As filed with the Securities and Exchange Commission on September 18, 2017.

Registration No. 333-219263333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3/A

REGISTRATION STATEMENT

Nova LifeStyle, Inc.

(Exact Namename of Registrantregistrant as Specifiedspecified in Its Charter)

Nevada | 90-0746568 | |

(State or incorporation or | (I.R.S. No.)Identification |

6565 E. Washington Blvd.

Commerce, CA 90040

(323) 888-9999

(Address Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Copies to:

Ralph V. De Martino, Esq.

Schiff Hardin LLP

901 K Street NW, Suite 200

700

Washington, D.C. 20007-3501

Tel: (202) 965-7880

Fax: (202) 778-6460

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of thisIf the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this formForm is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this formForm is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this formForm is a registration statement pursuant to General Instruction I.D.I.C. or a post-effective amendment thereto that shall become effective upon filing with the CommissionSEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this formForm is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.I.C. filed to register additional securities or additional classes of securities pursuant to ruleRule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”company as defined in Rule 12b-2405 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||

| Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

☐

Title of Securities To Be Registered (1) | Amount To Be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price (2) | Amount Of Registration Fee (3) | |||||||||||||

| Common Stock, $0.001 par value per share | |||||||||||||||||

| Preferred Stock | |||||||||||||||||

| Warrants | |||||||||||||||||

| Units | |||||||||||||||||

| Total | $ | 60,000,000 | N/A | $ | 60,000,000 | $ | 6,954.00 | (4) | |||||||||

| Title of Security Being Registered | Amount Being Registered (1) | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee | |||||||||

| Common Stock, par value $0.001 per share, to be offered by the selling shareholders | 1,225,959 | $ | 2,556,125 | $ | 237 | |||||||

(1) Fee computed pursuant to Rule 457(a) under the Securities Act of 1933. All of the shares being registered are offered by the Selling Shareholders listed in the registration statement. Accordingly, this registration statement includes an indeterminate number of additional shares of common stock issuable for no additional consideration pursuant to any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration, which results in an increase in the number of outstanding shares of our common stock. In the event of a stock split, stock dividend or similar transaction involving our common stock, in order to prevent dilution, and any other provisions of the warrants underlying the common stock that result in an adjustment of the number of shares to be issued, the number of shares registered shall be automatically increased to cover the additional shares in accordance with Rule 416(a) under the Securities Act of 1933.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices per share of the registrant’s shares as reported on The Nasdaq Stock Market on November 23, 2021.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until thethis Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated [________ __], 2021

PRELIMINARY PROSPECTUS

1,225,959 shares of Common Stock

Sold in a Private Placement

Offered by the Selling Shareholders of

This prospectus relates to the offer from timeand sale of up to time1,114,508 shares of our common stock, par value $0.001 (“Common Stock”per shares (the “shares”), preferred stock,issuable upon the exercise of warrants and units that include any of these securities. The aggregate initial offeringat an exercise price of the securities sold under this prospectus will not exceed $60,000,000. We will offer the securities in amounts, at prices and on terms$3.50 per share (the “July 2021 Warrants”), up to be determined at the time of the offering.

The Selling Shareholders may sell any securities, their names,or all of the shares on any stock exchange, market or trading facility on which the shares are traded or in privately negotiated transactions at fixed prices that may be changed, at market prices prevailing at the time of sale or at negotiated prices. Information on the Selling Shareholders and the times and manners in which they may offer and sell our shares is described under the sections entitled “Selling Shareholders” and “Plan of Distribution” in this prospectus. While we will bear all costs, expenses and fees in connection with the registration of the shares, we will not receive any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculableof the proceeds from the information set forth, insale of our shares by the applicableSelling Shareholders.

Our shares are currently traded on the Nasdaq Stock Market under the symbol “NVFY”. On November 23, 2021, the closing price for our shares on Nasdaq was $2.05 per share.

We may amend or supplement this prospectus supplement. See the section entitled “About This Prospectus” for more information.

Investing in our securities involves certain risks. See “Risk Factors”“Risk Factors” beginning on page 45 of this prospectus. In addition, see “

Risk FactorsNEITHER THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.”

PROSPECTUS DATED [_], 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is filed in our Annual Report on Form 10-K for the year ended December 31, 2016, which has beenconjunction with a registration statement that we filed with the Securities and Exchange Commission and is incorporated by reference intoCommission. Under this prospectus. You should carefully read and consider these risk factors before you investregistration process, the selling shareholders may from time to time sell up to 1,225,959 shares in our securities.

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The selling shareholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

Certain Defined Terms and Conventions

Unless otherwise indicated, references in this prospectus to:

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purpose of this prospectus only, Taiwan and the special administrative regions of Hong Kong and Macau. | |

| ● | “Warrants” collectively refers to the July 2021 Warrants and the Placement Agent Warrants. | |

| ● | “shares” and “common shares” are to shares of our Common Stock, par value $0.001 per share. | |

| ● | “US$” and “U.S. dollars” are to the legal currency of the United States. | |

| ● | “we,” “us,” “our,” refer to Nova LifeStyle, Inc. a Nevada corporation, and its subsidiaries. |

��

| 1 |

WHERE YOU CAN FIND MORE INFORMATION

For the purposes of this section, the term registration statement means the original registration statement and any and all amendments including the schedules and exhibits to the original registration statement or any amendment. This prospectus does not contain all of the information included in the registration statement we filed. For further information regarding us and the shares offered in this prospectus, you may desire to review the full registration statement, including the exhibits. The registration statement, including its exhibits and schedules, may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling 1-202-551-8090. Copies of such materials are also available by mail from the Public Reference Branch of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. In addition, the SEC maintains a website (http://www.sec.gov) from which interested persons can electronically access the registration statement, including the exhibits and schedules to the registration statement.

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In accordance with the Exchange Act, we file reports with the SEC, including annual reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such documents should not create any implication that there has been no change in our affairs since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information contained in documents that we have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus and information incorporated by reference into this prospectus, including without limitation, a discussion of any risk factors or other special considerationsyou should rely on the information contained in the document that apply to these offerings or securities orwas filed later.

We incorporate by reference the specific plan of distribution.documents listed below:

| ● | our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on March 29, 2021 and | |

| ● | our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2021, June 30, 2021, and September 30, 2021, filed on May 17, 2021, August 16, 2021 and November 15, 2021, respectively; | |

| ● | All documents that we file with the SEC on or after the effective time of this prospectus pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 and prior to the sale of all the securities registered hereunder or the termination of the registration statement. |

| 2 |

Unless expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC.

We will provide to each person, including in any beneficial owner, who receives a copy of this prospectus, upon written or oral request, without charge, a copy of any or all of the materials thatdocuments we refer to above which we have incorporated by reference in this prospectus, except for exhibits to such documents unless the exhibits are specifically incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you informationprospectus. You should direct your requests to the attention of our chief financial officer at our principal executive office located at 6565 E. Washington Blvd., Commerce, CA 90040. Our telephone number at this sort, you should not rely on it as authorized by us. address is (323) 888-9999.

You should rely only on the information contained or incorporated by reference in this prospectus, andin any accompanyingapplicable prospectus supplement.

You should also read and consider the information contained in the documents identified under the heading “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” in this prospectusOur Business.

Nova LifeStyle, Inc. is a broad based distributor and retailer of contemporary styled residential and commercial furniture incorporated into a dynamic marketing and sales platform offering retail as well as online selection and global purchase fulfillment globally.fulfillment. We monitor popular trends and workproducts to create design elements that are then integrated into our product lines that can be used as both stand-alone or whole-room and home furnishing solutions. Through our global network of retailers, e-commerce platforms, stagers and hospitality providers, Nova LifeStyle also sells (through an exclusive third partythird-party manufacturing partner) a managed variety of high quality bedding foundation components.

Our customers principally consist of distributors and retailers havingwith specific geographic coveragesterritories that deploy middle to high end private label home furnishings havingwhich have very little competitive overlap withinwith our specific furnishingsfurnishing products or product lines. Nova LifeStyle is constantly seeking to integrate new sources of distribution and manufacturing that are properly aligned with our growth strategy, thus allowingstrategy. This allows us to continually focus on building both same store sales growth as well as drive the expansion of our overall distribution and manufacturing relationships through a deployment of popular, as well as trend-based, furnishing solutions worldwide.

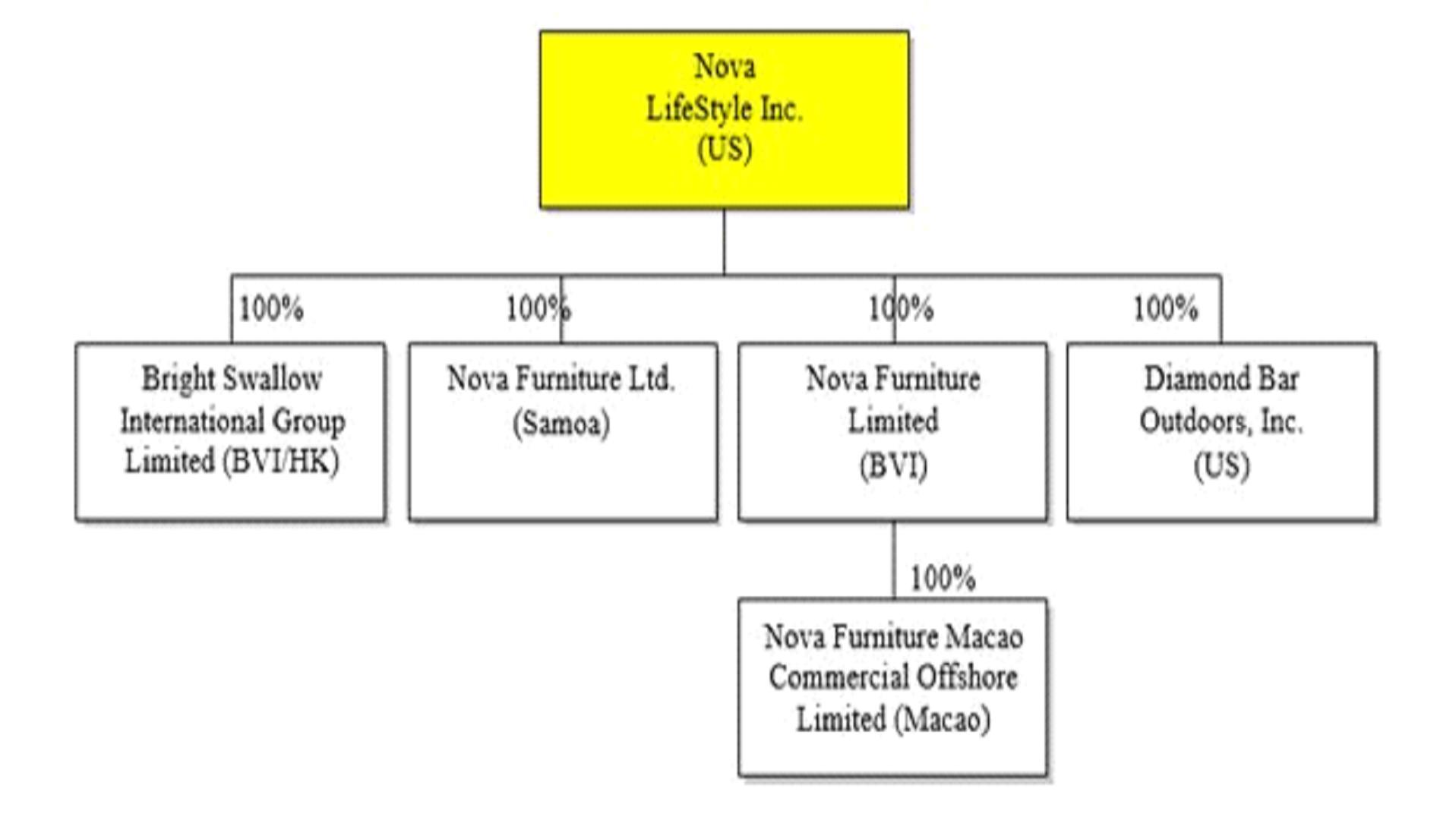

We are a U.S. holding company with no material assets in the U.S. other than the ownership interests of our wholly owned subsidiaries through which we market, design and sell residential furniture worldwide: Nova Furniture Limited domiciled in the British Virgin Islands (“Nova Furniture”), Nova Furniture LimitedLtd. Domiciled in Samoa (“Nova Samoa”), Diamond Bar Outdoors, Inc. domiciled in California (“Diamond Bar”), Nova Living (M) SDN. BHD. Domiciled in Malaysia (“Nova Malaysia”) and Nova Living (HK) Group Limited domiciled in Hong Kong (“Nova HK”). We had two former subsidiaries Bright Swallow International Group Limited domiciled in Hong Kong (“Bright Swallow” or “BSI”) which was sold in January 2020 and Nova Furniture Macao Commercial Offshore Limited domiciled in Macao (“Nova Macao”), Bright Swallow International Group Limited (“Bright Swallow”), which was de-registration and Diamond Bar Outdoors,liquidation in January 2021. On December 7, 2017, we incorporated i Design Blockchain Technology, Inc. (“Diamond Bar”). Nova Macao was organized under the laws of Macao on May 20, 2006. Nova Macao is a wholly owned subsidiary of Nova Furniture. Diamond Bar, doing business as Diamond Sofa, is a California corporation organized on June 15, 2000, which we acquired pursuant to a stock purchase agreement on August 31, 2011. On April 24, 2013, we acquired all of the outstanding stock of Bright Swallow; the purchase price was $6.5 million in cash and was fully paid at the closing of the acquisition.

| 3 |

3Company Information

Our principal executive offices are located at 6565 E. Washington Blvd., Commerce, CA 90040. Our telephone number is (323) 888-9999 and our website address is www.novalifestyle.com. TheWe do not incorporate by reference into this prospectus the information contained on our website, isand you should not consider it as part of this prospectus.

July 2021 Capital Raising Transaction

On July 23, 2021, Nova LifeStyle, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors (the “Investors”) for the sale by the Company of 1,114,508 shares (the “Common shares”) of the Company’s common stock (the “Common Stock”), at a purchase price of $2.80 per share. Concurrently with the sale of the Common shares, pursuant to a registered direct shelf takedown. The Common shares were offered and sold by the Company pursuant to an effective shelf registration statement on Form S-3, which was filed with the Securities and Exchange Commission (the “SEC”) on October 8, 2020 and subsequently declared effective on October 15, 2020 (File No. 333-249384) (the “Registration Statement”), and the base prospectus contained therein. In a concurrent private placement, we sold to such investors warrants to purchase 1,114,508 shares of Common Stock (the “July 2021 Warrants”). The July 2021 Warrants and the shares issuable upon exercise of those warrants were sold without registration under the Securities Act of 1933 (the “Securities Act”) in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and Rule 506 promulgated under the Securities Act as sales to accredited investors, and in reliance on similar exemptions under applicable state laws. The Company sold the Common shares and July 2021 Warrants for aggregate gross proceeds of approximately $3.1 million. The net proceeds from the transactions was approximately $2.9 million after deducting certain fees due to the placement agent and the Company’s estimated transaction expenses. The net proceeds received by the Company from the transactions will be used for working capital and for general corporate purposes.

Subject to certain beneficial ownership limitations, the July 2021 Warrants will be initially exercisable on the six-month anniversary of the issuance date at an exercise price equal to $3.50 per share of Common Stock, subject to adjustments as provided under the terms of the Warrants. The Warrants are exercisable for five years from the initial exercise date. The closing of the sales of these securities under the Purchase Agreement occurred on July 27, 2021, subject to the satisfaction of customary closing conditions.

Under the Purchase Agreement, the Company is precluded from engaging in equity or equity-linked securities offerings for a period of 90 days from closing of the offering, subject to certain exceptions. In addition, the Company agreed with the Investors that until the earlier of one year following the offering or the date on which no Investor holds any Warrants, the Company will not incorporated herein.effect or enter into an agreement to effect a “Variable Rate Transaction,” which means a transaction in which the Company:

● issues or sells any convertible securities either (A) at a conversion, exercise or exchange rate or other price that is based upon and/or varies with the trading prices of, or quotations for, the Company’s common stock at any time after the initial issuance of such convertible securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such convertible securities or upon the occurrence of specified or contingent events directly or indirectly related to the Company’s business or the market for the Company’s common stock; or

● enters into any agreement (including, without limitation, an “equity line of credit”) whereby the Company may sell securities at a future determined price (other than standard and customary “preemptive” or “participation” rights).

| 4 |

We agreed with the Investors that, subject to certain exceptions, if the Company issues securities within the two years following the closing of this offering, the Investors shall have the right to purchase 35% of the securities on the same terms, conditions and price provided for in the proposed issuance of securities.

The representations, warranties and covenants contained in the Purchase Agreement were made solely for the benefit of the parties to the Purchase Agreement. In addition, such representations, warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by stockholders of, or other investors in, the Company. Accordingly, the Purchase Agreement is included as an exhibit to the registration statement only to provide investors with information regarding the terms of transaction, and not to provide investors with any other factual information regarding the Company. Stockholders should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

The Company also entered into an engagement agreement with Dawson James Securities, Inc. (“Dawson”), pursuant to which Dawson agreed to serve as exclusive placement agent for the issuance and sale of the Common shares and Warrants. The Company agreed to pay Dawson an aggregate fee equal to 8.0% of the gross proceeds received by the Company from the sale of the securities in the transactions. Pursuant to the engagement agreement, the Company also granted to Dawson or its designees warrants to purchase up to 5.0% of the aggregate number of securities sold in the transactions (the “Placement Agent Warrants”) at an exercise price of $3.50 per Common Share and Warrant. The Placement Agent Warrants will expire on July 23, 2026. The Placement Agent Warrants and the shares issuable upon exercise of the Placement Agent Warrants will be issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and in reliance on similar exemptions under applicable state laws. The Company also reimbursed Dawson for its expenses in the amount of $60,000. The offer and sale of the shares issuable upon exercise of the Placement Agent Warrants are covered by this Prospectus.

4

Any investment in our securitiesthe shares is speculative and involves a high degree of risk. Before making anyan investment decision, you should carefully consider the risk factors set forth below,risks described under the caption “Risk Factors” in any applicable prospectus supplement and under the caption “Risk Factors” in our most recent annual reportAnnual Report on Form 10-K, andor any updates in our subsequent quarterly reportsQuarterly Reports on Form 10-Q, which aretogether with all of the other information appearing in, or incorporated by reference ininto, this prospectus, as well as in any applicable prospectus supplement, as updated byprospectus. The risks so described are not the only risks facing our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Warrants may not have value.

The Warrants underlying the Offering

Holders of our Common Stock, preferred stock, warrants, units or any combination of the foregoing in the public market, or the perception that such sales could occur, could negatively impact the price of our Common Stock. If one or more of ourWarrants will have no rights as shareholders were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing market price of our Common Stock could be negatively affected.

The holders of the securities pursuantWarrants have no rights with respect to our common stock until they acquire shares upon exercise of such warrants. Upon such exercise, they will be entitled to exercise the rights of a holder of common stock only as to matters for which the record date occurs after the exercise date.

| 5 |

There is no public market for the Warrants being offered by us in this prospectusoffering and an active trading market for the same is not expected to develop.

There is no established public trading market for the Warrants being offered in this offering, and we do not expect a market to develop. Without an active market, the liquidity of the Warrants will dilutebe severely limited.

Our shares may be delisted under the ownership interestHFCA Act if the PCAOB is unable to inspect auditors with presence in China, and the delisting of our common shareholdersshares, or the threat of their being delisted, may materially and adversely affect the value of your investment.

The Holding Foreign Companies Accountable Act was enacted on December 18, 2020. The HFCA Act states if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit our shares from being traded on a national securities exchange or in the over the counter trading market in the United States. Our financial statements contained in the annual report on Form 10-K for the year ended December 31, 2020 have been audited by Centurion ZD CPA & Co., an independent registered public accounting firm that is headquartered in Hong Kong. Centurion ZD CPA & Co., is a firm registered with the PCAOB, and is required by the laws of the U.S. to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards. According to Article 177 of the PRC Securities Law (last amended in March 2020), no overseas securities regulator is allowed to directly conduct investigation or evidence collection activities in China. Accordingly, without the consent of the competent PRC securities regulators and relevant authorities, no organization or individual may provide the documents and materials relating to securities business activities to overseas parties. As a result, the audit working papers of our financial statements may not be inspected by the PCAOB without the approval of the PRC authorities, since the audit work was carried out by Centurion ZD CPA & Co. Our shares may be delisted under the Holding Foreign Companies Accountable Act (the “HFCA Act”) if the PCAOB is unable to inspect auditors with presence in China. On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above. On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. The SEC may propose additional rules or guidance that could depressimpact us if our auditor is not subject to PCAOB inspections. For example, on August 6, 2020, the President’s Working Group on Financial Markets, or the PWG, issued the Report on Protecting United States Investors from Significant Risks from Chinese Companies to the then President of the United States. This report recommended the SEC implement five recommendations to address companies from jurisdictions that do not provide the PCAOB with sufficient access to fulfil its statutory mandate. Some of the concepts of these recommendations were implemented with the enactment of the HFCA Act. However, some of the recommendations were more stringent than the HFCA Act. For example, if a company was not subject to PCAOB inspections, the report recommended that the transition period before a company would be delisted would end on January 1, 2022. The SEC has announced that its staff is preparing a consolidated proposal for the rules regarding the implementation of the HFCA Act and to address the recommendations in the PWG report. It is unclear when the SEC will complete its rulemaking and when such rules will become effective and what, if any, of the PWG recommendations will be adopted. The implications of this possible regulation in addition the requirements of the HFCA Act are uncertain. Such uncertainty could cause the market price of our Common Stockshares to be materially and adversely affected, and our securities could be delisted or prohibited from being traded “over-the-counter” earlier than would be required by the HFCA Act. If our securities are unable to be listed on another securities exchange by then, such a delisting would substantially impair ouryour ability to raise capital throughsell or purchase our shares when you wish to do so, and the salerisk and uncertainty associated with a potential delisting would have a negative impact on the price of additional equity securities.

| 6 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of our securities pursuant tothe information in this prospectus, any prospectus supplement, and mightthe documents we incorporate by reference contains forward-looking statements within the meaning of the federal securities laws. You should not apply the proceedsrely on forward-looking statements in ways that increase the value of your investment.

Our shares have been listed on the NASDAQ Stock Market under the symbol “NVFY”, since January 17, 2014.

The following tables set forth, for the calendar quarters indicated and through November 23, 2021, the quarterly high and low sale prices for our shares, as reported on Nasdaq Stock Market. Prior to December 23, 2019, the sale prices of our shares were retroactively restated to reflect the 5:1 reverse split effected on that date.

| High Closing Price | Low Closing Price | |||||||

| Quarterly Highs and Lows | ||||||||

| 2018 | ||||||||

| First Quarter | 13.88 | 10.20 | ||||||

| Second Quarter | 10.20 | 8.00 | ||||||

| Third Quarter | 9.40 | 8.30 | ||||||

| Fourth Quarter | 8.65 | 2.25 | ||||||

| 2019 | ||||||||

| First Quarter | 4.55 | 2.65 | ||||||

| Second Quarter | 5.15 | 3.30 | ||||||

| Third Quarter | 4.25 | 3.10 | ||||||

| Fourth Quarter | 3.35 | 1.70 | ||||||

| 2020 | ||||||||

| First Quarter | 2.45 | 0.77 | ||||||

| Second Quarter | 2.45 | 1.05 | ||||||

| Third Quarter | 2.38 | 1.47 | ||||||

| Fourth Quarter | 2.66 | 1.62 | ||||||

| 2021 | ||||||||

| First Quarter | 4.94 | 2.24 | ||||||

| Second Quarter | 3.39 | 2.52 | ||||||

| Third Quarter | 6.50 | 1.93 | ||||||

On November 23, 2021, the closing price of our shares on the Nasdaq Stock Market was $2.05, with 6,687,052 shares issued and outstanding as of the same date. As of November 23, 2021 there were 45 shareholders of record.

The following table sets forth our capitalization as of September 30, 2021. Because we will make additional updates or correctionsnot be receiving any proceeds pursuant to the sale of any shares by the selling shareholders, our capitalization table is not adjusted to reflect such sales. You should read the following table in conjunction with respect thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from our forward-lookingfinancial statements, is included in our periodic reports filed with the SEC and in the “Risk Factors” section ofwhich are incorporated by reference into this prospectus.

| As of | ||||

Capitalization | September 30, 2021 (unaudited) | |||

| Common Stock Issued | 6,730,242 | |||

| Par Value Amount | 6,730 | |||

| Additional Paid-In Capital | 42,565,427 | |||

| Statutory Reserves | - | |||

| Retained Earnings | (8,148,085 | ) | ||

| Accumulated Other Comprehensive Income | 313,552 | |||

| Total: | 34,737,624 | |||

We will receive proceeds from any exercises of the applicable prospectus supplement, we intend to use the net proceeds we receiveWarrants, but not from the sale of the underlying common stock. The selling shareholders will receive all of the net proceeds from the sale of any shares offered by them under this prospectus. The selling shareholders will pay any underwriting discounts and commissions and expenses incurred by the selling shareholders for brokerage, accounting, tax, legal services or any other expenses incurred by the selling shareholders in disposing of these shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus.

| 7 |

We do not currently have any plans to pay any cash dividends in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. Even if our board of directors decides to pay dividends in the future, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that our board of directors may deem relevant.

This prospectus covers the public resale of the shares owned by the selling shareholders named below. Such selling shareholders may from time to time offer and sell pursuant to this prospectus any or all of the shares owned by them. The selling shareholders, however, make no representations that the shares will be offered for sale. The tables below present information regarding the selling shareholders and the shares that each such selling shareholder may offer and sell from time to time under this prospectus.

Unless otherwise indicated, all information with respect to ownership of our shares of the selling shareholders has been furnished by or on behalf of the selling shareholders and is as of November 23, 2021. We believe, based on information supplied by the selling shareholders, that except as may otherwise be indicated in the footnotes to the tables below, the selling shareholders have sole voting and dispositive power with respect to the shares reported as beneficially owned by them. Because the selling shareholders identified in the tables may sell some or all of the shares owned by them which are included in this prospectus, and because, except as set forth herein, there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares, no estimate can be given as to the number of shares available for resale hereby that will be held by the selling shareholders upon termination of this offering. In addition, the selling shareholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares they hold in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the information set forth on the table below. We have, therefore, assumed for the purposes of the following table, that the selling shareholders will sell all of the shares owned beneficially by them that are covered by this prospectus, but will not sell any other shares that they presently own. However, we are not aware of any agreements, arrangements or understandings with respect to the sale of any of the shares by any of the selling shareholders. Beneficial ownership for the purposes of this table is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days.

The selling shareholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act with respect to the shares offered by this prospectus, for general corporate purposes, whichand any profits realized or commissions received may include, among other things, repayment of debt, repurchases of common stock, capital expenditures, the financing of possible acquisitions or business expansions, increasing our working capital and the financing of ongoing operating expenses and overhead.

The following table sets forth:

| ● | the name of each selling shareholder holding shares; | |

| ● | the number of shares beneficially owned by each selling shareholder prior to the sale of the shares covered by this prospectus; | |

| ● | the number of shares that may be offered by each selling shareholder pursuant to this prospectus; | |

| ● | the number of shares to be beneficially owned by each selling shareholder following the sale of the shares covered by this prospectus; and | |

| ● | the percentage of our issued and outstanding shares to be owned by each selling shareholder before and after the sale of the shares covered by this prospectus. |

| 8 |

| Name Of Selling Shareholder | Number Of To This

| % Of Shares Sale Of Shares (7) | Number Of Shares Available Pursuant To This Prospectus | Number Of Shares Beneficially Owned After Sale Of Shares (8) | % Of Outstanding Shares Beneficially Owned After Sale Of Shares (8) | |||||||||||||||

| Anson Investments Master Fund LP (1) | 278,627 | 4.00 | % | 278,627 | 0 | * | ||||||||||||||

| Intracoastal Capital, LLC (2) | 351,900 | (9) | 4.99 | % | 371,502 | 0 | * | |||||||||||||

| CVI Investments, Inc. (3) | 351,900 | (10) | 4.99 | % | 371,503 | 0 | * | |||||||||||||

| Dawson James Securities, Inc. (4) | 74,115 | 1.10 | % | 115,028 | 0 | * | ||||||||||||||

| Robert Keyser, Jr. (5) | 18,668 | * | 18,668 | 0 | * | |||||||||||||||

| Douglas Armstrong (6) | 18,668 | * | 18,668 | 0 | * | |||||||||||||||

| (1) | Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”), hold voting and dispositive power over the Common Shares held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares except to the extent of their pecuniary interest therein. The principal business address of Anson is Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008, Cayman Islands. |

| (2) | Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended of the securities reported herein that are held by Intracoastal.The address of the selling shareholder is 245 Palm Trail, Delray Beach, FL 334832211A. |

| (3) | Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. CVI Investments, Inc.is affiliated with one or more FINRA member, none of whom are currently expected to participate in the sale pursuant to this prospectus. The address of the selling shareholder is c/o Heights Capital Management, Inc., 1010 California Street, Suite 3250, San Francisco, CA 94111. |

| (4) | The address of the selling shareholder is 1 North Federal Highway, 5th Floor, Boca Raton, FL 33432. |

| (5) | The address of the selling shareholder is 1 North Federal Highway, 5th Floor, Boca Raton, FL 33432. Does not include securities owned by Dawson James Securities, Inc. By virtue of his position as Chairman and CEO of Dawson James, Securities, Inc., Mr. Keyser may be deemed to beneficially own the securities owned by Dawson James, Securities, Inc. Mr. Keyser disclaims ownership of those securities. |

| (6) | The address of the selling shareholder is 1 North Federal Highway, 5th Floor, Boca Raton, FL 33432. |

| (7) | Based on 6,687,052 shares |

| (8) | Assumes that the selling shareholder sells all of the shares offered hereby. |

(9) (10) | The total number of shares of Common Stock issuable upon the exercise of Warrants is 371,502. The number of shares reflected as beneficially owned is shown at 351,900 or 4.99% of the outstanding number of shares of Common Stock by virtue of a provision set forth in the warrants that precludes the exercise by the holder if and to the extent that any such exercise would cause the number of shares of Common Stock held by the holder to exceed 4.99%. The total number of shares of Common Stock issuable upon the exercise of Warrants is 371,503. The number of shares reflected as beneficially owned is shown at 351,900 or 4.99% of the outstanding number of shares of Common Stock by virtue of a provision set forth in the warrants that precludes the exercise by the holder if and to the extent that any such exercise would cause the number of shares of Common Stock held by the holder to exceed 4.99%. |

| * | Less than 1% |

| 9 |

The selling shareholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares or interests in shares received after the date of this prospectus.

The selling shareholders may use any one or more of the following methods when disposing of shares:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; | |

| ● | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| ● | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; | |

| ● | a combination of any such methods of sale; and | |

| ● | any other method permitted by applicable law. |

The selling shareholders may, from time to time, pledge or grant a security interest in some or all of the shares owned by our boardthem and, if they default in the performance of directors out of legally available funds; however,their secured obligations, the current policy of our board of directors is to retain earnings, if any, for operationspledgees or secured parties may offer and growth. Upon liquidation, dissolution or winding-up,sell the holders of our Common Stock are entitled to share ratably in all assets that are legally available for distribution. The holders of our Common Stock have no preemptive, subscription, redemption or conversion rights.

| 10 |

In connection with the sale of Certain Provisions of Nevada Law

The aggregate proceeds to the warrants may be attached to or separate from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differselling shareholders from the terms described below.

The selling shareholders also may resell all or a portion of their shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The selling shareholders and any underwriters, broker-dealers or through underwriters;

To the extent required, the shares to purchasers, through a specific bidding or auction process or otherwise; or

In order to time in one or more transactions, by means of one or more of the following transactions, which may include cross or block trades:

We have advised the Securities Act, or to contribution by us to payments they may be required to make in respectselling shareholders that the anti-manipulation rules of such liabilities. The prospectus supplement will describe the terms and conditions of such indemnification or contribution. Some of the agents, underwriters or dealers, or their respective affiliates may be customers of, engage in transactions with or perform services for us in the ordinary course of business. We will describe in the prospectus supplement naming the underwriter the nature of any such relationship.

11

The validity of the securitiesshares of common stock offered in this prospectushereby will be passed upon for us by Garvey Schubert Barer.

The financial statements for the years ended December 31, 2016 and 2015, appearingincorporated by reference in this Prospectus and Registration Statementprospectus have been audited by theCenturion ZD CPA & Co., our independent registered public accounting firm, Centurion ZD CPA Limited, as set forth in its report thereon, appearing elsewhere herein, and are included in reliance upon such reportreports given onupon the authority of suchsaid firm as experts in accountingauditing and auditing.

12

| Item 14. | Other Expenses of Issuance and Distribution. |

We estimate the fees and expenses payableto be incurred by us in connection with the resale of the shares in this offering, of our securities being registered hereby. other than underwriting discounts and commissions, to be as follows:

237 26,237SEC registration fee $ Legal fees and expenses $ 20,000 Accounting fees and expenses $ 5,000 Miscellaneous expenses $ 1,000 Total $

All amounts shown are estimatesestimated except the SEC registration fee.

| Registration fee | $ | 6,954 | ||

| Legal fees and expenses | * | |||

| Accounting fees and expenses | * | |||

| Printing and miscellaneous expenses | * | |||

| Total expenses | $ | * |

| Item 15. | Indemnification of Directors and |

Section 78.138 of the NRS provides that a director or officer is not individually liable to the corporation or its shareholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that (1) the director’s or officer’s act or failure to act constituted a breach of his fiduciary duties as a director or officer and (2) his or her breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

This provision is intended to afford directors and officers protection against and to limit their potential liability for monetary damages resulting from suits alleging a breach of the duty of care by a director or officer. As a consequence of this provision, shareholders of our Company will be unable to recover monetary damages against directors or officers for action taken by them that may constitute negligence or gross negligence in performance of their duties unless such conduct falls within one of the foregoing exceptions. The provision, however, does not alter the applicable standards governing a director’s or officer’s fiduciary duty and does not eliminate or limit the right of our company or any shareholder to obtain an injunction or any other type of non-monetary relief in the event of a breach of fiduciary duty.

Our Articles of Incorporation and Amended and Restated Bylaws provide, among other things, that a director, officer, employee or agent of the corporation may be indemnified against expenses (including attorneys’ fees inclusive of any appeal)fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such claim, action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best of our interests, and with respect to any criminal action or proceeding, such person had no reasonable cause to believe that such person’s conduct was unlawful. The Company also maintains an insurance policy to assist in funding indemnification of directors and officers for certain liabilities.

| II-1 |

Insofar as indemnification for liabilities arising under the Securities Act may be provided for directors, officers, employees, agents or persons controlling an issuer pursuant to the foregoing provisions, the opinion of the SEC is that such indemnification is against public policy as expressed in the Securities Act, and is therefore unenforceable. In the event that a claim for indemnification by such director, officer or controlling person of us in the successful defense of any action, suit or proceeding is asserted by such director, officer or controlling person in connection with the securities being offered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

| Item 16. |

| Exhibit | Title |

| 3.1 | Articles of Incorporation* |

| 3.2 | Bylaws* |

| 4.1 | Form of Investor Warrant (1) |

| 4.2 | Form of Placement Agent Warrant (1) |

| 5.1 | Opinion of Schiff Hardin LLP* |

| 10.1 | Form of Securities Purchase Agreement (1) |

| 23.1 | Consent of Centurion ZD CPA & Co. |

| 23.2 | Consent of Schiff Hardin LLP (included in Exhibit 5.1)* |

| 24.1 | Power of Attorney (included in the signature page) |

* To be filed by reference.

| (1) | Incorporated by reference from the exhibit of the same number filed as an exhibit to the Registrant’s Current Report on Form 8-K filed on July 26, 2021. |

| Item 17. |

| (a) | The undersigned registrant hereby undertakes: | |

| (1) | to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by section 10(a)(3) of the Securities Act of 1933; | |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; | |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

provided, Provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information otherwise required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Registrantregistrant pursuant to Sectionsection 13 or Sectionsection 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in thisthe registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of thisthe registration statement.

| II-2 |

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. | |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. | |

| (4) | To file a post-effective amendment to the registration statement to include any financial statements required by Item 8 of Form 10-K at the start of any delayed offering or throughout a continuous offering; provided, however, that a post-effective amendment need not be filed to include financial statements and information otherwise required by Section 10(a)(3) of the Act or §210.3-19 if such financial statements and information are contained in periodic reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement. | |

| (5) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | If the registrant is relying on Rule 430B: |

| (A) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and | |

| (B) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or |

| (ii) | If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

| II-3 |

| (6) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: |

The undersigned Registrantregistrant undertakes that in a primary offering of securities of the undersigned Registrantregistrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrantregistrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; (ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and (iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. | |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. | |

| (d) | The undersigned registrant hereby further undertakes that: |

| (1) | For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4), or 497(h) under the Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was declared effective. | |

| (2) | For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| II-4 |

Pursuant to the requirements of the Securities Act of 1933, the Registrantregistrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statementRegistration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Commerce, State of California on the 18th24th day of September, 2017.

| NOVA LIFESTYLE, INC. | |||

| By: | /s/ Thanh H. Lam | ||

| Thanh H. Lam | |||

| Chief Executive Officer (Principal Executive Officer) | |||

Each person whose signature appears below constitutes and appoints Thanh Lam as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for her and in her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement on Form S-3 or other applicable form, with all exhibits thereto, or any and all amendments (including pre-effective and post-effective amendments) and supplements to a registration statement, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Amendment No. 1 to the registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | ||||||

| /s/ Thanh H. Lam | November 24, 2021 | Chief Executive Officer, President, | ||||

| Thanh H. Lam | Director and Chairperson (Principal Executive Officer) | |||||

| /s/ Jeffery Chuang | November 24, 2021 | Chief Financial Officer | ||||

| Jeffery Chuang | (Principal Financial and Accounting Officer) | |||||

| /s/ Min Su | November 24, 2021 | Director | ||||

| Min Su | ||||||

/s/ Umesh | Director | |||||

| Umesh Patel | ||||||

/s/ | November 24, 2021 | Director | ||||

/s/ Huy P. | November 24, 2021 | Director | ||||

| Huy P. La |