As filed with the Securities and Exchange Commission on May 16,September 9, 2002

Registration No. 333- 333-88388

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-4

REGISTRATION STATEMENT

UnderUNDER

THE SECURITIES ACT OF 1933

SEAGATE TECHNOLOGY HOLDINGS

(Exact name of Registrant Guarantor as specified in its charter)

Cayman Islands (State or other jurisdiction of incorporation or organization) | | 3572 (Primary Standard Industrial Classification Code Number) | | 98-0232277 (I.R.S. Employer Identification Number) |

SEAGATE TECHNOLOGY HDD HOLDINGS

(Exact name of Registrant Issuer as specified in its charter)

Cayman Islands (State or other jurisdiction of incorporation or organization) | | 3572 (Primary Standard Industrial Classification Code Number) | | 98-0355609 (I.R.S. Employer Identification Number) |

P.O. Box 309GT

Ugland House, South Church Street

George Town, Grand Cayman

Cayman Islands

(345) 949-8066

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s principal executive offices)Registrant Issuer’s and Registrant Guarantor’s Principal Executive Offices)

CT Corporation System

818 West Seventh Street, Suite 200

Los Angeles, California 90017

(800) 888-9207

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

With a copycopies to:

William L. Hudson, Esq. Senior Vice President, General Counsel 920 Disc Drive P.O. Box 66360 Scotts Valley, California 95067 (831) 438-6550 | | William H. Hinman, Jr., Esq. Simpson Thacher & Bartlett 3330 Hillview Avenue Palo Alto, CACalifornia 94304 (650) 251-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered

| | Amount to be Registered

| | Proposed Maximum Offering Price Per Note

| | Proposed Maximum Aggregate Offering Price (1)

| | Amount of

Registration Fee

|

| 8% Senior Notes due 2009 | | $400,000,000 | | 100% | | $400,000,000 | | $36,800 |

|

|

|

|

|

|

|

|

|

| Guarantee of 8% Senior Notes due 2009 (2) | | $400,000,000 | | 100% | | $400,000,000 | | (3) |

(1) | | Estimated solely for the purpose of calculating the registration fee. |

(2) | | The notes to be registered are guaranteed by Seagate Technology Holdings, a Cayman Islands limited liability company. Seagate Technology Holdings is also a registrant under this Registration Statement. The I.R.S. Employer Identification Number for Seagate Technology Holdings is 98-0232277. Seagate Technology Holdings’ primary standard industrial classification code number, address, telephone number and agent for service of process are the same as those of Seagate Technology HDD Holdings. |

(3) | | Pursuant to Rule 457(n) under the Securities Act of 1933, as amended, no separate fee for the guarantee is payable. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer, solicitation or sale is not permitted.

Subject to Completion, dated May 16,September 9, 2002

PROSPECTUS

$400,000,000

Seagate Technology HDD Holdings

Offer to Exchange All Outstanding Privately Placed 8% Senior Notes due 2009

for an Equal Amount of Registered 8% Senior Notes due 2009

Unconditionally Guaranteed by Seagate Technology Holdings

The Exchange Offer

| · | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| · | | You may withdraw tenders of outstanding notes at any time prior to the expiration of the exchange offer. |

| · | | The exchange offer expires at 5:00 p.m., New York City time, on , 2002, unless extended. |

| · | | The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

The Exchange Notes

| · | | The exchange notes are being offered in order to satisfy our obligations under the registration rights agreement entered into in connection with the placement of the outstanding notes. |

| · | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

Resales of Exchange Notes

| · | | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of these methods. |

If you are a broker-dealer and you receive the exchange notes for your own account, you must acknowledge that you will deliver a prospectus in connection with any resale of the exchange notes. By making this acknowledgement, you will not be deemed to admit that you are an “underwriter” under the Securities Act of 1933. Broker-dealers may use this prospectus in connection with any resale of exchange notes received in exchange for outstanding notes where the outstanding notes were acquired by the broker-dealer as a result of market-making activities or trading activities. We will make this prospectus available to any broker-dealer for use in the resale of exchange notes for a period of up to 180 days after the date of the prospectus. A broker-dealer may not participate in the exchange offer with respect to outstanding notes acquired other than as a result of market-making activities or trading activities. See “Plan of Distribution.”

If you are an affiliate of Seagate Technology HDD Holdings or Seagate Technology Holdings or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, you cannot rely on the applicable interpretations of the Securities and Exchange Commission, and you must comply with the registration requirements of the Securities Act of 1933 in connection with any resale transaction.

Seagate Technology HDD Holdings is a 100% owned, direct subsidiary of Seagate Technology Holdings.

You should consider carefully therisk factors beginning on page11 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2002.

| | | Page

|

| | 1 |

| | 11 |

| | 30 |

| | 28 |

| | 2931 |

| | 3132 |

| | 35 |

| | 5636 |

| | 5761 |

| | 7175 |

| | 8489 |

| | | Page

|

| | 8792 |

| | 9299 |

| | 102110 |

| | 147155 |

| | 150158 |

| | 153 |

| | 156161 |

| | 163 |

| | 164163 |

| | 165163 |

| | 165164 |

| | 165164 |

| | F-1 |

Shorthand References

Unless otherwise indicated, as used in this prospectus, the terms “we,” “our” and “us” refer to Seagate Technology Holdings, an exempted limited liability company incorporated under the laws of the Cayman Islands that is the guarantor of the notes, and its subsidiaries, which include Seagate Technology HDD Holdings, an exempted limited liability company incorporated under the laws of the Cayman Islands that is the issuer of the notes. The subsidiaries of Seagate Technology Holdings that operate its storage area network business, including Seagate Technology SAN Holdings and XIOtech Corporation, are not subject to the restrictive covenants or other provisions in the indenture that governs the notes and are not guarantors under the credit agreement that governs our new senior secured credit facilities. Therefore, the operations of those subsidiaries have not been described under “Summary” or “Business” in this prospectus. They are, however, included in “Selected Historical Consolidated Financial Information” and the consolidated financial statements and related notes of Seagate Technology Holdings and its predecessor included elsewhere in this prospectus. For more information, see “Risk Factors—Risks Relating to the Notes—Special Factors.”

Suez Acquisition Company refers to Suez Acquisition Company (Cayman) Limited, an exempted limited liability company incorporated under the laws of the Cayman Islands, before the series of transactions that closed on November 22, 2000, and to New SAC, an exempted limited liability company incorporated under the laws of the Cayman Islands, after those transactions. For shorthand purposes, we refer to those transactions as the “November 2000 transactions” throughout this prospectus. See the “November 2000 Transactions” section of this prospectus for more details about those transactions. Prior to November 22, 2000, Suez Acquisition Company had entered into a stock purchase agreement to purchase substantially all of the operating assets of Seagate Technology, Inc., a Delaware corporation. Suez Acquisition Company then assigned its rights and obligations under that stock purchase agreement to New SAC, a holding company that was formed in connection with the November 2000 transactions. After the closing of the November 2000 transactions, New SAC became the direct parent company of Seagate Technology Holdings and the indirect parent company of Seagate Technology HDD Holdings and various other former subsidiaries of Seagate Technology, Inc.

i

As used in this prospectus, the term “outstanding notes” refers to the $400 million aggregate principal amount of 8% senior notes due 2009 originally issued by Seagate Technology HDD Holdings to the initial purchasers in a private offering that was consummated on May 13, 2002, and the term “exchange notes” refers to the $400 million aggregate principal amount of 8% senior notes due 2009 being offered by Seagate Technology HDD Holdings in the exchange offer pursuant to this prospectus. The provisions of the exchange notes are the same as those of the outstanding notes, except that the exchange notes are registered under the Securities Act of 1933 and do not have provisions relating to transfer restrictions, registration rights and additional interest for failure to observe specified obligations in the registration rights agreement. Unless otherwise indicated, references to the “notes” in this prospectus are references to both the outstanding notes and the exchange notes.

Forward-Looking Statements

This prospectus includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included in this prospectus, including statements under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” regarding our financial condition, strategy, the industry in which we compete, restructuring activities and other statements regarding other future events or prospects, are forward-looking statements. We have used the words “may,” “will,” “expect,” “anticipate,” “believe,” “estimate,” “plan,” “intend” and similar expressions in this prospectus to identify forward-looking statements. Although we believe that the forward-looking statements are based on reasonable assumptions, these statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes to differ materially from those projected. These factors, risks and uncertainties include the following and other risks that are discussed in more detail under “Risk Factors:”

| · | | our substantial leverage, the restrictive covenants in our debt instruments and other risks related to our ability to comply with our debt obligations; |

| · | | competition within our industry and, in particular, the related effects of declining average unit sales prices of rigid disc drives and short product life cycles; |

| · | | weakness in the demand for computer or other systems in which our products are components; |

| · | | our ability to achieve a competitive time to market with new products; |

| · | | our need to successfully develop and market smaller form factor rigid disc drives; |

| · | | the uncertainty of the realization of cost savings from restructuring plans and other cost savings initiatives; |

| · | | our need to continually reduce operating expenses in order to compete effectively in our industry; |

| · | | technological changes and other trends in the information storage industry, in general, and the rigid disc drive industry, in particular, that may reduce demand for our traditional rigid disc drive products; |

| · | | the effects of high fixed costs associated with our vertical integration strategy; |

| · | | our dependence on obtaining a future supply of product components; |

| · | | our dependence on key customers; |

| · | | risks associated with our international operations and the risks related to us and some of our subsidiaries having been incorporated in jurisdictions outside the United States; |

| · | | the difficulty in predicting quarterly demand for our products; |

ii

| · | | control by New SAC and our sponsor group, whose interests may differ from yours; and |

| · | | other risks and uncertainties described in this prospectus. |

Our actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward-looking statements. We cannot assure you that any of the events anticipated by the forward- looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Except as required by the U.S. federal securities laws, we are not obligated to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this prospectus. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements.

Industry and Market Share Data

In this prospectus we rely on and refer to information and statistics regarding the information storage industry and the rigid disc drive sector of the information storage industry that we obtained from Dataquest Incorporated, a division of The Gartner Group, Inc. The Gartner Group, founded in 1979, is a research group that focuses on the computer hardware, software, communications and related information technology industries. Although most of the industry information was obtained from market statistics reports periodically published by Dataquest, some of the information was prepared by Dataquest specifically for inclusion in this prospectus. Although we believe this information is generally reliable, we cannot guarantee the accuracy and completeness of the information and have not independently verified it. Silver Lake Partners, which indirectly owns approximately 39.0% of our outstanding share capital, owns, together with Integral Capital Partners, whose partners are also principals of Silver Lake Partners, convertible securities that would represent, upon conversion, approximately 31.1% of the voting capital stock of The Gartner Group on a fully diluted basis. In addition, two members of our board of directors, Glenn D. Hutchins and David J. Roux, are members of the board of directors of The Gartner Group and Gartner, Inc., respectively.

Service of Process and Enforcement of Liabilities

Seagate Technology Holdings and Seagate Technology HDD Holdings are incorporated under the laws of the Cayman Islands. Some of the directors and officers and a substantial portion of the assets of these companies are located outside the United States. Although we are organized outside the United States, we have agreed to accept service of process in the United States through our agent designated for that purpose. We have designated CT Corporation as our agent for service of process in any action brought against us under the U.S. federal securities and other laws, with respect to the notes, the indenture that governs the notes and Seagate Technology Holdings’ guarantee of the notes. Nevertheless, it may be difficult for you to effect service of process within the United States upon our directors and officers or to enforce against them in courts outside the United States judgments of courts of the United States predicated upon civil liabilities under the U.S. federal securities or other laws.

We have been advised by our Cayman Islands legal counsel, Walkers, that there is doubt with respect to Cayman Islands law as to (1) whether a judgment of a U.S. court predicated solely upon the civil liability provisions of the U.S. federal securities or other laws would be enforceable in the Cayman Islands against us and (2) whether an action could be brought in the Cayman Islands against us in the first instance on the basis of liability predicated solely upon the provisions of the U.S. federal securities or other laws.

Trademarks

The “S” logo, “Seagate,” “Seagate Technology,” “Barracuda” and “Cheetah,” among others, are our registered trademarks.

iii

This summary highlights selected information from this prospectus and does not contain all of the information that may be important to you. You should read this entire prospectus, including the information set forth in “Risk Factors” and our consolidated and combined financial statements included elsewhere in this prospectus, as well as the other documents to which we refer you. Unless the context indicates otherwise, as used in this prospectus, the terms “we,” “our” and “us” refer to Seagate Technology Holdings, the guarantor of the notes, and its subsidiaries, which includes Seagate Technology HDD Holdings, the issuer of the notes. The operations of the subsidiaries of Seagate Technology Holdings that operate its storage area networks business, including Seagate Technology SAN Holdings and XIOtech Corporation, have not been described under “Summary” or “Business” but are included in the consolidated and combined financial statements and selected financial information included elsewhere in this prospectus. See “Risk Factors—Risks Relating to the Notes—Special Factors.”

Our Company

We are athe worldwide leader in the design, manufacturing and marketing of rigid disc drives. Businesses, other organizations and individuals use rigidRigid disc drives, which are commonly referred to as hard drives, are used as the primary medium for storing electronic information in computer systems ranging from desktop computers and consumer electronics to data centers delivering information over corporate networkscenters. According to IDC, we are the largest manufacturer of rigid disc drives in terms of unit shipments, with a 28.3% market share for the six months ended June 30, 2002 and the Internet.a 23.5% market share for calendar year 2001. We produce a broad range of rigid disc drive products that make us a leader in both the enterprise sector of our industry, where our products are primarily used in Internetenterprise servers, mainframes and workstations, and the desktoppersonal storage sector of our industry, where our products are used in desktop personal computers, or PCs.PCs, and consumer electronics.

We believehave achieved our leadership position through ownership of critical component technologies, a commitment to advanced research and development capabilities, combined withand a focus on manufacturing and supply chain efficiency and flexibility. We believe our vertically integrated manufacturing facilities, provide us with acurrent industry leadership position in bringing a broad range of next generation information storage products to market. Recently we have made extensive improvements to ourtechnology and manufacturing efficiency has been achieved through our “Factorysuccessful ongoing execution of the Future” initiative. As part of this effort,our long-term strategic plan, which we increased the degree of automationdeveloped in our manufacturing facilities while reducing the overall number of facilities we operate, reconfigured our production lines to accommodate multiple products without causing any operating disruptions and reduced worldwide employee headcount. We have successfully implemented these improvements while increasing our total unit production.1998. This long-term plan involves:

| · | | increasing our commitment to investment in fundamental research and technological innovation; |

| · | | introducing a disciplined methodology for commercializing our technological innovations; |

| · | | instituting common technology platforms throughout our product portfolio; |

| · | | streamlining our operations; |

| · | | increasing the automation of our manufacturing processes through our “Factory of the Future” initiative, a program for improving efficiency involving the reconfiguration of production lines and increased automation to allow us to close facilities and reduce headcount while increasing overall unit production; and |

| · | | implementing a highly disciplined quality management and process optimization methodology known as Six Sigma, which relies on the rigorous use of statistical techniques to assess process variability and defects, company wide. |

We sell our rigid disc drives primarily to major original equipment manufacturers, or OEMs, with whom we have longstanding relationships. These customers include Compaq, Dell Computer Corporation, EMC Corporation, Hewlett-Packard IBMCompany, International Business Machines Corporation and Sun Microsystems.Microsystems, Inc. We also have key relationships with major distributors, who sell our rigid disc drive products to small OEMs, dealers, system integrators and retailers in most geographic areas of the world.

The November 2000Our Strategy

To enhance our position as the leading designer and manufacturer of rigid disc drives and increase our market share, we intend to pursue the following business strategies:

Continue to Lead Technological Innovation. We intend to strengthen our industry leading position by continuing to make substantial investments in research and development while leveraging our integrated manufacturing operations.

Increase Manufacturing and Supply Chain Efficiency and Flexibility. We intend to continue our manufacturing improvement and cost reduction efforts. By further integrating our operations with our suppliers and customers, we believe that we can derive additional working capital reductions and improve our responsiveness to customer requirements.

Expand and Deepen Relationships with Customers. We intend to increase the strength and broaden the scope of our customer relationships by expanding our design and engineering services to become an integrated part of our customers’ supply chains.

Capitalize on Emerging Storage Demand and Increase Market Share. We are dedicated to being the industry leader in all markets for rigid disc drives. We believe that through our focus on technology innovation and manufacturing efficiency, we will continue to grow our market share as well as address new, high growth markets.

Continue to Pursue Select Alliances, Acquisitions and Investments. We will continue to evaluate and selectively pursue strategic alliances, acquisitions and investments that are complementary to our business.

Historical Transactions

Seagate Technology Holdings was formed in AugustNovember 2000 Transactions. We are the successor to be a holding company for the rigid disc drive and storage area networks operating businessesdivisions of Seagate Technology, Inc. In, a Delaware corporation. Throughout this prospectus, we refer to Seagate Technology, Inc. and, unless the context otherwise indicates, its subsidiaries as Seagate Delaware. New SAC acquired, among other things, the rigid disc drive and storage area networks division of Seagate Delaware in November 2000 in a series of transactions that we refer to as the November 2000 transactions and, as a result, became our parent company. In the November 2000 transactions, a group of private equity investment firms, which closed on November 22, 2000,we refer to as our sponsor group, contributed approximately $875 million for ordinary and preferred shares of New SAC, and New SAC used these proceeds, together with borrowings, to acquire the rigid disc drive and storage area networks divisions of Seagate Technology Holdings becameDelaware for $1.684 billion. In addition, certain officers of Seagate Delaware, which we refer to as the management group, converted a subsidiaryportion of their restricted shares of Seagate Delaware common stock and unvested options to acquire Seagate Delaware common stock, valued at approximately $184 million, into deferred compensation plan interests and restricted ordinary and preferred shares of New SAC. We refer to the conversion of the management group’s common stock and options in Seagate Delaware as the management rollover. The November 2000 transactions are described more fully in the “Historical Transactions—November 2000 Transactions” section of this prospectus.

The Refinancing. In May 2002, we refinanced all of our outstanding indebtedness in a series of transactions we refer to as the refinancing. These transactions consisted of the following:of:

| | · | | Capital Contribution—the contribution by a grouprepurchase of private equity investment firms, which we refer to as our sponsor group,all of approximately $875Seagate Technology International’s $210 million in cash to Suez Acquisition Company in exchange for ordinary and preferred shares of Suez Acquisition Company;

principal amount 12½% senior subordinated notes due 2007; |

| | · | | Asset Purchase—the purchaseissuance and private placement of $400 million in principal amount of 8% senior notes due 2009 by Suez Acquisition Company of substantially all of the operating assets of Seagate Technology Inc., including its rigid disc drive and other businesses, a portion of the cash on the balance sheet of Seagate Technology, Inc. and some other assets of Seagate Technology, Inc.; the assumption by Suez Acquisition Company of substantially all of the liabilities of Seagate Technology, Inc.; and the assignment by Suez Acquisition Company of all its rights and obligations under the stock purchase agreement to New SAC, a holding company formed in connection with these transactions;

HDD Holdings; |

| | · | | VERITAS Merger—the acquisition by a third party, VERITAS Software Corporation, which we refer to in this prospectus as VERITAS,repayment of the assets ofapproximately $673 million under Seagate Technology Inc. that Suez Acquisition Company did not purchase, by way of a merger of Seagate Technology, Inc. and a subsidiary of VERITAS, and thepayment by VERITAS to the shareholders of Seagate Technology, Inc. of cash and VERITAS common stock as the merger consideration;

|

| · | | Management Rollover—the conversion, which we refer to as the management rollover, by a group of officers of Seagate Technology, Inc., whom we refer to as the management group, of a portion of their shares of Seagate Technology, Inc. common stock and options to purchase these shares, valued in the aggregate at approximately $184 million, into interests in our deferred compensation plans and ordinary and preferred shares of New SAC; in addition, the management group invested approximately $41 million in cash in exchange for additional ordinary and preferred shares of New SAC;and

HDD Holdings’ previously existing senior secured credit facilities; |

| | · | | Financing Transactions—the financing of the purchase of the assets described above by New SAC, the redemptionentry by Seagate Technology HDD Holdings and Seagate Technology (US) Holdings, Inc. into new senior secured credit facilities, which consist of:

|

| — | | a $350 million term loan facility that has been drawn in full; |

| — | | a $150 million revolving credit facility that has not been drawn upon; |

| — | | the distribution of its then existing senior notes, which constituted substantially allapproximately $167 million to shareholders of its outstanding debt,Seagate Technology Holdings, consisting of New SAC and employees who had exercised options granted under Seagate Technology Holdings’ share option plan; and |

| — | | the payment of fees and expenses relatedapproximately $32 million to deferred compensation plan participants, consisting of members of the transactions.management group. |

These events, which are described in more detail under “The November 2000 Transactions,” are collectively referred to in this prospectus as the “November 2000 transactions.”

Our Sponsor Group

Silver Lake Partners organized a group of private equity investment firms that, together with members of our current and former management group, indirectly own over 99% of Seagate Technology Holdings’ outstanding share capital. Specifically, our sponsor group consists of affiliates of Silver Lake Partners, Texas Pacific Group, August Capital, J.P. Morgan Partners, LLC and investment funds affiliated with Goldman, Sachs & Co. These sponsors indirectly own approximately 39%33%, 26%22%, 10%11%, 4%7% and 3%2%, respectively, of our outstanding shares.

The Refinancing

The private placement of the outstanding notes was part of a plan to refinance our then existing $900 million senior secured credit facilities and $210 million in aggregate principal amount of outstanding 12 1/2% senior subordinated notes due 2007. Those senior secured credit facilities consisted of a $200 million revolving credit facility and $700 million in term loan facilities. Seagate Technology International, a co-borrower under those senior secured credit facilities andHoldings’ common shares through their ownership of New SAC. In addition, certain members of our management indirectly own, in the issuer of the then outstanding 12 1/2% senior subordinated notes, and Seagate Technology (US) Holdings, Inc., the other co-borrower under those senior secured credit facilities, are wholly owned subsidiariesaggregate, approximately 20% of Seagate Technology HDD Holdings,Holdings’ common shares through their ownership of New SAC. The sponsors’ and our management’s ownership of New SAC is subject to a shareholders agreement and other arrangements that result in the issuer of these notes. Seagate Technology HDD Holdings issponsors and our management acting as a direct subsidiarygroup with respect to all matters submitted to shareholders of Seagate Technology Holdings, the guarantor of these notes. The refinancing consisted of the following transactions, which are collectively referred to in this prospectus as the “refinancing:”Holdings.

| · | | The Private Offering. We issued $400 million in aggregate principal amount of 8% senior notes due 2009, which we refer to as the outstanding notes, pursuant to a private placement that closed on May 13, 2002.

|

| · | | Repayment of the Existing Senior Secured Credit Facilities. At the time of the consummation of the private placement of the outstanding notes, all indebtedness under the existing senior secured credit facilities of Seagate Technology International and Seagate Technology (US) Holdings, Inc., as co-borrowers, was repaid. The amount of this indebtedness that was outstanding as of March 29, 2002 was approximately $673 million.

|

| · | | Senior Secured Credit Facilities. At the time of the consummation of the private placement of the outstanding notes, Seagate Technology HDD Holdings and Seagate Technology (US) Holdings, Inc. also entered into new senior secured credit facilities that permit up to $500 million of borrowings, consisting of a $150 million revolving credit facility that was not drawn as part of the refinancing and a $350 million term loan facility that was drawn in full as part of the refinancing, each with a term of 5 years. The new senior secured credit facilities are, subject to a number of exceptions, secured by a first priority security interest in substantially all the tangible and intangible assets of Seagate Technology HDD Holdings and its subsidiaries, as well as a pledge of the shares of Seagate Technology HDD Holdings and many of its subsidiaries. In the case of Seagate Technology (US) Holdings, Inc., this pledge of shares is limited to

|

65% of the shares of its non-U.S. subsidiaries. Borrowings under our new senior secured credit facilities are also secured by a first priority pledge of all intercompany indebtedness of Seagate Technology Holdings and many of its subsidiaries. Seagate Technology Holdings and many of its direct and indirect subsidiaries have guaranteed the obligations under the new senior secured credit facilities.

| · | | Tender Offer. Seagate Technology International made an offer to purchase for cash any and all of its then outstanding 12 1/2% senior subordinated notes due 2007. In connection with that offer to purchase, Seagate Technology International solicited the consent of at least a majority of the registered holders of those notes to amend the indenture governing those notes. All of those notes were tendered and accepted for payment in connection with the tender offer.

|

| · | | Distribution. On or about May 20, 2002, we expect to make a $167 million distribution to our shareholders, including New SAC, to enable New SAC to make a distribution to its preferred shareholders. At the same time, distributions totaling approximately $33 million are expected to be made to participants in Seagate Technology HDD Holdings’ and Seagate Technology SAN Holdings’ deferred compensation plans. Prior to these distributions, the maximum potential obligation of Seagate Technology HDD Holdings to participants in its deferred compensation plan is approximately $178 million, assuming full vesting of all currently outstanding compensation accounts. We may make significant additional distributions in the future, including shareholder and deferred compensation plan distributions of up to $380 million in connection with and in addition to the proceeds of any initial public offering that we might undertake in the future. See “Management—Employment and Other Agreements—Rollover Agreements and Deferred Compensation Plans” and “Description of the Notes—Certain Covenants—Limitation on Restricted Payments.”

|

Sources and Uses

The refinancing had approximately the following sources and uses of funds:

| | | Amount

| | Amount

|

| | | (in millions) | | (in millions) |

| Sources of Funds: | | | | |

| New senior secured credit facilities | | $ | 350 | | $ | 350 |

| 8% senior notes due 2009 | | | 400 | | | 400 |

| Cash used in the refinancing | | | 428 | | | 419 |

| | |

|

| |

|

|

| Total Sources | | $ | 1,178 | | $ | 1,169 |

| | |

|

| |

|

|

| Uses of Funds: | | | | |

Repurchase 12 1/2% senior subordinated notes | | $ | 274 | |

Repurchase 12 1/2% senior subordinated notes due 2007 | | | $ | 274 |

| Repay former senior secured credit facilities | | | 679 | | | 679 |

| Refinancing fees and expenses | | | 25 | | | 17 |

| Shareholder and deferred compensation plan distributions | | | 200 | | | 199 |

| | |

|

| |

|

|

| Total Uses | | $ | 1,178 | | $ | 1,169 |

| | |

|

| |

|

|

Principal Executive Offices

Seagate Technology Holdings and Seagate Technology HDD Holdings are exempted companies incorporated with limited liability companies incorporated under the laws of the Cayman Islands and were formed on August 20,10, 2000. The address of the principal executive offices of these entities is c/o Maples & Calder,M&C Corporate Services Limited, P.O. Box 309GT, Ugland House, South Church Street, George Town, Grand Cayman, Cayman Islands, and the telephone number at that address is (345) 949-8066. Our world wideworldwide web site address isiswww.seagate.comhttp://www.seagate.com.. TheHowever, the information in, or that can be accessed through, our websiteweb site is not part of this prospectus.

Trademarks

The “S” logo, “Seagate,” “Seagate Technology,” “Barracuda” and “Cheetah,” among others, are our registered trademarks. This prospectus also includes trademarks of other persons.

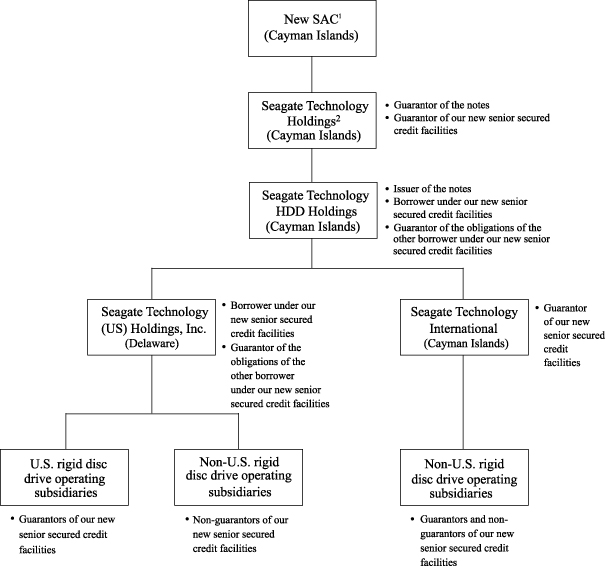

Our Corporate Structure

The following diagram provides a summary illustration of our corporate structure after giving effect to the refinancing. All companies shown below are 100% owned by their direct parent companies other than Seagate Technology Holdings, which is 99.7%99.4% owned by New SAC.

| (1) | | New SAC is also the parent company of Seagate Technology Investment Holdings LLC, Seagate Removable Storage Solutions Holdings and its subsidiaries, and Seagate Software (Caymans) Holdings and its subsidiaries (including Crystal Decisions, Inc.). These other subsidiaries of New SAC are not subject to the restrictive covenants or other provisions in the indenture that governs the notes and are not guarantors under the credit agreement that governs our new senior secured credit facilities. |

| (2) | | Seagate Technology Holdings is also the parent company of Seagate Technology SAN Holdings and its subsidiaries, including XIOtech Corporation. These other subsidiaries of Seagate Technology Holdings are not subject to the restrictive covenants or other provisions in the indenture that governs the notes and are not guarantors under the credit agreement that governs our new senior secured credit facilities. |

Summary of the Terms of the Exchange Offer

On May 13, 2002, weSeagate Technology HDD Holdings completed the private offering of its 8% senior notes due 2009. We refer to these 8% senior notes in this prospectus as the outstanding notes.

The issuer, Seagate Technology HDD Holdings, and the guarantor, Seagate Technology Holdings, of the outstanding notes entered into a registration rights agreement with the initial purchasers of the outstanding notes in which the issuer and the guarantor agreed to deliver to you this prospectus as part of the exchange offer, and the issuer agreed to use its reasonable best efforts to complete the exchange offer within 250 days after the date of original issuance of the outstanding notes. You are entitled to exchange the outstanding notes in the exchange offer that you currently hold for exchange notes that are identical in all material respects to the outstanding notes except:

| | · | | the exchange notes have been registered under the Securities Act of 1933 and will not bear legends restricting their transfer; |

| | · | | the exchange notes are not entitled to registration rights that are applicable to the outstanding notes under the registration rights agreement; and |

| | · | | the exchange notes will not provide for additional interest upon the failure of the issuer to fulfill its obligations to file and cause to be effective a registration statement. |

| The Exchange Offer | | The issuer is offering to exchange up to $400 million aggregate principal amount of outstanding notes for up to $400 million aggregate principal amount of exchange notes. Outstanding notes may be exchanged only in integral multiples of $1,000. |

|

| Resale | | Based on an interpretation by the staff of the SEC contained in no-action letters issued to third parties, we believe that the exchange notes issued under the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you, unless you are an “affiliate” of the issuer or the guarantor within the meaning of Rule 405 under the Securities Act of 1933, without compliance with the registration and prospectus delivery provisions of the Securities Act of 1933, provided that you are acquiring the exchange notes in the ordinary course of your business and that you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

|

| | | Each participating broker-dealer that receives exchange notes for its own account pursuant to the exchange offer in exchange for outstanding notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

|

| | | Any holder of outstanding notes who: · is an affiliate of the issuer or the guarantor of the outstanding notes, · does not acquire exchange notes in the ordinary course of its business, or · tenders in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes, |

| | cannot rely on the position of the staff of the SEC enunciated in Exxon Capital Holdings Corporation, Morgan Stanley & Co. Incorporated |

|

| | or similar no-action letters and, in the absence of an exemption from the registration and prospectus delivery requirements of the Securities Act of 1933, must comply with those requirements in connection with the resale of the exchange notes. |

|

| Conditions to the Exchange Offer | | The exchange offer is subject to the conditions that the exchange notes be tradeable by the holders without restriction under federal, state securities or blue sky laws, that the exchange offer not violate any applicable law or interpretation of law or interpretation of the staff of the SEC, that there would be no pending or threatened proceedings that would reasonably be expected to impair our ability to proceed with the exchange offer and that each holder has made the required representations to the issuer as further described in this prospectus. The issuer may waive any or all of these conditions. The exchange offer is not conditioned upon any minimum aggregate principal amount of outstanding notes being tendered in the exchange offer. Please read the section captioned “The Exchange Offer—Conditions to the Exchange Offer” of this prospectus for more information regarding the conditions of the exchange offer. |

|

Expiration Date; Withdrawal of Tender

| | The exchange offer will expire at 5:00 p.m., New York City time, on , 2002, or such later date and time to which the issuer may extend the offer. We refer to this date as the expiration date. The issuer does not currently intend to extend the expiration date. A tender of outstanding notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date. Any outstanding notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of the exchange offer. |

|

Conditions to the Exchange Offer | | The exchange offer is subject to customary conditions. The issuer, however, may waive these conditions. Please read the section captioned “The Exchange Offer—Conditions to the Exchange Offer” of this prospectus for more information regarding the conditions to the exchange offer. |

|

Procedures for Tendering Outstanding Notes

| | If you wish to accept the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. If you hold outstanding notes through The Depository Trust Company, or DTC, and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

|

| | | · any exchange notes that you receive will be acquired in the ordinary course of your business; · you have no arrangement or understanding with any person or entity to participate in a distribution of the exchange notes; |

| | · if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of the exchange notes; and · you are not an “affiliate,” as defined in Rule 405 of the Securities Act of 1933, of the issuer, or, if you are an affiliate, you will comply with any applicable registration and prospectus delivery requirements of the Securities Act of 1933. |

Special Procedures for Beneficial

Owners

| | If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender the outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

|

| Guaranteed Delivery Procedures | | If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other documents required by the letter of transmittal, or you cannot comply with the applicable procedures under DTC’s Automated Tender Offer Program prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

|

Effect on Holders of Outstanding

Notes

| |

As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of, the exchange offer, we will have fulfilled a covenant contained in the registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you are a holder of outstanding notes and you do not tender your outstanding notes in the exchange offer, you will continue to hold the outstanding notes and you will be entitled to all the rights and limitations applicable to the outstanding notes in the indenture, except for any rights under the registration rights agreement that by their terms terminate upon the consummation of the exchange offer.

|

|

| | | To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes could be adversely affected. |

|

Consequences of Failure to Exchange

| | All untendered outstanding notes that are not tendered or are not accepted for exchange by the issuer will continue to be subject to the restrictions on transfer provided for in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act of 1933, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act of 1933 and applicable state securities laws. Other than in connection with the exchange offer, the issuer does not currently anticipate that it will register the outstanding notes under the Securities Act of 1933. |

|

| U.S. Income Tax Considerations | | The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

|

| Use of Proceeds | | We will not receive any cash proceeds from the issuance of exchange notes pursuant to the exchange offer. |

|

| Exchange Agent | | U.S. Bank, N.A. is the exchange agent for the exchange offer. |

Summary of the Terms of the Exchange Notes

The following summary is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the notes, see “Description of the Notes.”

| Issuer | | Seagate Technology HDD Holdings. |

| Guarantor | | Seagate Technology Holdings. |

| Securities Offered | | $400 million aggregate principal amount of 8% senior notes due 2009. |

| Maturity | | May 15, 2009. |

Interest

| | 8% per annum, payable semi-annually in arrears on May 15 and November 15, commencing November 15, 2002. |

Ranking

| | The outstanding notes are, and the exchange notes will be, senior unsecured obligations ranking equally with Seagate Technology HDD Holdings’ existing and future senior indebtedness and senior to any present and future subordinated indebtedness of Seagate Technology HDD Holdings. The notes will effectively be subordinated to Seagate Technology Holdings’ and Seagate Technology HDD Holdings’ present and future secured debt, to the extent of the value of the assets securing that debt, and will be structurally subordinated to all present and future liabilities, including trade payables, of Seagate Technology HDD Holdings’ subsidiaries. |

| | | As of March 29,June 28, 2002, after giving effect to the refinancing, Seagate Technology HDD Holdings would have had outstanding: |

| | | · $751 million of senior indebtedness, including $350 million of secured indebtedness; |

| | | · $1.86$1.72 billion of liabilities of subsidiaries, including $350 million of secured indebtedness comprised of various subsidiaries’ guarantees of and borrowings under the new senior secured credit facilities; |

| | | · no senior subordinated indebtedness; and |

| | | · no subordinated indebtedness. |

| | | ·As of March 29,June 28, 2002, after giving effect to the refinancing, Seagate Technology Holdings would have had outstanding:

|

| | | · $751 million of senior indebtedness, including $350 million of secured indebtedness comprised of its guarantee of the new senior secured credit facilities; |

| | | · no senior subordinated indebtedness; and |

| | | · no subordinated indebtedness. |

| Optional Redemption | | Seagate Technology HDD Holdings may redeem any of the notes beginning on May 15, 2006. The initial redemption price is 104% of their principal amount, plus accrued interest to the date of redemption. The redemption price will decline each year after May 15, 2006 and will be 100% of their principal amount, plus accrued interest, beginning on May 15, 2008. |

| | | In addition, before May 15, 2005, Seagate Technology HDD Holdings may redeem up to 35% of the notes at a redemption price of 108% of their principal amount, plus accrued interest to the date of redemption, using the proceeds from sales of specified kinds of capital stock. Seagate Technology HDD Holdings may make this redemption only if, after the redemption, at least 65% of the aggregate principal amount of notes issued remains outstanding. |

| | | Seagate Technology HDD Holdings may redeem all, but not part, of the notes if there are specified changes in tax laws, at a redemption price equal to 100% of the principal amount of the notes, plus accrued interest to the date of redemption. |

Change of Control

| | Upon a change of control, Seagate Technology HDD Holdings will be required to make an offer to purchase the notes at a price equal to 101% of their principal amount, plus accrued interest to the date of repurchase. Seagate Technology HDD Holdings may not have sufficient funds available at the time of any change of control to make any required debt repayment. |

| | | Upon a change of control that occurs prior to May 15, 2006, Seagate Technology HDD Holdings is entitled to redeem all, but not part, of the notes at a redemption price determined in the manner described under “Description of the Notes—Optional Redemption,” plus accrued interest to the date of redemption. |

Guarantee

| | Seagate Technology Holdings will provide a guarantee ofhas guaranteed the payment of the principal, premium and interest on the notes on a senior unsecured basis. |

| | | The guarantee will rank equally with all existing and future senior indebtedness of Seagate Technology Holdings. |

Restrictive Covenants

| | The terms of the notes will limit our ability and the ability of Seagate Technology HDD Holdings’Holdings and its subsidiaries to: |

| | | · incur additional indebtedness; |

| | | · pay dividends and make distributions in respect of capital stock; |

| | | · redeem or repurchase capital stock; |

| | | · make investments or specified other restricted payments; |

| | | · sell assets; |

| | | · issue or sell stock of restricted subsidiaries; |

| | | · enter into transactions with affiliates; |

| | | · create liens; |

| | | · enter into sale/leaseback transactions; |

| | | · effect a consolidation or merger; and |

| | | · amend deferred compensation plans. |

| | | These covenants are subject to a number of important qualifications and exceptions, including exceptions that will permit us to make significant distributions of cash. In addition, the obligation to comply with many of these covenants will not apply if the notes achieve investment grade status. See “Description of the Notes—Certain Covenants.” |

Risks Relating to the Notes

Failure to Exchange—There may be adverse consequences if you do not exchange your outstanding notes.

If you do not exchange your outstanding notes for the exchange notes under the exchange offer, you will continue to be subject to the transfer restrictions on the outstanding notes as set forth in the offering memorandum distributed in connection with the offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered, or are exempt from registration, under the Securities Act of 1933 and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act of 1933.

In addition, the tender of outstanding notes under the exchange offer will reduce the principal amount of those notes outstanding, which may have an adverse effect upon, and increase the volatility of, the market price of the outstanding notes due to a reduction in liquidity.

Substantial Leverage—Our substantial leverage could adversely affect our ability to fulfill our obligations under the notes and operate our business.

We are highly leveraged and have significant debt service obligations. For fiscal year 2002 and the combined results for fiscal year 2001, and for the nine months ended March 29, 2002, our interest expense was $78$77 million and $61$78 million, respectively. Earnings were insufficient to cover fixed charges by $627 million for the combined results in fiscal year 2001. Our ratio of earnings to fixed charges was 6.53.9 to 1 for the nine months ended March 29,fiscal year 2002. As of March 29,June 28, 2002, our total debt excluding liabilities of our subsidiaries, after giving effect to the refinancing, would have been approximatelywas $751 million, excluding unused commitments, and our total shareholders’ equity after giving effect to the refinancing, would have been $705was $641 million. In addition, we may incur additional debt from time to time to finance working capital, product development efforts, strategic acquisitions, investments and alliances, capital expenditures or other general corporate purposes, subject to the restrictions contained in the credit agreement that governs our new senior secured credit facilities, in the indenture that governs the notes and in any other agreement under which we incur indebtedness.

Our substantial debt could have important consequences to you, including the following:

| | · | | we are required to use a substantial portion of our cash flow from operations to pay principal and interest on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, product development efforts, strategic acquisitions, investments and alliances and other general corporate requirements; |

| | · | | our interest expense could increase if prevailing interest rates increase, because a substantial portion of our debt will bear interest at floating rates; |

| | · | | our substantial leverage increases our vulnerability to economic downturns and adverse competitive and industry conditions and could place us at a competitive disadvantage compared to those of our competitors that are less leveraged; |

| | · | | our debt service obligations could limit our flexibility in planning for, or reacting to, changes in our business and our industry and could limit our ability to pursue other business opportunities, borrow more money for operations or capital in the information storage industry;future and implement our business strategies; |

| | · | | our level of debt may restrict us from raising additional financing on satisfactory terms to fund working capital, capital expenditures, product development efforts, strategic acquisitions, investments and alliances and other general corporate requirements; and |

| | · | | our level of debt may prevent us from raising the funds necessary to repurchase all of the notes tendered to Seagate Technology HDD Holdings upon the occurrence of a change of control, which would constitute an event of default under the notes. |

Ability to Service Debt—Servicing our debt requires a significant amount of cash, and our ability to generate cash depends on manymay be affected by factors beyond our control.

We expect to obtain the cash necessary to make payments on the notes and the new senior secured credit facilities and to fund working capital, capital expenditures, product development efforts, strategic acquisitions, investments and alliances and other general corporate requirements from our operations and from other sources of funding available to us. Our ability to generate cash is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations, that we will realize currently anticipated cost savings, revenue growth and operating improvements on schedule or at all, that future borrowings will be available to us under the new senior secured credit facilities or that other sources of funding will be available to us, in each case, in amounts sufficient to enable us to service our debt, including the notes, or to fund our other liquidity needs. that:

| · | | our business will generate sufficient cash flow from operations; |

| · | | we will continue to realize the cost savings, revenue growth and operating improvements that resulted from the execution of our long-term strategic plan; or |

| · | | future borrowings will be available to us under our senior secured credit facilities or that other sources of funding will be available to us, in each case, in amounts sufficient to enable us to service our debt, including the notes, or to fund our other liquidity needs. |

If we cannot service our debt, we will have to take actions such as reducing or delaying capital expenditures, product development efforts, strategic acquisitions or investments and alliances, selling assets or restructuring or refinancing our debt, which could include the notes, or seeking additional equity capital. We cannot assure you that any of these remedies could, if necessary, be effected on commercially reasonable terms, or at all. In addition, the terms of existing or future debt agreements, including the credit agreement relating to the new senior secured credit facilities and the indenture that governs the notes, may restrict us from pursuing any or all of these alternatives.

Additional Borrowing Capacity—Despite our substantial leverage, we are permitted to incur more debt, which may intensify the risks associated with our substantial leverage, including the risk that we will be unable to service our debt.

Our new senior secured credit facilities and the indenture that governs the notes permit us to incur a significant amount of additional debt.debt, as long as we remain in compliance with the covenants, including financial ratios, contained in those instruments. If we incur additional debt above the levels in effect upon the closing of the refinancing, the risks associated with our substantial leverage, including the risk that we will be unable to service our debt, could intensify.

Unsecured Obligations—Because the notes and the note guarantee are not secured and are effectively subordinated to the rights of secured creditors, the secured lenders may in some circumstances control or limit our ability to pay amounts due on the notes or under the note guarantee.

The notes and the note guarantee are unsecured obligations, whereas the loans outstanding under the new senior secured credit facilities are secured. These loans are, subject to a number of exceptions, secured by a first priority security interest in substantially all the tangible and intangible assets of Seagate Technology HDD Holdings and its subsidiaries, as well as a pledge of the shares of Seagate Technology HDD Holdings and many of its subsidiaries. In the case of non-U.S. subsidiaries of Seagate Technology (US) Holdings, Inc., this pledge of shares is limited to a pledge of 65% of the shares of its non-U.S. subsidiaries. Borrowings under our new senior secured credit facilities are also secured by a first priority pledge of all intercompany indebtedness of Seagate Technology Holdings and many of its subsidiaries. In addition, borrowings under the new senior secured credit facilities will be secured by all the capital stock of any newly formed subsidiary of ours, subject to specified exceptions.

As a result of the refinancing, we have $350 million of senior secured debt outstanding, excluding unused commitments. In addition, we may incur other senior debt, which may be substantial in amount, and which may, in some circumstances, be secured.

Because the notes and the note guarantee are unsecured obligations, your right of repayment may be adversely affected if any of the following situations were to occur:

| | · | | a dissolution, bankruptcy, liquidation, reorganization or other winding-up involving Seagate Technology HDD Holdings or Seagate Technology Holdings or any of their subsidiaries; |

| | · | | a default in payment under the new senior secured credit facilities or other secured debt; or |

| | · | | an acceleration of any debt under the new senior secured credit facilities or other secured debt. |

If any of these events were to occur, the secured lenders could foreclose on the assets to your exclusion, even if an event of default exists under the indenture governing the notes. As a result, the secured lenders may control or limit our ability to pay amounts due on the notes or the note guarantee, and we could have insufficient funds after repaying our secured indebtedness to pay amounts due on the notes or the note guarantee.

Structural Subordination—Seagate Technology HDD Holdings and Seagate Technology Holdings will depend on the receipt of dividends or other intercompany transfers from their subsidiaries to meet their obligations under the notes and the note guarantee. Claims of creditors of these subsidiaries may have priority over your claims with respect to the assets and earnings of these subsidiaries.

Seagate Technology HDD Holdings and Seagate Technology Holdings conduct a substantial portion of their operations through their subsidiaries. They will therefore be dependent upon dividends or other intercompany transfers of funds from their subsidiaries in order to meet their obligations under the notes and the note guarantee and to meet their other obligations. Generally, creditors of these subsidiaries will have claims to the assets and earnings of these subsidiaries that are superior to the claims of Seagate Technology HDD Holdings’ and Seagate Technology Holdings’ creditors, except to the extent the claims of those creditors are guaranteed by these subsidiaries. None of these subsidiaries will beis guaranteeing the notes.

In the event of the dissolution, bankruptcy, liquidation, other winding-up or reorganization of Seagate Technology HDD Holdings or Seagate Technology Holdings, the holders of the notes may not receive any amounts with respect to the notes or the note guarantee until after the payment in full of the claims of creditors of the subsidiaries of Seagate Technology HDD Holdings and Seagate Technology Holdings, as the case may be. The notes are unsecured obligations that are effectively subordinated to all of the secured indebtedness of Seagate Technology HDD Holdings, including the indebtedness under our new senior secured credit facilities, and the note guarantee of Seagate Technology Holdings is an unsecured obligation that is effectively subordinated to all of the secured indebtedness of Seagate Technology Holdings.

Although the indenture governing the notes limits the ability of the subsidiaries of Seagate Technology HDD Holdings to enter into consensual restrictions on their ability to pay dividends and make other payments to Seagate Technology HDD Holdings, these limitations have a number of significant qualifications and exceptions. For more information, see “Description of the Notes—Certain Covenants—LimitationsLimitation on Restrictions on Distributions from Restricted Subsidiaries.”

Restrictive Covenants in our Debt Instruments—Restrictions imposed by the indenture that governs the notes and the credit agreement that governs the new senior secured credit facilities will limit our ability to finance future operations or capital needs or engage in other business activities that may be in our interest.

The indenture governing the notes and the credit agreement governing the new senior secured credit facilities impose, and the terms of any future debt may impose, operating and other restrictions on Seagate Technology HDD Holdings and its subsidiaries. These restrictions willlimit the ability of Seagate Technology HDD Holdings to incur additional indebtedness if the aggregate consolidated EBITDA of Seagate Technology HDD Holdings and its restricted subsidiaries to the total interest expense of those entities is less than or equal to 3.0 to

1.0 during any four-quarter period. These restrictions also affect, and in many respects limit or prohibit, among other things, the ability of Seagate Technology HDD Holdings and its subsidiaries to:

| | · | | incur additional indebtedness; |

| · | | pay dividends or make distributions in respect of capital stock;shares; |

| | · | | redeem or repurchase capital stock;shares; |

| | · | | make investments or selected other restricted payments; |

| | · | | issue or sell stockshares of restricted subsidiaries; |

| | · | | enter into transactions with affiliates; |

| | · | | enter into sale/leaseback transactions; |

| | · | | effect a consolidation or merger; and |

| | · | | amendmake certain amendments to deferred compensation plans. |

These covenants are subject to a number of important qualifications and exceptions, including exceptions that permit us to make significant distributions of cash. In addition, the obligation to comply with many of these covenants will not apply if the notes achieve investment grade status.

Our new senior secured credit facilities include other, different covenants and limit Seagate Technology HDD Holdings’ ability to prepay debt, including the notes, while debt under our new senior secured credit facilities is outstanding. The credit agreement governing the new senior secured credit facilities also requires us to achieve specified financial and operating results and maintain compliance with specified financial ratios. Our ability to comply with these ratios may be affected by events beyond our control.

The restrictions contained in the indenture governing the notes and the credit agreement governing the new senior secured credit facilities could:

| | · | | limit our ability to plan for or react to market conditions, meet capital needs or otherwise restrict our activities or business plans; and |

| | · | | adversely affect our ability to finance our operations, product development efforts, strategic acquisitions, investments, alliances or other capital needs or to engage in other business activities that would be in our interest. |

A breach of any of these restrictive covenants or our inability to comply with the required financial ratios could result in a default under the credit agreement that governs the new senior secured credit facilities. If a default occurs, the lenders under the new senior secured credit facilities may elect to declare all borrowings outstanding, together with accrued interest and other fees, to be immediately due and payable, which would result in an event of default under the notes. The lenders under the new senior secured credit facilities will also have the right in these circumstances to terminate any commitments they have to provide further borrowings and may take other action that would restrict our ability to access cash for purposes of paying interest due on the notes. If Seagate Technology HDD Holdings and Seagate Technology (US) Holdings, Inc. are unable to repay outstanding borrowings when due, the lenders under the new senior secured credit facilities will also have the right to call on the guarantees and, ultimately, to proceed against the collateral granted to them to secure the debt. If the debt under the new senior secured credit facilities and the notes were to be accelerated, we cannot assure you that Seagate Technology HDD Holdings’ assets would be sufficient to repay in full that debt and its other debt, including the notes, or that Seagate Technology Holdings’ assets would be sufficient to satisfy its obligations under the note guarantee.

Change of Control Provisions—The change of control provisions in the indenture that governs the notes will not necessarily protect you in the event of a highly leveraged transaction.

The change of control provisions contained in the indenture that governs the notes will not necessarily afford you protection in the event of a highly leveraged transaction that may adversely affect you, including a

reorganization, restructuring, merger or other similar transaction involving usSeagate Technology Holdings or Seagate Technology HDD Holdings. These transactions may not involve a change in voting power or beneficial ownership or, even if they do, may not involve a change of the magnitude required under the definition of change of control in the indenture to trigger these provisions. Except as described under “Description of the Notes—Change of Control,” the indenture does not contain provisions that permit the holders of the notes to require Seagate Technology HDD Holdings to repurchase or redeem the notes in the event of a takeover, recapitalization or similar transaction.

No Prior Market for the Exchange Notes—There is no prior market for the exchange notes. If one develops, it may not be liquid.

We do not intend to list the exchange notes on any national securities exchange or to seek their quotation on any automated dealer quotation system. In addition, the market for non-investment grade debt has historically been subject to disruptions that have caused volatility in their prices independent of the operating and financial performance of the issuers of these securities. It is possible that the market for the exchange notes will be subject to these kinds of disruptions. Accordingly, declines in the liquidity and market price of the exchange notes may occur independent of our operating and financial performance. We cannot assure you that any liquid market for the exchange notes will develop.

Covenant Flexibility—The covenants under the credit agreement that governs our new senior secured credit facilities and the indenture that governs the notes allow us significant flexibility in terms of distributing cash and we expect to distribute significant amounts of cash in the future.

The covenants under the indenture that governs the notes and the credit agreement that governs our new senior secured credit facilities allow us significant flexibility to distribute cash. On or about May 20, 2002, we expect to makeSeagate Technology Holdings made a distribution to ourits shareholders, including New SAC, to enable New SAC to make a distribution to its preferred shareholders. At about the same time, distributions are expected to bewere made to participants in Seagate Technology HDD Holdings’ and Seagate Technology SAN Holdings’ deferred compensation plans. The aggregate amount of these shareholder and deferred compensation plan distributions is expected to bewas approximately $200$199 million. Subject to the restrictive covenants contained in the indenture that governs the notes, the credit agreement that governs our new senior secured credit facilities and any other agreements under which we may incur indebtedness, we will continue to have the ability to, and we believe that we are likely to, distribute significant amounts of cash to New SAC to enable New SAC to make distributions to its preferred shareholders in the future. This will trigger an obligation to make proportional distributions to participants in Seagate Technology HDD Holdings’ and Seagate Technology SAN Holdings’ deferred compensation plans. See “Management—Employment and Other Agreements—Rollover Agreements and Deferred Compensation Plans” and “Description of the Notes—Certain Covenants—Limitation on Restricted Payments.”

Special Factors—The subsidiaries of Seagate Technology Holdings that operate its storage area network business are not subject to the restrictive covenants or other provisions in the indenture that governs the notes and are not guarantors under the credit agreement that governs our new senior secured credit facilities.

The subsidiaries of Seagate Technology Holdings that operate its storage area network, or SAN, business, including Seagate Technology SAN Holdings and XIOtech Corporation, are not subject to the restrictive covenants or other provisions in the indenture that governs the notes and are not guarantors under the credit agreement that governs our new senior secured credit facilities. While we do not believe that the exclusion of these entities will adversely affect your ability to recover amounts due on the notes or the ability of our secured

creditors to recover amounts payable under our new senior secured credit facilities, the quality of the credit represented by our new senior secured credit facilities and the notes is unlikely to be improved if the SAN business experiences a significant upturn. Accordingly, you should not view any earnings or assets related to the subsidiaries that operate Seagate Technology Holdings’ SAN business as being available to meet our obligations under the notes. For the period from November 23, 2000 to June 29, 2001,fiscal year 2002, the SAN business had revenue of $37$74 million, gross profit of $20$36 million and a net loss of $51 million. As of June 29, 2001,28, 2002, it had total assets of $45$43 million.

Risks Related to Our Business

Competition—Our industry is highly competitive and our products have experienced significant price erosion.