As filed with the U.S. Securities and Exchange Commission on October 5, 2021

Registration Statement No. 333-_________January 2, 2020.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

DIAMEDICA THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

British Columbia, Canada | Not Applicable | ||

(State or other jurisdiction of

|

|

| (I.R.S. Employer

|

2Two Carlson Parkway, Suite 260

Minneapolis, Minnesota 55447

(763) 312-6755

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Rick Pauls

President and Chief Executive Officer

DiaMedica Therapeutics Inc.

2Two Carlson Parkway, Suite 260

Minneapolis, Minnesota 55447

(763) 312-6755

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Amy E. Culbert Fox Rothschild LLP

222 South Ninth Street Minneapolis, Minnesota (612) 607-7000 | Keith Inman Pushor Mitchell LLP 301 – 1665 Ellis Street Kelowna, British Columbia Canada V1Y 2B3 (250) 762-2108 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒box: ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additionaladdi‐tional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | |

Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) |

Voting Common Shares, no par value per share(3)(4)(5) | ||

Warrants(5) | ||

Units(6) | ||

Total | $50,000,000 | $6,490.00 |

Title of each class of securities to be registered(1) | Amount to be registered(1) | Proposed maximum offering price per share | Proposed maximum aggregate offering price | Amount of registration fee | ||||||||||||

Voting Common Shares, no par value per share | 7,653,060 | $ | 4.21 | (2) | $ | 32,219,382.60 | (2) | $ | 2,986.74 | |||||||

(1) |

|

(2) |

|

|

|

|

|

|

|

|

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities, and it is notneither we nor the selling shareholders are soliciting an offeroffers to buy these securities in any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 2, 2020OCTOBER 5, 2021

PRELIMINARY PROSPECTUS

$50,000,000

Common Shares

Warrants

Units

We mayThis prospectus relates to the resale, from time to time, offerof up to sell any combinationan aggregate of 7,653,060 common shares, warrants and units describedno par value per share, of DiaMedica Therapeutics Inc. by the selling shareholders named in this prospectus, in oneincluding their respective donees, pledgees, transferees, assignees or more offerings.other successors-in-interest. The aggregate initial offeringselling shareholders acquired these shares from us pursuant to a Securities Purchase Agreement, dated as of September 26, 2021 pursuant to which we issued 7,653,060 common shares at a purchase price of all securities sold$3.92 per share.

We are not selling any common shares under this prospectus and will not exceed $50,000,000.receive any proceeds from sales of the common shares offered by the selling shareholders, although we will incur expenses in connection with the offering. The registration of the resale of the common shares covered by this prospectus does not necessarily mean that any of the shares will be offered or sold by the selling shareholders. The timing and amount of any sales are within the sole discretion of the selling shareholders.

This prospectus provides a general description of the securities that we may offer. Each time we sell securities, we will provide the specific terms of the securitiesThe common shares offered in a supplement to this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. You should readunder this prospectus and the applicable prospectus supplement carefully before you invest in any securities. This prospectus may not be used to consummate a sale of securities unless accompaniedsold by the applicableselling shareholders through public or private transactions, on or off the Nasdaq Capital Market, at prevailing market prices or at privately negotiated prices. For more information on the times and manner in which the selling shareholders may sell the common shares under this prospectus, supplement.

We may from time to time offer and sell our securities in one offering or in separate offerings, to or through underwriters, dealers and agents or directly to purchasers. If any agents or underwriters are involved inplease see the salesection entitled “Plan of anyDistribution,” beginning on page 39 of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commissions or discounts.this prospectus.

Our common shares are listed on Thethe Nasdaq Capital Market under the symbol “DMAC.” On December 31, 2019,October 1, 2021, the closinglast reported sales price of our common shares as reported on Thethe Nasdaq Capital Market was $4.85$4.17 per share. As of the date of this prospectus, the aggregate market value of our common shares held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 is $52,130,710, which is calculated based on 10,748,600 common shares outstanding held by non-affiliates and a price of $4.85 per share, the closing price of our common shares on December 31, 2019, as reported on The Nasdaq Capital Market. During the prior 12 calendar month period that ends on and includes the date hereof, we have not offered or sold any of our common shares or other securities pursuant to General Instruction I.B.6 to Form S-3. Pursuant to General Instruction I.B.6 to Form S-3, in no event will we sell securities registered on this registration statement in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million.

We are an “emerging growth company,”company” as defined under federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements. See “About the Company – Implications of Being an Emerging Growth Company and Smaller Reporting Company” beginning on page 36 of this prospectus.

Investing in our securitiescommon shares involves risks.a high degree of risk. See You should consider carefully the risks and uncertainties set forth in the section entitled “Risk Factors”” beginning on page 49 of this prospectus, in the related prospectus supplement, andas well as those risk factors described in the documents we file withincorporate by reference.

Neither the Securities and Exchange Commission that are incorporated by reference innor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus before makingprospectus. Any representation to the contrary is a decision to purchase our securities.criminal offense.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 20202021.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS |

|

|

|

RISK FACTORS |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

USE OF PROCEEDS |

|

|

|

DESCRIPTION OF |

|

|

|

|

|

SELLING SHAREHOLDERS | 35 |

PLAN OF DISTRIBUTION |

|

LEGAL MATTERS |

|

EXPERTS |

|

WHERE YOU CAN FIND MORE INFORMATION |

|

INCORPORATION OF | 40 |

| 41 |

We are responsible for the information contained and incorporated by reference in this prospectus we prepare or authorize. Neither we nor the selling shareholders, as defined below, have authorized anyone to provide any information or to make any representations other than those contained in or incorporated by reference into this prospectus we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since those dates. It is important for you to read and consider all the information contained in this prospectus, including the documents incorporated by reference herein or therein, before making your investment decision.

For investors outside the United States: we have not, and the selling shareholders have not, taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offer and sale of the common shares and the distribution of this prospectus outside the United States.

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement on Form S-3 that we filed with the United States Securities and Exchange Commission (SEC) utilizing a “shelf” registration process., under the United States Securities Act of 1933, as amended (Securities Act). Under this shelf registration process, we may offer and sell any combination of the securities describedselling shareholders named in this prospectus may offer or sell common shares in one or more offerings upfrom time to time. Each time the selling shareholders named in this prospectus (or in any supplement to this prospectus) sell common shares under the registration statement of which this prospectus is a part, such selling shareholders must provide a copy of this prospectus and any applicable prospectus supplement, to a total dollar amount of $50,000,000.potential purchaser, as required by law.

This prospectus provides you with a general description of the respective securities thatIn certain circumstances we may offer. Each time we sell securities under this shelf registration statement, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. To the extent that anyAny statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by thoseany inconsistent statement made by us in thea prospectus supplement. You should read both this prospectus and the accompanyingany prospectus supplement, including all documents incorporated herein or therein by reference, together with additional information described under “Where You Can Find More Information” beginning on page 41 of this prospectusand “Incorporation of DocumentsCertain Information by Reference.” beginning on page 41 of this prospectus.

WeNeither we, nor the selling shareholders, have not authorized any dealer, salesperson or other person to giveprovide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor any of the selling shareholders will make an offer to sell our common shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information or to make any representation other than those contained or incorporated by referenceappearing in this prospectus and the accompanying prospectus supplement. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. This prospectus and the accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date subsequent toas of the date set forth on the front of the document orits respective cover, and that any information we have incorporated by reference is correct on any date subsequent toaccurate only as of the date of the document incorporated by reference, even thoughunless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless otherwise indicated, information contained in or incorporated by reference into this prospectus concerning our industry and any accompanying prospectus supplementthe markets in which we operate, including our general expectations and market position, market opportunity and market share, is delivered or securitiesbased on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are soldderived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a later date.high degree of uncertainty and risk due to a variety of factors, see “Risk Factors” beginning on page 9 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements” beginning on page 13 of this prospectus.

ThisSolely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® and ™ symbols, but those references are not be usedintended to offerindicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and sell securities unless it is accompanied by an additional prospectus or a prospectus supplement.tradenames.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “DiaMedica,” “DMAC,” “the Company,” “we,” “us,” and “our” or similar references mean DiaMedica Therapeutics Inc. and its subsidiaries. References in this prospectus to “voting common shares” or “common shares” meanrefer to our voting common shares, no par value per share. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the context otherwise requires.

All references in this prospectus to “$,” “U.S. Dollars” and “dollars” are to United States dollars.

We own various unregistered trademarks and service marks, including our corporate logo. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that the owner of such trademarks and trade names will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ABOUT THE COMPANYPROSPECTUS SUMMARY

OverviewThis summary highlights certain information about us, this offering and selected information contained in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common shares. For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed information included or incorporated by reference in this prospectus, including risk factors, see “Risk Factors” beginning on page 9 of this prospectus, and our most recent consolidated financial statements and related notes.

About DiaMedica Therapeutics Inc.

We are a clinical stage biopharmaceutical company primarily focusedcommitted to improving the lives of people suffering from serious diseases. DiaMedica’s lead candidate DM199 is the first pharmaceutically active recombinant (synthetic) form of the KLK1 protein to be studied in patients, an established therapeutic modality for the treatment of acute ischemic stroke and chronic kidney disease. Currently, our primary focus is on developing DM199, a proprietary recombinant KLK1 protein for the developmenttreatment of novel recombinant proteins.acute ischemic stroke (AIS). Our goal is to use our trade secrets and patented and licensed technologies to establish our companyCompany as a leader in the development and commercialization of therapeutic treatments derived from novel recombinant proteins. Our current focus is on chronic kidney disease (CKD) and acute ischemic stroke (AIS). We plan to advance DM199, our lead drug candidate, through required clinical trialsstudies to create shareholder value by establishing its clinical and commercial potential as a therapy for CKDAIS and AIS.chronic kidney disease (CKD).

DM199 is a recombinant form of human tissue kallikrein-1 (KLK1). KLK1 is a serine protease (protein), produced primarily in the kidneys, pancreas and salivary glands, thatwhich plays a criticalan important role in the regulation of local blood flow and vasodilation (the widening of blood vessels which decreases blood pressure) in the body, as well as an important role in mitigating inflammation and oxidative stress (an imbalance between potentially damaging reactive oxygen species, or free radicals, and antioxidants in yourthe body). We believe DM199 has the potential to treat a variety of diseases where healthy functioning requires sufficient activity of KLK1 and its system, the kallikrein-kinin system (KKS).

AIS and CKD patients suffer from a lack ofimpaired blood flow to the brain and kidneys, respectively. These patients also tend to exhibit lower than normal levels of endogenous (produced by the body) KLK1. We believe treatment with DM199 could replenish low levels of endogenous KLK1, thereby releasing physiological levelsallowing the natural function of KKS to release bradykinin (BK)in the body where and when and where needed, generating beneficial nitric oxide and prostacyclin, setting in motion metabolic pathways that can improve blood flow (through vasoregulation) to damaged, dampen inflammation and protect tissues and end-organs such as the brain and kidneys,from ischemic damage, supporting structural integrity and normal functioning.

Today, forms of KLK1 derived from human urine and porcine pancreas are sold in Japan, China and Korea to treat AIS, CKD, retinopathy, hypertension and related vascular diseases. We believe millions of patients have been treated with these KLK1 therapies and the data from more than 100 published papers and studies support their clinical benefit. However, there are numerous regulatory, commercial and clinical drawbacks associated with KLK1 derived from human urine and porcine pancreas thatwhich can be overcome by developing a synthetic version of KLK1 such as DM199. We believe higher regulatory drawbacksstandards are the primary reason why KLK1 derived from human urine and porcine pancreas are not currently available and used in the United StatesState or Europe. We are not aware of any synthetic version of KLK1 with regulatory approval for human use in any country, nor are we aware of any synthetic version in development other than our drug candidate, DM199.

As described in more detail below, positive top-line results from ReMEDy, a 92-subject study in acute ischemic stroke, including the achievement of primary safety and tolerability endpoints and no DM199-related serious adverse events, were announced in May 2020. In addition, there was also a demonstrated therapeutic effect in participants that received tissue plasminogen activator (tPA) prior to enrollment but not in participants receiving mechanical thrombectomy prior to enrollment according to top-line Phase II results.

We have conducted numerous internal and third-party analyses to evaluate the structural and functional performance of DM199 as compared to KLK1 derived from human urine. The results of these studies have demonstrated that DM199 is structurally and functionally equivalent to KLK1 derived from human urine in that (i) the amino acid structure of DM199 is identical to the human urine form, (ii) the enzymatic and pharmacokinetic profiles are substantially similar to human urinary derived KLK1 and (iii) the physiological effects of DM199 on blood pressure mirror that of human urinary derived KLK1. We believe at least five companiesthat the results of this work suggest that the therapeutic action of DM199 will be the same or better than that of the forms of KLK1 marketed in Asia. In addition, we have attemptedcompleted enrollment in seven clinical trials with DM199 treating over 200 subjects, and the results have shown that DM199 has been safe and well-tolerated. However, DM199 has not been, and we cannot provide any assurance that it ultimately will be, determined to createbe safe or effective for purposes of granting marketing approval by the U.S. Food and Drug Administration (FDA) or any comparable agency.

Our recombinant form of DM199 is protected by issued composition of matter and delivery patents in the United States and Europe (expiration 2033); a pending worldwide patent (expiration 2038) that covers a range of DM199 dose levels and dosing regimens useful for treating a wide range of diseases associated with microvascular dysfunction; an exclusive license with our manufacturing partner for use of their cell line and proprietary expression system for manufacturing synthetic KLK1; and numerous trade-secrets. In addition, we believe DM199 cannot be reverse engineered to develop a copycat version of our therapy. This adds additional protection to our intellectual property, especially as we evaluate DM199 licensing.

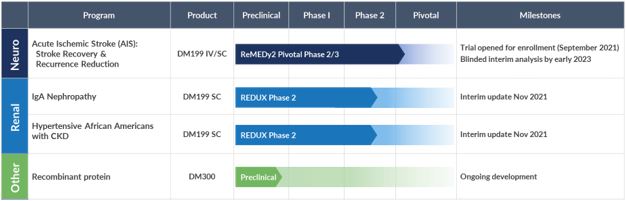

Our Programs

The primary focus for our DM199 program development is currently on AIS and CKD. The current status of our product candidates in clinical development is as follows:

Acute Ischemic Stroke

According to the World Health Organization, each year approximately 15 million people worldwide suffer a stroke, of which 5.0 million will die and 5.0 million will be permanently disabled. According to the U.S. Center for Disease Control and Prevention approximately 87% of all strokes are ischemic in nature, a blockage of blood flow in/to the brain. We believe that stroke represents an area of significant unmet medical need and a KLK1 buttreatment (such as DM199) could provide a significant patient benefit, in particular given its proposed therapeutic window of up to 24 hours after the first sign of symptoms. Currently, the only FDA-approved pharmacological intervention for AIS is tissue plasminogen activator (tPA), which must be given within 4.5 hours of symptom onset. Treating patients with tPA during this time window can be challenging because it is difficult to determine precisely when symptoms began and a patient must undergo complex brain imaging before treatment to rule out a hemorrhagic stroke, a ruptured blood vessel causing bleeding within the brain. Approximately 20% of strokes occur in the arteries supplying blood to the brain. Blockages in these vessels are called large vessel occlusions which are eligible for mechanical thrombectomy, a procedure which attempts to remove the clot using catheter-based tools. Despite the availability of these treatments, we believe they are relevant to approximately 10% of ischemic stroke patients due to the location of the clot, the elapsed time after the stroke occurred, availability of adequately trained physicians or other safety considerations. Thus, we believe DM199 may offer significant advantages over the current treatment options in that it fills a serious, unmet need for patients who cannot receive tPA or mechanical thrombectomy. Additionally, DM199 may also offer a complimentary follow-on treatment for patients who initially receive tPA or mechanical thrombectomy treatments by enabling sustained blood flow improvements within the brain during the critical weeks and months after a stroke. Based on the number of strokes each year (approximately 1.7 million in the U.S., Europe and Japan and 15 million worldwide) and considering the $8,500 estimated cost per patient for the current standard of care, tPA, we believe the annual market opportunity for DM199 could be significant.

Chronic Kidney Disease

CKD is a widespread health problem that generates significant economic burden throughout the world. According to the National Kidney Foundation, approximately 30 million Americans and 120 million Chinese suffer from this debilitating and potentially life-threatening condition. CKD is characterized by a progressive decline in overall kidney function, increasing the risk of premature death, cardiovascular events and hospitalization. End-stage renal disease (ESRD) is the final stage of CKD and requires ongoing dialysis or a kidney transplant to survive. However, many patients suffer serious health consequences or die from CKD prior to developing ESRD. Currently, there is no cure for CKD and treatment involves management of the symptoms of the disease. Blood pressure medications, such as angiotensin converting enzyme inhibitors (ACEi) or angiotensin receptor blockers (ARB), are often prescribed to control hypertension, and hopefully, slow the progression of CKD. Nevertheless, according to the National Kidney Foundation, many of these patients continue to show declining kidney function. We believe DM199 offers a potentially novel approach for the treatment of CKD because KLK1 protein plays a vital role in normal kidney function. Since patients with moderate to severe CKD often excrete abnormally low levels of KLK1 in their urine, we believe that DM199 may prevent or reduce further kidney damage by increasing levels of KLK1 and restoring the protective KKS to regulate the production and release of nitric oxide and prostacyclin.

Our Clinical Trials

Acute Ischemic Stroke

On September 13, 2021, we announced the initiation of the first site for our pivotal ReMEDy2 trial, a Phase 2/3 clinical study of DM199 for the treatment of AIS. The ReMEDy2 trial is a randomized, double-blind, placebo-controlled Phase 2/3 adaptive trial designed to enroll 350 patients at 75 sites in the United States. Patients enrolled in the study will be treated with either DM199 or placebo within 24 hours of the onset of AIS symptoms. The study excludes patients treated with tPA and those with large vessel occlusions. The study population is representative of the 80% of AIS patients who do not have been unsuccessful.treatment options today, primarily due to the short treatment window of 4.5 hours required for administration of tPA.

The ReMEDy2 trial has two primary endpoints and is powered for success with either endpoint: 1) physical recovery from stroke as measured by the well-established modified Rankin Scale (mRS) at day 90, and 2) the rate of ischemic stroke recurrence at day 30. Recurrent strokes represent 25% of all ischemic strokes, often occur in the first few weeks after an initial stroke and are typically more disabling, costly, and fatal than initial strokes. Secondary endpoints for the study will evaluate participant deaths, mRS shift (which shows the treatment effect on participants across the full spectrum of stroke severity) and additional standard stroke scores (NIHSS and Barthel Index scores).

In July 2019,May 2020, we completed aannounced top-line data from our Phase Ib clinicalII ReMEDy trial assessing the safety, tolerability and markers of therapeutic efficacy of DM199 in participants with moderate or severe CKD caused by Type I or Type II diabetes.patients suffering from AIS. We initiated dosing patientstreatment in this study in February 20192018 and completed enrollment in July 2019.October 2019 with 92 participants. The study drug (DM199 or placebo) was administered as an intravenous (IV) infusion within 24 hours of stroke symptom onset, followed by subcutaneous injections later that day and once every 3 days for 21 days. The study was performeddesigned to assessmeasure safety and tolerability along with multiple tests designed to investigate DM199’s therapeutic potential including plasma-based biomarkers and standard functional stroke measures assessed at 90 days post-stroke. Standard functional stroke measurements include the pharmacokinetics (PK)Modified Rankin Scale, National Institutes of three dose levelsHealth Stroke Scale, the Barthel Index and C-reactive protein, a measure of DM199 (3, 5 and 8 µg/kg), administered in a single subcutaneous dose, as well as the evaluation of safety, tolerability and secondary pharmacodynamic (PD) endpoints.inflammation. The study resultsmet primary safety and tolerability endpoints and there were no DM199-related serious adverse events. In addition, there was a demonstrated therapeutic effect on the rate of severe stroke recurrence inclusive of all participants and there was also a demonstrated therapeutic effect on the physical recoveries of participants that received tPA prior to enrollment but not in participants receiving mechanical thrombectomy prior to enrollment.

Prior to enrollment, 44 of the 91 evaluable patients (48%) received a mechanical thrombectomy, a catheter-based treatment indicated for those who have a large vessel occlusion and can be treated within 6 to 24 hours of the onset of stroke symptoms. While approximately 20% of AIS patients are believed to be eligible for a mechanical thrombectomy, currently only about 5% to 10% receive the treatment due to elapsed time post-stroke or unavailability of the therapy at the 3µg/kg dose level,hospital where they present. DM199 is intended to treat the PK profiles were similarapproximately 80% of AIS patients who are not eligible for either mechanical thrombectomy or tPA. Treatment for these patients is limited to supportive care. Due to the large volume of participants receiving mechanical thrombectomy prior to enrollment in ReMEDy, and a disproportionate distribution of these participants between moderatethe active treatment and severe CKD patients, and consistentplacebo groups, DM199 did not produce a therapeutic effect on physical recoveries in the overall study analysis.

When participants treated with healthy subjects (normal kidney function) tested previously, andmechanical thrombectomy are excluded from the study data set, which represents the group of participants most closely aligned with the target treatment population for DM199 in the ReMEDy2 trial, a positive therapeutic effect on participant physical recoveries was demonstrated. As shown in the table below, when evaluating the participants treated with DM199 (n=25) vs. supportive care and/or tPA (n=21), the results showed that 36% of participants receiving DM199 was well tolerated with no dose-limiting tolerability. There were no deaths, no discontinuations dueprogressed to a treatment-related adverse event (AE)full or nearly full recovery at 90 days (NIHSS: 0-1), and no treatment-related significant adverse events (SAEs). AEs were minor and consistent with standard treatment(s)compared to 14% of participants in the CKD patient population. In addition, favorable overall PD results were also observed, including short-term improvementsplacebo group. This represents a 22% absolute increase in Nitric Oxide (NO), average increasethe proportion of 35.2%, Prostaglandin E2 (PGE2), average increase of 41.2%, estimated glomerular flow rate (eGFR), average increase of 4.08 mL/min/1732, andparticipants achieving a full or nearly full recovery. Additionally, subject deaths decreased from 24% in the urinary albuminplacebo group to creatinine ratio (UACR), average decrease of 18.7%. PD results appeared to be drug related12% in that the greatest improvements occurred approximately 24 hours after DM199 administration and subsequently declined.active therapy group, a 50% relative reduction.

DM199 vs. Supportive Care and/or tPA

NIHSS Outcomes at 90 Days | ||||

0-1 | 2-8 | ≥ 9 | Death | |

Placebo (n=21) | 14% | 57% | 5% | 24% |

DM199 (n=24) | 36% | 36% | 16% | 12% |

In December 2019,addition, in the evaluable participants (n=91), a significant reduction in the number of participants with severe recurrent stroke was noted in the active treatment group: 1 (2%) patient treated with DM199 vs. 7 (16%) on placebo (p=0.028), with 4 of the 7 resulting in participant death.

Further, in reviewing evaluable participants (n=91), improvements in the following biomarkers were observed in participants treated with DM199, which we began enrollingbelieve are consistent with the DM199 mechanism of action:

● | Increased NO (+105%) and PGE2 (+54%) were observed at day 22 vs baseline (p<0.05). Changes in the placebo group were not statistically significant vs baseline (p>0.05). These changes noted in the active treatment group did not reach statistical significance compared to placebo. |

● | Reduction in C-reactive protein (CRP) of (-70%), a blood marker of inflammation, at 90 days. CRP decreased significantly vs. baseline (p<0.05), but was not statistically significant vs. placebo. The change in the placebo group was not statistically significant vs. baseline (p>0.05). |

We believe these findings from our Phase II ReMEDy trial, which are consistent with Chinese data on the urine-derived form of KLK1, provide a signal that recombinant human KLK1 appears safe and may have promise as a new tool for physicians who have limited options for the treatment of patients in asuffering AIS.

Chronic Kidney Disease

In June 2021, we announced interim results from our Phase II CKD trial named REDUX, Latin for restore, a multi-center, open-label investigation of approximately 6090 participants with CKD, who are being enrolled in two cohortsthree Cohorts (30 per cohort). The studyCohort), indicating that DM199 is being conducteddemonstrating clinically meaningful improvements in the United States at up to 10 sites and will be focused on participants with CKD. Cohort I of the study is focused on non-diabetic, hypertensive African Americans with Stage II or III CKD. African Americans are at greater risk for CKD than Caucasians, and those who have the APOL1 gene mutation are at an even higher risk. The study is designed to capture the APOL1 gene mutation as an exploratory biomarker in this cohort. Cohort II of the study is focused on participants with IgA Nephropathy (IgAN). The study will evaluate two dose levels of DM199 within each cohort. Study participants will receive DM199 by subcutaneous injection twice weekly for 95 days. The primary study endpoints include safety, tolerability, blood pressure, proteinuria and kidney function which will be evaluated by changes from baseline in eGFRCohorts I and albuminuria,II, as measured by simultaneously stabilizing estimated glomerular filtration rate (eGFR) and decreasing urine albumin-to-creatinine ratio (UACR). In participants who were hypertensive (Cohorts I and III), DM199 also reduced blood pressure by clinically significant levels and importantly, there was no effect on participants who were not hypertensive (Cohort II). We reported the UACR.following preliminary data:

● | AA: Decrease in UACR -27% in moderate to severe albuminuria (baseline UACR >500) (n=6), Increase in eGFR +2 ml/min (n=12) and decrease in blood pressure -8/-3 mmHg; |

● | IgAN: UACR decreased by -33% (P=0.002) (baseline UACR>500) (n=11) and eGFR and blood pressure were stable (n=16); and |

● | DKD: eGFR and UACR levels were stable and blood pressure decreased significantly by -5/1 mmHg (n=28). |

DM199 was safe and well tolerated across all cohorts, with no DM199 related severe adverse events (SAEs) or discontinuations due to drug-related adverse events (AEs). AEs were generally mild to moderate in severity, with the most common being local injection site irritation that resolved.

As of September 30, 2021, we had enrolled 78 subjects, including 22 African American subjects into Cohort I, 23 subjects with IgAN into Cohort II and completed enrollment with 33 subjects with Type 2 diabetes, hypertension and albuminuria into Cohort III. We have continued to experience slower than expected enrollment in the first two cohorts of the REDUX study. We believe this is due to continued concerns of potential study subjects related to visiting clinical study sites. We are evaluating the effects of the recent surge in COVID-19 infections related to the Delta variant and we will provide an update on the anticipated completion of Cohort I and Cohort II when we are able to reasonably estimate.

Potential DM199 Commercial Advantages

The growing understanding of KLK1’s role in human health and its use in Asia as an approved therapeutic treatment highlights two important potential commercial advantages for DM199:

● | KLK1 treatments currently sold in Japan, China and Korea. Research has shown that patients with low levels of KLK1 are associated with a variety of diseases related to vascular dysfunction, such as AIS, CKD, retinopathy and hypertension. Clinical trial data with human urine and porcine derived KLK1 has demonstrated statistically significant clinical benefits in treating a variety of patients with KLK1 compared to placebo. These efficacy results are further substantiated by established markets in Japan, China and Korea for pharmaceutical sales of KLK1 derived from human urine and porcine pancreas. We estimate that millions of patients have been treated with these forms of KLK1 in Asia. Altogether, we believe this supports a strong market opportunity for a synthetic version of KLK1 such as DM199. |

● | KLK1 treatment has had limited side effects and has been well tolerated to date. KLK1 is naturally produced by the human body; and, therefore, the body’s own control mechanisms act to limit potential side effects. The side effect observed to limit patient tolerability in our clinical trials was orthostatic hypotension, or a sudden drop in blood pressure, which has been primarily seen at doses ten to twenty times higher than our anticipated therapeutic dose levels. Moreover, we understand that routine clinical use of KLK1 treatment in Asia has been well-tolerated by patients for several decades. In 2017, we completed a clinical trial comparing the pharmacokinetic profile of DM199 to the human urinary form of KLK1 (Kailikang), which showed DM199, when administered in intravenous form, had a similar pharmacokinetic profile. Further, when DM199 was administered subcutaneously, DM199 demonstrated a longer acting pharmacokinetic profile, superior to the intravenously administered Kailikang and DM199. |

In addition, we believe there are also significant formulation, manufacturing, regulatory and other advantages for our synthetic human KLK1 drug candidate DM199:

● | Potency and Impurity Considerations. KLK1 derived from human urine or porcine pancreas may contain impurities, endotoxins, and chemical byproducts due to the inherent variability of the isolation and purification process. We believe that this creates the risk of inconsistencies in potency and impurities from one production run to the next. However, we expect to produce a consistent formulation of KLK1 that is free of endotoxins and other impurities. |

● | Cost and Scalability. Large quantities of human urine and porcine pancreas must be obtained to derive a small amount of KLK1. This creates potential procurement, cost and logistical challenges to source the necessary raw material, particularly for human urine sourced KLK1. Once sourced, the raw material is processed using chemicals and costly capital equipment and produces a significant amount of byproduct waste. Our novel recombinant manufacturing process utilizes widely available raw materials and can be readily scaled for commercial production. Accordingly, we believe our manufacturing process will have significant cost and scalability advantages. |

● | Regulatory. We are not aware of any attempts by manufacturers of the urine or porcine based KLK1 products to pursue regulatory approvals in the United States. We believe that this is related to challenges presented by using inconsistent and potentially hazardous biomaterials, such as human urine and porcine pancreas, and their resulting ability to produce a consistent drug product. Our novel recombinant manufacturing process utilizes widely available raw materials which we believe provides a significant regulatory advantage, particularly in regions such as the United States, Europe and Canada, where safety standards are high. In addition, we believe that DM199 could qualify for 12 years of data exclusivity under the Biologics Price Competition and Innovation Act of 2009, which was enacted as part of the Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act of 2010. |

Our Strategy

We aim to become a leader in the discovery, development and commercialization of recombinant proteins for the treatment of severe and life-threatening diseases. To achieve this goal, we are pursuing the following strategies:

● | Complete our Phase 2/3 trial for DM199 in AIS patients; |

● | Complete our ongoing Phase II trial for DM199 in CKD patients; and |

● | Explore regional partnerships to expand development efforts for DM199. |

Our Team

We have assembled a seasoned management team with extensive experience in drug discovery, development and manufacturing. Our Chief Executive Officer, Rick Pauls, MBA, is a successful venture capitalist and formerly the Co-Founder and Managing Director of CentreStone Ventures Inc., a life sciences venture capital fund which made early investments in DiaMedica. Our Senior Vice President of Clinical Operations, Harry Alcorn Jr., Pharm. D, has more than 30 years’ experience planning, operating, and executing clinical development programs across a range of diseases including kidney disease, diabetes, and cardiovascular disease, and most recently served as Chief Scientific Officer of DaVita Clinical Research. Our Vice President, Regulatory Affairs, Sydney Gilman, Ph.D., has more than 30 years’ experience in drug research, regulatory affairs and quality assurance, including six years as a chemistry reviewer in FDA’s Center for Drug Evaluation and Research. Edward Calamai, our consulting head of manufacturing, has over 30 years’ experience guiding manufacturing operations, including senior positions at Sensu and Seragen. Dr. Calamai is currently the Managing Partner at PM&C Associates, a company he co-founded in 2001. Our Chief Financial Officer, Scott Kellen, CPA, brings over 25 years of operational and corporate finance expertise including an extensive background working with publicly-traded healthcare and biotechnology companies.

In October 2019,July 2021, we completed enrollmentannounced the election of two experienced executives to our Board of Directors in addition to our existing four directors: Amy Burroughs and Charles Semba, M.D.:

● | Amy Burroughs has held senior leadership and advisory roles with a broad range of public and private biopharmaceutical companies over the last 20 years. She is currently president and chief executive officer of Cleave Therapeutics, a clinical stage, venture backed oncology company. Previously, she served as executive in residence at 5AM Ventures, a leading venture capital firm focused on building next-generation life science companies, and a senior advisor to Crinetics (NASDAQ: CRNX). She began her biopharmaceutical career at Genentech, where she held key roles in commercial strategy and planning across the portfolio and led the neurology commercial team. |

● | Charles Semba, M/D. has over 20 years of drug development experience in public and private biotechnology companies and is a recognized expert in endovascular therapy, thrombolysis, mechanical thrombectomy, and endovascular surgery. He is Chief Medical Officer (CMO) at Eluminex Biosciences and has served as CMO for SARcode Bioscience (acquired by Shire/Takeda), ForSight VISION5 (acquired by Allergan), and Graybug Vision (NASDAQ: GRAY). He has held senior leadership roles as Vice President Ophthalmic Medicine at Shire/Takeda and Ophthalmology Group Head at Genentech. Dr. Semba led the clinical development of ranibizumab (LUCENTIS®) and lifitegrast (XIIDRA®). He also led FDA approval for CathFlo Activase® (Alteplase) for ischemic stroke. |

Risks Affecting Us

Please carefully consider the section titled “Risk Factors” beginning on page 9 of this prospectus, as well as risk factors referenced in the REMEDY trial,accompanying prospectus and in our Annual Report on Form 10-K for the Company’s Phase II study assessingyear ended December 31, 2020, as amended, and our Quarterly Report on Form 10-Q for the safety, tolerability and markersquarterly period ended June 30, 2021, for a discussion of therapeutic efficacy of DM199 in participants suffering from AIS. Final enrollment was 92 participants. The markers of therapeutic efficacy will include multiple plasma-based biomarkers (e.g. C-reactive protein), the Modified Rankin Scale, National Institute of Health Stroke Scale and the Barthel Index. These markers are assessed at multiple points throughout the study, including 90 days post-stroke.factors you should carefully consider before deciding to purchase securities that may be offered by this prospectus.

Additional risks and uncertainties not presently known to us may also impair our business operations. You should be able to bear a complete loss of your investment.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

As a company with less than $1.07 billion of revenue during our last fiscal year, we are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act), and we may remain an emerging growth company for up to five years from December 31, 2018. However, if certain events occur prior to the end of such five-year period, including if we become a large accelerated filer, our annual gross revenue exceeds $1.07 billion (as adjusted for inflation pursuant to SEC rules from time to time), or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. In particular, we are required to only provide only two years of audited financial statements and are not required to disclose all of the executive compensation related information that would be required if we were not an emerging growth company. Accordingly, the information contained in our SEC reports may be different than the information you receive from other public companies in which you hold equity interests. However, we have irrevocably elected not to avail ourselves of the extended transition period for complying with new or revised accounting standards, and, therefore, we are subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

We are also a “smaller reporting company” as defined in the United States Securities Exchange Act of 1934, as amended (Exchange Act). We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting common shares held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues are more than $100 million during the most recently completed fiscal year and our voting and non-voting common shares held by non-affiliates is more than $700 million measured on the last business day of our second fiscal quarter.

CorporateCompany Information

Our principal executive offices are located at 2Two Carlson Parkway, Suite 260, Minneapolis, Minnesota 55447. Our telephone number is (763) 312-6755, and our Internet website address is www.diamedica.com. We make available on our website free of charge a link to our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as practicable after we electronically file such material with the SEC. Except for the documents specifically incorporated by reference into this prospectus, information contained on our website or that can be accessed through our website does not constitute a part of this prospectus. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

We are a corporation governed under the British ColumbiaColumbia’s Business Corporations Act.Act (BCBCA). Our company was initially incorporated under the name Diabex Inc. pursuant to TheCorporationsAct(Manitoba) by articles of incorporation dated January 21, 2000. Our articles were amended (i) on February 26, 2001 to change our corporate name to DiaMedica Inc., (ii) on April 11, 2016 to continue the Company from The Corporations Act (Manitoba) to the CBCA,Canada Business Corporations Act (CBCA), (iii) on December 28, 2016 to change our corporate name to DiaMedica Therapeutics Inc., (iv) on September 24, 2018 to permit us to hold shareholder meetings in the U.S. and to permit our directors, between annual general meetings of our shareholders, to appoint one or more additional directors to serve until the next annual general meeting of shareholders; provided, however, that the number of additional directors shall not at any time exceed one-third of the number of directors who held office at the expiration of the last meeting of shareholders, (v) on November 15, 2018 to effect a 1-for-20 consolidation of our common shares, and (vi) on May 31, 2019, to continue our existence from a corporation incorporated under the Canada Business Corporations ActCBCA into British Columbia under British Columbia’s Business Corporations Act.the BCBCA.

Our Recent Private Placement

Securities Purchase Agreement

On September 26, 2021, we entered into the Securities Purchase Agreement (Securities Purchase Agreement), pursuant to which we agreed to issue the purchasers named therein (Purchasers or sometimes selling shareholders) 7,653,060 of our common shares at a purchase price of $3.92 per share in a private placement (Private Placement). The closing of the Private Placement occurred on September 28, 2021.

We received gross proceeds of approximately $30 million, before deducting fees and other estimated offering expenses incurred in connection with the Private Placement. We intend to use the net proceeds from the Private Placement to continue our clinical development and product activities for DM199, including our recently initiated pivotal ReMEDy2 trial, and for other working capital and general corporate purposes.

Registration Rights Agreement

Under the terms of the Securities Purchase Agreement, we entered into a registration rights agreement (Registration Rights Agreement) with the Purchasers pursuant to which we agreed to prepare and file a registration statement (Resale Registration Statement) with the SEC within 10 days of the closing date for purposes of registering the resale of the common shares sold in the Private Placement. The registration statement of which this prospectus is a part has been filed to satisfy this obligation. Under the terms of the Registration Rights Agreement, we agreed to use our reasonable best efforts to cause the Resale Registration Statement to be declared effective by the SEC within 30 calendar days of the closing of the Private Placement (75 calendar days in the event the Resale Registration Statement is reviewed by the SEC). If we fail to meet the specified filing deadlines or keep the Resale Registration Statement effective, subject to certain permitted exceptions, we will be required to pay liquidated damages to the selling shareholders. We also agreed, among other things, to indemnify the selling holder under the Resale Registration Statement from certain liabilities and to pay all fees and expenses incident to our performance of or compliance with the Registration Rights Agreement.

The Offering

Common shares to be offered by the selling shareholders: | Up to 7,653,060 shares |

Common shares to be outstanding after the offering: | 26,439,217 shares |

Use of proceeds: | We will not receive any proceeds from the sale of shares in this offering. See “Use of Proceeds” beginning on page 15 of this prospectus. |

Risk factors: | You should read the “Risk Factors” beginning on page 9 of this prospectus and the “Risk Factors” sections of the documents incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in our common shares. |

Stock exchange listing: | Our common shares are listed on the Nasdaq Capital Market under the symbol “DMAC.” |

RISK FACTORS

An investment in our securitiescommon shares involves a high degree of risk. YouBefore making an investment decision, you should carefully consider the following risks and the risks described in the “Risk Factors” section of our most recent Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 10, 2021, as amended, and our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC referred to under the heading “Where You Can Find More Information,” including the risk factors incorporated by reference herein from our most recent annual report on Form 10-K and quarterly reports on Form 10-Q and from other reports and documents we file with the SEC after the dateSEC. The occurrence of this prospectus that are incorporated by reference herein, together with allany of the other information included in this prospectus, the applicable prospectus supplement and the documents we incorporate by reference.

If any of these risks were to occur,events described below could have a material adverse effect on our business, financial condition, results of operations, or cash flows, prospects or the value of our common shares. These risks are not the only ones that we face. Additional risks not currently known to us or that we currently deem immaterial also may impair our business.

Risks Related to our Business

The COVID-19 pandemic has resulted in a delay in enrollment in our REDUX trial and will likely continue to result in enrollment delay for that trial and may adversely affect our recently initiated ReMEDy2 trial, which could delay or prevent our receipt of necessary regulatory approvals for DM199.

The COVID-19 pandemic is having a severe effect on the clinical trials of many drug candidates. Some trials have been delayed, while others have been cancelled. Due to actions implemented at our clinical study sites to combat the COVID-19 pandemic, we have experienced and continue to experience slower than expected enrollment in the first two cohorts of our REDUX clinical trial. We believe this has been due to both the reduction or suspension of activities at our clinical study sites as they address staff and patient safety concerns, as well as patient concerns related to their personal risk in visiting clinical study sites in light of the COVID-19 pandemic. The reduction or suspension of activities at potential study sites for our recently initiated ReMEDy2 trial may adversely impact our ability to recruit and activate study sites which may result in slower than expected enrollment.

The extent to which the pandemic may impact our clinical trials will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the duration and severity of the pandemic, the effectiveness of actions to contain, treat and prevent COVID-19, including the availability, acceptance and effectiveness of vaccines and the spread of COVID-19 variants. The continued spread of COVID-19, including variants, could cause us to experience continued and/or additional disruptions that could severely impact our business and clinical trials, including:

● | continued or additional delays or difficulties in enrolling or retaining participants in our clinical trials; |

● | delays or difficulties in the initiation of additional clinical sites in the event that the current clinical sites are unable to recruit sufficient participants or at an acceptable rate; |

● | unavailability of research staff at the study sites, which may affect both the ability to get sites activated and to recruit subjects; |

● | delays in clinical sites receiving the supplies and materials needed to conduct our clinical trials, including interruption in shipping that may affect the transport of clinical trial materials; |

● | changes in local regulations as part of a response to the pandemic, which may require us to change the ways in which our clinical trials are conducted, which may result in unexpected costs, or to discontinue the clinical trials altogether; |

● | inability of participants to comply with clinical trial protocols, impede participant movement or interrupt healthcare services; |

● | interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others, or interruption of clinical trial subject visits and study procedures, the occurrence of which could affect the integrity of clinical trial data; |

● | risk that participants enrolled in our clinical trials will contract COVID-19 while the clinical trial is ongoing, which could result in participants dropping out of the trial, missing scheduled doses or follow-up visits or failing to follow protocol or otherwise impact the results of the clinical trial, including by increasing the number of observed adverse events; |

● | delays in receiving authorizations from local regulatory authorities to initiate our planned clinical trials; |

● | delays in necessary interactions with local regulatory authorities, ethics committees and other important agencies and contractors due to limitations in employee resources; and |

● | limitations in employee resources that would otherwise be focused on the conduct of our clinical trials, including because of sickness of employees or their families, required quarantines, the desire of employees to avoid contact with large groups of people or the current labor shortage of qualified personnel. |

As a result, the expected timeline for the full data readout of our REDUX clinical trial has been and may continue to be negatively impacted and the expected timeline for our ReMEDy2 trial may also be negatively impacted, which adversely affect the timing of certain regulatory filings and our ability to initiate additional required studies, obtain regulatory approval for and to commercialize our DM199 product candidate.

Risks Related to this Offering and Our Common Shares

Sales of shares in connection with this offering may cause the market price of our common shares to decline.

In connection with the Private Placement, we entered into the Securities Purchase Agreement and Registration Rights Agreement, pursuant to which we agreed to register for resale with the SEC the common shares issued to the selling shareholders in the Private Placement. The registration statement of which this prospectus is a part has been filed to satisfy this obligation. Upon the effectiveness of the registration statement, the shares we issued in the Private Placement may be freely sold in the open market. The sale of a significant amount of these shares in the open market, or the perception that these sales may occur, could cause the market price of our common shares to decline or become highly volatile.

Our common share price has been volatile and may continue to be volatile.

Our common shares trade on the Nasdaq Capital Market under the trading symbol “DMAC.” A number of factors could influence the volatility in the trading price of our common shares, including changes in the economy or in the financial markets, industry related developments, and the impact of material events and changes in our operations. Our quarterly losses may vary because of expenses we incur related to our research and development and clinical activities including the timing of costs for manufacturing DM199 and initiating and completing preclinical and clinical trials. Each of these factors could lead to increased volatility in the market price of our common shares. In addition, the market prices of the securities of our competitors may also lead to fluctuations in the trading price of our common shares. As a result of this volatility, you may not be able to sell your common shares at or above the public offering price.

We do not have a very active trading market for our common shares, and one may never develop.

Our common shares commenced trading in the United States on the Nasdaq Capital Market in December 2018. Previously our shares traded in Canada on the TSX Venture Exchange. We do not have a very active trading market for our common shares, and one may never develop, even after this offering. Although we anticipate a more active trading market for our shares will develop after this offering, we can give no assurance that this will occur or that an active trading market will be sustained following this offering. If an active market for our common shares does not develop, it may be difficult for you to sell our common shares you purchase in this offering at a favorable price or at all.

We may issue additional common shares resulting in share ownership dilution.

Future dilution will likely occur due to anticipated future equity issuances by us. To the extent we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our shareholders will be diluted. In addition, as of September 30, 2021, we had outstanding warrants to purchase 265,000 common shares, options to purchase 1,959,100 common shares, deferred share units representing 71,509 common shares and 457,651 common shares reserved for issuance in connection with future grants under the DiaMedica Therapeutics Inc. 2019 Omnibus Incentive Plan. If these or any future outstanding warrants, options, or deferred share units are exercised or otherwise converted into our common shares, our shareholders will experience additional dilution.

If there are substantial sales of our common shares or the perception that such sales could occur, the market price of our common shares could decline.

Sales of substantial numbers of our common shares or the perception that such sales could occur could cause a decline in the market price of our common shares. Any sales by existing shareholders or holders who exercise their warrants or stock options may have an adverse effect on our ability to raise capital and may adversely affect the market price of our common shares.

We could be adversely affected. Yousubject to securities class action litigation, which is expensive and could divert management attention.

In the past, securities class action litigation has often been brought against a company following a decline or increase in the market price of its securities or certain significant business transactions. We may become involved in this type of litigation in the future, especially if our clinical trial results are not successful or we enter into an agreement for a significant business transaction. If we face such litigation, it could result in substantial costs and a diversion of management’s attention and our resources, which could harm our business. This is particularly true in light of our limited securities litigation insurance coverage.

If securities or industry analysts do not publish research or reports about our business, or publish negative reports about our business, the market price of our common shares and trading volume could decline.

The market price and trading volume for our common shares in the United States depends in part on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over these analysts. There can be no assurance that analysts will continue to cover us or provide favorable coverage. If one or more of the analysts who cover us downgrades our common shares or changes their opinion of our common shares, the market price of our common shares would likely decline. If one or more of these analysts ceases coverage of our company or fails to regularly publish reports on us, we could lose allvisibility in the financial markets, which could cause the market price of our common shares or parttrading volume to decline.

We are an “emerging growth company” and a “smaller reporting company,” and the reduced disclosure requirements applicable to us as such may make our common shares less attractive to our shareholders and potential investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of your investment. When we offer and sell any securities2012. We may remain an emerging growth company until December 31, 2023, the last day of the fiscal year following the fifth anniversary of our first sale of common shares pursuant to a prospectusregistration statement under the Securities Act of 1933, as amended (the Securities Act) or until such earlier time as we have more than $1.07 billion (as adjusted for inflation pursuant to SEC rules from time to time) in annual revenue, the market value of our common shares held by non-affiliates is more than $700 million or we issue more than $1 billion of non-convertible debt over a three-year period. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (Section 404) not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements, reduced disclosure obligations regarding executive compensation and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Our shareholders and other investors may find our common shares less attractive as a result of our reliance on these exemptions. If some of our shareholders or other investors find our common shares less attractive as a result, there may be a less active trading market for our common shares, and the trading price of our common shares may be more volatile.

We are also a “smaller reporting company” under the federal securities laws and, as such, are subject to scaled disclosure requirements afforded to such companies. For example, as a smaller reporting company, we are subject to reduced executive compensation disclosure requirements.

Our shareholders and investors may find our common shares less attractive as a result of our status as an “emerging growth company” and “smaller reporting company” and our reliance on the reduced disclosure requirements afforded to these companies. If some of our shareholders or investors find our common shares less attractive as a result, there may be a less active trading market for our common shares and the market price of our common shares may be more volatile.

If we become unable to comply with Nasdaq’s continued listing requirements, our common shares could be delisted, which could affect the market price and liquidity of our common shares and reduce our ability to raise capital.

We are required to meet certain qualitative and financial tests to maintain the listing of our common shares on the Nasdaq Capital Market. If we do not maintain compliance with Nasdaq’s continued listing requirements within specified periods and subject to permitted extensions, our common shares may be recommended for delisting (subject to any appeal we would file). No assurance can be provided that we will comply with these continued listing requirements. If our common shares were delisted, it could be more difficult to buy or sell our common shares and to obtain accurate quotations, and the price of our common shares could suffer a material decline. Delisting would also impair our ability to raise additional capital.

Any failure to maintain an effective system of internal controls may result in material misstatements of our consolidated financial statements or cause us to fail to meet our reporting obligations or fail to prevent fraud; and in that case, our shareholders or other investors could lose confidence in our financial reporting, are business could be harmed and the market price of our common shares could be negatively impacted.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. If we fail to maintain an effective system of internal controls, we might not be able to report our financial results accurately or prevent fraud; and in that case, our shareholders or other investors could lose confidence in our financial reporting, which would harm our business and could negatively impact the market price of our common shares. Even if we conclude that our internal control over financial reporting provides reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles in the United States, because of its inherent limitations, internal control over financial reporting may not prevent or detect fraud or misstatements. Failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our results of operations or cause us to fail to meet our future reporting obligations.

If we fail to maintain the adequacy of our internal control over financial reporting, we may include additional risk factors relevantnot be able to that offeringproduce reliable financial reports or help prevent fraud. Our failure to achieve and maintain effective internal control over financial reporting could prevent us from complying with our reporting obligations on a timely basis, which could result in the prospectus supplement.loss of shareholder or other investor confidence in the reliability of our consolidated financial statements, harm our business and negatively impact the market price of our common shares.

Pursuant to Section 404, we are required to furnish a report by our management regarding our internal control over financial reporting, and if we become an accelerated filer under the federal securities laws, we will be required to include an attestation report on internal control over financial reporting issued by our independent registered public accounting firm. There is a risk that neither we nor our independent registered public accounting firm will be able to conclude within the prescribed timeframe that our internal control over financial reporting is effective as required by Section 404. This could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements.

We have never paid dividends and do not expect to do so in the foreseeable future.

We have not declared or paid any cash dividends on our common shares to date. The payment of dividends in the future will be dependent on our earnings and financial condition and on such other factors as our Board of Directors considers appropriate. Unless and until we pay dividends, shareholders may not receive a return on their common shares. There is no present intention by our Board of Directors to pay dividends on our common shares. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. In addition, the terms of any future debt agreements may preclude us from paying dividends. As a result, appreciation, if any, in the market price of our common shares will be your sole source of gain for the foreseeable future.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in or incorporated by reference into this prospectus and the related prospectus supplement that are not descriptions of historical facts are forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and share price. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would,” the negative of these terms or other comparable terminology, and the use of future dates.

The forward-looking statements in or incorporated by reference into this prospectus or the related prospectus supplement may include, among other things, statements about:

● | our plans to develop, obtain regulatory approval for and commercialize our DM199 product candidate for the treatment of |

● | our ability to conduct successful clinical testing of our DM199 product candidate for AIS and CKD and |

● | our ability to obtain required regulatory approvals of our DM199 product candidate for |

● | the perceived benefits of our DM199 product candidate over existing treatment options for |

● | the potential size of the markets for our DM199 product candidate and our ability to serve those markets; |

● | the rate and degree of market acceptance, both in the United States and internationally, of our DM199 product candidate for |

● | our ability to partner with and generate revenue from biopharmaceutical or pharmaceutical partners to develop, obtain regulatory approval for and commercialize our DM199 product candidate for |