as well as other statements regarding our future operations, financial condition, andgrowth prospects and business strategies.

ABOUT GODADDY6

Our customers have bold aspirations—the drive to be their own boss, write their own story and take a leap of faith to pursue their dreams. Launching that brewery, running that wedding planning service, organizing that fundraiser, expanding that web-design business or whatever sparks their passion. We are inspired by our customers and are dedicated to helping them turn their powerful ideas into meaningful action. Our vision is to radically shift the global economy toward small business by empowering passionate individuals to easily start, confidently grow and successfully run their own ventures.

Our customers are people and organizations with vibrant ideas—businesses, both large and small, entrepreneurs, universities, charities and hobbyists. They are defined by their guts, grit and determination to transform their ideas into something meaningful. They wear many hats and juggle many responsibilities, and they need to make the most of their time. Our customers need help navigating today's dynamic Internet environment and want the benefits of the latest technology to help them succeed. Since our founding in 1997, we have been a trusted partner and champion for organizations of all sizes in their quest to build successful online ventures.

We are a leading technology provider to small businesses, web design professionals and individuals, delivering simple, easy to use cloud-based products and outcome-driven, personalized Customer Care. We operate the world's largest domain marketplace, where our customers can find that unique piece of digital real estate perfectly matching their idea. We provide website building, hosting and security tools to help customers easily construct and protect their online presence. As our customers grow, we provide applications and access to relevant third party products helping them connect to their customers, manage and grow their businesses and get found online.

Our customers need help navigating today's dynamic Internet environment and want the benefits of the latest technology to help them succeed. The increase in broadband penetration, mobile device usage and the need for presence across search engines, content destinations, listings and e-commerce sites, and social media channels create both opportunities and challenges for them. We offer products and solutions to help our customers tackle this rapidly changing technology landscape. We develop the majority of our products internally and believe our solutions are among the best in the industry in terms of comprehensiveness, performance, functionality and ease of use.

Often technology companies force their customers to choose between technology and support, delivering one but not the other. At GoDaddy, we don't believe our customers should have to choose and strive to deliver both great technology and great support to our customers. We believe engaging with our customers in a proactive, consultative way helps them knock down the technology hurdles they face. And, through the thousands of conversations we have with our customers every day, we receive valuable feedback enabling us to continually evolve our products and solutions.

Our people and unique culture have been integral to our success. We live by the same principles that enable new ventures to survive and thrive: hard work, perseverance, conviction, an obsession with customer satisfaction and a belief that no one can do it better. We take responsibility for driving successful outcomes and are accountable to our customers, which we believe has been a key factor in enabling our rapid customer and revenue growth. We believe we have one of the most recognized brands in technology.

Corporate Information

We were incorporated in Delaware on May 28, 2014. Our principal executive offices are located at 14455 N. Hayden Road, Scottsdale, Arizona 85260 and our telephone number is (480) 505-8800. Our website is www.godaddy.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

USE OF PROCEEDS

Our Organizational Structure

In connection with the completionThe selling stockholders may make offers and sales of our initial public offering, or IPO, we completed a series of organizational transactions, or the Reorganization Transactions, pursuant to a reorganization agreement dated as of March 31, 2015 by and among us, Desert Newco and certain other parties, including:

the amendment and restatement of Desert Newco's limited liability company agreement, or the Newco LLC Agreement, to, among other things, appoint us as sole managing member and reclassify all of the outstanding limited liability company units of Desert Newco, or the LLC Units, as non-voting units; and

the issuance of shares of Class B common stock to each of Desert Newco's pre-IPO owners, or the Continuing LLC Owners, on a one-to-one basis with the number of LLC Units owned; and

the acquisition, by merger, of four members of Desert Newco, or the Reorganization Parties, for which we issued 38,825,912 shares of Class A common stock as consideration, or the Investor Corp Mergers.

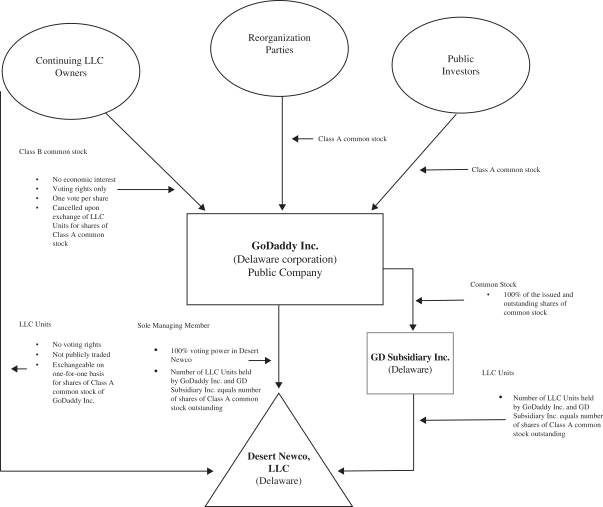

We are the sole managing member of Desert Newco. As its sole managing member, we operate and control the business and affairs of Desert Newco and its subsidiaries. Although we have a minority economic interest, we have sole voting power in, and control the management of, Desert Newco. As a result, we consolidate Desert Newco's financial results and report a non-controlling interest related to the portion of Desert Newco not owned by us. As of March 31, 2016, we owned approximately 43% of Desert Newco. The diagram below depicts our organizational structure.

THE OFFERING

|

| |

Class A common stock registered hereby to be issued upon exchange of certain of our LLC Units (together with the same number of shares of our Class B common stock) | Up to 4,193,829 shares of Class A common stock (2,804,736 of these shares are restricted from being transferred pursuant to agreements with us until July 6, 2016 and 608,708 of these shares are restricted from being transferred pursuant to agreements with us until March 31, 2018). |

Class A common stock to be outstanding after exchanges registered hereby | 86,164,110 shares (or 161,229,695 shares if all then outstanding exchangeable LLC Units were exchanged for newly-issued shares of Class A common stock on a one-for-one basis). |

Class B common stock to be outstanding after the exchanges registered hereby | 75,065,585 shares. |

Voting power held by holders of Class A common stock after giving effect to the exchanges registered hereby | 53.4% |

Voting power held by holders of Class B common stock after giving effect to the exchanges registered hereby | 46.6% |

Use of proceeds | We will not receive any cash proceeds from the issuance of any of the Class A common stock registered hereby. |

New York Stock Exchange trading symbol | "GDDY" |

Risk Factors | See "Risk Factors" for a discussion of risks you should carefully consider before investing in our Class A common stock. |

In this prospectus unless otherwise indicated,and any applicable prospectus supplement. We will not receive any proceeds from the numbersale or other disposition by the selling stockholders of the shares of our Class A common stock outstanding and thecovered hereby, or interests therein. The selling stockholders will pay any expenses incurred for brokerage, accounting, tax or legal services or any other information based thereon does not reflect:

27,760,906 shares of Class A common stock issuable upon the exercise of options outstanding as of March 31, 2016, with a weighted-average exercise price of $11.07 per share;

3,483 shares of Class A common stock issuable upon the exercise of warrants outstanding as of March 31, 2016, with an exercise price of $7.44 per share;

1,653,647 shares of Class A common stock issuable upon the vesting of restricted stock units, or RSUs, outstanding as of March 31, 2016;

13,289,827 additional shares of our Class A common stock, subject to increase on an annual basis, reserved for future issuance under our 2015 Equity Incentive Plan as of March 31, 2016;

2,325,431 additional shares of our Class A common stock, subject to increase on an annual basis, reserved for future issuance under our 2015 Employee Stock Purchase Plan as of March 31, 2016; and

89,807,354 shares of our Class A common stock issuable upon exchange of outstanding shares of our Class B common stock outstanding as of March 31, 2016 (together with the same number of LLC Units).

RISK FACTORS

You should consider the specific risks described in our most recent Annual Report on Form 10-K filed with the SEC, the risk factors described under the caption "Risk Factors" in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC, pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, before making an investment decision. See "Where You Can Find More Information" and "Incorporation of Certain Documents by Reference." Each of the risks described in these documents could materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a partial or complete loss of your investment. The risks and uncertainties are not limited to those set forth in the risk factors described in these documents. Additional risks and uncertainties not presently known to us or that we currently believe to be less significant than the risk factors incorporated by reference herein may also adversely affect our business. In addition, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

ORGANIZATIONAL STRUCTURE

In connection with the completion of our IPO, we completed the Reorganization Transactions. See "About GoDaddy—Our Organizational Structure."

Desert Newco Recapitalization

The Newco LLC Agreement, among other things, appointed us as Desert Newco's sole managing member and reclassified all outstanding LLC Units as non-voting units. Although we have a minority economic interest in Desert Newco as the sole managing member, we have the sole voting power in, and control the management of, Desert Newco. As a result, beginning in the second quarter of 2015, we began consolidating Desert Newco's financial results and reporting a non-controlling interest related to the portion of Desert Newco not owned by us.

Our amended and restated certificate of incorporation, or the amended and restated certificate of incorporation, and the Newco LLC Agreement require Desert Newco and us to maintain (i) a one-to-one ratio between the number of shares of Class A common stock outstanding and the number of LLC Units owned by us and (ii) a one-to-one ratio between the number of shares of Class B common stock ownedexpenses incurred by the Continuing LLC Owners and the number of LLC Units owned by the Continuing LLC Owners. We may issue shares of Class B common stock only to the extent necessary to maintain these ratios. Shares of Class B common stock are transferable only together with an equal number of LLC Units if we, at the election of a Continuing LLC Owner, exchange LLC Units for shares of Class A common stock.

Investor Corp Mergers

We acquired, by merger, the Reorganization Parties, to which we issued an aggregate of 38,825,912 shares of Class A common stock as consideration for the 38,825,912 aggregate LLC Units held by such entities. Upon consummation of the Investor Corp Mergers, we recognized the 38,825,912 LLC Units at carrying value, as these transactions were considered to be between entities under common control.

We also acquired the tax attributes of the Reorganization Parties, which were recorded generally as deferred tax assets at the time of the Investor Corp Mergers. These attributes included net operating losses, tax credit carryforwards and the original basis adjustments, or the OBAs, arising from the original acquisition of LLC Units by the Reorganization Parties, as described below.

Tax Receivable Agreements

Exchanges of LLC Units (together with the corresponding shares of Class B common stock) for shares of our Class A common stock are expected to produce favorable tax attributes for us. When we acquire LLC Units from our pre-IPO owners through these exchanges, both the existing tax basis and anticipated tax basis adjustments are likely to increase (for tax purposes) our depreciation and amortization deductions and therefore reduce the amount of income tax we would be required to payselling stockholders in the future in the absence of this existing and increased basis. This existing and increased tax basis may also decrease gain (or increase loss) on future dispositions of certain assets to the extent the tax basis is allocated to those assets.

We are a party to five TRAs. Under the first of those agreements, we generally will be required to pay to Desert Newco's pre-IPO owners approximately 85% of the applicable savings, if any, in income tax we are deemed to realize (using the actual applicable U.S. federal income tax rate plus an assumed combined state and local income tax rate of 5%) as a result of (1) certain tax attributes created as a result of the exchanges of their LLC Units for shares of our Class A common stock, (2) any existing tax attributes associated with their LLC Units, the benefit of which is allocable to us as a result of the exchanges of their LLC Units for shares of our Class A common stock (including the portion of Desert Newco's existing tax basis in its assets allocable to the exchanged LLC Units), (3) tax benefits related to imputed interest and (4) payments under such TRA.

Under the other four TRAs, we generally will be required to pay to each Reorganization Party approximately 85% of the amount of savings, if any, in U.S. federal, state and local income tax we are deemed to realize (using the actual U.S. federal income tax rate and an assumed combined state and local income tax rate) as a result of (1) any existing tax attributes of LLC Units acquired in the applicable Investor Corp Merger, the benefit of which is allocable to us as a result of such

Investor Corp Merger (including the allocable share of Desert Newco's existing tax basis in its assets), (2) NOLs available as a result of the applicable Investor Corp Merger and (3) tax benefits related to imputed interest.

For further discussion of the TRAs, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Payable to Related Parties Pursuant to the TRAs" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Tax Receivable Agreements" in our Quarterly Report on Form 10-Q for the three months ended March 31, 2016.

EXCHANGES OF LLC UNITS FOR CLASS A COMMON STOCK

Exchange Agreement

The Reorganization Transactions were designed to create a capital structure preserving our ability to conduct our business through Desert Newco, while permitting us to raise additional capital and provide access to liquidity through a publicly-traded company. Multiple classes of securities were necessary to achieve those objectives. Among other changes, the Reorganization Transactions modified our capital structure into two classes of common stock. For a descriptiondisposing of these shares, see "Description of Capital Stock."

In connection with the consummation of our IPO, weshares. We will bear all other costs, fees and the Continuing LLC Owners entered into the Exchange Agreement under which they (or certain permitted transferees thereof) were granted the right, subject to the terms of the Exchange Agreement, to exchange their LLC Units (together with a corresponding number of shares of Class B common stock) for shares of our Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends, reclassifications and other similar transactions. The Exchange Agreement provides, however, that such exchanges must be for a minimum of the lesser of 1,000 LLC Units or all of the vested LLC Units held by such owner.

The Newco LLC Agreement provides that as a general matter a Continuing LLC Owner does not have the right to exchange LLC Units if we determine such exchange would be prohibited by law or regulation or would violate other agreements with us to which the Continuing LLC Owner may be subject or would cause a technical tax termination of Desert Newco. However, each of KKR, Silver Lake, TCV and Bob Parsons may transfer all of its LLC Units even if such transfer could resultexpenses incurred in a technical tax termination if the transferring member indemnifies the other members of Desert Newco (including Go Daddy Inc.) for certain adverse tax consequences arising from any such technical tax termination and indemnifies Desert Newco for related costs.

We may impose additional restrictions on exchanges that we determine to be necessary or advisable so that Desert Newco is not treated as a "publicly traded partnership" for U.S. federal income tax purposes. As a holder exchanges LLC Units for shares of Class A common stock, the number of LLC Units held by us is correspondingly increased as we acquire the exchanged LLC Units, and a corresponding number of shares of Class B common stock are canceled.

As noted above, each of the Continuing LLC Owners also holds an equal number of shares of our Class B common stock. Although these shares have no economic rights, they will allow such Continuing LLC Owners to directly exercise voting power at GoDaddy Inc., the managing member of Desert Newco, at a level consistent with their overall equity ownership of our business. Under our amended and restated certificate of incorporation, each share of Class B common stock is entitled to one vote.

LLC Units

Subject to certain restrictions set forth in the Exchange Agreement, including those described above intended to ensure Desert Newco is not treated as a publicly traded partnership, each LLC Unit (together with the corresponding share of our Class B common stock) held by a member of Desert Newco (other than us or GD Subsidiary, Inc.) is exchangeable for one share of our Class A common stock. Each time the holder of an LLC Unit exchanges an LLC Unit for a share of our Class A common stock, we will receive a number of LLC Units equal to the number of shares of our Class A common stock they receive and we will cancel a share of our Class B common stock held by the exchanging holder.

As of the date of this prospectus, there were 68 holders of LLC Units (including us and GD Subsidiary, Inc.). As of such date, we and GD Subsidiary, Inc. held 81,970,281 LLC Units, or approximately 50.8% of the total outstanding equity interests of Desert Newco. If all LLC Units (other than those held by us and GD Subsidiary, Inc.) were exchanged for shares of our Class A common stock, 161,229,695 shares of Class A common stock would be outstanding and we would hold 100% of the outstanding equity interests of Desert Newco.

The holders of LLC Units who exchange their LLC Units generally may sell the shares of Class A common stock received upon exchange from time to time as each holder may determine through public or private transactions. Each holder may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

USE OF PROCEEDS

We are not offering any shares of Class A common stock for sale under this prospectus and will not receive any cash proceeds from the issuance of Class A common stock registered hereunder, but we will receive a number of LLC Units, equal to the number of shares of Class A common stock issued upon exchange of LLC Units.

DESCRIPTION OF CAPITAL STOCK

General

The following description of our capital stock is intended as a summary only. This description is based upon, and is qualified by reference to, our amended and restated certificate of incorporation as amended to date (the "amended and restated certificate of incorporation"), our amended and restated bylaws as amended to date (the "amended and restated bylaws") and applicable provisions of Delaware corporate law. This summary is not complete. You should read our amended and restated certificate of incorporation and amended and restated bylaws, which are filed as exhibits toeffecting the registration statement of which this prospectus forms a part, including, without limitation, all registration fees, listing fees of the NYSE and fees and expenses of our counsel and our accountants.

SELLING STOCKHOLDERS

We are registering for the provisions that are important to you.

Our authorized capital stock consistsresale an aggregate of 1,000,000,000 shares of Class A common stock, $0.001 par value per share, 500,000,000 shares of Class B common stock, $0.001 par value per share, and 50,000,000 shares of undesignated preferred stock, $0.001 par value per share. As of June 10, 2016, there were 81,970,281270,508 shares of our Class A common stock outstanding, 79,259,414that may be sold by the selling stockholders set forth herein. The shares of our Class B common stock outstanding and no shares of our preferred stock outstanding. Our board of directors is authorized, without stockholder approval except as required byregistered hereby were issued pursuant to the listing standards of the New York Stock Exchange, to issue additional shares of our capital stock.

Common Stock

We have two classes of common stock: Class A and Class B, each of which has one vote per share. The Class A and Class B common stock generally vote together asMerger in a single class on all matters submitted to a vote of stockholders, except as otherwise required by applicable law.

Class A Common Stock

Dividend Rights

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of our Class A common stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to issue dividends and then only at the times and in the amounts our board of directors may determine. See "Dividend Policy" for more information.

Voting Rights

Holders of our Class A common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders. We have not provided for cumulative voting for the election of directors in our amended and restated certificate of incorporation.

No Preemptive or Similar Rights

Our Class A common stock is not entitled to preemptive rights, and istransaction not subject to conversion, redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

If we become subject to a liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably amongregistration requirements of the holders of our Class A common stock and any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Class B Common Stock

Dividend Rights

Holders of our Class B common stock do not have any rights to receive dividends.

Voting Rights

Holders of our Class B common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders.Securities Act. In connection with our IPO, shares of Class B common stock were issued to our Continuing LLC Owners who held votingthe Merger, the limited liability company units before the Reorganization Transactions and were members of Desert Newco upon completion of the Reorganization Transactions (such Continuing LLC Owners are affiliates of KKR, Silver Lake, TCV and Bob Parsons, among others). Accordingly, such Continuing LLC Owners, by virtue of their Class B common stock, collectively have a number of votes in GoDaddy Inc. equal to the aggregate number of LLC Units they hold. When a LLC Unit is exchanged by a Continuing LLC owner, a corresponding share of Class B common stock held by the exchanging owner is also exchanged and will be cancelled.

No Preemptive or Similar Rights

Our Class B common stock is not entitled to preemptive rights, and is not subject to conversion, redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

Holders of our Class B common stock do not have any rights to receive a distribution upon a liquidation, dissolution or winding-up.

Conversion and Transferability

Shares of Class B common stock are not transferable except together with an equal number of LLC Units.

Preferred Stock

Our board of directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series, and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions, in each case without further vote or action by our stockholders. Our board of directors can also increase or decrease the number of shares of any series of preferred stock, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Class A common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in our control of our company and might adversely affect the market price of our Class A common stock and the voting and other rights of the holders of our Class A and Class B common stock. We have no current plan to issue any shares of preferred stock.

Equity Awards

As of March 31, 2016 we had outstanding options to purchase an aggregate of 27,760,906selling stockholders, which were exchangeable into shares of our Class A common stock, were cancelled. We currently intend to maintain the effectiveness of the registration statement of which this prospectus forms a part until such time as all such shares of Class A common stock issued in the Merger can be freely sold without volume limitations pursuant to Rule 144 of the Securities Act.

Beneficial ownership is determined in accordance with a weighted-average exercise pricethe rules of $11.07 per share,the SEC and 1,653,647includes voting or investment power with respect to our Class A common stock. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all shares of Class A common stock that they beneficially own, subject to applicable community property laws.

The selling stockholders may sell some, all or none of their shares of Class A common stock offered by this prospectus from time to time. We cannot advise you as to whether the selling stockholders will in fact sell any or all of such shares of Class A common stock. In addition, the selling stockholders may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of Class A common stock in transactions exempt from the registration requirements of the Securities Act after the date of this prospectus, subject to applicable law, including Rule 144 of the Securities Act. See “Plan of Distribution.”

The table below is based on 142,478,402 shares of Class A common stock outstanding as of February 23, 2024 and assumes the selling stockholders dispose of all the shares of Class A common stock covered by this prospectus and do not acquire beneficial ownership of any additional shares. The registration of these shares does not necessarily mean that the selling stockholders will sell all or any portion of the shares covered by this prospectus.

Unless otherwise indicated, the address of each selling stockholder listed in the table below is c/o GoDaddy Inc., 2155 E GoDaddy Way, Tempe, AZ 85284.

Any prospectus supplement may add, update, substitute, or change the information contained in this prospectus, including the identity of each selling stockholder and the number of shares registered on its behalf. A selling stockholder may sell all, some or none of such securities in this offering.

None of the selling stockholders hold any position or office with us, or have or have had any other material relationship with us within the past three years.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common Stock

Beneficially Owned | | Class A Common Stock

Registered

Hereby | | Class A Common Stock

Beneficially Owned

After Sale of All Common

Stock Offered Hereby |

| Name of Selling Stockholder | Shares | Percentage | | | | Shares | Percentage |

| James Lenhart | 45,010 | * | | 15,010 | | 30,000 | * |

| Angel Carradus | 150,852 | * | | 150,000 | | 852 | * |

| Hector Acencio | 25,118 | * | | 25,000 | | 118 | * |

| Keir Mierle | 44,689 | * | | 44,689 | | — | * |

| Scott Gerlach | 654 | * | | 654 | | — | * |

| Wei Cheng Lai | 21,979 | * | | 3,500 | | 18,479 | * |

| Todd Redfoot | 40,637 | * | | 18,500 | | 22,137 | * |

| Ahmed Elmalki | 10 | * | | 10 | | — | * |

| Marianne Curran | 10,500 | * | | 10,500 | | — | * |

| Brian Cayne | 2,645 | * | | 2,645 | | — | * |

| * | Less than one percent. |

PLAN OF DISTRIBUTION

The selling stockholders and any of their pledgees, assignees and successors-in-interest may, from time to time in one or more transactions on the NYSE or any other organized market where our shares of common stock may be traded, sell any or all of their shares of our Class A common stock issuable upon the vestingoffered hereby through underwriters, dealers or agents, directly to one or more purchasers or through a combination of RSUs.

Warrants

Asany such methods of March 31, 2016, we had outstanding warrants to purchase up to 3,483 shares of our Class A common stock at an exercise price of $7.44 per share, which were issued in connection with an acquisition by Desert Newco. In addition, each warrant has a net exercise provision pursuant to which the holdersale. The selling stockholders may in lieu of payment of the exercise price in cash, surrender the warrant and receive a net amount of shares based on the fair market value of our Class A common stock, as applicable, at the time of exercise of the warrant after deduction of the aggregate exercise price.

Stockholder Agreement

In connection with our IPO, we entered into a stockholder agreement with Desert Newco and affiliates of each of KKR, Silver Lake, TCV and Bob Parsons. The stockholder agreement, as further described below, contains specific rights, obligations and agreements of these parties as holders of our Class A common stock and Class B common stock.

Voting Agreement

Under the stockholder agreement, our existing securityholders who are affiliated with KKR, Silver Lake, TCV and Bob Parsons agree to take all necessary action, including casting all votes to which such existing securityholders are entitled to cast at any annual or special meeting of stockholders, so as to ensure the composition of our board or directors and its committees complies with (and includes all of the nominees in accordance with) the provisions of the stockholder agreement related to the composition of our board or directors and its committees, which include, among other things:

for so long as affiliates of KKR own, in the aggregate, (1) at least 10% ofdistribute the shares of our Class A common stock outstandingoffered hereby from time to time in one or more transactions:

•at a fixed price or prices, which may be changed;

•at market prices prevailing at the time of sale;

•at prices related to such prevailing market prices; or

•at negotiated prices.

The selling stockholders may use any one or more of the following methods when selling the shares offered hereby:

•on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

•in the over-the-counter market;

•in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

•through the writing or settlement of options, whether such options are listed on an as-exchanged basis immediately following our IPO, affiliatesoptions exchange or otherwise;

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•one or more block trades in which the broker-dealer will attempt to sell the shares as agent or principal of KKR will be entitledall such shares held by the selling stockholders;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•short sales;

•agreements between broker-dealers and the selling stockholders to nominate two directorssell a specified number of such shares at a stipulated price per share; and (2) less

•any other method or combination of methods of sale permitted pursuant to applicable law.

The selling stockholders may also sell shares pursuant to Rule 144 under the Securities Act, if available, rather than 10% but at least 5%under this prospectus.

If the selling stockholders effect such transactions by selling shares of Class A common stock offered hereby to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the shares of Class A common stock outstanding on an as-exchanged basis immediately following the IPO,offered hereby for whom they willmay act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be entitled to nominate one director;

for so long as affiliatesin excess of Silver Lake own,those customary in the aggregate, (1) at least 10%types of the shares of our Class A common stock outstanding on an as-exchanged basis immediately following our IPO, affiliates of Silver Lake will be entitled to nominate two directors and (2) less than 10% but at least 5%transactions involved). In connection with sales of the shares of Class A common stock outstanding on an as-exchanged basis immediately followingoffered hereby or otherwise, the IPO, they will be entitled to nominate one director;

for so long as Mr. Parsons and his affiliates own,selling stockholders may enter into hedging transactions with broker-dealers, which may in the aggregate, at least 5%turn engage in short sales of the shares of Class A common stock outstanding on an as-exchanged basis immediately following our IPO, Mr. Parsons and his affiliates will be entitled to nominate one director; and

for so long as their affiliated funds hold specified amounts of our stock, our board of directors will maintain an executive committee consisting of one director designated by each of KKR, Silver Lake and Bob Parsons.

In addition, under the stockholder agreement, affiliates of TCV agree to cast all votes in a manner directed by the affiliates of KKR and Silver Lake during the three year period following the completion of our IPO.

KKR and Silver Lake Approvals

Under the stockholder agreement and subject to our amended and restated certificate of incorporation, our amended and restated bylaws and applicable law, the actions listed below by us or any of our subsidiaries will require the approval of KKR and Silver Lake for so long as affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own at least 25% of the shares of our Class A common stock outstanding on an as-exchanged basis immediately following our IPO. Additionally, the approval requires the consent of each of KKR and Silver Lake for so long as such stockholder is entitled to nominate a KKR Director or a Silver Lake Director, as the case may be, pursuant to the stockholder agreement. The actions include:

change in control transactions;

acquiring or disposing of assets or entering into joint ventures with a value in excess of $50 million;

incurring indebtedness in an aggregate principal amount in excess of $50 million;

initiating any liquidation, dissolution, bankruptcy or other insolvency proceeding involving us or any of our significant subsidiaries;

making any material changeoffered hereby in the naturecourse of the business conducted by us or our subsidiaries;

terminating the employment of our Chief Executive Officer or hiring a new Chief Executive Officer;

increasing or decreasing the size of our board of directors;

waiving or amending the limited liability company agreement of Desert Newco Managers, LLC or the equity or employment agreements of our executive officers;

engaginghedging in certain transactions with affiliates; and

any merger or liquidation of Desert Newco or creating any new class of equity securities of Desert Newco.

Bob Parsons Approvals

Under the stockholder agreement, the actions listed below by us or any of our subsidiaries shall require the consent of affiliates of Bob Parsons for so long as such affiliates continue to own at least 50% of the shares of our Class A common stock held by YAM on an as-exchanged basis immediately prior to our IPO:

certain transactions with KKR and/or Silver Lake and/or their affiliates;

change in control transactions in which KKR and Silver Lake and/or their affiliates receive consideration from an unaffiliated third party that is not offered on a pro rata basis to Bob Parsons' affiliates; and

any tax election revoking Desert Newco's Section 754 election under the Internal Revenue Code or to treat Desert Newco as other than a partnership for tax purposes.

TCV Approvals

Under the stockholder agreement, the actions listed below by us or any of our subsidiaries require the consent of affiliates of TCV for so long as such affiliates continue to own at least 5% of the shares of our Class A common stock on an as-exchanged basis:

any redemption or repurchase of shares from KKR, Silver Lake, affiliates of Bob Parsons or Desert Newco Managers, LLC (other than certain repurchases of employee shares pursuant to compensation arrangements), or any payment of any fee to KKR or Silver Lake or its related management company (other than pursuant to the Transaction and Monitoring Fee Agreement as in effect on the date of our IPO), other than transactions effected on a pro rata basis in respect of all the shares held by KKR and its affiliates, Silver Lake and its affiliates, TCV and its affiliates, Bob Parsons and his affiliates and Desert Newco Managers, LLC.

Transfer Restrictions

Under the stockholder agreement, each of KKR, Silver Lake, TCV and Bob Parsons agreed, subject to certain limited exceptions, not to transfer,positions they assume. The selling stockholders may also sell exchange, assign, pledge, hypothecate, convey or otherwise dispose of or encumber any shares of our Class A common stock (including shares of Class A common stock issuable upon the exchange of LLC Units) during the three-year period following our IPO without the consent of each of KKRoffered hereby short and Silver Lake, for so long as each of KKR and Silver Lake is entitled to nominate at least one director to our board of directors.

Other Provisions

Under the stockholder agreement, we agreed, subject to certain exceptions, to indemnify KKR, Silver Lake, TCV and Bob Parsons and various respective affiliated persons from certain losses arising out of the indemnified persons' investment in, or actual, alleged or deemed control or ability to influence, us.

Registration Rights

Certain holders of our Class A common stock (and other securities convertible into or exchangeable or exercisable for shares of our Class A common stock) are entitled to rights with respect to the registration of their shares under the Securities Act. These registration rights are contained in our registration rights agreement and are described in additional detail below. Pursuant to our registration rights agreement, we have granted certain of our existing securityholders, their affiliates and certain of their transferees the right, under certain circumstances and subject to certain restrictions, to require us to register under the Securities Actdeliver shares of Class A common stock delivered upon exchange of LLC Units heldcovered by them (and other securities convertible into or exchangeable or exercisable forthis

prospectus to close out short positions and to return borrowed shares of our Class A common stock). We will not be obligated to register any shares pursuant to any demand registration rights or S-3 registration rights if the holder of such shares is able to sell all of its shares for which it requests registration in any 90-day period pursuant to Rule 144 or Rule 145 of the Securities Act. We will pay the registration expenses (other than underwriting discounts and applicable selling commissions) of the holders of the shares registered pursuant to the registrations described below.

Demand Registration Rights

Pursuant to the registration rights agreement, certain of our securityholders are entitled to demand registration rights, and can request that we register the offer and sale of their shares. Such request for registration must cover securities the anticipated aggregate offering price of which, net of registration expenses, is at least $50 million unless such demand is for a shelf registration. If we determine it would be detrimental to us or our stockholders to effect such a demand registration, we have the right to defer such registration or suspend an effective shelf registration, not more than once in any 12 month period, for a period of up to 90 days.

Piggyback Registration Rights

Pursuant to the registration rights agreement, if we propose to register, or receive a demand to register, the offer and sale of any of our securities under the Securities Act, in connection with the public offeringsuch short sales. The selling stockholders may also loan or pledge shares of such securities, certain of our securityholders are entitled to certain "piggyback" registration rights allowing the holders to include their shares in such registration, subject to certain marketing and other limitations. As a result, whenever we propose to file a registration statement under the Securities Act, the holders of our Class A common stock are entitledoffered hereby to notice of the registration and have the right, subject to limitations the underwritersbroker-dealers that in turn may impose on the number of shares included in the registration, to include shares in the registration, other than with respect to (i) a registration statement on Form S-4 or S-8, (ii) a registration relating solely to an offering and sale to our employees, directors or consultants or our subsidiaries pursuant to any employee stock plan or other benefit arrangement, (iii) a registration relating to a Rule 145 transaction as promulgated under the Securities Act, (iv) a registration by which we are exchanging our own securities for other securities, (v) a registration statement relating solely to dividend reinvestment or similar plans or (vi) a registration statement by which only the initial purchasers and subsequent transferees of our or our subsidiaries' debt securities that are convertible or exchangeable for Class A common stock and that are initially issued pursuant to an applicable exemption from the registration requirements of the Securities Act may resell such notes and sell such Class A common stock into which such notesshares.

The selling stockholders may be convertedfrom time to time pledge or exchanged.

S-3 Registration Rights

Pursuant to the registration rights agreement, certaingrant a security interest in some or all of our securityholders may make a written request that we register the offer and sale of their shares on Form S-3 if we are eligible to file a registration statement on Form S-3 so long as the request covers at least that number of shares with an anticipated aggregate offering price of at least $50 million, net of registration expenses, unless such request is for a shelf registration covering an unspecified number of shares. Each holder of demand registration rights is entitled to make two demands for shelf registration in any 12 month period. Each holder shall also have the right to make two takedown demands pursuant to an effective shelf registration in any 12 month period provided that we shall not be obligated to effect a marketed underwritten takedown if the shares requested to be sold in such takedown have an aggregate market value of less than $25 million. These holders may make no more than two requests for registration on Form S-3 in any 12 month period; however, we will not be required to effect a registration on Form S-3 if we determine that it would be detrimental to our stockholders to effect such a registration and we have the right to defer such registration, not more than once in any 12 month period, for a period of up to 90 days.

Exchange Agreement

See "Exchanges of LLC Units for Class A Common Stock."

Anti-Takeover Provisions

Our amended and restated certificate of incorporation, amended and restated bylaws and the Delaware General Corporation Law, or DGCL, contain provisions, which are summarized in the following paragraphs, that are intended to enhance the likelihood of continuity and stability in the composition of our board of directors and to discourage certain types of transactions that may involve an actual or threatened acquisition of our company. These provisions are intended to avoid costly takeover battles, reduce our vulnerability to a hostile change in control or other unsolicited acquisition proposal, and enhance the ability of our board of directors to maximize stockholder value in connection with any unsolicited offer to acquire us. However, these provisions may have the effect of delaying, deterring or preventing a merger or acquisition of our company by means of a tender offer, a proxy contest or other takeover attempt a stockholder might consider in its best interest, including attempts that might result in a premium over the prevailing market price for the shares of Class A common stock heldowned by stockholders.

Classified board of directors. Our amendedthem and, restated certificate of incorporation and bylaws provide that our board of directors is classified into three classes of directors. A third party may be discouraged from makinga tender offer or otherwise attempting to obtain control of us as it is more difficult and time consuming for stockholders to replace a majority of the directors on a classified board of directors.

Business combinations. We have opted out of Section 203 of the DGCL; however, our amended and restated certificate of incorporation contains similar provisions providing that we may not engage in certain "business combinations" with any "interested stockholder" for a three year period following the time the stockholder became an interested stockholder, unless:

prior to such time, our board of directors approved either the business combination or the transaction that resultedif they default in the stockholder becoming an interested stockholder;

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the votes of our voting stock outstanding at the time the transaction commenced, excluding certain shares; or

at or subsequent to that time, the business combination is approved by our board of directors and by the affirmative vote of holders of at least 66 2/3% of the votes of our outstanding voting stock not owned by the interested stockholder.

Generally, a "business combination" includes a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an "interested stockholder" is a person who, together with that person's affiliates and associates, owns, or within the previous three years owned, 15% or more of the votes of our outstanding voting stock. For purposes of this provision, "voting stock" means any class or series of stock entitled to vote generally in the election of directors.

Under certain circumstances, this provision will make it more difficult for a person who would be an "interested stockholder" to effect various business combinations with our company for a three year period. This provision may encourage companies interested in acquiring our company to negotiate in advance with our board of directors because the stockholder approval requirement would be avoided if our board of directors approves either the business combination or the transaction that results in the stockholder becoming an interested stockholder. These provisions also may have the effect of preventing changes in our board of directors and may make it more difficult to accomplish transactions stockholders may otherwise deem to be in their best interests.

Our amended and restated certificate of incorporation provides that KKR, Silver Lake, TCV and Bob Parsons, and their respective affiliates, and anyperformance of their respective directsecured obligations, the pledgees or indirect designated transferees (other than in certain market transferssecured parties may offer and gifts) and any group of which such persons are a party do not constitute "interested stockholders" for purposes of this provision.

Removal of directors. Undersell the DGCL, unless otherwise provided in our amended and restated certificate of incorporation, directors serving on a classified board may be removed by the stockholders only for cause. Our amended and restated certificate of incorporation provides that directors may be removed with or without cause upon the affirmative vote of a majority in voting power of all outstanding shares of stock entitled to vote thereon, voting together as a single class, so long as affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own at least 40% in voting power of the stock of our company entitled to vote generally in the election of directors; however, at anytime when these parties own, in the aggregate, less than 40% in voting power of the stock of our company entitled to vote generally in the election of directors, directors may only be removed for cause, and only by the affirmative vote of holders of at least two-thirds in voting power of all outstanding shares of stock of our company entitled to vote thereon, voting together as a single class. Our stockholder agreement provides that, in connection with votes for removal of a director, affiliates of each of KKR, Silver Lake, TCV and Bob Parsons (collectively, the "Voting Parties"), will vote their shares in accordance with the board composition requirements of such stockholder agreement.

Vacancies. In addition, our amended and restated certificate of incorporation also provides that, subject to the rights granted to one or more series of preferred stock then outstanding or the rights granted under the stockholder agreement, any newly created directorship on the board of directors that results from an increase in the number of directors and any vacancies on our board of directors will be filled by the affirmative vote of a majority of the remaining directors, even if less than a quorum, by a sole remaining director or by the affirmative vote of a majority of the voting power of all outstanding shares of stock entitled to vote thereon, voting together as a single class; provided, however, that at any time when affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own less than 40% in voting power of the stock of our company entitled to vote generally in the election of directors, any newly created directorship on the board of directors that results from an increase in the number of directors and any vacancy occurring in the board of directors may be filled only by a majority of the remaining directors, even if less than a quorum, or by a sole remaining director (and not by the stockholders). Our amended and restated certificate of incorporation provides that the board of directors may increase the number of directors by the affirmative vote of a majority of the directors or, at any time when affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own at least 40% in voting power of the stock of our company entitled to vote generally in the election of directors, by the affirmative vote of a majority in voting power of all outstanding shares of stock entitled to vote thereon, voting together as a single class. Our stockholder agreement provides that the Voting Parties will vote their shares in respect of vacancies in accordance with the board composition requirements of such stockholder agreement.

Quorum. Our amended and restated certificate of incorporation provides that at any meeting of the board of directors, a majority of the total number of directors then in office constitutes a quorum for all purposes, provided that so long as there is at least one KKR Director on the board, a quorum shall also require a KKR Director for all purposes, and so long as there is at least one Silver Lake Director on the board, a quorum shall also require a Silver Lake Director for all purposes.

No cumulative voting. Under Delaware law, the right to vote cumulatively does not exist unless the certificate of incorporation specifically authorizes cumulative voting. Our amended and restated certificate of incorporation does not authorize cumulative voting.

Special stockholder meetings. Our amended and restated certificate of incorporation provides that special meetings of our stockholders may be called at any time only by or at the direction of the board of directors or thechairman of the board of directors; provided, however, so long as affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own at least 40% in voting power of the stock of our company entitled to vote generally in the election of directors, special meetings of our stockholders shall also be called by the board of directors at the request of either a stockholder affiliated with KKR or a stockholder affiliated with Silver Lake. Our amended and restated bylaws also provide that special meetings of our stockholders may be called at any time by two directors of the board of directors. Our amended and restated bylaws prohibit the conduct of any business at a special meeting other than as specified in the notice for such meeting. These provisions may have the effect of deferring, delaying or discouraging hostile takeovers or changes in control or in management of our company.

Requirements for advance notification of director nominations and stockholder proposals. Our amended and restated bylaws establish advance notice procedures with respect to stockholder proposals and the nomination ofcandidates for

election as directors, other than nominations made by or at the direction of the board of directors or a committee of the board of directors or nominations made by affiliates of KKR, Silver Lake or Bob Parsons pursuant to their rights under the stockholder agreement. In order for any matter to be properly brought before a meeting of our stockholders, a stockholder will have to comply with advance notice requirements and provide us with certain information. Generally, to be timely, a stockholder's notice must be received at our principal executive offices not less than 90 days or more than 120 days prior to the first anniversary date of the immediately preceding annual meeting of stockholders. Our amended and restated bylaws also specifyrequirements as to the form and content of a stockholder's notice. Our amended and restated bylaws allow the chairman of the meeting at a meeting of the stockholders to adopt rules and regulations for the conduct of meetings, which may have the effect of precluding the conduct of certain business at a meeting if the rules and regulations are not followed. These provisions may also deter, delay or discourage a potential acquirer from conducting a solicitation of proxies to elect the acquirer's own slate of directors or otherwise attempting to influence or obtain control of our company.

Stockholder action by written consent. Pursuant to Section 228 of the DGCL, any action required to be taken at any annual or special meeting of the stockholders may be taken without a meeting, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares of our stock entitled to vote thereon were present and voted, unless the certificate of incorporation provides otherwise. Our amended and restated certificate of incorporation precludes stockholder action by written consent at any time when affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own less than 40% in voting power of the stock of our company entitled to vote generally in the election of directors.

Supermajority provisions. Our amended and restated certificate of incorporation and amended and restated bylaws provide that the board of directors is expressly authorized to make, alter, amend, change, add to, rescind or repeal, in whole or in part, our bylaws without a stockholder vote in any matter not inconsistent with the laws of the State of Delaware or our amended and restated certificate of incorporation. For so long as affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own at least 40% in voting power of the stock of our company entitled to vote generally in the election of directors, the amendment, alteration, rescission or repeal of certain provisions of our bylaws by our stockholders will require the affirmative vote of a majority in voting power of the outstanding shares of our stock entitled to vote on such amendment, alteration, change, addition, rescission or repeal. At any time when these parties own, in the aggregate, less than 40% in voting power of all outstanding shares of the stock of our company entitled to vote generally in the election of directors, any amendment, alteration, rescission or repeal of certain provisions of our bylaws by our stockholders will require the affirmative vote of the holders of at least two-thirds in voting power of all outstanding shares of stock of our company entitled to vote thereon, voting together as a single class.

The DGCL provides generally that the affirmative vote of a majority of votes of the outstanding shares entitled to vote thereon, voting together as a single class, is required to amend a corporation's certificate of incorporation, unless the certificate of incorporation requires a greater percentage.

Our amended and restated certificate of incorporation provides that for as long as affiliates of KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own at least 40% in voting power of the stock of our company entitled to vote generally in the election of directors, in addition to any vote required by applicable law, our amended and restated certificate of incorporation may be amended, altered, repealed or rescinded by the affirmative vote of the holders of a majority in voting power of all the then outstanding shares of stock of our company entitled to vote thereon, voting together as a single class. At any time when KKR and Silver Lake (together with affiliates of TCV, for so long as TCV is required to vote at the direction of KKR and Silver Lake) collectively own less than 40% in voting power of the stock of our company entitled to vote generally in the election of directors, the following provisions in our amended and restated certificate of incorporation may be amended, altered, repealed or rescinded only by the affirmative vote of the holders of at least two-thirds in voting power of all outstanding shares of stock of our company entitled to vote thereon, voting together as a single class:

the provisions providing for a classified board of directors (the election and term of our directors);

the provisions regarding resignation and removal of directors, quorum, special meetings and committees;

the provisions regarding corporate opportunities;

the provisions regarding entering into business combinations with interested stockholders;

the provisions regarding stockholder action by written consent;

the provisions regarding calling special meetings of stockholders;

the provisions regarding filling vacancies on our board of directors and newly created directorships;

the provisions eliminating monetary damages for breaches of fiduciary duty by a director; and

the amendment provision requiring that the above provisions be amended only with a 66 2⁄3% supermajority vote.

The combination of the classification of our board of directors, the lack of cumulative voting and the supermajority voting requirements will make it more difficult for our existing stockholders to replace our board of directors as well as for another party to obtain control of us by replacing our board of directors. Because our board of directors has the power to retain and discharge our officers, these provisions could also make it more difficult for existing stockholders or another party to effect a change in management.

Conflicts of interest. Delaware law permits corporations to adopt provisions renouncing any interest or expectancy in certain opportunities that are presented to the corporation or its officers, directors or stockholders. Our amended and restated certificate of incorporation, to the fullest extent permitted by law, renounces any interest or expectancy that we have in, or right to be offered an opportunity to participate in, specified business opportunities that are from time to time presented to KKR, Silver Lake, TCV and Bob Parsons, directors affiliated with these parties and their respective affiliates, and any other non-employee directors, and that, to the fullest extent permitted by law, such persons will have no duty to refrain from engaging in any transaction or matter that may be an investment or corporate or business opportunity or offer a prospective economic or competitive advantage in which we or any of our subsidiaries could have an interest or expectancy, which we refer to as a Competitive Opportunity, or otherwise competing with us or our subsidiaries. In addition, to the fullest extent permitted by law, in the event KKR, Silver Lake, TCV and Bob Parsons, directors affiliated with these parties and their respective affiliates, and any other non-employee directors acquires knowledge of a potential Competitive Opportunity or other corporate or business opportunity that may be a CompetitiveOpportunity for itself, himself or herself or its, his or her affiliates or for us or our subsidiaries, such person will have no duty to communicate or present such opportunity to us or any of our subsidiaries, and they may take any such opportunity for themselves or offer it to another person or entity. With respect to any non-employee director who is not a KKR Director, Silver Lake Director or Parsons Director or affiliated with TCV, our amended and restated certificate of incorporation does not renounce our interest in any Competitive Opportunity that is expressly offered to such a director solely in his or her capacity as a director of our company. A business or other opportunity will not be deemed to be a potential Competitive Opportunity for us if it is an opportunity we are not able or permitted to undertake, is not in line with our business or is an opportunity in which we have no interest or reasonable expectancy.

Transfer Agent and Registrar

The transfer agent and registrar for our Class A common stock is American Stock Transfer & Trust Company, LLC. The transfer agent and registrar's address is 6201 15th Avenue, Brooklyn, New York 11219, and its telephone number is (718) 921-8206.

Listing

Our Class A common stock is listed on the New York Stock Exchange under the symbol "GDDY."

PLAN OF DISTRIBUTION

This prospectus relates to the issuance by us from time to time of up to an aggregate of 4,193,829 shares of Class A common stock from time to certain holderstime under this prospectus or any amendment to this prospectus under Rule 424(b)(3), or other applicable provision of LLC Units upon exchanges by such holdersthe Securities Act, supplementing or amending, if necessary, the list of an equal number of such LLC Units (together withselling stockholders to include the same number of shares of our Class B common stock).pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of Class A common stock registered underin other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus will only be issued toprospectus.

The selling stockholders and any broker-dealer participating in the extent holdersdistribution of LLC Units exchange their LLC Units forthe shares of Class A common stock.stock offered hereby may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of Class A common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Any such discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the selling stockholders. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act. At the time a particular offering of the shares of Class A common stock offered hereby is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of Class A common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Underwriters, dealers and agents may engage in transactions with, or perform services for, us or our subsidiaries in the ordinary course of their businesses.

In order to facilitate the offering of the securities, any underwriters or agents, as the case may be, involved in the offering of such securities may engage in transactions that stabilize, maintain or otherwise affect the price of such securities or other securities the prices of which may be used to determine payments on the securities. Specifically, the underwriters or agents, as the case may be, may overallot in connection with the offering, creating a short position in such securities for their own account. In addition, to cover overallotments or to stabilize the price of the securities or of such other securities, the underwriters or agents, as the case may be, may bid for, and purchase, such securities in the open market. Finally, in any offering of such securities through a syndicate of underwriters, the underwriting syndicate may reclaim selling concessions allotted to an underwriter or a dealer for distributing such securities in the offering if the syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. The underwriters or agents, as the case may be, are not required to engage in these activities, and may end any of these activities at any time.

The selling stockholders may solicit offers to purchase securities directly from, and may sell securities directly to, institutional investors or others. The terms of any of those sales, including the terms of any bidding or auction process, if utilized, will be described in the applicable prospectus supplement.

We cannot and will not give any assurances as to the liquidity of the trading market for any of our securities.

Under the securities laws of some states, the shares of Class A common stock offered hereby may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of Class A common stock offered hereby may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any recipients of shares of Class A common stock issued upon exchange of LLC Units (together with the same number of shares of our Class B common stock)selling stockholder will sell any or all of the shares of Class A common stock registered pursuant to the shelf registration statement of which this prospectus forms a part.

The recipients of Class A shares of common stock issued upon exchange of LLC Units (together with the same number of shares of our Class B common stock) and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Class A common stock by such holder and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the Class A common stock to engage in market-making activities with respect to the Class A common stock. All of the foregoing may affect the marketability of the Class A common stock and the ability of any person or entity to engage in market-making activities with respect to the Class A common stock.

We will not receive any cash proceeds from our issuance of Class A common stock pursuant to this prospectus. Once issued to the holders pursuant tosold under the shelf registration statement, of which this prospectus forms a part, thesuch shares of Class A common stock will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

Certain legal matters relating toVALIDITY OF SECURITIES

The validity of the shares of Class A common stock offered by this offering will beprospectus has been passed upon for us by Wilson Sonsini GoodrichDavis Polk & Rosati, P.C., Palo Alto,Wardwell LLP, Menlo Park, California. Wilson Sonsini Goodrich & Rosati, P.C. own less than 0.2% of our LLC Units as of March 31, 2016, that may be exchanged for shares of our Class A common stock pursuant to the Exchange Agreement described in "Exchanges of LLC Units for Class A Common Stock—Exchange Agreement."

EXPERTS

The consolidated financial statements of GoDaddy Inc. appearing in GoDaddy Inc.'s’s Annual Report on Form 10-K(Form 10-K) for the year ended December 31, 20152023, and the effectiveness of GoDaddy Inc.’s internal control over financial reporting as of December 31, 2023 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reportreports thereon, which conclude, among other things, that GoDaddy Inc. did not maintain effective internal control over financial reporting as of December 31, 2023, based on Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission “(2013 framework)”, because of the effects of the material weakness described therein, included therein, and incorporated herein by reference. Such consolidated financial statements arehave been incorporated herein by reference in reliance upon such reportreports given on the authority of such firm as experts in accounting and auditing.

4,193,829WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated herein by reference for a copy of such contract, agreement or other document.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website at www.sec.gov. We also maintain a website at investors.godaddy.net, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider such information contained on, or accessed through, our website as part of this prospectus.

In addition, you may request copies of these filings at no cost, by writing or telephoning us at the following address or telephone number:

Investor Relations Department

GoDaddy Inc.

2155 E. GoDaddy Way

Tempe, AZ 85284

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to other documents we have filed separately with the SEC, without actually including the specific information in this prospectus. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC (and that is deemed to be “filed” with the SEC) will automatically update, and may supersede, information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File No. 001-36904):

•our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024;

•our current Reports on Form 8-K filed with the SEC on January 11, 2024, January 23, 2024 and February 8, 2024, to the extent the information in such reports is filed and not furnished; and

•the description of our common stock contained in our Registration Statement on Form 8-A (File No. 001-36904), filed with the SEC on April 1, 2015, including any amendments or reports filed for the purpose of updating such description.

We also incorporate by reference any future filings (except as specifically enumerated above, other than any filings or portions of such reports that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules, including current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus forms a part, until the selling stockholders identified herein sell all of the Class A common stock covered by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

To obtain copies of these filings, see “Where You Can Find More Information.”

270,508 Shares

Class A Common Stock

____________________

PROSPECTUS

____________________

February 29, 2024

June 14, 2016

PART II. II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution