As filed with the Securities and Exchange Commission on May 8, 2015January 14, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

Nxt-ID, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 46-0678374 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

288 Christian Street285 North Drive

Oxford, CT 06478Suite D

Melbourne, FL 32934

(203) 266-2103

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

National Corporate Research, Ltd.

615 South DuPont Highway

Dover, DE 19901

(800) 483-1140

(Name, address including zip code, and telephone number, including area code, of agent for service)

With copies to:

David E. Danovitch, Esq.

Nakia Elliott, Esq.

Zachary D. Blumenthal, Esq.

Avraham S. Adler, Esq.

Robinson Brog Leinwand Greene Genovese & Gluck P.C.

875 Third Avenue, 9th Floor

New York, NY 10022

Tel: (212) 603-6300

Fax: (212) 956-2164

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer | ||||

| Non-accelerated filer | ☐ | Smaller reporting company | þ | ||

| (Do not check if smaller reporting company) | |||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount | Proposed Maximum Offering Price Per Unit(2) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee | ||||||||||||

| Common Stock, $0.0001 par value per share | 2,099,998(3) | $ | 2.85 | $ | 5,984,994 | $ | 695.46 | |||||||||

| Title of Each Class of Securities to be Registered |

Amount | Proposed Maximum Offering Price Per Share(3) | Proposed Maximum Aggregate Offering Price(3) | Amount of Registration Fee | ||||||||||||

| Common Stock, $0.0001 par value per share | 12,240,000 | (2) | $ | 0.34 | $ | 4,161,600 | $ | 419.08 | ||||||||

| (1) | All shares registered pursuant to this registration statement are to be offered by the selling stockholders. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such indeterminate number of additional shares of the registrant’s common stock, $0.0001 par value per share (the “Common Stock”) issued to prevent dilution resulting from stock splits, stock dividends or similar events. |

| (2) | Represents the maximum number of shares of Common Stock initially issuable upon conversion of the Notes (as defined below). | |

| (3) | Estimated solely for purposes of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act based on the average of the high and low sales prices of the registrant’s Common Stock on the NASDAQ Capital Market on |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 8, 2015JANUARY 14, 2016

PROSPECTUS

2,099,99812,240,000 Shares of Common Stock

Nxt-ID, Inc.

This prospectus relates to the offer and resale by the selling stockholders identified in this prospectus of up to an aggregate of 2,099,998 shares12,240,000shares of our common stock, $0.0001 par value per share (the “Common Stock”). The offered shares of Common Stock are issuable, or may in the future become issuable, with respect to the conversion of secured convertible notesSenior Secured Convertible Notes (the “Convertible Notes”) and the interest thereon for up to 662,500 shares of Common Stock, a Class A Common Stock Purchase Warrant to purchase up to 468,749 shares of our Common Stock (the “Class A Warrants”) and a Class B Common Stock Purchase Warrant to purchase up to 468,749 shares of our Common Stock (the “Class B Warrants”“Notes”) issued in connection with a private placement we completed pursuant to a Securities Purchase Agreement, dated April 24,December 8, 2015 (the “Securities Purchase“Purchase Agreement”), between us and certain purchasers thereto. See “Private Placement of Convertible Notes, Class A Warrants and Class B Warrants.Notes.” In addition, the offered shares of Common Stock are issuable with respect to warrants to purchase up to 400,000 shares of Common Stock issued to investors in a June 2014 private placement (the “June Warrants”) and warrants to purchase up to 100,000 shares of Common Stock issued to investors in a private placement on August 21, 2014 (the “August Warrants,” and together with the Class A Warrants, Class B Warrants and June Warrants, the “Warrants”). For additional information on the June Warrants and August Warrants,Notes, see “Selling Stockholders—Material Relationships with Selling Stockholders.”

We will not receive any of the proceeds from the sale of the Common Stock by the selling stockholders. However, to the extent the Warrants are exercised for cash, if at all, we will receive up to $4,759,367.

The selling stockholders identified in this prospectus may offer the shares of Common Stock from time to time through public or private transactions at prevailing market prices or at privately negotiated prices. See “Plan of Distribution.”

We have agreed to pay certain expenses in connection with the registration of the shares of Common Stock. The selling stockholders will pay all brokerage expenses, fees, discounts and selling commissions, if any, in connection with the sale of the shares of Common Stock.

Our Common Stock is currently traded on the NASDAQ Capital Market under the symbol “NXTD.” On May 4, 2015,January 13, 2016, the last reported sale price of our Common Stock as reported on the NASDAQ Capital Market was $2.87$0.39 per share.

We are an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our securities involves risks. You should carefully review the risks described under the heading “Risk Factors”Factors” beginning on page 56 and in the documents which are incorporated by reference herein and contained in the applicable prospectus supplement before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2015.

TABLE OF CONTENTS

| Page | |

| ABOUT THIS PROSPECTUS | 1 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 2 |

| PROSPECTUS SUMMARY | 3 |

| RISK FACTORS | |

| USE OF PROCEEDS | |

| 10 | |

| 11 | |

| SELLING STOCKHOLDERS | 12 |

| EXPERTS | 17 |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION OF DOCUMENTS BY REFERENCE |

You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We and the selling stockholders have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the Securities and Exchange Commission (the “SEC”) and incorporated by reference, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus may not be used to consummate a sale of our securities unless it is accompanied by a prospectus supplement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

In this prospectus, we refer to Nxt-ID, Inc. as “we,” “us,” “our,” and the “Company” unless we specifically state otherwise or the context indicates otherwise.

| 1 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, the applicable prospectus supplement and the information incorporated by reference in this prospectus contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events. Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, and/or which include words such as “believes,” “plans,” “intends,” “anticipates,” “estimates,” “expects,” “may,” “will” or similar expressions. In addition, any statements concerning future financial performance, ongoing strategies or prospects, and possible future actions, which may be provided by our management, are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties, and assumptions about our company, economic and market factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance, and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future results and actions to differ materially from any forward-looking statements include, but are not limited to, those discussed under the heading “Risk Factors” in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. The forward-looking statements in this prospectus, the applicable prospectus supplement and the information incorporated by reference in this prospectus represent our views as of the date such statements are made. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date such statements are made.

| 2 |

This summary highlights selected information contained elsewhere in this prospectus or in documents incorporated herein by reference. This summary does not contain all the information that you should consider before investing in our securities. You should carefully read the entire prospectus, including “Risk Factors,” our consolidated financial statements and the information incorporated by reference herein, before making an investment decision.

Our Company

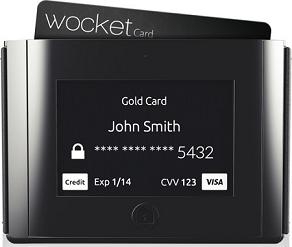

We are an early stage technology company that is focused on developing and marketing products, solutions, and services for organizations that have a need for biometric secure access control. We have three distinct lines of business that we are currently pursuing: mobile commerce (“m-commerce”); law enforcementenforcement; m-commerce; and biometric access control applications. Our initial efforts have primarily focused on the development of our secure products offering for law enforcement, the Department of Defense, and Homeland Security through our 3D FaceMatch® biometric identification systems. In parallel we have developed a secure biometric electronic smart wallet, the wocket® smart wallet, for the growing m-commerce market,market. We believe that the wocket® smart wallet constitutes unique technology because it takes a very different approach relative to the current offerings, instead of replacing the wallet through a smartphone, our aim is to improve it. We believe that our wocket® smart wallet will reduce the number of cards carried in a consumer’s wallet while supporting most immediately,payment methods currently available at point of sale at retailers around the world, including magnetic stripe, barcodes and Quick Response (QR) Codes and in the near future near field communications, all within a secure mobile electronic smart wallet. Wocket™biometric vault. We have also recently launched a new biometric authentication product named Voicematch®. This product is a smart wallet,new method of recognizing both the next evolution in smart devices following the smart phonevoice of speakers and smart watch, designedspecific words they use providing innovative multi-factor recognition that is efficient enough to protect your identity and replace all the cards in your wallet, with no smart phone required. Wocket™ works anywhere credit cards are accepted and only works with your biometric stamp of approval. Credit, debit, ATM, loyalty, gift, ID, membership, insurance, ticket, emergency, medical, business, contacts, coupon, and virtually any card can be protectedrun on Wocket™. More than 10,000 cards, records, coupons, etc. and 100 voice commands can also be stored on Wocket™.low-power devices.

Wocket™ prototype

Our plan also anticipates that we will use our core biometric facial and voice recognition algorithms to develop security applications (both cloud based and locally hosted) that can be used for corporations (industrial uses such as enterprise computer networks) as well as individuals (consumer uses such as smart phones, tablets or personal computers). Finally, our plan calls for a suite of high level security products and facial recognition applications that can be utilized by law enforcement, the defense industry and the U.S. Department of Homeland Security.

Our MobileBioTM products are products designed to provide security for individuals on mobile devices. We believe that our MobileBioTM products, together with our biometric security solutions, will provide distinct advantages within these markets by improving mobile security. Currently most mobile devices continue to be protected simply by PIN numbers. This security methodology is easily duplicated on another device, and can be easily spoofed or hacked. Our biometric security paradigm is Dynamic Pairing Codes (DPC). DPC is a new, proprietary method to secure users, devices, accounts, locations and servers over any communication media by sharing key identifiers, including biometric-enabled identifiers, between end-points by passing dynamic pairing codes (random numbers) between end-points to establish sessions and/or transactions without exposing identifiers or keys. The recent high-level breaches of personal credit card data raise serious concerns among consumers about the safety of their money. These consumers are also resistant to letting technology companies learn even more about their personal purchasing habits.

We also

| 3 |

In addition to offering security for individuals through our MobileBioTM products, we plan to service the access control and law enforcement facial recognition markets with 3D FaceMatch® and 3D SketchArtistTM, our existing 3D facial recognition technology products, beginning with U.S. federal and state governmental agencies. These 3D facial recognition technology products, whose underlying technologies have been licensed by us, provide customers with the capability to enroll subjects in a 3D database and use that database for verification of identities. During 2012, we acquired 100% of the membership interests in an entity affiliated with our founders as a means toward advancing our business plan.

Corporate InformationOur Intellectual Property

The Our ability to compete effectively depends to a significant extent on our ability to protect our proprietary information. We currently rely and will continue to rely primarily on patents and trade secret laws and confidentiality procedures to protect our intellectual property rights. We have filed seven (7) patent applications based on the wocket® and Dynamic Pairing Codes (DPC), a proprietary method used by us to secure users, devices, accounts, locations and servers over any communication media by sharing key identifiers, including biometric-enabled identifiers, between end-points by passing dynamic pairing codes (random numbers) between end-points to establish sessions and/or transactions without exposing identifiers or keys. We have filed two (2) patent applications on multi-factor voice authorization.

Company isInformation

We are a Delaware corporation formed on February 8, 2012. We were initially known as Trylon Governmental Systems, Inc. We changed our name to Nxt-ID, Inc. on June 25, 2012 to reflect our primary focus on our growing biometric identification, m-commerce and secure mobile platforms.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act. We will remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenue exceeds $1 billion, (ii) the date that we become a ‘‘large accelerated filer’’ as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. Pursuant to Section 107 of the JOBS Act, we have elected to utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

Where You Can Find Us

Our principal executive offices are located at 288 Christian Street, Oxford, CT 06478,285 North Drive, Suite D, Melbourne, FL 32934, and our telephone number is (203) 266-2103. Our website address is www.nxt-id.comwww.nxt-id.com.. The information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus supplement or the registration statement of which it forms a part. The information on our website is not part of this prospectus.prospectus supplement.

The Offering

| Common Stock Offered by the Selling | Up to | |

| Common Stock Outstanding (assuming | ||

| Terms of the Offering: | The selling stockholders will determine when and how they sell the Common Stock offered in this prospectus, as described in “Plan of Distribution.” | |

| Use of Proceeds: | We will not receive any of the proceeds from the sale of the shares of Common Stock being offered under this prospectus. | |

| NASDAQ Symbol: | Our Common Stock is listed on the NASDAQ Capital Market under the symbol “NXTD”. | |

| Risk Factors: | You should read the “Risk Factors” section of this prospectus for a discussion of factors to carefully consider before deciding to invest in shares of our Common Stock. |

RISK FACTORS

| 4 |

Recent Developments

Company Updates

Throughout 2015 and in the fourth quarter of 2015 in particular, credit card issuers together with merchants and others utilizing point of sale terminals rolled out the so-called EMV chip card technology. EMV is a technical standard for smart payment cards and for payment terminals and automated teller machines that can accept them. EMV cards are smart cards (also called chip cards or IC cards) which store their data on integrated circuits rather than magnetic stripes, although many EMV cards also have stripes for backward compatibility. The increased ubiquity of the EMV technology has presented challenges for the initial version of the wocket® smart wallet insofar as demand for the current wocket® smart wallet product, which is not EMV compatible, has dropped substantially and the Company’s growth expectations may be compromised going forward. The Company is responding to this and has developed an NFC capability for the wocket® smart wallet, similar to the NFC technology, which stands for “near field communication.” NFC technology enables devices to communicate with each other when they’re close together. NFC enables contactless payments, which are transactions that require no physical contact between the payments device and the payments reader.

The commercial launch of the NFC wocket® smart wallet is expected during the first half of 2016. Most components on the two versions of the wocket® smart wallet are common and the Company does not expect it to have a significant impact on the usability of inventory, however, there is no guarantee that the Company will be able to use its current inventory. We will require additional capital in the future to develop the NFC wocket® smart wallet.

Transactions with WorldVentures Holdings, LLC

On December 31, 2015, we entered into a Master Product Development Agreement (the “Development Agreement”) with WorldVentures Holdings, LLC (“WVH”). The Development Agreement commenced on December 31, 2015, and has an initial term of two (2) years (the “Initial Term”). Thereafter, the Development Agreement will automatically renew for additional successive one (1) year terms (each a “Renewal Term”) unless and until WVH provides written notice of non-renewal at least thirty (30) days prior to the end of the Initial Term or then-current Renewal Term. Each Renewal Term will commence immediately on expiration of the Initial Term or preceding Renewal Term. The Development Agreement may also be terminated earlier pursuant to certain conditions.

Pursuant to the Development Agreement, WVH has retained us to design, develop and manufacture a series of Proprietary Products (as defined in the Development Agreement) for distribution through WVH’s network of sales representatives, members, consumers, employees, contractors or affiliates. The Proprietary Products will utilize our existing Background Technology (as defined in the Development Agreement) and customized hardware designs/solutions and software tools/applications developed by us for WVH. In conjunction with the Development Agreement, the Company and WVH contractually agreed to dedicate $1,500,000 of the $2,000,000 in total proceeds received by the Company to the development and manufacture of the product for WVH. In addition, any expenditure of the $1,500,000 in proceeds is restricted in that the Company will need prior approval from WVH on a monthly basis in order to fund the estimated expenditures needed for the development of the product for WVH from the $1,500,000.

In connection with the Development Agreement, on December 31, 2015, we entered into a securities purchase agreement (the “WVH Purchase Agreement”) with WVH providing for the issuance and sale by us of 10,050,000 shares (the “WVH Shares”) of Common Stock and a common stock purchase warrant (the “WVH Warrant”) to purchase 2,512,500 shares (the “WVH Warrant Shares”) of Common Stock, for an aggregate purchase price of $2,000,000. The WVH Warrant is initially exercisable on the five (5) month anniversary of the issuance date at an exercise price equal to $0.75 per share and has a term of exercise equal to two (2) years and seven (7) months from the date on which first exercisable.

In connection with the sale of the WVH Shares and the WVH Warrant, the Company entered into a registration rights agreement, dated December 31, 2015 (the “WVH Registration Rights Agreement”), with WVH, pursuant to which the Company agreed to register the WVH Shares and the WVH Warrant Shares on a Form S-1 or Form S-3 registration statement (the “WVH Registration Statement”) to be filed with the SEC within ninety (90) days after the date of the issuance of the WVH Shares and the WVH Warrants (the “WVH Filing Date”) and to cause the WVH Registration Statement to be declared effective under the Securities Act within one hundred eight (180) days following the WVH Filing Date.

In the event that the WVH Registration Statement is filed with the SEC untimely, WVH may be, in addition to being entitled to exercise all rights granted by law and under the WVH Registration Rights Agreement, including recovery of damages, shall be entitled to specific performance of its rights under the WVH Registration Rights Agreement. Pursuant to the WVH Registration Rights Agreement each of us and WVH and agreed that monetary damages would not provide adequate compensation for any losses incurred by reason of a breach by it of any of the provisions of the WVH Registration Rights Agreement and that, in the event of any action for specific performance in respect of such breach, it shall not assert or shall waive the defense that a remedy at law would be adequate.

WVH will make the product available to approximately all of its 500,000 members for purchase and purchase WVH cards from us for all new members which have been running at approximately 70,000 a month. The Development Agreement calls for the purchase price from the Company to be at direct cost plus 30%.

The Company is also in discussions with smartphone manufacturers to implement its payment technology on their phones and pursuing brand development strategies with major cards issuing banks.

| 5 |

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” in our most recent Annual Report on Form 10-K on file with the SEC and any of our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, which are incorporated by reference in this prospectus and any prospectus supplement, and the additional risks and uncertainties described below before purchasing our securities. The risks and uncertainties we have described are not the only ones facing our company. If any of these risks actually occur, our business, financial condition or results of operations would likely suffer. In that case, the trading price of our common stock could fall, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. Before making an investment decision, you should carefully consider these risks as well as the other information we include or incorporate by reference in this prospectus and any prospectus supplement.

Risks Relating to our Convertible Notes and Warrants

We could be required to make substantial cash payments upon an event of default or change of control under the Convertible Notes described below.

The Convertible Notes provide for events of default including, among others, payment defaults, cross defaults, material breaches of any representations or warranties, breaches of covenants that are not cured within the applicable time period, failure to perform certain required activities in a timely manner, failure to comply with the requirements under the Registration Rights Agreement (as defined below), suspension from trading or failure of our Common Stock to be listed on an eligible market for certain periods and certain bankruptcy-type events involving us or a subsidiary.

If there is an event of default, a holder of the Convertible Notes may require us to immediately redeem the Convertible Notes in cash in an amount equal to the sum of(a) the greater of (i) the outstanding principal amount of the Convertible Notes divided by the conversion price on the date such default amount is either (A) demanded (if demand or notice is required to create an event of default) or otherwise due or (B) paid in full, whichever has a lower conversion price, multiplied by the volume weighted average price on the date the default amount is either (x) demanded or otherwise due or (y) paid in full, whichever has a higher volume weighted average price, or (ii) 115% of the outstanding principal amount of the Convertible Notes and (b) all other amounts, costs, expenses and liquidated damages due in respect of the Convertible Notes (the “Mandatory Default Amount”).

In addition, under the terms of the Convertible Notes, in the event of transactions involving a change of control, a holder of the Convertible Notes may require us to immediately redeem the Convertible Notes in cash at the Mandatory Default Amount.

If either an event of default or change of control occurs, our available cash could be seriously depleted and our ability to fund operations could be materially harmed.

The Convertible Notes contain various covenants and restrictions which may limit our ability to operate our business and raise capital.

The Convertible Notes impose certain restrictive covenants on us which may impede our ability to operate our business or raise further funds in the capital markets. So long as at least $100,000 in the aggregate of principal amount of the Convertible Notes remains outstanding, unless the holders of at least 51% in principal amount of the then outstanding Convertible Notes provide prior written consent, we cannot, and cannot permit any of our subsidiaries to, take actions, including, among others, to:

A breach of any of these covenants could result in an event of default under the Convertible Notes. If there is an event of default, a holder of the Convertible Notes may require us to immediately pay in cash the outstanding principal amount of the Convertible Notes, liquidated damages and other amounts owing in respect thereof through the date of acceleration, which could have a material adverse effect on our financial condition and cash flow.

Our stockholders may experience significant dilution.

As of May 4, 2015, we had approximately 662,500 and 1,437,498 shares of our Common Stock reserved or designated for future issuance in connection with the conversion of the Convertible Notes and interest thereon and the exercise of the Warrants, respectively, subject to potential future anti-dilution adjustments. Although we settle the interest and principal payments on the Convertible Notes in cash and certain conversion and exercise restrictions are placed upon the holders of the Convertible Notes, and Warrants, the issuance of material amounts of Common Stock by us would cause our existing stockholders to experience significant dilution in their investment in our company. In addition, if we obtain additional financing involving the issuance of equity securities or securities convertible into equity securities, our existing stockholders’ investment would be further diluted. Such dilution could cause the market price of our Common Stock to decline, which could impair our ability to raise additional financing.

Sales of a significant number of shares of our Common Stock in the public markets or significant short sales of our Common Stock, or the perception that such sales could occur, could depress the market price of our Common Stock and impair our ability to raise capital.

Sales of a substantial number of shares of our Common Stock or other equity-related securities in the public markets, including any shares of Common Stock issued upon conversion of the Convertible Notes, or upon exercise of the Warrants, could depress the market price of our Common Stock. If there are significant short sales of our Common Stock, the price decline that could result from this activity may cause the share price to decline more so, which, in turn, may cause long holders of the Common Stock to sell their shares, thereby contributing to sales of Common Stock in the market. Such sales also may impair our ability to raise capital through the sale of additional equity securities in the future at a time and price that our management deems acceptable, if at all.

We may not be able to maintain effectiveness of the registration statement of which this prospectus forms a part, which could impact the liquidity of our Common Stock.

Under the terms of the Registration Rights Agreement (defined below), we are obligated to include shares of Common Stock issued or issuable upon the conversion of the Convertible Notes, including conversion of all interest thereon through the maturity date, and upon the exercise of the Class A Warrants and Class B Warrants, in an effective registration statement. The registration statement of which this prospectus forms a part is intended to satisfy these obligations. We intend to use our best efforts to maintain the effectiveness of the registration statement, but may not be able to do so. We cannot assure you that no stop order will be issued, or if such a stop order is issued, we will be able to amend the registration statement to defeat the stop order. If the registration statement is not effective, the selling stockholders’ ability to sell the shares of Common Stock underlying the Convertible Notes and Warrants may be limited, which would have a material adverse effect on the liquidity of our Common Stock.

If we are not able to comply with the applicable continued listing requirements or standards of the NASDAQ Capital Market, NASDAQ could delist our common stock.

Our common stock is currently listed on the NASDAQ Capital Market. In order to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders' equity, minimum share price, and certain corporate governance requirements. There can be no assurances that we will be able to comply with the applicable listing standards.

| 6 |

On October 6, 2015, we received a deficiency notice from NASDAQ stating that that the Company was not in compliance with NASDAQ Listing Rule 5550(b)(2), as the Company’s Market Value of Listed Securities (“MVLS") was below $35 million for the previous thirty (30) consecutive business days. In accordance with NASDAQ Marketplace Rule 5810(c)(3), the Company has been granted a 180 calendar day compliance period, or until April 4, 2016, to regain compliance with the minimum MVLS requirement. To regain compliance, the Company's MVLS must close at $35 million or more for a minimum of ten (10) consecutive business days during the 180 calendar day compliance period. During the compliance period, the Company’s shares of common stock will continue to be listed and traded on the Nasdaq Capital Market. We intend to monitor its MVLS between now and April 4, 2016, and will consider and evaluate all available options to resolve the Company’s noncompliance with the MVLS requirement as may be necessary. There can be no assurance that the Company will be able to regain compliance with the MVLS requirement or will otherwise be in compliance with other NASDAQ listing criteria.

On November 30, 2015, Nxt-ID, Inc. we received a written notification from NASDAQ indicating that the Company was not in compliance with NASDAQ Listing Rule 5550(a)(2), as the Company’s closing bid price for its common stock was below $1.00 per share for the last thirty (30) consecutive business days.

Pursuant to NASDAQ Listing Rule 5810(c)(3)(A), the Company has been granted a 180-calender day compliance period, or until May 31, 2016, to regain compliance with the minimum bid price requirement. During the compliance period, the Company’s shares of common stock will continue to be listed and traded on NASDAQ. To regain compliance, the closing bid price of the Company’s shares of common stock must meet or exceed $1.00 per share for at least ten (10) consecutive business days during the 180-calender day compliance period.

If the Company is not in compliance by May 31, 2016, the Company may be afforded a second 180-calender day compliance period. To qualify for this additional time, the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for NASDAQ with the exception of the minimum bid price requirement. In addition, the Company will be required to notify NASDAQ of its intention to cure the minimum bid price deficiency by effecting a reverse stock split, if necessary.

If the Company does not regain compliance within the allotted compliance period(s), including any extensions that may be granted by NASDAQ, NASDAQ will provide notice that the Company’s shares of common stock will be subject to delisting.

In the event that our common stock is delisted from the NASDAQ Capital Market and is not eligible for quotation on another market or exchange, trading of our common stock could be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate price quotations for, our common stock, and there would likely also be a reduction in our coverage by securities analysts and the news media, which could cause the price of our common stock to decline further. Also, it may be difficult for us to raise additional capital if we are not listed on a major exchange.

In the event that our common stock is delisted from NASDAQ, U.S. broker-dealers may be discouraged from effecting transactions in shares of our common stock because they may be considered penny stocks and thus be subject to the penny stock rules.

The SEC has adopted a number of rules to regulate “penny stock” that restricts transactions involving stock which is deemed to be penny stock. Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Exchange Act. These rules may have the effect of reducing the liquidity of penny stocks. “Penny stocks” generally are equity securities with a price of less than $5.00 per share (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market if current price and volume information with respect to transactions in such securities is provided by the exchange or system). Our shares of common stock have in the past constituted, and may again in the future constitute, “penny stock” within the meaning of the rules. The additional sales practice and disclosure requirements imposed upon U.S. broker-dealers may discourage such broker-dealers from effecting transactions in shares of our common stock, which could severely limit the market liquidity of such shares of common stock and impede their sale in the secondary market.

| 7 |

A U.S. broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the “penny stock” regulations require the U.S. broker-dealer to deliver, prior to any transaction involving a “penny stock”, a disclosure schedule prepared in accordance with SEC standards relating to the “penny stock” market, unless the broker-dealer or the transaction is otherwise exempt. A U.S. broker-dealer is also required to disclose commissions payable to the U.S. broker-dealer and the registered representative and current quotations for the securities. Finally, a U.S. broker-dealer is required to submit monthly statements disclosing recent price information with respect to the “penny stock” held in a customer’s account and information with respect to the limited market in “penny stocks”.

Stockholders should be aware that, according to the SEC, the market for “penny stocks” has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, resulting in investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

An active, liquid trading market for our common stock may not develop, which may cause our common stock to trade at a discount from the initial offering price and make it difficult for you to sell the common stock you purchase.

Our common stock is currently listed on the NASDAQ Capital Market. However, there can be no assurance that there will be an active market for our common stock either now or in the future. If an active and liquid trading market does not develop or if developed cannot be sustained, you may have difficulty selling any of our common stock that you purchase. The market price of our common stock may decline below the initial offering price, and you may not be able to sell your shares of our common stock at or above the price you paid, or at all.

If and when a larger trading market for our common stock develops, the market price of our common stock is still likely to be highly volatile and subject to wide fluctuations, and you may be unable to resell your shares at or above the price at which you acquired them.

The market price of our common stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including, but not limited to:

| ● | Variations in our revenues and operating expenses; | |

| ● | Actual or anticipated changes in the estimates of our operating results or changes in stock market analyst recommendations regarding our common stock, other comparable companies or our industry generally; | |

| ● | Market conditions in our industry, the industries of our customers and the economy as a whole; | |

| ● | Actual or expected changes in our growth rates or our competitors’ growth rates; | |

| ● | Developments in the financial markets and worldwide or regional economies; | |

| ● | Announcements of innovations or new products or services by us or our competitors; |

| 8 |

| ● | Announcements by the government relating to regulations that govern our industry; | |

| ● | Sales of our common stock or other securities by us or in the open market; and | |

| ● | Changes in the market valuations of other comparable companies. |

In addition, if the market for technology stocks or the stock market in general experiences loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition or operating results. The trading price of our shares might also decline in reaction to events that affect other companies in our industry, even if these events do not directly affect us. Each of these factors, among others, could harm the value of your investment in our common stock. In the past, following periods of volatility in the market, securities class-action litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could materially and adversely affect our business, operating results and financial condition.

Risks Related to our Business

We are uncertain of our ability to continue as a going concern, indicating the possibility that we may not be able to operate in the future.

To date, we have completed only the initial stages of our business plan and we can provide no assurance that we will be able to generate a sufficient amount of revenue, if at all, from our business in order to achieve profitability. It is not possible for us to predict at this time the potential success of our business. The revenue and income potential of our proposed business and operations are currently unknown. If we cannot continue as a viable entity, you may lose some or all of your investment in our company.

We are an early stage entity and have incurred net losses since inception. Our ability to continue as a going concern is contingent upon, among other factors, our ability to raise additional cash from equity financings, secure debt financing, and/or generate revenue from the sales of our products. We cannot provide any assurance that we will be able to raise additional capital. If we are unable to secure additional capital, we may be required to curtail our research and development initiatives and take additional measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations.

We will require additional capital in the future to develop the NFC wocket® smart wallet. If we do not obtain any such additional financing, if required, our business prospects, financial condition and results of operations will be adversely affected.

We will require additional capital in the future to develop the NFC wocket® smart wallet. We may not be able to secure adequate additional financing when needed on acceptable terms, or at all. To execute our business strategy, we may issue additional equity securities in public or private offerings, potentially at a price lower than the market price of our common stock at the time of such issuance. If we cannot secure sufficient additional funding we may be forced to forego strategic opportunities or delay, scale back and eliminate future product development.

Existing or pending patents could adversely affect our business.

On November 12, 2015, we received a complaint that one or more of our technologies infringed one or more claims of a patent(s) issued to the claimant. We are still studying the complaint with our patent counsel, but our initial conclusion is that we have not infringed upon their patents. However, if the foregoing claim or similar claims against our intellectual property prove to be valid, such claims could materially and adversely affect our business, operating results and financial condition.

| 9 |

The selling stockholders will receive all of the proceeds from the sale of shares of Common Stock under this prospectus. We will not receive any proceeds from these sales. To the extent proceeds are received upon exercise of the Warrants, we will receive up to $4,759,367, which proceeds we intend to use for general corporate purposes, which may include, among other things, working capital, capital expenditures, product development, marketing activities, acquisitions of new technologies and investments, repayment of debt and repurchases and redemptions of securities. The selling stockholders will pay any agent’s commissions and expenses they incur for brokerage, accounting, tax or legal services or any other expenses they incur in disposing of the shares of Common Stock. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares of Common Stock covered by this prospectus and any prospectus supplement. These may include, without limitation, all registration and filing fees, SEC filing fees and expenses of compliance with state securities or “blue sky” laws.

| 10 |

PRIVATE PLACEMENT OF CONVERTIBLE NOTES

CLASS A WARRANTS AND CLASS B WARRANTS

On April 24,December 8, 2015,pursuant to the Purchase Agreementwe sold to certain purchasers $1,575,000the Notes in the aggregate principal amount of Convertible Notes, Class A Warrants and Class B Warrants pursuant to the Securities Purchase Agreement.$1,500,000 for a purchase price of $1,500,000.

Description of the Convertible Notes

Ranking

The Convertible Notes are our senior secured obligations.obligations of the Company. The Convertible Notes are secured by certain personal property of oursthe Company and its wholly-owned subsidiary, 3D-ID, LLC (“3D-ID”), pursuant to an Additional Secured Party Joinder, dated December 8, 2015, entered into between the Company, each Purchaser, and certain secured parties (the “Secured Parties”) who have the same security interests pursuant to a Security Agreement (as defined below). Each Convertible Note rankspari passu with other Convertible Notes issued pursuant toentered into on April 24, 2015, between the Securities Purchase Agreement.

Maturity Date

Company and the Secured Parties. Unless earlier converted or redeemed, the Convertible Notes will mature on April 25, 2016 (the “Maturity Date”).

Interest

December 8, 2016. The Convertible Notes bear interest at a rate of 6%8% per annum subject to increase to the lesser of 15% per annum or the maximum rate permitted under applicable law upon the occurrence and continuance of an event of default (as described below)(with all interest guaranteed). Interest on the Convertible Notes is payable on the Maturity Date in cash.

Conversion

All amounts due under the ConvertibleThe Notes are convertible at any time, in whole or in part, at the option of the holders into shares of Common Stockcommon stock at a conversion price the lesser of $2.52(a) $0.55 per share whichand (b) from and after an Event of Default (as defined in the Notes), 85% of the average of the five (5) lowest daily Weighted Average Prices (as defined in the Notes) in the prior fifteen (15) Trading Days (as defined in the Notes), until such Event of Default has been cured. The conversion price is subject to adjustment for stock splits,dividends, stock dividends, combinations or similar events.

Events of Default

The Convertible Notes provide for events of default including, among others, payment defaults, cross defaults, material breaches of any representations or warranties, breaches of covenants (after expiration of an applicable cure period with respect to certain covenants), failure to perform certain required activities in a timely manner, failure to comply with the requirements under the Registration Rights Agreement (defined below), suspension from trading or failure of our Common Stock to be listed on an eligible market for certain periods and certain bankruptcy-type events involving us or a subsidiary.

If there is an event of default, a holder of the Convertible Notes may require us to immediately redeem the Convertible Notes in cash in an amount equal to the sum of (a) the greater of (i) the outstanding principal amount of the Convertible Notes divided by the conversion price on the date such default amount is either (A) demanded (if demand or notice is required to create an event of default) or otherwise due or (B) paid in full, whichever has a lower conversion price, multiplied by the volume weighted average price on the date the default amount is either (x) demanded or otherwise due or (y) paid in full, whichever has a higher volume weighted average price, or (ii) 115% of the outstanding principal amount of the Convertible Notes and (b) all other amounts, costs, expenses and liquidated damages due in respect of the Convertible Notes (the “Mandatory Default Amount”).

On the Maturity Date and five (5) days after the occurrence of any event of default, interest on the Convertible Notes shall accrue at a rate equal to the lesser of 15% per annum or the maximum rate permitted under applicable law.

Change of Control

In the event of transactions involving a change of control, the holder of a Convertible Note may require us to immediately redeem the Convertible Note in cash at the Mandatory Default Amount.

Limitations on Conversion and Issuance

A Convertible Note may not be converted and shares of Common Stock may not be issued under the Convertible Notes if, after giving effect to the conversion or issuance, the holder, its affiliates and any persons acting as a group together with the holder or any of its affiliates would beneficially own in excess of 4.99% of the outstanding shares of our Common Stock. At each holder’s option, the ownership percentage limitation may be raised or lowered to any other percentage not in excess of 9.99%, except that any raise will only be effective upon 61-days’ prior notice to us.

Description of the Class A Warrants and Class B Warrants

The Class A Warrants and Class B Warrants entitle the holders to purchase up to 468,749 and 468,749 shares of Common Stock, respectively. The Class A Warrants and Class B Warrants are exercisable beginning six (6) months after issuance through the fifth (5th) anniversary of such initial exercisability date. The Class A Warrants have an initial exercise price equal to $3.02 per share and the Class B Warrants have an initial exercise price equal to $5.00 per share, which exercise prices are subject to adjustment for stock splits, stock dividends, combinations or similar events.

The Class A WarrantsIn consideration of the Secured Parties execution of each Additional Secured Party Joinder, the Secured Parties were issued an aggregate of $200,000 in principal amount of notes. Such notes contain the same rights and Class B Warrants may be exercised for cash, provided that, if there is no effective registration statement available registeringobligations as set forth in the shares of Common Stock underlying such warrants, the Class A Warrants and Class B Warrants may be exercised on a cashless basis.

Limitations on ExerciseNotes.

The Class A WarrantsCompany will make installment payments to the Investors from time to time. On each applicable Installment Date (as defined in the Notes), provided there has been no Equity Conditions Failure (as defined in the Notes), the Company shall pay to the Investors the Installment Amount (as defined in the Notes) due on such date by converting all or some of such Installment Amount into shares of the Company’s common stock, in accordance with the Notes; provided, however, that the Company may, at its option following notice to the Investors, pay the Installment Amount by redeeming such Installment Amount in cash or by any combination of a Company Conversion (as defined in the Notes) and Class B Warrantsa Company Redemption (as defined in the Notes) so long as all of the outstanding applicable Installment Amount due on any Installment Date shall be converted and/or redeemed by the Company on the applicable Installment Date, subject to the provisions of the Notes; provided, further, that the conversion Price shall in no event be less than $0.25. In the event the conversion price would be less than $0.25, the Company shall be required to pay the applicable Installment Amount in cash.

Limitations on Conversion

The Notes may not be exercisedconverted if, after giving effect to the exercise, the holder of such warrants,Notes, its affiliates and any persons acting as a group together with the holder or any of its affiliates would beneficially own in excess of 4.99% of the outstanding shares of our Common Stock. At a holder’s option, the ownership percentage limitation applicable to the exerciseconversion of the Class A Warrants and Class B WarrantsNotes may be raised or lowered to any other percentage not in excess of 9.99%, except that any increase will only be effective upon 61-days’ prior notice to us.

Registration Rights Agreement

Pursuant to the Registration Rights Agreement, dated April 24,December 8, 2015, between us and certain purchasers (the “Registration Right Agreement”) we are required to file a registration statement, any such purchaser at any time within ten (10)fifteen (15) business days after the closing date of the issuance of the Convertible Notes, Class A Warrants and Class B Warrants,may, by written notice to the Company, request that the Company effect the registration of the shares issuable upon conversion of the Notes. We are required to have such registration statement declared effective within ninety (90) days following the filing of such registration, statement and tobut in any event no later than the Effectives Date (as defined below). We must use our best efforts to maintain the effectiveness of such registration statement until all registrable securities covered by the registration statement have been sold thereunder or pursuant to Rule 144 or may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement for us to be in compliance with the current public information requirement under Rule 144. We are required to make certain payments to such purchaserspurchaser if we fail to meet our obligations under the Registration Rights Agreement.

Security Agreement

In connection “Effectiveness Date” means, with the sale of the Convertible Notes, Class A Warrants and Class B Warrants to certain purchasers, we entered into a security agreement, dated April 24, 2015 (the “Security Agreement”), between us, our wholly-owned subsidiary, 3D-ID, LLC (“3D-ID”) and the collateral agent thereto. Pursuantrespect to the Security Agreement, the purchasers were granted a security interest in certain personal property of ours and 3D-IDinitial registration statement required to secure the payment and performance of all of our obligations and 3D-ID’s obligations under the Convertible Notes, the Class A Warrants, the Class B Warrants, the Securities Purchase Agreement,be filed pursuant to the Registration Rights Agreement, and the Security Agreement. In addition, in connection90th calendar day following the filing of the initial registration statement with the Security Agreement, 3D-ID executed a subsidiary guaranty pursuant to which it agreed to guarantee and act as surety for paymentSEC provided, however, that in the event the Company is notified by the Commission that one or more of the Convertibleabove registration statements will not be reviewed or is no longer subject to further review and comments, the Effectiveness Date as to such registration statement shall be the fifth (5th) Trading Day following the date on which the Company is so notified if such date precedes the dates otherwise required above, provided, further, if such Effectiveness Date falls on a day that is not a trading day, then the Effectiveness Date shall be the next succeeding trading day.

In the event that registration of the shares upon conversion of the Notes is not filed with the SEC by the required filing date, the purchasers may be, in addition to being entitled to exercise all rights granted by law and other obligations of ours under the Class A Warrants, Class B Warrants, Securities Purchase Agreement, Registration Rights Agreement, and Securityincluding recovery of damages, shall be entitled to specific performance of their respective rights under the Registration Rights Agreement.

| 11 |

The shares of Common Stock being offered by the selling stockholders are those issuable to the selling stockholders pursuant to the termsupon conversion of the Convertible Notes and upon exercise of the Warrants.Notes. For additional information regarding the issuance of the Convertible Notes, and the Class A Warrants and Class B Warrants, see “Private Placement of Convertible Notes, Class A Warrants and Class B Warrants”Notes” above. See also “Material Relationships with the Selling Stockholders” below for additional information on the June Warrants and August Warrants.Notes. We are registering the shares of Common Stock in order to permit the selling stockholders to offer the shares of Common Stock for resale from time to time.

The table below lists the selling stockholders and other information regarding the “beneficial ownership” of the shares of Common Stock by each of the selling stockholders. In accordance with Rule 13d-3 of the Exchange Act, “beneficial ownership” includes any shares of Common Stock as to which the selling stockholders have sole or shared voting power or investment power and any shares of Common Stock the selling stockholders have the right to acquire within sixty (60) days (including shares of Common Stock issuable pursuant to convertible notes and warrants currently convertible or exercisable, or convertible or exercisable within sixty (60) days).

The second column indicates the number of shares of Common Stock beneficially owned by each selling stockholder,stockholders, based on its ownership of the Convertible Notes, and Warrants, as of May 4, 2015, even though the Class A Warrants and Class B Warrants are not exercisable until October 26, 2015 (i.e., not exercisable within sixty (60) days of May 4, 2015).January 12, 2016. The second column also assumes conversion or exercise of all the Convertible Notes and Warrants held by the selling stockholders on May 4, 2015January 12, 2016 without regard to any limitations on conversion or exercise described in this prospectus or in such Convertible Notes and Warrants.

Notes.

The third column lists the shares of Common Stock being offered by this prospectus by each selling stockholder. Such aggregate amount of Common Stock does not take into account any applicable limitations on conversion of the Convertible Notes or limitations on exercise of the Warrants.Notes.

This prospectus covers the resale of (i) all of the shares of Common Stock issued and issuable pursuant to the Convertible Notes, includingupon conversion of all interest thereon through the Maturity Date,Notes, (ii) all of the shares of Common Stock issued and issuable upon exercise of the related Warrants, (iii) any additional shares of Common Stock issued and issuable in connection with any anti-dilution provisions in the Convertible Notes or Warrants (in each case without giving effect to any limitations on exerciseconversion set forth in the Convertible NotesNotes) and Warrants) and (iv)(iii) any securities issued or then issuable upon any stock split, dividend or other distribution, recapitalization or similar event with respect to the foregoing. Because the conversion price of the Convertible Notes and the exercise price of the Warrants may be adjusted, the number of shares of Common Stock that will actually be issued may be more or less than the number of shares of Common Stock being offered by this prospectus. The selling stockholders can offer all, some or none of their shares of Common Stock, thus we have no way of determining the number of shares of Common Stock they will hold after this offering. Therefore, the fourth and fifth columns assume that the selling stockholders will sell all shares of Common Stock covered by this prospectus. See “Plan of Distribution.”

Each selling stockholder identified below has confirmed to us that it is not a broker-dealer or an affiliate of a broker-dealer within the meaning of United States federal securities laws.

| Name of Selling Stockholder | Number of Shares of Common Stock Owned Prior to Offering | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | Number of Shares of Common Stock Owned After Offering | Percentage Beneficially Owned After Offering | ||||||||||||

| Alpha Capital Anstalt (1) | 2,293,162 | (3) | 1,511,031 | (3) | 782,131 | 2.84 | % | |||||||||

| Osher Capital Partners LLC (2) | 521,967 | (4) | 288,967 | (4) | 233,000 | * | ||||||||||

| Matthew Rich | 197,500 | 100,000 | 97,500 | * | ||||||||||||

| Theodore Digilio Jr. | 100,000 | 100,000 | - | * | ||||||||||||

| Bradley Wolfthal | 130,770 | 100,000 | 30,770 | * | ||||||||||||

| TOTAL | 3,243,399 | 2,099,998 | 1,143,401 | 4.15 | % | |||||||||||

| Name of Selling Stockholder | Number of Shares of Common Stock Owned Prior to Offering | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | Number of Shares of Common Stock Owned After Offering | Percentage Beneficially Owned After Offering | ||||||||||||

| Delafield Investments Limited(1) | 7,200,000 | 7,200,000 | - | * | ||||||||||||

| Dominion Capital LLC (2) | 3,600,000 | 3,600,000 | - | * | ||||||||||||

| Alpha Capital Anstalt (3) | 4,548,519 | 1,209,600 | 3,338,919 | 5.6 | % | |||||||||||

| Osher Capital Partners LLC (4) | 910,576 | 230,400 | 680,176 | 1.2 | % | |||||||||||

| TOTAL | 16,259,095 | 12,240,000 | 4,019,095 | 6.8 | % | |||||||||||

| * | Less than 1% |

* Less than 1%

| 12 |

(1) | This stockholder has represented to us that Joshua Sason and Michael Abitebol are the natural persons with voting and investment control over these shares of Common Stock. | |

| (2) | This stockholder has represented to us that Mikhail Gurevich is the natural person with voting and investment control over these shares of Common Stock. | |

| (3) | This stockholder has represented to us that Konrad Ackernan is the natural person with voting and investment control over these shares of Common Stock. | |

| This stockholder has represented to us that | ||

Material Relationships with the Selling Stockholders

Along with the Convertible Notes and Class A Warrants and Class B Warrants issued pursuant to the Securities Purchase Agreement and the notes issued to the Secured Parties, we have had the following material relationships with the selling stockholders in the last three (3) years:

January 2014 Private Placement

On January 13, 2014, we entered into a private placement with Alpha Capital Anstalt, Osher Capital Partners LLC, Matthew Rich, Theodore Digilio Jr., Bradley Wolfthal and Blue Elephant Partners, LLC (each, a “January Purchaser”) pursuant to which we sold to the January Purchasers for $1,350,000 415,387 shares of Common Stock and warrants to purchase up to 1,350,000 shares of Common Stock (the “January Warrants”) atfor an aggregate purchase price of $1,350,000. The January Warrants have an exercise price of $3.25, subject to adjustment for certain events, including, without limitation, stock splits, combinations, dividends, reclassifications, distributions, mergers and other corporate changes. The exercise price of the January Warrants was amended to $2.00 on September 10, 2014. The January Warrants are exercisable for a period of five (5) years from the original issuance date. We registered the January Warrants and shares of Common Stock underlying the January Warrants on a registration statement on Form S-1 on February 25, 2014.

June 2014 Private Placement

Between June 12, 2014 and June 17, 2014, we entered into a private placement with Alpha Capital Anstalt, Matthew Rich, Theodore Digilio Jr. and Bradley Wolfthal (each, a “June Purchaser”) pursuant to which we sold to the June Purchasers June Warrantswarrants to purchase up to 400,000 shares of Common Stock (the “June Warrants”) at an exercise price of $3.00, subject to adjustment for certain events, including, without limitation, stock splits, combinations, dividends, reclassifications, distributions, mergers and other corporate changes. The exercise price of the June Warrants was amended to $2.00 on September 10, 2014. The June Warrants are exercisable for a period of five (5) years from the original issuance date. In connection with the June Warrants, we entered into a registration rights agreement with the June Purchasers pursuant to which we agreed to register shares of Common Stock and shares of Common Stock underlying the June Warrants. We did not file the registration statement by the filing date. On January 30, 2015, we received signed documentation from the June Purchasers agreeing to waive their right to liquidated damages and to terminate the registration rights agreement.

August 2014 Private Placement

On August 21, 2014, we entered into a private placement with Alpha Capital Anstalt and Osher Capital Partners, LLC (each, an “August Purchaser”) pursuant to which we sold to the August Purchasers August Warrantswarrants to purchase up to 100,000 shares of Common Stock (the “August Warrants”) at an exercise price of $3.00, subject to adjustment for certain events, including, without limitation, stock splits, combinations, dividends, reclassifications, distributions, mergers and other corporate changes. The exercise price of the August Warrants was amended to $2.00 on September 10, 2014. The August Warrants are exercisable for a period of five (5) years from the original issuance date. In connection with the August Warrants, we entered into a registration rights agreement with the August Purchasers pursuant to which we agreed to register shares of Common Stock and shares of Common Stock underlying the August Warrants. We did not file the registration statement by the filing date.

April 2015 Private Placement

On JanuaryApril 24, 2015, the Company entered into a securities purchase agreement (the “April Purchase Agreement”) with Alpha Capital Anstalt and Osher Capital Partners, LLC (the “April Purchasers”) pursuant to which the Company sold to such purchasers an aggregate of $1,575,000 principal amount of secured convertible notes (the “Convertible Notes”), a Class A Common Stock Purchase Warrant (the “Class A Warrant”) to purchase up to 468,749 shares of the Company’s common stock and a Class B Common Stock Purchase Warrant (the “Class B Warrant,” and together with the Class A Warrant, the “April Warrants”) to purchase up to 468,749 shares of the Company’s common stock. The Convertible Notes bear interest at 6% per annum and are convertible at any time, in whole or in part, at the option of the holders into shares of common stock at a conversion price of $2.52 per share. The April Warrants are exercisable beginning six (6) months after issuance through the fifth (5th) anniversary of such initial exercisability date. The Class A Warrant has an initial exercise price equal to $3.02 per share and the Class B Warrant has an initial exercise price equal to $5.00 per share. The Company received cash proceeds of $1,481,500 from the issuance of the Convertible Notes after deducting debt issuance costs of $93,500.

| 13 |

On December 8, 2015, we entered into an exchange agreement with each of the April Purchasers. The exchange agreements provide that the April Purchasers shall exchange their Convertible Notes with the Notes. Additionally, in consideration of the April Purchasers execution of an Additional Secured Party Joinder, the April Purchasers were issued an aggregate of $200,000 in principal amount of notes. Such notes contain the same rights and obligations as set forth in the Notes.

July 2015 Offerings

On July 27, 2015, we entered into a securities purchase agreement with Magna Equities I, LLC (“Magna”), an entity affiliated with Delafield Investments Limited, pursuant to which we sold an aggregate of $222,222 in principal amount of the 8% convertible notes (the “8% Convertible Notes”) for an aggregate purchase price of $200,000. We received net proceeds of $200,000 from the sale of the 8% Convertible Notes. The 8% Convertible Notes matured on September 11, 2015 (the “Maturity Date”), less any amounts converted or redeemed prior to the Maturity Date. The 8% Convertible Notes bear interest at a rate of 8% per annum, subject to increase to the lesser of 24% per annum or the maximum rate permitted under applicable law upon the occurrence of certain events of default. The 8% Convertible Notes were convertible at any time, in whole or in part, at the option of the holders into shares of common stock at a conversion price of $3.50 per share, which was subject to adjustment for stock dividends, stock splits, combinations or similar events. The Company was able to prepay in cash any portion of the principal amount of the 8% Convertible Notes and any accrued and unpaid interest. If such prepayment was made within sixty (60) days after the issuance date of the 8% Convertible Notes, the Company would pay an amount in cash equal to 109% of the sum of the then outstanding principal amount of the note and interest; thereafter, if such prepayment was made, the Company would pay an amount in cash equal to 114% of the sum of the then outstanding principal amount of the note and interest. In the event the Company effects a registered offering either utilizing Form S-1 or Form S-3 (a “Registered Offering”), the Holder would have the right to convert the entire amount of the purchase price into such Registered Offering.

On July 30, 2015, we received signed documentation fromentered into a Securities Purchase Agreement (the “July Purchase Agreement”) with certain purchasers (the “July Purchasers”) providing for the Augustissuance and sale by the Company of 1,721,429 shares of the Company’s common stock, par value $0.0001 per share, at a purchase price of $1.75 per share (the “Registered Shares”) for an aggregate purchase price of $3,012,500 (the “Registered Offering”). In connection with the sale of the Registered Shares, the Company also entered into a warrant purchase agreement with the July Purchasers agreeingproviding for the issuance and sale by the Company of warrants to waive their rightpurchase 860,716 shares of the Company’s common stock at a purchase price of $0.0000001 per warrant (the “July Warrants”). Alpha Capital Anstalt participated in the forgoing offering and Magna as the holder of the 8% Convertible Notes elected to liquidated damages and to terminateconvert the registration rights agreement.entire purchase price for such notes into the Registered Offering. Northland Capital Markets acted as the exclusive placement agent for the Registered Offering.

For additional information onOctober 2015 Offering

On October 21, 2015, the January 2014 Private Placement, June 2014 Private PlacementCompany closed an underwritten public offering of 1,500,000 shares of Common Stock, at a purchase price to the public of $0.70 per share, for net proceeds to the Company, after deducting underwriter discounts and August 2014 Private Placement, see our Annual Report on Form 10-K and attached exhibits filed withoffering expenses, of $1,050,000. Aegis Capital Corp. acted as the SEC on March 6, 2015.sole book-running manager for the offering. Dominion Capital LLC participated in this offering.

| 14 |

EachThe selling stockholderstockholders of the securities and any of theirits pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on any trading market, stock exchange or other trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. AThe selling stockholderstockholders may use any one or more of the following methods when selling securities:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | settlement of short sales; | |