As filed with the Securities and Exchange Commission on January 12, 2022April 25, 2023

Registration No. 333-_______333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Crown Electrokinetics Corp.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 47-5423944 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S.IRS Employer

Identification Number) |

1110 NE Circle Blvd.,

Corvallis, Oregon 97330

(800) 674-3612

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

DougDouglas Croxall

Chief Executive Officer

1110 NE Circle Blvd.

Corvallis, Oregon 97330

(800) 674-3612

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

CopiesPlease send copies of all communications to:

M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0820421-4100

Approximate date of commencement of proposed sale to the public: From time to timeAs soon as practicable after the effective date of this registration statement.Registration Statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this formForm are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. box: ☒

If this formForm is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this formForm is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this formForm is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this formForm is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to ruleRule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,”filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer ☐ | ☒ | Smaller reporting company | ☒ |

| | | | Emerging growth company ☐ | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities To Be Registered | | Amount

To Be

Registered | | | Proposed

Maximum

Offering

Price

Per Share | | | Proposed

Maximum

Aggregate

Offering

Price | | | Amount Of

Registration

Fee | |

| Primary Offering(1): | | | | | | | | | | $ | 100,000,000 | (2) | | $ | 9,270.00 | |

| Common Stock, par value $0.001 per share | | | | (1) | | | | (2) | | | | (2) | | | | |

| Preferred Stock, par value $0.001 per share | | | | (1) | | | | (2) | | | | (2) | | | | |

| Debt Securities | | | | (1) | | | | (2) | | | | (2) | | | | |

| Warrants | | | | (1) | | | | (2) | | | | (2) | | | | |

| Rights | | | | (1) | | | | (2) | | | | (2) | | | | |

| Units | | | | (1) | | | | (2) | | | | (2) | | | | |

| Secondary Offering: | | | | | | | | | | | | | | | | |

| Common Stock, par value $0.001 per share | | | 2,000,000 | (3) | | $ | 3.22 | (4) | | $ | 6,440,000 | (4) | | $ | 596.99 | |

| TOTAL | | | | | | | | | | $ | 106,440,000 | | | $ | 9,866.99 | |

(1) | There are being registered under this Registration Statement such indeterminate number of shares of common stock and preferred stock, such indeterminate principal amount of debt securities, such indeterminate number of warrants to purchase common stock, preferred stock and/or debt securities, such indeterminate number of rights to purchase common stock or preferred stock and such indeterminate number of units as may be sold by the Registrant from time to time, which together shall have an aggregate initial offering price not to exceed $100,000,000. If the Registrant issues any debt securities at an original issue discount, then the offering price of such debt securities shall be in such greater principal amount at maturity as shall result in an aggregate offering price not to exceed $100,000,000, less the aggregate dollar amount of all securities previously issued hereunder. The Registrant may sell any securities it is registering under this Registration Statement separately or as units with the other securities it is registering under this Registration Statement. The Registrant will determine, from time to time, the proposed maximum offering price per unit in connection with its issuance of the securities it is registering under this Registration Statement. The securities it is registering under this Registration Statement also include such indeterminate number of shares of common stock and preferred stock and such indeterminate principal amount of debt securities as the Registrant may issue upon conversion of or exchange for preferred stock or debt securities that provide for conversion or exchange, upon exercise of warrants or rights or pursuant to the anti-dilution provisions of any of such securities. In addition, pursuant to Rule 416 under the Securities Act of 1933 (the “Securities Act”), the shares the Registrant is registering under this Registration Statement include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares the Registrant is registering as a result of stock splits, stock dividends or similar transactions. |

(2) | The Registrant will determine the proposed maximum aggregate offering price per class of security from time to time in connection with its issuance of the securities the Registrant is registering under this Registration Statement and the Registrant is not specifying such price as to each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act. |

(3) | The shares being registered in connection with the secondary offering relate to the resale by the selling stockholder named herein of up to 2,000,000 shares of common stock of the Registrant that were acquired by the selling stockholder in connection with Registrant’s formation and through the selling stockholder’s service as Registrant’s Chairman and Chief Executive Officer, and an indeterminate number of shares of common stock of the Registrant as may be issuable from time to time as a result of a stock split, stock dividend, capitalization or similar event. The Registrant will not receive any proceeds from the sale of its common stock by the selling stockholder. |

(4) | The estimated price of $3.22 per share, which is the average of the high and low prices of the Registrant’s common stock as reported on the Nasdaq Capital Market on January 10, 2022 is set forth solely for the purpose of calculating the fee pursuant to Rule 457(c) under the Securities Act.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 12, 2022

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED APRIL 25, 2023 |

64,719,258 Shares

Crown Electrokinetics Corp.

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

UpThis prospectus relates to 2,000,000 Shares of Common Stock Offering by the Selling Stockholder

We may offerresale, from time to time, by the selling stockholders named herein (the “Selling Stockholders”) of (i) an aggregate of 5,000,000 shares of our common stock, preferredpar value $0.0001 per share (“common stock”), issuable upon the conversion of shares of our Series E Preferred Stock (the “Series E Preferred Stock”), (ii) an aggregate of 45,000,000 shares of common stock senior debtissuable upon the conversion of shares of our Series E Preferred Stock issuable upon exercise of certain outstanding warrants to purchase Series E Preferred Stock (the “Series E Warrants”), and (iii) an aggregate of 14,719,258 shares of common stock issuable upon exercise of certain outstanding warrants (the “Common Warrants” and, together with the Series E Warrants, the “Warrants”).

We are not selling any securities (whichunder this prospectus and we will not receive proceeds from the sale of the shares of our common stock by the Selling Stockholders. However, we may be convertible into or exchangeable forreceive proceeds from the cash exercise of the Warrants, which, if exercised in cash at the current applicable exercise price, with respect to all of the 59,719,258 shares of common stock), subordinated debt securities (which may be convertible into or exchangeable for common stock), warrants, rights and units that include anystock, would result in gross proceeds to us of these securities. approximately $27,235,185.

We will offerpay the securities in amounts, at pricesexpenses of registering the shares of common stock offered by this prospectus, but all selling and other expenses incurred by the Selling Stockholders will be paid by the Selling Stockholders. The Selling Stockholders may sell our shares of common stock offered by this prospectus from time to time on terms to be determined at the time of the offering.

The selling stockholder namedsale through ordinary brokerage transactions or through any other means described in this prospectus under “Plan of Distribution.” The prices at which the Selling Stockholders may also offer up to 2,000,000sell shares ofwill be determined by the prevailing market price for our common stock from time to timeor in connection with one or more offerings, at prices and on terms that will be determined in such offerings. We will not receive any proceeds from the sale of any securities by the selling stockholder.negotiated transactions.

Each time we sell securities hereunder, we will attach a supplement to this prospectus that contains specific information about the terms of the offering, including the price at which we are offering the securities to the public. In the case of an offering by the selling stockholder, information about the selling stockholder, including the relationship between the selling stockholder and us, will also be included in the applicable prospectus supplement. The prospectus supplement may also add, update or change information contained or incorporated in this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read this prospectus, the information incorporated by reference in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus carefully before you invest in our securities.

The securities hereunder may be offered directly by us, through agents designated from time to time by us or to or through underwriters or dealers. If any agents, dealers or underwriters are involved in the sale of any securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the section entitled “About This Prospectus” for more information.

The aggregate market value of our outstandingOur common stock held by non-affiliates is $ 49,066,408 basedquoted on 14,530,126 shares of outstanding common stock, of which 2,232,781 are held by affiliates, and a per share price of $3.99 based onThe Nasdaq Capital Market, or Nasdaq, under the closingsymbol “CRKN.” On April 24, 2023, the last reported sale price offor our common stock on December 31, 2021. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

Nasdaq was $0.09.

Investing in our securities involves certain risks.a high degree of risk. See “Risk Factors” beginning on page 1217 of this prospectus andfor a discussion of information that should be considered in the applicable prospectus supplement, as updatedconnection with an investment in our future filings made with the Securities and Exchange Commission that are incorporated by reference into this prospectus. You should carefully read and consider these risk factors before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacydetermined if this prospectus is truthful or accuracy of this prospectus.complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 20222023.

TABLE OF CONTENTS

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). You should read this prospectus and the information and documents incorporated herein by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find Additional Information” and “Incorporation of Certain Documents by Reference” in this prospectus.

You should rely only on the information contained in or the SEC, using a “shelf” registration process. Underincorporated by reference into this shelf registration process,prospectus. Neither we and/ornor the selling stockholderstockholders named herein (the “Selling Stockholders”) have authorized anyone to be namedprovide you with information different from, or in aaddition to, that contained in or incorporated by reference into this prospectus. This prospectus supplementis an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference into this prospectus is current only as of their respective dates or on the date or dates that are specified in those documents. Our business, financial condition, results of operations and prospects may from timehave changed since those dates.

The Selling Stockholders are not offering to time,sell or seeking offers to purchase these securities in any jurisdiction where the offer and sell sharesor sale is not permitted. Neither we nor the Selling Stockholders have done anything that would permit this offering or possession or distribution of our common stock; and we may, from time to time, offer and sell any combination of the securities described in this prospectus in one or more offerings.any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe any restrictions relating to this Offering and the distribution of this prospectus applicable to that jurisdiction.

This prospectus provides certain general information aboutIf required, each time the securities that we and/or the selling stockholder maySelling Stockholders offer hereunder. Each time we and/or the selling stockholder sell securities,shares of common stock, we will provide you with, in addition to this prospectus, a prospectus supplement that will contain specific information about the terms of the offering and the offered securities.that offering. We may also authorize the Selling Stockholders to use one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. In eachthat offering. We may also use a prospectus supplement we will include the following information:

| ● | the number and type of securities that we propose to sell; |

| ● | the public offering price; |

| ● | the names of any underwriters, agents or dealers through or to which the securities will be sold; |

| ● | any compensation of those underwriters, agents or dealers; |

| ● | any additional risk factors applicable to the securities or our business and operations; and |

| ● | any other material information about the offering and sale of the securities. |

In addition, the prospectus supplement orand any related free writing prospectus may alsoto add, update or change any of the information contained in this prospectus or in documents we have incorporated by reference. This prospectus, together with any applicable prospectus supplements, any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus. Theprospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this prospectus and any prospectus supplement or free writing prospectus will supersede this prospectustogether with the additional information described below under the section entitled “Incorporation of Certain Documents by Reference” before buying any of the securities offered.

Unless the context otherwise requires, the terms “Crown,” “the Company,” “we,” “us” and “our” refer to the extent it contains information that is different from, or that conflicts with, theCrown Electrokinetics Corp.

Unless otherwise indicated, information contained in this prospectus or incorporated by reference herein concerning our industry and the markets in this prospectus. You should readwhich we operate is based on information from independent industry and consider allresearch organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information contained in this prospectus, any accompanying prospectus supplementreleased by independent industry analysts and any free writing prospectus thatthird-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have authorized for usenot independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in connection withwhich we operate and our future performance are necessarily subject to uncertainty and risk due to a specific offering,variety of factors, including those described in making your investment decision. You should also read“Risk Factors” and consider the information contained“Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the documents identified underestimates made by the heading “Incorporation of Certain Documentsindependent parties and by Reference” and “Where You Can Find More Information” in this prospectus.

Unless the context otherwise requires, the terms “the Company,” “Crown,” “we,” “us,” and “our” in this prospectus each refer to Crown Electrokinetics Corp.us.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some ofWhen used in this prospectus, including the statements contained ordocuments that we have incorporated by reference, in this prospectus may befuture filings with the SEC or in press releases or other written or oral communications, statements which are not historical in nature, including those containing words such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters, are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our trends, liquidity and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,” “anticipate,” “intend,” “plan,” “estimate” and similar words, although somecapital resources, among others, contain forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Examples of forward-looking statements include, but are expressed differently.not limited to, statements about the following:

| ● | our prospects, including our future business, revenues, expenses, net income, earnings per share, gross margins, profitability, cash flows, cash position, liquidity, financial condition and results of operations, backlog of orders and revenue, our targeted growth rate, our goals for future revenues and earnings, and our expectations about realizing the revenues in our backlog and in our sales pipeline; |

Although we believe that the expectations reflected in such forward-looking

| ● | the potential impact of COVID-19 on our business and results of operations; |

| ● | the effects on our business, financial condition and results of operations of current and future economic, business, market and regulatory conditions, including the current economic and market conditions and their effects on our customers and their capital spending and ability to finance purchases of our products, services, technologies and systems; |

��

| ● | the effects of fluctuations in sales on our business, revenues, expenses, net income, earnings per share, margins, profitability, cash flows, capital expenditures, liquidity, financial condition and results of operations; |

| ● | our products, services, technologies and systems, including their quality and performance in absolute terms and as compared to competitive alternatives, their benefits to our customers and their ability to meet our customers’ requirements, and our ability to successfully develop and market new products, services, technologies and systems; |

| ● | our markets, including our market position and our market share; |

| ● | our ability to successfully develop, operate, grow and diversify our operations and businesses; |

| ● | our business plans, strategies, goals and objectives, and our ability to successfully achieve them; |

| ● | the sufficiency of our capital resources, including our cash and cash equivalents, funds generated from operations and other capital resources, to meet our future working capital, capital expenditure and business growth needs; |

| ● | the value of our assets and businesses, including the revenues, profits and cash flows they are capable of delivering in the future; |

| ● | the effects on our business operations, financial results, and prospects of business acquisitions, combinations, sales, alliances, ventures and other similar business transactions and relationships; |

| ● | industry trends and customer preferences and the demand for our products, services, technologies and systems; and |

| ● | the nature and intensity of our competition, and our ability to successfully compete in our markets. |

These statements are reasonable, these statementsnecessarily subjective, are not guarantees of future performancebased upon our current plans, intentions, objectives, goals, strategies, beliefs, projections and expectations, and involve certainknown and unknown risks, uncertainties and uncertaintiesother important factors that are difficult to predict, and which maycould cause our actual outcomes andresults, performance or achievements, or industry results, to differ materially from what is expressedany future results, performance or forecastedachievements described in or implied by such forward-looking statements. TheseActual results may differ materially from expected results described in our forward-looking statements, speak only asincluding with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the datepublicly-available information with respect to the factors upon which our business strategy is based, or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on which theyinformation available at the time those statements are made and exceptmanagement’s belief as required by law, we undertake no obligation to publicly release the results of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect thereto ortime with respect to other forward-looking statements. A detailed discussion offuture events and are subject to risks and uncertainties that could cause actual performance or results and events to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that may cause actual results, our performance or achievements, or industry results to differ materially from those contemplated by such forward-looking statements is includedinclude, without limitation, those discussed under the caption “Risk Factors” in this prospectus as well as other risks and factors identified from time to time in our periodic reports filed with the SEC and in the “Risk Factors” section of this prospectus.filings.

THE COMPANYPROSPECTUS SUPPLEMENT SUMMARY

OverviewThis summary highlights information contained elsewhere or incorporated by reference in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. We urge you to read this entire prospectus and the documents incorporated by reference herein carefully, including the financial statements and notes to those financial statements incorporated by reference herein and therein. Please read the section of this prospectus entitled “Risk Factors” for more information about important risks that you should consider before investing in our common stock.

Crown Electrokinetics Corp. (“Crown” or the “Company”) developsOur Company

Business Overview

We develop and sellssell optical switching film that can be embedded between sheets of glass or applied to the surface of glass, or other rigid substrates such as acrylic, to electronically control opacity (“DynamicTint™”). Originally developed by Hewlett-Packard (“HP”), our technology allows a transition between clear and dark in seconds and can be applied to a wide array of windows, including commercial buildings, automotive sunroofs, and residential skylights and windows. At the core of Crown’sour proprietary and patent-protected technology is a thin film that is powered by electrically charged pigment which can reduce heat gain replacing common window tints but also providing a more sustainable alternative to blinds and other traditional window treatments. We partner with leading glass and film manufacturers for mass production and distribution of DynamicTint.

Electrokinetic Film Technology

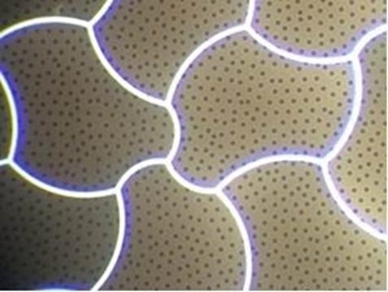

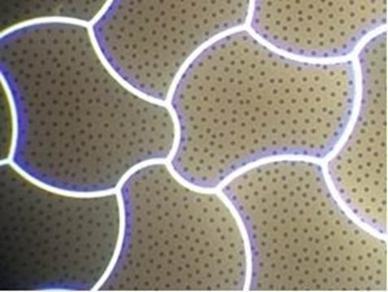

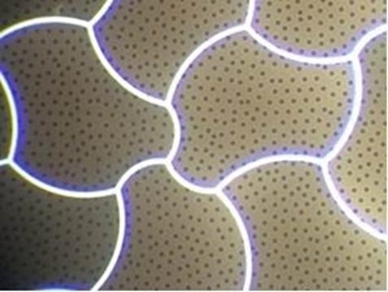

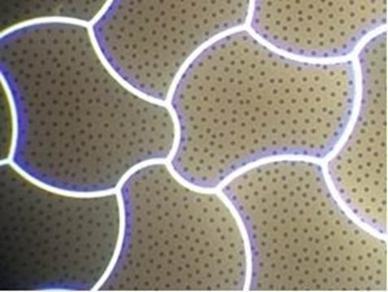

Crown’sOur electrokinetic (EK) technology was derived from proprietary ink and microfluidic technology developed at HP. Electrokinetic refers to the movement of particles within a fluid under the influence of an electric field. Our EK film technology utilizes nanometer-sized pigment particles that are electrically charged and suspended in a liquid that is sandwiched between two clear substrates that are coated with a transparent conductor oxide (TCO) film. Figure 1. In a non-energized state, the suspended pigment particles are distributed uniformly between the plastic films, and will absorb, transmit, or reflect light depending on the properties of the suspended pigment (dark state). When the proper electrical signal is applied to the conductive TCO layers, an electrical field is created, and the charged pigment particles collect in micro-embossed holes in a layer of polymer resin covering the transparent conductor surface. As the charged pigment particles are collected, the fluid becomes highly transparent (clear state). By applying a different electrical signal, the pigment can be dispersed back into the fluid to achieve the desired color density or opaqueness.

Figure 1. Schematic cross-section of electrokinetic film in clear and dark states.

Highlights

| ● | Clear Polyethylene Terephthalate (PET) Substrates –— Same material as window tinting films. |

| ● | Transparent Conductor on PET –— Indium Tin Oxide (ITO) -— same as most touch screens. |

| ● | Electronic Ink –— Nanoparticles suspended in a fluid which absorb light. |

| ● | Energy Source –— Nanoparticles are controlled through DC low voltage applied to the ITO conductor material which is powered by a lithium-ion battery that is charged with a solar cell strip, no hard-wiring necessary. |

Our plastic films are manufactured using industry standard roll-to-roll (R2R) processing equipment. The Company believes itsWe believe our R2R processing will have an inherently lower manufacturing cost compared to sheet-based processing methods used for other smart window technologies like electrochromic glass. There are three basic steps to making our film using R2R equipment.

| 1) | Deposition: R2R TCO deposition on clear polyethylene terephthalate (PET) plastic film using vacuum sputtering of indium-tin oxide (ITO). The ITO on PET film can be provided by a number of suppliers. Millions of square feet of ITO on PET are currently provided for nearly all capacitance-based display touch screens. |

| 2) | Embossing: R2R embossing of UV-curable resin in a proprietary and patent protected 3-D pattern for ink pigment control and containment on one of the two plastic films. An example of the embossed pattern is shown in Figure 2. The R2R embossing process can be completed by various plastic film companies. Crown has the capability to accomplish the coating and embossing steps within its current facility in addition to working with manufacturing partners. |

Figure 2. Microscopic Optical Image of Embossed Film

| 3) | Lamination: The final R2R process laminates the two layers of PET together with the proprietary and patent protected pigment-containing fluid contained by the wall structure shown by the white areas in Figure 2. The wall area has adhesion to the upper layer of PET with ITO film thereby sealing the fluid between the two plastic layers. The fluid contains nanometer-sized pigment particles that are charged electrically and suspended in the fluid. |

We believe that DynamicTintTM has the following distinct advantages over existing optical electronic film technologies:

| | ● | Neutral Color – — Pigment is designed to be color neutral and will not affect the hue of what is viewed through the window in any clear, dark or tinted state. |

| | |

| | ● | Speed –— Transition time is typically a few seconds. |

| | |

| | ● | Affordability – — Roll-to-Roll film manufacturing using relatively inexpensive materials. |

| | |

| | ● | Low Energy Requirements –— Film is low voltage and can be powered with a small battery charged by a solar cell strip or wired to an existing electrical infrastructure including a LAN line. |

| | ● | Retro-Fit –— Film can be applied in a Smart Window Insert (“Inserts”), which can be placed within existing window frames, eliminating the needs for both window treatments or to replace single pane windows with dual pane windows. |

| | |

| | ● | Sustainable –— Reduces energy used to heat or cool a room via HVAC systems and can use renewable energy to transition the film. |

| | |

| ● | Lease vs Purchase – Creative and flexible financing allows for customers to lease Inserts on a long-term basis and avoid large capital expenditures. |

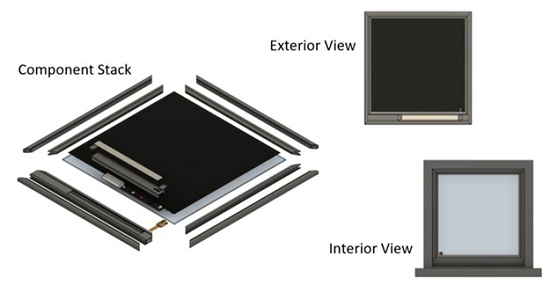

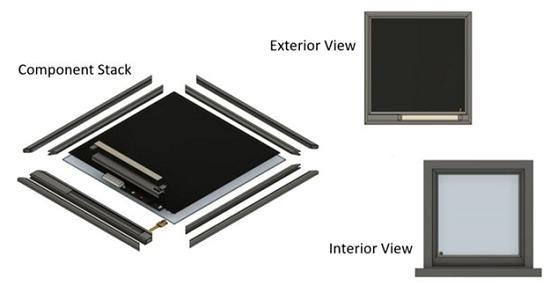

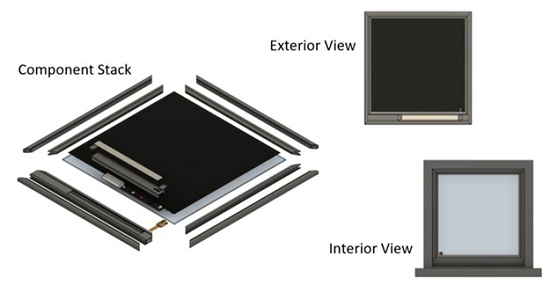

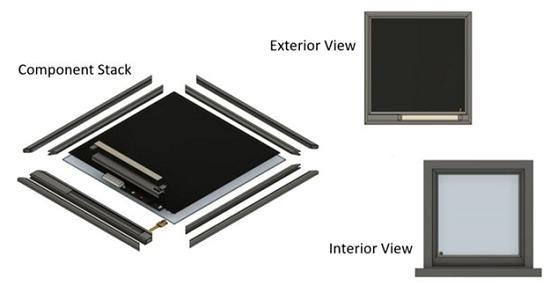

Smart Window Insert powered by DynamicTintTM

Crown’sOur first product will be the Smart Window Insert powered by DynamicTintTM which is specifically designed for retrofitting in the domestic and international commercial real estate install base. Our DynamicTintTM can be laminated to other surfaces like heat-treated glass or acrylic and the laminated sheet can be assembled in Smart Window Inserts that can be placed into the interior side of the window frame providing the dynamic tinting capability as well as additional insulation and sound proofing to the existing windows (Figure 3).

Figure 3. Smart Window Insert with EK Film

The Insert is a custom-sized panel comprised of a rigid substrate (thin glass or acrylic) with a silicon compliant edge seal that allows for the insert to securely fit into the interior side of the window frame.

Some of the Insert’s features include:

| ● | Solar-powered -— eliminating the need to hardwire it into the building’s electrical system |

| ● | Wirelessly enabled -— facilitating communication with all the other installed inserts and integration with the building’s management software system |

| ● | Sensor equipped -— enabling the Insert to auto-sense the intensity of exterior light and interior ambient light |

| ● | Software enabled -— can be managed via programmed macros, dynamically managed by the building, or user-controlled within an office |

| ● | Data collection –— allowing optimization of the Inserts/curtain wall energy performanceperformance. |

| ● | Lease vs Purchase - Creative and flexible financing allows for customers to lease Inserts on a long-term basis and avoid large capital expenditures |

We believe Crown’sour Smart Window Inserts can be easily installed into commercial buildings, residential windows, skylights, and windows within garage doors. In commercial buildings, our Smart Window Inserts can be used to convert existing single pane windows into dual pane windows. Crown believes thatWe believe there is a significant opportunity to provide Smart Window Inserts to commercial building owners who are looking to eliminate window blinds, gain energy efficiency, and reduce carbon emissions.

Sustainability

Crown is aware that working towards building a sustainable future is a common goal shared by many. Companies such as Walmart (NYSE: WMT), Amazon (NASDAQ: AMZN) and Apple (NASDAQ: AAPL) are now publishing their sustainability pledges, and we are seeing a trend of pledging to make their workplaces more environmentally friendly.

Crown’s patented technology provides a solution that helps address many sustainability issues such as:

| ● | Reducing waste– - as opposed to replacing single pane window units with newly manufactured dual pane windows, Crown allows building owners to install our retrofit Smart WindowDynamicTint Insert into existing single pane window frames thereby creating a dual pane window; |

| ● | Reducing energy– - Crown’s Insert reduces HVAC energy consumption by reducing the need for constantly cooling and heating a room, reducing the customers carbon emissions. Initial field testing suggests HVAC energy savings of up to 26% could potentially result from the installation of Smart Window Inserts. According to FacilitiesNet (https://www.facilitiesnet.com/windowsexteriorwalls/article/Smart-Window-Benefit-Energy-Savings-Reduced-Glare--17280), the ability to control the amount of heat entering a building reduces the heat load of the building which in turn reduces your HVAC usage.; |

| ● | Using renewable energy –- Crown’s Smart Window Insert is low voltage and low wattage and can be powered by a solar strip that captures the sun’s energy and is integrated into the Insert itself thereby eliminating the need to hardwire the Insert to the home or building’s electrical system. |

Another benefit of DynamicTint is being able to optimize daylight usage, thereby reducing the usage of lights. A study done by Project Drawdown (https://www.drawdown.org/solutions/dynamic-glass) projected that if 30-50% of commercial building spaces install dynamic glass, the potential climate-weighted energy efficiency from cooling is estimated at 9% and lighting at 9%—depending on local climate, building location and window orientation. This can result in 0.3-0.5 gigatons of emissions reductions from decreased energy use.

At Crown, we are committed to building a product that can be self-sufficient and does not require an additional power source or hard wiring into the electrical system of a residential home or commercial building. This ensures that as we reduce a building’s energy consumption, we are not adding to it and are working towards being carbon neutral.

Intellectual Property

On January 31, 2016, we entered into an IP agreement with HP to acquire a research license to determine the feasibility of incorporating HP’s electrokinetic display technology in our products. On February 4, 2021, Crown and HP entered into a fourth amendment to the agreement. Pursuant to such amendment, among other items, the parties agreed to amend the list of patent and patent applications, which includes two additional patents (the “HP Patents”) that are assignable to the Companyus by HP upon the exercise of the Company’sour option to acquire the HP Patents (the “Option”). In connection with the Company’sour exercise of the Option, the Companywe paid HP an aggregate amount equal to One Million Five Hundred Fifty Thousand Dollars ($1,550,000) on February 9, 2021. From the date of the exercise of the Option until January 1, 2030, the Companywe agreed to pay to HP a royalty fee based on the cumulative gross revenue received by the Companyus from the HP Patents as follows:

| Time Window | | Lifetime Cumulative Gross Revenue | | Royalty Rate | |

| Prior to December 31, 2029 | | $Less than $70,000,000 | 0.00% | | 0.00 | % |

| | $70,000,000 - $500,000,000 | 1.25% | | 1.25 | % |

| | $500,000,000 and beyond | 1.00% | | 1.00 | % |

| January 1, 2030 onward | 0.00% | | | | 0.00 | % |

We entered into a Patent Assignment Agreement with International Business Machines Corporation (“IBM”) to acquire an ownership interest in assigned patents. As consideration for the patents, we paid $264,000 (including legal fees of approximately $38,000) on July 23, 2021.

In addition, the Company haswe have current patent applications in the United States and other countries that if granted, would add three additional patents to its portfolio. The Company’sOur United States patents expire at various dates from March 26, 2028 through March 10, 2036.

On July 23, 2021,A 2022 appraisal of Crown’s intellectual property by one of the Company entered intopreeminent third-party IP-valuation firms indicated a Patent Assignment Agreement with International Business Machines Corporationtotal valuation of approximately $94 million, consisting of $35 million relating to acquire an ownership interest in ten patents.patents (limited to the US office building market, supplying its Smart Window Insert) and $59 million for trade secrets.

The Company believesWe believe that its EK technology is adequately protected by its patent position and by its proprietary technological know-how. However, the validity of the Company’sour patents has never been contested in any litigation. The CompanyWe also possessespossess know-how and relies on trade secrets and nondisclosure agreements to protect its technology. The Company requiresWe require any employee, consultant, or licensee having access to its confidential information to execute an agreement whereby such person agrees to keep such information confidential.

Crown-Owned Patents

| Application No. | | Country | | Filing Date | | Publication No. | | Status | | Title |

| 16/259,078 | | USA | | 28-Jan-19 | | 11174328 | | Issued | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 201980018649.7 | | China | | 28-Jan-19 | | CN111918894A | | Pending | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 19704995 | | Eur | | 28-Jan-19 | | 3752867 | | Pending | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 2020-566194 | | Japan | | 28-Jan-19 | | JP 2021514422A | | Pending | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 10-2020-7024977 | | Korea | | 28-Jan-19 | | KR 20200122333A | | Pending | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| PCT/US2019/015464 | | WO | | 28-Jan-19 | | WO 2019/160675 | | Expired | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 62/631,623 | | USA | | 16-Feb-18 | | | | Expired | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 16/741,622 | | USA | | 13-Jan-20 | | 2020-0225552 | | Pending | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

PCT/US2020/013396Country | | Filing Date | | Publication No. | | Title |

| USA | | 28-Jan-19 | | 11174328 | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| China | | 28-Jan-19 | | CN111918894A | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| Europe | | 28-Jan-19 | | 3752867 | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| Japan | | 28-Jan-19 | | JP 2021514422A | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| Korea | | 28-Jan-19 | | KR 20200122333A | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| WO | | 28-Jan-19 | | WO 2019/160675 | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| USA | | 16-Feb-18 | | | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| USA | | 13-Jan-20 | | WO2020/150166 | | Pending2020-0225552 | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| WO | | 13-Jan-20 | | WO2020/150166 | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| USA | | 16-Jan-19 | | | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| EPO | | 23-Jun-21 | | | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| CN | | 8-Jul-21 | | | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| Korea | | 5-Jul-21 | | | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| JP | | 15-Jul-21 | | | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| USA | | 7-Jul-16 | | 10377909 | | INKS INCLUDING SEGMENT COPOLYMER GRAFTED PIGMENTS VIA AZIDE CHEMISTRY |

| USA | | 22-Nov-10 | | 8179590 | | ELECTRO-OPTICAL DISPLAY |

| USA | | 29-Jul-10 | | 8054535 | | ELECTROPHORETIC DISPLAY DEVICE |

| USA | | 23-Aug-17 | | 10852615 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| EPO | | 2-Dec-15 | | 3256903 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS |

| EPO | | 2-Dec-15 | | 3250962 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| USA | | 23-Aug-17 | | 10656493 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS |

| USA | | 30-Nov-20 | | 2021-0108463 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| WO | | 2-Dec-15 | | WO2016/089957 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS |

| 62/793,250 | | USA | | 16-Jan-19 | | | | Expired | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| 20741846.8 | | EPO | | 23-Jun-21 | | | | Pending | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| 202080008471.0 | | CN | | 8-Jul-21 | | | | Pending | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| 10-2021-7020967 | | Korea | | 5-Jul-21 | | | | Pending | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| 2021-540869 | | JP | | 15-Jul-21 | | | | Pending | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| 15/204,505 | | USA | | 7-Jul-16 | | 10377909 | | Issued | | INKS INCLUDING SEGMENT COPOLYMER GRAFTED PIGMENTS VIA AZIDE CHEMISTRY |

| 12/951,348 | | USA | | 22-Nov-10 | | 8179590 | | Issued | | ELECTRO-OPTICAL DISPLAY |

| 12/865,255 | | USA | | 29-Jul-10 | | 8054535 | | Issued | | ELECTROPHORETIC DISPLAY DEVICE |

| 15/552,924* | | USA | | 23-Aug-17 | | 10852615 | | Issued | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| 15823847.7* | | EPO | | 2-Dec-15 | | 3256903 | | Issued | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS |

| 15810715.1* | | EPO | | 2-Dec-15 | | 3250962 | | Issued | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| 15/552,974* | | USA | | 23-Aug-17 | | 10656493 | | Issued | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS |

| 17/106,646* | | USA | | 30-Nov-20 | | 2021-0108463 | | Pending | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| PCT/US2015/063365* | | WO | | 2-Dec-15 | | WO2016/089957 | | Expired | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS |

| PCT/US2015/063390* | | WO | | 2-Dec-15 | | WO2016/089974 | | Expired | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| 14/574868 | | USA | | 18-Dec-14 | | 9567995 | | Expired | | WINDOW OPACITY ATTENUATION USING MICROFLUIDIC CHANNELS -- note: Patent expired prior to transfer (client contemplating reinstatement of patent) -- |

| 14/828559 | | USA | | 18-Aug-15 | | 9816501 | | Issued | | WINDOW OPACITY ATTENUATION USING MICROFLUIDIC CHANNELS |

| 15/916917 | | USA | | 9-Mar-18 | | 10926859 | | Issued | | SMART WINDOW ACTIVATION TO PREVENT LASER DISTURBANCE |

| 15/975996 | | USA | | 10-May-18 | | 10935818 | | Issued | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| 15/335325 | | USA | | 26-Oct-16 | | 10106018 | | Issued | | AUTOMATED WINDSHIELD GLARE ELIMINATION ASSISTANT |

| 15/255388 | | USA | | 2-Sep-16 | | 10144275 | | Issued | | ENVIRONMENTAL CONTROL IN VEHICLES |

| 2017048.6 | | GB | | 2-May-19 | | 2586760 | | Issued | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| 201980021319.3 | | CN | | 2-May-19 | | CN111936331A | | Pending | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| 112019000749.1 | | DE | | 2-May-19 | | 112019000749 | | Pending | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| 2020-560315 | | JP | | 2-May-19 | | | | Pending | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| IB2019/053578** | | PCT | | 2-May-19 | | WO2019/215544 | | Expired | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| 17/498,702 | | USA | | 11-Oct-21 | | 2586760 | | Pending | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| 2017048.6 | | GB | | 2-May-19 | | CN111936331A | | Issued | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| WO | | 2-Dec-15 | | WO2016/089974 * | | TWO PARTICLE ELECTROPHORETIC LAMINATE FOR USE WITH SMART WINDOWS WITH REDUCED DIFFRACTION |

| USA | | 18-Dec-14 | | 9567995 | | WINDOW OPACITY ATTENUATION USING MICROFLUIDIC CHANNELS |

| USA | | 18-Aug-15 | | 9816501 | | WINDOW OPACITY ATTENUATION USING MICROFLUIDIC CHANNELS |

| USA | | 9-Mar-18 | | 10926859 | | SMART WINDOW ACTIVATION TO PREVENT LASER DISTURBANCE |

| USA | | 10-May-18 | | 10935818 | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| USA | | 26-Oct-16 | | 10106018 | | AUTOMATED WINDSHIELD GLARE ELIMINATION ASSISTANT |

| USA | | 2-Sep-16 | | 10144275 | | ENVIRONMENTAL CONTROL IN VEHICLES |

| GB | | 2-May-19 | | 2586760 | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| CN | | 2-May-19 | | CN111936331A | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| DE | | 2-May-19 | | 112019000749 | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| JP | | 2-May-19 | | | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| PCT | | 2-May-19 | | WO2019/215544 ** | | EVENT-BASED, AUTOMATED CONTROL OF VISUAL LIGHT TRANSMISSION THROUGH VEHICLE WINDOW |

| USA | | 11-Oct-21 | | 11578150 | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| USA | | 24-Feb-22 | | | | WINDOW SYSTEM AND METHOD UTILIZING A WINDOW PANE ASSEMBLY AND LOCKING SYSTEM FOR EASY INSERTION OF A WINDOW PANE ASSEMBLY WITH ELECTRONICALLY CONTROLLABLE SCALABLE APERTURES FOR ATTENUATING OR OTHERWISE MODULATING LIGHT TRANSMISSION THROUGH SAID ASSEMBLY |

| USA | | 24-Feb-22 | | | | WINDOW SYSTEM AND METHOD UTILIZING A WINDOW PANE ASSEMBLY AND LOCKING SYSTEM FOR EASY INSERTION OF A WINDOW PANE ASSEMBLY WITH ELECTRONICALLY CONTROLLABLE SCALABLE APERTURES FOR ATTENUATING OR OTHERWISE MODULATING LIGHT TRANSMISSION THROUGH SAID ASSEMBLY |

| USA | | 29-Mar-22 | | | | SELF-ALIGNING MASTER AREA MULTIPLICATION FOR CONTINUOUS EMBOSSING |

| USA | | 11-Sep-22 | | | | APPLICATIONS OF AN ELECTROKINETIC DEVICE FOR AN IMAGING SYSTEM |

| USA | | 22-Jul-14 | | | | INKS INCLUDING SEGMENT COPOLYMER GRAFTED PIGMENTS VIA AZIDE CHEMISTRY (recently assigned to Crown) |

| USA | | 10-Feb-23 | | | | REFRACTIVE INDEX MATCHED RESIN FOR ELECTROPHORETIC DISPLAYS AND OTHER APPLICATIONS |

| PCT | | 23-Feb-23 | | | | WINDOW SYSTEM AND METHOD UTILIZING A WINDOW PANE ASSEMBLY AND LOCKING SYSTEM FOR EASY INSERTION OF A WINDOW PANE ASSEMBLY WITH ELECTRONICALLY CONTROLLABLE SCALABLE APERTURES FOR ATTENUATING OR OTHERWISE MODULATING LIGHT TRANSMISSION THROUGH SAID ASSEMBLY |

| * | Co-owned with University of Cincinnati |

In-Licensed Patents

| Patent No. | | Country | | Patent Date | | Publication No. | | Status | | Title |

| 8,183,757 | | USA | | May 22, 201222-May-12 | | | | Issued | | DISPLAY ELEMENT |

| 8,184,357 | | USA | | May 22, 201222-May-12 | | | | Issued | | DISPLAY ELEMENT |

| 8,331,014 | | USA | | December 11, 201211-Dec-12 | | | | Issued | | PIGMENT-BASED INKS |

| 8,384,659 | | USA | | February 26, 201326-Feb-13 | | | | Issued | | DISPLAY ELEMENT INCLUDING ELECTRODES AND A FLUID WITH COLORANT PARTICLES |

| 8,432,598 | | USA | | April 30, 201330-Apr-13 | | | | Issued | | TRANSPARENT CONDUCTOR STRUCTURE |

| 8,896,906 | | USA | | November 25, 201425-Nov-14 | | | | Issued | | INKS INCLUDING BLOCK COPOLYMER GRAFTED PIGMENTS VIA AZIDE CHEMISTRY |

| 8,018,642 | | USA | | September 13, 201113-Sep-2011 | | | | Issued | | ELECTRO-OPTICAL DISPLAY |

Business Model

We intend to develop and sellmanufacture our patented EK Technology under the name DynamicTint™. We intend to generate revenue by selling and in some cases leasing, DynamicTint™ film orour Smart Window Inserts powered by DynamicTint™ to our customers.

Crown’s first product will be the Smart Window Insert powered by DynamicTint™ for retrofitting in commercial buildings. Crown’s commercial building Smart Window Inserts will allow the building owner to quickly convert itsa single pane window unitsunit to a dual pane window unit. Crown’s insertsInserts will act as the “second pane” and will allow the building owner to enjoy all the benefits of a dual pane window without having to replace their existing single pane windows.

Crowns’Crown’s customers will be able to buy and own their Smart Window Inserts but also, at some stage, have the option to enter long-term leases of the Inserts with Crown.

Additional applications we are exploring with potential customers of Crown’s DynamicTintTM include:

| ● | Commercial and multi-family buildings: new construction.Smart Window Inserts for retrofitting of commercial buildings in markets outside the United States. |

| ● | Smart Window Inserts for retrofitting of multi-family buildings. |

| ● | Residential homes: residential windows, garage door windows, windows contained in and surrounding residential front doors as well as residential skylights. |

| ● | Automotive: sunroofs and sun visors.sunroofs. |

As Crown’s DynamicTint technology requires very little energy to effect that transition from clear to dark state, a rechargeable battery coupled with a built-in solar cell eliminates the need to hardwire the inserts to the building electrical system. Crown believes that the potential retrofit market for its Smart Window Inserts is significantly large. Each unit will have wireless communication capability for control of the film and communication with the building HVAC system.

Crown has also developed a working prototype of an insert for the residential skylight, which allows a homeowner to control the amount of light entering the room. Crown’s DynamicTint Insert does not require the homeowner to replace their skylight as it conveniently fits into the existing frame. Crown’s skylight insert will allow a homeowner (through a Bluetooth connection or RF controller) to adjust the level of desired tint easily and quickly, thereby controlling the amount of light and heat entering the room. The DynamicTint Skylight Insert will be powered by a rechargeable lithium battery and built-in solar cell thereby eliminating the need to wire the insert to the home’s electrical system.

Partners and Customers

On March 25, 2022, Crown executed a Master Supply Agreement (the “BDN MSA”) with Brandywine Operating Partnerships L.P. to install its Smart Window Inserts powered by DynamicTintTM in Brandywine office buildings. The BDN MSA provides the master terms and conditions under which purchase orders will be executed for Crown to supply units to retrofit windows at certain locations.

On December 27, 2021, Crown executed a Master Supply Agreement (the “HPP MSA”) with Hudson Pacific Properties L.P. for the installation of Crown’s energy saving Smart Window Inserts in several office properties across its West Coast portfolio. The HPP MSA provides the master terms and conditions under which purchase orders will be executed for Crown to supply units to retrofit windows at certain locations.

Prior to this, on September 27, 2021, Crown had entered into a Master Supply Agreement with MetroSpaces Inc., Crown’s first commercial customer, install its Smart Window Inserts in MetroSpaces’ 70,000 square-foot Houston, Texas office building.

In the future, Crown and both of theseits customers may enter into multiple specific transactions by executing purchase orders for additional buildings.

Additionally, discussions with multiple other building owners to buy Crown Smart Window Inserts are progressing as the regulatory and consumer pressure to reduce the level of energy consumption and carbon emissions continues to build.

Crown will pursue multiple paths

Purchase Orders

On August 12, 2022, the Company entered into two Purchase Orders (PO’s) with Hudson Pacific Properties, L.P. (“Hudson”) for the purchase of the Company’s Smart Window Inserts™ (“Inserts”). Hudson is a unique provider of end-to-end real estate solutions for tech and media tenants. The PO’s have a value of $85,450 and represent the first orders the Company has received prior to havingthe launch of its film manufactured which may include contracting manufacturing through third partiesInserts. Delivery and developing its own manufacturing capabilities, orinstallation are expected to begin in Q2 2023.

On August 12, 2022, as additional consideration for the PO’s, the Company issued a hybridwarrant to Hudson to purchase 300,000 shares of both. the Company’s common stock at $0.75 per share. The warrant has a five year life and expires on August 12, 2027.

Manufacturing

Crown is developing its manufacturing capabilities to meet anticipated demand for the Smart Window Insert through a combination of in-house tooling at both its Oregon facilities located in Corvallis, Oregon, for film production, and Salem, Oregon, for Smart Window Insert manufacturemanufacturing.

Crown plans to produce its EK film at its facilities in Corvallis using its existing roll to roll (the “R2R”) embossing equipment. We intend to perform all other film manufacturing processes at our Corvallis facility upon receipt of additional manufacturing equipment currently ordered and assembly,awaiting delivery.

Crown’s Smart Window Inserts will be produced at our Salem facility, where EK film will be laminated to glass, and then assembled into a frame. The inserts electronic components will also be integrated into the insert and the final assembled inserts will be packaged for shipment from Salem to our customers’ buildings.

The completion of Crown’s facilities in Corvallis and Salem marks our transition to being completely self-sufficient in manufacturing our products, eliminating any dependency on contract manufacturers or partners.

Commercial Office Building Market

Commercial buildings have gotten larger in the United States as welltheir floorspace continues to grow faster than the number of commercial buildings, according to preliminary results from the U.S. Energy Information Administration’s (EIA) 2018 Commercial Buildings Energy Consumption Survey (CBECS). CBECS estimates that 5.9 million U.S. commercial buildings contained a total of 97 billion square feet as via contract manufacturing partnerships which are currently being negotiated.of 2018. The number of commercial buildings increased by 6%, and commercial square footage increased by 11% since the CBECS was last conducted in 2012.

Smart Glass Industry Trends

We believe there are favorable converging global trends in the major near-term markets for “smart glass” products. Key factors driving the growth of the smart glass market are the growing demand for smart glass for energy savings for existing commercial and residential buildings. Added to this trend are government mandates and legislation for energy-efficient construction of both commercial and residential buildings. There is a growing opportunity for smart windows in the transportation industry including automobiles, commercial trucks, buses, and passenger rail cars.

In both public and private sectors across the world, there are substantial efforts targeted toward the promotion and use of energy efficient smart glass materials, including those used in automobiles, windows and other architectural glazings.

In September 2020, Markets and Markets issued Smart Glass Market with COVID-19 Impact by Technology (Suspended Particle Display, Electrochromic, Liquid Crystal), Application (Architecture, Transportation, Consumer Electronics), and Geography - Global Forecast to 2025. The smart glass market size is expected to grow from USD 3.8$3.8 billion in 2020 to USD 6.8$6.8 billion by 2025, at a CAGR of 12.1% during the forecast period. The growth of the smart glass industry is driven by factors, such as the growing adoption of smart glass in automotive application and, declining prices for electrochromic material. Other major driving factors for smart glass adoption include supportive government mandates and legislation on energy efficiency. Governing bodies of various countries are increasingly encouraging the use of these energy-efficient products.

Smart glass has inherent energy-saving and auto-dimming properties, which reducereduces its maintenance cost. As a result, the perceived benefits of these glass products are more than the incurred investments.

Crown believes that the smart glass industry is in the initial phase of growth and that DynamicTintTM film may have commercial applicability in many products where variable light-control is desired.

Our Technology

DynamicTintTM combines many of the favorable properties of the other smart window technologies. It has fast-switching time and unlike electrochromic (EC) technology, modulation in light level is not area dependent and the film is neutral in color in all settings. Unlike Suspended Particles Devices (SPD) and Polymer Dispersed Liquid Crystal (PDLC) technology, EK film does not need high voltage alternating current to power the film. Because of the low power requirements, EK films can be powered with batteries or combined with small area solar cells, allowing retrofit to existing windows. Furthermore, in the future, EK film could be made with other colorants and it is possible with modification to the design to use two colorants in the same film, which has been demonstrated in the recent past under a research project at the University of Cincinnati. Below is a table outlining some of the typical properties of each technology.

Other Smart Glass Technologies

Variable light transmission technologies can be classified into two basic types: “active” technologies that can be controlled electrically by the user either automatically or manually, and “passive” technologies that can only react to ambient environmental conditions such as changes in lighting or temperature. Most of the technologies are “active”. One type that is passive is thermochromic technology where a rise in temperature will darken the film applied to glass.

The Company believesWe believe that our DynamicTint has certain performance advantages over other “smart glass” technologies and that pricing and product performance are the two main factors critical to the adoption of smart glass products. Because the non-EK smart glass technologies listed below do not have published, consistent pricing or cost data that can be relied upon, the Companywe cannot accurately report itsour price position relative to these other technologies. In terms of product performance, the Company believeswe believe that DynamicTint offers numerous advantages over other smart glass technologies, as discussed below.

| Technology | | Can Retrofit | | Power Usage | | Can Tint

to Black | | Solar or

Battery

Powered | | Tint

Transition

Speed | | Light Transmission |

| DynamicTintTM (Electrokinetic) | | ✓ | | <0.01 W/M2 | | ✓ | | ✓ | | approx. 24 sec | | 3.0% - 70% or 0.4 %-50% |

| | | | | | | | | | | | | |

| Electrochromic (EC) | | ✕ | | 0.3 – 2 W/M2

(30X (30X EK) | | ✕ | | ✓✕ | | 5-40 min | | <1% - 58% |

| | | | | | | | | | | | | |

| Suspended Polymers in Particles (SPD)1 | | ✕ | | 1.1 W/M2 at 100V/50hz

(110X (110X EK) | | ✕ | | ✕ | | <3 sec | | 0.8% - 55% |

| | | | | | | | | | | | | |

| Polymer Dispersed Liquid Crystal (PDLC) | | ✕ | | 5 – 20 W/M2

(500X (500X EK) | | ✕ | | ✕ | | 1 – 3 sec | | ~80% |

Ref. 1: SPD Film - LCF-1103DHA90 Showa Denko Material Co.

Electrochromic Glass

Electrochromic (EC) glass technology has been used as a light absorbing technology for rear view mirrors in automobiles for decades, and more recently for large-scale windows. However, the EC technology developed for windows is based on a different set of materials that are directly deposited on the heat-treated glass panels. All of the current EC companies are usinguse tungsten oxide as the main component involved in the color transition from clear to blue. Because of the nature of the chemical transition of the tungsten oxide, the EC film does not absorb as much of the blue light, and so remaining light will have a strong blue hue both in the room and when looking through the window. The speed of the switching time from dark to light or the reverse changevice versa is directly related to the size of the window area and the electrode design which brings electrical current to the EC material to start the chemical transition. EC technology is basically a battery-like material that requires “charging and discharging”. The time to charge/discharge the EC material in a large window can take up to 40 minutes to change form the dark state to the clear state at nominal temperatures. Also, during switching of the EC film, there can be non-uniform areas which can vary in level of tint from center to edge. The larger the area of the window, the more non-uniform during the change of state. Longer switching time can minimize the non-uniform areas. The EC materials are typically vacuum deposited directly on “defect-free” glass. The typical investment required for a large window electrochromic factory can run into the hundreds of millions of dollars, due to the large-scale vacuum equipment required, low particulate cleanroom required, and the relatively slow speed of deposition for all the various layers. Halio, formerly Kinestral Technologies, is using a chemical liquid deposition technique to replace some of the vacuum deposition steps to lower the capital investment needed for manufacturing.

Suspended Particle Glass (SPD)

SPD is a film that has suspended long and narrow particles in an encapsulated liquid polymer film with layers of ITO on either side to allow generation of an alternating current electrical field to twist the particles from a random state to a near vertical state perpendicular to the ITO plane. In the vertical state light passes through the film and in the random state the light is absorbed by the particles. The color of the film is blue since the particles used in the film do not absorb blue light as well as other colors of sunlight. No other types of particles have been created for this type of device. The film responds quickly to the electrical field, however, requires constant high AC voltage to hold the clear state. The film is manufactured on plastic and uses roll-to-roll (R2R) equipment processing. Also, because the particles are aligned when in the clear state, the film has a limited viewing angle much like older liquid-crystal displays. When viewed at a side angle, the film will appear darker. The current market for SPD has been mainly automobile sunroofs where the viewing angle of the passengers is relatively fixed at nearly perpendicular angle to the SPD film.

Polymer-Dispersed Liquid Crystal (PDLC) Film

PDLC requires an AC electric field like the SPD film described above to achieve a clear state. However, the liquid-crystal based film can only scatter light in the power-off state, therefore, most of the incoming light is transmitted through the film (~80%). Typically, the PDLC film is used for interior windows or doors to create privacy. PDLC has similar manufacturing methods using R2R equipment and plastic film with ITO conductor to the SPD film. The film is available from many Far East manufacturing companies with some able to make ~150 cm width film. The quality of the film can vary based on the manufacturing company. The film was invented at Kent State University in the 1980’s and the patents have expired.

Competition

Several smart glass competitors have an operating history, including:

| ● | SAGE Electrochromic, Inc., a wholly owned subsidiary of Saint-Gobain, which develops and manufactures electrochromic glass; |

| ● | View Glass [NASDAQ: VIEW] and Halio, formerly Kinestral Technologies, manufacture electrochromic glass at their purpose-built manufacturing facilities and both are headquartered in California; and |

| ● | Research Frontiers, Inc. [NASDAQ: REFR] licenses an electronically controlled tinted film, utilizing SPD technology, to various companies. |

Crown Electrokinetics expects that other competitors will emerge in the future.

Research and Development

Crown has been using a 6” width R2R equipment capable of handling the deposition, embossing and lamination steps of the manufacturing process for its research and development for the past three years. Crown will have its proto-manufacturing roll-to-roll equipment at 12” width available in 2022. Production prototypes for qualification and system testing will be sourced from the 12” equipment in 2022.development. Crown will utilize the 12” width film for the first-generation Smart Window Insert. Larger scale manufacturing is planned at a minimum of 36” width film to address markets including appropriately sized commercial and residential building window inserts, larger format skylights inserts, and many automobile sunroofs. Thereafter, Crown will develop capability to manufacture DynamicTint film of at least 72” width capability. This will allow Crown to address the vast majority of window sizes for most applications.

As a result of the Company’sour research and development efforts, the Company believeswe believe that itsour EK technology is now, or with additional development will become, usable in a number of commercial products. Such products may include one or more of the following fields: “smart” windows, doors, skylights and partitions; self-dimmable automotive sunroofs, windows, sun visors, and mirrors.

The Company hasWe have devoted most of itsour financial resources to research and development activities with the goal of producing commercially viable EK products and has developed working samples of itsour EK technology.

Crown’s main goals in its research and development include:

| ● | developing wider ranges of light transmission, |

| ● | reducing the voltage required to operate DynamicTintTM, |

| ● | obtaining data and developing improved materials regarding environmental stability and longevity, and |

| | ● | quantifying the degree of energy savings expected by users of the Company’sour technology. |

| | |

| ● | development of the Smart Window Insert product |

Crown Fiber Optics

On January 3, 2023, we acquired substantially all of the assets (the “Asset Acquisition”) of Amerigen 7 LLC (“Amerigen”), which was engaged in the business of construction of 5G fiber optics infrastructure, for cash consideration of approximately $0.65 million. The Asset Acquisition included approximately 12 employees, customer contracts, and certain operating liabilities. On December 20, 2022, we incorporated our wholly-owned subsidiary Crown Fiber Optics Corp. (“Crown Fiber Optics” or “we”) in Delaware, to own and operate the business acquired from Amerigen.

Crown Fiber Optics supplies telecommunications providers with a comprehensive portfolio of specialty services, including program management; planning; engineering and design; aerial, underground, and wireless construction; maintenance; and fulfillment services. Crown Fiber Optics supplies the expertise, labor, equipment, and tools necessary to provide services to our customers.

Engineering Services. Crown Fiber Optics provides engineering services to telecommunications providers, including the planning and design of aerial, underground, and buried fiber optic, copper, and coaxial cable systems that extend from the telephone company hub location, or cable operator headend, to a consumer’s home or business. Crown Fiber Optics also plans and designs wireless networks in connection with the deployment of new and enhanced macro cell and new small cell sites. Additionally, we obtain rights of way and permits in support of our engineering activities and those of our customers and provide program and project management and inspection personnel in conjunction with engineering services or on a stand-alone basis.

Construction, Maintenance, and Installation Services. We provide a range of construction, maintenance, and installation services, including the placement and splicing of fiber, copper, and coaxial cables. We excavate trenches to place these cables; place related structures, such as poles, anchors, conduits, manholes, cabinets, and closures; place drop lines from main distribution lines to a consumer’s home or business; and maintain and remove these facilities. We provide these services for both telephone companies and cable multiple system operators in connection with the deployment, expansion, or maintenance of new and existing networks. We also provide tower construction, lines and antenna installation, foundation and equipment pad construction, small cell site placement for wireless carriers, and equipment installation and material fabrication and site testing services. Our underground facility locating services include locating telephone, cable television, power, water, sewer, and gas lines.

Capitalize on Long-Term Growth Drivers. We are well-positioned to benefit from the increased demand for network telecommunications bandwidth that is necessary to ensure reliable video, voice, and data services. Developments in consumer and business applications within the telecommunications industry, including advanced digital and video service offerings, continue to increase demand for greater wireline and wireless network capacity and reliability. Telecommunications network operators are increasingly deploying fiber optic cable technology deeper into their networks and closer to consumers and businesses in order to respond to consumer demand, competitive realities, and public policy support. Additionally, wireless carriers are upgrading their networks and contemplating next generation mobile solutions in response to the significant demand for wireless broadband, driven by the proliferation of smart phones, mobile data devices and other advances in technology. Increasing wireless data traffic and emerging wireless technologies are driving wireline deployments in many regions of the United States. Furthermore, significant consolidation and merger activity among telecommunications providers could also provide increased demand for our services as networks are integrated.