FORM S-3/A

3To

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact Namename of Registrantregistrant as Specifiedspecified in Its Charter)

Nevada | | 90-0746568 |

(State or Other Jurisdictionother jurisdiction of Incorporation incorporation or Organization)organization) | | 90-0746568

(I.R.S. Employer Employee

Identification Number) No.) |

(Address Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Thanh H. Lam

Chief Executive Officer

Nova LifeStyle, Inc.

6565 E. Washington Blvd.

Commerce, CA 90040

(323) 888-9999

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

principal executive offices, including zip code)Copies to:

Jeffrey Li

Peter B. Cancelmo

Chelsea Anderson

Garvey Schubert Barer

Flour Mill Building

1000 PotomacRalph V. De Martino, Esq.

ArentFox Schiff LLP

1717 K Street NW Suite 200

Washington, D.C. 20007-3501

DC 20006 Tel: (202) 965-7880

724-6848Fax: (202) 778-6460

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this

registration statement. Registration Statement.If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this formForm is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this formForm is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this formForm is a registration statement pursuant to General Instruction I.D.I.C. or a post-effective amendment thereto that shall become effective upon filing with the CommissionSEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this formForm is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.I.C. filed to register additional securities or additional classes of securities pursuant to ruleRule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”company as defined in Rule 12b-2405 of the Exchange Act. (Check one):

| Large accelerated filer☐ | ☐ | | Accelerated filer☐ |

Non-accelerated filer ☐ (Do not check if smaller reporting company)

| Smaller reporting company ☒

☐ |

| | Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

☐

CALCULATION OF REGISTRATION FEE

Title of Securities To Be Registered (1) | | Amount To Be Registered (1) | | | Proposed Maximum Offering Price Per Share (2) | | | Proposed Maximum Aggregate Offering Price (2) | | | Amount Of Registration Fee (3) | | |

| Common Stock, $0.001 par value per share | | | | | | | | | | | | | | | | | |

| Preferred Stock | | | | | | | | | | | | | | | | | |

| Warrants | | | | | | | | | | | | | | | | | |

| Units | | | | | | | | | | | | | | | | | |

| Total | | $ | 60,000,000 | | | | N/A | | | $ | 60,000,000 | | | $ | 6,954.00 | | (4) |

(1) | We are registering under this Registration Statement such indeterminate number of shares of common stock and preferred stock, such indeterminate number of warrants to purchase common stock and/or preferred stock, and such indeterminate number of units as may be sold by the registrant from time to time, which together shall have an aggregate initial offering price not to exceed $60,000,000. We may sell any securities we are registering under this Registration Statement separately or as units with the other securities we are registering under this Registration Statement. We will determine, from time to time, the proposed maximum offering price per unit in connection with our issuance of the securities we are registering under this Registration Statement. The securities we are registering under this Registration Statement also include such indeterminate number of shares of common stock and preferred stock as we may issue upon conversion of or exchange for preferred stock that provide for conversion or exchange, upon exercise of warrants or pursuant to the anti-dilution provisions of any of such securities. In addition, pursuant to Rule 416 under the Securities Act of 1933 (the “Securities Act”), the shares we are registering under this Registration Statement include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares we are registering as a result of stock splits, stock dividends or similar transactions. |

(2) | We will determine the proposed maximum aggregate offering price per class of security from time to time in connection with our issuance of the securities we are registering under this Registration Statement and we are not specifying such price as to each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act. |

(3) | Calculated pursuant to Rule 457(o) under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until thethis Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 18, 2017

PRELIMINARY PROSPECTUS

Nova LifeStyle, Inc.

$60,000,000

Common Stock

Preferred Stock

Warrants

Units

We may offer from time to time shares of our common stock, par value $0.001 (“Common Stock”), preferred stock, warrants and units that include any of these securities. The aggregate initial offering price of the securities sold under this prospectus will not exceed $60,000,000. We will offer the securities in amounts, at prices and on terms to be determined at the time of the offering.

Our Common Stock is quoted on The NASDAQ Stock Market LLC under the symbol “NVFY.” As of September 15, 2017, the aggregate market value of our outstanding Common Stock held by non-affiliates was approximately $23,571,363 based on 27,338,310 shares of outstanding Common Stock, of which 10,380,495 shares are held by affiliates, and a price of $1.39 per share, which was the last reported sale price of our Common Stock as quoted on The NASDAQ Stock Market LLC on that date. As of the date of this prospectus, we have not offered any securities during the past twelve months pursuant to General Instruction I.B.6 of Form S-3. You are urged to obtain current market quotations of our Common Stock.

Each time we sell securities hereunder, we will attach a supplement to this prospectus that contains specific information about the terms of the offering, including the price at which we are offering the securities to the public. The prospectus supplement may also add, update or change information contained or incorporated in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in our securities.

The securities hereunder may be offered directly by us, through agents designated from time to time by us or to or through underwriters or dealers. If any agents, dealers or underwriters are involved in the sale of any securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the section entitled “About This Prospectus” for more information.

Investing in our securities involves certain risks. See “Risk Factors” beginning on page 4 of this prospectus. In addition, see “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, which has been filed with the Securities and Exchange Commission and is incorporated by reference into this prospectus. You should carefully read and consider these risk factors before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 18, 2017.

TABLE OF CONTENTS

| | Page |

| 1 |

| 1 |

| 5 |

| 6 |

| 6 |

| 6 |

| 7 |

| 8 |

| 8 |

| 10 |

| 10 |

| 12 |

| 12 |

| 12 |

| 13 |

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. This prospectus, together with applicable prospectus supplements, any information incorporated by reference, and any related free writing prospectuses we file with the Securities and Exchange Commission (the “SEC”), includes all material information relating to these offerings and securities. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus, including without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell any combination of the securities described in this prospectus in one or more offerings. The aggregate initial offering price of all securities sold under this prospectus will not exceed $60,000,000.

This prospectus provides certain general information about the securities that we may offer hereunder. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. The prospectus supplement will contain the specific information about the terms of the offering. In each prospectus supplement, we will include the following information:

the number and type of securities that we propose to sell;

the public offering price;

the names of any underwriters, agents or dealers through or to which the securities will be sold;

any compensation of those underwriters, agents or dealers;

any additional risk factors applicable to the securities or our business and operations; and

any other material information about the offering and sale of the securities.

In addition, the prospectus supplement may also add, update or change the information contained or incorporated in this prospectus. The prospectus supplement will supersede this prospectus to the extent it contains information that is different from, or that conflicts with, the information contained or incorporated in this prospectus. You should read and consider all information contained in this prospectus and any accompanying prospectus supplement in making your investment decision. You should also read and consider the information contained in the documents identified under the heading “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” in this prospectusEXPLANATORY NOTE.

Unless the context otherwise requires, the terms “NVFY,” “the Company,” “we,” “us,” and “our” in this prospectus each refer to Nova LifeStyle, Inc., our subsidiaries, and our consolidated entities. “China” and the “PRC” refer to the People’s Republic of China.

Nova LifeStyle, Inc. is a broad based distributor and retailer of contemporary styled residential furniture incorporated into a dynamic marketing and sales platform offering retailfiling this Amendment No. 3 (this “Amendment”) to its Registration Statement on Form S-3 (File No. 333-261343) (the “Registration Statement”) as well as online selection and purchase fulfillment globally. We monitor popular trends and work to create design elements that are then integrated into our product lines that can be used as both stand-alone or whole-room and home furnishing solutions. Through our global network, Nova LifeStyle also sells (through an exclusive third party manufacturing partner) a managed variety of high quality bedding foundation components.

Nova LifeStyle’s brand family currently includes Diamond Sofa (www.diamondsofa.com), Colorful World, Giorgio Mobili, and Bright Swallow. The information contained on any of our websites is not part ofexhibits-only filing. Accordingly, this prospectus and is not incorporated herein.

Our customers principally consist of distributors and retailers having specific geographic coverages that deploy middle to high end private label home furnishings having very little competitive overlap within our specific furnishings products or product lines. Nova LifeStyle is constantly seeking to integrate new sources of distribution and manufacturing that are properly aligned with our growth strategy, thus allowing us to continually focus on building both same store sales growth as well as drive the expansion of our overall distribution and manufacturing relationships through a deployment of popular, as well as trend-based furnishing solutions worldwide.

We sell products to the U.S. and international markets under the Diamond Sofa brand and as a trading company. The markets in the U.S. and Europe remain challenging because they are experiencing a slower than anticipated recovery from the recent international financial crisis and the Euro-area crisis in particular. We believe that discretionary purchases of furniture by middle to upper middle-income consumers, our target global consumer market, will increase along with the expected growth in the worldwide furniture trade and recovery of housing markets. Furthermore, we believe that furniture featuring modern and contemporary styling such as ours will continue to be in greater demand.

In 2016, our products were sold in over 18 countries worldwide, with North America and Europe our principal international markets, while we expanded our sales in other regions. Sales to North America accounted for 62.8% and 83.9% of sales in 2016 and 2015, respectively. Sales to Europe accounted for 13.5% and 11.8% of sales in 2016 and 2015, respectively, with the increase attributed principally to the recoveryAmendment consists only of the Euro-area economic climate and our changing sales and marketing strategy to diversify international sales. Sales to other regions, primarily in Asia and Australia, accounted for 23.7% and 4.3%facing page, this explanatory note, Item 16 of total sales in 2016 and 2015, respectively. As we continue to expand our broad network of distributors, increase direct sales and enter emerging growth markets, we believe that we are well positioned to respond to changing market conditions, allowing us to take advantage of any upturns in the global and local economiesPart II of the markets we serve.

Our sales in North America decreased 23% to $58.20 million inRegistration Statement, the year ended December 31, 2016, compared to $75.45 million in 2015. We aggressively changed our product mix and our sales and marketing strategies with the aim of diversifying sales and improving margin in the long run. We sold high quality, higher-priced products while offering price discounts (which were deducted from gross sales when we recorded our revenues) during our promotion period, which lasted throughout the second and third quarter of 2016. The strategy resulted in a 17% increase in average unit selling price of our sales, while resulting a 32% decrease in our units sold, in 2016 as compared to 2015. We continued to increase marketing efforts in the U.S. markets while maintaining our marketing efforts and existing customer base in Europe.

During the three months ended March 31, 2017, there was a $4.41 million decrease in net sales, compared to the same period of 2016, which was mainly due to decreased sales to North America and Europe. Our North American sales decreased 27% to $12.53 million in the three months ended March 31, 2017, compared to $17.22 million in the same period of 2016. We aggressively changed our product mix and our sales and marketing strategies with the aim of diversifying sales and improving margin in the long run. We sold high quality, higher-priced products while offering price discounts (which were deducted from gross sales when we recorded our revenues) during our promotion period, which lasted throughout the second and third quarter of 2016. The strategy resulted in an 18% increase in average unit selling price of our sales, while resulting a 46% decrease in our units sold, in the first quarter of 2017 as compared to the same period in 2016. During this period, we continued to increase marketing efforts in the U.S. markets while maintaining our marketing efforts and existing customer base in Europe.

As we have previously indicated in our reports, our sales policy allows for the return of products within the warranty period if the product is defective and the defects are our fault. As alternatives for the product return option, the customers have options of asking a discount from us for the products with quality issues or receiving replacement parts from us at no cost. The amount for return of products, the discount provided to the customers and cost for the replacement parts were immaterial for the years ended December 31, 2016 and 2015. For this type of the customer discount, it only applies if the product that we sold is defective or the defect of product is our fault, then the customers have an option to ask a discount from us or receive product replacement. For 2016 and 2015, the customer discounts for defective products which included in cost of goods sold were $18,451 and $14,588, respectively. The discounts mentioned in the preceding paragraph are the price discounts that we provided for our new products in order to stimulate sales of new products. This type of selling price discount is already deducted from gross sales when we record our revenues.

Our accounting policy related to advance to suppliers is: it is reported net of allowance when the Company determines that amounts outstanding are not likely to be collected in cash or utilized against purchase of inventories. Based on our historical record and actual practice, we always received goods within 5 to 9 months from the date the advance payment is made. As such, no reserve on supplier prepayments had been made or recorded by us. Any provisions for allowance for advance to suppliers, if deemed necessary, will be included in general and administrative expenses in the consolidated statement of income.

The nature of the supplier prepayments is the payment that is made for goods before we actually receive them. The balances of advances to suppliers have kept increasing in order to secure our purchasing power over new materials and priority position of our production lines with our suppliers, especially when we are introducing eight new product lines in 2017. Also, the decision for such advances is to establish long term relationship with our suppliers. With tightened regulations and increased enforcement on environmental issues in recent years in China, where our suppliers are located, many factories have been affected with limited production hours. These advances can secure our products being treated as priorities and lock in the raw material prices with our suppliers. We do not foresee additional risk with the increase of the advances as we have contracts with the suppliers and our QC team is on site to monitor daily production of our suppliers. Based on our past experience, all products and projects have been delivered as promised with the existing suppliers.

For a brand new product, the normal lead time from new product R&D, prototype, mass production to delivery of goods from our suppliers to us is approximately six to nine months after we make advance payments to our suppliers. For other products, the typical time is five months after our advance payment. The Company will consider the need for a reserve when any suppliers fail to fulfill the orders within the time frame as stipulated in the purchase contracts.

In addition, the Company noticed the increasing demands in antique home furnishing and decorating market such as reclaimed wood flooring and one of the kind antique furniture. Due to the nature of antique furnishing business, funds are required up front in order for suppliers to source and secure these products whenever they are available in the market.

Our logistics and delivery capabilities provide our customers with the flexibility to select from our extensive furniture collections in their respective shipments. We design and supply our products for direct sales to private label retailers worldwide and for global furniture distributors and wholesalers that in turn offer our products to retailers under their own brand names, including Actona Company (Denmark), Artemis (Australia), BUT International (France), Dormitienda (Spain) and El Dorado Furniture (United States). We offer a wide selection of stand-alone pieces across a variety of product categories and approximately 20 product collections developed exclusively for international markets. During 2017, we expect to focus on both online and offline sales. We also sell products under the Diamond Sofa brand to distributors and retailers in North America and South America and to end-user consumers in the U.S. market through third-party shopping portals. Our research and development team works with our customers to modify our existing product designs and create new designs and styles for their market’s particular requirements. We believe that we can continue to expand our sales in the U.S. and international markets as we integrate the Diamond Sofa brand and increase our direct sales to retailers and chain stores as we expand and explore new markets worldwide.

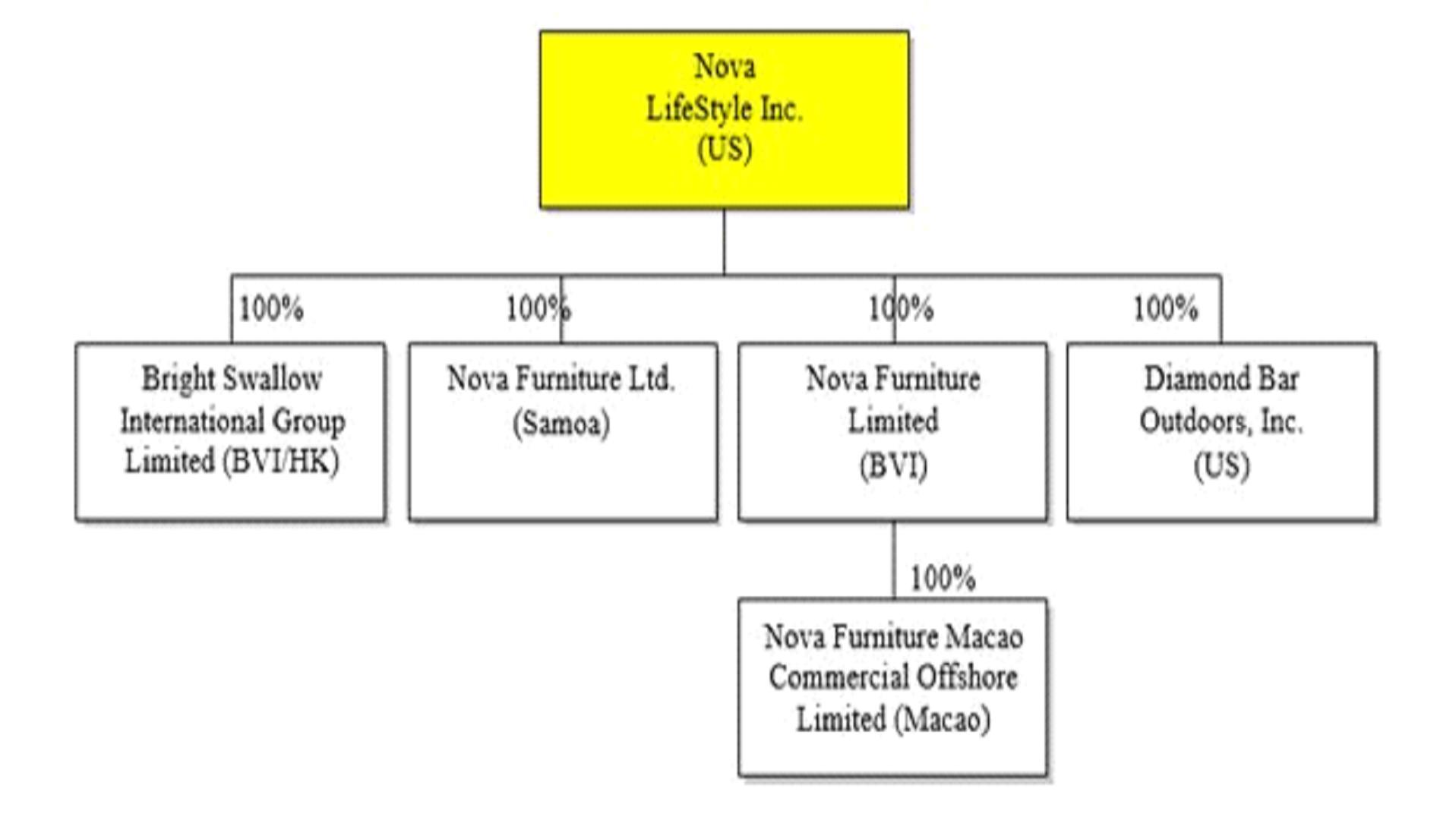

We are a U.S. holding company with no material assets other than the ownership interests of our wholly owned subsidiaries through which we market, design, and sell residential furniture worldwide: Nova Furniture Limited in the British Virgin Islands (“Nova Furniture”), Nova Furniture Limited in Samoa (“Nova Samoa”), Nova Furniture Macao Commercial Offshore Limited (“Nova Macao”), Bright Swallow International Group Limited (“Bright Swallow”), and Diamond Bar Outdoors, Inc. (“Diamond Bar”). Nova Macao was organized under the laws of Macao on May 20, 2006. Nova Macao is a wholly owned subsidiary of Nova Furniture. Diamond Bar, doing business as Diamond Sofa, is a California corporation organized on June 15, 2000, which we acquired pursuant to a stock purchase agreement on August 31, 2011. On April 24, 2013, we acquired all of the outstanding stock of Bright Swallow; the purchase price was $6.5 million in cash and was fully paid at the closing of the acquisition.

On October 24, 2013, Nova Furniture (Dongguan) Co., Ltd. (“Nova Dongguan”) incorporated Dongguan Ding Nuo Household Products Co., Ltd. (“Ding Nuo”) under the laws of the PRC and contributed capital of RMB 1 million ($162,994). Nova Dongguan made an additional capital contribution of RMB 0.1 million ($16,305) on November 27, 2013 through one of Nova Dongguan’s officers, Mr. Gu Xing Chang, who acted as the nominee shareholder of Ding Nuo.

On September 23, 2016, Nova Furniture, a wholly-owned subsidiary of the Company (the “Seller”), entered into a Share Transfer Agreement (the “Agreement”) with Kuka Design Limited, an unrelated company incorporated in British Virgin Islands (“Kuka Design BVI” or “Buyer”). Pursuant to the terms of the Agreement, the Seller sold all of the outstanding equity interests in Nova Dongguan, a wholly owned subsidiary of the Seller, to the Buyer for a total of $8,500,000 (the “Transaction”), which such value was primarily derived from Nova Dongguan and Nova Donguan’s wholly owned subsidiary, Nova Museum, and 90.97% owned subsidiary, Ding Nuo. Upon consummation of the Transaction on October 25, 2016, the Buyer became the sole owner of Nova Dongguan.

On November 10, 2016, Nova Furniture (“Assignor”) entered into a Trademark Assignment Agreement with Kuka Design BVI (“Assignee”). Pursuant to the terms of the Trademark Assignment Agreement, Assignor agreed to assign to the Assignee its full right to, and title in, the NOVA trademark in China for $6,000,000 (the “Assignment Fee”). Assignee was to pay the Assignment Fee in two installments: $1,000,000 on or before November 30, 2016, and $5,000,000 on or before December 31, 2016. As of December 31, 2016, $4,750,000 had been received, and the remaining balance of $1,250,000 was received in January 2017.

Our organizational structure is set forth in the following diagram:

Our principal executive offices are located at 6565 E. Washington Blvd., Commerce, CA 90040. Our telephone number is (323) 888-9999 and our website address is www.novalifestyle.com. The information contained on our website is not part of this prospectus and is not incorporated herein.

An investment in our securities involves a high degree of risk. Before making any investment decision, you should carefully consider the risk factors set forth below, under the caption “Risk Factors” in any applicable prospectus supplement and under the caption “Risk Factors” in our most recent annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q, which are incorporated by reference in this prospectus, as well as in any applicable prospectus supplement, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These risks could materially affect our business, results of operation or financial condition and affect the value of our securities. Additional risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment. You could lose all or part of your investment. For more information, see “Where You Can Find More Information.”

Risks Related to Our Securities and the Offering

Future sales or other dilution of our equity could depress the market price of our Common Stock.

Sales of our Common Stock, preferred stock, warrants, units or any combination of the foregoing in the public market, or the perception that such sales could occur, could negatively impact the price of our Common Stock. If one or more of our shareholders were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing market price of our Common Stock could be negatively affected.

In addition, the issuance of additional shares of our Common Stock, securities convertible into or exercisable for our Common Stock, other equity-linked securities, including preferred stock or warrants or any combination of the securities pursuant to this prospectus will dilute the ownership interest of our common shareholders and could depress the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities.

We may need to seek additional capital. If this additional financing is obtained through the issuance of equity securities or warrants to acquire equity securities, our existing shareholders could experience significant dilution upon the issuance, conversion or exercise of such securities.

Our management will have broad discretion over the use of the proceeds we receive from the sale of our securities pursuant to this prospectus and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from any offerings under this prospectus, and you will be relying on the judgment of our management regarding the application of these proceeds. Except as described in any prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities described in this prospectus will be added to our general funds and will be used for general corporate purposes. Our management might not apply the net proceeds from offerings of our securities in ways that increase the value of your investment and might not be able to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

FORWARD-LOOKING STATEMENTS

Some of the statements contained or incorporated by reference in this prospectus may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,” “anticipate,” “intend,” “plan,” “estimate” and similar words, although some forward-looking statements are expressed differently.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and results to differ materially from what is expressed or forecasted in such forward-looking statements. These forward-looking statements speak only as of the date on which they are made and except as required by law, we undertake no obligation to publicly release the results of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from our forward-looking statements is included in our periodic reports filed with the SEC and in the “Risk Factors” section of this prospectus.

Except as may be stated in the applicable prospectus supplement, we intend to use the net proceeds we receive from the sale of the securities offered by this prospectus for general corporate purposes, which may include, among other things, repayment of debt, repurchases of common stock, capital expenditures, the financing of possible acquisitions or business expansions, increasing our working capital and the financing of ongoing operating expenses and overhead.

DESCRIPTION OF CAPITAL STOCK

The following is a summary of our capital stock and certain provisions of our certificate of incorporation and bylaws. This summary does not purport to be complete and is qualified in its entirety by the provisions of our Articles of Incorporation, as amended, our Amended and Restated Bylaws, and applicable provisions of the Nevada Revised Statutes (the “NRS”).

See “Where You Can Find More Information” elsewhere in this prospectus for information on where you can obtain copies of our Certificate of Incorporation and Amended and Restated Bylaws, which have been filed with and are publicly available from the SEC.

Our authorized capital stock consists of 75,000,000 shares of Common Stock, par value $0.001 per share. Currently, we have no other authorized class of stock. There are warrants to purchase 858,334 shares of our Common Stock outstanding as of the date of this prospectus.

DESCRIPTION OF COMMON STOCK

As of September 15, 2017, there were 27,338,310 shares of our Common Stock outstanding, held by approximately 50 stockholders of record.

Our Common Stock is currently traded on The NASDAQ Stock Market LLC under the symbol “NVFY.”

The holders of our Common Stock are entitled to one vote per share. Our Articles of Incorporation do not provide for cumulative voting. The holders of our Common Stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors out of legally available funds; however, the current policy of our board of directors is to retain earnings, if any, for operations and growth. Upon liquidation, dissolution or winding-up, the holders of our Common Stock are entitled to share ratably in all assets that are legally available for distribution. The holders of our Common Stock have no preemptive, subscription, redemption or conversion rights.

All issued and outstanding shares of Common Stock are fully paid and nonassessable. Shares of our Common Stock that may be offered for resale, from time to time, under this prospectus will be fully paid and nonassessable.

Anti-Takeover Effects of Certain Provisions of Nevada Law

As a Nevada corporation, we are also subject to certain provisions of the Nevada Revised Statutes (the “NRS”) that have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors in connection with such a transaction. However, certain of these provisions may discourage a future acquisition of us, including an acquisition in which the stockholders might otherwise receive a premium for their shares. As a result, stockholders who might desire to participate in such a transaction may not have the opportunity to do so.

The NRS provides that specified persons who, with or through their affiliates or associates, own, or affiliates and associates of the subject corporation at any time within two years own or did own, 10% or more of the outstanding voting stock of a corporation cannot engage in specified business combinations with the corporation for a period of two years after the date on which the person became an interested stockholder, unless the combination meets all of the requirements of the articles of incorporation of the company, and: (i) the combination or transaction by which such person first became an interested stockholder was approved by the board of directors before they first became an interested stockholder; or (ii) such combination is approved by: (x) the board of directors; and (y) at an annual or special meeting of the stockholders (not by written consent), the affirmative vote of stockholders representing at least 60% of the outstanding voting power not beneficially owned by such interested stockholder. The law defines the term “business combination” to encompass a wide variety of transactions with or caused by an interested stockholder, including mergers, asset sales and other transactions in which the interested stockholder receives or could receive a benefit on other than a pro rata basis with other stockholders.

The Control Share Acquisition Statute generally applies only to Nevada corporations with at least 200 stockholders of record, including at least 100 stockholders of record who are Nevada residents, and which conduct business directly or indirectly in Nevada. This statute generally provides that any person that acquires a “controlling interest” acquires voting rights in the control shares, as defined, only as conferred by the disinterested stockholders of the corporation at a special or annual meeting. A person acquires a “controlling interest” whenever a person acquires shares of a subject corporation that, but for the application of these provisions of the NRS, would enable that person to exercise (1) one-fifth or more, but less than one-third, (2) one-third or more, but less than a majority or (3) a majority or more, of all of the voting power of the corporation in the election of directors. Once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares.” In the event control shares are accorded full voting rights and the acquiring person has acquired at least a majority of all of the voting power, any stockholder of record who has not voted in favor of authorizing voting rights for the control shares is entitled to demand payment for the fair value of its shares.

These laws may have a chilling effect on certain transactions if our Articles of Incorporation or Bylaws are not amended to provide that these provisions do not apply to us or to an acquisition of a controlling interest, or if our disinterested stockholders do not confer voting rights in the control shares.

DESCRIPTION OF PREFERRED STOCK

As of September 18, 2017, no shares of preferred stock had been issued or were outstanding and we are not authorized to issue any shares of preferred stock; however, it is possible that we could amend our Articles of Incorporation to authorize the issuance of shares of preferred stock.

We will file as an exhibitsignature page to the Registration Statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation or amendment to our Articles of Incorporation that describes the terms of any series of preferred stock we are offering before the issuance of that series of preferred stock. This description will include, but not be limited to, the following: (i) the title and stated value; (ii) the number of shares we are offering; (iii) the liquidation preference per share; (iv) the purchase price; (v) the dividend rate, period and payment date and method of calculation for dividends; (vi) whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate; (vii) the provisions for a sinking fund, if any; (viii) the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights; (ix) whether the preferred stock will be convertible into our Common Stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period; (x) whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period; (xi) voting rights, if any,filed exhibits. The remainder of the preferred stock; (x) preemptive rights, if any; (xi) restrictions on transfer, sale or other assignment, if any; (xii) a discussion of any material United States federal income tax considerations applicable to the preferred stock; (xiii) the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; (xiv) any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs and (xv) any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

We may issue warrants for the purchase of Common Stock and/or preferred stock in one or more series. We may issue warrants independently or together with Common Stock and/or preferred stock and the warrants may be attached to or separate from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below.

We will file as exhibits to the Registration Statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrantsunchanged and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus. We urge you to read the applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus, as well as any related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms of the warrants.

has been omitted.May 27, 2022

We will describe in the applicable prospectus supplement the terms of the series of warrants being offered, including: