As filed with the Securities and Exchange Commission on June 15, 2017April 27, 2018

Registration No. 333-216621

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No.1

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Attis Industries Inc.

MERIDIAN WASTE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| New York | 13-3832215 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

12540 Broadwell Road, Suite 2104

Milton, GA 30004

(404) 539-1147(678) 580-5661

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey S. Cosman

Chief Executive Officer

Attis Industries Inc.

12540 Broadwell Road, Suite 2104

Milton, GA 30004

(404) 539-1147

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joseph M. Lucosky, Esq.

Scott E. Linsky, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Iselin, NJ 08830

(732) 395-4400

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐(Do not check if a smaller reporting company) | Smaller reporting company | ☒ | |||

| Emerginggrowthcompany | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered/proposed maximum offering price per unit/proposed maximum aggregate offering price | Amount of registration fee | ||||||

| Common Stock | (1)(2) | (3) | ||||||

| Preferred Stock | (1)(2) | (3) | ||||||

| Warrants | (1)(2) | (3) | ||||||

| Rights | (1)(2) | (3) | ||||||

| Units | (1)(2) | (3) | ||||||

| Total | $ | 50,000,000 | $ | 5,795 | ||||

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee | ||||||||||||

| Common stock, $0.025 par value per share | 19,237,743 | $ | 0.65 | $ | 12,504,532.94 | $ | 1,556.81 | |||||||||

| (1) | |

| (2) | |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securitiesWe may not be soldsell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seekthese securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated June 15, 2017.SUBJECT TO COMPLETION DATED APRIL ___, 2018

PRELIMINARY PROSPECTUS

19,237,743 Shares of Common Stock

MERIDIAN WASTE SOLUTIONS, INC.

$50,000,000

Common Stock

Preferred Stock

Warrants

Rights

Units

WeThe selling stockholders identified in this prospectus may offer and sell up to $50 million in the aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides youup to 19,237,743 shares of our common stock consisting of (i) 6,604,663 shares of our common stock issuable upon conversion of the 2,500 shares of Series F Preferred Stock, par value $0.001 per share, with a general descriptionstated value of $1,000 per share (the “Series F Preferred”) that have been issued to the selling stockholders being registered for resale issued to the selling stockholders pursuant to that certain Securities Purchase Agreement dated February 22, 2018 (the “Series F Shares”) and (ii) 12,633,080 shares of our common stock being registered for resale issuable upon exercise of warrants that have been issued to certain of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information aboutselling stockholders in connection with the offering and the amounts, prices and termspurchase of the securities.Series F Preferred Stock (the “Warrant Shares” and, together with the Series F Shares, the “Shares”). The supplementselling stockholders may also add, updatefrom time to time sell, transfer or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the saleotherwise dispose of any or all of the securities, their namesShares in a number of different ways and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.at varying prices. See the sections“Plan of Distribution” beginning on page 18 of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 13 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our common stock is listed on the NasdaqNASDAQ Capital Market under the symbol “MRDN.” On June 13, 2017,April 25, 2018, the last reported sale price of our common stock on the Nasdaq Capital Market was $3.00$0.65 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

The aggregate market value of our outstanding common stock held by non-affiliates is $17,485,476 based on 7,354,420 shares of outstanding common stock, of which 5,828,492 shares are held by non-affiliates, and a per share price of $3.00 based on the closing sale price of

Investing in our common stock involves risks. See “Risk Factors” on June 13, 2017. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

page 16.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacydetermined if this prospectus is truthful or accuracy of this prospectus.complete. Any representation to the contrary is a criminal offense.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we nor the selling stockholders have authorized anyone to provide you with different information. The selling stockholders are not making an offer of the Shares in any state where such offer is not permitted.

The date of this prospectus is , 2017.April ____, 2018.

i

This prospectus is part of a registration statement that we filed withNo person has been authorized to give any information or make any representation concerning us, the U.S. Securities and Exchange Commission,selling stockholders or the SEC, using a “shelf” registration process. By using a shelf registration statement, we may sell securities from timeShares to time and in one or more offerings up to a total dollar amount of $50 millionbe registered hereunder (other than as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If thereprospectus) and, if any such other information or representation is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

We have not authorized any other person to provide you with different information. If anyone provides you with differentgiven or inconsistent information,made, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction whereit as having been authorized by us or the offer or sale is not permitted.selling stockholders. You should not assume that the information appearingcontained in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of any date other than the date on its respectivethe front cover of this prospectus or as otherwise set forth in this prospectus.

The selling stockholders named herein are offering the Shares only in jurisdictions where such offer is permitted. The distribution of this prospectus and that any information incorporated by reference is accurate only asthe sale of the dateShares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the distribution of this prospectus and the sale of the document incorporatedShares outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the Shares by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When we refer to “Meridian,”, “Attis”, “we,” “our,” “us” and the “Company” in this prospectus, we mean Meridian Waste Solutions,Attis Industries Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. Information filed with the SEC by us can be inspected and copied at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information by mail from the Public Reference Room of the SEC at prescribed rates. Further information on the operation of the SEC’s Public Reference Room in Washington, D.C. can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website ishttp://www.sec.gov.

Our websiteweb site address is [http://www.mwsinc.com.] The information on our website,web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

| 1 |

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

| ● | Our Annual Report on Form 10-K | |

| ● | Our Current Reports on Form 8-K and/or 8-K/A filed with the SEC | |

| ● | The description of our |

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

Meridian Waste Solutions,Attis Industries Inc.

12540 Broadwell Road, Suite 2104

Milton, GA 30004

(404) 539-1147(678) 580-5661

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements of historical fact contained in this prospectus, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

| 2 |

| Issuer | Attis Industries, Inc. |

| Shares offered for resale by the selling stockholders | 19,237,743shares |

| Common Stock outstanding prior to this offering | 17,123,416 shares |

| Common Stock outstanding after this offering | 36,361,159 shares(1) |

| Use of Proceeds | The selling stockholders will receive all of the proceeds from the sale of any Shares sold by it pursuant to this prospectus. We will not receive any proceeds from these sales. See “Use of Proceeds” in this prospectus. |

| Market for our Common Stock | Our shares of common stock are currently listed on the NASDAQ Capital Market. |

| NASDAQ Ticker Symbol | “MRDN” |

| Risk Factors | Any investment in the Shares is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” on page 16 of this prospectus. |

(1) The number of shares of our common stock outstanding after this offering is calculated including the Series F Preferred Shares and the Warrant Shares, without regard to any limitations on the exercise of the Series F Preferred Stock or the related warrants, respectively.

Overview

Historically, Meridian has generally operated three lines of business: (1) non-hazardous solid waste collection, transfer and disposal services (the “Waste Business”); (2) technologies, centering on creating community-based synergies through healthcare collaborations and software solutions, through its wholly-owned subsidiary, Mobile Science Technologies, Inc. (the “Technologies Business”); and (3) innovations, striving to create value from recovered resources, through advanced byproduct technologies and assets found in downstream production, through its wholly-owned subsidiary, Attis Innovations, LLC (the “Innovations Business”).

Late in the Summer of 2017, the Company began to explore the possibility of selling the Waste Business in order to reduce the Company’s leverage, dedicating resources to further growth in the Technologies Business and Innovations Business, where the Company saw robust pipelines for further opportunity. Such sale of the Waste Business was expected to clear the bottleneck caused by the debt encumbering the Waste Business, while, the Company believed, significantly increasing its enterprise value, and thereby paving the way to aggressively pursue acquisitions.

On February 20, 2018, the Company entered into an agreement for the sale of the Waste Business. Such sale of the Waste Business is expected to close on or about April 17, 2018.

We built the Company by providing everyday products and services that contribute to the lives of all people. We will continue to do so moving forward, but in new and, we believe, more profitable ways that capitalize on untapped opportunities and changing market conditions in healthcare and energy to build strategically compatible revenue lines in our Technologies Business and Innovations Business.

| 3 |

History

Meridian Waste Solutions, Inc. is an integrated providerwas incorporated in November 1993 in New York. Prior to October 17, 2014, the Company derived revenue by licensing its trademarks to a third party (the “Legacy Business”).

On October 17, 2014, the Company entered into that certain Membership Interest Purchase Agreement (the “Purchase Agreement”) by and among Here to Serve Holding Corp., a Delaware corporation, as seller (“Here to Serve”), the Company, as parent, Brooklyn Cheesecake & Dessert Acquisition Corp., a wholly-owned subsidiary of non-hazardous solid waste collection, transferthe Company, as buyer (the “Acquisition Corp.”), the Chief Executive Officer of the Company (the “Company Executive”), the majority shareholder of the Company (the “Company Majority Shareholder”) and disposal services. We currently havecertain shareholders of Here to Serve (the “Here to Serve Shareholders”), pursuant to which the Acquisition Corp acquired from Here to Serve all of our operationsHere to Serve’s right, title and interest in Missouri and Virginia but are aggressively looking to expand our presence across the Midwest, South and East regions(i) 100% of the United States.

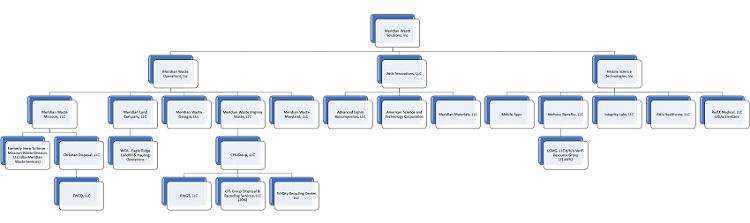

Corporate Structure

Missouri Waste Operations

membership interests of Here to Serve – Missouri Waste Division, LLC d/b/a Meridian Waste,

Here to Serve – a Missouri Waste Division, LLClimited liability company (“HTS Waste”) is a non-hazardous solid waste management company providing collection services for approximately 45,000 commercial, industrial and residential customers in Missouri. We own one collection operation based out of Bridgeton, Missouri. Approximately 100% of HTS Waste’s 2015 revenue and revenue in 2016 through September 30, 2016, was from collection, utilizing over 60 collection vehicles.

HTS began non-hazardous waste collection operations in May 2014 upon the acquisition of nearly all of the assets from Meridian Waste Services, LLC that in turn became the core of our operations. From our formation through today, we have begun to create the infrastructure needed to expand our operations through acquisitions and market development opportunities.

Christian Disposal, LLC; FWCD

Effective December 22, 2015, the Company consummated the closing of the Amended and Restated Membership Interest Purchase Agreement, dated October 16, 2015, by and among the Company, Timothy M. Drury, Christian Disposal LLC (“Christian Disposal”), FWCD, LLC (“FWCD”), Missouri Waste and Georgia Waste; as amended by that certain First Amendment thereto, dated December 4, 2015, pursuant to which Christian Disposal became a wholly-owned subsidiary of the Company in exchange for: (i) Thirteen Million Dollars ($13,000,000), subject to working capital adjustment,; (ii) 87,500 shares of the Company’s Common Stock, (iii) a Convertible Promissory Note in the amount of One Million Two Hundred Fifty Thousand Dollars ($1,250,000), bearing interest at 8% per annum and (iv) an additional purchase price of Two Million Dollars ($2,000,000), due upon completion of an extension under a certain contract to which Christian Disposal is party (the "Additional Purchase Price"), each payable to the former stockholders of Christian Disposal. The Additional Purchase Price has not, and likely will not, become due, as it presently appears that an extension will not be granted in connection with the relevant contract.

Christian Disposal, along with its subsidiary, FWCD, LLC, is a non-hazardous solid waste management company providing collection and transfer services for approximately 35,000 commercial, industrial and residential customers in Missouri. Christian Disposal’s collection operation is based out of Winfield, Missouri. Along with operations in Winfield, Christian Disposal operates two transfer stations, in O’Fallon, Missouri and St. Peters, Missouri, and owns one transfer station, in Winfield, Missouri. Approximately 100% of Christian Disposal and FWCD’s 2015 revenue and revenue in 2016 through September 30, 2016 was from collection and transfer, utilizing over 35 collection vehicles.

Christian Disposal began non-hazardous waste collection operations in 1978. Our acquisition of Christian Disposal is a key element of our strategy to create the vertically integrated infrastructure needed to expand our operations.

Meridian Land Company, LLC (Assets of Eagle Ridge Landfill & Hauling)

Effective December 22, 2015, Meridian Land Company, LLC, a wholly-owned subsidiary of the Company, consummated the closing of that certain Asset Purchase Agreement, dated November 13, 2015, by and between Meridian Land Company, LLC and Eagle Ridge Landfill, LLC (“Eagle”), as amended by that certain Amendment to Asset Purchase Agreement, dated December 18, 2015, to which the Company and WCA Waste Corporation are also party, pursuant to which the Company, through Meridian Land Company, LLC, purchased from Eagle, a landfill in Pike County, Missouri (the “Eagle Ridge Landfill”) and substantially all of the assets used by Eagle related to the Eagle Ridge Landfill, including certain debts, in exchange for $9,506,500 in cash, subject to a working capital adjustment.

The Eagle Ridge Landfill is currently permitted to accept municipal solid waste. The Eagle Ridge Landfill is located in Bowling Green, Missouri. Meridian Land Company currently owns 265 acres at Eagle Ridge with 56.7 acres permitted and constructed to receive waste.

In addition to the Eagle Ridge Landfill, the Company operates, through Meridian Land Company, hauling operations in Bowling Green, Missouri, servicing commercial, residential and roll off customers in this market. The Company will be looking to expand its footprint in the market through an aggressive sales and marketing strategy, as well as through additional acquisitions.

Virginia Waste Operations

The CFS Group, LLC; The CFS Disposal & Recycling Services, LLC; RWG5, LLC

On February 15, 2017, the Company consummated the closing of the Membership Interest Purchase Agreement (the “Virginia Purchase Agreement”) by and between the Company and Waste Services Industries, LLC ("Seller"), pursuant to which the Company purchased from Seller 100% of the membership interests of The CFS Group,Here to Serve Technology, LLC, a Georgia limited liability company (“CFS”HTS Tech”), The CFS Disposal & Recycling Services,; and (iii) 100% of the membership interests of Here to Serve Georgia Waste Division, LLC, a Georgia limited liability company (“CFS Disposal”)HTS Waste Georgia”, RWG5, LLC (“RWG5” and together with CFSHTS Waste and CFS Disposal,HTS Tech, collectively, the “CFS Companies”“Membership Interests”), in exchange. As consideration for the following:Membership Interests, on October 31, 2014 (the “Closing Date”) (i) $40,000,000 in cash and assumption of certain capital leases, subjectthe Company issued to a working capital adjustment in accordance with Section 2.6 of the Virginia Purchase Agreement and (ii) 500,000Here to Serve 452,707 shares of the Company’s common stock.stock (the “HTS Common Stock”); (ii) the Company issued to the holder of Class A Preferred Stock of Here to Serve (“Here to Serve’s Class A Preferred Stock”) 51 shares of the Company’s Series A Preferred Stock (the “Series A Preferred Stock”); (iii) the Company issued to the holder of Class B Preferred Stock of Here to Serve (“Here to Serve’s Class B Preferred Stock”) an aggregate of 71,120 shares of the Company’s Series B Preferred Stock (the “Series B Preferred Stock,” together with the HTS Common Stock and the Series A Preferred Stock, the “Purchase Price Shares”); and (iv) the Company assumed certain liabilities.

Collectively,As further consideration, on the CFS Companies are non-hazardous solid waste management companies providing collection and transfer services for more than 30,000 commercial, industrial and residential customers in Virginia, with main facilities in Petersburg, Virginia and satellite facilities in Lunenberg, Virginia and Prince George, Virginia. Along with collection operations in Petersburg, the CFS Companies operate a transfer station, in Lunenberg, and owns two landfills, in Petersburg and Lunenberg. Approximately 81%Closing Date of the CFS Companies’ 2015 revenue wastransaction contemplated under the Purchase Agreement, (i) in satisfaction of all accounts payable and shareholder loans, Here to Serve paid to the Company Majority Shareholder $70,000 and (ii) Here to Serve purchased from collectionthe Company Majority Shareholder 11,500 shares of the Company’s common stock for a purchase price of $230,000. Pursuant to the Purchase Agreement, to the extent Purchase Price Shares are issued to individual shareholders of Here to Serve at or upon closing of the Purchase Agreement: (i) shares of common stock of Here to Serve held by the individuals listed on Schedule 2.2 of the Purchase Agreement valued at $2,564,374.95 were cancelled in accordance with such Schedule 2.2; (ii) 50,000 shares of Here to Serve’s Class A Preferred Stock valued at $1,000 were cancelled; and transfer, utilizing over 60 collection vehicles.(iii) 71,120 shares of Here to Serve’s Class B Preferred Stock valued at $7,121,000 were cancelled.

Our acquisitionThe closing of the CFS Companies isPurchase Agreement resulted in a key elementchange of our strategycontrol of the Company and the Legacy Business was spun out to createa shareholder in connection with the vertically integrated infrastructure needed to expand our operations.same.

CustomersOn March 27, 2015, the Company filed a Certificate of Amendment of the Certificate of Incorporation to change the name of the Company from Brooklyn Cheesecake & Desserts Company, Inc. to Meridian Waste Solutions, Inc. (the “Name Change”).

ForOn February 20, 2018, the nine months ended September 30, 2016,Company entered into an Equity Securities Purchase Agreement (the “Purchase Agreement”) with Meridian has one municipal contract that accountedWaste Operations, Inc., a New York corporation (“Seller”) and a wholly-owned subsidiary of Meridian, Meridian Waste Acquisitions, LLC, a Delaware limited liability company (“Buyer”) and solely for 11%purposes of HTS Waste’s long-term contracted revenueSections 6.4, 6.7 and 11.18 thereof, Jeffrey S. Cosman, the Chief Executive Officer and Chairman of Meridian, providing for, such period. Meridian had two municipal contracts,subject to the firstsatisfaction or waiver (if permissible under applicable law) of which accounted for 26%specified conditions, the purchase of all of the membership interests of each of the direct wholly-owned subsidiaries of Seller (collectively, the “Acquired Parent Entities” and together with their direct and indirect subsidiaries, the “Acquired Entities”), comprising, with the Acquired Parent Entities’ subsidiaries, the Company’s Waste Business and constituting substantially all of the secondassets of which accounted for 18%the Company (such acquisition, the “Transaction”). Pursuant to the Purchase Agreement, at the time the Transaction closes (the “Closing”) in consideration of $100,000, the Company will issue to the Buyer a warrant (the “Warrant”) to purchase shares of common stock, par value $0.025 (“Common Stock”), of HTS Waste’s long-term contracted revenue for the year ended December 31, 2015.Company, equal to two percent of the issued and outstanding shares of capital stock of the Company on a fully-diluted basis as of the time of issuance of the Warrant (subject to adjustment as set forth therein).

Collection Services

Meridian, through its subsidiaries, provides solid waste collection services to approximately 65,000 industrial, commercial and residential customers inAt the Metropolitan St. Louis, Missouri area. In 2015, its collection revenue consisted of approximately 17% from services provided to industrial customers, 13% from services provided to commercial customers and 70% from services provided to residential customers.

In our commercial collection operations, we supply our customers with waste containers of various types and sizes. These containers are designed so that they can be lifted mechanically and emptied into a collection truck to be transported to a disposal facility. By using these containers, we can service most of our commercial customers with trucks operated by a single employee. Commercial collection services are generally performed under service agreements with a duration of one to five years with possible renewal options. Fees are generally determined by such considerations as individual market factors, collection frequency, the type of equipment we furnish, the type and volume or weighttime of the waste to be collected,Closing, Buyer will have satisfied $75.8 million of the distance toCompany’s outstanding indebtedness under the disposal facilityAmended and Restated Credit and Guaranty Agreement dated February 15, 2017 among certain of the costAcquired Entities, Meridian, and Goldman Sachs Specialty Lending Group, L.P. (as amended, the “Credit Agreement”) and assume the Acquired Entities’ obligations under certain equipment leases and other operating indebtedness. Meridian estimates that it will retain approximately $6.6 million of disposal.

Residential solid waste collection services often are performedindebtedness under contracts with municipalities, which we generally secure by competitive bid and which give us exclusive rights to service allthe Credit Agreement or a portionsuccessor agreement and certain promissory notes payable for an aggregate amount of the homes in these municipalities. These contracts usually range in duration from one to five years with possible renewal options. Generally, the renewal options are automatic upon the mutual agreement of the municipality and the provider; however, some agreements provide for mandatory re-bidding. Alternatively, residential solid waste collection services may be performed on a subscription basis, in which individual households or homeowners’ or similar associations contract directly with us. In either case, the fees received for residential collection are based primarily on market factors, frequency and type of service, the distance to the disposal facility and the cost of disposal.$1.475 million (the “Legacy Notes”).

Additionally, we rent waste containers and provide collection services to construction, demolition and industrial sites. We load the containers onto our vehicles and transport them with the waste to either a landfill or a transfer station for disposal. We refer to this as “roll-off” collection. Roll-off collection services are generally performed on a contractual basis. Contract terms tend to be shorter in length, in some cases having terms of only six months, and may vary according to the customers’ underlying projects.

| 4 |

This will leave the Company to operate its two remaining lines of business, the Technologies Business and the Innovations Business, unencumbered by $75.8 million of debt that was previously outstanding.

Corporate Structure

Technologies Division

The Technologies Division of the Company, sometimes referred to herein as “Attis Healthcare”, is comprised of two divisions — (i) healthcare and (ii) Bright City, a mobile application. Our healthcare group focuses on improving patient care and providing cost-saving opportunities through innovative, compliant, and comprehensive diagnostic and therapeutic solutions for patients and healthcare providers. We understand the challenges that come with trying to improve patient outcomes while driving down the cost of care, which is why we offer a broad portfolio of what we believe to be best-in-class solutions, combined with insight and expertise, to give providers tools that lead to healthier patients and communities. Attis Healthcare offers products and services in a variety of areas, including hospital consulting services for both laboratory services and emergency department revenue enhancement, polymerase chain reaction (“PCR”) molecular testing, pharmacogenetics (“PGx”) testing, and medication therapy management.

Bright City is an all-in-one citizen engagement mobile application that allows cities and their residents to communicate more directly. This allows to make for safer communities, community leadership to be more proactive, and citizens to be more connected. Bright City provides direct and two-way communication, which means citizens can reply and communicate directly with local law enforcement and town, city or municipal staff. Bright City is specific and targeted, which prevents communications from becoming lost in the clutter of social media and allows for communications from citizens to be routed directly to the appropriate city staff for response and resolution. Bright City includes camera, video, and GPS locator functionality, which provides specific location data and a more accurate description of the reported activity, expediting the flow of information. Bright City acts as the eyes and ears of the city, allowing towns, cities and municipalities to expand security and increase connectivity.

Customers

Currently, within our Technologies Division, we have agreements with three (3) hospitals to manage their laboratory services. As part of those agreements, we provide consulting services in the areas of equipment procurement, materials management, staffing, training, billing and laboratory compliance. In addition to the three (3) hospitals we currently work with, we have a plan in place to bring on at least another four (4) hospital laboratories during the remainder of 2018, but cannot guarantee that we will be able to reach agreement with these laboratories. We are also working several large hospital groups regarding emergency services coding, where we provide expertise in connection with billing in the emergency department with an expectation of growing revenue for the hospital through improved billing and coding.

| 5 |

In connection with our PCR testing services, we focus on long term care facilities, home healthcare agencies and physician practices. We expect to continue expanding our footprint in this business, both by adding additional physician practices and long term care facilities in the Southeast, as well as expanding across the country to the Midwest, Northeast, and beyond.

Our PGx services are designed to assist large employers with reducing the amount of money they spend in pharmacy costs for their workforce. Specifically, Attis Healthcare has engaged multiple health benefits brokers who work with large employers to help drive this technology to these employers. Attis Healthcare is currently analyzing pharmacy data for multiple large employers.

Attis Healthcare is also currently working directly with both community pharmacies and large pharmacy corporations to offer PGx and medication therapy management to patient customers of the pharmacies. Attis Healthcare has an agreement with four (4) community pharmacies in the Southeast and is engaged in discussions with corporations about adding this technology to their pharmacy shelves.

Bright City is currently in the pilot phase, with delivery to the first municipality, located in the Southeast U.S., scheduled for the early second quarter of 2018. The Company expects to add two (2) additional pilot municipalities in either the second quarter or third quarter of 2018 and will then concentrate on a larger scale sales pipeline across the U.S.

Growth Strategy

TransferGrowth in Existing Markets

We currently provide laboratory testing services to a variety of physician offices and Disposallong term care facilities and we currently manage hospital laboratories in three (3) hospitals, all largely concentrated in the Southeast U.S. We are focused on increasing our sales in these markets by growing our customer base through increased market penetration and expanding existing customers through use of our other services. We have also begun engaging large employers on the PGx portion of our business and will continue to look to expand the number of employers who utilize our PGx and medication therapy management solution as a means of reducing their pharmacy costs.

Expanding into New Markets

In 2018 and beyond, we plan to expand into new markets, specifically targeting the Midwest United States and the Western part of the United States. We have and will continue to engage sales professionals that have strong relationships in all areas of the United States and will utilize those relationships to build our business into previously untapped markets.

Integration

Our growth strategy also includes the plan to become more integrated across our business lines by purchasing long term care facilities, nursing homes, and rural hospitals, which will allow us to further integrate our laboratory testing in the markets where the testing is most effective. We also plan to offer billing services and other consulting services, further integrating our various service offerings in the healthcare market.

Acquisition

Our revenue model is based on organic growth of operations, the acquisition of established operations in new markets, as well as being able to execute value-adding, tuck-in acquisitions. We hope to direct acquisition efforts towards those markets in which we would be able to provide vertically integrated services. Prior to acquisition, we analyze each prospective target for cost savings through the elimination of inefficiencies and excesses that are typically associated with private companies competing in fragmented industries. We aim to realize synergies from consolidating businesses into our existing operations, which we hope will allow us to reduce capital and expense requirements.

| 6 |

Competition

Competition in the lab services industry is dominated by two large national laboratories, Quest Diagnostics and Labcorp, with multiple regional laboratories providing laboratory services as well. However, because of their size, these laboratories struggle to provide high quality customer service. Our focus in building out hospital laboratories is to improve the customer service available to physician practices and other healthcare facilities, including turnaround time for test results, while bolstering the healthcare services offered in rural America and offering jobs in underserved communities.

Sales & Marketing

We focus our marketing efforts on increasing and extending business with existing customers, as well as increasing our new customer base. We target physician practices, hospitals, long term care facilities, and large employers. With respect to hospitals, we particularly focus on rural hospitals, which are historically underserved. We believe that by improving the healthcare in the rural community, we can help stimulate job growth and improve the quality of life in this historically underserved population. We have a seasoned sales force of both executives and direct line sales employees with a wealth of experience in the healthcare sector. We utilize relationships across the United States to build our sales force, relying on relationships with strong sales professionals.

Government Contracts

We currently have one (1) governmental contract with a municipality in connection with Bright City. Bright City is still in the pilot phase; we expect to grow the number of governmental contracts in the second and third quarters of 2018.

Regulation

Our business is subject to extensive and evolving federal, state and local environmental, health, safety and healthcare laws and regulations. Governmental agencies have the authority to enforce compliance with these laws and regulations and to obtain injunctions or impose civil or criminal penalties in cases of violations. We believe that regulation of the healthcare industry will continue to evolve, and we will adapt to future legal and regulatory requirements to ensure compliance. Attis Healthcare strives to operate under the regulations and laws put in place to protect our medical communities and to comply with all regulations and laws that are put in place. Because compliance is important to us, we constantly review and assess our policies, practices and procedures. This compliance is, and may in the future continue to be, costly. In particular, the governing laws regarding medical laboratories are strictly enforced and reviewed frequently. Clinical Laboratory Improvement Amendments (“CLIA”) inspections take place every two years, and the laboratories we manage or own must be in strict compliance. The section of the federal regulations titled “Standards and Certification: Laboratory Requirements” is issued by the Centers for Medicare & Medicaid Services (“CMS”) to enact the CLIA law passed by Congress. In general terms, the CLIA regulations establish quality standards for laboratory testing performed on specimens from humans, such as blood, body fluid and tissue, for the purpose of diagnosis, prevention, or treatment of disease, or assessment of health.

The federal Health Insurance Portability and Accountability Act of 1996 and the regulations issued thereunder (collectively, “HIPAA”) impose extensive requirements on the way in which health plans, health care providers, health care clearinghouses (known as “covered entities”) and their business associates use, disclose and safeguard protected health information (“PHI”). Criminal penalties and civil sanctions may be imposed for failing to comply with HIPAA standards. The Health Information Technology for Economic and Clinical Health Act (the “HITECH Act”), enacted as part of the American Recovery and Reinvestment Act of 2009, amended HIPAA to impose additional restrictions on third-party funded communications using PHI and the receipt of remuneration in exchange for PHI. It also extended HIPAA privacy and security requirements and penalties directly to business associates. In addition to HIPAA, state health privacy laws apply to the extent they are more protective of individual privacy than is HIPAA.

| 7 |

Finally, the Health Insurance Marketplaces (formerly known as the “exchanges”) are required to adhere to privacy and security standards with respect to PII, and to impose privacy and security standards that are at least as protective of PII as those the Health Insurance Marketplace has implemented for itself or non-Health Insurance Marketplace entities, which include insurers offering plans through the Health Insurance Marketplaces and their designated downstream entities, including PBMs and other business associates. These standards may differ from, and be more stringent than, HIPAA.

Attis Healthcare aims to strictly comply with HIPAA regulations. Annual certification for all employees with a reasonable expectation of coming into contact with protected health information is required. Our customers and prospective customers are “Covered Entities” under HIPAA and its accompanying regulations. As such, Customer is required to make reasonable efforts to limit as necessary the disclosure of PHI as defined by HIPAA. To the extent that a Vendor or Customer has access to such PHI while supplying products or services or otherwise performing under the Order or complying with these Terms, Vendor or Customer will treat such PHI in accordance with the applicable Business Associate Addendum between the parties, including but not limited to the use of commercially reasonable safeguards to prevent the use or disclosure of PHI except as provided under the Order.

The Joint Commission on the Accreditation of Healthcare Organizations (JCAHO) applies, or may apply, to some of the laboratories that Attis Healthcare manages. When JCAHO does have an oversight role, the hospital laboratories that we manage are in compliance with their safety regulations. JCAHO’s focus is on healthcare systems. Today, most hospitals are accredited by JCAHO. Laboratories are part of these healthcare systems and are thereby required to comply with the JCAHO safety regulations. JCAHO regulations are extensive and numerous. They have very specific requirements on many safety matters. JCAHO also has a “deemed status” acknowledgement by the federal government.

Passed in 2010, the Affordable Care Act (“ACA”) affects virtually every aspect of health care in the country. In addition to establishing the framework for every individual to have health coverage, ACA enacted a number of significant health care reforms. Many of these reforms affect the coverage and plan designs that are provided by our health plan clients. As a result, these reforms impact a number of our services and business practices. Some significant ACA provisions are still being finalized (e.g., implementation of the excise tax on high-cost employer-sponsored health coverage has been delayed by Congress) and parts of ACA may still face potential Congressional changes, so the full impact of ACA on our Company is still uncertain.

Innovations Division

Attis Innovations, LLC

Attis Innovations (“Innovations”) focuses on producing sustainable materials and fuels from renewable sources at costs equal to or less than those otherwise produced from fossil fuels. By processing targeted feedstocks, we believe Innovations will be able to produce materials used in the following markets: bioplastics, consumer goods, adhesives, carbon fiber, renewable fuels, and green chemicals, among others.

We intend to leverage our expertise in waste streams and our technology development experience to harvest value from biomass. To this end, we have assembled a growing portfolio of technologies that are being designed and developed to refine biomass in a series of process steps that are analogous to petroleum refining, in which crude oil is sequentially processed into a wide range of products. Our patented and patent-pending lignin conversion and refining processes, which fractionate and convert cellulosic biomass into ethanol or butanol and a renewable alternative for petroleum-derived resins, were recently awarded a $3 million grant from the USDA.

Our ultimate plan for this business is to finance, build, own and operate facilities based on our technologies to generate shareholder value by producing and selling renewable fuels, plastics, resins and other carbon-neutral offsets from low-value lignin and other cellulosic feedstocks; including pulp and paper by-products, first generation biofuel by-products, and other overlooked carbon-containing residuals. The Company is continuing to evaluate acquisitions and other transactions, some of which include existing production assets that are ideal for co-location of facilities based on our technologies. First generation biofuel plants can be particularly favorable targets inasmuch as our technologies have been proven to have the potential to generate more income by converting and refining existing by-products as compared to the income of current plants using traditional methods.

| 8 |

Innovations is comprised of three divisions:

| ● | Attis R&D Services | |

| ● | Attis Biomaterials | |

| ● | Attis Biofuels |

Attis R&D Services

Landfills are the main depositoryBeginning in January 2018, Attis R&D Services, through American Science and Technology Corporation (AST), holds a ‘for hire’ 15,000 sq. ft. R&D facility (the “AST Facility”) capable of processing almost any form of biomass and converting it into targeted materials for solid waste in the United States. Solid waste landfills are built, operated,testing and tied to a state permit under stringent federal, state and local regulations. Currently, solid waste landfills in the United States must be designed, permitted, operated, closed and maintained after closure in compliance with federal, state and local regulations pursuant to Subtitle D of the Resource Conservation and Recovery Act of 1976, as amended. We do not operate hazardous waste landfills, which may be subject to even greater regulations. Operating a solid waste landfill includes excavating, constructing liners, continually spreading and compacting waste and covering waste with earth or other inert material as required, final capping, closure and post-closure monitoring. The objectives of these operations are to maintain sanitary conditions, to ensure the best possible use of the airspace and to prepare the site so that it can ultimately be used for other end useevaluation purposes.

Access to a disposal This facility is a necessityfull-service pilot test facility, available to this industry and dedicated to developing innovative biobased products using its patented AST-Organosolv process to convert lignocellulosic biomass into high-value, bio-based chemicals and products. The AST Facility, located in Wausau, Wisconsin, operates at various scales from a laboratory level to multi-ton batches and is equipped with a wide range of biomass processing equipment to provide a unique opportunity to accelerate the advancement of the bio-based economy. The AST Facility was built through a series of grants and private funding to generate slightly positive cash flow on annual testing revenues between $0.9 to $1.3 million over the past three years. Innovations is in the process of executing its plan to upgrade the AST Facility to generate improved revenues.

Attis Biomaterials

Attis Biomaterials is intended to provide for all solid waste management companies. While accessthe recovery and conversion of practically any form of biomass into targeted bio-based materials. Attis Biomaterials plans to disposal facilities owned or operated by third partiesproduce and supply high-performance plant-derived materials, chemicals, and molecularly consistent feedstocks to manufacturing industries at costs competitive with those for materials otherwise derived from fossil fuels. Plastic, adhesives, and transportation fuels are typically produced from non-renewable materials such as crude oil and natural gas. Innovations is focusing on providing the same materials directly from biomass, which can be obtained,sustainably harvested and replanted. We believe Attis Biomaterials can cost-effectively recover greater amounts of high-quality sources of carbon-based feedstocks from biomass than those previously available, thereby substantially increasing the revenues and profits generated per unit of biomass harvested.

In addition to processing virgin biomass feedstocks, we believe that it is preferableAttis Biomaterials will also be able to internalizerecover lignin from byproduct streams from the waste streams when possible. Meridian is targeting further geographic,pulp and paper industry, as well as operational expansion by focusing on markets with transfer stationsfrom the cellulosic ethanol industry. Presently, these pulp and landfills availablepaper producers and biorefineries typically burn their lignin byproduct generating only about $50 per ton for acquisition.its energy content, whereas Attis Biomaterials is expected to be able to result in the recovery of about 50% of the byproduct stream as a valuable lignin polymer that can instead be sold for $500 to $800 per ton.

Our transfer stations allow usThe United States produces about 73 million metric tons of paper from about 219 million metric tons of trees. This paper industry does not target the recovery of lignin from its byproduct leaving more than 35 million metric tons of lignin available from this industry alone. Innovations’ technology is capable of recovering up to consolidate waste30% of this lignin for subsequent transferuse in larger loads, thereby making disposal inhigher valued markets. While the global demand for biomaterials cannot currently consume this volume of material, Innovations is collaborating with various entities to integrate our otherwise remote landfills economically feasible. A transfer station is a facility located near residential and commercial collection routes where collection trucks take the solid waste that has been collected. The waste is unloaded from the collection trucks and reloaded onto larger transfer trucks for transportation to a landfill for final disposal. Transfer stations are generally owned by municipalities, with contracts to operate such transfer stations awarded based on bids. bio-based materials into traditional product offerings.

As an alternativeexample, the team working with Innovations on a $3 million USDA grant to operatingdevelop lignin into residential siding products is comprised of Oak Ridge National Laboratory, the University of Tennessee’s Center for Renewable Carbon, University of Wisconsin-Stevens Point, the Natural Resource Research Institute, Long Trail Sustainability, and Innovations’ research and development unit, American Science and Technology Corporation.

Innovations is engaging partners for services agreements for Attis Biomaterials, with revenue-generating operations expected to begin in the fourth quarter of 2018, following the Company’s acquisition of certain property. Additionally, Innovations has hired Emerging Fuels Technology to develop a transfer station directly, wemethod to convert the Innovations lignin into transportation fuels such as diesel and gasoline.

| 9 |

In order to meet the EPA’s biofuel production goals, more than 500 new traditional cellulosic ethanol facilities would need to be built by 2022. Because these traditional facilities do not currently recover a valuable form of lignin, they are unable to compete against fossil fuels due to the low revenues generated per unit of biomass consumed. Like pulp and paper producers, these cellulosic biorefineries burn the lignin they produce for an energy value of only about $50 per ton. Attis Biomaterials can allow these facilities to increase revenue and value by adding technology that would enable such facilities to recover the lignin. Further, the availability of this technology could negotiateresult in the EPA requiring more strict compliance with existing regulations and granting fewer waivers for non-compliance, which in turn would cause a greater demand of Attis Biomaterials’ technology.

Attis Biofuels

Attis Biofuels is intended to produce biofuels from low-cost feedstocks. These feedstocks include cellulose, hemicellulose lignin, sugars, fats and vegetable oils.

Attis Biofuels plans to purchase sugars from Attis Biomaterials and to convert this sugar into ethanol. This form of ethanol is referred to as cellulosic ethanol and sold at a premium to corn derived ethanol due the additional renewable energy credits it receives.

In addition, Attis Biofuels plans to use its capital and energy efficient biodiesel and renewable diesel process technology to convert fats and oils into fuels. Attis Biofuels has designed a hybrid process technology that allows for the production of either biodiesel or renewable diesel depending on the market demand for each.

When producing biodiesel, Attis Biofuels’ process does not require the use of a transfer station ownedcatalyst; as a result, the system is able to produce biodiesel at an advantage of about a 10 to 30 cents per gallon over companies that use such other catalysts.

When producing renewable diesel, Attis Biofuels’ process consumes about 30-50% less hydrogen than those processes currently in production. This is accomplished by stripping glycerin from the triglycerides prior to hydroprocessing. Hydrogen accounts for between 25 and 60 cents of the processing cost associated with producing a private party or operatedsingle gallon of renewable diesel and the Attis Biofuels technology provides a cost advantage by a competitor, which may not bereducing the amount of hydrogen consumed. Furthermore, the use of less hydrogen, reduces the energy conversion requirement and can increase incentive payments from places like California where Low Carbon Fuel Standards (“LCFS”) are in place to incentives more efficient fuel conversion.

Innovations is engaging partners for services agreements for Attis Biofuels, with revenue-generating operations expected to begin in the fourth quarter of 2018, following the Company’s acquisition of certain property. Attis Biofuels would use the same property and same facility as profitable as operating our own transfer station. Attis Biomaterials.

Attis IP Holdings

In addition to increasing our abilitythe three divisions of Innovations, Attis IP Holdings is a company designated to internalizehold and manage Innovations’ patent portfolio. This business unit will charge each of Innovations’ process subsidiaries a royalty fee to be used to account for the waste that our collection operations collect, using transfer stations reduces the costscost associated with transporting wastemanaging and prosecuting the patents. The objective of this business unit is to final disposal sites because the trucks we use for transferbe cash flow neutral.

Customers

Presently, Innovations does not have a larger capacity than collection trucks, thus allowing more wastefully commercialized system in operation; therefore, it currently has a limited customer base that is solely associated with its contract R&D service work out of its Wausau, WI biomass processing facility. Our plan is to target customers that will be transported to the disposal facility on each trip.feedstock providers for its fully commercialized process technologies once we have a fully commercialized system in operation.

| 10 |

Our Operating Strengths

Experienced Leadership

We haveInnovations has an experienced management team that has a provensuccessful track record in multiple industries including waste and experienced senior management team. Our Chief Executive Officer, Jeffrey S. Cosman,byproduct recovery, renewable fuel production, intellectual property development, plastics, federal and Presidentstate policy initiatives and COO Walter H. Hall, Jr. combineprocess and chemical engineering. Innovations division president is David Winsness who has over 3525 years of experience in process engineering and technology development. Over the solid wastelast 15 years, Mr. Winsness has worked in the corn-based ethanol industry including significantin the US where he and his team developed and commercialized a patented process to extract corn oil from the backend of dry mill ethanol facilities for use as a feedstock in renewable fuel production and animal feed. Today, that technology is deployed at an estimated 92% in the US ethanol industry and is responsible for an estimated $750 million in annual revenue.

Innovations draws on the deep experience inlocalof its team and regional operations, local and regional accounting, mergers & acquisitions, integration andrelies heavily on years of industry experience across multiple competencies to drive the development of disposal capacity. Membersits patented and patent-pending technologies to full commercialization as well as various biobased end product offerings.

Vertically Integrated Operations

Innovations vertically integrated operations enable us to control the entire biobased supply chain from feedstock to end product, allowing us to maximize revenues by tightly controlling input costs and increasing the gross margin on finished products. This starts with identifying and forming strategic partnerships with biomass suppliers who possess high-quality materials that are not currently being processed due to location or scale.

With a steady stream of our team have held senior positions at Republic Services, Advanced Disposal, Southland Waste Services and Browning Ferris Industries. Our team has a proven track record withdevelopment and implementation of strategic marketplace plans, sales, safety, acquisitions, and coordination of assets and personnel.While our senior leadership team creates and drives our overall growth strategy, we rely on a decentralized management structure which does not interfere with local management and may afford us the opportunityinexpensive, high-quality biomass feedstock, Innovations is able to capitalize on growthits AST process technology that cost-effectively and cost reductionefficiently processes and converts biomass into refined forms of commodities such as sugar and lignin polymers. Providing further flexibility is our technologies’ ability to process at the local level.varying scales economically, opening opportunities to process biomass feedstocks previously thought too difficult due to quantity available or location.

The vertical integrationInnovations can market these materials independently or utilize them in downstream conversion systems that enable end-use product manufacturing of our operations allows ussiding and other types of durable, thermoplastic products. This provides tremendous flexibility to manage the waste stream from the point of collection through disposal, which we hope will enablesell intermediate biomaterials for further processing or end products, allowing us to maximize profit by controlling costsrevenue throughout the supply chain and gaininggain significant competitive advantages, while still providing high-quality service to our customers. In the St. Louis market, because we have integrated our network of collection, transfer and disposal assets, primarily using our own resources, we generate a steady, predictable stream of waste volume and capture an incremental disposal margin. We charge tipping fees to third-party collection service providers for the use of our transfer stations or landfills, providing a source of recurring revenue. We believe this internalization rate provides us with a significant cost advantage over our competitors, positioning us well to win additional profitable business through new customer acquisition and municipal contract awards. We also believe this vertically integrated structure enables us to quickly and efficiently integrate future acquisitions of transfer stations, collection operations or landfills into our current operations.advantages.

Technology Assets

We have one activeThrough a combination of intellectual property and strategically located landfill at the core ofproprietary know-how, we are well positioned to maintain and grow our integrated operations which we believe provides us a significant competitive advantage in Missouri, in that we do not need to use our competitors’ landfills. Our landfill has substantial remaining airspace.processing and end product offerings.

The valueThrough recent acquisitions and internal development, Innovations has a strong intellectual property base that comprises both issued patents and pending patent applications that cover a range of process and product applications. Below is a list of our landfill may be further enhanced by synergies associated with our vertically integrated operations, including our transfer stations, which enable us to cover a greater geographic area surrounding the landfill, and provide competitive advantages in that we would not need to use our competitors’ landfills. In our experience there has generally been a shift towards fewer, larger landfills, which has resulted in landfills that are generally located farther from population centers, with waste being transported longer distances between collection and disposal, typically after consolidation at a transfer station. With a landfill, transfer stations and collection services in place, we aim to provide vertically integrated operations that cover the substantial geographic area surrounding the landfill.

Our business model contemplates our ability to execute and integrate value-enhancing, tuck-in acquisitions and win new municipal contracts as a core componentcurrent portfolio of our growth.

As a management team, we have experience executing large-scale transactions by direct association with our historical success at Republic Services, Advanced Disposal and Browning Ferris Industries. In addition to significantly expanding our scale of operations, the acquisitions of Christian Disposal and Eagle Ridge Landfill enhanced our geographic footprint by providing us with complementary operations throughout the state of Missouri. This has helped us realize cost efficiencies through improved internalization by virtue of increased route concentration and more efficient utilization of our assets.

Finally, our management team has demonstrated success in municipal contract bidding, as we currently serve approximately 30 municipalities and townships via contracts, historical arrangements or subscriptions with residents.

We serve approximately 65,000 residential, commercial and Construction and Industrial customers, with no single customer representing more than 12% of revenue in 2015. Our municipal customer relationships are generally supported by contracts ranging from three to seven years in initial duration with subsequent renewal periods, and we have a historical renewal rate of 100% with such customers. Our standard C&I service agreement is a five-year renewable agreement. We believe our customer relationships, long-term contracts and exceptional retention rate provide us with a high degree of stability as we continue to grow.

We maintain a central focus on customer service and we pride ourselves on trying to consistently exceed our customers' expectations. We believe investing in our customers' satisfaction will ultimately maximize customer loyalty price stability.

Commitment to Safety

The safety of our employees and customers is extremely important to us and we have a strong track record of safety and environmental compliance. We constantly review and assess our policies practices and procedures in order to create a safer work environment for our employees and to reduce the frequency of workplace injuries.

We believe that as the residential population and number of businesses grow in our existing market, we will see waste volumes increase organically. We seek to remain active and alert with respect to the changing landscapes in the communities in which we already provide service in order obtain long-term contracts for collecting solid waste for residential collection, collection from municipalities, as well as collection from small and large commercial and industrial contracts. Obtaining long-term contracts may enable us to grow our revenue base at the same rate as the underlying economic growth in these markets. Furthermore, securing long-term contracts provides a significant barrier to entry from competitors in these markets.

Expanding into New Markets

Our operating model focuses on vertically integrated operations. We continue to pursue a growth strategy that includes acquiring solid waste companies that complement our existing business. Our goal is to create market-specific, vertically integrated operations consisting of one or more collection operations, transfer stations and landfills.

As we expand, we plan to focus our business in the secondary markets where competition from national service providers is limited. We plan to start new market development projects in certain disposal-neutral markets in which we will provide services under exclusive arrangements with municipal customers, which facilitates highly-efficient and profitable collection operations and lower capital requirements. We believe this strategic focus positions us to maintain significant share within our target markets, maximize customer retention and benefit from a higher and more stable pricing environment.

Our revenue model is based on organic growth of operations, the acquisition of established operations in new markets as well as being able execute value-adding, tuck-in acquisitions. We hope to direct acquisition efforts towards those markets in which we would be able to provide vertically integrated collection and disposal services and/or provide waste collection services, pursuant to contracts that grant exclusivity. Prior to acquisition, we analyze each prospective target for cost savings through the elimination of inefficiencies and excesses that are typically associated with private companies competing in fragmented industries. We aim to realize synergies from consolidating businesses into our existing operations, which we hope will allow us to reduce capital and expense requirements associated with truck routing, personnel, fleet maintenance, inventories and back-office administration.

We intend to devote significant resources to securing additional municipal contracts. Our management team is well versed in bidding for municipal contracts with over 35 years of experience and working knowledge in the solid waste industry and local service areas in existing and target markets. We hope to procure and negotiate additional exclusive municipal contracts, allowing us to maintain stable recurring revenue but also providing a significant barrier to entry to our competitors in those markets.

We will continue to invest in our infrastructure to support growth and increase our margins. Given the long remaining life of our existing landfill, we will invest resources toward its development and enhancement in order to increase our disposal capacity. Similarly, we will continue to evaluate opportunities to maximize the efficiency of our collection operations.

Waste Industry Overview

The non-hazardous solid waste industry can be divided into the following three categories: collection, transfer and disposal services. In our management’s experience, companies engaging in collection and/or transfer operations of solid waste typically have lower margins than those performing disposal service operations. By vertically integrating collection, transfer and disposal operations, operators seek to capture significant waste volumes and improve operating margins.

During the past four decades, our industry has experienced periods of substantial consolidation activity; however, we believe significant fragmentation remains. We believe that there are two primary factors that lead to consolidation:issued patents:

| ● | ||

| ● | ||

| ● | US Patent #9,815,985 – High-Performance Lignin-Acrylonitrile Polymer Blend Materials |

Competition