Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on November 18, 2005

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION ON AUGUST 23, 2000

REGISTRATION NO. 333-42508

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

Washington, D.C. 20549

------------------------

AMENDMENT NO. 2

TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF

Under the

Securities Act of 1933

------------------------

SKYWEST, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

SkyWest, Inc.

(Exact name of registrant as specified in its charter)

| Utah (State or other jurisdiction of incorporation or organization) | 87-0292166 (I.R.S. employer identification number) |

444 South River Road

St. George, Utah 84790

(435) 634-3200

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Bradford R. RICH

EXECUTIVE VICE PRESIDENT,

CHIEF FINANCIAL OFFICER AND TREASURER

SKYWEST, INC.

Rich

Executive Vice President, Chief Financial Officer and Treasurer

SkyWest, Inc.

444 SOUTH RIVER ROAD

ST. GEORGE, UTAHSouth River Road

St. George, Utah 84790

(435) 634-3000

(NAME, ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE NUMBER,

INCLUDING AREA CODE, OF AGENT FOR SERVICE)

------------------------

COPIES TO:

634-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to: | ||

| Brian G. Seth R. King, Esq. PARR WADDOUPS BROWN GEE & LOVELESS 185 Salt Lake City, Utah 84111 (801) 532-7840 | Mark C. Smith, Esq. Allison R. Schneirov, Esq. SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP Four Times Square New York, New York 10036 (212) 735-3000 | |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: [ ]o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: [ ]o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ] __________o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box: [ ]

THE REGISTRANT HEREBY AMENDS THISo

CALCULATION OF REGISTRATION STATEMENT ON SUCH DATE OR

DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL

FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION

STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF

THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME

EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a),

MAY DETERMINE.

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

2

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED.

THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED

WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS

PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT

SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER

OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED AUGUST 23, 2000

PROSPECTUS

2,636,100 SHARES

SKYWEST LOGO

COMMON STOCK

------------------------

We are offering 2,500,000FEE

| Title of each class of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per share(2) | Proposed maximum aggregate offering price(2) | Amount of registration fee | ||||

|---|---|---|---|---|---|---|---|---|

| Common Stock, no par value | 4,600,000 | $32.24 | $148,304,000 | $17,456 | ||||

- (1)

- Includes 600,000 shares which the underwriters have the option to purchase solely to cover overallotments, if any.

- (2)

- Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) based on the average high and low reported sales prices of our common stock on The Nasdaq National Market on November 17, 2005.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion

Preliminary Prospectus dated November 18, 2005

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

P R O S P E C T U S

4,000,000 Shares

Common Stock

SkyWest, Inc. andis selling all of the selling stockholdersshares.

The shares are offering 136,100 shares of common stock. We will not

receive any proceeds from the sale of common stock by the selling stockholders.

Our common stock is quoted on theThe Nasdaq National Market under the symbol "SKYW." On August 21, 2000,November 17, 2005, the closinglast sale price of our common stock,the shares as reported by theThe Nasdaq National Market was $45.13$32.59 per share.

YOU SHOULD CONSIDER THE RISKS WHICH WE HAVE DESCRIBED IN "RISK FACTORS" ON PAGE

5 BEFORE DECIDING WHETHER TO INVEST IN SHARES OF OUR COMMON STOCK.

------------------------

Investing in our common stock involves risks that are described in the "Risk Factors" section beginning on page 11 of this prospectus.

| Per Share | Total | |||

|---|---|---|---|---|

| Public offering | $ | $ | ||

| Underwriting discount | $ | $ | ||

| Proceeds, before expenses, to | $ | $ |

The underwriters a 30-day option tomay also purchase up to 395,415an additional 600,000 shares of common stock solely to cover over-allotments, if any. If

such option is exercised in full,from us at the total public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be $ , the total underwriting discount will be $ , and the total

proceeds to us will be $ .

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE

ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

Raymond James & Associates, Inc., on behalf of the underwriters, expects to

deliver the shares to purchasersready for delivery on or beforeabout , 2000.

------------------------

RAYMOND JAMES & ASSOCIATES, INC.

2005.

| Merrill Lynch & Co. | Raymond James |

The date of this prospectus is , 2000

3

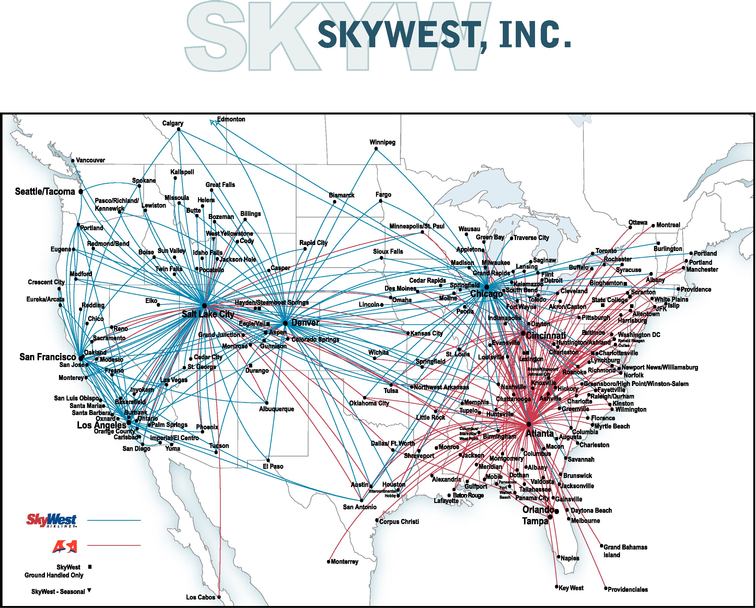

[MAP DISPLAYING SKYWEST ROUTES]

SkyWest's2005.

We are a holding company that operates two independent subsidiaries, SkyWest Airlines and Atlantic Southeast Airlines ("ASA"), with a total fleet of approximately 376 aircraft and approximately 13,550 employees. Our fleet consists of the 30-passengerBombardier CRJ200 Regional Jets seating 40 or 50 passengers ("CRJ200s"), Bombardier CRJ700 Regional Jets seating 66 or 70 passengers ("CRJ700s"), Embraer EMB-120 Brasilia turbopropturboprops seating 30 passengers ("Brasilia turboprops") and Avions de Transport 72-210 turboprops seating 66 passengers ("ATR-72 turboprops"). We provide on each of these aircraft and the 50-passenger Canadair Regional Jet. Both equipment

types offerflight attendant service, as well as in-flight amenities such as snack and beverage service, lavatory facilities and overhead storage. SkyWest Airlines is a regional carrier with a fleet of 104

aircraft and 3,593 employees.

We operate over 2,400 total daily flights as The Delta Connection® in Atlanta, Salt Lake City and Cincinnati, and as United Express(R)Express® in Chicago (O'Hare), Denver, Los Angeles, San Francisco, Seattle/Tacoma and Portland and as The Delta Connection(R) in Salt Lake CitySeattle/Tacoma under code-sharingcode-share agreements with United AirlinesDelta Air Lines and DeltaUnited Air Lines. We provide scheduled air service to 63 cities212 destinations in 13 western statesthe United States, Canada, Mexico and Canada.

United(R)the Caribbean. We have obtained federal registration of the SkyWest®, SkyWest Airlines®, Atlantic Southeast Airlines® and United Express(R)ASA® trademarks. Delta®, Delta Connection® and The Delta Connection® are trademarks of Delta Air Lines, Inc. United® and United Airlines, Inc.

Delta(R), Delta Connection(R) and The Delta Connection(R)Express® are trademarks of DeltaUnited Air Lines, Inc. All other trademarks and service marks appearing in this prospectus are the property of their respective holders.

------------------------

IN CONNECTION WITH AN UNDERWRITTEN OFFERING, THE SEC RULES PERMIT THE

UNDERWRITERS TO ENGAGE IN TRANSACTIONS THAT STABILIZE THE PRICE

TABLE OF OUR COMMON

STOCK. THESE TRANSACTIONS MAY INCLUDE PURCHASES FOR THE PURPOSE OF FIXING OR

MAINTAINING THE PRICE OF THE COMMON STOCK AT A LEVEL THAT IS HIGHER THAN THE

MARKET WOULD DICTATE IN THE ABSENCE OF SUCH TRANSACTIONS.

4

CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition and prospects may have changed since that date.

This summary contains basic information about our company and this offering, but does not contain all of the information that you should consider before investing in our common stock. You should read this summary, together with the entire prospectus, including Risk Factors,"Risk Factors" and the information incorporated by reference into this prospectus as described below under "Incorporation Of Certain Information By Reference," for important information regarding our company and the common stock being sold in this offering. Unless otherwise indicated, "we,"we," "us," "our"us", "our" and similar terms refer to SkyWest, Inc. and our subsidiaries, and "SkyWest"subsidiaries; "SkyWest Airlines" refers to our wholly-owned subsidiary SkyWest Airlines, Inc.,; and "ASA" refers to our principal operating subsidiary.

SKYWEST, INC.wholly-owned subsidiary Atlantic Southeast Airlines, Inc. Unless otherwise indicated, all information in this prospectus assumes that the underwriters' overallotment option to purchase up to 600,000 shares from us will not be exercised.

Our Company

We operateare a holding company that operates two independent subsidiaries, SkyWest Airlines aand ASA. SkyWest Airlines and ASA are regional airlineairlines offering scheduled passenger service with approximately 1,000over 2,400 daily departures to 63 cities212 destinations in 13

western statesthe United States, Canada, Mexico and Canada. Allthe Caribbean. Substantially all of our flights are operated as either Delta Connection or United Express or The Delta Connection under code-sharingcode-share arrangements with United

Airlines or Delta Air Lines. ForLines, Inc. ("Delta") or United Air Lines, Inc. ("United"), with significant presence in their key domestic hubs and focus cities. SkyWest Airlines and ASA provide regional flying to our partners, primarily under long-term, fixed-fee code-share agreements that we believe improve our ability to accurately forecast our revenue stream. Under this type of agreement, our partners assume many of the three months ended March 31, 2000,most common financial risks inherent to our industry, including those relating to fuel prices, airfares and passenger load factors.

SkyWest wasAirlines and ASA have developed industry-leading reputations for providing quality, low-cost regional airline service during their long operating histories—SkyWest Airlines has been flying since 1972 and ASA since 1979. As of September 30, 2005, our consolidated fleet consisted of a total of 376 aircraft, of which 220 were in service with Delta, 152 were in service with United and four were unassigned. We currently operate one type of regional jet aircraft in two differently sized configurations, the 40- and 50-seat CRJ200s and the 66- and 70-seat CRJ700s, and two types of turboprop aircraft, the 30-seat Brasilia turboprops and the 66-seat ATR-72 turboprops (which we expect to remove from service by August 2007). SkyWest Airlines and ASA have combined firm orders to acquire an additional 37 CRJ700s over the next two years and ASA is committed to sublease six additional CRJ200s from Delta commencing in early 2006. We have agreements with Delta or United to place all of these aircraft into service upon their delivery. In addition, we have options to acquire an additional 80 Bombardier Regional Jets over the next two years. We believe the option aircraft, which we can elect to take in configurations ranging between 66 and 90 seats, position us to capitalize on additional growth opportunities with our existing and other potential code-share partners.

The following table summarizes certain key elements of the SkyWest Airlines and ASA operations as of September 30, 2005.

| SkyWest Airlines | Atlantic Southeast Airlines | |||

|---|---|---|---|---|

| Partners | Delta, United | Delta | ||

Contract Terms | Delta—Effective through September 2020 Assumed by Delta with Bankruptcy Court approval | Delta—Effective through September 2020 Assumed by Delta with Bankruptcy Court approval | ||

United—Expires incrementally in December 2011, 2013 and 2015 Approved in Bankruptcy Court | ||||

Aircraft (number of planes) | 66-passenger CRJ700s (37) (all United) | 70-passenger CRJ700s (35) | ||

50-passenger CRJ200s (125) (56 Delta, 65 United, 4 unassigned) | 40- and 50-passenger CRJ200s (104) | |||

30-passenger Brasilia turboprops (63) (13 Delta, 50 United) | 66-passenger ATR-72 turboprops (12) | |||

Average daily scheduled departures | United:1,019 Delta:482 Total:1,501 | Delta:919 Total:919 | ||

Hubs/Focus Cities | Chicago (O'Hare), Denver, Los Angeles, San Francisco, Portland, Seattle/Tacoma, Salt Lake City | Atlanta, Salt Lake City, Cincinnati | ||

Employees | Approximately 8,050 employees(1) | Approximately 5,500 employees(1) | ||

Passengers carried in 2004 | 13.4 million | 10.4 million |

- (1)

- Full-time equivalent

Our Acquisition of Atlantic Southeast Airlines

On September 7, 2005, we completed the acquisition of ASA from Delta for $425 million in cash. Additionally, as part of the purchase, we paid $6.6 million of transaction fees and ASA retained approximately $1.25 billion in long-term debt. In addition, we returned to Delta $50 million in deposits that Delta had previously paid on future ASA aircraft deliveries. The combination of SkyWest Airlines and ASA created the largest regional airline atin the San Francisco International Airport

(100%United States, with over $2 billion in pro forma 2004 revenues. In addition to the potential benefits of scale that our increased size provides us, the combination of SkyWest Airlines and ASA presents our company with new opportunities for growth through our two separate, geographically-focused regional airline platforms—SkyWest Airlines in the Western United States and ASA in the Eastern United States. Although we currently intend to operate the two subsidiaries as separate and independent entities, the skills and knowledge built by these organizations over the years will be available to benefit both. We believe the ASA acquisition also established us as Delta's most important regional airline partner, based on our percentage of Delta's

total regional capacity. We now provide the vast majority of regional airline passengers),service for Delta in Atlanta, its most important eastern hub, and Salt Lake City, its most important western hub. In connection with the ASA acquisition, we have established new, separate, but substantially similar, long-term fixed-fee Delta Connection Agreements with Delta for both SkyWest Airlines and ASA. Under the agreements, which have initial terms of 15 years (subject to certain extension and termination rights), Delta has agreed that ASA will provide at least 80% of all Delta Connection departures from Atlanta, and that at least 50% of ASA's Delta Connection departures will be from Atlanta. We also obtained control of 26 gates in the Hartsfield-Jackson International Airport (99%located in Atlanta, from which we currently provide service to Delta. Delta has committed to provide to us opportunities to utilize 28 additional regional jets in our fleet by the end of 2007. Delta has also agreed that, starting in 2008, ASA is guaranteed to maintain its percentage of total Delta Connection flights that it has in 2007, so long as its bid for additional regional flying is competitive with other regional carriers.

We believe our primary strengths are:

• Largest U.S. Regional Airline with Strong Partner Relationships. As a result of our acquisition of ASA, we are the largest regional airline passengers)in the United States, measured by the number of passengers carried. On a combined pro forma basis for the year ended December 31, 2004, SkyWest Airlines and Los Angeles International Airport (65%ASA carried in excess of 23.8 million passengers and produced more than 14.4 billion "available seat miles," which represents the number of seats available for passengers, multiplied by the number of miles those seats are flown ("ASMs"). We believe the increased scale of our operations will enable us to further reduce our unit costs by more efficiently spreading our overhead and leveraging our operations, which in turn will allow us to offer our services to our partners at even more competitive costs going forward. Based on our consistent provision of high quality, low-cost regional airline passengers).services, we have established strong code-share relationships with our current partners Delta and United, who are currently the world's second and third-largest airlines, respectively, measured by the number of passengers carried. SkyWest offers a convenient schedule and frequent

flights designed to encourage connecting and local traffic. For 17 of the 63

airports that SkyWest serves, it is the only scheduled commercial air service.

SkyWestAirlines has been a code-sharingcode-share partner with Delta since 1987 and with United since 1997, andwhile ASA has been a code-share partner with Delta since 1987. SkyWest's development1984. Through these two platforms, we currently account for approximately 50% of code-sharing relationshipsDelta's and approximately 58% of United's regional flight departures, which, we believe, makes us the most important regional partner of both airlines. In addition, our dominant position in our partners' hubs and focus cities, including ASA's position in Atlanta, further reinforces our importance as an integral part of our partners' networks.

��• Two Strong Operating Platforms with multiple major airlinesSignificant Growth Opportunities. During more than 30 years of flight operations, SkyWest Airlines has established a strong regional airline platform in the Western United States. ASA has established its operational strength in the Eastern United States, where it holds the largest market share of all regional carriers serving Atlanta's Hartsfield-Jackson International Airport. Concentrating our operations geographically, with one platform serving the Western United States and another serving the Eastern United States, enables us to reduce our relianceunit costs by minimizing our number of crew bases and maintenance and other facilities, and by utilizing our human and capital resources more efficiently. We believe our code-share agreements position us for continued growth of both platforms. For instance, beyond the 43 committed aircraft additions in our contracts, the ASA Delta Connection Agreement contains provisions enabling ASA to maintain its percentage of total Delta Connection flights that it has in 2007, so long as its bid for additional regional flying is competitive with other regional carriers. Moreover, we believe the combination of the two platforms will allow us to capitalize on operational efficiencies in order to reduce costs, which, coupled with our strong financial resources, will provide us with opportunities to expand service to our existing partners or add new partners.

• Long-Term, Fixed-Fee Code-Share Agreements. We have entered into long-term, fixed-fee code-share agreements with both Delta and United that are subject to us maintaining specified

performance levels. Our Delta Connection Agreements provide for minimum aircraft utilization at fixed rates, reimbursement of direct operating costs (such as fuel) and provide a single major

airline partnermore predictable revenue stream than the historically utilized "pro-rate" revenue-sharing arrangements. Under our code-share agreements, we authorize our partners to identify our flights and fares under their flight designation codes in the central reservation systems, and we are authorized to paint our aircraft in the livery of our partners, to use their service marks and to market ourselves as a code-share carrier for our partners. Notably, our Delta Connection Agreements have been assumed by Delta with U.S. Bankruptcy Court approval, and SkyWest Airlines' United Express Agreement was approved by the U.S. Bankruptcy Court prior to its execution. We believe these court orders significantly reduce the possibility that our code-share agreements will be disrupted by the Delta and United bankruptcy proceedings, and increase theour prospects for long-term revenue stability and visibility.

• Experienced Management Team. The four members of our senior management team possess an average of 25.5 years of operating results. For the

year ended March 31, 2000, 64% of SkyWest's operating revenues was derived from

United code-share service and 36% was derived from Delta code-share service.

Approximately 76% of SkyWest's current flights are structured as contract

flights. On contract flights, United or Delta controls scheduling, ticketing,

pricing and seat inventories, and SkyWest is compensated with a fixed fee for

each flight completed and an amount per passenger, and is eligible for

additional compensation if certain service quality levels are achieved. Also,

United and Delta, under contractual arrangements, have agreed to reimburse

SkyWest for the actual cost of fuel on all of SkyWest's contract flights. On

SkyWest-controlled flights, SkyWest controls scheduling, ticketing, pricing and

seat inventories, and shares revenues with United or Delta according to prorate

formulas for those SkyWest passengers connecting to a United- or Delta-operated

flight.

The following are the principal elements of our business strategy:

- Focus on Marketsexperience in the Western United States. We believe the market for

air travel in the western United States offers attractive opportunities

for long-term profitable growth for SkyWest. Generally, western air

corridors are less congested than comparable routes in the eastern United

States; longer stage lengths make air travel more attractive than

alternate forms of travel; many western cities are experiencingairline industry. Since 1987, SkyWest Airlines' management team has successfully managed through several industry cycles while delivering industry-leading operational performance, consistent profitability and significant population and economic growth; and mild year-round weather

is common in many of the markets in which SkyWest operates.

- Build Upon Relationships with Code-Sharing Partners. United is the

world's largest airline, and Delta is the world's fourth-largest airline.

SkyWest's significant recent growth in traffic and profitability are

partially attributablevalue to the success of its code-share relationships

with United and Delta. At the same time, multiple code-sharing agreements

reduce SkyWest's reliance on a single major airline.

- Provide Excellent Customershareholders.

• High-Quality Service. We strive for excellent customerto deliver high-quality service in every aspect of our operations. For the yearnine months ended March 31,

2000, ourSeptember 30, 2005, SkyWest Airlines' average on-time performance ratio was 93.5%85.5% and ourits flight completion ratio was 98.6%. AllAlso for the nine months ended September 30, 2005, SkyWest Airlines' aircraft in revenue service operated an average of 10.0 hours per day, which we believe is among the highest aircraft utilization rates in the regional airline industry. In March 2005, SkyWest Airlines was named the 2004 Regional Airline of the Year byRegional Airline World Magazine. In February 2005, SkyWest Airlines was named the number one on-time mainland airline in the United States for 2004 by the U.S. Department of Transportation. ASA is committed to high-quality service, and we believe the combination of the SkyWest Airlines and ASA platforms presents an opportunity for both carriers to enhance the quality of their service.

• Financial Resources and Flexibility. Due in part to our success in implementing our business strategy, we possess financial resources and flexibility which distinguish us from many other regional and major carriers and which constitute a competitive advantage. At September 30, 2005, after giving effect to this offering, we would have had cash and marketable securities of approximately $337.4 million, which would have represented 21.8% of our revenues over the twelve months ending September 30, 2005. The strength of our balance sheet and credit profile have enabled us to enter into lease and other financing transactions on terms we believe are more favorable than the terms available to many other carriers. Many major carriers currently face significant financial challenges and are experiencing difficulty financing the acquisition and operation of aircraft for themselves and their regional partners. As a result, regional carriers themselves are increasingly financing the expansion and operation of the fleet offer "cabin class"serving the major carrier's passengers. Our lower aircraft ownership costs can be shared with our partners, which we believe represents a competitive advantage when we seek additional growth. We believe our financial flexibility also allows us to take advantage of growth opportunities—such as the acquisition of ASA or placing a large aircraft order—that we might otherwise be unable to pursue if we did not possess these financial resources.

Our business strategy consists of the following elements:

• Capitalize on the ASA Acquisition to Reduce Operating Costs. We believe our acquisition of ASA provides a number of significant opportunities to reduce the unit operating costs of both the SkyWest Airlines and ASA platforms without compromising passenger safety, service including a stand-up cabin,quality or

operational reliability. Among those opportunities, we intend to focus our initial cost reduction efforts in four key areas:

- •

- improve the utilization of our equipment and facilities through the refinement of operational processes, elimination of redundancies and collaborative identification and implementation of operational best practices;

- •

- increase employee productivity by incorporating best practices, efficiently utilizing our employees to support both operating platforms, and providing incentive-based compensation and benefits that are competitive with packages offered by other regional carriers with whom we compete;

- •

- leverage our position as the largest U.S. regional carrier to allocate overhead and

underseat storage, lavatories,administrative expenses over a substantially larger platform, thereby reducing unit costs; andin-flight snack - •

- reduce our aircraft acquisition and

beveragefinancing costs by continuing to strengthen our balance sheet through the proceeds raised from this offering and by refinancing our debt and lease obligations where appropriate.

• Expand Existing and Develop New Code-Share Agreements. We enjoy strong relationships with our existing code-share partners and work closely with these partners to expand service to their existing markets, open new markets and schedule convenient and frequent flights. We view the continued development of our Delta and United relationships as significant opportunities to achieve stable, long-term growth of our business. We believe the principal reason SkyWest Airlines has attracted multiple code-share partners is its ability to maintain a competitive cost structure while delivering high-quality customer service. 1

5

-We believe that multiple code-share agreements with major carriers diversifies financial and operating risks by reducing reliance on a single major carrier. This diversification may also allow us to grow at a faster rate and not be limited by the rate at which any single partner can, or wishes to, grow. We intend to explore opportunities to develop additional code-share relationships with other carriers to the extent they are consistent with our business strategy.

• Focus on Larger Gauge Aircraft. We operate a greater number of large gauge regional jets than any other U.S. carrier. Large gauge regional jets, which seat approximately 70 or more passengers, offer significant opportunities for revenue and profitability growth among major and regional carriers. Most major carriers, including Delta and United, have recognized the growth opportunities created by larger regional aircraft and are exploring opportunities to add larger gauge regional jets, flown by themselves or their regional partners, to their flight systems. As of September 30, 2005, we operated a total of 72 CRJ700s, and we believe the expansion of our CRJ700 fleet will create growth opportunities in many markets in which we are the most competitive provider. For us, the operational commonality of CRJ700s and CRJ200s, which we have been flying and maintaining for more then eleven years, offers additional operating efficiencies which we believe will enable us to provide larger gauge services at lower costs than our competitors. SkyWest Airlines and ASA currently have combined firm orders to acquire an additional 37 CRJ700s (which can be configured to seat between 66 and 70 passengers) over the next two years and ASA is committed to sublease six additional CRJ200s from Delta commencing in early 2006. In addition, we have options to acquire an additional 80 Bombardier Regional Jets which we can elect to be delivered in configurations ranging between 66 and 90 seats. We believe the strength of our balance sheet has provided us the flexibility to place aircraft orders on a scale and timetable not easily matched by our competitors.

• Operate Limited TypesFleet Types. As of Aircraft. We operateSeptember 30, 2005, we operated 376 aircraft, principally of just two types, of aircraft,

Embraer EMB-120Bombardier Regional Jets and Brasilia turboprop aircraft ("Brasilia Turboprops") and

Canadair Regional Jets.turboprops. By simplifying our fleet, we believe we gainare able to limit our operating costs due to efficiencies in employee training, aircraft maintenance, lower spare parts inventory requirements and flight operations.

- Emphasize Contract Flying.aircraft scheduling. While ASA

currently operates twelve ATR-72 turboprops, we expect these aircraft to be removed from service by August 2007.

• Maintain a Positive Employee Culture. We believe our emphasis on fixed-fee contract

flying has reducedemployees have been, and will continue to be, a key to our exposure to fluctuations in fuel prices, fare

competitionsuccess. While none of the employees of SkyWest Airlines are represented by a union and passenger volumes. In the future,ASA's pilots, flight attendants and flight controllers are all unionized, we anticipate that our

contract flying operations as a percentage of our total daily flights

will increase as additional United and Delta contract flights are added

to the SkyWest system.

- Foster Our Employees' Best Efforts. With our anticipated growth in

capacity, it is importantbelieve that we encourage the best efforts ofoffer our employees in both our operating subsidiaries substantially similar compensation and minimize turnover in all positions. We have a number of

special employee compensation programsbenefits packages that we believe differentiate SkyWest asus from other carriers and make us an attractive place to work and build a career. With the expansion of our operations resulting from our acquisition of ASA, the best efforts of all of our employees will be required to achieve the potential benefits envisioned by the transaction and continue to make our business successful. We have neverbelieve that these factors, in combination with our historically low employee turnover rate, are a significant reason that neither SkyWest Airlines nor ASA has ever had a work stoppage and none of our employees are represented bydue to a union.

SkyWest's aircraft fleet consists of ninety-two 30-seat Brasilia

Turboprops, which, as of June 30, 2000, had an average age of 5.7 years, and

twelve 50-seat Canadair Regional Jets, which, as of June 30, 2000, had an

average age of 5.0 years. In order to accommodate our expanding operations, we

have placed a firm order to acquire an additional 54 Canadair Regional Jets over

the next four years and a conditional order to acquire an additional 40 Canadair

Regional Jets. If we acquire all such 94 aircraft, we will also be eligible to

exercise options to acquire an additional 155 Canadair Regional Jets, 95 of

which have been assigned scheduled delivery dates through 2005, and the balance

of which have unspecified delivery dates.strike or other labor dispute.

Our executive offices, which also serve as the executive offices of SkyWest Airlines, are located at 444 South River Road, St. George, Utah 84790. Our primary telephone number at that location is (435) 634-3000 and our web sitewebsite address is www.skywest.com. ASA's executive offices are located at 100 Hartsfield Centre Parkway, Suite 800, Atlanta, Georgia 30354. ASA's primary telephone number is (404) 766-1400, and its website address is www.flyasa.com. The information on our web sitethese websites is not part of this prospectus.

GROWTH OPPORTUNITIES

During the five fiscal years ended March 31, 2000, our total operating

revenues expanded at an annual growth rate

Our Operating Platforms

SkyWest Airlines offered approximately 1,501 daily scheduled departures as of 20.8%September 30, 2005, of which approximately 1,019 were United Express flights and approximately 482 were Delta Connection flights. SkyWest Airlines' operations are conducted from hubs located in Chicago (O'Hare), and we increased the number

of daily flights from approximately 550 in 1995 to approximately 1,000 in 2000.

All of our growth during the five-year period was internally generated. We have

not made any material business acquisitions. We believe that we are

well-positioned for continued growth for several reasons, including the

following:

- 54 New Canadair Regional Jets Under Contract. We have placed firm orders

for 54 additional Canadair Regional Jets to be delivered between

September 2000 and October 2003. We have contracts with Delta covering

our operation of 34 of such Canadair Regional Jets on a fixed-fee basis,

and we have contracts with United covering our operation of an additional

ten of such Canadair Regional Jets on a fixed-fee basis. The assignment

of the remaining ten Canadair Regional Jets that are under firm orders

will be determined upon United's completion of pending labor negotiations

with its pilots and modification of contractual limitations on the number

of regional jets that may be operated by United code-sharing partners.

- 40 Additional Canadair Regional Jets Under a Conditional Order and

Additional Opportunities for Placement. We have placed a conditional

order (which currently expires in January 2001) to acquire an additional

40 Canadair Regional Jets with delivery dates scheduled between March

2002 and December 2004. Although we do not have agreements with United or

Delta with respect to the placement of such Canadair Regional Jets, we

believe that there are numerous opportunities for expansion of our

relationship with both carriers. These opportunities include:

- West Coast for United. United does not currently operate any regional

jets from theDenver, Los Angeles, San Francisco, Portland, Seattle/Tacoma or Portland

markets. We expect United to deploy most of the 20 Canadair Regional

Jets we have designated for United service, and possibly additional

Canadair Regional Jets, to medium and longer-distance, low-volume

markets from such airports.

2

6

- Denver for United. We do not currently operate out of Denver

International Airport, but were recently selected by United to commence

Denver operations in October 2000 with two Canadair Regional Jets. In

May 2000, United announced that it will build a new $100 million

regional aircraft terminal in Denver. Construction of the facility is

scheduled to begin in 2001, and the terminal is expected to feature up

to 36 regional aircraft gates. We believe that United's Denver hub could

support up to 100 regional jets over the next several years. Because

SkyWest is the only United Express carrier located west of Denver, we

believe SkyWest is well-positioned to operate as United Express flying

westward out of Denver.

- Intermountain Flights for Delta. During 1999, Delta replaced its service

to six markets with our Canadair Regional Jets as part of its

rationalization process at Salt Lake City. Delta's rationalization

process involves increasingFor the numberyear ended December 31, 2004, SkyWest Airlines generated operating revenues of longer-haul east/westapproximately $1.16 billion, of which approximately 58% was attributable to United code-share service and 38% was attributable to Delta code-share service. The balance of our operating revenues was derived from code-share service we previously provided to Continental Airlines, Inc. as well as ground handling and other services. SkyWest Airlines' fleet as of September 30, 2005 consisted of 37 CRJ700s, all of which were flown for United; 125 CRJ200s, of which 65 were flown for United, 56 were flown for Delta and four were unassigned; and 63 Brasilia turboprops, of which 50 were flown for United and 13 were flown for Delta. SkyWest Airlines conducts its Delta code-share operations pursuant to the terms of a Delta Connection Agreement which obligates Delta to primarily compensate SkyWest Airlines for its direct costs associated with operating Delta Connection flights, intoplus a payment based on block hours flown. SkyWest Airlines' United operations are conducted under a United Express Agreement pursuant to which SkyWest Airlines is paid primarily on a fee-per-completed block hour and departure basis plus a margin based on performance incentives, and is reimbursed for fuel and certain other costs. Under the United Express Agreement, excess margins over certain percentages must be returned or shared with United, depending on various conditions.

ASA offered more than 900 daily scheduled departures as of September 30, 2005, all of which were Delta Connection flights. ASA's operations are conducted primarily from hubs located in Atlanta, Salt Lake City and Cincinnati. For the transitioningyear ended December 31, 2004, ASA generated operating revenues of approximately $947.6 million, substantially all of which was attributable to Delta code-share service. ASA's fleet as of September 30, 2005 consisted of 35 CRJ700s, 104 CRJ200s, and twelve ATR-72 turboprops. Under the terms of the ASA Delta Connection Agreement, Delta has agreed to compensate ASA for its direct costs associated with operating Delta Connection flights, plus, if ASA completes a certain minimum percentage of its regionalDelta Connection flights, to SkyWest. With its smaller aircraft, SkyWest can often

substitute several flightsa specified margin on such costs. Additionally, the ASA Delta Connection Agreement provides for eachincentive compensation upon satisfaction of certain performance goals. Under the ASA Delta flight, providing increased

frequency of service at a lower overall cost. As such rationalization

continues, we believe thatConnection Agreement, excess margins over certain percentages must be returned or shared with Delta, could substitute our Canadair Regional

Jets for many of its flights between Salt Lake City and other cities.

Delta currently has no system-wide limitationsdepending on the number of regional

jets operated by its code-sharing partners.

THE OFFERINGvarious conditions.

The Offering

The following information, which is based on 24,858,904the number of shares outstanding as of August 21, 2000,November 10, 2005, assumes that the underwriters do not exercise their over-allotmentoverallotment option to purchase 395,415600,000 additional shares. Please see "Underwriting" for more information concerning this option.

Common stock offered by SkyWest, Inc. ........ 2,500,000 shares

Common stock offered by the selling

stockholders.................................. 136,100 shares

| Common stock offered by SkyWest, Inc. | 4,000,000 shares | |

Common stock outstanding after the offering | 62,053,904 shares(1) | |

Use of proceeds | We estimate that our net proceeds from this offering will be approximately $123.5 million. We intend to use these net proceeds for repayment of short-term debt, reduction of amounts outstanding under our revolving credit facility, and working capital and general corporate purposes. See "Use of Proceeds" for more information concerning our proposed use of proceeds. | |

Risk factors | See "Risk Factors" and other information included in this prospectus for discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | |

Nasdaq National Market Symbol | "SKYW" | |

Overallotment option | 600,000 shares subject to the underwriters' overallotment option may be sold by us. |

- (1)

- The number of shares outstanding after the

offering(1)................................... 27,358,904 shares Use of proceeds............................... For expansion of our operations, including the acquisition of additional aircraft and related spare parts and support equipment, and for general corporate purposes. We will not receive any of the proceeds from the sale ofoffering excludes 6,996,038 shares of common stockby the selling stockholders. See "Use of Proceeds"reserved formore information concerning our proposed use of proceeds. Nasdaq National Market symbol................. "SKYW" - --------------- (1) Excludes 1,547,316 shares issuableissuance upon exercise of outstanding stock options with an estimated weighted average exercise price of $18.66 per share.

Summary Consolidated Financial and Operating Data

| | Historical | | | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma(1) | |||||||||||||||||||||||

| | | | | Nine Months Ended September 30, | ||||||||||||||||||||

| | Years Ended December 31, | | Nine Months Ended September 30, 2005 | |||||||||||||||||||||

| | Year Ended December 31, 2004 | |||||||||||||||||||||||

| | 2002(2) | 2003(2) | 2004(2) | 2004(2) | 2005(3) | |||||||||||||||||||

| | (in thousands, except share, per share and airline operating data) | |||||||||||||||||||||||

| Consolidated Statements of Income: | ||||||||||||||||||||||||

| Operating revenues | $ | 774,447 | $ | 888,026 | $ | 1,156,044 | $ | 829,356 | $ | 1,221,684 | $ | 2,091,486 | $ | 2,021,805 | ||||||||||

| Operating income (loss)(4) | 119,555 | 108,480 | 144,776 | 107,958 | 135,038 | (261,395 | ) | 224,168 | ||||||||||||||||

| Net income (loss) | 86,866 | 66,787 | 81,952 | 60,703 | 73,583 | (382,567 | ) | 100,770 | ||||||||||||||||

| Net income (loss) per common share: | ||||||||||||||||||||||||

| Basic | 1.52 | 1.16 | 1.42 | 1.05 | 1.27 | (6.61 | ) | 1.75 | ||||||||||||||||

| Diluted | 1.51 | 1.15 | 1.40 | 1.04 | 1.26 | (6.61 | ) | 1.72 | ||||||||||||||||

| Dividends declared per common share | $ | 0.08 | $ | 0.08 | $ | 0.12 | $ | 0.09 | $ | 0.09 | — | — | ||||||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||||||||||

| Basic | 57,229 | 57,745 | 57,858 | 57,991 | 57,729 | 57,858 | 57,729 | |||||||||||||||||

| Diluted | 57,551 | 58,127 | 58,350 | 58,478 | 58,512 | 58,350 | 58,512 | |||||||||||||||||

| Other Financial Data: | ||||||||||||||||||||||||

| Net cash from: | ||||||||||||||||||||||||

| Operating activities | 173,703 | 157,743 | 246,866 | 129,143 | 147,254 | 318,291 | 199,400 | |||||||||||||||||

| Investing activities | (120,592 | ) | (811,690 | ) | (237,525 | ) | (199,703 | ) | (398,079 | ) | (484,930 | ) | (266,452 | ) | ||||||||||

| Financing activities | 35,157 | 635,394 | (8,728 | ) | 2,559 | 248,400 | 37,129 | 84,751 | ||||||||||||||||

| Airline Operating Data: | ||||||||||||||||||||||||

| Passengers carried | 8,388,935 | 10,738,691 | 13,424,520 | 9,811,577 | 12,988,939 | 23,834,850 | 21,237,052 | |||||||||||||||||

| Revenue passenger miles (000s)(5) | 2,990,753 | 4,222,669 | 5,546,069 | 4,013,486 | 6,000,078 | 10,314,957 | 10,047,157 | |||||||||||||||||

| Available seat miles (000s)(6) | 4,356,053 | 5,875,029 | 7,546,318 | 5,453,588 | 8,001,001 | 14,456,733 | 13,540,685 | |||||||||||||||||

| Passenger load factor(7) | 68.7 | % | 71.9 | % | 73.5 | % | 73.6 | % | 75.0 | % | 71.4 | % | 74.2 | % | ||||||||||

| Revenue per available seat mile(8) | 17.8 | ¢ | 15.1 | ¢ | 15.3 | ¢ | 15.2 | ¢ | 15.3 | ¢ | 14.4 | ¢ | 14.9 | ¢ | ||||||||||

| Cost per available seat mile(9) | 15.1 | ¢ | 13.4 | ¢ | 13.6 | ¢ | 13.5 | ¢ | 13.9 | ¢ | 16.6 | ¢ | 13.8 | ¢ | ||||||||||

| EBITDA(10) | 198,062 | 193,797 | 231,643 | 171,960 | 214,856 | (103,074 | ) | 351,962 | ||||||||||||||||

| EBITDAR(10) | 301,380 | 318,733 | 377,584 | 277,744 | 359,408 | 97,416 | 529,117 | |||||||||||||||||

| Average passenger trip length (miles) | 356 | 393 | 413 | 409 | 462 | 433 | 473 | |||||||||||||||||

| Number of aircraft in service (end of period): | ||||||||||||||||||||||||

| Bombardier Regional Jets: | ||||||||||||||||||||||||

| Owned | 6 | 30 | 32 | 32 | 113 | 108 | 113 | |||||||||||||||||

| Leased | 67 | 79 | 101 | 96 | 188 | 139 | 188 | |||||||||||||||||

| Brasilia Turboprops: | ||||||||||||||||||||||||

| Owned | 21 | 21 | 21 | 21 | 15 | 21 | 15 | |||||||||||||||||

| Leased | 55 | 55 | 52 | 53 | 48 | 53 | 48 | |||||||||||||||||

| ATR-72 Turboprops (Leased) | 0 | 0 | 0 | 0 | 12 | 19 | 12 | |||||||||||||||||

| Total Aircraft | 149 | 185 | 206 | 202 | 376 | 340 | 376 | |||||||||||||||||

As of September 30, 2005 | ||||||

|---|---|---|---|---|---|---|

| | Actual | As Adjusted(11) | ||||

| | (in thousands) | |||||

| Consolidated Balance Sheet Information: | ||||||

| Cash and marketable securities | $ | 303,762 | $ | 337,430 | ||

| Aircraft and other equipment, net | 2,490,785 | 2,490,785 | ||||

| Total assets | 3,376,206 | 3,409,874 | ||||

| Long-term debt, including current maturities(12) | 1,779,779 | 1,779,779 | ||||

| Lines of credit | 90,000 | 0 | ||||

| Total stockholder's equity | 850,068 | 973,736 | ||||

- (1)

- The unaudited pro forma financial information included in these columns has been prepared to illustrate the pro forma effects of the acquisition of ASA as if it had occurred on January 1, 2004 and the pro forma effects of the amended Delta Connection Agreement entered into between ASA and Delta as of

August 21, 2000. RISK FACTORS See "Risk Factors" beginningSeptember 8, 2005, as if it had been entered into as of January 1, 2004. Such information has been prepared for informational purposes only and does not purport to be indicative of what would have resulted had the acquisition actually occurred onpage 5January 1, 2004 or what may result in the future. - (2)

- Reflects our operations for periods prior to our acquisition of ASA. Does not reflect the financial or operating performance of ASA.

- (3)

- Reflects financial and operating performance of ASA for the last 23 days of September, 2005, since the acquisition by SkyWest, Inc.

- (4)

- The pro forma consolidated operating loss of $261.4 million for the year ended December 31, 2004 includes an impairment of goodwill of $498.7 million. For the year ended December 31, 2004, operating income excluding the impairment of goodwill would have been $237.3 million.

- (5)

- Revenue passengers multiplied by miles carried.

- (6)

- Passenger seats available multiplied by miles flown.

- (7)

- Revenue passenger miles divided by available seat miles.

- (8)

- Total airline operating revenues divided by available seat miles.

- (9)

- Total operating and interest expenses divided by available seat miles. Total operating and interest expenses is not a

discussion of certain factors thatcalculation based on generally accepted accounting principles and should not be considered as an alternative to total operating expenses. Cost per available seat mile utilizing this measurement is included as it is a measurement recognized byprospective purchasers of our common stock. 37 SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATATHREE MONTHS ENDED FISCAL YEAR ENDED MARCH 31, JUNE 30, -------------------------------------------------------------- ----------------------- 1996 1997 1998 1999 2000 1999 2000 ---------- ---------- ---------- ---------- ---------- ---------- ---------- (DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)CONSOLIDATED STATEMENTS OF INCOME DATA(1): Operating revenues................. $ 212,483 $ 245,766 $ 266,135 $ 388,626 $ 474,778 $ 111,562 $ 130,387 Operating income................... 5,636 16,025 32,819 64,305 86,680 20,476 25,174 Net income......................... 4,366 10,111 21,944 41,835 57,104 13,581 16,547 Net income per common share: Basic............................ $ 0.21 $ 0.50 $ 1.06 $ 1.73 $ 2.32 $ 0.55 $ 0.67 Diluted.......................... $ 0.21 $ 0.50 $ 1.04 $ 1.69 $ 2.29 $ 0.55 $ 0.65 Dividends declared per common share............................ $ 0.13 $ 0.12 $ 0.10 $ 0.12 $ 0.13 $ 0.03 $ 0.04 OTHER FINANCIAL DATA: EBITDA(2).......................... $ 24,827 $ 38,388 $ 57,360 $ 95,747 $ 125,126 $ 29,408 $ 35,767 EBITDAR(2)......................... 53,094 70,378 91,061 143,721 179,399 42,629 49,691 Cash flows from (used by): Operating activities............. 26,864 31,971 48,407 78,006 86,499 18,401 40,546 Investing activities............. (50,090) (11,627) (15,224) (181,480) (105,328) (41,741) (43,068) Financing activities............. 20,339 (7,087) 68,803 15,939 (8,864) (2,894) 12,729 AIRLINE OPERATING DATA(3): Passengers carried................. 2,340,366 2,656,602 2,989,062 4,900,921 5,503,290 1,365,706 1,401,113 Revenue passenger miles (000s)..... 617,136 717,322 745,386 1,015,872 1,196,680 290,590 319,830 Available seat miles (000s)........ 1,254,334 1,413,170 1,463,975 1,844,123 2,165,380 525,104 565,409 Passenger load factor.............. 49.2% 50.8% 50.9% 55.1% 55.3% 55.3% 56.6% Breakeven load factor.............. 48.4% 47.9% 45.0% 46.3% 45.5% 45.4% 45.9% Yield per revenue passenger mile... 33.2c 33.3c 34.8c 37.5c 39.0c 37.8c 40.1c Revenue per available seat mile.... 16.9c 17.3c 18.1c 21.0c 21.8c 21.1c 23.0c Cost per available seat mile....... 16.6c 16.3c 16.0c 17.6c 18.0c 17.4c 18.6c Average passenger trip length (miles).......................... 264 270 249 207 217 213 228 Number of aircraft (end of period): Canadair Regional Jet............ 10 10 10 11 11 11 12 Embraer Brasilia Turboprop....... 35 50 50 88 92 89 92 Fairchild Metroliner III......... 18 -- -- -- -- -- -- ---------- ---------- ---------- ---------- ---------- ---------- ---------- Total aircraft................. 63 60 60 99 103 100 104 ========== ========== ========== ========== ========== ========== ==========AS OF JUNE 30, 2000 -------------------------- ACTUAL AS ADJUSTED(4) -------- --------------CONSOLIDATED BALANCE SHEET DATA: Cash and marketable securities............................ $189,675 $296,472 Working capital........................................... 160,692 267,489 Property and equipment, net............................... 260,734 260,734 Total assets.............................................. 515,260 622,057 Long-term debt, including current maturities(5)........... 74,043 74,043 Stockholders' equity...................................... 328,324 435,121- --------------- (1) Reflectsthereclassification of consolidated statements of income data to reflect the operations of Scenic Airlines, Inc., a subsidiary we sold in 1999 which provided sight-seeing tours of the Grand Canyon area, as discontinued operations. (2)investing public. - (10)

- EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. EBITDAR represents earnings before interest expense, income taxes, depreciation, amortization and

rental expense.aircraft rents. See "Selected Consolidated Financial and Operating Data" herein for a reconciliation of EBITDA and EBITDAR to net cash from operating activities for the periods indicated. EBITDA and EBITDAR arewidely accepted financial indicators of a company's ability to incur and service debt. Neither EBITDA nor EBITDAR should, however, be considered in isolation, as a substitute for net income or cash flow prepared in accordance withnot calculations based on generally accepted accounting principlesorand should not be considered as alternatives to cash flow as a measure ofa company's profitability orliquidity.For the fiscal year ended March 31, 1996,In addition, our calculations may not be comparable to other similarly titled measures of other companies. EBITDA and EBITDARdataare included as supplemental disclosures because they may provide useful information regarding our ability to service debt and lease payments and to fund capital expenditures. Our ability to service debt and lease payments and to fund capital expenditures in the future, however, may be affected by other operating or legal requirements or uncertainties. Currently, aircraft and engine ownership costs are our most significant cash expenditure. In addition, EBITDA and EBITDAR are well recognized performance measurements in the regional airline industry and, consequently, we havenot been reduced to reflect $6.2 million of fleet restructuring and transition expenses. (3) Excludes the operations of Scenic Airlines, Inc., a subsidiary we sold in 1999, and National Parks Transportation, Inc., a subsidiary we sold on July 21, 2000, which operates a rental car business serving small regional airports. (4)provided this information. - (11)

- Adjusted to reflect the sale of

2,500,000shares we are offering hereby at an assumed offering price of$45.13$32.59 per share, and the application of the estimated net proceeds therefrom.(5) - (12)

- At

JuneSeptember 30,2000, 822005, 248 of the aircraft operated by SkyWest Airlines and ASA were financed through operating leases. In addition to our indebtedness, at September 30, 2005, we had$554.2 millionapproximately $3.2 billion of mandatory future minimum payments under operating leases, primarily for aircraft and ground facilities. Atan 8%a 7% discount factor, the present value of these obligations would be equal to approximately$365.5 million at June 30, 2000. 48$2.0 billion.

Before you invest in theour common stock, offered with this prospectus, you should be aware that such investment involves a high degree of risk, including thosethe risks described below. You should consider carefully these risk factors, together with all of the other information included in this prospectus, before you decide to purchase any shares of our common stock. Additional risks and uncertainties not presently known to us or that we currently do not deem material may also impair our business operations. If any of the risks we describe below occur, or if any unforeseen risk develops, our operating results may suffer, our financial condition may deteriorate, the trading price of our common stock may decline and you may lose all or part of your investment.

This prospectus contains various "forward-looking statements" within

Risks Related to Our Operations

We may be negatively impacted by the meaningtroubled financial condition, bankruptcy proceedings and restructurings of Section 27ADelta and United.

Substantially all of our revenues are attributable to our code-share agreements with Delta and United, both of which are currently reorganizing under Chapter 11 of the Securities Act of 1933, as amended, and Section

21EU.S. Bankruptcy Code. The U.S. Bankruptcy Courts charged with administration of the Securities Exchange ActDelta and United bankruptcy cases have entered final orders approving or authorizing the assumption of 1934, as amended. Such statements can be

identifiedour code-share agreements. Notwithstanding those judicial actions, both bankruptcy cases present considerable continuing risks and uncertainties for our code-share agreements and, consequently, for our operations.

Although Delta and United have reported that they intend to reorganize and emerge from Chapter 11, there is no assurance that either of their reorganizations will succeed or that Delta and United ultimately will remain going concerns. Likewise, even though Delta has assumed our Delta Connection Agreements with U.S. Bankruptcy Court approval and the SkyWest Airlines' United Express Agreement was approved by the useU.S. Bankruptcy Court prior to its execution, there is no assurance that these agreements will survive the Chapter 11 cases. A Bankruptcy Court could still approve the termination of our code-share agreements under certain circumstances. For example, either or both of the forward-looking words "anticipate," "estimate,"

"project," "likely," "believe," "intend," "expect," "hope"Delta and United reorganizations could be converted to liquidations, or similar words.

These statements discuss future expectations, contain projections regarding

future developments, operations Delta and/or financial conditions,United could liquidate some or state other

forward-looking information. When considering such forward-looking statements,

you should keep in mind the risks noted in this "Risk Factors" section and other

cautionary statements throughout this prospectus, any prospectus supplement, and

our periodic filings with the SEC that are incorporated by reference. You should

also keep in mind that all forward-looking statements are based on our existing

beliefs about present and future events outside of our control and on

assumptions that may prove to be incorrect. Iftheir assets through one or more risks identified in

this prospectus, a prospectus supplement,transactions with one or any applicable filings

materializes, more third parties with Bankruptcy Court approval. In addition, Delta and/or any other underlying assumptions prove incorrect, our actual

resultsUnited may vary materially from those anticipated, estimated, projected or

intended.

RISKS RELATED TO OUR OPERATIONS

WE ARE DEPENDENT ON OUR CODE-SHARING RELATIONSHIPS WITH UNITED AND DELTA.

Terminationnot be able to develop, prosecute, confirm and consummate successful plans of Relationship. We depend on relationships created by

code-sharing agreements with United and Deltareorganization that provide for a substantial portioncontinued performance of our

business. Our code-sharing agreement with United terminates on May 31, 2008.

Nevertheless,their obligations under the United code-sharing agreement is subject to termination by

United upon 180 days' prior notice for any or no reason. The termcode-share agreements.

Other aspects of the Delta code-sharing agreement continues until June 20, 2010, but is subjectand United Chapter 11 cases pose additional risks to termination inour code-share agreements. Delta and/or United may not be able to obtain Bankruptcy Court approval of various circumstancesmotions necessary for them to administer their respective bankruptcy cases. As a consequence, they may not be able to maintain normal commercial terms with vendors and service providers, including 180 days' notice by either party

for any or no reason. Any material modificationother code-share partners, that are critical to ortheir operations. They also may be unable to reach satisfactory resolutions of disputes arising out of collective bargaining agreements. In addition, they may not be able to obtain sufficient financing to fund their businesses while they reorganize. These and other factors not identified here of which we are not aware could delay the resolution of the Delta and United Chapter 11 cases significantly and could threaten the ability of Delta and United to emerge from bankruptcy.

In light of the importance of the code-share agreements with Delta and United to our business, the termination of these agreements or the failure of either Delta or United to emerge from bankruptcy could jeopardize our code-

sharing agreements with United or Deltaoperations. Such events could leave us unable to operate much of our current aircraft fleet and the additional aircraft we are obligated to purchase. As a result, they could have a material adverse effect on our operations and financial condition.

Even if Delta and United successfully emerge from bankruptcy, their respective financial positions will continue to pose risks for our operations. Serial bankruptcies are not unprecedented in

the commercial airline industry, and Delta and/or United could file for bankruptcy again after emergence from their present Chapter 11 cases, in which case our code-share agreements could be subject to termination under the Bankruptcy Code. Regardless of whether subsequent bankruptcy filings prove to be necessary, Delta and United have required, and will likely continue to require, our participation in efforts to reduce costs and improve their respective financial positions. These efforts could result in lower utilization rates of our aircraft, lower departure rates on the contract flying portion of our business, and more volatile operating margins. We believe that any of these developments could have a negative effect on many aspects of our operations and financial performance.

We are highly dependent on Delta and United.

The current terms of the SkyWest Airlines and ASA Delta Connection Agreements are subject to certain early termination provisions. Delta's termination rights include cross-termination rights (meaning that a breach by SkyWest Airlines or ASA of its Delta Connection Agreement could, under certain circumstances, permit Delta to terminate both Delta Connection Agreements), the right to terminate each of the Delta Connection Agreements upon the occurrence of certain force majeure events (including certain labor-related events) that prevent SkyWest Airlines or ASA from performance for certain periods and the right to terminate each of the Delta Connection Agreements if SkyWest Airlines or ASA, as applicable, fails to maintain competitive base rate costs, subject to certain rights of SkyWest Airlines or ASA, as applicable, to take corrective action by adjusting its base rate costs. Furthermore, upon certain terminations of our Delta Connection Agreements, Delta could require us to transfer to them certain gates that we control, including the gates at Atlanta's Hartsfield-Jackson International Airport. The current term of our United Express Agreement is subject to certain early termination provisions and subsequent renewals. United may terminate the United Express Agreement due to an uncured breach by SkyWest Airlines of certain operational and performance provisions, including measures and standards related to flight completions, baggage handling and on-time arrivals. Additionally, upon certain terminations of the United Express Agreement, United could require us to transfer aircraft in service under the United Express Agreement to United.

If any of our code-share agreements are terminated pursuant to the terms of those agreements, due to the ultimate resolution of the bankruptcy proceedings of Delta and United, or otherwise, we would be significantly impacted and likely would not have an immediate source of revenue or earnings to offset such loss. A termination of any of these agreements would have a material adverse effect on our financial condition, operating revenues and net income unless we are able to enter into satisfactory substitute arrangements for the utilization of these aircraft by other code-share partners, or, alternatively, obtain the airport facilities and gates and make the other arrangements necessary to fly as an independent airline. We may not be able to enter into substitute code-share arrangements, and any such arrangements we might secure may not be as favorable to us as our current agreements. Operating our airline independent from major partners would be a significant departure from our business plan, would likely be very difficult and may require significant time and resources, which may not be available to us at that point.

We currently use Delta's and United's systems, facilities and services to support a significant portion of our operations, including airport and terminal facilities and operations, information technology support, ticketing and reservations, scheduling, dispatching, fuel purchasing and ground handling services. If Delta or United were to cease any of these operations or no longer provide these services to us, due to termination of one of our code-share agreements, a strike by Delta or United personnel or for any other reason, we may not be able to replace these services on terms and conditions as favorable as those we currently receive, or at all. Since our revenues and operating profits are dependent on our level of flight operations, we could then be forced to significantly reduce our operations. As a result, in order to offer airline service after termination of any of our code-share

agreements, we may have to replace these airport facilities, assets and services. We may be unable to arrange such replacements on satisfactory terms, or at all.

We may not achieve the potential benefits of the ASA acquisition.

Our achievement of the potential benefits of the ASA acquisition will depend, in substantial part, on our ability to successfully implement our business strategy, including improving the utilization of equipment and facilities, increasing employee productivity and allocating overhead and administrative expenses over a larger platform. The implementation of our ASA acquisition strategy may be costly, complex and time-consuming, and the managements of SkyWest Airlines and ASA will have to devote substantial effort to such integration. If we are not able to successfully achieve these objectives, the potential benefits of the ASA acquisition may not be realized fully or at all, or it may take longer to realize than expected. In addition, assumptions underlying estimates of expected cost savings and expected revenues may be inaccurate, or general industry and business conditions may deteriorate. Our combined operations with ASA may experience increased competition that limits our ability to expand our business. We cannot assure you that the ASA acquisition will result in combined results of operations and financial condition consistent with our expectations or superior to what we and ASA could have achieved independently. Nor do we represent to you that any estimates or projections we have developed or presented in connection with the ASA acquisition can or will be achieved.

The amounts we receive under our code-share agreements may be less than the actual amounts of the corresponding costs we incur.

Under our code-share agreements with Delta and United, we are primarily compensated for certain costs we incur in providing services. With respect to costs that are defined as "pass-through" costs, our code-share partner is obligated to pay to us the actual amount of the cost (and, with respect to the ASA Delta Connection Agreement, a pre-determined rate of return based upon the actual cost we incur). With respect to other costs, our code-share partner is obligated to pay to us amounts based, in part, on pre-determined rates for certain costs. During the nine months ended September 30, 2005, approximately 57% of our costs were pass-through costs and 43% of our costs were reimbursable at pre-determined rates. These pre-determined rates may not be based on the actual expenses we incur in delivering the associated services. If we incur expenses that are greater than the pre-determined reimbursement amounts payable by our code-share partners, our financial results will be negatively affected.

We have a significant amount of contractual obligations.

As of September 30, 2005, we had a total of approximately $1.8 billion in total long-term debt obligations. Substantially all of this long-term debt was incurred in connection with the acquisition of aircraft, engines and related spare parts. We also have significant long-term lease obligations primarily relating to our aircraft fleet. These leases are classified as operating leases and therefore are not reflected as liabilities in our condensed consolidated balance sheets. At September 30, 2005, we had 222 aircraft under lease, including 26 aircraft leased from Delta at nominal rates, with remaining terms ranging from one to 17.5 years. Future minimum lease payments due under all long-term operating leases were approximately $3.2 billion at September 30, 2005. At a 7% discount factor, the present value of these lease obligations was equal to approximately $2.0 billion at September 30, 2005. As of September 30, 2005, our total aircraft commitments consisted of 37 CRJ700s and six CRJ200s over the next two years, with gross committed expenditures for these aircraft and related equipment (including amounts for contractual price escalations) estimated to be approximately $1.1 billion. We continued taking delivery of these aircraft in October 2005 and expect to complete these deliveries in April 2007. Our high level of fixed obligations could impact our ability to obtain additional financing to support

additional expansion plans or divert cash flows from operations and expansion plans to service the fixed obligations.

There are risks associated with our regional jet strategy, including potential oversupply and possible passenger dissatisfaction.

Our selection of Bombardier Regional Jets as the primary aircraft for our existing operations and projected growth involves risks, including the possibility that there may be an oversupply of regional jets available for sale in the foreseeable future, due, in part, to the financial difficulties of regional and major airlines, including Delta, United, Northwest, Comair, Mesaba, and FLYi. A large supply of regional jets may allow other carriers, or even new carriers, to acquire aircraft for unusually low acquisition costs, allowing them to compete more effectively in the industry, which may ultimately harm our operations and financial performance.

Our regional jet strategy also presents the risk that passengers may find the Bombardier Regional Jets to be less attractive than other aircraft, including other regional jets. Recently, other models of regional jets have been introduced by manufacturers other than Bombardier. If passengers develop a preference for other regional jet models, our results of operation and financial results could be negatively impacted.

We may be limited from expanding our flying within the Delta and United flight systems, and there are constraints on our ability to provide airline services to airlines other than Delta and United.

Additional growth opportunities within the Delta and United flight systems are limited by various factors. Except as currently contemplated by our existing code-share agreements, we cannot assure that Delta or United will contract with us to fly any additional aircraft. We may not receive additional growth opportunities, or may agree to modifications to our code-share agreements that reduce certain benefits to us in order to obtain additional aircraft, or for other reasons. Furthermore, the troubled financial condition, bankruptcies and restructurings of Delta and United may reduce the growth of regional flying within their flight systems. Given the troubled nature of the airline industry, we believe that some of our competitors may be more inclined to accept reduced margins and less favorable contract terms in order to secure new or additional code-share operations. Even if we are offered growth opportunities by our major partners, those opportunities may involve economic terms or financing commitments that are unacceptable to us. Any one or more of these factors may reduce or eliminate our ability to expand our flight operations with our existing code-share partners. Additionally, even if Delta and/or United choose to expand our fleet on terms acceptable to us, they may be allowed at any time to subsequently reduce the number of aircraft covered by our code-share agreements. We also cannot assure you that we will be able to obtain the additional ground and maintenance facilities, including gates, and support equipment, to expand our operations. The failure to obtain these facilities and equipment would likely impede our efforts to implement our business strategy and could materially adversely affect our operating results and our financial condition.

Delta and/or United may be restricted in increasing their business with us, due to "scope" clauses in the current collective bargaining agreements with their pilots that restrict the number and size of regional jets that may be operated in their flight systems not flown by their pilots. Delta's scope limitations restrict its partners from operating aircraft with over 70 seats even if those aircraft are operated for an airline other than Delta. We cannot assure that these scope clauses will not become more restrictive in the future. Any additional limit on the number of regional jets we can fly for our code-share partners could have a material adverse effect on our expansion plans and the price of our common stock. Delta Air Lines has adopted a

policy of orderly monetization of minority ownership positions it holds in

various companies. Consistent with this policy, Delta has already sold all or

portions of its stakes in at least three other travel-related businesses. Delta

has advised us that it may in the future consider the sale of all or a portion

of its 3,107,798 shares of common stock in our company. Delta's stockholdings in

our company may serve as a disincentive for Delta to terminate its code-sharing

relationship with SkyWest or take other actions adverse to SkyWest. If Delta

significantly reduces or completely liquidates its stock ownership in our

company, Delta may be more likely to take actions, including terminating the

code-sharing agreement, which would have an adverse effect on our share price.

Direct Operation of Regional Jets by Majors.

Our code-sharing relationships

dependbusiness models depends on major airlines, likeincluding Delta and United, and Delta electing to contract with us instead of purchasing and operating their own regional jets. However, theseSome major airlines, possess the resources to acquireincluding Delta,