The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 8, 2014APRIL 26, 2019

PRELIMINARY PROSPECTUS

China Jo-Jo Drugstores, Inc.

$30,000,0004,840,000 Shares

of

Common Stock

Common StockPreferred StockDebt SecuritiesWarrantsRights

Units

We may offerThis prospectus relates to the resale, from time to time, of up to 4,840,000 shares of our common stock, preferred stock, senior debt securities (which may be convertible into or exchangeable for common stock), subordinated debt securities (which may be convertible into or exchangeable for common stock), warrants, rights and units that include any of these securities. The aggregate initial offering price of the securities sold under this prospectus will not exceed $30,000,000. We will offer the securities in amounts, at prices and on terms to be determined at the time of the offering.

Each time we sell securities hereunder, we will attach a supplement to this prospectus that contains specific information about the terms of the offering, including the price atpar value $0.001 per share, which we are offering the securities to the public. The prospectus supplement may also add, update or change information contained or incorporated in this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read this prospectus, the information incorporated by reference in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus carefully before you invest in our securities.

The securities hereunder may be offered directly by us, through agents designatedand sold from time to time by us ora single stockholder set forth in the “Selling Stockholder” section of this prospectus. The shares of common stock that are being registered for resale pursuant to the registration statement of which this prospectus forms a part were issued by our company to the selling stockholder in a private placement of $10,648,000 at a purchase price of $2.20 per share, which closed on January 23, 2017.

The selling stockholder will receive all of the net proceeds from the sale of common stock offered hereby. The selling stockholder may resell the shares of common stock offered for resale through this prospectus to or through underwriters, broker-dealers, or dealers. Ifagents, who may receive compensation in the form of discounts, concessions or commissions. We will not receive any agents, dealers or underwriters are involved inproceeds from the sale of these shares by the selling stockholder, but we will bear all costs, fees and expenses in connection with the registration of the shares of common stock offered by the selling stockholder. The selling stockholder will bear all commissions and discounts, if any, securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among themattributable to the sale of the shares of common stock offered for resale through this prospectus.

The selling stockholder will be set forth, or will be calculable fromdetermine where they may sell the information set forth,shares in all cases, including, in the applicable prospectus supplement. Seeover-the-counter market or otherwise, at market prices prevailing at the section entitled “About This Prospectus” for more information.time of sale, at prices related to the prevailing market prices, or at negotiated prices. For information regarding the selling stockholder and the times and manner in which they may offer or sell shares of our common stock, see “Selling Stockholder” or “Plan of Distribution.”

Our common stock is listed on the NASDAQ Capital Market under the symbol CJJD. On April 25, 2019, the last reported sale price for our common stock on the NASDAQ Capital Market was $1.43 per share.

Investing in securities involves certain risks. See “Risk Factors” beginning on page 5 of this prospectus and in the applicable prospectus supplement, as updated in our future filings made with the Securities and Exchange Commission that are incorporated by reference into this prospectus. You should carefully read and consider these risk factors before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014.[ ]

| ABOUT THIS PROSPECTUS | 1 |

| FORWARD-LOOKING STATEMENTS | 1 |

| THE COMPANY | 2 |

| RISK FACTORS | 5 |

| USE OF PROCEEDS | 6 |

| DESCRIPTION OF CAPITAL STOCK | 6 |

| DESCRIPTION OF COMMON STOCK | 6 |

| DESCRIPTION OF PREFERRED STOCK | 7 |

| 8 | |

| 9 | |

| 11 | |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | |

| WHERE YOU CAN FIND MORE INFORMATION |

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

i

ThisYou should carefully read this prospectus and the information described under the heading “Where You Can Find More Information.” Neither we nor the selling stockholder have authorized anyone to give any information or make any representation about our company that is part of a registration statement on Form S-3 we filed with the Securities and Exchange Commission,different from, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may, from timein addition to, time, offer and sell any combination of the securities describedthat contained in this prospectus, including in one or more offerings. The aggregate initial offering priceany of all securities sold underthe materials that have been incorporated by reference into this prospectus willor any accompanying prospectus supplement. Therefore, if anyone does give you information of this sort, you should not exceed $30,000,000.rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

This prospectus provides certain general information about the securitiesYou should not assume that we may offer hereunder. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. In each prospectus supplement, we will include the following information:

In addition, the prospectus supplement or free writing prospectus may also add, update or change the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or in documentsthat any information that has been incorporated by reference in this prospectus. The prospectus supplement or free writing prospectus will supersedeis correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the extentdate of such information.

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it contains information that is different from, or that conflicts with,unlawful to direct these types of activities, then the information containedoffer presented in this prospectus or incorporated by reference in this prospectus. You should read and consider all information contained in this prospectus, any accompanying prospectus supplement and any free writing prospectus that we have authorized for use in connection with a specific offering, in making your investment decision.You should also read and consider the information contained in the documents identified under the heading “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” in this prospectus.does not extend to you.

Unless the context otherwise requires, the terms “the Company,” “we,” “us,” and “our” in this prospectus each refer to China Jo-Jo Drugstores, Inc., our subsidiaries and our consolidated entities. “China” and “the PRC” refer to the People’s Republic of China.

Some of the statements contained or incorporated by reference in this prospectus may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,” “anticipate,” “intend,” “plan,” “estimate” and similar words, although some forward-looking statements are expressed differently.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and results to differ materially from what is expressed or forecasted in such forward-looking statements. These forward-looking statements speak only as of the date on which they are made and except as required by law, we undertake no obligation to publicly release the results of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from our forward-looking statements is included in our periodic reports filed with the SEC and in the “Risk Factors” section of this prospectus.

We were incorporated in Nevada on December 19, 2006, under the name “Kerrisdale Mining Corporation.”

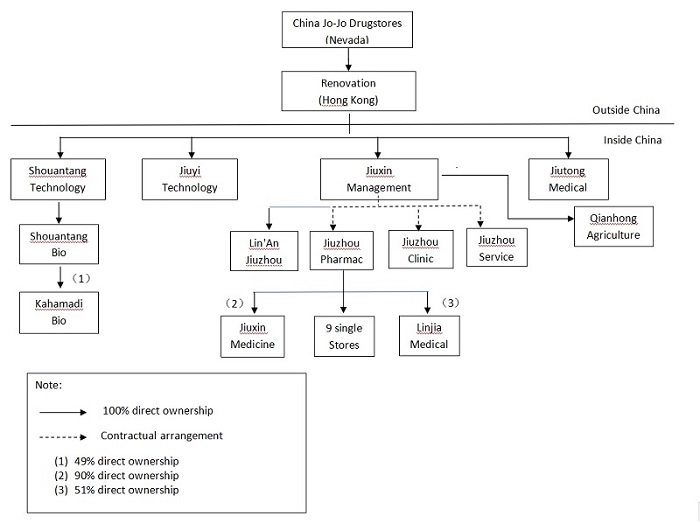

On September 17, 2009, we acquired control of Renovation Investment (Hong Kong) Co., Ltd., a limited liability company incorporated in Hong Kong on September 2, 2008 (“Renovation”), pursuant to a share exchange agreement. Renovation has no substantive operations of its own except for its holdings of Zhejiang Jiuxin Investment Management Co., Ltd. (“Jiuxin Management”), Zhejiang Shouantang Medical Technology Co., Ltd. (“Shouantang Technology”) and Hangzhou Jiutong Medical Technology Co., Ltd (“Jiutong Medical”), and Hangzhou Jiuyi Medical Technology Co. Ltd. (“Jiuyi Technology”), its wholly-owned subsidiaries.

On September 24, 2009, we amended our Articles of Incorporation to change our name from “Kerrisdale Mining Corporation” to “China Jo-Jo Drugstores, Inc.” We are a retail and wholesale distributor of pharmaceutical and other healthcare products in China.

On April 9, 2010, we implemented a 1-for-2 reverse stock split of our issued and outstanding shares of common stock and a proportional reduction of our authorized shares of common stock, by filing a Certificate of Change pursuant to Nevada Revised Statutes 78.209 with the Nevada Secretary of State on April 6, 2010. All share information in this report takes into account this reverse stock split.

On April 28, 2010, we completed a registered public offering of 3,500,000 shares of our common stock at a price of $5.00 per share, resulting in gross proceeds to us, prior to deducting underwriting discounts, commissions and offering expenses, of approximately $17,500,000.

On July 24, 2015, we closed a registered direct offering of 1.2 million shares of common stock at $2.50 per share with gross proceeds of approximately $3 million from our effective shelf registration statement on Form S-3.

On January 23, 2017, we completed a private offering of 4,840,000 shares of the common stock at a price of $2.20 per share with gross proceeds of approximately $10,648,000.

On April 15, 2019, we closed a registered direct offering with several institutional investors for an aggregate of 4,000,008 shares of the common stock, at a purchase price of $2.50 per share, for aggregate gross proceeds of approximately $10 million to us. In a concurrent private placement, we issued to the investors unregistered warrants to purchase up to an aggregate of 3,000,006 shares of the common stock at an exercise price of $3.00 per share.

Our Business

Our primary business is retailonline and offline retailer and wholesale distribution of pharmaceutical and other healthcare products typically found in a retail pharmacy in the PRC.People’s Republic of China (“PRC” or “China”). We currently have fifty (50)one hundred and twenty-four (124) store locations under the store brand “Jiuzhou Grand Pharmacy” in Hangzhou.Hangzhou city and its adjacent town Lin’an. During the fiscal year 2018, the Company opened as many as fifty-seven new stores. Our stores provide customers with a wide variety of pharmaceutical products, including prescription and over-the-counter (“OTC”) drugs, nutritional supplements, traditional Chinese medicine (“TCM”), personal and family care products, and medical devices, as well as convenience products, including consumable, seasonal, and promotional items. Additionally, we have licensed doctors of both western medicine and TCM on site for consultation, examination and treatment of common ailments at scheduled hours.

We operate our pharmacies (including the medical clinics) through the following companies in China that we control through contractual arrangements:

| ● | Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”), which we control contractually, operates our “Jiuzhou Grand Pharmacy” stores; |

| ● | Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (General Partnership) (“Jiuzhou Clinic”), which we control contractually, operates one (1) of our two (2) medical clinics; and |

2

| ● | Hangzhou Jiuzhou Medical & Public Health Service Co., Ltd. (“Jiuzhou Service”), which we control contractually, operates our other medical clinics. |

As of March 29, 2019, Jiuzhou Pharmacy has established the following companies, each of which operates a drugstore in Hangzhou City:

| Entity Name | Date Established | |

| Hangzhou Jiuben Pharmacy Co., Ltd (“Jiuben Pharmacy”) | April 27, 2017 | |

| Hangzhou Jiuli Pharmacy Co., Ltd (“Jiuli Pharmacy”) | May 22, 2017 | |

| Hangzhou Jiuxiang Pharmacy Co., Ltd (“Jiuxiang Pharmacy”) | May 26, 2017 | |

| Hangzhou Jiuheng Pharmacy Co., Ltd (“Jiuheng Pharmacy”) | June 6, 2017 | |

| Hangzhou Jiujiu Pharmacy Co., Ltd (“Jiujiu Pharmacy”) | June 8, 2017 | |

| Hangzhou Jiuyi Pharmacy Co., Ltd (“Jiuyi Pharmacy”) | June 8, 2017 | |

| Hangzhou Jiuyuan Pharmacy Co., Ltd (“Jiuyuan Pharmacy”) | July 13, 2017 | |

| Hangzhou Jiumu Pharmacy Co., Ltd (“Jiumu Pharmacy”) | July 21, 2017 | |

| Hangzhou Jiurui Pharmacy Co., Ltd (“Jiurui Pharmacy”) | August 4, 2017 |

The Company’s offline retail business also includes three medical clinics through Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”), both of which are also controlled by the Company through contractual arrangements. On December 18, 2013, Jiuzhou Service established, and held 51% of, Hangzhou Shouantang Health Management Co. Ltd. (“Shouantang Health”) in December 2013 and holds 51% equity interests in Shouantang Health.

We also retail OTC drugs and nutritional supplements through a website (www.dada360.com) that we operate through Zhejiang Shouantang Pharmaceutical Technology Co., Ltd. (“Shouantang Technology”Health”), a wholly-owned subsidiary,PRC company licensed to sell health care products. Shouantang Health was closed in April 2015. In May 2016, Hangzhou Shouantang Bio-technology Co., Ltd. (“Shouantang Bio”) set up and held 49% of Hangzhou Kahamadi Bio-technology Co., Ltd. (“Kahamadi Bio”), a joint venture specialized in brand name development for nutritional supplements. In 2018, Jiuzhou Pharmacy invested a total of $741,540 (RMB 5,100,000) in and held 51% of Zhejiang Jiuzhou Linjia Medical Investment and Management Co. Ltd (“Linjia Medical”), which opened nine new clinics in Hangzhou as of December 31, 2018.

The Company currently conducts its subsidiary,online retail pharmacy business through Jiuzhou Pharmacy, which holds the Company’s online pharmacy license. Prior to November 2015, the Company primarily conducted its online retail pharmacy business through Zhejiang Quannuo Internet Technology Co., Ltd. (“Quannuo Technology”). QuannuoIn May 2015, the Company established Zhejiang Jianshun Network Technology has an wholly-owned subsidiary, Hangzhou Quannuo Grand PharmacyCo. Ltd, a joint venture with Shanghai Jianbao Technology Co., Ltd. (“Hangzhou Quannuo”Jianshun Network”). For, in order to develop its online pharmaceutical sales from large commercial medical insurance companies. On September 10, 2015, Renovation set up a new entity Jiuyi Technology to provide additional technical support such as webpage development to our online pharmacy business. In November 2015, the fiscal year ended March 31, 2014, retail revenue, including pharmacies, medical clinics and online sales, accountedCompany sold all of the equity interests of Quannou Technology to six individuals for approximately 72.0% of$17,121 (RMB 107,074). After the sale, its technical support function has been transferred back to Jiuzhou Pharmacy, which hosts our total revenue.online pharmacy.

Since August 2011, we have operatedIn 2019, the Company took a step in the development of its smart drug diagnosis model. The core of the smart drug diagnosis model is a chronic disease management platform and a member management platform. In April 2019, the Jo-Jo Internet Hospital officially began trial operation, including the implementation of video consultations for the Company’s customers. Future features are expected to improve strength in specializations including gynecology, ophthalmology, pediatrics and traditional Chinese medicine.

The Company’s wholesale business is primarily conducted through Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”), distributing third-partywhich is licensed to distribute prescription and non-prescription pharmaceutical products (similar to those carried by our pharmacies) primarily to trading companies throughout China. Jiuzhou Pharmacy acquired Jiuxin Medicine is wholly owned by Jiuzhou Pharmacy. For the fiscal year March 31, 2014, wholesale revenue accountedon August 25, 2011. On April 20, 2018, 10% of Jiuxin Medicine shares were sold to Hangzhou Kangzhou Biotech Co. Ltd. for approximately 28.0%a total proceeds of our total revenue.$79,625 (RMB 507,760).

We also have anThe Company’s herb farming business cultivating and wholesaling herbs used for TCM. This business is conducted throughby Hangzhou Qianhong Agriculture Development Co., Ltd. (“Qianhong Agriculture”), a wholly-owned subsidiary. During the fiscal year ended March 31, 2014, we generated no revenue from our herb farming business.subsidiary of Jiuxin Management, which operates a cultivation project of herbal plants used for TCM.

Corporate Structure

Our current corporate structure as of April 23, 2019 is set forth in the diagram below:

Our Corporate Information

We are headquartered in Zhejiang Province inHangzhou, China. Our principal executive office is located at 1st6th Floor, Yuzheng Plaza, No. 76, Yuhuangshan Road,Hai Wai Hai Tongxin Mansion, Gong Shu District, Hangzhou City, Zhejiang Province, China, 310002.Zip Code 310008. Our main telephone number is +86-571-8807-7078, and fax number is +86-571-8807-7108. Our website address iswww.chinajojodrugstores.com.www.jiuzhou360.com.Information contained on our website is not incorporated by reference into this prospectus and you should not consider information on our website to be part of this prospectus.

4

An investment in our securities involves a high degree of risk. Before making any investment decision, you should carefully consider the risk factors set forth below, the information under the caption “Risk Factors” in any applicable prospectus supplement, any related free writing prospectus that we may authorize to be provided to you and the information under the caption “Risk Factors” in our annual report on Form 10-K that is incorporated by reference in this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

These risks could materially affect our business, results of operation or financial condition and affect the value of our securities. Additional risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment. You could lose all or part of your investment. For more information, see “Where You Can Find More Information.”

Risks Related to Our Securities and the Offering5

Future sales or other dilutionTable of our equity could depress the market price of our common stock.Contents

Sales of our common stock, preferred stock, warrants, rights or convertible debt securities, or any combination of the foregoing, in the public market, or the perception that such sales could occur, could negatively impact the price of our common stock. We have a number of institutional and individual shareholders that own significant blocks of our common stock. If one or more of these shareholders were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing market price of our common stock could be negatively affected.

In addition, the issuance of additional shares of our common stock, securities convertible into or exercisable for our common stock, other equity-linked securities, including preferred stock, warrants or rights or any combination of these securities pursuant to this prospectus will dilute the ownership interest of our common shareholders and could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities.

We may need to seek additional capital. If this additional financing is obtained through the issuance of equity securities, debt securities convertible into equity or options, warrants or rights to acquire equity securities, our existing shareholders could experience significant dilution upon the issuance, conversion or exercise of such securities.

Our management will have broad discretion over the use of the proceeds we receive from the sale our securities pursuant to this prospectus and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from any offerings under this prospectus, and you will be relying on the judgment of our management regarding the application of these proceeds. Except as described in any prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities described in this prospectus will be added to our general funds and will be used for general corporate purposes. Our management might not apply the net proceeds from offerings of our securities in ways that increase the value of your investment and might not be able to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

Except as may be stated in the applicable prospectus supplement andWe will not receive any related free writing prospectus that we may authorize to be provided to you, we intend to use the net proceeds we receive from the sale of the securitiesour common stock offered by this prospectus for general corporate purposes, which may include, among other things, repaymentprospectus. The Selling Stockholder will receive all of debt, repurchasesthe proceeds. We will pay all costs, fees and expenses incurred in connection with the registration of the shares of our common stock capital expenditures, the financing of possible acquisitions or business expansions, increasing our working capital and the financing of ongoing operating expenses and overhead.covered by this prospectus.

The following is a summary of our capital stock and certain provisions of our articles of incorporation and bylaws. This summary does not purport to be complete and is qualified in its entirety by the provisions of our articles of incorporation, as amended, our bylaws and applicable provisions of the laws of the State of Nevada.

See “Where You Can Find More Information” elsewhere in this prospectus for information on where you can obtain copies of our articles of incorporation and our bylaws, which have been filed with and are publicly available from the SEC.

Our authorized capital stock consists of 250,000,000 shares of common stock, par value $.001 per share, and 10,000,000 shares of preferred stock, par value $.001 per share. As of August 5, 2014,April 23, 2019, (i) 15,035,50432,936,786 shares of common stock were issued and outstanding, (ii) no shares of preferred stock were issued and outstanding, and (iii) aan incentive stock option plan for our directors, officers, and employees to purchase 105,000967,000 shares of common stock, and a warrant(iv) warrants to purchase 150,000672,000 shares of common stock were issued and outstanding, noneoutstanding. As of which were then exercisable.April 23, 2019, the warrants had not been exercised.

As of August 5, 2014,April 23, 2019, there were 15,035,50432,936,786 shares of our common stock issued and outstanding, held by approximately 23 stockholders of record.outstanding.

Our common stock is currently traded on the NASDAQ Capital Market under the symbol “CJJD.”

The holders of our common stock are entitled to one vote per share on all matters submitted to a vote of our stockholders and do not have cumulative voting rights. Accordingly, holders of a majority of the shares of common stock entitled to vote in any election of directors may elect all of the directors standing for election. The holders of outstanding shares of common stock are entitled to receive ratably any dividends declared by our board of directors out of assets legally available. Upon our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preference of any then outstanding shares of preferred stock. Holders of common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to our common stock. The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219, and its telephone number is (718) 921-8206.

All issued and outstanding shares of common stock are fully paid and non-assessable. Shares of our common stock that may be offered, from time to time, under this prospectus will be fully paid and non-assessable.

6

DESCRIPTION OF PREFERRED STOCK

As of August 8, 2014,April 23, 2019, no shares of preferred stock had been issued or were outstanding.

Our board of directors has the authority to issue up to 10,000,000 shares of preferred stock in one or more series and to determine the rights and preferences of the shares of any such series without stockholder approval. Our board of directors may issue preferred stock in one or more series and has the authority to fix the designation and powers, rights and preferences and the qualifications, limitations or restrictions with respect to each class or series of such class without further vote or action by the stockholders, unless action is required by applicable law or the rules of any stock exchange on which our securities may be listed. The ability of our board of directors to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control of us or the removal of existing management. Further, our board of director may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our common stock. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock.

We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock we are offering before the issuance of that series of preferred stock. This description will include, but not be limited to, the following:

| ● | the title and stated value; | |

| ● | the number of shares we are offering; | |

| ● | the liquidation preference per share; | |

| ● | the purchase price; | |

| ● | the dividend rate, period and payment date and method of calculation for dividends; | |

| ● | whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate; | |

| ● | the provisions for a sinking fund, if any; | |

| ● | the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights; | |

| ● | whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period; | |

| ● | whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period; | |

| ● | voting rights, if any, of the preferred stock; | |

| ● | preemptive rights, if any; | |

| ● | restrictions on transfer, sale or other assignment, if any; | |

| ● | a discussion of any material United States federal income tax considerations applicable to the preferred stock; | |

| ● | the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; |

| ● | any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and | |

| ● | any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock. |

DESCRIPTION OF DEBT SECURITIES7

We have agreed to register 4,840,000 shares of our common stock which are beneficially owned by the Selling Stockholder.

On January 3, 2017, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with CareRetail Holdings Limited, an exempt company incorporated under the laws of the Cayman Islands (the “Investor” or the “Selling Stockholder”) pursuant to which the Company sold to the Investor, through a private placement, an aggregate of 4,840,000 shares (the “Shares”) of the common stock, at a purchase price of $2.20 per share, for aggregate gross proceeds to the Company of $10,648,000 (the “Private Placement”). The Shares are restricted shares and cannot be resold without an effective registration statement or a valid exemption. The Private Placement closed on January 23, 2017 (the “Closing”).

Concurrently to the entry into the Purchase Agreement, the Company entered into an Investor Rights Agreement (the “IRA”) with the Investor, Mr. Lei Liu, Ms. Li Qi (Mr. Liu and Ms. Qi are collectively referred to as the “Founder Parties”) and certain other parties. Pursuant to the IRA, the Investor shall be entitled to appoint one director to the Company’s board of directors. In no event can the Investor have the right to designate such a director if it holds less than 5% of the total outstanding shares of the Company. The Investor also has certain consent rights over actions such as, without limitation, change of control transactions, issuances of preferred stock, amendments to the charter or bylaws of the Company, the incurrence of indebtedness over $2 million and certain material asset purchases and dispositions. The Investor shall have the demand registration rights, piggy-back registration rights and Form S-3/F-3 registration rights over the Shares, as customary in such types of transactions, exercisable six months after the Closing. The Investor shall, pursuant to the IRA, also has first refusal and tag-along rights over the sale of Common Stock by the Founder Parties and the preemptive rights on the Company’s future issuance of securities (with certain customary exceptions such as equity grants to the Company’s employees, directors, consultants and other service providers) until the Investor holds less than 50% of the Shares and such holding is less than 10% of the total issued and outstanding shares of Common Stock. The Investor shall not transfer its Shares to a competitor of the Company without the prior written consent of the Founder Parties.

The shares of common stock beneficially owned by the Selling Stockholder are being registered to permit public secondary trading of these securities, and the Selling Stockholder may issue debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. When we offer to sell debt securities, we will describe the specific terms of any debt securities offeredthese shares for resale from time to time as described in a supplement to this prospectus, which may supplement or change the terms outlined below. Senior debt securities will be issued under one or“Plan of Distribution.”

The Selling Stockholder holds more senior indentures, datedthan 10% of our outstanding shares of the common stock.

The following table sets forth the names of the Selling Stockholder, the number of shares of common stock owned beneficially by the Selling Stockholder as of a date prior to such issuance, between usApril 23, 2019, and a trustee tothe number of shares that may be named in a prospectus supplement, as amended or supplementedoffered for resale by the Selling Stockholder from time to time. Any subordinated debt securities willThese shares may also be issued under onesold by donees, pledgees, and other transferees or more subordinated indentures, dated assuccessors in the interest of a date prior to such issuance, between us and a trustee to be named in a prospectus supplement, as amended or supplemented from time to time. The indentures will be subject to and governed by the Trust Indenture Act of 1939, as amended.Selling Stockholder.

Before we issue any debt securities,The Selling Stockholder may decide to sell all, some, or none of the formshares of indentures will be filedthe common stock listed below. We currently have no agreements, arrangements or understandings with the SEC and incorporated by reference as an exhibit toSelling Stockholder regarding the registration statementsale of which this prospectus is a part or as an exhibit to a current report on Form 8-K. For the complete termsany of the debt securities covered by this prospectus. We cannot provide you should refer to the applicable prospectus supplement and the formwith any estimate of indentures for those particular debt securities. We encourage you to read the applicable prospectus supplement and the form of indenture for those particular debt securities before you purchase any of our debt securities.

We will describe in the applicable prospectus supplement the terms of the series of debt securities being offered, including:

Conversion or Exchange Rights

We will set forth in the prospectus supplement the terms on which a series of debt securities may be convertible into or exchangeable for our common stock or our other securities. We will include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of shares of our common stock or our other securities that the holders ofSelling Stockholder will hold in the series of debt securities receive would be subject to adjustment.future.

DESCRIPTION OF WARRANTS

We may issue warrantsFor purposes of this table, beneficial ownership is determined in accordance with Rule 13d-3 promulgated under the Exchange Act, and includes voting power and investment power with respect to such shares. In calculating the percentage ownership or percent of equity vote for a given individual or group, the purchasenumber of shares of common stock preferred stock and/outstanding for that individual or debt securities in onegroup includes unissued shares subject to options, warrants, rights or more series. We may issue warrants independentlyconversion privileges exercisable within sixty days held by such individual or together with common stock, preferred stock and/group, but are not deemed outstanding by any other person or debt securities, and the warrants may be attached to or separate from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below.group.

We will file as exhibits to the registration statementThe applicable percentages of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the formownership are based on an aggregate of warrant agreement, including a form32,936,786 shares of warrant certificate, that describes the terms of the particular series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrants and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus. We urge you to read the applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus, as well as any related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms of the warrants.our Common Stock outstanding on April 23, 2019.

| Name of Selling Stockholder | Number of Shares of Common Stock Owned Before the Offering | Percent of Common Stock Owned Before the Offering | Shares Available for Sale Under This Prospectus | Number of Shares of Common Stock To Be Owned After the Termination of the Offering | Percent of Common Stock to be Owned After Completion of the Offering | |||||||||||||||

| CareRetail Holdings Limited (2) | 4,840,000 | 14.7 | % | 4,840,000 | (1) | (1) | ||||||||||||||

General

We will describe in the applicable prospectus supplement the terms of the series of warrants being offered, including:

| Because (a) the Selling Stockholder may offer all or some of the shares of our common stock that it holds in the offering | ||

| The address of CareRetail Holdings Limited is Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008. Hillhouse Capital Management, Ltd., an exempted Cayman Islands company (“Hillhouse Capital”) is hereby deemed to be the | ||

Before exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including:

Exercise of Warrants

Each warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus supplement. Holders of the warrants may exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with specified information, and paying the required amount to the warrant agent in immediately available funds, as provided in the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the information that the holder of the warrant will be required to deliver to the warrant agent.

If fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for warrants.

DESCRIPTION OF RIGHTS

We may issue rights to purchase our common stock or preferred stock, in one or more series. Rights may be issued independently or together with any other offered security and may or may not be transferable by the person purchasing or receiving the subscription rights. In connection with any rights offering to our stockholders, we may enter into a standby underwriting arrangement with one or more underwriters pursuant to which such underwriters will purchase any offered securities remaining unsubscribed after such rights offering. In connection with a rights offering to our stockholders, we will distribute certificates evidencing the rights and a prospectus supplement to our stockholders on the record date that we set for receiving rights in such rights offering. The applicable prospectus supplement or free writing prospectus will describe the following terms of rights in respect of which this prospectus is being delivered:

Each right will entitle the holder thereof the right to purchase for cash such amount of shares of common stock or preferred stock, or any combination thereof, at such exercise price as shall in each case be set forth in, or be determinable as set forth in, the prospectus supplement relating to the rights offered thereby. Rights may be exercised at any time up to the close of business on the expiration date for such rights set forth in the prospectus supplement. After the close of business on the expiration date, all unexercised rights will become void. Rights may be exercised as set forth in the prospectus supplement relating to the rights offered thereby. Upon receipt of payment and the proper completion and due execution of the rights certificate at the office of the rights agent, if any, or any other office indicated in the prospectus supplement, we will forward, as soon as practicable, the shares of common stock and/or preferred stock purchasable upon such exercise. We may determine to offer any unsubscribed offered securities directly to persons other than stockholders, to or through agents, underwriters or dealers or through a combination of such methods, including pursuant to standby underwriting arrangements, as set forth in the applicable prospectus supplement.

8

DESCRIPTION OF UNITS

As specified in the applicable prospectus supplement, we may issue, in one more series, units consisting of common stock, preferred stock, debt securities and/or warrants or rights for the purchase of common stock, preferred stock and/or debt securities in any combination. The applicable prospectus supplement will describe:

The securitiescommon stock covered by this prospectus may be offered and sold from time to time by the Selling Stockholder. The term “Selling Stockholder” includes pledgees, donees, transferees or other successors in interest selling shares received after the date of this prospectus from each of the Selling Stockholder as a pledge, gift, partnership distribution or other non-sale related transfer. The number of shares beneficially owned by Selling Stockholder will decrease as and when they effect any such transfers. The plan of distribution for the Selling Stockholder’s shares sold hereunder will otherwise remain unchanged, except that the transferees, pledgees, donees or other successors will be Selling Stockholders hereunder. To the extent required, we may amend and supplement this prospectus from time to time to describe a specific plan of distribution. The Selling Stockholder will act independently of us in making decisions with respect to the timing, manner and size of each sale. Once sold under this registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

We will not receive any of the proceeds from the sale by the Selling Stockholder of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The Selling Stockholder may make these sales at prices and under terms then prevailing or at prices related to the then current market price. The Selling Stockholder may also make sales in negotiated transactions. The Selling Stockholder may offer their shares from time to time pursuant to one or more of the following methods:

| ● | ||

| ● | one or more block trades in which the broker-dealer will attempt to | |

| ● | ||

| ● | an exchange distribution in | |

| ● |

| ● | on the NASDAQ Capital Market (or through the facilities of any national securities exchange or U.S. inter- dealer quotation system of a registered national securities association, on which the shares are then listed, admitted to | |

| ● | through underwriters, brokers or dealers (who may act as agents or principals) or directly to one or more purchasers; |

| ● | a combination of any such methods of |

| ● | any other method permitted pursuant to applicable law. |

Agents,In connection with distributions of the shares or otherwise, the Selling Stockholder may:

| ● | enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares in the course of hedging the positions they assume; |

| ● | sell the shares short after the effective date of the registration statement of which this prospectus forms a part and redeliver the shares to close out such short positions; |

| ● | enter into option or other transactions with broker-dealers or other financial institutions which require the delivery to them of shares offered by this prospectus, which they may in turn resell; and |

| ● | pledge shares to a broker-dealer or other financial institution, which, upon a default, they may in turn resell. |

In addition to the foregoing methods, the Selling Stockholder may offer their shares from time to time in transactions involving principals or brokers not otherwise contemplated above, in a combination of such methods as described above or any other lawful methods. The Selling Stockholder may also transfer, donate or assign their shares to lenders, family members and others and each of such persons will be deemed to be a Selling Stockholder for purposes of this prospectus. The Selling Stockholder or their successors in interest may from time to time pledge or grant a security interest in some or all of the shares of common stock, and if the Selling Stockholder default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time under this prospectus;provided,however in the event of a pledge or then default on a secured obligation by the Selling Stockholder, in order for the shares to be sold under this registration statement, unless permitted by law, we must distribute a prospectus supplement and/or amendment to this registration statement amending the list of Selling Stockholder to include the pledgee, secured party or other successors in interest of the Selling Stockholder under this prospectus.

9

The Selling Stockholder may also sell their shares pursuant to Rule 144 under the Securities Act, provided the Selling Stockholder meets the criteria and conform to the requirements of such rule.

The Selling Stockholder may effect such transactions directly or indirectly through underwriters, broker-dealers or agents acting on their behalf. Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Stockholder, in amounts to be negotiated immediately prior to the sale (which compensation as to a particular broker-dealer might be in excess of customary commissions for routine market transactions). If the shares of common stock are sold through underwriters or broker-dealers, maythe Selling Stockholder will be paid compensationresponsible for offering and selling the securities. That compensation may be in the form ofunderwriting discounts concessions or commissions to be received fromor agent's commissions. Neither we, nor the Selling Stockholder, can presently estimate the amount of that compensation. If the Selling Stockholder notifies us fromthat a material arrangement has been entered into with a broker- dealer for the purchaserssale of shares through a block trade, special offering, exchange, distribution or secondary distribution or a purchase by a broker or dealer, we will file a prospectus supplement, if required by Rule 424 under the Securities Act, setting forth: (i) the name of each of the securities or from both usselling stockholder and the purchasers. Any underwriters, dealers, agentsparticipating broker-dealers; (ii) the number of shares involved; (iii) the price at which the shares were sold; (iv) the commissions paid or discounts or concessions allowed to the broker-dealers, where applicable; (v) a statement to the effect that the broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus; and any other investorsfact material to the transaction.

The Selling Stockholder and any other person participating in a distribution of the shares covered by this prospectus will be subject to applicable provisions of the Exchange Act, including, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the shares by the Selling Stockholder and any other such person. Furthermore, under Regulation M, any person engaged in the distribution of the securitiesshares may not simultaneously engage in market-making activities with respect to the particular shares being distributed for certain periods prior to the commencement of, or during, that distribution. All of the above may affect the marketability of the shares and the ability of any person or entity to engage in market-making activities with respect to the shares. We have advised the Selling Stockholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply.

In offering the shares covered by this prospectus, the Selling Stockholder, and any broker-dealers and any other participating broker-dealers who execute sales for the Selling Stockholder, may be deemed to be “underwriters,” as that term is defined in“underwriters” within the meaning of the Securities Act in connection with these sales. Any profits realized by the Selling Stockholder and the compensation and profits received by them on sale of the securitiessuch broker-dealers may be deemed to be underwriting commissions, asdiscounts and commissions. We are not aware that term is defined in the rules promulgated under the Securities Act.

Each time securities are offered by this prospectus, the prospectus supplement, if required, will set forth:

��

The securities may be sold at a fixed price or prices, which may be changed, at market prices prevailing at the time of sale, at prices relating to the prevailing market prices or at negotiated prices. The distribution of securities may be effected from time to time in one or more transactions, by means of one or more of the following transactions, which may include cross or block trades:

If underwriters are used in a sale, securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions. Our securities may be offered to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters. If an underwriter or underwriters are used inbroker-dealers regarding the sale of securities, an underwriting agreement will be executed with the underwriter or underwriters at the time an agreement for the sale is reached. This prospectus and the prospectus supplement will be used by the underwriters to resell theits shares of our securities.common stock.

10

In compliance with the guidelines of the Financial Industry Regulatory Authority, or FINRA, the aggregate maximum discount, commission or agency fees or other items constituting underwriting compensation to be received by any FINRA member or independent broker-dealer will not exceed 8% of the offering proceeds from any offering pursuant to this prospectus and any applicable prospectus supplement.

If 5% or more of the net proceeds of any offering of our securities made under this prospectus will be received by a FINRA member participating in the offering or affiliates or associated persons of such FINRA member, the offering will be conducted in accordance with FINRA Rule 5121.

To comply with the securities laws of certain states, if applicable, the securities offered by this prospectus will be offered and sold in those states only through registered or licensed brokers or dealers.

Agents, underwriters and dealers may be entitled under agreements entered into with us to indemnification by us against specified liabilities, including liabilities incurred under the Securities Act, or to contribution by us to payments they may be required to make in respect of such liabilities. The prospectus supplement will describe the terms and conditions of such indemnification or contribution. Some of the agents, underwriters or dealers, or their respective affiliates, may be customers of, engage in transactions with or perform services for us in the ordinary course of business. We will describe in the prospectus supplement naming the underwriter the nature of any such relationship.

Certain persons participating in the offering may engage in over-allotment, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. We make no representation or prediction as to the direction or magnitude of any effect that such transactions may have on the price of the securities. For a description of these activities, see the information under the heading “Underwriting” in the applicable prospectus supplement.

The validity of the securities offered in this prospectus will behereby has been passed upon for us by Pryor Cashman LLP.Holley Driggs Walch Fine Puzey Stein & Thompson.

EXPERTS

Our consolidated financial statements as of March 31, 20142018 and 2013,2017, and for each of the years in the two-year period ended March 31, 2014,2018, have been incorporated by reference in the registration statement in reliance on the report of FriedmanBDO China Shu Lun Pan Certified Public Accountants LLP, an independent registered public accounting firm, and upon the authority of said firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them into this prospectus. This means that we can disclose important information about us and our financial condition to you by referring you to another document filed separately with the SEC instead of having to repeat the information in this prospectus. The information incorporated by reference is considered to be part of this prospectus and later information that we file with the SEC will automatically update and supersede this information. This prospectus incorporates by reference any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, between the date of the initial registration statement and prior to effectiveness of the registration statement and the documents listed below that we have previously filed with the SEC:

| ● | our Current Reports on Form 8-K (including the Amendment to the Form 8-K), filed with the SEC on September 6, 2018, October 26, 2018, November 9, 2018, March 13, 2019, April 11, 2019 and April 12, 2019, respectively; |

| ● | our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2018, September 30, 2018 and December 31, 2018, respectively, filed with the SEC on August 14, 2018, November 14, 2018 and February 14, 2019, respectively; |

| ● | our Annual Report on Form 10-K for the year ended March 31, | |

| ● | Definitive Proxy Statement on Schedule 14A, filed with the SEC on January 24, 2019; and | |

| ● | the description of our common stock contained in the registration statement on Form 8-A, dated April 21, 2010, File No. 001-34711, and any other amendment or report filed for the purpose of updating such description. |

We also incorporate by reference all documents that we file with the SEC on or after the effective time of this prospectus pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act and prior to the sale of all the securities registered hereunder or the termination of the registration statement. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in the applicable prospectus supplement or in any other subsequently filed document that also is or is deemed to be incorporated by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a copy of the filings incorporated herein by reference, including exhibits to such documents that are specifically incorporated by reference, at no cost, by writing or calling us at the following address or telephone number:

| China Jo-Jo Drugstores, Inc. |

| People’s Republic of China |

| (86 - 571) |

Statements contained in this prospectus as to the contents of any contract or other documents are not necessarily complete, and in each instance you are referred to the copy of the contract or other document filed as an exhibit to the registration statement or incorporated herein, each such statement being qualified in all respects by such reference and the exhibits and schedules thereto.

11

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC registering the securities that may be offered and sold hereunder. The registration statement, including exhibits thereto, contains additional relevant information about us and these securities, as permitted by the rules and regulations of the SEC, we have not included in this prospectus. A copy of the registration statement can be obtained at the address set forth below or at the SEC’s website as noted below. You should read the registration statement, including any applicable prospectus supplement, for further information about us and these securities.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http:/www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because our common stock is listed on the NASDAQ Capital Market, you may also inspect reports, proxy statements and other information at the offices of the NASDAQ Capital Market.

12

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth all expenses payable by us in connection with the offering of our securities being registered hereby. All amounts shown are estimates except the SEC registration fee.

| SEC registration fee | $ | 3,864 | $ | 821.25 | ||||

| Legal fees and expenses | * | * | ||||||

| Accounting fees and expenses | * | * | ||||||

| Printing and miscellaneous expenses | * | * | ||||||

| Total expenses | $ | * | $ | * |

*Estimated expenses are presently not known and cannot be estimated.

| * | Estimated expenses are presently not known and cannot be estimated. |

Item 15. Indemnification of Directors and Officers.

Under Sections 78.7502 and 78.751 of the Nevada Revised Statutes, the Company has broad powers to indemnify and insure its directors and officers against liabilities they may incur in their capacities as such. These indemnification provisions may be sufficiently broad to permit indemnification of the Company’s directors and officers for liabilities, including reimbursement of expenses incurred, arising under the Securities Act.

Insofar as indemnification for liabilities arising under the Securities Act, is permitted for our directors, officers or controlling persons, pursuant to the above mentioned statutes or otherwise, we understand that the SEC is of the opinion that such indemnification may contravene federal public policy, as expressed in the Securities Act, and therefore, is unenforceable. Accordingly, in the event that a claim for such indemnification is asserted by any of our directors, officers or controlling persons, and the SEC is still of the same opinion, we (except insofar as such claim seeks reimbursement from us of expenses paid or incurred by a director, officer of controlling person in successful defense of any action, suit or proceeding) will, unless the matter has theretofore been adjudicated by precedent deemed by our counsel to be controlling, submit to a court of appropriate jurisdiction the question whether or not indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

At present, there is no pending litigation or proceeding involving any of our directors, officers or employees as to which indemnification is sought, nor are we aware of any threatened litigation or proceeding that may result in claims for indemnification.

Item 16. Exhibits and Financial Schedule

See the Exhibit Index attached to this registration statement and incorporated herein by reference.

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

II-1

(ii) to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act, that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2) That, for the purposes of determining any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at the time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

II-2

(5) That, for the purpose of determining liability of a Registrant under the Securities Act to any purchaser in the initial distribution of the securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) the portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(6) The undersigned registrant hereby undertakes that:

(i) For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(ii) For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initialbona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the indemnification provisions described herein, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-3

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Hangzhou, the People’s Republic of China on the 826th day of August, 2014.April, 2019.

| CHINA JO-JO DRUGSTORES, INC. | ||

| By: | /s/Lei Liu | |

| Lei Liu | ||

Chief Executive Officer (Principal Executive Officer) | ||

Each person whose signature appears below constitutes and appoints Lei Liu and Ming Zhao as his true and lawful attorneys-in-fact and agents, each acting alone, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement on Form S-3 and any subsequent registration statement the Registrant may hereafter file with the Securities and Exchange Commission pursuant to Rule 462 under the Securities Act to register additional securities in connection with this registration statement, and to file this registration statement, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in order to effectuate the same as fully, to all intents and purposes, as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | Title | Date | ||

| /s/ Lei Liu | Chief Executive Officer and Director | |||

| Lei Liu | (Principal Executive Officer) | |||

| /s/ Ming Zhao | Chief Financial Officer | |||

| Ming Zhao | (Principal Financial Officer and Principal Accounting Officer) | |||

| /s/ Li Qi | Director | April 26, 2019 | ||

| Li Qi | ||||

| /s/ | ||||

| Director | ||||

| Caroline Wang | ||||

| /s/ | ||||

| Director | ||||

| Jiangliang He | ||||

| /s/ Genghua Gu | Director | April 26, 2019 | ||

| Genghua Gu | ||||

| /s/ Pingfan Wu | Director | |||

| Pingfan Wu |

II-4

EXHIBIT INDEX

_______________

| ** | Filed herewith |

E-1