some or all of these securities in any combination, as may be sold from time to time by the Registrant. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. There are also being registered hereunder an indeterminate number of shares of common stock, preferred stock and debt securities as shall be issuable upon conversion, exchange or exercise of any securities that provide for such issuance. In no event will the aggregate offering price of all types of securities issued by the Registrant pursuant to this registration statement exceed $150,000,000. |

(2) | Pursuant to Rule 416(a), this registration statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction. |

(3) | The proposed maximum offering price per share and proposed maximum aggregate offering price for each type of security will be determined from time to time by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder. |

(4) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment whichthat specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until thethis registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two prospectuses:

a base prospectus, which covers the offering, issuance and sale by us of up to a maximum aggregate offering price of $150,000,000 of our common stock, preferred stock, debt securities, warrants to purchase our common stock, preferred stock or debt securities, subscription rights to purchase our common stock, preferred stock or debt securities and/or units consisting of some or all of these securities; and

| • | | a sales agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of $20,000,000 of our common stock that may be issued and sold under a Capital on DemandTM Sales Agreement dated May 1, 2017 with JonesTrading Institutional Services LLC. |

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The sales agreement prospectus immediately follows the base prospectus. The $20,000,000 of common stock that may be offered, issued and sold under the sales agreement prospectus is included in the $150,000,000 of securities that may be offered, issued and sold by us under the base prospectus.

The information in this prospectus is not complete and may be changed. WeThe selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any statejurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 1, 2017AUGUST 7, 2023

PROSPECTUS

$150,000,000

Aeglea BioTherapeutics, Inc.

1,099,284,385 Shares

Common Stock Preferred Stock,

Debt Securities, Warrants, Subscription Rights and UnitsOffered by the Selling Stockholders

From timeThis prospectus relates to time, we may offerthe proposed resale or other disposition by the selling stockholders identified herein (the “Selling Stockholders”), of up to $150,000,000 aggregate dollar amount of(i) 12,945,385 shares (“Merger Common Shares”) of our common stock, par value $0.0001 per share (“Common Stock”), (ii) 364,887,000 shares of Common Stock (“Merger Conversion Shares”), issuable upon the conversion of 364,887 shares (“Merger Preferred Shares”) of our Series A Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”), and (iii) 721,452,000 shares of Common Stock (“Private Placement Conversion Shares”), issuable upon the conversion of 721,452 shares (“Private Placement Preferred Shares”) of our Series A Preferred Stock. Subject to receiving the requisite stockholder approval and certain beneficial ownership limitations set by each preferred stockholder, each share of Series A Preferred Stock will automatically convert into an aggregate of approximately 1,000 shares of our Common Stock. The shares of Common Stock registered by this prospectus are referred to herein as the “Resale Shares.”

The Merger Common Shares and Merger Preferred Shares were issued and sold to former stockholders of Spyre Therapeutics, Inc., a Delaware corporation (“Spyre”), in connection with the acquisition (the “Asset Acquisition”) of Spyre, which closed on June 22, 2023. The Private Placement Preferred Shares were issued and sold to accredited investors in a private placement (the “PIPE” and, together with the Asset Acquisition, the “Transactions”), which closed on June 26, 2023. We are not selling any Resale Shares under this prospectus and will not receive any of the proceeds from the sale or preferred stock, debtother disposition of Resale Shares by the Selling Stockholders.

The Selling Stockholders may sell the Resale Shares on any national securities warrants to purchase our common stock, preferred stockexchange or debtquotation service on which the securities subscription rights to purchase our common stock, preferred stockmay be listed or debt securities and/or units consistingquoted at the time of some or all of these securities, in any combination, together or separately,sale, on the over-the-counter market, in one or more offerings, in amounts,transactions otherwise than on these exchanges or systems, such as privately negotiated transactions, or using a combination of these methods, and at fixed prices, and on the terms that we will determineat prevailing market prices at the time of the offering and which will be set forth in a prospectus supplement and any related free writing prospectus. The prospectus supplement and any related free writing prospectus may also add, updatesale, at varying prices determined at the time of sale, or change information containedat negotiated prices. See the disclosure under the heading “Plan of Distribution” elsewhere in this prospectus. prospectus for more information about how the Selling Stockholders may sell or otherwise dispose of their Resale Shares hereunder.

The totalSelling Stockholders may sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the Selling Stockholders may sell their Resale Shares hereunder following the effective date of these securities will have an initial aggregate offering pricethe registration statement of up to $150,000,000.which this prospectus forms a part.

You should carefully read this prospectus, the information incorporated, or deemed to be incorporated, by reference in this prospectus and any applicable prospectus supplement, and related free writing prospectus carefullyas well as any documents incorporated by reference herein or therein, before you invest.invest in any of the securities being offered.

Our common stockCommon Stock is traded on The NASDAQ GlobalNasdaq Capital Market under the symbol “AGLE.” On April 28, 2017August 4, 2023, the last reported sales price for our common stockCommon Stock was $7.15$0.48 per share. None of the other securities we may offer are currently traded on any securities exchange. The applicable prospectus supplement and any related free writing prospectus will contain information, where applicable, as to any other listing on The NASDAQ Global Market or any securities market or exchange of the securities covered by the prospectus supplement and any related free writing prospectus.

An investment in our securities involves a high degree of risk. You should carefully consider the information under the heading “Risk Factors” beginning on page 635 of this prospectus before investing in our securities.

Common stock, preferred stock, debt securities, warrants, subscription rights and/or units may be sold by us to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus. If any underwriters, dealers or agents are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters or agents and any applicable fees, discounts or commissions, details regarding over-allotment options, if any,prospectus supplement, and under similar headings in the net proceeds to us will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange CommissionSEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 20172023

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3that we filed with the Securities and Exchange Commission, or the SEC using a “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to time, we may sell any combination of the securities described in this prospectus in one or more offerings, up to a total dollar amount of $150,000,000. We have provided to you in thisofferings.

This prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration process, we will provide a prospectus supplementcontains and incorporates by reference information that will contain specific information about the terms of the offering. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely onconsider when making your investment decision. Neither we, nor the information in the prospectus supplement;provided that, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement. You should read both this prospectus and any prospectus supplement together with additional information described under the next heading “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference into this prospectus or any applicable prospectus supplement. No dealer, salesperson or any other person isSelling Stockholders, have authorized anyone to give any information or to make any representation other than the information and representationsthose contained in or incorporated by reference intoin this prospectus or any applicable prospectus supplement. Ifprospectus. The Selling Stockholders are offering to sell, and seeking offers to buy, our securities only in jurisdictions where it is lawful to do so. We have not authorized anyone to provide you with different information is given or different representations are made, you may not rely on that information or those representations as having been authorized by us. You may not imply from the delivery of this prospectus and any applicable prospectus supplement, nor from a sale made under this prospectus and any applicable prospectus supplement, that our affairs are unchanged since the date of this prospectus and any applicable prospectus supplement or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus and any applicable prospectus supplement or any sale of a security.information. This prospectus and any applicableaccompanying prospectus supplement may only be used where it is legaldo not constitute an offer to sell or the securities.

THIS PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY AN ADDITIONAL PROSPECTUS OR A PROSPECTUS SUPPLEMENT.solicitation of an offer to buy any securities other than the securities described in any accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

In this prospectus, unless the context otherwise requires, the terms “Aeglea,” the “Company,” “we,” “us,” and “our” refer to Aeglea BioTherapeutics, Inc., a Delaware corporation, and its consolidated subsidiaries.

This prospectus contains trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols.

All references to “our product candidates,” “our programs” and “our pipeline” in this prospectus refer to the research programs with respect to which we have exercised the option to acquire intellectual property license rights to or have the option to acquire intellectual property license rights to pursuant to that certain antibody discovery and option agreement by and among Spyre, Paragon Therapeutics, Inc. (“Paragon”) and Parapyre Holding LLC (“Parapyre”) dated May 25, 2023 (the “Spyre Option Agreement”).

1

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements involve a number of risks and uncertainties. We caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. These statements are based on current expectations of future events.

All statements, other than statements of historical facts contained in this prospectus, including, without limitation, statements regarding: stockholder approval of the conversion rights of the Series A Preferred Stock; any future payouts under the CVR (as defined herein); our ability to achieve the expected benefits or opportunities and related timing with respect to our acquisition of Spyre or to monetize any of our legacy assets, our future results of operations and financial position, business strategy, the length of time that we believe our existing cash resources will fund our operations, our market size, our potential growth opportunities, our preclinical and future clinical development activities, the efficacy and safety profile of our product candidates, the potential therapeutic benefits and economic value of our product candidates, the timing and results of preclinical studies and clinical trials, the expected impact of macroeconomic conditions, including inflation, increasing interest rates and volatile market conditions, current or potential bank failures, as well as global events, including the ongoing military conflict in Ukraine and geopolitical tensions in China on our operations, and the receipt and timing of potential regulatory designations, approvals and commercialization of product candidates. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements generally relate to future events or our future financial or operating performance. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “predict,” “target,” “intend,” “could,” “would,” “should,” “project,” “plan,” “expect,” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Factors that might cause such a difference include those discussed in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we have filed or will file with the SEC, and in other documents which are incorporated by reference into this prospectus, as well as the risk factors and other information contained in or incorporated by reference into any accompanying prospectus supplement. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus or, in the case of documents referred to or incorporated by reference, the date of those documents.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this prospectus. While we believe that such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events, except as may be required under applicable U.S. securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

2

PROSPECTUS SUMMARY

This summary may not contain all the information that you should consider before investing in securities. You should read the entire prospectus and the information incorporated by reference in this prospectus carefully, including “Risk Factors” and the financial data and related notes and other information incorporated by reference herein, before making an investment decision.

Company Overview

We areOn June 22, 2023, we completed the Asset Acquisition pursuant to Spyre Acquisition Agreement. Spyre was apre-clinical stage biotechnology company committedthat was incorporated on April 28, 2023 under the direction of Peter Harwin, a Managing Member of Fairmount, for the purpose of holding rights to certain intellectual property being developed by Paragon. Fairmount is a founder of Paragon.

Through the Asset Acquisition, we received the option to acquire the intellectual property rights related to four research programs (collectively, the “Option”) pursuant to the Spyre Option Agreement. On July 12, 2023, we exercised the Option with respect to one of these research programs to exclusively license intellectual property rights related to such research program directed to antibodies that selectively bind to a4b7 integrin and methods of using these antibodies, including methods of treating IBD using SPY001. If this research program is pursued non-provisionally and matures into issued patents, we would expect those patents to expire no earlier than 2044 subject to any disclaimers or extensions. The license agreement pertaining to such research program is currently being finalized. Furthermore, as of the date of this registration statement, the Option remains unexercised with respect to the intellectual property rights related to the three remaining research programs under the Spyre Option Agreement. For more information on the Spyre Option Agreement, see discussion under the heading “Spyre Option Agreement” below.

On July 27, 2023, we announced that we entered into an agreement to sell the global rights to pegzilarginase, an investigational treatment for the rare metabolic disease Arginase 1 Deficiency, to Immedica Pharma AB (“Immedica”) for $15.0 million in upfront cash proceeds and up to $100.0 million in contingent milestone payments (the “Immedica APA”). The sale of pegzilarginase to Immedica supersedes and terminates the license agreement between us and Immedica dated March 2021. See the section titled “Recent Developments” below for more information regarding the Immedica APA.

Following the Asset Acquisition and the entry into the Immedica APA, we have significantly reshaped the business into a preclinical stage biotechnology company focused on developing enzyme-basednext generation therapeutics for patients living with inflammatory bowel disease (“IBD”), including ulcerative colitis (“UC”) and Crohn’s disease (“CD”). Our portfolio of novel and proprietary monoclonal antibody product candidates has the potential to address unmet needs in the field of amino acid metabolismIBD care by improving efficacy, safety, and/or dosing convenience relative to treat rare genetic diseasesproducts currently available or product candidates in development. We have purposely engineered our product candidates to bind potently and cancer. Our engineered human enzymes are designed to degrade specific amino acids in the bloodselectively to target these diseases. In inborn errorsepitopes with extended half-lives. We plan to use combinations of metabolism, or IEM,our proprietary antibodies and patient enrichment strategies via companion diagnostics to enhance efficacy. We intend to deliver our product candidates through convenient, infrequently self-administered, subcutaneous (“SC”) injection as a subset of rare genetic diseases, we are seeking to reduce the toxic levels of amino acids in patients to the normal range. In oncology, we are seeking to reduce amino acid blood levels below the normal range where we believe we will be able to exploit the dependence of certain cancers on specific amino acids.pre-filled pen.

Our lead product candidate, AEB1102 (pegzilarginase),Strategy

Our goal is engineered to degrade the amino acid arginine and is being developed to treat two extremes of arginine metabolism, including arginine excess in patients with Arginase I deficiency, an IEM, as well as some cancers which have been shown to have a metabolic dependence on arginine. AEB1102 has demonstrated clinical proof of mechanism in both scenarios. In a Phase 1 clinical trialdevelop next-generation therapeutics for the treatment of patients with Arginase I deficiency,IBD, relying on three strategic pillars:

| • | | Advancing novel, potentially best-in-class, long-acting antibodies against validated IBD targets; |

| • | | Evaluating rational therapeutic combinations of potentially best-in-class antibodies; and |

3

| • | | Developing genetic- or biomarker-based companion diagnostics to match treatment targets to IBD sub-populations. |

Inflammatory Bowel Disease

IBD is a dose-proportional reduction in plasma arginine levels was observed inchronic condition characterized by inflammation within the gastrointestinal tract. It encompasses two patients. A reduction in blood arginine levels was also observed in Phase 1 clinical trials formain disorders: UC and CD. UC primarily affects the treatment of patients with advanced solid tumorscolon and the hematological malignancies relapsed refractory acute myeloid leukemia,rectum. Inflammation occurs in the innermost lining of the colon leading to ulcers. Symptoms include bloody diarrhea, abdominal pain, bowel urgency, and frequent bowel movements. CD can affect any part of the gastrointestinal tract, from the mouth to the anus. It is characterized by inflammation that extends through multiple layers of the bowel wall. Symptoms include abdominal pain, diarrhea, weight loss, fatigue, and complications such as strictures or AML,fistulas. Both conditions can significantly impact patients’ quality of life in terms of physical health, emotional well-being, and myelodysplastic syndrome,the unpredictability of symptom onset.

IBD affects millions of individuals worldwide, with increasing prevalence and incidence in both developed and developing countries. In the United States, it is estimated that approximately 1.7 million individuals currently have IBD, with approximately 70,000 patients newly diagnosed every year. The prevalence of UC in the United States is approximately 900,000 individuals, and the prevalence of CD in the United States is approximately 800,000 individuals. Based on research from the Crohn’s and Colitis Foundation of America, the market for IBD therapeutics is expected to experience steady growth, driven by rising disease prevalence, increasing diagnosis rates, and evolving treatment paradigms.

A range of pharmaceutical options exists, including anti-inflammatory drugs, immunosuppressants, and biologics. Treatment plans are often tailored to the individual patient’s disease severity, location, and response to therapy. In some cases, surgical interventions such as bowel resection or MDS. These preliminary results support AEB1102’s potential use as a therapeuticostomy formation may be necessary to manage complications or improve quality of both Arginase I deficiency and certain cancers associated with abnormal amino acid metabolism.life.

Despite available treatments, there remain substantial unmet needs in IBD management, including:

| • | | Inadequate response or loss of response to existing therapies; |

| • | | Side effects and safety concerns associated with long-term medication use; |

| • | | Limited options for patients with refractory or severe disease; and |

| • | | Adherence to frequent and/or inconvenient dosing regimens. |

Our Portfolio

We are conducting three clinical trials for AEB1102, consistingadvancing a broad pipeline of one Phase 1/2 clinical trial for the treatment of Arginase I deficiency and two Phase 1 clinical trials for the treatment of certain cancers.

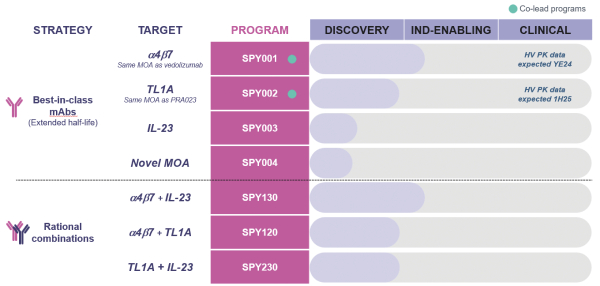

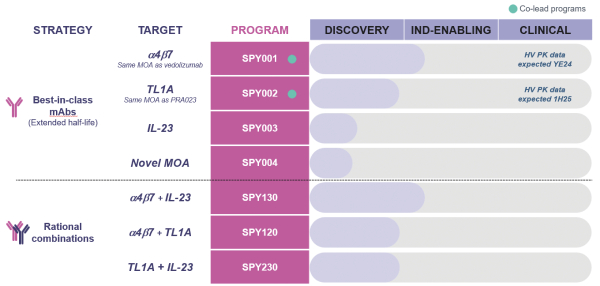

Arginase I Deficiency. Following completion of dosing for the first two adult patientspotentially best-in-class monoclonal antibodies (“mAbs”) in our Phase 1 clinical trial for the treatment of patients with Arginase I deficiency, we submitted a protocol amendment in November 2016 to broaden the scope of our Phase 1 trial into a Phase 1/2 trial. The amended protocol includes dosing of pediatric patients (two and older) and weekly repeat dosing,connection with the intentresearch programs with respect to assesswhich we have exercised the safety, tolerability, pharmacokinetics, pharmacodynamics, and clinical response of AEB1102 in patients with this IEM. InOption to acquire intellectual property license rights to or have the first quarter of 2017, we received IRB approval forOption to acquire intellectual property license rights to pursuant to the Phase 1/2 protocol for the treatment of patients with Arginase I deficiency at multiple clinical trial sites. In March 2017, we received an information request from the FDA which included comments and recommendations on the protocol amendment and a request for supporting documents based on their review of our completed toxicology studies, our dose escalation plan and our information to support the inclusion of pediatric patients. As recommended by the FDA, we replied with supporting information and completed a follow-up meeting. At this time, we believe our Phase 1/2 protocol provides an appropriate path to evaluate the safety and tolerability of AEB1102 in pediatric patients, and pending FDA feedback, we plan to initiate dosing in pediatric patients in the middle of 2017. In March 2017, we announced results from the first two adult patients in our Phase 1 clinical trial for the treatment of Arginase I deficiency at the 2017 American College of Medical Genetics and Genomics Annual Clinical Genetics Meeting, or ACMG Annual Meeting. We intend to continue enrollment of adult patientsSpyre Option Agreement and plan to dose additional adult patientsdevelop a companion diagnostic for each program. The following table summarizes these programs*.

4

| * | We exercised the Option to acquire intellectual property license rights related to SPY001 on July 12, 2023. Although we hold the Option to acquire intellectual property license rights related to SPY002, SPY003 and SPY004, such Option remains unexercised as the date of this registration statement. See discussion under the heading “Spyre Option Agreement” in our next Quarterly Report on Form 10-Q, which will be incorporated by reference herein, for more information. |

SPY001 – anti-a4b7 mAb

Our most advanced product candidate, SPY001, is a highly potent, highly selective, and fully human monoclonal immunoglobulin G1 antibody designed to bind selectively to the a4b7 integrin. Thea4b7 integrin is a protein found on the surface of immune cells known as lymphocytes. This integrin regulates the migration of lymphocytes to the gut where they contribute to the inflammatory process in IBD. By binding to the a4b7 integrin, SPY001 is designed to prevent the interaction of these lymphocytes with MAdCAM-1, a molecule expressed on endothelial cells lining the blood vessels in the middlegut. This interaction is responsible for guiding lymphocytes from the bloodstream into the gut tissue, where they cause inflammation. By blocking the interaction between a4b7 integrin and MAdCAM-1, SPY001 aims to reduce the recruitment of 2017. Toplinelymphocytes to the gut, leading to a decrease in inflammation. Since it specifically targets the gut immune system, SPY001 is designed to help minimize systemic immunosuppressive effects unrelated to IBD pathology.

Vedolizumab is an anti-a4b7 integrin mAb marketed by Takeda as Entyvio. It is available in the United States as an intravenously administered product with an every 8-week maintenance dosing regimen. A SC version with an every 2-week dosing regimen is under review by the United States Food and Drug Administration (the “FDA”) for use in the maintenance setting and is approved in Europe and Japan. Vedolizumab is one of the leading therapies for moderate-to-severe IBD given its exquisite safety profile as a gut selective mechanism and its high efficacy rates in UC (particularly in the maintenance setting where it has the highest remission rates among approved biologics). In the induction setting, exposure-response data suggests that higher exposures may increase the likelihood of early remission in UC. In 2022, Takeda reported $5.3 billion in sales for Entyvio and updated its peak annual sales guidance to $7.5-9.0 billion. We believe that there is a significant opportunity for a SC regimen with a more infrequent dosing schedule (every eight to twelve weeks) in the maintenance settings, and potential efficacy upside in induction.

Our preclinical development program has demonstrated that SPY001 binds to the same epitope as vedolizumab with similar potency and selectivity. Both SPY001 and vedolizumab potently block MAdCAM-1 adhesion and

5

avoid interactions with a4b1 to prevent adhesion to VCAM-1, which can be associated with the risk of progressive multifocal leukoencephalopathy. Additionally, our preclinical studies have demonstrated that SPY001 binds to memory T-helper cells from this trialhuman donors with a comparable potency as vedolizumab.

SPY001 is engineered with half-life extension technology. This approach relies on modifying the Fc domain to improve the pharmacokinetic (“PK”) profile of the antibody and support infrequent dosing as a convenient SC injection. An evaluation of SPY001’s PK in non-human primates suggests an increase in half-life of approximately 2-fold relative to vedolizumab, potentially supporting a SC dosing administration of every eight to twelve weeks in humans.

We aim to achieve the following target product profile for SPY001 in IBD:

| • | | Less frequent administration: Lower the frequency of administration by incorporating half-life extension technology and deliver SPY001 through a single SC injection every eight to twelve weeks. |

| • | | High concentration, citrate-free formulation: Deliver at least 300 mg in a single 2 mL injection suitable for a pre-filled pen without the need for citrate to enhance patient comfort. |

| • | | Potential for increased induction efficacy in UC: Target greater exposure in the induction setting given exposure-response relationships observed with vedolizumab in UC. |

SPY001 is currently progressing through IND-enabling studies and is expected to enter first-in-human (“FIH”) studies in the first half of 2018.2024. We believe SPY001 has the potential to meaningfully transform the standard of care in IBD as a potent, low-frequency and self-administered SC injection.

SPY002 – anti-TL1A mAb

Our co-lead product candidate, SPY002, is a highly potent, highly selective, and fully human mAb designed to bind to tumor necrosis factor-like ligand 1A (“TL1A”). TL1A is a protein that plays a role in regulating the immune system and is found to be elevated in the gut tissue of individuals with IBD. TL1A interacts with its receptor, death receptor 3 (“DR3”), which is expressed in various immune cells, including T cells. This interaction triggers signaling pathways that contribute to inflammation and immune system activation, leading to IBD symptomology. SPY002 has been designed to block the interaction between TL1A and DR3 and thereby inhibit the downstream signaling events and dampen the inflammatory response. By neutralizing TL1A, SPY002 has the potential to modulate the immune response in IBD patients, potentially reducing disease activity and promoting mucosal healing.

TL1A is a clinically validated target that has been studied in multiple Phase 2 trials in UC and CD. Merck’s anti-TL1A molecule (PRA023) was studied in a randomized controlled Phase 2 trial where it showed a 25% placebo-adjusted clinical remission rate at week 12 and a placebo-adjusted endoscopic improvement rate of 31% for patients with UC. PRA023 was additionally studied in a Phase 2a open label trial in CD where it showed a 49% clinical remission rate at week 12 compared to a prespecified 16% historical placebo rate and a 26% endoscopic response compared to a prespecified 12% historical placebo rate. Roivant is also advancing an anti-TL1A molecule (RVT-3101) that showed a 21% placebo-adjusted clinical remission rate and a 21% placebo-adjusted endoscopic response in a Phase 2b study in UC patients. In the maintenance setting at week 56, RVT-3101 showed a compelling clinical remission rate of 36% (absolute) at the expected Phase 3 dose. Both PRA023 and RVT-3101 lack any half-life extension technologies and are dosed every four weeks in the maintenance setting.

Like SPY001, SPY002 is engineered with half-life extension technology to support infrequent, self-administration as a convenient SC injection. It is expected that these modifications, along with a high concentration formulation, will enable dosing every eight weeks or less frequently in humans.

6

Advanced Solid Tumors. In October 2015, we initiated enrollmentWe aim to achieve the following target product profile for a Phase 1 dose escalation trial for cancer patients with advanced solid tumors. In this ongoing trial, patients have demonstrated aSPY002 in IBD and other inflammatory diseases:

| | • | | reduction in blood arginine levels fromLess frequent administration: Lower the dosingfrequency of AEB1102, providing proof-of-mechanism. We expect to announce results of this Phase 1 dose escalation in patients with advanced solid tumorsadministration by incorporating half-life extension technology and anticipate initiating expansion arms in specific solid tumor types, potentially in combination with existingdeliver SPY002 through a single SC injection every eight weeks or emerging standards of care, in the fourth quarter of 2017 or the first quarter of 2018.less frequently.

|

Hematological Malignancies. In July 2016, we initiated | • | | High potency: High affinity to TL1A trimers, enabling lower doses. |

| • | | High concentration, citrate-free formulation: Deliver at least 300 mg in a single 2 mL injection suitable for a pre-filled pen. |

We expect to enter FIH studies in the second half of 2024. We believe SPY002 has the potential to be a Phase 1best-in-class TL1A antibody compared to others in development as a highly potent, highly selective and infrequently self-administered SC injection.

SPY003 – anti-IL-23 mAb

Our third program, SPY003, is a discovery stage program designed to bind to Interleukin 23 (“IL-23”). IL-23 is a cytokine that is produced by immune cells and is involved in immune response regulation. IL-23 promotes the differentiation and activation of Th17 cells. Th17 cells produce other inflammatory cytokines, such as IL-17, which contribute to the inflammation seen in IBD. IL-23 also helps in the recruitment and activation of other immune cells, such as neutrophils, which further contribute to tissue damage in the gut.

Several IL-23 mAbs have been approved or are in late-stage development for IBD including Skyrizi (AbbVie), Tremfya (Johnson & Johnson), and mirikizumab (Lilly).

We aim to achieve the following target product profile for SPY003 in IBD:

| • | | Less frequent administration: Lower the frequency of administration by incorporating half-life extension technology and deliver SPY003 through a single SC injection every eight weeks or less frequently. |

| • | | High concentration, citrate-free formulation: Deliver at least 300 mg in a single 2 mL injection suitable for a pre-filled pen. |

SPY004 – novel MOA mAb

SPY004 is an undisclosed novel mechanism of action (“MOA”) and incorporates half-life extension modifications.

Our combination programs – SPY120, SPY130, and SPY230

We aim to advance rational combinations of our therapeutic antibodies into clinical trialstudies. SPY120 combines SPY001 (a4b7) and SPY002 (TL1A), SPY130 combines SPY001(a4b7) and SPY003 (IL-23), and SPY230 combines SPY002 (TL1A) and SPY003 (IL23). We believe these combinations target orthogonal biology and could lead to greater remission rates in IBD.

Clinical proof-of-concept for the potential of combination therapy in IBD was demonstrated by Johnson & Johnson’s VEGA study which evaluated their anti-TNFa antibody, Simponi, in combination with their anti-IL-23 antibody, Tremfya, in patients with the hematological malignancies AML and MDSUC. The combination resulted in an absolute clinical remission rate of 47% in the United Statesinduction setting, which was nearly additive of the remission rates observed with either TNFa (25%) or IL-23 (24%) alone. We believe there is potential to build on this result by combining mechanisms that have shown greater efficacy rates in specific indications and Canada. Assettings and that exhibit a superior safety profile relative to the TNFa class.

7

Our precision immunology approach

We aim to develop genetic- or biomarker-based companion diagnostics across our portfolio of therapeutics to aid patients and physicians in selecting the optimal treatment regimen. Clinical proof-of-concept for the potential of companion diagnostic (“CDx”) approaches in IBD was demonstrated by both Prometheus (now Merck) and Roivant for their anti-TL1A programs. In Phase 2 studies, UC patients that were CDx positive were more likely to respond to anti-TL1A therapy as evidenced by a 7-13% increase in clinical remission rate at week 12 compared to all-comers. We are in discussions with several potential partners with access to large scale IBD biobanks to support CDx development across our portfolio.

Our Team and Investors

Our portfolio of potentially best-in-class antibodies were discovered and developed by Paragon. Spyre is the second company that was founded upon technology spun out of Paragon, a group of entrepreneurial scientists and investors with extensive mAb experience. Its scientific founders’ discoveries have also led to the creation of other successful biotechnology companies, including Cogent Biosciences, Inc., Viridian Therapeutics, Inc., Dianthus Therapeutics, Inc., and Apogee Therapeutics, Inc.

On June 22, 2023, we announced the completion of the Asset Acquisition with the sole focus on advancing a pipeline of next-generation antibodies for IBD with respect to which we have exercised the Option to acquire intellectual property license rights to or have the Option to acquire intellectual property license rights to pursuant to the Spyre Option Agreement. Concurrent with the closing of the acquisition, we completed a $210 million private placement of our Series A Preferred Stock with a syndicate of healthcare investors led by Fairmount Funds Management LLC, with participation from Fidelity Management & Research Company, Venrock Healthcare Capital Partners, Commodore Capital, Deep Track Capital, Perceptive Advisors, RTW Investments, Cormorant Asset Management, Driehaus Capital Management, Ecor1 Capital, RA Capital Management, Surveyor Capital (a Citadel company), and Wellington Management Company LLP, as well as additional institutional investors.

With respect to the Asset Acquisition, we determined that Aeglea was the acquiror for accounting purposes under ASC 805-10-25-4 and ASC 805-10-55-11. The primary factors considered were a) the relative voting rights in the trialcombined entity not resulting in a change of control, b) legacy members of our board of directors maintained control of the board, and c) the only change in the composition of senior management was the appointment of a new Chief Operating Officer. Next, we considered whether the Asset Acquisition should be defined as a business under ASC 805. ASC 805-10-55-5A through 55-5C describe a screen test to determine whether an acquired set of assets and activities is not a business. We determined that substantially all (greater than 90%) of the fair value of the assets acquired were concentrated in a single asset, Spyre’s Option to license intellectual property rights related to SPY001, SPY002, SPY003 and SPY004 pursuant to the Spyre Option Agreement. Accordingly, we treated the Asset Acquisition as an asset acquisition for accounting purposes. Even if the transaction would have failed the screen test, Spyre lacked the financial resources to have inputs, processes, and outputs to constitute a business under ASC 805. Following the Asset Acquisition, we will need to invest in infrastructure and the continuing research and development being conducted under the Spyre Option Agreement to be able to have any measurable outputs.

We have a strong management team and group of employees with diverse backgrounds and significant experience in developing novel treatments for patients at biopharmaceutical companies such as AbbVie, BridgeBio Pharma, Genentech, and Johnson & Johnson. Together, our team has a proven track record in the discovery, development, and commercialization of numerous approved therapeutics.

8

Recent Developments

On June 22, 2023, we acquired Spyre pursuant to an Agreement and Plan of Merger (the “Acquisition Agreement”), by and among the Company, Aspen Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“First Merger Sub”), Sequoia Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company (“Second Merger Sub”), and Spyre. Pursuant to the Acquisition Agreement, First Merger Sub merged with advanced solid tumors,and into Spyre, pursuant to which Spyre was the first three cohortssurviving corporation and became a wholly owned subsidiary of this trial have demonstrated proof-of-mechanism.the Company (the “First Merger”). Immediately following the First Merger, Spyre merged with and into Second Merger Sub, pursuant to which Second Merger Sub became the surviving entity.

The Asset Acquisition was structured as a stock-for-stock transaction pursuant to which all of Spyre’s outstanding equity interests were exchanged based on a fixed exchange ratio of 1-for-13.73622, for consideration of a combination of 12,945,385 shares of Common Stock and 364,887 shares of Series A Preferred Stock (or 364,887,000 shares on an as-converted-to-common basis) in addition to the assumption of outstanding and unexercised stock options to purchase 68,365 shares of Common Stock from the Amended and Restated Spyre 2023 Equity Incentive Plan. Concurrently with the Asset Acquisition, we entered into a definitive agreement (the “Securities Purchase Agreement”) for a PIPE investment with existing and new investors (the “Investors”) to raise approximately $210 million in which the Investors were issued 721,452 shares of Series A Preferred Stock (or 721,452,000 shares on an as-converted-to-common basis) at a price of $291.08 per share (or $0.29108 per share on an as-converted-to-common basis). The Asset Acquisition was approved by our Board of Directors and the Board of Directors and stockholders of Spyre. The closings of the Transactions were not subject to the approval of Aeglea stockholders. Subject to Aeglea stockholder approval and certain beneficial ownership limitations set by each holder, each share of Series A Preferred Stock will automatically convert into 1,000 shares of Common Stock. We expect to announce resultsfile a proxy statement with the SEC to solicit such stockholder approval, among other matters, at a special meeting of Aeglea stockholders. Except as otherwise required by law (e.g. voting on a change to the authorized shares of Series A Non-Voting Preferred Stock or the rights of such shares as required by Delaware General Corporation Law) and Aeglea’s Certificate of Designation of Series A Non-Voting Convertible Preferred Stock (the “Certificate of Designation”), the Series A Preferred Stock does not have voting rights. For more information on the Series A Preferred Stock, please refer to the Certificate of Designation, which is incorporated by reference herein.

In connection with the execution of the Phase 1 dose escalation trialAcquisition Agreement, Aeglea and Spyre entered into stockholder support agreements (the “Support Agreements”) with certain of Aeglea’s officers and directors, which collectively own an aggregate of less than 1% of the outstanding shares of the Common Stock. The Support Agreements provide that, among other things, each of the parties thereto has agreed to vote or cause to be voted all of the shares of Common Stock owned by such stockholder in patientsfavor of the approval of the conversion of the Series A Preferred Stock into shares of Common Stock in accordance with AMLNasdaq Stock Market Rules at Aeglea’s stockholders’ meeting to be held in connection therewith.

Concurrently and MDS in the fourth quarter of 2017 or the first quarter of 2018.

Our pipeline of engineered human enzyme product candidates in preclinical development includes: AEB3103, an enzyme that degrades the amino acid cysteine, and its oxidized form cystine, to target a widely recognized, but previously underexploited vulnerability of cancer to oxidative stress; AEB2109, an enzyme that degrades the amino acid methionine to target methionine-dependent cancers and AEB4104, an engineered human enzyme to treat another IEM by degrading the amino acid homocysteine. We plan to continue preclinical development of AEB3103, AEB2109, AEB4104 and related variants of these candidatesconnection with the aim of submitting an IND for one or more of these development candidates in 2018.

We are a patient-focused organization consciousexecution of the fact that IEMAcquisition Agreement, certain Spyre stockholders as of immediately prior to the Asset Acquisition, and oncology patients have limited treatment options, and we recognize that their lives and well-being are highly dependent upon our efforts and the efforts of others to develop improved therapies. For this reason, we are passionate about discovering and developing therapeutics to address IEM and oncology indications where there is a significant unmet medical need. Our goal is to create a world-class company committed to efficiently developing a portfolio of product candidates to treat these diseases.

The Securities We May Offer

With this prospectus, we may offer common stock, preferred stock, debt securities, warrants, subscription rights to purchase our common stock, preferred stock or debt securities, and/or units consisting of some or all of these securities in any combination. The aggregate offering price of securities that we offer with this prospectus will not exceed $150,000,000. Each time we offer securities with this prospectus, we will provide offerees with a prospectus supplement that will contain the specific termscertain of the securities being offered. The following isdirectors and officers of Aeglea as of immediately prior to the Asset Acquisition entered into lock-up agreements with Aeglea and Spyre, pursuant to which each such stockholder will be subject to a summary of180-day lockup on the securities we may offer with this prospectus.

Common Stock

We may offer shares of our common stock, par value $0.0001 per share.

Preferred Stock

We may offer shares of our preferred stock, par value $0.0001 per share, in onesale or more series. Our board of directors or a committee designated by the board will determine the dividend, voting, conversion and other rights of the seriestransfer of shares of preferred stock being offered. Each seriesCommon Stock held by each such stockholder at the closing of preferred stockthe Asset Acquisition, including those shares received by such Spyre stockholders in the Asset Acquisition.

In connection with the Asset Acquisition, a non-transferrable contingent value right (a “CVR”) was distributed to Aeglea stockholders of record as of the close of business on July 3, 2023, but was not distributed to holders of shares of Common Stock or Series A Preferred Stock issued to the Investors or former stockholders of Spyre in

9

connection with the Transactions. Holders of the CVR will be entitled to receive certain stock and/or cash payments from proceeds received by us, if any, related to the disposition or monetization of Aeglea’s legacy assets for a period of one year following the closing of the Asset Acquisition.

On July 27, 2023, we announced that we entered the Immedica APA. The sale of pegzilarginase to Immedica supersedes and terminates the license agreement between the us and Immedica dated March 2021.

The milestone payments under the Immedica APA are contingent on formal reimbursement decisions by national authorities in key European markets and pegzilarginase approval by the FDA, among other events. The upfront payment and contingent milestone payments if paid, net of expenses and adjustments, will be distributed to holders of Aeglea’s CVR pursuant to the CVR Agreement that was entered into in connection with the Asset Acquisition.

For more fully described ininformation about the particular prospectus supplement that will accompany this prospectus, including redemption provisions, rights in the event of our liquidation, dissolutionTransactions or the winding up, voting rights and rights to convert into common stock.

Debt Securities

We may offer general obligations, which may be secured or unsecured, senior or subordinated and convertible into shares of our common stock or preferred stock. In this prospectus, we refer to the senior debt

securities and the subordinated debt securities together as the “debt securities.” Our board of directors will determine the terms of each series of debt securities being offered.

We will issue the debt securities under an indenture between us and a trustee. In this document, we have summarized general features of the debt securities from the indenture. We encourageImmedica APA, you to read the indenture, which is an exhibit to the registration statement of which this prospectus is a part.

Warrants

We may offer warrants for the purchase of debt securities, shares of preferred stock or shares of common stock. We may issue warrants independently or together with other securities. Our board of directors will determine the terms of the warrants.

Subscription Rights

We may offer subscription rights for the purchase of common stock, preferred stock or debt securities. We may issue subscription rights independently or together with other securities. Our board of directors will determine the terms of the subscription rights.

Units

We may offer units consisting of some or all of the securities described above, in any combination, including common stock, preferred stock, warrants and/or debt securities. The terms of these units will be set forth in a prospectus supplement. The description of the terms of these units in the related prospectus supplement will not be complete. You should refer to our Current Reports on Form 8-K filed with the applicable form of unitSEC on June 23, 2023 (excluding exhibit 99.1 furnished thereto) and unit agreement for complete information with respect to these units.July 27, 2023, respectively, which are incorporated by reference herein.

* * *Corporation Information

We were formed as a limited liability company under the laws of the State of Delaware in December 2013 and converted to a Delaware corporation in March 2015. In connection with our conversionOn June 22, 2023, we completed the Asset Acquisition, pursuant to which all of Spyre’s outstanding equity interests were exchanged based on a Delaware corporation, eachfixed exchange ratio of our outstanding13.73522 to 1 for consideration from Aeglea of 12,945,385 shares of the members of the limited liability company was converted intoCommon Stock and 364,887 shares of capital stock. On the date of conversion, each Series A convertible preferred share converted into a share of Series A convertible preferredPreferred Stock in addition to the assumption of outstanding and unexercised stock and each Common A share, Common A-1 share and Common B share converted intooptions to purchase 68,365 shares of common stock.Common Stock from the Amended and Restated Spyre 2023 Equity Incentive Plan. Our principal executive offices are located at 901 S. MoPac Expressway, Barton Oaks Plaza One,221 Crescent Street, Building 17, Suite 250, Austin, Texas 78746,102B, Waltham, MA 02453, and our telephone number is (512) 942-2935.

Our Relationship with Paragon and Parapyre

Paragon and Parapyre, a related party of Paragon, beneficially own more than 5% of our capital stock collectively through their holdings of our Common Stock and Series A Preferred Stock. Fairmount Funds Management LLC beneficially owns more than 5% of our capital stock, has two seats on our Board and beneficially owns more than 5% of Paragon, which is a joint venture between Fairmount Funds Management LLC and Fair Journey Biologics. Fairmount Funds Management LLC has appointed Paragon’s board of directors and has the contractual right to approve the appointment of any executive officers.

In connection with the Asset Acquisition, we assumed the rights and obligations of Spyre under the Spyre Option Agreement. Under the Spyre Option Agreement, we are obligated to compensate Paragon on a quarterly basis for its services performed under each research program based on the actual costs incurred. As of the date of the Asset Acquisition, Spyre had incurred total expenses of $19.3 million under the Spyre Option Agreement since inception, inclusive of a $3.0 million research initiation fee that was due upon signing of the Spyre Option Agreement and $16.3 million of reimbursable expenses under the Spyre Option Agreement for historical costs incurred by Paragon. As of the acquisition date, $19.3 million was unpaid and was assumed by us through the Asset Acquisition.

In July 2023, we exercised our option for SPY001 with the remaining three options for SPY002, SPY003, SPY004 remaining outstanding.

10

In connection with the Asset Acquisition, the Company assumed the Parapyre Option Obligation (as described under the section titled “Spyre Option Agreement” below)which provided for an annual equity grant of options to purchase 1% of the then outstanding shares of Spyre’s common stock, on a fully diluted basis, on the last business day of each calendar year, at the fair market value determined by the board of directors of Spyre. As a result of the Asset Acquisition, the Parapyre Option Obligation shall continue and Parapyre shall be entitled to receive the equivalent shares of the Company with the same terms.

See the section titled “Spyre Option Agreement” below for more information on the Spyre Option Agreement.

Spyre Option Agreement

In May 2023, Spyre entered into the Spyre Option Agreement with Paragon and Parapyre. In consideration for the Option granted under the Spyre Option Agreement, Spyre was obligated to pay Paragon an upfront cash amount of $3.0 million in research initiation fees. In addition, Spyre was obligated to pay incurred reimbursable research costs of $16.3 million to Paragon as of the closing of the Asset Acquisition. Furthermore, the Spyre Option Agreement provided for an annual equity grant of options to purchase 1% of the then outstanding shares of Spyre’s common stock, on a fully diluted basis, on the last business day of each calendar year, at the fair market value determined by the board of directors of Spyre (the “Parapyre Option Obligation”). As a result of the Asset Acquisition, we assumed the rights and obligations of Spyre under the Spyre Option Agreement, including the Parapyre Option Obligation. Pursuant to the Spyre Option Agreement, on a research program-by-research program basis following the finalization of the research plan for each respective research program, we are required to pay Paragon a nonrefundable fee in cash of $0.75 million. We are also obligated to compensate Paragon on a quarterly basis for its services performed under each research program based on the actual costs incurred. For the period from June 22, 2023 (Asset Acquisition date) to June 30, 2023, we did not make any payments to Paragon.

On July 12, 2023, we exercised our Option available under the Spyre Option Agreement with respect to the SPY001 research program and will enter into a SPY001 license agreement (the “SPY001 License Agreement”). Our Option available under the Spyre Option Agreement with respect to SPY002, SPY003 and SPY004 remains unexercised.

Following the execution of the SPY001 License Agreement, we will also obligated to pay Paragon up to $23.0 million upon the achievement of specific development and clinical milestones for the first product under the SPY001 License Agreement that achieves such specified milestones. Upon execution of the SPY001 License Agreement, we will pay Paragon a $1.5 million fee for nomination of a development candidate, and we are obligated to make a further milestone payment of $2.5 million upon the first dosing of a human patient in a Phase 1 trial. Subject to the execution of the Option with respect to SPY002, SPY003 or SPY004, we expect to be obligated to make similar payments upon and following the execution of license agreements with respect to SPY002, SPY003 and SPY004, respectively. For additional detail regarding our arrangements with Paragon, see the section titled “Our Relationship with Paragon and Parapyre” above.

Commercial

Should any of our product candidates be approved for commercialization, we intend to develop a plan to commercialize them in the United States and other key markets, through internal infrastructure and/or external partnerships in a manner that will enable us to realize the full commercial value of our programs. Given our stage of development, we have not yet established a commercial organization or distribution capabilities.

11

Manufacturing

We do not currently own or operate facilities for product manufacturing, testing, storage, and distribution. We are currently in the process of novating certain agreements with third parties for the performance of future clinical manufacturing and toxicology activities from Paragon to us. The initial forms of these agreements are generally non-specific master services agreements that allow an entity to begin the process of future manufacturing or toxicology services, respectively. As clinical development activities are commenced by us, the agreements will be revised to provide for the specific deliverables and associated costs that are needed under our development plan.

Competition

We expect to face intense competition from other biopharmaceutical companies that are developing agents for the treatment of inflammatory diseases. If approved for the treatment of patients with moderate-to-severe IBD, our portfolio of products would compete with TNF antibodies including Humira (AbbVie), Remicade (Johnson & Johnson), and Simponi (Johnson & Johnson); IL-12/23 and IL-23 antibodies including Stelara (Johnson & Johnson) and Skyrizi (AbbVie); a4b7 antibody Entyvio (Takeda); JAK inhibitors including Xeljanz (Pfizer), Rinvoq (AbbVie); and S1P1 receptor modulating therapies including Zeposia (Bristol Myers Squibb).

We are aware of several companies with product candidates in development for the treatment of patients with IBD, including Merck’s PRA023, Roivant’s RVT-3101, and Teva’s TEV-48574 TL1A antibodies; additional IL-23s including Tremfya (Johnson & Johnson) and mirikizumab (Lilly); additional S1P1 modulator etrasimod (Pfizer); and oral anti-integrin agents including Morphic Therapeutic’s MORF-057 and Gilead’s GS-1427, and a discovery program at Dice Therapeutics (Lilly).

Government Regulation

The FDA and other regulatory authorities at federal, state and local levels, as well as in foreign countries, extensively regulate, among other things, the research, development, testing, manufacture, quality control, import, export, safety, effectiveness, labeling, packaging, storage, distribution, record keeping, approval, advertising, promotion, marketing, post-approval monitoring and post-approval reporting of biologics such as those we are developing. We, along with our third-party contractors, will be required to navigate the various preclinical, clinical and commercial approval requirements of the governing regulatory agencies of the countries in which we wish to conduct studies or seek approval or licensure of our product candidates. Failure to comply with the applicable United States requirements at any time during the product development process, approval process or post-market may subject an applicant to administrative or judicial sanctions. These sanctions could include, among other actions, the FDA’s refusal to approve pending applications, withdrawal of an approval, a clinical hold, untitled or warning letters, product recalls or market withdrawals, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

United States Biologics Regulation

In the United States, biological products are subject to regulation under the Federal Food, Drug, and Cosmetic Act (“FDCA”) and the Public Health Service Act (“PHSA”) and their implementing regulations, as well as other federal, state, local, and foreign statutes and regulations. The process required by the FDA before biologic product candidates may be marketed in the United States generally involves the following:

completion of preclinical laboratory tests and animal studies performed in accordance with applicable regulations, including the FDA’s current Good Laboratory Practices;

12

submission to the FDA of an investigational new drug application (“IND”), which must become effective before clinical trials may begin and must be updated annually or when significant changes are made;

approval by an independent institutional review board (“IRB”), or ethics committee at each clinical site before the trial may be commenced;

manufacture of the proposed biologic candidate in accordance with current Good Manufacturing Practices (“cGMPs”);

performance of adequate and well-controlled human clinical trials in accordance with applicable IND regulations, current Good Clinical Practice (“cGCP”) requirements and other clinical-trial related regulations to establish the safety, purity and potency of the proposed biologic product candidate for its intended purpose;

preparation of and submission to the FDA of a biologics license application (“BLA”), after completion of all pivotal clinical trials;

satisfactory completion of an FDA Advisory Committee review, if applicable;

a determination by the FDA within 60 days of its receipt of a BLA to file the application for review;

satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the proposed product is produced to assess compliance with cGMPs, and to assure that the facilities, methods and controls are adequate to preserve the biological product’s continued safety, purity and potency, and potential audit of selected clinical investigation sites to assess compliance with cGCPs;

payment of user fees for FDA review of the BLA, unless a waiver is applicable; and

FDA review and approval of a BLA to permit commercial marketing of the product for a particular indication(s) for use in the United States.

Preclinical and Clinical Development

Prior to beginning the first clinical trial with a product candidate, in the United States, we must submit an IND to the FDA. An IND is a request for authorization from the FDA to administer an investigational new drug product to humans. The central focus of an IND submission is on the general investigational plan and the protocol or protocols for preclinical studies and clinical trials. The IND also includes results of animal and in vitro studies assessing the toxicology, pharmacokinetics, pharmacology and pharmacodynamic characteristics of the product, chemistry, manufacturing and controls information, and any available human data or literature to support the use of the investigational product. An IND must become effective before human clinical trials may begin. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day period, raises safety concerns or questions about the proposed clinical trial. In such a case, the IND may be placed on clinical hold and the IND sponsor and the FDA must resolve any outstanding concerns or questions before the clinical trial can begin. Submission of an IND therefore may or may not result in FDA authorization to begin a clinical trial. Similar processes exist in countries outside the United States that we will be required to follow if we choose to execute trials in other countries.

Clinical trials involve the administration of the investigational product to human subjects under the supervision of qualified investigators in accordance with cGCPs, which include the requirement that all research subjects provide their informed consent for their participation in any clinical study. Clinical trials are conducted under protocols detailing, among other things, the objectives of the study, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. A separate submission to the existing IND must be made for

13

each successive clinical trial conducted during product development and for any subsequent protocol amendments. Furthermore, an independent IRB for each site proposing to conduct the clinical trial must review and approve the plan for any clinical trial and its informed consent form before the clinical trial begins at that site, and must monitor the study until completed.

Regulatory authorities, the IRB or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects are being exposed to an unacceptable health risk or that the trial is unlikely to meet its stated objectives. Some studies also include oversight by an independent group of qualified experts organized by the clinical study sponsor, known as a data safety monitoring board, which provides authorization for whether or not a study may move forward at designated check points based on access to certain data from the study and may recommend halting the clinical trial if it determines that there is an unacceptable safety risk for subjects or other grounds, such as no demonstration of efficacy. There are also requirements governing the reporting of ongoing preclinical studies and clinical trials and clinical study results to public registries. Sponsors of clinical trials of FDA-regulated products, including biological products, are required to register and disclose certain clinical trial information, which is publicly available at www.clinicaltrials.gov.

A sponsor who wishes to conduct a clinical trial outside of the United States may, but need not, obtain FDA authorization to conduct the clinical trial under an IND. If a foreign clinical trial is not conducted under an IND, the sponsor may submit data from the clinical trial to the FDA in support of a BLA. The FDA will accept a well-designed and well-conducted foreign clinical trial not conducted under an IND if the trial was conducted in accordance with cGCP requirements and the FDA is able to validate the data through an onsite inspection if deemed necessary.

For the purposes of BLA approval, human clinical trials are typically conducted in three sequential phases that may overlap.

| • | | Phase 1. The investigational product is initially introduced into healthy human subjects or patients with the target disease or condition. These studies are designed to test the safety, dosage tolerance, absorption, metabolism and distribution of the investigational product in humans and the side effects associated with increasing doses, and, if possible, to gain early evidence on effectiveness. |

| • | | Phase 2. The investigational product is administered to a limited patient population with a specified disease or condition to evaluate the preliminary efficacy, optimal dosages and dosing schedule and to identify possible adverse side effects and safety risks. Multiple Phase 2 clinical trials may be conducted to obtain information prior to beginning larger and more expensive Phase 3 clinical trials. |

| • | | Phase 3. The investigational product is administered to an expanded patient population to further evaluate dosage, to provide statistically significant evidence of clinical efficacy and to further test for safety, generally at multiple geographically dispersed clinical trial sites. These clinical trials are intended to establish the overall risk/benefit ratio of the investigational product and to provide an adequate basis for product approval. |