Q4: Can I change my vote after I have mailed my signed proxy card?

A: Yes. There are three ways for you to revoke your proxy and change your vote. First, you may send a written notice to the person to whom you submitted your proxy stating that you would like to revoke your proxy. Second, you may complete and submit a new proxy card with a later date. Third, you may vote in person at the special meeting. If you have instructed a broker to vote your shares, you must follow directions received from your broker to change your vote.

Q5: Should I send in my stock certificates now?

A: No. Shortly after the merger is completed, Fulton will send you written instructions for exchanging your stock certificates. Fulton will request that you return your First Washington stock certificates at that time.

Q6: When do you expect to merge?

A: Fulton and First Washington expect to complete the merger on or before April 15, 2005. In addition to the approval of First Washington shareholders, Fulton must also obtain regulatory approvals. Fulton and First Washington expect to receive all necessary approvals no later than April 15, 2005.

Q7: Who should I call with questions or to obtain additional copies of this document?

A: You should call either:

| Nora Rauscher, Assistant Corporate Secretary | George R. Barr, Jr., Secretary | |

| First Washington FinancialCorp | Fulton Financial Corporation | |

| U. S. Route 130 and Main Street | One Penn Square | |

| Windsor, NJ 08561 | Lancaster, PA 17602 | |

| (609) 426-1000 | (717) 291-2411 |

This summary highlights selected information from this document. Because this is a summary, it does not contain all of the information that is important to you. To understand the merger fully, you should carefully read this entire document and the attached exhibits. See “Where You Can Find More Information” on page 6851 for reference to additional information available to you regarding Fulton and Premier.First Washington.

Agreement to Merge (See page 21)

Fulton and First Washington entered into a merger agreement on June 14, 2004. The merger agreement provides that each share of First Washington common stock outstanding on the effective date of the merger will be exchanged for 1.35 shares (subject to adjustment) of Fulton common stock, and following the exchange First Washington will merge with Fulton. In addition, the merger agreement permits First Washington to pay its shareholders a cash dividend of $0.11 per share on each of September 30, 2004 and December 31, 2004, provided that the merger has not closed on or before the record date for the dividend on Fulton Stock to be paid on or about October 15, 2004 and January 14, 2005, respectively. In addition, First Washington may pay its shareholders a cash dividend of $0.22 per share on March 31, 2005 and each quarter thereafter provided that the merger has not closed or the merger agreement has not been terminated, on or before the record date for the dividend on Fulton Stock scheduled to be paid on or about April 15, 2005, and thereafter on or before the record date for each subsequent quarterly Fulton dividend. A copy of the merger agreement is attached to this document as Exhibit A and is incorporated herein by reference.

Each First Washington Share Will Be Exchanged For 1.35 Shares Of Fulton Common Stock (See page 28)

If the merger is completed, you will receive 1.35 shares of Fulton common stock for each share of First Washington common stock you own, subject to adjustment in certain limited circumstances. Fulton will not issue any fractional shares, and therefore, you will receive a cash payment for any fractional shares based on the market price of Fulton common stock during a period leading up to completion of the merger. OnOctober 1, 2004, the closing price of Fulton common stock was $21.52, making the value of 1.35 shares of Fulton common stock equal to $29.05 on that date. The closing price of First Washington’s common stock on that date was $28.46. Because the market price of Fulton stock fluctuates, when you vote at the special meeting you will not know what the shares will be worth when issued in the merger. The market prices of both Fulton and First Washington common stock will fluctuate prior to the merger, but the exchange ratio in the merger will remain fixed despite these fluctuations. You should obtain current market quotations for Fulton common stock and First Washington common stock.

Fulton and First Washington have summarized below the per share information for each company on an historical, pro forma combined and equivalent basis. You should read this information in conjunction with the historical financial statements and the related notes contained in the annual and quarterly reports and other documents Fulton and First Washington have filed with the SEC or attached to this document. See “Where You Can Find More Information” on page 51. The Fulton pro forma information gives effect to the merger, assuming that 1.35 shares of Fulton common stock are issued for each outstanding share of First Washington common stock.

Selected Historical and Pro Forma

Combined Per Share Data (A)

Fulton | As of or for the Year Ended December 31, 2003 | As of or for the Six Months Ended June 30, 2004 | ||||

Historical Per Common Share: | ||||||

Average Shares Outstanding (Basic) | 112,268,000 | 117,904,000 | ||||

Average Shares Outstanding (Diluted) | 113,135,000 | 119,372,000 | ||||

Book Value | $ | 8.33 | $ | 9.09 | ||

Cash Dividends | $ | 0.593 | $ | 0.317 | ||

Net Income (Basic) | $ | 1.23 | $ | 0.63 | ||

Net Income (Diluted) | $ | 1.22 | $ | 0.62 | ||

Fulton, First Washington Combined Pro Forma Per Common Share: | ||||||

Average Shares Outstanding (Basic) | 117,979,372 | 123,626,211 | ||||

Average Shares Outstanding (Diluted) | 119,158,866 | 125,559,145 | ||||

Book Value | $ | 8.98 | $ | 9.66 | ||

Cash Dividends | $ | 0.593 | $ | 0.317 | ||

Net Income (Basic) | $ | 1.20 | $ | 0.61 | ||

Net Income (Diluted) | $ | 1.19 | $ | 0.60 | ||

| (A) | The above combined pro forma per share information is based on average shares outstanding during the period except for the book value per share which is based on period end shares outstanding. Financial information reflects the acquisition of First Washington accounted for under the purchase method of accounting applied to historical financial information as of June 30, 2004, and for the year and six months ended December 31, 2003 and June 30, 2004, respectively. Per share dividends reflect Fulton’s historic payment history. Net income utilized in the calculation of income per share does not reflect any anticipated expense savings, revenue enhancements or capital restructuring anticipated by Fulton as a result of the merger. |

Selected Historical and Pro Forma

Per Share Equivalent Data (A)

First Washington | As of or for the Year Ended December 31, 2003 | As of or for the Six Months Ended | ||||

Historical Per Common Share: | ||||||

Average Shares Outstanding (Basic) | 4,230,646 | 4,238,675 | ||||

Average Shares Outstanding (Diluted) | 4,462,123 | 4,583,070 | ||||

Book Value | $ | 8.01 | $ | 7.97 | ||

Net Income (Basic) | $ | 1.12 | $ | 0.63 | ||

Net Income (Diluted) | $ | 1.07 | $ | 0.58 | ||

Equivalent Pro Forma Per Common Share: | ||||||

Book Value | $ | 12.13 | $ | 13.04 | ||

Cash Dividends | $ | 0.801 | $ | 0.428 | ||

Net Income (Basic) | $ | 1.62 | $ | 0.83 | ||

Net Income (Diluted) | $ | 1.60 | $ | 0.81 | ||

| (A) | The above pro forma per share equivalent information is based on average shares outstanding during the period except for the book value per share which is based on period end shares outstanding. The number of shares in each case has been adjusted for stock dividends and stock splits by each institution through the periods. The equivalent pro forma per common share information is derived by applying the exchange ratio of 1.35 shares of Fulton common stock, $2.50 par value per share, for each share of First Washington common stock, no par value, to the Fulton, First Washington combined pro forma per common share information. |

The following tables show selected historical consolidated summary financial data for both Fulton and First Washington. This information is derived from the consolidated financial statements of Fulton and First Washington incorporated by reference in this document. See “Where You Can Find More Information” on page 51.

Fulton Financial Corporation

Selected Historical Financial Data

(In thousands, except per share data)

| 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||

FOR THE YEAR | |||||||||||||||

Interest income | $ | 435,531 | $ | 469,288 | $ | 518,680 | $ | 519,661 | $ | 465,221 | |||||

Interest expense | 131,094 | 158,219 | 227,962 | 243,874 | 199,128 | ||||||||||

Net interest income | 304,437 | 311,069 | 290,718 | 275,787 | 266,093 | ||||||||||

Provision for loan losses | 9,705 | 11,900 | 14,585 | 15,024 | 9,943 | ||||||||||

Other income | 136,987 | 115,783 | 102,744 | 76,980 | 68,002 | ||||||||||

Other expenses | 234,176 | 225,536 | 218,921 | 186,472 | 177,026 | ||||||||||

Income before income taxes | 197,543 | 189,416 | 159,956 | 151,271 | 147,126 | ||||||||||

Income taxes | 59,363 | 56,468 | 46,367 | 44,437 | 42,499 | ||||||||||

Net income | $ | 138,180 | $ | 132,948 | $ | 113,589 | $ | 106,834 | $ | 104,627 | |||||

PER SHARE DATA | |||||||||||||||

Net income (basic) | $ | 1.23 | $ | 1.17 | $ | 1.00 | $ | 0.95 | $ | 0.92 | |||||

Net income (diluted) | 1.22 | 1.17 | 0.99 | 0.95 | 0.91 | ||||||||||

Cash dividends | 0.593 | 0.531 | 0.481 | 0.430 | 0.387 | ||||||||||

AT YEAR END | |||||||||||||||

Total assets | $ | 9,767,288 | $ | 8,387,778 | $ | 7,770,711 | $ | 7,364,804 | $ | 6,787,424 | |||||

Loans, Net of Unearned Income | 6,159,994 | 5,317,068 | 5,373,020 | 5,374,659 | 4,882,606 | ||||||||||

Deposits | 6,751,783 | 6,245,528 | 5,986,804 | 5,502,703 | 5,051,512 | ||||||||||

Long-term debt | 568,730 | 535,555 | 456,802 | 559,503 | 460,573 | ||||||||||

Shareholders’ equity | 946,936 | 863,742 | 811,454 | 731,171 | 662,749 | ||||||||||

AVERAGE BALANCES | |||||||||||||||

Shareholders’ equity | $ | 894,469 | $ | 838,213 | $ | 779,014 | $ | 673,971 | $ | 663,841 | |||||

Total assets | 8,802,138 | 7,900,500 | 7,520,071 | 7,019,523 | 6,533,632 | ||||||||||

Fulton Financial Corporation

Selected Historical Financial Data

(In thousands, except per share data)

Six Months Ended June 30 | ||||||

| 2004 | 2003 | |||||

FOR THE PERIOD | ||||||

Interest income | $ | 235,960 | $ | 217,350 | ||

Interest Expense | 64,287 | 67,342 | ||||

Net interest income | 171,673 | 150,008 | ||||

Provision for loan losses | 2,540 | 5,325 | ||||

Other income | 69,266 | 66,199 | ||||

Other expenses | 133,375 | 113,947 | ||||

Income before income taxes | 105,024 | 96,935 | ||||

Income taxes | 31,314 | 28,830 | ||||

Net income | $ | 73,710 | $ | 68,105 | ||

PER SHARE DATA | ||||||

Net income (basic) | $ | 0.63 | $ | 0.61 | ||

Net income (diluted) | 0.62 | 0.61 | ||||

Cash dividends | 0.317 | 0.288 | ||||

AT PERIOD END | ||||||

Total assets | $ | 10,556,421 | $ | 9,767,288 | ||

Net loans | 7,042,311 | 6,159,994 | ||||

Deposits | 7,430,988 | 6,751,783 | ||||

Long-term debt | 654,886 | 568,730 | ||||

Shareholders’ equity | 1,107,482 | 946,936 | ||||

AVERAGE BALANCES | ||||||

Average shareholders’ equity | $ | 1,025,658 | $ | 864,991 | ||

Average total assets | 10,140,019 | 8,352,671 | ||||

First Washington FinancialCorp

Selected Historical Financial Data

(In thousands, except for per share data)

| 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||

FOR THE YEAR | |||||||||||||||

Interest income | $ | 20,444 | $ | 20,216 | $ | 20,031 | $ | 18,420 | $ | 15,718 | |||||

Interest expense | 5,926 | 6,817 | 9,582 | 9,515 | 7,576 | ||||||||||

Net interest income | 14,518 | 13,399 | 10,449 | 8,905 | 8,142 | ||||||||||

Provision for loan losses | 300 | 600 | 535 | 255 | 210 | ||||||||||

Other income | 2,937 | 2,295 | 1,720 | 1,426 | 1,419 | ||||||||||

Other expenses | 11,058 | 9,709 | 8,561 | 7,598 | 7,083 | ||||||||||

Income before income taxes | 6,097 | 5,385 | 3,073 | 2,478 | 2,268 | ||||||||||

Income taxes | 1,342 | 1,238 | 550 | 326 | 333 | ||||||||||

Net income | $ | 4,755 | $ | 4,147 | $ | 2,523 | $ | 2,152 | $ | 1,935 | |||||

PER SHARE DATA | |||||||||||||||

Net income (basic) | $ | 1.12 | $ | 0.99 | $ | 0.64 | $ | 0.55 | $ | 0.50 | |||||

Net income (diluted) | $ | 1.07 | $ | 0.97 | $ | 0.61 | $ | 0.53 | $ | 0.48 | |||||

AT YEAR END | |||||||||||||||

Total assets | $ | 446,116 | $ | 384,899 | $ | 320,092 | $ | 274,275 | $ | 243,486 | |||||

Loans, net of unearned income | 207,294 | 195,122 | 182,155 | 154,726 | 137,005 | ||||||||||

Deposits | 385,032 | 328,877 | 280,191 | 246,685 | 221,374 | ||||||||||

Long-term debt | 7,500 | 4,500 | 4,500 | 2,000 | 2,500 | ||||||||||

Shareholders’ equity | 33,914 | 30,218 | 23,972 | 18,131 | 14,929 | ||||||||||

AVERAGE BALANCES | |||||||||||||||

Shareholders’ equity | $ | 32,127 | $ | 26,450 | $ | 20,513 | $ | 16,110 | $ | 14,760 | |||||

Total assets | 411,918 | 349,211 | 299,200 | 257,294 | 227,917 | ||||||||||

First Washington FinancialCorp

Selected Historical Financial Data

(In thousands, except per share data)

Six Months Ended June 30 | ||||||

| 2004 | 2003 | |||||

FOR THE PERIOD | ||||||

Interest income | $ | 10,735 | $ | 10,163 | ||

Interest expense | 2,925 | 3,061 | ||||

Net interest income | 7,810 | 7,102 | ||||

Provision for loan losses | — | 180 | ||||

Other income | 1,203 | 1,642 | ||||

Other expenses | 5,604 | 5,265 | ||||

Income before income taxes | 3,409 | 3,299 | ||||

Income taxes | 734 | 792 | ||||

Net income | $ | 2,675 | $ | 2,507 | ||

PER SHARE DATA | ||||||

Net income (basic) | $ | 0.63 | $ | 0.59 | ||

Net income (diluted) | $ | 0.58 | $ | 0.57 | ||

Cash dividends | $ | 0.00 | $ | 0.00 | ||

AT PERIOD END | ||||||

Total assets | $ | 474,408 | 416,513 | |||

Loans, net of unearned income | 225,669 | 199,413 | ||||

Deposits | 409,294 | 353,714 | ||||

Long-term debt | 9,500 | 7,500 | ||||

Shareholders’ equity | 33,817 | 33,177 | ||||

AVERAGE BALANCES | ||||||

Average shareholders’ equity | $ | 34,967 | $ | 31,366 | ||

Average total assets | 457,946 | 396,190 | ||||

No Federal Income Tax On Shares Received In Merger (See page 38)

First Washington shareholders generally will not recognize gain or loss for federal income tax purposes on the shares of Fulton common stock they receive in the merger. Fulton’s attorneys have issued a legal opinion to this effect, which is included as an exhibit to the registration statement filed with the SEC for the shares to be issued in the merger. First Washington shareholders will be taxed on cash received instead of any fractional share. Tax matters are complicated, and tax results may vary among shareholders. Fulton and First Washington urge you to contact your own tax advisor to understand fully how the merger will affect you.

Share Information And Market Prices

Fulton common stock trades on the National Market System of the Nasdaq Stock Market under the symbol “FULT”. First Washington common stock trades on the SmallCap Market of the Nasdaq Stock Market under the trading symbol “FWFC”. The table below shows the last sale prices of Fulton common stock, First Washington common stock and the equivalent price per share of First Washington common stock based on the exchange ratio on June 14, 2004 andOctober 1, 2004.

On June 14, 2004, the last full trading day before public announcement of the merger agreement, the per share closing price for Fulton common stock was $19.81. Based on such closing price for such date and the conversion ratio of 1.35 shares of Fulton common stock for each share of First Washington common stock, the pro forma value of the shares of Fulton common stock to be received in exchange for each share of First Washington common stock was $26.74.

On June 14, 2004, the last full trading day before public announcement of the merger agreement, the per share closing price for First Washington common stock was $20.75.

The foregoing historical and pro forma equivalent per share market information is summarized in the following table.

Historical Price Per Share | Pro Forma Equivalent Price Per Share (1) | |||||

Fulton Common Stock | ||||||

Closing Price on June 14, 2004 | $ | 19.81 | N/A | |||

Closing Price onOctober 1, 2004 | 21.52 | N/A | ||||

First Washington Common Stock | ||||||

Closing Price on June 14, 2004 | $ | 20.75 | $ | 26.74 | ||

Closing Price onOctober 1, 2004 | 28.46 | 29.05 | ||||

| (1) | Based upon the product of the conversion ratio (1.35) and the closing price of Fulton common stock. |

Exchange Ratio Is Fair From A Financial Point Of View According To First Washington’s Financial Advisors (See page 24)

Advest, Inc. has given an opinion to First Washington’s Board of Directors that, as of both June 14, 2004 andOctober 4, 2004, the exchange ratio in the merger is fair from a financial point of view to First Washington’s shareholders. The full text of Advest’s opinion is attached as Exhibit C to this document. Fulton and First Washington encourage you to read the opinion carefully. Pursuant to an engagement letter between First Washington and Advest, in exchange for Advest’s services, Advest received a retainer of $50,000 and a fee of $75,000 upon signing of the merger agreement. In addition, Advest received a fee of $100,000 when it delivered its opinion to First Washington and First Washington will pay Advest a transaction fee equal to 0.9% of the consideration provided for in the Merger Agreement upon closing of the transaction, less the $225,000 in payments described above. First Washington will also reimburse Advest for its out-of-pocket expenses, up to $5,000 without First Washington’s prior approval.

No Dissenters’ Rights Of Appraisal (See page 39)

First Washington’s shareholders are not entitled to exercise dissenters’ rights under the provisions of Section 14A:11-1(1)(a)(i)(B) of the New Jersey Business Corporation Act.

Your Rights As Shareholders Will Change After The Merger (See page 47)

Upon completion of the merger, you will become a shareholder of Fulton. Fulton’s Articles of Incorporation and Bylaws and Pennsylvania law determine the rights of Fulton’s shareholders. The rights of shareholders of Fulton differ in certain respects from the rights of shareholders of First Washington. The most significant of these differences include:

The Companies (See page 4541 for Fulton, page 4947 for Premier)First Washington)

Fulton Financial Corporation

One Penn Square

Lancaster, Pennsylvania 1760417602

717-291-2411(717) 291-2411

Fulton Financial Corporation is a Pennsylvania business corporation and a registered financial holding company that maintains its headquarters in Lancaster, Pennsylvania. As a financial holding company, Fulton engages in general commercial and retail banking and trust business, and also in related financial businesses, through its 1924 directly-held bank and nonbank subsidiaries. Fulton’s bank subsidiaries currently operate 125207 banking offices in Pennsylvania, 19 banking offices in Maryland, 12 banking offices in Delaware, New Jersey and 37 banking offices in New Jersey.Virginia. As of December 31, 2002,June 30, 2004, Fulton had consolidated total assets of approximately $8.4$10.6 billion.

The principal assets of Fulton are its tentwelve wholly-owned bank subsidiaries:

In addition, Fulton has ninetwelve wholly-owned nonbank direct subsidiaries:

Premier Bancorp, Inc.First Washington FinancialCorp

379 NorthU. S. Route 130 and Main Street

Doylestown, PA 18901Windsor, NJ 08561

215-345-5100(609) 426-1000

Premier,First Washington FinancialCorp, a PennsylvaniaNew Jersey corporation, is the bank holding company for PremierFirst Washington State Bank, a PennsylvaniaNew Jersey state chartered bank. At December 31, 2002, PremierJune 30, 2004, First Washington had total consolidated assets of approximately $610$474.4 million, deposits of approximately $456$409.3 million and shareholders’ equity of approximately $38$33.8 million. PremierFirst Washington State Bank has seven16 branches located in Bucks, NorthamptonMonmouth, Ocean, and MontgomeryMercer Counties, Pennsylvania. PremierNew Jersey. First Washington State Bank is engaged principally in the business of taking deposits and making commercial loans, residential mortgage loans, consumer loans and home equity and property improvement loans. PremierFirst Washington State Bank has twothe following wholly-owned non-bank subsidiaries, PBI Capital Trust and Premier Capital Trust II.subsidiaries:

Premier

Agreement to Merge (See page 18)

Fulton and Premier entered into a merger agreement on January 16, 2003. The merger agreement provides that each share of Premier common stock outstanding on the effective date of the merger will be exchanged for 1.34 shares (subject to adjustment) of Fulton common stock, and Premier will merge with Fulton. A copy of the merger agreement is attached to this document as Exhibit A and is incorporated herein by reference.

Each Premier Share Will Be Exchanged For 1.34 Shares Of Fulton Common Stock (See page 32)

If the merger is completed, you will receive 1.34 shares of Fulton common stock for each share of Premier common stock you own. Fulton will not issue any fractional shares. Premier common shareholders will receive a cash payment for any fractional shares based on the market price of Fulton common stock during a period leading up to completion of the merger. On, 2003, the closing price of Fulton common stock was $, making the

value of 1.34 shares of Fulton common stock equal to $on that date. Because the market price of Fulton stock fluctuates, you will not know when you vote what the shares will be worth when issued in the merger.

If the average price of Fulton common stock is below $11.18 for a ten day period just before the merger, and if the price of Fulton common stock has also declined 20% more than the decline (if any) in the average NASDAQ Bank Index for the same period as compared to the NASDAQ Bank Index on January 15, 2003, Premier may terminate the merger. Neither party would owe the other any penalty or fee as a result of termination of the merger agreement. The market price termination provisions will be based on an average of the closing bid and asked prices for the Fulton common stock for the ten (10) consecutive trading days immediately preceding the date which is two (2) business days prior to the closing date of the merger. See “Termination; Effect of Termination” on page 39.

No Federal Income Tax On Shares Received In Merger (See page 41)

Premier shareholders generally will not recognize gain or loss for federal income tax purposes for the shares of Fulton common stock they receive in the merger. Fulton’s attorneys have issued a legal opinion to this effect, which is included as an exhibit to the registration statement filed with the SEC for the shares to be issued in the merger. Premier shareholders will be taxed on cash received instead of any fractional share. Tax matters are complicated, and tax results may vary among shareholders. Fulton and Premier urge you to contact your own tax advisor to understand fully how the merger will affect you.

PremierFirst Washington Board Recommends Shareholder Approval (See page 20)23)

The PremierFirst Washington Board believes that the merger is in the best interests of PremierFirst Washington and its shareholders and recommends that you vote “FOR” approval of the merger agreement.

Exchange Ratio Is Fair From A Financial Point Of View According To Premier’s Financial Advisor (See page 21)

Boenning & Scattergood, Inc. has given an opinion to the Premier Board that, as of January 16, 2003 and as of [date], the exchange ratio in the merger is fair from a financial point of view to Premier’s shareholders. The full text of this opinion is attached as Exhibit C to this document. Fulton and Premier encourage you to read the opinion carefully. Premier has agreed to pay Boenning & Scattergood, Inc. a fee equal to approximately $915,000. A portion of this fee was paid upon engagement, a portion when the fairness opinion was issued and an additional portion will be paid upon completion of the merger.

Vote Required To Approve Merger Agreement (See page 17)20)

Approval of the merger agreement requires the affirmative vote of the holders of at least 66 2/3%a majority of Premier’sFirst Washington’s outstanding common stock. The directors and executive officers of PremierFirst Washington and their affiliates together own about 44.77%45.19% of Premier’sFirst Washington’s outstanding common stock as of MarchDecember 31, 2003. The directors and executive officers of PremierFirst Washington have signed voting agreements with Fulton pursuant to which they have agreed to vote their shares in favor of the merger.

Brokers who hold shares of PremierFirst Washington common stock as nominees will not have authority to vote suchthose shares with respect to the merger unless shareholders provide them with voting instructions.

The merger does not require the approval of Fulton’s shareholders.

AnnualSpecial Meeting To Be Held May 9, 2003November 5, 2004 (See page 16)19)

PremierFirst Washington will hold its annualspecial meeting of shareholders on Friday, May 9, 2003,November 5, 2004, at 9:10:00 a.m., local time,EST at the Doylestown Country Club, Greenballroom at the Ramada Inn, 399 Monmouth Street, Doylestown, Pennsylvania.East Windsor, NJ 08520.

At the special meeting, you will vote on the election of five Class 2 directors,a proposal to approve the merger agreement a proposalunder which First Washington would merge with Fulton, to adjourn the special meeting to solicit additional proxies, if necessary, in the event there are not sufficient votes at the time of the annualspecial meeting to approve the merger agreement, and any other business that properly arises.arises at the special meeting.

Record Date Set At March 31, 2003;September 22, 2004; Voting (See page 16)19)

You are entitled to vote at the annualspecial meeting if you owned shares of PremierFirst Washington common stock at the close of business on March 31, 2003September 22, 2004,the record date. On March 31, 2003,September 22, 2004, there were 3,417,5154,253,741 shares of PremierFirst Washington common stock outstanding. You will have one vote on all matters at the special meeting for each share of PremierFirst Washington common stock you owned on March 31, 2003 for all matters except the election of directors, for which you are entitled to exercise cumulative voting rightsSeptember 22, 2004.

Conditions That Must Be Satisfied For The Merger To Occur (See page 33)30)

The following conditions must be met for Fulton and PremierFirst Washington to complete the merger in addition to other customary conditions:

Regulatory Approvals Required (See page 40)37)

Fulton and PremierFirst Washington cannot complete the merger unless Fulton obtains the approvals of the Federal Reserve Board and the PennsylvaniaNew Jersey Department of Banking. Fulton has filed the required applications and notices seeking approval of the merger. Although Fulton and PremierFirst Washington believe regulatory approvals will be received in a timely manner, Fulton and PremierFirst Washington cannot be certain when or if they will be obtained.

Termination And Amendment Of The Merger Agreement (See page 39)35)

PremierFirst Washington and Fulton can mutually agree at any time to terminate the merger agreement without completing the merger. Either party can also terminate the merger agreement in the following circumstances:

In addition, Fulton may terminate the merger agreement if Premier’sFirst Washington’s Board of Directors exercises its fiduciary duty with respect to a proposed acquisition of PremierFirst Washington by someone other than Fulton. First Washington can also terminate the merger agreement if the closing market price for Fulton Common Stock, determined by averaging the price of Fulton’s stock over a ten day period occurring just before the merger, is less than both:

Fulton and PremierFirst Washington can agree to amend the merger agreement in any way, except that after the shareholders’ special meeting they cannot decrease the consideration you will receive in the merger. Either companyparty can waive any of the

requirements of the other companyparty in the merger agreement, except that neither companyparty can waive any required regulatory approval.

No Dissenters’ Rights Of Appraisal (See page 42)

Premier’s shareholders are not entitled to exercise dissenters’ rights under the provisions of Subchapter D of Chapter 15 of the Pennsylvania Business Corporation Law of 1988, as amended.

Fulton To Continue As Surviving Corporation (See page 31)28)

Fulton will continue as the surviving corporation after the merger. The Boardsboards of Directorsdirectors and executive officers of Fulton and its subsidiaries will not change as a result of the merger, except that:

Your Rights As Shareholders Will Change After The MergerWarrant Agreement Makes Third Party Offers For First Washington More Expensive (See page 65)

Upon completion of the merger, you will become a shareholder of Fulton. Fulton’s Articles of Incorporation and Bylaws and Pennsylvania law determine the rights of Fulton’s shareholders. The rights of shareholders of Fulton differ in certain respects from the rights of shareholders of Premier.

Warrant Agreement (See page 37)33)

In connection with the merger agreement, PremierFirst Washington granted Fulton a warrant to purchase up to 835,000850,000 shares of PremierFirst Washington common stock at an exercise price of $17.85$21.00 per share. The warrant acts to discourage other companies from acquiring Premier andFirst Washington by making third party offers for First Washington more expensive. It also provides compensation to Fulton in the event that the merger falls throughfails to close because another party gains control of Premier.First Washington. Generally, Fulton may exercise this warrant only if another party seeks to gain control of Premier. WeFirst Washington. Fulton and First Washington do not believe that any of the events which would permit Fulton to exercise the warrant have occurred as of the date of this document.

The warrant agreement and warrant are attached to this document as Exhibit B.

Financial Interests of Certain PersonsManagement In The Merger (See page 43)39)

When considering the recommendation of the PremierFirst Washington’s Board of Directors, you should be aware that some directors and executive officers have interests in the merger which may conflict with their interests as shareholders. These interests include:

| • |

Forward LookingAccounting Treatment (see page 38)

Fulton will account for the merger under the purchase method of accounting for business combinations.

This document contains and incorporates some “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding intent, belief or current expectations about matters including statements as to “beliefs,” “expectations,” “anticipations,” “intentions” or similar words. Forward-looking statements are also statements that are not statements of historical fact. Forward-looking statements are subject to risks, uncertainties and assumptions. These include, by their nature:

If one or more of these risks or uncertainties occurs or if the underlying assumptions prove incorrect, actual results, performance or achievements in 20032004 and beyond could differ materially from those expressed in, or implied by, the forward-looking statements.

Share Information And Market Prices

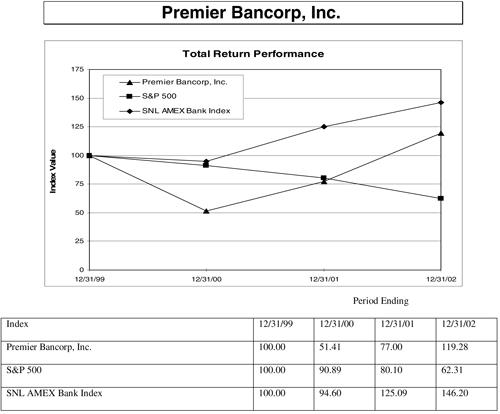

Fulton common stock trades on the National Market System of the NASDAQ Stock Market under the symbol “FULT”. Premier common stock trades on the American Stock Exchange under the trading symbol “PPA”. The table below shows the last sale prices of Fulton common stock, Premier common stock and the equivalent price per share of Premier common stock based on the exchange ratio on January 15, 2003 and, 2003.

On January 15, 2003, the last trading day before public announcement of the merger agreement, the per share closing price for Fulton common stock was $18.64. Based on such closing price for such date and the conversion ratio of 1.34 shares of Fulton common stock for each share of Premier common stock, the pro forma value of the shares of Fulton common stock to be received in exchange for each share of Premier common stock was $24.98.

On January 15, 2003, the last trading day before public announcement of the merger agreement, the per share closing price for Premier common stock was $17.85.

The foregoing historical and pro forma equivalent per share market information is summarized in the following table.

Historical Price Per Share | Pro Forma Equivalent Price Per Share1 | |||||

Fulton Common Stock | ||||||

Closing Price on January 15, 2003 | $ | 18.64 |

| N/A | ||

Closing Price on , 2003 |

| N/A | ||||

Premier Common Stock | ||||||

Closing Price on January 15, 2003 | $ | 17.85 | $ | 24.98 | ||

Closing Price on , 2003 | $ |

| ||||

The market prices of both Fulton and Premier common stock will fluctuate prior to the merger. You should obtain current market quotations for Fulton common stock and Premier common stock.

Fulton and Premier have summarized below the per share information for each company on an historical, pro forma combined and equivalent basis. You should read this information in conjunction with the historical financial statements and the related notes contained in the annual and quarterly reports and other documents Fulton and Premier have filed with the SEC or attached to this document. See “Where You Can Find More Information” on page 68. The Fulton pro forma information gives effect to the merger, assuming that 1.34 shares of Fulton common stock are issued for each outstanding share of Premier common stock.

Selected Historical and Pro Forma

Combined Per Share Data (A)

|

| |

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Selected Historical and Pro Forma

Combined Per Share Data (A)

|

| |

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

|

| |

|

| |

|

| |

|

|

The following tables show certain historical consolidated summary financial data for both Fulton and Premier. This information is derived from the consolidated financial statements of Fulton and Premier incorporated by reference in, or included with, this document. See “Where You Can Find More Information” on page 68.

Fulton Financial Corporation

Selected Historical Financial Data

(In thousands, except per share data)

FOR THE YEAR | 2002 | 2001 | 2000 | 1999 | 1998 | ||||||||||

Interest income | $ | 469,288 | $ | 518,680 | $ | 519,661 | $ | 465,221 | $ | 450,195 | |||||

Interest expense |

| 158,219 |

| 227,962 |

| 243,874 |

| 199,128 |

| 199,430 | |||||

Net interest income |

| 311,069 |

| 290,718 |

| 275,787 |

| 266,093 |

| 250,765 | |||||

Provision for loan losses |

| 11,900 |

| 14,585 |

| 15,024 |

| 9,943 |

| 6,848 | |||||

Other income |

| 115,783 |

| 102,744 |

| 76,980 |

| 68,002 |

| 65,999 | |||||

Other expenses |

| 225,536 |

| 218,921 |

| 186,472 |

| 177,026 |

| 173,274 | |||||

Income before income taxes |

| 189,416 |

| 159,956 |

| 151,271 |

| 147,126 |

| 136,642 | |||||

Income taxes |

| 56,468 |

| 46,367 |

| 44,437 |

| 42,499 |

| 41,635 | |||||

Net income | $ | 132,948 | $ | 113,589 | $ | 106,834 | $ | 104,627 | $ | 95,007 | |||||

PER-SHARE DATA | |||||||||||||||

Net income (basic) | $ | 1.30 | $ | 1.10 | $ | 1.05 | $ | 1.02 | $ | 0.92 | |||||

Net income (diluted) |

| 1.29 |

| 1.09 |

| 1.05 |

| 1.01 |

| 0.92 | |||||

Cash dividends |

| 0.586 |

| 0.530 |

| 0.426 |

| 0.426 |

| 0.384 | |||||

AT YEAR END | |||||||||||||||

Total assets | $ | 8,387,778 | $ | 7,770,711 | $ | 7,364,804 | $ | 6,787,424 | $ | 6,433,612 | |||||

Net loans |

| 5,317,068 |

| 5,373,020 |

| 5,374,659 |

| 4,882,606 |

| 4,420,481 | |||||

Deposits |

| 6,245,528 |

| 5,986,804 |

| 5,502,703 |

| 5,051,512 |

| 5,048,924 | |||||

Long-term debt |

| 535,555 |

| 456,802 |

| 559,503 |

| 460,573 |

| 358,696 | |||||

Shareholders’ equity |

| 863,742 |

| 811,454 |

| 731,171 |

| 662,749 |

| 654,070 | |||||

AVERAGE BALANCES | |||||||||||||||

Shareholders’ equity | $ | 838,213 | $ | 779,014 | $ | 673,971 | $ | 663,841 | $ | 633,056 | |||||

Total assets |

| 7,900,500 |

| 7,520,071 |

| 7,019,523 |

| 6,533,632 |

| 6,093,496 | |||||

Premier Bancorp, Inc.

Selected Historical Financial Data

(In thousands, except for per share data)

2002 | 2001 | 2000 | 1999 | 1998 | |||||||||||

For the Year | |||||||||||||||

Interest income | $ | 32,794 | $ | 29,651 | $ | 26,693 | $ | 21,929 | $ | 16,516 | |||||

Interest expense |

| 15,265 |

| 16,625 |

| 15,294 |

| 11,420 |

| 8,922 | |||||

Net interest income |

| 17,529 |

| 13,026 |

| 11,399 |

| 10,509 |

| 7,594 | |||||

Provision for loan losses |

| 870 |

| 818 |

| 528 |

| 719 |

| 505 | |||||

Other income |

| 937 |

| 594 |

| 319 |

| 124 |

| 357 | |||||

Other expenses |

| 10,953 |

| 9,405 |

| 8,454 |

| 6,744 |

| 4,903 | |||||

Income before income taxes |

| 6,643 |

| 3,397 |

| 2,736 |

| 3,170 |

| 2,543 | |||||

Income taxes |

| 1,929 |

| 863 |

| 675 |

| 765 |

| 788 | |||||

Net income | $ | 4,714 | $ | 2,534 | $ | 2,061 | $ | 2,405 | $ | 1,755 | |||||

LESS: preferred stock dividends | $ | 468 | $ | — | $ | — | $ | — | $ | — | |||||

Net income applicable to common shareholder | $ | 4,246 | $ | 2,534 | $ | 2,061 | $ | 2,405 | $ | 1,755 | |||||

Per—Share Data | |||||||||||||||

Net income (basic) | $ | 1.26 | $ | 0.79 | $ | 0.67 | $ | 0.80 | $ | 0.67 | |||||

Net income (diluted) |

| 1.22 |

| 0.74 |

| 0.60 |

| 0.70 |

| 0.56 | |||||

Cash dividends |

| — |

| — |

| — |

| — |

| — | |||||

At Year End | |||||||||||||||

Total assets | $ | 609,972 | $ | 450,569 | $ | 355,201 | $ | 318,660 | $ | 249,193 | |||||

Net loans |

| 355,598 |

| 310,876 |

| 235,552 |

| 196,121 |

| 138,100 | |||||

Deposits |

| 456,486 |

| 358,282 |

| 303,293 |

| 237,481 |

| 191,226 | |||||

Long-term debt |

| 60,000 |

| 30,000 |

| — |

| — |

| 15,000 | |||||

Subordinated debt |

| 1,500 |

| 3,500 |

| 1,500 |

| 1,500 |

| 1,500 | |||||

Shareholders’ equity |

| 38,436 |

| 19,609 |

| 16,455 |

| 12,647 |

| 11,767 | |||||

Average Balances | |||||||||||||||

Shareholders’ equity | $ | 29,297 | $ | 18,549 | $ | 13,510 | $ | 13,671 | $ | 10,933 | |||||

Total assets |

| 525,217 |

| 399,102 |

| 339,758 |

| 291,040 |

| 214,118 | |||||

An investment in the Fulton common stock in connection with the merger involves certain risks.the risks described below. In addition to the other information contained in this proxy statement/prospectus,document, you should carefully consider the following risk factors in deciding whether to vote for approval of the merger agreement.

RISK FACTORS RELATED TO THE MERGER

Fluctuations in the Market Price of Fulton Common Stock May Cause the Value of the Merger Consideration to Decrease, and Premier’sFirst Washington’s Board of Directors may abandonMay be Able to Abandon the merger.Merger as a Result of Such a Decrease.

Upon completion of the merger, your shares of PremierFirst Washington common stock will be converted into shares of Fulton common stock. While the merger consideration has been structured to provide that PremierFirst Washington shareholders will receive 1.35 shares of Fulton common stock for each of their shares of Premier common stock, 1.34 shares of FultonFirst Washington common stock, the value of 1.341.35 shares of Fulton common stock at the time of the merger is uncertain. Stock price changes may result from a variety of factors that are beyond the control of Fulton, including, among other things, changes in Fulton’s business, operations and prospects, regulatory considerations and general market and economic conditions.

Although theThe aggregate market value of the Fulton common stock that you will receive in the merger is not fixed, within certain limits, Premier will haveand First Washington has the right to terminate the merger agreement and abandon the merger before the closing if:

Accordingly,terminate. The opportunity to evaluate such termination provisions will take place only at the time you vote with respect to the merger, you will not know the market value or the numberend of the shares of Fulton common stock that you will receivetransaction in accordance with its terms. In the merger nor will you know whether Premier’s Board of Directors will optevent the termination provision conditions set forth above allow First Washington to terminate the merger agreement ifMerger Agreement, Fulton shall have the above conditions occur.right to amend the Merger Agreement and increase the exchange ratio in lieu of terminating the Merger Agreement.

The price of Fulton common stock may vary from its price on the date of this proxy statement/prospectus,document, the date of the Premier annualFirst Washington special meeting and the date for determining the average trading price discussed above.of closing. Because the date the merger is completed will be later than the date of the annualspecial meeting, the price of the Fulton common stock on the date of the annualspecial meeting may not be indicative of itsdifferent than the price on the date the merger is completed.

You Will Have Less Influence as a Shareholder of Fulton Than as a Shareholder of Premier.First Washington.

As a PremierFirst Washington shareholder, you currently have the right to vote in the election of the boardBoard of directorsDirectors of PremierFirst Washington and on other matters affecting Premier.First Washington. The merger will transfer control of Premier to Fulton andFirst Washington to the shareholders of Fulton. WhenAlthough when the merger occurs you will become a shareholder of Fulton, with ayour percentage ownership of Fulton that iswill be significantly smaller than your percentage ownership of Premier.First Washington. Because of this, you will have less influence on the management and policies of Fulton than you now have on the management and policies of Premier.First Washington.

Future Results for Fulton Could Differ Materially from its Historical Results or Forward-Looking Statements in its Filings with the SEC.

Fulton has made, and may continue to make, certain forward-looking statements in its filings with the SEC with respect to its acquisition and growth strategies, net interest income and margin, the ability to realize gains on equity investments, allowance and provision for loan losses, expected levels of certain non-interest expenses and the liquidity position of Fulton. Fulton cautions that these forward-looking statements are subject to various assumptions, risks and uncertainties. Because of the possibility of changes in these assumptions, risks and uncertainties, actual results could differ materially from forward-looking statements. Fulton’s forward-looking statements are relevant only as of the date on which such statements are made. By making any forward-looking statements, Fulton assumes no duty to update them to reflect new, changing or unanticipated events or circumstances.

Fulton’s filings with the Securities and Exchange Commission include descriptions of a number of factors affecting its performance which shareholders of First Washington should consider. First Washington shareholders should review these filings with these factors in mind. Fulton believes the most material of these factors can be summarized as follows:

• If market interest rates remain at historically low levels, Fulton’s earnings may be negatively affected. Net interest income is the most significant component of Fulton’s net income, accounting for approximately73% of total revenues in 2003 and 75% for the six months ended June 30, 2004. The ability to manage net interest income over a variety of interest rate and economic environments is important to the success of a financial institution. Net interest income growth is generally dependent upon balance sheet growth and maintaining or growing the net interest margin. Fulton’s net interest income has been impacted by a series of reductions to short-term interest rates enacted by the Federal Reserve Board (“FRB”) over the past two years. These rate reductions resulted in significant decreases to Fulton’s prime lending rate as well as a decline in the general interest rate environment. The rate reductions initially had a negative impact on Fulton’s net interest income and net interest margin as its assets, particularly floating rate loans, repriced to lower rates more quickly than its time deposits. Short term interest rates remained low throughout the second quarter and first six months with the average overnight borrowing rate, or Federal funds rate, and the average prime lending rate at 1.00% and 4.00% respectively. Over the past year, the low short-term interest rates had a negative impact on Fulton’s net interest income and net interest margin, as reducing the rates paid on deposits became exceedingly difficult. As a result, average rates on earning assets decreased more than the average rate paid on liabilities, causing a decrease in net interest margin in 2004. If rates remain low in the future, the net interest margin may continue to trend lower.

• Market Conditions and the Composition of Fulton’s Loan Portfolios Could Increase the Risk in its Loan Portfolio and Require a Higher Loan Loss Allowance. The credit risk associated with lending activities is accounted for by Fulton through its allowance and provision for loan losses. The provision is the expense recognized in the income statement to adjust the allowance to its proper balance, as determined through the application of Fulton’s allowance methodology procedures. These procedures include the evaluation of the risk characteristics of the portfolio and documentation in accordance with applicable accounting standards. Management of Fulton believes that the allowance balance at June 30, 2004 is sufficient to cover losses inherent in the loan portfolio on that date and is appropriate based on applicable accounting standards. However, trends that could indicate the need for a higher provision include the general national and regional economies and the continued growth in Fulton’s commercial loan and commercial mortgage portfolios, which are inherently more risky.

• Fulton’s Investment in Equity Securities Exposes It To Negative Movements in the Stock Prices of the Companies Whose Stock It Owns. Equity market price risk is the risk that changes in the values of equity investments could have a material impact on the financial position or results of operations of Fulton. Fulton’s equity investments consist primarily of common stocks of publicly traded financial institutions. Although the carrying value of equity investments accounted for only 1.0% of Fulton’s total assets, the unrealized gains on the portfolio represent a potential source of revenue and, if values were to decline significantly, this revenue source could be lost. Management of Fulton continuously monitors the fair value of its equity investments and evaluates current market conditions and operating results of the companies. Periodic sale and purchase decisions are made based on this monitoring process. Certain of Fulton’s equity investments have shown negative returns in tandem with the general performance of equity markets. Fulton has evaluated, based on current accounting guidance, whether the decreases in value of any of these investments constitute “other than temporary” impairment which would require a write-down through a charge to earnings. In 2003, Fulton recorded a write-down for specific equity securities which were deemed to exhibit “other than temporary” impairment in value. If a downturn in the equity market occurs over the next 12 months, additional impairment charges may be necessary. In addition to its equity portfolio, Fulton’s investment management and trust services could be impacted by fluctuations in the securities markets. A portion of Fulton’s trust revenue is based on the value of the underlying investment portfolios. If securities markets contract, Fulton’s revenue could be negatively impacted. In addition, the ability of Fulton to sell its brokerage services is dependent, in part, upon consumers’ level of confidence in the outlook for rising securities prices.

• Fulton May Not Be Able to Supplement Its Growth With Acquisitions in the Future and Future Evaluations of Goodwill Recorded in Connection With Acquisitions May Require Write-Downs. Fulton has historically supplemented its internal growth with strategic acquisitions of banks,

branches and other financial services companies. There can be no assurance that Fulton will be able to effect future acquisitions on favorable terms or that Fulton will be able to assimilate acquired institutions successfully. Applicable accounting standards require that the purchase method of accounting be used for all business combinations and eliminated the use of pooling of interests for transactions initiated subsequent to June 30, 2001. Under purchase accounting, if the purchase price of an acquired company exceeds the fair value of the company’s net assets, the excess is carried on the acquiror’s balance sheet as goodwill. Goodwill is to be evaluated for impairment at least annually. Write-downs of the amount of any impairment, if necessary, are to be charged to the results of operations in the period in which the impairment is determined. Based on tests of goodwill impairment conducted to date, Fulton has concluded that there has been no impairment, and no write-downs have been recorded. There can be no assurance that the future evaluations of goodwill will not result in findings of impairment and write-downs.

• The Level of Some of Fulton’s Non-Interest Expenses is Beyond Its Control and Could Adversely Affect Its Earnings. Fulton strives to control its level of non-interest expenses. However, some of these expenses are beyond Fulton’s control. For example, Fulton’s defined benefit plan expense can be greatly impacted by the return realized on invested plan assets. A downturn in the equity markets could result in an increase in expense. This occurred in 2003, when Fulton’s defined benefit plan expense increased 66.9%.

• The Competition Fulton Faces is Increasing and May Have a Negative Impact on Fulton’s Performance. The banking and financial services industries are highly competitive. Within its geographical region, Fulton’s subsidiaries face direct competition from other commercial banks, varying in size from local community banks to larger regional and national banks, and credit unions. With the growth in electronic commerce and distribution channels, Fulton’s banks also face competition from banks not physically located in Fulton’s geographic markets.

The competition in the industry has also increased as a result of the passage of various legislation. Under such legislation, banks, insurance companies or securities firms may affiliate under a financial holding company structure, allowing expansion into non-banking financial services activities that were previously restricted. These include a full range of banking, securities and insurance activities, including securities and insurance underwriting, issuing and selling annuities and merchant banking activities. While Fulton does not currently engage in all of these activities, the ability to do so without separate approval from the Federal Reserve Board enhances the ability of Fulton — and financial holding companies in general — to compete more effectively in all areas of financial services.

As a result of this legislation, there is more competition for customers who were traditionally served by the banking industry. While the legislation increased competition, it also provided opportunities for Fulton to expand its financial services offerings. Fulton also competes through the variety of products that it offers and the quality of service that it provides to its customers. However, there is no guarantee that these efforts will insulate Fulton from competitive pressure which could impact its pricing decisions for loans, deposits and other services and ultimately impact financial results.

• The Supervision and Regulation to Which Fulton is Subject Can be a Competitive Disadvantage. Fulton is a registered financial holding company and its subsidiary banks are depository institutions whose deposits are insured by the Federal Deposit Insurance Corporation. Fulton and its subsidiaries are subject to various regulations and examinations by regulatory authorities. In general, various statutes establish the corporate governance and eligible business activities of Fulton, certain acquisition and merger restrictions, limitations on inter-company transactions such as loans and dividends, and capital adequacy requirements, among other regulations. While these statutes are generally designed to minimize potential loss to depositors and the FDIC insurance funds, they do not eliminate risk and compliance with such statutes increases Fulton’s expense, requires management’s attention and can be a disadvantage from a competitive standpoint with respect to non-regulated competitors.

• Monetary and Fiscal Policy May Affect Fulton’s Earnings and Are Not Predictable. Fulton and its subsidiary banks are affected by fiscal and monetary policies of the federal government,

including those of the Federal Reserve Board, which regulates the national money supply in order to manage recessionary and inflationary pressures. Among the techniques available to the Federal Reserve Board are engaging in open market transactions of U.S. Government securities, changing the discount rate and changing reserve requirements against bank deposits. The use of these techniques may also affect interest rates charged on loans and paid on deposits. The effect of monetary policies on the earnings of Fulton cannot be predicted.

We areThe board of directors of First Washington is providing this document to holders of PremierFirst Washington common stock to solicit your proxy for use at the annualspecial meeting of PremierFirst Washington shareholders and any adjournments or postponements of the special meeting.

The annualspecial meeting of Premier’sFirst Washington’s shareholders will be held at 9:10:00 a.m., local time,EST, on Friday, May 9, 2003,November 5, 2004, at the Doylestown Country Club, locatedballroom at Greenthe Ramada Inn, 399 Monmouth Street, Doylestown, Pennsylvania 18901.East Windsor, NJ 08520.

The purposes of the annualspecial meeting are to elect five Class 2 directors to the Board of Directors, to consider, and approve and adopt the merger agreement, to approve a proposal to adjourn the special meeting, if necessary, because more time is needed to solicit proxies, and to transact such other business as may properly come before the annualspecial meeting or any adjournment or postponement of the annualspecial meeting. At this time, the PremierFirst Washington’s board of directors is unaware of any matters, other than set forth in the preceding sentence,matters that may be presented for action at the annualspecial meeting.

A vote for approval of the merger agreement is a vote for approval of the merger of PremierFirst Washington into Fulton and for the exchange of PremierFirst Washington common stock for Fulton common stock. If the merger is completed, PremierFirst Washington common stock will be cancelled and you will receive 1.341.35 shares (subject to adjustment for stock splits, stock dividends and similar matters) of Fulton common stock in exchange for each share of PremierFirst Washington common stock that you hold. Fulton will pay cash in lieu of issuing any fractional share interests to you.

Shares Outstanding and Entitled to Vote; Record Date

The close of business on March 31, 2003September 22, 2004 has been fixed by Premier’s boardFirst Washington’s Board of directorsDirectors as the record date for the determination of holders of PremierFirst Washington common stock entitled to notice of and to vote at the annualspecial meeting and any adjournment or postponement of the annualspecial meeting. At the close of business on the record date, 3,417,5154,253,741 shares of PremierFirst Washington common stock were outstanding and entitled to vote. Each share of PremierFirst Washington common stock entitles the holder to one vote at the annualspecial meeting on all matters properly presented at the annual meeting, except for the election of five (5) Class 2 directors, where cumulative voting is permitted.special meeting.

Shareholders of record may vote by mail or by attending the annualspecial meeting and voting in person. If you choose to vote by mail, simply mark the enclosed proxy card, date and sign it, and return it in the postage paid envelope provided.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Also, please note that if the holder of record of your shares is a broker, bank or other nominee and you wish to vote in person at the annualspecial meeting, you must bring a letter from the broker, bank or other nominee confirming that you are the beneficial owner of the shares.

Any shareholder executing a proxy may revoke it at any time before it is voted by:

Attendance at the annualspecial meeting will not, in and of itself, constitute revocation of a proxy.

Each proxy returned to PremierFirst Washington (and not revoked) by the holder of PremierFirst Washington common stock will be voted in accordance with the instructions indicated thereon. If no instructions are indicated, the proxy will be votedFOR election of each of the nominees,FORapproval and adoption of the merger agreement, andFOR each proposal.adjournment of the special meeting if necessary to allow First Washington time to solicit more votes in favor of the merger agreement and, as to any other proposal properly brought before the special meeting, in their discretion.

At this time, the PremierFirst Washington’s board of directors is unaware of any matters, other than set forth above, that may be presented for action at the annualspecial meeting or any adjournment or postponement of the annualspecial meeting. If other matters are properly presented, however, the persons named as proxies will vote in accordance with their judgment with respect to such matters. The persons named as proxies by a shareholder may propose and vote for one or more adjournments or postponements of the annualspecial meeting to permit additional solicitation of proxies in favor of approval and adoption of the merger agreement, but no proxy voted against the merger agreement will be voted in favor of any such adjournment or postponement.agreement.

A quorum, consisting of the holders of a majority of the issued and outstanding shares of PremierFirst Washington common stock, must be present in person or by proxy before any action may be taken at the annualspecial meeting. Abstentions will be treated as shares that are present for purposes of determining the presence of a quorum but will not be counted in the voting on a proposal.

Cumulative voting rights exist only with respect to the election of directors. This means that each shareholder has the number of votes equal to the number of directors to be elected multiplied by the number of shares owned and is entitled to cast the whole number of votes for one nominee or to distribute them among two or more nominees, as the shareholder determines. The proxy holders also have the right to vote cumulatively and to distribute their votes among nominees as they consider advisable, unless a shareholder indicates on his or her proxy how he or she desires the votes to be cumulated for voting purposes. On all other matters to come before the annualspecial meeting, each share of common stock is entitled to one vote for each share owned.vote.

If a quorum is present,Under First Washington’s Certificate of Incorporation, the five nominees for Class 2 Director receiving a majority of the votes cast by the shareholders entitled to vote will be elected. The proxy holders will not cast votes withheld or broker non-votes for or against any director nominees.

The affirmative vote of 66 2/3%a majority of the outstanding shares of PremierFirst Washington common stock, in person or by proxy, is necessary to approve and adopt the merger agreement on behalf of Premier.First Washington.

PremierFirst Washington intends to count shares of PremierFirst Washington common stock present in person at the annualspecial meeting but not voting, and shares of PremierFirst Washington common stock for which it has received proxies but with respect to which holders of such shares have abstained on any matter, as “present” at the annualspecial meeting for purposes of determining whether a quorum exists. Because approval and adoption of the merger agreement requires the affirmative vote of 66 2/3%a majority of the outstanding shares of PremierFirst Washington common stock, such nonvoting shares and abstentions will not be counted in determining whether or not the required number of shares have been voted to approve and adopt the merger agreement. Therefore, they will effectively act as a vote against the merger. In addition, under applicable rules, brokers who hold shares of PremierFirst Washington common stock in street name for customers who are the beneficial owners of such shares are prohibited from giving a proxy to vote shares held for such customers in favor of the approval of the merger agreement without specific instructions to that effect from such customers. Accordingly, shares held by customers who fail to provide instructions with respect to their shares of PremierFirst Washington common stock to their broker will not be voted for or against the merger. However, failing to vote effectively acts as a vote against the merger agreement. Such “broker non-votes,” if any, will be counted as present for determining the presence or absence of a quorum for the transaction of business at the annualspecial meeting or any adjournment or postponement thereof.

The directors and executive officers of PremierFirst Washington collectively owned approximately 44.77%39.45% of the outstanding shares of PremierFirst Washington common stock as of the record date for the annual meeting (inclusive of stock options exercisable within 60 days). Premier’sspecial meeting. First Washington’s directors have entered into Voting Agreementsvoting agreements with Fulton pursuant to which they have agreed to vote all of their shares in favor of the merger agreement. See “Security Ownership of Certain Beneficial Owners and Management,” beginning on page 61.

PremierFirst Washington will pay for the costs of mailing this document to its shareholders, as well as all other costs incurred by it in connection with the solicitation of proxies from its shareholders on behalf of its board of directors. In addition to solicitationdirectors with the exception of printing and mailing this document, the cost of which will be paid by mail,Fulton. Additionally, the directors, officers and employees of PremierFirst Washington and its subsidiaries may solicit proxies from

shareholders of PremierFirst Washington in person or by telephone, facsimile or other electronic methods without compensation other than reimbursement by PremierFirst Washington for their actual expenses.

Arrangements also will be made with brokerage firms and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of PremierFirst Washington common stock held of record by such persons, and PremierFirst Washington will reimburse such firms, custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in connection therewith.You should not send in your stock certificates with your proxy card. As described below under the caption “The Merger—Merger – Exchange of PremierFirst Washington Stock Certificates” on page 33,30, you will receive materials for exchanging shares of PremierFirst Washington common stock shortly after the merger.

The following information is intended to summarize the most significantmaterial aspects of the merger agreement. This description is not complete.only a summary. We have attached the full merger agreement and the warrant agreement to this document as ExhibitExhibits A and Exhibit B, respectively, and we incorporate each in this document by reference. We urge all shareholdersyou to read the merger agreement carefully.

The merger agreement provides that:

The Boardboard of Directorsdirectors of PremierFirst Washington has unanimously approved and adopted the merger agreement and believes the merger is in your best interests. Premier’s BoardFirst Washington’s board of Directorsdirectors recommends that you vote “FOR”FOR the merger agreement.

FromFirst Washington has, from time to time, overreceived unsolicited indications of interest regarding potential business combination transactions. Although First Washington has generally evaluated the past several years, Premier’s management and boardindications of directors have considered various strategic alternatives as part of their continuing efforts to enhance Premier’s community banking franchise and to maximize shareholder value. These strategic alternatives have included continuing as an independent institution, acquiring branch offices or other community banks, establishing related lines of business, issuing trust preferred securities and preferred stock, and entering into a strategic merger with similarly-sized or larger institutions. The board alsointerest it has sought to enhance shareholder value through a stock dividend and a share repurchase program.

In October 2002, thereceived, its Board of Directors authorized Clark S. Frame, Chairmanin the past has concluded that it was in the best interest of First Washington’s shareholders that First Washington continue to implement its strategic plan and remain as a stand alone institution.

However, in late 2003 and early 2004, management and the Board, and John C. Soffronoff, President and Chief Executive Officer, to prepare information for theFirst Washington Board of Directors regardingbegan to evaluate the community-banking environment in light of anticipated increases in interest rates, enhanced competition and economic circumstances, as well as First Washington’s place within its banking market. As a reviewresult of this analysis, at a meeting on February 18, 2004, the strategic options available to theFirst Washington Board of Directors voted to retain Advest, Inc. as financial advisor to solicit indications of interest from potential acquirers, to analyze the indications of interest and to meet with Boenning & Scattergood, Inc. (“Boenning”). Theadvise the First Washington Board of Directors authorized assessment of strategic options and engagement of Boenning as Premier Bancorp, Inc.’s financial advisor. Assessment of Premier’s strategic options was made subject toon the Board of Directors’ further consideration and action. Later that month, Clark S. Frame, John C. Soffronoff, Bruce E. Sickel and John J. Ginley from Premier met with representatives of Boenning to review and discuss business and valuation issues, potential interest levels of possible transaction candidates, and whether, given available information, it might be in the best interests of Premier and its constituencies to engage in a business combination with another financial institution.

Premier engaged Boenning on October 25, 2002. After that date, Boenning contacted 11 financial institutions, one of which was Fulton Financial Corporation. Of the 11 contacted financial institutions, seven executed confidentiality agreements with Boenning, including Fulton on October 30, 2002. Information regarding Premier was provided to each of the seven financial institutions that executed the confidentiality agreement.

On November 1, 2002, representatives of Boenning, on behalf of Premier, met with Rufus A. Fulton, Jr., Chairman and Chief Executive Officer, and R. Scott Smith, Jr., President and Chief Operating Officer, of Fulton Financial Corporation to discuss Fulton’s interest in expanding its banking presence in the Bucks, Montgomery and

Northampton county markets. Based on Fulton’s interest in the geographic region, Boenning advised Fulton of Premier’s interest in exploring a potential affiliation with Fulton. After further discussion and the exchange of information on Premier, Fulton notified Boenning of its desire to pursue a potential affiliation with Premier and to have a meeting with representatives of its management team. Between October 30 and November 8, 2002, Boenning met with the representatives of five other financial institutions regarding exploration of a potential affiliation with Premier.

A meeting with representatives of Boenning, Fulton and Premier occurred on November 12, 2002, whereby Fulton and Premier discussed strategic visions and the future of each company and the financial services industry in general. Based on their similar philosophies, Fulton and Premier agreed to continue to explore a potential combination between their respective companies.

Between November 12 and 19, 2002, Boenning and/or Premier also met with four other financial institutions which had previously executed confidentiality agreements to discuss the strategic visions and future of those companies.

On November 20, 2002, Fulton submitted a confidential non-binding indication of interest, including a range of potential financial terms, to Premier via Boenning. On November 27, 2002, two of the four other financial institutions that Boenning had met with also submitted written indications of interest through Boenning.

At Premier’s December 4, 2002, special meeting of the Board of Directors, representatives of Boenning presented to the Board the confidential non-binding indications of interest including the one received from Fulton Financial Corporation, dated November 20, 2002. Termsvalue of the indications of interest for First Washington versus the value First Washington could expect to realize as an independent institution.

In February and March of 2004, First Washington management worked with representatives of Advest to create an information package to be used by Advest in soliciting indications of interest and management reviewed with Advest lists of potentially interested bidders. Information packages were discussed, including financial terms. Information regardingdistributed to possible interested parties in late March 2004.

At a meeting on April 20, 2004, representatives of Advest met with the First Washington Board of Directors to review the three indications of interest they had received, from Fulton and two other depository institution holding companies. Representatives of Advest reviewed with the First Washington Board of Directors their analysis of the three indications of interest and, on the basis of the indications of interest, the First Washington Board of Directors elected to allow each of the companies submitting an indicationthree interested parties to conduct a diligence review of First Washington in order to finalize their indications of interest was presented to and discussed byin First Washington.

During the boardlast week of directors. At this meeting, Premier’s Board authorized continued discussions with Fulton and one other companyApril and the conductfirst week of dueMay, 2004, each of the interested parties was permitted to undertake a diligence on Premier by Fulton and one other company. Duereview of First Washington. On the basis of the diligence on Premier was conducted between December 9-12, 2002.review, each of the three interested parties submitted revised indications of interest.

On December 12, 2002, at Premier’s regularly scheduledAt a Board Meeting of May 24, 2004, representatives of Advest presented the updated and enhanced indications of interest to the First Washington Board of Directors meeting, Messrs. Frame and Soffronoff provided a status reportanalyzed each of the two companies’ resultsproposals. Representatives of due diligence and further discussions betweenAdvest also analyzed the parties. On December 13, 2002, Boenning was informedvalues represented by each of the other company that had performed due diligence on Premier that it was no longer interested in pursuing a business combination with Premier. Also, on December 13, 2002, representatives of Boenning telephoned Mr. Fulton to generally discuss Fulton’s due diligence review of Premier and to request information on Fulton. On December 16, 2002, Fulton and Boenning executed a confidentiality agreement and certain confidential financial information of Fulton was provided to Boenning.

On December 17, 2002, Fulton submitted a revised indicationindications of interest to Premier via Boenning. Atagainst their valuation of First Washington on a stand alone basis. In light of this analysis, the December 19, 2002, PremierFirst Washington Board of Directors special meeting, which was attended by representativesdetermined that the Fulton proposal represented the best transaction for First Washington’s shareholders and authorized and directed Advest and First Washington’s counsel, Windels Marx Lane & Mittendorf, LLP, to seek to negotiate the terms of Boenning and Shumaker Williams, P.C., Fulton’s December 17, 2002 indication of interest was reviewed and discussed. Transaction terms were discussed with and by the Board of Directors, including proposed financial terms. Information regarding the proposed transaction and Fulton Financial Corporation were reviewed and discussed by the board of directors. At this meeting, the Board of Directors rejected Fulton’s revised proposal as presented but authorized continued negotiationsa final agreement with Fulton.

On December 23, 2002, at a meeting among representatives of Boenning, Premier and Fulton, the parties discussed price and other matters related to the proposed transaction. Over the next week, several telephone calls betweentwo weeks, representatives of Boenning, PremierAdvest and Windels Marx, with input from First Washington’s Chairman and President, negotiated final proposed terms of the business combination with Fulton occurred in which financial and other issues were discussed.its outside legal counsel, Barley, Snyder, Senft & Cohen, LLC.

On January 6, 2003, Fulton submitted a second revised confidential indication of interest to Premier via Boenning. At a January 7, 2003 Premiermeeting of the First Washington Board of Directors special meeting, in which representatives of Boenning and Shumaker Williams, P.C. were present, proposed transaction terms were discussedon June 9, 2004, counsel for First Washington reviewed with the Board of Directors including financial terms. The January 6, 2003 Fulton revised confidential non-binding indicationthe current status of interest was reviewed and discussed by the Board of Directors. Clark S. Frame, Chairman of the Board, John C. Soffronoff, President and Chief Executive Officer, and Premier’s representatives were authorized to continue negotiations with Fulton and the proposed terms which had been agreed to conduct due diligence regardingby the parties, including an exchange ratio of 1.35 Fulton shares for further considerationeach First Washington share, subject to adjustment in certain limited circumstances, and action bythe ability of First Washington to commence paying a cash dividend of $0.11 per share in each of the third and fourth quarters of 2004. Counsel to First Washington reviewed with the Board of Directors. On January 8, 2003, Premier, through Boenning, sent a due diligence request listDirectors the issues which were still open in the negotiations and the First Washington Board of Directors provided direction with regard to Fulton, and on January 9, 2003, representatives of Boenning telephoned Fulton representatives and discussed due diligence items.